Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Golub Capital BDC 3, Inc. | gbdc3investorpresentation8.htm |

GOLUB CAPITAL BDC 3, INC. INVESTOR PRESENTATION QUARTER ENDED SEPTEMBER 30, 2018

Disclaimer Some of the statements in this presentation constitute forward-looking statements, Such forward-looking statements may include statements preceded by, followed by which relate to future events or our future performance or financial condition. The or that otherwise include the words “may,” “might,” “will,” “intend,” “should,” “could,” forward-looking statements contained in this presentation involve risks and “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,” “potential,” “plan” uncertainties, including statements as to: our future operating results; our business or similar words. prospects and the prospects of our portfolio companies; the effect of investments We have based the forward-looking statements included in this presentation on that we expect to make and the competition for those investments; our contractual information available to us on the date of this presentation. Actual results could differ arrangements and relationships with third parties; completion of a public offering of materially from those anticipated in our forward-looking statements and future our securities or other liquidity event; actual and potential conflicts of interest with results could differ materially from historical performance. You are advised to GC Advisors LLC ("GC Advisors"), our investment adviser, and other affiliates of Golub consult any additional disclosures that we may make directly to you or through Capital LLC (collectively, "Golub Capital"); the dependence of our future success on the reports that we have filed or in the future may file with the Securities and Exchange general economy and its effect on the industries in which we invest; the ability of Commission (“SEC”). our portfolio companies to achieve their objectives; the use of borrowed money to finance a portion of our investments; the adequacy of our financing sources and This presentation contains statistics and other data that have been obtained from or working capital; the timing of cash flows, if any, from the operations of our portfolio compiled from information made available by third-party service providers. We have companies; general economic and political trends and other external factors; the not independently verified such statistics or data. ability of GC Advisors to locate suitable investments for us and to monitor and In evaluating prior performance information in this presentation, you should administer our investments; the ability of GC Advisors or its affiliates to attract and remember that past performance is not a guarantee, prediction or projection of retain highly talented professionals; our ability to qualify and maintain our future results, and there can be no assurance that we will achieve similar results in qualification as a regulated investment company and as a business development the future. company; general price and volume fluctuations in the stock markets; the impact on our business of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules and regulations issued thereunder and any actions toward repeal thereof; and the effect of changes to tax legislation and our tax position. 2

Summary of Quarterly Results Fourth Fiscal Quarter 2018 Highlights − Net increase in net assets resulting from operations (i.e. net income) for the quarter ended September 30, 2018 was $2.1 million, resulting in an annualized return on equity of 10.8%. This compares to net income of $1.2 million and an annualized return on equity of 12.4% for the quarter ended June 30, 2018. − For the quarter ended September 30, 2018, new middle-market investment commitments totaled $74.8 million in 20 portfolio companies. The fair value of investments as of September 30, 2018 was $143.7 million. Overall, total investments in portfolio companies at fair value increased by $54.5 million. − The investment income yield1 for the three months ended September 30, 2018 was 10.1% as compared to 9.4% for the three months ended June 30, 2018. − On July 1, 2018, we closed on total investor capital subscriptions of $46.1 million. As of September 30, 2018, we had total investor capital subscriptions of $470.4 million and contributed capital of $85.9 million (18.3% called capital ratio). On October 1, 2018, we closed on additional capital subscriptions of $23.8 million, increasing total capital subscriptions to $494.3 million. − On October 4, 2018, October 16, 2018, November 16, 2018 and December 6, 2018, we issued capital calls of 2.0%, 3.0%, 3.0% and 7.0% respectively, of total investor commitments. 1. Investment income yield is calculated as (a) the actual amount earned on earning investments, including interest, fee income and amortization of capitalized fees and discounts, divided by the (b) daily average of total earning investments at fair value. 3

Summary of Quarterly Results Fourth Fiscal Quarter 2018 Highlights Select Financial Data Q1 2018 Q2 2018 Q3 2018 Q4 2018 New Investment Commitments $ 20,195,865 $ 47,115,720 $ 66,963,615 $74,827,297 Fair Value of Investments 17,149,979 42,826,086 89,117,105 143,658,485 Net income 97,957 656,649 1,197,371 2,115,858 Earnings per weighted average share1 0.26 0.46 0.46 0.41 Annualized return on equity – net income2 7.0% 12.5% 12.4% 10.8% Net asset value $ 15.00 $ 15.00 $ 15.00 $ 15.00 Asset Mix of New Originations Q1 2018 Q2 2018 Q3 2018 Q4 2018 Senior Secured 38% 1% 13% 10% One Stop 61% 98% 86% 89% Subordinated Debt 0% 0% 0%* 0% Equity 1% 1% 1% 1% * Represents an amount less than 1.0%. 1. Per share returns are calculated based on the daily weighted average shares outstanding during the period presented. Due to the significant changes in net assets and net income that may occur quarter-to-quarter as a result of Golub Capital BDC 3, Inc. (“we,” “us,” “our,” or the “Company”) commencing operations on October 2, 2017, earnings per weighted average share may fluctuate significantly from quarter-to-quarter and quarterly comparisons may not be meaningful. 2. Return on equity calculations are based on daily weighted average of total net assets during the period presented. 4

Portfolio Highlights – Portfolio Diversity as of September 30, 2018 Asset Mix by Loan Type Portfolio Risk Ratings September 30, 2018 Subordinated debt Investments at 1.4% 0.1% Internal Fair Value % of Performance Rating (000s) Total Portfolio 13.3% 5 $ 1,585,697 1.1% 4 142,072,788 98.9% 3 - - 2 - - 1 - - Total $ 143,658,485 100.0% 85.2% Internal Performance Ratings Definition Subordinated Debt Senior Secured Rating Definition Borrower is performing above expectations and the trends and risk One Stop Equity 5 factors are generally favorable Borrower is generally performing as expected and the risk factors 4 are neutral to favorable Borrower may be out of compliance with debt covenants; however, 3 loan payments are generally not past due Borrower is performing materially below expectations and the loan’s 2 risk has increased materially since origination Borrower is performing substantially below expectations and the 1 loan’s risk has substantially increased since origination 5

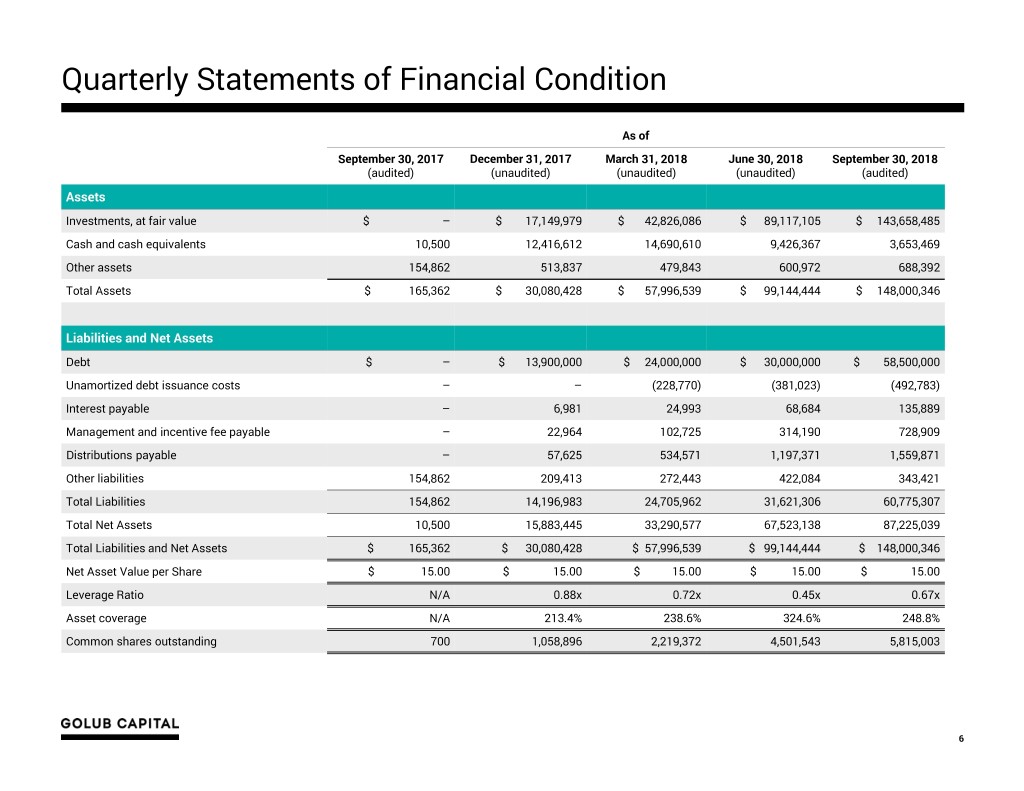

Quarterly Statements of Financial Condition As of September 30, 2017 December 31, 2017 March 31, 2018 June 30, 2018 September 30, 2018 (audited) (unaudited) (unaudited) (unaudited) (audited) Assets Investments, at fair value $ – $ 17,149,979 $ 42,826,086 $ 89,117,105 $ 143,658,485 Cash and cash equivalents 10,500 12,416,612 14,690,610 9,426,367 3,653,469 Other assets 154,862 513,837 479,843 600,972 688,392 Total Assets $ 165,362 $ 30,080,428 $ 57,996,539 $ 99,144,444 $ 148,000,346 Liabilities and Net Assets Debt $ – $ 13,900,000 $ 24,000,000 $ 30,000,000 $ 58,500,000 Unamortized debt issuance costs – – (228,770) (381,023) (492,783) Interest payable – 6,981 24,993 68,684 135,889 Management and incentive fee payable – 22,964 102,725 314,190 728,909 Distributions payable – 57,625 534,571 1,197,371 1,559,871 Other liabilities 154,862 209,413 272,443 422,084 343,421 Total Liabilities 154,862 14,196,983 24,705,962 31,621,306 60,775,307 Total Net Assets 10,500 15,883,445 33,290,577 67,523,138 87,225,039 Total Liabilities and Net Assets $ 165,362 $ 30,080,428 $ 57,996,539 $ 99,144,444 $ 148,000,346 Net Asset Value per Share $ 15.00 $ 15.00 $ 15.00 $ 15.00 $ 15.00 Leverage Ratio N/A 0.88x 0.72x 0.45x 0.67x Asset coverage N/A 213.4% 238.6% 324.6% 248.8% Common shares outstanding 700 1,058,896 2,219,372 4,501,543 5,815,003 6

Quarterly Operating Results For the quarter ended December 31, 2017 March 31, 2018 June 30, 2018 September 30, 2018 (unaudited) (unaudited) (unaudited) (unaudited) Investment Income Interest income $ 126,348 $ 644,765 $ 1,317,249 $ 2,778,867 Fee income -- 1,359 -- 130,610 Total Investment Income 126,348 646,124 1,317,249 2,909,477 Expenses Interest and other debt financing expenses 6,981 64,233 224,800 465,852 Base management fee, net of waiver 15,014 70,862 145,654 280,532 Incentive fee – net investment income, net of waiver -- 5,941 73,823 284,998 Incentive fee – capital gains 7,950 17,972 68,791 68,666 Other operating expenses, net of reimbursement waiver 1 51,449 178,197 217,668 263,106 Total Expenses 81,394 337,205 730,736 1,363,154 Excise tax -- 853 -- -- Net Investment Income after excise tax 44,954 308,066 586,513 1,546,323 Net Gain (Loss) on Investments Net realized gain (loss) on investments -- -- -- -- Net unrealized appreciation (depreciation) on investments 53,003 348,583 610,858 569,535 Net gain (loss) on investments 53,003 348,583 610,858 569,535 Net Increase in Net Assets Resulting from Operations $ 97,957 $ 656,649 $ 1,197,371 $ 2,115,858 Per Share Data Earnings per weighted average share 2 $ 0.26 $ 0.46 $ 0.46 $ 0.41 Net investment income per weighted average share 2 $ 0.12 $ 0.22 $ 0.23 $ 0.30 Distributions declared per share 3 $ 0.17 $ 0.42 $ 0.49 $ 0.39 Weighted average common shares outstanding 370,424 1,425,525 2,588,187 5,201,292 1. GC Advisors waived reimbursement of $111,783 in professional fees incurred on behalf of the Company for the quarter ended December 31, 2017. 2. Per share data is calculated based on the daily weighted average shares outstanding during the period presented. 3. Per share data are based on (i) the total distributions paid for each respective record date during the period presented divided by (ii) the total number of shares outstanding on each respective record date. Please see slide titled, “Common Stock and Distribution Information” included in this presentation for details on the distributions declared during the period. 7

Common Stock and Distribution Information Distributions Paid Amount Per Date Declared Record Date Earnings Period Shares Outstanding Payment Date Total Amount Share August 2, 2017 October 23, 2017 October 2017 248,166.664 December 28, 2017 $ 0.0461 $ 11,434 December 6, 2017 December 7, 2017 November 2017 495,633.336 December 28, 2017 0.0583 28,898 December 6, 2017 December 22, 2017 December 2017 916,833.336 February 26, 2018 0.0629 57,625 Total for Quarter Ended December 31, 2017 0.1673 97,957 December 6, 2017 January 23, 2018 January 2018 1,058,896.360 February 26, 2018 0.1153 122,078 February 6, 2018 February 23, 2018 February 2018 1,750,996.360 May 23, 2018 0.0840 147,111 February 6, 2018 March 23, 2018 March 2018 1,757,971.828 May 23, 2018 0.2204 387,460 Total for Quarter Ended March 31, 2018 0.4197 656,649 February 6, 2018 April 27, 2018 April 2018 2,219,371.824 July 24, 2018 0.1270 281,950 DistributionsMay 4, 2018 DeclaredMay 22, 2018 May 2018 2,219,371.824 July 24, 2018 0.1894 420,310 May 4, 2018 June 21, 2018 June 2018 2,804,322.532 July 24, 2018 0.1766 495,111 Total for Quarter Ended June 30, 2018 0.4930 1,197,371 May 4, 2018 July 19, 2018 July 2018 4,501,542.532 September 28, 2018 0.1235 555,987 August 7, 2018 August 31, 2018 August 2018 5,797,393.892 November 27, 2018 0.1577 914,488 September 21, August 7, 2018 September 2018 5,820,752.441 November 27, 2018 0.1113 645,383 2018 Total for Quarter Ended September 30, 2018 $ 0.3925 $ 2,115,858 8

Common Stock and Distribution Information Distributions Declared Amount Per Date Declared Record Date Earnings Period Shares Outstanding Payment Date Total Amount Share August 7, 2018 October 17, 2018 October 2018 6,474,023.277 December 28, 2018 TBD TBD November 27, 2018 November 28, 2018 November 2018 8,500,263.562 December 28, 2018 TBD TBD November 27, 2018 December 26, 2018 December 2018 TBD February 27, 2019 TBD TBD November 27, 2018 January 21, 2019 January 2019 TBD February 27, 2019 TBD TBD 9