Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Apptio Inc | d672452d8k.htm |

Exhibit 99.1

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF DELAWARE

| STEPHEN BUSHANSKY, Individually and on | Case No. | |||

| Behalf of All Others Similarly Situated, | ||||

| CLASS ACTION | ||||

| Plaintiff, | ||||

| COMPLAINT FOR | ||||

| v. | VIOLATIONS OF THE | |||

| FEDERAL SECURITIES | ||||

| APPTIO, INC. SUNNY GUPTA, THOMAS | LAWS | |||

| BOGAN, PETER KLEIN, JOHN MCADAM, | ||||

| MATTHEW MCILWAIN, REBECCA | JURY TRIAL DEMAND | |||

| JACOBY, RAJEEV SINGH, and KATHLEEN | ||||

| PHILIPS, | ||||

| Defendants. | ||||

Plaintiff Stephen Bushansky (“Plaintiff”), by and through his undersigned counsel, for his complaint against defendants, alleges upon personal knowledge with respect to himself, and upon information and belief based upon, inter alia, the investigation of counsel as to all other allegations herein, as follows:

NATURE AND SUMMARY OF THE ACTION

1. This is a stockholder class action brought by Plaintiff on behalf of himself and all other public stockholders of Apptio, Inc. (“Apptio” or the “Company”) against Apptio and the members of Apptio’s Board of Directors (the “Board” or the “Individual Defendants”) for their violations of Sections 14(a) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), 15 U.S.C. §§ 78n(a) and U.S. Securities and Exchange Commission (“SEC”) Rule 14a-9, 17 C.F.R. § 240.14a-9, and to enjoin the vote on a proposed transaction, pursuant to which Apptio will be acquired by Vista Equity Partners Management, LLC (“Vista”) through Vista’s affiliates Bellevue Parent, LLC (“Parent”) and Bellevue Merger Sub, Inc. (“Merger Sub”) (the “Proposed Transaction”).

2. On November 11, 2018, Apptio issued a press release announcing it had entered into an Agreement and Plan of Merger dated November 9, 2018 to sell Apptio to Vista. Under the terms of the Merger Agreement, each Apptio stockholder will receive $38.00 in cash for each share of Apptio common stock they own (the “Merger Consideration”). The Proposed Transaction is valued at approximately $1.94 billion.

3. On December 10, 2018, Apptio filed a Definitive Proxy Statement on Schedule 14A (the “Proxy Statement”) with the SEC. The Proxy Statement, which recommends that Apptio stockholders vote in favor of the Proposed Transaction, omits or misrepresents material information concerning, among other things: (i) Company insiders’ potential conflicts of interest; (ii) the data and inputs underlying the financial valuation analyses that support the fairness opinion provided by Qatalyst Partners LP (“Qatalyst”); and (iii) the background process leading to the Proposed Transaction. The failure to adequately disclose such material information constitutes a violation of Sections 14(a) and 20(a) of the Exchange Act as Apptio stockholders need such information in order to make a fully informed decision whether to vote in favor of the Proposed Transaction or seek appraisal.

4. In short, unless remedied, Apptio’s public stockholders will be forced to make a voting or appraisal decision on the Proposed Transaction without full disclosure of all material information concerning the Proposed Transaction being provided to them. Plaintiff seeks to enjoin the stockholder vote on the Proposed Transaction unless and until such Exchange Act violations are cured.

- 2 -

JURISDICTION AND VENUE

5. This Court has jurisdiction over the claims asserted herein for violations of Sections 14(a) and 20(a) of the Exchange Act and SEC Rule 14a-9 promulgated thereunder pursuant to Section 27 of the Exchange Act, 15 U.S.C. § 78aa, and 28 U.S.C. § 1331 (federal question jurisdiction).

6. This Court has jurisdiction over the defendants because each defendant is either a corporation that conducts business in and maintains operations within this District, or is an individual with sufficient minimum contacts with this District so as to make the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice.

7. Venue is proper under 28 U.S.C. § 1391(b) because a substantial portion of the transactions and wrongs complained of herein occurred in this District.

THE PARTIES

8. Plaintiff is, and has been at all times relevant hereto, a continuous stockholder of Apptio.

9. Defendant Apptio is a Delaware corporation, with its principal executive offices located at 11100 NE 8th Street, Suite 600, Bellevue, Washington 98004. The Company provides cloud-based technology business management solutions to enterprises. Apptio’s common stock trades on the NASDAQ Global Market under the ticker symbol “APTI.” 10. Defendant Sunny Gupta (“Gupta”), Apptio’s Co-Founder, has been Chief Executive Officer (“CEO”), President and a director of the Company since October 2007.

11. Defendant Thomas Bogan (“Bogan”) has been a director of the Company since November 2007 and Chairman of the Board since February 2012.

12. Defendant Peter Klein (“Klein”) has been a director of the Company since November 2013.

- 3 -

13. Defendant John McAdam (“McAdam”) has been a director of the Company since February 2013.

14. Defendant Matthew McIlwain (“McIlwain”) has been a director of the Company since November 2007.

15. Defendant Rebecca Jacoby (“Jacoby”) has been a director of the Company since July 2018.

16. Defendant Rajeev Singh (“Singh”) has been a director of the Company since October 2010.

17. Defendant Kathleen Philips (“Philips”) has been a director of the Company since May 2017.

18. Defendants identified in paragraphs 10-17 are referred to herein as the “Board” or the “Individual Defendants.”

OTHER RELEVANT ENTITIES

19. Vista is a U.S.-based investment firm focused on software, data and technology-enabled businesses. Vista has offices in Austin, San Francisco, Chicago, and Oakland and over $43 billion in cumulative capital commitments.

20. Parent is a Delaware limited liability company and an affiliate of Vista.

21. Merger Sub is a Delaware corporation, a wholly owned subsidiary of Parent, and an affiliate of Vista.

CLASS ACTION ALLEGATIONS

22. Plaintiff brings this action as a class action pursuant to Rule 23 of the Federal Rules of Civil Procedure on behalf of all persons and entities that own Apptio common stock (the “Class”). Excluded from the Class are defendants and their affiliates, immediate families, legal representatives, heirs, successors or assigns and any entity in which defendants have or had a controlling interest.

- 4 -

23. Plaintiff’s claims are properly maintainable as a class action under Rule 23 of the Federal Rules of Civil Procedure.

24. The Class is so numerous that joinder of all members is impracticable. While the exact number of Class members is unknown to Plaintiff at this time and can only be ascertained through discovery, Plaintiff believes that there are thousands of members in the Class. As of December 6, 2018, there were 45,566,879 shares of Company common stock issued and outstanding. All members of the Class may be identified from records maintained by Apptio or its transfer agent and may be notified of the pendency of this action by mail, using forms of notice similar to those customarily used in securities class actions.

25. Questions of law and fact are common to the Class and predominate over questions affecting any individual Class member, including, inter alia:

a) Whether defendants have violated Section 14(a) of the Exchange Act and Rule 14a-9 promulgated thereunder;

b) Whether the Individual Defendants have violated Section 20(a) of the Exchange Act; and

c) Whether Plaintiff and the other members of the Class would suffer irreparable injury were the Proposed Transaction consummated.

26. Plaintiff will fairly and adequately protect the interests of the Class, and has no interests contrary to or in conflict with those of the Class that Plaintiff seeks to represent. Plaintiff has retained competent counsel experienced in litigation of this nature.

- 5 -

27. A class action is superior to all other available methods for the fair and efficient adjudication of this controversy. Plaintiff knows of no difficulty to be encountered in the management of this action that would preclude its maintenance as a class action.

28. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole.

SUBSTANTIVE ALLEGATIONS

Background of the Company

29. Founded in 2007, Apptio is the business management system of record for hybrid information technology (“IT”), a technique in which an enterprise uses a combination of on-premises and cloud-based services. Apptio’s cloud-based platform and Software as a Service (“SaaS”) applications allow IT leaders to manage, plan and optimize their technology spending across on-premises and the cloud.

30. Apptio’s technology business management solutions consist of a cloud-based platform and a suite of SaaS applications: Cost Transparency, IT Benchmarking, Business Insights, Bill of IT and IT Planning. The Company has customers across various industries, including financial services, professional services, technology, energy, consumer goods, manufacturing, healthcare, media, retail, transportation, and federal and state government agencies. It offers its solutions on a subscription basis, with subscription fees based on spend managed by its applications and the number of applications or capabilities for which the customer has subscribed.

31. Following its September 2016 initial public offering (“IPO”), the Company has consistently generated positive results, with year-over-year revenue increases of 17% and 24% in 2017 and 2016, respectively.

- 6 -

32. This exceptional growth and positive results have continued. For example, on April 30, 2018, the Company announced its first quarter 2018 financial results, including total revenue of $54.1 million, a 23% increase from the first quarter of 2017, beating analysts’ estimates by $2.42 million. In the press release, defendant Gupta was quoted as stating:

Our first quarter subscription revenue growth accelerated to 26%, year over year, and we reached break-even Non-GAAP operating income . . . . The quarter was driven by large strategic deals, continued momentum in the enterprise segment, solid renewals and upsells, and a strong contribution from the Digital Fuel business.

33. On August 1, 2018, the Company announced its second quarter 2018 financial results. For the quarter, total revenue was $59 million, a 31% increase from the second quarter of 2017, beating analysts’ expectations by $3.38 million. Defendant Gupta commented on the successful quarter, stating:

Our second quarter subscription revenue growth accelerated to 32% year over year and we generated positive non-GAAP operating income . . . . The quarter was driven by momentum with our IT Financial Management Foundation application, solid renewals and upsells, and strength in the public sector. The growth of cloud spending, the complexity of hybrid IT, and the shift toward digital and agile are all serving as market tailwinds for Apptio.

34. On October 3, 2018, Apptio announced it had completed its acquisition of FittedCloud, Inc., a provider of machine learning-based cloud optimization software. In the press release, defendant Gupta touted the acquisition, stating:

Apptio is known for its unique ability to provide visibility, optimization, benchmarking and planning capabilities for corporate technology spending across multicloud and on-premises environments . . . . FittedCloud’s anomaly detection and adaptive learning algorithms analyze millions of lines of utilization data from public cloud services to predict and optimize utilization in real-time. This differentiated technology combined with Apptio’s existing multicloud and hybrid business management applications will provide increased value to our customers and make it easier for them to manage the complex world of hybrid IT.

- 7 -

35. The positive news continued for Apptio stockholders. On October 29, 2018, the Company announced its third quarter 2018 financial results. The Company reported total revenue of $59 million, a 26% increase from the third quarter of 2017, beating analysts’ expectations by $1.11 million. In the press release, defendant Gupta was quoted as stating:

Our third quarter highlights include 26% year over year revenue growth and expanding non-GAAP operating income to $4 million . . . . We had strong contributions from our strategic segment and continued progress with our upsells, further validating our land and expand strategy. The move toward a digital enterprise, enabled by cloud, is fueling the need for CIOs to adopt Apptio. We are excited about our recent acquisition of FittedCloud, which will add capabilities to our offering in the rapidly expanding Hybrid and Multi-cloud market.

The Sale Process

36. On September 14, 2018, defendant Gupta discussed with representatives of Qatalyst the possibility of having Qatalyst assist the Company with a strategic process to identify third parties that might be interested in exploring a possible acquisition.

37. During the week of September 17, 2018, defendant Gupta held individual discussions with members of the Board regarding management’s plan to pursue strategic alternatives, including a potential sale, and have Qatalyst assist in identifying third parties who might be interested in an acquisition of the Company. The Board directed defendant Gupta and Apptio management to pursue strategic alternatives with the assistance of Qatalyst.

38. Beginning on October 3, 2018, Qatalyst contacted twelve strategic parties and/or financial sponsors. Six parties executed non-disclosure agreements with Apptio (Vista and parties referred to in the Proxy Statement as Parties A, C, D, E and F). Four of the non-disclosure agreements (with Vista and Parties A, C and F) contained standstill provisions preventing the parties from making public acquisition proposals for a period of one year after their respective execution of the non-disclosure agreements, with the standstill provisions

- 8 -

terminating in certain proscribed circumstances. The Proxy Statement fails to disclose whether the non-disclosure agreement the Company entered into with Parties D and E are still in effect and/or contain “don’t ask, don’t waive” standstill provisions that are presently precluding these parties from making a topping bid for the Company. The Proxy Statement further fails to disclose the circumstances under which the standstill provisions in the non-disclosure agreements the Company entered into with Vista and Parties A, C and F will terminate.

39. Over the next several weeks, the parties conducted due diligence.

40. Between October 26 and 28, 2018, Qatalyst notified Vista, Party A and Party F that formal proposals were due by November 9, 2018.

41. On November 2, 2018, Vista submitted a non-binding indication of interest to acquire Apptio for $34.00 per share. Vista’s proposal expired at 9:00 a.m. pacific time on November 5, 2018.

42. Between November 2 and 3, 2018, Qatalyst notified Party A, E and F that the timeline to submit a proposal had accelerated as Apptio had received an indication of interest from a third party.

43. On November 3, 2018, Party A informed Qatalyst it remained interested in acquiring Apptio jointly with Parties B and C, that their collective proposal would be in the “low $30s,” and that the parties required an additional 1-2 weeks to finalize their due diligence.

44. Also on November 3, 2018, Party F informed Qatalyst it remained interested in acquiring Apptio, that its proposal would be for a per share price of $30, and that it required one or two weeks of additional due diligence.

45. Between November 4 and 5, 2018, at the request of the Board, Qatalyst informed Vista that the Board was not prepared to accepts its $34 per share proposal.

- 9 -

46. At a November 6, 2018 Board meeting, the Board indicated to Apptio management that is should target a proposal valuing Apptio at $40 per share.

47. That same day, Vista indicated to Qatalyst that its final offer to acquire Apptio was $38 per share, conditioned on, among other things, a go-shop period of 30 days.

48. The Board met later that day and, following discussion, informed Apptio management that the Board supported Vista’s offer at $38 per share.

49. Over the next several days, the parties finalized the remaining open issues in the Merger Agreement.

50. On November 9, 2018, Qatalyst rendered its fairness opinion and the Board approved the Merger Agreement. Later that evening, Apptio and Vista executed the Merger Agreement.

51. Qatalyst commenced the go-shop period on November 12, 2018 and it expired on December 9, 2018. During the go-shop period, two parties entered into confidentiality agreements with Apptio. The Proxy Statement fails to disclose the terms of these confidentiality agreements, including whether they contain standstill provision that are still in effect and operate to preclude either of these potential bidders from submitting a topping bid for the Company.

The Proposed Transaction

52. On November 11, 2018, Apptio issued a press release announcing the Proposed Transaction, which states, in relevant part:

BELLEVUE WA., November 11, 2018 — Apptio, Inc. (NASDAQ: APTI), the business management system of record for hybrid IT, today announced that it has entered into a definitive agreement to be acquired by an affiliate of Vista Equity Partners (“Vista”), a leading investment firm focused on software, data and technology-enabled businesses.

- 10 -

Under the terms of the agreement, Vista will acquire all outstanding shares of Apptio common stock for a total value of approximately $1.94 billion. Apptio shareholders will receive $38.00 in cash per share, representing a 53% premium to the unaffected closing price as of November 9, 2018.

“Since founding, our focus has been on building the next great cloud software platform by dedicating ourselves to helping companies of all sizes and industries manage, plan, and optimize technology investments across their hybrid IT environments,” said Sunny Gupta, Co-Founder and CEO of Apptio. “As we look to the next chapter of Apptio, we are thrilled to provide immediate liquidity to our shareholders at a significant premium to market prices and we remain deeply committed to our mission, product innovation, geographical expansion, and the work of the TBM Council. Vista’s investment and deep expertise in growing world-class SaaS businesses and the flexibility we will have as a private company will help us accelerate our growth while helping us maintain our commitment to creating wildly successful customers.”

“Today, with companies across sectors increasingly depending on technology to stay competitive, IT is becoming a critical component for every business on the planet, and Apptio has created the leading platform to help customers manage this new paradigm,” said Brian Sheth, co-founder and president of Vista. “We’re thrilled to partner with Sunny and the entire Apptio team on the next chapter in the company’s growth.”

Apptio’s Board of Directors unanimously approved the deal and recommended that stockholders vote their shares in favor of the transaction. Apptio’s headquarters will remain in Bellevue, with regional offices across the US, EMEA and APAC. Closing of the deal is subject to customary closing conditions, including the approval of Apptio shareholders and antitrust approval in the United States. The transaction is expected to close in Q1 2019 and is not subject to a financing condition.

The merger agreement includes a 30 day “go-shop” period, which permits Apptio’s Board and advisors to actively initiate, solicit, encourage, and potentially enter negotiations with parties that make alternative acquisition proposals. Apptio will have the right to terminate the merger agreement to enter into a superior proposal subject to the terms and conditions of the merger agreement. There can be no assurance that this 30 day “go-shop” will result in a superior proposal, and Apptio does not intend to disclose developments with respect to the solicitation process unless and until the Board makes a determination requiring further disclosure.

Insiders’ Interests in the Proposed Transaction

53. Apptio and Vista insiders are the primary beneficiaries of the Proposed Transaction, not the Company’s public stockholders. The Board and the Company’s executive officers are conflicted because they will have secured unique benefits for themselves from the Proposed Transaction not available to Plaintiff and the public stockholders of Apptio.

- 11 -

54. Notably, certain of the Company’s executive officers have potentially secured positions for themselves upon consummation of the Proposed Transaction. According to a November 11, 2018 Reuters article titled, “Apptio to go private in $1.94 billion with Vista Equity Partners,” “[Gupta] will remain Apptio’s CEO post the deal.”

55. Moreover, Apptio’s directors and executive officers stand to reap substantial financial benefits for securing the deal with Vista. The following table sets forth the value of each of the Company’s executive officers and non-employee directors’ shares and equity awards that are outstanding as of November 15, 2018:

Equity Interests of Apptio’s Executive Officers and Non-employee Directors

| Name |

Shares (#)(1) |

Shares ($) |

Company Options (#)(2) |

Company Options ($)(2) |

Company RSUs (#)(3) |

Company RSUs ($) |

Company PSUs (#)(4) |

Company PSUs ($) |

Total ($) |

|||||||||||||||||||||||||||

| Sachin Gupta |

4,271,810 | 162,328,780 | 1,086,400 | 31,634,204 | 127,000 | 4,826,000 | 31,000 | 1,178,000 | 199,966,984 | |||||||||||||||||||||||||||

| Kurt Shintaffer |

609,276 | 23,152,488 | 267,600 | 6,443,546 | 68,375 | 2,598,250 | 13,000 | 494,000 | 32,688,284 | |||||||||||||||||||||||||||

| Lawrence Blasko |

947 | 35,986 | 223,714 | 5,719,789 | 71,125 | 2,702,750 | 11,500 | 437,000 | 8,895,525 | |||||||||||||||||||||||||||

| John Morrow |

1,186 | 45,068 | 63,251 | 1,511,463 | 42,094 | 1,599,572 | 7,500 | 285,000 | 3,441,103 | |||||||||||||||||||||||||||

| Christopher Pick |

2,138 | 81,244 | 237,834 | 5,908,956 | 58,750 | 2,232,500 | 11,500 | 437,000 | 8,659,700 | |||||||||||||||||||||||||||

| Matthew McIlwain |

81,448 | 3,095,024 | 30,000 | 710,700 | 4,652 | 176,776 | — | — | 3,982,500 | |||||||||||||||||||||||||||

| Peter Klein |

8,685 | 330,030 | 86,127 | 2,337,822 | 4,652 | 176,776 | — | — | 2,844,628 | |||||||||||||||||||||||||||

| John McAdam |

8,685 | 330,030 | 98,127 | 2,888,720 | 4,652 | 176,776 | — | — | 3,395,526 | |||||||||||||||||||||||||||

| Rebecca Jacoby (5) |

0 | — | 20,000 | 742,800 | 8,221 | 312,398 | — | — | 1,055,198 | |||||||||||||||||||||||||||

| Thomas Bogan |

254,303 | 9,663,514 | 30,000 | 710,700 | 4,652 | 176,776 | — | — | 10,550,990 | |||||||||||||||||||||||||||

| Rajeev Singh |

8,685 | 330,030 | 30,000 | 710,700 | 4,652 | 176,776 | — | — | 1,217,506 | |||||||||||||||||||||||||||

| Kathleen Philips |

7,566 | 287,508 | — | — | 15,245 | 579,310 | — | — | 866,818 | |||||||||||||||||||||||||||

| Ravi Mohan (6) |

19,238 | 731,044 | — | — | — | — | — | — | 731,044 | |||||||||||||||||||||||||||

The Proxy Statement Contains Material Misstatements and Omissions

56. The defendants filed a materially incomplete and misleading Proxy Statement with the SEC and disseminated it to Apptio’s stockholders. The Proxy Statement misrepresents or omits material information that is necessary for the Company’s stockholders to make an informed decision whether to vote their shares in favor of the Proposed Transaction or seek appraisal.

- 12 -

57. Specifically, as set forth below, the Proxy Statement fails to provide Company stockholders with material information or provides them with materially misleading information concerning: (i) Company insiders’ potential conflicts of interest; (ii) the data and inputs underlying the financial valuation analyses that support the fairness opinion provided by Qatalyst; and (iii) the background process leading to the Proposed Transaction. Accordingly, Apptio stockholders are being asked to make a voting or appraisal decision in connection with the Proposed Transaction without all material information at their disposal.

Material Omissions Concerning Company Insiders’ Potential Conflicts of Interest

58. The Proxy Statement fails to disclose material information concerning potential conflicts of interest faced by Apptio insiders.

59. For example, the Proxy Statement sets forth:

As of the date of this proxy statement, none of our executive officers has entered into any agreement with Parent or any of its affiliates regarding employment with, or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates. Except as approved by the Board of Directors, from the date of the Merger Agreement, to the earlier of the termination of the Merger Agreement or the Effective Time, Parent and Merger Sub covenant not to, and covenant to not permit any of their subsidiaries or respective affiliates to, authorize, make or enter into, any arrangements or understandings (formal or informal, binding or otherwise) with any executive officer of Apptio (1) regarding any continuing employment or consulting relationship with the Surviving Corporation. . . . Prior to and following the closing of the Merger, however, certain of our executive officers may have discussions, and following the closing of the Merger, may enter into agreements with, Parent or Merger Sub, their subsidiaries or their respective affiliates regarding employment with, or the right to purchase or participate in the equity of, the Surviving Corporation or one or more of its affiliates.

Proxy Statement at 44-45. Yet, according to a November 11, 2018 Reuters article titled, “Apptio to go private in $1.94 billion with Vista Equity Partners,” “[Gupta] will remain Apptio’s CEO post the deal.” The Proxy Statement must clarify whether defendant Gupta will remain with the combined company upon consummation of the Proposed Transaction. The Proxy Statement

- 13 -

must also disclose the details of all employment and retention-related discussions and negotiations that occurred between Vista and Apptio executive officers prior to the date of the Merger Agreement, including who participated in all such communications, when they occurred and their content, as well as whether any of Vista’s prior proposals or indications of interest mentioned management retention in the combined company.

60. Communications regarding post-transaction employment during the negotiation of the underlying transaction must be disclosed to stockholders. This information is necessary for stockholders to understand potential conflicts of interest of management and the Board, as that information provides illumination concerning motivations that would prevent fiduciaries from acting solely in the best interests of the Company’s stockholders.

61. The omission of this information renders the statements in the “Interests of Apptio’s Directors and Executive Officers in the Merger” and “Background of the Merger” sections of the Proxy Statement false and/or materially misleading in contravention of the Exchange Act.

Material Omissions Concerning Qatalyst’s Financial Analyses

62. The Proxy Statement describes Qatalyst’s fairness opinion and the various valuation analyses performed in support of its opinion. However, the description of Qatalyst’s fairness opinion and analyses fails to include key inputs and assumptions underlying these analyses. Without this information, as described below, Apptio’s public stockholders are unable to fully understand these analyses and, thus, are unable to determine what weight, if any, to place on Qatalyst’s fairness opinion in determining whether to vote in favor of the Proposed Transaction or seek appraisal. This omitted information, if disclosed, would significantly alter the total mix of information available to Apptio’s stockholders.

- 14 -

63. With respect to Qatalyst’s Discounted Cash Flow Analysis, the Proxy Statement fails to disclose: (i) Apptio’s forecasted tax attributes outstanding as of December 31, 2022 based on the Management Projections; (ii) the statutory tax rate applicable to Apptio, as provided by Apptio management; (iii) quantification of the inputs and assumptions underlying the discount rate range of 10% to 13%; and (iv) the basis for applying a range of multiples of enterprise value to next-twelve-months estimated unlevered free cash flow of 20.0x to 30.0x in the analysis.

64. When a banker’s endorsement of the fairness of a transaction is touted to stockholders, the valuation methods used to arrive at that opinion as well as the key inputs and range of ultimate values generated by those analyses must also be fairly disclosed.

65. The omission of this information renders the statements in the “Fairness Opinion of Qatalyst Partners” section of the Proxy Statement false and/or materially misleading in contravention of the Exchange Act.

Material Omissions Concerning the Background Process of the Proposed Transaction

66. The Proxy Statement omits material information relating to the sale process leading up to the Proposed Transaction.

67. In connection with the sale process, the Proxy Statement sets forth:

[S]ix parties executed non-disclosure agreements with Apptio . . . . (Vista, and Parties A, C, D, E and F[)] . . . . Of the six non-disclosure agreements, four (each of Vista and Parties A, C and F) contained standstill provisions preventing Vista and Parties A, C and F from making public acquisition proposals for a period of one year after their respective execution of such non-disclosure agreements, which standstill restrictions would terminate and be of no further force and effect in certain proscribed circumstances.

- 15 -

Proxy Statement at 26. The Proxy Statement further sets forth that “[d]uring the go-shop period, which expired at 12:00pm Pacific time on December 9, 2018, representatives of Qatalyst Partners contacted 17 strategic parties and 21 financial sponsors in connection with the go-shop period; two of these parties entered into confidentiality agreements with Apptio.” Id. at 32. The Proxy Statement fails, however, to expressly indicate the terms of the remaining two non-disclosure agreements Apptio executed with Parties D and E, and with two parties during the go-shop period, including whether they contain standstill provisions that are still in effect and/or contain “don’t ask, don’t waive” standstill provisions that are presently precluding these parties from making a topping bid for the Company. The Proxy Statement further fails to disclose the circumstances under which the standstill provisions in the non-disclosure agreements the Company entered into with Vista and Parties A, C and F will terminate.

68. The disclosure of the existence and terms of any confidentiality agreements Apptio entered into with parties during the sale process is crucial to Apptio stockholders being fully informed of whether their fiduciaries have put in place restrictive devices to foreclose a topping bid for the Company.

69. The omission of this information renders the statements in the “Background of the Merger” section of the Proxy Statement false and/or materially misleading in contravention of the Exchange Act.

70. The Individual Defendants were aware of their duty to disclose this information and acted negligently (if not deliberately) in failing to include this information in the Proxy Statement. Absent disclosure of the foregoing material information prior to the stockholder vote on the Proposed Transaction, Plaintiff and the other members of the Class will be unable to make a fully-informed voting or appraisal decision in connection with the Proposed Transaction and are thus threatened with irreparable harm warranting the injunctive relief sought herein.

- 16 -

CLAIMS FOR RELIEF

COUNT I

Against All Defendants for Violations of Section 14(a) of the

Exchange Act and Rule 14a-9 Promulgated Thereunder

71. Plaintiff repeats all previous allegations as if set forth in full.

72. During the relevant period, defendants disseminated the false and misleading Proxy Statement specified above, which failed to disclose material facts necessary to make the statements, in light of the circumstances under which they were made, not misleading in violation of Section 14(a) of the Exchange Act and SEC Rule 14a-9 promulgated thereunder.

73. By virtue of their positions within the Company, the defendants were aware of this information and of their duty to disclose this information in the Proxy Statement. The Proxy Statement was prepared, reviewed, and/or disseminated by the defendants. It misrepresented and/or omitted material facts, including material information about potential conflicts of interest faced by Company insiders, the financial analyses performed by the Company’s financial advisor, and the background process leading to the Proposed Transaction. The defendants were at least negligent in filing the Proxy Statement with these materially false and misleading statements.

74. The omissions and false and misleading statements in the Proxy Statement are material in that a reasonable stockholder would consider them important in deciding how to vote on the Proposed Transaction or whether to seek to exercise their appraisal rights.

75. By reason of the foregoing, the defendants have violated Section 14(a) of the Exchange Act and SEC Rule 14a-9(a) promulgated thereunder.

- 17 -

76. Because of the false and misleading statements in the Proxy Statement, Plaintiff and the Class are threatened with irreparable harm, rendering money damages inadequate. Therefore, injunctive relief is appropriate to ensure defendants’ misconduct is corrected.

COUNT II

Against the Individual Defendants for Violations of Section 20(a) of the Exchange Act

77. Plaintiff repeats all previous allegations as if set forth in full.

78. The Individual Defendants acted as controlling persons of Apptio within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their positions as officers and/or directors of Apptio, and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the false statements contained in the Proxy Statement filed with the SEC, they had the power to influence and control and did influence and control, directly or indirectly, the decision-making of the Company, including the content and dissemination of the various statements which Plaintiff contends are false and misleading.

79. Each of the Individual Defendants was provided with or had unlimited access to copies of the Proxy Statement and other statements alleged by Plaintiff to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause the statements to be corrected.

80. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control or influence the particular transactions giving rise to the securities violations as alleged herein, and exercised the same. The Proxy Statement at issue contains the unanimous recommendation of each of the Individual Defendants to approve the Proposed Transaction. They were, thus, directly involved in the making of the Proxy Statement.

- 18 -

81. In addition, as the Proxy Statement sets forth at length, and as described herein, the Individual Defendants were each involved in negotiating, reviewing, and approving the Proposed Transaction. The Proxy Statement purports to describe the various issues and information that they reviewed and considered—descriptions the Company directors had input into.

82. By virtue of the foregoing, the Individual Defendants have violated Section 20(a) of the Exchange Act.

83. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(a) and SEC Rule 14a-9, promulgated thereunder, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of defendants’ conduct, Apptio’s stockholders will be irreparably harmed.

PRAYER FOR RELIEF

WHEREFORE, Plaintiff demands judgment and preliminary and permanent relief, including injunctive relief, in his favor on behalf of Apptio, and against defendants, as follows:

| A. | Ordering that this action may be maintained as a class action and certifying Plaintiff as the Class representative and Plaintiff’s counsel as Class counsel; |

| B. | Preliminarily and permanently enjoining defendants and all persons acting in concert with them from proceeding with, consummating, or closing the Proposed Transaction and any vote on the Proposed Transaction, unless and until defendants disclose and disseminate the material information identified above to Apptio stockholders; |

- 19 -

| C. | In the event defendants consummate the Proposed Transaction, rescinding it and setting it aside or awarding rescissory damages to Plaintiff and the Class; |

| D. | Declaring that defendants violated Sections 14(a) and/or 20(a) of the Exchange Act, as well as SEC Rule 14a-9 promulgated thereunder; |

| E. | Awarding Plaintiff the costs of this action, including reasonable allowance for Plaintiff’s attorneys’ and experts’ fees; and |

| F. | Granting such other and further relief as this Court may deem just and proper. |

JURY DEMAND

Plaintiff demands a trial by jury.

| Dated: December 11, 2018 | O’KELLY ERNST & JOYCE, LLC | |||||

| By | /s/ Ryan M. Ernst | |||||

| Ryan M. Ernst (#4788) | ||||||

| 901 N. Market St., Suite 1000 | ||||||

| Wilmington, DE 19801 | ||||||

| Tel.: (302) 778-4000 | ||||||

| Email: rernst@oelegal.com | ||||||

OF COUNSEL:

WEISSLAW LLP

Richard A. Acocelli

Michael A. Rogovin

Kelly K. Moran

1500 Broadway, 16th Floor

New York, New York 10036

Tel: (212) 682-3025

Fax: (212) 682-3010

Attorneys for Plaintiff

- 20 -

CERTIFICATION PURSUANT TO FEDERAL SECURITIES LAWS

The undersigned certifies as follows:

1. I have reviewed the complaint in this matter against Apptio, Inc. (“Apptio”) and others and authorized the filing thereof.

2. I did not purchase the security that is the subject of this action at the direction of counsel or in order to participate in any private action.

3. I am willing to serve as a representative party on behalf of a class, including providing testimony at deposition and trial, if necessary.

4. My transactions in Apptio securities that are the subject of the complaint during the class period specified in the complaint are set forth in the chart attached hereto.

5. I have not sought to serve or served as a class representative under the federal securities laws in the last three years, other than as listed below (if any):

6. I will not accept any payment for serving as a representative party beyond the undersigned’s pro rata share of any recovery, except as ordered or approved by the court, including any award for reasonable costs and expenses (including lost wages) directly relating to the representation of the class.

I hereby certify, under penalty of perjury, that the foregoing is true and correct.

| /s/ Stephen Bushansky |

| Stephen Bushansky (Dec 7, 2018) |

| Stephen Bushansky |

| Transaction (Purchase or Sale) |

Trade Date | Quantity | Price per Share | |||||||||

| Purchase |

6/23/2016 | 50 | $ | 16.00 | ||||||||

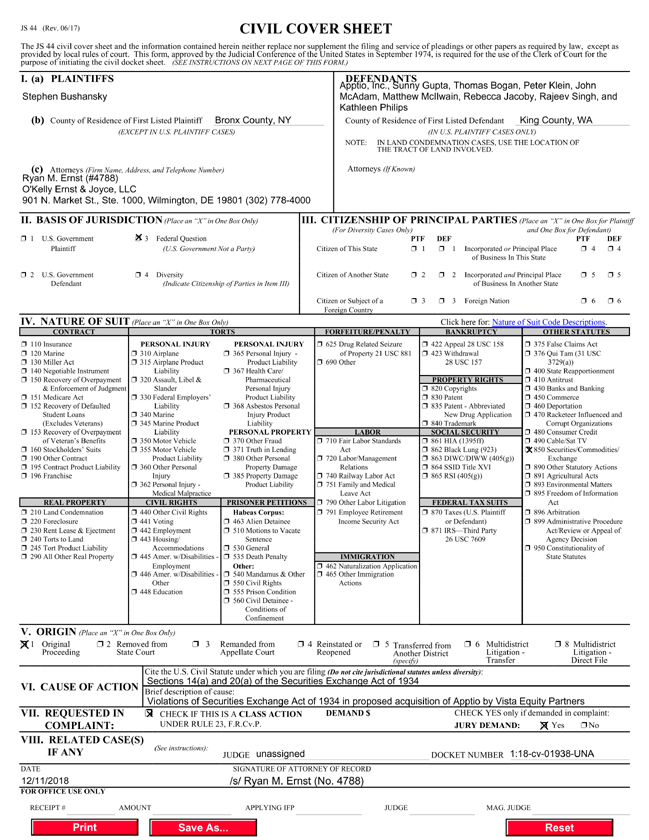

The JS 44 civil cover sheet and the information contained herein neither replace nor supplement the filing and service of pleadings or other papers as required by law, except as provided by local rules of court. This form, approved by the Judicial Conference of the United States in September 1974, is required for the use of the Clerk of Court for the purpose of initiating the civil docket sheet. (SEE INSTRUCTIONS ON NEXT PAGE OF THIS FORM.) I. (a) PLAINTIFFS Stephen Bushansky (b) County of Residence of First Listed Plaintiff Bronx County, NY (EXCEPTIN U.S. PLAINTIFF CASES) tio, inc., bunny Gupta, Thomas Bogan, Peter Klein, John McAdam, Matthew McIlwain, Rebecca Jacoby, Rajeev Singh, and Kathleen Philips County of Residence of First Listed Defendant King County, WA (IN U.S. PLAINTIFF CASES ONLY) IN LAND CONDEMNATION CASES, USE THE LOCATION OF THE TRACT OF LAND INVOLVED. NOTE: (c) Attorneys (Firm Name, Address, and Telephone Number) Ryan M. Ernst (#4788) O’Kelly Ernst & Joyce, LLC 901 N. Market St., Ste. 1000, Wilmington, DE 19801 (302) 778-4000 Attorneys (If Known) III. CITIZENSHIP OF PRINCIPAL PARTIES (Place an “X” in One Box for Plaintiff (For Diversity Cases Only) and One Box for Defendant) II. BASIS OF JURISDICTION (Place an “X” in One Box Only) ‘ 3 Federal Question (U.S. Government Not a Party) 1 U.S. Government Plaintiff PTF DEF DEF PTF Citizen of This State Incorporated or Principal Place of Business In This State Incorporated and Principal Place of Business In Another State Foreign Nation 4 4 Diversity (Indicate Citizenship of Parties in Item III) Citizen of Another State 2 U.S. Government Defendant 2 5 5 Citizen or Subject of a Foreign Country 3 6 6 I CONTRACT TORTS FORFEITURE/PENALTY BANKRUPTCY OTHER STATUTES 1 110 Insurance PERSONAL INJURY PERSONAL INJURY 625 Drug Related Seizure 422 Appeal 28 USC 158 375 False Claims Act 120 Marine 310 Airplane 365 Personal Injury - of Property 21 USC 881 423 Withdrawal 376 Qui Tam (31 USC 130 Miller Act 315 Airplane Product Product Liability 690 Other 28 USC 157 3729(a)) 140 Negotiable Instrument Liability 367 Health Care/ 400 State Reapportionment 150 Recovery of Overpayment 320 Assault, Libel & Pharmaceutical PROPERTY RIGHTS 410 Antitrust & Enforcement of Judgment Slander Personal Injury 820 Copyrights 430 Banks and Banking 151 Medicare Act 330 Federal Employers’ Product Liability 830 Patent 450 Commerce 152 Recovery of Defaulted Liability 368 Asbestos Personal 835 Patent - Abbreviated 460 Deportation Student Loans 340 Marine Injury Product New Drug Application 470 Racketeer Influenced and (Excludes Veterans) 345 Marine Product Liability 840 Trademark Corrupt Organizations 153 Recovery of Overpayment Liability PERSONAL PROPERTY LABOR SOCIAL SECURITY 480 Consumer Credit of Veteran’s Benefits 350 Motor Vehicle 370 Other Fraud 710 Fair Labor Standards 861 HIA (1395ff) 490 Cable/Sat TV 160 Stockholders’ Suits 355 Motor Vehicle 371 Truth in Lending Act 862 Black Lung (923) 850 Securities/Commodities/ 190 Other Contract Product Liability 380 Other Personal 720 Labor/Management 863 DIWC/DIWW (405(g)) Exchange 195 Contract Product Liability 360 Other Personal Property Damage Relations 864 SSID Title XVI 890 Other Statutory Actions 196 Franchise Injury 385 Property Damage 740 Railway Labor Act 865 RSI (405(g)) 891 Agricultural Acts 362 Personal Injury - Product Liability 751 Family and Medical 893 Environmental Matters Medical Malpractice Leave Act 895 Freedom of Information 1 REAL PROPERTY CIVIL RIGHTS PRISONER PETITIONS 790 Other Labor Litigation FEDERAL TAX SUITS Act 210 Land Condemnation 440 Other Civil Rights Habeas Corpus: 791 Employee Retirement 870 Taxes (U.S. Plaintiff 896 Arbitration 220 Foreclosure 441 Voting 463 Alien Detainee Income Security Act or Defendant) 899 Administrative Procedure 230 Rent Lease & Ejectment 442 Employment 510 Motions to Vacate 871 IRS—Third Party Act/Review or Appeal of 240 Torts to Land 443 Housing/ Sentence 26 USC 7609 Agency Decision 245 Tort Product Liability Accommodations 530 General 950 Constitutionality of 290 All Other Real Property 445 Amer. w/Disabilities - 535 Death Penalty IMMIGRATION State Statutes Employment Other: 462 Naturalization Application 446 Amer. w/Disabilities - 540 Mandamus & Other 465 Other Immigration Other 550 Civil Rights Actions 448 Education 555 Prison Condition 560 Civil Detainee - Conditions of Confinement IV. NATURE OF SUIT (Place an “X” in One Box Only) Click here for: Nature of Suit Code Descriptions. V. ORIGIN (Place an “X” in One Box Only) 1 Original 2 Removed from Multidistrict Litigation - Transfer Remanded from Appellate Court 8 Multidistrict Litigation - Direct File 3 5 Transferred from Another District specify) 6 4 Reinstated or Reopened Proceeding State Court Cite the U.S. Civil Statute under which you are filing (Do not cite jurisdictional statutes unless diversity): Sections 14(a) and 20(a) of the Securities Exchange Act of 1934 VI. CAUSE OF ACTION Brief description of cause: Violations of Securities Exchange Act of 1934 in proposed acquisition of Apptio by Vista Equity Partners VII. REQUESTED IN COMPLAINT: DEMAND $ CHECK YES only if demanded in complaint: JURY DEMAND: ‘ Yes No CHECK IF THIS IS A CLASS ACTION UNDER RULE 23, F.R.Cv.P. VIII. RELATED CASE(S) IF ANY (See instructions): JUDGE DOCKET NUMBER SIGNATURE OF ATTORNEY OF RECORD Is/ Ryan M. Ernst (No. 4788) DATE 12/11/2018 FOR OFFICE USE ONLY RECEIPT APPLYING IFP AMOUNT MAG. JUDGE Save As...Reset