Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ARENA PHARMACEUTICALS INC | arna-8k_20190107.htm |

Corporate Presentation Nasdaq: ARNA January 2019 Exhibit 99.1

This presentation includes forward-looking statements that involve a number of risks and uncertainties, including statements about the Arena investment thesis, catalysts, value, our investigative stage drug candidates, including with respect to their potential (including to become first or best-in-class), safety, efficacy, indications, significance of data, development plans, differentiation, the market and unmet needs and commercialization, expected data readouts and initiation and progress of new clinical trials; our focus, goals, strategy, plans, timelines and guidance; our partnered programs; financial and other guidance; and other statements that are not historical facts, including statements that may include words such as “may,” “will,” “intend,” “plan,” “expect,” “potential,” “opportunity” or other similar words. For such statements, we claim the protection of the Private Securities Litigation Reform Act of 1995. Actual events or results may differ materially from expectations, and you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the time they were made. Factors that could cause actual results to differ materially from such statements include, without limitation: we expect to need additional funds to advance all of our programs, and you and others may not agree with the manner in which we allocate our resources; topline data may not accurately reflect the complete results of a particular study or trial; results of clinical trials and other studies are subject to different interpretations and may not be predictive of future results; clinical and nonclinical data is voluminous and detailed, and regulatory agencies may interpret or weigh the importance of data differently and reach different conclusions than Arena or others, request additional information, have additional recommendations or change their guidance or requirements; the timing and outcome of research, development and regulatory review and feedback is uncertain; unexpected or unfavorable new data; our drug candidates may not advance in development or be approved for marketing; clinical trials and other studies may not proceed at the time or in the manner expected or at all; enrolling patients in our ongoing and intended clinical trials is competitive and challenging; data and information related to our programs may not meet regulatory requirements or otherwise be sufficient for further development, regulatory review, partnering or approval at all or on our projected timeline; other risks related to developing, seeking regulatory approval of and commercializing drugs, including regulatory, manufacturing, supply and marketing issues and drug availability; Arena's and third parties' intellectual property rights; competition; reimbursement and pricing decisions; risks related to relying on partners and other third parties; and satisfactory resolution of litigation or other disagreements. Additional factors that could cause actual results to differ materially from those stated or implied by our forward-looking statements are disclosed in our Securities and Exchange Commission (SEC) filings, including under the heading “Risk Factors.” We disclaim any intent or obligation to update these forward-looking statements, other than as may be required under applicable law. Forward Looking Statements

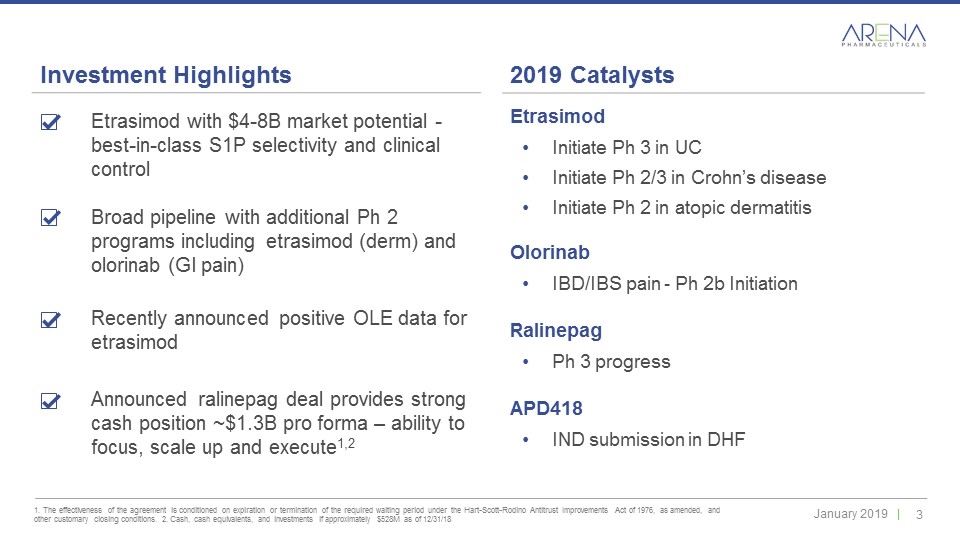

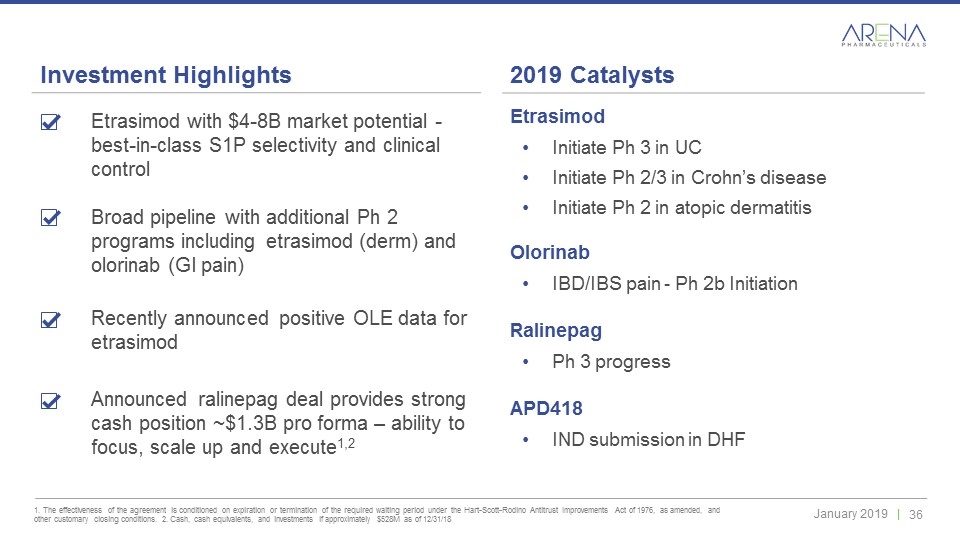

Etrasimod with $4-8B market potential - best-in-class S1P selectivity and clinical control Broad pipeline with additional Ph 2 programs including etrasimod (derm) and olorinab (GI pain) Recently announced positive OLE data for etrasimod Announced ralinepag deal provides strong cash position ~$1.3B pro forma – ability to focus, scale up and execute1,2 Investment Highlights 1. The effectiveness of the agreement is conditioned on expiration or termination of the required waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and other customary closing conditions. 2. Cash, cash equivalents, and investments if approximately $528M as of 12/31/18 2019 Catalysts Etrasimod Initiate Ph 3 in UC Initiate Ph 2/3 in Crohn’s disease Initiate Ph 2 in atopic dermatitis Olorinab IBD/IBS pain - Ph 2b Initiation Ralinepag Ph 3 progress APD418 IND submission in DHF

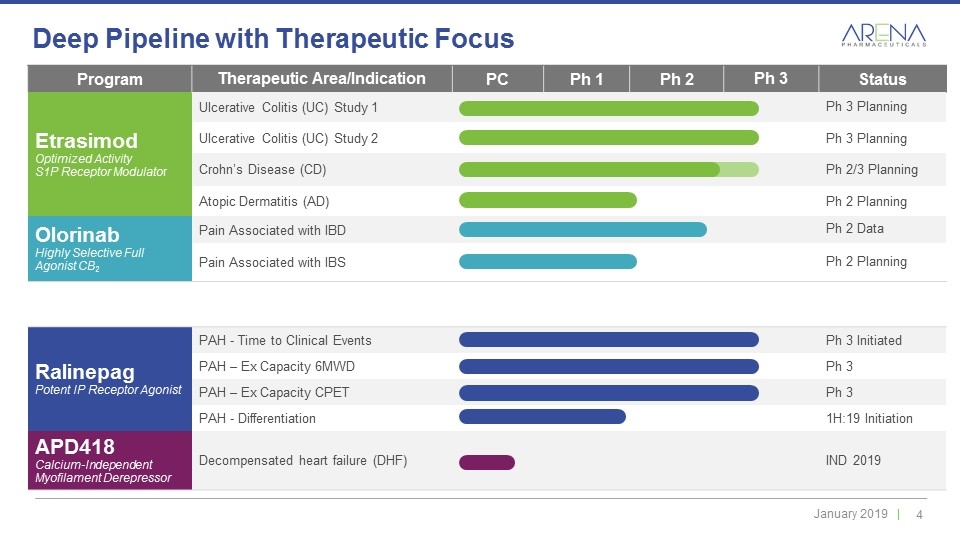

Ralinepag Potent IP Receptor Agonist PAH - Time to Clinical Events Ph 3 Initiated PAH – Ex Capacity 6MWD Ph 3 PAH – Ex Capacity CPET Ph 3 PAH - Differentiation 1H:19 Initiation APD418 Calcium-Independent Myofilament Derepressor Decompensated heart failure (DHF) IND 2019 Deep Pipeline with Therapeutic Focus Program Therapeutic Area/Indication PC Ph 1 Ph 2 Ph 3 Status Etrasimod Optimized Activity S1P Receptor Modulator Ulcerative Colitis (UC) Study 1 Ph 3 Planning Ulcerative Colitis (UC) Study 2 Ph 3 Planning Crohn’s Disease (CD) Ph 2/3 Planning Atopic Dermatitis (AD) Ph 2 Planning Olorinab Highly Selective Full Agonist CB2 Pain Associated with IBD Ph 2 Data Pain Associated with IBS Ph 2 Planning

Oral, Next Generation, S1P Receptor Modulator with Optimized Activity Being Evaluated for Multiple Immune and Inflammatory-Mediated Etrasimod

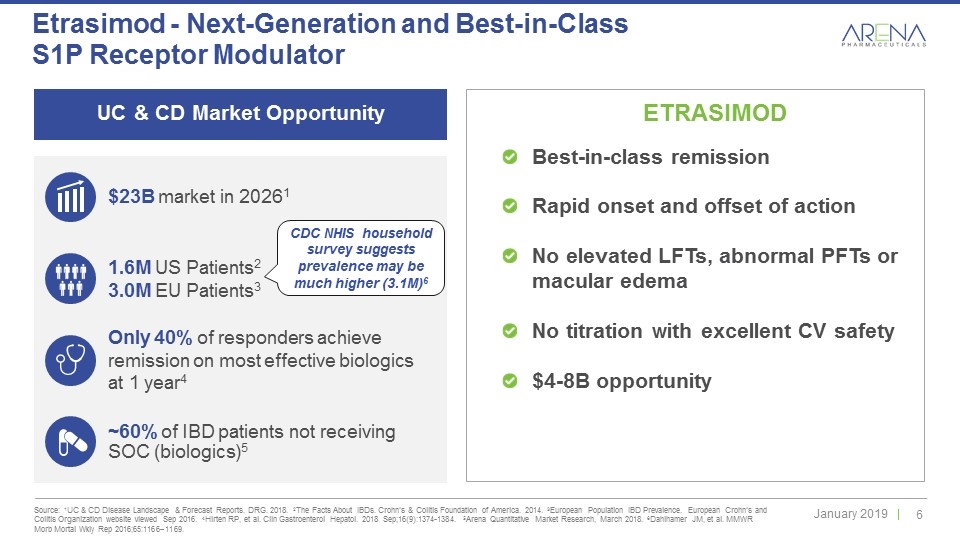

Source: 1UC & CD Disease Landscape & Forecast Reports. DRG. 2018. 2The Facts About IBDs. Crohn’s & Colitis Foundation of America. 2014. 3European Population IBD Prevalence. European Crohn’s and Colitis Organization website viewed Sep 2016. 4Hirten RP, et al. Clin Gastroenterol Hepatol. 2018 Sep;16(9):1374-1384. 5Arena Quantitative Market Research, March 2018. 6Dahlhamer JM, et al. MMWR Morb Mortal Wkly Rep 2016;65:1166–1169. Etrasimod - Next-Generation and Best-in-Class S1P Receptor Modulator ETRASIMOD Best-in-class remission Rapid onset and offset of action No elevated LFTs, abnormal PFTs or macular edema No titration with excellent CV safety $4-8B opportunity Only 40% of responders achieve remission on most effective biologics at 1 year4 ~60% of IBD patients not receiving SOC (biologics)5 $23B market in 20261 1.6M US Patients2 3.0M EU Patients3 CDC NHIS household survey suggests prevalence may be much higher (3.1M)6 UC & CD Market Opportunity

Well characterized, developed in-house Higher selectivity drives efficacy and safety Improved PD – rapid on-rate + rapid off-rate with true 36 hour half-life UC data supportive of category leading efficacy with good safety / tolerability Moving to Ph 3 in UC and Ph 2/3 in Crohn’s disease Moving aggressively in Ph 2 in AD Ph 3 IBD (UC & CD) - potential $3-4B opportunity Ph 2 new indications - potential $1.5-4B opportunity Etrasimod Progressing Rapidly with Best-in-Class Profile

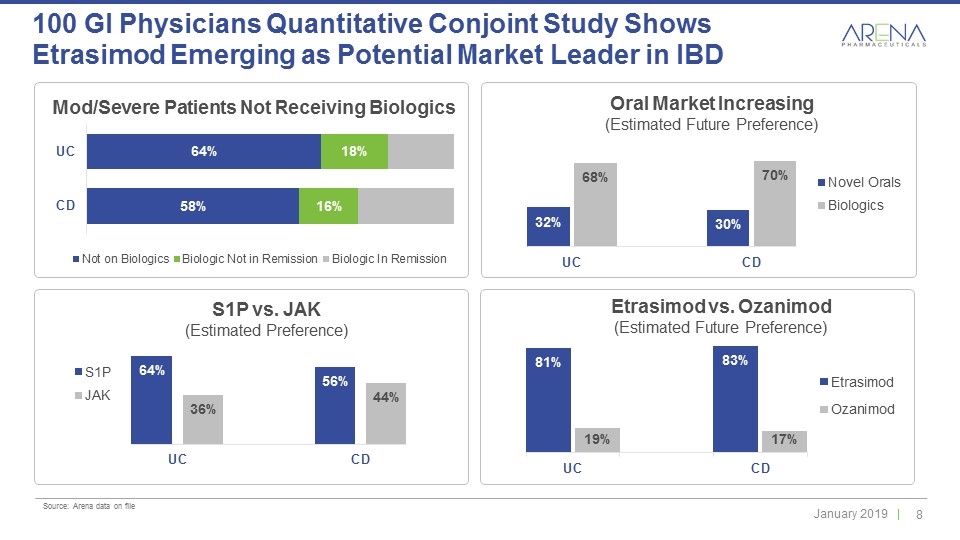

Source: Arena data on file 100 GI Physicians Quantitative Conjoint Study Shows Etrasimod Emerging as Potential Market Leader in IBD Mod/Severe Patients Not Receiving Biologics Etrasimod vs. Ozanimod (Estimated Future Preference) Oral Market Increasing (Estimated Future Preference) S1P vs. JAK (Estimated Preference)

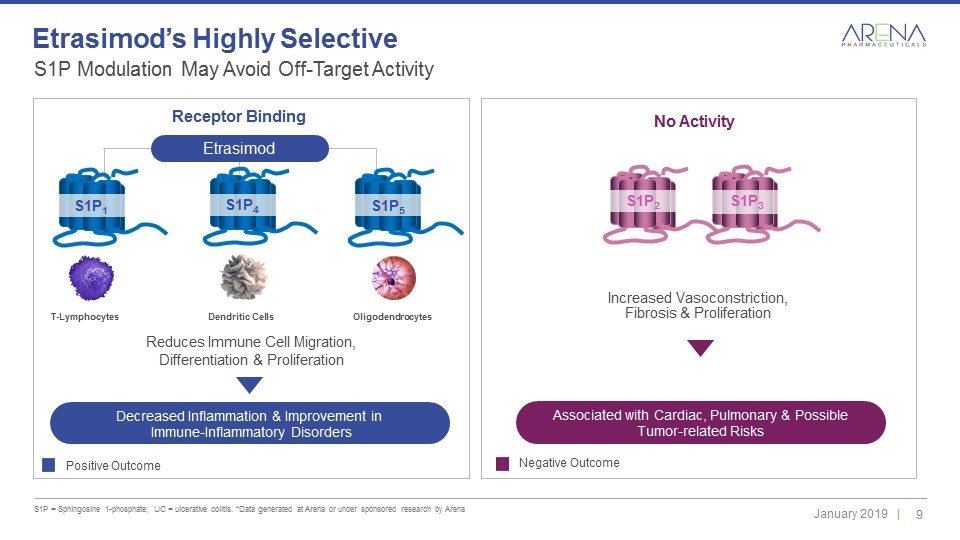

S1P Modulation May Avoid Off-Target Activity S1P = Sphingosine 1-phosphate; UC = ulcerative colitis. *Data generated at Arena or under sponsored research by Arena Etrasimod’s Highly Selective Etrasimod Decreased Inflammation & Improvement in Immune-Inflammatory Disorders Positive Outcome Negative Outcome Reduces Immune Cell Migration, Differentiation & Proliferation Increased Vasoconstriction, Fibrosis & Proliferation No Activity Receptor Binding Dendritic Cells T-Lymphocytes Oligodendrocytes S1P1 S1P4 S1P5 S1P2 S1P3 Associated with Cardiac, Pulmonary & Possible Tumor-related Risks

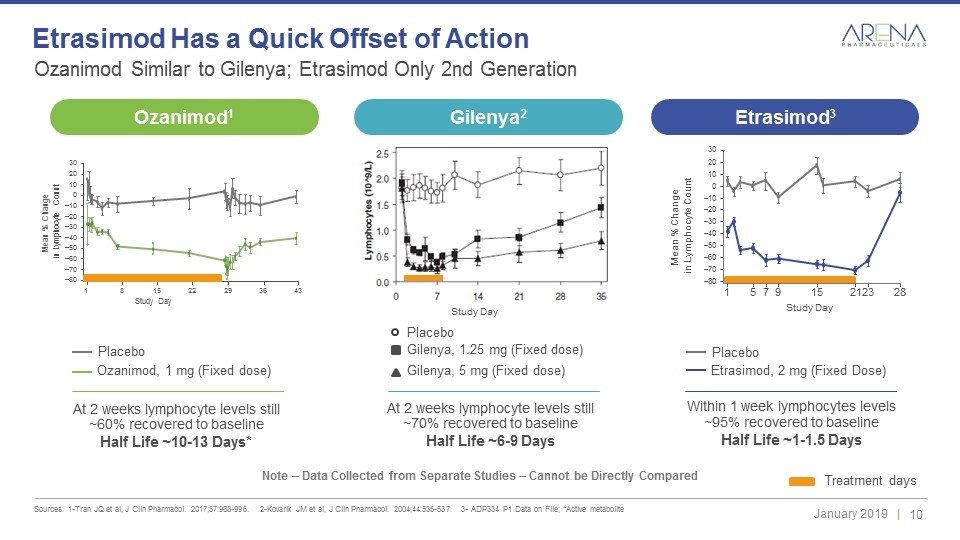

Ozanimod Similar to Gilenya; Etrasimod Only 2nd Generation Sources: 1-Tran JQ et al, J Clin Pharmacol. 2017;57:988-996. 2-Kovarik JM et al, J Clin Pharmacol. 2004;44:535-537. 3- ADP334 P1 Data on File; *Active metabolite Etrasimod Has a Quick Offset of Action Note – Data Collected from Separate Studies – Cannot be Directly Compared Ozanimod, 1 mg (Fixed dose) Placebo Etrasimod, 2 mg (Fixed Dose) Placebo Within 1 week lymphocytes levels ~95% recovered to baseline Half Life ~1-1.5 Days At 2 weeks lymphocyte levels still ~60% recovered to baseline Half Life ~10-13 Days* Treatment days Study Day 30 Mean % Change in Lymphocyte Count 20 10 0 –10 –20 –30 –40 –50 –60 –70 –80 1 5 7 9 15 21 23 28 At 2 weeks lymphocyte levels still ~70% recovered to baseline Half Life ~6-9 Days Study Day Gilenya, 1.25 mg (Fixed dose) Gilenya, 5 mg (Fixed dose) Placebo Study Day 30 20 10 0 –10 –20 –30 –40 –50 –60 –70 –80 1 8 15 22 29 36 43 Mean % Change in Lymphocyte Count Ozanimod1 Gilenya2 Etrasimod3

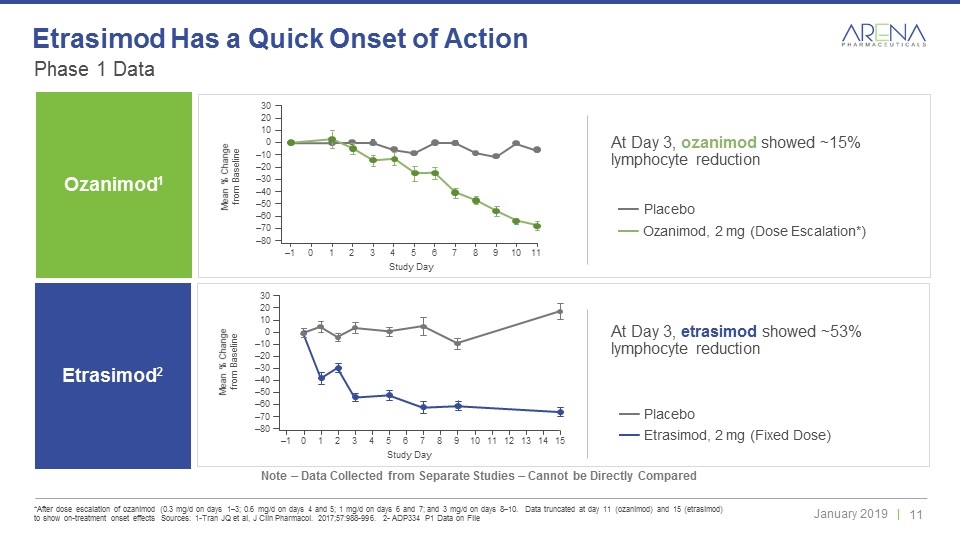

Phase 1 Data *After dose escalation of ozanimod (0.3 mg/d on days 1–3; 0.6 mg/d on days 4 and 5; 1 mg/d on days 6 and 7; and 3 mg/d on days 8–10. Data truncated at day 11 (ozanimod) and 15 (etrasimod) to show on-treatment onset effects Sources: 1-Tran JQ et al, J Clin Pharmacol. 2017;57:988-996. 2- ADP334 P1 Data on File Etrasimod Has a Quick Onset of Action Note – Data Collected from Separate Studies – Cannot be Directly Compared Ozanimod1 Ozanimod, 2 mg (Dose Escalation*) Placebo Mean % Change from Baseline 30 20 10 0 –10 –20 –30 –40 –50 –60 –70 –80 –1 0 1 2 3 4 5 6 7 8 9 10 11 Study Day Study Day 30 20 10 0 –10 –20 –30 –40 –50 –60 –70 –80 –1 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Mean % Change from Baseline Etrasimod, 2 mg (Fixed Dose) Placebo At Day 3, etrasimod showed ~53% lymphocyte reduction At Day 3, ozanimod showed ~15% lymphocyte reduction Etrasimod2

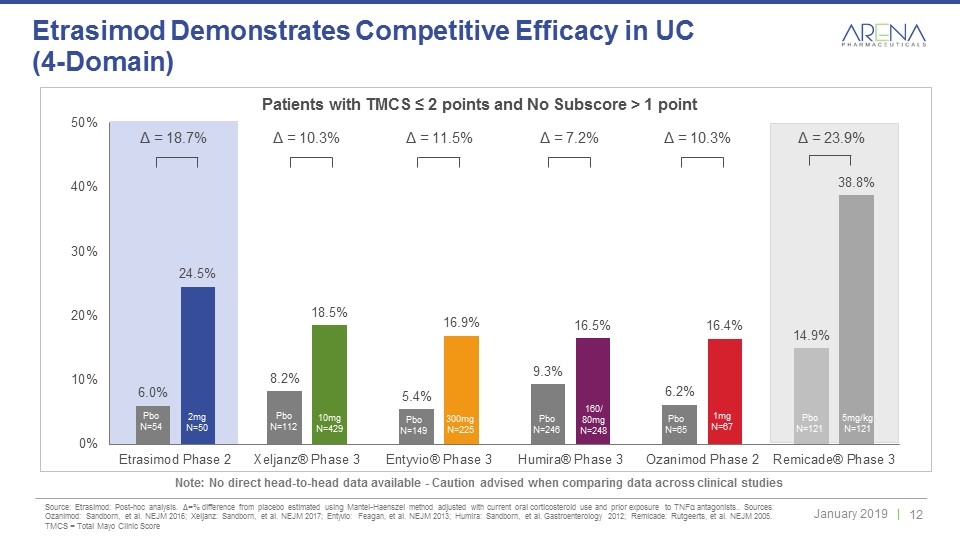

Source: Etrasimod: Post-hoc analysis. Δ=% difference from placebo estimated using Mantel-Haenszel method adjusted with current oral corticosteroid use and prior exposure to TNFα antagonists.. Sources: Ozanimod: Sandborn, et al. NEJM 2016; Xeljanz: Sandborn, et al. NEJM 2017; Entyvio: Feagan, et al. NEJM 2013; Humira: Sandborn, et al. Gastroenterology 2012; Remicade: Rutgeerts, et al. NEJM 2005. TMCS = Total Mayo Clinic Score Etrasimod Demonstrates Competitive Efficacy in UC (4-Domain) Note: No direct head-to-head data available - Caution advised when comparing data across clinical studies Pbo N=121 Pbo N=65 1mg N=67 Pbo N=112 10mg N=429 Pbo N=149 300mg N=225 5mg/kg N=121 Pbo N=246 160/ 80mg N=248 Δ = 10.3% Δ = 10.3% Δ = 11.5% Δ = 7.2% Δ = 23.9% Pbo N=54 2mg N=50 Δ = 18.7% Patients with TMCS ≤ 2 points and No Subscore > 1 point

Etrasimod was generally safe and well tolerated Adverse events were predominantly mild to moderate No serious adverse events (SAEs) at the 2 mg dose Impact on HR and AV conduction was low throughout the study with no discontinuations related to bradycardia or AV block. No SAEs related to HR changes or AV block No cases of sinoatrial arrest No increases in liver function tests compared to placebo No reports of macular edema No reports of abnormal pulmonary function tests Phase 2 Safety Profile

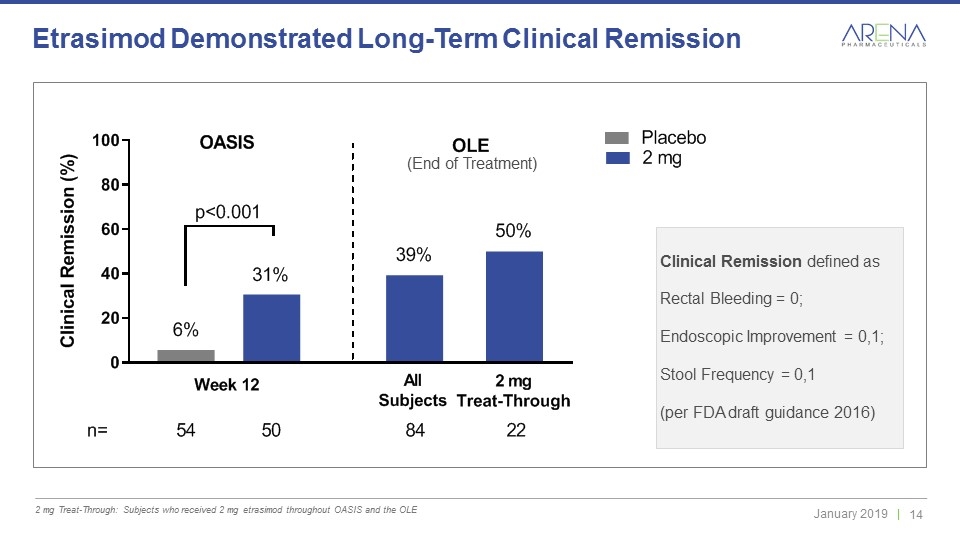

Etrasimod Demonstrated Long-Term Clinical Remission 2 mg Treat-Through: Subjects who received 2 mg etrasimod throughout OASIS and the OLE Clinical Remission defined as Rectal Bleeding = 0; Endoscopic Improvement = 0,1; Stool Frequency = 0,1 (per FDA draft guidance 2016) (End of Treatment)

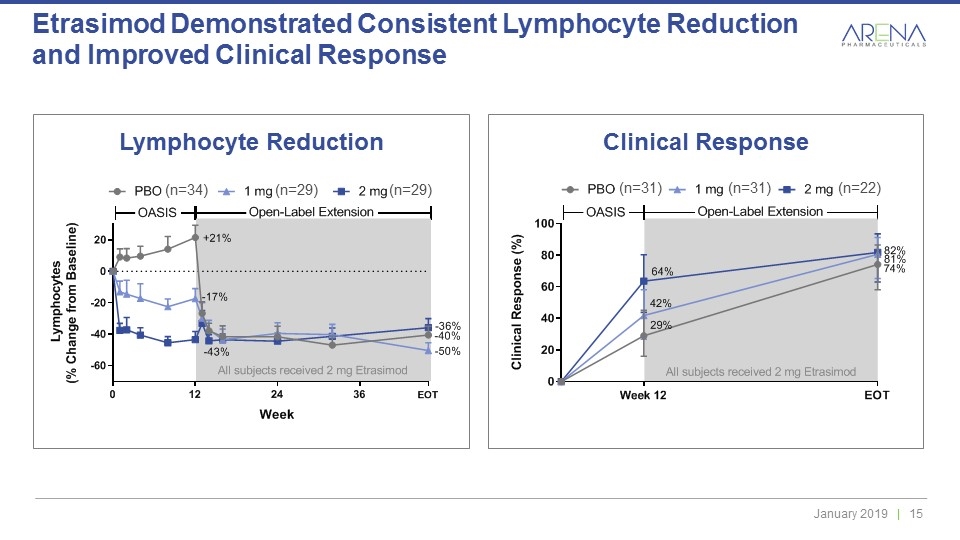

Etrasimod Demonstrated Consistent Lymphocyte Reduction and Improved Clinical Response Lymphocyte Reduction Clinical Response (n=34) (n=29) (n=29) (n=31) (n=31) (n=22)

Etrasimod OLE Safety and Tolerability Etrasimod demonstrated a favorable long-term safety profile; adverse events were generally mild to moderate in severity Impact on heart rate and atrioventricular (AV) conduction was minimal throughout the study with no discontinuations from study related to bradycardia or AV block No new safety findings were noted during the OLE study

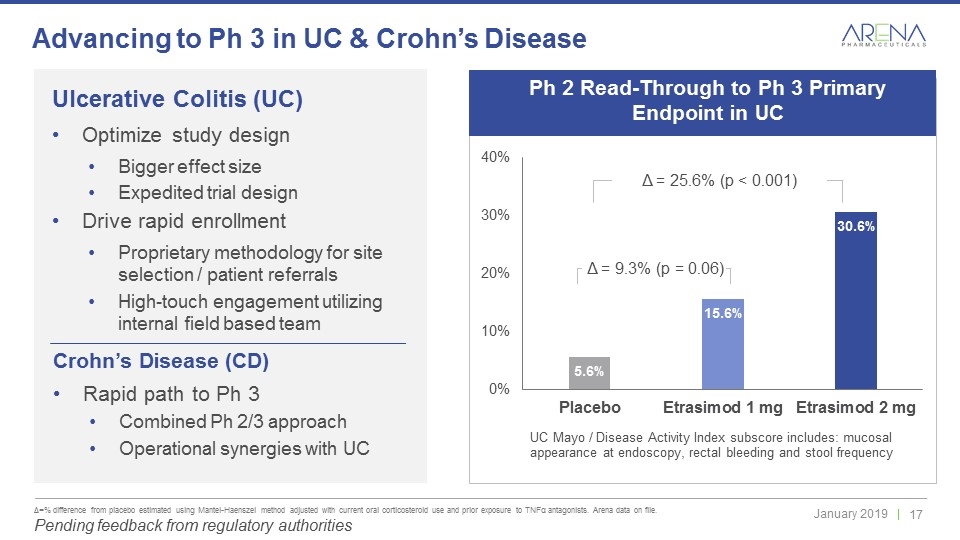

Δ=% difference from placebo estimated using Mantel-Haenszel method adjusted with current oral corticosteroid use and prior exposure to TNFα antagonists. Arena data on file. Advancing to Ph 3 in UC & Crohn’s Disease Ulcerative Colitis (UC) Optimize study design Bigger effect size Expedited trial design Drive rapid enrollment Proprietary methodology for site selection / patient referrals High-touch engagement utilizing internal field based team Crohn’s Disease (CD) Rapid path to Ph 3 Combined Ph 2/3 approach Operational synergies with UC UC Mayo / Disease Activity Index subscore includes: mucosal appearance at endoscopy, rectal bleeding and stool frequency Ph 2 Read-Through to Ph 3 Primary Endpoint in UC Pending feedback from regulatory authorities Δ = 25.6% (p < 0.001) Δ = 9.3% (p = 0.06)

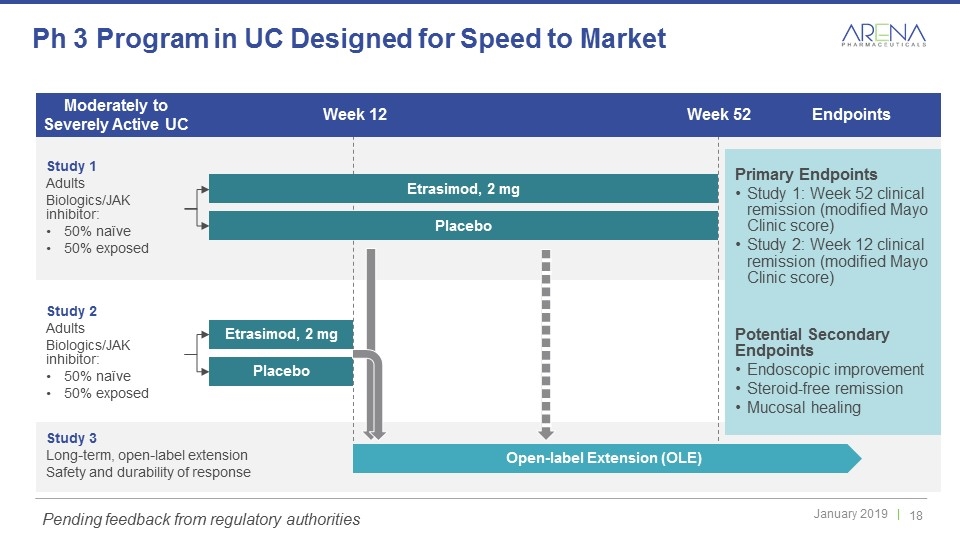

Ph 3 Program in UC Designed for Speed to Market Study 1 Adults Biologics/JAK inhibitor: 50% naïve 50% exposed Etrasimod, 2 mg Placebo Week 12 Week 52 Primary Endpoints Study 1: Week 52 clinical remission (modified Mayo Clinic score) Study 2: Week 12 clinical remission (modified Mayo Clinic score) Potential Secondary Endpoints Endoscopic improvement Steroid-free remission Mucosal healing Study 2 Adults Biologics/JAK inhibitor: 50% naïve 50% exposed Etrasimod, 2 mg Placebo Open-label Extension (OLE) Moderately to Severely Active UC Endpoints Study 3 Long-term, open-label extension Safety and durability of response Pending feedback from regulatory authorities

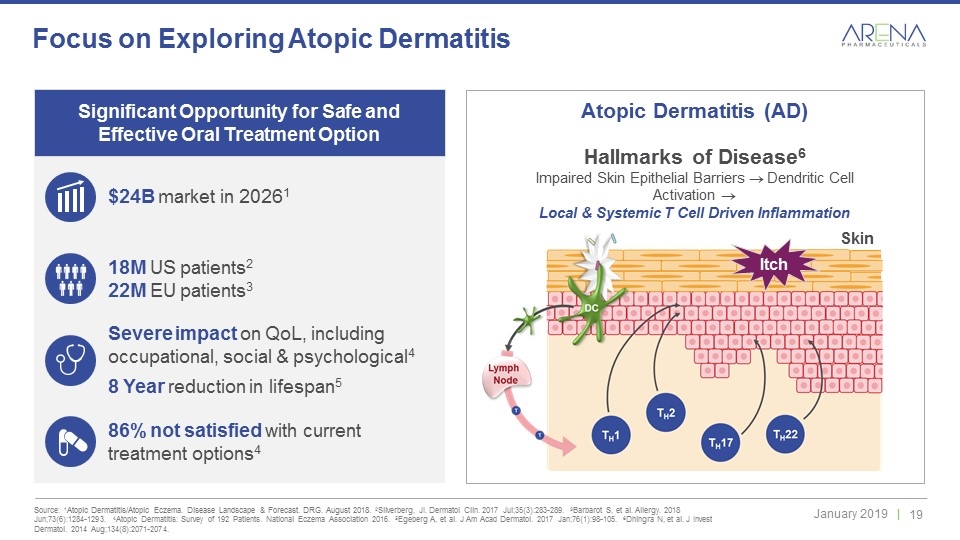

Source: 1Atopic Dermatitis/Atopic Eczema. Disease Landscape & Forecast. DRG. August 2018. 2Silverberg, JI. Dermatol Clin. 2017 Jul;35(3):283-289. 3Barbarot S, et al. Allergy. 2018 Jun;73(6):1284-1293. 4Atopic Dermatitis: Survey of 192 Patients. National Eczema Association 2016. 5Egeberg A, et al. J Am Acad Dermatol. 2017 Jan;76(1):98-105. 6Dhingra N, et al. J Invest Dermatol. 2014 Aug;134(8):2071-2074. Focus on Exploring Atopic Dermatitis Severe impact on QoL, including occupational, social & psychological4 8 Year reduction in lifespan5 86% not satisfied with current treatment options4 $24B market in 20261 18M US patients2 22M EU patients3 Atopic Dermatitis (AD) Hallmarks of Disease6 Impaired Skin Epithelial Barriers ® Dendritic Cell Activation ® Local & Systemic T Cell Driven Inflammation Significant Opportunity for Safe and Effective Oral Treatment Option Itch Skin

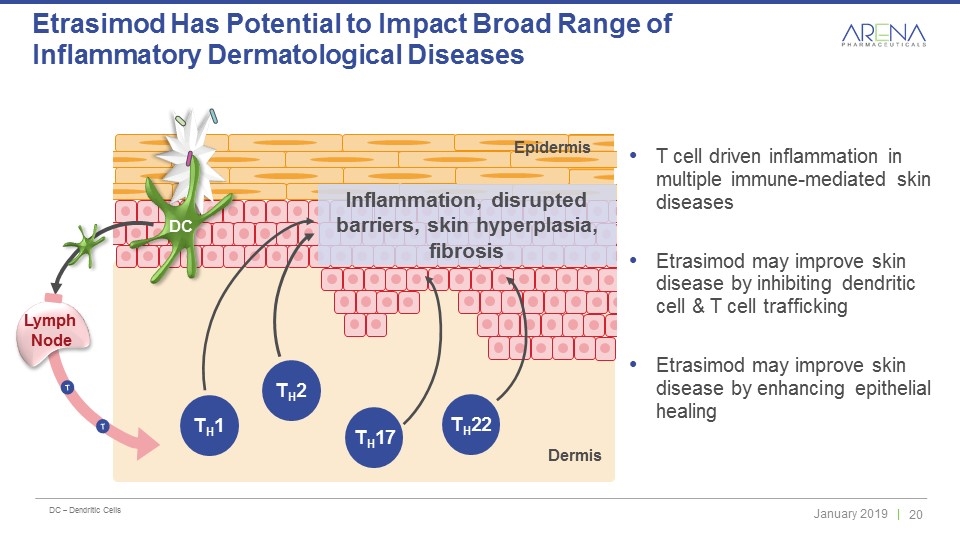

DC – Dendritic Cells Etrasimod Has Potential to Impact Broad Range of Inflammatory Dermatological Diseases DC TH1 TH17 TH2 TH22 Epidermis Lymph Node T T Dermis T cell driven inflammation in multiple immune-mediated skin diseases Etrasimod may improve skin disease by inhibiting dendritic cell & T cell trafficking Etrasimod may improve skin disease by enhancing epithelial healing Inflammation, disrupted barriers, skin hyperplasia, fibrosis

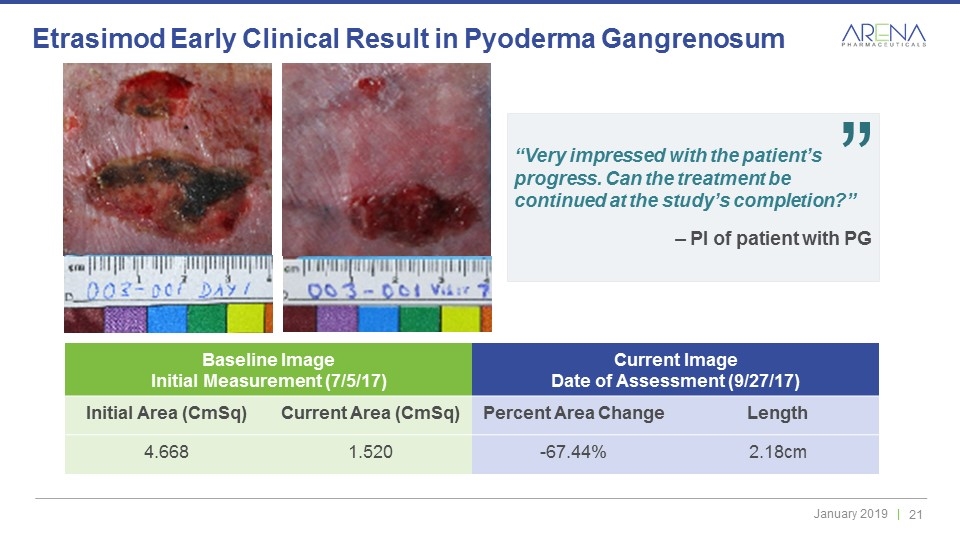

Etrasimod Early Clinical Result in Pyoderma Gangrenosum Baseline Image Initial Measurement (7/5/17) Current Image Date of Assessment (9/27/17) Initial Area (CmSq) Current Area (CmSq) Percent Area Change Length 4.668 1.520 -67.44% 2.18cm “Very impressed with the patient’s progress. Can the treatment be continued at the study’s completion?” – PI of patient with PG ”

Peripherally Restricted, Highly–Selective, Full-Agonist to Cannabinoid 2 Receptor (CB2) for Gastrointestinal Pain Olorinab

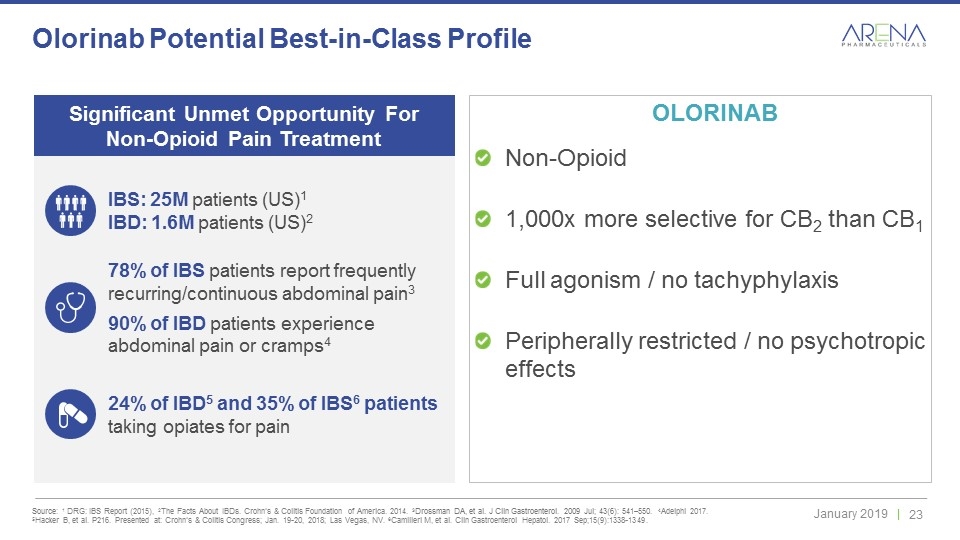

Source: 1 DRG: IBS Report (2015), 2The Facts About IBDs. Crohn’s & Colitis Foundation of America. 2014. 3Drossman DA, et al. J Clin Gastroenterol. 2009 Jul; 43(6): 541–550. 4Adelphi 2017. 5Hacker B, et al. P216. Presented at: Crohn’s & Colitis Congress; Jan. 19-20, 2018; Las Vegas, NV. 6Camilleri M, et al. Clin Gastroenterol Hepatol. 2017 Sep;15(9):1338-1349. Olorinab Potential Best-in-Class Profile OLORINAB Non-Opioid 1,000x more selective for CB2 than CB1 Full agonism / no tachyphylaxis Peripherally restricted / no psychotropic effects 78% of IBS patients report frequently recurring/continuous abdominal pain3 90% of IBD patients experience abdominal pain or cramps4 24% of IBD5 and 35% of IBS6 patients taking opiates for pain IBS: 25M patients (US)1 IBD: 1.6M patients (US)2 Significant Unmet Opportunity For Non-Opioid Pain Treatment

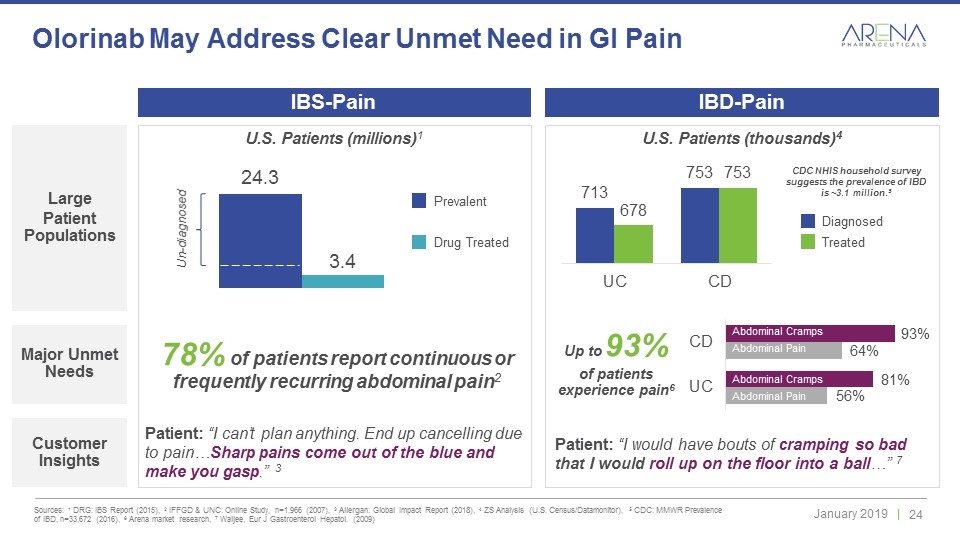

Olorinab May Address Clear Unmet Need in GI Pain Sources: 1 DRG: IBS Report (2015), 2 IFFGD & UNC: Online Study, n=1,966 (2007), 3 Allergan: Global Impact Report (2018), 4 ZS Analysis (U.S. Census/Datamonitor), 5 CDC: MMWR Prevalence of IBD, n=33,672 (2016), 6 Arena market research, 7 Waljee, Eur J Gastroenterol Hepatol. (2009) Large Patient Populations Major Unmet Needs Customer Insights U.S. Patients (millions)1 IBS-Pain Prevalent Drug Treated 78% of patients report continuous or frequently recurring abdominal pain2 Patient: “I can’t plan anything. End up cancelling due to pain…Sharp pains come out of the blue and make you gasp.” 3 Un-diagnosed IBD-Pain U.S. Patients (thousands)4 Patient: “I would have bouts of cramping so bad that I would roll up on the floor into a ball…” 7 Up to 93% of patients experience pain6 Abdominal Cramps Abdominal Pain Abdominal Cramps Abdominal Pain Diagnosed Treated CDC NHIS household survey suggests the prevalence of IBD is ~3.1 million.5

Successful Ph 2a Study Results Inform Development Path Olorinab trial results demonstrate meaningful efficacy in patients with Crohn’s disease experiencing abdominal pain Reductions in abdominal pain seen within first wk of treatment Statistically significant improvements in pain over 8 wks of treatment 100% of pts with evaluable data exhibited clinical response of >30% change from BL in AAPS (wk 8) Olorinab appeared safe and generally well tolerated in this study No clinically significant changes in heart rate or blood pressure No psychotropic effects No discontinuations due to adverse events Development Plan includes Ph 2b IBS and Ph 2b IBD studies Olorinab in GI Pain - potential $1-3B opportunity

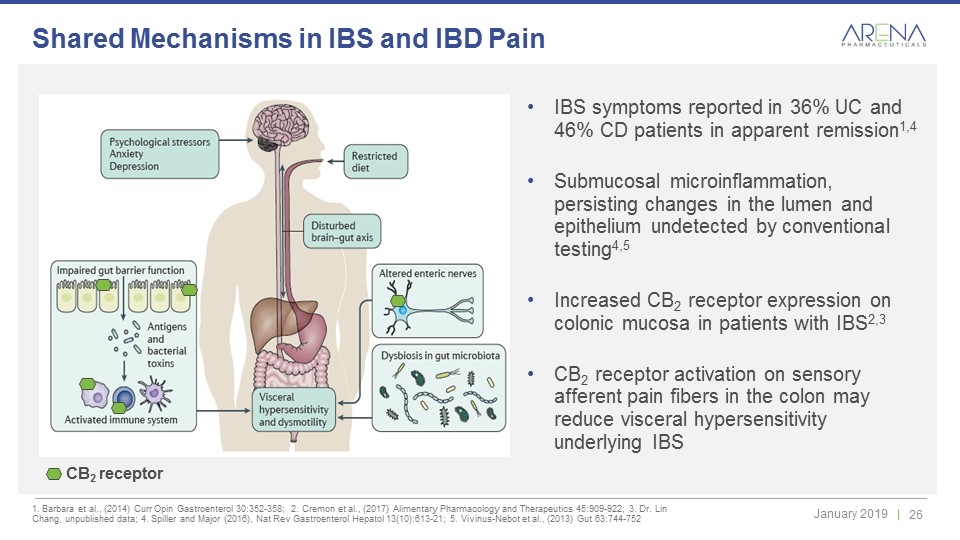

1. Barbara et al., (2014) Curr Opin Gastroenterol 30:352-358; 2. Cremon et al., (2017) Alimentary Pharmacology and Therapeutics 45:909-922; 3. Dr. Lin Chang, unpublished data; 4. Spiller and Major (2016), Nat Rev Gastroenterol Hepatol 13(10):613-21; 5. Vivinus-Nebot et al., (2013) Gut 63:744-752 Shared Mechanisms in IBS and IBD Pain CB2 receptor IBS symptoms reported in 36% UC and 46% CD patients in apparent remission1,4 Submucosal microinflammation, persisting changes in the lumen and epithelium undetected by conventional testing4,5 Increased CB2 receptor expression on colonic mucosa in patients with IBS2,3 CB2 receptor activation on sensory afferent pain fibers in the colon may reduce visceral hypersensitivity underlying IBS

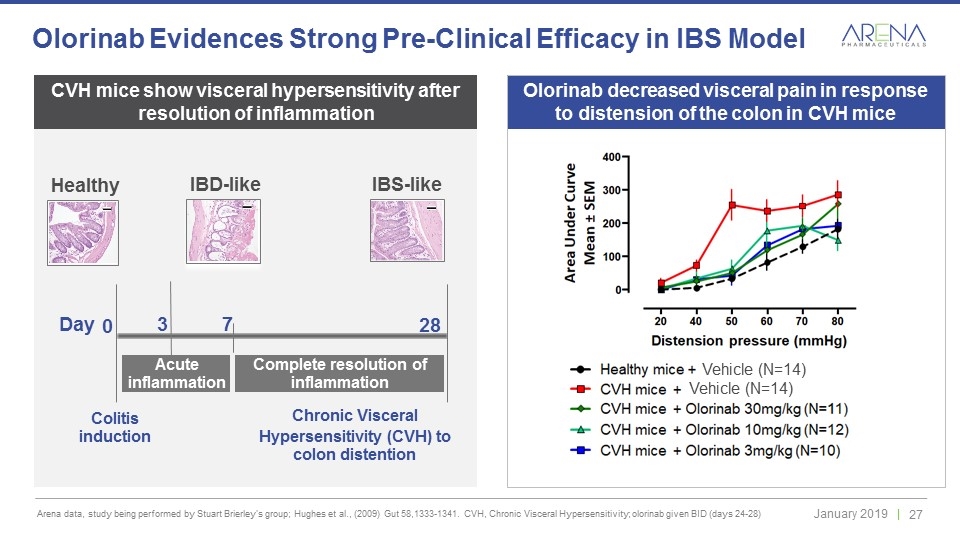

Arena data, study being performed by Stuart Brierley's group; Hughes et al., (2009) Gut 58,1333-1341. CVH, Chronic Visceral Hypersensitivity; olorinab given BID (days 24-28) Olorinab Evidences Strong Pre-Clinical Efficacy in IBS Model Vehicle (N=14) Vehicle (N=14) Healthy IBD-like IBS-like Colitis induction 0 28 3 Day Chronic Visceral Hypersensitivity (CVH) to colon distention 7 Complete resolution of inflammation Acute inflammation CVH mice show visceral hypersensitivity after resolution of inflammation Olorinab decreased visceral pain in response to distension of the colon in CVH mice

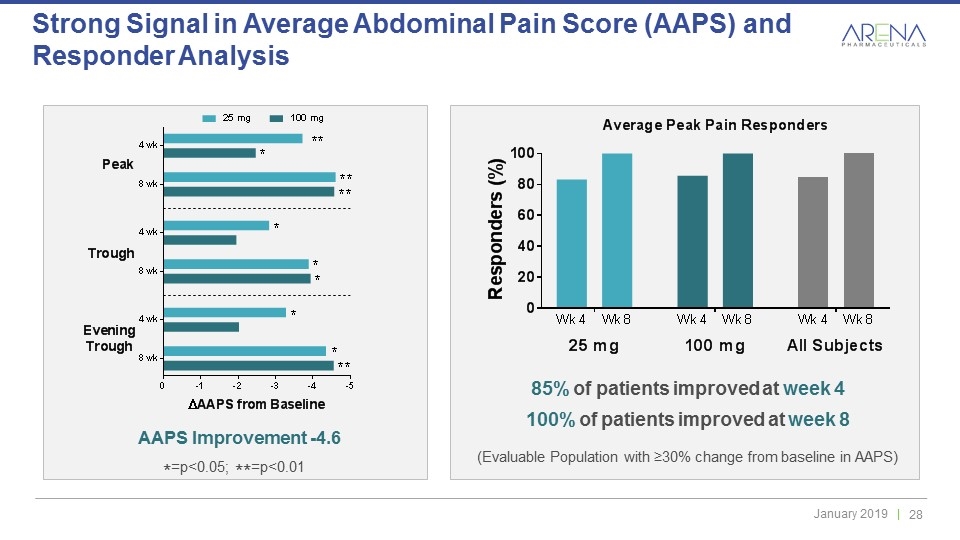

Strong Signal in Average Abdominal Pain Score (AAPS) and Responder Analysis AAPS Improvement -4.6 *=p<0.05; **=p<0.01 85% of patients improved at week 4 100% of patients improved at week 8 (Evaluable Population with ≥30% change from baseline in AAPS)

Next-Generation, Oral, Selective Prostacyclin Receptor (IP) Agonist for Pulmonary Arterial Hypertension Ralinepag

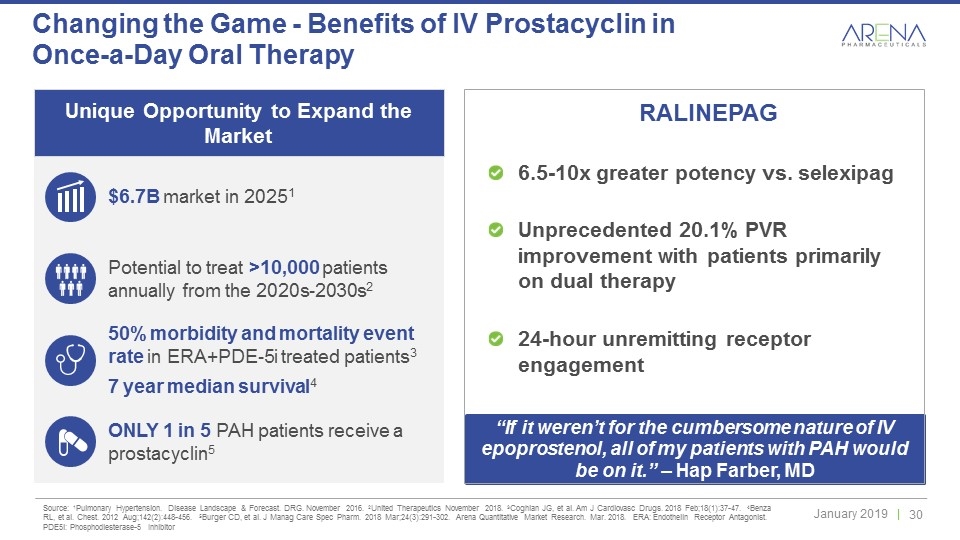

Source: 1Pulmonary Hypertension. Disease Landscape & Forecast. DRG. November 2016. 2United Therapeutics November 2018. 3Coghlan JG, et al. Am J Cardiovasc Drugs. 2018 Feb;18(1):37-47. 4Benza RL, et al. Chest. 2012 Aug;142(2):448-456. 5Burger CD, et al. J Manag Care Spec Pharm. 2018 Mar;24(3):291-302. Arena Quantitative Market Research. Mar. 2018. ERA: Endothelin Receptor Antagonist. PDE5i: Phosphodiesterase-5 Inhibitor Changing the Game - Benefits of IV Prostacyclin in Once-a-Day Oral Therapy RALINEPAG 6.5-10x greater potency vs. selexipag Unprecedented 20.1% PVR improvement with patients primarily on dual therapy 24-hour unremitting receptor engagement “If it weren’t for the cumbersome nature of IV epoprostenol, all of my patients with PAH would be on it.” – Hap Farber, MD 50% morbidity and mortality event rate in ERA+PDE-5i treated patients3 7 year median survival4 ONLY 1 in 5 PAH patients receive a prostacyclin5 $6.7B market in 20251 Potential to treat >10,000 patients annually from the 2020s-2030s2 Unique Opportunity to Expand the Market

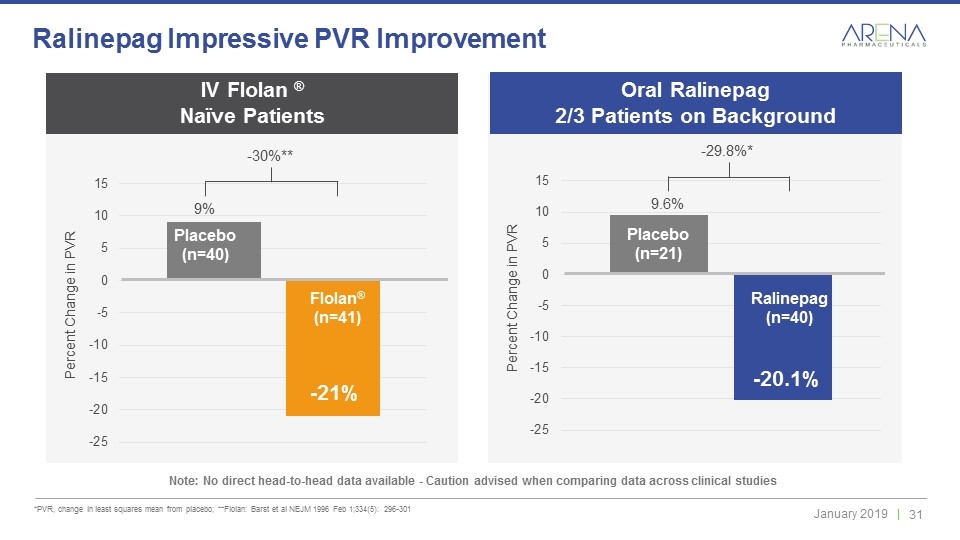

*PVR, change in least squares mean from placebo; **Flolan: Barst et al NEJM 1996 Feb 1;334(5): 296-301 Ralinepag Impressive PVR Improvement Ralinepag (n=40) Placebo (n=40) Placebo (n=21) -20.1% -21% Flolan® (n=41) 9% -30%** 9.6% -29.8%* Note: No direct head-to-head data available - Caution advised when comparing data across clinical studies Percent Change in PVR Percent Change in PVR IV Flolan ® Naïve Patients Oral Ralinepag 2/3 Patients on Background

First-in-Class Calcium-independent Myofilament Derepressor (CMD) for Decompensated Heart Failure (DHF) APD418

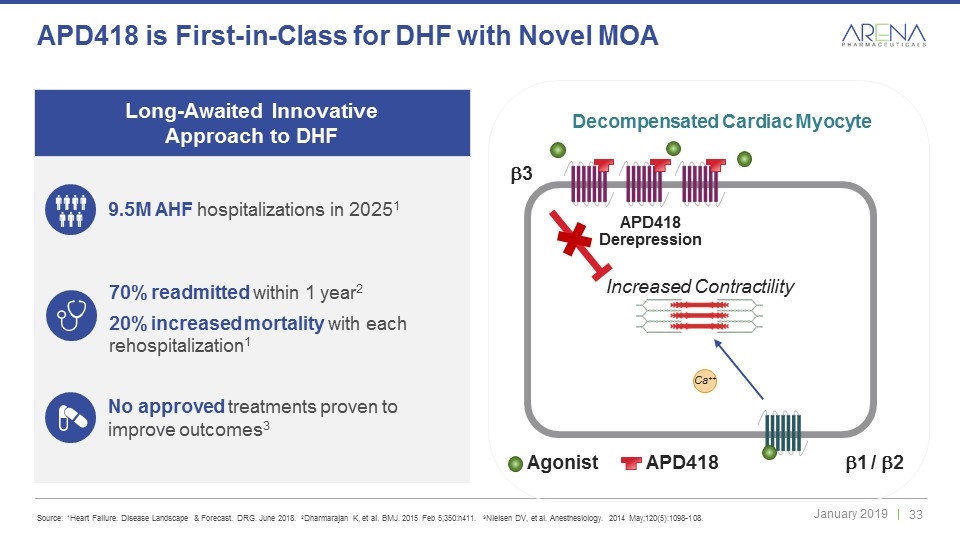

Source: 1Heart Failure. Disease Landscape & Forecast. DRG. June 2018. 2Dharmarajan K, et al. BMJ. 2015 Feb 5;350:h411. 3Nielsen DV, et al. Anesthesiology. 2014 May;120(5):1098-108. APD418 is First-in-Class for DHF with Novel MOA 70% readmitted within 1 year2 20% increased mortality with each rehospitalization1 No approved treatments proven to improve outcomes3 9.5M AHF hospitalizations in 20251 Long-Awaited Innovative Approach to DHF Decompensated Cardiac Myocyte Increased Contractility b3 b1 / b2 APD418 Derepression Agonist Ca++ APD418

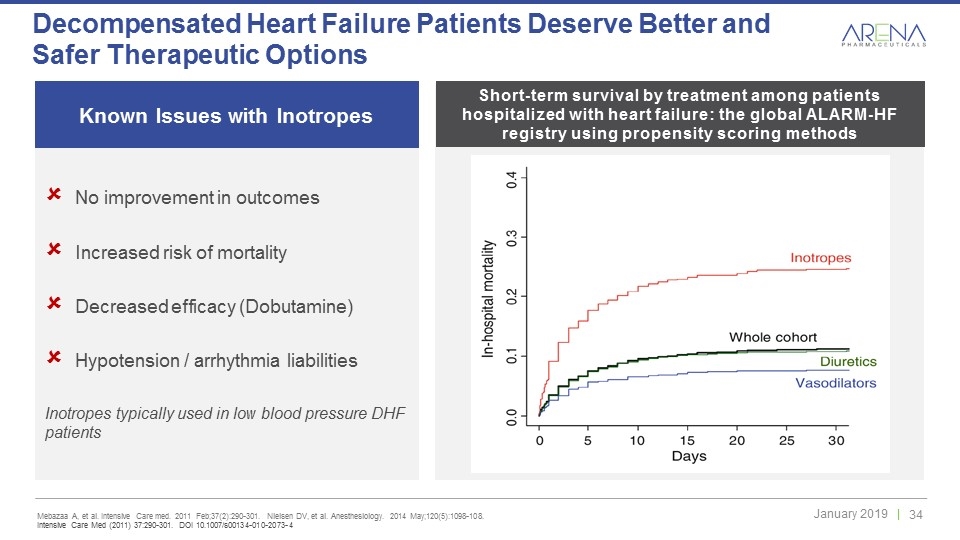

Mebazaa A, et al. Intensive Care med. 2011 Feb;37(2):290-301. Nielsen DV, et al. Anesthesiology. 2014 May;120(5):1098-108. Intensive Care Med (2011) 37:290-301. DOI 10.1007/s00134-010-2073-4 Decompensated Heart Failure Patients Deserve Better and Safer Therapeutic Options Known Issues with Inotropes No improvement in outcomes Increased risk of mortality Decreased efficacy (Dobutamine) Hypotension / arrhythmia liabilities Inotropes typically used in low blood pressure DHF patients Short-term survival by treatment among patients hospitalized with heart failure: the global ALARM-HF registry using propensity scoring methods

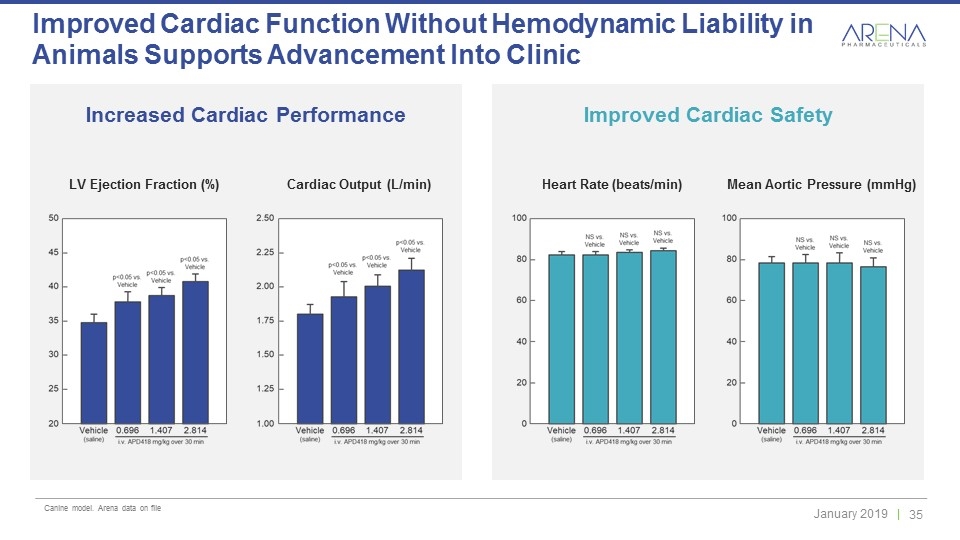

Increased Cardiac Performance Canine model. Arena data on file Improved Cardiac Function Without Hemodynamic Liability in Animals Supports Advancement Into Clinic Improved Cardiac Safety Cardiac Output (L/min) LV Ejection Fraction (%) Heart Rate (beats/min) Mean Aortic Pressure (mmHg)

Etrasimod with $4-8B market potential - best-in-class S1P selectivity and clinical control Broad pipeline with additional Ph 2 programs including etrasimod (derm) and olorinab (GI pain) Recently announced positive OLE data for etrasimod Announced ralinepag deal provides strong cash position ~$1.3B pro forma – ability to focus, scale up and execute1,2 Investment Highlights 1. The effectiveness of the agreement is conditioned on expiration or termination of the required waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and other customary closing conditions. 2. Cash, cash equivalents, and investments if approximately $528M as of 12/31/18 2019 Catalysts Etrasimod Initiate Ph 3 in UC Initiate Ph 2/3 in Crohn’s disease Initiate Ph 2 in atopic dermatitis Olorinab IBD/IBS pain - Ph 2b Initiation Ralinepag Ph 3 progress APD418 IND submission in DHF

Thank you Nasdaq: ARNA