Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Mallinckrodt plc | d661728dex991.htm |

| EX-10.1 - EX-10.1 - Mallinckrodt plc | d661728dex101.htm |

| 8-K - FORM 8-K - Mallinckrodt plc | d661728d8k.htm |

| Exhibit 99.2

|

Planned Spin-Off of Specialty Generics Business

December 6, 2018

|

|

Forward-looking statements

Statements in this document that are not strictly historical, including statements regarding future clinical trials and commercial launches, future financial condition and operating results, economic, business, competitive and/or regulatory factors affecting Mallinckrodt’s businesses and any other statements regarding events or developments that the company believes or anticipates will or may occur in the future, may be “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, and involve a number of risks and uncertainties. There are a number of important factors that could cause actual events to differ materially from those suggested or indicated by such forward-looking statements and you should not place undue reliance on any such forward-looking statements.

These factors include risks and uncertainties related to, among other things:

The proposed spin-off of the Specialty Generics/API (Specialty Generics) business inclusive of Mallinckrodt’s AMITIZA® (lubiprostone) product, including the costs associated with the contemplated separation and spin-off, the expected benefits of the transaction, and the expected timeframe to complete such a transaction;

General economic conditions and conditions affecting the industries in which Mallinckrodt operates;

Mallinckrodt’s ability to obtain regulatory approval to market its products or the timing of such approval process;

The commercial success of Mallinckrodt’s products;

Mallinckrodt’s ability to realize anticipated growth, synergies and cost savings from acquisitions;

Conditions that could necessitate an evaluation of Mallinckrodt’s goodwill and/or intangible assets for possible impairment;

Changes in laws and regulations;

Mallinckrodt’s ability to successfully integrate acquisitions of operations, technology, products and businesses generally and to realize anticipated growth, synergies and cost savings;

Mallinckrodt’s and Mallinckrodt’s licensers’ ability to successfully develop or commercialize new products;

Mallinckrodt’s and Mallinckrodt’s licensers’ ability to protect intellectual property rights;

Mallinckrodt’s ability to receive procurement and production quotas granted by the U.S. Drug Enforcement Administration;

Customer concentration;

Mallinckrodt’s reliance on certain individual products that are material to its financial performance;

Cost containment efforts of customers, purchasing groups, third-party payers and governmental organizations

|

|

Forward-looking statements

The reimbursement practices of a small number of public or private insurers;

Pricing pressure on certain of Mallinckrodt’s products due to legal changes or changes in insurers’ reimbursement practices resulting from recent increased public scrutiny of healthcare and pharmaceutical costs;

Limited clinical trial data for H.P. Acthar® Gel;

Complex reporting and payment obligations under healthcare rebate programs;

Mallinckrodt’s ability to navigate price fluctuations;

Future changes to U.S. and foreign tax laws;

Mallinckrodt’s ability to achieve expected benefits from restructuring activities;

Complex manufacturing processes;

Competition;

Product liability losses and other litigation liability;

Ongoing governmental investigations;

Material health, safety and environmental liabilities;

Retention of key personnel;

Conducting business internationally;

The effectiveness of information technology infrastructure; and

Cybersecurity and data leakage risks.

These and other factors are identified and described in more detail in the “Risk Factors” section of Mallinckrodt’s Annual Report on Form 10-K for the fiscal year ended December 29, 2017. The forward-looking statements made herein speak only as of the date hereof and Mallinckrodt does not assume any obligation to update or revise any forward-looking statement, whether as a result of new information, future events and developments or otherwise, except as required by law.

|

|

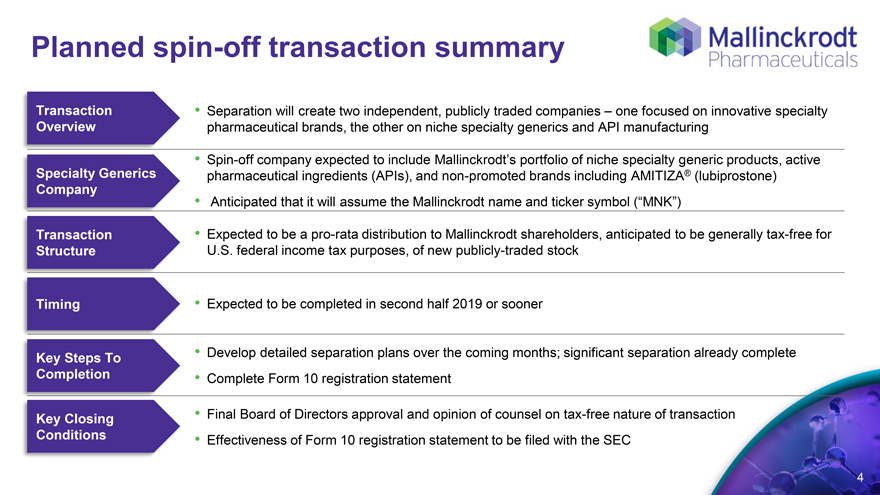

Planned spin-off transaction summary

Transaction Overview Separation will create two independent, publicly traded companies – one focused on innovative specialty pharmaceutical brands, the other on niche specialty generics and API manufacturing

Spin-off company Company expected to include Mallinckrodt’s portfolio of niche specialty generic products, active

Specialty Generics pharmaceutical ingredients (APIs), and non-promoted brands including AMITIZA® (lubiprostone)

Anticipated that it will assume the Mallinckrodt name and ticker symbol (“MNK”)

Transaction Structure Expected to be a pro-rata distribution to Mallinckrodt shareholders, anticipated to be generally tax-free for U.S. federal income tax purposes, of new publicly-traded stock

Timing Expected to be completed in second half 2019 or sooner

Key Steps To Completion Develop detailed separation plans over the coming months; significant separation already complete Complete Form 10 registration statement

Key Closing Conditions Final Board of Directors approval and opinion of counsel on tax-free nature of transaction Effectiveness of Form 10 registration statement to be filed with the SEC

4

|

|

Strategic rationale for a proposed separation

Anticipated second half 2019 or sooner

Creates two independent, publicly traded companies, each with resources to plan for success and be positioned for sustainable growth

Reflects two distinct markets and business models with separate fundamental drivers

Allows respective management teams to commit to long-term strategic priorities aligned with each company’s stakeholders, which is expected to unlock value

Enables distinct, focused investment strategies in innovation to drive each company’s long-term growth

Provides investors with separate businesses focused on two distinct strategies

5

|

|

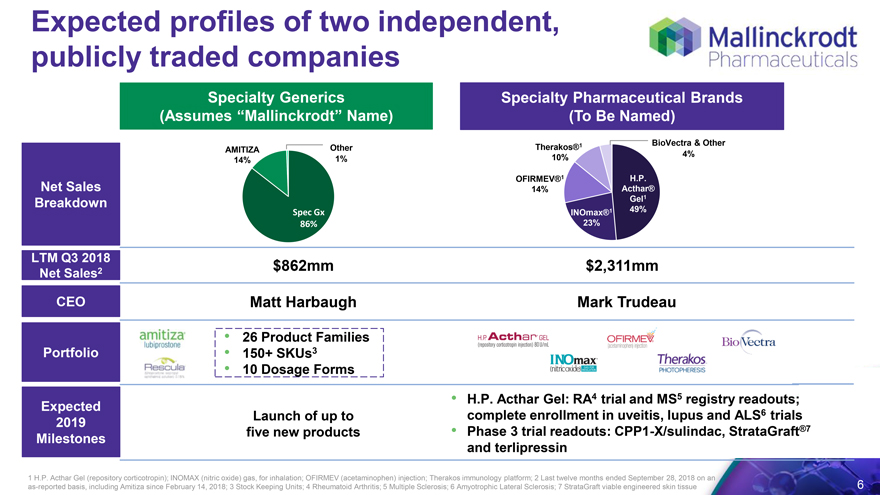

Expected profiles of two independent, publicly traded companies

Specialty Generics (Assumes “Mallinckrodt” Name) Specialty Pharmaceutical Brands (To Be Named)

1 BioVectra & Other AMITIZA Other Therakos® 10% 4% 14% 1%

Net Sales Breakdown OFIRMEV®1 H.P.

14% Acthar®

Gel1

Spec Gx INOmax®1 49%

86% 23%

LTM Q3 2018

2 $862mm $2,311mm

Net Sales

CEO Matt Harbaugh Mark Trudeau

26 Product Families

6

Portfolio 150+ SKUs3

10 Dosage Forms

Expected H.P. Acthar Gel: RA4 trial and MS5 registry readouts; 2019 Launch of up to complete enrollment in uveitis, lupus and ALS6 trials Milestones five new products Phase 3 trial readouts: CPP1-X/sulindac, StrataGraft®7 and terlipressin

1 H.P. Acthar Gel (repository corticotropin); INOMAX (nitric oxide) gas, for inhalation; OFIRMEV (acetaminophen) injection; Therakos immunology platform; 2 Last twelve months ended September 28, 2018 on an as-reported basis, including Amitiza since February 14, 2018; 3 Stock Keeping Units; 4 Rheumatoid Arthritis; 5 Multiple Sclerosis; 6 Amyotrophic Lateral Sclerosis; 7 StrataGraft viable engineered skin tissue 6

|

|

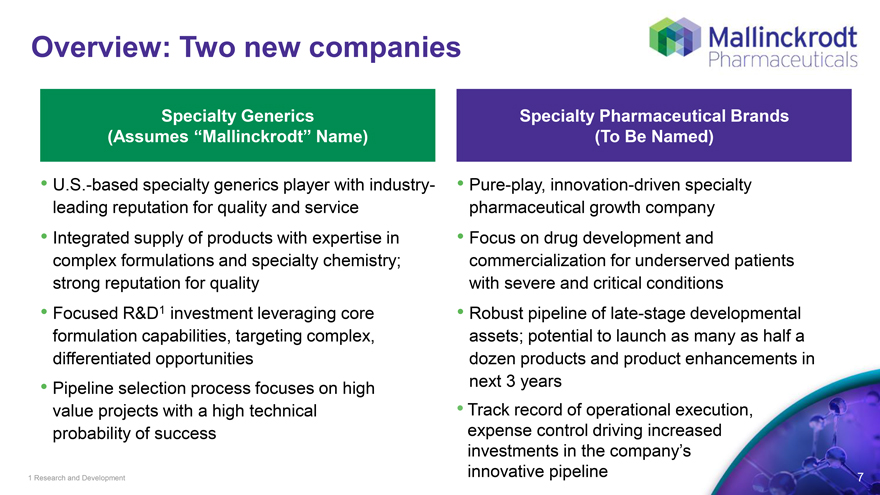

Overview: Two new companies

Specialty Generics Specialty Pharmaceutical Brands

(Assumes “Mallinckrodt” Name) (To Be Named)

U.S.-based specialty generics player with industry- Pure-play, innovation-driven specialty leading reputation for quality and service pharmaceutical growth company

Integrated supply of products with expertise in Focus on drug development and complex formulations and specialty chemistry; commercialization for underserved patients strong reputation for quality with severe and critical conditions

Focused R&D1 investment leveraging core Robust pipeline of late-stage developmental formulation capabilities, targeting complex, assets; potential to launch as many as half a differentiated opportunities dozen products and product enhancements in

Pipeline selection process focuses on high next 3 years value projects with a high technical Track record of operational execution, probability of success expense control driving increased investments in the company’s innovative pipeline

1 Research and Development 7

|

|

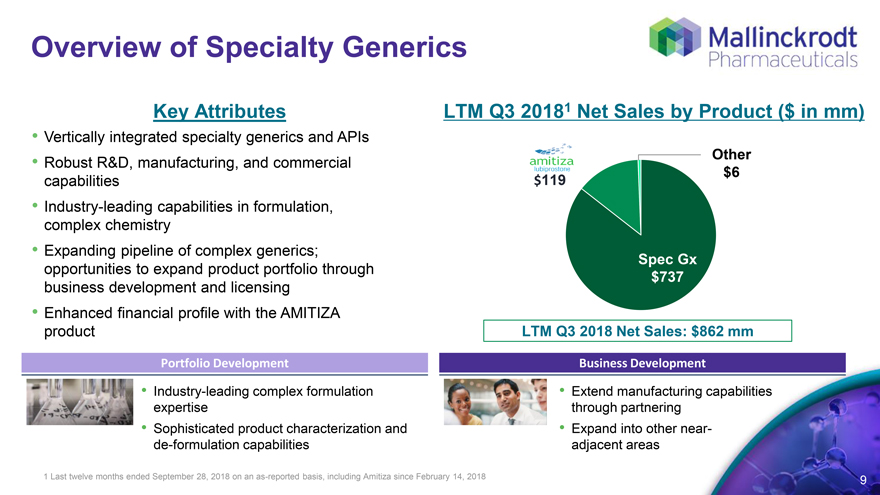

Overview of Specialty Generics

|

|

Overview of Specialty Generics

Key Attributes LTM Q3 2018 1 Net Sales by Product ($ in mm)

Vertically integrated specialty generics and APIs

Other

Robust R&D, manufacturing, and commercial capabilities $119 $6

Industry-leading capabilities in formulation, complex chemistry

Expanding pipeline of complex generics;

opportunities to expand product portfolio through business development and licensing Spec Gx $737

Enhanced financial profile with the AMITIZA product LTM Q3 2018 Net Sales: $862 mm

Portfolio Development Business Development

Industry-leading complex formulation expertise Extend manufacturing capabilities through partnering

Sophisticated product characterization and de-formulation capabilities Expand into other near- adjacent areas

1 Last twelve months ended September 28, 2018 on an as-reported basis, including Amitiza since February 14, 2018 9

|

|

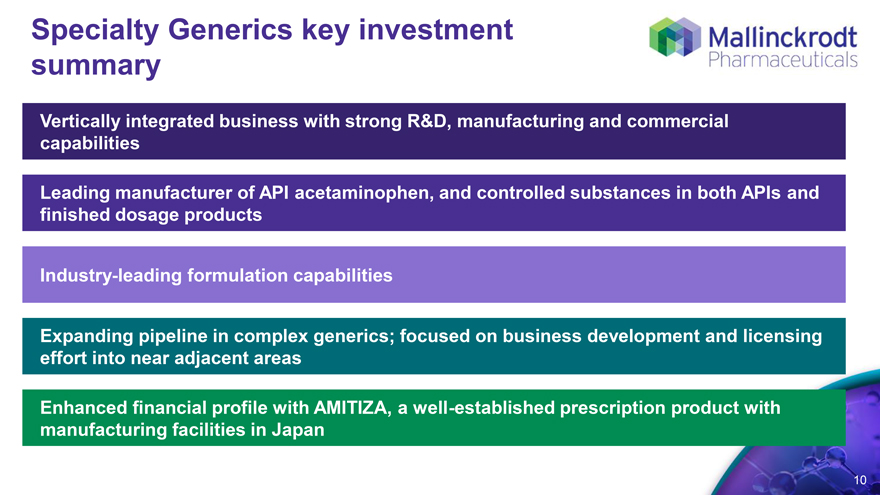

Specialty Generics key investment summary

Vertically integrated business with strong R&D, manufacturing and commercial capabilities

Leading manufacturer of API acetaminophen, and controlled substances in both APIs and finished dosage products

Industry-leading formulation capabilities

Expanding pipeline in complex generics; focused on business development and licensing effort into near adjacent areas

Enhanced financial profile with AMITIZA, a well-established prescription product with manufacturing facilities in Japan

10

|

|

Overview of Innovation-Driven Specialty Pharmaceutical Brands

|

|

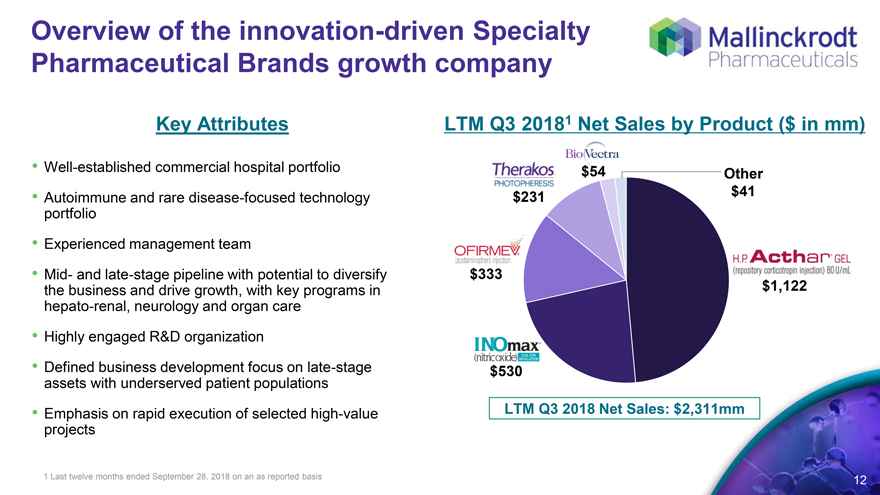

Overview of the innovation-driven Specialty Pharmaceutical Brands growth company

Key Attributes LTM Q3 2018 1 Net Sales by Product ($ in mm)

Well-established commercial hospital portfolio $54

Other

Autoimmune and rare disease-focused technology portfolio $231 $41

Experienced management team

Mid- and late-stage pipeline with potential to diversify the business and drive growth, with key programs in hepato-renal, neurology and organ care $333 $1,122

Highly engaged R&D organization

Defined business development focus on late-stage assets with underserved patient populations $530

Emphasis on rapid execution of selected high-value projects LTM Q3 2018 Net Sales: $2,311mm

1 Last twelve months ended September 28, 2018 on an as reported basis 12

|

|

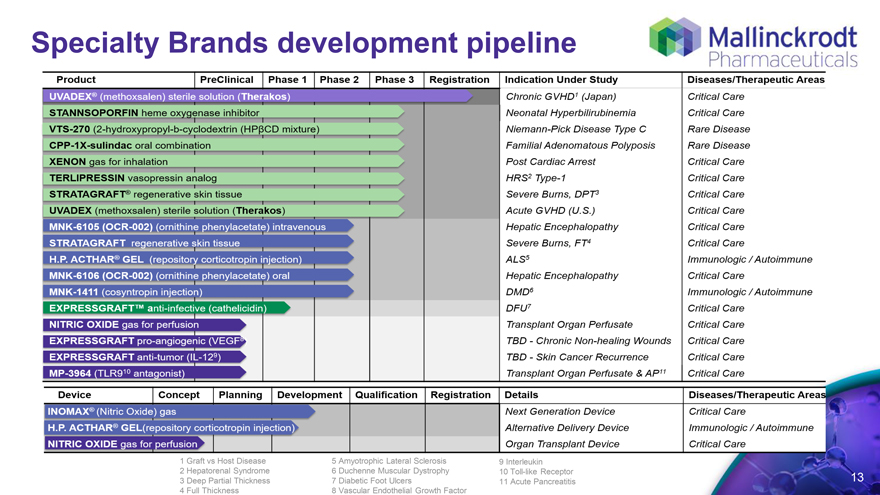

Specialty Brands development pipeline

Product Preclinical phase 1 phase 2 phase 3 registration indication under study disease/therapecutic areas

1 Graft vs Host Disease 5 Amyotrophic Lateral Sclerosis 9 Interleukin

2 Hepatorenal Syndrome 6 Duchenne Muscular Dystrophy 10 Toll-like Receptor

3 Deep Partial Thickness 7 Diabetic Foot Ulcers 11 Acute Pancreatitis 13

4 Full Thickness 8 Vascular Endothelial Growth Factor

Specialty Brands development pipeline

UVADEX® (methoxsalen) sterile solution (Therakos) STANNSOPORFIN heme oxygenase inhibitor VTS-270 (2-hydroxypropyl-b-cyclodextrin (HPßCD mixture) CPP-1X-sulindac oral combination XENON gas for inhalation TERLIPRESSIN vasopressin analog STRATAGRAFT® regenerative skin tissue UVADEX (methoxsalen) sterile solution (Therakos) MNK-6105 (OCR-002) (ornithine phenylacetate) intravenous STRATAGRAFT regenerative skin tissue H.P. ACTHAR® GEL (repository corticotropin injection)

MNK-6106 (OCR-002) (ornithine phenylacetate) oral MNK-1411 (cosyntropin injection) EXPRESSGRAFT™ anti-infective (cathelicidin) NITRIC OXIDE gas for perfusion EXPRESSGRAFT pro-angiogenic (VEGF8)

EXPRESSGRAFT anti-tumor (IL-129) MP-3964 (TLR910 antagonist) device concept

Planning I Development Qualification Registration, details, disease/therapecutic areas INOMAX® (Nitric Oxide) gas H.P. ACTHAR® GEL(repository corticotropin injection) NITRIC OXIDE gas for perfusion

Indication Under Study

Chronic GVHD 1 (Japan) Neonatal Hyperbilirubinemia

Niemann-Pick Disease Type C Familial Adenomatous Polyposis Post Cardiac Arrest HRS 2 Type-1 Severe Burns, DPT 3 Acute GVHD (U.S.) Hepatic Encephalopathy Severe Burns, FT 4 ALS 5 Hepatic Encephalopathy DMD 6 DFU 7 Transplant Organ Perfusate TBD - Chronic Non-healing Wounds TBD - Skin Cancer Recurrence Transplant Organ Perfusate &AP 11

Details

Next Generation Device Alternative Delivery Device Organ Transplant Device

Diseases/therapeutics areas

Critical Care Critical Care

Critical Care Critical Care Critical Care Critical Care Critical Care Critical Care rare disease immunologic/Autoimmune Critical Care immunologic/Autoimmune Critical Care Critical Care Critical Care

Critical Care Critical Care

Critical Care

Immunologic / Autoimmune Critical Care

|

|

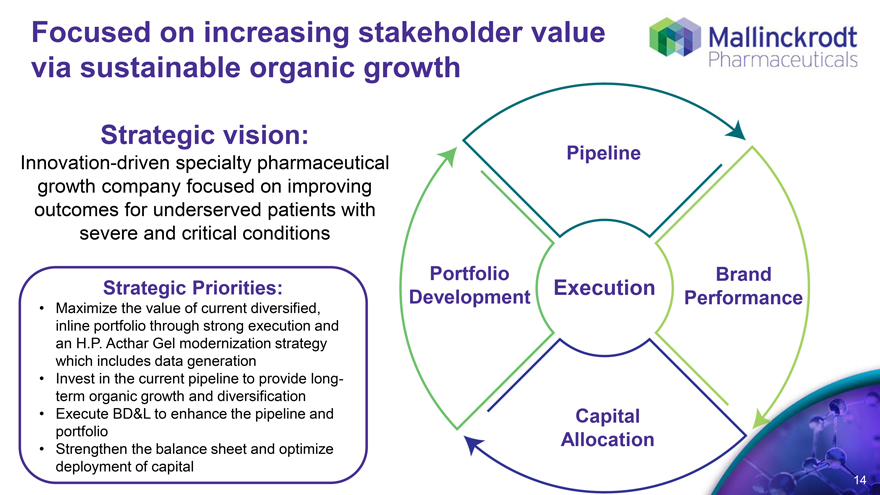

Focused on increasing stakeholder value via sustainable organic growth

Strategic vision:

Innovation-driven specialty pharmaceutical growth company focused on improving outcomes for underserved patients with severe and critical conditions

Strategic Priorities:

Maximize the value of current diversified, inline portfolio through strong execution and an H.P. Acthar Gel modernization strategy which includes data generation

Invest in the current pipeline to provide long-term organic growth and diversification

Execute BD&L to enhance the pipeline and portfolio

Strengthen the balance sheet and optimize deployment of capital

Pipeline

Portfolio Development Brand Performance

Execution

Capital Allocation

14

|

|

Thank you

Mallinckrodt, the “M” brand mark, the Mallinckrodt Pharmaceuticals logo and other brands 15 are trademarks of a Mallinckrodt company. © 2018 Mallinckrodt.