Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAMBRIDGE BANCORP | catc-8k_20181205.htm |

| EX-99.1 - EX-99.1 - CAMBRIDGE BANCORP | catc-ex991_7.htm |

| EX-2.1 - EX-2.1 - CAMBRIDGE BANCORP | catc-ex21_119.htm |

Cambridge Bancorp Announces Merger with Optima Bank & Trust Company December 5, 2018 Nasdaq: CATC Ex: 99.2 Ex: 99.2 Cambridge Bancorp Cambridge Bancorp Announces Merger with Optima Bank & Trust Company Cambridge Trust PRIVATE BANKING WEALTH MANAGEMENT Optima BANK & TRUST December 5, 2018 Nasdaq: CATC

Forward Looking Statements & Disclosures This presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about Cambridge Bancorp (together with its bank subsidiary unless the context otherwise requires, “Cambridge” or the “Company”) and its industry involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding the Company’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact of any laws or regulations applicable to the Company, are forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Such factors are described within the Company’s filings with the Securities & Exchange Commission. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to the following: (1) the businesses of Cambridge and Optima may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of Optima may fail to approve the merger; (6) changes to interest rates, (7) the ability to control costs and expenses, (8) general economic conditions, (9)the success of the Company’s efforts to diversify its revenue base by developing additional sources of non-interest income while continuing to manage its existing fee-based business, and (10) risks associated with the quality of the Company’s assets and the ability of its borrowers to comply with repayment terms. Further information about these and other relevant risks and uncertainties may be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and in subsequent filings with the Securities and Exchange Commission. The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements. Important Additional Information and Where to Find It The Company intends to file with the SEC a Registration Statement on Form S-4 relating to the proposed merger as well as the proxy statement/prospectus of Optima for the solicitation of proxies from Optima’s shareholders. SHAREHOLDERS OF THE COMPANY AND OPTIMA ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the proxy statement/prospectus, as well as other filings containing information about the Company and Optima, may be obtained at the SEC’s website at http://www.sec.gov. In addition, copies of the proxy statement/prospectus can also be obtained free of charge by directing a request to Cambridge Bancorp, 1336 Massachusetts Avenue, Cambridge, MA 02138, attention: Corporate Secretary (617) 876-5500. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Forward Looking Statements & Disclosures This presentation contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements about Cambridge Bancorp (together with its bank subsidiary unless the context otherwise requires, “Cambridge” or the “Company”) and its industry involve substantial risks and uncertainties. Statements other than statements of current or historical fact, including statements regarding the Company’s future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact of any laws or regulations applicable to the Company, are forward-looking statements. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward-looking statements. Such statements are subject to factors that could cause actual results to differ materially from anticipated results. Such factors are described within the Company’s filings with the Securities & Exchange Commission. Among the risks and uncertainties that could cause actual results to differ from those described in the forward-looking statements include, but are not limited to the following: (1) the businesses of Cambridge and Optima may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of Optima may fail to approve the merger; (6) changes to interest rates, (7) the ability to control costs and expenses, (8) general economic conditions, (9)the success of the Company’s efforts to diversify its revenue base by developing additional sources of non-interest income while continuing to manage its existing fee-based business, and (10) risks associated with the quality of the Company’s assets and the ability of its borrowers to comply with repayment terms. Further information about these and other relevant risks and uncertainties may be found in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2017 and in subsequent filings with the Securities and Exchange Commission.The Company does not undertake, and specifically disclaims any obligation, to publicly release the result of any revisions which may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. You are cautioned not to place undue reliance on these forward-looking statements. Important Additional Information and Where to Find It The Company intends to file with the SEC a Registration Statement on Form S-4 relating to the proposed merger as well as the proxy statement/prospectus of Optima for the solicitation of proxies from Optima’s shareholders. SHAREHOLDERS OF THE COMPANY AND OPTIMA ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the proxy statement/prospectus, as well as other filings containing information about the Company and Optima, may be obtained at the SEC’s website at http://www.sec.gov. In addition, copies of the proxy statement/prospectus can also be obtained free of charge by directing a request to Cambridge Bancorp, 1336 Massachusetts Avenue, Cambridge, MA 02138, attention: Corporate Secretary (617) 876-5500. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.Cambridge Bancorp

Transaction Rationale In-Market Acquisition Strengthening our Existing New Hampshire Franchise Provides established commercial banking franchise to complement Cambridge Trust’s presence in the attractive and familiar southern New Hampshire market Cambridge has provided wealth management services in southern New Hampshire since 1996, and currently manages over $1 billion of wealth assets in three New Hampshire offices Acquisition provides the ability to: Utilize Cambridge’s commercial lending expertise and higher legal lending limit to expand and diversify banking relationships with Optima’s existing clients Extend local banking services to Cambridge’s existing New Hampshire-based wealth management clients Provide wealth management services to Optima’s banking clients Addition of talented banking team with significant experience in southern New Hampshire: Daniel Morrison; Chairman, President, and CEO Pamela Morrison; Chief Administrative Officer William Young; Chief Lending Officer All have been with Optima since inception Financially Attractive Immediately accretive to Cambridge earnings per share, with a compelling internal rate of return and acceptable tangible book value dilution earnback period. Low Risk Transaction Low execution risk reflecting cultural compatibility: Retention of local management team and key personnel Shared lending discipline and conservative approach to banking Established track record of strong asset quality metrics Transaction Rationale In-Market Acquisition Strengthening our Existing New Hampshire Franchise Provides established commercial banking franchise to complement Cambridge Trust’s presence in the attractive and familiar southern New Hampshire market Cambridge has provided wealth management services in southern New Hampshire since 1996, and currently manages over $1 billion of wealth assets in three New Hampshire offices Acquisition provides the ability to: Utilize Cambridge’s commercial lending expertise and higher legal lending limit to expand and diversify banking relationships with Optima’s existing clients Extend local banking services to Cambridge’s existing New Hampshire-based wealth management clients Provide wealth management services to Optima’s banking clients Addition of talented banking team with significant experience in southern New Hampshire: Daniel Morrison; Chairman, President, and CEO - William Young; Chief Lending Officer Pamela Morrison; Chief Administrative Officer - All have been with Optima since inception Financially Attractive Immediately accretive to Cambridge earnings per share, with a compelling internal rate of return and acceptable tangible book value dilution earnback period. Low Risk Transaction Low execution risk reflecting cultural compatibility: Retention of local management team and key personnel Shared lending discipline and conservative approach to banking Established track record of strong asset quality metrics Cambridge Bancorp

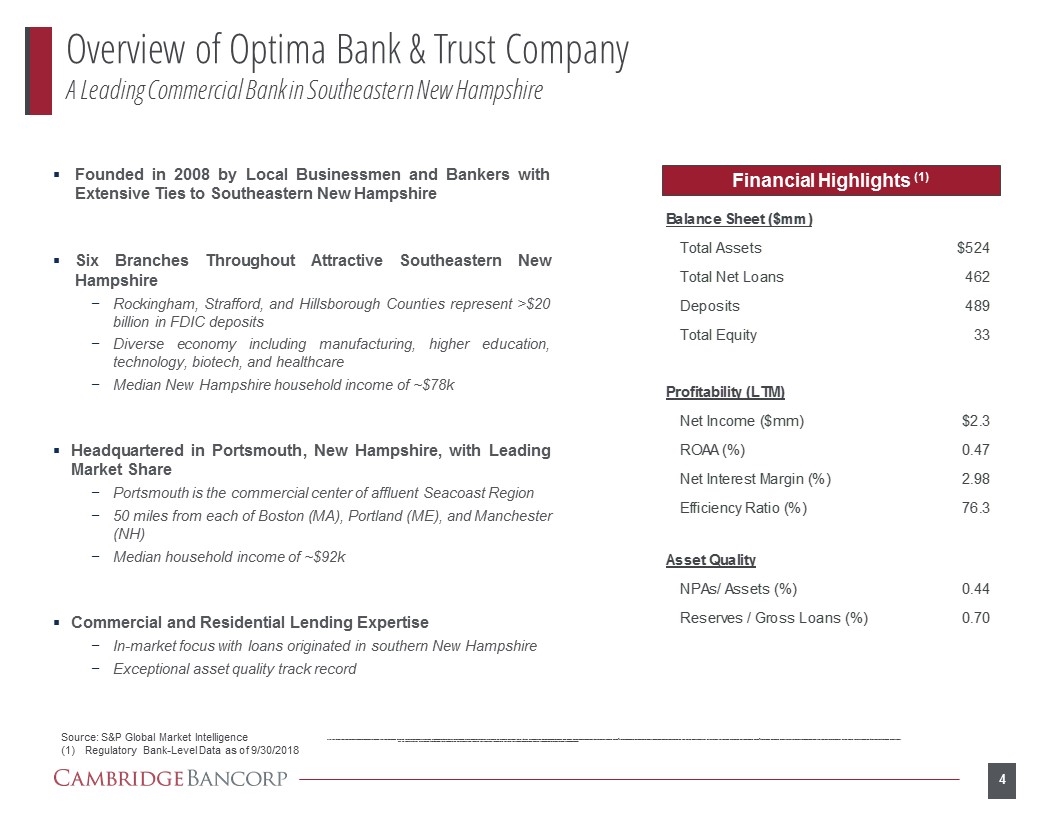

Financial Highlights (1) Source: S&P Global Market Intelligence Regulatory Bank-Level Data as of 9/30/2018 Overview of Optima Bank & Trust Company A Leading Commercial Bank in Southeastern New Hampshire Founded in 2008 by Local Businessmen and Bankers with Extensive Ties to Southeastern New Hampshire Six Branches Throughout Attractive Southeastern New Hampshire Rockingham, Strafford, and Hillsborough Counties represent >$20 billion in FDIC deposits Diverse economy including manufacturing, higher education, technology, biotech, and healthcare Median New Hampshire household income of ~$78k Headquartered in Portsmouth, New Hampshire, with Leading Market Share Portsmouth is the commercial center of affluent Seacoast Region 50 miles from each of Boston (MA), Portland (ME), and Manchester (NH) Median household income of ~$92k Commercial and Residential Lending Expertise In-market focus with loans originated in southern New Hampshire Exceptional asset quality track record Overview of Optima Bank & Trust Company A Leading Commercial Bank in Southeastern New Hampshire Founded in 2008 by Local Businessmen and Bankers with Extensive Ties to Southeastern New Hampshire Six Branches Throughout Attractive Southeastern New Hampshire Rockingham, Strafford, and Hillsborough Counties represent >$20 billion in FDIC deposits Diverse economy including manufacturing, higher education, technology, biotech, and healthcare Median New Hampshire household income of ~$78k Headquartered in Portsmouth, New Hampshire, with Leading Market Share Portsmouth is the commercial center of affluent Seacoast Region 50 miles from each of Boston (MA), Portland (ME), and Manchester (NH) Median household income of ~$92k Commercial and Residential Lending Expertise In-market focus with loans originated in southern New Hampshire Exceptional asset quality track record Financial Highlights(1) Balance Sheet ($mm) Total Assets $524 Total Net Loans 462 Deposits489 Total Equity 33 Profitability (LTM) Net Income ($mm) $2.3 ROAA (%) 0.47 Net Interest Margin (%) 2.98 Efficiency Ratio (%) 76.3 Asset Quality NPAs/ Assets (%) 0.44 Reserves / Gross Loans (%) 0.70 Source: S&P Global Market Intelligence (1)Regulatory Bank-Level Data as of 9/30/2018 Cambridge Bancorp

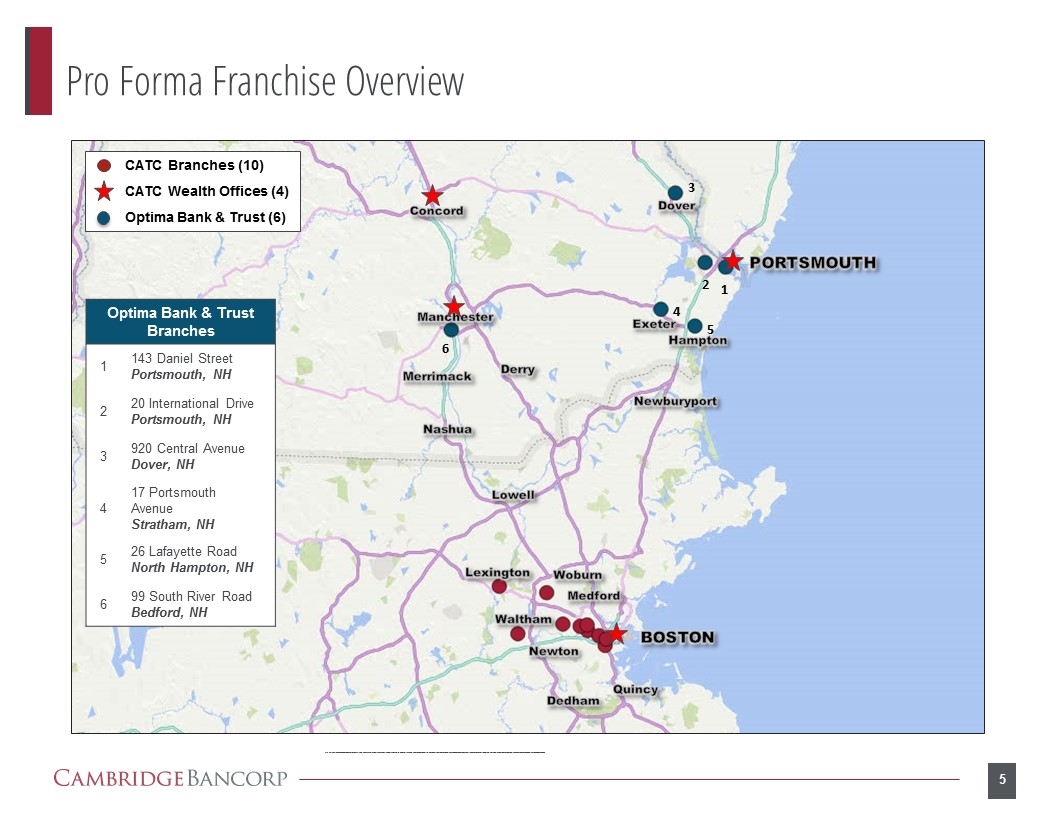

Waltham Pro Forma Franchise Overview CATC Branches (10) CATC Wealth Offices (4) Optima Bank & Trust (6) 1 2 3 4 5 6 Optima Bank & Trust Branches 1 143 Daniel Street Portsmouth, NH 2 20 International Drive Portsmouth, NH 3 920 Central Avenue Dover, NH 4 17 Portsmouth Avenue Stratham, NH 5 26 Lafayette Road North Hampton, NH 6 99 South River Road Bedford, NH BOSTON PORTSMOUTH Manchester Concord Dover Hampton Exeter Newton Lexington Woburn Medford Lowell Newburyport Nashua Merrimack Derry Dedham Quincy Pro Forma Franchise Overview CATC Branches (10) CATC Wealth Offices (4) Optima Bank & Trust (6) Optima Bank & Trust Branches 1 143 Daniel Street Portsmouth, NH 2 20 International Drive Portsmouth, NH 3 920 Central Avenue Dover, NH 4 17 Portsmouth Avenue Stratham, NH 5 26 Lafayette Road North Hampton, NH 6 99 South River Road Bedford, NH Cambridge Bancorp

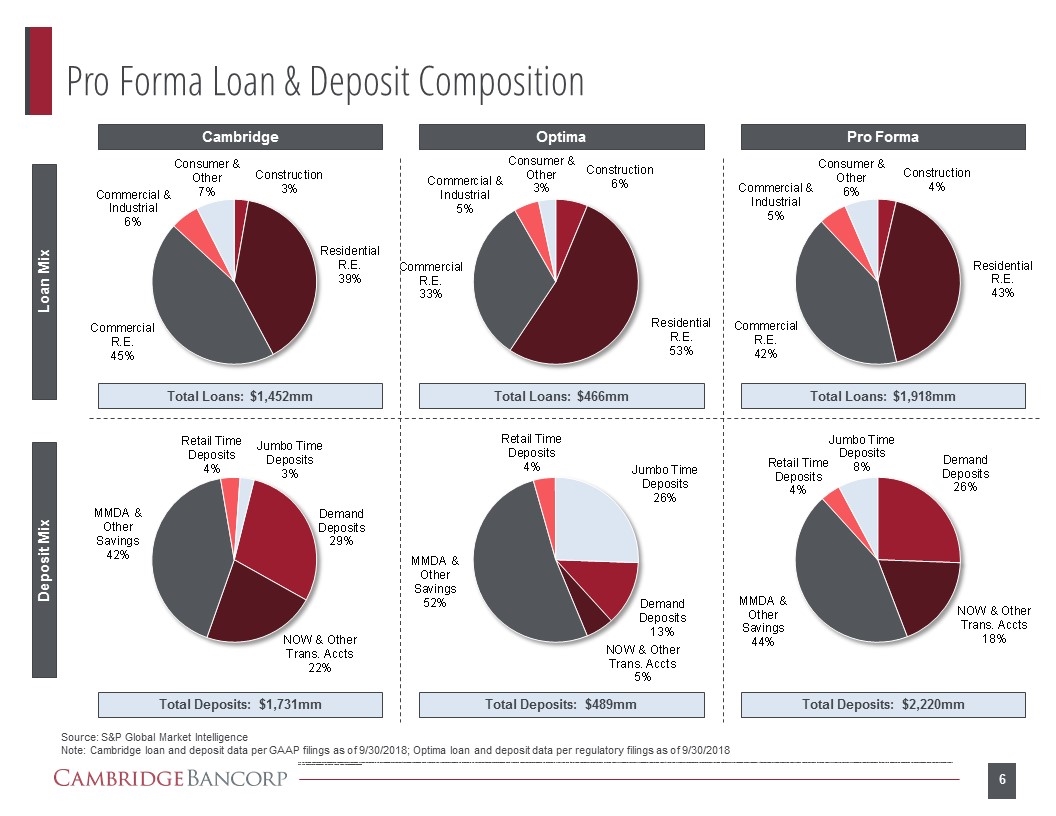

Pro Forma Loan & Deposit Composition Source: S&P Global Market Intelligence Note: Cambridge loan and deposit data per GAAP filings as of 9/30/2018; Optima loan and deposit data per regulatory filings as of 9/30/2018 Total Loans: $1,452mm Total Loans: $466mm Total Loans: $1,918mm Total Deposits: $1,731mm Total Deposits: $489mm Total Deposits: $2,220mm Cambridge Optima Pro Forma Loan Mix Deposit Mix Pro Forma Loan & Deposit Composition Cambridge Consumer & Other Construction 3% Commercial & 7% Industrial 6% Commercial R.E. 45% Residential R.E. 39% Total Loans: $1,452mm Optima Commercial & Industrial 5% Consumer & Other 3% Construction 6% Residential R.E. 53% Commercial R.E. 33% Total Loans: $466mm Pro Forma Commercial & Industrial 5% Consumer & Other 6% Construction 4% Residential R.E. 43% Commercial R.E. 42% Total Loans: $1,918mm Retail Time Deposits 4% Jumbo Time Deposits 3% Demand Deposits 29% NOW & Other Trans. Accts 22% MMDA & Other Savings 42% Total Deposits: $1,731mm Retail Time Deposits 4% Jumbo Time Deposits 26% Demand Deposits 13% NOW & Other Trans. Accts 5% MMDA & Other Savings 52% Total Deposits: $489mm Jumbo Time Jumbo Time Deposits Retail Time 8% Deposits Retail Time 8% Deposits 4% Demand Deposits 26% NOW & Other Trans. Accts 18% MMDA & Other Savings 44% Total Deposits: $2,220mm Source: S&P Global Market Intelligence Note: Cambridge loan and deposit data per GAAP filings as of 9/30/2018; Optima loan and deposit data per regulatory filings as of 9/30/2018 Loan Mix Deposit Mix CAMBRIDGE BANCORP

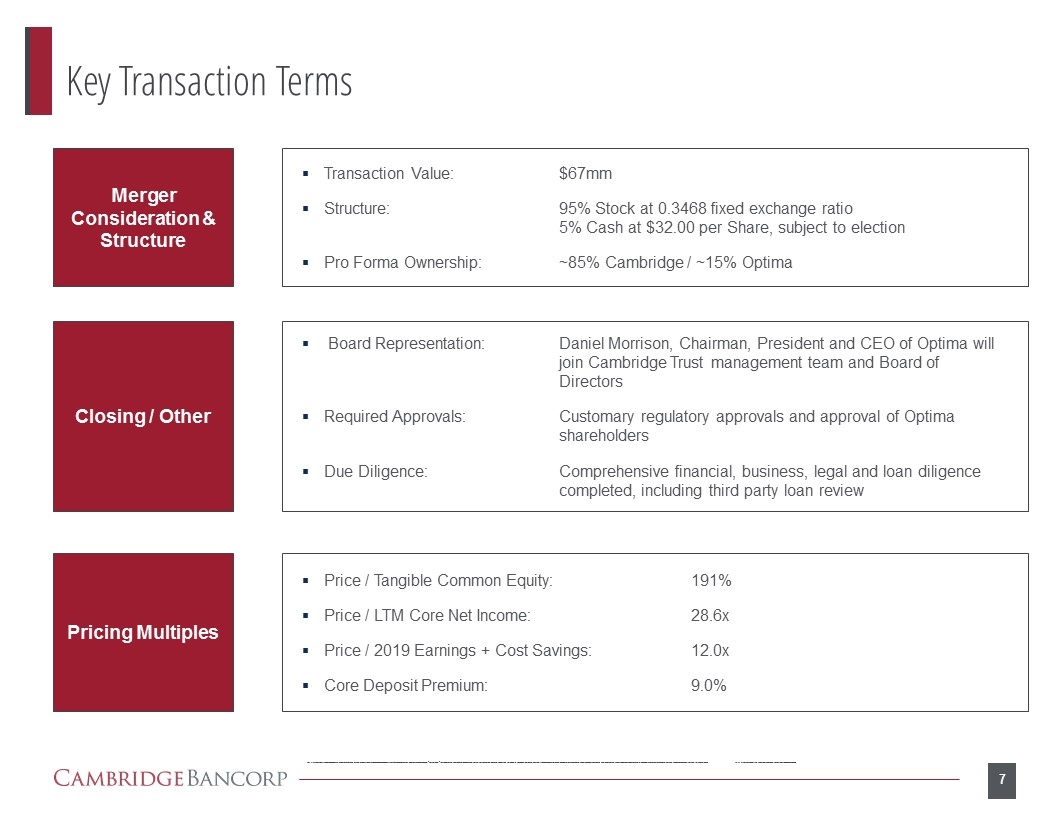

Key Transaction Terms Merger Consideration & Structure Transaction Value:$67mm Structure:95% Stock at 0.3468 fixed exchange ratio 5% Cash at $32.00 per Share, subject to election Pro Forma Ownership:~85% Cambridge / ~15% Optima Closing / Other Board Representation:Daniel Morrison, Chairman, President and CEO of Optima will join Cambridge Trust management team and Board of Directors Required Approvals:Customary regulatory approvals and approval of Optima shareholders Due Diligence:Comprehensive financial, business, legal and loan diligence completed, including third party loan review Pricing Multiples Price / Tangible Common Equity:191% Price / LTM Core Net Income:28.6x Price / 2019 Earnings + Cost Savings:12.0x Core Deposit Premium: 9.0% Key Transaction Terms Merger Consideration & Structure Transaction Value: $67mm Structure: 95% Stock at 0.3468 fixed exchange ratio 5% Cash at $32.00 per Share, subject to election Pro Forma Ownership: ~85% Cambridge / ~15% Optima Closing / Other Board Representation: Daniel Morrison, Chairman, President and CEO of Optima will join Cambridge Trust management team and Board of Directors Required Approvals: Customary regulatory approvals and approval of Optima shareholders Due Diligence: Comprehensive financial, business, legal and loan diligence completed, including third party loan review Pricing Multiples Price / Tangible Common Equity:191% Price / LTM Core Net Income:28.6x Price / 2019 Earnings + Cost Savings:12.0x Core Deposit Premium: 9.0% Cambridge Bancorp

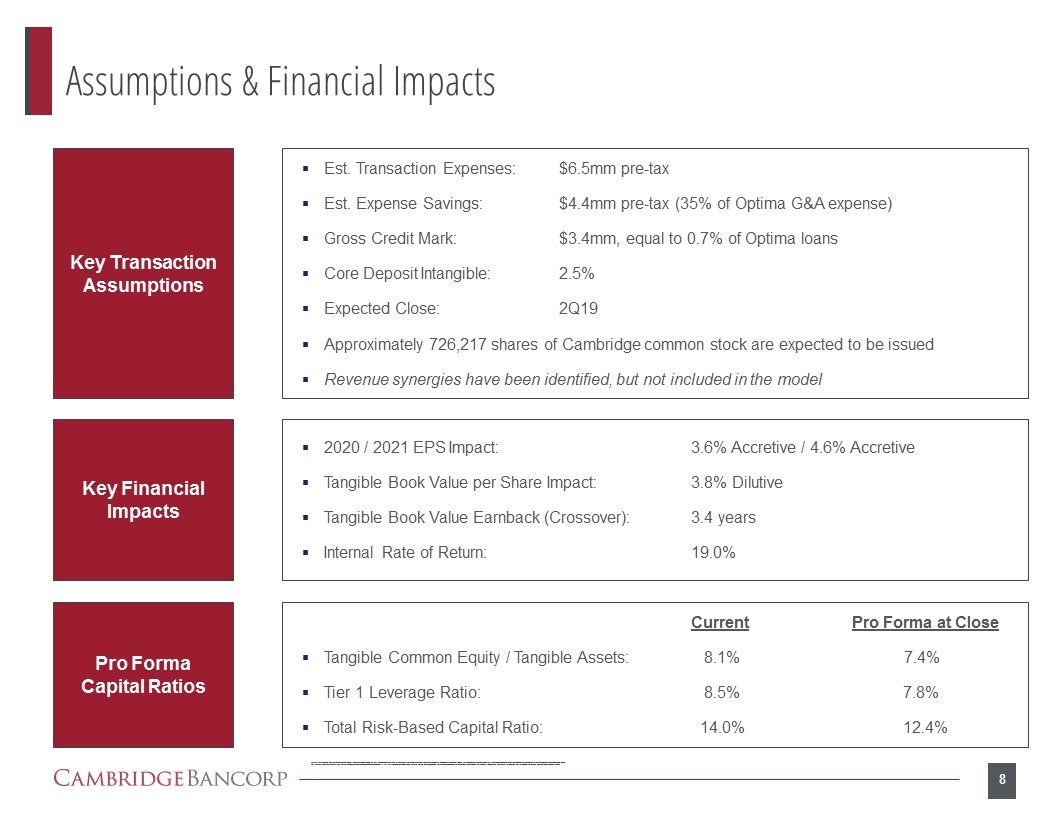

Assumptions & Financial Impacts Key Transaction Assumptions Key Financial Impacts Pro Forma Capital Ratios Est. Transaction Expenses:$6.5mm pre-tax Est. Expense Savings:$4.4mm pre-tax (35% of Optima G&A expense) Gross Credit Mark:$3.4mm, equal to 0.7% of Optima loans Core Deposit Intangible:2.5% Expected Close:2Q19 Approximately 726,217 shares of Cambridge common stock are expected to be issued Revenue synergies have been identified, but not included in the model 2020 / 2021 EPS Impact:3.6% Accretive / 4.6% Accretive Tangible Book Value per Share Impact:3.8% Dilutive Tangible Book Value Earnback (Crossover):3.4 years Internal Rate of Return:19.0% Current Pro Forma at Close Tangible Common Equity / Tangible Assets: 8.1% 7.4% Tier 1 Leverage Ratio: 8.5% 7.8% Total Risk-Based Capital Ratio: 14.0% 12.4% Assumptions & Financial Impacts Key Transaction Assumptions Est. Transaction Expenses: $6.5mm pre-tax Est. Expense Savings: $4.4mm pre-tax (35% of Optima G&A expense) Gross Credit Mark: $3.4mm, equal to 0.7% of Optima loans Core Deposit Intangible: 2.5% Expected Close: 2Q19 Approximately 726,217 shares of Cambridge common stock are expected to be issued Revenue synergies have been identified, but not included in the model Key Financial Impacts 2020 / 2021 EPS Impact: 3.6% Accretive / 4.6% Accretive Tangible Book Value per Share Impact:3.8% Dilutive Tangible Book Value Earnback (Crossover): 3.4 years Internal Rate of Return: 19.0% Pro Forma Capital Ratios Current Pro Forma at Close Tangible Common Equity / Tangible Assets: 8.1% 7.4% Tier 1 Leverage Ratio: 8.5% 7.8% Total Risk-Based Capital Ratio: 14.0% 12.4%Cambridge Bancorp

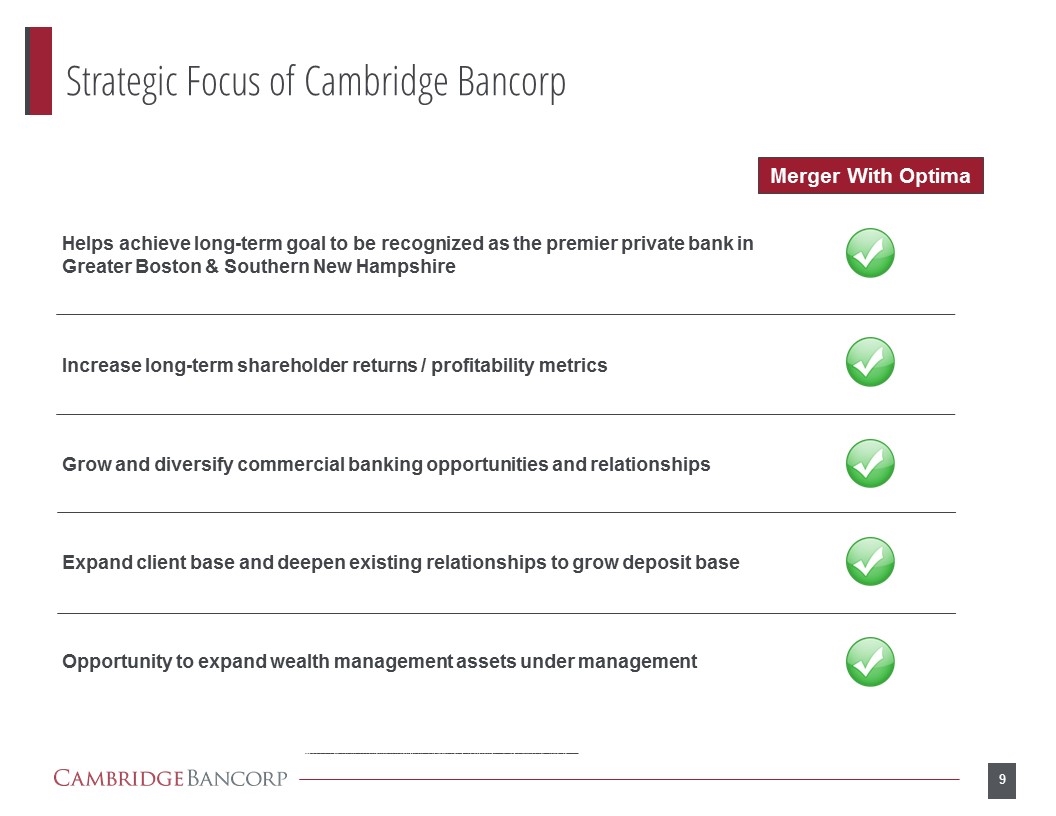

Strategic Focus of Cambridge Bancorp Helps achieve long-term goal to be recognized as the premier private bank in Greater Boston & Southern New Hampshire Increase long-term shareholder returns / profitability metrics Grow and diversify commercial banking opportunities and relationships Expand client base and deepen existing relationships to grow deposit base Opportunity to expand wealth management assets under management Merger With Optima Strategic Focus of Cambridge Bancorp Merger With Optima Helps achieve long-term goal to be recognized as the premier private bank in Greater Boston & Southern New Hampshire Increase long-term shareholder returns / profitability metrics Grow and diversify commercial banking opportunities and relationships Expand client base and deepen existing relationships to grow deposit base Opportunity to expand wealth management assets under management Cambridge Bancorp

Transaction Summary Compelling expansion of Cambridge Trust’s service-oriented private banking model into the attractive and familiar southern New Hampshire market. Immediately accretive to Cambridge earnings per share, with an acceptable tangible book value dilution earnback period and compelling IRR. Provides a platform for future growth of banking and wealth management services in southern New Hampshire, a market in which we have operated since 1996. Cultural compatibility highlighted by a conservative banking approach and diligent credit underwriting. Low execution risk given retention of key in-market personnel and significant financial, business, legal and loan due diligence performed. Transaction Summary Compelling expansion of Cambridge Trust’s service-oriented private banking model into the attractive and familiar southern New Hampshire market. Immediately accretive to Cambridge earnings per share, with an acceptable tangible book value dilution earn back period and compelling IRR. Provides a platform for future growth of banking and wealth management services in southern New Hampshire, a market in which we have operated since 1996. Cultural compatibility highlighted by a conservative banking approach and diligent credit underwriting. Low execution risk given retention of key in-market personnel and significant financial, business, legal and loan due diligence performed. CAMBRIDGE BANCORP

Appendix Appendix CAMBRIDGE BANCORP

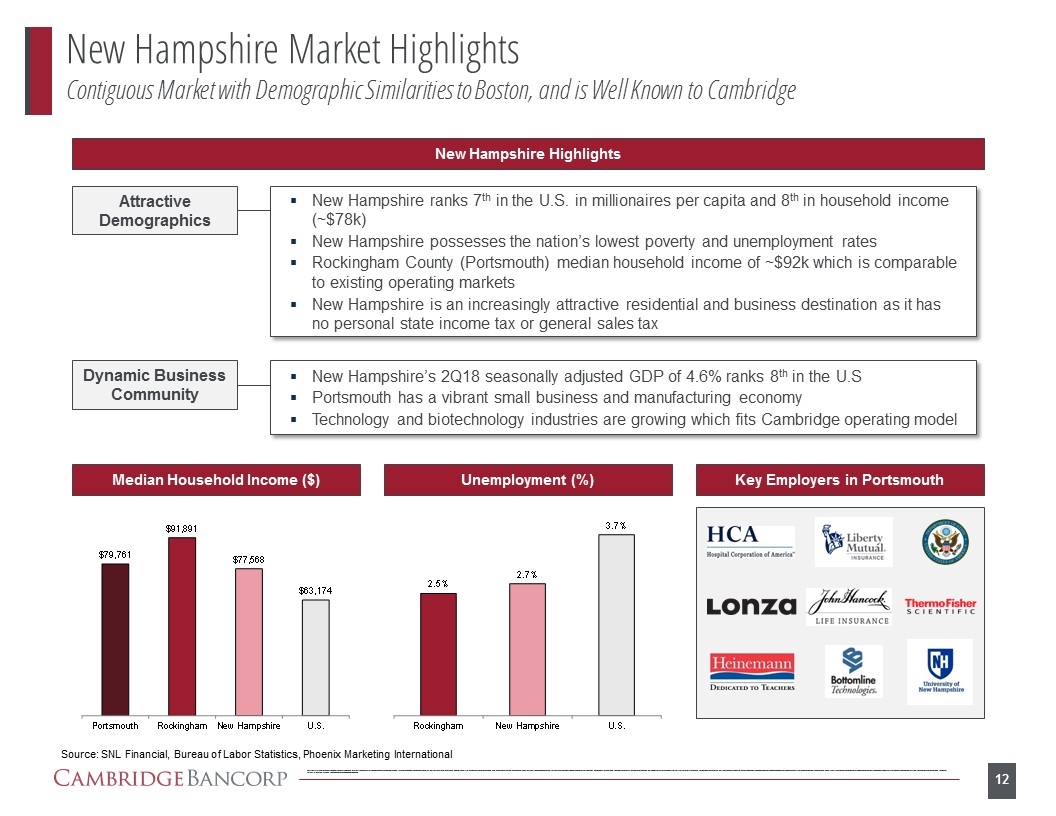

New Hampshire Market Highlights Contiguous Market with Demographic Similarities to Boston, and is Well Known to Cambridge New Hampshire Highlights Median Household Income ($) Unemployment (%) Key Employers in Portsmouth Attractive Demographics New Hampshire ranks 7th in the U.S. in millionaires per capita and 8th in household income (~$78k) New Hampshire possesses the nation’s lowest poverty and unemployment rates Rockingham County (Portsmouth) median household income of ~$92k which is comparable to existing operating markets New Hampshire is an increasingly attractive residential and business destination as it has no personal state income tax or general sales tax Dynamic Business Community New Hampshire’s 2Q18 seasonally adjusted GDP of 4.6% ranks 8th in the U.S Portsmouth has a vibrant small business and manufacturing economy Technology and biotechnology industries are growing which fits Cambridge operating model Source: SNL Financial, Bureau of Labor Statistics, Phoenix Marketing International New Hampshire Market Highlights Contiguous Market with Demographic Similarities to Boston, and is Well Known to Cambridge New Hampshire Highlights Attractive Demographics New Hampshire ranks 7th in the U.S. in millionaires per capita and 8th in household income (~$78k) New Hampshire possesses the nation’s lowest poverty and unemployment rates Rockingham County (Portsmouth) median household income of ~$92k which is comparable to existing operating markets New Hampshire is an increasingly attractive residential and business destination as it has no personal state income tax or general sales tax Dynamic Business Community New Hampshire’s 2Q18 seasonally adjusted GDP of 4.6% ranks 8th in the U.S Portsmouth has a vibrant small business and manufacturing economy Technology and biotechnology industries are growing which fits Cambridge operating model Median Household Income ($) $79,761 Portsmouth $91,891 Rockingham $77,568 New Hampshire $63,174 US Unemployment (%) 2.5% Rockingham 2.7% New Hampshire 3.7% U.S. Key Employers in Portsmouth Source: SNL Financial, Bureau of Labor Statistics, Phoenix Marketing International CAMBRIDGE BANCORP

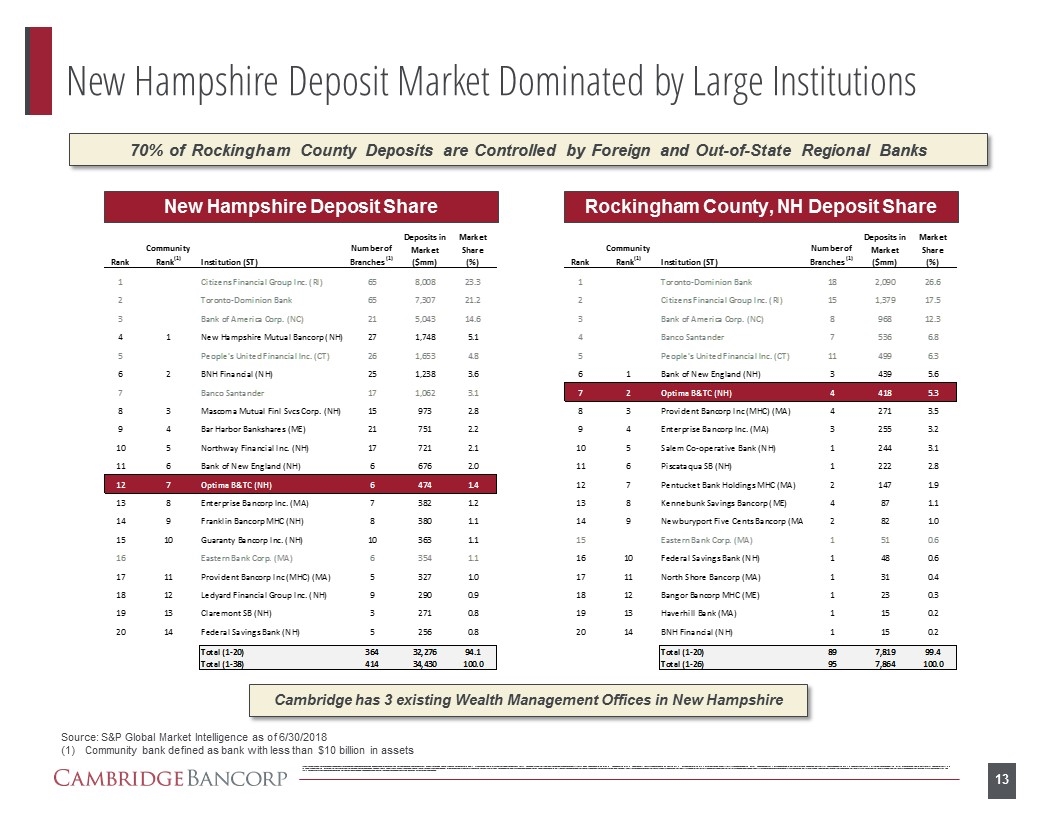

New Hampshire Deposit Market Dominated by Large Institutions New Hampshire Deposit Share Rockingham County, NH Deposit Share Cambridge has 3 existing Wealth Management Offices in New Hampshire 70% of Rockingham County Deposits are Controlled by Foreign and Out-of-State Regional Banks Source: S&P Global Market Intelligence as of 6/30/2018 Community bank defined as bank with less than $10 billion in assets 10New Hampshire Deposit Market Dominated by Large Institutions 70% of Rockingham County Deposits are Controlled by Foreign and Out-of-State Regional Banks New Hampshire Deposit Rank Community Rank(1) Institution (ST) Number of Branches (1) Deposits in Market ($mm) Market Share (%) 1 Citizens Financial Group Inc. (RI) 65 8,008 23.3 2 Toronto-Dominion Bank 65 7,307 21.2 3 Bank of America Corp. (NC) 21 5,043 14.6 4 1 New Hampshire Mutual Bancorp (NH) 27 1,748 5.1 5 People's United Financial Inc. (CT) 26 1,653 4.8 6 2 BNH Financial (NH) 25 1,238 3.6 7 Banco Santander 17 1,062 3.1 8 3 Mascoma Mutual Finl Svcs Corp. (NH) 15 973 2.8 9 4 Bar Harbor Bankshares (ME) 21 751 2.2 10 5 Northway Financial Inc. (NH) 17 721 2.1 11 6 Bank of New England (NH) 6 676 2.0 12 7 Optima B&TC (NH) 6 474 1.4 13 8 Enterprise Bancorp Inc. (MA) 7 382 1.2 14 9 Franklin Bancorp MHC (NH) 8 380 1.1 15 10 Guaranty Bancorp Inc. (NH) 10 363 1.1 16 Eastern Bank Corp. (MA) 6 354 1.1 17 11 Provident Bancorp Inc (MHC) (MA) 5 327 1.0 18 12 Ledyard Financial Group Inc. (NH) 9 290 0.9 19 13 Claremont SB (NH) 3 271 0.8 20 14 Federal Savings Bank (NH) 5 256 0.8 Total (1-20) 364 32,276 94.1 Total (1-38) 414 34,430 100.0 Rockingham County, NH Deposit Share ank Community Rank(1) Institution (ST) Number of Branches (1) Deposits in Market ($mm) Market Share (%) 1 Toronto-Dominion Bank 18 2,090 26.6 2 Citizens Financial Group Inc. (RI) 15 1,379 17.5 3 Bank of America Corp. (NC) 8 968 12.3 4 Banco Santander 7 536 6.8 5 People's United Financial Inc. (CT) 11 499 6.3 6 1 Bank of New England (NH) 3 439 5.6 7 2 Optima B&TC (NH) 4 418 5.3 8 3 Provident Bancorp Inc (MHC) (MA) 4 271 3.5 9 4 Enterprise Bancorp Inc. (MA) 3 255 3.2 10 5 Salem Co-operative Bank (NH) 1 244 3.1 11 6 Piscataqua SB (NH) 1 222 2.8 12 7 Pentucket Bank Holdings MHC (MA) 2 147 1.9 13 8 Kennebunk Savings Bancorp (ME) 4 87 1.1 14 9 Newburyport Five Cents Bancorp (MA 2 82 1.0 15 Eastern Bank Corp. (MA) 1 51 0.6 16 10 Federal Savings Bank (NH) 1 48 0.6 17 11 North Shore Bancorp (MA) 1 31 0.4 18 12 Bangor Bancorp MHC (ME) 1 23 0.3 19 13 Haverhill Bank (MA) 1 15 0.2 20 14 BNH Financial (NH) 1 15 0.2 Total (1-20) 89 7,819 99.4 Total (1-26) 95 7,864 100.0 Cambridge has 3 existing Wealth Management Offices in New Hampshire Source: S&P Global Market Intelligence as of 6/30/2018 (1)Community bank defined as bank with less than $10 billion in assets CAMBRIDGE BANCORP

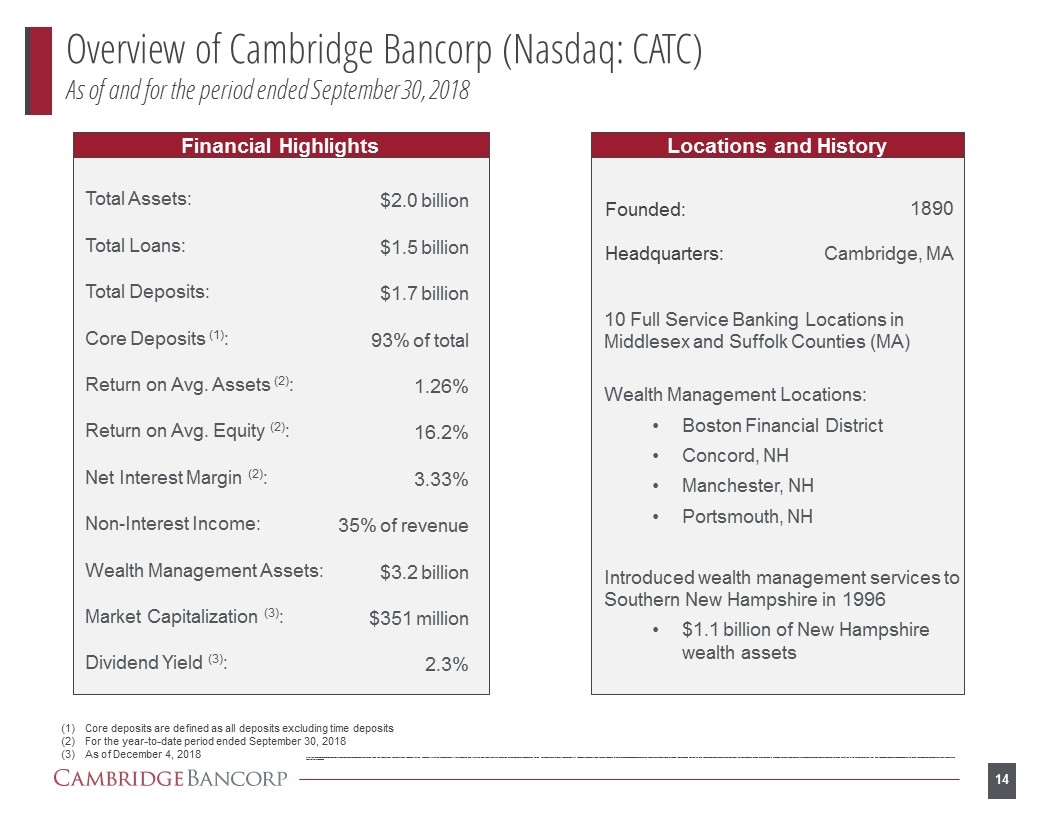

Overview of Cambridge Bancorp (Nasdaq: CATC) As of and for the period ended September 30, 2018 Total Assets: Total Loans: Total Deposits: Core Deposits (1): Return on Avg. Assets (2): Return on Avg. Equity (2): Net Interest Margin (2): Non-Interest Income: Wealth Management Assets: Market Capitalization (3): Dividend Yield (3): $2.0 billion $1.5 billion $1.7 billion 93% of total 1.26% 16.2% 3.33% 35% of revenue $3.2 billion $351 million 2.3% Financial Highlights Locations and History Founded: Headquarters: 1890 Cambridge, MA 10 Full Service Banking Locations in Middlesex and Suffolk Counties (MA) Wealth Management Locations: Boston Financial District Concord, NH Manchester, NH Portsmouth, NH Introduced wealth management services to Southern New Hampshire in 1996 $1.1 billion of New Hampshire wealth assets Core deposits are defined as all deposits excluding time deposits For the year-to-date period ended September 30, 2018 As of December 4, 2018 Overview of Cambridge Bancorp (Nasdaq: CATC) As of and for the period ended September 30, 2018 Financial Highlights Total Assets: $2.0 billion Total Loans: $1.5 billion Total Deposits: $1.7 billion Core Deposits (1): 93% of total Return on Avg. Assets (2): 1.26% Return on Avg. Equity (2): 16.2% Net Interest Margin (2): 3.33% Non-Interest Income: 35% of revenue Wealth Management Assets: $3.2 billion Market Capitalization (3): $351 million Dividend Yield (3): 2.3% Core deposits are defined as all deposits excluding time deposits For the year-to-date period ended September 30, 2018 As of December 4, 2018 Locations and History Founded: 1890 Headquarters: Cambridge, MA 10 Full Service Banking Locations in Middlesex and Suffolk Counties (MA) Wealth Management Locations: Boston Financial District Concord, NH Manchester, NH Portsmouth, NH Introduced wealth management services to Southern New Hampshire in 1996 $1.1 billion of New Hampshire wealth assets (1) Core deposits are defined as all deposits excluding time deposits (2) For the year-to-date period ended September 30, 2018 (3) As of December 4, 2018 CAMBRIDGE BANCORP

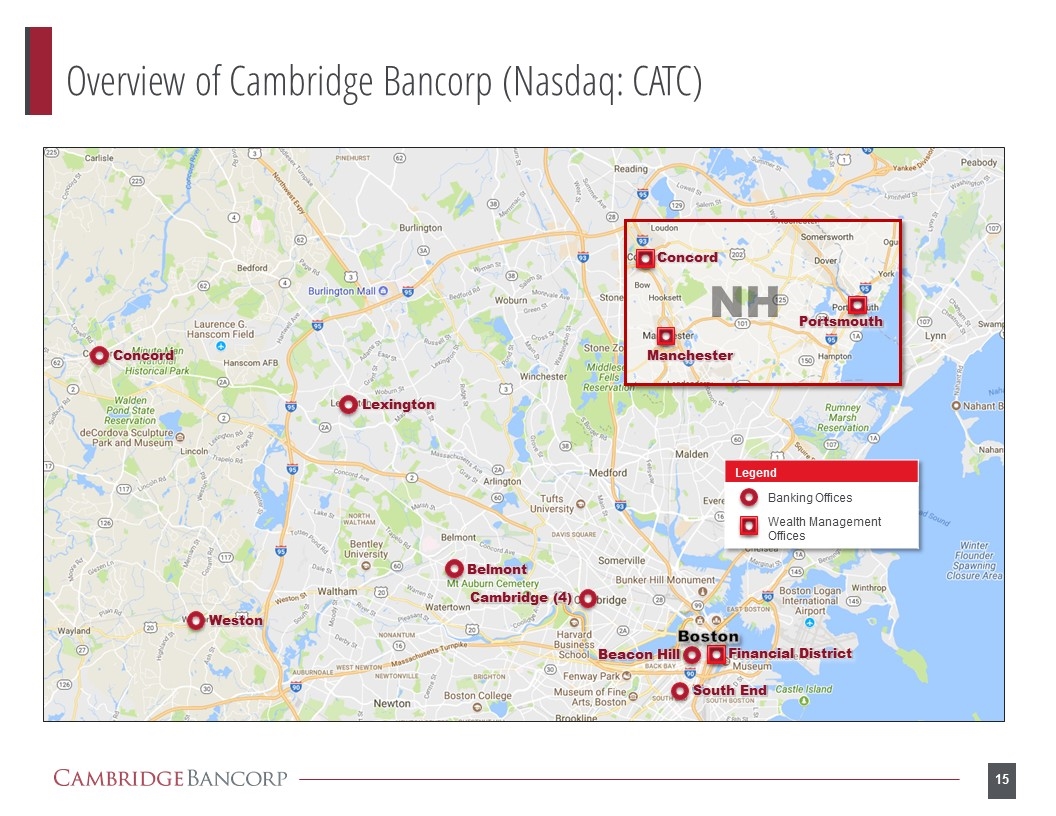

Overview of Cambridge Bancorp (Nasdaq: CATC) Cambridge (4) Beacon Hill Legend Banking Offices Wealth Management Offices Weston Concord Lexington Belmont South End Financial District NH Manchester Portsmouth Concord Boston Overview of Cambridge Bancorp (Nasdaq: CATC) CAMBRIDGE BANCORP

Why Cambridge Bancorp? Continued Focus on Client Service While Investing for Future Growth Client-Centric Service Culture Loyal Client Base Experienced, Conservative Leadership Commitment to our Community Attractive Geographic Markets Focused Private Banking Business Model Affluent Client Base Investing for Future Growth Business Model Culture Performance Superior Profitability Core Deposit-Funded Well-Capitalized Credit Strong Asset Quality Sound Underwriting and Risk Management Practices Why Cambridge Bancorp? Continued Focus on Client Service While Investing for Future Growth Business Model Attractive Geographic Markets Focused Private Banking Business Model Affluent Client Base Investing for Future Growth Performance Superior Profitability Core Deposit-Funded Well- Capitalized Credit Strong Asset Quality Sound Underwriting and Risk Management Practices Culture Client-Centric Service Culture Loyal Client Base Experienced, Conservative Leadership Commitment to our Community CAMBRIDGE BANCORP

Cambridge Bancorp Investment Merits Private Banking Business Model Non-interest income comprises 35% of total revenue Diverse revenue streams from traditional banking services and wealth management Attractive Geographic Markets Boston-Cambridge-Quincy, MA-NH unemployment rate of 2.9% (1) Diverse and innovative local economy Excellent wealth concentration Strong Financial Performance Year-to-date returns on average assets and average equity of 1.26% and 16.2% as of September 30, 2018 Top decile return on average equity as compared to peers (2) Core Deposit Funded Demand deposits represent 29% of total deposits Total cost of deposits of 0.25% Loan / deposit ratio of 84% Sound Risk Manager with Excellent Asset Quality Track Record 0.01% of average annual net charge-offs over the last 10 years Bureau of Labor Statistics September 2018 (preliminary) As compared to the most recent BHCPR Report for Peer 3 ($1bn - $3bn, data as of June 2018) Cambridge Bancorp Investment Merits Private Banking Business Model Non-interest income comprises 35% of total revenue Diverse revenue streams from traditional banking services and wealth management Attractive Geographic Markets Boston-Cambridge-Quincy, MA-NH unemployment rate of 2.9% (1) Diverse and innovative local economy Excellent wealth concentration Strong Financial Performance Year-to-date returns on average assets and average equity of 1.26% and 16.2% as of September 30, 2018 Top decile return on average equity as compared to peers (2) Core Deposit Funded Demand deposits represent 29% of total deposits Total cost of deposits of 0.25% Loan / deposit ratio of 84% Sound Risk Manager with Excellent Asset Quality Track Record 0.01% of average annual net charge-offs over the last 10 years (1) Bureau of Labor Statistics September 2018 (preliminary) (2) As compared to the most recent BHCPR Report for Peer 3 ($1bn - $3bn, data as of June 2018) CAMBRIDGE BANCORP

NASDAQ Ticker: CATC www.cambridgetrust.com Michael Carotenuto, SVP, Treasurer & CFO (617) 520-5520 Cambridge Bancorp NASDAQ Ticker: CATC www.cambridgetrust.com Michael Carotenuto, SVP, Treasurer & CFO (617) 520-5520 CAMBRIDGE BANCORP