Attached files

| file | filename |

|---|---|

| S-1/A - FORM S-1/A - TEB Bancorp, Inc. | tv508700_s1a.htm |

| EX-99.6 - EXHIBIT 99.6 - TEB Bancorp, Inc. | tv508700_ex99-6.htm |

| EX-99.3.1 - EXHIBIT 99.3.1 - TEB Bancorp, Inc. | tv508700_ex99-3x1.htm |

| EX-23.5 - EXHIBIT 23.5 - TEB Bancorp, Inc. | tv508700_ex23-5.htm |

| EX-23.4 - EXHIBIT 23.4 - TEB Bancorp, Inc. | tv508700_ex23-4.htm |

| EX-23.2 - EXHIBIT 23.2 - TEB Bancorp, Inc. | tv508700_ex23-2.htm |

Exhibit 2

PLAN OF REORGANIZATION

OF

THE EQUITABLE BANK, S.S.B.

FROM A MUTUAL SAVINGS BANK

TO A MUTUAL HOLDING COMPANY

TABLE OF CONTENTS

Page

| 1. | Introduction | 1 |

| 2. | Definitions | 1 |

| 3. | Business Purposes for the Reorganization | 6 |

| 4. | Method of Reorganization and Certain Effects of the Reorganization | 7 |

| 5. | Conditions to Implementation of the Reorganization and Timing of the Reorganization | 10 |

| 6. | Special Meeting of Members and Vote Required to Approve this Plan of Reorganization | 11 |

| 7. | Articles of Incorporation and Bylaws | 11 |

| 8. | Status of Deposit Accounts and Loans Subsequent to Reorganization | 11 |

| 9. | Voting, Liquidation Rights and Running Proxies | 12 |

| 10. | Minority Stock Offering | 12 |

| 11. | Conversion of Mutual Holding Company to Stock Form | 12 |

| 12. | Reorganization Expenses | 13 |

| 13. | Interpretation | 13 |

| 14. | Amendment or Termination of this Plan of Reorganization | 13 |

| Exhibit A | Stock Issuance Plan |

| Exhibit B | Plan of Merger |

| Exhibit C | Articles of Incorporation of Mutual Holding Company |

| Exhibit D | Bylaws of Mutual Holding Company |

| Exhibit E | Articles of Incorporation of Stock Holding Company |

| Exhibit F | Bylaws of Stock Holding Company |

| Exhibit G | Articles of Incorporation of Stock Savings Bank |

| Exhibit H | Bylaws of Stock Savings Bank |

| Exhibit I | Bank Branch Offices |

| Exhibit J | Form of Proposed Stock Certificate |

| Exhibit K | Form of Proposed Stock Order Form |

| Exhibit L | Estimate of Expenses |

| 1. | Introduction |

The Board of Directors of The Equitable Bank, S.S.B. (the “Bank”) has adopted this Plan of Reorganization pursuant to which the Bank proposes to reorganize into the mutual holding company structure pursuant to federal law and the laws of the State of Wisconsin and the regulations of the DFI, the FDIC and the Federal Reserve (the “Reorganization’). Upon consummation of the Reorganization, the Bank will become a stock savings bank.

A principal part of the Reorganization is (i) the formation of the Mutual Holding Company as a Wisconsin-chartered mutual holding company, (ii) the formation of the Stock Holding Company as a Maryland capital stock corporation that must be a majority-owned subsidiary of the Mutual Holding Company as long as the Mutual Holding Company is in existence, and (iii) the conversion of the Bank to the Stock Savings Bank, which will be a Wisconsin-chartered stock savings bank and a wholly owned subsidiary of the Stock Holding Company.

Contemporaneously with or immediately following the Reorganization and subject to the approval of the DFI, the FDIC and the Federal Reserve, the Stock Holding Company intends to issue approximately 49.9% of its Common Stock in a Stock Offering pursuant to a Stock Issuance Plan initially adopted by the Board of Directors of the Bank on September 6, 2018. The Stock Issuance Plan is attached hereto as Exhibit A and is incorporated herein by reference. The closing of the Stock Offering is expected to occur contemporaneously with or as soon as possible following the closing of the Reorganization.

The Reorganization is subject to the approval or non-objection of the Bank Regulators. The Plan of Reorganization has been approved by at least two-thirds of the members of the Board of Directors of the Bank and must be approved by a majority of the total votes of Voting Members eligible to be cast at a meeting called and held for such purpose.

| 2. | Definitions |

As used in this Plan of Reorganization, the terms set forth below have the following meanings:

Affiliate: Any Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with another Person.

Associate: The term “Associate,” when used to indicate a relationship with any Person, shall mean: (a) any corporation or organization (other than the Bank or a majority-owned subsidiary of the Bank, the Stock Holding Company or the Mutual Holding Company) of which such Person is an officer or partner or is, directly or indirectly, the beneficial owner of 10% or more of any class of equity securities; and (b) any trust or other estate in which such Person has a substantial beneficial interest or as to which such Person serves as trustee or in a similar fiduciary capacity, except that the term “Associate” does not include any Employee Plan in which a Person has a substantial beneficial interest or serves as a trustee or in a similar fiduciary capacity; and (c) any relative by blood or marriage of such Person, or any relative by blood or marriage of such Person’s spouse, who has the same home as such Person or who is a Director or Officer of the Bank, the Stock Holding Company or the Mutual Holding Company, or any of their Subsidiaries.

Bank: The Equitable Bank, S.S.B. in its pre-Reorganization mutual form or post-Reorganization stock form, as indicated by the context.

Bank Regulators: The Federal Reserve and other bank regulatory agencies, including the DFI and FDIC, as applicable, responsible for reviewing and approving the Reorganization and Stock Offering, including the organization of an interim stock savings bank and the Stock Savings Bank, the insurance of deposit accounts, and the transfer of assets and liabilities to the Stock Savings Bank or, alternatively, the organization of one or more interim savings associations and any merger required to effect the Reorganization.

BHCA: Bank Holding Company Act of 1956.

Capital Stock: Any and all authorized capital stock of the Bank or of the Stock Holding Company.

Common Stock: All of the shares of Capital Stock offered and sold by the Stock Holding Company in the Stock Offering or issued to the Mutual Holding Company contemporaneously with or immediately following the Reorganization pursuant to the Stock Issuance Plan, which Common Stock will not be insured by the FDIC or any other government agency.

Community Offering: The offering to certain members of the general public, of any shares of Common Stock unsubscribed for in the Subscription Offering. The Community Offering may occur concurrently with the Subscription Offering and/or any Syndicated Community Offering.

Control: (including the terms “controlling,” “controlled by” and “under common control with”) means the direct or indirect power to direct or exercise a controlling influence over the management and policies of a person, whether through the ownership of voting securities, by contract, or otherwise as described in applicable Regulations.

Conversion Transaction: A mutual-to-stock conversion of the Mutual Holding Company.

Deposit Account(s): Any withdrawable account as defined in applicable DFI and FDIC regulations and shall include all NOW account deposits, demand accounts as defined in applicable DFI and FDIC regulations, statement, passbook or money market account, and certificates of deposits.

DFI: The Wisconsin Department of Financial Institutions.

Director: A member of the Board of Directors of the Bank, but does not include an advisory director, honorary director, director emeritus or person holding a similar position unless such person is otherwise performing functions similar to those of a member of the Board of Directors of the Bank.

2

Eligible Account Holder: Any person holding a Qualifying Deposit as of the close of business on the Eligibility Record Date for purposes of determining subscription rights.

Eligibility Record Date: June 30, 2017, the date for determining the Depositors that qualify as Eligible Account Holders.

FDIC: The Federal Deposit Insurance Corporation.

FDIC Notice: The Notice of Mutual Holding Company Reorganization, submitted by the Bank to the FDIC, to notify the FDIC of the Reorganization and the Stock Offering.

Federal Reserve: The Board of Governors of the Federal Reserve System.

Interim One: An interim Wisconsin stock savings bank being formed to effect the Reorganization, which will become the Mutual Holding Company as a result of the Reorganization.

Interim Two: An interim Wisconsin stock savings bank being formed to effect the Reorganization, which will be merged out of existence in connection with the Merger.

Members: Any member of the Bank pursuant to the Bank’s articles of incorporation and bylaws and Chapter 214 of the Statutes of Wisconsin and DFI regulations, and following the completion of the Reorganization, any member of the Mutual Holding Company pursuant to the Mutual Holding Company’s articles of incorporation, bylaws and DFI regulations.

Minority Ownership Interest: The shares of the Stock Holding Company’s Common Stock owned by persons other than the Mutual Holding Company, expressed as a percentage of the total shares of Stock Holding Company Common Stock outstanding.

Minority Stock Offering: One or more offers and sales of common stock by the Stock Holding Company, after which offering the Mutual Holding Company would continue to own a majority of the outstanding shares of Voting Stock of the Stock Holding Company.

Minority Stockholder: Any owner of the Stock Holding Company’s Common Stock, other than the Mutual Holding Company.

Mutual Holding Company: The mutual holding company formed in the Reorganization.

Officer: An executive officer of the Bank, the Stock Holding Company or the Mutual Holding Company, including the chairperson of the board of directors, president, vice presidents, secretary, treasurer or principal financial officer, comptroller or principal accounting officer, and any other person performing similar functions with respect to the applicant.

Other Member: Any Member of the Bank at the close of business on the Voting Record Date who is not an Eligible Account Holder or Supplemental Eligible Account Holder, or Tax-Qualified Employee Plan.

3

Person: An individual, a corporation, a partnership, an association, a savings bank, a joint stock company, a trust, any unincorporated organization, or a government or political subdivision thereof.

Plan of Reorganization: This Plan of Reorganization from a Savings Bank to a Mutual Holding Company.

Plan of Merger: The Plan of Merger between Stock Savings Bank and Interim Two, which is attached hereto as Exhibit B.

Prospectus: The prospectus forming part of the Registration Statement.

Qualifying Deposit: The total of the deposit balances of the Deposit Accounts of an Eligible Account Holder or Supplemental Eligible Account Holder in the Bank as of the close of business on the Eligibility Record Date or, in the case of a Supplemental Eligible Account Holder, the Supplemental Eligibility Record Date, provided that Deposit Accounts of an Eligible Account Holder or Supplemental Eligible Account Holder with total deposit balances of less than $50 shall not constitute a Qualifying Deposit.

Registration Statement: The registration statement of the Stock Holding Company filed with the SEC under the Securities Act of 1933, as amended, for purposes of registering Capital Stock of the Stock Holding Company to be issued pursuant to the Stock Issuance Plan.

Regulations: The rules and regulations of the Bank Regulators, including the Federal Reserve rules and regulations regarding mutual holding companies and any applicable rules and regulations of the DFI and the FDIC.

Reorganization: The reorganization of the Bank into the mutual holding company structure including the organization of the Mutual Holding Company, the Stock Holding Company and the Stock Savings Bank pursuant to this Plan of Reorganization.

SEC: The Securities and Exchange Commission.

Special Meeting: The Special Meeting of Members called for the purpose of voting on this Plan of Reorganization.

Stock Holding Company: The Maryland capital stock corporation that will own 100% of the Stock Savings Bank’s common stock and will be majority-owned by the Mutual Holding Company.

Stock Issuance Plan: The Stock Issuance Plan attached hereto as Exhibit A, under which the Stock Holding Company shall offer for sale up to 49.9% of its Common Stock.

Stock Offering: The offering of the Common Stock for sale to Persons, other than the Mutual Holding Company, on a priority basis as set forth in the Stock Issuance Plan, which offering is expected to occur concurrently with or as soon as possible following the Reorganization. Shares sold may not exceed 49.9% of the Common Stock outstanding. The remaining outstanding shares must be held by the Mutual Holding Company.

4

Stock Savings Bank: The newly organized Wisconsin-chartered stock savings bank established as part of the Reorganization, which will be wholly owned by the Stock Holding Company.

Subscription Offering: The offering of shares of Common Stock to the Eligible Account Holders, Tax-Qualified Employee Plans, Supplemental Eligible Account Holders and Other Members.

Supplemental Eligible Account Holder: Any Person holding a Qualifying Deposit on the Supplemental Eligibility Record Date, who is not an Eligible Account Holder, a Tax-Qualified Employee Plan or an Officer or Director of the Bank or their Associates.

Supplemental Eligibility Record Date: The date for determining Supplemental Eligible Account Holders, which shall be the last day preceding adoption of the Plan of Reorganization by the Bank’s Board of Directors.

Syndicated Community Offering: The offering of Common Stock through a syndicate of broker-dealers, which may occur either following or contemporaneously with the Community Offering.

Tax-Qualified Employee Plan: Any defined benefit plan or defined contribution plan (including any employee stock ownership plan, stock bonus plan, profit-sharing plan, or other plan) of the Bank, the Stock Holding Company, the Mutual Holding Company or any of their Affiliates, which, with its related trusts, meets the requirements to be qualified under Section 401 of the Internal Revenue Code. The term “Non-Tax-Qualified Employee Plan” means any stock benefit plan which is not so qualified under Section 401 of the Internal Revenue Code.

Voting Member: Any Person who at the close of business on the Voting Record Date is entitled to vote as a Member of the Bank pursuant to its articles of incorporation and bylaws.

Voting Record Date: The date established by the Bank for determining which Members are entitled to vote on this Plan of Reorganization.

Voting Stock:

| (1) | Voting Stock means common stock or preferred stock, or similar interests if the shares by statute, charter or in any manner, entitle the holder: |

| (i) | To vote for or to select directors of the Bank or the Stock Holding Company; and |

| (ii) | To vote on or to direct the conduct of the operations or other significant policies of the Bank or the Stock Holding Company. |

| (2) | Notwithstanding anything in paragraph (1) above, preferred stock is not “Voting Stock” if: |

5

| (i) | Voting rights associated with the preferred stock are limited solely to the type customarily provided by statute with regard to matters that would significantly and adversely affect the rights or preferences of the preferred stock, such as the issuance of additional amounts or classes of senior securities, the modification of the terms of the preferred stock, the dissolution of the Bank, or the payment of dividends by the Bank when preferred dividends are in arrears; |

| (ii) | The preferred stock represents an essentially passive investment or financing device and does not otherwise provide the holder with Control over the issuer; and |

| (iii) | The preferred stock does not at the time entitle the holder, by statute, charter, or otherwise, to select or to vote for the selection of directors of the Bank or the Stock Holding Company. |

| (3) | Notwithstanding anything in paragraphs (1) and (2) above, “Voting Stock” shall be deemed to include preferred stock and other securities that, upon transfer or otherwise, are convertible into Voting Stock or exercisable to acquire Voting Stock where the holder of the stock, convertible security or right to acquire Voting Stock has the preponderant economic risk in the underlying Voting Stock. Securities immediately convertible into Voting Stock at the option of the holder without payment of additional consideration shall be deemed to constitute the Voting Stock into which they are convertible; other convertible securities and rights to acquire Voting Stock shall not be deemed to vest the holder with the preponderant economic risk in the underlying Voting Stock if the holder has paid less than 50% of the consideration required to directly acquire the Voting Stock and has no other economic interest in the underlying Voting Stock. |

| 3. | Business Purposes for the Reorganization |

The Bank has several business purposes for effecting the proposed Reorganization. The Reorganization will structure the Bank in the stock form, which is used by commercial banks, most major business corporations and an increasing number of savings banks and savings and loan associations.

The Reorganization also will permit the Stock Holding Company to raise capital for the Stock Savings Bank by issuing common stock, preferred stock or trust preferred securities (a source of capital not available to mutual savings banks) and contributing the net proceeds of such stock issuance to the Stock Savings Bank. This new capital will support the Stock Savings Bank’s future growth and expanded operations as business needs dictate. The ability to attract new capital will enhance the Bank’s ability to effect future acquisitions and investments, as well as increase the capabilities of the Bank to address the needs of the communities it serves. The Bank has no current plans regarding any such acquisitions.

The Reorganization will allow the Mutual Holding Company and/or the Stock Holding Company to borrow funds, on a secured and unsecured basis, and to issue debt to the public or in a private placement. The proceeds of any such borrowings or debt issuance may be contributed to the Stock Savings Bank as core capital for regulatory capital purposes. There are no current plans at this time to incur any such borrowings.

6

The Reorganization also will enable customers, employees, management and directors to have an equity ownership interest in the Stock Savings Bank, which should enhance the long-term growth and performance of the Stock Savings Bank and the Stock Holding Company by enabling the Stock Savings Bank to attract and retain qualified employees who have a direct interest in the Stock Savings Bank’s financial success and that customer ownership may enhance our connection with our customers. The ability of the Stock Holding Company to issue Capital Stock also will enable the Stock Holding Company to establish stock-based benefit plans for management and employees, including incentive stock option plans, stock award plans, and employee stock ownership plans, and will benefit the Members and the stockholders of the Stock Holding Company by creating employee incentives based on corporate and stock performance and enhance the ability to retain and attract qualified employees.

Finally, the Reorganization will also permit the Bank to make, subject to applicable regulations, capital distributions to its parent companies although, except as set forth in Section 4 hereof, there are no current plans in this regard.

The Bank is committed to being an independent community savings institution, and to meeting the financial and credit needs of the communities in which it operates. The Board of Directors believes that the mutual holding company structure is best suited for this purpose since the Bank’s mutual form of ownership will be preserved in the Mutual Holding Company, and the Mutual Holding Company, as a mutual corporation, will at all times control a majority of the Voting Stock of the Stock Holding Company so long as the Mutual Holding Company remains in existence. However, the Reorganization will enable the Bank to achieve the benefits of a stock company without a loss of control that often follows standard conversions from mutual to stock form.

| 4. | Method of Reorganization and Certain Effects of the Reorganization |

| A. | Organization of the Mutual Holding Company, the Stock Holding Company and the Stock Savings Bank |

As part of the Reorganization and pursuant to this Plan of Reorganization, the Bank will convert to the Stock Savings Bank, and will establish the Stock Holding Company and the Mutual Holding Company as a Maryland corporation and a Wisconsin mutual holding company, respectively, all of which will be effected as follows, or in any manner approved by the Bank Regulators that is consistent with the purposes of this Plan of Reorganization and applicable laws and regulations:

| (i) | the Bank will organize Interim One as a wholly owned subsidiary; |

| (ii) | Interim One will organize Interim Two as a wholly owned subsidiary; |

| (iii) | Interim One will organize the Stock Holding Company as a wholly owned subsidiary; |

7

| (iv) | the Bank will amend and restate its articles of incorporation to Wisconsin stock savings bank articles of incorporation to become the Stock Savings Bank and Interim One will exchange its articles of incorporation for Wisconsin mutual holding company articles of incorporation to become the Mutual Holding Company; |

| (v) | simultaneously with step (iv), Interim Two will merge with and into the Stock Savings Bank with the Stock Savings Bank as the resulting institution; |

| (vi) | all of the initially issued stock of the Stock Savings Bank will be transferred to the Mutual Holding Company in exchange for membership interests in the Mutual Holding Company; and |

| (vii) | the Mutual Holding Company will contribute the capital stock of the Stock Savings Bank to the Stock Holding Company, and the Stock Savings Bank will become a wholly owned subsidiary of the Stock Holding Company. |

The Stock Holding Company will also issue stock representing a minority interest in the Stock Holding Company to the public according to the terms of the Stock Issuance Plan. However, the Mutual Holding Company will at all times continue to hold at least a majority of the stock of the Stock Holding Company for so long as the Mutual Holding Company is in existence.

Upon consummation of the Reorganization, the legal existence of the Bank will not terminate, but the Stock Savings Bank will be a continuation of the Bank, and, except to the extent set forth herein, all property of the Bank, including its right, title and interest in and to all property of whatsoever kind and nature, interest and asset of every conceivable value or benefit then existing or pertaining to the Bank, or which would inure to the Bank, immediately by operation of law and without the necessity of any conveyance or transfer and without any further act or deed, will vest in the Stock Savings Bank, except for $100,000. The Stock Savings Bank will have, hold, and enjoy the same in its right and fully and to the same extent as the same was possessed, held, and enjoyed by the Bank. The Stock Savings Bank will continue to have, succeed to, and be responsible for all the rights, assets, liabilities, deposits and obligations of the Bank (other than assets expressly transferred to or retained by the Mutual Holding Company or the Stock Holding Company), and will maintain its headquarters and operations at the Bank’s present locations, as listed on Exhibit I. The Stock Savings Bank may distribute additional capital to the Stock Holding Company following the Reorganization, subject to the applicable requirements set forth in the Regulations governing capital distributions.

| B. | Ownership and Operation of the Mutual Holding Company |

The Mutual Holding Company will be a mutual corporation organized under Wisconsin law. As a mutual corporation, the Mutual Holding Company will have no stockholders. The Mutual Holding Company will initially own 100% of the Voting Stock of the Stock Holding Company, and will be required to own a majority of the Voting Stock of the Stock Holding Company so long as the Mutual Holding Company remains in existence. The Mutual Holding Company will have a board of directors that will consist initially of all of the members of the board of directors of the Bank. The management of the Mutual Holding Company will consist initially of the current management persons of the Bank.

8

The rights and powers of the Mutual Holding Company will be defined by the Mutual Holding Company’s articles of incorporation and bylaws and by the statutory and regulatory provisions under Wisconsin law and DFI regulations, including those imposed on bank holding companies by the BHCA. The Members of the Mutual Holding Company will have exclusive voting authority as to all matters requiring a vote of Members under the articles of incorporation of the Mutual Holding Company. Persons who have membership rights with respect to the Bank under its existing articles of incorporation immediately prior to the Reorganization will continue to have such rights solely with respect to the Mutual Holding Company after the Reorganization so long as such persons remain depositors of the Stock Savings Bank. In addition, all persons who become depositors of the Stock Savings Bank following the Reorganization will have membership rights with respect to the Mutual Holding Company.

The Bank will apply, if required, to the DFI, the FDIC and the Federal Reserve to have the Mutual Holding Company receive or retain (as the case may be) up to $100,000 in connection with the Reorganization. All assets, rights, obligations and liabilities of whatever nature of the Bank not expressly retained by the Mutual Holding Company will be deemed transferred to the Stock Savings Bank. The Stock Holding Company may distribute additional capital to the Mutual Holding Company following the Reorganization subject to applicable regulations.

| C. | Ownership and Operation of the Stock Holding Company |

The Stock Holding Company will be a capital stock corporation organized under Maryland law and DFI regulations. So long as the Mutual Holding Company is in existence, the Mutual Holding Company will be required to own a majority of the Voting Stock of the Stock Holding Company. However, the Stock Holding Company may issue any amount of Non-Voting Stock to persons other than the Mutual Holding Company, and will be authorized to undertake one or more Minority Stock Offerings of less than a majority in the aggregate of the total outstanding Voting Stock of the Stock Holding Company, subject to any required regulatory approvals, and the Stock Holding Company intends to offer for sale up to 49.9% of its Common Stock in the Stock Offering. Unless required by the DFI or the Federal Reserve, any subsequent Minority Stock Offering will not require the approval of Members. The Stock Holding Company will own 100% of the Voting Stock of the Stock Savings Bank so long as the Mutual Holding Company is in existence.

The initial board of directors of the Stock Holding Company will be the existing board of directors of the Bank. Thereafter, the holders of shares of the Stock Holding Company’s Voting Stock (which initially will be the Mutual Holding Company) will elect approximately one-third of the Stock Holding Company’s board of directors annually. Management of the Stock Holding Company will consist initially of the current management persons of the Bank.

The Stock Holding Company will be able to exercise all of the powers authorized to a Maryland corporation, subject to the restrictions applicable to bank holding companies under Wisconsin laws and DFI regulations. Initially, the sole business activity of the Stock Holding Company will be the ownership of all of the Voting Stock of the Stock Savings Bank.

9

| D. | Ownership and Operation of the Stock Savings Bank |

The Stock Savings Bank will be a capital Stock Savings Bank organized under Wisconsin law and DFI regulations. The initial Board of Directors of the Stock Savings Bank will be the existing Board of Directors of the Bank. Thereafter, the Stock Holding Company, as the sole stockholder of the Stock Savings Bank, will elect approximately one-third of the Stock Savings Bank’s Board of Directors annually. The current management of the Bank will continue as the management of the Stock Savings Bank following the Reorganization.

The Stock Savings Bank will have all of the powers, rights and privileges of, and shall be subject to all limitations applicable to, capital stock savings banks under Wisconsin and federal law and DFI and FDIC regulations. Except for transaction expenses and the assets of the Bank retained by, or distributed to, the Mutual Holding Company, the Reorganization will not reduce the retained earnings, the undivided profits, or the general loss reserves that the Bank had prior to the Reorganization. Such retained earnings and general loss reserves will be accounted for by the Mutual Holding Company, the Stock Holding Company and the Stock Savings Bank on a consolidated basis in accordance with generally accepted accounting principles.

| 5. | Conditions to Implementation of the Reorganization and Timing of the Reorganization |

The Reorganization is subject to the following conditions, and the Bank intends to consummate the Reorganization as soon as possible after all approvals are obtained:

| A. | Approval of the Plan of Reorganization by the affirmative vote of a majority of total votes of Voting Members eligible to be cast at a meeting called and held for such purpose, pursuant to a proxy statement and form of proxy cleared in advance by the Bank Regulators. |

| B. | The filing of the FDIC Notice with the FDIC, and the approval or non-objection of such FDIC Notice by the FDIC. |

| C. | Approval by the Federal Reserve pursuant to the BHCA for the Stock Holding Company and Mutual Holding Company to become bank holding companies and any related acquired approvals under applicable law. |

| D. | The receipt of any other approval or non-objection from the Bank Regulators, of the Plan of Reorganization (including the Stock Issuance Plan), the Stock Offering, the adoption of the articles of incorporation and bylaws of the Mutual Holding Company, the Stock Holding Company and the Stock Savings Bank, and the merger of Interim One with and into the Stock Savings Bank pursuant to the Plan of Merger; and all conditions specified or otherwise imposed by the Bank Regulators, in connection with their approvals and/or non-objections, have been satisfied. |

10

| E. | Receipt of either a private letter ruling of the Internal Revenue Service or an opinion of the Bank’s counsel or public accounting firm as to the material federal income tax consequences of the Reorganization to the Stock Savings Bank, the Stock Holding Company, the Mutual Holding Company and the Members. |

| F. | Receipt of either a private letter ruling from the Wisconsin Department of Revenue, or an opinion of or a letter of advice from the Bank’s counsel or public accounting firm as to the material Wisconsin tax consequences of the Reorganization to the Stock Savings Bank, the Stock Holding Company, the Mutual Holding Company and the Members. |

| G. | The Registration Statement has been declared effective by the SEC. |

| 6. | Special Meeting of Members and Vote Required to Approve this Plan of Reorganization |

The Special Meeting shall be scheduled by order of the Board of Directors, to be held after the approval of the Plan of Reorganization by the Bank Regulators. Proxy materials relating to the meeting shall be filed with the Bank Regulators, and shall not be distributed prior to authorization, if required, by the Bank Regulators, and shall be mailed within 10 days of Bank Regulator authorization (unless extended by the Bank Regulators). Notice shall be given not more than 40 days nor less than 10 days prior to the meeting to Voting Members. The Voting Record Date shall be determined by the board of directors and may not be more than 60 days prior to the date of the Special Meeting. The Plan of Reorganization must be approved by the affirmative vote of a majority of total votes of Voting Members eligible to be cast at the meeting. Each Voting Member shall be entitled to cast one (1) vote for each $100 of the withdrawable value of the Voting Member’s Deposit Accounts as of the Voting Record Date, provided that any Member who shall cease to be a Member on the date of the Special Meeting shall not be entitled to any vote. Proxy voting may be via telephone and/or Internet. The Bank shall notify the Bank Regulators promptly of the actions of the Voting Members. By voting in favor of the adoption of the Plan of Reorganization, the Members will be voting in favor of the Plan of Merger, which is attached hereto as Appendix B, and the transactions contemplated therein.

| 7. | Articles of Incorporation and Bylaws |

Copies of the proposed articles of incorporation and bylaws of the Mutual Holding Company, the Stock Holding Company and the Stock Savings Bank are attached hereto as Exhibits C through H, and are made a part of this Plan of Reorganization. By their approval of this Plan of Reorganization, the Members shall have approved and adopted such articles of incorporation and bylaws. The total shares of common stock authorized under the articles of incorporation of the Stock Holding Company and of the Stock Savings Bank will exceed the shares of common stock to be issued to the Mutual Holding Company and the Stock Holding Company in the Reorganization.

| 8. | Status of Deposit Accounts and Loans Subsequent to Reorganization |

All Deposit Accounts will be unaffected by the Reorganization, except that each Deposit Account will become a Deposit Account in the Stock Savings Bank. After the Reorganization, all Deposit Accounts will continue to be insured on the same terms up to the applicable limits of FDIC insurance coverage. All loans will retain the same status with the Stock Savings Bank after the Reorganization as they had with the Bank prior to the Reorganization.

11

| 9. | Voting, Liquidation Rights and Running Proxies |

Except as set forth in Exhibits C and D hereto, the liquidation and voting rights of Members shall be preserved as Members’ rights in the Mutual Holding Company. No liquidation account shall be established in connection with the Reorganization.

A proxy that may be cast on behalf of a Member of the Bank may be cast on behalf of a member of the Mutual Holding Company until the proxy is revoked or superseded pursuant to regulations of the DFI.

| 10. | Minority Stock Offering |

The Stock Holding Company will be authorized, subject to applicable federal regulatory approvals and, if required, DFI approval, to undertake one or more Minority Stock Offerings following completion of the Reorganization. Members of the Mutual Holding Company will be offered subscription rights in any Minority Stock Offering.

The Stock Holding Company expects to offer for sale in the Stock Offering approximately 49.9% of its Common Stock contemporaneously with or immediately upon completion of the Reorganization, subject to approval of the DFI, the FDIC and the Federal Reserve, and effectiveness with the SEC of the Registration Statement. The Bank may close the Stock Offering before the Special Meeting, provided that the offer and sale of the Common Stock shall be conditioned upon approval of the Plan of Reorganization by the Members at the Special Meeting. The Stock Holding Company shall not distribute the Prospectus until the Registration Statement has been declared effective by the SEC and becomes effective under DFI, FDIC and Federal Reserve regulations, as required by applicable law.

| 11. | Conversion of Mutual Holding Company to Stock Form |

Following the completion of the Reorganization, the Mutual Holding Company may elect to convert to stock form in accordance with applicable laws. There can be no assurance when, if ever, a Conversion Transaction will occur.

In a Conversion Transaction, it is expected that the Mutual Holding Company would merge with and into the Holding Company with the Holding Company as the resulting entity, followed by the merger of the Holding Company with and into a new stock holding company with the new stock holding company as the resulting entity, and the depositors of the Stock Savings Bank would receive the right to subscribe for shares of common stock of the new stock holding company, which shares would represent the ownership interest of the Mutual Holding Company in the Holding Company immediately prior to the Conversion Transaction. The additional shares of Common stock of the new stock holding company issued in the Conversion Transaction would be sold at their aggregate pro forma market value as determined by an independent appraisal.

12

Any Conversion Transaction shall be fair and equitable to Minority Stockholders. In any Conversion Transaction, Minority Stockholders will be entitled without additional consideration to maintain the same percentage ownership interest in the new stock holding company after the Conversion Transaction as their percentage ownership interest in the Holding Company immediately prior to the Conversion Transaction (i.e., the “Minority Ownership Interest”), subject to adjustment, if any, required by the Bank Regulators to reflect assets of the Mutual Holding Company and any dividends waived by the Mutual Holding Company.

At the sole discretion of the Boards of Directors of the Mutual Holding Company and the Holding Company, a Conversion Transaction may be effected in any other manner necessary to qualify the Conversion Transaction as a tax-free reorganization under applicable federal and state tax laws, provided such Conversion Transaction does not diminish the rights and ownership interest of Minority Stockholders other than as set forth in this Plan of Reorganization. If a Conversion Transaction does not occur, the Mutual Holding Company will always own a majority of the Voting Stock of the Holding Company. The Board of Directors of the Bank has no current intention to conduct a Conversion Transaction.

A Conversion Transaction would require the approval of the Federal Reserve and would be presented to a vote of the members of the Mutual Holding Company and the stockholders, including the Mutual Holding Company, of the Holding Company. Federal regulatory policy requires that in any Conversion Transaction the members of the Mutual Holding Company will be accorded the same stock purchase priorities as if the Mutual Holding Company were a mutual savings association converting to stock form.

| 12. | Reorganization Expenses |

In accordance with the regulations of the Bank Regulators, the expenses incurred by the Bank and the Stock Holding Company in effecting the Reorganization and the Stock Offering will be reasonable. Exhibit L attached to the Plan of Reorganization contains an estimate of the expenses to be incurred by the Bank in connection with the Reorganization and Stock Offering.

| 13. | Interpretation |

All interpretations of this Plan of Reorganization and application of its provisions to particular circumstances by a majority of the Board of Directors of the Bank shall be final, subject to the authority of the Bank Regulators.

| 14. | Amendment or Termination of this Plan of Reorganization |

The terms of this Plan of Reorganization may be amended by a two-thirds vote of the Bank’s Board of Directors at any time prior to submission of this Plan of Reorganization to a vote of Members. At any time after submission of this Plan of Reorganization to a vote of Members, the Plan of Reorganization may be amended by a two-thirds vote of the Board of Directors with the concurrence of the Bank Regulators, as required. The Plan of Reorganization may be terminated by a two-thirds vote of the Board of Directors at any time prior to submission of this Plan of Reorganization to a vote of Members. Terms of the Plan of Reorganization relating to the Stock Offering including, without limitation, Sections 3 through 15 of the Stock Issuance Plan, may be amended by a majority vote of the Board of Directors of the Bank as a result of comments from the Bank Regulators or otherwise at any time prior to the approval of the Plan of Reorganization by the Bank Regulators, and at any time thereafter with the concurrence of the Bank Regulators. However, any material amendment of the terms of the Plan of Reorganization that relate to the Reorganization which occur after the Special Meeting shall require a resolicitation of Members. At any time after submission of this Plan of Reorganization to a vote of Members, the Plan of Reorganization may be terminated by a two-thirds vote of the Board of Directors with the concurrence of the Bank Regulators, as required. Failure of the Members to approve the Plan of Reorganization will result in the termination of the Plan of Reorganization.

13

Unless an extension is granted by the Bank Regulators (which extension, with respect to the DFI, shall be requested in writing for good cause shown and approved in writing by the DFI), the Stock Issuance Plan shall be terminated if not completed within 90 days of the date of its approval by the Bank Regulators. The Plan of Reorganization shall be terminated if the Reorganization is not completed within 24 months from the date the Members approve the Plan of Reorganization, and may not be extended by the Bank or the Bank Regulators.

Dated: September 6, 2018, as amended October 4, 2018 and December 6, 2018

14

EXHIBIT A

PLAN OF STOCK ISSUANCE

OF

THE EQUITABLE BANK, S.S.B.

TABLE OF CONTENTS

| Page | ||

| 1. | Introduction | A-1 |

| 2. | Definitions | A-1 |

| 3. | Timing of the Sale of Capital Stock | A-7 |

| 4. | Number of Shares to be Offered | A-8 |

| 5. | Independent Valuation and Purchase Price of Shares | A-8 |

| 6. | Method of Offering Shares and Rights to Purchase Stock | A-9 |

| 7. | Additional Limitations on Purchases of Common Stock | A-13 |

| 8. | Payment for Stock | A-15 |

| 9. | Manner of Exercising Subscription Rights Through Order Forms | A-16 |

| 10. | Undelivered, Defective or Late Order Form; Insufficient Payment | A-17 |

| 11. | Completion of the Stock Offering | A-18 |

| 12. | Market for Common Stock | A-18 |

| 13. | Stock Purchases by Management Persons After the Stock Offering | A-18 |

| 14. | Resales of Stock by Directors and Officers | A-18 |

| 15. | Stock Certificates | A-18 |

| 16. | Restriction on Financing Stock Purchases | A-19 |

| 17. | Stock Benefit Plans and Employment Agreements | A-19 |

| 18. | Post-Reorganization Filing and Market Making | A-19 |

| 19. | Payment of Dividends and Repurchase of Stock | A-19 |

| 20. | Reorganization and Stock Offering Expenses | A-20 |

| 21. | Residents of Foreign Countries and Certain States | A-20 |

| 22. | Interpretation | A-20 |

| 23. | Amendment or Termination of the Stock Issuance Plan | A-20 |

| 1. | Introduction |

The Board of Directors of The Equitable Bank, S.S.B. (the “Bank”) has adopted a Plan of Reorganization pursuant to which the Bank proposes to reorganize into the mutual holding company structure pursuant to federal law and the laws of the State of Wisconsin and the regulations of the DFI, the FDIC and the Federal Reserve (the “Reorganization’). Upon consummation of the Reorganization, the Bank will become a stock savings bank.

A principal part of the Reorganization is (i) the formation of the Mutual Holding Company as a Wisconsin-chartered mutual holding company, (ii) the formation of the Stock Holding Company as a Maryland capital stock corporation that must be a majority-owned subsidiary of the Mutual Holding Company as long as the Mutual Holding Company is in existence, and (iii) the conversion of the Bank to the Stock Savings Bank, which will be a Wisconsin-chartered stock savings bank and a wholly owned subsidiary of the Stock Holding Company.

Contemporaneously with or immediately following the Reorganization and subject to the approval of the DFI, the FDIC and the Federal Reserve, the Stock Holding Company intends to issue approximately 49.9% of its Common Stock in a Stock Offering pursuant to this Stock Issuance Plan initially adopted by the Board of Directors of the Bank on September 6, 2018. The closing of the Stock Offering is expected to occur contemporaneously with or as soon as possible following the closing of the Reorganization.

| 2. | Definitions |

As used in this Stock Issuance Plan, the terms set forth below have the following meanings:

Acting in Concert: The term Acting in Concert means (i) knowing participation in a joint activity or interdependent conscious parallel action towards a common goal whether or not pursuant to an express agreement; or (ii) a combination or pooling of voting or other interests in the securities of an issuer for a common purpose pursuant to any contract, understanding, relationship, agreement or other arrangement, whether written or otherwise. A Person or company which acts in concert with another Person or company (“other party”) shall also be deemed to be Acting in Concert with any Person or company who is also Acting in Concert with that other party, except that any Tax-Qualified Employee Plan will not be deemed to be Acting in Concert with its trustee or a Person who serves in a similar capacity solely for the purpose of determining whether stock held by the trustee and stock held by the plan will be aggregated.

Actual Purchase Price: The price per share, determined as provided in this Stock Issuance Plan, at which the Common Stock will be sold in the Stock Offering.

Affiliate: Any Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with another Person.

| A-1 |

Associate: The term “Associate,” when used to indicate a relationship with any Person, shall mean: (a) any corporation or organization (other than the Bank or a majority-owned subsidiary of the Bank, the Stock Holding Company or the Mutual Holding Company) of which such Person is an officer or partner or is, directly or indirectly, the beneficial owner of 10% or more of any class of equity securities; and (b) any trust or other estate in which such Person has a substantial beneficial interest or as to which such Person serves as trustee or in a similar fiduciary capacity, except that the term “Associate” does not include any Employee Plan in which a Person has a substantial beneficial interest or serves as a trustee or in a similar fiduciary capacity; and (c) any relative by blood or marriage of such Person, or any relative by blood or marriage of such Person’s spouse, who has the same home as such Person or who is a Director or Officer of the Bank, the Stock Holding Company or the Mutual Holding Company, or any of their Subsidiaries.

Bank: The Equitable Bank, S.S.B. in its pre-Reorganization mutual form or post-Reorganization stock form, as indicated by the context.

Bank Regulators: The Federal Reserve and other bank regulatory agencies, including the DFI and FDIC, as applicable, responsible for reviewing and approving the Reorganization and Stock Offering, including the organization of an interim stock savings bank and the Stock Savings Bank, the insurance of deposit accounts, and the transfer of assets and liabilities to the Stock Savings Bank or, alternatively, the organization of one or more interim savings associations and any merger required to effect the Reorganization.

Capital Stock: Any and all authorized stock of the Bank or of the Stock Holding Company.

Common Stock: All of the shares of Capital Stock offered and sold by the Stock Holding Company in the Stock Offering or issued to the Mutual Holding Company contemporaneously with or immediately following the Reorganization pursuant to the Stock Issuance Plan, which Common Stock will not be insured by the FDIC or any other government agency.

Community: The Wisconsin counties of Milwaukee, Racine and Waukesha.

Community Offering: The offering to certain members of the general public, of any shares of Common Stock unsubscribed for in the Subscription Offering. The Community Offering may occur concurrently with the Subscription Offering and/or any Syndicated Community Offering.

Control: (including the terms “controlling,” “controlled by” and “under common control with”) means the direct or indirect power to direct or exercise a controlling influence over the management and policies of a person, whether through the ownership of voting securities, by contract, or otherwise as described in applicable Regulations.

Deposit Account(s): Any withdrawable account as defined in applicable DFI and FDIC regulations and shall include all NOW account deposits, demand accounts as defined in applicable DFI and FDIC regulations, statement, passbook or money market account, and certificates of deposits.

DFI: The Wisconsin Department of Financial Institutions.

| A-2 |

Director: A member of the Board of Directors of the Bank, but does not include an advisory director, honorary director, director emeritus or person holding a similar position unless such person is otherwise performing functions similar to those of a member of the Board of Directors of the Bank.

Eligible Account Holder: Any person holding a Qualifying Deposit as of the close of business on the Eligibility Record Date for purposes of determining subscription rights.

Eligibility Record Date: June 30, 2017, the date for determining the Depositors that qualify as Eligible Account Holders.

Employee Plans: The Tax-Qualified and Non-Tax Qualified Employee Plans of the Bank and/or the Company.

ESOP: The Stock Savings Bank’s employee stock ownership plan.

Estimated Valuation Range: The range of the estimated pro forma market value of the total number of shares of Common Stock to be issued by the Stock Holding Company to the Mutual Holding Company and to Minority Stockholders, as determined by the Independent Appraiser prior to the Subscription Offering and as it may be amended from time to time thereafter.

Exchange Act: The Securities Exchange Act of 1934, as amended.

FDIC: The Federal Deposit Insurance Corporation.

Federal Reserve: The Board of Governors of the Federal Reserve System.

Firm Commitment Underwritten Offering: The offering, at the sole discretion of the Stock Holding Company, of shares of Common Stock not subscribed for in the Subscription Offering and any Community Offering or Syndicated Community Offering, to members of the general public through one or more underwriters. A Firm Commitment Underwritten Offering may occur following the Subscription Offering and any Community Offering or Syndicated Community Offering.

Independent Appraiser: The appraiser retained by the Bank to prepare an appraisal of the pro forma market value of the Bank and the Stock Holding Company.

Management Person: Any Officer or director of the Bank or any Affiliate of the Bank, and any person Acting in Concert with any such Officer or director.

Market Maker: A dealer (i.e., any person who engages directly or indirectly as agent, broker, or principal in the business of offering, buying, selling or otherwise dealing or trading in securities issued by another person) who, with respect to a particular security, (1) regularly publishes bona fide competitive bid and offer quotations on request, and (2) is ready, willing and able to effect transactions in reasonable quantities at the dealer’s quoted prices with other brokers or dealers.

| A-3 |

Member: Any member of the Bank pursuant to the Bank’s articles of incorporation and bylaws and Chapter 214 of the Statutes of Wisconsin and DFI regulations, and following the completion of the Reorganization, any member of the Mutual Holding Company pursuant to the Mutual Holding Company’s articles of incorporation, bylaws and DFI regulations.

Mutual Holding Company: The mutual holding company formed in the Reorganization.

Minority Ownership Interest: The shares of the Stock Holding Company’s Common Stock owned by persons other than the Mutual Holding Company, expressed as a percentage of the total shares of Stock Holding Company Common Stock outstanding.

Minority Stock Offering: One or more offerings of less than 50% in the aggregate of the outstanding Common Stock of the Stock Holding Company to persons other than the Mutual Holding Company.

Minority Stockholder: Any owner of the Stock Holding Company’s Common Stock, other than the Mutual Holding Company.

Offering Range: The aggregate purchase price of the Common Stock to be sold in the Stock Offering based on the Independent Valuation expressed as a range, which may vary within 15% above or 15% below the midpoint of such range, with a possible adjustment by up to 15% above the maximum of such range. The Offering Range will be based on the Estimated Valuation Range, but will represent a Minority Ownership Interest equal to up to 49.9% of the Common Stock.

Officer: An executive officer of the Bank, the Stock Holding Company or the Mutual Holding Company, including the chairperson of the board of directors, president, vice presidents, secretary, treasurer or principal financial officer, comptroller or principal accounting officer, and any other person performing similar functions with respect to the applicant.

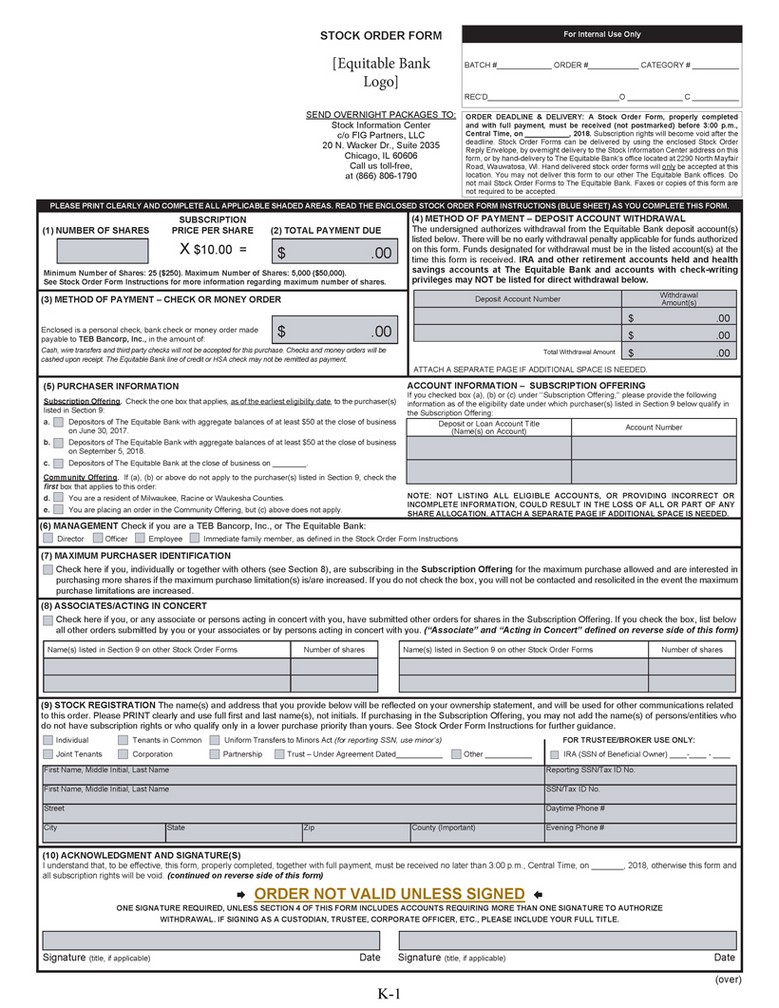

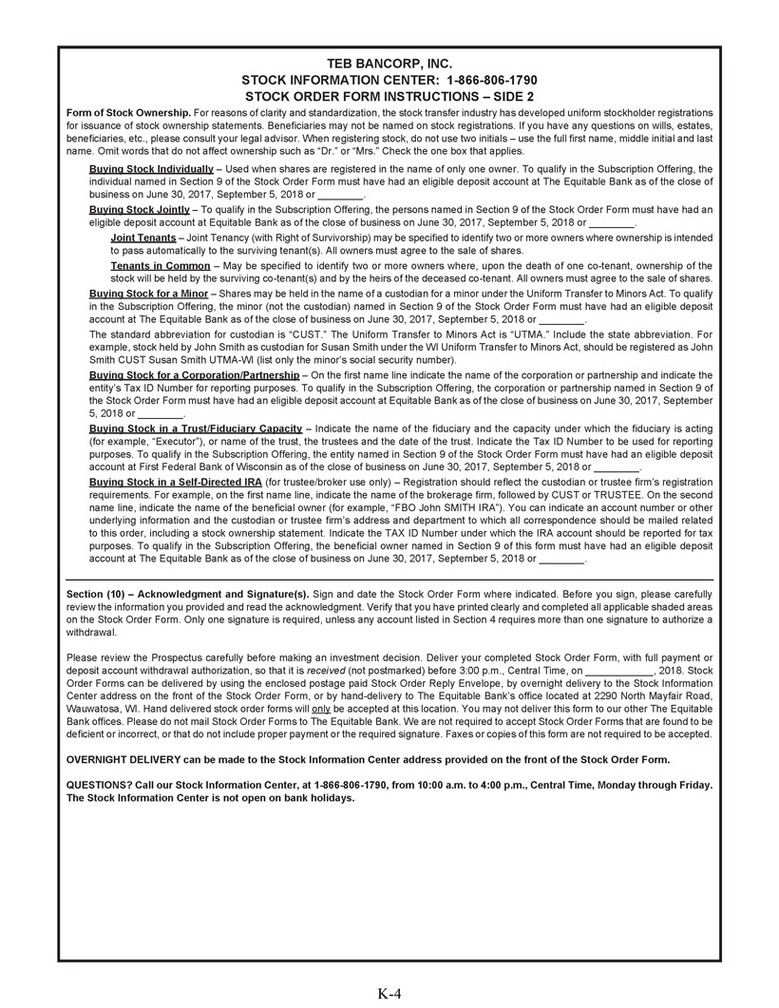

Order Form: Any form (together with any attached cover letter and/or certifications or acknowledgements), sent by the Bank to any Person containing among other things a description of the alternatives available to such Person under the Stock Issuance Plan and by which any such Person may make elections regarding purchases of Common Stock in the Subscription and Community Offerings.

Other Member: Any Member of the Bank at the close of business on the Voting Record Date who is not an Eligible Account Holder or Supplemental Eligible Account Holder, or Tax-Qualified Employee Plan.

Person: An individual, a corporation, a partnership, an association, a savings bank, a joint stock company, a trust, any unincorporated organization, or a government or political subdivision thereof.

| A-4 |

Plan of Reorganization: The Plan of Reorganization from a Mutual Savings Bank to a Mutual Holding Company.

Qualifying Deposit: The total of the deposit balances of the Deposit Accounts of an Eligible Account Holder or Supplemental Eligible Account Holder in the Bank as of the close of business on the Eligibility Record Date or, in the case of a Supplemental Eligible Account Holder, the Supplemental Eligibility Record Date, provided that Deposit Accounts of an Eligible Account Holder or Supplemental Eligible Account Holder with total deposit balances of less than $50 shall not constitute a Qualifying Deposit.

Registration Statement: The registration statement of the Stock Holding Company filed with the SEC under the Securities Act of 1933, as amended, for purposes of registering Capital Stock of the Stock Holding Company to be issued pursuant to this Stock Issuance Plan.

Regulations: The rules and regulations of the Bank Regulators, including the Federal Reserve rules and regulations regarding mutual holding companies and any applicable rules and regulations of the DFI and the FDIC.

Reorganization: The reorganization of the Bank into the mutual holding company structure including the organization of the Mutual Holding Company, the Stock Holding Company and the Stock Savings Bank pursuant to the Plan of Reorganization.

Resident: The terms “resident,” “residence,” “reside,” “resided” or “residing” as used herein with respect to any person shall mean any person who occupies a dwelling within the Bank’s Community, has an intent to remain with the Community for a period of time, and manifests the genuineness of that intent by establishing an ongoing physical presence within the Community together with an indication that such presence within the Community is something other than merely transitory in nature. To the extent a Person is a corporation or other business entity, the principal place of business or headquarters shall be in the Community. To the extent a Person is a personal benefit plan, the circumstances of the beneficiary shall apply with respect to this definition. In the case of all other benefit plans, the circumstances of the trustee shall be examined for purposes of this definition. The Bank may utilize deposit or loan records or such other evidence provided to it to make a determination as to whether a Person is a resident. In all cases, however, such a determination shall be in the sole discretion of the Bank.

SEC: The Securities and Exchange Commission.

Stock Holding Company: The Maryland capital stock corporation that will own 100% of the Stock Savings Bank’s common stock and will be majority-owned by the Mutual Holding Company.

Stock Issuance Plan: This Stock Issuance Plan.

Special Meeting: The Special Meeting of Members called for the purpose of voting on the Plan of Reorganization.

| A-5 |

Stock Offering: The offering of Common Stock of the Stock Holding Company for sale to persons other than the Mutual Holding Company, in a Subscription Offering and, to the extent shares remain available, in a Community Offering, Syndicated Community Offering and/or Firm Commitment Underwritten Offering, as the case may be.

Stock Savings Bank: The newly organized Wisconsin-chartered stock savings bank established as part of the Reorganization, which will be wholly owned by the Stock Holding Company.

Subscription Offering: The offering of Common Stock of the Stock Holding Company for subscription and purchase pursuant to Section 6 of this Stock Issuance Plan.

Subsidiary: A company that is controlled by another company, either directly or indirectly through one or more subsidiaries.

Supplemental Eligible Account Holder: Any Person holding a Qualifying Deposit on the Supplemental Eligibility Record Date, who is not an Eligible Account Holder, a Tax-Qualified Employee Plan or an Officer or Director of the Bank or their Associates.

Supplemental Eligibility Record Date: The date for determining Supplemental Eligible Account Holders, which shall be the last day preceding adoption of the Plan of Reorganization by the Bank’s Board of Directors.

Syndicated Community Offering: The offering of Common Stock through a syndicate of broker-dealers, which may occur either following or contemporaneously with the Community Offering.

Tax-Qualified Employee Plan: Any defined benefit plan or defined contribution plan (including any employee stock ownership plan, stock bonus plan, profit-sharing plan, or other plan) of the Bank, the Stock Holding Company, the Mutual Holding Company or any of their affiliates, which, with its related trusts, meets the requirements to be qualified under Section 401 of the Internal Revenue Code. The term “Non-Tax-Qualified Employee Plan” means any stock benefit plan which is not so qualified under Section 401 of the Internal Revenue Code.

Voting Record Date: The date established by the Bank for determining which Members are entitled to vote on the Plan of Reorganization.

Voting Stock:

| (1) | Voting Stock means common stock or preferred stock, or similar interests if the shares by statute, charter or in any manner, entitle the holder: |

| (i) | To vote for or to select directors of the Bank or the Stock Holding Company; and |

| (ii) | To vote on or to direct the conduct of the operations or other significant policies of the Bank or the Stock Holding Company. |

| A-6 |

| (2) | Notwithstanding anything in paragraph (1) above, preferred stock is not “Voting Stock” if: |

| (i) | Voting rights associated with the preferred stock are limited solely to the type customarily provided by statute with regard to matters that would significantly and adversely affect the rights or preferences of the preferred stock, such as the issuance of additional amounts or classes of senior securities, the modification of the terms of the preferred stock, the dissolution of the Bank, or the payment of dividends by the Bank when preferred dividends are in arrears; |

| (ii) | The preferred stock represents an essentially passive investment or financing device and does not otherwise provide the holder with Control over the issuer; and |

| (iii) | The preferred stock does not at the time entitle the holder, by statute, charter, or otherwise, to select or to vote for the selection of directors of the Bank or the Stock Holding Company. |

| (3) | Notwithstanding anything in paragraphs (1) and (2) above, “Voting Stock” shall be deemed to include preferred stock and other securities that, upon transfer or otherwise, are convertible into Voting Stock or exercisable to acquire Voting Stock where the holder of the stock, convertible security or right to acquire Voting Stock has the preponderant economic risk in the underlying Voting Stock. Securities immediately convertible into Voting Stock at the option of the holder without payment of additional consideration shall be deemed to constitute the Voting Stock into which they are convertible; other convertible securities and rights to acquire Voting Stock shall not be deemed to vest the holder with the preponderant economic risk in the underlying Voting Stock if the holder has paid less than 50% of the consideration required to directly acquire the Voting Stock and has no other economic interest in the underlying Voting Stock. |

| 3. | Timing of the Sale of Capital Stock |

Subject to the approval of the Bank Regulators, the Stock Holding Company intends to commence the Stock Offering concurrently with the proxy solicitation of Members. The Stock Holding Company may close the Stock Offering before the Special Meeting, provided that the offer and sale of the Common Stock shall be conditioned upon approval of the Plan of Reorganization by the Members at the Special Meeting. Subject to Bank Regulator approval, the Bank’s proxy solicitation materials may permit certain Members to return to the Bank by a reasonable date certain a postage paid card or other written communication requesting receipt of the prospectus if the prospectus is not mailed concurrently with the proxy solicitation materials. The Stock Offering shall be conducted in compliance with the Regulations, including 12 CFR § 239.24 and § 239.25 of the Federal Reserve’s Regulation MM and the securities offering regulations of the SEC.

| A-7 |

| 4. | Number of Shares to be Offered |

The total number of shares (or range thereof) of Common Stock to be issued and offered for sale pursuant to the Stock Issuance Plan shall be determined initially by the Boards of Directors of the Bank and the Stock Holding Company in conjunction with the determination of the Independent Appraiser. The number of shares to be offered may be adjusted prior to completion of the Stock Offering. The total number of shares of Common Stock that may be issued to persons other than the Mutual Holding Company at the close of the Stock Offering must be less than 50% of the issued and outstanding shares of Common Stock of the Stock Holding Company.

| 5. | Independent Valuation and Purchase Price of Shares |

All shares of Common Stock sold in the Stock Offering shall be sold at a uniform price per share. The purchase price and number of shares to be outstanding shall be determined by the Board of Directors of the Stock Holding Company on the basis of the estimated pro forma market value of the Stock Holding Company and the Bank. The aggregate purchase price for the Common Stock will be consistent with the market value of the Stock Holding Company and the Bank. The pro forma market value of the Stock Holding Company and the Bank will be determined for such purposes by the Independent Appraiser.

Prior to the commencement of the Stock Offering, an Estimated Valuation Range will be established, which range may vary within 15% above to 15% below the midpoint of such range, and up to 15% greater than the maximum of such range, as determined by the Board of Directors of the Stock Holding Company at the time of the Stock Offering and consistent with applicable requirements set forth in the Regulations. The Stock Holding Company intends to issue up to 49.9% of its Common Stock in the Stock Offering. The number of shares of Common Stock to be issued and the ownership interest of the Mutual Holding Company may be increased or decreased by the Stock Holding Company, taking into consideration any change in the independent valuation and other factors, at the discretion of the Boards of Directors of the Bank and the Stock Holding Company.

Based upon the independent valuation as updated prior to the commencement of the Stock Offering, the Board of Directors may establish the minimum and maximum percentage of shares of Common Stock that will be offered for sale in the Stock Offering, or it may fix the percentage of shares that will be offered for sale in the Stock Offering. In the event the percentage of the shares offered for sale in the Minority Stock Offering is not fixed in the Stock Offering, the Minority Ownership Interest resulting from the Stock Offering will be determined as follows: (a) the product of (x) the total number of shares of Common Stock sold by the Stock Holding Company and (y) the purchase price per share, divided by (b) the aggregate pro forma market value of the Bank and the Stock Holding Company upon the closing of the Stock Offering and sale of all the Common Stock.

Notwithstanding the foregoing, no sale of Common Stock may be consummated unless, prior to such consummation, the Independent Appraiser confirms to the Stock Holding Company, the Bank and to the Bank Regulators, that, to the best knowledge of the Independent Appraiser, nothing of a material nature has occurred which, taking into account all relevant factors, would cause the Independent Appraiser to conclude that the aggregate value of the Common Stock sold in the Stock Offering at the Actual Purchase Price is incompatible with its estimate of the aggregate consolidated pro forma market value of the Stock Holding Company and the Bank. If such confirmation is not received, the Stock Holding Company may cancel the Stock Offering, extend the Stock Offering and establish a new price range and/or estimated price range, extend, reopen or hold a new Stock Offering or take such other action as the Bank Regulators may permit.

| A-8 |

The estimated market value of the Stock Holding Company and the Bank shall be determined for such purpose by an Independent Appraiser on the basis of such appropriate factors as are not inconsistent with the applicable Regulations. The Common Stock to be issued in the Stock Offering shall be fully paid and nonassessable.

If there is a Community Offering, Syndicated Community Offering or Firm Commitment Underwritten Offering of shares of Common Stock not subscribed for in the Subscription Offering, the price per share at which the Common Stock is sold in such Community Offering, Syndicated Community Offering or Firm Commitment Underwritten Offering shall be the Actual Purchase Price which will be equal to the purchase price per share at which the Common Stock is sold to persons in the Subscription Offering. Shares sold in the Community Offering, Syndicated Community Offering or Firm Commitment Underwritten Offering will be subject to the same limitations as shares sold in the Subscription Offering.

| 6. | Method of Offering Shares and Rights to Purchase Stock |

In descending order of priority, the opportunity to purchase Common Stock shall be given in the Subscription Offering to: (1) Eligible Account Holders; (2) Tax-Qualified Employee Plans; (3) Supplemental Eligible Account Holders; and (4) Other Members, pursuant to priorities established by the Board of Directors. Any shares of Common Stock that are not subscribed for in the Subscription Offering may at the discretion of the Bank and the Stock Holding Company be offered for sale in a Community Offering, a Syndicated Community Offering or a Firm Commitment Underwritten Offering. The minimum purchase by any Person shall be 25 shares. The Stock Holding Company shall determine in its sole discretion whether each prospective purchaser is a Resident, Associate, or Acting in Concert as defined in the Stock Issuance Plan, and shall interpret all other provisions of the Plan of Reorganization and Stock Issuance Plan in its sole discretion. All such determinations are in the sole discretion of the Stock Holding Company, and may be based on whatever evidence the Stock Holding Company chooses to use in making any such determination.

In addition to the priorities set forth below, the Board of Directors of the Bank may establish other priorities for the purchase of Common Stock, subject to the approval of the Bank Regulators. The priorities for the purchase of shares in the Stock Offering are as follows:

| A. | Subscription Offering |

Priority 1: Eligible Account Holders. Each Eligible Account Holder shall receive non-transferable subscription rights to subscribe for shares of Common Stock offered in the Stock Offering in an amount equal to the greater of $100,000, one-tenth of one percent (0.1%) of the total shares offered in the Stock Offering, or 15 times the product (rounded down to the nearest whole number) obtained by multiplying the total number of shares of Common Stock to be issued in the Stock Offering by a fraction, of which the numerator is the Qualifying Deposit of the Eligible Account Holder and the denominator is the total amount of Qualifying Deposits of all Eligible Account Holders, in each case on the Eligibility Record Date and subject to the provisions of Section 7; provided that the Bank may, in its sole discretion and without further notice to or solicitation of subscribers or other prospective purchasers, increase such maximum purchase limitation to 5% of the maximum number of shares offered in the Stock Offering or decrease such maximum purchase limitation to 0.1% of the maximum number of shares offered in the Stock Offering, subject to the overall purchase limitations set forth in Section 7. If there are insufficient shares available to satisfy all subscriptions of Eligible Account Holders, shares will be allocated to Eligible Account Holders so as to permit each such subscribing Eligible Account Holder to purchase a number of shares sufficient to make his total allocation equal to the lesser of 100 shares or the number of shares subscribed for. Thereafter, unallocated shares will be allocated pro rata to remaining subscribing Eligible Account Holders whose subscriptions remain unfilled in the same proportion that each such subscriber’s Qualifying Deposit bears to the total amount of Qualifying Deposits of all subscribing Eligible Account Holders whose subscriptions remain unfilled. To ensure proper allocation of stock, each Eligible Account Holder must list on his subscription Order Form all accounts in which he had an ownership interest as of the Eligibility Record Date. Officers, directors, and their Associates may be Eligible Account Holders. However, if an officer, director, or his or her Associate receives subscription rights based on increased deposits in the year before the Eligibility Record Date, subscription rights based upon these increased deposits are subordinate to the subscription rights of other Eligible Account Holders.

| A-9 |

Priority 2: Tax-Qualified Employee Plans. The Tax-Qualified Employee Plans shall be given the opportunity to purchase in the aggregate up to 4.9% of the shares issued and outstanding following the completion of the Stock Offering. In the event of an oversubscription in the Stock Offering, subscriptions for shares by the Tax-Qualified Employee Plans may be satisfied, in whole or in part, out of authorized but unissued shares of the Stock Holding Company subject to the maximum purchase limitations applicable to such plans as set forth herein, or may be satisfied, in whole or in part, through open market purchases by the Tax-Qualified Employee Plans subsequent to the closing of the Stock Offering.

Priority 3: Supplemental Eligible Account Holders. To the extent there are sufficient shares remaining after satisfaction of subscriptions by Eligible Account Holders, and the Tax-Qualified Employee Plans, each Supplemental Eligible Account Holder shall receive non-transferable subscription rights to subscribe for shares of Common Stock offered in the Stock Offering in an amount equal to the greater of $100,000, one-tenth of one percent (0.1%) of the total shares offered in the Stock Offering, or 15 times the product (rounded down to the nearest whole number) obtained by multiplying the total number of shares of Common Stock to be issued in the Stock Offering by a fraction, of which the numerator is the Qualifying Deposit of the Supplemental Eligible Account Holder and the denominator is the total amount of Qualifying Deposits of all Supplemental Eligible Account Holders, in each case on the Supplemental Eligibility Record Date and subject to the provisions of Section 7; provided that the Bank may, in its sole discretion and without further notice to or solicitation of subscribers or other prospective purchasers, increase such maximum purchase limitation to 5% of the maximum number of shares offered in the Stock Offering or decrease such maximum purchase limitation to 0.1% of the maximum number of shares offered in the Stock Offering, subject to the overall purchase limitations set forth in Section 7. In the event Supplemental Eligible Account Holders subscribe for a number of shares which, when added to the shares subscribed for by Eligible Account Holders and the Tax-Qualified Employee Plans, is in excess of the total shares offered in the Stock Offering, the subscriptions of Supplemental Eligible Account Holders will be allocated among subscribing Supplemental Eligible Account Holders so as to permit each subscribing Supplemental Eligible Account Holder to purchase a number of shares sufficient to make his total allocation equal to the lesser of 100 shares or the number of shares subscribed for. Thereafter, unallocated shares will be allocated to each subscribing Supplemental Eligible Account Holder whose subscription remains unfilled in the same proportion that such subscriber’s Qualifying Deposits on the Supplemental Eligibility Record Date bear to the total amount of Qualifying Deposits of all subscribing Supplemental Eligible Account Holders whose subscriptions remain unfilled. Directors, Officers and their associates do not qualify as Supplemental Eligible Account Holders.

| A-10 |

Priority 4: Other Members. To the extent that there are sufficient shares remaining after satisfaction of subscriptions by Eligible Account Holders, the Tax-Qualified Employee Plans and Supplemental Eligible Account Holders, each Other Member shall receive non-transferable subscription rights to subscribe for shares of Common Stock offered in the Stock Offering in an amount equal to $100,000, provided that the Bank may, in its sole discretion and without further notice to or solicitation of subscribers or other prospective purchasers, increase such maximum purchase limitation to 5% of the maximum number of shares offered in the Stock Offering, or decrease such maximum purchase limitation to 0.1% of the maximum number of shares offered in the Stock Offering, subject to the overall purchase limitations set forth in Section 7. In the event Other Members subscribe for a number of shares which, when added to the shares subscribed for by the Eligible Account Holders, Tax-Qualified Employee Plans and Supplemental Eligible Account Holders, is in excess of the total number of shares offered in the Stock Offering, the subscriptions of such Other Members will be allocated among subscribing Other Members on a pro rata basis based on the size of such Other Members’ orders.

| B. | Community Offering |