UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(AMENDMENT NO. 2)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 13, 2018 (April 12, 2018)

MONSTER PRODUCTS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 333-211681 | 81-1736095 | ||

| (State

or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S.

Employer Identification Number) |

601 Gateway Blvd., Suite 900

South San Francisco, CA 94080

(Address of principal executive offices) (zip code)

(415) 330-3479

(Registrant’s telephone number, including area code)

Copies to:

Andrea Cataneo, Esq.

Sheppard, Mullin, Richter & Hampton LLP

30 Rockefeller Plaza, 39th Floor

New York, New York 10112

Phone: (212) 653-8700

Atlantic Acquisition Inc.

(Former Name)

15321 NW 60th Ave 51 St. Suite 109

Miami Lakes, FL

(Former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

EXPLANATORY NOTE

The Registrant is filing this Amendment No. 2 to its Current Report on Form 8-K (the “Amendment”) as originally filed with the Securities and Exchange Commission (the “SEC”) on April 16, 2018 (the “Original Filing”), as amended on July 18, 2018 (the “Frist Amendment”) to amend and restate the filing in its entirety and to, among other things, (i) disclose the material terms of the Share Exchange Agreement and (ii) disclose that the Registrant did not comply with the requirement of Rule 419 in connection with its offering conducted in September 2016 (the “419 Offering”) and how the Registrant intends to unwind the 419 Offering. Except as described above, no other information in the Original Filing and the First Amendment has been updated and this Amendment continues to speak as of the date of the Original Filing and the First Amendment. Other events occurring after the filing of the Original Filing, the First Amendment or other disclosure necessary to reflect subsequent events will be addressed in other reports filed with or furnished to the SEC subsequent to the date of the filing of the Original Filing and the Amended Filings.

| -2- |

Item 1.01 Entry into a Material Definitive Agreement.

On February 13, 2018, Monster, Inc., a California corporation, and Monster, LLC, a Nevada limited liability company (collectively, the “Companies”) entered into a share exchange agreement (the “Share Exchange Agreement”), with Atlantic Acquisition Inc., a Nevada corporation (“AA”). Pursuant to the terms of the Share Exchange Agreement, on the Closing Date (as defined below), the shareholders of the Companies agreed to transfer all of the issued and outstanding voting interests in the Companies to AA in exchange for 300,000,000 newly issued shares of common stock of AA (the “Reverse Acquisition”). Upon closing of the Reverse Acquisition, AA will have 316,000,000 shares of common stock outstanding.

In addition, in connection the Reverse Acquisition, Miguel Dotres, a former director of AA, agreed to cancel his 5,000,000 shares of common stock upon the closing of the Reverse Acquisition.

For a period of one (1) year from the Closing Date, existing AA shareholders who collectively own five percent (5%) of AA’s issued and outstanding common stock as of the Closing Date (the “Existing AA Shareholders”), were provided a non-dilutive right to their existing ownership position in AA such that they would be issued such number of additional shares of common stock which would maintain their ownership percentage of AA (on a fully diluted basis) equal to five percen (5%); provided, however, that in no event shall AA be required to issue any additional shares to such Existing AA Shareholders to maintain their aggregate ownership percentage at 5% when the number of AA’s issued and outstanding shares of common stock is greater than or equal to 400,000,000 shares. As of the Closing Date, Benny Doro, Bob Bubeck and Margret M. McLaughlin, the Company’s former President and Director, Secretary and Director and Treasurer and Director, respectively, as well as Fred Khalilian, our President and chief operating officer, owned more than 5% of the outstanding shares of AA. In connection with the conversion of existing debt held by entities controlled by Mr. Noel Lee as further described herein, the Existing AA Shareholders were issued an aggregate of 1,150,001 shares of common stock. No other securities were issued to the Existing AA Shareholders pursuant to the rights set forth above.

Item 2.01 Completion of Acquisition or Disposition of Assets.

Information in response to this Item 2.01 is keyed to the Item numbers of Form 10.

Item 1. Description of Business.

The Reverse Acquisition closed on April 12, 2018 (the “Closing Date”). As a result of the Reverse Acquisition, the Companies became two wholly-owned subsidiaries of AA, with the Companies’ former shareholders acquiring a majority of the outstanding shares of common stock of AA.. The acquisition of the Companies is being accounted for as a reverse acquisition, and the business of the Companies became the business of AA, which will be renamed as Monster, Inc. after Closing. At the time of the Reverse Acquisition, AA was not engaged in any active business.

References to “Monster,” “we,” “us,” “our” and similar words refer to Monster, Inc., Monster, LLC and their subsidiaries, which are described in detail in the BUSINESS Section. References to “AA” are made to the blank check company prior to the Acquisition. References to the “Company” refer to the entity after the Reverse Acquisition.

| -3- |

SUMMARY

Monster, Inc. is a California corporation formed on October 23, 1978. Monster, LLC is a Nevada limited liability company, formed on December 23, 2002.

Our executive offices are located at 601 Gateway Blvd., Suite 900, South San Francisco, Ca 94080, and our telephone number at such address is (415) 330-3479.

RISK FACTORS

An investment in the Company’s common stock involves a high degree of risk. In determining whether to purchase the Company’s common stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this report before making a decision to purchase the Company’s securities. An investor should only purchase the Company’s securities if he or she can afford to suffer the loss of his or her entire investment.

Risks related to our business and our industry

If our design and marketing efforts do not effectively raise the recognition and reputation of our brands, we may not be able to successfully implement our growth strategy.

We believe that our ability to raise the recognition and favorable perception of our brands is critical to implement our growth strategy, which includes further penetrating our domestic retail channel, accelerating our international growth and expanding complementary product categories. To extend the reach of our brands, we believe we must devote significant time and resources to product design and development, marketing and promotions. These expenditures, however, may not result in a sufficient increase in net sales to cover such expenses over the short term. Furthermore, we must balance our growth with the effect it has on the authenticity of our brand. For example, our credibility and brand image could be weakened if our consumers perceive our distribution channels to be too broad or our retailers to not fit with our lifestyle image. If any of these events occur, our consumer base and our net sales may decline and we may not be able to successfully implement our growth strategy.

If we are unable to continue to develop innovative and popular products, our brand image may be harmed and demand for our products may decrease.

Consumer electronics and youth culture lifestyle are subject to constantly and rapidly changing consumer preferences based on industry trends and performance features. Our success depends largely on our ability to lead, anticipate, gauge and respond to these changing consumer preferences and trends in a timely manner, while preserving and strengthening the perception and authenticity of our brand. We must continue to develop innovative, trend-setting and stylish products that provide better design and performance attributes than the products of our competitors. Market acceptance of new designs and products is subject to uncertainty and we cannot assure you that our efforts will be successful. The inability of new product designs or new product lines to gain market acceptance could adversely affect our brand image, our business and financial condition. Achieving market acceptance for new products may also require substantial marketing efforts and expenditures to increase consumer demand, which could constrain our management, financial and operational resources. If new products we introduce do not experience broad market acceptance or demand for our existing products wanes, our net sales and market share could decline.

We may not be able to compete effectively, which could cause our net sales and market share to decline.

The consumer electronics industry is highly competitive, and characterized by frequent introduction of new competitors, as well as increased competition from established companies expanding their product portfolio, aggressive price cutting and resulting downward pressure on gross margins and rapid consolidation of the market resulting in larger competitors. We face competition from consumer electronics brands that have historically dominated the stereo headphone market, in addition to sport brand and lifestyle companies that also produce headphone products. These companies include, among others, Sony, JBL, Bose, LG, Turtle Beach and Apple (which includes Beats by Dr. Dre, which was purchased by Apple in 2014). These competitors may have significant competitive advantages, including greater financial, distribution, marketing and other resources, longer operating histories, better brand recognition among certain groups of consumers, and greater economies of scale. In addition, these competitors have long-term relationships with many of our larger retailers that are potentially more important to those retailers. As a result, these competitors may be better equipped to influence consumer preferences or otherwise increase their market share by:

| -4- |

| ● | quickly adapting to changes in consumer preferences; | |

| ● | readily taking advantage of acquisition and other opportunities; | |

| ● | discounting excess inventory; | |

| ● | devoting greater resources to the marketing and sale of their products, including significant advertising, media placement and product endorsement; | |

| ● | adopting aggressive pricing policies; and | |

| ● | engaging in lengthy and costly intellectual property and other legal disputes. |

Additionally, the industry in which we compete generally has low barriers to entry that allow the introduction of new products or new competitors at a fast pace. Some retailers have begun to introduce their own private label headphones, which could reduce the volume of product they buy from us, as well as decrease the shelf space they allocate to our products. If we are unable to protect our brand image and authenticity, while carefully balancing our growth, we may be unable to effectively compete with these new market entrants or new products. The inability to compete effectively against new and existing competitors could have an adverse effect on our net sales and results of operations, preventing us from achieving future growth.

If we are unable to obtain intellectual property rights and/or enforce those rights against third parties who are violating those rights, our business could suffer.

We rely on various intellectual property rights, including patents, trademarks, trade secrets and trade dress to protect our brand name, reputation, product appearance and technology. If we fail to obtain, maintain, or in some cases enforce our intellectual property rights, our competitors may be able to copy our designs, or use our brand name, trademarks or technology. As a result, if we are unable to successfully protect our intellectual property rights, or resolve any conflicts effectively, our results of operations may be harmed.

We are susceptible to counterfeiting of our products, which may harm our reputation for producing high-quality products and force us to incur expenses in enforcing our intellectual property rights. Such claims and lawsuits can be expensive to resolve, require substantial management time and resources, and may not provide a satisfactory or timely result, any of which would harm our results of operations. It can be particularly difficult and expensive to detect and stop counterfeiting, whether in the United States or abroad. Despite our efforts to enforce our intellectual property, counterfeiters may continue to violate our intellectual property rights by using our trademarks or imitating or copying our products, which could harm our brand, reputation and financial condition. Since our products are sold internationally, we are also dependent on the laws of a range of countries to protect and enforce our intellectual property rights. These laws may not protect intellectual property rights to the same extent or in the same manner as the laws of the United States.

We also face competition from competitors in the United States and abroad that are not “counterfeiters” but that may be using our patented technology, using confusingly similar trademarks, or copying the “look-and-feel” of our products. We may have to engage in expensive and distracting litigation to enforce and defend our patents, trademarks, trade dress, or other intellectual property rights. Our enforcement of our intellectual property rights also places such assets at risk. For example, it is common for a competitor that is accused of infringing a patent, trademark, or other intellectual property right to challenge the validity of that intellectual property right. If that intellectual property right is invalidated, it is no longer available to assert against other competitors. Finally, competitors may also circumvent a patent by designing around the patent.

| -5- |

If the popularity or growth of the portable media device, smartphone and gaming console markets stagnates or our products are no longer compatible with these devices, our business and financial condition may be negatively affected.

We have experienced growth in the past due in part to the popularity of, and increase in demand for, portable media devices, smartphones and gaming consoles. We expect that sales of such products will continue to drive a substantial portion of our net sales in the future. However, the markets for portable media devices, smartphones and gaming consoles continue to evolve rapidly and are dominated by several large companies. Increased competition in the headphone market from established media device companies, including enhanced headphones bundled by the manufacturer, a decline in demand or popularity for such products due to technological changes or otherwise, legal restrictions or the inability to use our products with portable media devices, smartphones or gaming consoles, may negatively affect our business and financial condition.

Our results of operations could be materially harmed if we are unable to accurately forecast demand for our products.

To ensure adequate inventory supply, we must forecast inventory needs and place orders with our manufacturers before firm orders are placed by our retailers and distributors. In addition, a portion of our net sales are generated by orders for immediate delivery, particularly during our historical peak season from August through December. If we fail to accurately forecast retailer and distributor demand we may experience excess inventory levels or a shortage of product to deliver to our retailers or distributors. Factors that could affect our ability to accurately forecast demand for our products include:

| ● | changes in consumer demand for our products; | |

| ● | lack of consumer acceptance for our new products; | |

| ● | product introductions and/or discounting by competitors; | |

| ● | changes in general market conditions or other factors, | |

| ● | which may result in cancellations of advance orders or a reduction or increase in the rate of reorders; | |

| ● | weakening of economic conditions or consumer confidence in future economic conditions, which could reduce demand for discretionary items; and | |

| ● | terrorism or acts of war, or the threat thereof, which could adversely affect consumer confidence and spending or interrupt production and distribution of product and raw materials. |

Inventory levels in excess of retailer and distributor demand may result in inventory write-downs or write-offs and the sale of excess inventory at discounted prices, which would have an adverse effect on our gross margin. In addition, if we underestimate the demand for our products, our manufacturers may not be able to produce a sufficient number of products to meet such unanticipated demand, and this could result in delays in the shipment of our products and damage to our relationship with our retailers and distributors.

We must order components for our products and build inventory in advance of product announcements and shipments. Consistent with industry practice, components are normally acquired through a combination of purchase orders, supplier contracts, and open orders, in each case based on projected demand. Because our markets are volatile, competitive and subject to rapid technology and price changes, there is a risk we will forecast incorrectly and order or produce excess or insufficient amounts of components or products, or not fully utilize firm purchase commitments.

| -6- |

Our net sales and operating income fluctuate on a seasonal basis and decreases in sales or margins during our peak seasons could have a disproportionate effect on our overall financial condition and results of operations.

Historically, we have experienced greater net sales in the second half of a calendar year relative to those in the first half, due to a concentration of shopping around the fall and holiday seasons. As a result, our net sales and gross margins are typically higher in the third and fourth quarters and lower in the first and second quarters, as fixed operating costs are spread over the differing levels of sales volume. Given the strong seasonal nature of our sales, appropriate forecasting is critical to our operations. We anticipate that this seasonal impact on our net sales is likely to continue and any shortfall in expected third and fourth quarter net sales would cause our annual results of operations to suffer significantly.

We have a history of operating losses, and expect to incur significant additional operating losses in the future if we fail to execute our strategy.

Monster, Inc. (formerly known as Monster Cable Products, Inc.) was formed in 1978 and together with its subsidiaries and affiliates, has almost 40 years of operating history. We continue to incur operating losses. At December 31, 2017 and 2016, we had $7.8 million and $8.3 million in cash and cash equivalents, respectively. We had negative working capital as of December 31, 2017 and 2016 of $75.9 million and $10.5 million, respectively. For the year ended December 31, 2017, we had a net loss of $26.7 million. The amount of future losses and when, if ever, we will achieve profitability are uncertain. As set forth in Note 1 to our financial statements, the management team of Monster (the “Management”) has taken several actions to address our operating losses, including reducing headcount across functional areas, negotiating with customers to lower returns and incentives under dealer programs, reducing marketing spend and branding partnerships to refocus on digital and social marketing, outsourcing distribution to a 3PLsolution, closing down its manufacturing facility in Tijuana, Mexico and eliminating unprofitable products and streaming the product portfolio by reducing the SKU count. If we are unsuccessful at some or all of these undertakings, our business, prospects, and results of ope may be materially adversely affected.

We may need to secure additional financing.

We anticipate that we will incur operating losses for the foreseeable future. We may require additional funds for our anticipated operations and if we are not successful in securing additional financing, we may need to curtail our business operations.

Our auditors have issued a “going concern” audit opinion.

Our independent auditors have indicated, in their report on our December 31, 2017 financial statements, because of our recurring significant operating losses and net capital deficiency that there is substantial doubt about our ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Therefore, you should not rely on our balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation.

We owe substantial debt to certain shareholder of Monster and if we are unable to pay the debt when due, the debt in such amount may have an adverse effect on our operations.

At December 31, 2017, the Company had collateralized notes payable to shareholders totaling approximately $100.5 million. On April 12, 2018, the two noteholders under common control of Mr. Noel Lee, our CEO and chairman, converted approximately $92,573,824 of the notes owed by Monster, LLC to 10,007,981 shares of Series A Convertible Preferred Stock of the Company, the certificate of designation of which is attached herein as Exhibit 4.1. As of the date of this current report, the principal and accrued interest on the outstanding notes amounted to approximately $37,288,249. These outstanding notes payable bear interest at the rate of 5% per annum, and matured or will mature between February 2018 and April 2020 . The principal and accrued interest of the matured notes amounted to $36,972,350. The Company is in the process of extending the maturity dates of these notes to February 2020. Repaying these outstanding notes may put a strain on our limited our cash on hand and in the event that we are unable to pay these notes when due and we in default and as such this could have a material adverse effect on our business.

| -7- |

In the event that we lose our action against a former vendor we may be liable for damages.

We had a license agreement (the “License Agreement”) with a consumer electronics company (the “Licensor” or “Vendor”) to sell headphone products under the Licensor’s trade name and pay related royalties. The License Agreement was terminated on June 30, 2012.

As a result of the termination of the License Agreement, we and the Licensor simultaneously entered into several other agreements (collectively, the “Vendor Agreements”) to wind down their business relationship.

Under the Vendor Agreements, the parties agreed to settle related receivables and payables based on a final reconciliation report for contract compliance by an independent accounting firm mutually appointed by the Company and Vendor.

In January 2015, the Company and its majority shareholder and managing member brought a complaint (the “Complaint”) against the Vendor, as well as the Vendor’s current and former owners and managers, seeking damages relating to numerous actions, including several relating to the License Agreement and Vendor Agreements. In August 2016, the court granted the Vendor’s Motion for Summary Judgment. In January 2016, the Vendor filed a cross-complaint (the “Cross-Complaint”) against the Company and its majority shareholder and managing members alleging certain breaches relating to the Vendor Agreements and seeking damages for attorneys’ fees and costs incurred in responding to the Complaint. As of March 15, 2018, no accrual has been provided for this matter as management intends to vigorously defend these allegations and believes that the likelihood of an unfavorable outcome to the Cross-Complaint is neither probable nor estimable at this time.

On January 16, 2018, Monster and Noel Lee, the chairman and CEO of Monster, posted a bond on the Complaint and have filed an appeal of the judgement. On January 30, 2018, a judgement was issued against Monster and Noel Lee on the Cross-Complaint. On March 6, 2018, Monster and Noel Lee filed an appeal of the judgement.

In the event that this action is decided against the Company, the Company may have to pay several million dollars or more in damages which could strain its cash position.

One of our retailers accounts for a significant amount of our net sales, and the loss of, or reduced purchases from, this or other retailers could have a material adverse effect on our operating results.

In 2017, we had no customers which accounting for more than 10% of our gross sales. In 2016, two customers accounting for 21.9% of gross sales. We do not have long-term contracts with any of our retailers and all of our retailers generally purchase from us on a purchase order basis. As a result, retailers generally may, with no notice or penalty, cease ordering and selling our products, or materially reduce their orders. If certain retailers, individually or in the aggregate, choose to no longer sell our products, to slow their rate of purchase of our products or to decrease the number of products they purchase, our results of operations would be adversely affected.

We may be adversely affected by the financial condition of our retailers and distributors.

Some of our retailers and distributors have experienced financial difficulties in the past. A retailer or distributor experiencing such difficulties generally will not purchase and sell as many of our products as it would under normal circumstances and may cancel orders. In addition, a retailer or distributor experiencing financial difficulties generally increases our exposure to uncollectible receivables. We extend credit to our retailers and distributors based on our assessment of their financial condition, generally without requiring collateral, and sometimes are not able to obtain information regarding their current financial status. Failure of these retailers or distributors to remain current on their obligations to us could result in losses that exceed the reserves we set aside in anticipation of this risk. Additionally, while we have credit insurance against some of our larger retailers, there is no assurance that such insurance will sufficiently cover any losses. We are also exposed to the risk of our customers declaring bankruptcy, exposing us to claims of preferential payment claims. Financial difficulties on the part of our retailers or distributors could have a material adverse effect on our results of operations and financial condition.

| -8- |

Changes in the mix of retailers and distributors to whom we sell our products could impact our gross margin and brand image, which could have a material adverse effect on our results of operations.

We sell our products through a mix of retailers, including specialty, consumer electronics, big-box, sporting goods and mobile phone retailers and to distributors. The retail landscape is changing with consumers shopping habits shifting away from the traditional brick and mortar stores to online sales. Any changes to our current mix of retailers and distributors could adversely affect our gross margin and could negatively affect both our brand image and our reputation. We generally realize lower gross margins when we sell through our distributors, and therefore our gross margins may be adversely impacted if we increase product sales made through distributors as opposed to direct to our retailers. In addition, we sell certain products at higher margins than others and any significant changes to our product mix made available to our retailers could adversely affect our gross margin. A negative change in our gross margin or our brand image could have a material adverse effect on our results of operations and financial condition.

To remain competitive and stimulate customer demand, we must keep up with changes in technology and successfully manage frequent product introductions and transitions.

Due to the highly volatile and competitive nature of the industries in which we compete, we must continually introduce new products, services and technologies, enhance existing products and services, and effectively stimulate customer demand for new and upgraded products. In addition, our products must remain compatible with smartphones, tablets, computers and other similar consumer electronic devices that transmit audio. The success of new product introductions depends on a number of factors including: remaining compatible with changes in technology; timely and successful product development; market acceptance; our ability to manage the risks associated with the new product production ramp-up issues, the effective management of purchase commitments and inventory levels in line with anticipated product demand, the availability of products in appropriate quantities and costs to meet anticipated demand, and the risk that new products may have quality or other defects or deficiencies in the early stages of introduction. Accordingly, if technology changes and our products are no longer compatible or we cannot effectively introduce new products and manage transitions, our financial condition would be negatively impacted.

We face business, political, operational, financial and economic risks because a portion of our net sales are generated internationally and substantially all of our products are manufactured outside of the United States.

For the year ended December 31, 2017 international net sales were $26.6 million, or 46.3% of net sales. In addition, substantially all of our products are manufactured in China. In the past we have experienced increased lead-time from some of our manufacturers in China and we may encounter such increased lead-times in the future. Changing economic conditions in China may cause further issues with lead-time and impact the financial solvency of our third party manufacturers. Because we operate on a build-to-forecast model, extended lead-time can cause unexpected inventory shortages or excesses which may reduce our net sales.

In addition, we face business, political, operational, financial and economic risks inherent in international business, many of which are beyond our control, including:

| ● | difficulties obtaining domestic and foreign export, import and other governmental approvals, permits and licenses, and compliance with foreign laws, which could halt, interrupt or delay our operations if we cannot obtain such approvals, permits and licenses, and that could have a material adverse effect on our results of operations; | |

| ● | difficulties encountered by our international distributors or us in staffing and managing foreign operations or international sales, including higher labor costs, which could increase our expenses and decrease our net sales and profitability; | |

| ● | transportation delays and difficulties of managing international distribution channels, which could halt, interrupt or delay our operations; |

| -9- |

| ● | longer payment cycles for, and greater difficulty collecting, accounts receivable, which could reduce our net sales and harm our financial results; | |

| ● | changes in the financial solvency of our third party manufacturers would impact our ability to receive inventory timely; | |

| ● | trade restrictions, higher tariffs, currency fluctuations or the imposition of additional regulations relating to import or export of our products, especially in China, where substantially all of our products are manufactured, which could force us to seek alternate manufacturing sources or increase our expenses, either of which could have a material adverse effect on our results of operations; | |

| ● | political and economic instability, including wars, terrorism, political unrest, boycotts, strikes, curtailment of trade and other business restrictions, any of which could materially and adversely affect our net sales and results of operations; and | |

| ● | natural disasters, which could have a material adverse effect on our results of operations; | |

| ● | disruptions in the global transportation network such as a port strike, and work stoppages or other labor unrest. |

Any of these factors could reduce our net sales, decrease our gross margins and increase our expenses.

We are subject to laws and regulations worldwide, changes to which could increase our costs and individually or in the aggregate adversely affect our business.

We are subject to laws and regulations affecting our domestic and international operations in a number of areas. These U.S. and foreign laws and regulations affect our activities including, but not limited to, areas of labor, advertising, digital content, consumer protection and compliance, e-commerce, promotions, quality of services, mobile communications, intellectual property ownership and infringement, tax, import and export requirements, anti-corruption, foreign exchange controls and cash repatriation restrictions, data privacy requirements, environmental, health, and safety.

By way of example, laws and regulations related to consumer electronics in the many jurisdictions in which we operate are extensive and subject to change. Such changes could include, among others, restrictions on the production, manufacture, distribution, and use of devices. These devices are also subject to certification and regulation by governmental and standardization bodies. These certification processes are extensive and time consuming, and could result in additional testing requirements, product modifications, delays in product shipment dates, or preclude us from selling certain products. Compliance with these laws, regulations and similar requirements may be onerous and expensive, and they may be inconsistent from jurisdiction to jurisdiction, further increasing the cost of compliance and doing business. Any such costs, which may rise in the future as a result of changes in these laws and regulations or in their interpretation could individually or in the aggregate make our products and services less attractive to our customers, delay the introduction of new products in one or more regions, or cause us to change or limit its business practices. We have implemented policies and procedures designed to ensure compliance with applicable laws and regulations, but there can be no assurance that our employees, contractors, or agents will not violate such laws and regulations or our policies and procedures.

If our relationship with our manufacturers terminates or is otherwise impaired, we would likely experience increased costs, disruptions in the manufacture and shipment of our products and a material loss of net sales.

We have no long-term contracts with our manufacturers and, as a result, our manufacturers could cease to provide products to us without notice. We have a limited number of manufactures we use and some of our products are produced by one manufacturer. We cannot be certain that we will not experience operational difficulties with our manufacturers, including reductions in the availability of production capacity, errors in complying with product specifications and regulatory schemes covering our products in our key markets, insufficient quality control, failures to meet production deadlines, increases in manufacturing costs and increased lead times. In the event our manufacturers experience operational or financial difficulties, or terminate our relationship, our results of operations could be adversely affected.

| -10- |

We have created a manufacturer selection and qualification program and are actively looking for new manufacturing sources in other countries and other regions of China. Qualifying new manufacturing sources may result in increased costs, disruptions and delays in the manufacture and shipment of our products while seeking alternative manufacturing sources, and a corresponding loss of net sales. In addition, any new manufacturer may not perform to our expectations or produce quality products in a timely, cost-efficient manner, either of which could make it difficult for us to meet our retailers’ and distributors’ orders on satisfactory commercial terms.

The failure of any manufacturer to perform to our expectations could result in supply shortages or delivery delays, either of which could harm our business.

Any shortage of raw materials or components could impair our ability to ship orders of our products in a cost-efficient manner or could cause us to miss the delivery requirements of our retailers or distributors, which could harm our business.

The ability of our manufacturers to supply our products is dependent, in part, upon the availability of raw materials and certain components. Our manufacturers may experience shortages in the availability of raw materials or components, which could result in delayed delivery of products to us or in increased costs to us. For example, we are dependent on the supply of certain components for our production of iPhone compatible headphones. These components are in high demand and we have experienced supply shortages in the past. Any shortage of raw materials or components or inability to control costs associated with manufacturing could increase the costs for our products or impair our ability to ship orders in a timely cost-efficient manner. As a result, we could experience cancellation of orders, refusal to accept deliveries or a reduction in our prices and margins, any of which could harm our financial performance and results of operations.

Our products and services may experience quality problems from time to time that can result in decreased sales and operating margin and harm to our reputation.

From time to time, our products may contain design and manufacturing defects. There can be no assurance we will be able to detect and fix all defects in the hardware we sell. Failure to do so could result in lost revenue, significant warranty and other expenses, and harm to our reputation.

Our business could suffer if any of our manufacturers fail to use acceptable labor practices.

We do not control our manufacturers or their labor practices. The violation of labor or other laws by a manufacturer utilized by us, or the divergence of an independent manufacturer’s labor practices from those generally accepted as ethical or legal in the United States, could damage our reputation or disrupt the shipment of finished products to us if such manufacturer is ordered to cease its manufacturing operations due to violations of laws or if such manufacturer’s operations are adversely affected by such failure to use acceptable labor practices. If this were to occur, it could have a material adverse effect on our financial condition and results of operations.

Changes in tariffs, import or export restrictions, Chinese regulations or other trade barriers may reduce gross margins.

We may incur increases in costs due to changes in tariffs, import or export restrictions, other trade barriers, or unexpected changes in regulatory requirements, any of which could reduce our gross margins. For example, the Trump administration proposed tariffs of as much as $60 billion against Chinese goods in Mid-March 2018. It is difficult to anticipate the impact on our business caused by the proposed tariffs or whether the proposed changes in tariffs will materialize in the future. Given the relatively fluid regulatory environment in China and the United States, there could be additional tax, tariffs or other regulatory changes in the future. Any such changes could directly and materially adversely impact our financial results and general business condition.

| -11- |

If we experience problems with our distribution network for domestic and international retailers, our ability to deliver our products to the market could be adversely affected.

We rely on our distribution facilities operated by third party supply chain providers for the majority of our domestic and international product distribution. Our distribution facilities utilizes computer controlled and automated equipment, which means the operations are complicated and may be subject to a number of risks related to security or computer viruses, the proper operation of software and hardware, power interruptions or other system failures. We have experienced some of these problems in the past and we cannot assure you that we will not experience similar problems in the future. We maintain business interruption insurance, but it may not adequately protect us from the adverse effects that could be caused by significant disruptions in our distribution facilities, such as the long-term loss of retailers or an erosion of our brand image. In addition, our distribution capacity is dependent on the timely performance of services by third parties, including the shipping of product to and from our warehouse facilities. If we encounter problems with the facilities, our ability to meet retailer expectations, manage inventory, complete sales and achieve objectives for operating efficiencies could be materially adversely affected.

Our current executive officers are critical to our success and the loss of any of these individuals, or other key personnel, could harm our business and brand image.

We are heavily dependent upon the contributions, talent and leadership of our current executive officers. The loss of executive officers or the inability to attract or retain qualified executive officers could delay the development and introduction of, and harm our ability to sell our products and damage our brand, which could have a material adverse effect on our results of operations. Changes in management may have a negative effect on our business and operations. Our future success also depends on our ability to attract and retain additional qualified design and marketing personnel. We face significant competition for these individuals worldwide and we may not be able to attract or retain these employees.

Claims that we violate a third party’s intellectual property rights may give rise to burdensome litigation, result in potential liability for damages or impede our development efforts.

We cannot assure you that our products or activities do not violate the patents or other intellectual property rights of third parties. Patent infringement, trade secret misappropriation and other intellectual property claims and proceedings brought against us, whether successful or not, could result in substantial costs and harm our reputation. Such claims and proceedings can also distract and divert management and key personnel from other tasks important to the success of our business. In addition, intellectual property litigation could force us to do one or more of the following:

| ● | cease developing, manufacturing, or selling products that incorporate the challenged intellectual property; |

| ● | obtain and pay for licenses from the holder of the infringed intellectual property right, which licenses may not be available on reasonable terms, or at all; |

| ● | redesign or reengineer products; |

| ● | change our business processes; and |

| ● | pay substantial damages, court costs and attorneys’ fees, including potentially increased damages for any infringement or violation found to be willful. |

In the event of an adverse determination in an intellectual property suit or proceeding, or our failure to license essential technology, our sales could be harmed and/or our costs could increase, which could harm our financial condition.

We may be subject to product liability or warranty claims that could result in significant direct or indirect costs, or we could experience greater returns from retailers than expected, which could harm our net sales.

We generally provide a limited warranty on all of our products. The occurrence of any quality problems due to defects in our products could make us liable for damages and warranty claims in excess of our current reserves. In addition to the risk of direct costs to correct any defects, warranty claims or other problems, any negative publicity related to the perceived quality of our products could also affect our brand image, decrease retailer and distributor demand and our operating results and financial condition could be adversely affected.

| -12- |

Changes in tax laws and unanticipated tax liabilities could adversely affect our effective income tax rate and profitability.

We are subject to income taxes in the United States and numerous foreign jurisdictions. Our effective income tax rate could be adversely affected in the future by a number of factors, including: changes in the mix of earnings in countries with differing statutory tax rates, changes in the valuation of deferred tax assets and liabilities, changes in tax laws, and any repatriation of non-US earnings for which we have not previously provided for U.S. taxes. We regularly assess all of these matters to determine the adequacy of our tax provision.

Currency exchange rate fluctuations may disrupt our business and make our products less competitive, having a material adverse impact on our business.

With approximately 46.3% of our net sales for the year ended December 31, 2017 arising from foreign net sales, a growing percentage of our net revenues are derived from markets outside the U.S. Our international businesses operate in functional currencies other than the U.S. dollar. Products sold by our international businesses and the cost of these products may be affected by relative changes in the value of the local currencies of our subsidiaries and our manufacturers. Price increases caused by currency exchange rate fluctuations may make our products less competitive or have an adverse effect on our net revenues, margins and operating results. Currency exchange rate fluctuations may also disrupt the business of the contract manufacturers from which we source our products by making their purchases of raw materials more expensive and more difficult to finance. As a result, currency fluctuations may have a material adverse effect on our financial condition.

Additionally, concerns regarding the short- and long-term stability of the euro and its ability to serve as a single currency for countries in the Eurozone could lead individual countries to revert, or threaten to revert, to their former local currencies, potentially dislocating the euro. If this were to occur, the assets we hold in a country that re-introduces its local currency could be significantly devalued, the cost of raw materials or our manufacturing operations could substantially increase, and the demand and pricing for our products could be materially adversely affected. Furthermore, if it were to become necessary for us to conduct business in additional currencies, we could be subject to additional earnings volatility as amounts in these currencies are translated into U.S. dollars.

An information systems interruption or breach in security could adversely affect us.

Privacy, security, and compliance concerns have continued to increase as technology has evolved. We rely on accounting, financial and operational management information systems to conduct our operations.

Risks Related to Our Common Stock

There is currently no public trading market for our common stock and an active trading market for our common stock may not develop.

There is currently no public or other market for shares of our common stock. Although we intend to seek listing on a market, we may never become listed on a market or exchange and a liquid trading market for our common stock may not develop.

Even if our common stock becomes listed on a market, we cannot predict the extent to which investor interest in us will lead to the development of an active trading market on the market or how liquid that market might become. An active public market for our common stock may not develop or be sustained. If an active public market does not develop or is not sustained, it may be difficult for you to sell your shares of common stock at a price that is attractive to you, or at all.

| -13- |

Our common stock may be subject to the “penny stock” rules of the Securities and Exchange Commission, which may make it more difficult for stockholders to sell our common stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require that a broker or dealer approve a person’s account for transactions in penny stocks, and the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

In order to approve a person’s account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination, and that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of the Company’s common stock if and when such shares are eligible for sale and may cause a decline in the market value of its stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

Because we became public by means of a reverse acquisition, we may not be able to attract the attention of brokerage firms.

Because we became public through a “reverse acquisition”, securities analysts of brokerage firms may not provide coverage of us since there is little incentive to brokerage firms to recommend the purchase of our common stock. No assurance can be given that brokerage firms will want to conduct any secondary offerings on behalf of the Company in the future.

Applicable regulatory requirements, including those contained in and issued under the Sarbanes-Oxley Act of 2002, may make it difficult for the Company to retain or attract qualified officers and directors, which could adversely affect the management of its business and its ability to obtain or retain listing of its common stock.

The Company may be unable to attract and retain those qualified officers, directors and members of board committees required to provide for effective management because of the rules and regulations that govern publicly held companies, including, but not limited to, certifications by principal executive officers. The enactment of the Sarbanes-Oxley Act has resulted in the issuance of a series of related rules and regulations and the strengthening of existing rules and regulations by the SEC, as well as the adoption of new and more stringent rules by the stock exchanges. The perceived increased personal risk associated with these changes may deter qualified individuals from accepting roles as directors and executive officers.

Further, some of these changes heighten the requirements for board or committee membership, particularly with respect to an individual’s independence from the corporation and level of experience in finance and accounting matters. The Company may have difficulty attracting and retaining directors with the requisite qualifications. If the Company is unable to attract and retain qualified officers and directors, the management of its business and its ability to obtain or retain listing of our shares of common stock on any stock exchange (assuming the Company elects to seek and are successful in obtaining such listing) could be adversely affected.

| -14- |

If the Company fails to maintain an effective system of internal controls, it may not be able to accurately report its financial results or detect fraud. Consequently, investors could lose confidence in the Company’s financial reporting and this may decrease the trading price of its stock.

The Company must maintain effective internal controls to provide reliable financial reports and detect fraud. The Company has been assessing its internal controls to identify areas that need improvement. It is in the process of implementing changes to internal controls, but has not yet completed implementing these changes. Failure to implement these changes to the Company’s internal controls or any others that it identifies as necessary to maintain an effective system of internal controls could harm its operating results and cause investors to lose confidence in the Company’s reported financial information. Any such loss of confidence would have a negative effect on the trading price of the Company’s stock.

Voting power of our shareholders is highly concentrated by insiders.

The Company’s officers and directors beneficially own approximately 93% of our outstanding shares of common stock. Such concentrated control of the Company may adversely affect the price of our common stock. If you acquire common stock, you may have no effective voice in the management of the Company. Sales by insiders or affiliates of the Company, along with any other market transactions, could affect the market price of our common stock.

We do not intend to pay dividends for the foreseeable future.

We have paid no dividends on our common stock to date and it is not anticipated that any dividends will be paid to holders of our common stock in the foreseeable future. While our future dividend policy will be based on the operating results and capital needs of the business, it is currently anticipated that any earnings will be retained to finance our future expansion and for the implementation of our business plan. As an investor, you should take note of the fact that a lack of a dividend can further affect the market value of our stock, and could significantly affect the value of any investment in our Company.

| -15- |

FORWARD-LOOKING STATEMENTS

Statements in this current report on Form 8-K may be “forward-looking statements.” Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this report, including the risks described under “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report and in other documents which we file with the Securities and Exchange Commission. In addition, such statements could be affected by risks and uncertainties related to:

| ● | our ability to raise funds for general corporate purposes and operations, including our clinical trials; | |

| ● | the commercial feasibility and success of our technology; | |

| ● | our ability to recruit qualified management and technical personnel; | |

| ● | the success of our clinical trials; | |

| ● | our ability to obtain and maintain required regulatory approvals for our products; and | |

| ● | the other factors discussed in the “Risk Factors” section and elsewhere in this report. |

Any forward-looking statements speak only as of the date on which they are made, and except as may be required under applicable securities laws, we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this current report.

BUSINESS

Executive Summary

AA is a Nevada corporation formed on December 29, 2015 as a blank check company with no active business. AA’s registration statement on Form S-1 became effective on September 27, 2016, at 4:00 pm .

The Company filed a registration statement on Form S-1 with the Securities and Exchange Commission on May 27, 2016 (the “419 Registration Statement”). The 419 Registration Statement became effective with the SEC on September 27, 2016,. Pursuant to the 419 Registration Statement the Company offered (the “Offering”), a minimum of 250,000 shares of its common stock at $0.02 per share and a maximum of 1,000,000 shares of its common stock at a price of $0.02 per share. In addition, there were 15,000,000 shares of common stock registered for sale from the selling shareholders also at $0.02 per share. Shortly after the effective date of the 419 Registration Statement, the Company sold an aggregate of 1,000,000 shares of common stock to an aggregate of 34 shareholders. None of the 15,000,000 shares registered on behalf of selling shareholders were sold in the Offering.

The Offering was a “Blank Check” offering subject to Rule 419 of Regulation C (“Rule 419”) as promulgated by the SEC under the Securities Act of 1933, as amended (the “Securities Act”). Under the Offering, the Company sold 1,000,000 shares of its common stock (“Deposited Securities”) at $.02 per share and received gross proceeds of $20,000 (“Deposited Funds”). The Deposited Funds and Deposited Securities were deposited in a non-interest bearing escrow account (the “Escrow Account”) with Branch Banking & Trust Company (the “Escrow Agent”). While held in the Escrow Account, the Deposited Securities were not traded or transferred. Except for an amount of up to 10% of the Deposited Funds otherwise allowed to be disbributed in accordance with Rule 419 , the Deposited Funds and the Deposited Securities could not be released until an acquisition meeting the requirements of Rule 419 has been consummated and 80% of investors reconfirm their investment in accordance with the procedures set forth in Rule 419. Pursuant to these procedures, a new prospectus, by means of filing a post-effective amendment to the 419 Registration Statement , which describes an acquisition candidate and its business and includes audited financial statements, was required delivered to all investors. AA is required to return the pro rata portion of the Deposited Funds to any investor who does not elect to remain an investor. Unless 80% of investors elect to remain investors, all investors will be entitled to the return of a pro rata portion of the Deposited Funds and none of the Deposited Securities will be issued to investors. In the event an acquisition is not consummated by March 27, 2018 (18 months after the effective date of the Rule 419 Registration Statement), the Deposited Funds will be returned on a pro rata basis to all investors.

Upon the closing of Reverse Acquisition, AA obtained reconfirmations from the investors of their investment in AA by providing the investors a copy of this Current Report on Form 8-K on or about April 18, 2018 and asking them to confirm whether they reconfirm their investment in AA. Neither a post-effective amendment to the 419 Registration Statement nor a prospectus satisfying Rule 419 nor the 419 Registration Statement were ever filed with the SEC or sent to investors. All investors in the Offering provided a reconfirmation to AA. After receipt of these reconfirmations, the Deposited Funds were released from escrow and the Deposited Securities were delivered to the investors in book entry. The Deposited Funds that were released from escrow was paid to the Company’s former officers for reimbursement of expenses advanced by such officers.

| -16- |

After closing of the Reverse Acquisition, it came to the attention of new management that the Reverse Acquisition did not comply with the requirements under Rule 419 and the Rule 419 Registration Statement since (i) the Reverse Acquisition was not consummated within 18 months of the effective date of the Rule 419 Registration Statement (ii) AA never filed a post-effective amendment to the 419 Registration Statement, which included a new prospectus which described the Reverse Acquisition, the businesses of the Companies and included the Companies’ audited financial statements, (iii) a prospectus meeting the requirements set forth in (ii) above was never delivered to all investors and (iv) all investors did not reconfirm their investment in accordance with the requirements under Rule 419.

In connection with the entry into the Share Exchange Agreement and the consummation of the Reverse Acquisition, the Companies relied upon advice provided by its advisors and counsel along with representations made by former management of compliance by AA with all applicable laws and the satisfaction of all necessary requirements under the Rule 419 Registration Statement and Rule 419 for the entry into and the consummation of the transactions contemplated by the Share Exchange Agreement. If prior to the Closing Date the Companies were properly advised that AA (i) had not complied with Rule 419 or the terms of the blank check offering disclosed in the 419 Registration Statement for the Offering and (ii) did not satisfy Section 1.02 of the Share Exchange Agreement, it would not have consummated the Reverse Acquisition with AA.

Since AA did not consummate an acquisition meeting the requirements of Rule 419 within 18 months after the effective date of the 419 Registration Statement, we are required to return the Deposited Funds to the purchasers in the Offering and the Deposited Securities are required to be returned to AA. As indicated above, the former officers released the Deposited Funds to themselves for reimbursement of expenses advanced by such officers and the Deposited Securities were released to the investors in book entry form. Current management believes that the Escrowed Funds and the Escrowed Securities were released by the Escrow Agent based on representations made by former management of AA in accordance with Section 8 of the Escrow Agreement that, among other things, allowed AA to certify that (i) it had executed an agreement for the acquisition of a business the value of which represents at least 80% of the maximum offering proceeds (ii) it had filed the required post-effective amendment, (iii) the post-effective amendment had been declared effective, (iv) the mandated reconfirmation offer satisfied the conditions prescribed by Rule 419 had been completed and (v) AA satisfied all of the prescribed conditions of the reconfirmation offer.

While current management is continuing to evaluate its options and potential recourse against AA’s former management and directors as well as the Companies own advisors, former management and counsel for the actions described above, Mr. Lee has decided it to be in the best interest of AA and the Companies to loan AA the money to repay the Deposited Funds to the investors as soon as commercially practicable upon receipt of current contact information for such investors. While AA intends to try and complete this unwinding of the Offering on or prior to January 15, 2019, there can be no assurance that AA will be able to get in contact with any such investors to unwind their investment. Upon confirmation of receipt of such Deposited Funds by an investor, AA shall cancel the Deposited Shares currently held in book-entry form held in the name of such investor.

Monster, Inc. together with approximately ten of its affiliates and subsidiaries created and established the Monster’s brand as end-to-end high-quality audio solutions for consumer and professional use. Starting at the “electrical outlets,” we deliver surge protectors, high quality cables to carry audio signals, and headphones and speakers to deliver high quality sound featuring Pure Monster Sound Technology. We have a portfolio of over 500 patents and over 3,000 trademarks in the United States and internationally. We offer over 5,000 different products in over 160 countries worldwide. Monster has historically sold the majority of its products through retail distribution with limited online sales.

We currently offer five primary categories of consumer products, which are cables, headphones, speakers, power and other mobile phone accessories and add-ons, such as portable chargers and screen cleaning spray . Monster’s sales of its products grew steadily in the past 25 years and exponentially with the introduction of Beats headphones from 2007 to 2012. In 2012, Monster achieved sales of over $1.0 billion in revenues primarily driven by Beats headphones. In December 2012, the partnership between Monster and Beats, under which Monster had the exclusive manufacturing and distribution rights to the Beats headphones, was terminated on December 31, 2012, when Beats provided notice of termination, exercising a so-called “change of control” provision in the parties’ agreement under which Monster’s exclusive manufacturing and distributing rights expired with the acquisition by HTC America Holding (“HTC”) of 51% of Beats. This termination dramatically interrupted Monster’s product lines and strategies.

Monster contends in the “fraud” litigation filed against Beats in 2015 ( Monster, Noel Lee v. Beats Electronics, HTC America Holding and Paul Wachter, trial court No. BC595235; Appellate No. B288598) that the sale of 51% of Beats to HTC was a fraudulent transaction, designed solely to effectuate a termination of Monster’s exclusive manufacturing and distribution rights, and make possible the anticipated sale of Beats to Apple for $3.2 billion.

The remaining obligations between Monster and Beats (i.e. those in addition to the obligation of Beats to pay damages to Monster and Noel Lee in connection with the “fraud” litigation referenced above), are those outstanding financial obligations of Monster to Beats and Beats to Monster in connection with the sales of Beats headphones during the last period of Monster’s distribution of the Beats headphones, June 1, 2012, through December 31, 2012, as established by the final “settlement” agreements between the parties, i.e. the Distribution Agreement, the Termination Agreement, the Sales Representation Agreement and the Royalty Agreement, all the Agreements which are the subject of the claims and cross-claims asserted in the “audit” litigation between Beats and Monster (Beats Electronics vs. Monster- Case No. BC675937), currently pending in the Los Angeles Superior Court. Monster contends in this litigation that when the results of the final audits which have now been completed by Price Waterhouse are combined or totaled (offsetting those amounts owed by Monster to Beats against those amounts owed by Beats to Monster), Beats owes Monster approximately $35 million. Beats contends in the audit litigation that approximately $105 million that the Price Waterhouse auditors determined Beats owes Monster for inventory buyback and reimbursement of certain payments by Monster in connection with its distribution of Beats headphones, has been waived by Monster’s failure to sue Beats for nonpayment of this amount in the earlier litigation, and not until January of 2018 when Monster filed its cross-claims in this litigation.

| -17- |

After the departure of Beats, the management of Monster indicated that it has expanded its product mix to include several headphone lines, a High-Definition Multimedia Interface (“HDMI”) cable and a home audio service line named “SoundStage.”

Monster’s current business strategy is shifting focus away from simply building its product range to pursuing alternative retail platforms and implementing new marketing campaigns. Over the next five years, Monster’s business strategy is to revitalize relationships with the Company’s existing retail relationships as well as target expansion into new retail venues.

Background and History

The management team believes that Monster is a well-recognized provider of high quality consumer electronics and accessories. Monster was the pioneer in the development and retail of high-quality audio products, starting from audio cables. At its inception, Monster was the market leader in the production of quality audio cables and centered its organizational model around the supplying industry. Through the addition of complimentary products over time, Monster has introduced sales tactics utilized by retailers to increase profit margin through “attachment” selling, involving bundling products to the customers. In addition to its cable business, Monster further expanded into new markets. In 1988, Monster launched “Monster Power,” providing high quality AC power sources to audio/video components and computer products and high joule surge protectors for home theater and audio applications. In 2008, we again diversified its product offering with its partnership with Beats Headphones (“Beats”). Monster engineered the technology for Beats, designed, manufactured, and distributed Beats headphones, which achieving a market share of approximately 40% in 2012. In the same year, Beats and Monster terminated the relationship. Thereafter, from 2013 to 2015, Monster launched several headphone lines, reinvented HDMI cables, and improved the home audio devices, including SuperStar series and SoundStage series. Since 2016 up to the date of this current report on Form 8-k, Monster continues its innovation, such as Monster SuperStar, one of the world’s smallest portable wireless speakers as of the date of this current report and Power Bank, a line of small but powerful batteries for mobile devices.

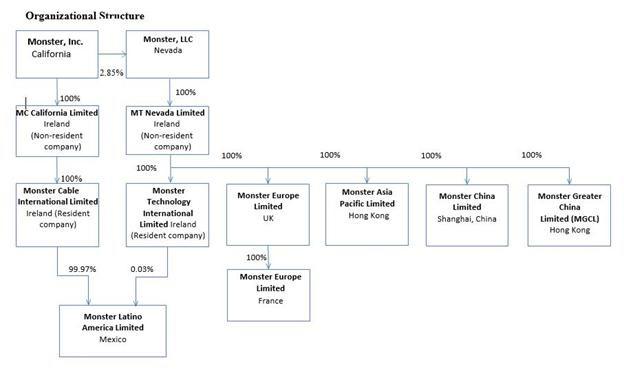

The following is Monster’s organizational structure upon completion of the Reverse Acquisition.

| -18- |

Management Team

Our management is led by Mr. Noel Lee, the founder of Monster, and a skillful and devoted executive team, including the chief operating officer, chief financial officer, and chief technology officer as well as other key employees. Our research and development team members have extensive experience in developing new products and technologies with full awareness of the market demand and consumer trends. Our marketing and sales department consists of talents that are devoted to utilizing creative methods and avenues to increase our market shares in various markets, such as cables, audio devices, speakers, headphones, power products, and mobile phone accessories. Our current board of directors (the “Board”) consists of Mr. Noel Lee, our chairman of the Board and Chief Executive Officer, and Mr. Fereidoun Khalilian, the Chief Operating Officer and interim President. We plan to expand our Board by electing additional board members, including independent directors, in the future.

Monster Products

Monster currently offers five primary categories of consumer products, which are cables, headphones, speakers, power and other mobile-related accessories.

Cables

Cables were Monster’s first product offering, based on its observation that the market was lacking high quality audio cables in the music industry. Monster introduced the industry-first high performance speaker cable in 1978. We expanded dramatically from there and now offer a range of applications, including audio, computer, HDMI, mobile phone, music/instrument, speaker, video and headphone cables.

Headphones

Aiming to preserve the sound quality, Monster engineered and developed its own headphones with a focus on high definition audio and strong bass without overpowering audio quality. Monster offers a variety of headphones, such as wireless, in-ear, on-ear and over-ear. Monster’s current headphone family includes ClarityBT DS, ClarityHD, Fatal1ty, iSport Wireless, iSport Wired, NTune and Elements.

Speakers

Monster’s speaker line includes both portable speakers and wireless home theater speaker systems. Monster’s portable boom box range was designed to promote sharing music, dancing, skateboarding and other shared activities via the boom box speaker. The Monster speakers vary by sizes and can connect via Bluetooth to mobile devices. Our SoundStage software allows playback of music through individual speakers or the collective speakers throughout an entire home.

Power Products

Monster Power was launched in 1988 following the success of Monster cable products. Monster discovered the niche market of power source for portable devices because it believes that all electronics require connection to a power source. Monster’s portable power products include mobile power units, car power plugs and wall outlets. The power product range also includes Monster’s home theater power systems, which were introduced as a “clean” power system, effectively reducing debris, noise and interference from outside sources. Monster’s power systems currently have applications ranging from home theaters to professional recording studios. Monster power products feature surge protection with fire-proof technology MOV compression circuits. Our ceramic MOV has become a widely accepted product to safeguard against power surges and protect the power systems from fires, power surges caused by natural disasters and power outages. Monster’s latest power product range includes Power Stations, which are rechargeable power stations for mobile phones, blue tooth speakers and laptops.

Other Monster Products

Monster also provides accessories and add-ons for mobile phones, such as portable chargers and cables, as well as its ScreenClean, a type of non-alcohol cleaning spray that can be applied to any types of screens, including TVs, tablets and smartphones. In addition, Monster offers a range of portable chargers and batteries with various capacity and charging rates, such as reinforced cables and adapters for charging technology.

| -19- |

Goals

Our Monster team is devoted to providing high quality consumer electronic products and outstanding customer services. We are shifting our business focus away from simply expanding the product range to pursuing alternative retail platforms and implementing new marketing campaigns to amplify our brand recognition and marketing effects. We evaluate the demand factors for each product line and develop our products to better fulfill its demand. The termination of our relationship with Beats disrupted our revenue, approximately 80% of which in 2012 derived from sales of Beats headphones. In the post-Beats era, we have been adjusting our team to a smaller scale and at the same time exploring new avenues to revitalize our business. In 2017, Monster established a new executive team to engineer and implement performance-based initiatives and programs to bring back profitability to Monster. Over the next five years, Monster’s retail strategy will focus on expanding distribution with existing traditional retail customers (national CE, mass market, independent A/V, TV/regionals, warehouse/clubs) and new alternative retail channels (travel, hotels/resorts, cruise lines, outdoor recreation, home shopping, stadiums, college book stores, military, drug/grocery, B2B, fashion/department stores, and shows/festivals)

Patents & Proprietary Rights

Our success depends in part on our ability to protect our technologies and products by obtaining and maintaining a strong proprietary position. To develop and maintain our position, we intend to continue relying upon patent protection, trademark registration, trade secrets, know-how, continuing technological innovations and licensing opportunities. We intend to seek patent protection whenever available for any products or product candidates and related technology we develop or acquire in the future.