Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - Hudson Global, Inc. | a20181204ex992.htm |

| 8-K - 8-K - Hudson Global, Inc. | a201812048k.htm |

EX-99.1 Hudson Global, Inc. Investor Presentation Q4 2018

Forward-Looking Statements This presentation contains statements that the Company believes to be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this press release, including statements regarding the Company's future financial condition, results of operations, business operations and business prospects, are forward-looking statements. Words such as “anticipate,” "estimate," "expect," "project," "intend," "plan," "predict," "believe" and similar words, expressions and variations of these words and expressions are intended to identify forward-looking statements. All forward-looking statements are subject to important factors, risks, uncertainties and assumptions, including industry and economic conditions' that could cause actual results to differ materially from those described in the forward-looking statements. Such factors, risks, uncertainties and assumptions include, but are not limited to, Hudson Global’s ability to achieve anticipated benefits from the sales of its recruitment and talent management operations in Europe and Asia Pacific and operate successfully as a Company focused on its RPO business; global economic fluctuations; the Company’s ability to successfully achieve its strategic initiatives; risks related to fluctuations in the Company's operating results from quarter to quarter; the ability of clients to terminate their relationship with the Company at any time and the impact of any loss of a significant client; competition in the Company's markets; the negative cash flows and operating losses that may recur in the future; risks associated with the Company's investment strategy; risks related to international operations, including foreign currency fluctuations; the Company's dependence on key management personnel; the Company's ability to attract and retain highly skilled professionals; the Company's ability to collect accounts receivable; the Company’s ability to maintain costs at an acceptable level; the Company's heavy reliance on information systems and the impact of potentially losing or failing to develop technology; risks related to providing uninterrupted service to clients; the Company's exposure to employment-related claims from clients, employers and regulatory authorities, current and former employees in connection with the Company’s business reorganization initiatives and limits on related insurance coverage; the Company’s ability to utilize net operating loss carry-forwards; volatility of the Company's stock price; the impact of government regulations; restrictions imposed by blocking arrangements; and risks related to potential acquisitions or dispositions of businesses by the Company. Additional information concerning these and other factors is contained in the Company's filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this document. The Company assumes no obligation, and expressly disclaims any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise. 2

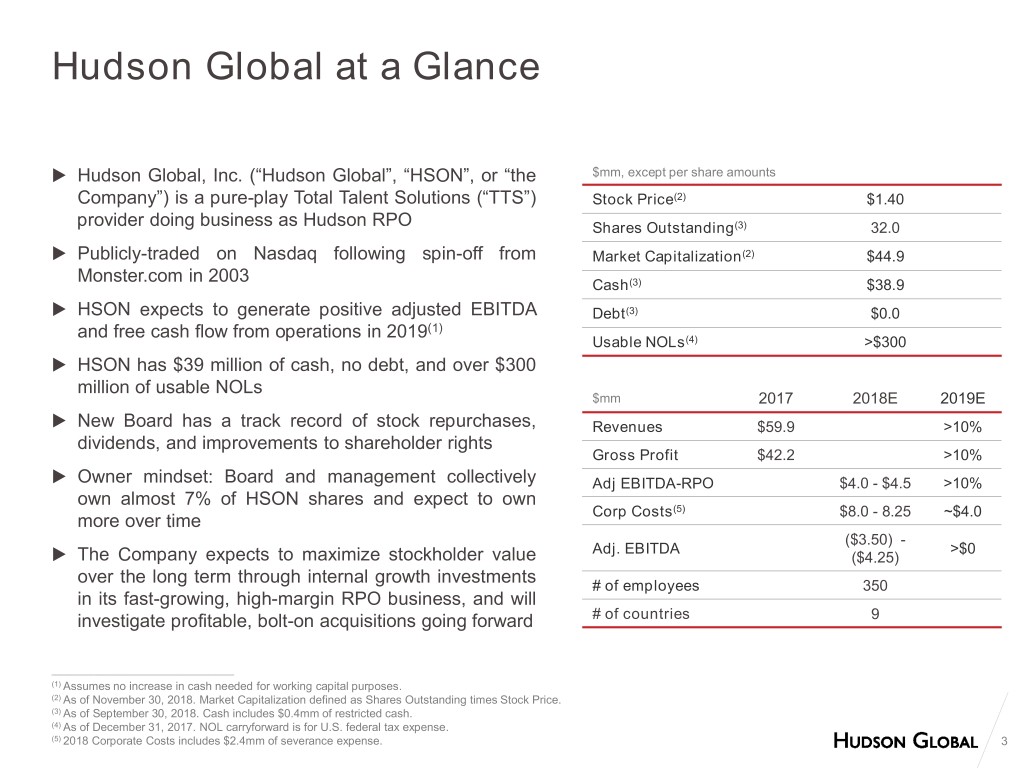

Hudson Global at a Glance ▶ Hudson Global, Inc. (“Hudson Global”, “HSON”, or “the $mm, except per share amounts Company”) is a pure-play Total Talent Solutions (“TTS”) Stock Price(2) $1.40 provider doing business as Hudson RPO Shares Outstanding(3) 32.0 ▶ Publicly-traded on Nasdaq following spin-off from Market Capitalization(2) $44.9 Monster.com in 2003 Cash(3) $38.9 ▶ HSON expects to generate positive adjusted EBITDA Debt(3) $0.0 and free cash flow from operations in 2019(1) Usable NOLs(4) >$300 ▶ HSON has $39 million of cash, no debt, and over $300 million of usable NOLs $mm 2017 2018E 2019E ▶ New Board has a track record of stock repurchases, Revenues $59.9 >10% dividends, and improvements to shareholder rights Gross Profit $42.2 >10% ▶ Owner mindset: Board and management collectively Adj EBITDA-RPO $4.0 - $4.5 >10% own almost 7% of HSON shares and expect to own Corp Costs(5) $8.0 - 8.25 ~$4.0 more over time ($3.50) - Adj. EBITDA >$0 ▶ The Company expects to maximize stockholder value ($4.25) over the long term through internal growth investments # of employees 350 in its fast-growing, high-margin RPO business, and will investigate profitable, bolt-on acquisitions going forward # of countries 9 ___________________________________________ (1) Assumes no increase in cash needed for working capital purposes. (2) As of November 30, 2018. Market Capitalization defined as Shares Outstanding times Stock Price. (3) As of September 30, 2018. Cash includes $0.4mm of restricted cash. (4) As of December 31, 2017. NOL carryforward is for U.S. federal tax expense. (5) 2018 Corporate Costs includes $2.4mm of severance expense. 3

What is RPO? RPO is in the Business Services sector, and a subcomponent of the Business Process Outsourcing (“BPO”), and Human Capital Management (“HCM”) subsectors ► An RPO company can provide its own staff or may assume a client’s staff, technology, methodologies, and reporting ► RPO differs significantly from contingent/ Recruitment Process Outsourcing is where an retained search (“agency model”) in that it employer utilizes an external service provider to assumes ownership of the design and perform all or part of its recruitment processes, management of the recruitment process, and often replacing work performed by external responsibility for the results recruitment agencies and/or in-house teams ► RPO is about improving the talent procurement ► RPO personnel can be located on-site at the process of a client, and implementing and client’s offices, or offsite monitoring a system that handles all the client’s talent needs – a true long-term partnership to ► Offshore and/or centralized, shared-service improve outcomes and lower costs facilities offsite are often used to supplement work done by client-facing RPO personnel, and ► RPO is a fairly new concept and an emerging these centers often perform work for multiple industry and it has just begun to penetrate the clients and work in multiple time zones market 4

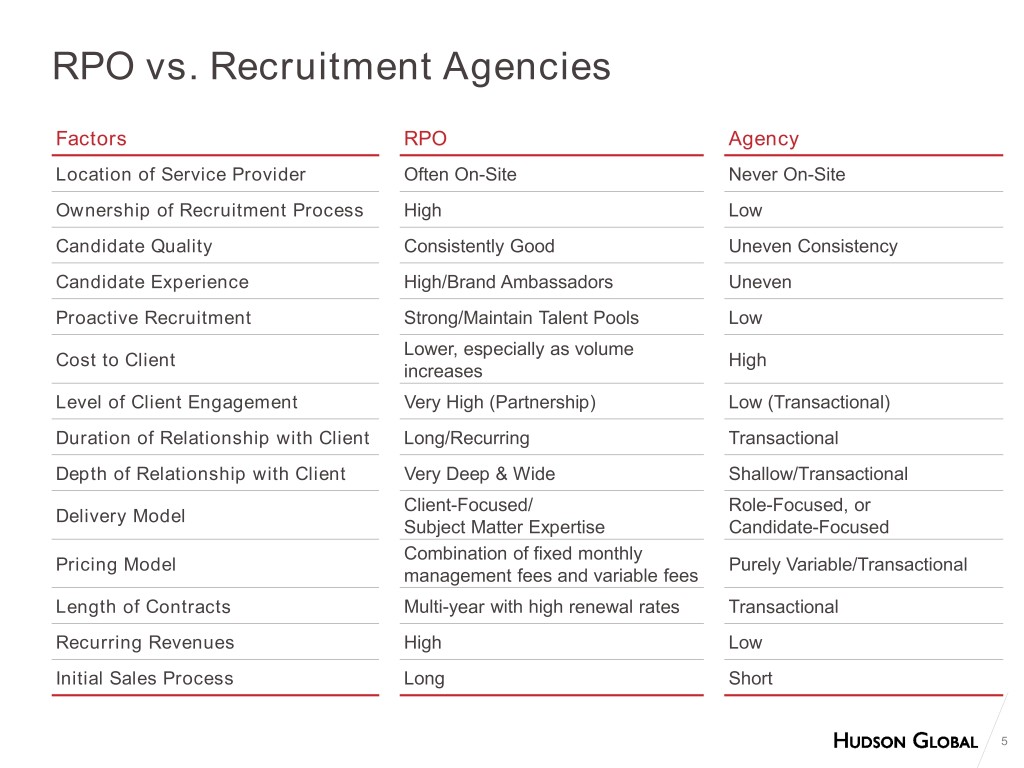

RPO vs. Recruitment Agencies Factors RPO Agency Location of Service Provider Often On-Site Never On-Site Ownership of Recruitment Process High Low Candidate Quality Consistently Good Uneven Consistency Candidate Experience High/Brand Ambassadors Uneven Proactive Recruitment Strong/Maintain Talent Pools Low Lower, especially as volume Cost to Client High increases Level of Client Engagement Very High (Partnership) Low (Transactional) Duration of Relationship with Client Long/Recurring Transactional Depth of Relationship with Client Very Deep & Wide Shallow/Transactional Client-Focused/ Role-Focused, or Delivery Model Subject Matter Expertise Candidate-Focused Combination of fixed monthly Pricing Model Purely Variable/Transactional management fees and variable fees Length of Contracts Multi-year with high renewal rates Transactional Recurring Revenues High Low Initial Sales Process Long Short 5

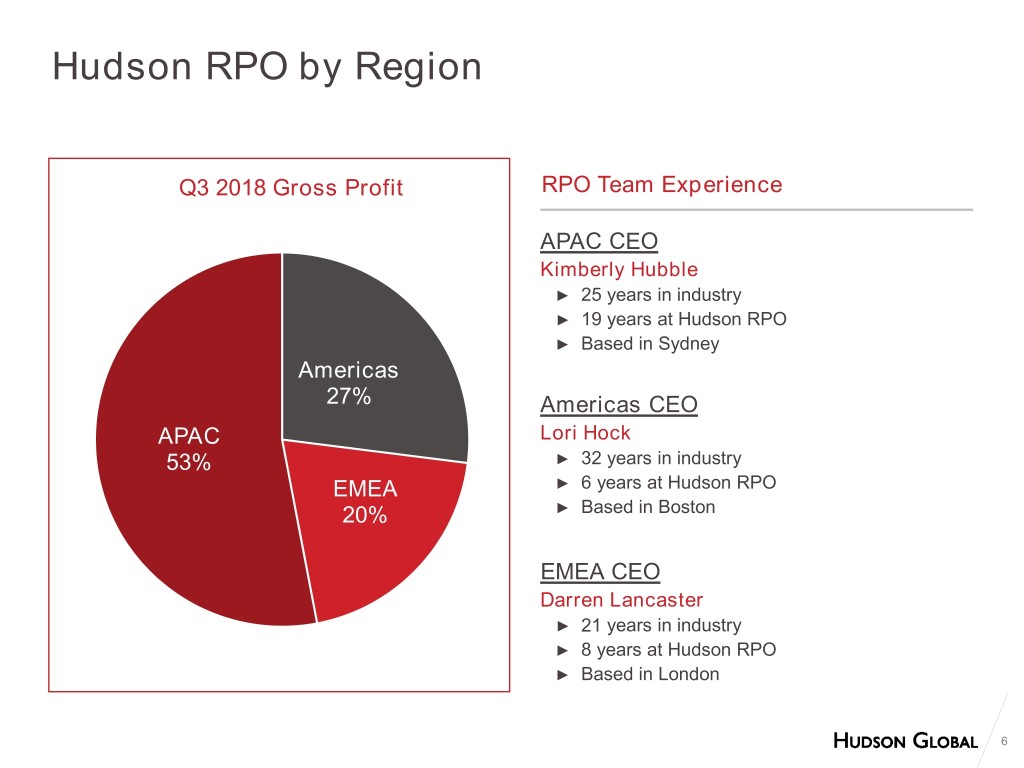

Hudson RPO by Region Q3 2018 Gross Profit RPO Team Experience APAC CEO Kimberly Hubble ► 25 years in industry ► 19 years at Hudson RPO ► Based in Sydney Americas 27% Americas CEO APAC Lori Hock 53% ► 32 years in industry EMEA ► 6 years at Hudson RPO 20% ► Based in Boston EMEA CEO Darren Lancaster ► 21 years in industry ► 8 years at Hudson RPO ► Based in London 6

Hudson RPO: Regional Market Observations Asia-Pacific Americas EMEA ► Smaller market size than Americas or ► Largest and fastest-growing market ► Large market, particularly in the UK, EMEA, but strong market adoption in but not quite as fast-growing as Australia, China, HK, and Singapore ► Hudson RPO is a small player, but Americas growing ► Hudson RPO believes it has #1 ► Emerging market in continental market share in Australia ► Hudson RPO is particularly strong in Europe, with growth from large • Hudson’s first ever RPO project Life Sciences, Medical Devices, multinationals benefiting from RPO was in 1999 for J&J in Australia, Financial Services, and Manufacturing solutions in the US and UK and we believe this project was ► Hudson RPO is a small player, but one of the first RPO projects in ► Growing presence in Latin America, growing history especially for large multinationals ► Hudson RPO is particularly strong in ► Hudson RPO believes it is top 3 in creating regional hubs Life Sciences, Financial Services, and Greater China (Mainland China & Manufacturing Hong Kong) ► Smaller RPO companies in this region could become acquisition targets for ► Smaller RPO companies in this ► Hudson RPO is growing in SE Asia via its hub in Singapore, and has Hudson RPO market could become acquisition recently expanded its presence targets for Hudson RPO throughout SE Asia through local ► Center of Excellence in Edinburgh, partnerships in Taiwan, Malaysia, Scotland Philippines, Thailand, Vietnam, South Korea, and India; these partnerships allow Hudson RPO to embed teams in these countries as requested by our clients ► Centers of Excellence in Manila, Philippines and Shanghai, China 7

Hudson RPO’s Strengths ► Professional Services/White Collar – comprehensive talent acquisition and total talent solutions for employers needing mission critical professional talent ► Senior Management to Entry Level – source and recruit roles from senior executives to interns/graduates ► Mid-to-Large Sized Corporations – focus on custom-built solutions for mid-to-large sized corporations ► Emerging Growth Companies – partner with them at every stage of their growth/life cycle ► RPO to Total Talent Solutions – grow current RPO solutions, build first generation RPO programs, and Our Focus offer other, value-added outsourced talent solutions ► We focus on clients where acquiring and retaining top talent, and specialized talent, is the key to success ► Our clients purchase on value and outcomes, much more than on price given the critical importance of talent to their businesses ► We deeply know our clients – their needs, their business, and their culture so we can deliver the best solutions and be a very valuable, long-term partner ► We have a prestigious client portfolio, and we have a high retention rate because we work diligently to Our Clients truly partner with our clients, and we evolve our solutions to best support our clients’ growth, needs, and objectives ► Hudson RPO’s global and regional leadership teams have deep expertise across Human Capital solutions, and have high tenure at Hudson RPO and on-site with the clients ► Hudson RPO’s teams are committed to a culture of engaging leadership, disciplined execution, and profitable growth ► Hudson RPO rates very favorably on service, performance, and results relative to our competition as measured by independent client surveys done via SharedXpertise for the HRO Today’s Baker’s Dozen Program Our Team ► Hudson RPO has been recognized on the Baker’s Dozen List for nine consecutive years 8

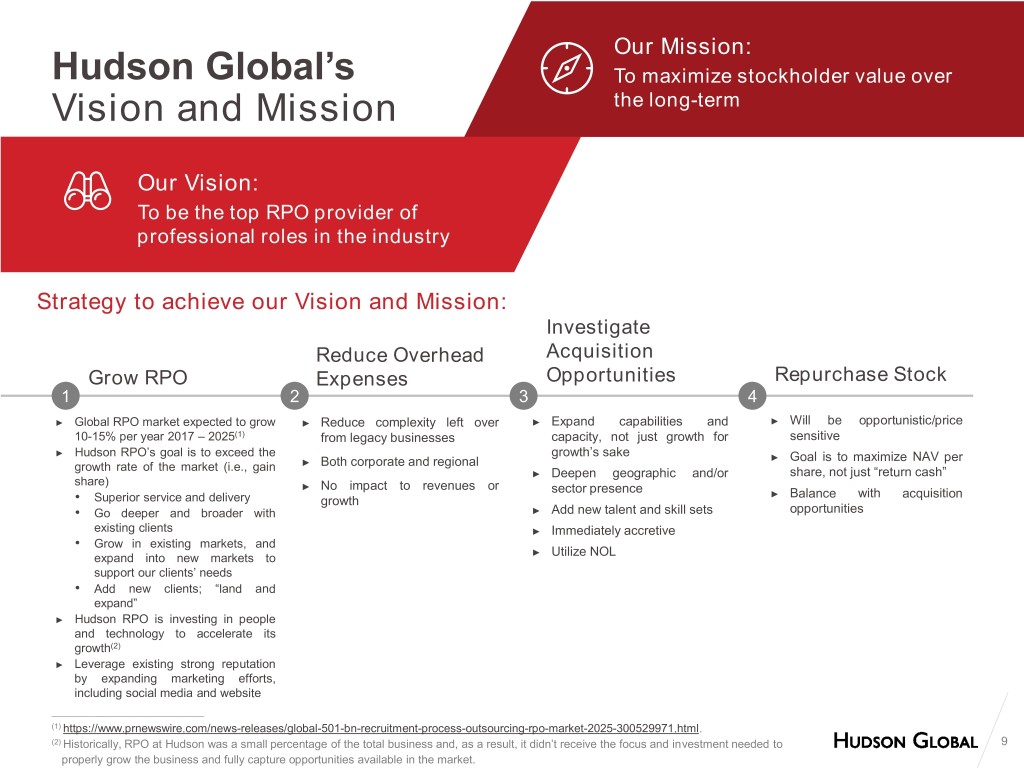

Our Mission: Hudson Global’s To maximize stockholder value over Vision and Mission the long-term Our Vision: To be the top RPO provider of professional roles in the industry Strategy to achieve our Vision and Mission: Investigate Reduce Overhead Acquisition Grow RPO Expenses Opportunities Repurchase Stock 1 2 3 4 ► Global RPO market expected to grow ► Reduce complexity left over ► Expand capabilities and ► Will be opportunistic/price 10-15% per year 2017 – 2025(1) from legacy businesses capacity, not just growth for sensitive ► Hudson RPO’s goal is to exceed the growth’s sake ► Goal is to maximize NAV per growth rate of the market (i.e., gain ► Both corporate and regional ► Deepen geographic and/or share, not just “return cash” share) ► No impact to revenues or sector presence ► Balance with acquisition • Superior service and delivery growth • Go deeper and broader with ► Add new talent and skill sets opportunities existing clients ► Immediately accretive • Grow in existing markets, and ► Utilize NOL expand into new markets to support our clients’ needs • Add new clients; “land and expand” ► Hudson RPO is investing in people and technology to accelerate its growth(2) ► Leverage existing strong reputation by expanding marketing efforts, including social media and website ____________________________________ (1) https://www.prnewswire.com/news-releases/global-501-bn-recruitment-process-outsourcing-rpo-market-2025-300529971.html. (2) Historically, RPO at Hudson was a small percentage of the total business and, as a result, it didn’t receive the focus and investment needed to 9 properly grow the business and fully capture opportunities available in the market.

Hudson Global’s Our Mission: To maximize stockholder value over Vision and Mission the long-term Our Vision: To be the top RPO provider of professional roles in the industry Long-Term Financial ▶ Profitable in 2019 – a watershed event Goals to Achieve Vision ▶ Generate high returns on internal growth projects as well as on bolt-on acquisitions and Mission: • Incremental ROIC and ROE will be key metrics to track ▶ Adjusted EBITDA of 20% of Gross Profit at RPO level (i.e., pre Corporate Costs) • Keep Corporate Costs low, even as profits from operating businesses grow • Adjusted EBITDA/GP margins of mid-teens at the corporate level (i.e., after Corporate Costs) ▶ Maximize earnings per share over the long term through: • Revenues and Gross Profit growing faster than costs, enabling EBITDA to increase as a percentage of Gross Profit over time • Continually reducing regional and Corporate Costs, especially as a percentage of Gross Profit • Reducing share count through opportunistic stock repurchases 10

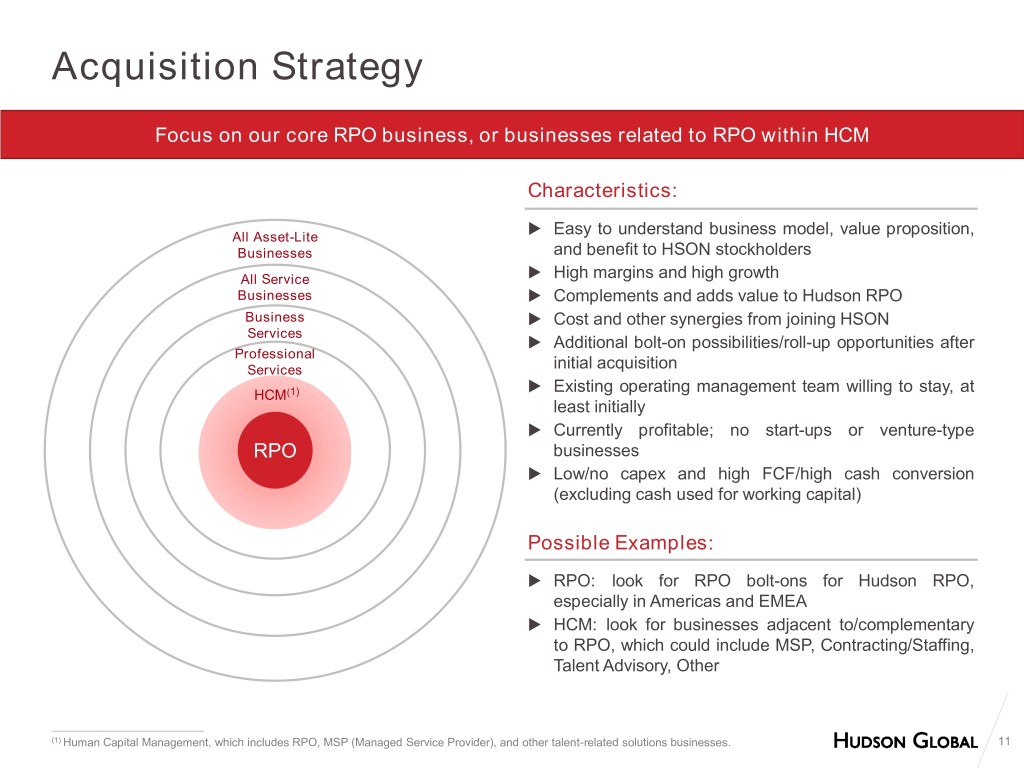

Acquisition Strategy Focus on our core RPO business, or businesses related to RPO within HCM Characteristics: All Asset-Lite ▶ Easy to understand business model, value proposition, Businesses and benefit to HSON stockholders All Service ▶ High margins and high growth Businesses ▶ Complements and adds value to Hudson RPO Business ▶ Cost and other synergies from joining HSON Services ▶ Additional bolt-on possibilities/roll-up opportunities after Professional Services initial acquisition ▶ Existing operating management team willing to stay, at HCM(1) least initially ▶ Currently profitable; no start-ups or venture-type RPO businesses ▶ Low/no capex and high FCF/high cash conversion (excluding cash used for working capital) Possible Examples: ▶ RPO: look for RPO bolt-ons for Hudson RPO, especially in Americas and EMEA ▶ HCM: look for businesses adjacent to/complementary to RPO, which could include MSP, Contracting/Staffing, Talent Advisory, Other ____________________________________ (1) Human Capital Management, which includes RPO, MSP (Managed Service Provider), and other talent-related solutions businesses. 11

Hudson Global: Corporate Costs 2018 2019E $8.0-8.5 $8.0-8.5 $8.0-8.25 $mm $7.5 ~$4.0 (3) (4) (5) 2/13/18 (1) 5/15/18 (2) 8/2/18 11/1/18 2019E Corp Costs (ex-severance) Upper Bound of Guidance Severance Expense ____________________________________ (1) Guidance provided in Definitive Proxy Statement filed 2/13/18. (2) Guidance provided in Q1 2018 press release on 5/15/18 and includes $1.8mm of severance expense. (3) Guidance provided in Q2 2018 earnings press release on 8/2/18 and includes $2.4mm of severance expense. (4) Guidance provided in Q3 2018 earnings press release on 11/1/18 and includes $2.4mm of severance expense. (5) Guidance provided in Q3 2018 earnings press release on 11/1/18. 12

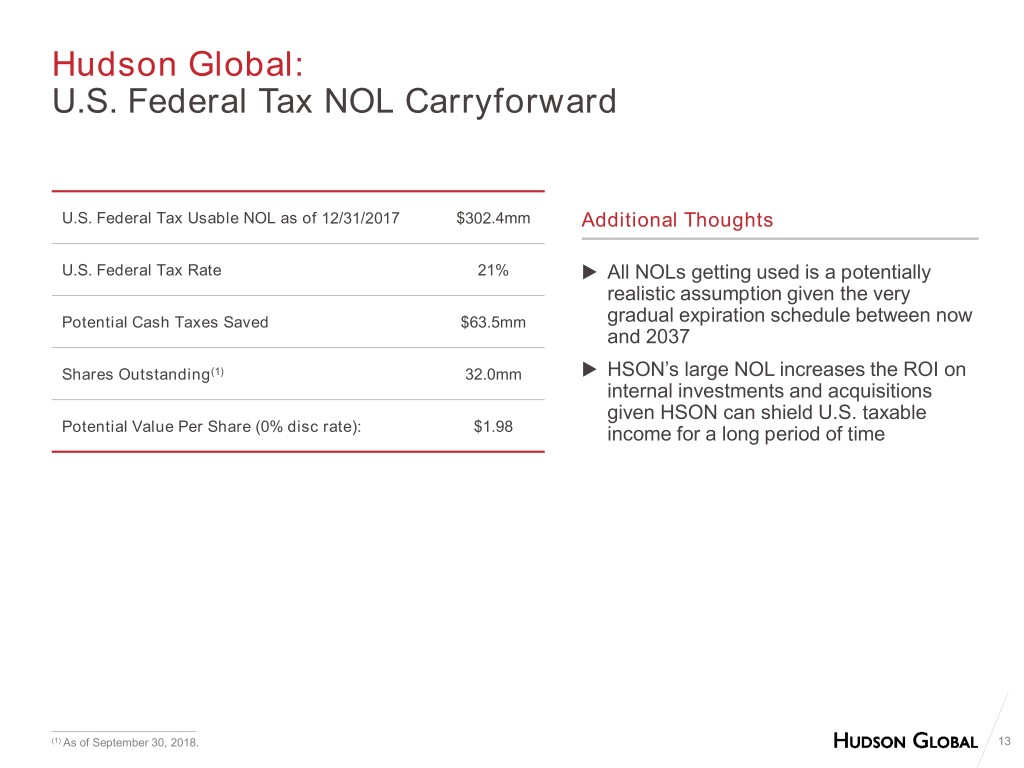

Hudson Global: U.S. Federal Tax NOL Carryforward U.S. Federal Tax Usable NOL as of 12/31/2017 $302.4mm Additional Thoughts U.S. Federal Tax Rate 21% ▶ All NOLs getting used is a potentially realistic assumption given the very Potential Cash Taxes Saved $63.5mm gradual expiration schedule between now and 2037 Shares Outstanding(1) 32.0mm ▶ HSON’s large NOL increases the ROI on internal investments and acquisitions given HSON can shield U.S. taxable Potential Value Per Share (0% disc rate): $1.98 income for a long period of time __________________________________ (1) As of September 30, 2018. 13

Hudson Global: Our History 1999 – 2001 Hudson Global originated from a collection of 67 • Declassified the Board so all director positions would be recruitment agency acquisitions made by TMP Worldwide, elected annually which later became Monster Worldwide, Inc. (i.e., Monster.com) • Eliminated all supermajority voting requirements • Allowed stockholders to call special meetings March, 2003 Monster distributed out all the shares of Hudson • Allowed stockholders to act by written consent Global to Monster stockholders and, since that time, Hudson • Implemented a plan to protect valuable NOL asset Global has operated as an independent, publicly-held company July, 2015 Announced a $10 million share buyback plan with 2003 – 2013 Poor business structure and very poor leadership approximately $7.4 million purchased through 9/30/18 led to poor operating and financial performance; HSON stock price declined 11% over this 11 year period and 85% from its 2016 Paid two cash dividend payments to stockholders totaling all-time high in 2005, significantly underperforming its peer $3.4 million group and all relevant stock market indices 2015 – 2017 The Board of Directors initiated a strategic review 2013 – 2014 Hudson Global’s current CEO, Jeff Eberwein, process to explore options to enhance stockholder value, invested in HSON shares and launched a proxy contest to gain including the potential sale of non-core businesses, and this shareholder representation on the Board to improve Hudson process culminated in the Company’s announcement on Global’s performance; Jeff Eberwein and Rick Coleman, December 17, 2017 of three divestitures HSON’s current Chairman, elected to HSON board in an 80% to 6% vote December, 2017 & March, 2018 Hudson Global announced three divestitures to exit its agency recruitment businesses so it 2015 could focus on its global RPO business going forward; these ▶ Hudson Global changed its CEO and CFO, and all legacy transactions closed at the end of March 2018, and, at that time, Board members left the Board; Eberwein named Chairman Hudson Global’s CEO, Stephen Nolan, retired and was replaced ▶ The new Board of Directors implemented a series of by Board Chairman, Jeff Eberwein; Rick Coleman became stockholder-friendly measures designed to enhance Chairman of the Board stockholder rights including: 14