Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ally Financial Inc. | allyfinancialgoldmansachsc.htm |

Ally Financial Inc. Goldman Sachs US Financial Services Conference December 5, 2018 1

Forward-Looking Statements and Additional Information This presentation and related communications should be read in conjunction with the financial statements, notes, and other information contained in our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This information is preliminary and based on company and third-party data available at the time of the presentation or related communication. This presentation and related communications contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts—such as our statements about targets and expectations for various financial and operating metrics. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results. All forward-looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, or results may differ materially from those set forth in any forward-looking statement. Some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements are described in our Annual Report on Form 10-K for the year ended December 31, 2017, our subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, or other applicable documents that are filed or furnished with the U.S. Securities and Exchange Commission (collectively, our “SEC filings”). Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent SEC filings. This presentation and related communications contain specifically identified non-GAAP financial measures, which supplement the results that are reported according to generally accepted accounting principles (“GAAP”). These non-GAAP financial measures may be useful to investors but should not be viewed in isolation from, or as a substitute for, GAAP results. Differences between non-GAAP financial measures and comparable GAAP financial measures are reconciled in the presentation. Our use of the term “loans” describes all of the products associated with our direct and indirect lending activities. The specific products include loans, retail installment sales contracts, lines of credit, leases, and other financing products. The term “lend” or “originate” refers to our direct origination of loans or our purchase or acquisition of loans. 2

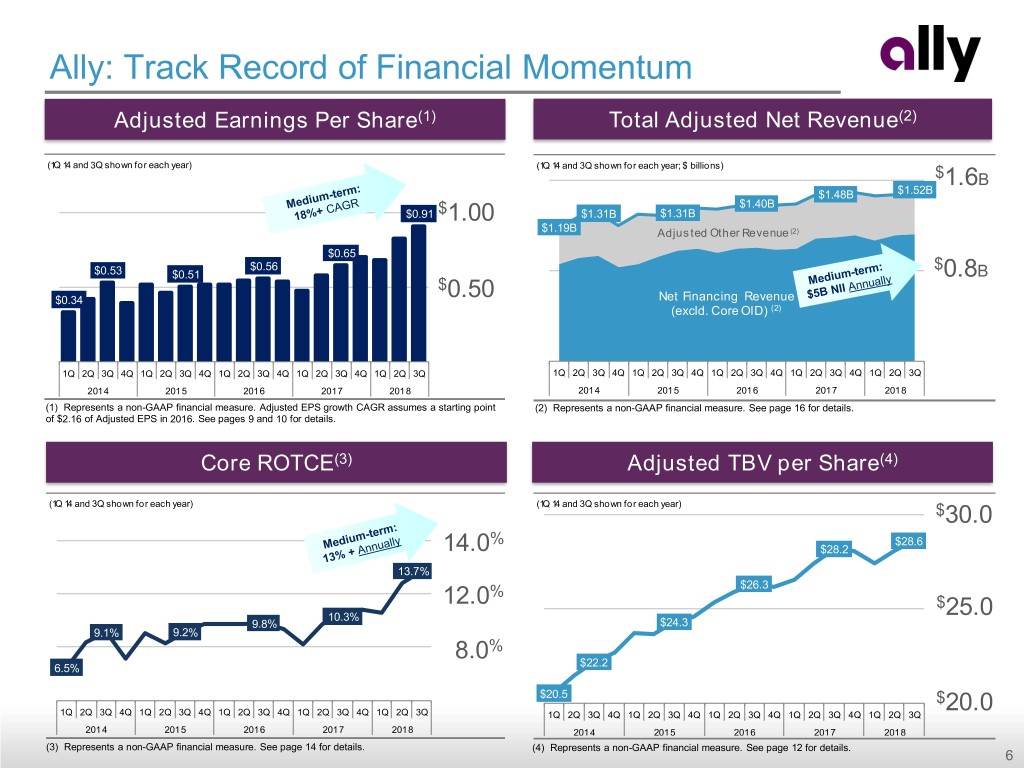

GAAP and Core Results ($ millions except per share data) 3Q 18 3Q 17 3Q 16 3Q 15 3Q 14 1Q 14 GAAP earnings per common share ("EPS") (diluted, NIAC) $ 0.88 $ 0.63 $ 0.43 $ 0.47 $ 0.74 $ 0.33 Adjusted EPS (1)(2) $ 0.91 $ 0.65 $ 0.56 $ 0.51 $ 0.53 $ 0.34 Return (net income) on GAAP shareholder's equity 11.4% 8.3% 6.1% 7.4% 11.2% 6.4% Core ROTCE (1)(3) 13.7% 10.3% 9.8% 9.2% 9.1% 6.5% GAAP common shareholder's equity per share $ 31.4 $ 30.6 $ 28.7 $ 28.6 $ 29.0 $ 27.5 Adjusted tangible book value per share (1)(4) $ 28.6 $ 28.2 $ 26.3 $ 24.3 $ 22.2 $ 20.5 GAAP total net revenue $ 1,505 $ 1,462 $ 1,384 $ 1,302 $ 1,264 $ 1,142 Adjusted total net revenue (1)(5) $ 1,521 $ 1,480 $ 1,399 $ 1,313 $ 1,311 $ 1,186 (1) The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements, but which are supplemental to and not a substitute for GAAP measures: Adjusted Earnings per Share (Adjusted EPS), Core Net Income Attributable to Common Shareholders, Core Return on Tangible Common Equity (Core ROTCE), Adjusted Total Net Revenue, Net Financing Revenue, excluding Core OID, Adjusted Other Revenue, Core original issue discount (Core OID) amortization expense, Core outstanding original issue discount balance (Core OID balance) and Adjusted Tangible Book Value per Share (Adjusted TBVPS). These measures are used by management and we believe are useful to investors in assessing the company’s operating performance and capital. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this document. (2) Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. See page 10 for calculation methodology and details. (3) Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for Core OID balance and the net deferred tax asset. See page 14 for calculation methodology and details. (4) Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity attributable to shareholders even if tax-effected Core OID balance were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an assessment of value that is more conservative than GAAP common shareholder’s equity per share. See page 12 for calculation methodology and details. (5) Adjusted total net revenue is a non-GAAP financial measure that adjusts GAAP total net revenue for Core OID and for change in the fair value of equity securities due to the implementation of ASU 2016-01, effective 1/1/18, which requires change in the fair value of equity securities to be recognized in current period net income as compared to prior periods in which such adjustments were recognized through other comprehensive income, a component of equity. See page 16 for calculation methodology and details. 3

Ally: Who We Are Leading digital financial services company and top 25 U.S. financial holding company Deposits Auto & Insurance Company Profile Nationwide | Zero Branches Nationwide | Industry Leading Founded 1919 1.6M Retail customers 4M Auto Customers 18K Auto Dealers 2M Insurance Customers NYSE Ticker ALLY Employees ~8,000 Assets $173B Loans & Leases $135B Deposits $101B Consumer Products Corporate Finance Branches 0 Ally Invest: +20% YoY @ 3Q ‘18 Senior Secured Middle Market Lending Brokerage Account Growth +18% YoY +50% YoY Ally Home: $0.5B YTD’18 Portfolio Growth YTD ‘18 Customers 7M+ Direct-to-Consumer Originations @ 3Q’18 Pretax Income Ally CashBack Card(1) Note: Employees, customers, total assets, loans & leases, and deposits as of 9-30-2018. Highly Requested Product End-of-period balances. YTD ‘18 represents 1-1-2018 through 9-30-2018. (1) Co-branded cash back card offered through third party 4

Ally: Strategic Position Positioned for Sustainable Earnings Growth Ally is leveraging our Built Around the Digital Bank capability and scale as Modern Customer Leader America's leading all-digital Bank and our deep expertise in Auto to build an institution around the modern consumer Unmatched Digital-first Do It Right Auto Finance Culture and Comprehensive Products & Core Values Services Adaptive Focused on Driving Long-term Shareholder Value 5

Ally: Track Record of Financial Momentum Adjusted Earnings Per Share(1) Total Adjusted Net Revenue(2) (1Q 14 and 3Q shown for each year) (1Q 14 and 3Q shown for each year; $ billions) $1.6B $1.48B $1.52B $ $1.40B $0.91 1.00 $1.31B $1.31B $1.19B Adjusted Other Revenue (2) $0.65 $0.56 $ $0.53 $0.51 0.8B $ $0.34 0.50 Net Financing Revenue (excld. Core OID) (2) 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 (1) Represents a non-GAAP financial measure. Adjusted EPS growth CAGR assumes a starting point (2) Represents a non-GAAP financial measure. See page 16 for details. of $2.16 of Adjusted EPS in 2016. See pages 9 and 10 for details. Core ROTCE(3) Adjusted TBV per Share(4) (1Q 14 and 3Q shown for each year) (1Q 14 and 3Q shown for each year) $30.0 % $28.6 14.0 $28.2 13.7% % $26.3 12.0 $ 10.3% 25.0 9.8% $24.3 9.1% 9.2% 8.0% 6.5% $22.2 $20.5 $ 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q 3Q 20.0 2014 2015 2016 2017 2018 2014 2015 2016 2017 2018 (3) Represents a non-GAAP financial measure. See page 14 for details. (4) Represents a non-GAAP financial measure. See page 12 for details. 6

Supplemental CONFIDENTIAL 8

Supplemental Notes on non-GAAP and other financial measures The following are non-GAAP financial measures which Ally believes are important to the reader of the Consolidated Financial Statements, but which are supplemental to, and not a substitute for, GAAP measures: Adjusted Earnings per Share (Adjusted EPS), Core Net Income Attributable to Common Shareholders, Core Return on Tangible Common Equity (Core ROTCE), Adjusted Total Net Revenue, Net Financing Revenue, excluding Core OID, Adjusted Other Revenue, Core original issue discount (Core OID) amortization expense, Core outstanding original issue discount balance (Core OID balance), and Adjusted Tangible Book Value per Share (Adjusted TBVPS). These measures are used by management and we believe are useful to investors in assessing the company’s operating performance and capital. Refer to the Definitions of Non-GAAP Financial Measures and Other Key Terms, and Reconciliation to GAAP later in this document. 1) Accelerated issuance expense (Accelerated OID) is the recognition of issuance expenses related to calls of redeemable debt. 2) Core net income attributable to common shareholders is a non-GAAP financial measure that serves as the numerator in the calculations of Adjusted EPS and Core ROTCE and that, like those measures, is believed by management to help the reader better understand the operating performance of the core businesses and their ability to generate earnings. Core net income attributable to common shareholders adjusts GAAP net income attributable to common shareholders for discontinued operations net of tax, tax-effected Core OID expense, tax-effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, certain discrete tax items and preferred stock capital actions and tax-effected changes in equity investments measured at fair value. Note - Ally’s Core net income available to common utilized a static 34% tax rate for purposes of calculating Core ROTCE through 4Q 2015. As of 1Q 2016, Ally’s Core net income attributable to common shareholders for purposes of calculating Core ROTCE is based on the actual effective tax rate for the period adjusted for any discrete tax items including tax reserve releases. See page 10 for calculation methodology and details. 3) Core original issue discount (Core OID) amortization expense is a non-GAAP financial measure for OID, primarily related to bond exchange OID which excludes international operations and future issuances. See page 17 for calculation methodology and details. 4) Core outstanding original issue discount balance (Core OID balance) is a non-GAAP financial measure for outstanding OID, primarily related to bond exchange OID which excludes international operations and future issuances. See page 17 for calculation methodology and details. 5) Tangible Common Equity is a non-GAAP financial measure that is defined as common stockholders’ equity less goodwill and identifiable intangible assets, net of deferred tax liabilities. Ally considers various measures when evaluating capital adequacy, including tangible common equity. Ally believes that tangible common equity is important because we believe readers may assess our capital adequacy using this measure. Additionally, presentation of this measure allows readers to compare certain aspects of our capital adequacy on the same basis to other companies in the industry. For purposes of calculating Core return on tangible common equity (Core ROTCE), tangible common equity is further adjusted for Core OID balance and net deferred tax asset. See page 12 for more details. 6) Medium-term is referring to the next 1-2 years. Excludes potential impact of Current Expected Credit Losses (“CECL”). The medium-term for the Adjusted EPS compound annual growth rate (“CAGR”) assumes a starting point of $2.16 in 2016. 9

Supplemental GAAP to Core Results – Adjusted EPS Adjusted Earnings per Share ("Adjusted EPS") 3Q 18 2Q 18 1Q 18 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 Numerator ($ millions) GAAP net income attributable to common shareholders $ 374 $ 349 $ 250 $ 181 $ 282 $ 252 $ 214 $ 248 $ 209 $ 345 Discontinued operations, net of tax - (1) 2 (2) (2) 2 (1) (2) 52 (3) Core OID and Accelerated OID 22 21 20 19 18 17 16 15 15 14 Repositioning Items - - - - - - - - - 4 Change in the fair value of equity securities (6) (8) 40 - - - - - - - Tax on Core OID, repositioning items, & change in the fair value of equity (3) (3) (13) (7) (6) (6) (6) (5) (5) (6) securities (tax rate 21% starting 1Q18, 35% starting 1Q16; 34% prior) Significant discrete tax items - - - 119 - - - - - (91) Series G Actions - - - - - - - - - - Series A Actions - - - - - - - - - 1 Core net income attributable to common shareholders [a] $ 386 $ 358 $ 300 $ 310 $ 292 $ 265 $ 224 $ 256 $ 271 $ 263 Denominator Weighted-average common shares outstanding - (Diluted, thousands) [b] 424,784 432,554 438,931 444,985 451,078 458,819 466,829 474,505 483,575 486,074 0 Metric GAAP EPS $ 0.88 $ 0.81 $ 0.57 $ 0.41 $ 0.63 $ 0.55 $ 0.46 $ 0.52 $ 0.43 $ 0.71 Discontinued operations, net of tax - (0.00) 0.00 (0.00) (0.00) 0.00 (0.00) (0.00) 0.11 (0.01) Core OID 0.05 0.05 0.05 0.04 0.04 0.04 0.04 0.03 0.03 0.03 Repositioning Items - - - - - - - - - 0.01 Change in the fair value of equity securities (0.01) (0.02) 0.09 - - - - - - - Tax on Core OID, repositioning items, & change in the fair value of equity (0.01) (0.01) (0.03) (0.01) (0.01) (0.01) (0.01) (0.01) (0.01) (0.01) securities (tax rate 21% starting 1Q18, 35% starting 1Q16; 34% prior) Significant discrete tax items - - - 0.27 - - - - - (0.19) Adjust Fav / (Unf): Series G Actions per share - - - - - - - - - - Adjust Fav / (Unf): Series A Actions per share - - - - - - - - - - Adjusted EPS [a] / [b] $ 0.91 $ 0.83 $ 0.68 $ 0.70 $ 0.65 $ 0.58 $ 0.48 $ 0.54 $ 0.56 $ 0.54 Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. In the numerator of Adjusted EPS, GAAP net income attributable to common shareholders is adjusted for the following items: (1) excludes discontinued operations, net of tax, as Ally is primarily a domestic company and sales of international businesses and other discontinued operations in the past have significantly impacted GAAP EPS, (2) adds back the tax-effected non-cash Core OID, (3) adds back tax- effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, (4) excludes equity fair value adjustments (net of tax) related to ASU 2016-01, effective 1/1/2018, which requires change in the fair value of equity securities to be recognized in current period net income as compared to prior periods in which such adjustments were recognized through other comprehensive income, a component of equity, (5) excludes certain discrete tax items that do not relate to the operating performance of the core businesses, and (6) adjusts for preferred stock capital actions (e.g., Series A and Series G) that have been taken by the company to normalize its capital structure. 10

Supplemental GAAP to Core Results – Adjusted EPS (continued) Adjusted Earnings per Share ("Adjusted EPS") 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 2Q 14 1Q 14 Numerator ($ millions) GAAP net income attributable to common shareholders $ 235 $ (953) $ 230 $ (1,069) $ 509 $ 109 $ 356 $ 258 $ 159 Discontinued operations, net of tax (3) 13 5 (13) (397) (26) (130) (40) (29) Core OID and Accelerated OID 15 12 11 18 17 42 47 53 44 Repositioning Items 7 3 2 154 190 167 - 16 3 Change in the fair value of equity securities - - - - - - - - - Tax on Core OID, repositioning items, & change in the fair value of equity (8) (5) (5) (58) (71) (71) (16) (24) (16) securities (tax rate 21% starting 1Q18, 35% starting 1Q16; 34% prior) Significant discrete tax items 7 - - - - (30) - (62) - Series G Actions - 1,179 - 1,171 - - - - - Series A Actions - - - 22 - - - - - Core net income attributable to common shareholders [a] $ 253 $ 249 $ 244 $ 224 $ 249 $ 192 $ 257 $ 203 $ 161 Denominator Weighted-average common shares outstanding - (Diluted, thousands) [b] 484,654 484,845 484,399 483,687 482,782 483,091 482,506 482,343 479,768 Metric GAAP EPS $ 0.49 $ (1.97) $ 0.47 $ (2.22) $ 1.06 $ 0.23 $ 0.74 $ 0.54 $ 0.33 Discontinued operations, net of tax (0.01) 0.03 0.01 (0.03) (0.82) (0.05) (0.27) (0.08) (0.06) Core OID 0.03 0.03 0.02 0.04 0.04 0.09 0.10 0.11 0.09 Repositioning Items 0.01 0.01 0.00 0.32 0.39 0.35 - 0.03 0.01 Change in the fair value of equity securities - - - - - - - - - Tax on Core OID, repositioning items, & change in the fair value of equity (0.02) (0.01) (0.01) (0.12) (0.15) (0.15) (0.03) (0.05) (0.03) securities (tax rate 21% starting 1Q18, 35% starting 1Q16; 34% prior) Significant discrete tax items 0.01 - - - - (0.06) - (0.13) - Adjust Fav / (Unf): Series G Actions per share - 2.43 - 2.42 - - - - - Adjust Fav / (Unf): Series A Actions per share - - - 0.05 - - - - - Adjusted EPS [a] / [b] $ 0.52 $ 0.52 $ 0.51 $ 0.46 $ 0.52 $ 0.40 $ 0.53 $ 0.42 $ 0.34 Adjusted earnings per share (Adjusted EPS) is a non-GAAP financial measure that adjusts GAAP EPS for revenue and expense items that are typically strategic in nature or that management otherwise does not view as reflecting the operating performance of the company. Management believes Adjusted EPS can help the reader better understand the operating performance of the core businesses and their ability to generate earnings. In the numerator of Adjusted EPS, GAAP net income attributable to common shareholders is adjusted for the following items: (1) excludes discontinued operations, net of tax, as Ally is primarily a domestic company and sales of international businesses and other discontinued operations in the past have significantly impacted GAAP EPS, (2) adds back the tax-effected non-cash Core OID, (3) adds back tax- effected repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities, (4) excludes equity fair value adjustments (net of tax) related to ASU 2016-01, effective 1/1/2018, which requires change in the fair value of equity securities to be recognized in current period net income as compared to prior periods in which such adjustments were recognized through other comprehensive income, a component of equity, (5) excludes certain discrete tax items that do not relate to the operating performance of the core businesses, and (6) adjusts for preferred stock capital actions (e.g., Series A and Series G) that have been taken by the company to normalize its capital structure. 11

Supplemental GAAP to Core Results – Adjusted TBVPS Adjusted Tangible Book Value per Share ("Adjusted TBVPS") 3Q 18 2Q 18 1Q 18 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 Numerator ($ billions) GAAP shareholder's equity $ 13.1 $ 13.1 $ 13.1 $ 13.5 $ 13.6 $ 13.5 $ 13.4 $ 13.3 $ 13.6 $ 13.6 Preferred equity - - - - - - - - - - GAAP common shareholder's equity $ 13.1 $ 13.1 $ 13.1 $ 13.5 $ 13.6 $ 13.5 $ 13.4 $ 13.3 $ 13.6 $ 13.6 Goodwill and identifiable intangibles, net of DTLs (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) Tangible common equity 12.8 12.8 12.8 13.2 13.3 13.2 13.1 13.0 13.3 13.3 Tax-effected Core OID balance (21% tax rate starting 4Q17, 35% starting 1Q16; 34% prior) (0.9) (0.9) (0.9) (0.9) (0.8) (0.8) (0.8) (0.8) (0.8) (0.8) Series G discount - - - - - - - - - - Adjusted tangible book value [a] $ 11.9 $ 12.0 $ 11.9 $ 12.3 $ 12.5 $ 12.4 $ 12.3 $ 12.2 $ 12.5 $ 12.5 Denominator Issued shares outstanding (period-end, thousands) [b] 416,591 425,752 432,691 437,054 443,796 452,292 462,193 467,000 475,470 483,753 Metric GAAP shareholder's equity per share $ 31.4 $ 30.9 $ 30.2 $ 30.9 $ 30.6 $ 29.8 $ 28.9 $ 28.5 $ 28.7 $ 28.1 Preferred equity per share - - - - - - - - - - GAAP common shareholder's equity per share $ 31.4 $ 30.9 $ 30.2 $ 30.9 $ 30.6 $ 29.8 $ 28.9 $ 28.5 $ 28.7 $ 28.1 Goodwill and identifiable intangibles, net of DTLs per share (0.7) (0.7) (0.7) (0.7) (0.6) (0.6) (0.6) (0.6) (0.6) (0.6) Tangible common equity per share 30.7 30.2 29.6 30.2 29.9 29.2 28.3 27.9 28.0 27.6 Tax-effected Core OID balance (21% tax rate starting 4Q17, 35% starting 1Q16; 34% prior) per share (2.1) (2.1) (2.1) (2.1) (1.8) (1.7) (1.7) (1.7) (1.7) (1.7) Series G discount per share - - - - - - - - - - Adjusted tangible book value per share [a] / [b] $ 28.6 $ 28.1 $ 27.4 $ 28.1 $ 28.2 $ 27.4 $ 26.6 $ 26.2 $ 26.3 $ 25.9 Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity attributable to shareholders even if Core OID balance were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an assessment of value that is more conservative than GAAP common shareholder’s equity per share. Adjusted TBVPS generally adjusts common equity for: (1) goodwill and identifiable intangibles, net of DTLs, (2) tax-effected Core OID balance to reduce tangible common equity in the event the corresponding discounted bonds are redeemed/tendered and (3) Series G discount which reduces tangible common equity as the company has normalized its capital structure. Note: in December 2017, tax-effected Core OID balance was adjusted from a statutory U.S. Federal tax rate of 35% to 21% (“rate”) as a result of changes to U.S. tax law. The adjustment conservatively increased the tax-effected Core OID balance and consequently reduced Adjusted TBVPS as any acceleration of the non-cash charge in future periods would flow through the financial statements at a 21% rate versus a previously modeled 35% rate. 12

Supplemental GAAP to Core Results – Adjusted TBVPS (continued) Adjusted Tangible Book Value per Share ("Adjusted TBVPS") 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 2Q 14 1Q 14 Numerator ($ billions) GAAP shareholder's equity $ 13.8 $ 13.4 $ 14.6 $ 14.3 $ 15.9 $ 15.4 $ 15.2 $ 14.9 $ 14.5 Preferred equity (0.7) (0.7) (0.8) (0.8) (1.3) (1.3) (1.3) (1.3) (1.3) GAAP common shareholder's equity $ 13.1 $ 12.7 $ 13.8 $ 13.5 $ 14.7 $ 14.1 $ 13.9 $ 13.6 $ 13.2 Goodwill and identifiable intangibles, net of DTLs (0.0) (0.0) (0.0) (0.0) (0.0) (0.0) (0.0) (0.0) (0.0) Tangible common equity 13.1 12.7 13.8 13.5 14.7 14.1 13.9 13.6 13.2 Tax-effected Core OID balance (21% tax rate starting 4Q17, 35% starting 1Q16; 34% prior) (0.8) (0.9) (0.9) (0.9) (0.9) (0.9) (0.9) (0.9) (1.0) Series G discount - - (1.2) (1.2) (2.3) (2.3) (2.3) (2.3) (2.3) Adjusted tangible book value [a] $ 12.3 $ 11.9 $ 11.7 $ 11.4 $ 11.4 $ 10.9 $ 10.6 $ 10.3 $ 9.9 Denominator Issued shares outstanding (period-end, thousands) [b] 483,475 481,980 481,750 481,750 481,503 480,095 479,818 479,773 479,768 Metric GAAP shareholder's equity per share $ 28.6 $ 27.9 $ 30.3 $ 29.7 $ 33.1 $ 32.1 $ 31.7 $ 31.0 $ 30.1 Preferred equity per share (1.4) (1.4) (1.7) (1.7) (2.6) (2.6) (2.6) (2.6) (2.6) GAAP common shareholder's equity per share $ 27.2 $ 26.4 $ 28.6 $ 28.0 $ 30.5 $ 29.5 $ 29.0 $ 28.4 $ 27.5 Goodwill and identifiable intangibles, net of DTLs per share (0.1) (0.1) (0.1) (0.1) (0.1) (0.1) (0.1) (0.1) (0.1) Tangible common equity per share 27.1 26.4 28.6 27.9 30.4 29.4 29.0 28.3 27.5 Tax-effected Core OID balance (21% tax rate starting 4Q17, 35% starting 1Q16; 34% prior) per share (1.7) (1.8) (1.8) (1.8) (1.8) (1.9) (1.9) (2.0) (2.0) Series G discount per share - - (2.4) (2.4) (4.9) (4.9) (4.9) (4.9) (4.9) Adjusted tangible book value per share [a] / [b] $ 25.4 $ 24.6 $ 24.3 $ 23.7 $ 23.7 $ 22.7 $ 22.2 $ 21.5 $ 20.5 Adjusted tangible book value per share (Adjusted TBVPS) is a non-GAAP financial measure that reflects the book value of equity attributable to shareholders even if Core OID balance were accelerated immediately through the financial statements. As a result, management believes Adjusted TBVPS provides the reader with an assessment of value that is more conservative than GAAP common shareholder’s equity per share. Adjusted TBVPS generally adjusts common equity for: (1) goodwill and identifiable intangibles, net of DTLs, (2) tax-effected Core OID balance to reduce tangible common equity in the event the corresponding discounted bonds are redeemed/tendered and (3) Series G discount which reduces tangible common equity as the company has normalized its capital structure. Note: in December 2017, tax-effected Core OID balance was adjusted from a statutory U.S. Federal tax rate of 35% to 21% (“rate”) as a result of changes to U.S. tax law. The adjustment conservatively increased the tax-effected Core OID balance and consequently reduced Adjusted TBVPS as any acceleration of the non-cash charge in future periods would flow through the financial statements at a 21% rate versus a previously modeled 35% rate. 13

Supplemental GAAP to Core Results – Core ROTCE Core Return on Tangible Common Equity ("Core ROTCE") 3Q 18 2Q 18 1Q 18 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 Numerator ($ millions) GAAP net income attributable to common shareholders $ 374 $ 349 $ 250 $ 181 $ 282 $ 252 $ 214 $ 248 $ 209 $ 345 Discontinued operations, net of tax - (1) 2 (2) (2) 2 (1) (2) 52 (3) Core OID and Accelerated OID 22 21 20 19 18 17 16 15 15 14 add back: Repositioning Items - - - - - - - - - 4 Change in the fair value of equity securities (6) (8) 40 - - - - - - - Tax on Core OID & change in the fair value of equity securities (tax rate 21% starting in 1Q18, 35% prior) (3) (3) (13) (7) (6) (6) (6) (5) (5) (6) Significant discrete tax items & other - - - 119 - - - - - (91) Series G Actions - - - - - - - - - - Series A Actions - - - - - - - - - 1 Core net income attributable to common shareholders [a] $ 386 $ 358 $ 300 $ 310 $ 292 $ 265 $ 224 $ 256 $ 271 $ 263 Denominator (2-period average, $ billions) GAAP shareholder's equity $ 13.1 $ 13.1 $ 13.3 $ 13.5 $ 13.5 $ 13.4 $ 13.3 $ 13.5 $ 13.6 $ 13.7 less: Preferred equity - - - - - - - - - (0.3) Goodwill & identifiable intangibles, net of deferred tax liabilities ("DTLs") (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.3) (0.2) Tangible common equity $ 12.8 $ 12.8 $ 13.0 $ 13.2 $ 13.2 $ 13.1 $ 13.0 $ 13.2 $ 13.3 $ 13.2 Core OID balance (1.1) (1.1) (1.2) (1.2) (1.2) (1.2) (1.2) (1.3) (1.3) (1.3) Net deferred tax asset ("DTA") (0.4) (0.5) (0.5) (0.6) (0.7) (0.9) (1.0) (1.0) (1.0) (1.1) Normalized common equity [b] $ 11.2 $ 11.2 $ 11.3 $ 11.5 $ 11.3 $ 11.1 $ 10.8 $ 10.9 $ 11.0 $ 10.8 Core Return on Tangible Common Equity [a] / [b] 13.7% 12.8% 10.6% 10.8% 10.3% 9.6% 8.2% 9.4% 9.8% 9.7% Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for Core OID balance and net DTA. Ally’s Core net income available to common utilized a static 34% tax rate for purposes of calculating Core ROTCE through 4Q 2015. As of 1Q 2016, Ally’s Core net income attributable to common shareholders for purposes of calculating Core ROTCE is based on the actual effective tax rate for the period adjusted for any discrete tax items including tax reserve releases, which aligns with the methodology used in calculating adjusted earnings per share. (1) In the numerator of Core ROTCE, GAAP net income attributable to common shareholders is adjusted for discontinued operations net of tax, tax-effected Core OID, fair value adjustments (net of tax) related to ASU 2016-01, effective 1/1/2018, which requires change in the fair value of equity securities to be recognized in current period net income as compared to prior periods in which such adjustments were recognized through other comprehensive income, a component of equity, certain discrete tax items and preferred stock capital actions. (2) In the denominator, GAAP shareholder’s equity is adjusted for preferred equity and goodwill and identifiable intangibles net of DTL, Core OID balance, and net DTA. 14

Supplemental GAAP to Core Results – Core ROTCE (continued) Core Return on Tangible Common Equity ("Core ROTCE") 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 2Q 14 1Q 14 Numerator ($ millions) GAAP net income attributable to common shareholders $ 235 $ (953) $ 230 $ (1,069) $ 509 $ 109 $ 356 $ 258 $ 159 Discontinued operations, net of tax (3) 13 5 (13) (397) (26) (130) (40) (29) Core OID and Accelerated OID 15 12 11 18 17 42 47 53 44 add back: Repositioning Items 7 3 2 154 190 167 - 16 3 Change in the fair value of equity securities - - - - - - - - - Tax on Core OID & change in the fair value of equity securities (tax rate 21% starting in 1Q18, 35% prior) (8) (5) (5) (58) (71) (71) (16) (24) (16) Significant discrete tax items & other 7 8 2 4 7 (28) (16) (54) (5) Series G Actions - 1,179 - 1,171 - - - - - Series A Actions - - - 22 - - - - - Core net income attributable to common shareholders [a] $ 253 $ 257 $ 246 $ 229 $ 256 $ 194 $ 241 $ 210 $ 156 Denominator (2-period average, $ billions) GAAP shareholder's equity $ 13.6 $ 14.0 $ 14.4 $ 15.1 $ 15.7 $ 15.3 $ 15.0 $ 14.7 $ 14.3 less: Preferred equity (0.7) (0.8) (0.8) (1.0) (1.3) (1.3) (1.3) (1.3) (1.3) Goodwill & identifiable intangibles, net of deferred tax liabilities ("DTLs") (0.0) (0.0) (0.0) (0.0) (0.0) (0.0) (0.0) (0.0) (0.0) Tangible common equity $ 12.9 $ 13.2 $ 13.6 $ 14.1 $ 14.4 $ 14.0 $ 13.8 $ 13.4 $ 13.1 Core OID balance (1.3) (1.3) (1.3) (1.3) (1.3) (1.4) (1.4) (1.5) (1.5) Net deferred tax asset ("DTA") (1.2) (1.4) (1.5) (1.6) (1.7) (1.8) (1.8) (1.9) (2.0) Normalized common equity [b] $ 10.4 $ 10.5 $ 10.7 $ 11.1 $ 11.3 $ 10.8 $ 10.5 $ 10.1 $ 9.6 Core Return on Tangible Common Equity [a] / [b] 9.8% 9.8% 9.2% 8.2% 9.1% 7.1% 9.1% 8.4% 6.5% Core return on tangible common equity (Core ROTCE) is a non-GAAP financial measure that management believes is helpful for readers to better understand the ongoing ability of the company to generate returns on its equity base that supports core operations. For purposes of this calculation, tangible common equity is adjusted for Core OID balance and net DTA. Ally’s Core net income available to common utilized a static 34% tax rate for purposes of calculating Core ROTCE through 4Q 2015. As of 1Q 2016, Ally’s Core net income attributable to common shareholders for purposes of calculating Core ROTCE is based on the actual effective tax rate for the period adjusted for any discrete tax items including tax reserve releases, which aligns with the methodology used in calculating adjusted earnings per share. (1) In the numerator of Core ROTCE, GAAP net income attributable to common shareholders is adjusted for discontinued operations net of tax, tax-effected Core OID, fair value adjustments (net of tax) related to ASU 2016-01, effective 1/1/2018, which requires change in the fair value of equity securities to be recognized in current period net income as compared to prior periods in which such adjustments were recognized through other comprehensive income, a component of equity, certain discrete tax items and preferred stock capital actions. (2) In the denominator, GAAP shareholder’s equity is adjusted for preferred equity and goodwill and identifiable intangibles net of DTL, Core OID balance, and net DTA. 15

Supplemental Notes on non-GAAP and other financial measures Net Financing Revenue (ex. Core OID) ($ millions) 3Q 18 2Q 18 1Q 18 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 GAAP Net Financing Revenue $ 1,107 $ 1,094 $ 1,049 $ 1,094 $ 1,081 $ 1,067 $ 979 $ 976 $ 996 $ 984 Core OID 22 21 20 19 18 17 16 15 15 14 Net Financing Revenue (ex. Core OID) [a] $ 1,129 $ 1,115 $ 1,069 $ 1,113 $ 1,099 $ 1,084 $ 995 $ 991 $ 1,011 $ 998 Adjusted Other Revenue ($ millions) 3Q 18 2Q 18 1Q 18 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 GAAP Other Revenue $ 398 $ 364 $ 354 $ 379 $ 381 $ 388 $ 396 $ 392 $ 388 $ 374 Accelerated OID & repositioning items - - - - - - - - - - Change in the fair value of equity securities (6) (8) 40 - - - - - - - Adjusted Other Revenue [b] $ 392 $ 356 $ 394 $ 379 $ 381 $ 388 $ 396 $ 392 $ 388 $ 374 Adjusted Total Net Revenue [a]+[b] $ 1,521 $ 1,471 $ 1,463 $ 1,492 $ 1,480 $ 1,472 $ 1,391 $ 1,383 $ 1,399 $ 1,372 Net Financing Revenue (ex. Core OID) ($ millions) 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 2Q 14 1Q 14 GAAP Net Financing Revenue $ 951 $ 983 $ 970 $ 916 $ 850 $ 799 $ 889 $ 866 $ 821 Core OID 13 12 11 11 10 36 47 46 44 Net Financing Revenue (ex. Core OID) [a] $ 964 $ 995 $ 981 $ 927 $ 860 $ 835 $ 936 $ 912 $ 865 Adjusted Other Revenue ($ millions) 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 2Q 14 1Q 14 GAAP Other Revenue $ 376 $ 356 $ 332 $ 211 $ 243 $ 215 $ 375 $ 365 $ 321 Accelerated OID & repositioning items 4 2 - 157 197 155 - 7 - Change in the fair value of equity securities - - - - - - - - - Adjusted Other Revenue [b] $ 380 $ 358 $ 332 $ 368 $ 440 $ 370 $ 375 $ 372 $ 321 Adjusted Total Net Revenue [a]+[b] $ 1,344 $ 1,353 $ 1,313 $ 1,295 $ 1,301 $ 1,205 $ 1,311 $ 1,284 $ 1,186 Note: Accelerated OID and repositioning items primarily related to the extinguishment of high-cost legacy debt and strategic activities. Equity fair value adjustments related to ASU 2016-01, effective 1/1/2018, requires change in the fair value of equity securities to be recognized in current period net income as compared to prior periods in which such adjustments were recognized through other comprehensive income, a component of equity. See page 9 for definitions. 16

Supplemental Notes on non-GAAP and other financial measures Original issue discount amortization expense ($ millions) 3Q 18 2Q 18 1Q 18 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 Core original issue discount (Core OID) amortization expense (1) $ 22 $ 21 $ 20 $ 19 $ 18 $ 17 $ 16 $ 15 $ 15 $ 14 Other OID 4 4 4 5 5 5 5 6 6 4 GAAP original issue discount amortization expense $ 25 $ 25 $ 24 $ 24 $ 23 $ 22 $ 21 $ 21 $ 21 $ 18 Outstanding original issue discount balance ($ millions) 3Q 18 2Q 18 1Q 18 4Q 17 3Q 17 2Q 17 1Q 17 4Q 16 3Q 16 2Q 16 Core outstanding original issue discount balance (Core OID balance) $ (1,115) $ (1,137) $ (1,158) $ (1,178) $ (1,197) $ (1,215) $ (1,232) $ (1,249) $ (1,264) $ (1,279) Other outstanding OID balance (46) (49) (53) (57) (62) (67) (72) (77) (83) (88) GAAP outstanding original issue discount balance $ (1,161) $ (1,187) $ (1,211) $ (1,235) $ (1,259) $ (1,282) $ (1,304) $ (1,326) $ (1,347) $ (1,367) Original issue discount amortization expense ($ millions) 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 2Q 14 1Q 14 Core original issue discount (Core OID) amortization expense (1) $ 13 $ 12 $ 11 $ 11 $ 10 $ 36 $ 47 $ 46 $ 44 Other OID 5 5 5 4 4 4 4 3 2 GAAP original issue discount amortization expense $ 18 $ 17 $ 16 $ 15 $ 14 $ 40 $ 51 $ 49 $ 46 Outstanding original issue discount balance ($ millions) 1Q 16 4Q 15 3Q 15 2Q 15 1Q 15 4Q 14 3Q 14 2Q 14 1Q 14 Core outstanding original issue discount balance (Core OID balance) $ (1,293) $ (1,304) $ (1,316) $ (1,327) $ (1,339) $ (1,351) $ (1,388) $ (1,434) $ (1,488) Other outstanding OID balance (82) (87) (84) (89) (86) (64) (67) (57) (61) GAAP outstanding original issue discount balance $ (1,375) $ (1,391) $ (1,400) $ (1,416) $ (1,425) $ (1,415) $ (1,455) $ (1,491) $ (1,548) (1) Excludes accelerated OID. See page 9 for definitions. 17