Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BayCom Corp | tv508732_8k.htm |

Exhibit 99.1

December 10, 2018 Expands Southern California Footprint

2 Forward Looking Statements When used in this presentation and in other documents filed with or furnished to the Securities and Exchange Commission (the “SEC”), in press releases or other public shareholder communications, or in oral statements made with the approval of an authorized executive officer, the words or phrases "may," "believe," "will," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," "plans," "potential," or similar expressions are intended to identify "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 . You are cautioned not to place undue reliance on any forward - looking statement, which speak only as of the date made . These statements may relate to future financial performance, strategic plans or objectives, revenues or earnings projections, or other financial information . By their nature, these statements are subject to numerous uncertainties that could cause actual results to differ materially from those anticipated in the statements . Statements about the expected timing, completion and effects of the proposed merger and all other statements in this presentation other than historical facts constitute forward - looking statements . Important factors that could cause actual results to differ materially from the results anticipated or projected include, but are not limited to, the following : expected revenues, cost savings, synergies and other benefits from the proposed merger of BayCom Corp (“ BayCom”or “BCML”) and Uniti Financial Corporation (“ Uniti ” or “UIFC”) and the recent merger of Bethlehem Financial Corporation and BayCom might not be realized within the expected time frames or at all and costs or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected ; the requisite shareholder and regulatory approvals and other closing conditions for the proposed merger may be delayed or may not be obtained or the merger agreement may be terminated ; business disruption may occur following or in connection with the proposed merger ; BayCom’s or Uniti's businesses may experience disruptions due to transaction - related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities ; the possibility that the proposed merger is more expensive to complete than anticipated, including as a result of unexpected factors or events ; the diversion of managements' attention from ongoing business operations and opportunities as a result of the proposed merger or otherwise ; and future acquisitions by the Company of other depository institutions or lines of business . Additional factors which could affect the forward - looking statements can be found in the cautionary language included under the headings “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in BayCom’s prospectus filed with the SEC pursuant to Rule 424 (b) of the Securities Act on May 4 , 2018 and other documents subsequently filed by BayCom with the SEC . Consequently, no forward - looking statement can be guaranteed . Neither BayCom nor Uniti undertakes any obligation to update or revise any forward - looking statements, whether as a result of new information, future events or otherwise . Annualized , pro forma, projected and estimated numbers are used for illustrative purposes only, are not forecasts and may not reflect actual results .

3 Safe Harbor Additional Information : In connection with the proposed merger, BayCom will file with the SEC a registration statement on Form S - 4 that will include a proxy statement of Uniti and a prospectus of BayCom , as well as other relevant documents concerning the proposed transaction . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval . WE URGE INVESTORS AND SECURITY HOLDERS TO READ THE REGISTRATION STATEMENT ON FORM S - 4 , THE PROXY STATEMENT/PROSPECTUS INCLUDED WITHIN THE REGISTRATION STATEMENT ON FORM S - 4 AND ANY OTHER RELEVANT DOCUMENTS WHEN FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BAYCOM, UNITI AND THE PROPOSED MERGER . The proxy statement/prospectus will be sent to the shareholders of Uniti seeking the required shareholder approvals . Investors and security holders will be able to obtain free copies of the registration statement on Form S - 4 and the related proxy statement/prospectus, when filed, as well as other documents filed with the SEC by BayCom through the web site maintained by the SEC at www . sec . gov . These documents, when available, also can be obtained free of charge by accessing BayCom’s website at www . unitedbusinessbank . com under the tab “Investor Information” and then under “Documents” . Alternatively, these documents, when filed with the SEC by BayCom , can be obtained free of charge by directing a written request to either BayCom Corp . , 500 Ygnacio Valley Road, Suite 200 , Walnut Creek, California, 94596 , Attn : Agnes Chiu or by calling ( 925 ) 476 - 1843 , or to Uniti Financial Corporation, 6301 Beach Boulevard, Buena Park, California 90621 , Attn : Jessica Lee or by calling ( 714 ) 736 - 5700 . Participants in the Transaction : BayCom , Uniti and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Uniti in connection with the proposed transaction . Information about BayCom’s participants may be found in the definitive proxy statement of BayCom filed with the SEC on June 6 , 2018 and information about Uniti’s participants and additional information regarding the interests of these participants will be included in the proxy statement/prospectus regarding the proposed transaction when it becomes available . The definitive proxy statement can be obtained free of charge from the sources described above .

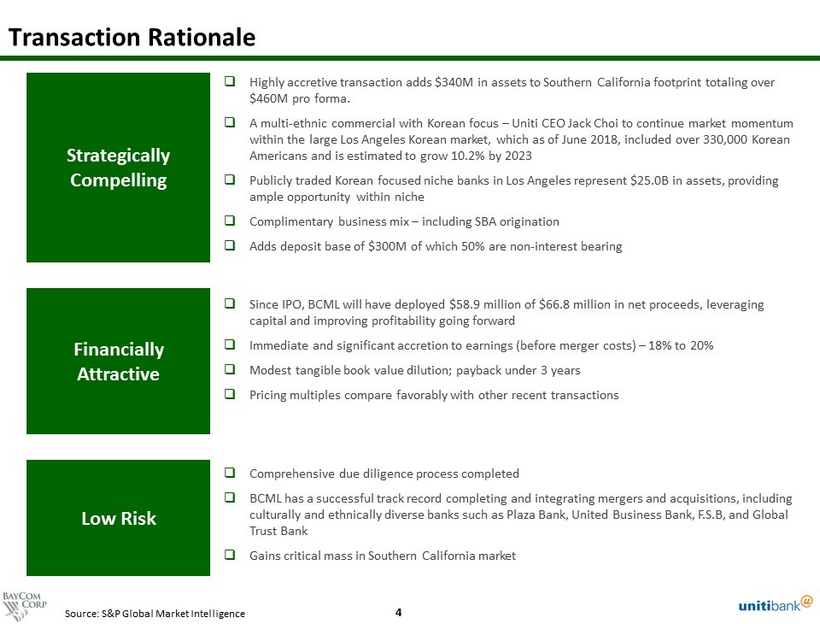

4 Transaction Rationale Strategically Compelling Financially Attractive Low Risk □ Comprehensive due diligence process completed □ BCML has a successful track record completing and integrating mergers and acquisitions, including culturally and ethnically diverse banks such as Plaza Bank, United Business Bank, F.S.B, and Global Trust Bank □ Gains critical mass in Southern California market □ Highly accretive transaction adds $340M in assets to Southern California footprint totaling over $460M pro forma. □ A multi - ethnic commercial with Korean focus – Uniti CEO Jack Choi to continue market momentum within the large Los Angeles Korean market, which as of June 2018, included over 330,000 Korean Americans and is estimated to grow 10.2% by 2023 □ Publicly traded Korean focused niche banks in Los Angeles represent $25.0B in assets, providing ample opportunity within niche □ Complimentary business mix – including SBA origination □ Adds deposit base of $300M of which 50% are non - interest bearing □ Since IPO, BCML will have deployed $58.9 million of $66.8 million in net proceeds, leveraging capital and improving profitability going forward □ Immediate and significant accretion to earnings (before merger costs) – 18% to 20 % □ Modest tangible book value dilution; payback under 3 years □ Pricing multiples compare favorably with other recent transactions Source: S&P Global Market Intelligence

5 □ Balance Sheet: ▪ Assets: $ 343.6 million ▪ Loans: $262.4 million ▪ Deposits: $294.6 million □ Capital Ratios: ▪ TE/TA: 13.56% ▪ Leverage Ratio: 13.89% ▪ Total Risk - Based Capital Ratio: 18.58% □ Asset Quality: ▪ NPAs/Assets (ex. TDRs): 0.02% ▪ Reserves/Loans: 1.27% □ Profitability: ▪ ROAA: 1.17% ▪ ROAE: 9.21% ▪ Net interest margin: 4.37% 1) Financial data for last twelve months ended September 30, 2018 Source: S&P Global Market Intelligence Corporate Overview – Uniti Financial Corporation Overview Branch Map Financial Highlights 1 Map excludes BayCom’s Washington and New Mexico locations UIFC Locations BCML Locations BCML LPO As the largest Korean - American bank headquartered in Orange County, California, Uniti Bank serves a diverse mix of loan and deposit customers reflecting the communities served. Since commencing operations on December 17, 2001, Uniti has provided financial solutions to individuals, professionals, small to mid - size businesses through three branches strategically located in Buena Park/Fullerton, Los Angeles Koreatown, and Garden Grove. In July 2005, Uniti Financial Corporation was formed as a bank holding company and, presently, the Bank is the sole subsidiary of the holding company .

6 Transaction Terms Aggregate Deal Value 1 Termination Fee Anticipated Closing □ Q2 2019 □ $ 63.9 million □ Price/2018 Est. EPS: 17.3x □ Price/2019 Est. EPS after cost saves: 11.6x Purchase Price Consideration Mix P/TBV Required Approvals □ Approximately $3.99 per share □ 42.4% stock and 57.6% cash based on fixed exchange ratio of 0.07234 shares of BCML stock, and $2.30 in fixed cash for each share of UIFC □ $2.0 million □ Customary regulatory approvals and UIFC shareholder approval 1) Based on BCML stock price of $ 23.39 as of December 7, 2018, and 15,415,587 common shares of UIFC outstanding and $2.4 million in for the cash out of options P/E □ 137.2% fully diluted

7 Key Transaction Assumptions Estimated Cost Savings Capital Contingency: □ 25% □ None modeled Purchase Accounting Marks Core Deposit Intangible Revenue Synergies: □ $ 1.1 million loan mark, net of elimination of discounts on purchased loans □ $1.5 million mark on mortgage servicing asset □ $2.9 million, 1.4% on non - maturity deposits □ None

8 Pro Forma Loan Portfolio 1 ) Includes combination with MyBank which closed November 30, 2018 As of September 30, 2018 Bank level regulatory data shown; does not include purchase accounting adjustments Source: Regulatory call reports, S&P Global Market Intelligence BCML¹ UIFC Pro Forma Composition Composition Composition Loan Type ($000) % of Total Loan Type ($000) % of Total Loan Type ($000) % of Total Constr & Dev 45,800 4.7% Constr & Dev 2,066 0.8% Constr & Dev 47,866 3.8% 1-4 Family Residential 91,871 9.4% 1-4 Family Residential 20,112 7.6% 1-4 Family Residential 111,983 9.0% Home Equity 12,349 1.3% Home Equity 2,983 1.1% Home Equity 15,332 1.2% Owner - Occ CRE 259,003 26.4% Owner - Occ CRE 88,671 33.7% Owner - Occ CRE 347,674 27.9% Other CRE 314,815 32.1% Other CRE 103,510 39.3% Other CRE 418,325 33.6% Multifamily 123,460 12.6% Multifamily 5,372 2.0% Multifamily 128,832 10.3% Commercial & Industrial 108,501 11.0% Commercial & Industrial 33,536 12.7% Commercial & Industrial 142,037 11.4% Consr & Other 26,291 2.7% Consr & Other 7,059 2.7% Consr & Other 33,350 2.7% Total Loans $981,709 100.0% Total Loans $263,309 100.0% Total Loans $1,245,399 100.0% MRQ Yield on Loans: 5.28% MRQ Yield on Loans: 5.80% MRQ Yield on Loans: 5.39% C&D 4.7% 1 - 4 Fam 9.4% HELOC 1.3% OwnOcc CRE 26.4% Other CRE 32.1% Multifam 12.6% C&I 11.0% Consr & Other 2.7% C&D 0.8% 1 - 4 Fam 7.6% HELOC 1.1% OwnOcc CRE 33.7% Other CRE 39.3% Multifam 2.0% C&I 12.7% Consr & Other 2.7% C&D 3.8% 1 - 4 Fam 9.0% HELOC 1.2% OwnOcc CRE 27.9% Other CRE 33.6% Multifam 10.3% C&I 11.4% Consr & Other 2.7%

9 Pro Forma Deposit Composition BCML¹ UIFC Pro Forma 1 ) Includes combination with MyBank which closed November 30, 2018 As of September 30, 2018 Bank level regulatory data shown; does not include purchase accounting adjustments Source: Regulatory call reports, S&P Global Market Intelligence Composition Composition Composition Deposit Type ($000) % of Total Deposit Type ($000) % of Total Deposit Type ($000) % of Total Non Interest Bearing 388,438 30.9% Non Interest Bearing 144,768 48.5% Non Interest Bearing 533,206 34.2% NOW & Other Trans 193,929 15.4% NOW & Other Trans 421 0.1% NOW & Other Trans 194,350 12.5% MMDA & Sav 458,075 36.4% MMDA & Sav 58,585 19.6% MMDA & Sav 516,660 33.2% Time Deposits < $100k 37,424 3.0% Time Deposits < $100k 11,777 3.9% Time Deposits < $100k 49,201 3.2% Time Deposits > $100k 180,540 14.3% Time Deposits > $100k 83,170 27.8% Time Deposits > $100k 263,710 16.9% Total Deposits $1,258,406 100.0% Total Deposits $298,721 100.0% Total Deposits $1,557,127 100.0% MRQ Cost of Deposits: 0.36% MRQ Cost of Deposits: 0.76% MRQ Cost of Deposits: 0.44% Loans / Deposits: 78.01% Loans / Deposits: 88.15% Loans / Deposits: 79.98% Non Int. Bearing 30.9% NOW Accts 15.4% MMDA & Sav 36.4% Time Deposits < $100k 3.0% Time Deposits > $100k 14.3% Non Int. Bearing 48.5% NOW Accts 0.1% MMDA & Sav 19.6% Time Deposits < $100k 3.9% Time Deposits > $100k 27.8% Non Int. Bearing 34.2% NOW Accts 12.5% MMDA & Sav 33.2% Time Deposits < $100k 3.2% Time Deposits > $100k 16.9%

10 Uniti Financial Corporation Financial Overview For the Twelve Months Ended In $000s except for per share data 12/31/15 12/31/16 12/31/17 3/31/18 6/30/18 9/30/18 Balance Sheet Total Assets $232,706 $263,488 $319,525 $316,317 $325,379 $343,578 Total Gross Loans $161,040 $200,912 $249,961 $245,342 $249,072 $262,395 Total Deposits $195,563 $223,583 $274,190 $263,820 $277,915 $294,588 Loans/Deposits 79.25% 85.52% 87.49% 88.88% 86.99% 89.07% Capital Common Equity $35,832 $38,563 $43,696 $44,554 $45,504 $46,585 Preferred Equity $0 $0 $0 $0 $0 $0 Tang. Common Equity/Tang. Assets 15.40% 14.64% 13.68% 14.09% 13.98% 13.56% Tangible Equity/Tangible Assets 15.40% 14.64% 13.68% 14.09% 13.98% 13.56% Tier 1 Capital - Bank 18.99% 16.96% 15.38% 15.97% 15.91% 15.76% Leverage Ratio - Bank 13.03% 13.66% 12.72% 12.76% 12.50% 12.64% Profitability Measures Net Interest Margin 3.40% 3.56% 3.93% 4.22% 4.26% 4.37% Non Interest Income/Average Assets 1.59% 1.71% 1.39% 1.16% 0.98% 0.94% Non Interest Expense/Average Assets 3.82% 3.79% 3.58% 3.64% 3.53% 3.57% Efficiency Ratio 78.46% 72.03% 68.81% 70.09% 67.48% 68.47% ROAA 1.09% 0.99% 1.01% 1.09% 1.17% 1.19% ROAE 7.13% 6.46% 7.36% 7.89% 8.31% 9.20% Earnings per share $0.18 $0.18 $0.21 $0.06 $0.06 $0.06 Net Income $2,364 $2,392 $3,031 $870 $936 $966 Asset Quality NPAs/Assets 0.57% 0.28% 0.28% 0.27% 0.27% 0.15% NPAs (excl TDRs)/Assets 0.51% 0.28% 0.23% 0.22% 0.22% 0.15% NCOs/Avg Loans -0.24% -0.13% 0.05% -0.04% 0.52% -0.08% Reserves/Loans 2.53% 1.84% 1.43% 1.47% 1.32% 1.27% Reserves/NPAs 306.24% 508.53% 406.81% 430.39% 694.09% NM Quarters Ended Source : S&P Global Market Intelligence