Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FGL Holdings | fglholdings8-kinvestorpres.htm |

FGL Holdings Investor Marketing January 7, 2019 FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 1

Legal Disclosures ► All data in this presentation are as of September 30, 2018, unless stated otherwise. ► Caution regarding forward-looking statements: ► This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are subject to risks and uncertainties that could cause actual results, events and developments to differ materially from those set forth in, or implied by, such statements. These statements are based on the beliefs and assumptions of F&G’s management and the management of its subsidiaries. ► Generally, forward-looking statements include actions, events, results, strategies and expectations and are often identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” “continues,” “outlook” or similar expressions. Factors that could cause actual results, events and developments to differ from those set forth in, or implied by, the statements set forth herein are discussed from time to time in F&G’s filings with the SEC, as well as those of its predecessor companies—FGL and CFCO. You can find these filings on the SEC’s website, www.sec.gov. ► All forward-looking statements we describe herein are qualified by these cautionary statements and we can provide no assurance that the actual results, events or developments referenced herein will occur or be realized. F&G does not undertake any obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results. ► All estimates and forecasts for the effects of purchase accounting are preliminary and subject to change. ► Permission neither sought nor obtained with reference to third party sources. FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 2

F&G Overview Established FGL Holdings (NYSE: FG), Cayman Islands based holding company, in transformative 4Q17 acquisition of Fidelity & Guaranty Life Created high-ROE company positioned for sustained growth Operations in Des Moines, IA; Baltimore, MD; Hamilton, Bermuda Oldest subsidiary dates to 1959 Provide retirement & life insurance solutions for more than 700,000 customers Fixed Indexed Annuities (FIA) Multi-Year Guarantee Annuities (MYGA) Indexed Universal Life (IUL) Employ ~300 associates dedicated to serving policyholders, distribution partners and shareholders Distribute retail sales through independent agents serving growing retirement demographic and reinsurance sales through its Bermuda based operations FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 3

Driving Profitable Growth Attractive Demographic ► Products serve growing consumer demand for safe money Trends Organic Growth retirement products Secure Ratings Upgrades ► Upgraded to A- by A.M. Best ► Strategic partnership delivers improved asset diversification, Blackstone Partnership quality, volume and yield ► Actively pursuing accretive M&A opportunities Inorganic Growth ► Existing platform enables growth without added fixed costs ► Leveraging reinsurance platform ► Long-term commitment to F&G Strong Sponsorship ► Extensive insurance leadership experience through multiple & Leadership cycles; committed to growth FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 4

Key Focus Areas Organic Inorganic Serve retirement needs of Capture accretive M&A deals growing retirement demographic Newly appointed Head of Corporate Development & Strategy Maintain strong position within Lead shareholders/sponsors have high growth indexed product strong appetite for acquisitions markets Disciplined pricing & active Grow independent distribution pipeline Focus: products aligned with Develop new channels current portfolio and risks + Execute block reinsurance with Expand flow reinsurance tax-efficient Bermuda platform $15M targeted cost reduction Deploy excess capital (~$300M) FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 5

Progress on 2018 Objectives 2018 Investor Day Objective: Year End Estimate ► F&G annuity target growth: 10% to 12% 4Q18: outlook >30% Retail Sales 9/30 YTD growth 26% ► Meaningful progress on portfolio re-positioning Phase 1 block trade ► Targeting Phase 1 completion by year-end complete 2018; Phases 2 & 3 between 2018 and 2019 Phase 2 structured Investments rotation ~90% done; complete in 1Q19 Alternative assets target funding complete by YE20 ► Plan for ~20% AOI effective tax rate in 2018 2018 AOI ETR <20% Tax ► Growth in reinsurance platform to reduce ETR No downside from BEAT to ~15% over time ► Leverage Bermuda platform—both block M&A Active pipeline both flow Reinsurance and flow reinsurance opportunities and M&A ► Achieve A.M. Best rating of “A-” (Excellent) Achieved upgrade to A- Ratings ► Pursue additional upgrades 4Q18E RBC >450% ► Maintain > 450% RBC FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 6

Delivering Strong Financial Performance 3Q YTD 2018 Results vs. 3Q YTD 2017 Total Annuity Sales +26% $842M Fixed Indexed Annuity (FIA) Sales +23% $631M Average AUM (ex-PGAAP) +9%1 $25.9B Adjusted Operating Income (AOI)2 +25% $62M; $0.29 EPS Return on Equity +380 bps 15.3% 1Including PGAAP impact of $3.1B reported growth was 24% 2Based on 214M shares outstanding on 9/30/2018; see appendix for definition FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 7

3Q18 Sales Trend 3Q18 sales from all products totaled $894M, up 51% from 3Q17 & up 8% from 2Q18 ($M) VPY: 43% Annuity Sales 842 769 MYGA / FHLB 211 FIA 588 220 164 631 549 424 3Q17 2Q18 3Q18 IUL1 6 7 7 Flow reinsurance2 0 54 45 ► FIA sales 49% to $631M and 15% to 2Q18 ► MYGA sales 29% to $211M ► Flow reinsurance deposits continue to build; $45M in 3Q18 and on track for ~$175M in 2018 ► Achieving mid-teens returns 1IUL at annualized target premium—industry standard basis 2Flow reinsurance reflects post merger deposits beginning December 2017 FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 8

3Q18 Investment Portfolio Investment Portfolio by Asset Class ► Investment portfolio performing well ► Net investment income ↑ 9% from 3Q17 (ex-PGAAP premium amortization); 46% Corporates ↑ 2% as reported 14% ABS ► Benefitting from Blackstone’s 12% Other 1 investment; enhanced yield and returns within appropriate risk 7% CMBS framework 6% Non-Agency RMBS $25B ► Ongoing portfolio reposition progress 5% Municipals with moves into structured securities 4% Hybrids complete by early ’19 and alternatives by end of ’20 4% Cash & Equiv. ► Maintaining a disciplined approach to 2% U.S. & Foreign Gov't portfolio risk management while optimizing yields on both in-force and new business High quality fixed income portfolio: Average NAIC 1.5 1Consists of commercial mortgage loans, derivatives, preferred stocks, policy loans and common stock FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 9

Net Investment Spread FIAs: Quarterly Net Spread Trend ► Core spreads consistently achieving (BPS) Post Core Investment Spread pricing targets of ~280bps or better; with PGAAP PGAAP Amort. & Expenses stable interest credited and option costs Bond Prepay Income ► PGAAP impacts and planned fees in line 300 254 264 234 216 with expectations during reposition period 15 ► Benefits of portfolio reposition will increase spreads throughout 2019 306 293 300 288 281 (Phase 2) and throughout 2020 (Phase 3) as alternative asset portfolio is fully (6) funded (17) (59) (61) (72) 3Q17 4Q17 1Q18 2Q18 3Q18 FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 10

Earnings Trend AOI – Year-to-Date Ended 9/301 ($M) VPY: 25% Strong performance continues 181 across all key metrics 145 Strong 25% year-to-date AOI growth AOI excluding favorable items in both periods grew 27% year-to-date AOI return on equity mid-teens YTD17 YTD18 YTD Net Income $115 $140 AOI EPS1 $0.68 $0.84 AOI ROE2 11.5% 15.3% 1Earnings, EPS, and ROE reflect common shareholder metrics and post-merger definitions 2Reflects 12-month rolling average FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 11

F&G Portfolio Repositioning FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 12

F&G Portfolio Repositioning: 2018 Investment Thesis ► Investment Thesis (1Q18 Investor Day) ► Credit quality & underwriting standards of the most liquid corporates became stretched ► Flat curve did not compensate for a typical duration posture ► Actions Implemented ► Reduced allocation to NAIC 1 and NAIC 2 rated corporate bonds ► Increased allocation to floating rate/less rate sensitive securities with equivalent NAIC ratings ► Focused on underwriting structure and complexity; leveraging asset sourcing and underwriting capabilities to use liquidity profile wisely ► Risk Mitigated ► Maintained credit discipline with low “pass rate” for investments sourced for F&G balance sheet ► Guarded against downside risk by negotiating for stronger covenants/strengthened deal language in securitized products ► Leveraged knowledge of residual/equity risk in analysis of liquid real estate debt securities FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 13

F&G Portfolio Reposition Update Funding structured and alternatives allocations from investment grade corporates: ► Additive to net book yield on ~$25B portfolio ► Duration gap well within targeted +/- one year while maintaining high average quality IG Corporates Structured Alternatives (Funded) (% of Portfolio) (% of Portfolio) ~35% (% of Portfolio) 6% 23% 5% 43% ~2% 5% 10% ~30% 6% 4% 1% 14% 8% 12/31/2017 12/31/2018E 12/31/2017 12/31/2018E 12/31/2017 12/31/2018E CLO CMBS RMBS ABS Net Book Yield1 Asset/Liability Duration Gap NAIC Rating (Years) 0.8 0.7 ~4.75% ~ 0.6 0.4 1.5 ~1.5 4.21% 0.1 Dec 31 Mar 31 Jun 30 Sep 30 Dec 31 12/31/2017 12/31/2018E 2017 2018 2018 2018 2018E 12/31/2017 12/31/2018E 1Reflects 2018 estimated average IMA fee rate and sub-manager fees FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 14

F&G Portfolio Positioning: Structured Assets Summary Summary statistics 12/31/2018E Investment Rationale GAAP Book Value (M) $8,750 Structured assets strengthen ALM profile as LIBOR based assets benefit from rising rates Net book yield 4.75% Rotated out of corporates into structured assets Duration (years) 3.2 to lower asset duration at similar capital levels NAIC rating (weighted average) 1.3 Structured Asset Portfolio (% of fixed income portfolio) RMBS CLO ABS CMBS ~35% 6 24% 5 4 19% 10 5 5 3 9 3 14 6 8 1 F&G 12/31/17 F&G 12/31/2018E Peer Average 1Peer group 2017 data includes American Equity Life, American International Group, Athene Holdings, CNO Financial, Global Atlantic, Guggenheim, Jackson, Lincoln Financial, Nationwide Mutual Group, Nassau Reinsurance, and Voya Financial. FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 15

F&G Alternatives: Building a Well-Diversified Portfolio ► Leveraging BX’s industry-leading capabilities to expand into alternatives ► Commitments are diversified by collateral, geography and vintage ► Through YE 2018: $1.6B committed, of which 30% funded / 2% of total portfolio Collateral Geography Vintage 2% 5% 5% 2% 5% 16% 32% 36% 39% 37% 51% 40% 30% Credit Global 2019 2018 2017 Private Equity North America 2016 2015 Real Estate Europe Multi Strategy Asia FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 16

Portfolio Management: Looking Ahead ►Focused on protecting the downside ►Opportunistic rotation out of broadly syndicated IG-rated corporate bonds with ratings downgrade potential to maximize capital efficiency ►Continue to allocate to privately sourced, IG-rated structured assets that have been underwritten to conservative baseline assumptions and demonstrate enhanced covenant protection ►Preserve portfolio’s flexibility to capitalize on market dislocation ►ALM Profile well-matched assets vs. liabilities and large floating rate exposure provide flexibility as rate environment changes ►Liquidity Profile deep knowledge of liability profile informs our decision to underwrite complexity in structured assets ►Capital Flexibility target RBC ratio at 450% or better to keep “powder dry” as credit cycle matures FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 17

Appendix FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 18

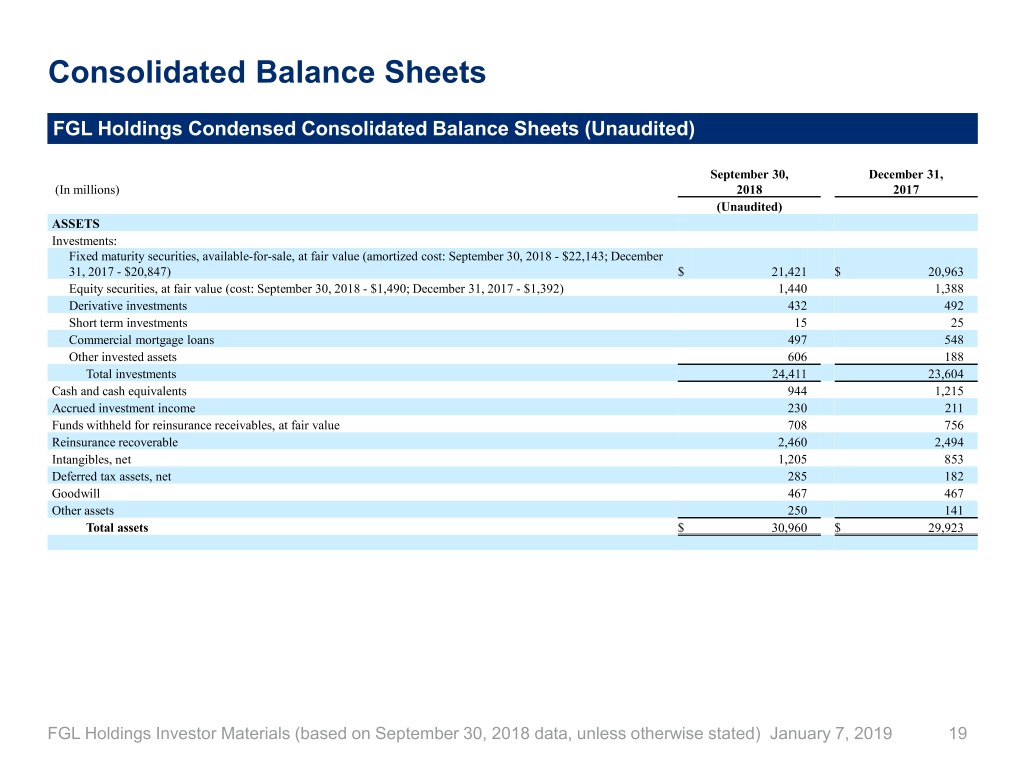

Consolidated Balance Sheets FGL Holdings Condensed Consolidated Balance Sheets (Unaudited) September 30, December 31, (In millions) 2018 2017 (Unaudited) ASSETS Investments: Fixed maturity securities, available-for-sale, at fair value (amortized cost: September 30, 2018 - $22,143; December 31, 2017 - $20,847) $ 21,421 $ 20,963 Equity securities, at fair value (cost: September 30, 2018 - $1,490; December 31, 2017 - $1,392) 1,440 1,388 Derivative investments 432 492 Short term investments 15 25 Commercial mortgage loans 497 548 Other invested assets 606 188 Total investments 24,411 23,604 Cash and cash equivalents 944 1,215 Accrued investment income 230 211 Funds withheld for reinsurance receivables, at fair value 708 756 Reinsurance recoverable 2,460 2,494 Intangibles, net 1,205 853 Deferred tax assets, net 285 182 Goodwill 467 467 Other assets 250 141 Total assets $ 30,960 $ 29,923 FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 19

Consolidated Balance Sheets FGL Holdings Condensed Consolidated Balance Sheets (Unaudited) September 30, December 31, (In millions) 2018 2017 (Unaudited) LIABILITIES AND SHAREHOLDERS' EQUITY Contractholder funds (a) $ 23,164 $ 21,827 Future policy benefits, including $684 and $728 at fair value at September 30, 2018 and December 31, 2017, respectively (b) 4,631 4,751 Liability for policy and contract claims (c) 60 78 Debt 540 307 Revolving credit facility — 105 Other liabilities 1,091 892 Total liabilities 29,486 27,960 Shareholders' equity: Preferred stock ($.0001 par value, 100,000,000 shares authorized, 391,694 and 375,000 shares issued and outstanding at September 30, 2018 and December 31, 2017, respectively) — — Common stock ($.0001 par value, 800,000,000 shares authorized, 214,370,000 issued and outstanding at September 30, 2018 and December 31, 2017, respectively) — — Additional paid-in capital 2,056 2,037 Retained earnings (Accumulated deficit) (13) (149) Accumulated other comprehensive income (loss) (569) 75 Total shareholders' equity 1,474 1,963 Total liabilities and shareholders' equity $ 30,960 $ 29,923 (a) Contractholder funds include amounts on deposit for annuity and universal life contracts plus the fair value of future index credits and guarantees on our FIA and IUL products. (b) Future policy benefits include the present value of future benefits on our traditional life insurance products and life contingent SPIA contracts. (c) Liability for policy and contract claims represents policyholder pending claims. FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 20

Condensed Consolidated Statements of Operations FGL Holdings Condensed Consolidated Statement of Operations (Unaudited) Three Months Ended Nine months ended September 30, September 30, September 30, September 30, 2018 2017 2018 2017 Predecessor Predecessor (Unaudited) (Unaudited) (Unaudited) (Unaudited) Revenues: Premiums $ 12 $ 16 $ 45 $ 31 Net investment income 267 261 812 765 Net investment gains (losses) 119 117 (74) 265 Insurance and investment product fees and other 46 41 139 129 Total revenues 444 435 922 1,190 Benefits and expenses: Benefits and other changes in policy reserves 297 320 475 823 Acquisition and operating expenses, net of deferrals 40 36 126 109 Amortization of intangibles 28 (14) 72 70 Total benefits and expenses 365 342 673 1,002 Operating income 79 93 249 188 Interest expense (8) (6) (21) (18) Income (loss) before income taxes 71 87 228 170 Income tax expense (15) (26) (67) (55) Net income (loss) $ 56 $ 61 $ 161 $ 115 Less preferred stock dividend 7 — 21 — Net income (loss) available to common shareholders $ 49 $ 61 $ 140 $ 115 Net income (loss) per common share: Basic $ 0.23 $ 1.06 $ 0.65 $ 1.98 Diluted $ 0.23 $ 1.06 $ 0.65 $ 1.98 Weighted average common shares used in computing net income per common share: Basic 214,370,000 58,335,216 214,370,000 58,332,666 Diluted 214,418,693 58,478,612 214,390,931 58,437,832 Cash dividend per common share $ — $ 0.065 $ — $ 0.195 FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 21

Non-GAAP Measures and Definitions While management believes that non-GAAP measurements are useful supplemental information, such adjusted results are not intended to replace GAAP financial results and should be read in conjunction with those GAAP results. Non-GAAP Measures: ► Adjusted operating income (AOI) is a non-GAAP economic measure we use to evaluate financial performance each period. AOI is calculated by adjusting net income (loss) to eliminate (i) the impact of net investment gains/losses including other than temporary impairment ("OTTI") losses recognized in operations, but excluding gains and losses on derivatives hedging our indexed annuity policies, (ii) the effect of changes in fair values of FIA related derivatives and embedded derivatives, net of hedging cost, (iii) the tax effect of affiliated reinsurance embedded derivative, (iv) the effect of integration, merger related & other non- operating items, (v) impact of extinguishment of debt, and (vi) net impact from Tax Cuts and Jobs Act. Adjustments to AOI are net of the corresponding impact on amortization of intangibles, as appropriate. The income tax impact related to these adjustments is measured using an effective tax rate of 21%, as appropriate. While these adjustments are an integral part of the overall performance of the Company, market conditions and/or the non-operating nature of these items can overshadow the underlying performance of the core business. Accordingly, Management considers this to be a useful measure internally and to investors and analysts in analyzing the trends of our operations. Beginning with the quarter ended March 31, 2018, the Company updated its AOI definition to remove the residual impacts of fair value accounting on its FIA products, including gains and losses on derivatives hedging those policies. Management believes the revised measure enhances the understanding of the business post-merger and is more useful and relevant to investors as compared to the previous definition which eliminated only the effects of changes in the interest rates used to discount the FIA embedded derivative. Periods shown prior to March 31, 2018 have not been adjusted to reflect the new definition. ► AOI available to common shareholders is a non-GAAP economic measure we use to evaluate financial performance attributable to our common shareholders each period. AOI available to common shareholders is calculated by adjusting net income (loss) available to common shareholders to eliminate the items in the AOI paragraph above. While these adjustments are an integral part of the overall performance of the Company, market conditions impacting these items can overshadow the underlying performance of the business. Accordingly, Management considers this to be a useful measure internally and to investors and analysts in analyzing the trends of our operations. Our non-GAAP measures may not be comparable to similarly titled measures of other organizations because other organizations may not calculate such non-GAAP measures in the same manner as we do ► Average assets under management (AAUM) is the sum of (i) total invested assets at amortized cost, excluding derivatives; (ii) related party loans and investments; (iii) accrued investment income; (iv) funds withheld at fair value; (v) the net payable/receivable for the purchase/sale of investments and (iv) cash and cash equivalents, excluding derivative collateral, at the beginning of the period and the end of each month in the period, divided by the total number of months in the period plus one. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the rate of return on assets available for reinvestment. ► Yield on AAUM is calculated by dividing annualized net investment income by AAUM. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the level of return earned on AAUM. ► Net investment spread is the excess of net investment income earned over the sum of interest credited to policyholders and the cost of hedging our risk on FIA policies. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the performance of the Company’s invested assets against the level of investment return, inclusive of hedging costs, provided to policyholders. ► Investment book yield on bonds purchased during the period excludes yield on short-term treasuries and cash and cash equivalents. The Predecessor considered this non-GAAP financial measure to be useful internally and to investors and analysts when assessing the level of returned on their income generating invested assets. FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 22

Non-GAAP Measures and Definitions—Continued Non-GAAP Measures (continued): ► Sales are not derived from any specific GAAP income statement accounts or line items and should not be viewed as a substitute for any financial measure determined in accordance with GAAP. For GAAP purposes annuity and IUL sales are recorded as deposit liabilities (i.e. contract holder funds). Management believes that presentation of sales as measured for management purposes enhances the understanding of our business and helps depict longer term trends that may not be apparent in the results of operations due to the timing of sales and revenue recognition. ► Common shareholders’ equity is based on Total Shareholders’ Equity excluding Equity Available to Preferred Shareholders. Management considers this to be a useful measure internally and to investors to assess the level of equity that is attributable common stock holders. ► Common shareholders’ equity excluding AOCI is based on Common Shareholders Equity excluding the effect of AOCI. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, Management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts assessing the level of earned equity on common equity. ► Adjusted operating return on common shareholders’ equity excluding AOCI is a non-GAAP financial measure. It is calculated by dividing AOI Available to Common Shareholders’ by total average Common Shareholders’ Equity Excluding AOCI. Average Common Shareholders’ Equity Excluding AOCI for the twelve months rolling, is the average of 5 points throughout the period and for the quarterly average Common Shareholders Equity is calculated using the beginning and ending Common Shareholders Equity, Excluding AOCI, for the period. For periods less than a full fiscal year, amounts disclosed in the table are annualized. As a result of the merger, the starting point for calculation of average Common Shareholders’ Equity was reset to December 1, 2017. The rolling average will be updated from the merger date forward to use available historical data points for the successor until 5 historical data points are available. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, Management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts assessing the level of adjusted earned return on common equity. ► Book value per common share including and excluding AOCI is calculated as Common Shareholders’ Equity and Common Shareholders Equity Excluding AOCI divided by the total number of shares of common stock outstanding. Management considers this to be a useful measure internally and for investors and analysts to assess the capital position of the Company. ► Total capitalization excluding AOCI is based on shareholders’ equity excluding the effect of AOCI. Since AOCI fluctuates from quarter to quarter due to unrealized changes in the fair value of available for sale investments, Management considers this non-GAAP financial measure to provide useful supplemental information internally and to investors and analysts to help assess the capital position of the Company. ► Debt-to-capital ratio is computed by dividing total debt by total capitalization excluding AOCI. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing its capital position. ► Rating agency adjusted debt to capitalization, excluding AOCI is computed by dividing the sum of total debt and 50% Equity Available to Preferred Shareholders by total capitalization excluding AOCI less a 50% credit for Equity Available to Preferred Shareholders. Management considers this non-GAAP financial measure to be useful internally and to investors and analysts when assessing its capital position. ► Equity available to preferred shareholders is equal to the product of (a) the number of preferred shares outstanding plus share dividends declared but not yet issued and (b) the original liquidation preference amount per share. Management considers this non-GAAP measure to provide useful information internally and to investors and analysts to assess the level of equity that is attributable to preferred stock holders. FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 23

Non-GAAP Measure Reconciliations Reconciliation from Net Income (Loss) to Adjusted Operating Income (AOI) One month Two months Three months Three months ended ended ended ended Nine months ended September 30, June 30, March 31, December 31, November 30, September 30, September 30, September 30, 2018 2018 2018 2017 2017 2017 2018 2017 Successor Successor Successor Successor Predecessor Predecessor Successor Predecessor (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Unaudited) (Dollars in millions, except per share data) Net income (loss) $ 56 $ 40 $ 65 $ (91) $ 28 $ 61 $ 161 $ 115 Adjustments to arrive at AOI: Effect of investment losses (gains), net of offsets (d) 38 37 39 — (6) (5) 114 14 Effect of changes in fair values of FIA related derivatives, net of hedging costs (a) (b) (30) (9) (63) (8) (10) 3 (102) (3) Effect of change in fair value of reinsurance related embedded derivative, net of offsets (a) (c) — — — — (1) 5 — 21 Effect of integration, merger related & other non-operating items 4 3 8 (8) 29 2 15 9 Effects of extinguishment of debt — (2) — — — — (2) — Tax effect of affiliated reinsurance embedded derivative — — 15 (20) — — 15 — Net impact of Tax Cuts and Jobs Act 3 — — 131 — — 3 — Tax impact of adjusting items (2) (4) 4 (1) (4) (1) (2) (11) AOI $ 69 $ 65 $ 68 $ 3 $ 36 $ 65 $ 202 $ 145 Dividends on preferred stock (7) (7) (7) (2) — — (21) — AOI available to common shareholders $ 62 $ 58 $ 61 $ 1 $ 36 $ 65 $ 181 $ 145 Per diluted common share: Net income (loss) available to common shareholders $ 0.23 $ 0.15 $ 0.27 $ (0.44) $ 0.47 $ 1.06 $ 0.65 $ 1.98 Adjustments to arrive at AOI: Effect of investment (gains) losses, net of offsets (d) 0.18 0.17 0.18 — (0.10) (0.09) 0.53 0.24 Effect of changes in fair values of FIA related derivatives, net of hedging costs (a) (b) (0.14) (0.04) (0.29) (0.04) (0.17) 0.05 (0.47) (0.06) Effect of change in fair value of reinsurance related embedded derivative, net of offsets (a) (c) — — — — (0.02) 0.09 — 0.37 Effect of integration, merger related & other non-operating items 0.02 0.01 0.04 (0.04) 0.50 0.02 0.07 0.14 Effects of extinguishment of debt — (0.01) — — — — (0.01) — Tax effect of affiliated reinsurance embedded derivative — — 0.07 (0.09) — — 0.07 — Net impact of Tax Cuts and Jobs Act 0.01 — — 0.61 — — 0.01 — Tax impact of adjusting items (0.01) (0.01) 0.01 — (0.06) (0.02) (0.01) (0.19) AOI available to common shareholders per diluted share $ 0.29 $ 0.27 $ 0.28 $ — $ 0.62 $ 1.11 $ 0.84 $ 2.48 (a) Amounts are net of offsets related to value of business acquired ("VOBA"), deferred acquisition cost ("DAC"), deferred sale inducement ("DSI"), and unearned revenue ("UREV") amortization, as applicable. (b) The updated definition of AOI removes the impact of fair value accounting on FIA products for periods after December 31, 2017. Included in the one-month period ended December 31, 2017 is the impact of the immaterial error resulting from the model code error, net of VOBA amortization, as disclosed within the Company's Form 10-Q. (c) Adjustment is not applicable subsequent to the Business Combination as the reinsurance agreement and related activity are eliminated via consolidation for U.S. GAAP reporting. (d)The Company recorded an immaterial out of period adjustment related to the December 1, 2017 fair value of the deferred income tax valuation allowance acquired from the Business Combination. See "Note 2. Significant Accounting Policies and Practices" of the Company’s Form 10-Q for additional information FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 24

Non-GAAP Measure Reconciliations Reconciliation of Book Value Per Common Share Excluding AOCI (Unaudited) (In millions, except per share data) September 30, 2018 December 31, 2017 (Unaudited) (Unaudited) Reconciliation to total shareholders' equity: Total shareholders' equity $ 1,474 $ 1,963 Less: AOCI (569) 75 Less: Preferred equity 398 377 Total common shareholders' equity excluding AOCI (1) $ 1,645 $ 1,511 Total common shares outstanding 214.4 214.4 Weighted average common shares outstanding - basic 214.4 214.4 Weighted average common shares outstanding - diluted 214.4 214.4 Book value per common share including AOCI (1) $ 5.02 $ 7.40 Book value per common share excluding AOCI(1) $ 7.67 $ 7.05 Rollforward of Assets Under Management (AAUM) (Unaudited) (In billions) AAUM AAUM as of September 30, 2017 $ 20.5 Purchase accounting mark-to-market valuation of investment portfolio 1.2 Inclusion of acquired Front Street Re and FGL Holdings 1.9 Net new business asset flows 1.7 Other items 0.1 AAUM as of September 30, 2018 $ 25.4 FGL Holdings Investor Materials (based on September 30, 2018 data, unless otherwise stated) January 7, 2019 25