Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - AMICUS THERAPEUTICS, INC. | exhibit992.htm |

| 8-K - 8-K - AMICUS THERAPEUTICS, INC. | form8-kjanuary72019jpm.htm |

37th Annual J.P. Morgan Healthcare Conference John F. Crowley, Chairman and Chief Executive Officer January 8, 2019

2 Forward-Looking Statements This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 relating to preclinical and clinical development of our product candidates, the timing and reporting of results from preclinical studies and clinical trials, the prospects and timing of the potential regulatory approval of our product candidates, commercialization plans, manufacturing and supply plans, market potential projections, financing plans, and the projected revenues and cash position for the Company. The inclusion of forward-looking statements should not be regarded as a representation by us that any of our plans will be achieved. Any or all of the forward-looking statements in this press release may turn out to be wrong and can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties. For example, with respect to statements regarding the goals, progress, timing, and outcomes of discussions with regulatory authorities, and in particular the potential goals, progress, timing, and results of preclinical studies and clinical trials, actual results may differ materially from those set forth in this release due to the risks and uncertainties inherent in our business, including, without limitation: the potential that results of clinical or preclinical studies indicate that the product candidates are unsafe or ineffective; the potential that it may be difficult to enroll patients in our clinical trials; the potential that regulatory authorities, including the FDA, EMA, and PMDA, may not grant or may delay approval for our product candidates; the potential that we may not be successful in commercializing Galafold in Europe and other geographies or our other product candidates if and when approved; the potential that preclinical and clinical studies could be delayed because we identify serious side effects or other safety issues; the potential that we may not be able to manufacture or supply sufficient clinical or commercial products; and the potential that we will need additional funding to complete all of our studies and manufacturing. Further, the results of earlier preclinical studies and/or clinical trials may not be predictive of future results. With respect to statements regarding projections of the Company's revenue and cash position, actual results may differ based on market factors and the Company's ability to execute its operational and budget plans. In addition, all forward-looking statements are subject to other risks detailed in our Annual Report on Form 10-K for the year ended December 31, 2017 as well as our Quarterly Report on Form 10- Q for the quarter September 30, 2018 filed November 5, 2018 with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement, and we undertake no obligation to revise or update this news release to reflect events or circumstances after the date hereof.

Introduction 3 Amicus Highlights GALAFOLD’S EXTRAORDINARY LAUNCH AT-GAA IN POMPE: POTENTIAL TO LEADING GENE THERAPY PORTFOLIO IN RARE SUCCESS BECOME STANDARD OF CARE METABOLIC DISEASES • 650+ Patients and ~$91M Global Sales in FY18 • Continued Strength of Clinical Data • Pipeline of 14 Gene Therapies • FY19 Guidance of $160M-$180M • Multiple Data Expected Throughout 2019 • 2 Clinical Stage Programs • $500M Potential Sales by 2023 • 100+ Pompe Patients on AT-GAA by YE19 • Amicus as “Consolidator” of Best Minds and • $1B+ Addressable Market Opportunity by 2028 • $1B-$2B+ Market Opportunity Technologies • $1B+ Peak Recurring Market Opportunity FINANCIAL STRENGTH 2023 VISION • $500M+ Cash at 12/31/18 (runway into mid-2021) • 5,000+ Lives Transformed • Growing Contribution from Galafold Revenues • $1B+ in Revenue • Leading Global Rare Disease Biotech

4 WHERE we came from

5 Amicus. Definition: \əˈmēkəs (noun) Latin Friend

6

Introduction 7 Amicus Founding Beliefs WE BELIEVE... WE BELIEVE... WE BELIEVE… In the Fight to Remain In Our Future to Build In Each Other to at the ForefrontWe push of ideas as Longfar-term and Value as for fast as possibleFoster Teamwork and Therapies for Rare and Our Stakeholders Respect for Each Orphan Diseases Individual’s Contribution We encourage and embrace constant innovation • We seek to deliver the highest quality therapies for • We are all owners of this business • Our passion for making a persons living with these diseases difference unites us • We are business led and science • We support the disease communities - and their families We have a duty to obsoletedriven our own technologies• Diversity of experience and • We are passionate about what we do thought is essential • Maximizing value for our • We encourage and embrace constant innovation shareholders is the foundation of our • We communicate openly, • We have a duty to obsolete our own technologies future successes honestly and respectfully • We push ideas as far and as fast as possible We are business• Our medicines led mustand be fairly science priced driven• Our families are part of the • We take smart risks and broadly accessible Amicus experience • We work hard • We build strategic partnerships • Work-life balance keeps us • We keep asking the tough questions healthy • • We will never be constrained by prior thinking We will not lie, cheat or steal • We learn from ourOur mistakes passion for making• We take full responsibility a difference for our unites us • We think differently - very differently actions

8 Build a great and enduring company.

9 WHERE we are today

Introduction 10 PORTFOLIO 500+ of 15 programs for rare EMPLOYEES metabolic diseases globally BIOLOGICS AT-GAA* PLATFORM Phase 3 Leading Expertise in Protein Engineering Investigational Lysosomal & Glycobiology Therapy for Pompe Storage GLOBAL Disorders $500M+ Gene Therapy FOOTPRINT Cash in 27 countries (12/31/18) Platforms * AT-GAA, also known as ATB200/AT2221

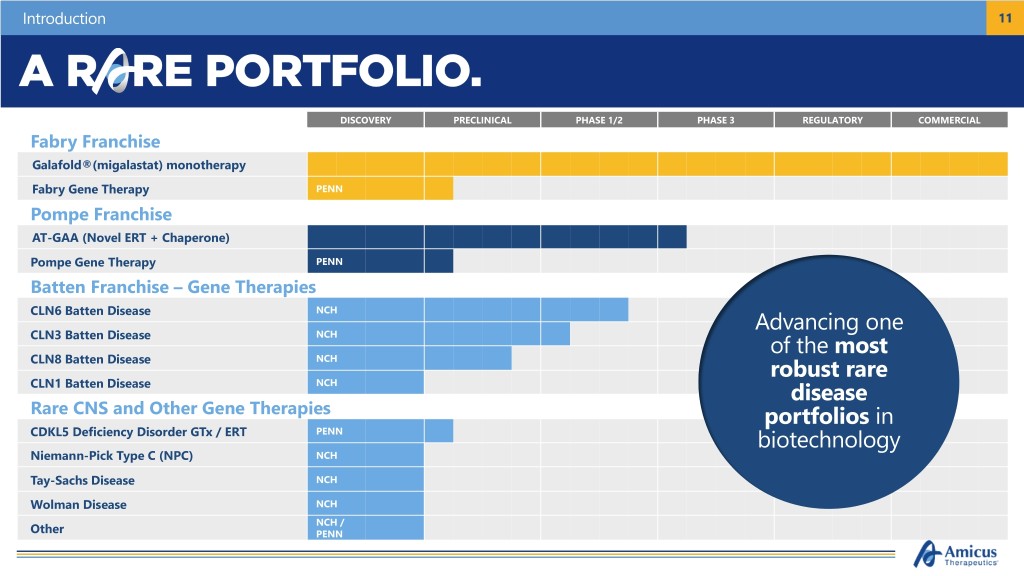

Introduction 11 DISCOVERY PRECLINICAL PHASE 1/2 PHASE 3 REGULATORY COMMERCIAL Fabry Franchise Galafold®(migalastat) monotherapy Fabry Gene Therapy PENN Pompe Franchise AT-GAA (Novel ERT + Chaperone) Pompe Gene Therapy PENN Batten Franchise – Gene Therapies NCH CLN6 Batten Disease Advancing one NCH CLN3 Batten Disease of the most CLN8 Batten Disease NCH robust rare CLN1 Batten Disease NCH disease Rare CNS and Other Gene Therapies portfolios in CDKL5 Deficiency Disorder GTx / ERT PENN biotechnology Niemann-Pick Type C (NPC) NCH Tay-Sachs Disease NCH Wolman Disease NCH NCH / Other PENN

Introduction 12 Key Drivers of Value Pompe Gene Galafold ERT Therapy $1B+ $1B-2B+ Portfolio Opportunity Opportunity $1B+ Opportunity Transformthe Lives of Thousands of Patients

Introduction 13 2018: A Year in Headlines

Introduction 14 2018 Key Strategic Priorities 1 Galafold (migalastat) revenue of $80-$90M 2 Secure approvals for migalastat in Japan and the U.S. Achieve clinical, manufacturing & regulatory milestones to advance 3 AT-GAA toward global regulatory submissions and approvals Develop and expand preclinical pipeline to ensure at least one new 4 clinical program in 2019 5 Maintain strong financial position

15 WHERE we are going

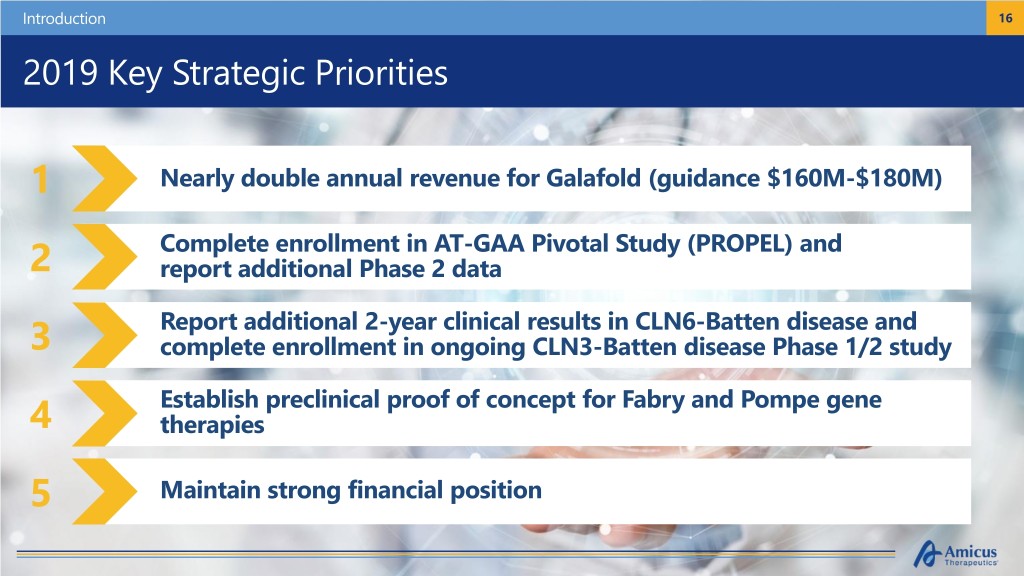

Introduction 16 2019 Key Strategic Priorities 1 Nearly double annual revenue for Galafold (guidance $160M-$180M) Complete enrollment in AT-GAA Pivotal Study (PROPEL) and 2 report additional Phase 2 data Report additional 2-year clinical results in CLN6-Batten disease and 3 complete enrollment in ongoing CLN3-Batten disease Phase 1/2 study Establish preclinical proof of concept for Fabry and Pompe gene 4 therapies 5 Maintain strong financial position

Introduction 17 Impacting Lives >350 Patients* | ~$36M Global Sales >700 Patients* | ~$91M1 Global Sales 5,000 Patients* | $1B Global Sales YE17 YE18 2023 *Clinical & commercial, all figures approximate 1Preliminary unaudited

Introduction 18 Amicus in 2023 Our Path to Become One of the Leading Global Biotechnology Companies in Rare Diseases ~$1B / ~5,000 patients in 2023 Gene Therapies & In- Galafold AT-GAA* Approved licensed Products* ~$500M ~$200M ~$300M Clinical 5+ Programs in Clinic Preclinical 1+ New IND Every 12-18 Months *Assumes successful clinical trials and regulatory approvals

Fabry Disease Overview “We support the disease communities – and their families” - Amicus Belief Statement

Fabry Disease 20 Fabry Disease Overview Fabry Disease is a Fatal Leading Causes of Death: Genetic Disorder that Affects Transient Ischemic Attack Multiple Organs and is (TIA) & Stroke1 Believed to be Significantly Underdiagnosed Heart Disease2 Kidney Disease3 Key Facts: • α-Gal A enzyme deficiency leads to substrate (GL-3) accumulation • >1,000 known mutations • ~10K diagnosed WW (51% Life-Limiting Symptoms: female/49% male4) 3 • Newborn screening studies Gastrointestinal suggest prevalence of ~1:1000 to ~1:4000 1. Desnick R, et al. Ann Intern Med. 2003; 2. Yousef Z, et al. Eur Heart J. 2013; 3. Germain D. Orphanet J Rare Dis. 2010 4. Fabry Registry 2011

Fabry Disease 21 Global Fabry Market Growth Driven by New Patients Global Fabry Market Exceeded $1.4B as of 3Q18 and Tracking Toward $2.2B by 2023 (8.6% 5-Year CAGR)* Annualized 3Q18 Fabry sales increased $2,500 ∆ 10% $2,000 $1,500 Japan ROW 15% 20% (millions) $1,000 EU 34% U.S. $500 31% $0 2015 2016 2017 2018 2019E 2020E 2021E 2022E 2023E Global Fabry Market and growth measured by reported CER (constant exchange rates) Adjusted Net Sales through 3Q18 ∆ 2018 – 2023 are based on estimated 8.6% annual growth rate (5-Year CAGR rate)

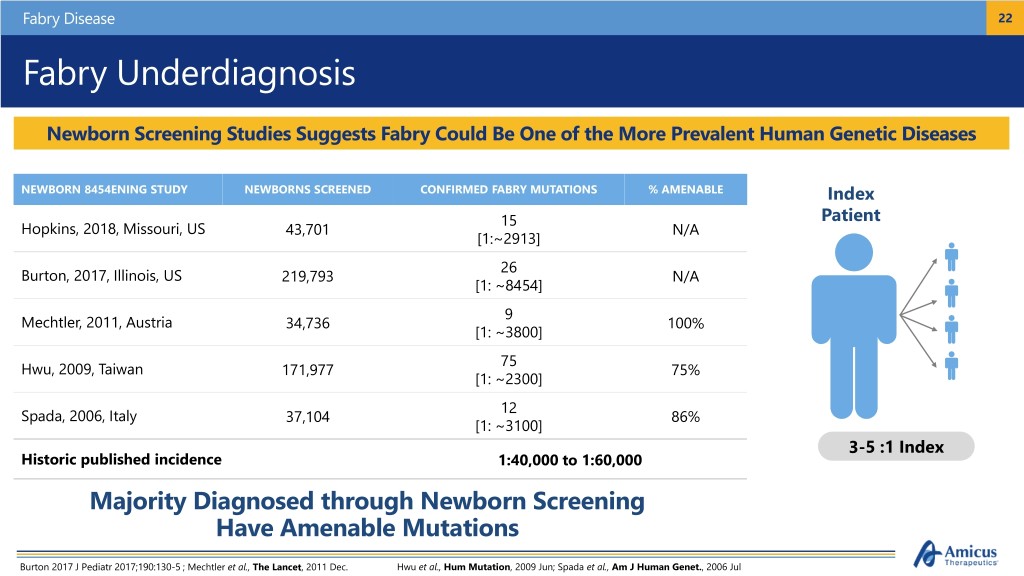

Fabry Disease 22 Fabry Underdiagnosis Newborn Screening Studies Suggests Fabry Could Be One of the More Prevalent Human Genetic Diseases NEWBORN 8454ENING STUDY NEWBORNS SCREENED CONFIRMED FABRY MUTATIONS % AMENABLE Index 15 Patient Hopkins, 2018, Missouri, US 43,701 N/A [1:~2913] 26 Burton, 2017, Illinois, US 219,793 N/A [1: ~8454] 9 Mechtler, 2011, Austria 34,736 100% [1: ~3800] 75 Hwu, 2009, Taiwan 171,977 75% [1: ~2300] 12 Spada, 2006, Italy 37,104 86% [1: ~3100] 3-5 :1 Index Historic published incidence 1:40,000 to 1:60,000 Majority Diagnosed through Newborn Screening Have Amenable Mutations Burton 2017 J Pediatr 2017;190:130-5 ; Mechtler et al., The Lancet, 2011 Dec. Hwu et al., Hum Mutation, 2009 Jun; Spada et al., Am J Human Genet., 2006 Jul

Fabry Disease 23 Fabry Misdiagnosis Recent Studies in Multiple Disease Areas Show Significant Rate of Fabry Disease as Underlying Cause 36,820 # Patients Screened Patients # 5,978 5,491 3,074 2,360 361 273 88 6.8 5.5 Diagnosed Diagnosed withFabry % % 1.3 0.8 0.5 0.5 0.6 0.3 Renal: CV: CV: Renal: Specialty Neuropathic MS GI: Dialysis Stroke LVH / HCM Transplant Clinics* Pain IBS Source: Summary of N=63 completed high-risk screening associated studies, Huron Analysis *Specialty clinics include neurology, cardiology, nephrology, and pediatrics **1 MS completed study refers to % of FD patients misdiagnosed with MS

Galafold® (migalastat) Global Launch… …taking a leadership role in the treatment of Fabry disease “We push ideas as far and as fast as possible” - Amicus Belief Statement

Galafold: Precision Medicine for Fabry Disease 25 Galafold Snapshot (as of December 31, 2018) ~$91M* $160-180M One of the Most FY18 Galafold FY19 Global Revenue Galafold Successful Rare Rev. Guidance Disease Launches Geographic 24 Countries with Expansion in Pricing & 2019 Reimbursement 8 Regulatory 348 Approvals: Amenable Australia, Canada, EU, Variants in U.S. Israel, Japan, S. Korea, Switzerland , U.S. Label Galafold is indicated for adults with a confirmed diagnosis of Fabry Disease and an amenable mutation/variant. The most common adverse reactions reported with Galafold (≥10%) were headache, nasopharyngitis, urinary tract infection, nausea and pyrexia. For additional information about Galafold, including the full U.S. Prescribing Information, please visit https://www.amicusrx.com/pi/Galafold.pdf. For further important safety information for Galafold, including posology and method of administration, special warnings, drug interactions and adverse drug reactions, please see the European SmPC for Galafold available from the EMA website at www.ema.europa.eu. *Preliminary and unaudited

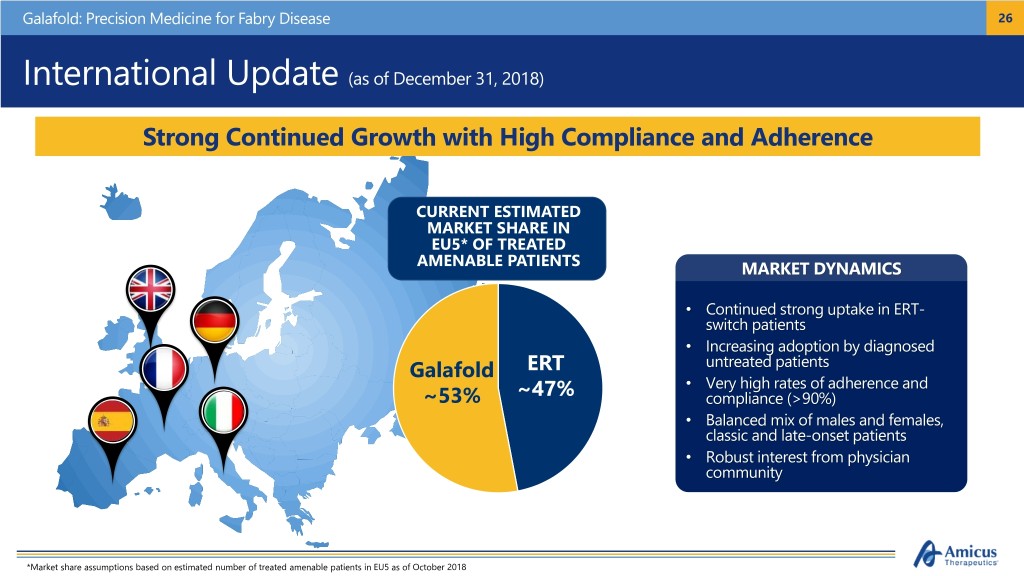

Galafold: Precision Medicine for Fabry Disease 26 International Update (as of December 31, 2018) Strong Continued Growth with High Compliance and Adherence CURRENT ESTIMATED MARKET SHARE IN EU5* OF TREATED AMENABLE PATIENTS MARKET DYNAMICS • Continued strong uptake in ERT- switch patients • Increasing adoption by diagnosed Galafold ERT untreated patients • Very high rates of adherence and ~53% ~47% compliance (>90%) • Balanced mix of males and females, classic and late-onset patients • Robust interest from physician community *Market share assumptions based on estimated number of treated amenable patients in EU5 as of October 2018

Galafold: Precision Medicine for Fabry Disease 27 Key U.S. Launch Metric – Individual Prescriptions (Patient Referral Forms) 149 Individual Prescriptions (12/31/18) Significantly Exceeds Internal Forecast and Provides Strong Foundation for 2019 Individual Actual PRFs 149 Prescriptions Market Dynamics 126 • 100+ U.S. patients now on Galafold 103 • Strong patient and physician demand 75 • Growing prescriber base of 60+ 64 Forecast physicians • <60 day average PRF to shipment 66 • Patient demographics in line with 24 54 launch strategy 43 • Broad reimbursement coverage 32 20 August 31 September 30 October 31 November 30 December 31

Galafold: Precision Medicine for Fabry Disease 28 Galafold Success and FY18 Galafold Revenue Guidance On Track to Nearly DOUBLE Revenue Again and Serve 1,000+ Patients in 2019 $160M-180M Guidance ~$91M* ~$32M* $36.9M $20.6M $80$21.3M-90M $4.9M $16.7M FY16 FY17 FY18 FY19 *Preliminary and unaudited

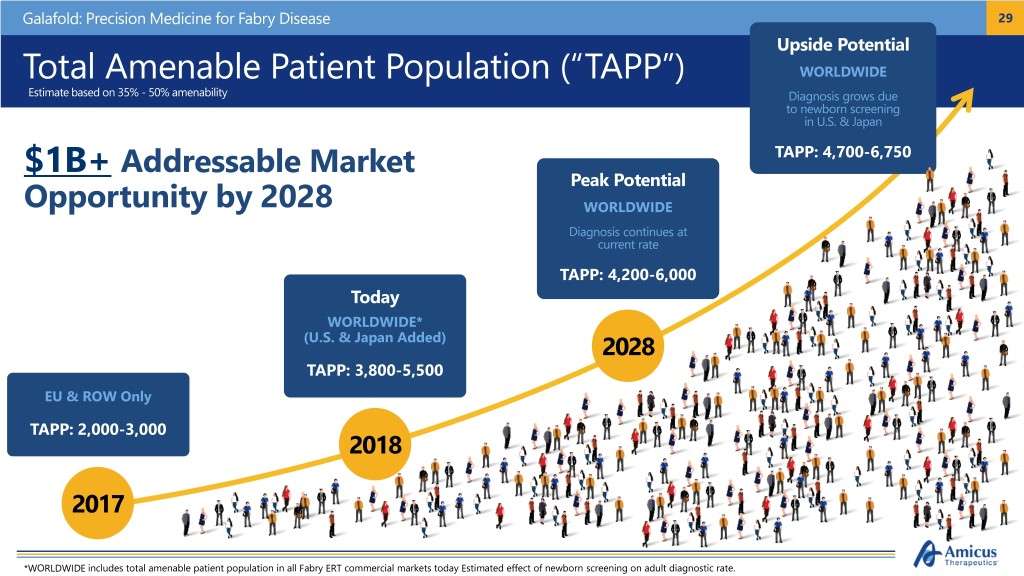

Galafold: Precision Medicine for Fabry Disease 29 Upside Potential Total Amenable Patient Population (“TAPP”) WORLDWIDE Estimate based on 35% - 50% amenability Diagnosis grows due to newborn screening in U.S. & Japan $1B+ Addressable Market TAPP: 4,700-6,750 Peak Potential Opportunity by 2028 WORLDWIDE Diagnosis continues at current rate TAPP: 4,200-6,000 Today WORLDWIDE* (U.S. & Japan Added) 2028 TAPP: 3,800-5,500 EU & ROW Only TAPP: 2,000-3,000 2018 2017 *WORLDWIDE includes total amenable patient population in all Fabry ERT commercial markets today Estimated effect of newborn screening on adult diagnostic rate.

AT-GAA Novel ERT for Pompe Disease “We encourage and embrace constant innovation” - Amicus Belief Statement

AT-GAA for Pompe Disease 31 Pompe Disease Overview Pompe Disease is a Fatal Neuromuscular Disorder that Affects a Broad Range of People Respiratory and cardiac 5,000 – 10,000 patients Age of onset ranges from infancy to failure are leading causes of morbidity diagnosed WW1 adulthood and mortality Deficiency of GAA leading to glycogen Symptoms include muscle weakness, ~$900M+ Global Pompe accumulation respiratory failure, and cardiomyopathy ERT sales in FY172 1. National Institute of Neurological Disorders and Stroke (NIH). 2. Sanofi Press Release & 10-K

AT-GAA for Pompe Disease 32 AT-GAA (ATB200 + Chaperone): A Differentiated Treatment Paradigm

AT-GAA for Pompe Disease 33 Pompe Patient Experience in Phase 1/2 Clinical Study (ATB200-02) Consistent and Durable Responses Across Key Measures of Safety, Functional Outcomes and Biomarkers in both ERT-Switch and ERT-Naïve Pompe Patients out to Month 18 6-Minute Walk Test (m) Change at Month 18 Cohort Baseline (n=10) (n=9) Mean (SD) Cohort 1 397.2 +51.7 ERT-Switch Ambulatory (96.8) (45.9) Change at Month 18 Cohort Baseline (n=5) (n=5) Mean (SD) Cohort 3 399.5 +49.0 ERT-Naïve (83.5) (28.3) FVC (% Predicted) Change at Month 18 Cohort Baseline (n=9*) (n=8) Mean (SD) Cohort 1 52.6 -3.7 ERT-Switch Ambulatory* (14.7) (7.0) Change at Month 18 Cohort Baseline (n=5) (n=5) Mean (SD) Cohort 3 53.4 +5.0 ERT-Naïve (20.3) (2.9)

AT-GAA for Pompe Disease 34 PROPEL (ATB200-03) Study Design 52-Week Primary Treatment Period Long-Term Extension (Double-Blind) (Open-Label) Participants with Late-Onset AT-GAA Pompe Disease Bi-Weekly ~100 Patients AT-GAA 90 Clinical Sites Worldwide Bi-weekly Standard of Care ERT-Switch ERT-Naïve Bi-Weekly Primary Endpoint: 6-Minute Walk Test at Week 52 Multiple Secondary Endpoints

AT-GAA for Pompe Disease 35 Pompe Biologics Manufacturing Successful Scale Up to 1000L GMP Clinical and Commercial Scale to Fully Supply Global Pompe Population • Key quality attributes maintained from 5L to 250L to 1000L • Agreements on biocomparability with key regulators (FDA, BfARM) • PROPEL participants now treated with drug manufactured at 1000L • Current bioreactor capacity to supply global population • WuXi partnership strengthened with 5-year supply agreement

AT-GAA for Pompe Disease 36 AT-GAA: 2019 Objectives Advance AT-GAA for as Many Patients Worldwide as Quickly as Possible • Enroll PROPEL study (n=100) • Present additional Phase 1/2 data • Report natural history study data • Initiate supportive studies • Advance agreed upon CMC requirements to support BLA

Gene Therapy Pipeline “We have a duty to obsolete our own technologies” - Amicus Belief Statement

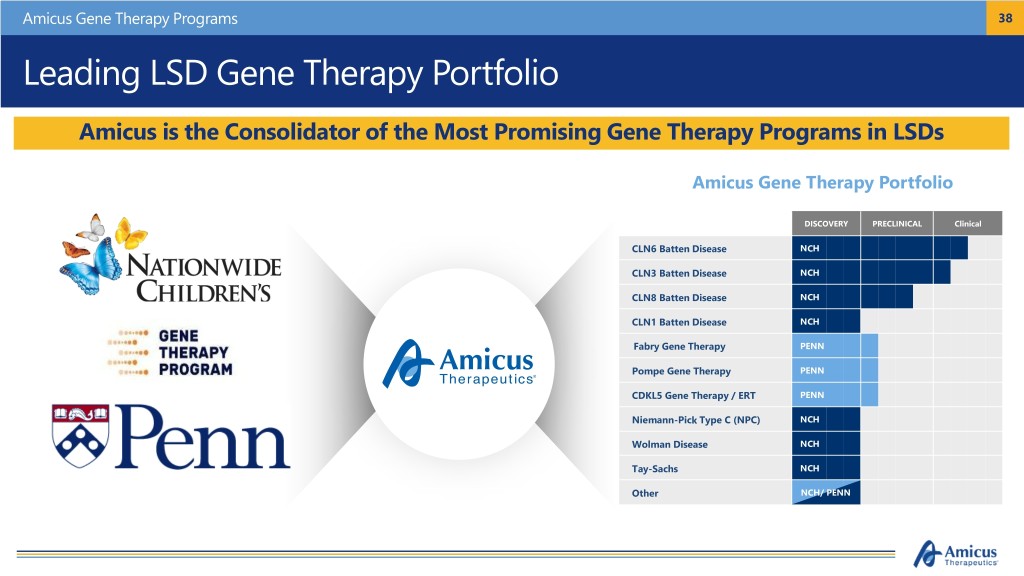

Amicus Gene Therapy Programs 38 Leading LSD Gene Therapy Portfolio Amicus is the Consolidator of the Most Promising Gene Therapy Programs in LSDs Amicus Gene Therapy Portfolio DISCOVERY PRECLINICAL Clinical CLN6 Batten Disease NCH CLN3 Batten Disease NCH CLN8 Batten Disease NCH CLN1 Batten Disease NCH Fabry Gene Therapy PENN Pompe Gene Therapy PENN CDKL5 Gene Therapy / ERT PENN Niemann-Pick Type C (NPC) NCH Wolman Disease NCH Tay-Sachs NCH Other NCH/ PENN

Amicus Gene Therapy Programs 39 Addressable Patient Populations in Neurologic LSDs* 10,000+ Addressable Patients in 10 Indications $1B+ Annual Recurring Revenue CLN6 Batten Disease Phase 1/2 Target Enrollment Achieved – 2-Year Data Mid-2019 >3,500 CLN3 Batten Disease Phase 1/2 Study Initiated Niemann-Pick, Wolman Disease, ~750 Tay Sachs, and CLN8 Others ~5,000 ~1,000 CLN3 CLN6 *Estimated addressable U.S., EU, Japan, and other major, reimbursable markets based on published incidence and prevalence

Amicus Gene Therapy Programs 40 Amicus Protein Engineering Expertise & Technologies for Gene Therapy Collaboration to Enable Greater Protein Expression and Delivery at Lower Gene Therapy Doses Increased Increased Improved Protein Protein Protein Targeting & Expression Secretion Stabilization Novel untranslated sequences Effective signal sequences to Targeting moieties to avoid inhibition of increase protein expression & initiation and drive efficient secretion Protein design protein synthesis

Amicus Gene Therapy Programs 41 Early Proof of Principle for Optimized Gene Therapy Amicus DNA Constructs Enable Optimized Gene Therapy in Pompe and Fabry GAA Binding to Intended Receptor SecretedS e c re te d GAArh G A Ain i nMedia M e d ia 8 0 0 0 y t 8 0 A m ic u s G T - G A A i ) v i ) r y t r W T r h G A A t u i c h 6 0 0 0 o / v 6 0 A i h L t / c A L m / A A l 4 0 0 0 Pompe m 4 0 / o G l A o m A d n n m G ( 2 0 0 0 A m ic u s G T - G A A u 2 0 n ( o W T r h G A A B 0 0 0 2 4 6 0 2 0 4 0 6 0 8 0 1 0 0 D a y s rh G A A (n M ) Alpha-Gal Activity: pH 7.4 Alpha-Gal Activity: pH 4.6 W T ) p H 4 .6 3 0 0 ) c o n s tru c t 1 % W T ( p H 7 .4 % c o n s tru c t 2 ( y c o n s tru c t 1 3 0 0 t 2 5 0 i y v t i c o n s tru c t 2 i 2 5 0 t 2 0 0 v c i t A 2 0 0 c Fabry 1 5 0 l A a l 1 5 0 u 1 0 0 a d i u 1 0 0 s d 5 0 i e s R 5 0 0 e 0 1 2 3 4 5 6 7 R 0 T im e (d a y s )

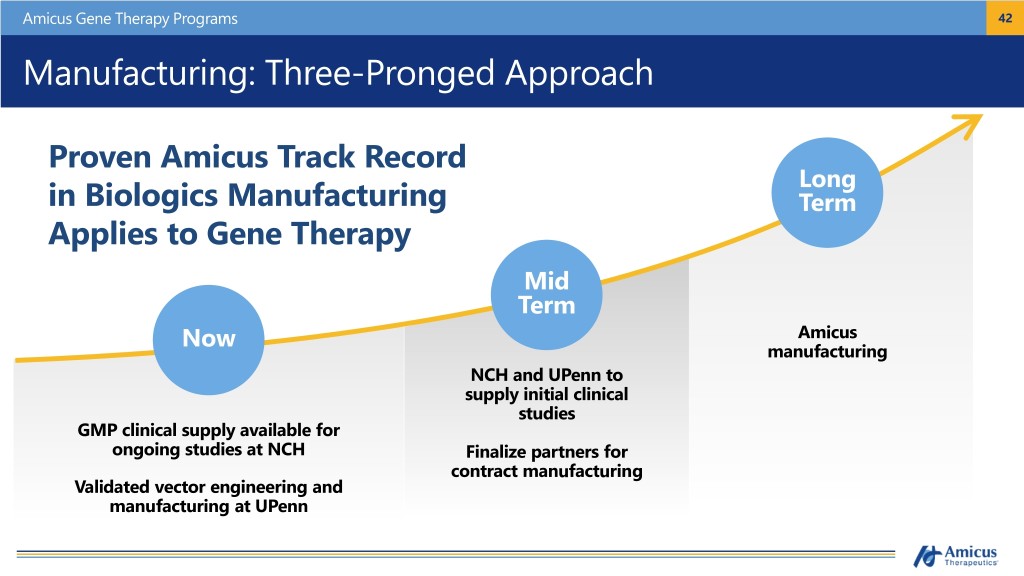

Amicus Gene Therapy Programs 42 Manufacturing: Three-Pronged Approach Proven Amicus Track Record Long in Biologics Manufacturing Term Applies to Gene Therapy Mid Term Now Amicus manufacturing NCH and UPenn to supply initial clinical studies GMP clinical supply available for ongoing studies at NCH Finalize partners for contract manufacturing Validated vector engineering and manufacturing at UPenn

Financial Summary & Milestones “We are business led and science driven” - Amicus Belief Statement

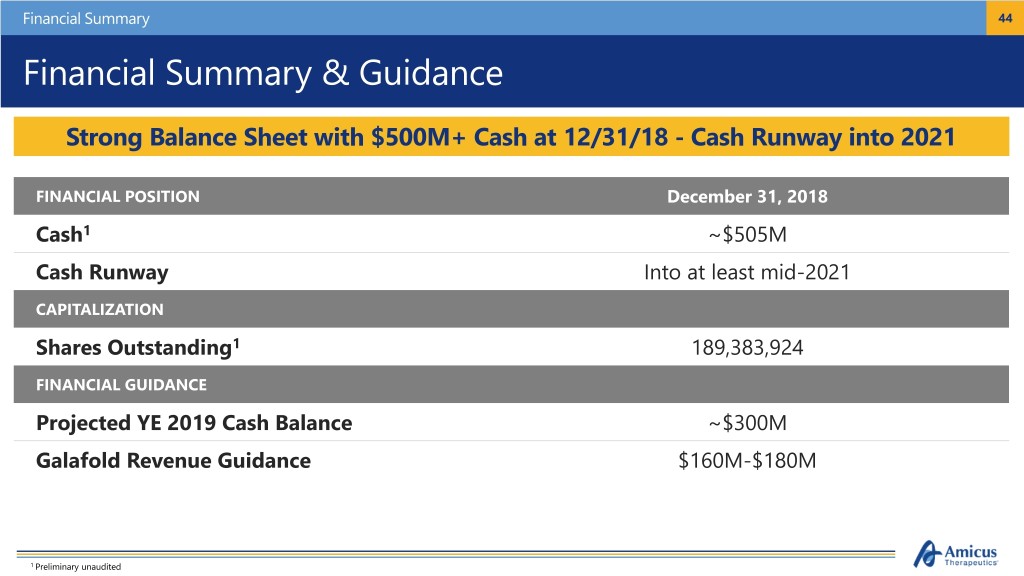

Financial Summary 44 Financial Summary & Guidance Strong Balance Sheet with $500M+ Cash at 12/31/18 - Cash Runway into 2021 FINANCIAL POSITION December 31, 2018 Cash1 ~$505M Cash Runway Into at least mid-2021 CAPITALIZATION Shares Outstanding1 189,383,924 FINANCIAL GUIDANCE Projected YE 2019 Cash Balance ~$300M Galafold Revenue Guidance $160M-$180M 1 Preliminary unaudited

Upcoming Milestones 45 Anticipated Milestones: 2019 Well-Positioned to Create Significant Value for Shareholders and Patients in 2019 Galafold: Fabry Disease AT-GAA: Pompe Disease Gene Therapy Programs • FY19 revenue guidance • PROPEL pivotal study • Ongoing CLN3 Batten $160M-$180M enrollment (n=100) disease Phase 1/2 study • Growth in existing markets • Additional Phase 1/2 data enrollment • Additional 2-year data from • Expansion into new markets • Natural history study data CLN6 Batten disease Phase • Diagnostic initiatives • Additional supportive 1/2 study studies • Preclinical proof of concept • Advance CMC requirements for Fabry, Pompe and CDD to support BLA • Preclinical work across additional neurologic LSDs

Introduction 46 Amicus Highlights GALAFOLD’S EXTRAORDINARY LAUNCH AT-GAA IN POMPE: POTENTIAL TO LEADING GENE THERAPY PORTFOLIO IN RARE SUCCESS BECOME STANDARD OF CARE METABOLIC DISEASES • 650+ Patients and ~$91M Global Sales in FY18 • Continued Strength of Clinical Data • Pipeline of 14 Gene Therapies • FY19 Guidance of $160M-$180M • Multiple Data Expected Throughout 2019 • 2 Clinical Stage Programs • $500M Potential Sales by 2023 • 100+ Pompe Patients on AT-GAA by YE19 • Amicus as “Consolidator” of Best Minds and • $1B+ Addressable Market Opportunity by 2028 • $1B-$2B+ Market Opportunity Technologies • $1B+ Peak Recurring Market Opportunity FINANCIAL STRENGTH 2023 VISION • $500M+ Cash at 12/31/18 (runway into mid-2021) • 5,000+ Lives Transformed • Growing Contribution from Galafold Revenues • $1B+ in Revenue • Leading Global Rare Disease Biotech

Thank You “Our passion for making a difference unites us” -Amicus Belief Statement