Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PROGRESSIVE CORP/OH/ | a8-knovember2018earningsre.htm |

| EX-99..1 - EXHIBIT 99..1 - PROGRESSIVE CORP/OH/ | pgr20181130exhibit99earnin.htm |

Exhibit 99.2

NEW DIVIDEND POLICY Q&A

(December 2018)

What is Progressive’s capital management philosophy?

Effective capital management is an important component of our financial brand. When considering how to deploy capital, we look first to invest to support the growth of our current and future earnings power. We seek to run an efficient balance sheet that grows with the business and that delivers a return on equity over time that exceeds our cost of equity. If we have capital beyond what is needed to fund growth and innovation, that is, when we have “underleveraged capital,” we will return it to shareholders. This philosophy has allowed us to achieve industry-leading returns on equity over time.

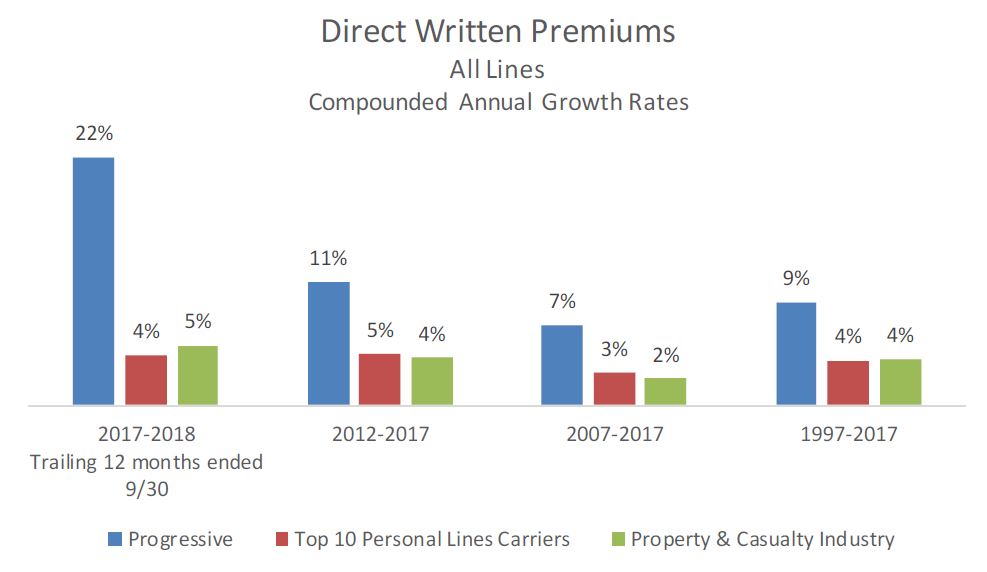

Note: Top 10 Personal Lines Carriers, which are determined by Direct Written Premiums for

Personal Lines over the twelve months ended September 30, 2018, exclude Progressive results.

Source: Company reports for Progressive, SNL for Industry and Top 10

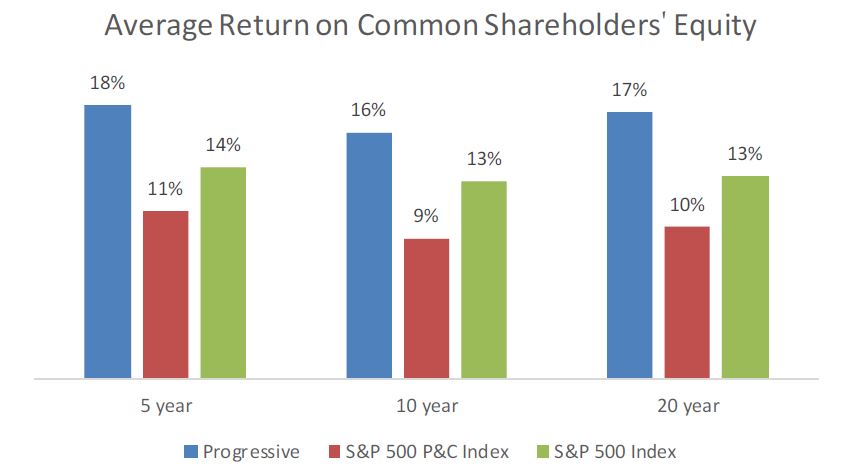

Note: Arithmetic average of quarterly annualized returns as of September 30, 2018

Source: Company reports for Progressive, Bloomberg for indices

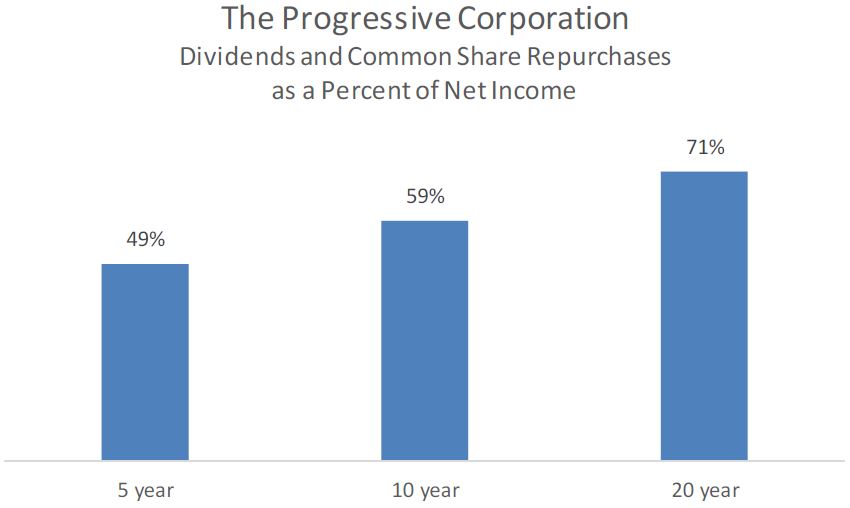

Source: Company reports, as of September 30, 2018

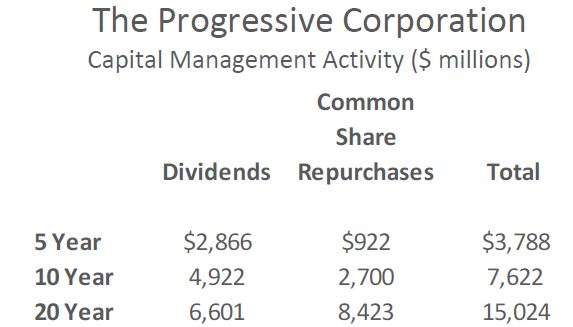

Source: Company reports, as of September 30, 2018

Why is the Company changing its common share dividend policy?

After extensive review within Progressive’s management team and with our Board of Directors as well as outside consultation, we determined that this was the right time for Progressive to change its dividend policy.

In addition to the substantial opportunity we have to execute around growing our core business, we believe that we have a variety of exciting opportunities to expand beyond our core and explore other opportunities to grow our long-term value. Because of this, we see the value in having greater flexibility in our dividend plan. While the mechanics of our common share dividend are changing, our capital management philosophy is not.

What is the Company’s fiscal year 2018 dividend policy?

Our existing policy is to pay an annual, variable cash dividend on our common shares. The amount of the dividend is determined by a formula equal to our after-tax underwriting income times our Gainshare factor times a Board-selected target percentage, which for 2018 is 33-1/3%. While the Board has ultimate discretion on the amount we pay, the Board has declared a dividend which will be determined based on full-year 2018 financial results following this formula, subject to the constraints that no dividend will be paid if:

• | After-tax comprehensive income is less than after-tax underwriting income, or |

• | Underwriting income is negative, or |

• | The Gainshare factor is zero. |

When will the new common share dividend policy go into effect?

As announced, the new policy will go into effect in 2019. This means that our variable dividend in its current form will be discontinued after we pay our annual variable dividend in February 2019. The initial quarterly dividend under the new policy is expected to be declared by the Board in the first quarter 2019 and paid early in the second quarter 2019. The initial variable dividend for calendar year 2019, if any, will be declared during the fourth quarter 2019 to be paid at or shortly after the end of 2019.

How does this new dividend policy differ from the current policy?

The new dividend policy will differ in two main ways from our current policy. First, we will be initiating a regular quarterly dividend. Second, while we expect to maintain the annual variable dividend concept, it will no longer be determined based on the formula that is currently used.

How will the dividend be determined under the new policy?

In addition to regular quarterly dividends, the Board will consider a variable dividend payment at least annually. While the Board will have the discretion to implement such a payment at any time, its meeting in December will be targeted as the regular time for this discussion. The total amount paid under our dividend policy will be determined by the Board after considering our existing capital resources and current and future capital needs. Among the items that affect our capital needs are:

• | Growth and profitability and related regulatory and ratings agency capital requirements |

• | The performance of our investment portfolios |

• | The amount of capital already distributed to shareholders in the form of regular quarterly dividends or deployed for common share repurchases |

• | Other potential uses for our capital, such as share repurchases and strategic investments |

• | Significant external events or disruptions in capital markets |

Will the new variable dividend carry forward the constraint that after-tax comprehensive income must exceed after-tax underwriting income in order for a dividend to be payable?

No, the new dividend policy will not have this "trigger" mechanism found in the current policy. As highlighted in the current calendar year, this trigger mechanism can present a capital management challenge as its binary nature suggests variable dividend payouts ranging from nothing to a payout potentially exceeding a billion dollars. However, after-tax comprehensive income and after-tax underwriting income are expected to be among the factors considered by the Board when deciding whether or not to declare dividends.

Will the Board of Directors retain the discretion to modify or suspend the common share dividend to be paid under the new policy in any given year?

Yes, consistent with current practice and best practices in corporate governance, the Board of Directors must make the final decision. Each quarter the Board will decide, based on relevant facts and circumstances, whether or not to declare a dividend and, if the Board determines that a dividend is appropriate, the amount of the dividend. Although we expect to follow the approach described above, and we currently anticipate that we would pay a variable dividend every year, the Board must retain this discretion to act in the best interests of the Company and its shareholders.

What effect will the variable dividend policy have on your monthly financial statements?

Neither the variable dividend nor the quarterly dividend will have a direct effect on net income or earnings per share. In the period a dividend is declared by the Board, the Company will recognize a reduction in shareholders’ equity.

What will be the Federal income tax consequences of the variable dividend for individual shareholders?

We can’t give tax advice and each shareholder’s tax situation is different. In addition, Federal tax laws, regulations and interpretations are subject to change, so shareholders should consult with personal tax advisors for additional information. Generally (under Federal laws and regulations in effect in December 2018), we expect that an individual shareholder receiving dividends under our new policy would pay Federal income taxes on those dividends at the same rate as the individual pays on dividends under our current policy. Corporate and foreign taxpayers may be subject to different rules.

Could changes in the taxation of dividends under Federal law change the Company’s view of its dividend policy?

Yes. The Company views its dividend policy as an attractive additional way to manage the accumulation of capital and provide a return to shareholders based, in part, on current Federal tax policy. If the Federal tax rules relating to dividends were to change, the Company could reconsider the new dividend policy and would have the discretion to change or terminate the policy at any time.

Will the Company continue to repurchase its shares?

The new dividend policy is just one capital management method that the Company has available to deploy when the circumstances are appropriate. Subject to the Board’s approval, the Company will continue to have the discretion under our capital management policies to repurchase our shares when warranted in view of the Board’s and management’s assessment of our capital needs, business prospects and share price. As mentioned above, repurchases of our shares could impact the amount of dividends that the Board ultimately declares. At a minimum, we continue to maintain our financial policy to neutralize dilution from equity-based compensation in the year of issuance through repurchases of our common shares. Our most recent share repurchase authorization of 25 million common shares, dated May 11, 2018, has 24.3 million shares remaining as of November 30, 2018.