Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - TIVITY HEALTH, INC. | d614292dex991.htm |

| EX-2.1 - EX-2.1 - TIVITY HEALTH, INC. | d614292dex21.htm |

| 8-K - 8-K - TIVITY HEALTH, INC. | d614292d8k.htm |

Tivity Health + Nutrisystem Expanding our Healthy Lifestyle Brand Portfolio Exhibit 99.2

Cautionary Note on Forward-Looking Statements Note On Forward Looking Statements This communication contains certain statements that are “forward-looking” statements within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based upon current expectations and include all statements that are not historical statements of fact and those regarding the intent, belief or expectations, including, without limitation, statements that are accompanied by words such as “will,” “expect,” “outlook,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” or other similar words, phrases or expressions and variations or negatives of these words. These forward-looking statements include, but are not limited to, statements regarding the proposed merger, integration and transition plans, synergies, opportunities and anticipated future performance. Readers of this communication should understand that these statements are not guarantees of performance or results. Many risks and uncertainties could affect actual results and cause them to vary materially from the expectations contained in the forward-looking statements. These risks and uncertainties include, among other things: the timing and likelihood of, and any conditions or requirements imposed in connection with, obtaining required stockholder or regulatory approval of the proposed transaction; the possibility that the closing conditions to the proposed transaction may not be satisfied or waived; delay in closing the proposed transaction or the possibility of non-consummation of the proposed transaction; the risk that expected benefits, synergies and growth opportunities of the proposed transaction may not be achieved in a timely manner or at all, including that the proposed transaction may not be accretive within the expected timeframe or to the extent anticipated; the occurrence of any event that could give rise to termination of the merger agreement; the risk that stockholder litigation in connection with the proposed transaction may affect the timing or occurrence of the proposed transaction or result in significant costs of defense, indemnification and liability; the risk that Tivity Health and Nutrisystem will be unable to retain or hire key personnel; the ability to successfully integrate Nutrisystem’s business with Tivity Health following the closing; the risk that the significant indebtedness incurred to fund the purchase price may limit Tivity Health’s ability to adapt to changes in the economy or market conditions, expose the company to interest rate risk for the variable rate indebtedness and require a substantial portion of cash flows from operations to be dedicated to the payment of indebtedness; and the risk that disruption from the proposed transaction may adversely affect Tivity Health’s and Nutrisystem’s business and their respective relationships with customers, vendors or employees. For additional information about factors that could cause actual results to differ materially from those described in the forward-looking statements, please refer to both Tivity Health’s and Nutrisystem’s filings with the Securities and Exchange Commission (“SEC”). Except as required by law, neither Tivity Health nor Nutrisystem undertakes any obligation to update forward-looking statements made by it to reflect new information, subsequent events or circumstances.

Additional Information Important Additional Information and Where to Find It In connection with the proposed transaction, Tivity Health expects to file with the SEC a registration statement of Tivity Health on Form S-4 (the “registration statement”) that will include a proxy statement of Nutrisystem and that will also constitute a prospectus of Tivity Health (the “proxy statement/prospectus”). Nutrisystem expects to mail the proxy statement/prospectus to its stockholders in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ THE ENTIRE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT INFORMATION FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TIVITY HEALTH, NUTRISYSTEM AND THE PROPOSED TRANSACTION. The registration statement and other documents filed by Tivity Health with the SEC may be obtained free of charge at Tivity Health’s website at http://www.tivityhealth.com or at the SEC’s website at http://www.sec.gov. These documents may also be obtained free of charge from Tivity Health by requesting them by mail at Tivity Health, Inc., 701 Cool Springs Boulevard, Franklin, Tennessee 37067, Attention: Investor Relations, or by telephone at (615) 614-4576. The proxy statement/prospectus and other documents filed by Nutrisystem with the SEC may be obtained free of charge at Nutrisystem’s website at http://www.nutrisystem.com or at the SEC’s website at http://www.sec.gov. These documents may also be obtained free of charge from Nutrisystem by requesting them by mail at Nutrisystem, Inc., 600 Office Center Drive, Fort Washington, PA 19034, Attention: Investor Relations, or by telephone at (215) 346-8136. Participants in Solicitation Tivity Health and Nutrisystem and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about Tivity Health’s directors and executive officers is available in Tivity Health’s proxy statement for Tivity Health’s 2018 annual meeting of stockholders filed with the SEC on April 13, 2018 on Schedule 14A. Information about Nutrisystem’s directors and executive officers is available in Nutrisystem’s proxy statement for Nutrisystem’s 2018 annual meeting of stockholders filed with the SEC on March 26, 2018 on Schedule 14A. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the transaction when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from Tivity Health or Nutrisystem as indicated above. No Offer or Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

We empower adults to live their best lives now—with vitality, dignity and purpose. We enable healthy aging—both in place, and in community. Our Mission “Our Why” Transform the aging experience—reducing the burden of chronic conditions among adults, enabling them to live their best lives. Our Vision Driven by this mission and vision, we are constantly exploring opportunities that will create value for all stakeholders

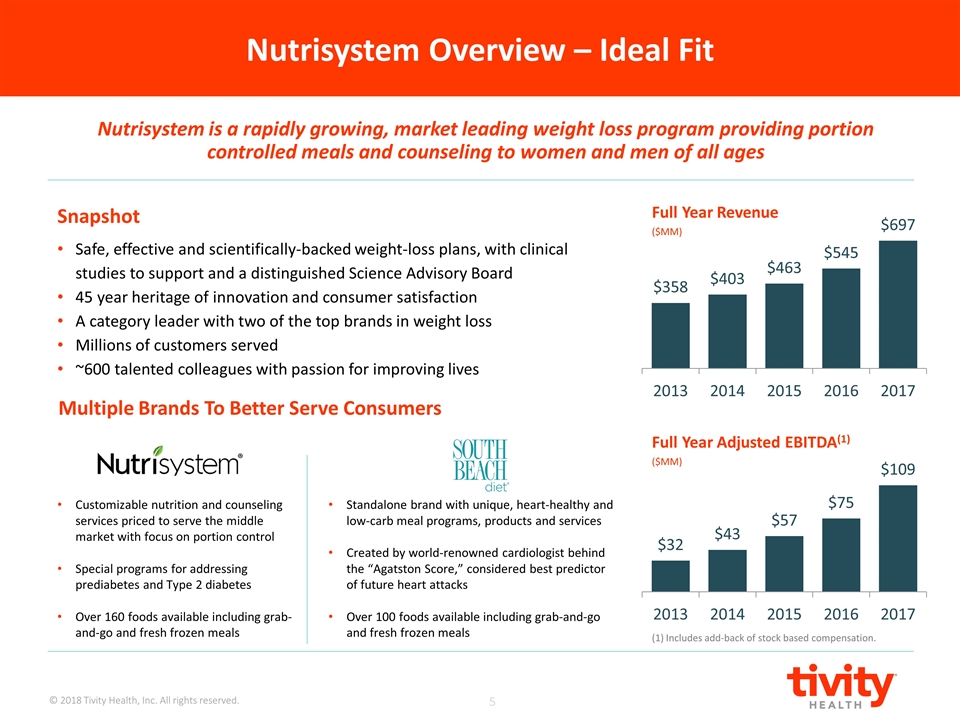

Nutrisystem Overview – Ideal Fit Customizable nutrition and counseling services priced to serve the middle market with focus on portion control Special programs for addressing prediabetes and Type 2 diabetes Over 160 foods available including grab-and-go and fresh frozen meals Standalone brand with unique, heart-healthy and low-carb meal programs, products and services Created by world-renowned cardiologist behind the “Agatston Score,” considered best predictor of future heart attacks Over 100 foods available including grab-and-go and fresh frozen meals Nutrisystem is a rapidly growing, market leading weight loss program providing portion controlled meals and counseling to women and men of all ages (1) Includes add-back of stock based compensation. Snapshot Safe, effective and scientifically-backed weight-loss plans, with clinical studies to support and a distinguished Science Advisory Board 45 year heritage of innovation and consumer satisfaction A category leader with two of the top brands in weight loss Millions of customers served ~600 talented colleagues with passion for improving lives Full Year Revenue ($MM) Full Year Adjusted EBITDA(1) ($MM) Multiple Brands To Better Serve Consumers

Nutrisystem Core Competencies Multiple brands with track records of success Proven programs to address prediabetes and Type 2 diabetes Strong ecommerce capabilities and platform Strong and complementary marketing and data analytics expertise #1 in Customer Service in weight loss category1 Cost-effective distribution network Retail and grocer channel presence through Amazon, Walmart, supermarkets and Costco Diverse offerings, marketing and analytical expertise, multi-channel experience and effective distribution driving growth in the business 1. Newsweek Nov 30, 2018.

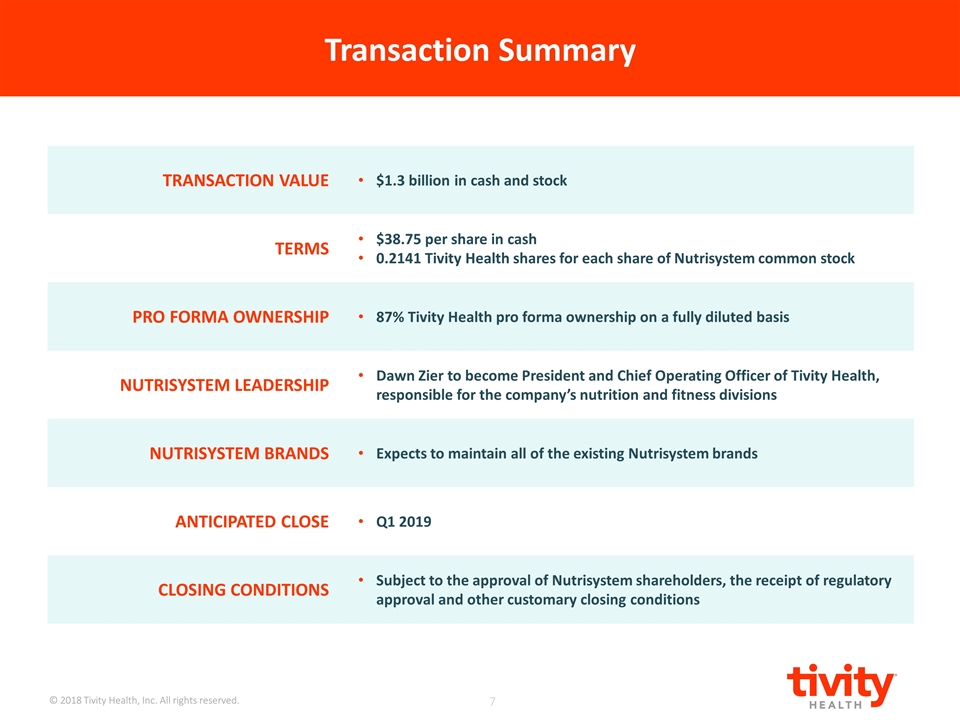

Transaction Summary TRANSACTION VALUE $1.3 billion in cash and stock TERMS $38.75 per share in cash 0.2141 Tivity Health shares for each share of Nutrisystem common stock PRO FORMA OWNERSHIP 87% Tivity Health pro forma ownership on a fully diluted basis NUTRISYSTEM LEADERSHIP Dawn Zier to become President and Chief Operating Officer of Tivity Health, responsible for the company’s nutrition and fitness divisions NUTRISYSTEM BRANDS Expects to maintain all of the existing Nutrisystem brands ANTICIPATED CLOSE Q1 2019 CLOSING CONDITIONS Subject to the approval of Nutrisystem shareholders, the receipt of regulatory approval and other customary closing conditions

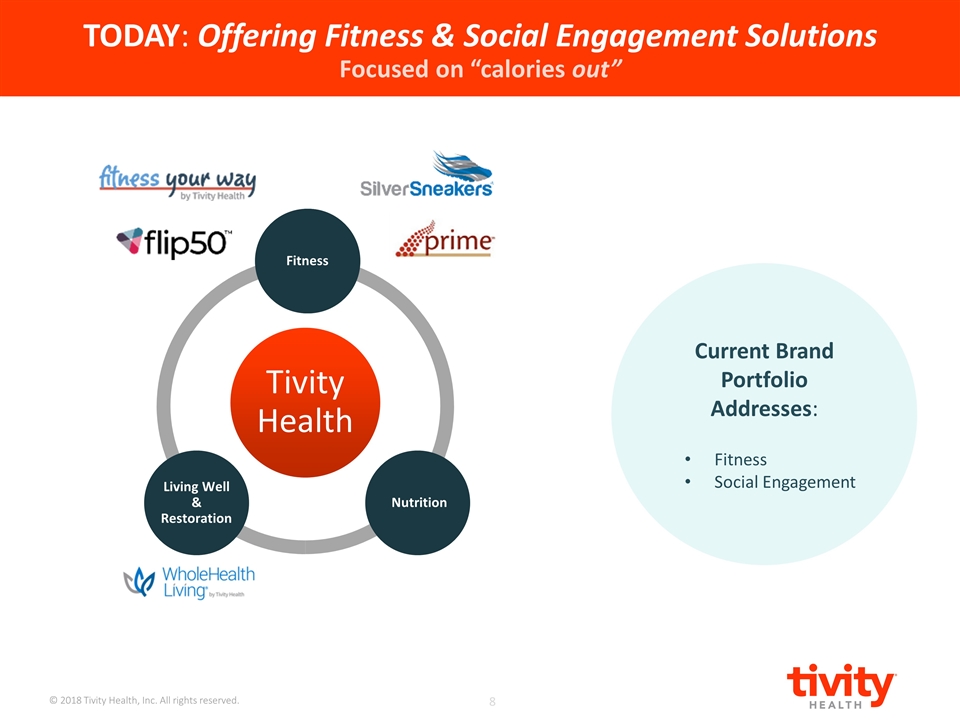

Tivity Health Fitness TODAY: Offering Fitness & Social Engagement Solutions Focused on “calories out” Current Brand Portfolio Addresses: Fitness Social Engagement Fitness Nutrition Living Well & Restoration

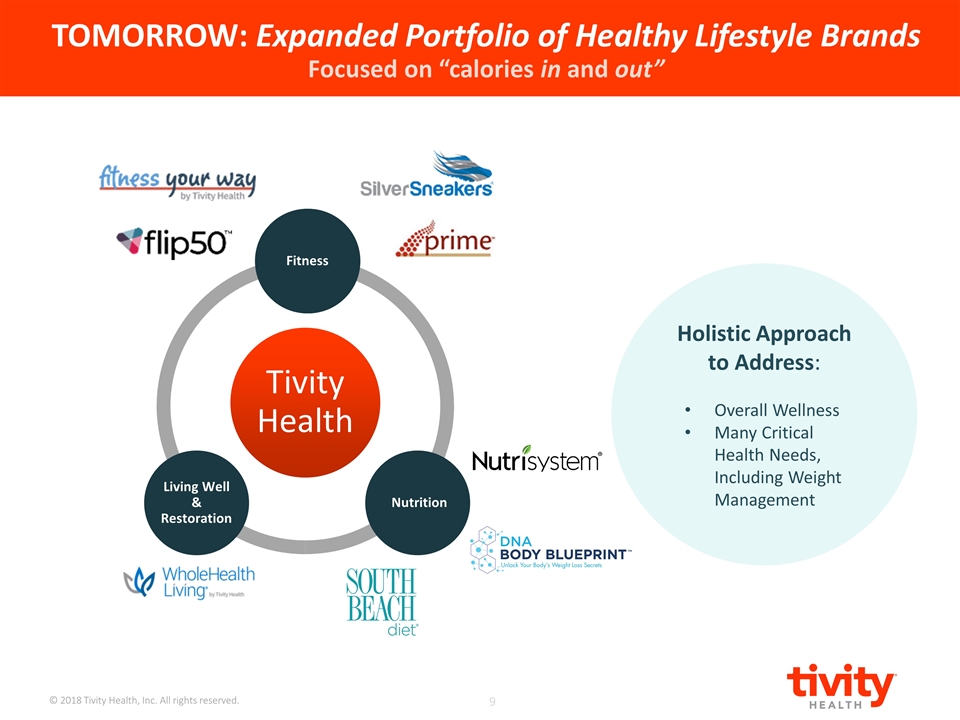

Holistic Approach to Address: Overall Wellness Many Critical Health Needs, Including Weight Management TOMORROW: Expanded Portfolio of Healthy Lifestyle Brands Focused on “calories in and out” Tivity Health Fitness Fitness Nutrition Living Well & Restoration

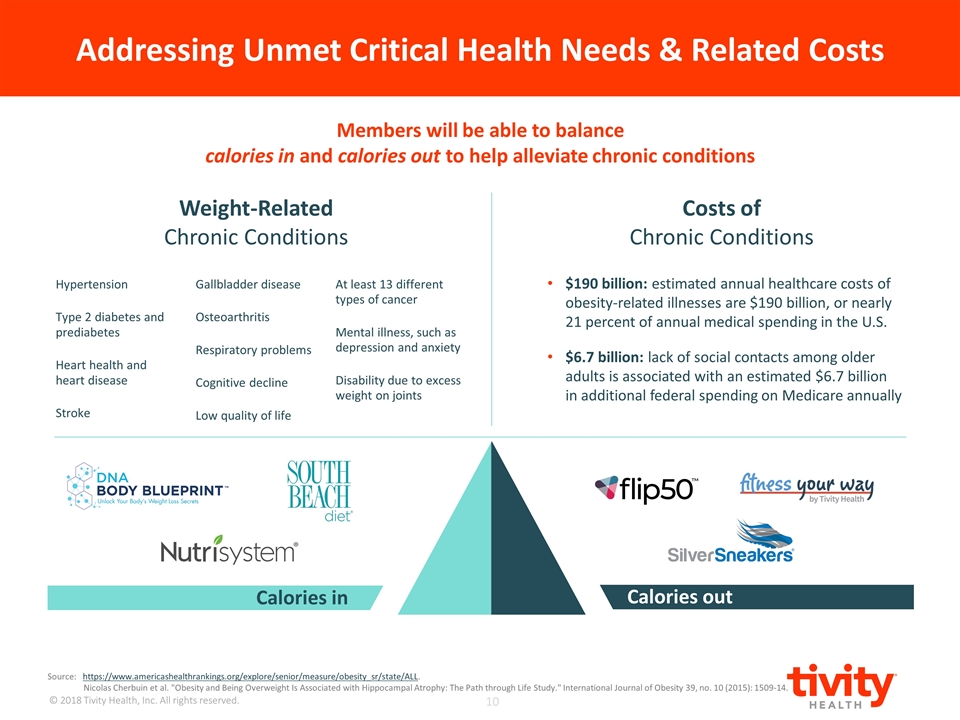

Addressing Unmet Critical Health Needs & Related Costs Calories out Calories in Hypertension Type 2 diabetes and prediabetes Heart health and heart disease Stroke Gallbladder disease Osteoarthritis Respiratory problems Cognitive decline Low quality of life At least 13 different types of cancer Mental illness, such as depression and anxiety Disability due to excess weight on joints Weight-Related Chronic Conditions Source: https://www.americashealthrankings.org/explore/senior/measure/obesity_sr/state/ALL. Nicolas Cherbuin et al. "Obesity and Being Overweight Is Associated with Hippocampal Atrophy: The Path through Life Study." International Journal of Obesity 39, no. 10 (2015): 1509-14. Costs of Chronic Conditions $190 billion: estimated annual healthcare costs of obesity-related illnesses are $190 billion, or nearly 21 percent of annual medical spending in the U.S. $6.7 billion: lack of social contacts among older adults is associated with an estimated $6.7 billion in additional federal spending on Medicare annually Members will be able to balance calories in and calories out to help alleviate chronic conditions

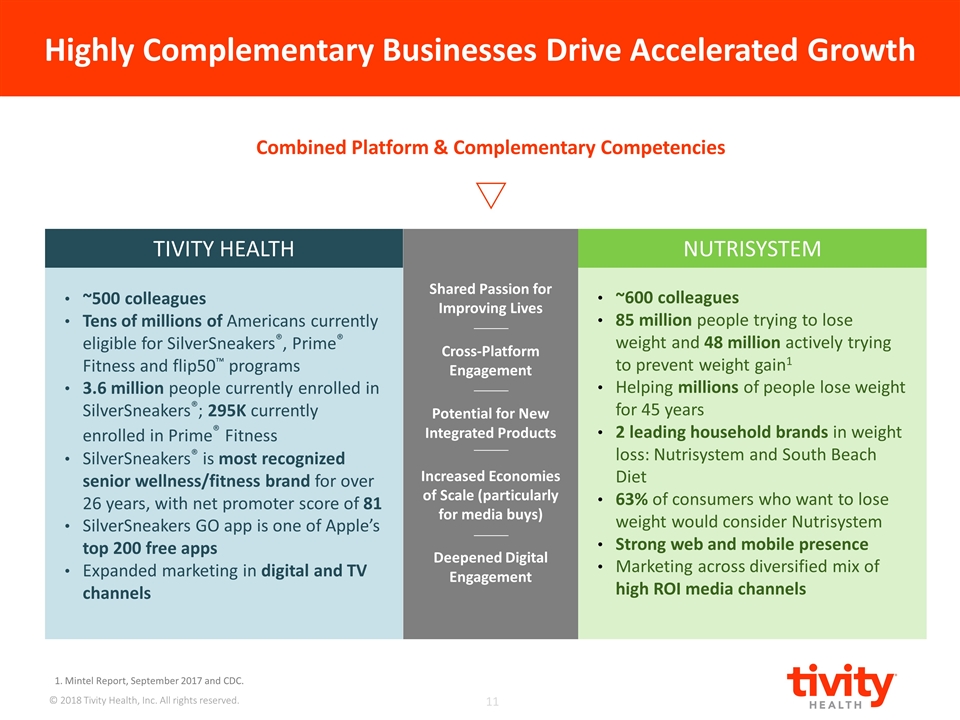

Shared Passion for Improving Lives Cross-Platform Engagement Potential for New Integrated Products Increased Economies of Scale (particularly for media buys) Deepened Digital Engagement Highly Complementary Businesses Drive Accelerated Growth ~500 colleagues Tens of millions of Americans currently eligible for SilverSneakers®, Prime® Fitness and flip50™ programs 3.6 million people currently enrolled in SilverSneakers®; 295K currently enrolled in Prime® Fitness SilverSneakers® is most recognized senior wellness/fitness brand for over 26 years, with net promoter score of 81 SilverSneakers GO app is one of Apple’s top 200 free apps Expanded marketing in digital and TV channels TIVITY HEALTH ~600 colleagues 85 million people trying to lose weight and 48 million actively trying to prevent weight gain1 Helping millions of people lose weight for 45 years 2 leading household brands in weight loss: Nutrisystem and South Beach Diet 63% of consumers who want to lose weight would consider Nutrisystem Strong web and mobile presence Marketing across diversified mix of high ROI media channels NUTRISYSTEM Combined Platform & Complementary Competencies 1. Mintel Report, September 2017 and CDC.

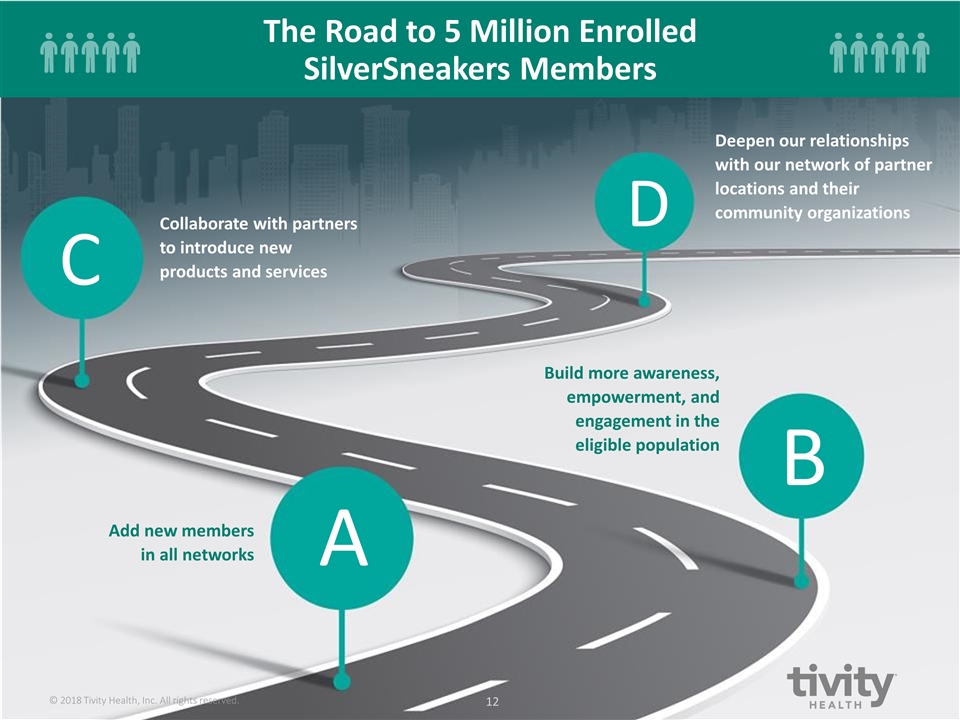

Build more awareness, empowerment, and engagement in the eligible population Deepen our relationships with our network of partner locations and their community organizations Collaborate with partners to introduce new products and services A B C D Add new members in all networks The Road to 5 Million Enrolled SilverSneakers Members © 2018 Tivity Health, Inc. All rights reserved.

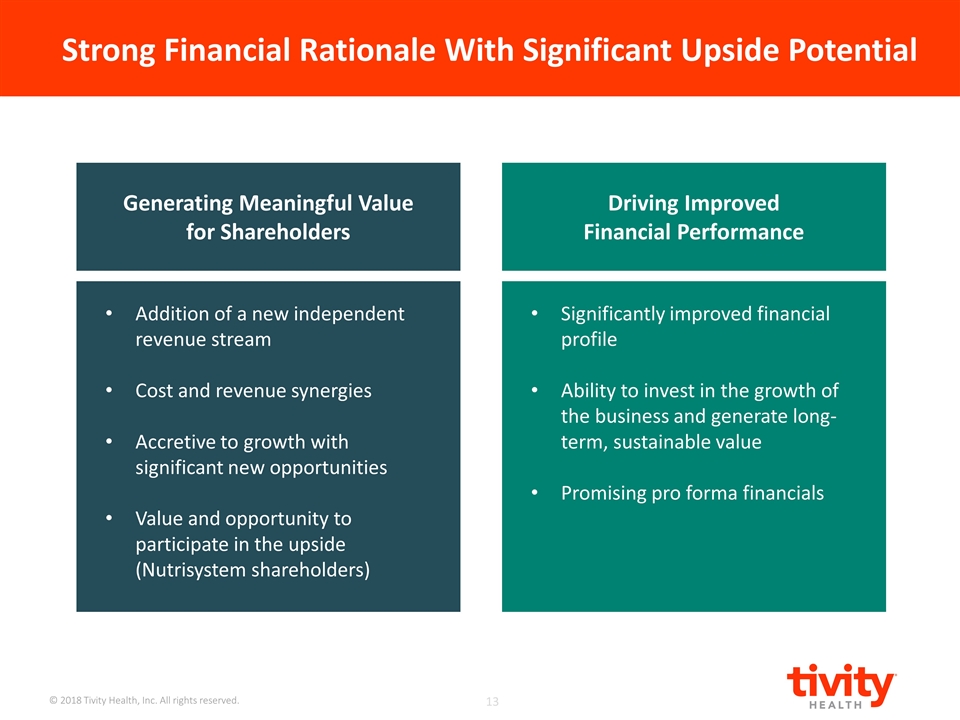

Strong Financial Rationale With Significant Upside Potential Generating Meaningful Value for Shareholders Driving Improved Financial Performance Significantly improved financial profile Ability to invest in the growth of the business and generate long-term, sustainable value Promising pro forma financials Addition of a new independent revenue stream Cost and revenue synergies Accretive to growth with significant new opportunities Value and opportunity to participate in the upside (Nutrisystem shareholders)

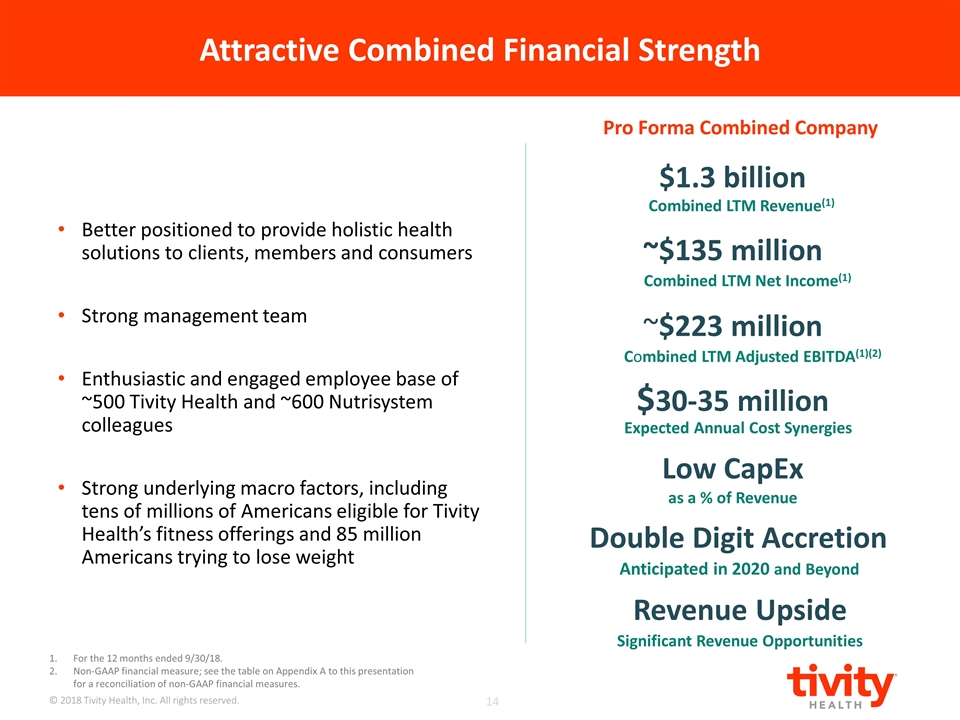

Attractive Combined Financial Strength For the 12 months ended 9/30/18. Non-GAAP financial measure; see the table on Appendix A to this presentation for a reconciliation of non-GAAP financial measures. Pro Forma Combined Company Combined LTM Revenue(1) $1.3 billion Revenue Upside Significant Revenue Opportunities ~$223 million Combined LTM Adjusted EBITDA(1)(2) Double Digit Accretion Anticipated in 2020 and Beyond Expected Annual Cost Synergies $30-35 million Better positioned to provide holistic health solutions to clients, members and consumers Strong management team Enthusiastic and engaged employee base of ~500 Tivity Health and ~600 Nutrisystem colleagues Strong underlying macro factors, including tens of millions of Americans eligible for Tivity Health’s fitness offerings and 85 million Americans trying to lose weight ~$135 million Combined LTM Net Income(1) Low CapEx as a % of Revenue

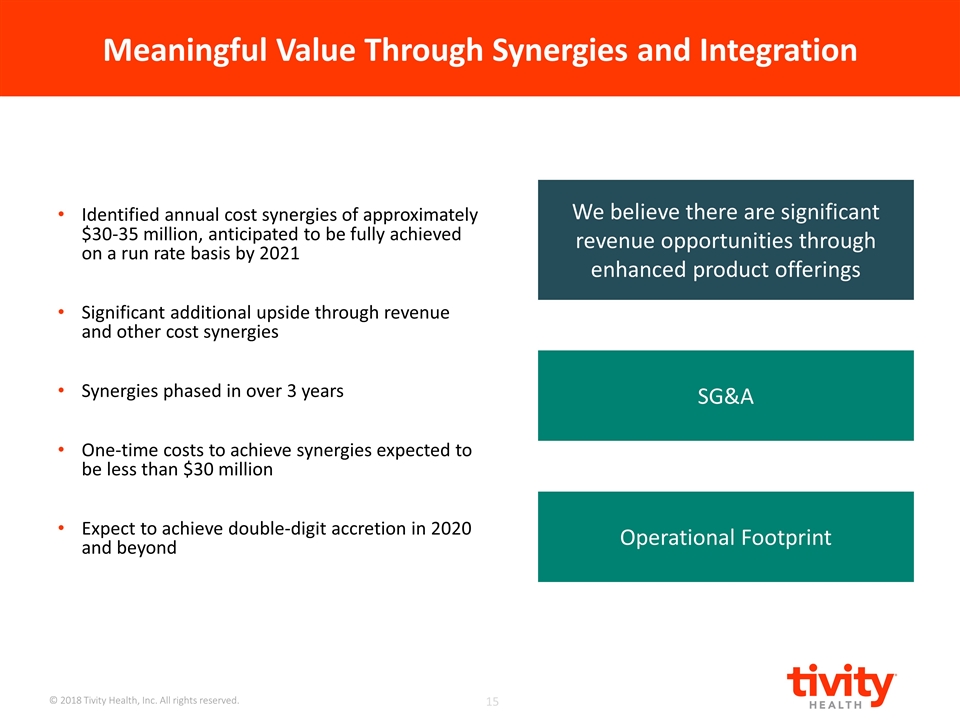

Meaningful Value Through Synergies and Integration Identified annual cost synergies of approximately $30-35 million, anticipated to be fully achieved on a run rate basis by 2021 Significant additional upside through revenue and other cost synergies Synergies phased in over 3 years One-time costs to achieve synergies expected to be less than $30 million Expect to achieve double-digit accretion in 2020 and beyond We believe there are significant revenue opportunities through enhanced product offerings SG&A Operational Footprint

Substantial Cash Flow to De-lever the Balance Sheet Intend to finance cash portion of the acquisition with fully committed term loan financing from Credit Suisse and existing cash on hand At the closing of the transaction, Tivity Health’s pro forma net leverage is expected to be ~4.4x, including the benefit of identified cost synergies Tivity Health expects to reduce net leverage to less than 3.5x by the end of 2020, and less than 2.5x by the end of 2021 Expect to close in Q1 2019, subject to the approval of Nutrisystem shareholders, the receipt of regulatory approval and other customary closing conditions

NEXT STEP IN GROWTH OF TIVITY HEALTH Acquisition is the result of a comprehensive exploration of strategic growth opportunities and is a next step in our evolution. IDEAL STRATEGIC FIT We have successful and complementary portfolios of leading brands with dedicated consumer and member followings. We also share a common strategic vision, mission and culture. Additionally, Nutrisystem and South Beach Diet brands will expand our reach to the under 50 market. TOGETHER WE PROVIDE A UNIQUE OFFERING AT SCALE TO IMPROVE HEALTH & WELLNESS Combination will be unique in offering, at scale, a portfolio of healthy lifestyle brands, which includes SilverSneakers®, Prime® Fitness, WholeHealth Living™, flip50™, Nutrisystem®, South Beach Diet® and DNA BodyBlueprint™. UNIQUE ABILITY TO ADDRESS CRITICAL HEALTH NEEDS Tivity Health will be better positioned to address weight management – a major factor contributing to many chronic diseases. DELIVERING VALUE We believe combining our two companies creates entirely new value propositions for health plans, fitness partners, members and consumers, and will generate significant value for shareholders. Summary

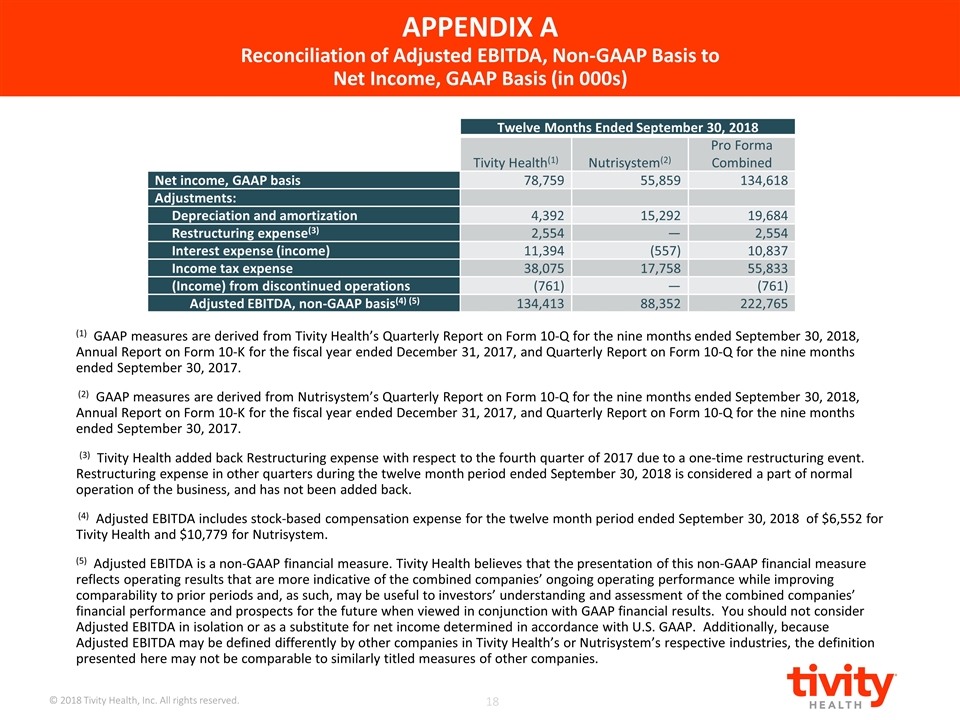

APPENDIX A Reconciliation of Adjusted EBITDA, Non-GAAP Basis to Net Income, GAAP Basis (in 000s) Twelve Months Ended September 30, 2018 Tivity Health(1) Nutrisystem(2) Pro Forma Combined Net income, GAAP basis 78,759 55,859 134,618 Adjustments: Depreciation and amortization 4,392 15,292 19,684 Restructuring expense(3) 2,554 — 2,554 Interest expense (income) 11,394 (557) 10,837 Income tax expense 38,075 17,758 55,833 (Income) from discontinued operations (761) — (761) Adjusted EBITDA, non-GAAP basis(4) (5) 134,413 88,352 222,765 (1) GAAP measures are derived from Tivity Health’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2018, Annual Report on Form 10-K for the fiscal year ended December 31, 2017, and Quarterly Report on Form 10-Q for the nine months ended September 30, 2017. (2) GAAP measures are derived from Nutrisystem’s Quarterly Report on Form 10-Q for the nine months ended September 30, 2018, Annual Report on Form 10-K for the fiscal year ended December 31, 2017, and Quarterly Report on Form 10-Q for the nine months ended September 30, 2017. (3) Tivity Health added back Restructuring expense with respect to the fourth quarter of 2017 due to a one-time restructuring event. Restructuring expense in other quarters during the twelve month period ended September 30, 2018 is considered a part of normal operation of the business, and has not been added back. (4) Adjusted EBITDA includes stock-based compensation expense for the twelve month period ended September 30, 2018 of $6,552 for Tivity Health and $10,779 for Nutrisystem. (5) Adjusted EBITDA is a non-GAAP financial measure. Tivity Health believes that the presentation of this non-GAAP financial measure reflects operating results that are more indicative of the combined companies’ ongoing operating performance while improving comparability to prior periods and, as such, may be useful to investors’ understanding and assessment of the combined companies’ financial performance and prospects for the future when viewed in conjunction with GAAP financial results. You should not consider Adjusted EBITDA in isolation or as a substitute for net income determined in accordance with U.S. GAAP. Additionally, because Adjusted EBITDA may be defined differently by other companies in Tivity Health’s or Nutrisystem’s respective industries, the definition presented here may not be comparable to similarly titled measures of other companies.

Thank You