Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CARVANA CO. | d657976d8k.htm |

LONG-TERM FINANCIAL GOALS Mark Jenkins, CFO Exhibit 99.1

SAFE HARBOR FY 2017 YTD 2018 Long Term Target Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect Carvana’s current expectations and projections with respect to, among other things, our financial condition, results of operations, plans, objectives, future performance, and business. These statements may be preceded by, followed by or include the words "aim," "anticipate," "believe," "estimate," "expect," "forecast," "intend," "likely," "outlook," "plan," "potential," "project," "projection," "seek," "can," "could," "may," "should," "would," "will," the negatives thereof and other words and terms of similar meaning. Forward-looking statements include all statements that are not historical facts. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Among these factors are risks related to the “Risk Factors” identified in the Carvana’s Annual Report on Form 10-K for 2017 and Quarterly Report on Form 10-Q for Q3 2018. There is no assurance that any forward-looking statements will materialize. You are cautioned not to place undue reliance on forward-looking statements, which reflect expectations only as of this date. Carvana does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise. Market and Industry Data This presentation includes information concerning economic conditions, the Company’s industry, the Company’s markets and the Company’s competitive position that is based on a variety of sources, including information from independent industry analysts and publications, as well as Carvana’s own estimates and research. Carvana’s estimates are derived from publicly available information released by third party sources, as well as data from its internal research, and are based on such data and the Company’s knowledge of its industry, which the Company believes to be reasonable. The independent industry publications used in this presentation were not prepared on the Company’s behalf. While the Company is not aware of any misstatements regarding any information in this presentation, forecasts, assumptions, expectations, beliefs, estimates and projects involve risk and uncertainties and are subject to change based on various factors.

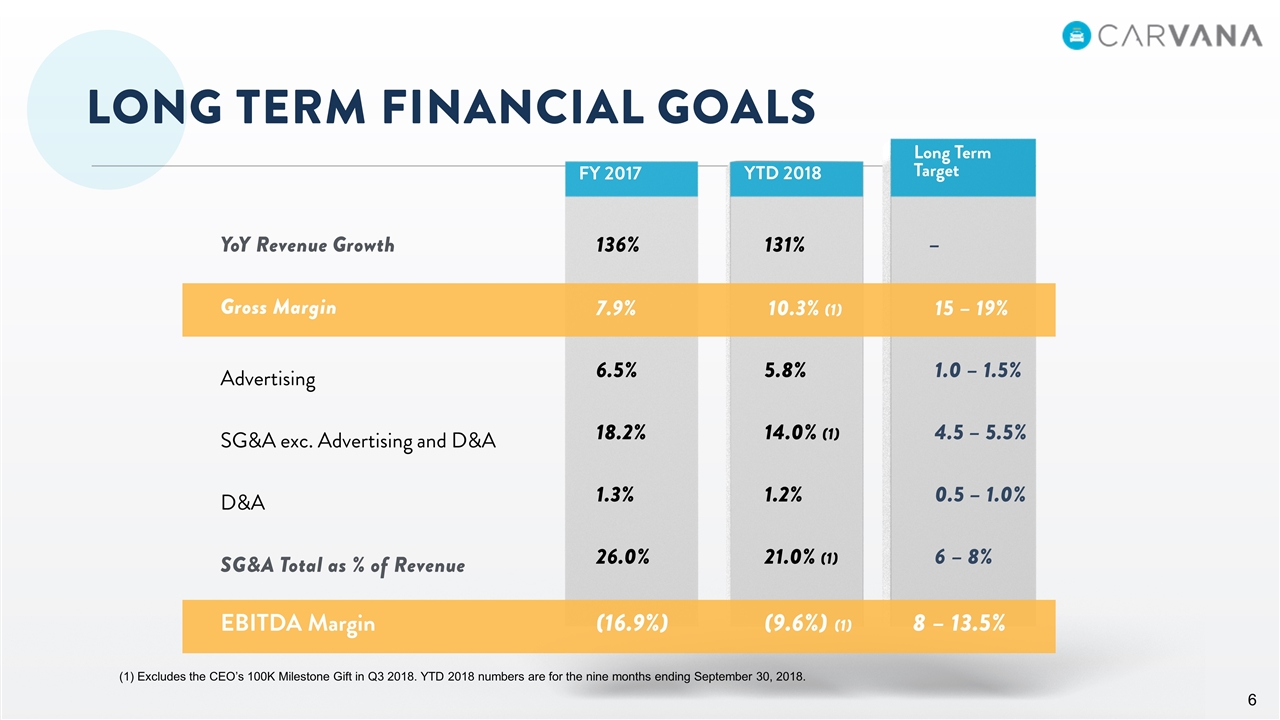

LONG TERM FINANCIAL GOALS FY 2017 YTD 2018 Long Term Target (16.9%) 26.0% 136% 7.9% 6.5% 18.2% 1.3% (9.6%) (1) 21.0% (1) 131% 5.8% 14.0% (1) 1.2% YoY Revenue Growth SG&A Total as % of Revenue Gross Margin EBITDA Margin Advertising D&A SG&A exc. Advertising and D&A 6 – 8% 1.0 – 1.5% 4.5 – 5.5% 0.5 – 1.0% 8 – 13.5% 15 – 19% 10.3% (1) – (1) Excludes the CEO’s 100K Milestone Gift in Q3 2018. YTD 2018 numbers are for the nine months ending September 30, 2018.

NON-GAAP FINANICIAL MEASURES

NON-GAAP MEASURES FY 2017 YTD 2018 Long Term Target This presentation contains financial measures which are not recognized under U.S. Generally Accepted Accounting Principles (“GAAP”)—Gross Profit ex-Gift and Gross Profit per Unit ex-Gift; Gross Margin ex-Gift; and EBITDA ex-Gift and EBITDA Margin ex-Gift. These are described below. None of these should be considered as a substitute for other measures of financial performance reported in accordance with GAAP. In addition, the Company’s definitions of these non-GAAP financial measures may not be comparable to similarly titled measures of other companies. A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP financial measure can be found at the end of this presentation. Gross Profit ex-Gift and Gross Profit per Unit ex-Gift Gross Profit ex-Gift and Gross Profit per Unit ex-Gift are non-GAAP supplemental measures of operating performance that do not represent and should not be considered an alternative to gross profit, as determined by GAAP. Gross Profit ex-Gift is defined as gross profit before compensation expense related to the 100k Milestone Gift included in cost of sales. Gross Profit per Unit ex-Gift is Gross Profit ex-Gift divided by units sold. We use Gross Profit ex-Gift to measure the operating performance of our business and Gross Profit per Unit ex-Gift to measure our operating performance relative to our units sold. Carvana believes that Gross Profit ex-Gift and Gross Profit per Unit ex-Gift are useful measures to investors because they exclude the expense associated with the 100k Milestone Gift recognized in cost of sales. We expect the 100k Milestone Gift to be a one-time award program for which we will recognize varying amounts of expense through the first half of 2020, and therefore believe the related expense does not reflect our core operations, is not included in our past operations, and may not be indicative of our future operations. Additionally, the shares issued to settle the 100k Milestone Gift are offset by share contributions from Mr. Garcia to Carvana, therefore we expect the impact on shares outstanding to be zero. We believe that excluding it enables us to more effectively evaluate our performance period-over-period and relative to our competitors. Gross Profit ex-Gift and Gross Profit per Unit ex-Gift have limitations as an analytical tool and you should not consider these measures either in isolation or as a substitute for gross profit and gross profit per unit or other methods of analyzing the Company’s results as reported under GAAP.

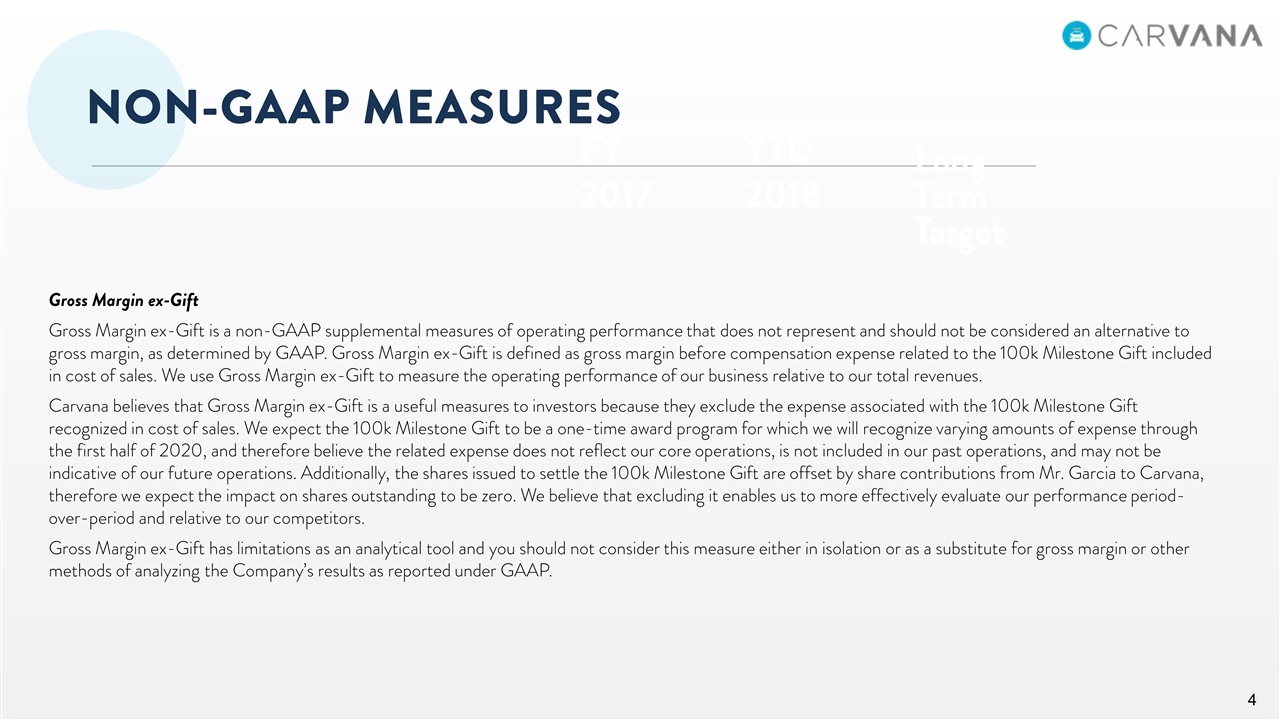

NON-GAAP MEASURES FY 2017 YTD 2018 Long Term Target Gross Margin ex-Gift Gross Margin ex-Gift is a non-GAAP supplemental measures of operating performance that does not represent and should not be considered an alternative to gross margin, as determined by GAAP. Gross Margin ex-Gift is defined as gross margin before compensation expense related to the 100k Milestone Gift included in cost of sales. We use Gross Margin ex-Gift to measure the operating performance of our business relative to our total revenues. Carvana believes that Gross Margin ex-Gift is a useful measures to investors because they exclude the expense associated with the 100k Milestone Gift recognized in cost of sales. We expect the 100k Milestone Gift to be a one-time award program for which we will recognize varying amounts of expense through the first half of 2020, and therefore believe the related expense does not reflect our core operations, is not included in our past operations, and may not be indicative of our future operations. Additionally, the shares issued to settle the 100k Milestone Gift are offset by share contributions from Mr. Garcia to Carvana, therefore we expect the impact on shares outstanding to be zero. We believe that excluding it enables us to more effectively evaluate our performance period-over-period and relative to our competitors. Gross Margin ex-Gift has limitations as an analytical tool and you should not consider this measure either in isolation or as a substitute for gross margin or other methods of analyzing the Company’s results as reported under GAAP.

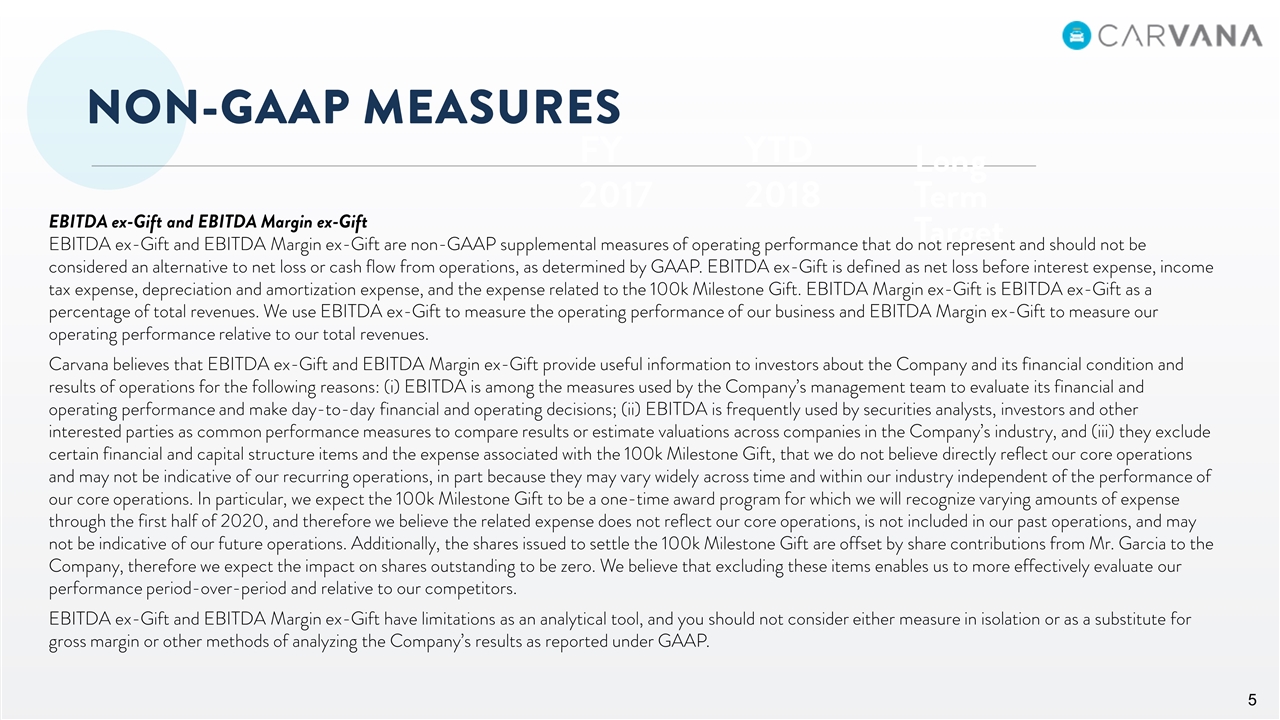

NON-GAAP MEASURES FY 2017 YTD 2018 Long Term Target EBITDA ex-Gift and EBITDA Margin ex-Gift EBITDA ex-Gift and EBITDA Margin ex-Gift are non-GAAP supplemental measures of operating performance that do not represent and should not be considered an alternative to net loss or cash flow from operations, as determined by GAAP. EBITDA ex-Gift is defined as net loss before interest expense, income tax expense, depreciation and amortization expense, and the expense related to the 100k Milestone Gift. EBITDA Margin ex-Gift is EBITDA ex-Gift as a percentage of total revenues. We use EBITDA ex-Gift to measure the operating performance of our business and EBITDA Margin ex-Gift to measure our operating performance relative to our total revenues. Carvana believes that EBITDA ex-Gift and EBITDA Margin ex-Gift provide useful information to investors about the Company and its financial condition and results of operations for the following reasons: (i) EBITDA is among the measures used by the Company’s management team to evaluate its financial and operating performance and make day-to-day financial and operating decisions; (ii) EBITDA is frequently used by securities analysts, investors and other interested parties as common performance measures to compare results or estimate valuations across companies in the Company’s industry, and (iii) they exclude certain financial and capital structure items and the expense associated with the 100k Milestone Gift, that we do not believe directly reflect our core operations and may not be indicative of our recurring operations, in part because they may vary widely across time and within our industry independent of the performance of our core operations. In particular, we expect the 100k Milestone Gift to be a one-time award program for which we will recognize varying amounts of expense through the first half of 2020, and therefore we believe the related expense does not reflect our core operations, is not included in our past operations, and may not be indicative of our future operations. Additionally, the shares issued to settle the 100k Milestone Gift are offset by share contributions from Mr. Garcia to the Company, therefore we expect the impact on shares outstanding to be zero. We believe that excluding these items enables us to more effectively evaluate our performance period-over-period and relative to our competitors. EBITDA ex-Gift and EBITDA Margin ex-Gift have limitations as an analytical tool, and you should not consider either measure in isolation or as a substitute for gross margin or other methods of analyzing the Company’s results as reported under GAAP.

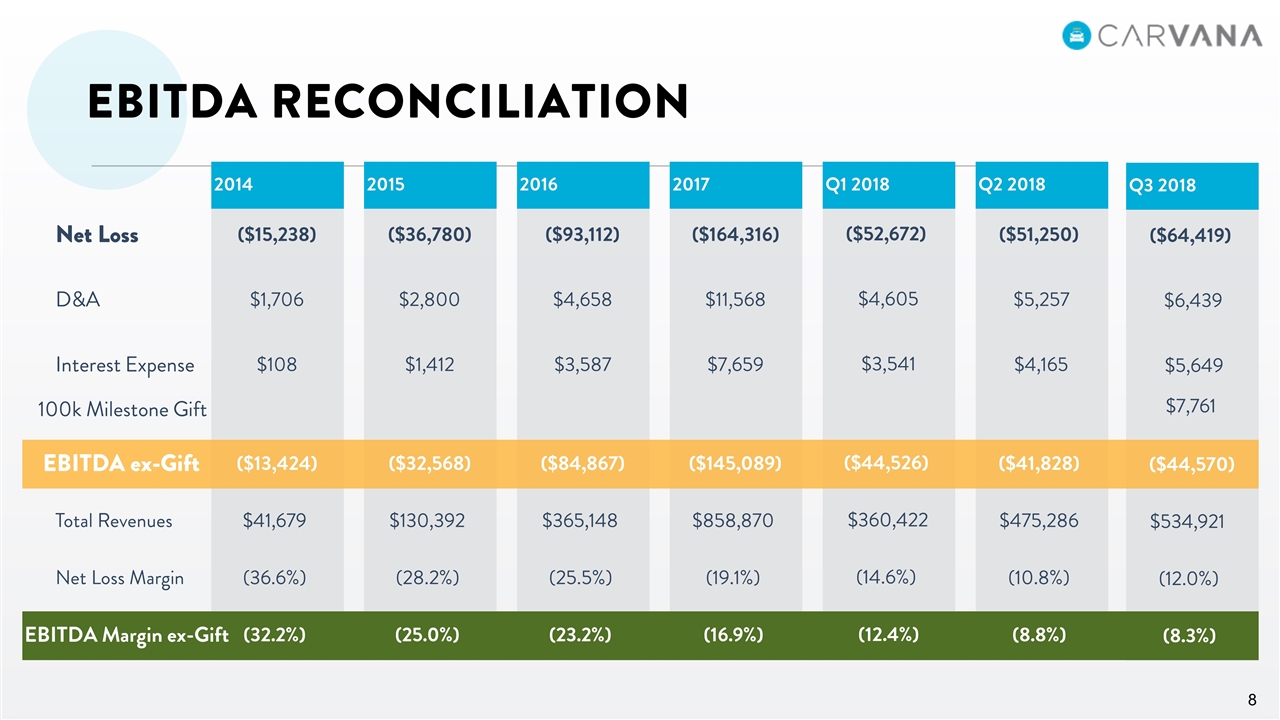

EBITDA RECONCILIATION Net Loss EBITDA ex-Gift Interest Expense D&A Total Revenues Net Loss Margin EBITDA Margin ex-Gift 2015 ($36,780) ($32,568) $1,412 $2,800 $130,392 (28.2%) (25.0%) 2016 ($93,112) ($84,867) $3,587 $4,658 $365,148 (25.5%) (23.2%) 2017 ($164,316) ($145,089) $7,659 $11,568 $858,870 (19.1%) (16.9%) Q2 2018 ($51,250) ($41,828) $4,165 $5,257 $475,286 (10.8%) (8.8%) 2014 ($15,238) ($13,424) $108 $1,706 $41,679 (36.6%) (32.2%) Q1 2018 ($52,672) ($44,526) $3,541 $4,605 $360,422 (14.6%) (12.4%) Q3 2018 ($64,419) ($44,570) $5,649 $6,439 $534,921 (12.0%) (8.3%) 100k Milestone Gift $7,761

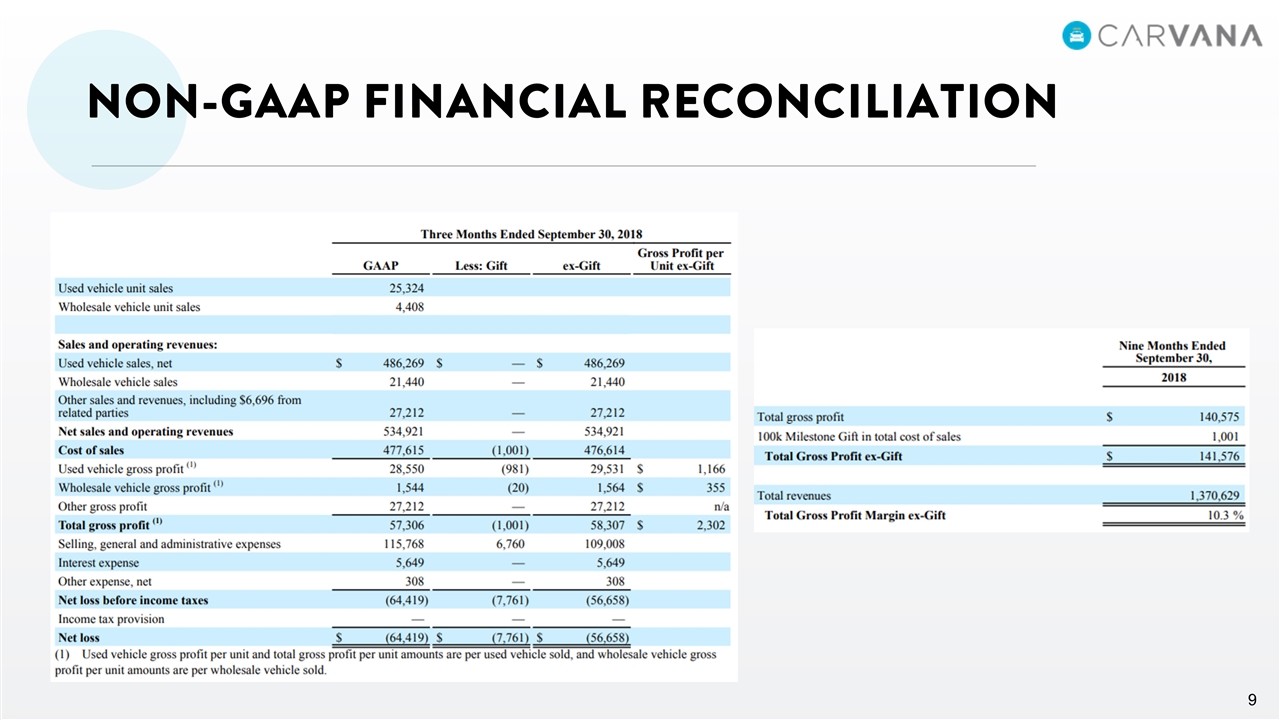

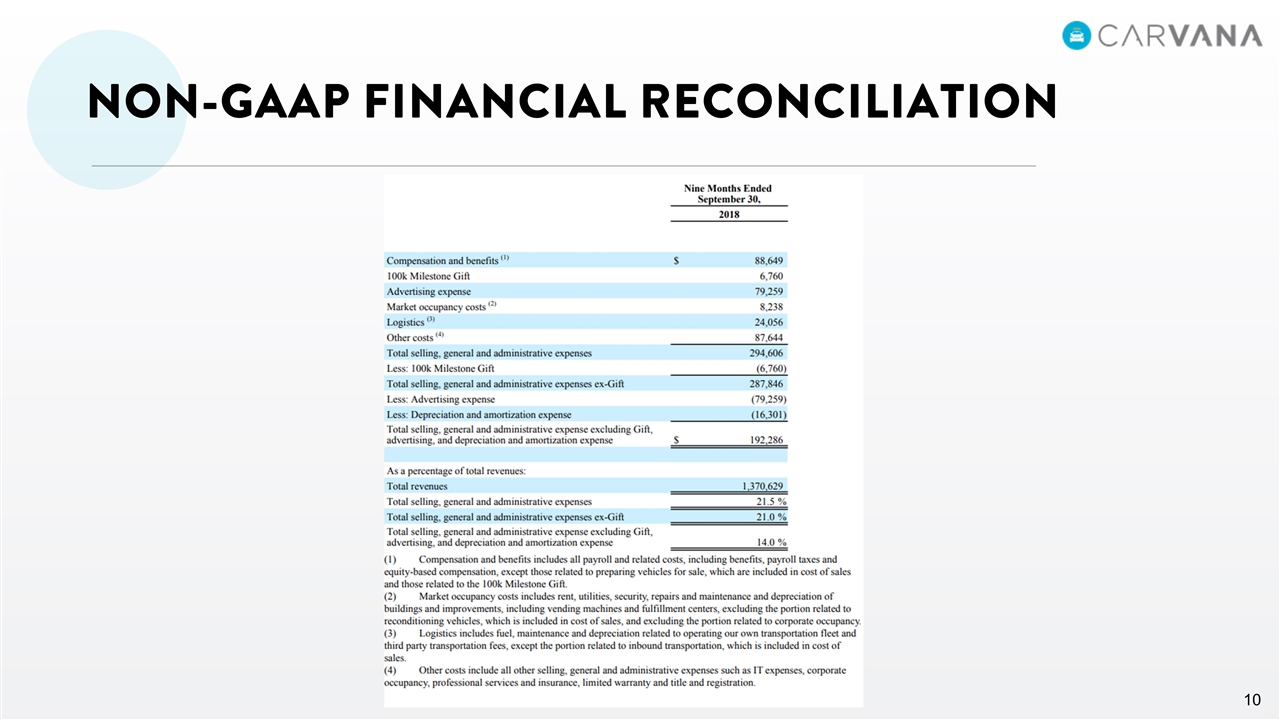

NON-GAAP FINANCIAL RECONCILIATION

NON-GAAP FINANCIAL RECONCILIATION