Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - NEWMARK GROUP, INC. | d657782dex991.htm |

| 8-K - FORM 8-K - NEWMARK GROUP, INC. | d657782d8k.htm |

Exhibit 99.2

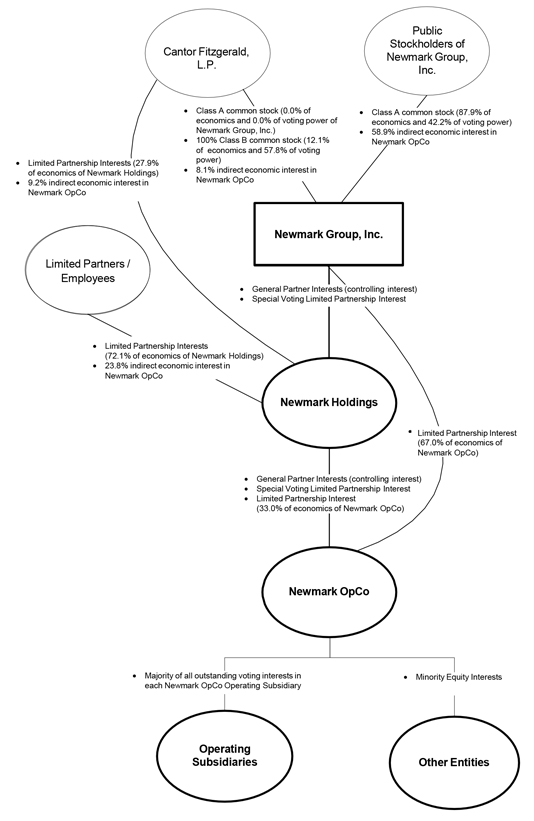

NEWMARK GROUP, INC. ORGANIZATIONAL STRUCTURE FOLLOWING THE DISTRIBUTION (SPIN-OFF)

Ownership of Newmark Group, Inc. Common Stock

As of November 30, 2018, immediately following the previously announced pro rata distribution (the “Distribution”) by BGC Partners, Inc. (“BGC Partners”) of all of the shares of common stock of Newmark Group, Inc. (“Newmark”) owned by BGC Partners as of immediately prior to the effective time of the Distribution to the holders of shares of BGC Partners common stock of record as of the close of business on November 23, 2018, 155,235,913 shares of Class A common stock of Newmark were outstanding, none of which was held by Cantor Fitzgerald, L.P., Newmark’s controlling stockholder (“Cantor”), or CF Group Management, Inc., Cantor’s managing general partner (“CFGM”). Each share of Newmark Class A common stock is entitled to one vote on matters submitted to a vote of Newmark’s stockholders.

In addition, as of November 30, 2018, immediately following the Distribution, 21,285,538 shares of Newmark Class B common stock were outstanding (which represents all of the outstanding shares of Newmark Class B common stock), all of which were held by Cantor and CFGM, representing 57.8% of Newmark’s voting power as of such date, with the stockholders of Newmark other than Cantor and CFGM holding 42.2% of the voting power in Newmark. Each share of Newmark Class B common stock is generally entitled to the same rights as a share of Newmark Class A common stock, except that, on matters submitted to a vote of Newmark’s stockholders, each share of Class B common stock is entitled to ten votes. The Newmark Class B common stock generally votes together with the Newmark Class A common stock on all matters submitted to a vote of Newmark’s stockholders.

Newmark Partnership Structure

Newmark is a holding company with no direct operations and conducts substantially all of its operations through its operating subsidiary, Newmark Partners, L.P. (“Newmark OpCo”).

Newmark holds the general partnership interest in Newmark Holdings, L.P. (“Newmark Holdings”) and the special voting limited partnership interest in Newmark Holdings, which entitle Newmark to remove and appoint the general partner of Newmark Holdings, and serve as the general partner of Newmark Holdings, which entitles Newmark to control Newmark Holdings. Newmark Holdings, in turn, holds the general partnership interest and the special voting limited partnership interest in Newmark OpCo, which entitle Newmark Holdings to remove and appoint the general partner of Newmark OpCo, and serve as the general partner of Newmark OpCo, which entitles Newmark Holdings (and indirectly Newmark) to control Newmark OpCo.

As of November 30, 2018, immediately following the Distribution, Newmark directly held Newmark OpCo limited partnership interests consisting of approximately 176,521,451 units representing 67.0% of the outstanding Newmark OpCo limited partnership interests (not including Newmark OpCo exchangeable preferred limited partnership units). As of November 30, 2018, Newmark Holdings held Newmark OpCo limited partnership interests consisting of 86,898,365 units, representing 33.0% of the outstanding Newmark OpCo limited partnership interests (not including Newmark OpCo exchangeable preferred limited partnership units).

Newmark is a holding company that holds the interests described above, serves as the general partner of Newmark Holdings and, through Newmark Holdings, acts as the general partner of Newmark OpCo. As a result of Newmark’s ownership of the general partnership interest in Newmark Holdings and Newmark Holdings’ general partnership interest in Newmark OpCo, Newmark consolidates Newmark OpCo’s results for financial reporting purposes.

Limited partnership unit holders, founding partners and Cantor directly hold Newmark Holdings limited partnership interests. As of November 30, 2018, immediately following the Distribution, excluding Preferred Units and NPSUs, the outstanding Newmark Holdings partnership interests included 57,241,165 limited partnership units, 5,405,936 founding partner units and 24,251,264 exchangeable limited partnership units held by Cantor, which exchangeable limited partnership units held by Cantor are exchangeable for shares of Newmark Class A common stock or Class B common stock at the current exchange ratio of 0.9793 shares of Newmark common stock per Newmark Holdings unit (subject to adjustment). Since Newmark Holdings in turn holds Newmark OpCo limited partnership interests, Newmark Holdings limited partnership unit holders, founding partners and Cantor indirectly hold interests in Newmark OpCo limited partnership interests.

The following diagram illustrates the ownership structure of Newmark as of November 30, 2018, immediately following the Distribution. The diagram does not reflect the various subsidiaries of Newmark, Newmark OpCo or Cantor (including certain operating subsidiaries that are organized as corporations whose equity is either wholly owned by Newmark or whose equity is majority-owned by Newmark with the remainder owned by Newmark OpCo) or the results of any exchange of Newmark Holdings exchangeable limited partnership interests or, to the extent applicable, Newmark Holdings founding partner interests, Newmark Holdings working partner interests or Newmark Holdings limited partnership units. In addition, the diagram does not reflect the Newmark OpCo exchangeable preferred limited partnership units since they are not allocated any gains or losses of Newmark OpCo for tax purposes and are not entitled to regular distributions from Newmark OpCo.

Post-Spin-Off Diagram

as of November 30, 2018

Shares of Newmark Class B common stock are convertible into shares of Newmark Class A common stock at any time in the discretion of the holder on a one-for-one basis. Accordingly, if Cantor and CFGM converted all of their shares of Newmark Class B common stock into shares of Newmark Class A common stock, Cantor and CFGM would hold 12.1% of the voting power in Newmark and the stockholders of Newmark other than Cantor and CFGM would hold 87.9% of the voting power in Newmark (and the indirect economic interests in Newmark OpCo would remain unchanged). In addition, if Cantor and CFGM continued to hold their Newmark Class B common stock and if Cantor exchanged all of the exchangeable limited partnership units held by Cantor for Newmark Class B common stock, Cantor and CFGM would hold 74.6% of the voting power in Newmark, and the stockholders of Newmark other than Cantor and CFGM would hold 25.4% of the voting power in Newmark.

Repurchases of Newmark Common Stock and Partnership Interests

As previously disclosed, Newmark’s board of directors and audit committee have authorized repurchases of shares of Newmark Class A common stock and redemptions or repurchases of limited partnership interests or other equity interests in Newmark’s subsidiaries up to $200 million. This authorization includes repurchases of stock or units from executive officers, other employees and partners, including of Cantor, as well as other affiliated persons or entities. From time to time, Newmark may actively repurchase shares of Newmark Class A common stock in the market or in private transactions, including from Cantor, Newmark’s executive officers, other employees, partners and others.

-2-