Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Sculptor Capital Management, Inc. | d665930dex992.htm |

| EX-10.1 - EX-10.1 - Sculptor Capital Management, Inc. | d665930dex101.htm |

| 8-K - FORM 8-K - Sculptor Capital Management, Inc. | d665930d8k.htm |

Strategic Actions – Positioning for Long-Term Success December 6, 2018 Exhibit 99.1

Disclaimer Forward-Looking Statements The information contained in this presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that reflect the Company's current views with respect to, among other things, the recapitalization and other transactions described herein, including the timing for completing the recapitalization and other transactions described herein; their effect on the Company, including on the Company’s cash flows, balance sheet and earnings; the Company’s ability to create value; the Company’s growth prospects; the anticipated benefits of changing the Company’s tax classification from a partnership to a corporation (the “Conversion”); and future events and financial performance. The Company generally identifies forward-looking statements by terminology such as "outlook," "believe," "expect," "potential," "continue," "may," "will," "should," "could," "seek," "approximately," "predict," "intend," "plan," "estimate," "anticipate," "opportunity," "comfortable," "assume," "remain," "maintain," "sustain," "achieve," "see," "think," "position" or the negative version of those words or other comparable words. Any forward-looking statements contained in this presentation are based upon historical information and on the Company's current plans, estimates and expectations. The inclusion of this or other forward-looking information should not be regarded as a representation by the Company or any other person that the future plans, estimates or expectations contemplated by the Company will be achieved. The Company cautions that forward-looking statements are subject to numerous assumptions, estimates, risks and uncertainties, including but not limited to the following: global economic, business, market and geopolitical conditions; U.S. and foreign regulatory developments relating to, among other things, financial institutions and markets, government oversight, fiscal and tax policy; the outcome of third-party litigation involving the Company; the consequences of the Foreign Corrupt Practices Act settlements with the SEC and the U.S. Department of Justice; the Company's ability to implement the Conversion and the recapitalization and the other transactions described in this presentation, including obtaining all applicable consents and approvals, satisfying all conditions to effectiveness on a timely basis or at all and reaching agreement on the further agreements relating to the implementation of all such transactions, and whether the Company realizes all or any of the anticipated benefits from the Conversion and the recapitalization; whether the Conversion and the recapitalization result in any increased or unforeseen costs or have an impact on the Company's ability to retain or compete for professional talent or investor capital; conditions impacting the alternative asset management industry; the Company's ability to retain existing investor capital; the Company's ability to successfully compete for fund investors, assets, professional talent and investment opportunities; the Company's ability to retain its active executive managing directors, managing directors and other investment professionals; the Company's successful formulation and execution of its business and growth strategies; the Company's ability to appropriately manage conflicts of interest and tax and other regulatory factors relevant to the Company's business; and assumptions relating to the Company's operations, investment performance, financial results, financial condition, business prospects, growth strategy and liquidity. If one or more of these or other risks or uncertainties materialize, or if the Company's assumptions or estimates prove to be incorrect, the Company's actual results may vary materially from those indicated in these statements. These factors are not and should not be construed as exhaustive and should be read in conjunction with the other cautionary statements and risks that are included in the Company's filings with the SEC, including but not limited to the Company's Annual Report on Form 10-K for the year ended December 31, 2017, dated February 23, 2018, as well as may be updated from time to time in the Company's other SEC filings. There may be additional risks, uncertainties and factors that the Company does not currently view as material or that are not known. The Company does not undertake to update any forward-looking statement, because of new information, future developments or otherwise. This presentation does not constitute an offer of any Oz Management fund. 1

Oz Management Highlights 24 year track record delivering strong investment performance Broad suite of investment products and solutions Deep bench and long-tenured investment talent Transition plan to next generation announced Strategic actions expected to position the Company to grow assets under management 2

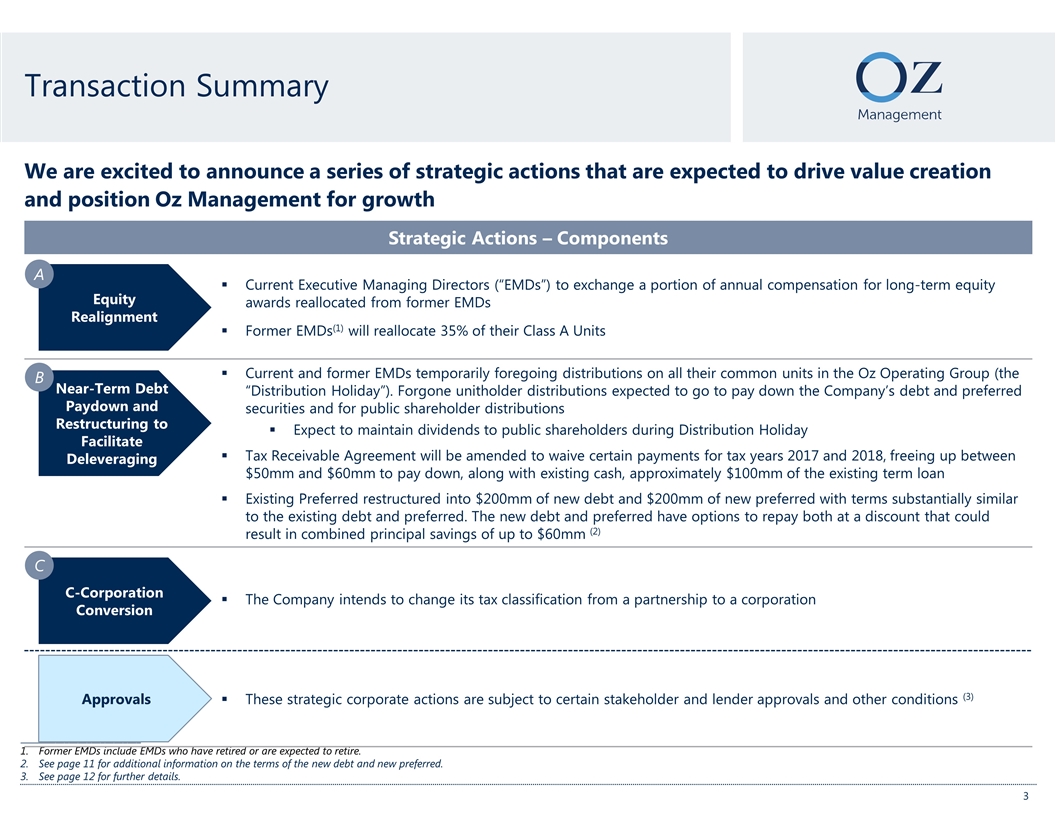

Transaction Summary We are excited to announce a series of strategic actions that are expected to drive value creation and position Oz Management for growth Strategic Corporate Actions – Components ___________________________ Former EMDs include EMDs who have retired or are expected to retire. See page 11 for additional information on the terms of the new debt and new preferred. See page 12 for further details. Current Executive Managing Directors (“EMDs”) to exchange a portion of annual compensation for long-term equity awards reallocated from former EMDs Former EMDs(1) will reallocate 35% of their Class A Units Current and former EMDs temporarily foregoing distributions on all their common units in the Oz Operating Group (the “Distribution Holiday”). Forgone unitholder distributions expected to go to pay down the Company’s debt and preferred securities and for public shareholder distributions Expect to maintain dividends to public shareholders during Distribution Holiday Tax Receivable Agreement will be amended to waive certain payments for tax years 2017 and 2018, freeing up between $50mm and $60mm to pay down, along with existing cash, approximately $100mm of the existing term loan Existing Preferred restructured into $200mm of new debt and $200mm of new preferred with terms substantially similar to the existing debt and preferred. The new debt and preferred have options to repay both at a discount that could result in combined principal savings of up to $60mm (2) The Company intends to change its tax classification from a partnership to a corporation These strategic corporate actions are subject to certain stakeholder and lender approvals and other conditions (3) Equity Realignment Near-Term Debt Paydown and Restructuring to Facilitate Deleveraging A B C-Corporation Conversion C Strategic Actions – Components Approvals 3

Strategic Rationale Materially improves long-term alignment of current EMDs Drives enhanced core earnings power Near-term repayment of Term Loan Restructuring facilitates deleveraging Simplifies shareholder tax reporting which expands eligible investor universe Positions firm to grow assets under management The strategic actions are expected to achieve a number of key objectives and unlock long-term value for all Oz Management stakeholders 4

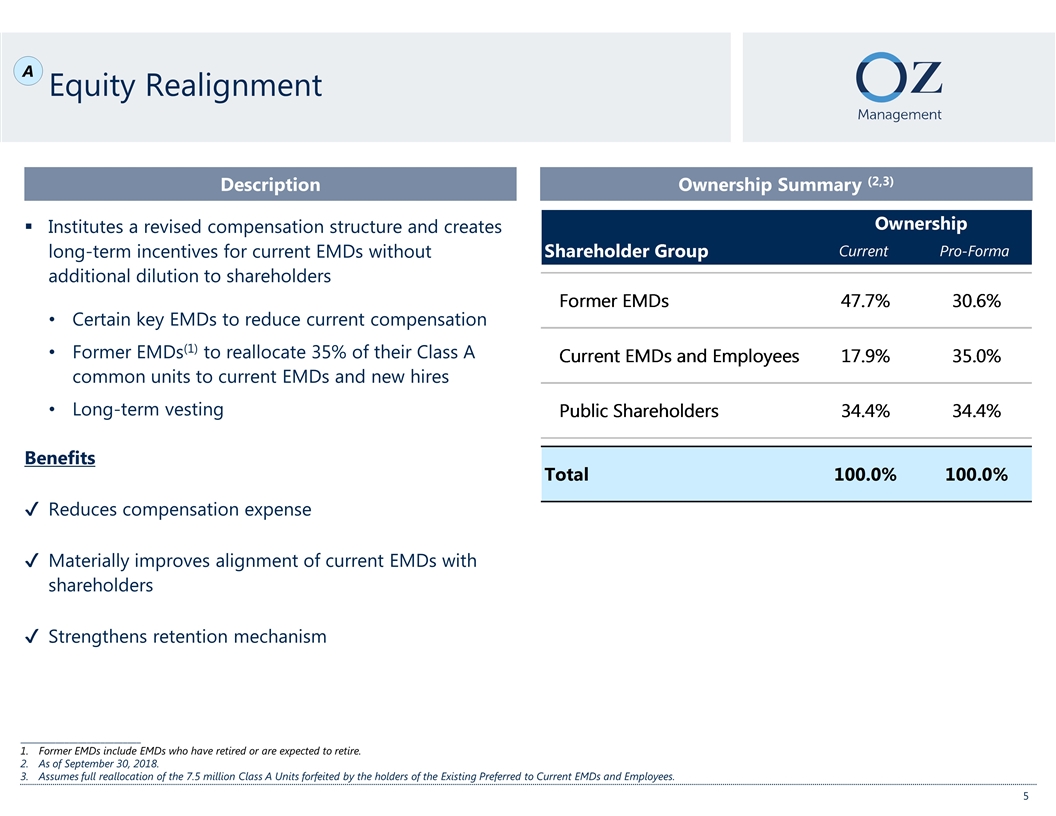

Equity Realignment Description Ownership Summary (2,3) Institutes a revised compensation structure and creates long-term incentives for current EMDs without additional dilution to shareholders Certain key EMDs to reduce current compensation Former EMDs(1) to reallocate 35% of their Class A common units to current EMDs and new hires Long-term vesting Benefits Reduces compensation expense Materially improves alignment of current EMDs with shareholders Strengthens retention mechanism A ___________________________ Former EMDs include EMDs who have retired or are expected to retire. As of September 30, 2018. Assumes full reallocation of the 7.5 million Class A Units forfeited by the holders of the Existing Preferred to Current EMDs and Employees. 5

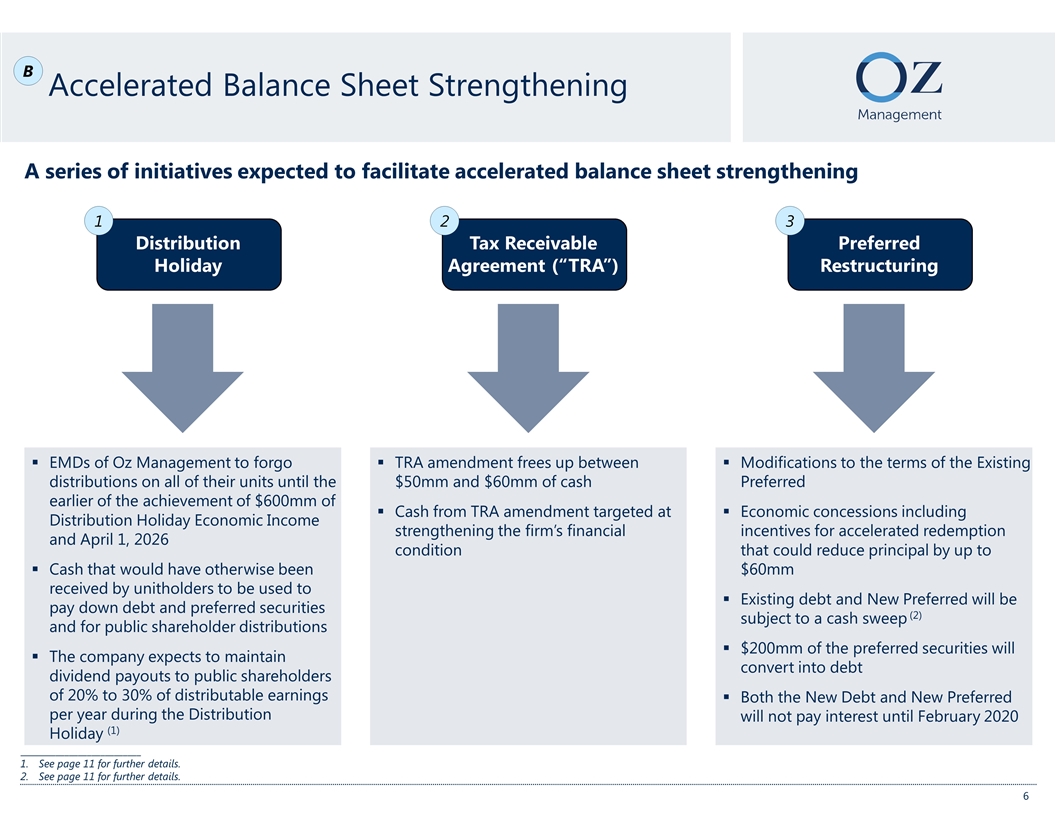

Accelerated Balance Sheet Strengthening A series of initiatives expected to facilitate accelerated balance sheet strengthening Distribution Holiday 1 Tax Receivable Agreement (“TRA”) 2 Preferred Restructuring 3 EMDs of Oz Management to forgo distributions on all of their units until the earlier of the achievement of $600mm of Distribution Holiday Economic Income and April 1, 2026 Cash that would have otherwise been received by unitholders to be used to pay down debt and preferred securities and for public shareholder distributions The company expects to maintain dividend payouts to public shareholders of 20% to 30% of distributable earnings per year during the Distribution Holiday (1) Modifications to the terms of the Existing Preferred Economic concessions including incentives for accelerated redemption that could reduce principal by up to $60mm Existing debt and New Preferred will be subject to a cash sweep (2) $200mm of the preferred securities will convert into debt Both the New Debt and New Preferred will not pay interest until February 2020 TRA amendment frees up between $50mm and $60mm of cash Cash from TRA amendment targeted at strengthening the firm’s financial condition B ___________________________ See page 11 for further details. See page 11 for further details. 6

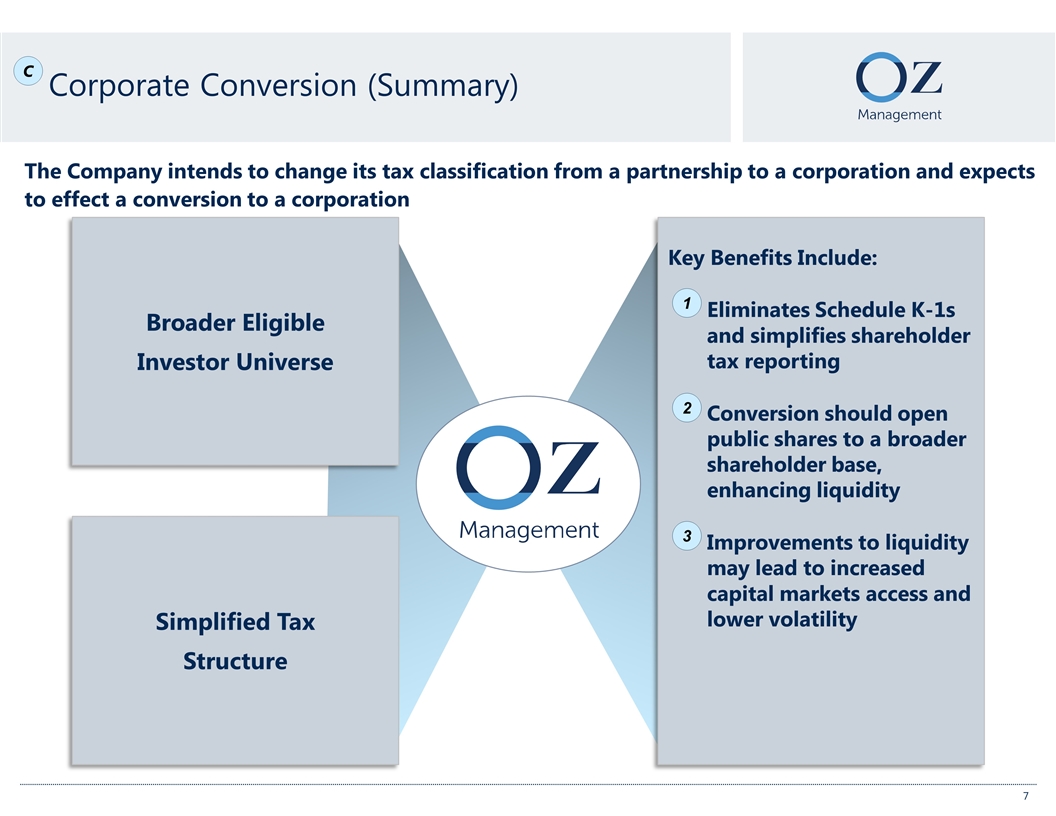

Simplified Tax Structure Broader Eligible Investor Universe Key Benefits Include: Eliminates Schedule K-1s and simplifies shareholder tax reporting Conversion should open public shares to a broader shareholder base, enhancing liquidity Improvements to liquidity may lead to increased capital markets access and lower volatility 1 2 3 The Company intends to change its tax classification from a partnership to a corporation and expects to effect a conversion to a corporation Corporate Conversion (Summary) C 7

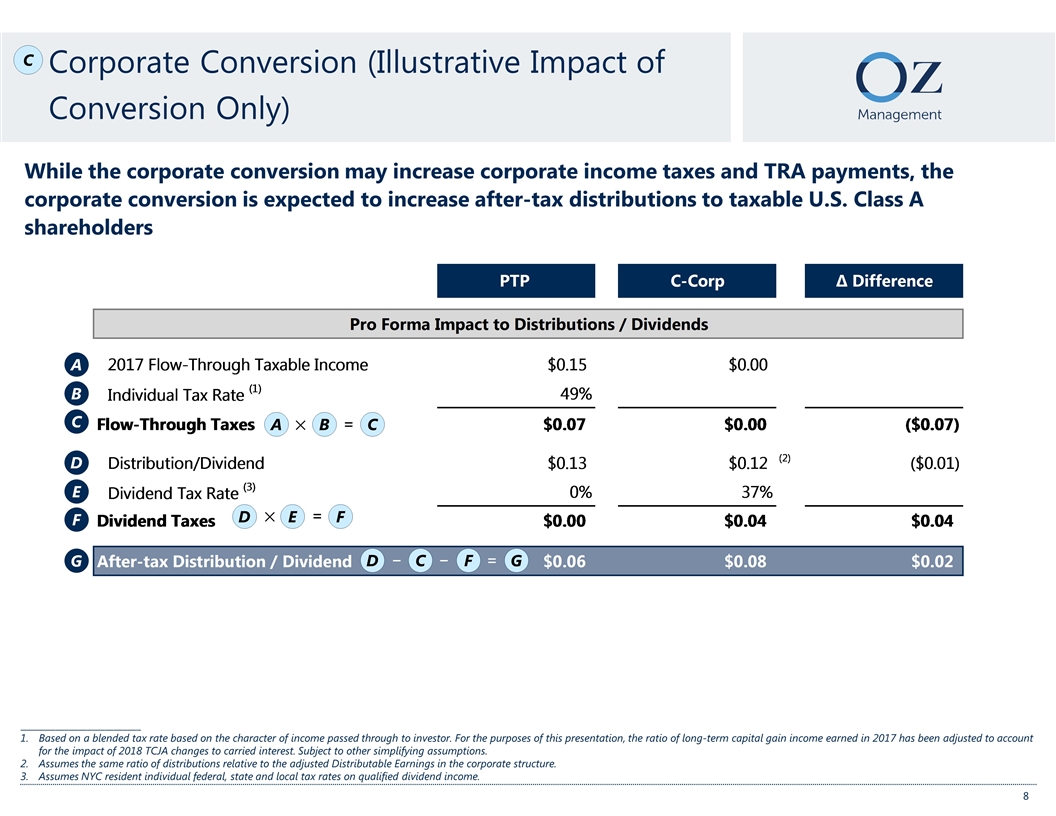

___________________________ Based on a blended tax rate based on the character of income passed through to investor. For the purposes of this presentation, the ratio of long-term capital gain income earned in 2017 has been adjusted to account for the impact of 2018 TCJA changes to carried interest. Subject to other simplifying assumptions. Assumes the same ratio of distributions relative to the adjusted Distributable Earnings in the corporate structure. Assumes NYC resident individual federal, state and local tax rates on qualified dividend income. While the corporate conversion may increase corporate income taxes and TRA payments, the corporate conversion is expected to increase after-tax distributions to taxable U.S. Class A shareholders Corporate Conversion (Illustrative Impact of Conversion Only) C A B A B C D E D E F ✕ = ✕ = D C F G − = − C F G 8

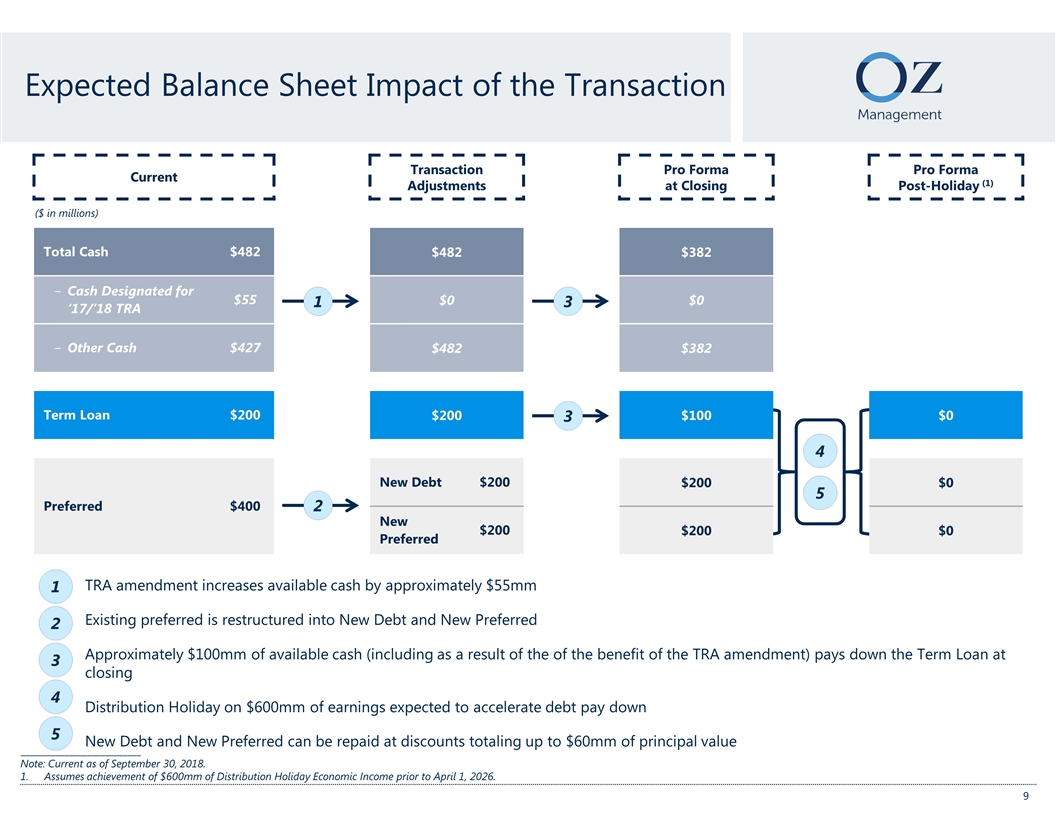

4 5 Current Transaction Adjustments Pro Forma at Closing Pro Forma Post-Holiday (1) ($ in millions) Total Cash $482 $482 $382 Cash Designated for ‘17/’18 TRA $55 $0 $0 Other Cash $427 $482 $382 Term Loan $200 $200 $100 $0 Preferred $400 New Debt $200 $200 $0 New Preferred $200 $200 $0 Expected Balance Sheet Impact of the Transaction 1 TRA amendment increases available cash by approximately $55mm Existing preferred is restructured into New Debt and New Preferred Approximately $100mm of available cash (including as a result of the of the benefit of the TRA amendment) pays down the Term Loan at closing Distribution Holiday on $600mm of earnings expected to accelerate debt pay down New Debt and New Preferred can be repaid at discounts totaling up to $60mm of principal value 1 2 3 4 5 ___________________________ Note: Current as of September 30, 2018. Assumes achievement of $600mm of Distribution Holiday Economic Income prior to April 1, 2026. 2 3 3 9

Expected Earnings Impact of the Transaction Positions firm to drive growth in assets under management Reduces compensation expense to enhance earnings power Lower interest payments from pay down of outstanding term loan Incentive to repay New Debt and New Preferred at a discount Dividend payout ratio to public shareholders of at least 20% of distributable earnings anticipated during the Distribution Holiday Dividend payout ratios expected to return to historical levels following the Distribution Holiday 10

Appendix

Preferred Securities Terms $200mm of the Existing Preferred will be restructured into debt (the “New Debt”) The New Debt will be unsecured and have a maturity date of the earlier of (i) 5 years from the repayment of the New Preferred and (ii) April 1, 2026 The New Debt will not accrue interest until February 2020, after such date New Debt will accrue interest at the rate of the 2018 Term Loan The New Debt shall be subject to mandatory, straight-line annual amortization of 20% per annum (subject to a $40mm annual limit), commencing upon the earlier of (i) the one-year anniversary of the repayment of the New Preferred and (ii) 3/31/22 For a period of nine months after the repayment of the New Preferred, the Company will have the option to voluntarily repay up to $200M of the initial New Debt at a 5% discount The remaining $200mm of the Existing Preferred will be restructured into a new preferred equity security (the “New Preferred”) which will have substantially the same terms and conditions as the Existing Preferred Except subject to certain discount termination events, the Company will have the option to voluntarily repay the remaining $200M of the New Preferred at a (1) 25% discount until 4/1/21; and then (2) 10% discount at any time between 4/1/21 and 3/31/22, and any mandatory payments as a result of the cash sweep described below will be entitled to the same discount To the extent the New Preferred is not repaid in full on or prior to 3/31/22, at the option of the holder, all or any outstanding portion of the New Preferred shall be automatically converted into debt (the “Incremental Debt”) on the same terms as the New Debt During the Distribution Holiday, on a quarterly basis, 100% of all adjusted economic income (after accounting for normalized public dividends as determined by the Board (but subject to an annual minimum of 20% of distributable earnings per year, and an annual maximum of up to 30% of distributable earnings or, if the minimum would be $0.10 or less, then up to $0.10 per public share per annum) will be applied to repay the 2018 credit facility and then repurchase the New Preferred (in each case, together with accrued interest) In no situation shall the Cash Sweep force the Company to drop below a minimum free cash balance of $200mm Additionally, any gross proceeds resulting from the realization of Accrued Unrecognized Incentive in respect of the Specified Funds (the “Designated Accrued Unrecognized Incentive”) (net of compensation) and 85% of the after tax proceeds from any asset sales or other dispositions will be used to repay the 2018 credit facility and then the New Preferred New Preferred New Debt Cash Sweep ___________________________ Note: Full details of the Preferred Securities available in the Term Sheet. 11

Conditions to Effectiveness and Additional Information The restructuring contemplated by the plan described in this presentation are, unless otherwise mutually agreed by the Company and Mr. Och, subject to and conditioned upon, among other things, (i) approval by the holders of a majority of the minority of the holders of Class A Units (which for the avoidance of doubt does not include Mr. Och or any holders of Class A Units that will receive Class E Units); (ii) with respect to the TRA Amendment, approval by the requisite beneficiaries under the TRA; (iii) approval of the senior lenders of the Company and its subsidiaries; (iv) the absence of a material adverse effect on the Company; (v) the execution of definitive release agreements by the applicable releasing parties; (vi) the receipt by Oz Management of a customary solvency opinion; (vii) the Company and its subsidiaries and certain current EMDs entering into binding management arrangements regarding commitments, compensation and restrictive covenants that are no less favorable than those set forth in the plan; and (viii) entry into of definitive documentation implementing the recapitalization and related transactions. Details about the strategic realignment and its impact to shareholders and clients are in the Company’s Current Report on Form 8-K filed on December 6, 2018 (the "Form 8-K"), and an investor presentation, which is available at http://shareholders.ozm.com. The Company encourages current or potential shareholders to read both of these documents prior to making any investment decisions. 12