Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EARTHSTONE ENERGY INC | form8-kxinvestorpresentati.htm |

Exhibit 99.1 Investor Presentation December 4, 2018 1

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “guidance,” “target,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about the expected benefits of the pending acquisition of Sabalo Energy, LLC, including certain interests of Shad Permian, LLC (“Shad”) to be acquired by Sabalo (collectively, "Sabalo") by Earthstone Energy, Inc. ("Earthstone," "ESTE" or the "Company"), the expected future reserves, sales volumes, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements, including guidance, are based on current expectations and assumptions and analyses made by Earthstone and its management in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: Earthstone's ability to integrate the operations of Sabalo successfully and achieve the anticipated benefits from the Sabalo acquisition; risks relating to any unforeseen liabilities of Earthstone or Sabalo; risks related to servicing of significant debt expected to be issued in connection with the Sabalo acquisition; declines in oil, natural gas liquids (“NGLs”) or natural gas prices; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write-downs; risks related to level of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit agreement; Earthstone’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; Earthstone’s ability to obtain external capital to finance exploration and development operations and acquisitions; the ability to successfully complete any other potential asset acquisitions and the risks related thereto; the impacts of hedging on results of operations; uninsured or underinsured losses resulting from oil and natural gas operations; Earthstone’s ability to replace oil and natural gas reserves; unforeseen technical difficulties in well drilling, completion and operation and product delivery bottlenecks; and any loss of senior management or key technical personnel. Earthstone’s 2017 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, recent current reports on Form 8-K and any amendments of such filings, and other Securities and Exchange Commission (“SEC”) filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. Earthstone undertakes no obligation to revise or update publicly any forward-looking statements except as required by law. This presentation contains Earthstone’s 2018 and 2019 sales volumes, production, capital expenditure and Adjusted EBITDAX guidance and such guidance after giving pro forma effect to the pending acquisition. The actual levels of production, capital expenditures, expenses and Adjusted EBITDAX may be higher or lower than these estimates due to, among other things, uncertainty in drilling schedules, changes in market demand and unanticipated delays in production. These estimates are based on numerous assumptions, including assumptions related to number of wells drilled, average spud to release times, rig count, and production rates for wells placed on production. These estimates are provided for illustration purposes only and are based on budgets and forecasts that have not been finalized. All or any of these assumptions may not prove to be accurate, which could result in actual results differing materially from estimates. If any of the rigs currently being utilized or intended to be utilized becomes unavailable for any reason, and Earthstone is not able to secure a replacement on a timely basis, we may not be able to drill, complete and place on production the expected number of wells. No assurance can be made that new wells will produce in line with historic performance, or that existing wells will continue to produce in line with expectations. Our ability to finance our 2018, 2019 and future capital budgets is subject to numerous risks and uncertainties, including reductions in our borrowing base, volatility in commodity prices and the potential for unanticipated increases in costs associated with drilling, production and transportation. In addition, our production estimates assume there will not be any new federal, state or local regulation applicable to us, or an interpretation of existing regulations, that will be materially adverse to our business. For additional discussion of the factors that may cause us not to achieve our production estimates, see Earthstone’s filings with the SEC, including its forms 10-K, 10-Q and 8-K and any amendments thereto. We do not undertake any obligation to release publicly the results of any future revisions we may make to this prospective data or to update this prospective data to reflect events or circumstances after the date of this presentation. Therefore, you are cautioned not to place undue reliance on this information. Industry and Market Data This presentation has been prepared by Earthstone and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although Earthstone believes these third-party sources are reliable as of their respective dates, Earthstone has not independently verified the accuracy or completeness of this information. Some data are also based on Earthstone’s good faith estimates, which are derived from its review of internal sources as well as the third-party sources described above. 2

Disclaimer Oil and Gas Reserves The SEC generally permits oil and gas companies, in filings made with the SEC, to disclose estimated proved reserves, which are estimates of reserve quantities that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, and certain probable and possible reserves that meet the SEC’s definitions for such terms. Earthstone discloses only estimated proved reserves in its filings with the SEC. Additional information regarding Earthstone’s and Sabalo’s estimated proved reserves is contained in Earthstone’s filings with the SEC. Certain estimates of proved reserves contained herein were independently prepared by Earthstone management utilizing NYMEX 5-year strip prices (future prices) for oil, natural gas and NGL’s as of October 1, 2018. Management believes this alternate pricing case is useful to investors because it uses future prices and not historical prices in its planning and strategic decision making. Future plugging and abandonment costs net of salvage value have been excluded from the NYMEX 5-year strip price reserves case. Actual quantities that may be ultimately recovered may differ substantially from estimates. Factors affecting ultimate recovery include the scope of the operators' ongoing drilling programs, which will be directly affected by the availability of capital, drilling and production costs, availability of drilling services and equipment, drilling results, lease expirations, transportation constraints, regulatory approvals and other factors, and actual drilling results, including geological and mechanical factors affecting recovery rates. Estimates of potential resources may also change significantly as the development of the properties underlying Earthstone's mineral interests provides additional data. This presentation also contains Earthstone’s internal estimates of its and Sabalo’s potential drilling locations, which may prove to be incorrect in a number of material ways. The actual number of locations that may be drilled may differ substantially. Adjusted EBITDAX Earthstone uses Adjusted EBITDAX, a financial measure that is not presented in accordance with United States generally accepted accounting principles (“GAAP”). Adjusted EBITDAX is a supplemental non-GAAP financial measure that is used by Earthstone’s management team and external users of its financial statements, such as industry analysts, investors, lenders and rating agencies. Earthstone’s management team believes Adjusted EBITDAX is useful because it allows Earthstone to more effectively evaluate its operating performance and compare the results of its operations from period to period without regard to its financing methods or capital structure. Earthstone defines Adjusted EBITDAX as net income (loss) plus, when applicable, (gain) on sale of oil and gas properties; accretion; impairment expense; depletion, depreciation and amortization; exploration expense; transaction costs; interest expense; interest income; unrealized loss on mark-to-market of hedges; non-cash stock based compensation; and income tax (benefit). Earthstone excludes the foregoing items from net income (loss) in arriving at Adjusted EBITDAX because these amounts can vary substantially from company to company within their industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income (loss) as determined in accordance with GAAP or as an indicator of Earthstone’s operating performance or liquidity. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDAX. Earthstone’s computation of Adjusted EBITDAX may not be comparable to other similarly titled measures of other companies or to similar measures in Earthstone’s revolving credit facility. Please see page 35 for a reconciliation of Adjusted EBITDAX to net income (loss), Earthstone’s most directly comparable financial measure calculated in accordance with GAAP, for Earthstone. PV-10 Present Value Discounted at 10% (“PV-10”) is a non-GAAP measure that differs from a measure under GAAP known as “standardized measure of discounted future net cash flows” in that PV-10 is calculated without including future income taxes. Each of Earthstone’s and Sabalo’s management believes that the presentation of the PV-10 value of their oil and natural gas properties is relevant and useful to investors because it presents the estimated discounted future net cash flows attributable to their respective estimated proved reserves independent of income tax attributes, thereby isolating the intrinsic value of the estimated future cash flows attributable to their respective reserves. Each of Earthstone’s and Sabalo’s management believes the use of a pre-tax measure provides greater comparability of assets when evaluating companies because the timing and quantification of future income taxes is dependent on company-specific factors, many of which are difficult to determine. For these reasons, each of Earthstone’s and Sabalo’s management uses and believes that the industry generally uses the PV-10 measure in evaluating and comparing acquisition candidates and assessing the potential rate of return on investments in oil and natural gas properties. PV-10 does not necessarily represent the fair market value of oil and natural gas properties. PV-10 is not a measure of financial or operational performance under GAAP, nor should it be considered in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under GAAP. 3

Disclaimer Additional Information and Where to Find It This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of a vote or proxy. In connection with the proposed Sabalo acquisition (the “Acquisition”), Earthstone filed with the SEC on November 6, 2018 and subsequently mailed to its security holders a definitive proxy statement and other relevant documents in connection with the proposed Acquisition. This presentation is not a substitute for the definitive proxy statement or any other document that Earthstone may file with the SEC or send to its stockholders in connection with the proposed Acquisition. EARTHSTONE URGES SECURITY HOLDERS TO READ THE DEFINITIVE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS LATER FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT EARTHSTONE AND THE PROPOSED ACQUISITION. Investors and security holders can obtain these materials and other documents filed with the SEC free of charge at the SEC’s website, www.sec.gov. In addition, a copy of the definitive proxy statement may be obtained free of charge from Earthstone’s website at www.earthstoneenergy.com. Investors and security holders may also read and copy any reports, statements and other information filed by Earthstone, with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. In addition, the documents filed with the SEC by Earthstone can be obtained free of charge from Earthstone’s website at www.earthstoneenergy.com or by contacting Earthstone by mail at 1400 Woodloch Forest Drive, Suite 300, The Woodlands, Texas, 77380, or by telephone at 281-298-4246. Participants in the Solicitation Earthstone and its directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the Acquisition. Information regarding Earthstone’s directors and executive officers is available in its definitive proxy statement filed with the SEC by Earthstone on November 6, 2018 in connection with the special meeting of stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the definitive proxy statement filed with the SEC on November 6, 2018. 4

Earthstone Investment Highlights Midland Basin “Must Own” Growth Story Track record for creating shareholder value Proven Management Four prior successful public entities and Technical Team Long-term demonstrated operational excellence Repeat institutional investors Signed agreement in October 2018 to acquire Sabalo Energy, LLC (1) (2) Pro-forma ~50,800 net acres and 990 gross operated drilling locations, primed for Transformational Sabalo years of low-cost growth Acquisition Attractive economics creating scale and growth Significant production growth with high oil cut Development supported by attractive full-cycle economics Attractive Corporate Visible path to cash flow generation Level Returns Balancing capital efficiency with growth Strong pro forma liquidity position enhances capital flexibility Strong Financial Profile Focus on debt-adjusted cash flow growth Targeted leverage below 2.0x Source: ESTE Management and investor presentations (1) Pro forma for the Sabalo acquisition; includes ~1,330 net acres acquired by Sabalo after effective date (5/1/18); historical ESTE acreage figure includes recently announced acreage trade with an offset operator 5 (2) Pro forma for the Sabalo acquisition; Sabalo includes only WCA, WCB, LSBY and MSBY; historical ESTE locations reflect Midland Basin-only

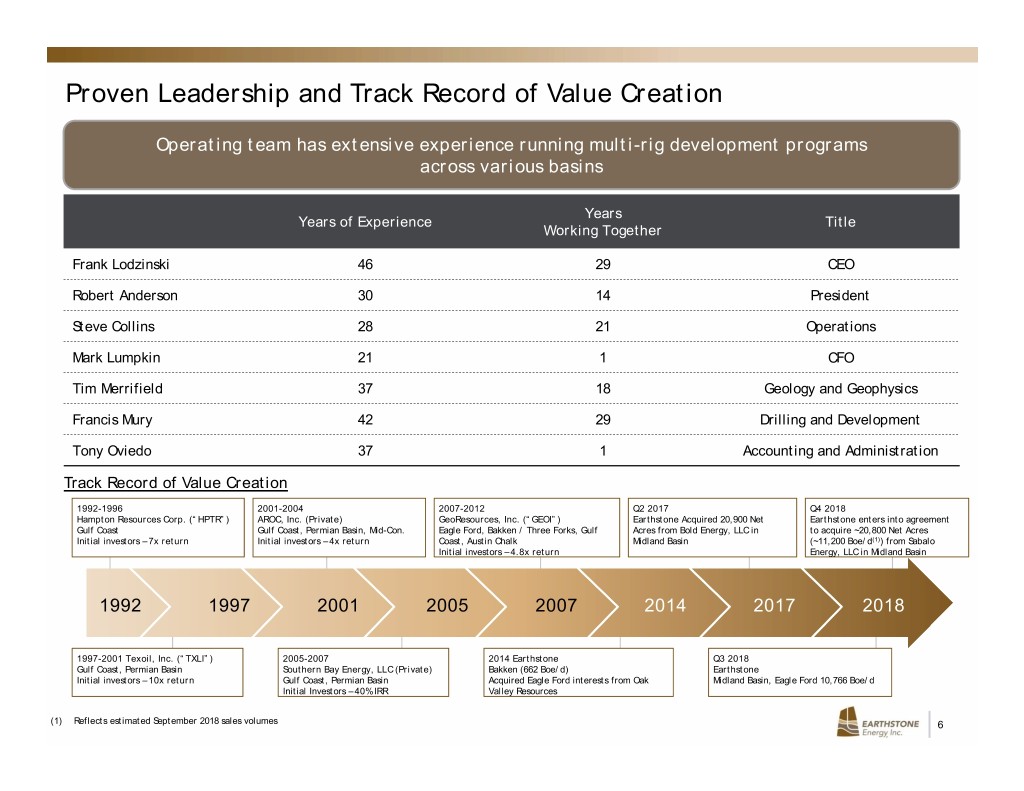

Proven Leadership and Track Record of Value Creation Operating team has extensive experience running multi-rig development programs across various basins Years Years of Experience Title Working Together Frank Lodzinski 46 29 CEO Robert Anderson 30 14 President Steve Collins 28 21 Operations Mark Lumpkin 21 1 CFO Tim Merrifield 37 18 Geology and Geophysics Francis Mury 42 29 Drilling and Development Tony Oviedo 37 1 Accounting and Administration Track Record of Value Creation 1992-1996 2001-2004 2007-2012 Q2 2017 Q4 2018 Hampton Resources Corp. (“HPTR”) AROC, Inc. (Private) GeoResources, Inc. (“GEOI”) Earthstone Acquired 20,900 Net Earthstone enters into agreement Gulf Coast Gulf Coast, Permian Basin, Mid-Con. Eagle Ford, Bakken / Three Forks, Gulf Acres from Bold Energy, LLC in to acquire ~20,800 Net Acres Initial investors – 7x return Initial investors – 4x return Coast, Austin Chalk Midland Basin (~11,200 Boe/d(1)) from Sabalo Initial investors – 4.8x return Energy, LLC in Midland Basin 1992 1997 2001 2005 2007 2014 2017 2018 1997-2001 Texoil, Inc. (“TXLI”) 2005-2007 2014 Earthstone Q3 2018 Gulf Coast, Permian Basin Southern Bay Energy, LLC (Private) Bakken (662 Boe/d) Earthstone Initial investors – 10x return Gulf Coast, Permian Basin Acquired Eagle Ford interests from Oak Midland Basin, Eagle Ford 10,766 Boe/d Initial Investors – 40% IRR Valley Resources (1) Reflects estimated September 2018 sales volumes 6

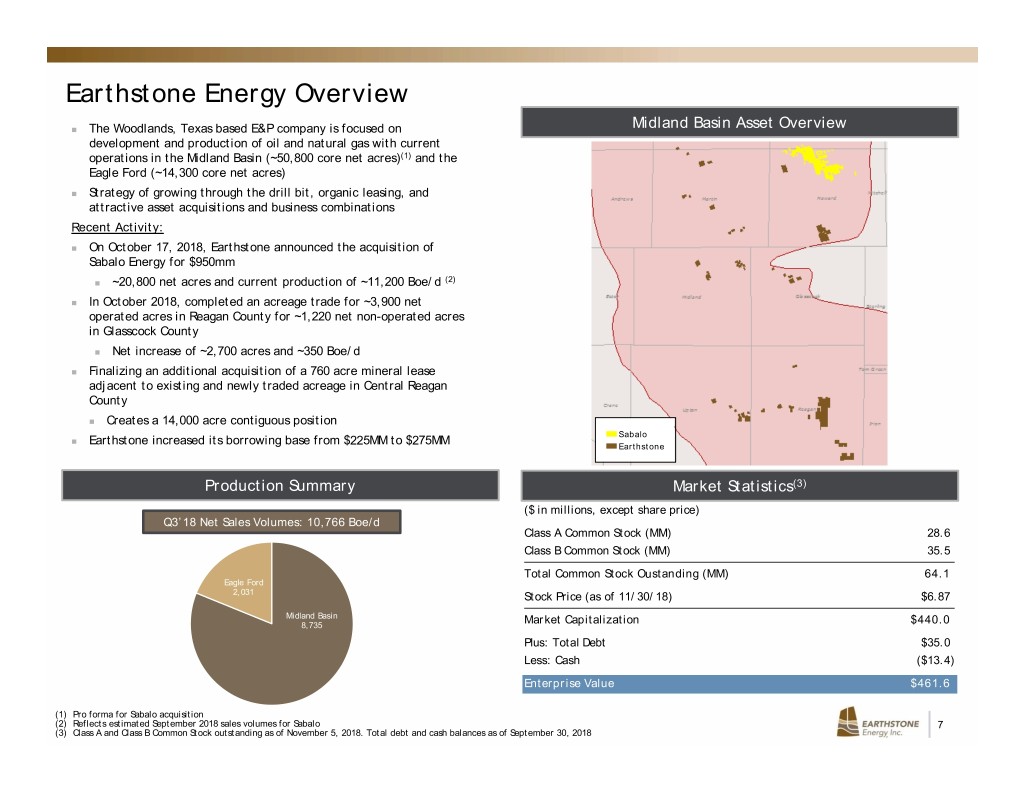

Earthstone Energy Overview The Woodlands, Texas based E&P company is focused on Midland Basin Asset Overview development and production of oil and natural gas with current operations in the Midland Basin (~50,800 core net acres)(1) and the Eagle Ford (~14,300 core net acres) Strategy of growing through the drill bit, organic leasing, and attractive asset acquisitions and business combinations Recent Activity: On October 17, 2018, Earthstone announced the acquisition of Sabalo Energy for $950mm (2) ~20,800 net acres and current production of ~11,200 Boe/d In October 2018, completed an acreage trade for ~3,900 net operated acres in Reagan County for ~1,220 net non-operated acres in Glasscock County Net increase of ~2,700 acres and ~350 Boe/d Finalizing an additional acquisition of a 760 acre mineral lease adjacent to existing and newly traded acreage in Central Reagan County Creates a 14,000 acre contiguous position Sabalo Earthstone increased its borrowing base from $225MM to $275MM Earthstone Production Summary Market Statistics(3) ($ in millions, except share price) Q3’18 Net Sales Volumes: 10,766 Boe/d Class A Common Stock (MM) 28.6 Class B Common Stock (MM) 35.5 Total Common Stock Oustanding (MM) 64.1 Eagle Ford 2,031 Stock Price (as of 11/30/18) $6.87 Midland Basin 8,735 Market Capitalization $440.0 Plus: Total Debt $35.0 Less: Cash ($13.4) Enterprise Value $461.6 (1) Pro forma for Sabalo acquisition (2) Reflects estimated September 2018 sales volumes for Sabalo 7 (3) Class A and Class B Common Stock outstanding as of November 5, 2018. Total debt and cash balances as of September 30, 2018

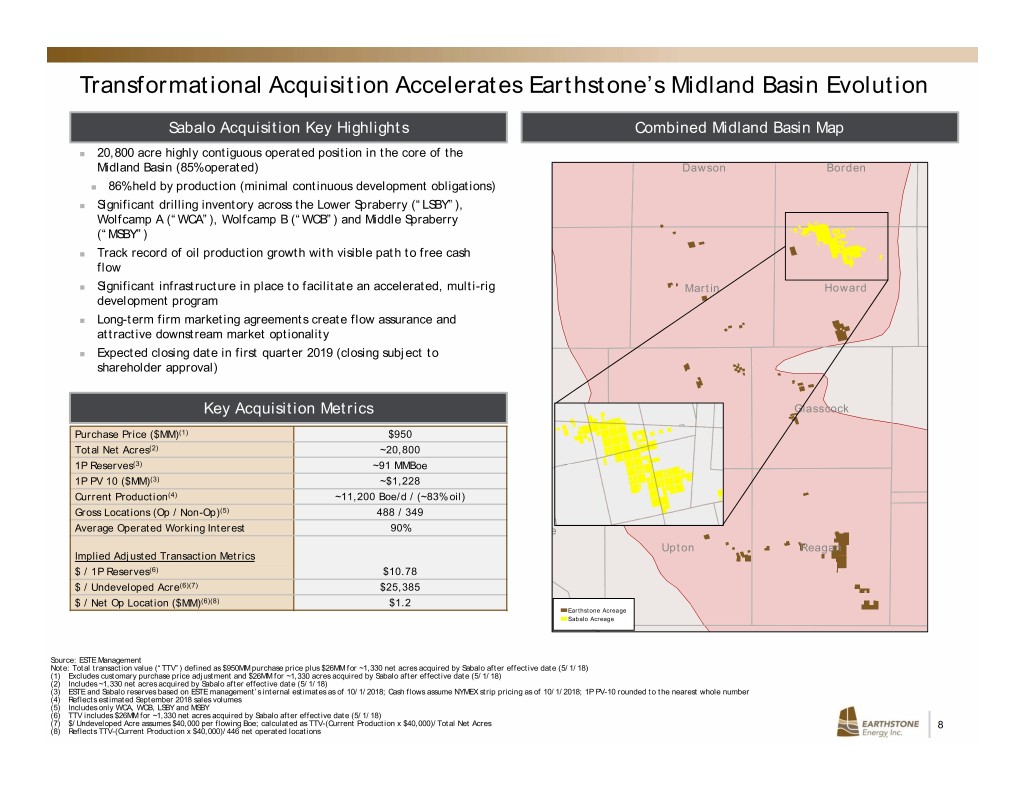

Transformational Acquisition Accelerates Earthstone’s Midland Basin Evolution Sabalo Acquisition Key Highlights Combined Midland Basin Map 20,800 acre highly contiguous operated position in the core of the Midland Basin (85% operated) Dawson Borden 86% held by production (minimal continuous development obligations) Significant drilling inventory across the Lower Spraberry (“LSBY”), Wolfcamp A (“WCA”), Wolfcamp B (“WCB”) and Middle Spraberry (“MSBY”) Track record of oil production growth with visible path to free cash flow Significant infrastructure in place to facilitate an accelerated, multi-rig Martin Howard development program Long-term firm marketing agreements create flow assurance and attractive downstream market optionality Expected closing date in first quarter 2019 (closing subject to shareholder approval) Key Acquisition Metrics r Midland Glasscock Purchase Price ($MM)(1) $950 Total Net Acres(2) ~20,800 1P Reserves(3) ~91 MMBoe 1P PV 10 ($MM)(3) ~$1,228 Current Production(4) ~11,200 Boe/d / (~83% oil) Gross Locations (Op / Non-Op)(5) 488 / 349 Average Operated Working Interest 90% e Upton Reagan Implied Adjusted Transaction Metrics $ / 1P Reserves(6) $10.78 $ / Undeveloped Acre(6)(7) $25,385 $ / Net Op Location ($MM)(6)(8) $1.2 Earthstone Acreage Sabalo Acreage Source: ESTE Management Note: Total transaction value (“TTV”) defined as $950MM purchase price plus $26MM for ~1,330 net acres acquired by Sabalo after effective date (5/1/18) (1) Excludes customary purchase price adjustment and $26MM for ~1,330 acres acquired by Sabalo after effective date (5/1/18) (2) Includes ~1,330 net acres acquired by Sabalo after effective date (5/1/18) (3) ESTE and Sabalo reserves based on ESTE management’s internal estimates as of 10/1/2018; Cash flows assume NYMEX strip pricing as of 10/1/2018; 1P PV-10 rounded to the nearest whole number (4) Reflects estimated September 2018 sales volumes (5) Includes only WCA, WCB, LSBY and MSBY (6) TTV includes $26MM for ~1,330 net acres acquired by Sabalo after effective date (5/1/18) (7) $/Undeveloped Acre assumes $40,000 per flowing Boe; calculated as TTV-(Current Production x $40,000)/Total Net Acres 8 (8) Reflects TTV-(Current Production x $40,000)/446 net operated locations

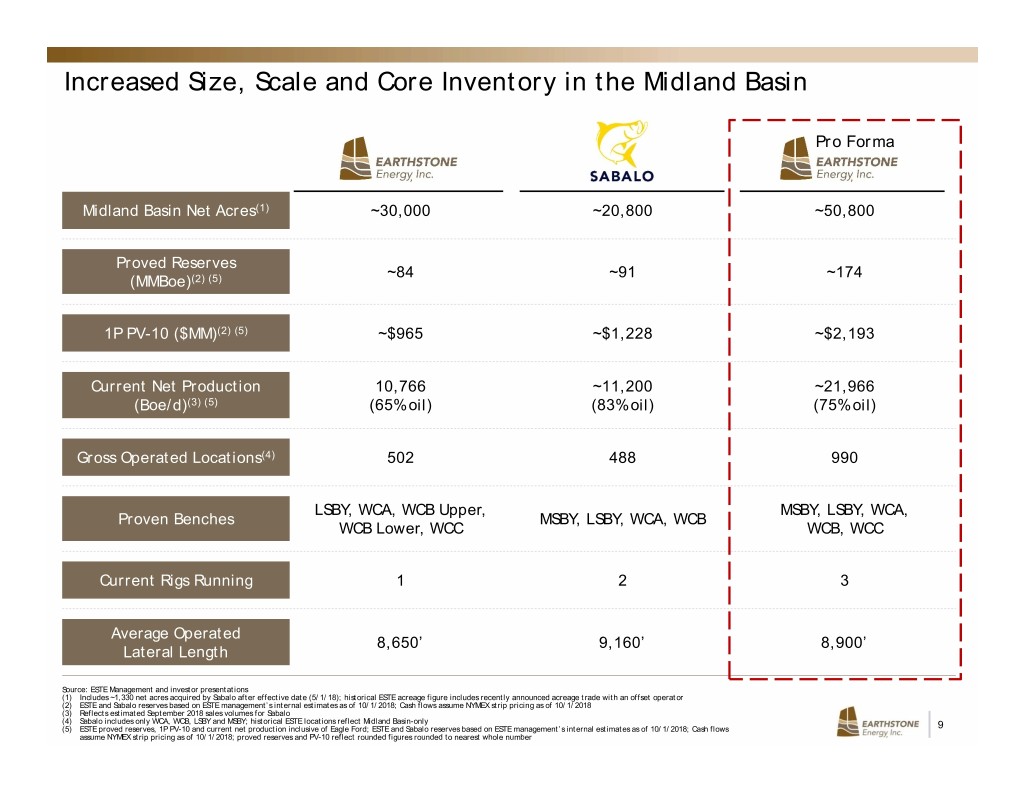

Increased Size, Scale and Core Inventory in the Midland Basin Pro Forma Midland Basin Net Acres(1) ~30,000 ~20,800 ~50,800 Proved Reserves ~84 ~91 ~174 (MMBoe)(2) (5) 1P PV-10 ($MM)(2) (5) ~$965 ~$1,228 ~$2,193 Current Net Production 10,766 ~11,200 ~21,966 (Boe/d)(3) (5) (65% oil) (83% oil) (75% oil) Gross Operated Locations(4) 502 488 990 LSBY, WCA, WCB Upper, MSBY, LSBY, WCA, Proven Benches MSBY, LSBY, WCA, WCB WCB Lower, WCC WCB, WCC Current Rigs Running 123 Average Operated 8,650’ 9,160’ 8,900’ Lateral Length Source: ESTE Management and investor presentations (1) Includes ~1,330 net acres acquired by Sabalo after effective date (5/1/18); historical ESTE acreage figure includes recently announced acreage trade with an offset operator (2) ESTE and Sabalo reserves based on ESTE management’s internal estimates as of 10/1/2018; Cash flows assume NYMEX strip pricing as of 10/1/2018 (3) Reflects estimated September 2018 sales volumes for Sabalo (4) Sabalo includes only WCA, WCB, LSBY and MSBY; historical ESTE locations reflect Midland Basin-only (5) ESTE proved reserves, 1P PV-10 and current net production inclusive of Eagle Ford; ESTE and Sabalo reserves based on ESTE management’s internal estimates as of 10/1/2018; Cash flows 9 assume NYMEX strip pricing as of 10/1/2018; proved reserves and PV-10 reflect rounded figures rounded to nearest whole number

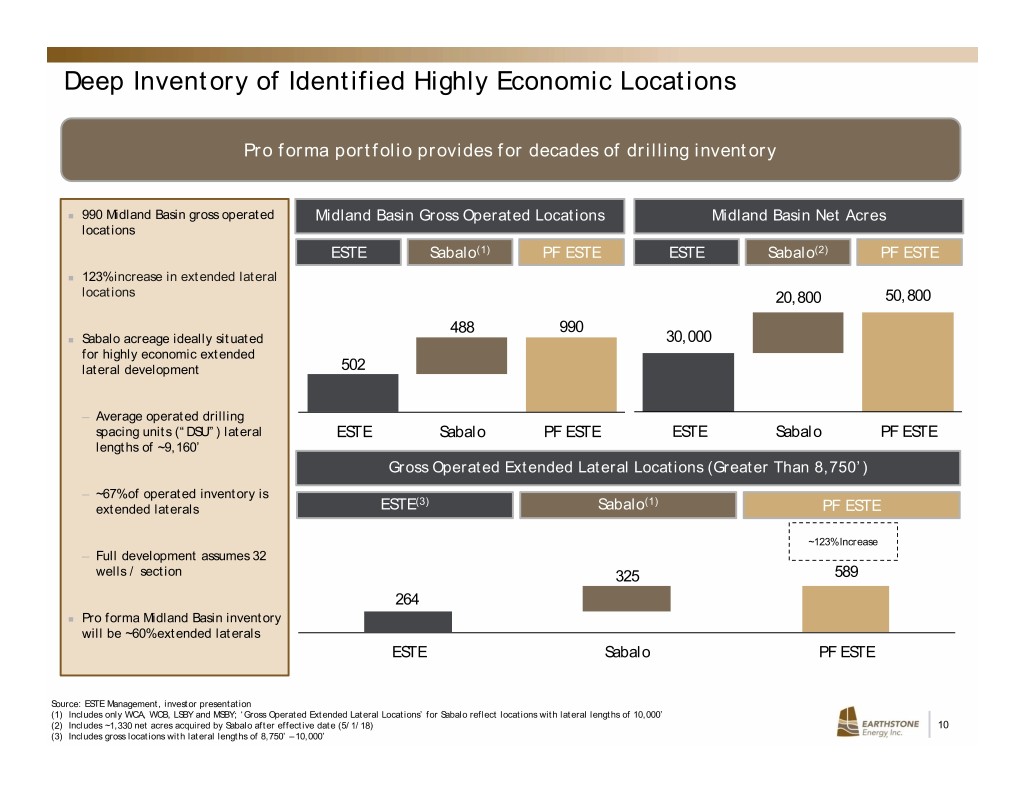

Deep Inventory of Identified Highly Economic Locations Pro forma portfolio provides for decades of drilling inventory 990 Midland Basin gross operated Midland Basin Gross Operated Locations Midland Basin Net Acres locations ESTE Sabalo(1) PF ESTE ESTE Sabalo(2) PF ESTE 123% increase in extended lateral locations 20,800 50,800 488 990 Sabalo acreage ideally situated 30,000 for highly economic extended lateral development 502 ─ Average operated drilling spacing units (“DSU”) lateral ESTE Sabalo PF ESTE ESTE Sabalo PF ESTE lengths of ~9,160’ Gross Operated Extended Lateral Locations (Greater Than 8,750’) ─ ~67% of operated inventory is (3) (1) extended laterals ESTE Sabalo PF ESTE ~123% Increase ─ Full development assumes 32 wells / section 325 589 264 Pro forma Midland Basin inventory will be ~60% extended laterals ESTE Sabalo PF ESTE Source: ESTE Management, investor presentation (1) Includes only WCA, WCB, LSBY and MSBY; ‘Gross Operated Extended Lateral Locations’ for Sabalo reflect locations with lateral lengths of 10,000’ (2) Includes ~1,330 net acres acquired by Sabalo after effective date (5/1/18) 10 (3) Includes gross locations with lateral lengths of 8,750’ – 10,000’

Sabalo Acquisition 11

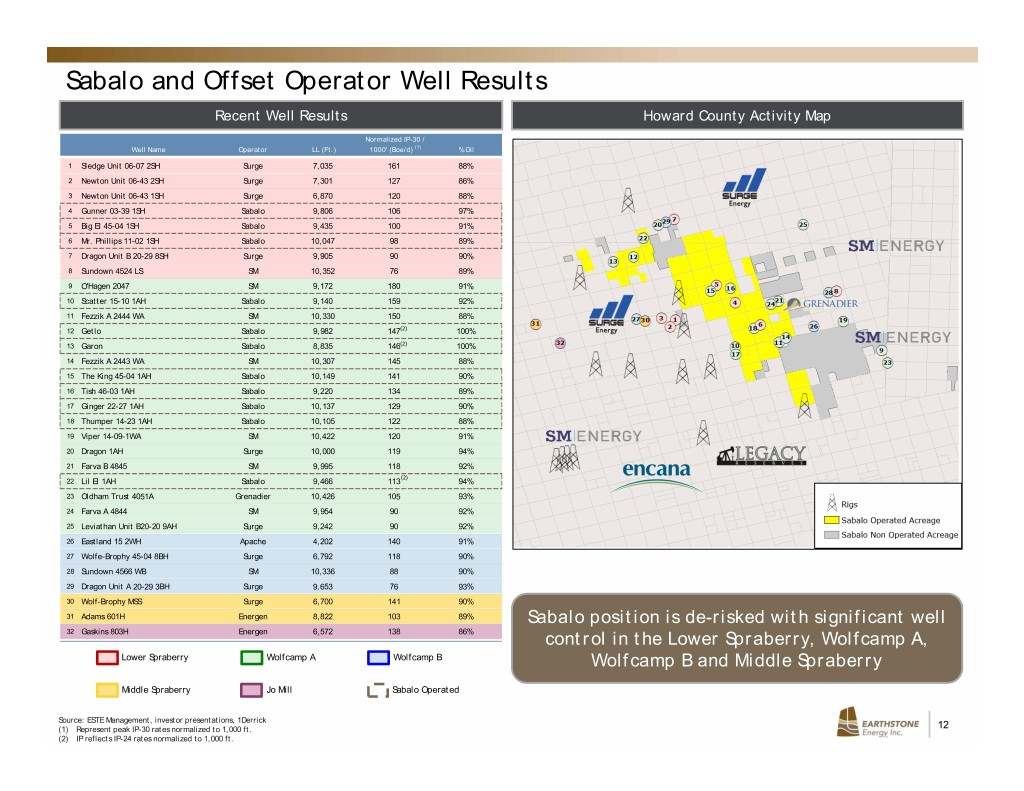

Sabalo and Offset Operator Well Results Recent Well Results Howard County Activity Map Normalized IP-30 / Well Name Operator LL (Ft.) 1000' (Boe/d) (1) % Oil 1 Sledge Unit 06-07 2SH Surge 7,035 161 88% 2 Newton Unit 06-43 2SH Surge 7,301 127 86% 3 Newton Unit 06-43 1SH Surge 6,870 120 88% 4 Gunner 03-39 1SH Sabalo 9,806 106 97% 5 Big El 45-04 1SH Sabalo 9,435 100 91% 6 Mr. Phillips 11-02 1SH Sabalo 10,047 98 89% 7 Dragon Unit B 20-29 8SH Surge 9,905 90 90% 8 Sundown 4524 LS SM 10,352 76 89% 9 O'Hagen 2047 SM 9,172 180 91% 10 Scatter 15-10 1AH Sabalo 9,140 159 92% 11 Fezzik A 2444 WA SM 10,330 150 88% 12 Getlo Sabalo 9,982 147(2) 100% 13 Garon Sabalo 8,835 146(2) 100% 14 Fezzik A 2443 WA SM 10,307 145 88% 15 The King 45-04 1AH Sabalo 10,149 141 90% 16 Tish 46-03 1AH Sabalo 9,220 134 89% 17 Ginger 22-27 1AH Sabalo 10,137 129 90% 18 Thumper 14-23 1AH Sabalo 10,105 122 88% 19 Viper 14-09-1WA SM 10,422 120 91% 20 Dragon 1AH Surge 10,000 119 94% 21 Farva B 4845 SM 9,995 118 92% (2) 22 Lil El 1AH Sabalo 9,466 113 94% 23 Oldham Trust 4051A Grenadier 10,426 105 93% 24 Farva A 4844 SM 9,954 90 92% 25 Leviathan Unit B20-20 9AH Surge 9,242 90 92% 26 Eastland 15 2WH Apache 4,202 140 91% 27 Wolfe-Brophy 45-04 8BH Surge 6,792 118 90% 28 Sundown 4566 WB SM 10,336 88 90% 29 Dragon Unit A 20-29 3BH Surge 9,653 76 93% 30 Wolf-Brophy MSS Surge 6,700 141 90% 31 Adams 601H Energen 8,822 103 89% Sabalo position is de-risked with significant well 32 Gaskins 803H Energen 6,572 138 86% control in the Lower Spraberry, Wolfcamp A, Lower Spraberry Wolfcamp A Wolfcamp B Wolfcamp B and Middle Spraberry Middle Spraberry Jo Mill Sabalo Operated Source: ESTE Management, investor presentations, 1Derrick (1) Represent peak IP-30 rates normalized to 1,000 ft. 12 (2) IP reflects IP-24 rates normalized to 1,000 ft.

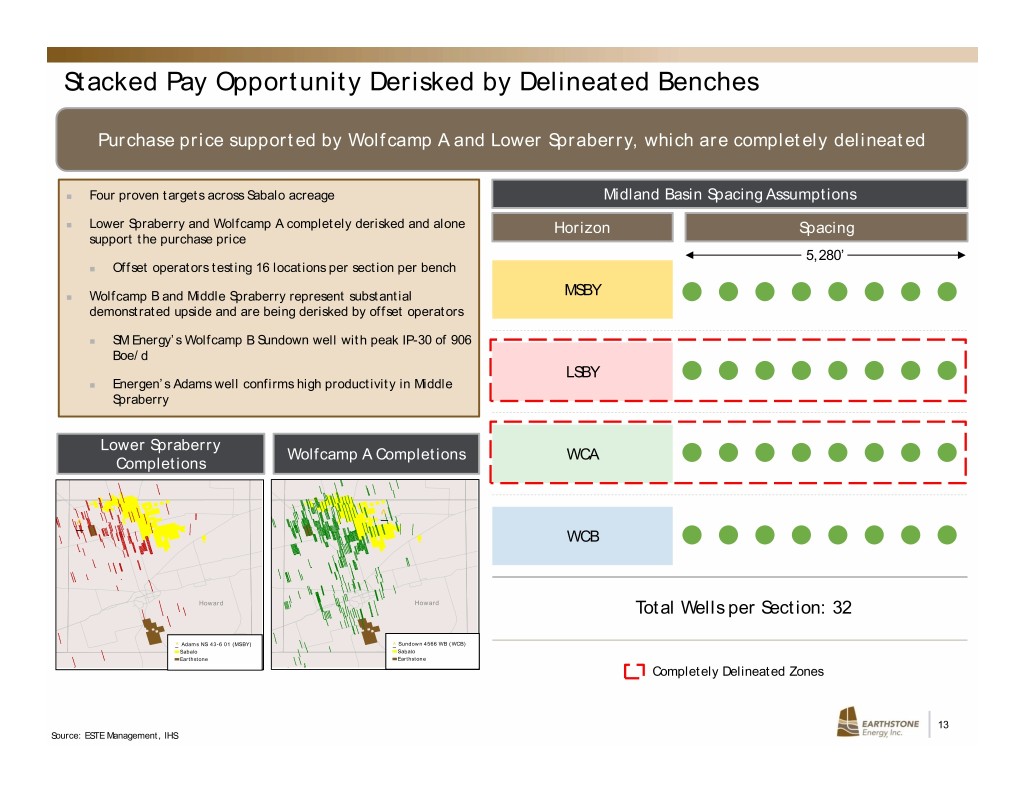

Stacked Pay Opportunity Derisked by Delineated Benches Purchase price supported by Wolfcamp A and Lower Spraberry, which are completely delineated Four proven targets across Sabalo acreage Midland Basin Spacing Assumptions Lower Spraberry and Wolfcamp A completely derisked and alone Horizon Spacing support the purchase price 5,280’ Offset operators testing 16 locations per section per bench MSBY Wolfcamp B and Middle Spraberry represent substantial demonstrated upside and are being derisked by offset operators SM Energy’s Wolfcamp B Sundown well with peak IP-30 of 906 Boe/d LSBY Energen’s Adams well confirms high productivity in Middle Spraberry Lower Spraberry Wolfcamp A Completions WCA Completions ^_ ^_ WCB Howard Howard Total Wells per Section: 32 _^ Adams NS 43-6 01 (MSBY) ^_ Sundown 4566 WB (WCB) Sabalo Sabalo Earthstone Earthstone Completely Delineated Zones 13 Source: ESTE Management, IHS

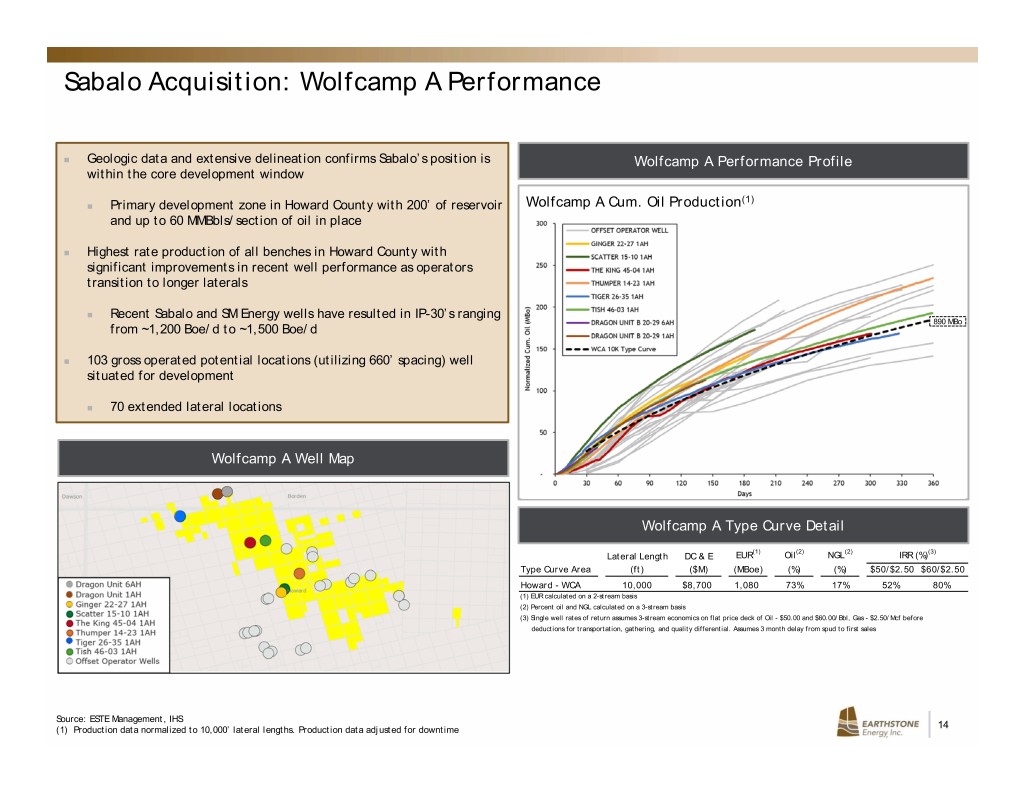

Sabalo Acquisition: Wolfcamp A Performance Geologic data and extensive delineation confirms Sabalo’s position is Wolfcamp A Performance Profile within the core development window (1) Primary development zone in Howard County with 200’ of reservoir Wolfcamp A Cum. Oil Production and up to 60 MMBbls/section of oil in place Highest rate production of all benches in Howard County with significant improvements in recent well performance as operators transition to longer laterals Recent Sabalo and SM Energy wells have resulted in IP-30’s ranging 890 MBo from ~1,200 Boe/d to ~1,500 Boe/d 103 gross operated potential locations (utilizing 660’ spacing) well situated for development 70 extended lateral locations Wolfcamp A Well Map Wolfcamp A Type Curve Detail (1) (2) (2) (3) Lateral Length DC & E EUR Oil NGL IRR (%) Type Curve Area (ft) ($M) (MBoe) (%) (%) $50/$2.50 $60/$2.50 Howard - WCA 10,000 $8,700 1,080 73% 17% 52% 80% (1) EUR calculated on a 2-stream basis (2) Percent oil and NGL calculated on a 3-stream basis (3) Single well rates of return assumes 3-stream economics on flat price deck of Oil - $50.00 and $60.00/Bbl, Gas - $2.50/Mcf before deductions for transportation, gathering, and quality differential. Assumes 3 month delay from spud to first sales Source: ESTE Management, IHS (1) Production data normalized to 10,000’ lateral lengths. Production data adjusted for downtime 14

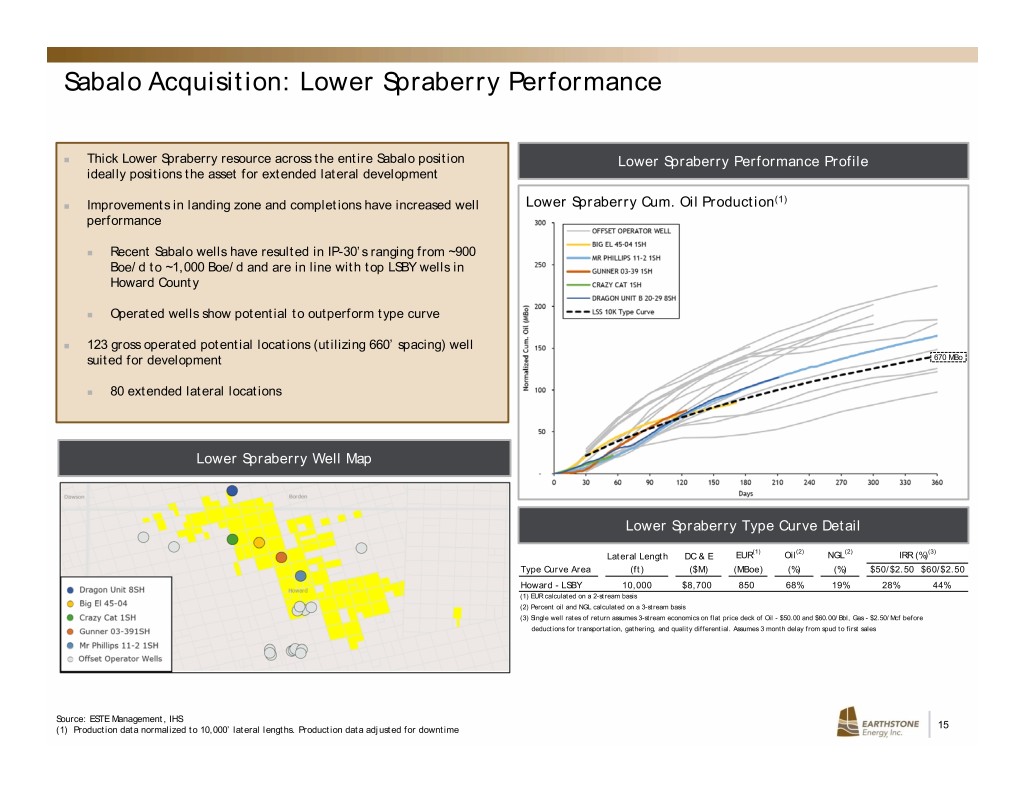

Sabalo Acquisition: Lower Spraberry Performance Thick Lower Spraberry resource across the entire Sabalo position Lower Spraberry Performance Profile ideally positions the asset for extended lateral development (1) Improvements in landing zone and completions have increased well Lower Spraberry Cum. Oil Production performance Recent Sabalo wells have resulted in IP-30’s ranging from ~900 Boe/d to ~1,000 Boe/d and are in line with top LSBY wells in Howard County Operated wells show potential to outperform type curve 123 gross operated potential locations (utilizing 660’ spacing) well suited for development 670 MBo 80 extended lateral locations Lower Spraberry Well Map Lower Spraberry Type Curve Detail (1) (2) (2) (3) Lateral Length DC & E EUR Oil NGL IRR (%) Type Curve Area (ft) ($M) (MBoe) (%) (%) $50/$2.50 $60/$2.50 Howard - LSBY 10,000 $8,700 850 68% 19% 28% 44% (1) EUR calculated on a 2-stream basis (2) Percent oil and NGL calculated on a 3-stream basis (3) Single well rates of return assumes 3-stream economics on flat price deck of Oil - $50.00 and $60.00/Bbl, Gas - $2.50/Mcf before deductions for transportation, gathering, and quality differential. Assumes 3 month delay from spud to first sales Source: ESTE Management, IHS (1) Production data normalized to 10,000’ lateral lengths. Production data adjusted for downtime 15

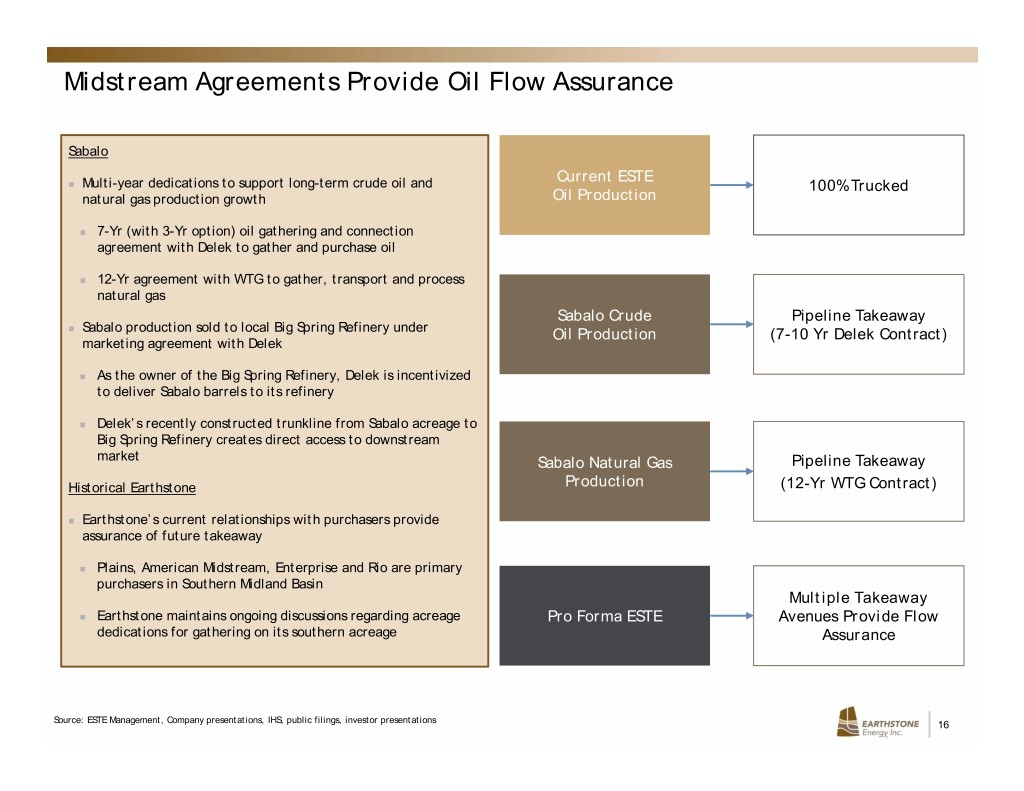

Midstream Agreements Provide Oil Flow Assurance Sabalo Current ESTE Multi-year dedications to support long-term crude oil and 100% Trucked natural gas production growth Oil Production 7-Yr (with 3-Yr option) oil gathering and connection agreement with Delek to gather and purchase oil 12-Yr agreement with WTG to gather, transport and process natural gas Sabalo Crude Pipeline Takeaway Sabalo production sold to local Big Spring Refinery under Oil Production (7-10 Yr Delek Contract) marketing agreement with Delek As the owner of the Big Spring Refinery, Delek is incentivized to deliver Sabalo barrels to its refinery Delek’s recently constructed trunkline from Sabalo acreage to Big Spring Refinery creates direct access to downstream market Sabalo Natural Gas Pipeline Takeaway Historical Earthstone Production (12-Yr WTG Contract) Earthstone’s current relationships with purchasers provide assurance of future takeaway Plains, American Midstream, Enterprise and Rio are primary purchasers in Southern Midland Basin Multiple Takeaway Earthstone maintains ongoing discussions regarding acreage Pro Forma ESTE Avenues Provide Flow dedications for gathering on its southern acreage Assurance Source: ESTE Management, Company presentations, IHS, public filings, investor presentations 16

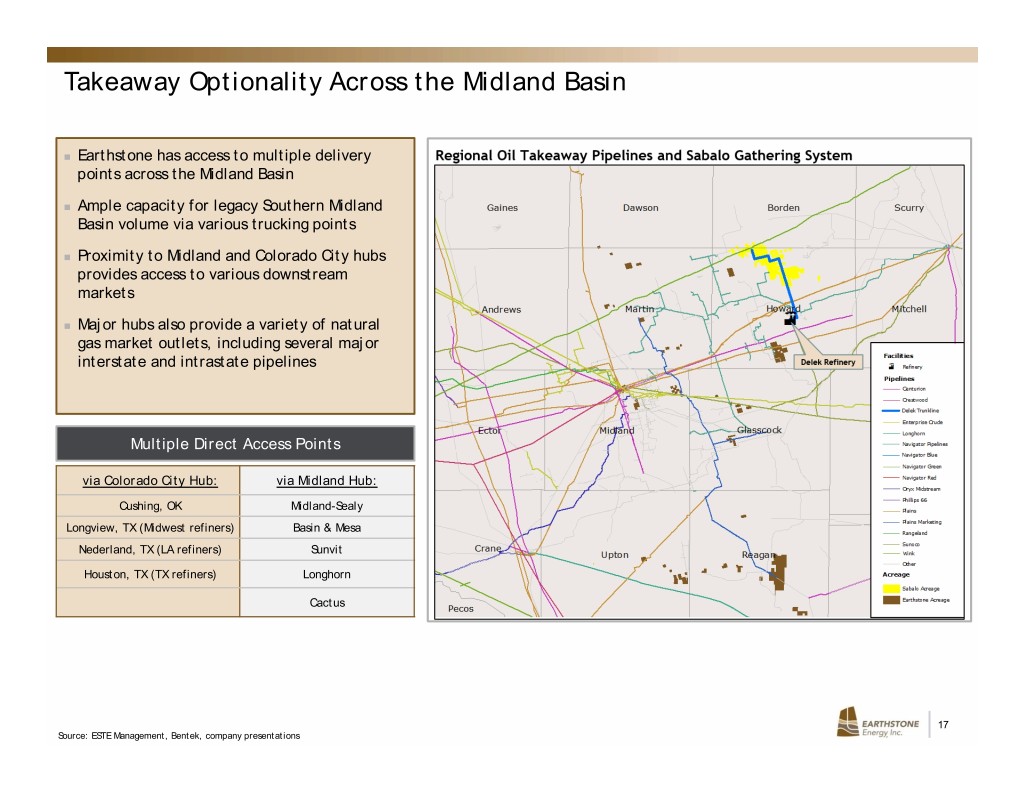

Takeaway Optionality Across the Midland Basin Earthstone has access to multiple delivery points across the Midland Basin Ample capacity for legacy Southern Midland Basin volume via various trucking points Proximity to Midland and Colorado City hubs provides access to various downstream markets Major hubs also provide a variety of natural gas market outlets, including several major interstate and intrastate pipelines Multiple Direct Access Points via Colorado City Hub: via Midland Hub: Cushing, OK Midland-Sealy Longview, TX (Midwest refiners) Basin & Mesa Nederland, TX (LA refiners) Sunvit Houston, TX (TX refiners) Longhorn Cactus 17 Source: ESTE Management, Bentek, company presentations

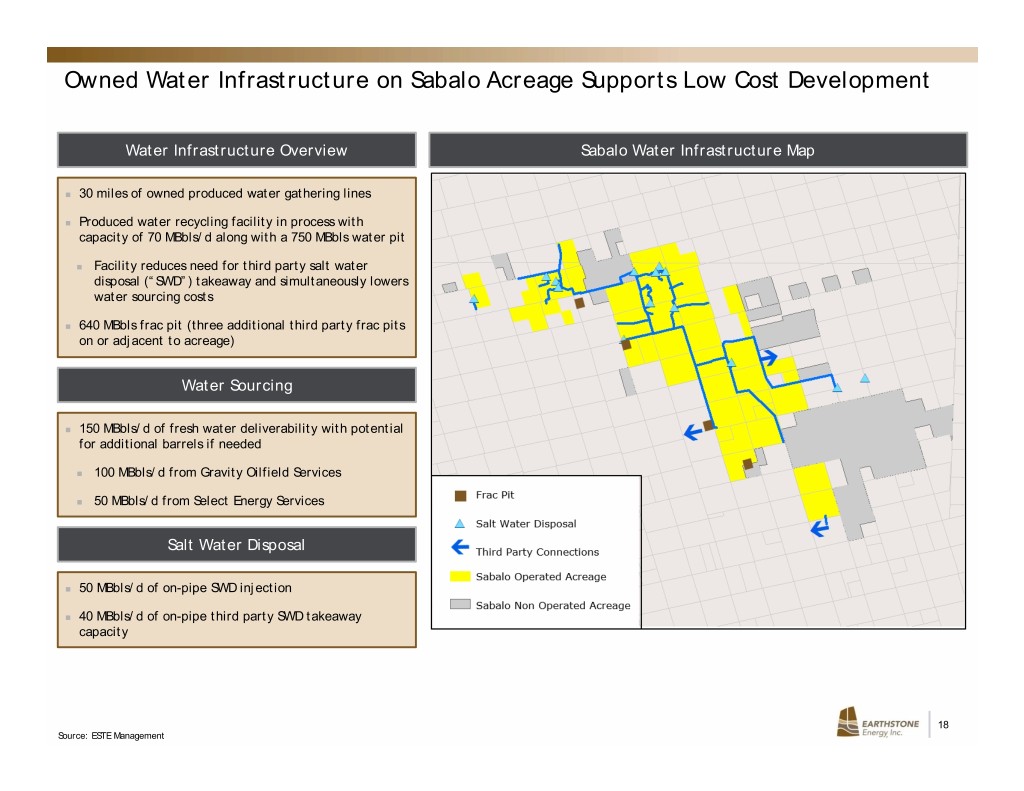

Owned Water Infrastructure on Sabalo Acreage Supports Low Cost Development Water Infrastructure Overview Sabalo Water Infrastructure Map 30 miles of owned produced water gathering lines Produced water recycling facility in process with capacity of 70 MBbls/d along with a 750 MBbls water pit Facility reduces need for third party salt water disposal (“SWD”) takeaway and simultaneously lowers water sourcing costs 640 MBbls frac pit (three additional third party frac pits on or adjacent to acreage) Water Sourcing 150 MBbls/d of fresh water deliverability with potential for additional barrels if needed 100 MBbls/d from Gravity Oilfield Services 50 MBbls/d from Select Energy Services Salt Water Disposal 50 MBbls/d of on-pipe SWD injection 40 MBbls/d of on-pipe third party SWD takeaway capacity 18 Source: ESTE Management

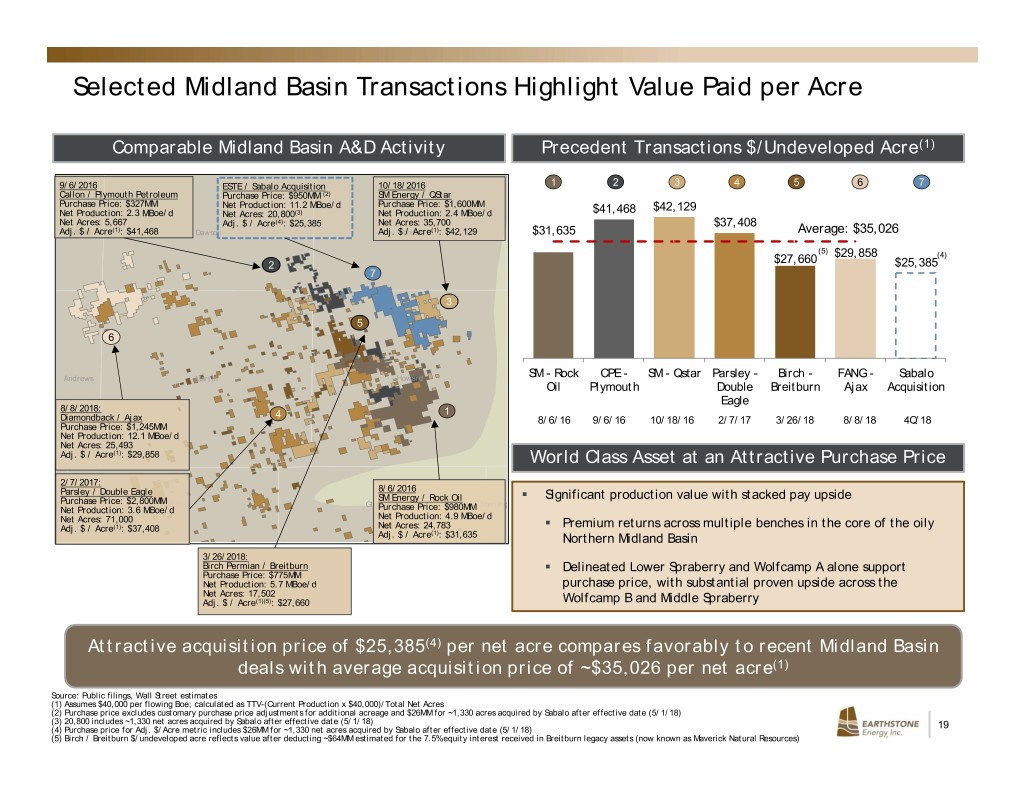

Selected Midland Basin Transactions Highlight Value Paid per Acre Comparable Midland Basin A&D Activity Precedent Transactions $/Undeveloped Acre(1) 9/6/2016 ESTE / Sabalo Acquisition 10/18/2016 1 2 3 4 5 6 7 Callon / Plymouth Petroleum Purchase Price: $950MM (2) SM Energy / QStar Purchase Price: $327MM Net Production: 11.2 MBoe/d Purchase Price: $1,600MM $42,129 Net Production: 2.3 MBoe/d Net Acres: 20,800(3) Net Production: 2.4 MBoe/d $41,468 Net Acres: 5,667 Adj. $ / Acre(4): $25,385 Net Acres: 35,700 $37,408 Adj.Gaines $ / Acre(1): $41,468 Dawson Adj. $Borden / Acre(1): $42,129 $31,635 Average: $35,026 (5) $29,858 (4) $27,660 2 $25,385 7 3 5 6 Andrews Martin Howard SM - Rock CPE - SM - Qstar Parsley - Birch - FANG - Sabalo Oil Plymouth Double Breitburn Ajax Acquisition Eagle 8/8/2018: 4 1 Diamondback / Ajax 8/6/16 9/6/16 10/18/16 2/7/17 3/26/188/8/18 4Q’18 Purchase Price: $1,245MM Net Production: 12.1 MBoe/d Net Acres: 25,493 Adj. $ / Acre(1): $29,858 World Class Asset at an Attractive Purchase Price 2/7/2017: Parsley / Double Eagle 8/6/2016 Purchase Price: $2,800MM SM Energy / Rock Oil . Significant production value with stacked pay upside Ector Midland Glasscock Sterling Net Production: 3.6 MBoe/d Purchase Price: $980MM Net Acres: 71,000 Net Production: 4.9 MBoe/d Adj. $ / Acre(1): $37,408 Net Acres: 24,783 . Premium returns across multiple benches in the core of the oily Adj. $ / Acre(1): $31,635 Northern Midland Basin 3/26/2018: Birch Permian / Breitburn . Delineated Lower Spraberry and Wolfcamp A alone support Purchase Price: $775MM Net Production: 5.7 MBoe/d purchase price, with substantial proven upside across the Net Acres: 17,502 Adj. $ / Acre(1)(5): $27,660 Wolfcamp B and Middle Spraberry Attractive acquisition price of $25,385(4) per net acre compares favorably to recent Midland Basin deals with average acquisition price of ~$35,026 per net acre(1) Source: Public filings, Wall Street estimates (1) Assumes $40,000 per flowing Boe; calculated as TTV-(Current Production x $40,000)/Total Net Acres (2) Purchase price excludes customary purchase price adjustments for additional acreage and $26MM for ~1,330 acres acquired by Sabalo after effective date (5/1/18) (3) 20,800 includes ~1,330 net acres acquired by Sabalo after effective date (5/1/18) (4) Purchase price for Adj. $/Acre metric includes $26MM for ~1,330 net acres acquired by Sabalo after effective date (5/1/18) 19 (5) Birch / Breitburn $/undeveloped acre reflects value after deducting ~$64MM estimated for the 7.5% equity interest received in Breitburn legacy assets (now known as Maverick Natural Resources)

Legacy Earthstone Overview 20

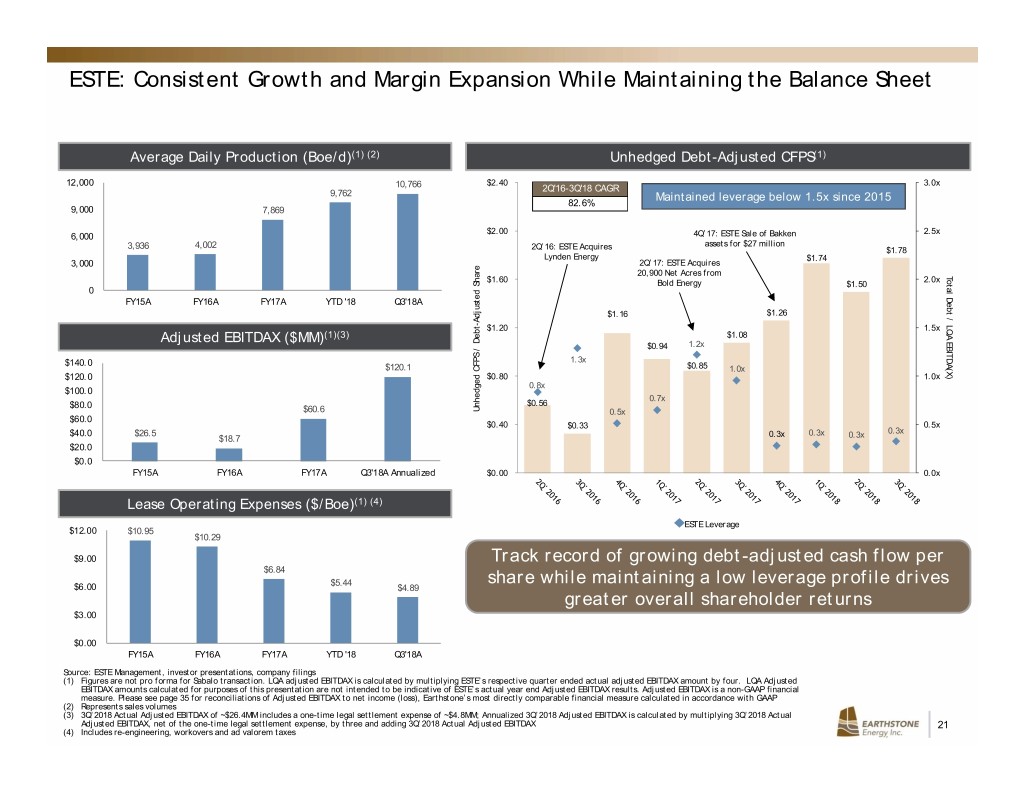

ESTE: Consistent Growth and Margin Expansion While Maintaining the Balance Sheet Average Daily Production (Boe/d)(1) (2) Unhedged Debt-Adjusted CFPS(1) 12,000 $2.40 3.0x 10,766 2Q'16-3Q'18 CAGR 9,762 Maintained leverage below 1.5x since 2015 82.6% 9,000 7,869 $2.00 2.5x 6,000 4Q’17: ESTE Sale of Bakken 3,936 4,002 assets for $27 million 2Q’16: ESTE Acquires $1.78 Lynden Energy $1.74 3,000 2Q’17: ESTE Acquires 20,900 Net Acres from TotalDebt / LQA EBITDA(X) $1.60 2.0x Bold Energy $1.50 0 FY15A FY16A FY17A YTD '18 Q3'18A $1.16 $1.26 $1.20 1.5x Adjusted EBITDAX ($MM)(1)(3) $1.08 $0.94 1.2x $140.0 1.3x $120.1 $0.85 1.0x $120.0 $0.80 1.0x 0.8x $100.0 0.7x $80.0 $0.56 $60.6 Share Debt-Adjusted / CFPS Unhedged 0.5x $60.0 $0.40 $0.33 0.5x $40.0 $26.5 0.3x 0.3x 0.3x $18.7 0.3x $20.0 $0.0 FY15A FY16A FY17A Q3'18A Annualized $0.00 0.0x Lease Operating Expenses ($/Boe)(1) (4) ESTE Leverage $12.00 $10.95 $10.29 $9.00 Track record of growing debt-adjusted cash flow per $6.84 $5.44 share while maintaining a low leverage profile drives $6.00 $4.89 greater overall shareholder returns $3.00 $0.00 FY15A FY16A FY17A YTD '18 Q3'18A Source: ESTE Management, investor presentations, company filings (1) Figures are not pro forma for Sabalo transaction. LQA adjusted EBITDAX is calculated by multiplying ESTE’s respective quarter ended actual adjusted EBITDAX amount by four. LQA Adjusted EBITDAX amounts calculated for purposes of this presentation are not intended to be indicative of ESTE’s actual year end Adjusted EBITDAX results. Adjusted EBITDAX is a non-GAAP financial measure. Please see page 35 for reconciliations of Adjusted EBITDAX to net income (loss), Earthstone’s most directly comparable financial measure calculated in accordance with GAAP (2) Represents sales volumes (3) 3Q’2018 Actual Adjusted EBITDAX of ~$26.4MM includes a one-time legal settlement expense of ~$4.8MM; Annualized 3Q’2018 Adjusted EBITDAX is calculated by multiplying 3Q’2018 Actual Adjusted EBITDAX, net of the one-time legal settlement expense, by three and adding 3Q’2018 Actual Adjusted EBITDAX 21 (4) Includes re-engineering, workovers and ad valorem taxes

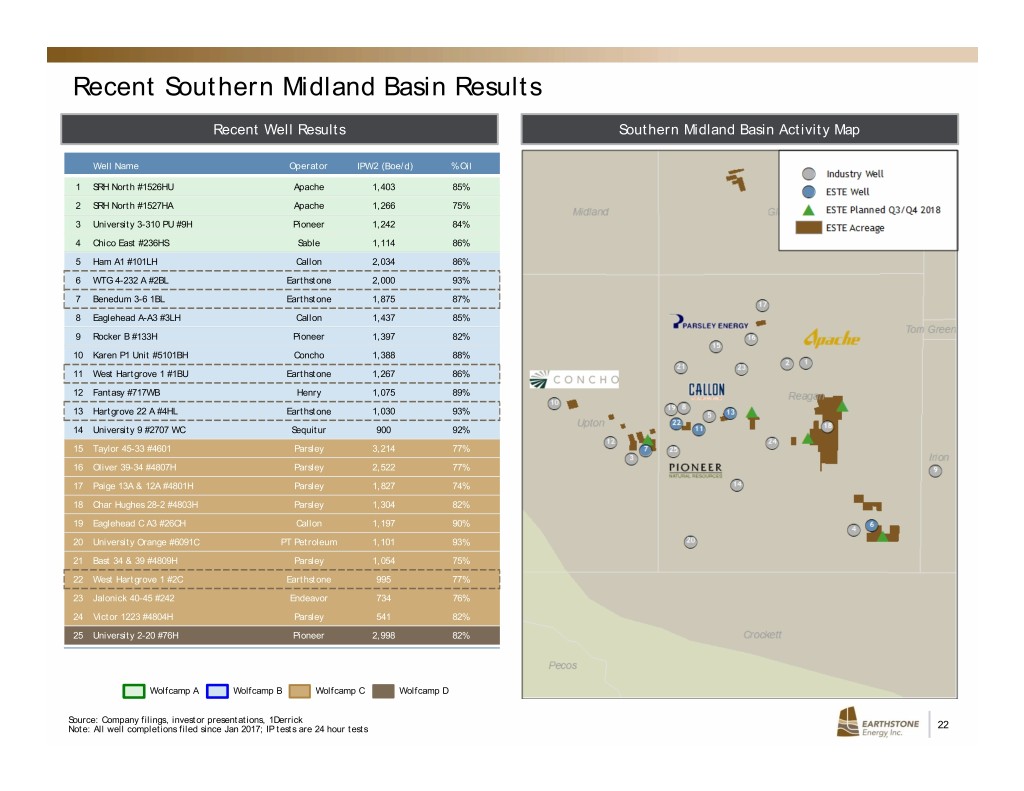

Recent Southern Midland Basin Results Recent Well Results Southern Midland Basin Activity Map Well Name Operator IPW2 (Boe/d) % Oil 1 SRH North #1526HU Apache 1,403 85% 2 SRH North #1527HA Apache 1,266 75% 3 University 3-310 PU #9H Pioneer 1,242 84% 4 Chico East #236HS Sable 1,114 86% 5 Ham A1 #101LH Callon 2,034 86% 6 WTG 4-232 A #2BL Earthstone 2,000 93% 7 Benedum 3-6 1BL Earthstone 1,875 87% 8 Eaglehead A-A3 #3LH Callon 1,437 85% 9 Rocker B #133H Pioneer 1,397 82% 10 Karen P1 Unit #5101BH Concho 1,388 88% 11 West Hartgrove 1 #1BU Earthstone 1,267 86% 12 Fantasy #717WB Henry 1,075 89% 13 Hartgrove 22 A #4HL Earthstone 1,030 93% 14 University 9 #2707 WC Sequitur 900 92% 15 Taylor 45-33 #4601 Parsley 3,214 77% 16 Oliver 39-34 #4807H Parsley 2,522 77% 17 Paige 13A & 12A #4801H Parsley 1,827 74% 18 Char Hughes 28-2 #4803H Parsley 1,304 82% 19 Eaglehead C A3 #26CH Callon 1,197 90% 20 University Orange #6091C PT Petroleum 1,101 93% 21 Bast 34 & 39 #4809H Parsley 1,054 75% 22 West Hartgrove 1 #2C Earthstone 995 77% 23 Jalonick 40-45 #242 Endeavor 734 76% 24 Victor 1223 #4804H Parsley 541 82% 25 University 2-20 #76H Pioneer 2,998 82% Wolfcamp A Wolfcamp B Wolfcamp C Wolfcamp D Source: Company filings, investor presentations, 1Derrick Note: All well completions filed since Jan 2017; IP tests are 24 hour tests 22

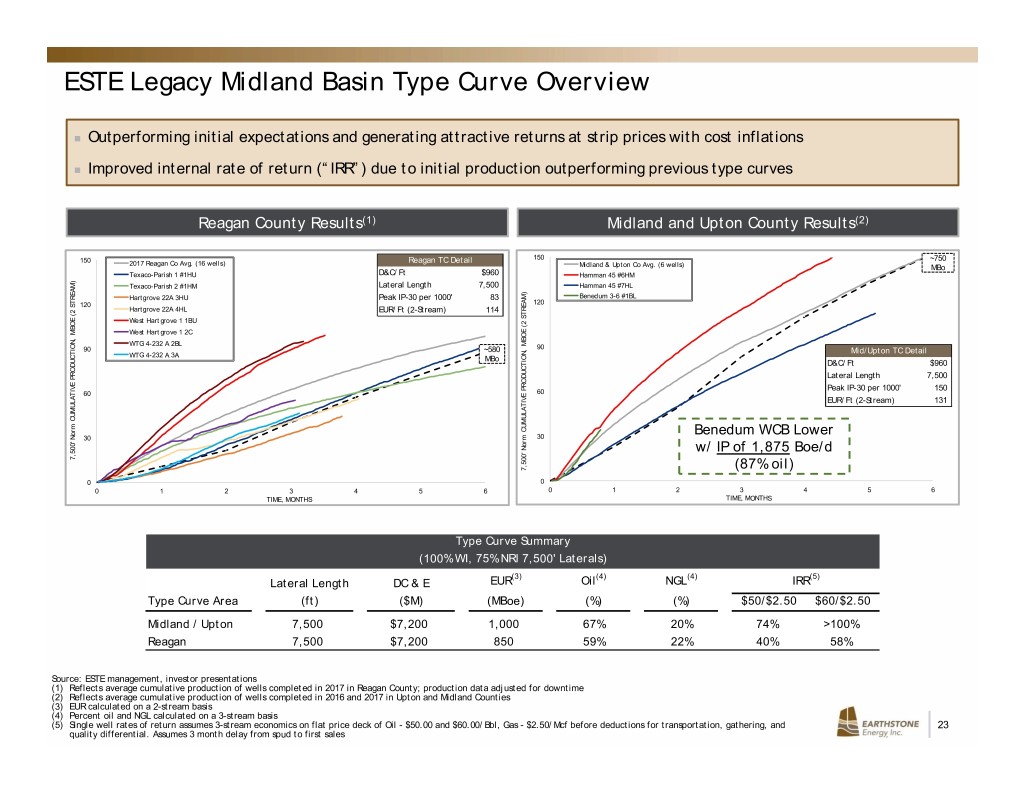

ESTE Legacy Midland Basin Type Curve Overview Outperforming initial expectations and generating attractive returns at strip prices with cost inflations Improved internal rate of return (“IRR”) due to initial production outperforming previous type curves Reagan County Results(1) Midland and Upton County Results(2) 150 ~750 150 2017 Reagan Co Avg. (16 wells) Reagan TC Detail Midland & Upton Co Avg. (6 wells) MBo Texaco-Parish 1 #1HU D&C/Ft $960 Hamman 45 #6HM Texaco-Parish 2 #1HM Lateral Length 7,500 Hamman 45 #7HL Hartgrove 22A 3HU Peak IP-30 per 1000' 83 Benedum 3-6 #1BL 120 120 Hartgrove 22A 4HL EUR/Ft (2-Stream) 114 West Hartgrove 1 1BU West Hartgrove 1 2C WTG 4-232 A 2BL 90 ~580 90 Mid/Upton TC Detail WTG 4-232 A 3A MBo D&C/Ft $960 Lateral Length 7,500 Peak IP-30 per 1000' 150 60 60 EUR/Ft (2-Stream) 131 Benedum WCB Lower 30 30 w/ IP of 1,875 Boe/d 7,500' Norm CUMULATIVE PRODUCTION, MBOE (2 STREAM) (2 MBOE PRODUCTION, CUMULATIVE Norm 7,500' 7,500' Norm CUMULATIVE PRODUCTION, STREAM) (2 MBOE PRODUCTION, CUMULATIVE Norm 7,500' (87% oil) 0 0 01234560123456 TIME, MONTHS TIME, MONTHS Type Curve Summary (100% WI, 75% NRI 7,500' Laterals) (3) (4) (4) (5) Lateral Length DC & E EUR Oil NGL IRR Type Curve Area (ft) ($M) (MBoe) (%) (%) $50/$2.50 $60/$2.50 Midland / Upton 7,500 $7,200 1,000 67% 20% 74% >100% Reagan 7,500 $7,200 850 59% 22% 40% 58% Source: ESTE management, investor presentations (1) Reflects average cumulative production of wells completed in 2017 in Reagan County; production data adjusted for downtime (2) Reflects average cumulative production of wells completed in 2016 and 2017 in Upton and Midland Counties (3) EUR calculated on a 2-stream basis (4) Percent oil and NGL calculated on a 3-stream basis (5) Single well rates of return assumes 3-stream economics on flat price deck of Oil - $50.00 and $60.00/Bbl, Gas - $2.50/Mcf before deductions for transportation, gathering, and 23 quality differential. Assumes 3 month delay from spud to first sales

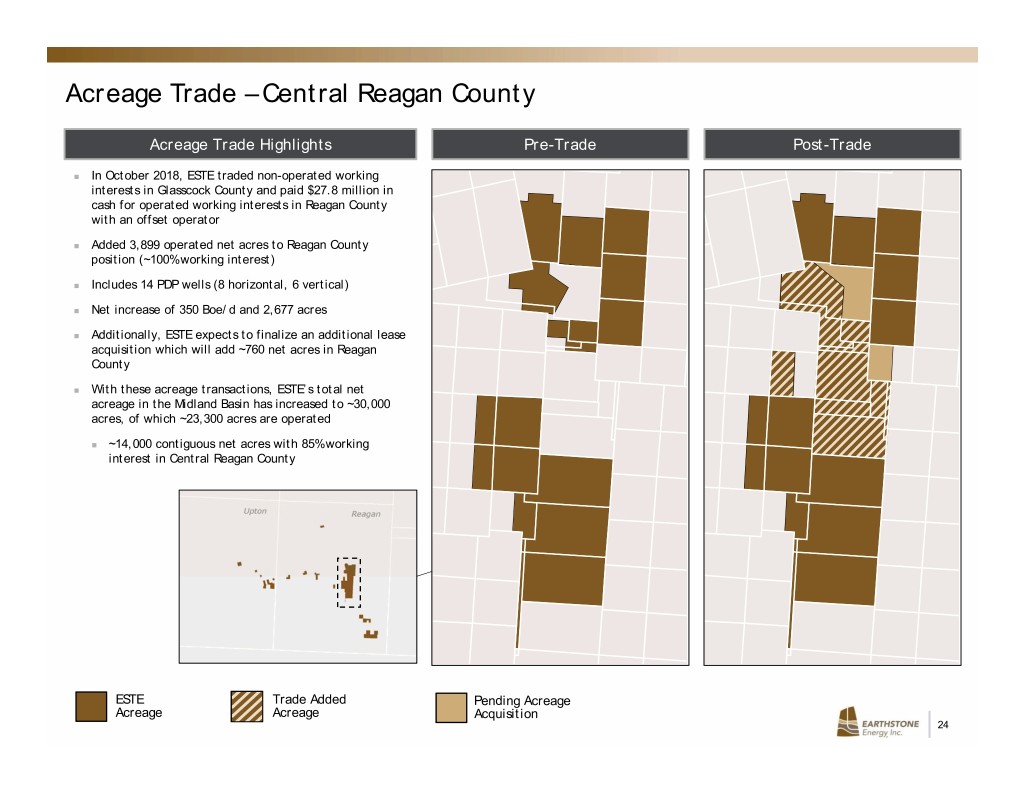

Acreage Trade – Central Reagan County Acreage Trade Highlights Pre-Trade Post-Trade In October 2018, ESTE traded non-operated working interests in Glasscock County and paid $27.8 million in cash for operated working interests in Reagan County with an offset operator Added 3,899 operated net acres to Reagan County position (~100% working interest) Includes 14 PDP wells (8 horizontal, 6 vertical) Net increase of 350 Boe/d and 2,677 acres Additionally, ESTE expects to finalize an additional lease acquisition which will add ~760 net acres in Reagan County With these acreage transactions, ESTE’s total net acreage in the Midland Basin has increased to ~30,000 acres, of which ~23,300 acres are operated ~14,000 contiguous net acres with 85% working interest in Central Reagan County ESTE Trade Added Pending Acreage Acreage Acreage Acquisition 24

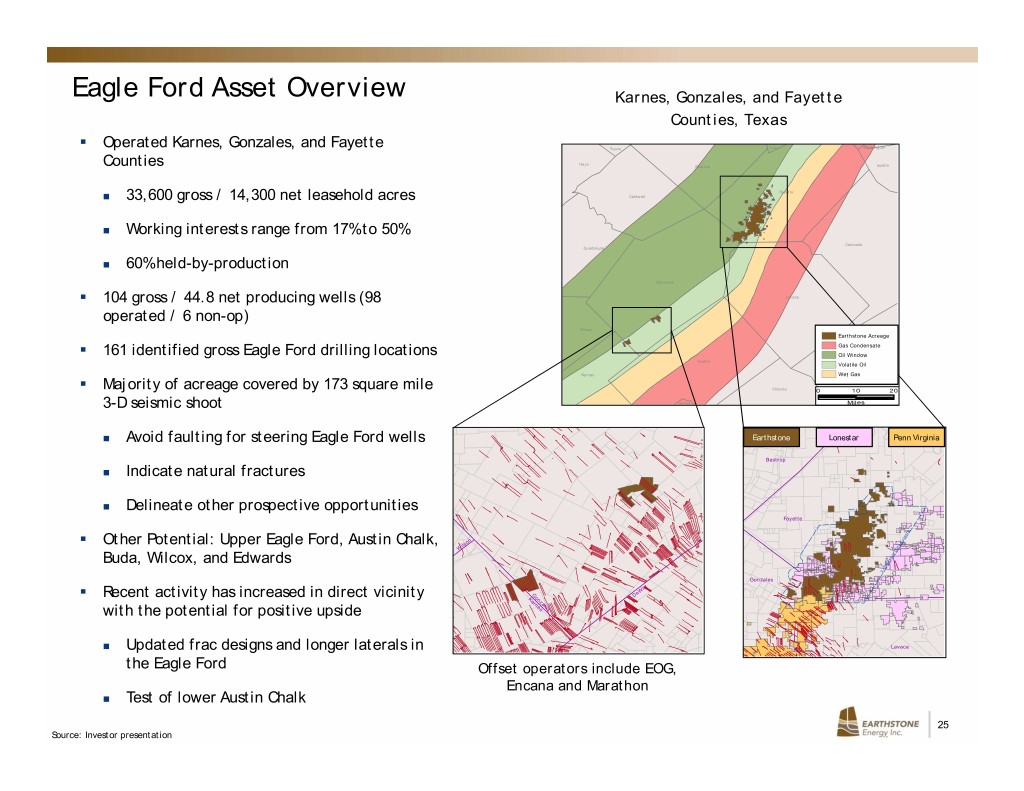

Eagle Ford Asset Overview Karnes, Gonzales, and Fayette Counties, Texas . Operated Karnes, Gonzales, and Fayette Lee Washington Tr av is Hays Counties Bastrop Austin Fa yet te 33,600 gross / 14,300 net leasehold acres Caldwell Working interests range from 17% to 50% Colorado Guadalupe 60% held-by-production Gonzales . 104 gross / 44.8 net producing wells (98 Lavaca operated / 6 non-op) Wilson Wharton Earthstone Acreage Gas Condensate . 161 identified gross Eagle Ford drilling locations Oil Window DeWitt Volatile Oil Jackson Karnes Wet Gas . Majority of acreage covered by 173 square mile Victoria 01020 3-D seismic shoot Goliad Miles Avoid faulting for steering Eagle Ford wells Earthstone Lonestar Penn Virginia Bastrop Indicate natural fractures Delineate other prospective opportunities Fayette s t n e t x n E o . Other Potential: Upper Eagle Ford, Austin Chalk, ls a i t W a D ic m is e Buda, Wilcox, and Edwards S D - 3 Gonzales t it W G e . o D Recent activity has increased in direct vicinity K n a z rn a e le with the potential for positive upside s s Updated frac designs and longer laterals in Lavaca the Eagle Ford Offset operators include EOG, Encana and Marathon Test of lower Austin Chalk 25 Source: Investor presentation

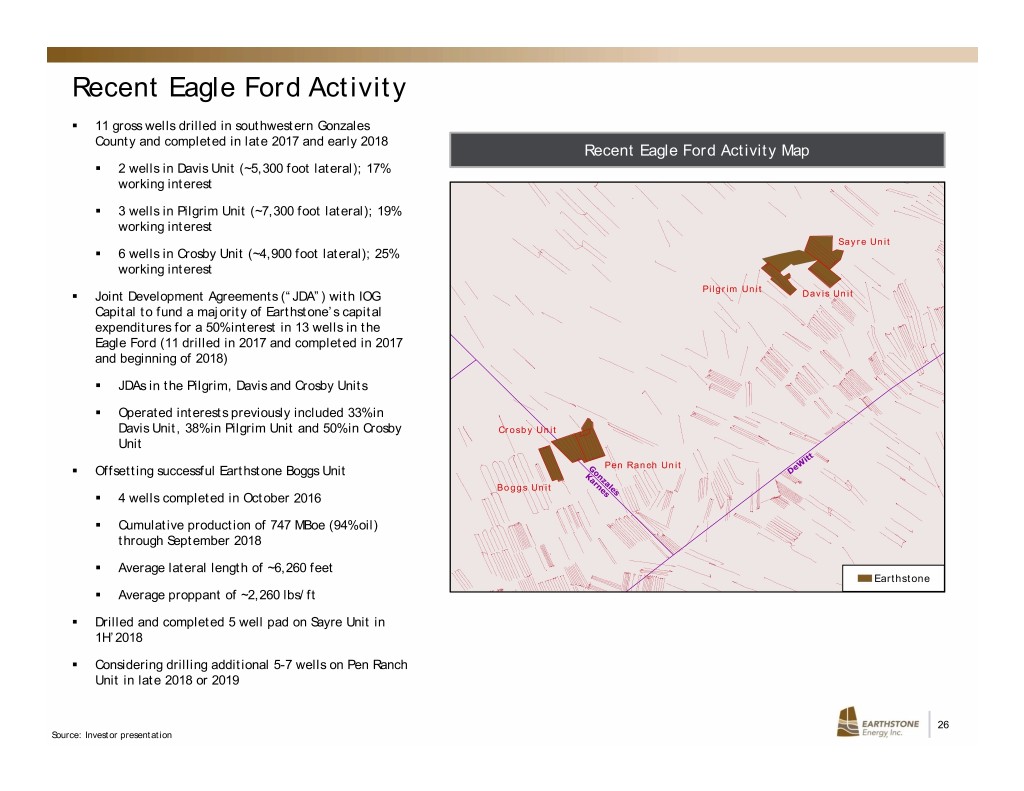

Recent Eagle Ford Activity . 11 gross wells drilled in southwestern Gonzales County and completed in late 2017 and early 2018 Recent Eagle Ford Activity Map . 2 wells in Davis Unit (~5,300 foot lateral); 17% working interest . 3 wells in Pilgrim Unit (~7,300 foot lateral); 19% working interest Sayre Unit . 6 wells in Crosby Unit (~4,900 foot lateral); 25% working interest Pilgrim Unit . Joint Development Agreements (“JDA”) with IOG Davis Unit Capital to fund a majority of Earthstone’s capital expenditures for a 50% interest in 13 wells in the Eagle Ford (11 drilled in 2017 and completed in 2017 and beginning of 2018) . JDAs in the Pilgrim, Davis and Crosby Units . Operated interests previously included 33% in Davis Unit, 38% in Pilgrim Unit and 50% in Crosby Crosby Unit Unit . Offsetting successful Earthstone Boggs Unit Pen Ranch Unit Boggs Unit . 4 wells completed in October 2016 . Cumulative production of 747 MBoe (94% oil) through September 2018 . Average lateral length of ~6,260 feet Earthstone . Average proppant of ~2,260 lbs/ft . Drilled and completed 5 well pad on Sayre Unit in 1H’2018 . Considering drilling additional 5-7 wells on Pen Ranch Unit in late 2018 or 2019 26 Source: Investor presentation

Earthstone is Uniquely Positioned to Create Shareholder Value ~50,800 net acres primed for years of low-cost growth Creation of “Must Own” Entire Midland Basin portfolio offers attractive economics creating Midland Basin Growth Right Assets scale, growth and added upside Story Proven management team with strong operational track record Development supported by full-cycle economics Attractive Corporate Visible path to positive free cash flow Level Returns Balancing capital efficiency with growth Right Team Infrastructure and Multi-year marketing agreements provide flow assurance Midstream Contracts in Proximity to multiple downstream markets Place Significant new takeaway projects in the basin underway Right Capital Structure (1) Pro forma leverage of ~2.2x with target below 2.0x Strong Financial Profile Strong pro forma liquidity position enhances capital flexibility Focus on debt-adjusted cash flow growth = Select group of pure play, high growth oil stories with upside Peer group will include Callon Petroleum Company, Jagged Peak Strong Risk-Adjusted Expanding into New Peer Energy Inc., Matador Resources Company and Centennial Resource Returns Group Development, Inc. Low-risk oil growth positions Earthstone favorably relative to peers Source: ESTE Management and Company presentations (1) Pro forma leverage based on 3Q’18 pro forma LQA Adjusted EBITDAX, which gives effect to the Sabalo transaction. Earthstone’s 3Q’2018 Actual Adjusted EBITDAX of ~$26.4MM includes a one- time legal settlement expense of ~$4.8MM; Annualized 3Q’2018 Adjusted EBITDAX is calculated by multiplying 3Q’2018 Actual Adjusted EBITDAX, net of the one-time legal settlement expense, by three and adding 3Q’2018 Actual Adjusted EBITDAX. Please see page 32 for a reconciliation of pro forma leverage 27

Financial Overview 28

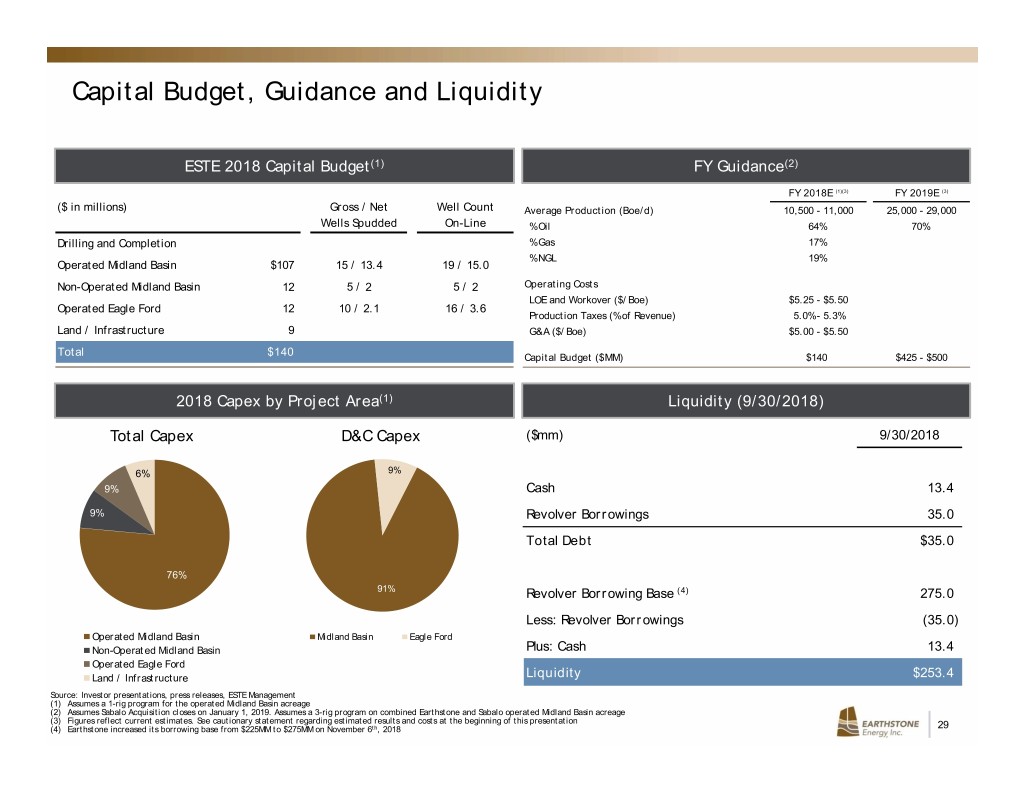

Capital Budget, Guidance and Liquidity ESTE 2018 Capital Budget(1) FY Guidance(2) FY 2018E (1)(3) FY 2019E (3) ($ in millions) Gross / Net Well Count Average Production (Boe/d) 10,500 - 11,000 25,000 - 29,000 Wells Spudded On-Line % Oil 64% 70% Drilling and Completion % Gas 17% % NGL 19% Operated Midland Basin $107 15 / 13.4 19 / 15.0 Non-Operated Midland Basin 12 5 / 2 5 / 2 Operating Costs LOE and Workover ($/Boe) $5.25 - $5.50 Operated Eagle Ford 12 10 / 2.1 16 / 3.6 Production Taxes (% of Revenue) 5.0% - 5.3% Land / Infrastructure 9 G&A ($/Boe) $5.00 - $5.50 Total $140 Capital Budget ($MM) $140 $425 - $500 2018 Capex by Project Area(1) Liquidity (9/30/2018) Total Capex D&C Capex ($mm) 9/30/2018 6% 9% 9% Cash 13.4 9% Revolver Borrowings 35.0 Total Debt $35.0 76% 91% Revolver Borrowing Base (4) 275.0 Less: Revolver Borrowings (35.0) Operated Midland Basin Midland Basin Eagle Ford Non-Operated Midland Basin Plus: Cash 13.4 Operated Eagle Ford Land / Infrastructure Liquidity $253.4 Source: Investor presentations, press releases, ESTE Management (1) Assumes a 1-rig program for the operated Midland Basin acreage (2) Assumes Sabalo Acquisition closes on January 1, 2019. Assumes a 3-rig program on combined Earthstone and Sabalo operated Midland Basin acreage (3) Figures reflect current estimates. See cautionary statement regarding estimated results and costs at the beginning of this presentation (4) Earthstone increased its borrowing base from $225MM to $275MM on November 6th, 2018 29

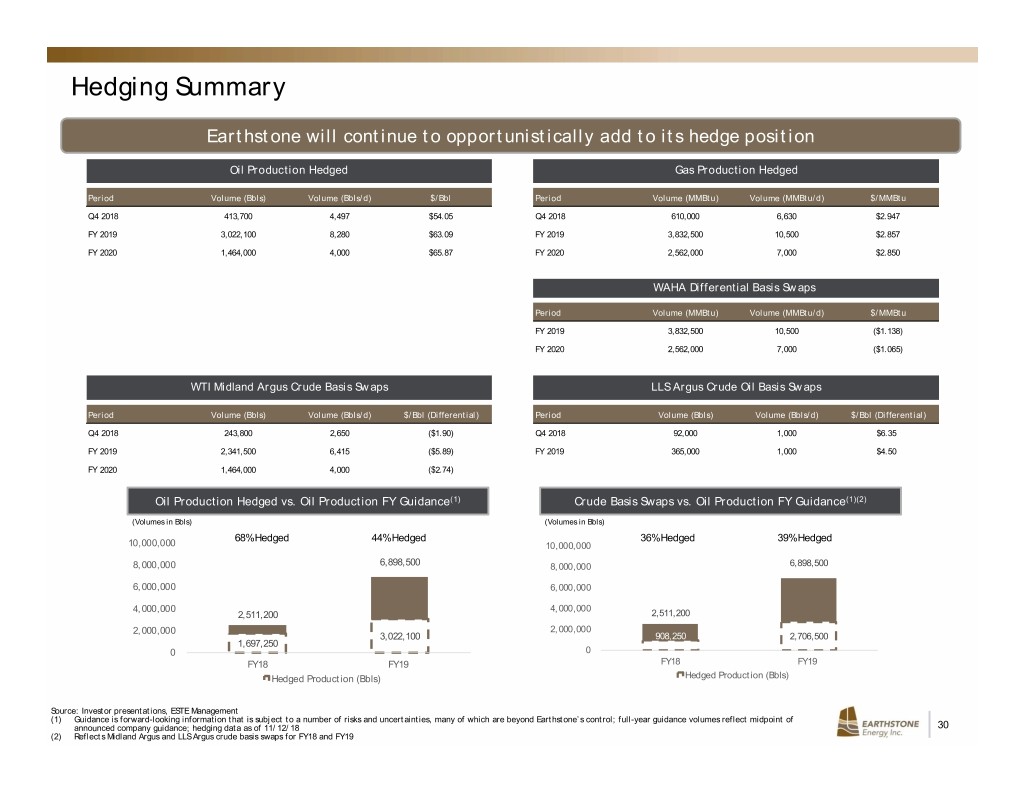

Hedging Summary Earthstone will continue to opportunistically add to its hedge position Oil Production Hedged Gas Production Hedged Period Volume (Bbls) Volume (Bbls/d) $/Bbl Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu Q4 2018 413,700 4,497 $54.05 Q4 2018 610,000 6,630 $2.947 FY 2019 3,022,100 8,280 $63.09 FY 2019 3,832,500 10,500 $2.857 FY 2020 1,464,000 4,000 $65.87 FY 2020 2,562,000 7,000 $2.850 WAHA Differential Basis Swaps Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu FY 2019 3,832,500 10,500 ($1.138) FY 2020 2,562,000 7,000 ($1.065) WTI Midland Argus Crude Basis Swaps LLS Argus Crude Oil Basis Swaps Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Differential) Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Differential) Q4 2018 243,800 2,650 ($1.90) Q4 2018 92,000 1,000 $6.35 FY 2019 2,341,500 6,415 ($5.89) FY 2019 365,000 1,000 $4.50 FY 2020 1,464,000 4,000 ($2.74) Oil Production Hedged vs. Oil Production FY Guidance(1) Crude Basis Swaps vs. Oil Production FY Guidance(1)(2) (Volumes in Bbls) (Volumes in Bbls) 68% Hedged 44% Hedged 36% Hedged 39% Hedged 10,000,000 10,000,000 8,000,000 6,898,500 8,000,000 6,898,500 6,000,000 6,000,000 4,000,000 4,000,000 2,511,200 2,511,200 2,000,000 2,000,000 3,022,100 908,250 2,706,500 1,697,250 0 0 FY18 FY19 FY18 FY19 Hedged Production (Bbls) Hedged Production (Bbls) Source: Investor presentations, ESTE Management (1) Guidance is forward-looking information that is subject to a number of risks and uncertainties, many of which are beyond Earthstone’s control; full-year guidance volumes reflect midpoint of announced company guidance; hedging data as of 11/12/18 30 (2) Reflects Midland Argus and LLS Argus crude basis swaps for FY18 and FY19

Appendix 31

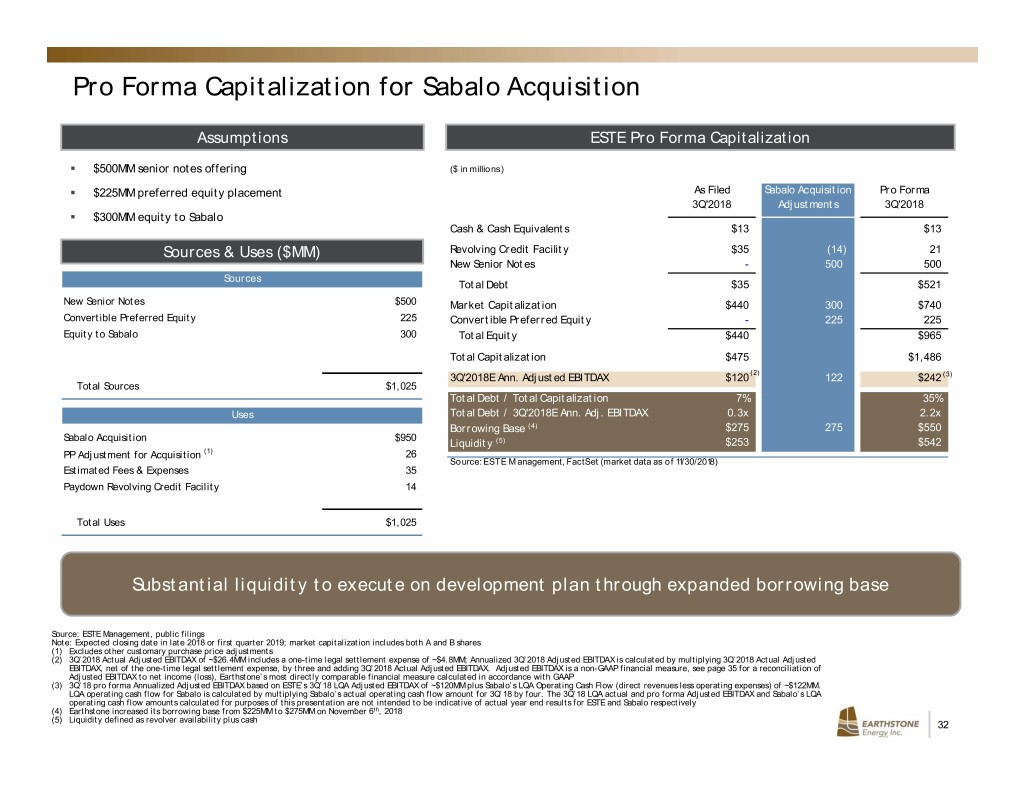

Pro Forma Capitalization for Sabalo Acquisition Assumptions ESTE Pro Forma Capitalization . $500MM senior notes offering ($ in millions) . $225MM preferred equity placement As Filed Sabalo Acquisition Pro Forma 3Q'2018 Adjustments 3Q'2018 . $300MM equity to Sabalo Cash & Cash Equivalents $13 $13 Sources & Uses ($MM) Rev olv ing C r edit F a c ilit y $35 (14) 21 New Senior Notes - 500 500 Sources Total Debt $35 $521 New Senior Notes $500 Market Capitalization $440 300 $740 Convertible Preferred Equity 225 Convertible Preferred Equity - 225 225 Equity to Sabalo 300 Total Equity $440 $965 Total Capitalization $475 $1,486 3Q'2018E Ann. Adjusted EBITDAX $120 (2) 122 $242 (3) Total Sources $1,025 Total Debt / Total Capitalization 7% 35% Uses Total Debt / 3Q'2018E Ann. Adj. EBITDAX 0.3x 2.2x Borrowing Base (4) $275 275 $550 Sabalo Acquisition $950 Liquidity (5) $253 $542 PP Adjustment for Acquisition (1) 26 Source: ESTE M anagement, FactSet (market data as of 11/30/2018) Estimated Fees & Expenses 35 Paydown Revolving Credit Facility 14 Total Uses $1,025 Substantial liquidity to execute on development plan through expanded borrowing base Source: ESTE Management, public filings Note: Expected closing date in late 2018 or first quarter 2019; market capitalization includes both A and B shares (1) Excludes other customary purchase price adjustments (2) 3Q’2018 Actual Adjusted EBITDAX of ~$26.4MM includes a one-time legal settlement expense of ~$4.8MM; Annualized 3Q’2018 Adjusted EBITDAX is calculated by multiplying 3Q’2018 Actual Adjusted EBITDAX, net of the one-time legal settlement expense, by three and adding 3Q’2018 Actual Adjusted EBITDAX. Adjusted EBITDAX is a non-GAAP financial measure, see page 35 for a reconciliation of Adjusted EBITDAX to net income (loss), Earthstone’s most directly comparable financial measure calculated in accordance with GAAP (3) 3Q’18 pro forma Annualized Adjusted EBITDAX based on ESTE’s 3Q’18 LQA Adjusted EBITDAX of ~$120MM plus Sabalo’s LQA Operating Cash Flow (direct revenues less operating expenses) of ~$122MM. LQA operating cash flow for Sabalo is calculated by multiplying Sabalo’s actual operating cash flow amount for 3Q’18 by four. The 3Q’18 LQA actual and pro forma Adjusted EBITDAX and Sabalo’s LQA operating cash flow amounts calculated for purposes of this presentation are not intended to be indicative of actual year end results for ESTE and Sabalo respectively (4) Earthstone increased its borrowing base from $225MM to $275MM on November 6th, 2018 (5) Liquidity defined as revolver availability plus cash 32

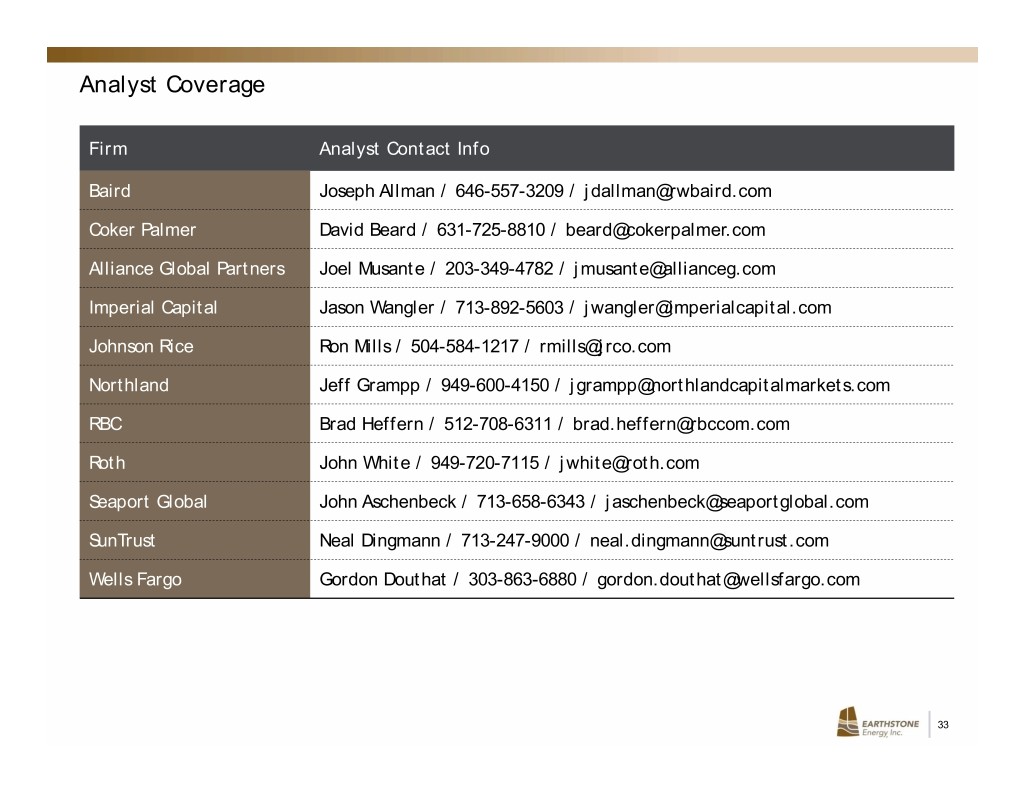

Analyst Coverage Firm Analyst Contact Info Baird Joseph Allman / 646-557-3209 / jdallman@rwbaird.com Coker Palmer David Beard / 631-725-8810 / beard@cokerpalmer.com Alliance Global Partners Joel Musante / 203-349-4782 / jmusante@allianceg.com Imperial Capital Jason Wangler / 713-892-5603 / jwangler@imperialcapital.com Johnson Rice Ron Mills / 504-584-1217 / rmills@jrco.com Northland Jeff Grampp / 949-600-4150 / jgrampp@northlandcapitalmarkets.com RBC Brad Heffern / 512-708-6311 / brad.heffern@rbccom.com Roth John White / 949-720-7115 / jwhite@roth.com Seaport Global John Aschenbeck / 713-658-6343 / jaschenbeck@seaportglobal.com SunTrust Neal Dingmann / 713-247-9000 / neal.dingmann@suntrust.com Wells Fargo Gordon Douthat / 303-863-6880 / gordon.douthat@wellsfargo.com 33

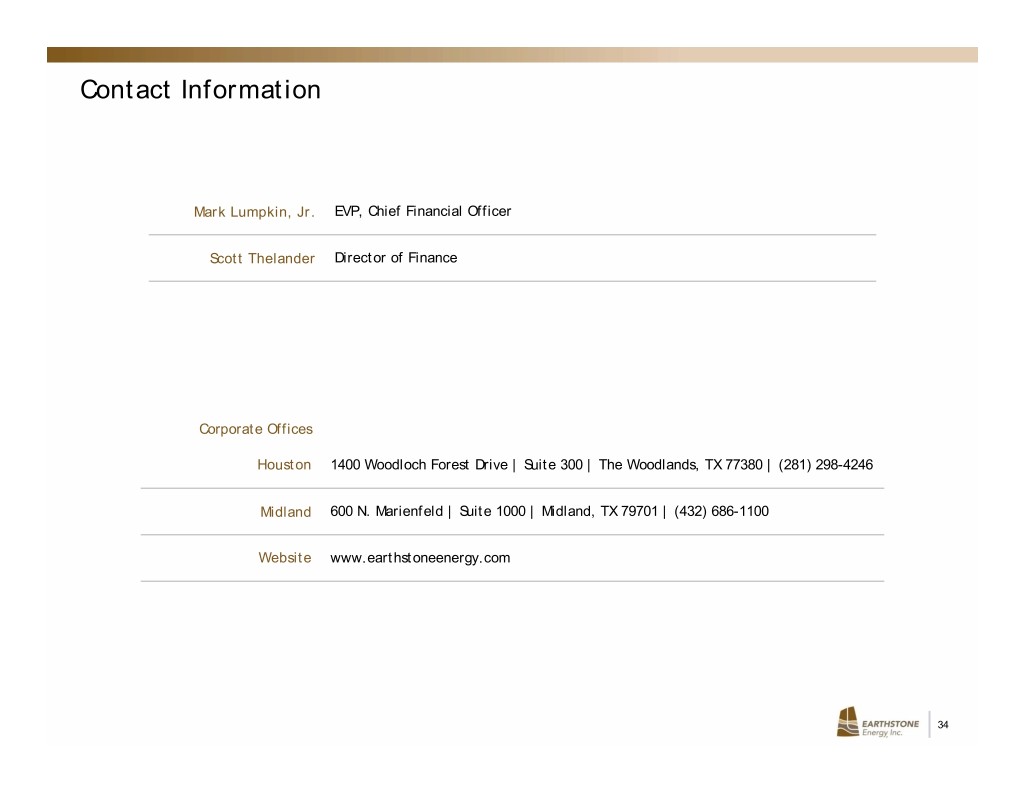

Contact Information Mark Lumpkin, Jr. EVP, Chief Financial Officer Scott Thelander Director of Finance Corporate Offices Houston 1400 Woodloch Forest Drive | Suite 300 | The Woodlands, TX 77380 | (281) 298-4246 Midland 600 N. Marienfeld | Suite 1000 | Midland, TX 79701 | (432) 686-1100 Website www.earthstoneenergy.com 34

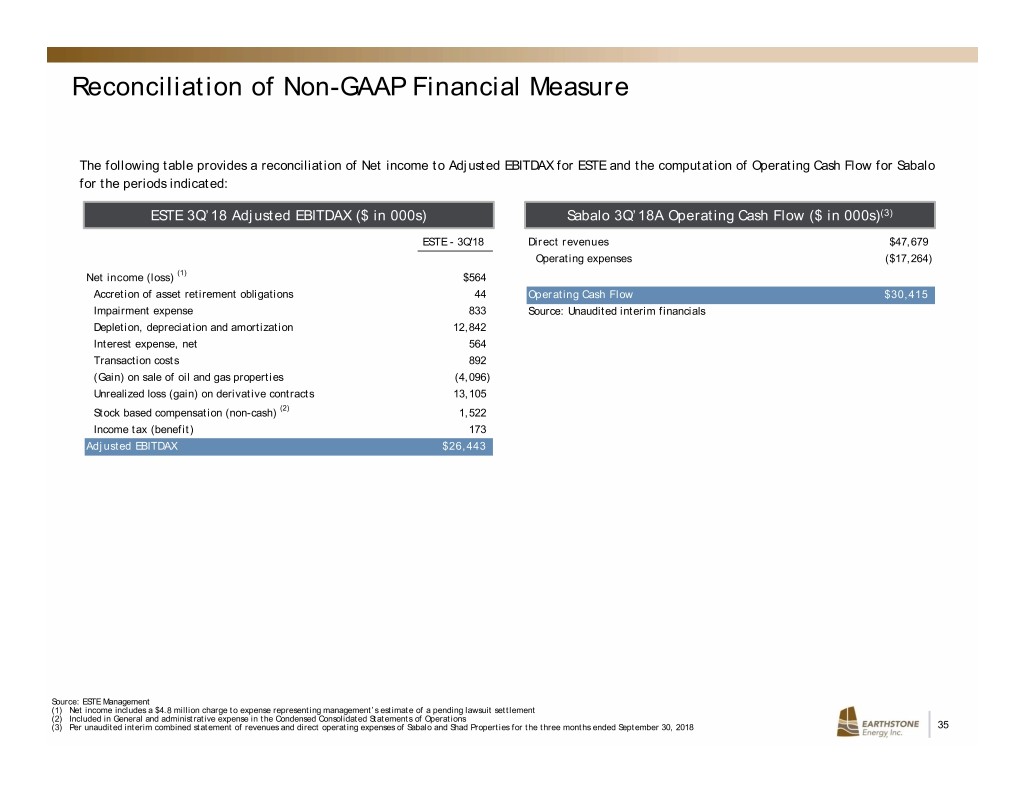

Reconciliation of Non-GAAP Financial Measure The following table provides a reconciliation of Net income to Adjusted EBITDAX for ESTE and the computation of Operating Cash Flow for Sabalo for the periods indicated: ESTE 3Q’18 Adjusted EBITDAX ($ in 000s) Sabalo 3Q’18A Operating Cash Flow ($ in 000s)(3) ESTE - 3Q'18 Direct revenues $47,679 Operating expenses ($17,264) Net income (loss) (1) $564 Accretion of asset retirement obligations 44 Operating Cash Flow $30,415 Impairment expense 833 Source: Unaudited interim financials Depletion, depreciation and amortization 12,842 Interest expense, net 564 Transaction costs 892 (Gain) on sale of oil and gas properties (4,096) Unrealized loss (gain) on derivative contracts 13,105 Stock based compensation (non-cash) (2) 1,522 Income tax (benefit) 173 Adjusted EBITDAX $26,443 Source: ESTE Management (1) Net income includes a $4.8 million charge to expense representing management’s estimate of a pending lawsuit settlement (2) Included in General and administrative expense in the Condensed Consolidated Statements of Operations (3) Per unaudited interim combined statement of revenues and direct operating expenses of Sabalo and Shad Properties for the three months ended September 30, 2018 35