Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EARTHSTONE ENERGY INC | form8-kxinvestorpresentati.htm |

Exhibit 99.1 Investor Presentation December 27, 2018 1

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “guidance,” “target,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about the expected future reserves, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Earthstone and its management in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: further and substantial declines in oil, natural gas liquids or natural gas prices; risks relating to any unforeseen liabilities; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write- downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit agreement; Earthstone’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; Earthstone’s ability to obtain external capital to finance exploration and development operations and acquisitions; the ability to successfully complete any potential asset acquisitions and the risks related thereto; the impacts of hedging on results of operations; uninsured or underinsured losses resulting from oil and natural gas operations; Earthstone’s ability to replace oil and natural gas reserves; and any loss of senior management or key technical personnel. Earthstone’s 2017 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, recent current reports on Form 8-K and any amendments of such filings, and other Securities and Exchange Commission (“SEC”) filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. Earthstone undertakes no obligation to revise or update publicly any forward-looking statements except as required by law. This presentation contains Earthstone’s 2018 production, capital expenditure and operating expense guidance. The actual levels of production, capital expenditures and operating expenses may be higher or lower than these estimates due to, among other things, uncertainty in drilling schedules, changes in market demand and unanticipated delays in production. These estimates are based on numerous assumptions. All or any of these assumptions may not prove to be accurate, which could result in actual results differing materially from estimates. No assurance can be made that new wells will produce in line with historic performance, or that existing wells will continue to produce in line with expectations. For additional discussion of the factors that may cause us not to achieve our production estimates, see Earthstone’s filings with the SEC, including its forms 10-K, 10-Q and 8-K and any amendments thereto. We do not undertake any obligation to release publicly the results of any future revisions we may make to this prospective data or to update this prospective data to reflect events or circumstances after the date of this presentation. Therefore, you are cautioned not to place undue reliance on this information. Industry and Market Data This presentation has been prepared by Earthstone and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although Earthstone believes these third-party sources are reliable as of their respective dates, Earthstone has not independently verified the accuracy or completeness of this information. Some data are also based on Earthstone’s good faith estimates, which are derived from its review of internal sources as well as the third-party sources described above. Estimated Ultimate Recovery and Locations Management’s use of the term estimated ultimate recovery (“EUR”) in this presentation describes estimates of potentially recoverable hydrocarbons that the SEC rules prohibit from being included in filings with the SEC. These are more speculative than estimates of proved, probable and possible reserves and accordingly are subject to substantially greater risk of being actually realized, particularly in areas or zones where there has been limited or no drilling history. We include EUR estimates to demonstrate what we believe to be the potential for future drilling and production by Earthstone. Actual quantities that may be ultimately recovered may differ substantially from estimates. Factors affecting ultimate recovery include the scope of the operators' ongoing drilling programs, which will be directly affected by the availability of capital, drilling and production costs, availability of drilling services and equipment, drilling results, lease expirations, transportation constraints, regulatory approvals and other factors, and actual drilling results, including geological and mechanical factors affecting recovery rates. Estimates of potential resources may also change significantly as the development of the properties underlying Earthstone's mineral interests provides additional data. This presentation also contains Earthstone’s internal estimates of its potential drilling locations, which may prove to be incorrect in a number of material ways. The actual number of locations that may be drilled may differ substantially. 2

Investment Highlights Actively growing in the Midland Basin Midland Basin Focused Growth through drill bit, acquisitions and significant business combinations Company with Growing Inventory ~950 total gross drilling locations across core play in Midland Basin Upside from additional benches in the Spraberry and Wolfcamp Conservative capital structure with low leverage Traditional reserve-based credit facility with standard covenants Prudent Financial Management Significant liquidity Favorable hedge position Visible Production Midland Basin wells-in-progress provide ability to ramp up production Growth & Drilling Majority of acreage in key areas is HBP Program with Substantial Optionality Minimal obligation drilling in 2019 Four prior successful public entities Operational excellence Proven Management Team Repeat institutional investors Management recognition from investors and sellside research analysts 3

Proven Leadership and Track Record of Value Creation Operating team has extensive experience running multi-rig development programs across various basins Years Years of Experience Title Working Together Frank Lodzinski 46 29 CEO Robert Anderson 30 14 President Steve Collins 28 21 Operations Mark Lumpkin 21 1 CFO Tim Merrifield 37 18 Geology and Geophysics Francis Mury 42 29 Drilling and Development Tony Oviedo 37 2 Accounting and Administration Track Record of Value Creation 1992-1996 2001-2004 2007-2012 Q2 2017 Hampton Resources Corp. (“HPTR”) AROC, Inc. (Private) GeoResources, Inc. (“GEOI”) Earthstone Acquired 20,900 Net Gulf Coast Gulf Coast, Permian Basin, Mid-Con. Eagle Ford, Bakken / Three Forks, Gulf Acres from Bold Energy, LLC in Initial investors – 7x return Initial investors – 4x return Coast, Austin Chalk Midland Basin Initial investors – 4.8x return 1992 1997 2001 2005 2007 2014 2017 2018 1997-2001 Texoil, Inc. (“TXLI”) 2005-2007 2014 Earthstone Q3 2018 Gulf Coast, Permian Basin Southern Bay Energy, LLC (Private) Bakken (662 Boe/d) Earthstone Initial investors – 10x return Gulf Coast, Permian Basin Acquired Eagle Ford interests from Oak Midland Basin, Eagle Ford 10,766 Boe/d Initial Investors – 40% IRR Valley Resources 4

Company Overview Midland Basin Asset Overview The Woodlands, Texas based E&P company is focused on development and production of oil and natural gas with current operations in the Midland Basin (~30,000 core net acres) and the Eagle Ford (~14,300 core net acres) Strategy of growing through the drill bit, organic leasing, and attractive asset acquisitions and business combinations (1) Q1-Q3 2018 production of 9,762 Boe/d (64% oil, 82% liquids) Recent Activity: In October 2018, completed an acreage trade for ~3,900 net operated acres in Reagan County for ~1,220 net non-operated acres in Glasscock County Net increase of ~2,700 acres and ~350 Boe/d Finalizing an additional acquisition of a 760 acre mineral lease adjacent to existing and newly traded acreage in Central Reagan County Creates a 14,000 acre contiguous position In November 2018, Earthstone increased its borrowing base from $225MM to $275MM Production Summary Market Statistics(2) ($ in millions, except share price) Q3’18 Net Sales Volumes: 10,766 Boe/d Class A Common Stock (MM) 28.6 Class B Common Stock (MM) 35.5 Total Common Stock Oustanding (MM) 64.1 Eagle Ford 2,031 Stock Price (as of 12/26/18) $4.54 Midland Basin Market Capitalization $290.8 8,735 Plus: Total Debt $35.0 Less: Cash ($13.4) Enterprise Value $312.4 (1) Reflects reported sales volumes (2) Class A and Class B Common Stock outstanding as of November 1, 2018. Total debt and cash balances as of September 30, 2018 5

Continue to Increase Size, Scale and Core Inventory in the Midland Basin Midland Basin Net Acres 30,000 Net Midland Basin Locations 500 % Operated in Midland Basin 77% Operations Q3 2018 Production (Boe/d)(1) 10,766 Q3 2018 Production (% Oil / % Liquids) 65% / 84% Q3 2018 Revenue ($mm) $46.1 Q3 2018 Adjusted EBITDAX ($mm)(2) $26.4 Q3 2018 LOE ($/boe)(3) $4.89 Q3 2018 G&A ($/boe)(4) $3.46 Q3 2018 Financial Q3 2018 Borrowing Base ($mm) $275 (1) Represents reported sales volumes (2) See “Reconciliation of Non-GAAP Financial Measure” on page 24 (3) Includes re-engineering, workovers and ad valorem taxes (4) Excludes non-cash stock-based compensation 6

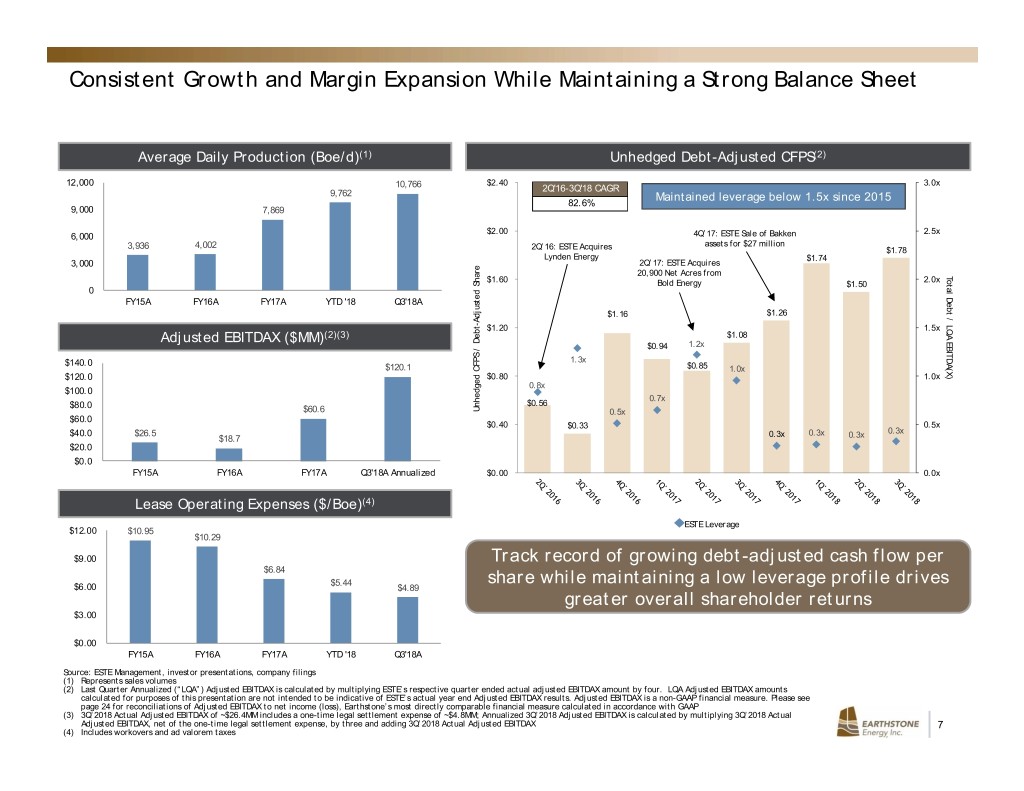

Consistent Growth and Margin Expansion While Maintaining a Strong Balance Sheet Average Daily Production (Boe/d)(1) Unhedged Debt-Adjusted CFPS(2) 12,000 $2.40 3.0x 10,766 2Q'16-3Q'18 CAGR 9,762 Maintained leverage below 1.5x since 2015 82.6% 9,000 7,869 $2.00 2.5x 6,000 4Q’17: ESTE Sale of Bakken 3,936 4,002 assets for $27 million 2Q’16: ESTE Acquires $1.78 Lynden Energy $1.74 3,000 2Q’17: ESTE Acquires 20,900 Net Acres from TotalDebt / LQA EBITDA(X) $1.60 2.0x Bold Energy $1.50 0 FY15A FY16A FY17A YTD '18 Q3'18A $1.16 $1.26 $1.20 1.5x Adjusted EBITDAX ($MM)(2)(3) $1.08 $0.94 1.2x $140.0 1.3x $120.1 $0.85 1.0x $120.0 $0.80 1.0x 0.8x $100.0 0.7x $80.0 $0.56 $60.6 Share Debt-Adjusted / CFPS Unhedged 0.5x $60.0 $0.40 $0.33 0.5x $40.0 $26.5 0.3x 0.3x 0.3x $18.7 0.3x $20.0 $0.0 FY15A FY16A FY17A Q3'18A Annualized $0.00 0.0x Lease Operating Expenses ($/Boe)(4) ESTE Leverage $12.00 $10.95 $10.29 $9.00 Track record of growing debt-adjusted cash flow per $6.84 $5.44 share while maintaining a low leverage profile drives $6.00 $4.89 greater overall shareholder returns $3.00 $0.00 FY15A FY16A FY17A YTD '18 Q3'18A Source: ESTE Management, investor presentations, company filings (1) Represents sales volumes (2) Last Quarter Annualized (“LQA”) Adjusted EBITDAX is calculated by multiplying ESTE’s respective quarter ended actual adjusted EBITDAX amount by four. LQA Adjusted EBITDAX amounts calculated for purposes of this presentation are not intended to be indicative of ESTE’s actual year end Adjusted EBITDAX results. Adjusted EBITDAX is a non-GAAP financial measure. Please see page 24 for reconciliations of Adjusted EBITDAX to net income (loss), Earthstone’s most directly comparable financial measure calculated in accordance with GAAP (3) 3Q’2018 Actual Adjusted EBITDAX of ~$26.4MM includes a one-time legal settlement expense of ~$4.8MM; Annualized 3Q’2018 Adjusted EBITDAX is calculated by multiplying 3Q’2018 Actual Adjusted EBITDAX, net of the one-time legal settlement expense, by three and adding 3Q’2018 Actual Adjusted EBITDAX 7 (4) Includes workovers and ad valorem taxes

Areas of Operations Total Q3 2018 Net Production (Boe/d)(1) 10,766 Gross Producing Wells 387 Core Net Acres 44,300 Core Gross Drilling Locations 1,104 Midland Basin Q3 2018 Net Production (Boe/d)(1) 8,734 Gross Producing Wells 209 Core Net Acres 30,000 Core Gross Drilling Locations 943 Eagle Ford Q3 2018 Net Production (Boe/d)(1) 2,031 Gross Producing Wells 178 Core Net Acres 14,300 Core Gross Drilling Locations 161 (1) Represents reported sales volumes 8

Asset Overview 9

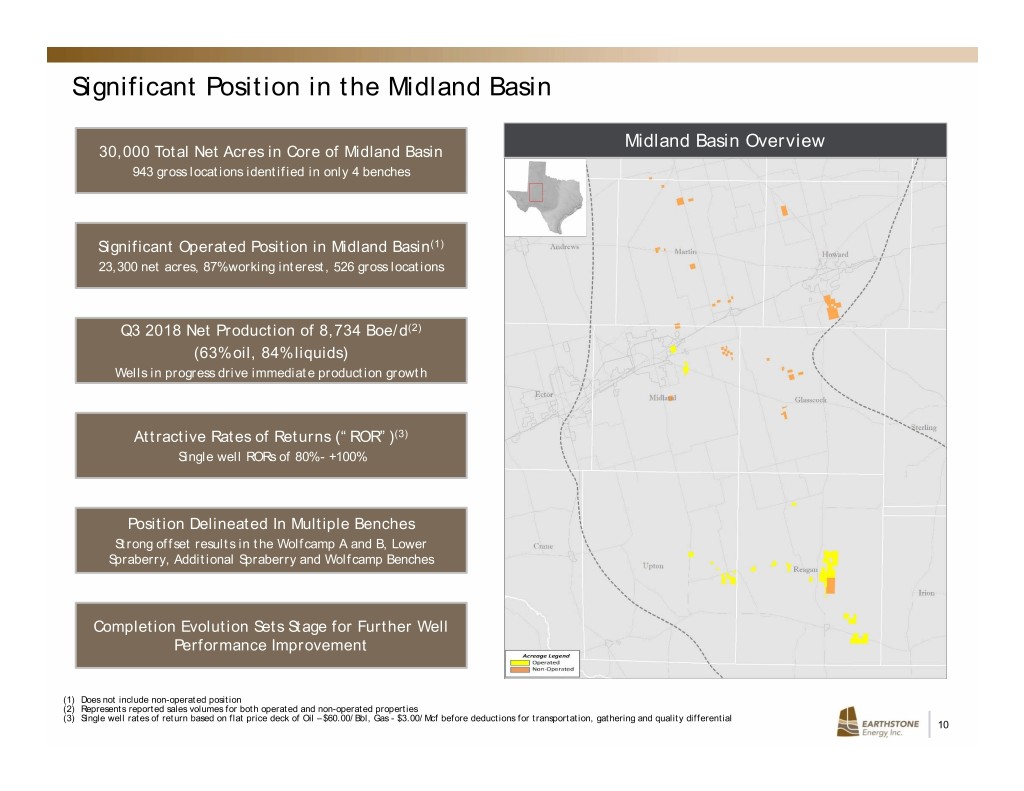

Significant Position in the Midland Basin Midland Basin Overview 30,000 Total Net Acres in Core of Midland Basin 943 gross locations identified in only 4 benches Significant Operated Position in Midland Basin(1) 23,300 net acres, 87% working interest, 526 gross locations Q3 2018 Net Production of 8,734 Boe/d(2) (63% oil, 84% liquids) Wells in progress drive immediate production growth Attractive Rates of Returns (“ROR”)(3) Single well RORs of 80% - +100% Position Delineated In Multiple Benches Strong offset results in the Wolfcamp A and B, Lower Spraberry, Additional Spraberry and Wolfcamp Benches Completion Evolution Sets Stage for Further Well Performance Improvement (1) Does not include non-operated position (2) Represents reported sales volumes for both operated and non-operated properties (3) Single well rates of return based on flat price deck of Oil – $60.00/Bbl, Gas - $3.00/Mcf before deductions for transportation, gathering and quality differential 10

Consistent Thickness in Place Across the Operated Position • Reagan County Wolfcamp Wolfcamp Formation Isopach (Midland Basin)(1) ‐ Thickest Wolfcamp shale section in Midland Basin • Current Reagan inventory ‐ 1 Wolfcamp A target ‐ 2 Wolfcamp B targets ‐ 1 Wolfcamp C target • 7 viable target benches tested or developed by industry ‐ 2 Wolfcamp A targets ‐ 3 Wolfcamp B targets ‐ 1 Wolfcamp C target ‐ 1 Wolfcamp D target • Offset operators have developed five benches in a stacked “wine rack” pattern ‐ 2 Wolfcamp A targets ‐ 3 Wolfcamp B targets • Thermal maturity places ESTE’s acreage in oil window with low gas/oil ratios (“GOR”) ‐ Average 80% Liquids, 20% Gas • Shallower true vertical depth (“TVD”) than northern end of Midland Basin ‐ D&C costs are lower Source: University of Texas Bureau of Economic Geology (1) Does not include Wolfcamp A in the Wolfcamp Isopach 11

High Quality Pay Across Multiple Zones Reagan County Type Section Reagan Co. Resource Greater than Midland Co. North Midland Central Reagan Dean Dean Wolfcamp A Wolfcamp A Wolfcamp Wolfcamp B Upper B Wolfcamp A Thickness increases 50-100’ from Midland to Reagan County. Wolfcamp Lower B Wolfcamp B Wolfcamp C Thickness increases 250-300’ Wolfcamp from Midland to Reagan County. C Wolfcamp C Bench is much thicker in Reagan County. Wolfcamp D Wolfcamp D Primary Targets Prospective Targets(1) (1) Prospective targets tested in offset wells by other operators 12

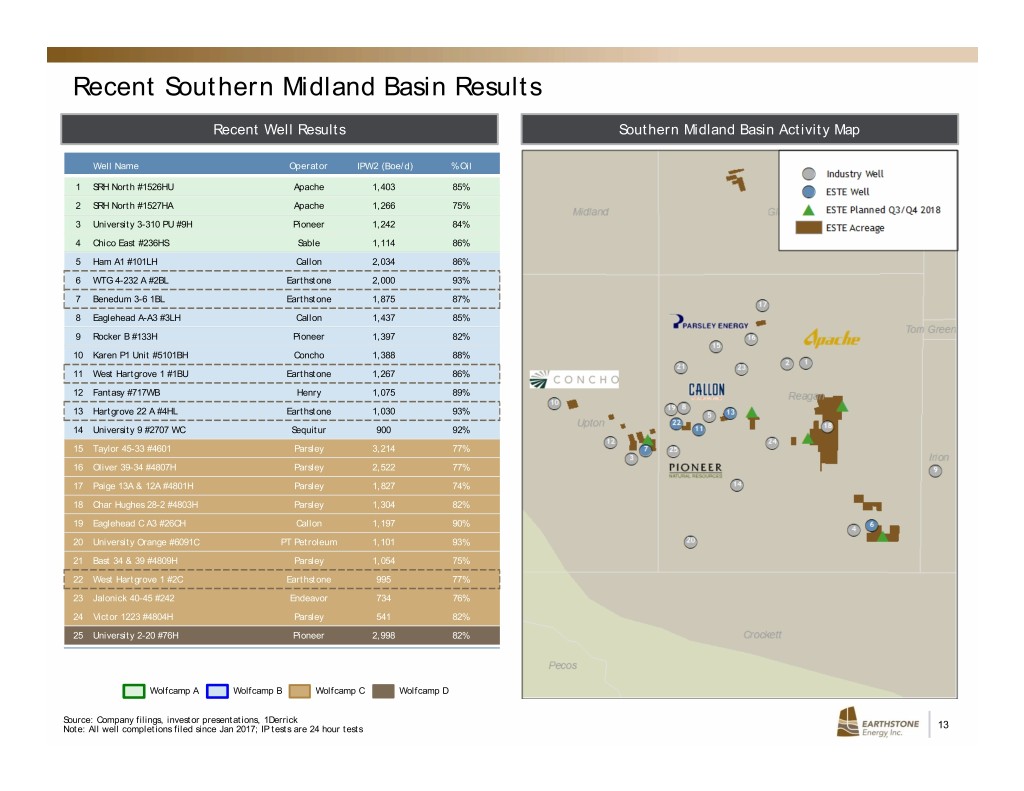

Recent Southern Midland Basin Results Recent Well Results Southern Midland Basin Activity Map Well Name Operator IPW2 (Boe/d) % Oil 1 SRH North #1526HU Apache 1,403 85% 2 SRH North #1527HA Apache 1,266 75% 3 University 3-310 PU #9H Pioneer 1,242 84% 4 Chico East #236HS Sable 1,114 86% 5 Ham A1 #101LH Callon 2,034 86% 6 WTG 4-232 A #2BL Earthstone 2,000 93% 7 Benedum 3-6 1BL Earthstone 1,875 87% 8 Eaglehead A-A3 #3LH Callon 1,437 85% 9 Rocker B #133H Pioneer 1,397 82% 10 Karen P1 Unit #5101BH Concho 1,388 88% 11 West Hartgrove 1 #1BU Earthstone 1,267 86% 12 Fantasy #717WB Henry 1,075 89% 13 Hartgrove 22 A #4HL Earthstone 1,030 93% 14 University 9 #2707 WC Sequitur 900 92% 15 Taylor 45-33 #4601 Parsley 3,214 77% 16 Oliver 39-34 #4807H Parsley 2,522 77% 17 Paige 13A & 12A #4801H Parsley 1,827 74% 18 Char Hughes 28-2 #4803H Parsley 1,304 82% 19 Eaglehead C A3 #26CH Callon 1,197 90% 20 University Orange #6091C PT Petroleum 1,101 93% 21 Bast 34 & 39 #4809H Parsley 1,054 75% 22 West Hartgrove 1 #2C Earthstone 995 77% 23 Jalonick 40-45 #242 Endeavor 734 76% 24 Victor 1223 #4804H Parsley 541 82% 25 University 2-20 #76H Pioneer 2,998 82% Wolfcamp A Wolfcamp B Wolfcamp C Wolfcamp D Source: Company filings, investor presentations, 1Derrick Note: All well completions filed since Jan 2017; IP tests are 24 hour tests 13

Differentiated, Balanced Inventory in Midland Basin Midland Basin Overview Gross Locations by Lateral Length and Target • Contiguous acreage positions provide significant Gross Locations by Lateral Length development advantage Target 5,000' - 6,250' 6,250' - 8,750' 8,750' - 10,000' Total % Total • Long lateral development increases capital efficiency Lower Spraberry 1 46 40 87 9% Wolfcamp A 9 112 160 281 30% • Over 95% of Midland horizontal locations have laterals of ~6,250 feet or greater Upper Wolfcamp B 9 98 159 266 28% – Over 50% of horizontal locations 8,750 feet or greater Lower Wolfcamp B 7 81 119 207 22% • Additional upside from: Wolfcamp C 6 55 41 102 11% – Middle Spraberry Total Gross Locations 32 392 519 943 100% – Jo Mill Total Net Locations 500 – Additional Lower Spraberry % Total (Gross) 3% 42% 55% 100% – Additional benches in Wolfcamp B – Wolfcamp D • Actively pursuing acreage and acquisition bolt-on opportunities to increase lateral lengths and ownership • Near-term drilling focused in the Wolfcamp A and the Wolfcamp B based on positive offset results, but are optimistic about the upside potential in other zones 14

Midland Basin Type Curve Overview Outperforming initial expectations and generating attractive returns at strip prices Improved internal rate of return (“IRR”) due to initial production outperforming previous type curves Reagan County Results(1) Midland and Upton County Results(2) 150 ~750 150 2017 Reagan Co Avg. (16 wells) Reagan TC Detail Midland & Upton Co Avg. (6 wells) MBo Texaco-Parish 1 #1HU D&C/Ft $960 Hamman 45 #6HM Texaco-Parish 2 #1HM Lateral Length 7,500 Hamman 45 #7HL Hartgrove 22A 3HU Peak IP-30 per 1000' 83 Benedum 3-6 #1BL 120 120 Hartgrove 22A 4HL EUR/Ft (2-Stream) 114 West Hartgrove 1 1BU West Hartgrove 1 2C WTG 4-232 A 2BL 90 ~580 90 Mid/Upton TC Detail WTG 4-232 A 3A MBo D&C/Ft $960 Lateral Length 7,500 Peak IP-30 per 1000' 150 60 60 EUR/Ft (2-Stream) 131 30 30 7,500' Norm CUMULATIVE PRODUCTION, MBOE (2 STREAM) (2 MBOE PRODUCTION, CUMULATIVE Norm 7,500' 7,500' Norm CUMULATIVE PRODUCTION, STREAM) (2 MBOE PRODUCTION, CUMULATIVE Norm 7,500' 0 0 01234560123456 TIME, MONTHS TIME, MONTHS Type Curve Summary (100% WI, 75% NRI 7,500' Laterals) (3) (4) (4) (5) Lateral Length DC & E EUR Oil NGL IRR Type Curve Area (ft) ($M) (MBoe) (%) (%) $50/$2.50 $60/$2.50 Midland / Upton 7,500 $7,200 1,000 67% 20% 74% >100% Reagan 7,500 $7,200 850 59% 22% 40% 58% Source: ESTE management, investor presentations (1) Reflects average cumulative production of wells completed in 2017 in Reagan County; production data adjusted for downtime (2) Reflects average cumulative production of wells completed in 2016 and 2017 in Upton and Midland Counties (3) EUR calculated on a 2-stream basis (4) Percent oil and NGL calculated on a 3-stream basis (5) Single well rates of return assumes 3-stream economics on flat price deck of Oil - $50.00 and $60.00/Bbl, Gas - $2.50/Mcf before deductions for transportation, gathering, and 15 quality differential. Assumes 3 month delay from spud to first sales

Acreage Trade – Central Reagan County Acreage Trade Highlights Pre-Trade Post-Trade In October 2018, ESTE traded non-operated working interests in Glasscock County and paid $27.8 million in cash for operated working interests in Reagan County with an offset operator Added 3,899 operated net acres to Reagan County position (~100% working interest) Includes 14 PDP wells (8 horizontal, 6 vertical) Net increase of 350 Boe/d and 2,677 acres Additionally, ESTE expects to finalize an additional lease acquisition which will add ~760 net acres in Reagan County With these acreage transactions, ESTE’s total net acreage in the Midland Basin has increased to ~30,000 acres, of which ~23,300 acres are operated ~14,000 contiguous net acres with 85% working interest in Central Reagan County ESTE Trade Added Pending Acreage Acreage Acreage Acquisition 16

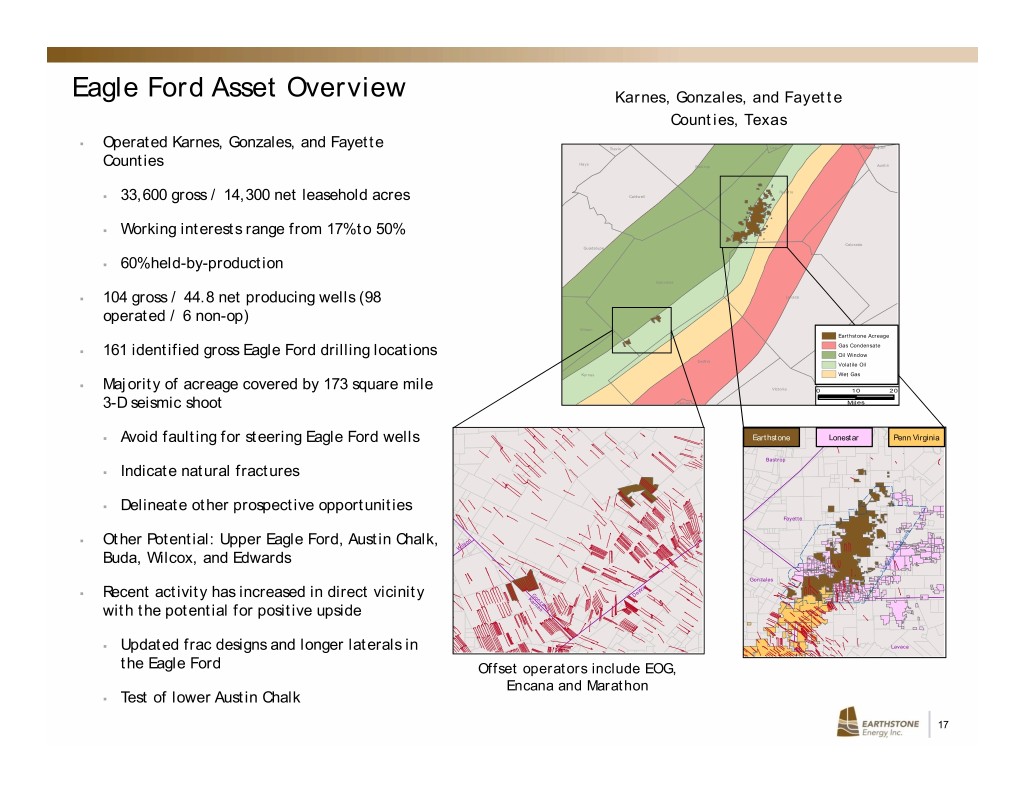

Eagle Ford Asset Overview Karnes, Gonzales, and Fayette Counties, Texas . Operated Karnes, Gonzales, and Fayette Lee Washington Tr av is Hays Counties Bastrop Austin Fa yet te . 33,600 gross / 14,300 net leasehold acres Caldwell . Working interests range from 17% to 50% Colorado Guadalupe . 60% held-by-production Gonzales . 104 gross / 44.8 net producing wells (98 Lavaca operated / 6 non-op) Wilson Wharton Earthstone Acreage Gas Condensate . 161 identified gross Eagle Ford drilling locations Oil Window DeWitt Volatile Oil Jackson Karnes Wet Gas . Majority of acreage covered by 173 square mile Victoria 01020 3-D seismic shoot Goliad Miles . Avoid faulting for steering Eagle Ford wells Earthstone Lonestar Penn Virginia Bastrop . Indicate natural fractures . Delineate other prospective opportunities Fayette s t n e t x n E . o Other Potential: Upper Eagle Ford, Austin Chalk, ls a i t W a D ic m is e Buda, Wilcox, and Edwards S D - 3 Gonzales t it eW G D . Recent activity has increased in direct vicinity K o n a z rn a e le with the potential for positive upside s s . Updated frac designs and longer laterals in Lavaca the Eagle Ford Offset operators include EOG, Encana and Marathon . Test of lower Austin Chalk 17

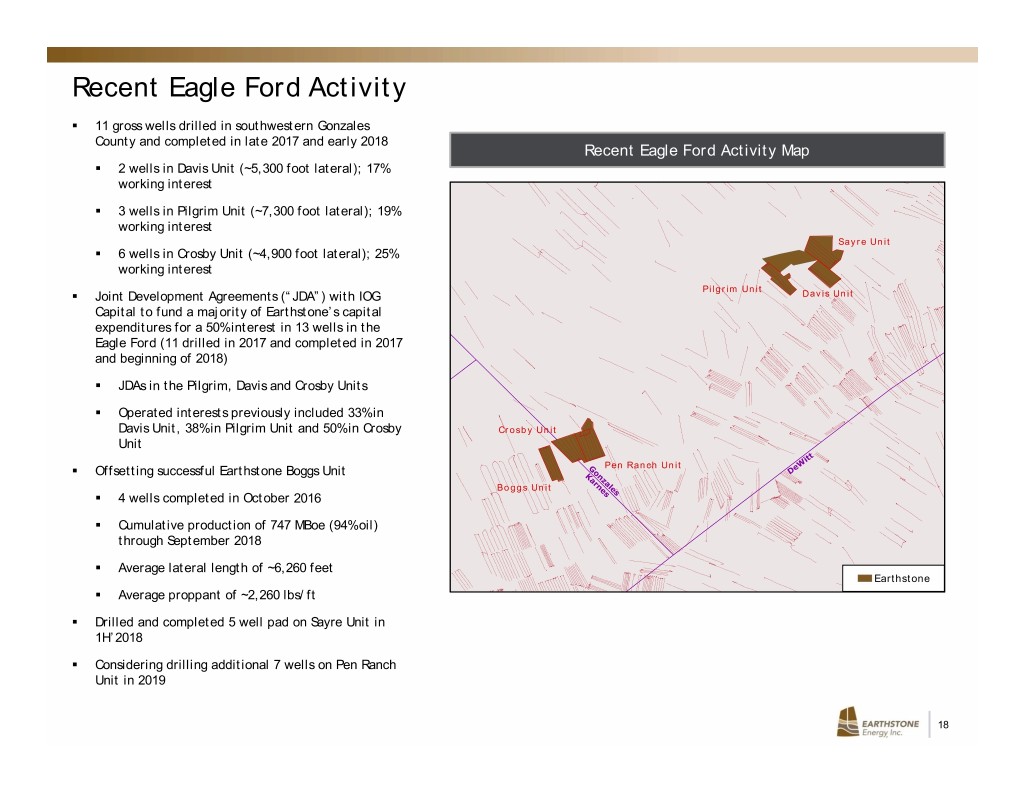

Recent Eagle Ford Activity . 11 gross wells drilled in southwestern Gonzales County and completed in late 2017 and early 2018 Recent Eagle Ford Activity Map . 2 wells in Davis Unit (~5,300 foot lateral); 17% working interest . 3 wells in Pilgrim Unit (~7,300 foot lateral); 19% working interest Sayre Unit . 6 wells in Crosby Unit (~4,900 foot lateral); 25% working interest Pilgrim Unit . Joint Development Agreements (“JDA”) with IOG Davis Unit Capital to fund a majority of Earthstone’s capital expenditures for a 50% interest in 13 wells in the Eagle Ford (11 drilled in 2017 and completed in 2017 and beginning of 2018) . JDAs in the Pilgrim, Davis and Crosby Units . Operated interests previously included 33% in Davis Unit, 38% in Pilgrim Unit and 50% in Crosby Crosby Unit Unit . Offsetting successful Earthstone Boggs Unit Pen Ranch Unit Boggs Unit . 4 wells completed in October 2016 . Cumulative production of 747 MBoe (94% oil) through September 2018 . Average lateral length of ~6,260 feet Earthstone . Average proppant of ~2,260 lbs/ft . Drilled and completed 5 well pad on Sayre Unit in 1H’2018 . Considering drilling additional 7 wells on Pen Ranch Unit in 2019 18

Financial Overview 19

Capital Budget, Guidance and Liquidity ESTE 2018 Capital Budget(1) 2018 FY Guidance(1) (2) 2018 Average Production (Boe/d) 10,500 – 11,000 ($ in millions) Gross / Net Well Count Wells Spudded On-Line % Oil 64% Drilling and Completion % Gas 17% Operated Midland Basin $107 15 / 13.4 19 / 15.0 % NGL 19% Non-Operated Midland Basin 12 5 / 2 5 / 2 Operated Eagle Ford 12 10 / 2.1 16 / 3.6 Operating Costs: Land / Infrastructure 9 Lease Operating and Workover ($/Boe) $5.25 – $5.50 Total $140 Production Taxes (% of Revenue) 5.0% – 5.3% G&A ($/Boe) $5.00 – $5.50 2018 Capex by Project Area(1) Liquidity (9/30/2018) Total Capex D&C Capex ($mm) 9/30/2018 6% 9% 9% Cash 13.4 9% Revolver Borrowings 35.0 Total Debt $35.0 76% 91% Revolver Borrowing Base (3) 275.0 Less: Revolver Borrowings (35.0) Operated Midland Basin Midland Basin Eagle Ford Non-Operated Midland Basin Plus: Cash 13.4 Operated Eagle Ford Land / Infrastructure Liquidity $253.4 (1) Assumes a 1-rig program for the operated Midland Basin acreage (2) Figures reflect current estimates. See cautionary statement regarding estimated results and costs at the beginning of this presentation (3) Earthstone increased its borrowing base from $225MM to $275MM on November 6th, 2018 20

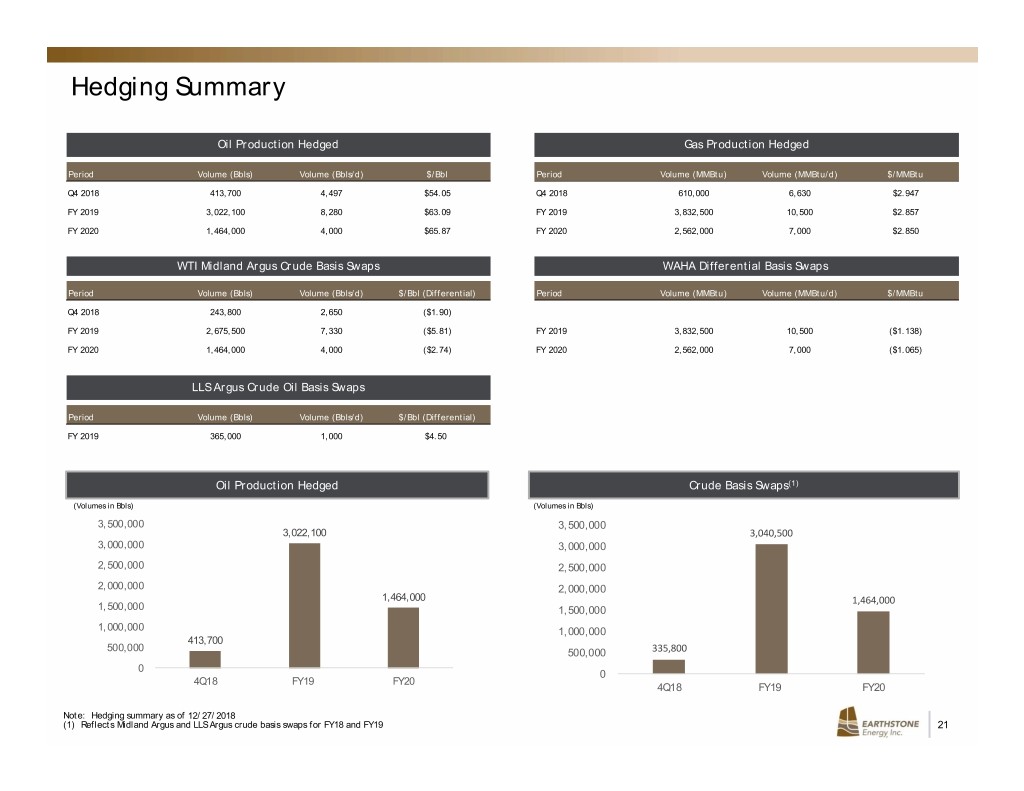

Hedging Summary Oil Production Hedged Gas Production Hedged Period Volume (Bbls) Volume (Bbls/d) $/Bbl Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu Q4 2018 413,700 4,497 $54.05 Q4 2018 610,000 6,630 $2.947 FY 2019 3,022,100 8,280 $63.09 FY 2019 3,832,500 10,500 $2.857 FY 2020 1,464,000 4,000 $65.87 FY 2020 2,562,000 7,000 $2.850 WTI Midland Argus Crude Basis Swaps WAHA Differential Basis Swaps Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Differential) Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu Q4 2018 243,800 2,650 ($1.90) FY 2019 2,675,500 7,330 ($5.81) FY 2019 3,832,500 10,500 ($1.138) FY 2020 1,464,000 4,000 ($2.74) FY 2020 2,562,000 7,000 ($1.065) LLS Argus Crude Oil Basis Swaps Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Differential) FY 2019 365,000 1,000 $4.50 Oil Production Hedged Crude Basis Swaps(1) (Volumes in Bbls) (Volumes in Bbls) 3,500,000 3,500,000 3,022,100 3,040,500 3,000,000 3,000,000 2,500,000 2,500,000 2,000,000 2,000,000 1,464,000 1,464,000 1,500,000 1,500,000 1,000,000 1,000,000 413,700 500,000 500,000 335,800 0 0 4Q18 FY19 FY20 4Q18 FY19 FY20 Note: Hedging summary as of 12/27/2018 (1) Reflects Midland Argus and LLS Argus crude basis swaps for FY18 and FY19 21

Analyst Coverage Firm Analyst Contact Info Baird Joseph Allman / 646-557-3209 / jdallman@rwbaird.com Coker Palmer David Beard / 631-725-8810 / beard@cokerpalmer.com Alliance Global Partners Joel Musante / 203-349-4782 / jmusante@allianceg.com Imperial Capital Jason Wangler / 713-892-5603 / jwangler@imperialcapital.com Johnson Rice Ron Mills / 504-584-1217 / rmills@jrco.com Northland Jeff Grampp / 949-600-4150 / jgrampp@northlandcapitalmarkets.com RBC Brad Heffern / 512-708-6311 / brad.heffern@rbccom.com Roth John White / 949-720-7115 / jwhite@roth.com Seaport Global John Aschenbeck / 713-658-6343 / jaschenbeck@seaportglobal.com Stephens Gail Nicholson / 301-904-7466 / gail.nicholson@stephens.com SunTrust Neal Dingmann / 713-247-9000 / neal.dingmann@suntrust.com Wells Fargo Gordon Douthat / 303-863-6880 / gordon.douthat@wellsfargo.com 22

Contact Information Mark Lumpkin, Jr. EVP, Chief Financial Officer Scott Thelander Vice President of Finance Corporate Offices Houston 1400 Woodloch Forest Drive | Suite 300 | The Woodlands, TX 77380 | (281) 298-4246 Midland 600 N. Marienfeld | Suite 1000 | Midland, TX 79701 | (432) 686-1100 Website www.earthstoneenergy.com 23

Reconciliation of Non-GAAP Financial Measure Earthstone uses Adjusted EBITDAX, a financial measure that is not presented in accordance with United States generally accepted accounting principles (“GAAP”). Adjusted EBITDAX is a supplemental non- GAAP financial measure that is used by Earthstone’s management team and external users of its financial statements, such as industry analysts, investors, lenders and rating agencies. Earthstone’s management team believes Adjusted EBITDAX is useful because it allows Earthstone to more effectively evaluate its operating performance and compare the results of its operations from period to period without regard to its financing methods or capital structure. Earthstone defines Adjusted EBITDAX as net income (loss) plus, when applicable, loss (gain) on sale of oil and gas properties; accretion; impairment expense; depletion, depreciation and amortization; transaction costs; interest expense; interest income; unrealized loss (gain) on mark-to-market of hedges; non-cash stock based compensation; and income tax (benefit). Earthstone excludes the foregoing items from net income (loss) in arriving at Adjusted EBITDAX because these amounts can vary substantially from company to company within their industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income (loss) as determined in accordance with GAAP or as an indicator of Earthstone’s operating performance or liquidity. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDAX. Earthstone’s computation of Adjusted EBITDAX may not be comparable to other similarly titled measures of other companies or to similar measures in Earthstone’s revolving credit facility. The following table provides a reconciliation of Net income to Adjusted EBITDAX for: 3Q’18 Adjusted EBITDAX ($ in 000s) YTD 9/30/18 Adjusted EBITDAX ($ in 000s) 3Q'18 YTD 9/30/18 Net income (loss) (1) $564 Net income (loss) (1) $14,227 Accretion of asset retirement obligations 44 Accretion of asset retirement obligations 128 Impairment expense 833 Impairment expense 833 Depletion, depreciation and amortization 12,842 Depletion, depreciation and amortization 33,362 Interest expense, net 564 Interest expense, net 1,787 Transaction costs 892 Transaction costs 892 (Gain) on sale of oil and gas properties (4,096) (Gain) on sale of oil and gas properties (4,608) Unrealized loss (gain) on derivative contracts 13,105 Unrealized loss (gain) on derivative contracts 19,963 Stock based compensation (non-cash) (2) 1,522 Stock based compensation (non-cash) (2) 5,535 Income tax (benefit) 173 Income tax (benefit) 119 Adjusted EBITDAX $26,443 Adjusted EBITDAX $72,239 (1) Net income includes a $4.8 million charge to expense representing management’s estimate of a pending lawsuit settlement (2) Included in General and administrative expense in the Condensed Consolidated Statements of Operations 24