Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - STERLING CONSOLIDATED Corp | tv509882_ex99-1.htm |

| 8-K - FORM 8-K - STERLING CONSOLIDATED Corp | tv509882_8k.htm |

Exhibit 10.1

LOAN AGREEMENT

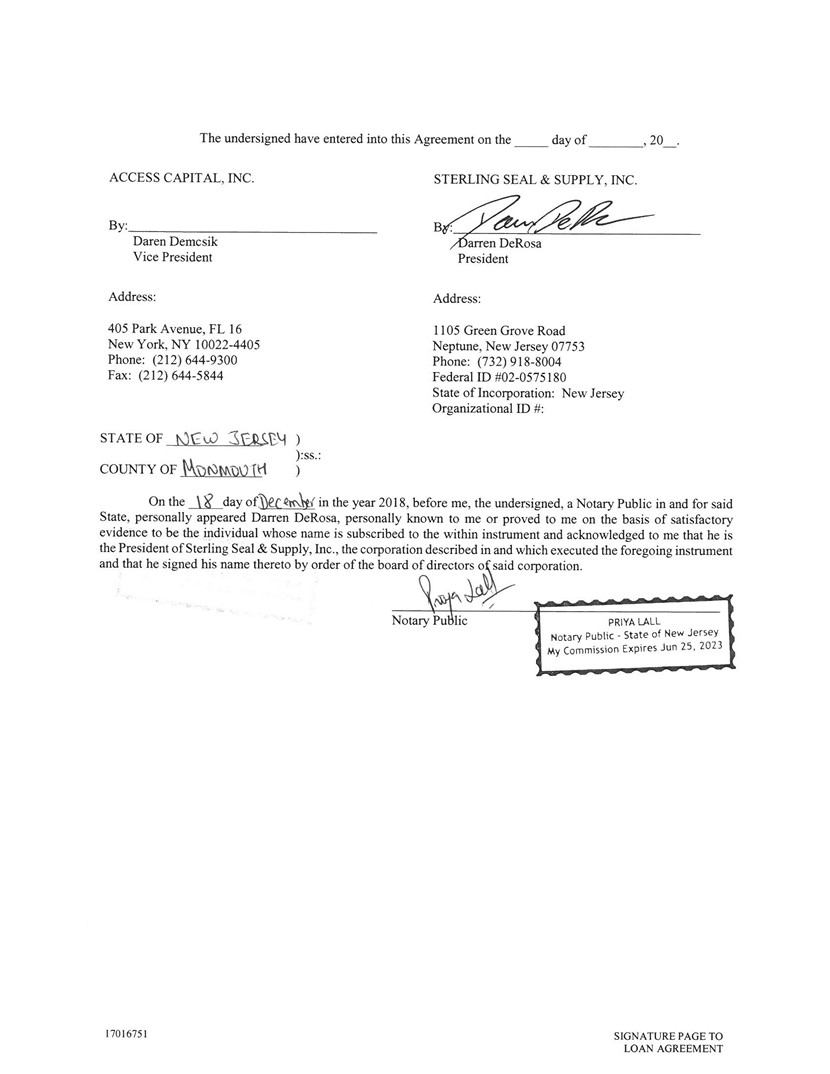

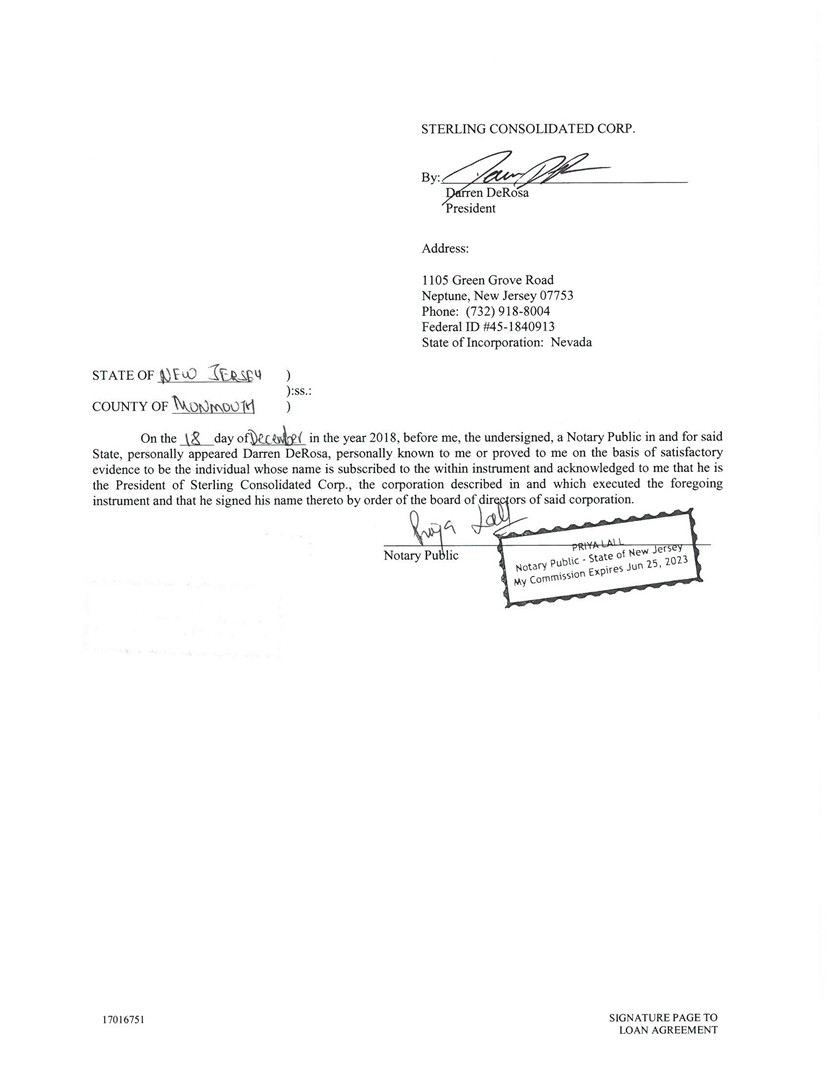

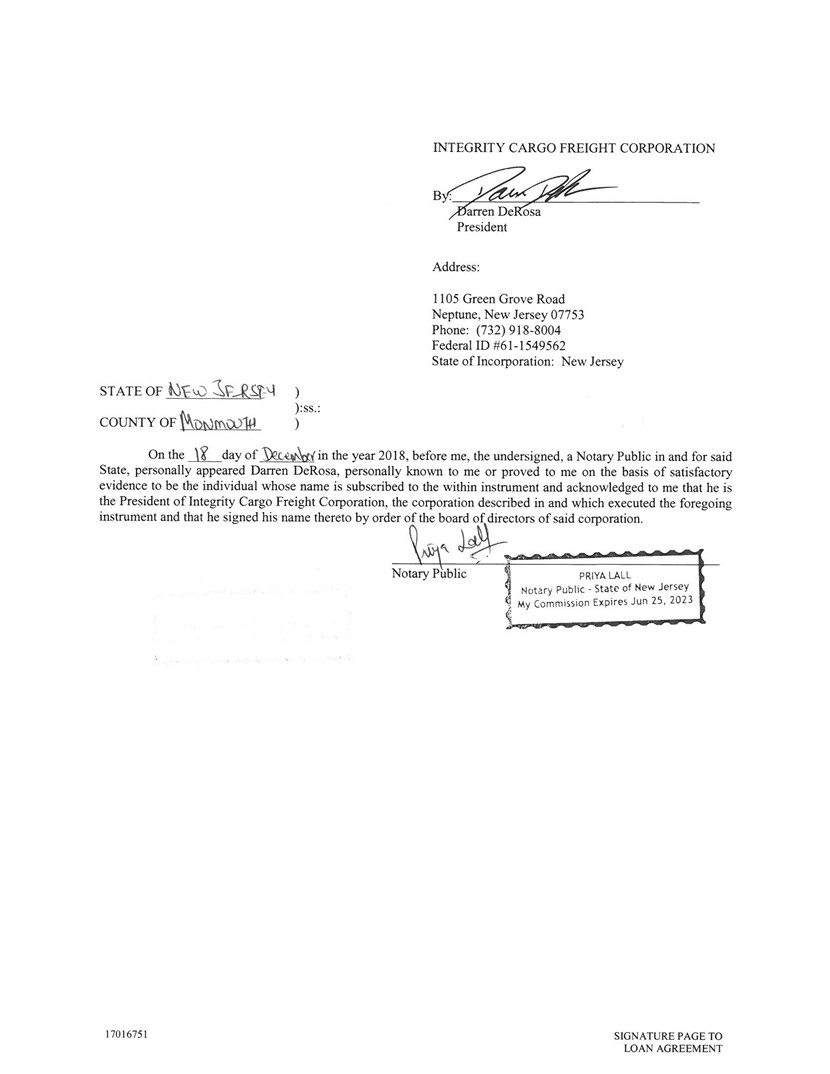

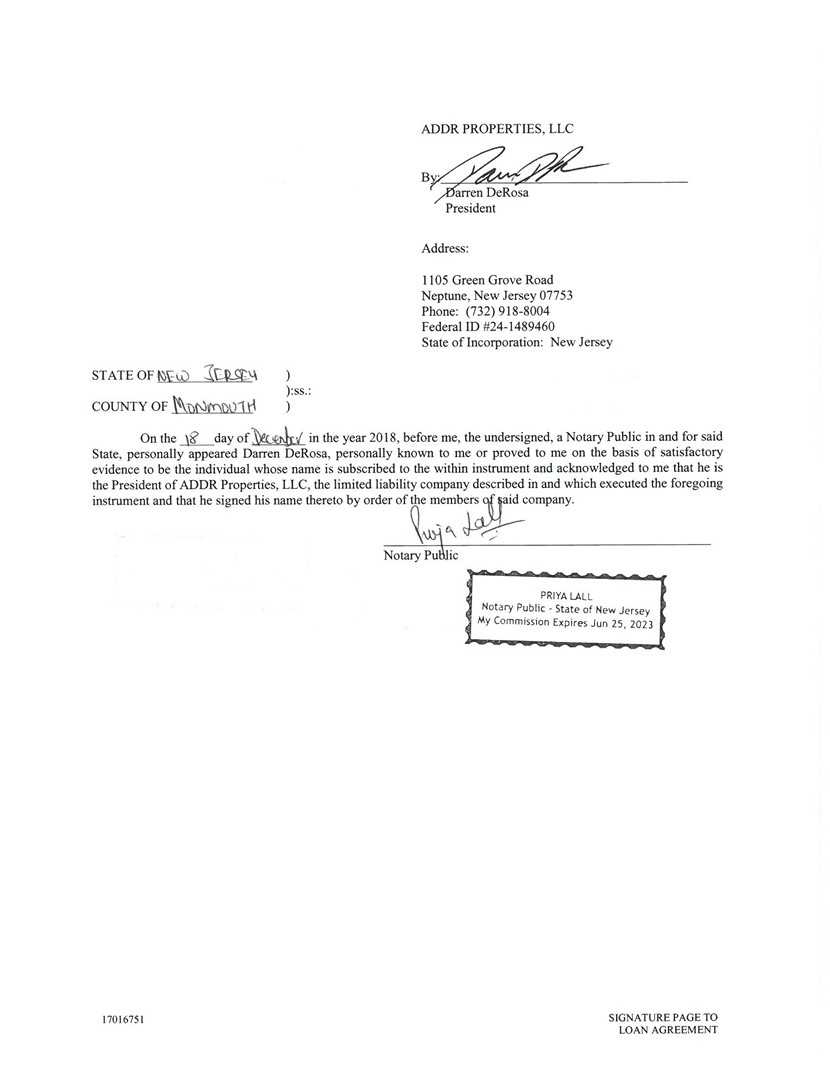

Access Capital, Inc. (“Access Capital”) and the undersigned companies named below, and set forth on Exhibit A, jointly and severally (each a “Company” and collectively the “Companies”) hereby mutually agree to the creation of a funding relationship between the parties, on the terms and conditions contained within this Loan Agreement (the “Loan Agreement”) and in accordance with the Standard Terms and Conditions of Loan Agreement attached hereto as Exhibit A and made a part hereof (the “Standard Terms”; the Loan Agreement and the Standard Terms are collectively referred to as the “Agreement”; all defined terms used herein and not expressly defined herein shall have the meaning given to such terms in the Standard Terms):

1. Invoice Delivery; Advances If requested by Access Capital, each Company will deliver copies of all of its customer invoices (each, an “Account Receivable” and collectively, the “Accounts Receivable”) to Access Capital for verification and processing promptly after their creation. Each Company will forward each invoice to the respective customer of such Company (individually an “Account Debtor” and collectively, “Account Debtors”). Access Capital may in its sole discretion make revolving credit advances (the “Advances”) to each Company from time to time during the term of this Agreement which in the aggregate at any time outstanding, will not exceed (without the consent of Access Capital) the lesser of (i) $2,500,000 (the “Capital Availability Amount”) minus such reserves as Access Capital may reasonably deem proper and necessary from time to time based on, for example, unpaid taxes, judgments, liens against the Collateral which have not been subordinated in favor of Access Capital, amounts deemed necessary by Access Capital to preserve or protect the Collateral, or any deterioration in the Collateral (the “Reserves”) or (ii) the sum of (1) up to 85% of the net face amount of those Accounts Receivable (as hereinafter defined) of each Company which Access Capital deems to be eligible for borrowing purposes (as determined by Access Capital in the exercise of its commercially reasonable discretion) minus Reserves plus (2) the lesser of (a) the Inventory Sublimit Amount (as hereafter defined) or (b) up to 50% of the value (calculated at the lower of cost or market value) of that inventory of each Company which Access Capital deems eligible for borrowing purposes (the “Eligible Inventory”) minus Reserves. For purposes hereof, the term “Inventory Sublimit Amount” means $1,150,000, provided that immediately after giving effect to the Mortgage Refinance (as defined in Section 3(b) of the Standard Terms) the Inventory Sublimit Amount shall be reduced to $500,000 (such reduction, the “Inventory Sublimit Reduction”).

2. Interest and Fees. The Companies shall jointly and severally pay Access Capital interest and fees as follows, each of which shall constitute an Obligation:

(a) Interest on the unpaid principal balance of each Advance until such time as such Advance is collected in full in good funds in dollars of the United States of America at a per annum rate equal to 1.50% over Prime (the “Contract Rate”). “Prime” shall mean the prime or “Base Rate” of Citibank, N.A. from time to time. Interest and fees shall be computed on the basis of actual days elapsed in a year of 360 days.

(b) An annual fee (the “Annual Fee”) equal to 1% of the Capital Availability Amount on the Closing Date (as hereafter defined) and on each anniversary of the Closing Date. The Annual Fee shall be deemed earned in full as of the Closing Date and shall not be subject to rebate or proration for any reason.

3. Term. This Loan Agreement shall be in effect for an initial term beginning on the date hereof (the “Closing Date”) and continuing until three years from the date on which any Company shall have first received the proceeds of the initial Advances from Access Capital (the “Initial Term”).

4. Conditions Precedent. Unless otherwise consented to by Access Capital, Access Capital shall not be obligated to make any Advances until the conditions precedent set forth on Exhibit B attached hereto shall have been satisfied (this Agreement, the documents listed on Exhibit B and any and all other documents, instruments and agreements from time to time entered into by the Companies and/or any Responsible Party (as hereafter defined) in favor of Access Capital are collectively referred to as the “Transaction Documents”).

5. The Companies’ Representations, Warranties and Covenants. Each Company represents, warrants and covenants to Access Capital as follows:

(a) The Company in whose name the invoice has been billed is the sole owner of the Collateral free and clear of all liens and encumbrances; such Company has the full power and authority to grant Access Capital a security interest in the Collateral and such security interest grant has been duly authorized by all necessary company action;

(b) The goods or services listed or referred to in the invoices related to each Account Receivable have been shipped or rendered to the Account Debtor, and the prices and terms of shipment set forth therein conform in all material respects to the terms of any related purchase order or agreement with the Account Debtor;

(c) The invoices representing each Account Receivable correctly set forth the full purchase price of the goods or services covered thereby, and such amount is due and owing from the Account Debtor, subject to no set-offs, deductions, disputes, contingencies or counterclaims against such Company or the invoice, and payment thereof is not contingent upon fulfillment of any obligation;

(d) Such Company will perform all steps from time to time as requested by Access Capital to create and maintain in Access Capital’s favor a valid perfected first priority security interest in the Collateral; and

(e) All inventory manufactured by each Company in the United States of America shall be produced in accordance with the requirements of the Federal Fair Labor Standards Act of 1938, as amended and all rules, regulations and orders related thereto or promulgated thereunder.

6. Servicing Agent. For the purpose of administrative convenience in the servicing of this Agreement, Sterling Seal & Supply Company, Inc., a New Jersey corporation (the “Servicing Agent”), is hereby appointed by the other Companies as the servicing agent for the Companies and the Companies hereby instruct Access Capital to make all payments due to any Company, directly to the Servicing Agent.

7. Governing Law. This Agreement has been made in, and shall be governed by the laws of, the State of New York, without giving effect to conflicts of laws rules.

8. Complete Agreement. This Agreement and the other Transaction Documents set forth the complete and entire understanding among the Companies, each Responsible Party and Access Capital and may only be modified by a written instrument signed by the party to be bound thereby.

[Remainder of this page intentionally left blank; signatures follow]

EXHIBIT A

STANDARD TERMS AND CONDITIONS OF LOAN AGREEMENT

The following Standard Terms and Conditions are attached to, and hereby incorporated by reference in, the Loan Agreement. All defined terms used herein and not expressly defined herein shall have the meaning given to such terms in the Loan Agreement.

1. Verification, Credit and Availability. Access Capital will conduct such examination and verification of the Companies’ Accounts Receivable, and such credit investigation of the Account Debtors, as it considers necessary or desirable. Access Capital shall have the absolute right, in the exercise of its commercially reasonable discretion, to deem any or all Accounts Receivable of any Company ineligible for borrowing purposes Access Capital shall have no obligation to deem any Account Receivable from a specific Account Debtor to be an Eligible Receivable if: (i) the Account Receivable exceeds the Eligibility Period (as such term is defined in paragraph 3 herein), (ii) 25% or more of the Accounts Receivable from the applicable Account Debtor exceeds the Eligibility Period, (iii) the Account Receivable due from any affiliate of any of the Companies, (iv) the Account Receivable is due from an Account Debtor to which any of the Companies is also a debtor or (v) the total unpaid Accounts Receivable from the applicable Account Debtor exceeds 25% of all Eligible Accounts Receivable. In determining Account Debtor eligibility, Access Capital shall act in a commercially reasonable manner and its credit department will follow its standard operating procedures in making credit decisions consistent with its regular practices. Access Capital shall have the absolute right, in the exercise of its commercially reasonable discretion, to deem any or all inventory of any Company as ineligible for borrowing purposes, including without limitation, if such inventory (i) is not subject to Access Capital’s first priority security interest, (ii) is located on premises with respect to which Access Capital has not received a landlord waiver or bailee letter acceptable in form and substance to Access Capital, (iii) is in transit, (iv) is not in good condition, (v) fails to meet all standards imposed by any governmental agency, department or division, (vi) is not currently either usable or salable in the normal course of such Company’s business, (vii) such inventory is work in process, (viii) such inventory is slow moving or aged beyond twelve-months or (ix) such inventory is anything other than finished goods.

2. Procedure for Advances; Collection of Collateral. Any Company may by written notice to Access Capital request a borrowing of Advances prior to 12:00 noon (New York time) on the business day of its request to incur, on that day, an Advance. Together with each request for an Advance (or at such other intervals as Access Capital may request), such Company shall deliver to Access Capital a Borrowing Base Certificate in the form of Exhibit C, which shall be certified as true and correct by the President or Chief Financial Officer of each Company together with all supporting documentation relating thereto (each, a “Borrowing Base Certificate”). All Advances shall be charged to the Companies’ account on Access Capital’s books. The proceeds of each Advance made by Access Capital shall be made available to the Companies on the business day following the business day so requested in accordance with the terms of this Section 2 by way of credit to the Companies’ operating account maintained with such bank as the Servicing Agent designates to Access Capital. Any and all Obligations due and owing under this Agreement and the other Transaction Documents may be charged to the Companies’ account and shall constitute Advances. The Companies shall be required to (a) make a mandatory prepayment hereunder at any time that the aggregate outstanding principal balance of the Advances is in excess of the maximum amount of Advances permitted under this Agreement, in an amount equal to such excess; and (b) repay on the expiration of the term of this Agreement (i) the then aggregate outstanding principal balance of the Advances together with accrued and unpaid interest, fees and charges and (ii) all other amounts owed Access Capital under this Agreement and the other Transaction Documents. Any payments of principal, interest, fees or any other amounts payable under this Agreement or under any other Transaction Documents shall be made prior to 12:00 noon (New York time) on the due date thereof in immediately available funds. Access Capital will credit (conditional upon final collection) all proceeds of Accounts Receivable to the Companies’ account one (1) business day after receipt by Access Capital of good funds in dollars of the United States of America in Access Capital’s account; provided, however, for purposes of computing interest and fees hereunder, Access Capital will credit (conditioned upon final collection) all such payments to the Companies’ account three business days after receipt by Access Capital of good funds in dollars of the United States of America in Access Capital’s account. Any amount received by Access Capital after 12:00 noon (New York time) on any business day shall be deemed received on the next business day.

3. Nonconforming Receivables; Shortfall.

(a) If any Eligible Receivable is not paid by the Account Debtor within 90 days after the date that such Eligible Receivable was invoiced (the “Eligibility Period”), or if any Account Debtor asserts at any time a deduction, dispute, contingency, set-off or counterclaim with respect to any Eligible Receivable, the Companies shall reimburse Access Capital on demand for the amount of the Advance made with respect to such Eligible Receivable. The Companies shall be jointly and severally obligated to pay (and Access Capital shall have the right to retain) all applicable interest and fees due with respect to such Eligible Receivable even if the Companies are required to reimburse Access Capital for such Eligible Receivable.

(b) In the event that the average outstanding Advances during any month (the “Actual Amount”) is less than the Minimum Average Monthly Borrowing Amount (as hereafter defined), then the Companies shall jointly and severally pay to Access Capital at the end of each such month an amount equal to the interest payments (the “Monthly Fees”) Access Capital would have been paid on the amount by which the Minimum Average Monthly Borrowing Amount exceeds the Actual Amount for such month (herein called the “Shortfall”). For purposes of calculating the Monthly Fees hereunder for any month, the Shortfall shall be deemed to have been outstanding from the first to the last day of such month. For purposes hereof, (1) the term “Minimum Average Monthly Borrowing Amount” means $750,000, provided that in the event Access Capital shall (i) have received cash proceeds in an amount of not less than the Required Repayment Amount (as hereafter defined) from the refinancing of Access Capital’s first mortgage lien (the “Mortgage Refinance”) on the real property located at 1105 Green Grove Road, Neptune, New Jersey (the “Real Property”), which such proceeds shall be applied to reduce the then outstanding Obligations and (ii) retain a second mortgage lien on the Real Property (the occurrence of (i) and (ii), the “Trigger Event”), then upon the occurrence of the Trigger Event the Minimum Average Monthly Borrowing Amount shall be reduced to $500,000; and (2) the term “Required Repayment Amount” means the amount, if any, which would be necessary to eliminate any overadvance in existence immediately after giving effect to the Inventory Sublimit Reduction (as defined in Section 1(a) of the Loan Agreement).

4. Collection of Accounts Receivable.

(a) Each Company will irrevocably instruct all present and future Account Debtors and all other persons and entities obligated to make payments constituting Collateral to mail or deliver such payments: (i) directly to such Company which such payments such Company will, within one (1) business day of receipt, deposit into a deposit account maintained by such Company with Customers Bank or such other financial institution accepted by Access Capital in writing (the “Blocked Account Bank”) pursuant to the terms of a Control Agreement (as hereafter defined) or (ii) if such payments are made by wire transfer, to a deposit account of such Companies covered by a Control Agreement. Such instructions shall not be rescinded or modified without Access Capital's prior written consent. All such payments received by any Company shall be so received in trust for the benefit of Access Capital until so deposited in a deposit account subject to a Control Agreement. For purposes hereof, the term “Control Agreement” means a deposit account control agreement in form and substance reasonably acceptable to Access Capital entered into among the applicable Companies, Access Capital and the Blocked Account Bank covering the Companies’ blocked account(s) maintained with such Blocked Account Bank, as such agreement may be amended, restated or otherwise modified from time to time.

(b) Following the occurrence of an Event of Default (as such term is hereafter defined), Access Capital (i) may notify the Companies’ Account Debtors of Access Capital’s security interest in the Accounts Receivable, collect them directly and charge the collection costs and expenses thereof to the Companies’ account and (ii) shall have the full power and authority to collect each Account Receivable, through legal action or otherwise, and may, in its sole discretion, settle, compromise, or assign (in whole or in part) the claim for any of the Accounts Receivable, or otherwise exercise any other right now existing or hereafter arising with respect to any of the Accounts Receivable, if such action will facilitate collection, the costs with respect to which shall be charged, in each case, by Access Capital to the Companies’ loan account. If Access Capital is required to enforce its rights hereunder or under any other Transaction Document against one or more of the Account Debtors, any Company and/or any Responsible Party, then in any such event the Companies shall be jointly and severally liable to Access Capital for its reasonable attorneys’ fees incurred in connection therewith together with interest thereon from the date of the occurrence of the Event of Default upon which such enforcement is based to the date of satisfaction at the maximum rate permitted by law. All reimbursable expenses described in the Standard Terms shall be charged by Access Capital to the Companies’ loan account. The Companies acknowledge and agree that, following the occurrence and during the continuance of an Event of Default, Access Capital shall have the sole and exclusive right to commence legal action to collect any Account Receivable

(c) Access Capital shall have no liability to any Company for any mistake in the application of any payment received by it with respect to any Account Receivable, so long as Access Capital acts in good faith and without gross negligence.

5. Payment of Expenses and Taxes; Indemnification.

(a) The Companies will jointly and severally pay or reimburse Access Capital for all of Access Capital’s reasonable out of pocket costs and expenses incurred in connection with the preparation and execution of, and any amendment, supplement or modification to this Agreement and any of the other Transaction Documents and the consummation of the transactions contemplated hereby and thereby, including, without limitation, the reasonable fees and disbursements of counsel to Access Capital (whether or not such counsel is affiliated with Access Capital). The Companies shall jointly and severally pay or reimburse Access Capital for all reasonable costs and expenses incurred for such additional services as may be required hereunder, in each case in accordance with the regular practices of Access Capital and in accordance with Access Capital’s regular service charge rate schedule.

(b) The Companies will jointly and severally pay or reimburse Access Capital for all its reasonable costs and expenses incurred in connection with the enforcement and preservation of any and all rights under this Agreement and the other Transaction Documents, including, without limitation, fees and disbursements of counsel to Access Capital (whether or not such counsel is affiliated with Access Capital) and any collateral evaluation (e.g. field examinations, collateral analysis or other business analysis) performed by Access Capital or for its benefit as Access Capital deems necessary, as well as for the costs at Access Capital’s regularly posted rates, for overnight mail delivery, UCC, tax lien and judgment searches (and all updates with respect thereto) and bank wire transfer fees, as outlined in Exhibit D. Access Capital shall have the right to visit any Company at any time to review and photocopy the books and records of such Company, or portions thereof, as Access Capital shall determine to facilitate its work hereunder.

(c) The Companies will jointly and severally pay, indemnify, and hold Access Capital harmless from, any and all recording and filing fees and any and all liabilities with respect to, or resulting from, any delay in paying stamp, excise and other taxes, if any, which may be payable or determined to be payable in connection with the execution and delivery of, or consummation of any of the transactions contemplated by, or any amendment, supplement or modification of, or any waiver or consent under or in respect of, this Agreement and the other Transaction Documents.

(d) The Companies will jointly and severally pay, indemnify, and hold Access Capital harmless from and against any and all claims, liabilities, obligations, losses, damages, penalties, actions, judgments, suits, costs, expenses and disbursements of any kind or nature whatsoever, whether threatened, pending or determined (including attorneys’ fees and court costs now or hereafter arising from the enforcement of this clause), (1) with respect to the execution, delivery, enforcement and performance of this Agreement and the other Transaction Documents, including, without limitation, the custody, preservation, use or operation of, or the sale of, collection from, or other realization upon, any collateral securing Obligations, (2) arising directly or indirectly from the activities of any Company or any subsidiary, its predecessors in interest, or third parties with whom it has a contractual relationship, or arising directly or indirectly from the violation of any environmental protection, health, or safety law, whether such claims are asserted by any governmental agency or any other person or entity, and/or (3) arising by virtue of or in connection with any representation or warranty by any Company or any Responsible Party being untrue or misleading or any agreement or covenant by any Company or any Responsible Party not being performed as and when required hereunder or under any other Transaction Document (all of the foregoing, collectively, the “indemnified liabilities”); provided, that no Company shall have any obligation hereunder to Access Capital with respect to indemnified liabilities arising from (i) the gross negligence or willful misconduct of Access Capital, (ii) salaries and other amounts payable by Access Capital to its employees in the ordinary course of business (other than for legal fees specifically billed with respect to a particular matter to which the foregoing relates) or (iii) expenses incurred by Access Capital (other than those specifically enumerated above) in the ordinary course of business in connection with the performance of its obligations hereunder. To the extent that Access Capital shall provide amounts to any Company in excess of amounts permitted by Section 1 of the Loan Agreement, all such amounts shall bear interest at a per annum rate equal to the Prime Rate plus 10% of the amounts so provided. The obligations in this Section shall survive the termination of this Agreement and the other Transaction Documents.

6. Termination. This Agreement shall be deemed to be automatically renewed for an additional term of three years at the expiration of the Initial Term, and thereafter to be automatically renewed for succeeding three year terms at the end of the first and each succeeding renewal term, unless (a) the Companies shall (1) deliver written notice of cancellation to Access Capital not earlier than 90 days and not later than 60 days prior to the expiration date of the Initial Term or any succeeding renewal term and (2) have paid in full all Obligations (as defined below) on or prior to the expiration date of the Initial Term or any renewal term, as applicable; or (b) Access Capital shall deliver written notice of cancellation to the Servicing Agent not earlier than 90 days and not later than 60 days prior to the expiration date of the Initial Term or any renewal term, as applicable. At Access Capital’s election following the occurrence of an Event of Default, Access Capital may terminate this Agreement. The termination of this Agreement shall not affect any of Access Capital’s rights hereunder or under any other Transaction Document and the provisions hereof and thereof shall continue to be fully operative until all transactions entered into, rights or interests created and the Obligations have been disposed of, concluded or liquidated in a manner acceptable to Access Capital. If for any reason this Agreement is terminated prior to the end of the Initial Term or any renewal term, as applicable, or the Obligations are repaid prior to the end of the Initial Term or any renewal term, as applicable, the Companies shall jointly and severally pay to Access Capital, upon the effective date of such termination or repayment, an early termination fee equal to the Required Minimum Amount (as hereinafter defined) Access Capital would have been paid through the remainder of the term calculated in accordance with the provisions of this Agreement and the other Transaction Documents. For purposes hereof, the term “Required Minimum Amount” means both during and following the expiration of the Initial Term, (a) the aggregate interest payments which would have been payable to Access Capital for each month (or portion thereof) remaining during the Initial Term or any renewal term, as applicable, based upon the Minimum Average Monthly Borrowing Amount for each such remaining month (or portion thereof) and (b) the Annual Fees payable to Access Capital for the Initial Term or any renewal term, as applicable, all of which payments and fees shall be deemed fully earned on the Closing Date; such amount being intended to compensate Access Capital for its costs and expenses incurred in initially approving this Agreement or extending same. Such early termination fee shall also be due and payable by the Companies to Access Capital upon termination of this Agreement by Access Capital after the occurrence of an Event of Default.

The representations, warranties and covenants of the Companies and the remedies of Access Capital for a breach of such representations, warranties and/or covenants, shall survive the termination of this Agreement, and such termination shall not affect the rights of Access Capital to enforce its remedies under this Agreement and the other Transaction Documents against any Company, each Responsible Party any Collateral and/or other assets pledged by any Responsible Party to Access Capital following the occurrence of an Event of Default.

7. Security Interest.

(a) Each Company hereby grants Access Capital a security interest (the “Security Interest”) in all of the following property now owned or at any time hereafter acquired by such Company, or in which such Company now has or at any time in the future may acquire any right, title or interest (the “Collateral”): all accounts and all other personal property and fixtures of each Company, including, without limitation, inventory, equipment, goods, documents, instruments (including, without limitation, promissory notes), contract rights, general intangibles (including without limitation, payment intangibles), chattel paper (whether tangible or electronic), supporting obligations, investment property, cash, deposit accounts, letter-of-credit rights, books and records, trademarks, tradestyles, patents and copyrights in which such Company now has or hereafter may acquire any right, title or interest and the proceeds and products thereof (including without limitation, proceeds of insurance) and all additions, accessions and substitutions thereto or therefor, all rights of such Company pursuant to this Agreement and the other Transaction Documents, and all contract rights and other general intangibles related to the Accounts Receivable and associated therewith and the proceeds and products thereof (including without limitation proceeds of insurance) and all additions, accessions and substitutions thereto or therefor. Terms used in this Section which are defined in the Uniform Commercial Code as enacted and in effect from time to time in the State of New York (the “Code”) are used as so defined in the Code.

(b) This Security Interest shall secure any and all obligations and liabilities of each Company and each other party to any Transaction Document to Access Capital, whether such liabilities and obligations be direct or indirect, absolute or contingent, secured or unsecured, now existing or hereafter arising or acquired, due or to become due (the “Obligations”).

(c) Each Company will do all lawful acts which Access Capital deems necessary or desirable to protect the Security Interest or otherwise to carry out the provisions of this Agreement and the other Transaction Documents, including, but not limited to, the execution, if required, of Uniform Commercial Code financing, continuation, amendment and termination statements and similar instruments in form satisfactory to Access Capital and will promptly pay on demand any filing fees or other costs in connection with the filing or recordation of such statements and instruments. Each Company irrevocably appoints Access Capital as its attorney-in-fact during the term of this Agreement, to do all acts which it may be required to do in connection with the creation and perfection of its security interest under this Agreement and the other Transaction Documents, such appointment being deemed to be a power coupled with an interest, including, without limitation, the filing of UCC-1 Financing Statements (or such other filings required under applicable law) in the name of such Company to reflect the security interest created hereby and/or thereby.

(d) Each Company warrants that (i) its principal place of business, chief executive office and the place where the records concerning its accounts and contract rights are located are at the address(es) set forth herein and (ii) it is duly organized in the state named below its signature on the signature page of the Loan Agreement (the “Signature Page”) with the Organizational ID # stated on the Signature Page. None of the Companies’ Accounts Receivable is evidenced by a promissory note or other instrument. Each Company shall keep its principal place of business and chief executive office and the office where it keeps its records concerning its accounts and contract rights at the location therefor specified in the first sentence of this clause or, upon 30 days’ prior written notice to Access Capital, at any other locations in the continental United States so long as such Company shall have taken all action required by Access Capital to preserve and maintain Access Capital’s first priority perfected security interest in and its rights with respect to the Collateral, including delivery of landlord agreements, mortgagee agreements and warehouse agreements, each in form and substance satisfactory to Access Capital. Each Company shall hold and preserve its records concerning its accounts and contract rights and shall permit representatives of Access Capital at any time during normal business hours upon advance notice to inspect and make abstracts from such records. Notwithstanding the above, in the event that an Event of Default has occurred and is continuing or Access Capital believes, in the exercise of its commercially reasonable discretion that such access is necessary to preserve or protect the Collateral, each Company shall permit representatives of Access Capital at any time, without prior notice, during normal business hours to inspect and make abstracts from such records.

(e) Each Company warrants that it has title to the Collateral purportedly owned by it and that there are no sums owed or claims, liens, security interests or other encumbrances (collectively, “Liens”) against the Collateral other than in favor of Access Capital. Each Company will notify Access Capital of any Liens against the Collateral, will defend the Collateral against any Liens adverse to Access Capital, and will not create, incur, assume, or suffer to exist now or at any time throughout the duration of the term of this Agreement, any Liens against the Collateral, whether now owned or hereafter acquired, except liens in favor of Access Capital.

(f) Each Company authorizes Access Capital to file, without the signature of such Company, where permitted by law, one or more financing or continuation statements, and amendments thereto, relating to the Collateral. Access Capital may file a photographic or other reproduction of this Agreement in lieu of a financing or continuation statement in any filing office where it is permissible to do so.

(g) Each Company irrevocably appoints Access Capital as its attorney-in-fact (which power of attorney is coupled with an interest) and proxy, with full authority in the place and stead of such Company and in its name or otherwise, from time to time in Access Capital’s discretion, to take any action or execute any instrument which Access Capital may deem necessary or advisable to accomplish the purposes of this Agreement and the other Transaction Documents, including, without limitation: (i) the right of endorsement on all payments received in connection with each Account Receivable; (ii) to obtain and adjust insurance required to be paid to Access Capital pursuant to this Agreement and the other Transaction Documents; (iii) to ask, demand, collect, sue for, recover, compound, receive, and give acquittance and receipts for moneys due and to become due under or in respect of any of the Collateral; (iv) to receive, endorse, and collect any checks, drafts or other instruments, documents, and chattel paper of such Company; (v) to sign such Company’s name on any invoice or bill of lading relating to any account, on drafts against customers, on schedules and assignments of accounts, on notices of assignment, financing statements and other public records, on verification of accounts and on notices to customers (including notices directing customers to make payment directly to Access Capital); (vi) if an Event of Default has occurred and is continuing, to notify the postal authorities to change the address for delivery of its mail to an address designated by Access Capital, to receive, open and process all mail addressed to any Company, to send requests for verification of accounts to customers; and (vii) to file any claims or take any action or institute any proceedings which Access Capital may deem necessary or desirable for the collection of any of the Collateral or otherwise to enforce the rights of Access Capital with respect to any of the Collateral. Each Company ratifies and approves all acts of said attorney; and so long as the attorney acts in good faith and without gross negligence it shall have no liability to any Company for any act or omission or for any error of judgment or mistake of fact or law as such attorney.

(h) If any Company fails to perform any agreement contained in this Agreement or any other Transaction Document, Access Capital may itself perform, or cause performance of, such agreement or obligation, and the costs and expenses of Access Capital incurred in connection therewith shall be jointly and severally payable by the Companies and shall be fully secured hereby.

(i) The powers conferred on Access Capital hereunder are solely to protect its interest in the Collateral and shall not impose any duty upon Access Capital to exercise any such powers. Except for the safe custody of any Collateral in its possession and the accounting for moneys actually received by it hereunder, Access Capital shall have no duty as to any Collateral or as to the taking of any necessary steps to preserve rights against prior parties or any other rights pertaining to any Collateral.

(j) Anything herein to the contrary notwithstanding, (i) each Company shall remain liable under any and all contracts and agreements relating to the Collateral, to the extent set forth therein, to perform all of its obligations thereunder, to the same extent as if this Agreement had not been executed; (ii) the exercise by Access Capital of any of its rights hereunder shall not release any Company from any of its obligations under the contracts and agreements relating to the Collateral; and (iii) Access Capital shall not have any obligation or liability by reason of this Agreement under any contracts and agreements relating to the Collateral, nor shall Access Capital be obligated to perform any of the obligations or duties of any Company thereunder or to take any action to collect or enforce any claim for payment assigned hereunder.

(k) Notwithstanding payment in full of all Obligations to Access Capital under the Transaction Documents, Access Capital shall not be required to record any terminations or satisfactions of Liens on the Collateral unless and until each Company and each Responsible Party have executed and delivered to Access Capital a general release in a form reasonably satisfactory to Access Capital.

8. Events of Default; Remedies. If any of the following events (each herein referred to as an “Event of Default”) shall occur:

(a) Any representation, warranty or statement made by any Company and/or any Responsible Party, as applicable, in any of the Transaction Documents, any certificate, statement or document delivered pursuant to the terms hereof, in connection with the transactions contemplated by the Transaction Documents should at any time be false, incomplete or misleading; or

(b) Any Company and/or any other person or entity shall fail to perform under and/or shall commit a breach of any term or provision of this Agreement or any other Transaction Document or any other agreement between any Company and/or any Responsible Party and Access Capital; or

(c) Any Company shall fail to pay any amount owing to Access Capital under this Agreement or any other Transaction Document when due; or

(d) Any Company shall fail to provide to Access Capital (i) all such information from time to time requested by Access Capital with respect to such Company’s Accounts Receivable and/or inventory and (ii) Borrowing Base Certificates, in each case as and when requested by Access Capital; or

(e) Any Company shall (i) instruct any Account Debtor to mail or deliver payment on Accounts Receivable to a person, entity and/or place other than as expressly provided for in this Agreement; or (ii) deposit any Account Debtor payments and fail to deliver the proceeds thereof to Access Capital in accordance with the terms of this Agreement; or

(f) There shall be any change in the controlling ownership or senior management of any Company; or

(g) Any Company, any Responsible Party, any affiliate of any Company, subsidiary of any Company, affiliate of any Responsible Party or subsidiary of any Responsible Party (i) shall generally not pay, or shall be unable to pay, or shall admit in writing its/his/her inability to pay its/his/her debts as such debts become due; or (ii) shall make an assignment for the benefit of creditors, or petition or apply to any tribunal for the appointment of a custodian, receiver, trustee or liquidator for it/him/her or a substantial part of its/his/her assets; or (iii) shall commence any proceeding under any bankruptcy, reorganization, arrangement, readjustment of debt, dissolution, or liquidation law or statute of any jurisdiction, whether now or hereafter in effect; or (iv) shall have had any such petition or application filed or any such proceeding commenced against it/him/her in which an order for relief is entered or an adjudication or appointment is made, or (v) shall take any action indicating its/his/her consent to, approval of, or acquiescence in any such petition, application, proceeding, or order for relief or the appointment of a custodian, receiver, trustee or liquidator for all or any substantial part of its/his/her properties; or (vi) shall suffer any such custodianship, receivership, or trusteeship to continue undischarged; or (vii) shall take any action for the purpose of effecting any of the foregoing; or

(h) The Companies shall fail to maintain, at of the end of each quarter (calculated on a rolling four (4) quarter basis), positive Cash Flow. “Cash Flow” shall mean, for any period, the net income (as defined by Generally Accepted Accounting Principles (“GAAP”) of the Companies, plus any non-cash charges less (i) any withdrawals by, loan advances to or repayments to the officers or owners of the Companies or any other cash payments paid or scheduled to be repaid to any other party, (ii) principal repayments and any indebtedness by the Company paid or scheduled to be paid during such period, (iii) payments under capital leases paid or scheduled to be paid during said period, (iv) capital expenditures paid or scheduled to be paid during said period and (v) any non-cash extraordinary gains.

For purposes of this Agreement, a breach of any financial covenant set forth herein shall be deemed to have occurred as of any date of determination by Access Capital or as of the last day of any specified measurement period, regardless of when the financial statements reflecting such breach are delivered to Access Capital; or

(i) Any Company shall fail to provide Access Capital with any one or more of the following: (i) within one hundred and twenty (120) days after the end of each of such Company’s fiscal years, each of such Company’s audited balance sheet as at the end of such fiscal year and the related statements of income, retained earnings and changes in cash flow for such fiscal year with a report of independent certified public accountants of recognized standing selected by the Companies and acceptable to Access Capital, setting forth in comparative form the figures as at the end of and for the previous fiscal year; (ii) within thirty (30) days after the end of each month, Sterling Seal & Supply, Inc.’s internal balance sheet and statement of income, retained earnings and cash flow as at the end of and for such month, and for the year to date period then ended, in reasonable detail and stating in comparative form the figures for the corresponding date and periods in the previous year; (iii) within forty-five (45) days after the end of each fiscal quarter of the Companies, the Companies’ consolidated internal balance sheet and statement of income, retained earnings and cash flow as at the end of and for such fiscal quarter, and for the year to date period then ended, in reasonable detail and stating in comparative form the figures for the corresponding date and periods in the previous year; (iv) no later than thirty (30) days prior to the end of a fiscal year-end period, a complete set of projections, (which shall be prepared on a monthly basis and include balance sheets, income statements, and schedules of cash flows) for the forthcoming fiscal period; (iv) no later than 10 days after the end of each monthly period, an accounts receivable and accounts payable detailed aging for said month; (v) within thirty (30) days after the filing thereof in accordance with applicable law (including any applicable filing extensions granted to each Company, notice of any such filing extensions to be promptly provided to Access Capital), copies of each Company’s federal income tax returns and any amendments thereto and promptly upon request from Access Capital, satisfactory evidence of each Company’s payment of all withholding and other taxes required to be paid by such Company; (vi) within ninety (90) days after the end of each fiscal year, each Responsible Party’s annual financial statement; (vii) within thirty (30) days after filing thereof is in accordance with applicable law (including any applicable filing extensions granted to each Responsible Party, notice of any such filing extensions to be promptly provided to Access Capital) copies of all federal and state income tax returns of each Responsible Party; and (viii) promptly after each fiscal quarter, a copy of each Company’s’ 941 payroll tax filing along with proof of payment of the applicable required tax payment. At the times the financial statements are furnished pursuant to (i) and (ii) above, a certificate of each Company’s President or Chief Financial Officer shall be delivered to Access Capital stating that, based on an examination sufficient to enable him or her to make an informed statement, no Event of Default exists, or, if such is not the case, specifying such Event of Default and its nature, when it occurred, whether it is continuing and the steps being taken by such Company with respect to such event. All financial statements required to be delivered hereunder shall be prepared in accordance with generally accepted accounting principles, subject to normal year-end adjustments in the case of any monthly statement.; or

(j) Any Company’s trade accounts payable shall be more than sixty (60) days past due unless such trade accounts payable are subject to bona fide disputes and adequate reserves have been provided on the applicable Company’s books with respect thereto; or

(k) Any Company shall fail to pay its taxes (payroll, sales and/or other) when due unless such Company shall have delivered to Access Capital a valid written extension (acceptable to Access Capital) from the applicable taxing authority for such taxes and the applicable taxing authority agrees to subordinate its lien, if any, in all assets of such Company in favor of Access Capital; or

(l) An attachment or levy is made upon any Company’s and/or any Responsible Party’s assets having an aggregate value in excess of $25,000 or a judgment is rendered against any Company and/or any Responsible Party or any Company’s or any Responsible Party’s property involving a liability of more than $25,000 which shall not have been vacated, discharged, stayed or bonded pending appeal within thirty (30) days from the entry thereof; or

(m) Any change in any Company’s condition or affairs (financial or otherwise) which in Access Capital’s reasonable opinion impairs the Collateral or the ability of such Company to perform its Obligations; or

(n) Any lien created hereunder or under any other Transaction Document for any reason ceases to be or is not a valid and perfected lien having a first priority interest other than as a result of any action or inaction by Access Capital; or

(o) Any Company directly or indirectly sells, assigns, transfers, conveys, or suffers or permits to occur any sale, assignment, transfer or conveyance of any assets of such Company or any interest therein, except as permitted in this Agreement and the other Transaction Documents; or

(p) If any Responsible Party attempts to terminate, challenges the validity of, or challenges his/her liability under this Agreement or any other Transaction Document or if any individual Responsible Party shall die and the Companies shall fail to provide Access Capital with a replacement Responsible Party acceptable to Access Capital within thirty (30) days of such occurrence or if any other Responsible Party shall cease to exist; or

(q) Any of the Companies fail to operate in the ordinary course of business; or

(r) The indictment or threatened indictment of any of the Companies, or any officer of any of the Companies or any Responsible Party under any criminal statute, or the commencement or threatened commencement of criminal or civil proceedings against any of the Companies, any officer of any of the Companies or any Responsible Party pursuant to which statute or proceeding penalties or remedies sought or available include forfeiture or any of the property of any of the Companies or any Responsible Party; or

(s) A default by any of the Companies in the payment, when due, of any principal of or interest on any indebtedness for borrowed money other than indebtedness to Access Capital; or

(t) Access Capital shall in good faith deem itself insecure or shall fear diminution in value, removal or waste of the Collateral; or

(u) Any of the Companies shall take or participate in any action which would be prohibited under the provisions of any subordination agreement or intercreditor agreement (collectively, a “Subordination Agreement”) made by any subordinated creditor in favor of Access Capital or make any payment on any indebtedness subordinated under any Subordination Agreement that any person or entity was not entitled to receive under the provisions of the Subordination Agreement;

then, and in any of the foregoing such events,

(1) Access Capital may exercise in respect of the Collateral, in addition to other rights and remedies provided for herein, in the Transaction Documents and/or otherwise available to it, all the rights and remedies of a secured party on default under the Code (whether or not the Code applies to the affected Collateral), and also may (x) require each Company to, and each Company hereby agrees that it will at its expense and upon request of Access Capital forthwith, assemble all or part of the Collateral as directed by Access Capital and make it available to Access Capital at a place to be designated by Access Capital which is reasonably convenient to both parties and (y) without notice except as specified below, sell the Collateral or any part thereof in one or more parcels at public or private sale, at any of Access Capital’s offices or elsewhere for cash, on credit or for future delivery, and upon such other terms as Access Capital may deem commercially reasonable. Each Company agrees that, to the extent notice of sale shall be required by law, at least ten days’ notice to such Company of the time and place of any public sale or the time after which any private sale is to be made shall constitute reasonable notification. Access Capital shall not be obligated to make any sale of Collateral regardless of notice of sale having been given. Access Capital may adjourn any public or private sale from time to time by announcement at the time and place fixed therefor, and any such sale may, without further notice, be made at the time and place to which it was so adjourned.

(2) Any cash held by Access Capital as Collateral and all cash proceeds received by Access Capital in respect of any sale of, collection from, or other realization upon all or any part of the Collateral may, in the discretion of Access Capital, be held by Access Capital as Collateral for, and/or then or any time thereafter be applied in whole or in part by Access Capital against, all or any part of the Obligations in such order as Access Capital shall elect. Any surplus of such cash or cash proceeds held by Access Capital and remaining after payment in full of all the Obligations shall be paid over to the Companies or to whomsoever may be lawfully entitled to receive such surplus.

(3) Access Capital may exercise any and all rights and remedies of each Company under or in connection with the Collateral, including, without limitation, any and all rights of each Company to demand or otherwise require payment of any amount under, or performances of any provision of, any account, contract or agreement.

(4) The Contract Rate shall be increased by an additional 5% per annum (the “Default Rate”) until the Event of Default has been cured.

(5) Access Capital shall have the right, which may be exercised in its sole and absolute discretion at any time and from time to time during the continuance of such Event of Default, to apply all amounts collected with respect to Accounts Receivable as follows, before any payment from such collections shall be made to any Company: (i) against the unreimbursed balance of the Advances made by Access Capital to any Company; (ii) to the payment of all interest and fees accrued with respect to the Advances and the Accounts Receivables, whether or not such fees have become due and payable pursuant to the terms of this Agreement; and (iii) to the payment of any and all other liabilities and Obligations of any Company to Access Capital pursuant to this Agreement and the other Transaction Documents and any other agreement entered into between Access Capital and the Companies. For purposes of this Section, “Company” and “Companies” means and includes each person named as a Company in the preamble to this Agreement and any parent, subsidiary, controlling person or other affiliate thereof.

An Event of Default hereunder shall be a default under each of the Transaction Documents and Access Capital, without notice to any Company, may exercise all of the rights provided in this Agreement and the other Transaction Documents and, by notice to any Company, may: (i) declare all Required Minimum Amounts and Annual Fees Access Capital would have been paid through the remainder of the Initial Term or any renewal term, as applicable, all of which payments and fees shall be deemed fully earned on the Closing Date, and all other Obligations payable under the Transaction Documents to be forthwith due and payable, whereupon such amounts shall become and be forthwith due and payable, without demand, protest, or further notice of any kind, all of which are hereby expressly waived by the Companies; or (ii) elect to cease making Advances pursuant to this Agreement; or (iii) both.

9. Responsible Party Obligations.

(a) Each Responsible Party shall be jointly and severally liable for the prompt and complete payment and performance of all Obligations that shall become due or owing to Access Capital by any Company under this Agreement and each other Transaction Document and the payment of any and all costs and expenses incurred by Access Capital in enforcing the same (the “Responsible Party Obligations”) and this liability shall continue until all Obligations have been paid in full in cash and this Agreement and the other Transaction Documents have been irrevocably terminated and payments may be required by Access Capital on demand for satisfaction at its offices on any number of occasions.

(b) Notwithstanding any payment or payments made by a Responsible Party hereunder, the Responsible Party will not exercise any rights of Access Capital against any Company by way of subrogation, reimbursement or indemnity, and shall have no right of recourse to any assets or property of any Company held for the payment and performance of its Responsible Party Obligations, whether or not the Responsible Party Obligations shall be satisfied. Each Responsible Party agrees not to seek contribution from any other Responsible Party until all the Responsible Party Obligations shall have been paid in full. If any amount shall nevertheless be paid to the Responsible Party, such amount shall be held in trust for the benefit of Access Capital and shall forthwith be paid to Access Capital to be credited and applied to the Responsible Party Obligations, whether matured or not matured. The provisions of this sub section shall survive termination of this Agreement.

(c) Each Responsible Party hereby assents, to the extent permitted by law, to all the terms and conditions of the Responsible Party Obligations and waives: (i) notice of acceptance hereof and all notice of the creation, extension or accrual of any Responsible Party Obligations; (ii) presentment, demand for payment, notice of dishonor and protest; (iii) notice of any other nature whatsoever; (iv) any requirement of diligence or promptness on the part of Access Capital in the enforcement of any of its rights under the provisions of this Agreement or any other Transaction Document; (v) any requirement that Access Capital take any action whatsoever against the Companies or any other party or file any claim in the event of the bankruptcy of any Company; or (vi) failure of Access Capital to protect, preserve or resort to any collateral unless through the gross negligence or willful misconduct of Access Capital or (vii) any other circumstance which might otherwise constitute a defense available to, or a discharge of, such Responsible Party. Each Responsible Party waives any and all defenses and discharges available to surety, guarantor or accommodation co-obligor. The waivers set forth in this section shall be effective notwithstanding the fact that any Company ceases to exist by reason of its liquidation, merger, consolidation or otherwise.

(d) Each Responsible Party hereby consents that from time to time, and without further notice to or consent of any Responsible Party, Access Capital may take any or all of the following actions without affecting the liability of a Responsible Party: (i) extend, renew, modify, compromise, settle or release the Responsible Party Obligations; (ii) modify and/or amend any terms or provisions of this Agreement or any other Transaction Document; (iii) release or compromise any liability of any party or parties with respect to the Responsible Party Obligations; (iv) release its security interest in the Collateral or any other assets of any Responsible Party pledged to Access Capital or exchange, surrender or otherwise deal with the Collateral or any other assets of any Responsible Party pledged to Access Capital as Access Capital may determine; or (v) exercise or refrain from exercising any right or remedy of Access Capital.

10. Notices. All notices and other communications hereunder and under this Agreement and each other Transaction Document (unless otherwise specified in such Transaction Document) shall be deemed given by registered or certified mail, return receipt requested, hand delivery, overnight mail or telecopy (confirmed by mail) if to a party hereto at the address for such party on the signature page set forth herein unless a party shall give notice in writing of a different address or facsimile number in the manner provided herein. Notices and other communications shall be (i) in the case of those by hand delivery, deemed to have been given when delivered to any officer of the party to whom it is addressed, (ii) in the case of those by mail or overnight mail, deemed to have been given when deposited in the mail or with the overnight mail carrier and (iii) in the case of a telecopy, deemed given when dispatched.

11. Amendments; Etc. No amendment, modification, termination, or waiver of any provision of this Agreement or any other Transaction Document to which any Company or any Responsible Party is a party, nor consent to any departure by any Company or any Responsible Party from any Transaction Document to which it/he/she is a party, shall in any event be effective unless the same shall be in writing and signed by Access Capital, and then such waiver or consent shall be effective only in the specific instance and for the specific purpose for which given.

12. No Waiver. No course of dealing between Access Capital and any Company, nor any failure or delay on the part of Access Capital in exercising any right, power, or remedy hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any such right, power, or remedy preclude any other or further exercise thereof or the exercise of any other right, power, or remedy hereunder. The rights and remedies provided in this Agreement and the other Transaction Documents are cumulative, and are not exclusive of any other rights, powers, privileges, or remedies, now or hereafter existing, at law or in equity or otherwise.

13. Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of each Company, each Responsible Party party hereto, Access Capital and their respective heirs successors and assigns, except that no Company nor any Responsible Party may assign or transfer any of its/his/her/ rights under this Agreement or any other Transaction Document to which it/he/she is a party without the prior written consent of Access Capital.

14. Integration. This Agreement and the other Transaction Documents contain the entire agreement between the parties relating to the subject matter hereof and supersede all oral statements and prior writings with respect thereto.

15. Severability of Provisions. Any provision of this Agreement or any other Transaction Document which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions of this Agreement or such Transaction Document or affecting the validity or enforceability of such provision in any other jurisdiction.

16. Additional Reports. In the event that at any time after the expiration of the term of this Agreement (as the same may be extended or modified, or terminated following the occurrence of an Event of Default), any Company or any successor or assignee of such Company, shall request additional information from Access Capital including, without limitation, account reports, collections advice for previously concluded transactions or information for such Company’s accounting records, such information shall be supplied by Access Capital to such Company if available, and the Companies shall jointly and severally pay Access Capital based on the time spent by Access Capital personnel in the preparation of such information for such Company, and for the disbursements incurred by Access Capital in connection therewith, at the hourly rates established by Access Capital for the consulting services of its personnel.

17. Headings. Section headings in this Agreement and the other Transaction Documents are included herein and in such Transaction Documents for the convenience of reference only and shall not constitute a part hereof or of the applicable Transaction Documents for any other purpose.

18. Counterparts. This Agreement may be executed in any number of counterparts, all of which shall constitute one and the same agreement, and any party hereto may execute this Agreement by signing one or more counterparts.

19. Relief from Automatic Stay in Bankruptcy Case. If any voluntary or involuntary petition is filed under any section of the United States Bankruptcy Code by or against any Company, each Company represents, warrants and agrees that to the fullest extent permitted by applicable law: (a) Access Capital shall be entitled to immediate relief from the automatic stay to permit enforcement of Access Capital’s rights and remedies pursuant to this Agreement, the other Transaction Documents and applicable law; (b) consent is hereby unconditionally given to the immediate termination of the automatic stay and no contest or objection will be made to any motion, application or petition filed by Access Capital for such determination of lifting of the automatic stay; (c) the exclusive period for such Company or the debtor in any such bankruptcy proceeding to file a plan in bankruptcy, reorganization, arrangement, wage earner’s plan or otherwise and to seek acceptances of any such plan, will terminate on the earlier of the one hundred twentieth (120th) day following the filing of any such voluntary petition or, on the one hundred twentieth (120th) day following the initial order for relief, without extension of any kind; (d) to the best knowledge and belief of each Company, the property as to which Access Capital is given or granted a security interest pursuant to the terms of this Agreement would not be necessary to any plan of reorganization or liquidation; (e) the filing of any petition in bankruptcy will constitute bad faith on the part of any Company if the primary purpose of same is to delay any pending foreclosure or enforcement of any lien or security interest held by Access Capital; (f) absent such foreclosure of enforcement of the lien or security interest of Access Capital, Access Capital has no adequate protection; and (g) each Company will do all things and assign and deliver all documents, papers and instruments requested by Access Capital to facilitate the obtaining by Access Capital of a release from any automatic stay or order or in obtaining any order to dismiss such bankruptcy case.

20. Invalid Provisions. Nothing contained in this Agreement or any other Transaction Document shall be construed so as to require the commission of any act contrary to law and wherever there is any conflict between any provision(s) of this Agreement or any other Transaction Document and any material statute, law or ordinance, contrary to which the parties have no legal right to contract, the latter shall prevail; but in such event, the provision(s) of this Agreement and the other Transaction Documents affected shall be curtailed and limited only to the scope and extent necessary to bring it within the legal requirements.

If any provision(s) of this Agreement or any other Transaction Document is held by a court of competent jurisdiction to be illegal, invalid or unenforceable, such provision(s) shall be fully severable and this Agreement and the other Transaction Documents shall be then construed and enforced as if such illegal, invalid or unenforceable provision(s) was never part of this Agreement or any other Transaction Document in the first instance and the remaining provision(s) shall continue in full force and effect without being affected by any such illegal, invalid or unenforceable provision(s) or by its severance from this Agreement or any other Transaction Document. In addition, upon the finding of any such illegal, invalid or unenforceable provision(s), the parties agree that to the extent legally possible so that the same may be valid and enforceable, a provision shall be added to this Agreement and the other Transaction Documents as similar in its terms to the illegal, invalid or unenforceable provision as may be so within the confines of legality, validity and enforceability. In all events, if this entire Agreement or the entire agreement of any other Transaction Document or such material parts thereof are held illegal, invalid or unenforceable so that it cannot effectively continue so that its intents and purposes are carried out, or, if this Agreement or any Transaction Document is terminated as a result of any default on the part of any Company or any Responsible Party, then, in any such event, notwithstanding anything to the contrary contained in this Agreement or otherwise, Access Capital shall, nevertheless, be entitled to immediate joint and several payment by and from the Companies of all Obligations then outstanding.

21. Limitation of Liability. Access Capital shall have no liability whatsoever pursuant to this Agreement or any other Transaction Document (i) for any loss or damages (including, without limitation, indirect, special or consequential damages) resulting from the refusal of Access Capital, in the exercise of it commercially reasonable discretion, to make Advances against any Accounts Receivable or with respect to any malfunction, failure or interruption of computer, communication facilities, labor difficulties or Acts of God or other causes beyond its control; or (ii) for indirect, special or consequential damages arising from accounting or ministerial errors with respect to the account of any Company with Access Capital. The liability of Access Capital for any default on its part pursuant to, or tort arising out of, this Agreement or any other Transaction Document shall be limited to a refund to the Companies of any fees paid by it during the period starting on the occurrence of the default or tort and ending when it is cured or waived, or when this Agreement is terminated, whichever is earlier except to the extent such liability is determined to result from the willful misconduct or gross negligence of Access Capital.

22. JURISDICTION; JURY TRIAL WAIVER. EACH PARTY HERETO IRREVOCABLY SUBMITS TO THE JURISDICTION OF ANY NEW YORK STATE COURT SITTING IN THE BOROUGH OF MANHATTAN, THE CITY OF NEW YORK OVER ANY SUIT, ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT OR ANY OTHER TRANSACTION DOCUMENT. EACH PARTY IRREVOCABLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY LAW, ANY OBJECTION WHICH IT/HE /SHE MAY NOW OR HEREAFTER HAVE TO THE LAYING OF THE VENUE OF ANY SUCH SUIT ACTION OR PROCEEDING BROUGHT IN SUCH A COURT AND ANY CLAIM THAT ANY SUCH SUIT, ACTION OR PROCEEDING BROUGHT IN SUCH A COURT HAS BEEN BROUGHT IN AN INCONVENIENT FORUM. EACH PARTY AGREES THAT A FINAL JUDGMENT IN ANY SUCH SUIT ACTION OR PROCEEDING BROUGHT IN SUCH A COURT, AFTER ALL APPROPRIATE APPEALS, SHALL BE CONCLUSIVE AND BINDING UPON IT/HIM/HER. THE PARTIES HERETO DO HEREBY WAIVE ANY AND ALL RIGHT TO A TRIAL BY JURY IN ANY ACTION OR PROCEEDING ARISING OUT OF THIS AGREEMENT OR ANY OTHER TRANSACTION DOCUMENT. NOTHING CONTAINED HEREIN SHALL LIMIT IN ANY MANNER WHATSOEVER ACCESS CAPITAL’S RIGHT TO LITIGATE ANY AND ALL ACTIONS AND PROCEEDINGS RELATING DIRECTLY OR INDIRECTLY TO THIS AGREEMENT OR ANY OTHER TRANSACTION DOCUMENT IN ANY OTHER COURTS AS ACCESS CAPITAL MAY SELECT, WHICH SUCH COURTS ARE CONVENIENT FORUMS AND THE COMPANIES AND EACH RESPONSIBLE PARTY SUBMIT TO THE PERSONAL JURISDICTION OF SUCH COURTS.

EXHIBIT B

TRANSACTION DOCUMENTS

Access Capital shall have received the following documents, all of which shall be in form and substance satisfactory to Access Capital, in such number of counterparts as Access Capital may require and, in the case of instruments or agreements, shall have been executed by all the parties thereto:

| 1. | This Agreement; |

| 2. | Uniform Commercial Code initial financing statements and such other security interest perfection documentation as shall be required under the applicable law for filing in such jurisdictions as Access Capital shall determine against each Company; |

| 3. | The results of lien searches against the Companies showing no liens or judgments of record; |

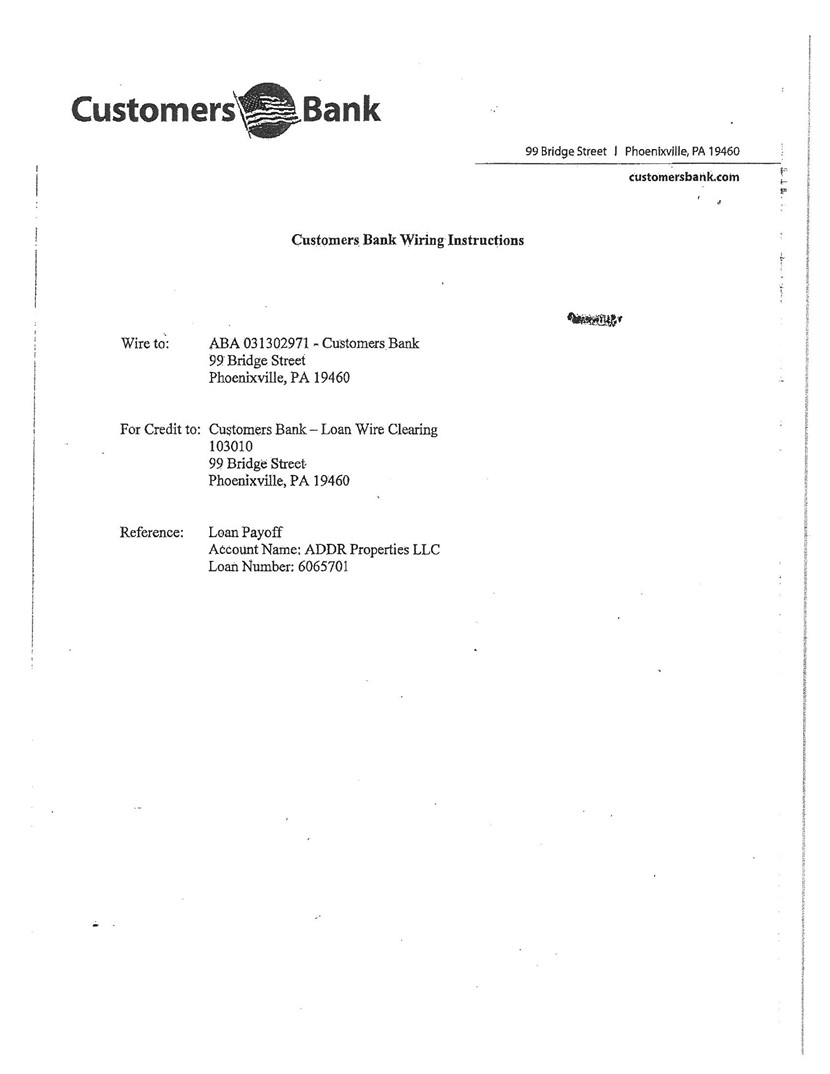

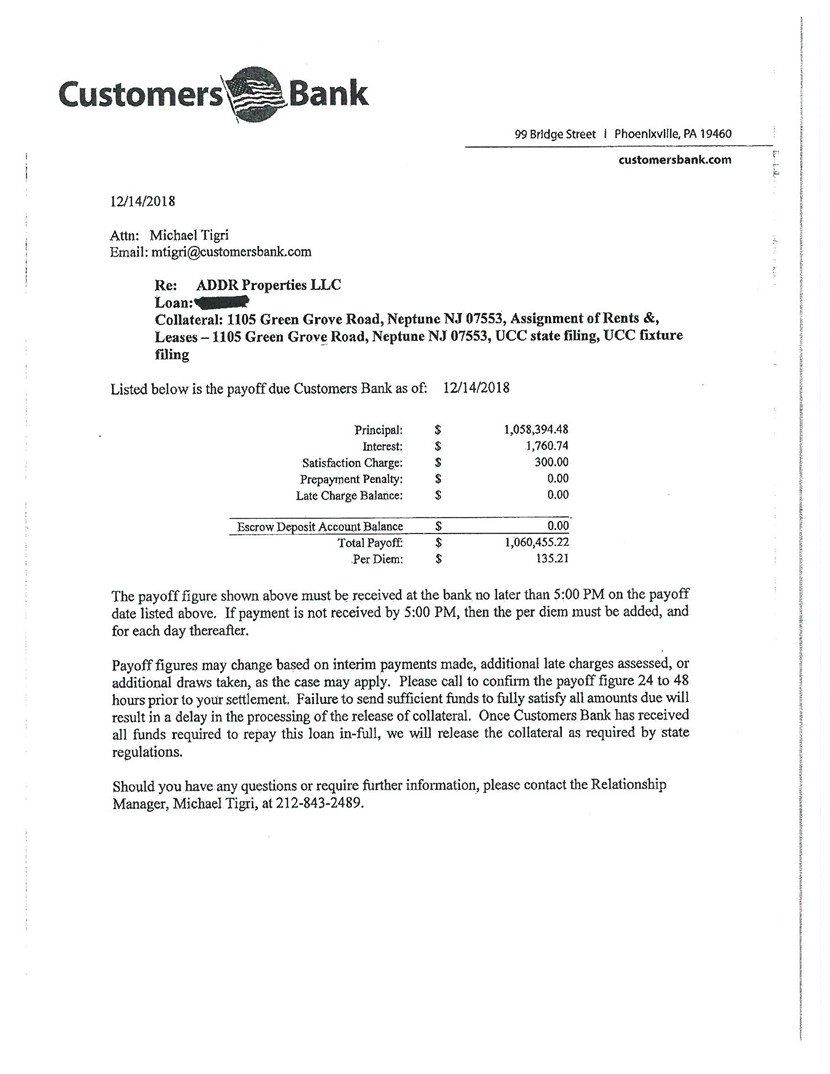

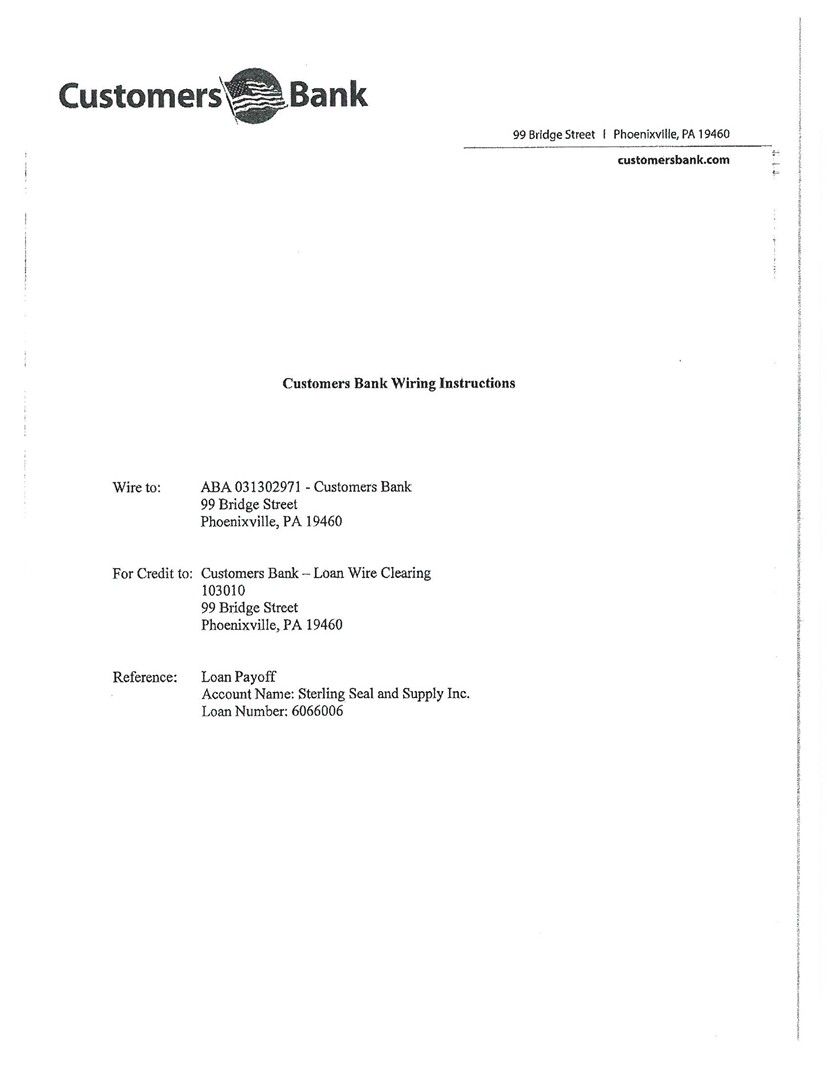

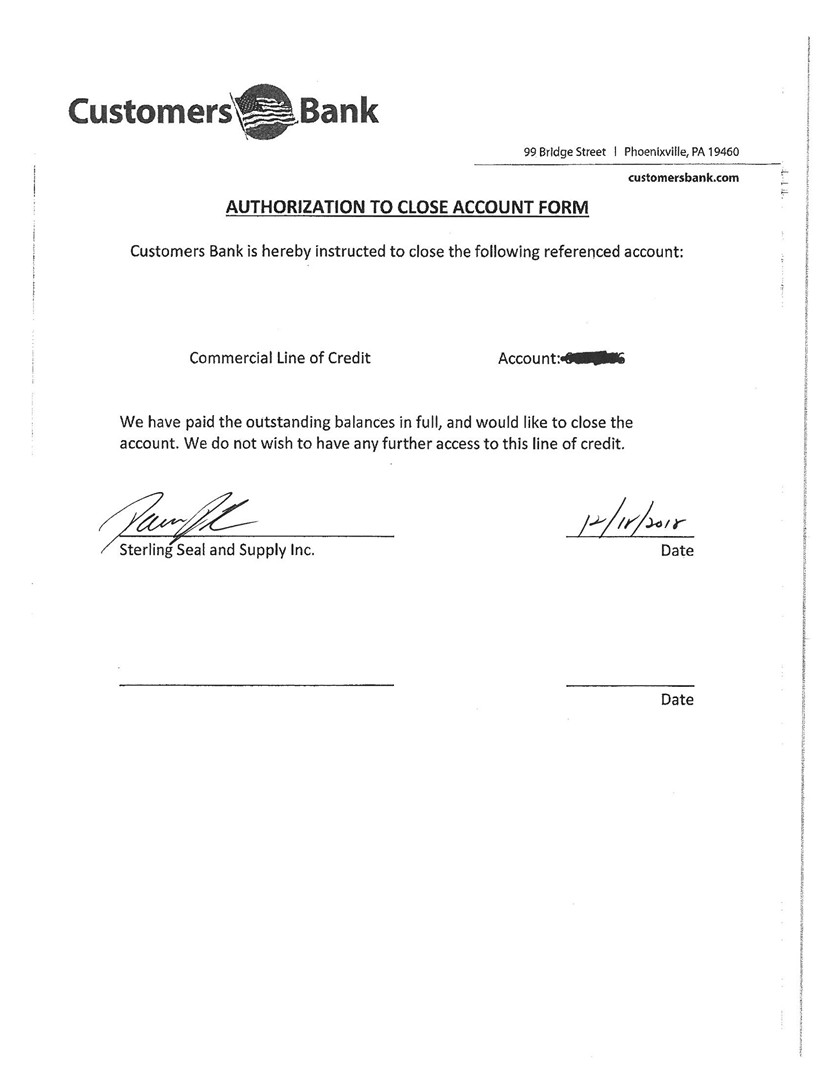

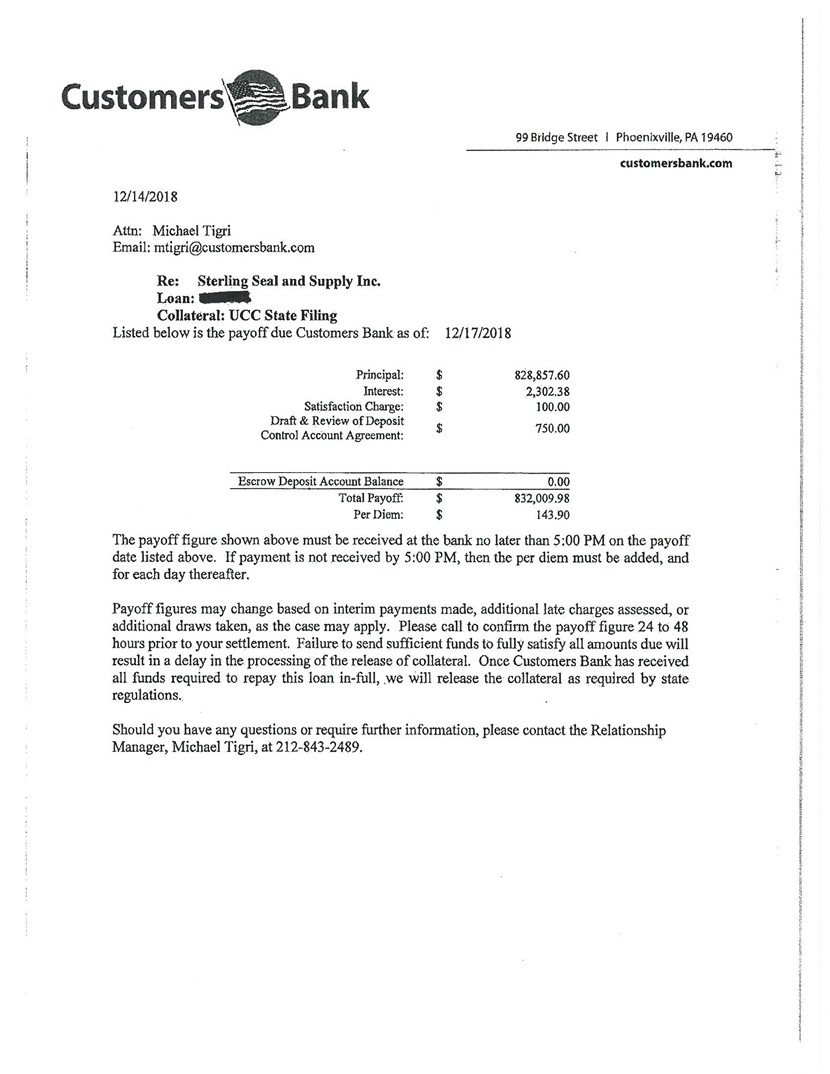

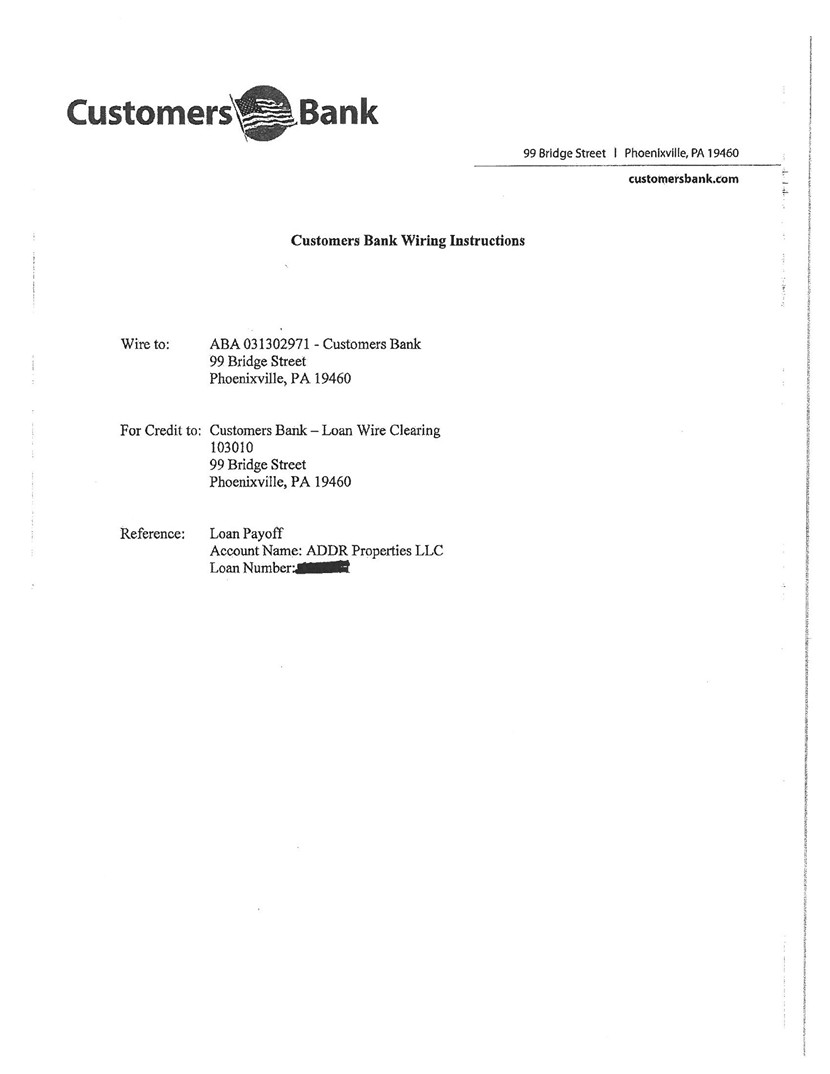

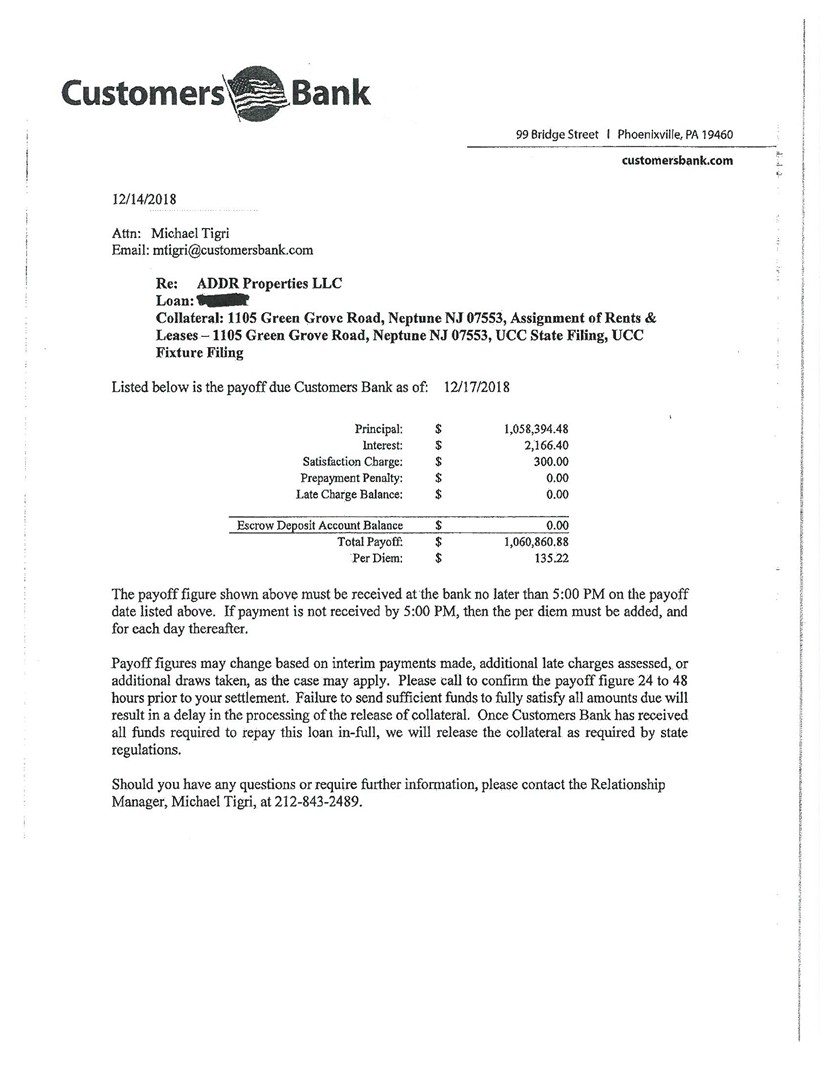

| 4. | The following documents, in form and substance satisfactory to Access Capital, duly executed by Customers Bank (the “Bank”): |

| a. | Payoff letter from the Bank with respect to all amounts owing to the Bank (the “Bank Loan”); |

| b. | Release of all liens in connection with the Bank Loan and authorization to file Uniform Commercial Code termination statements in respect thereof; and |

| c. | Uniform Commercial Code termination statements; |

| 5. | Account Debtor Notification Letters; |

| 6. | Account Verification Letter; |

| 7. | Letters of Instruction; |

| 8. | Corporate Certificates; |

| 9. | IRS Form 8821 for each Company and each Responsible Party and Tax Information Authorization Form for the state of New Jersey for each Company; |

| 10. | Certificates of Insurance and Evidence of Property Insurance covering each Company under which Access Capital is named as a Lender Loss Payee and Additional Insured; |

| 11. | Copy of state issued driver’s license of all signatories and Responsible Parties to the Agreement; |

| 12. | Fully executed Deposit Account Control Agreement between Access Capital, Inc. and Customers Bank; |

| 13. | Mortgage, Assignment of Leases and Rents, Fixture Filing and Security Agreement with respect to the real property located at 1105 Green Grove Road, Neptune, New Jersey 07753 and all other agreements required by Access Capital in connection therewith; |

| 14. | Landlord Waiver with respect to each location leased by a Company; |

| 15. | Subordination Agreement between Angelo DeRosa and Access Capital, Inc.; |

| 16. | Collateral Assignment of Rights Under Asset Purchase Agreement; and |

| 17. | Other documents as deemed necessary by Access Capital as determined during due diligence. |

EXHIBIT D

REIMBURSABLE EXPENSES

| Wire Transfer Fee/ Domestic | $50.00 each |

| Wire Transfer Fee/ Foreign | $60.00 each |

| Third Party Credit Reports | $100.00 each |

| UCC Filings/Searches | Client Specific |

| Returned Checks- Insufficient Funds/Stop Payment | $40.00 each |

| Online Reporting Access | $75.00 per month |

| 8821 Monitoring Fee | $21.00 per month |

EXHIBIT C

BORROWING BASE CERTIFICATE