Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Hi-Crush Inc. | exhibit991-q42018update.htm |

| 8-K - 8-K - Hi-Crush Inc. | q42018operationalupdate8-k.htm |

INVESTOR PRESENTATION JANUARY 2019 NYSE: HCLP hicrush.com

Forward Looking Statements and Non-GAAP Measures No Solicitation This communication relates to the Conversion. This communication is for informational purposes only and does not constitute a solicitation of any vote or approval, in any jurisdiction, pursuant to the Conversion or otherwise. Important Additional Information In connection with the Conversion, the Partnership will file with the U.S. Securities and Exchange Commission (“SEC”) a proxy statement. The Conversion will be submitted to Partnership’s unitholders for their consideration. The Partnership may also file other documents with the SEC regarding the Conversion. The definitive proxy statement will be sent to the unitholders of the Partnership. This document is not a substitute for the proxy statement that will be filed with the SEC or any other documents that the Partnership may file with the SEC or send to unitholders of the Partnership in connection with the Conversion. INVESTORS AND SECURITY HOLDERS OF THE PARTNERSHIP ARE URGED TO READ THE PROXY STATEMENT REGARDING THE CONVERSION WHEN IT BECOMES AVAILABLE AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE CONVERSION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of proxy statement (when available) and all other documents filed or that will be filed with the SEC by the Partnership through the website maintained by the SEC at http://www.sec.gov. Copies of documents filed with the SEC by the Partnership will be made available free of charge on the Partnership’s website at www.hicrush.com, under the heading “Investors,” or by directing a request to Investor Relations, Hi-Crush Partners LP, 1330 Post Oak Blvd., Suite 600, Houston, TX 77056, Tel. No. (713) 980-6270. Participants in the Solicitation The Partnership is managed and operated by the board of directors and executive officers of its general partner, Hi-Crush GP LLC (our “General Partner”). The Partnership, our General Partner and our General Partner’s directors and executive officers may be deemed to be participants in the solicitation of proxies in respect to the Conversion. Information regarding our General Partner’s directors and executive officers is contained in the Partnership’s Annual Report on Form 10-K for the 2017 fiscal year filed with the SEC on February 20, 2018, and certain of its Current Reports on Form 8-K. You can obtain a free copy of these documents at the SEC’s website at http://www.sec.gov or by accessing the Partnership’s website at www.hicrush.com. Investors may obtain additional information regarding the interests of those persons and other persons who may be deemed participants in the Conversion by reading the proxy statement regarding the Conversion when it becomes available. You may obtain free copies of this document as described above. Forward-Looking Statements and Cautionary Statements The foregoing contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that the Partnership expects, believes or anticipates will or may occur in the future are forward-looking statements. Words such as “estimate,” “project,” “predict,” “believe,” “expect,” “anticipate,” “potential,” “create,” “intend,” “could,” “may,” “foresee,” “plan,” “will,” “guidance,” “look,” “outlook,” “goal,” “future,” “assume,” “forecast,” “build,” “focus,” “work,” “continue” or the negative of such terms or other variations thereof and words and terms of similar substance used in connection with any discussion of future plans, actions, or events identify forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the Conversion, descriptions of the post-Conversion company and its operations, transition plans, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ materially from the forward-looking statements included in this communication. These include the expected timing and likelihood of completion of the Conversion, the occurrence of any event, change or other circumstances that could give rise to the abandonment of the proposed Conversion, the possibility that unitholders of the Partnership may not approve the Conversion, risks related to disruption of management time from ongoing business operations due to the Conversion, the risk that any announcements relating to the Conversion could have adverse effects on the market price of the Partnership’s common units, the risk that the Conversion and its announcement could have an adverse effect on the ability of the Partnership to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating results and businesses generally, the risk the pending Conversion could distract management of the Partnership and that the Partnership will incur substantial costs, the risk that problems arise that may result in the post-Conversion company not operating as effectively and efficiently as expected, the risk that the post-Conversion company may be unable to achieve expected benefits of the Conversion or it may take longer than expected to achieve those benefits and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond the Partnership’s control, including those detailed in the Partnership’s annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K that are available on its website at www.hicrush.com and on the SEC’s website at http://www.sec.gov. All forward-looking statements are based on assumptions that the Partnership believes to be reasonable but that may not prove to be accurate. Any forward-looking statement speaks only as of the date on which such statement is made, and the Partnership undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.. Use of Non-GAAP Information This presentation may include non-GAAP financial measures. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to Hi-Crush’s most recent earnings release at www.hicrush.com. 2

Business Update

Hi-Crush’s Unique Service Offering Emerge Energy U.S. Silica Covia Smart Sand Solaris Services Northern White In-Basin MINE. Owned & Operated Terminal Network Containerized Last Mile Solution MOVE. Silo-Based Last Mile Solution Fully-Integrated Last Mile Services E&P Customer 51% Not Publicly Available Base1 MANAGE. 1) Based on 4Q 2018 volumes 4

Business Updates Volume Update: Sales volumes for 4Q 2018 were 2.0mm tons, reflecting weaker than expected completions activity and timing of our customers’ work Strong Balance Sheet: Suspending quarterly distribution in response to current market conditions; maintains balance sheet strength, strong liquidity position and flexibility Strategic Development: Completed construction of the second Kermit facility on time and under budget; customer-driven expansion of Wyeville is on track for 1Q 2019 completion Contracts: Announced contract with Chesapeake Energy for deployment of additional PropStream container crew to the Northeast; executed additional contracts with E&P customers for Northern White sand and logistics services PropStream® Expansion: Completed successful field testing of the FB Atlas conveyor system with an existing E&P customer; executed additional contracts with E&P customers 5

4Q 2018 Volume Update HCLP Quarterly Volumes Sold 000s tons 3,500 Quarterly Volumes Sold 3,000 Quarterly Nameplate Capacity 2,985 3,038 2,775 2,500 2,618 2,456 2,000 2,113 1,977 1,500 1,482 1,409 1,359 1,385 1,000 1,181 1,195 1,190 1,209 1,083 1,024 963 898 849 500 0 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 • Sales of 2.0mm tons for the fourth quarter of 2018, below previous guidance of 2.3-2.5mm tons • Reduced volumes reflect increased pressure on Northern White from growing in-basin supply, and reduced demand due to E&P budget exhaustion and completions timing within our customer base • Strong volumes from the existing Kermit facility; volumes delivered from the second Kermit facility beginning in January 2019 and expected to ramp to full capacity by March 2019 • 51% of volumes sold direct to E&P customers in the fourth quarter of 2018 6

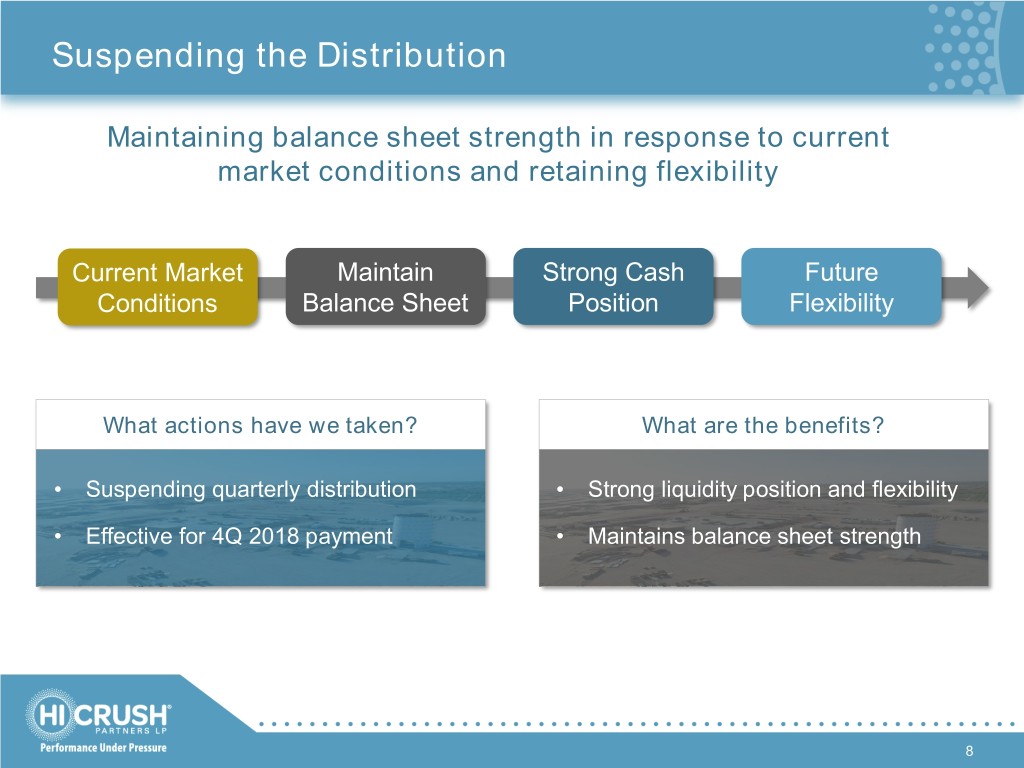

Maintaining Capital Discipline Hi-Crush Action Rationale • Current cash balance alone funds maintenance capex and Maintaining Capex remaining growth capex from 2018 expansion projects Flexibility • 2019 growth capex is flexible and discretionary based on customer demand and market conditions • Focusing investment in last mile technology and solutions Optimizing Company • Idled Whitehall facility due to reduced customer demand Operations • Negotiating freight rates with Class-1 railroads • Closely managing expenses across operations Managing G&A • Rationalizing G&A to fit business model and logistics focus • Strong cash position and liquidity Suspending Quarterly • Maintains balance sheet strength Distribution • Aligns with current market conditions 7

Suspending the Distribution Maintaining balance sheet strength in response to current market conditions and retaining flexibility Current Market Maintain Strong Cash Future Conditions Balance Sheet Position Flexibility What actions have we taken? What are the benefits? • Suspending quarterly distribution • Strong liquidity position and flexibility • Effective for 4Q 2018 payment • Maintains balance sheet strength 8

Sustainable Capital Position Balance sheet flexibility enables Hi-Crush to respond to changing market dynamics and opportunities Strong Flexible Conservative Cash & liquidity Capital position Leverage vs. peers $114mm1 No $444mm / $330mm1 Cash Position Maintenance Covenants Total Debt / Net Debt No No 1.8x2 ABL Borrowings Principal Payments3 Total Debt / LTM EBITDA 2018 capex expected to be below the previous guidance range of $155-165mm 1) As of December 31, 2018 2) As of September 30, 2018 3) ABL matures 2023; Senior Notes due 2026; interest payments of $21.4mm due each of February 1, 2019 and August 1, 2019 9

Continued Focus on Logistics Expansion Hi-Crush continues to execute on its Mine. Move. Manage. operating strategy through the expansion of its industry-leading proppant logistics platform Equipment Acquisition • FB Atlas conveyor system successfully field tested • Positive customer feedback received on diversified last mile silo system offering resulting in further deployment Operational Improvements • Enhanced operations at Pecos terminal • Forward placement of sand facilitates customer access and minimizes logistics bottlenecks Continued Investment • Investing in systems and technology to improve product tracking and operational efficiencies • Adding talent to enhance our expertise 10

The Premier Last Mile Service with Unrivaled Flexibility PropStream is the industry’s most flexible and only fully-integrated last mile service offering both silo and container systems Containers Silo System Flexible wellsite footprint Easy set up in 2 hours Enhanced mobility & flexibility Maximum onsite storage Reduced trucking costs Minimal footprint Fast loading & unloading Fast innovative top fill option Precise, accurate volume control Up to 27 tons per truckload OSHA-compliant dust control 11

Focus on Growing Relationships with E&Ps PropStream’s integrated proppant logistics service complements Hi-Crush’s focus on serving E&P customers Container Crews1 Silo Crews1 % E&P Sales Volumes 51% 40% 33% 31% 8 25% 16 16 14% 14 3% 12 0% 2% 10 2 1 4 6 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 • 51% of fourth quarter 2018 volumes sold direct to E&Ps • Signed agreement with Chesapeake Energy for supply of Northern White sand in the Northeast and Powder River Basin, and deployment of an incremental PropStream container crew to the Northeast • Signed contracts with additional E&P customers for deployment of PropStream container and silo systems in 1Q 2019 1) Reflects crews active at the end of each respective quarter 12

The Benefits of Aligning with E&P Customers Relationship Driven: Long project lead times and significant capital requirements drive E&Ps to value strategic relationships with suppliers who offer differentiated solutions Growth Opportunity: Better Visibility: Direct-sourcing E&Ps’ Closer relationships need for a preferred provide greater visibility provider of flexible, full- E&P into constantly-evolving scope proppant and activity, demand trends and logistics solutions Customers market fundamentals currently underserved Less Volatility: Partnering with the right E&P customers reduces volatility as drilling and completion programs are more consistent through commodity cycles 13

Corporate Conversion Process Update Simplify Current Corporate Structure Remove structural hurdles to conversion and align interests of management and the unitholders Determine Optimal Conversion Structure Due diligence to determine how to eliminate or minimize any tax implications for unitholders Issue Proxy Statement Proxy statement to outline company strategy post-conversion and any potential tax implications Unitholder Vote Unitholders of record to vote on proposed conversion to C-Corporation Conversion to C-Corporation Upon approval from unitholders, finalize conversion to C-Corporation and issue shares of common stock Finalize Governance Structure Following conversion, finalize corporate governance structure to enhance shareholder participation Conversion to C-Corporation likely to be completed in 1H 2019 14

Business Overview

A Differentiated Platform for Growth We provide our customers with the high-quality, cost-effective proppant and logistics services they require, when and where needed MINE. MOVE. MANAGE. • 17.3mm TPY pro-forma • Largest owned and operated • Fully-integrated, mine to annual production capacity1 terminal network in the wellsite supplier of frac sand • High-quality Northern White industry and logistics solutions and in-basin Permian • Origins and destination • Our PropStream proprietary reserves ownership provides cost- last mile logistics solution • Industry-leading production effective service to all major delivers sand to the wellsite cost profile U.S. oil and gas basins • Following acquisition of FB • Partnering with preferred Industries, Hi-Crush is the only trucking providers for last mile provider to offer both logistics to ensure efficiency silo and container solutions 1) Includes 3.0mm TPY second Kermit facility completed in December 2018 and 850k TPY Wyeville expansion expected to be operational in mid- 1Q 2019; also includes 2.86mm TPY Whitehall facility, which is temporarily idled due to market conditions 16

MINE: Capacity to Meet Customer Needs Kermit Wyeville Blair Augusta Whitehall3 Capacity1 6.00mm TPY 2.70mm TPY 2.86mm TPY 2.86mm TPY 2.86mm TPY Permian Northern Northern Northern Northern Type Pearl White White White White Reserve Life1, 2 17 years 27 years 40 years 13 years 27 years Direct to Union Canadian Union Canadian Takeaway Truck Pacific National Pacific National Location West Texas Wisconsin Wisconsin Wisconsin Wisconsin Site 1) Wyeville and Kermit capacity and reserve life calculations are pro-forma for expansions 2) Reserve life estimates based on reserve reports prepared by JT Boyd as of December 31, 2017 3) Whitehall facility temporarily idled due to market conditions 17

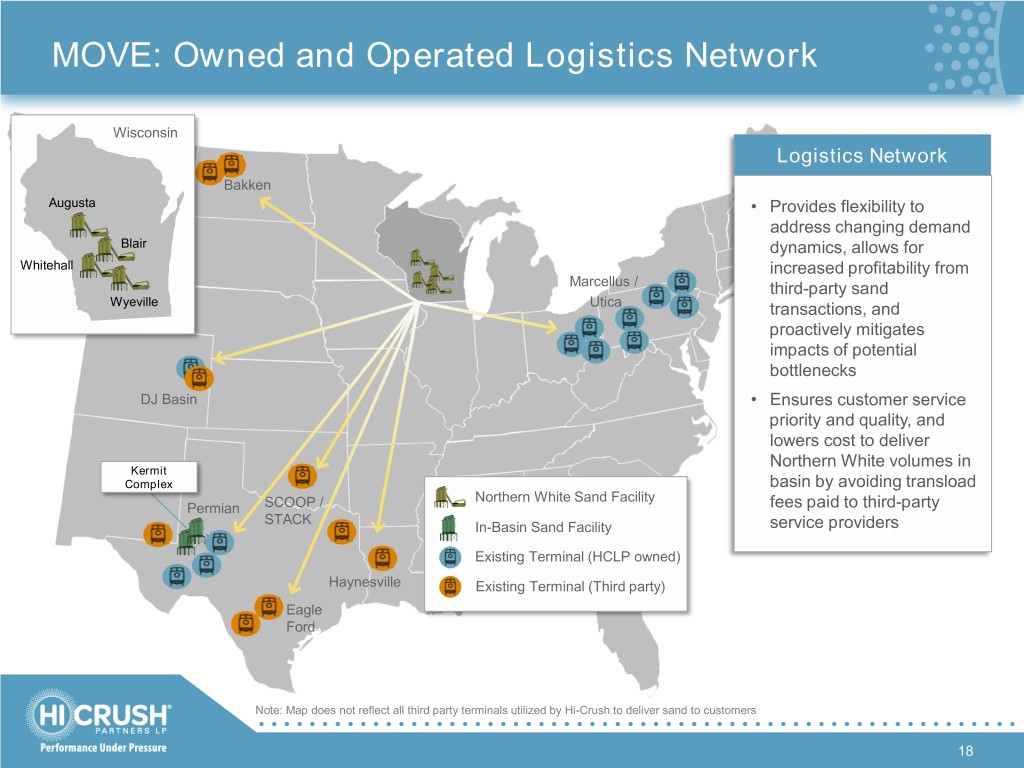

MOVE: Owned and Operated Logistics Network Wisconsin Logistics Network Bakken Augusta • Provides flexibility to address changing demand Blair dynamics, allows for Whitehall increased profitability from Marcellus / third-party sand Wyeville Utica transactions, and proactively mitigates impacts of potential bottlenecks DJ Basin • Ensures customer service priority and quality, and lowers cost to deliver Northern White volumes in Kermit Complex basin by avoiding transload Northern White Sand Facility Permian SCOOP / fees paid to third-party STACK In-Basin Sand Facility service providers Existing Terminal (HCLP owned) Haynesville Existing Terminal (Third party) Eagle Ford Note: Map does not reflect all third party terminals utilized by Hi-Crush to deliver sand to customers 18

MANAGE: Flexible Solutions for Our Customers E&P MINE. MOVE. MANAGE. Customer Priorities • Our ability to offer customers the option of container- and silo-based last mile Surety of solution enables optimization of logistics for each wellsite Supply • FB Industries’ silo solution offers increased capacity for onsite storage, while PropStream containers allow for more flexible delivery and wellsite management • Our integrated container and silo offering completely eliminates need for Asset pneumatic trucks, improving asset turns and driving cost savings Utilization • Flexible offering allows customers to structurally reduce their costs by & ROI choosing the last mile solution best suited for individual wellsite environments • Completely enclosed containerized delivery system and top-fill conveyor Health & solution for silo system meet all OSHA regulations, eliminate use of pneumatic Safety trailers and reduce overall wellsite traffic • Facilitates improved wellsite environment through noise reduction 19

Remaining Proactive in Our Evolution STRATEGIC FINANCIAL STRUCTURAL • July 2018: Acquired FB • July 2018: Announced • October 2018: Simplified Industries, expanding our private placement of Hi-Crush’s partnership last mile offering; the only $450mm senior unsecured structure through the 100% diversified last mile provider notes and a new 5-year equity-financed acquisition offering both container and asset-backed credit facility, of Hi-Crush Proppants LLC silo-based solutions enhancing balance sheet and economic control from flexibility, extending debt the general partner, • July 2018: Announced maturities, removing conserving cash, further customer-backed maintenance covenants strengthening the balance development of a second and maintaining capital sheet, accelerating the 3.0mm TPY Kermit facility return flexibility path to a potential C-Corp and 850K TPY expansion of conversion and maximizing our existing Wyeville facility • January 2019: our flexibility to continue to Announced suspension of • January 2019: Continue to execute strategic growth quarterly distribution in execute on shift to E&P initiatives response to current market customer base with 51% of conditions to maintain volumes sold direct to E&Ps balance sheet strength, in 4Q 2018 strong liquidity position and flexibility 20

Investor Contacts Investor Relations Contacts Caldwell Bailey, Lead Analyst, Investor Relations Marc Silverberg, ICR (713) 980-6270 IR@hicrush.com 21