Attached files

| file | filename |

|---|---|

| EX-99.1 - Emergent BioSolutions Inc. | exhibit99_1.htm |

| 8-K - Emergent BioSolutions Inc. | form8-k_jpm_1_7_19.htm |

EXHIBIT 99.2

37th Annual J.P. MorganHealthcare Conference January 8, 2019 Robert KramerPresident and COO Corporate

Update

Forward-Looking Statements / Non-GAAP Financial Measures / Trademarks Safe-Harbor StatementThis

presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, including, without limitation, our projected revenue and income

growth, future margins and other financial projections, and any other statements containing the words “will,” “believes,” “expects,” “anticipates,” “intends,” “plans,” “targets,” “forecasts,” “estimates” and similar expressions in conjunction

with, among other things, discussions of the Company's outlook, anticipated financial and operational performance or financial condition, financial and operation goals, strategic goals, perceived growth drivers and strategy, forecasted domestic

and international product demand, product sales, government development or procurement contract awards and renewals, government appropriations, manufacturing capacity expansion, the timing of clinical trials, product development and delivery

timelines, dual market capabilities and Emergency Use Authorization (EUA) and the timing of other regulatory approvals or expenditures are forward-looking statements. These forward-looking statements are based on our current intentions, beliefs

and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual

results could differ materially from our expectations. Investors are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statement speaks only as of the date of this presentation, and, except

as required by law, we do not undertake to update any forward-looking statement to reflect new information, events or circumstances.There are a number of important factors that could cause the Company's actual results to differ materially from

those indicated by such forward-looking statements, including the availability of funding and the exercise of options under our BioThrax and NuThrax contracts; appropriations for the procurement of our products; our ability to secure EUA

pre-authorization approval and licensure of NuThrax from the U.S. Food and Drug Administration within the anticipated timeframe, if at all; availability of funding for our U.S. government grants and contracts; our ability to successfully

integrate and develop the operations, products, product candidates, programs, and personnel from our recently completed acquisitions of PaxVax and Adapt; our ability and the ability of our collaborators to protect our intellectual property

rights; our ability to establish multi-year follow on contracts for ACAM2000® and raxibacumab; whether anticipated synergies and benefits from an acquisition or in-license will be realized within expected time periods, if at all; our ability to

utilize our manufacturing facilities and expand our capabilities; our ability to accurately forecast demand for our products and our suppliers to maintain an adequate supply of the materials needed to produce them; our ability and the ability of

our contractors and suppliers to maintain compliance with Current Good Manufacturing Practices and other regulatory obligations; the timing and results of clinical trials; the timing of and our ability to obtain and maintain regulatory approvals

for our product candidates; and our commercialization, marketing and manufacturing capabilities and strategy. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any

forward-looking statement. Investors should consider this cautionary statement, as well as the risk factors identified in our periodic reports filed with the Securities and Exchange Commission, when evaluating our forward-looking statements.

Non-GAAP Financial Measures This presentation contains three financial measures (Adjusted Net Income, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) and Adjusted EBTIDA) that are considered “non-GAAP” financial measures

under applicable Securities and Exchange Commission rules and regulations. These non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted

accounting principles. The Company’s definition of these non-GAAP measures may differ from similarly titled measures used by others. Adjusted Net Income adjusts for specified items that can be highly variable or difficult to predict, or reflect

the non-cash impact of charges resulting from purchase accounting. EBITDA reflects net income excluding the impact of depreciation, amortization, interest expense and provision for income taxes. Adjusted EBITDA also excludes specified items that

can be highly variable and the non-cash impact of certain purchase accounting adjustments (which are tax effected utilizing the statutory tax rate for the US). The Company views these non-GAAP financial measures as a means to facilitate

management’s financial and operational decision-making, including evaluation of the Company’s historical operating results and comparison to competitors’ operating results. These non-GAAP financial measures reflect an additional way of viewing

aspects of the Company’s operations that, when viewed with GAAP results and the reconciliations to the corresponding GAAP financial measure, may provide a more complete understanding of factors and trends affecting the Company’s business. The

determination of the amounts that are excluded from these non-GAAP financial measures are a matter of management judgment and depend upon, among other factors, the nature of the underlying expense or income amounts. Because non-GAAP financial

measures exclude the effect of items that will increase or decrease the Company’s reported results of operations, management strongly encourages investors to review the Company’s consolidated financial statements and publicly filed reports in

their entirety.TrademarksBioThrax® (Anthrax Vaccine Adsorbed), RSDL® (Reactive Skin Decontamination Lotion Kit), BAT® [Botulism Antitoxin Heptavalent (A,B,C,D,E,F,G)-(Equine)], Anthrasil® (Anthrax Immune Globulin Intravenous [human]), NuThrax™

(anthrax vaccine adsorbed with CPG 7909 adjuvant), VIGIV [Vaccinia Immune Globulin Intravenous (Human)], Trobigard™ (atropine sulfate, obidoxime chloride), ACAM2000®, (Smallpox (Vaccinia) Vaccine, Live), raxibacumab (Anthrax Monoclonal), Vivotif®

(Typhoid Vaccine Live Oral Ty21a), Vaxchora® (Cholera Vaccine, Live, Oral), NARCAN® (naloxone HCI) Nasal Spray and any and all Emergent BioSolutions Inc. brands, products, services and feature names, logos and slogans are trademarks or registered

trademarks of Emergent BioSolutions Inc. or its subsidiaries in the United States or other countries. All other brands, products, services and feature names or trademarks are the property of their respective owners.

As a global life sciences company, Emergent is focused on providing specialty products for civilian and

military populations that address accidental, deliberate and naturally occurring public health threats Who We Are Our mission is simple – To Protect and Enhance Life

MultipleCDMO Services 19Global

Locations >15PipelineProducts 11MarketedProducts 4PlatformTechnologies

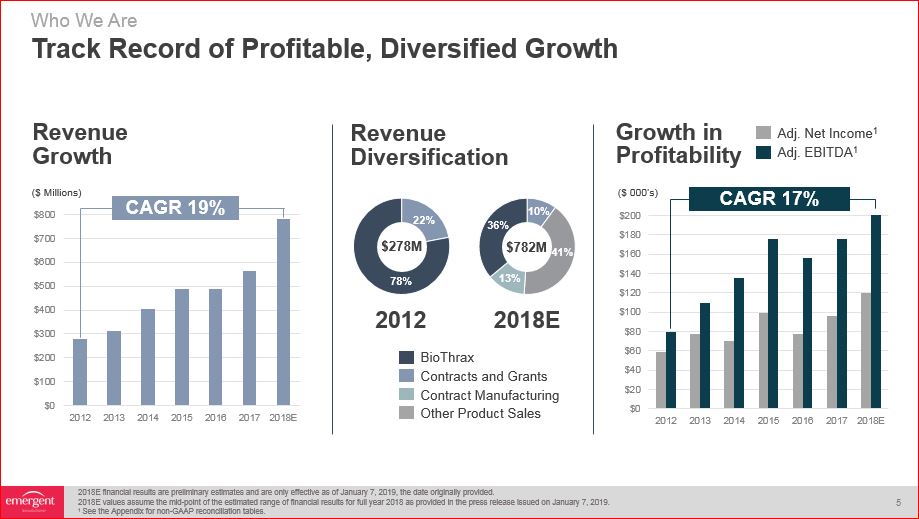

Track Record of Profitable, Diversified Growth Revenue Diversification 2012 2018E Other

Product Sales Contract Manufacturing Contracts and Grants 78% 22% Growth in Profitability $278M ($ 000’s) ($ Millions) Revenue Growth Who We Are Adj. Net Income1 Adj. EBITDA1 $782M 41% 10% 13% 2018E financial results are

preliminary estimates and are only effective as of January 7, 2019, the date originally provided.2018E values assume the mid-point of the estimated range of financial results for full year 2018 as provided in the press release issued on January

7, 2019.1 See the Appendix for non-GAAP reconciliation tables. CAGR 17% CAGR 19% 36% BioThrax

A Diverse and Growing Global Threat Landscape Global Public Health

Threats1 CBRNE EID Travelers’Diseases Opioids Public CHEMICAL:Nerve agents, cyanide, chlorine, toxic industrial chemicalsBIOLOGICAL:Anthrax, smallpox, botulism, Ebola, other category A threats RADIOLOGICAL/NUCLEAR:Nuclear, radiological

agentsEXPLOSIVE:Trauma, burn, wound care EMERGING INFECTIOUS DISEASES:AdenovirusBurkholderiaChikungunyaDengueGram-negative organisms LassaMarburgMERSMulti-drug resistant pathogensNipahPandemic influenza SARSZika TRAVELERS’

DISEASES:CholeraETECHepatitis A/Hepatitis BJapanese encephalitisMalariaPolioRabiesShigellaTyphoidYellow fever OPIOIDS:Addiction treatmentOverdose response Health Threats 1 Includes public health threats that represent future opportunities for

Emergent

Business Unit Structure Drives Strategy Execution Focused leadership teamsTailored strategies and

plansRevenue-generating products/servicesUnique development programsDistinctive core competenciesStreamlined operations Our Business Vaccines & Anti-Infectives Antibody Therapeutics Devices CDMO

BioThrax® (Anthrax Vaccine Adsorbed) Anthrasil® [Anthrax Immune Globulin Intravenous

(human)] Raxibacumab injectionA fully human monoclonal antibody Product Portfolio | Vaccines, Antibody Therapeutics, Drug-Device Combinations Our Business VIGIV CNJ-016 ® [Vaccinia Immune Globulin Intravenous (Human)] (VIGIV) ACAM2000®

(Smallpox (Vaccinia) Vaccine, Live) Smallpox BAT ® [Botulism Antitoxin Heptavalent (A, B, C, D, E, F, G) - (Equine)] Botulism RSDL® (Reactive Skin Decontamination Lotion Kit) Trobigard Atropine sulfate, obidoxime

chlorideauto-injector1 Nerve & Chemical Agents TM Vivotif ®(Typhoid Vaccine Live Oral Ty21a) Vaxchora®(Cholera Vaccine, Live, Oral) NARCAN® (naloxone HCl) Nasal Spray Travelers’ Diseases Opioid Overdose 11 Products 1 Trobigard is

not currently approved or cleared by the United States (U.S.) Food and Drug Administration (FDA) or any similar regulatory body, and is only distributed to authorized government buyers for use outside the U.S. This product is not distributed in

the U.S. Anthrax

Our Business Development Pipeline | Vaccines, Anti-Infectives, Antibody Therapeutics Development

Candidate Threat Partner Priority Review Voucher1 Pre Clinical Clinical Phase I II III NuThrax™ AV7909(anthrax vaccine adsorbed with CPG 7909 adjuvant) CBRNE HHS - BARDA - 20192 FLU-IGIV(Seasonal Influenza A

therapeutic) EID - - 20202 Chikungunya(Chikungunya VLP vaccine) EID - 20202 Adenovirus 4/7(Live, attenuated vaccine) EID DoD - DTRA - ZIKV-IG**(Zika Virus therapeutic) EID - UNI-FLU (Universal

influenza vaccine) EID - EBX-205(Broad-spectrum antibiotic) EID - GC-072 (EV-035 Series)(Burkholderia antibiotic) CBRNE DoD - DTRA FILOV(Pan-Ebola and Sudan Virus

therapeutic) CBRNE - EBI-001(Pan-respiratory iminosugar antiviral) EID - rVSV-VHF(Vector vaccine for viral hemorrhagic fevers) EID CEPI 1 Priority Review Program authorizes the FDA to

award a voucher for priority review to the sponsor/manufacturer of a newly approved drug or biologic targeting a neglected tropical disease or rare pediatric disease.2 Target for First Subject Enrollment.

Development Pipeline | Drug-Device Combinations Our Business Development

Candidate Threat Partner Priority Review Voucher1 Formative Studies RegistrationTrials Regulatory Application D4(2PAM/Atropine) CBRNE DoD - MCS - SIAN(Stabilized Isoamyl Nitrite) CBRNE HHS - BARDA/SwRI - Development

Candidates from Adapt Pharma Acquisition(Drug and Drug-Device Combinations) Opioid Overdose - - Multiple constructs in various stages of development focused on new treatments and delivery options for opioid overdose

response 1 Priority Review Program authorizes the FDA to award a voucher for priority review to the sponsor/manufacturer of a newly approved drug or biologic targeting a neglected tropical disease or rare pediatric

disease.

Robust and Growing CDMO Service Business Experienced Service Provider Producing or supporting

manufacture of >30 commercial productsContributed to development, production of >200 clinical products Inspected by: Our Business Lansing, MI Hattiesburg, MS Baltimore, MD (Bayview) - CIADM Baltimore, MD (Camden) Rockville,

MD Canton, MA Winnipeg, Canada Bern, Switzerland Clinical and commercial scaleProcess developmentAnalytical and laboratory servicescGMP bulk drug substancecGMP final drug productFill/finish + label/pack + distributionBacterial + viral +

mammalian Sporeformer/Non-sporeformer change-over BSL3 containmentStainless steel + single-useRegulatory + quality Marketed Services Government-Selected Solutions Provider: CIADM One of three Centers for Innovation in Advanced Development and

Manufacturing (CIADM) in the U.S.Public-private partnership with BARDASurge-capacity ready, infrastructure for biologics-based MCMsFlexible manufacturing addresses biological threats, EIDs U.S. Food and Drug Administration (FDA)Health Canada

European Medicines Agency (EMA)Medicines and Healthcare Products Regulatory Agency U.K. (MHRA)Federal Ministry of Health Germany (BMGS)National Health Surveillance Agency Brazil (ANVISA)Pharmaceuticals and Medical Devices Agency (PMDA)Gulf

Cooperation Council (GCC)

2018 Performance Financial Profile 1 2018 preliminary unaudited financial results shown in this

presentation are only effective as of January 7, 2018, the date it was originally provided. Please see the appendix for non-GAAP reconciliation tables.2 See the Appendix for non-GAAP reconciliation tables.3 Assumes the midpoint of the forecasted

range for each of the relevant inputs supporting this calculation. Preliminary Unaudited Financial Results1 Total Revenue Pre-Tax Income GAAP Net Income Adjusted Net

Income2Margin3 EBITDA2 $152M-$156M $117M-$121M15% $60M-$64M $79M-$83M $779M-$784M Selected Operational Accomplishments Completed two revenue-generating acquisitionsSubmitted EUA filing for NuThrax™Increased pipeline to at least 4

product candidates in advanced developmentSecured licensure of BioThrax® in 6 additional countriesSecured financing of up to $1.1B to support current and future M&A Adjusted EBITDA2Margin3 $198M-$202M26%

2019 Financial and Operational Goals Financial Profile Full Year Financial Goals1 Total

Revenue Adjusted Net Income2Margin3 $150M-$180M15% $1,060M-$1,140M Operational Goals Secure EUA approval for NuThrax™ and complete deliveries under existing BARDA contractSecure new multi-year ACAM2000® and raxibacumab procurement

contracts to enable continuous deliveries to Strategic National StockpileContinue programs to support awareness, availability and affordability of NARCAN® Nasal Spray 4 mgProgress 3 products into phase 3 or beyond Adjusted

EBITDA2Margin3 $280M-$310M27% 1 The financial forecast for 2019 shown in this presentation is only effective as of January 7, 2018, the date it was originally provided. Please see the appendix for non-GAAP reconciliation tables.2 See the

Appendix for non-GAAP reconciliation tables.3 Assumes the midpoint of the forecasted range for each of the relevant inputs supporting this calculation.

Growth Drivers | Organic Business Future Plans Platform technologiesInternational marketsDual-market

productsPriority Review Vouchers New Contracts and Grants funding (USG, NGO)Novel regulatory pathways (EUA, fast track and breakthrough)Expanded manufacturing technology and service offerings Near-Term Drivers Long-Term

Drivers BioThrax®/NuThrax™ transition, ACAM2000® domestic and international demand, travelers’ vaccines expanded demand, USG contract renewals, new contracts and grants funding Vaccines & Anti-Infectives Antibody

Therapeutics Raxibacumab deliveries, Anthrasil®, BAT® and VIG expanded demand, USG contract renewals, FLU-IGIV and ZIKV-IG progress, new contracts and grants funding Devices NARCAN® Nasal Spray sales, RSDL® domestic and international demand,

auto-injector platform expansion, new contracts and grants funding CDMO Capacity expansion, capability build, leverage vertically integrated supply chain

Adapt PharmaFirst and only FDA approved nasal (non-needle) form of naloxone for opioid overdose

(drug/device combination), development pipeline Growth Drivers | Mergers & Acquisitions Future Plans Revenue-generating/accretive opportunitiesDual-market productsCommercial products that leverage core capabilitiesR&D investing

leveraging internal fundsExternal funds from governments, NGOs and other partners Key M&A Considerations Recent M&A Success | 2018Company 2018Company PaxVaxMultiple revenue-generating products; travelers’ commercial sales

infrastructure, commercial sales, manufacturing sites 2017Product RaxibacumabAnthrax monoclonal antibody 2017Business/Product ACAM2000® Vaccine BusinessSmallpox vaccine business, manufacturing sites 2015Platform Auto-Injector

PlatformMilitary-grade auto-injector platform 2015Product IminosugarSeries of small molecules 2014Product EV-035Family of broad-spectrum antimicrobials 2014Company Cangene CorporationMultiple revenue-generating products; manufacturing and

fill/finish sites Companies, Divisions, and Individual Products 2013Division/Product HPPDRSDL drug-device combination for neutralization or decontamination of chemical warfare agents on skin

Key Takeaways Expand leadership position in select public health marketsLeverage broadened product

portfolio and extend into new and adjacent marketsCapture dual-market and commercial product opportunitiesFurther develop pipelineComplement organic growth with acquisitionsDrive material top- and bottom-line growth in 2019Revenue > $1

billion, an increase of over 40% versus 2018Adjusted Net Income growth ~ 40%Leverage strong organizational culture and focused operational execution to continue to drive shareholder value Fortune 500 global life sciences company recognized for

protecting and enhancing life, driving innovation and living our values Vision for the Future We will continue to

37th Annual J.P. MorganHealthcare Conference January 8, 2019 Robert KramerPresident and COO APPENDIX

Glossary of Terms Appendix Term Definition ANVISA National Health Surveillance Agency Brazil

BARDA Biomedical Advanced Research and Development Authority BMGS Federal Ministry of Health Germany BSL3 A biosafety level of biocontainment precautions required to isolate dangerous agents in an enclosed laboratory

facility CAGR Compound annual growth rate CBRNE Chemical, Biological, Radiological, Nuclear, and Explosives CDC Centers for Disease Control and Prevention CDMO Contract development and manufacturing organization CEPI Coalition for

Epidemic Preparedness Innovations cGMP Certified Good Manufacturing Practices DHS U.S. Department of Homeland Security DoD U.S. Department of Defense DOS U.S. Department of State DTRA U.S. Defense Threat Reduction

Agency EBITDA Earnings before interest, tax, depreciation and amortization EID Emerging Infectious Disease

Glossary of Terms Appendix Term Definition EMA European Medicines Agency EUA Emergency Use

Authorization FDA U.S. Food and Drug Administration GAAP U.S. Generally Accepted Accounting Principles HHS U.S. Department of Health and Human Services M&A Mergers and acquisitions MCS Medical Countermeasure Systems MCMs Medical

countermeasures MHRA Medicines and Healthcare Products Regulatory Agency U.K. NGOs Non-governmental organizations PMDA Pharmaceuticals and Medical Devices Agency SwRI Southwest Research Institute USG United States Government

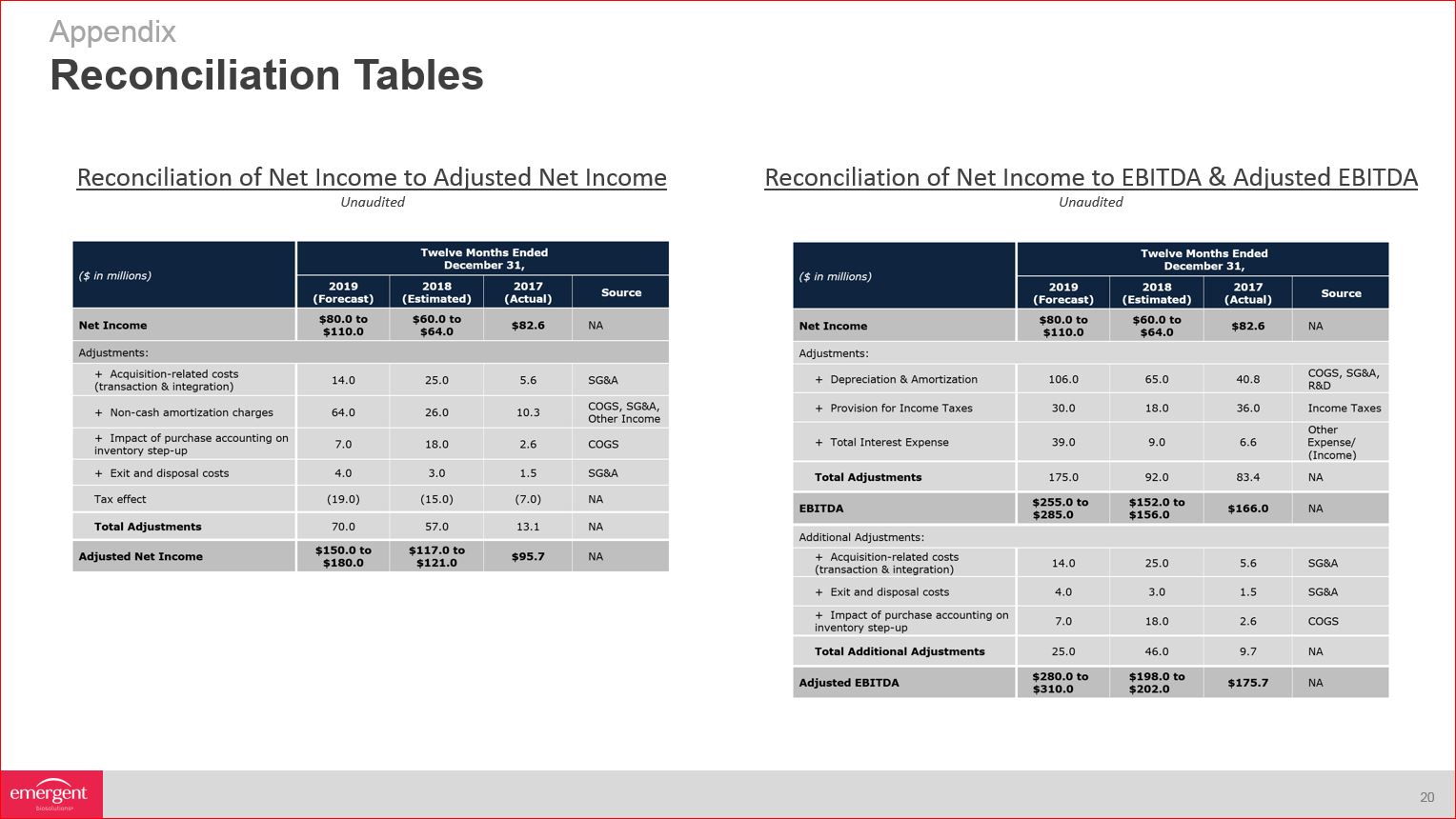

Reconciliation Tables Appendix Reconciliation of Net Income to Adjusted Net Income Reconciliation of Net

Income to EBITDA & Adjusted EBITDA Unaudited Unaudited