Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NUCOR CORP | d684171dex991.htm |

| 8-K - FORM 8-K - NUCOR CORP | d684171d8k.htm |

Nucor Corporation Nucor to Build State-of-the-Art Plate Mill January 7, 2019 Exhibit 99.2

Forward-Looking Statements Certain statements made in this presentation are forward-looking statements that involve risks and uncertainties. The words “believe,” “expect,” “project,” “will,” “should,” “could” and similar expressions are intended to identify those forward-looking statements. These forward-looking statements reflect the Company’s best judgment based on current information, and although we base these statements on circumstances that we believe to be reasonable when made, there can be no assurance that future events will not affect the accuracy of such forward-looking information. As such, the forward-looking statements are not guarantees of future performance, and actual results may vary materially from the projected results and expectations discussed in this report. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to: (1) competitive pressure on sales and pricing, including pressure from imports and substitute materials; (2) U.S. and foreign trade policies affecting steel imports or exports; (3) the sensitivity of the results of our operations to prevailing steel prices and changes in the supply and cost of raw materials, including pig iron, iron ore and scrap steel; (4) availability and cost of electricity and natural gas which could negatively affect our cost of steel production or could result in a delay or cancellation of existing or future drilling within our natural gas working interest drilling programs; (5) critical equipment failures and business interruptions; (6) market demand for steel products, which, in the case of many of our products, is driven by the level of nonresidential construction activity in the U.S.; (7) impairment in the recorded value of inventory, equity investments, fixed assets, goodwill or other long-lived assets; (8) uncertainties surrounding the global economy, including the severe economic downturn in construction markets and excess world capacity for steel production; (9) fluctuations in currency conversion rates; (10) significant changes in laws or government regulations affecting environmental compliance, including legislation and regulations that result in greater regulation of greenhouse gas emissions that could increase our energy costs and our capital expenditures and operating costs or cause one or more of our permits to be revoked or make it more difficult to obtain permit modifications; (11) the cyclical nature of the steel industry; (12) capital investments and their impact on our performance; and (13) our safety performance. 1

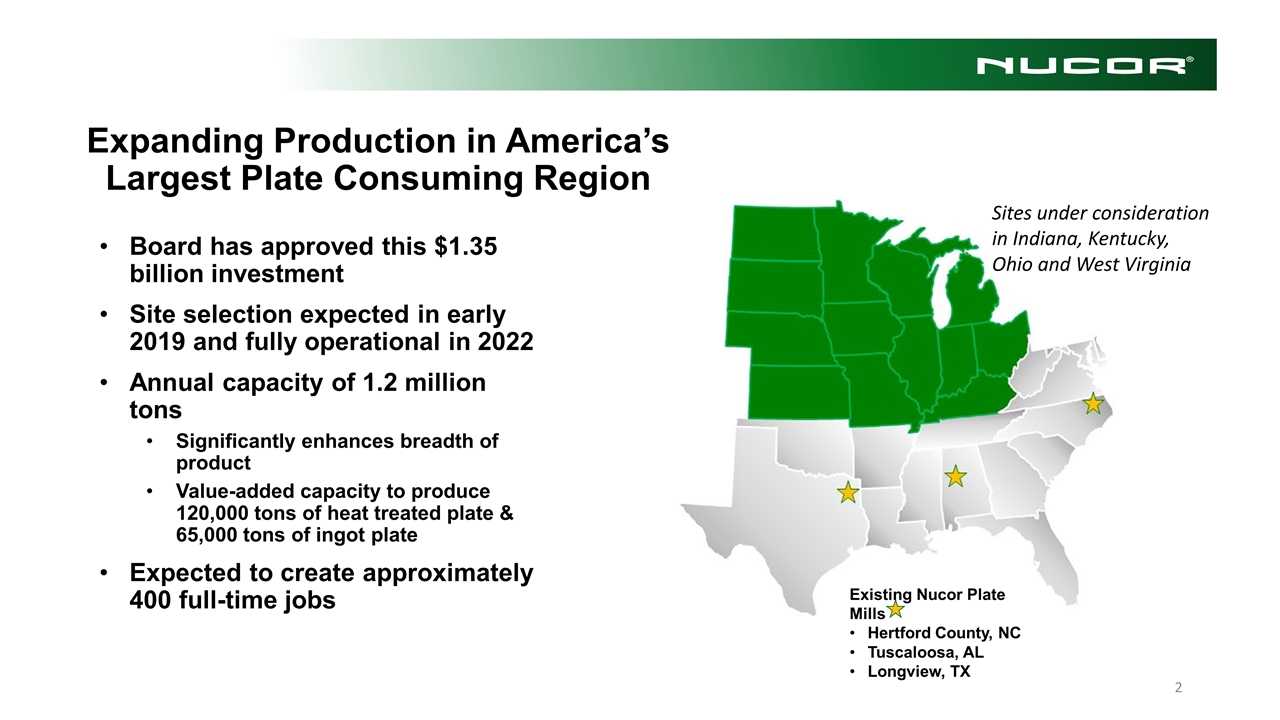

Expanding Production in America’s Largest Plate Consuming Region Board has approved this $1.35 billion investment Site selection expected in early 2019 and fully operational in 2022 Annual capacity of 1.2 million tons Significantly enhances breadth of product Value-added capacity to produce 120,000 tons of heat treated plate & 65,000 tons of ingot plate Expected to create approximately 400 full-time jobs Existing Nucor Plate Mills Hertford County, NC Tuscaloosa, AL Longview, TX 2 Sites under consideration in Indiana, Kentucky, Ohio and West Virginia

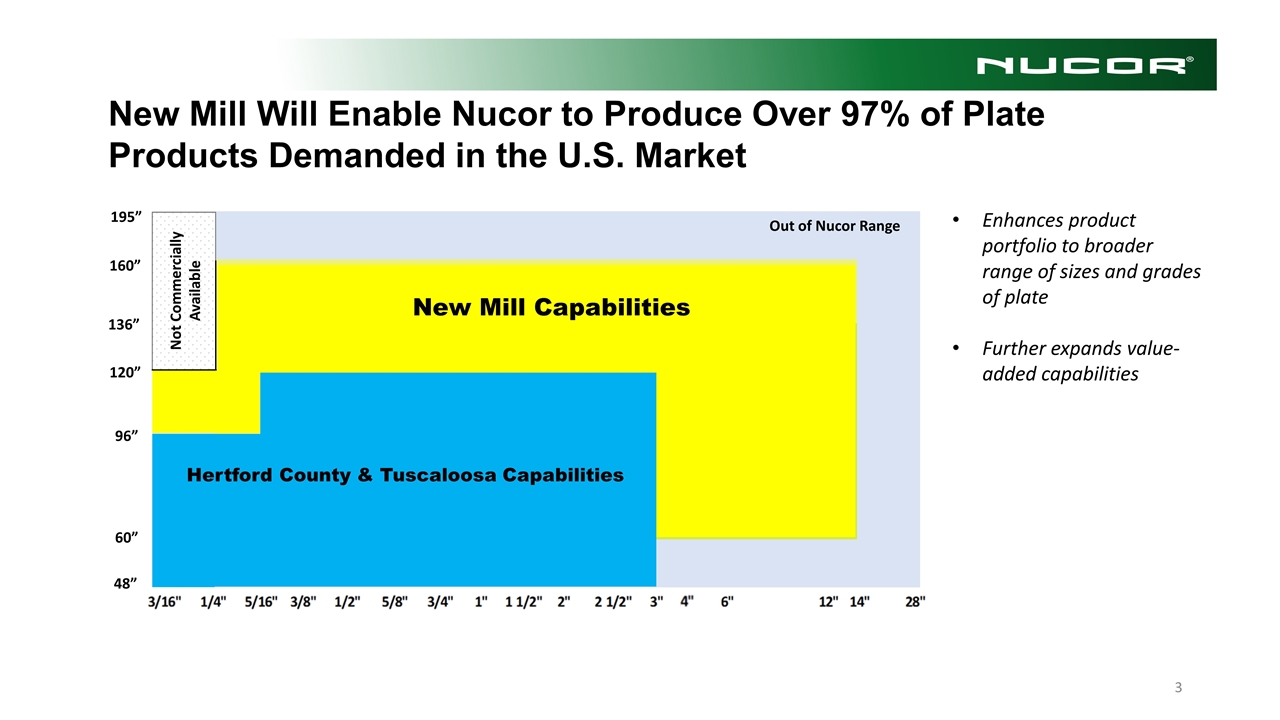

New Mill Will Enable Nucor to Produce Over 97% of Plate Products Demanded in the U.S. Market Not Commercially Available Out of Nucor Range 195” 48” 60” 96” 120” 136” 160” New Mill Capabilities Hertford County & Tuscaloosa Capabilities 3 Enhances product portfolio to broader range of sizes and grades of plate Further expands value-added capabilities

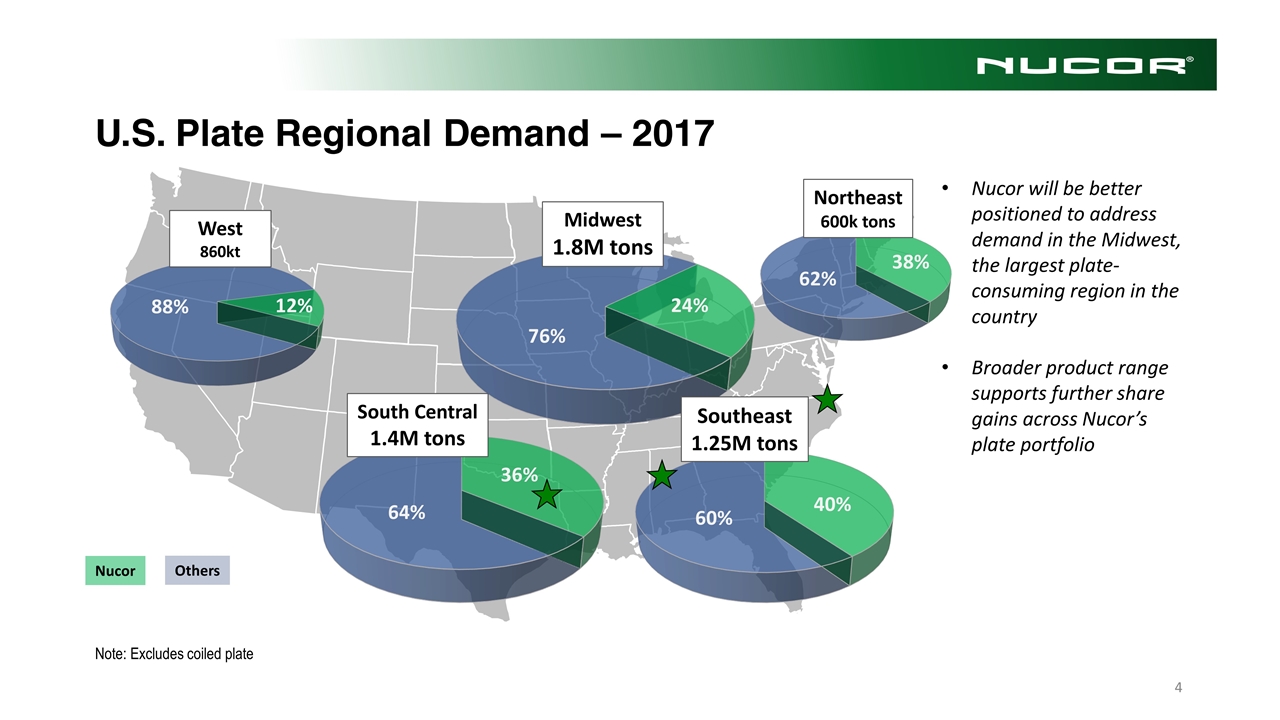

U.S. Plate Regional Demand – 2017 Note: Excludes coiled plate 4 Nucor will be better positioned to address demand in the Midwest, the largest plate-consuming region in the country Broader product range supports further share gains across Nucor’s plate portfolio Nucor Others Southeast 1.25M tons Northeast 600k tons South Central 1.4M tons West 860kt 38% 40% 36% 12% 24% 76% 62% 60% 64% 88% Midwest 1.8M tons

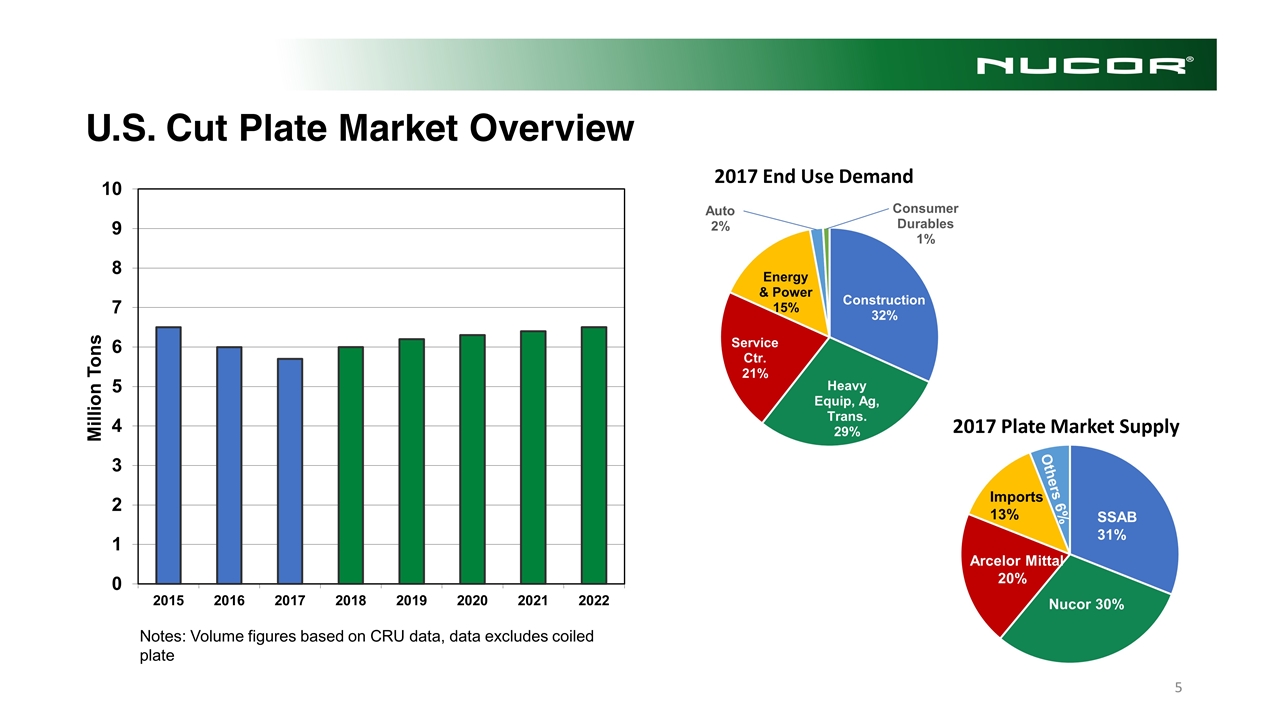

U.S. Cut Plate Market Overview 5 Notes: Volume figures based on CRU data, data excludes coiled plate 2017 Plate Market Supply 2017 End Use Demand

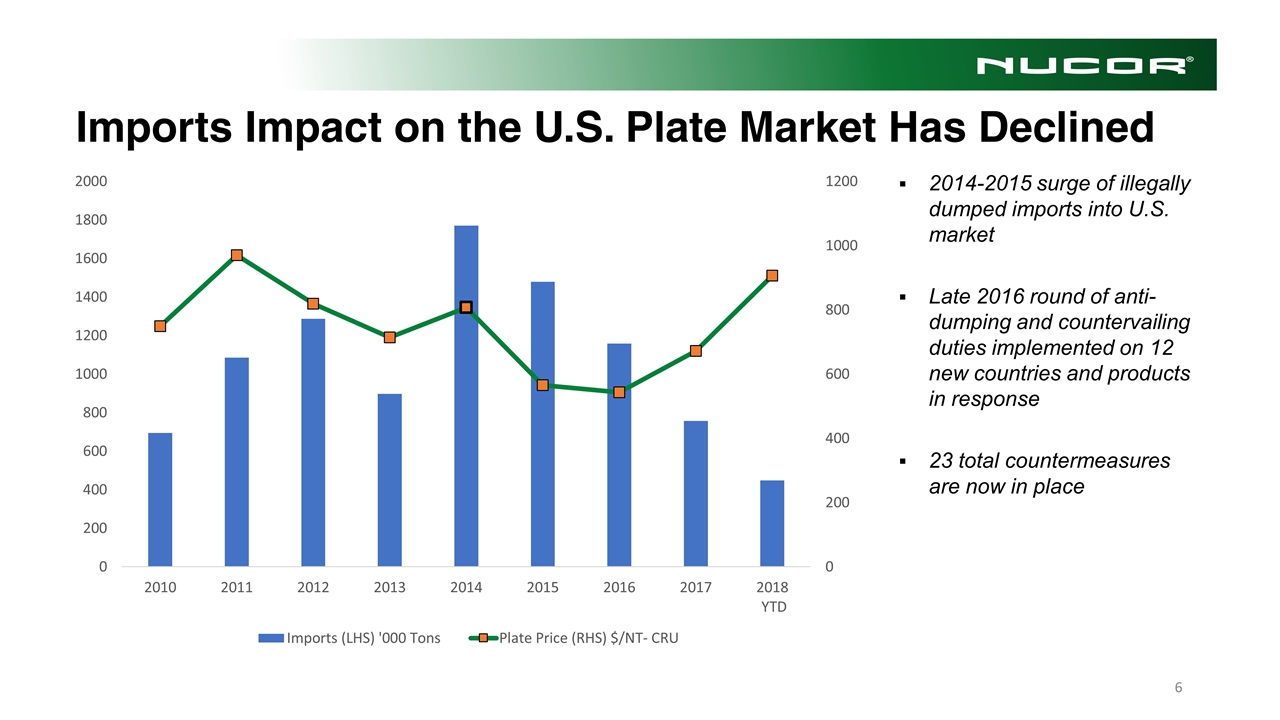

Imports Impact on the U.S. Plate Market Has Declined 2014-2015 surge of illegally dumped imports into U.S. market Late 2016 round of anti-dumping and countervailing duties implemented on 12 new countries and products in response 23 total countermeasures are now in place 6

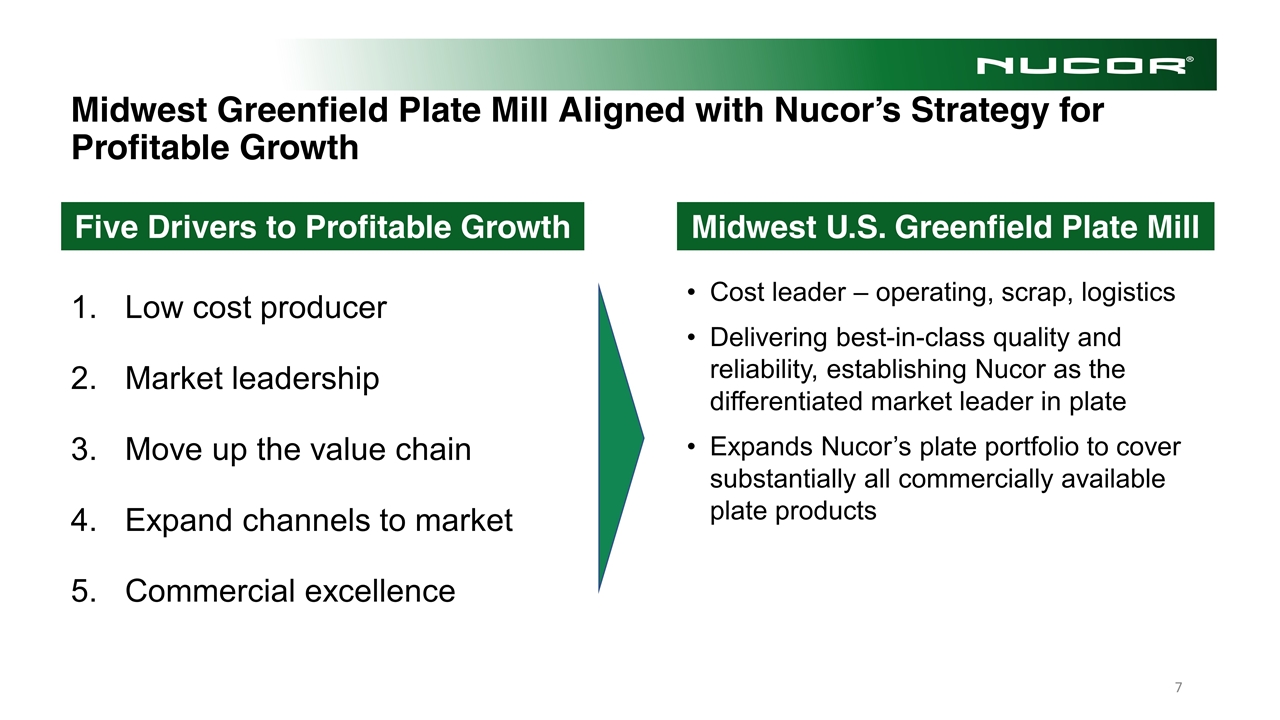

Midwest Greenfield Plate Mill Aligned with Nucor’s Strategy for Profitable Growth Low cost producer Market leadership Move up the value chain Expand channels to market Commercial excellence Five Drivers to Profitable Growth 7 Midwest U.S. Greenfield Plate Mill Cost leader – operating, scrap, logistics Delivering best-in-class quality and reliability, establishing Nucor as the differentiated market leader in plate Expands Nucor’s plate portfolio to cover substantially all commercially available plate products

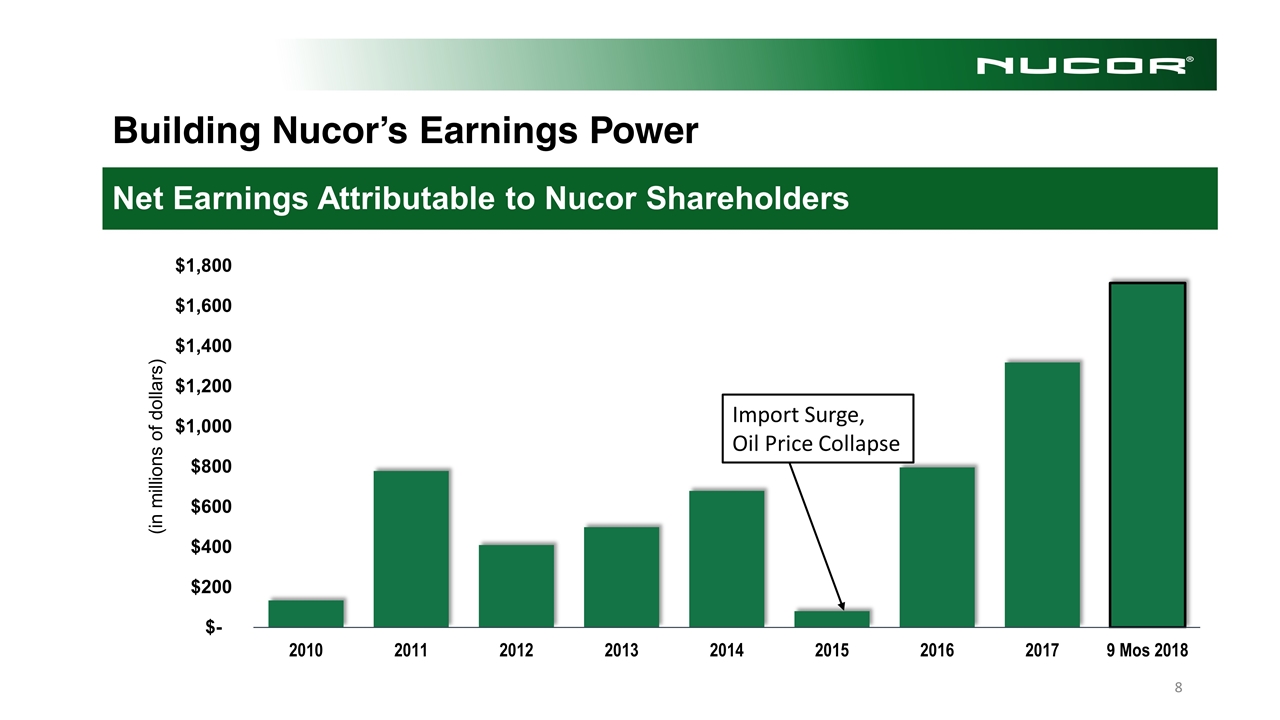

Building Nucor’s Earnings Power Net Earnings Attributable to Nucor Shareholders Import Surge, Oil Price Collapse 8