Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BUCKEYE PARTNERS, L.P. | a8-kcoverxinvestorpresenta.htm |

Investor Presentation Houston, TX November 29, 2018

LEGAL NOTICE / FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” that we believe to be reasonable as of the date of this presentation. These statements, which include any statement that does not relate strictly to historical facts, use terms such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “plan,” “position,” “potential,” “predict,” “project,” or “strategy” or the negative connotation or other variations of such terms or other similar terminology. In particular, statements, expressed or implied, regarding future results of operations or ability to generate sales, income or cash flow, to make acquisitions, to complete divestitures, to achieve target coverage or leverage ratios or to make distributions to unitholders are forward-looking statements. These forward-looking statements are based on management’s current plans, expectations, estimates, assumptions and beliefs concerning future events impacting Buckeye Partners, L.P. (the “Partnership”, “Buckeye” or “BPL”) and therefore involve a number of risks and uncertainties, many of which are beyond management’s control. Although the Partnership believes that its expectations stated in this presentation are based on reasonable assumptions, actual results may differ materially from those expressed or implied in the forward-looking statements. The factors listed in the “Risk Factors” sections of, as well as any other cautionary language in, the Partnership’s public filings with the Securities and Exchange Commission, provide examples of risks, uncertainties and events that may cause the Partnership’s actual results to differ materially from the expectations it describes in its forward-looking statements. Each forward-looking statement speaks only as of the date of this presentation, and the Partnership undertakes no obligation to update or revise any forward-looking statement. This presentation contains forward looking estimates of Adjusted EBITDA and cash flows related to the Asset Divestitures (as defined herein). We cannot provide a reconciliation of estimated Adjusted EBITDA or cash flows to estimated GAAP net income, which is the GAAP financial measure most directly comparable to each non-GAAP measure, without unreasonable efforts due to the inherent difficulty and impracticality of quantifying certain amounts that would be required to calculate projected GAAP net income, such as unrealized gains and losses on derivatives marked to market and potential changes in estimates for certain contingent liabilities. In addition, interest and debt expense are corporate-level expenses that are not allocated among Buckeye’s individual assets and could not be allocated to the operations of the assets being divested without unreasonable effort. These amounts that would require unreasonable effort to quantify could be significant, such that the amount of projected GAAP net income would vary substantially from the amount of projected Adjusted EBITDA or cash flows. © Copyright 2018 Buckeye Partners, L.P. 2

ORGANIZATIONAL OVERVIEW Buckeye owns and operates a diversified network of integrated assets providing midstream logistic solutions, and is committed to achieving a strong balance sheet, solid investment grade credit rating and financial flexibility to fund attractive growth opportunities without accessing public equity Domestic Pipelines & Terminals(1) LTM Adjusted EBITDA(2) - $1.1 billion One of the largest independent liquid petroleum products $15.7 pipeline and terminal operators with assets located (2%) primarily in the Northeast, Midwest and Southeast United States $471.6 (46%) • ~6,000 miles of pipeline with ~105 delivery locations (52%) • ~110 active liquid petroleum product terminals $572.9 • ~56 million barrels of liquid petroleum product tank capacity Global Marine Terminals(1) One of the largest networks of marine terminals located primarily in the East Coast and Gulf Coast regions of the Market and Financial Highlights United States as well as in the Caribbean (3) • 7 liquid petroleum product terminals located in key Market Data global energy hubs Unit Price $30.65 Market Capitalization $4.7 billion • ~62 million barrels of liquid petroleum product storage Yield 9.8% capacity (2) Merchant Services Financial Data Markets liquid petroleum products in certain areas Adjusted EBITDA $1.1 billion served by Domestic Pipelines & Terminals and Global Distribution per Unit (Annualized) $3.00 Marine Terminals Distribution Coverage Ratio - Q3 2018 1.35x (1) Excludes the sale of non-integrated domestic pipeline and terminal assets as well as the equity interest in VTTI B.V. (“Asset © Copyright 2018 Buckeye Partners, L.P. Divestitures”), which are expected to close in the fourth quarter of 2018. (2) Includes contribution from the Asset Divestitures. Last twelve months through September 30, 2018 presented in millions. See Non-GAAP Reconciliations at end of presentation. 3 (3) As of November 26, 2018.

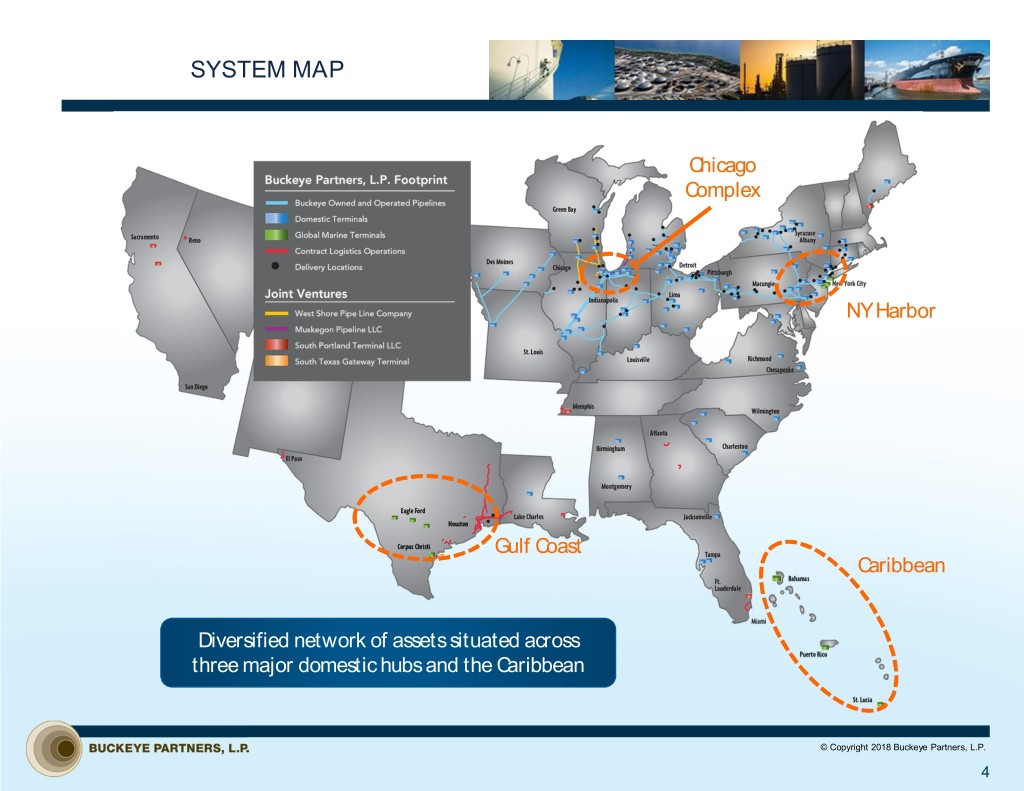

SYSTEM MAP Chicago Complex NY Harbor Gulf Coast Caribbean Diversified network of assets situated across three major domestic hubs and the Caribbean © Copyright 2018 Buckeye Partners, L.P. 4

STRATEGIC REVIEW On November 2, 2018, Buckeye announced the outcome of its strategic review Situation Analysis oIncreased need for capital based on attractive investment opportunities oDislocated public equity markets oEquity markets have not rewarded Buckeye for: oLevel of distribution being paid oSignificant level of cash flows being generated and expected to grow in the future oNear-term weakness in segregated storage Timing influenced by significant increases in attractive growth capital investments Expect to spend over $600 million of growth capital in 2018 Objectives oMaintain investment grade credit rating oProvide increased financial flexibility, eliminating the need to access the public equity markets oReallocate capital to higher return growth opportunities Reposition Buckeye to maximize long-term unitholder value © Copyright 2018 Buckeye Partners, L.P. 5

STRATEGIC REVIEW Actions and Benefits • Given scarcity of reasonably priced capital, sale allows Buckeye to Sale of Entire Equity Interest in VTTI B.V. allocate available capital to higher return domestic growth initiatives for $975 Million • Buckeye avoids any future VTTI capital investment requirements Represents multiple > 12x expected (estimated to be in excess of $100 million annually) 2019 cash flows • Eliminates Buckeye share of VTTI debt of approximately $500 million • Raise significant capital at attractive multiple for non-integrated Sale of Non-integrated Pipeline and assets Terminal Assets for $450 Million • Expect to operate these assets for buyer under long-term contract Represents multiple of 13x expected • No ownership risk going forward 2019 Adjusted EBITDA • No impact to Buckeye personnel Multiples realized are believed to be more representative of the intrinsic value of Buckeye’s asset portfolio • Buckeye expected to retain nearly $300 million of cash flow Quarterly Cash Distribution Adjustment to • Fund growth capital without need to access public equity markets $0.75 per unit (equates to $3.00 per year) • Significantly improve distribution coverage Actions expected to solidify investment grade credit rating, improve distribution coverage and eliminate the need to access public equity © Copyright 2018 Buckeye Partners, L.P. 6

DOMESTIC PIPELINES & TERMINALS Recent Highlights Significant growth capital investment opportunities across our terminal assets oSubstantial growth in pipeline revenue primarily due to increased throughput volumes resulting from stronger demand as well as higher average pipeline tariffs 2010 Pipelines Terminals 2018(1) oSignificant increase in terminal throughput volumes driven by incremental market share as well as enhanced service offerings from growth capital investments 30% oStrength was offset by the expiration of the crude-by-rail contract in Q1 2018 and two product releases during Q3 2018 70% oAggregate impact in excess of $12 million Outlook As % of Domestic P&T Revenue oExpect tariff increases on market-based and BPL Pipeline Tariff Mix FERC index-based tariff pipelines to drive pipeline throughput revenue growth 2018(2) Projected 2019(3) oTerminal throughput revenue growth expected to be driven by completion of growth capital 6% 6% initiatives and expansion of market share oForecast continued growth through investments 33% in capital projects and expanded service offerings 43% oContinuing to advance on a number of 51% projects with attractive return profiles across 61% our portfolio of assets oBoth Michigan/Ohio Expansion Phase II FERC INDEX and Chicago Complex Expansion to be in MARKET/NEGOTIATED service by mid-2019 OTHER © Copyright 2018 Buckeye Partners, L.P. (1) For the nine months ended September 30, 2018. (2) Reflects expected tariff mix through October 2018. (3) Reflects expected tariff mix for 2019. 7

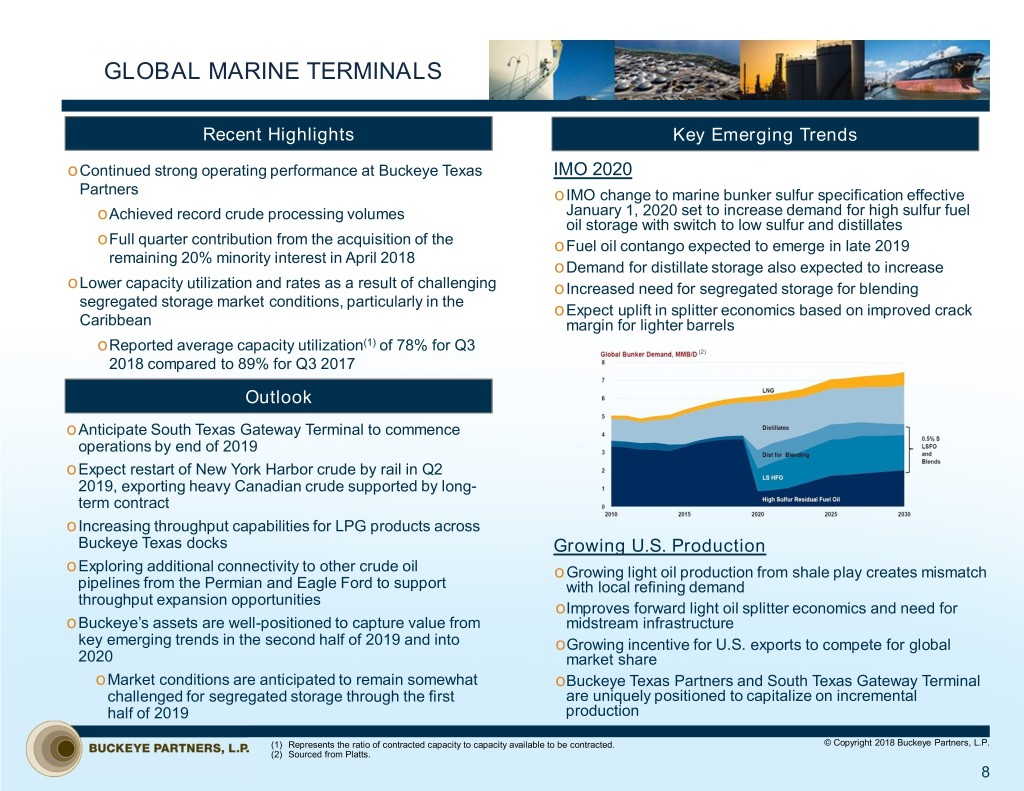

GLOBAL MARINE TERMINALS Recent Highlights Key Emerging Trends oContinued strong operating performance at Buckeye Texas IMO 2020 Partners oIMO change to marine bunker sulfur specification effective oAchieved record crude processing volumes January 1, 2020 set to increase demand for high sulfur fuel oil storage with switch to low sulfur and distillates oFull quarter contribution from the acquisition of the oFuel oil contango expected to emerge in late 2019 remaining 20% minority interest in April 2018 oDemand for distillate storage also expected to increase oLower capacity utilization and rates as a result of challenging oIncreased need for segregated storage for blending segregated storage market conditions, particularly in the oExpect uplift in splitter economics based on improved crack Caribbean margin for lighter barrels (1) oReported average capacity utilization of 78% for Q3 (2) 2018 compared to 89% for Q3 2017 Outlook oAnticipate South Texas Gateway Terminal to commence operations by end of 2019 oExpect restart of New York Harbor crude by rail in Q2 2019, exporting heavy Canadian crude supported by long- term contract oIncreasing throughput capabilities for LPG products across Buckeye Texas docks Growing U.S. Production oExploring additional connectivity to other crude oil oGrowing light oil production from shale play creates mismatch pipelines from the Permian and Eagle Ford to support with local refining demand throughput expansion opportunities oImproves forward light oil splitter economics and need for oBuckeye’s assets are well-positioned to capture value from midstream infrastructure key emerging trends in the second half of 2019 and into oGrowing incentive for U.S. exports to compete for global 2020 market share oMarket conditions are anticipated to remain somewhat oBuckeye Texas Partners and South Texas Gateway Terminal challenged for segregated storage through the first are uniquely positioned to capitalize on incremental half of 2019 production (1) Represents the ratio of contracted capacity to capacity available to be contracted. © Copyright 2018 Buckeye Partners, L.P. (2) Sourced from Platts. 8

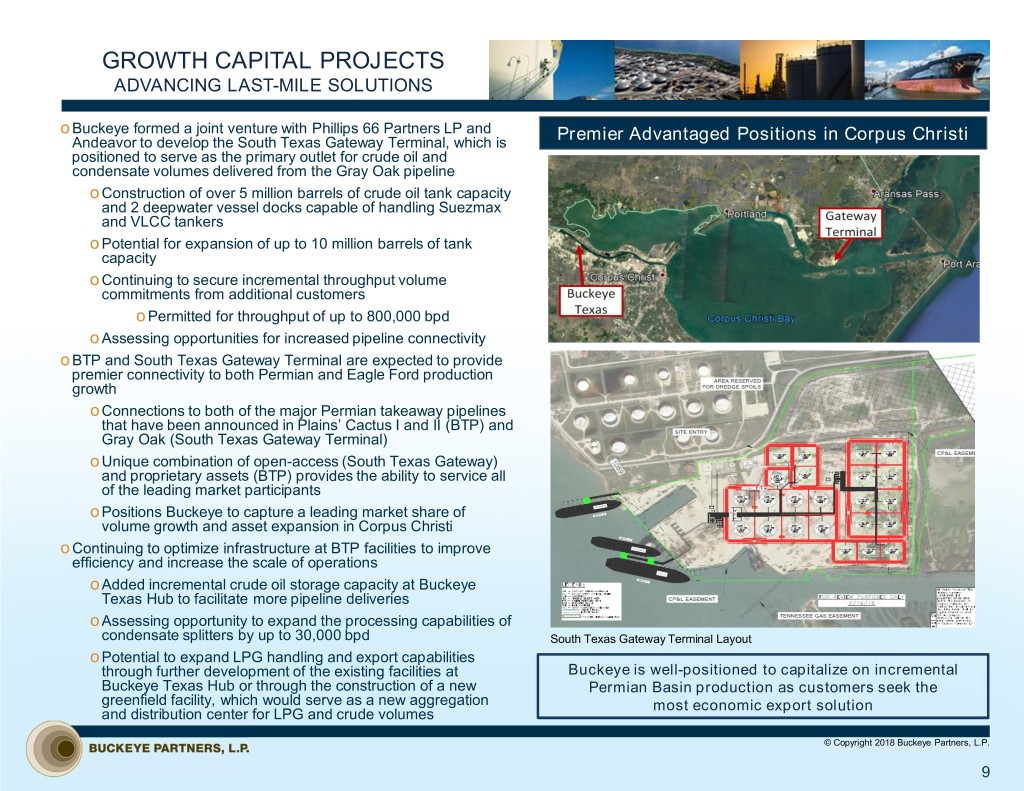

GROWTH CAPITAL PROJECTS ADVANCING LAST-MILE SOLUTIONS oBuckeye formed a joint venture with Phillips 66 Partners LP and Andeavor to develop the South Texas Gateway Terminal, which is Premier Advantaged Positions in Corpus Christi positioned to serve as the primary outlet for crude oil and condensate volumes delivered from the Gray Oak pipeline oConstruction of over 5 million barrels of crude oil tank capacity and 2 deepwater vessel docks capable of handling Suezmax and VLCC tankers oPotential for expansion of up to 10 million barrels of tank capacity oContinuing to secure incremental throughput volume commitments from additional customers oPermitted for throughput of up to 800,000 bpd oAssessing opportunities for increased pipeline connectivity oBTP and South Texas Gateway Terminal are expected to provide premier connectivity to both Permian and Eagle Ford production growth oConnections to both of the major Permian takeaway pipelines that have been announced in Plains’ Cactus I and II (BTP) and Gray Oak (South Texas Gateway Terminal) oUnique combination of open-access (South Texas Gateway) and proprietary assets (BTP) provides the ability to service all of the leading market participants oPositions Buckeye to capture a leading market share of volume growth and asset expansion in Corpus Christi oContinuing to optimize infrastructure at BTP facilities to improve efficiency and increase the scale of operations oAdded incremental crude oil storage capacity at Buckeye Texas Hub to facilitate more pipeline deliveries oAssessing opportunity to expand the processing capabilities of condensate splitters by up to 30,000 bpd South Texas Gateway Terminal Layout oPotential to expand LPG handling and export capabilities through further development of the existing facilities at Buckeye is well-positioned to capitalize on incremental Buckeye Texas Hub or through the construction of a new Permian Basin production as customers seek the greenfield facility, which would serve as a new aggregation most economic export solution and distribution center for LPG and crude volumes © Copyright 2018 Buckeye Partners, L.P. 9

GROWTH CAPITAL PROJECTS MAJOR PROJECTS Chicago Complex Expansion Michigan/Ohio Expansion – Phase Two o$80 million expansion project backed by a long-term oExtends Midwest supplies from Pittsburgh to Central agreement with BP Products North America, Inc., with Pennsylvania using Buckeye’s Laurel Pipeline approximately 600,000 additional barrels of product blending tankage and the build-out of an existing truck oProvides bi-directional service between Pittsburgh and rack Altoona in response to shipper desire for optionality to supply from Midwest or East coast oEnhances liquidity of the Chicago Complex and further solidifies our position as the premier storage and trading oAdds approximately 40,000 barrels per day of new facility in the area capacity from Midwest while maintaining historic volume capacity from the east oExpected completion in mid-2019 oBacked by 10-year shipper commitments oProject is ahead of schedule and all necessary permits have been obtained oAnticipate a decision from FERC on the proposed service that will allow service to begin in early 2019 oExpect this expansion to be the first phase of additional growth, as the Midwestern refining industry is materially cost-advantaged to certain of its competitors in other Michigan/Ohio Expansion Benefits parts of the country and poised for continued growth and investment oDriven by the clear long-term trend of increasing availability of lower-cost North American crudes oFor over a decade, Midwest refiners have been increasing production of lower-cost fuels made from these advantaged crudes oProvides safe and reliable pipeline option for Midwestern refiners to move these fuels eastward to meet consumer demand oIncreases Pennsylvania consumers’ access to lower-cost domestically produced fuels, decreasing dependence on more costly imports Buckeye Chicago Complex Expansion © Copyright 2018 Buckeye Partners, L.P. 10

GROWTH CAPITAL PROJECTS Smaller Organic Growth Projects Growth Capital Funding Consistently average $75 million to oMoving toward a “self-funding” business model in order to $125 million annual spend strengthen balance sheet, solidify investment grade rating and improve distribution coverage oExpansion of Jacksonville, FL terminal to increase oWell-positioned to fund planned growth capital without throughput capacity and provide ethanol and butane by accessing the public equity markets rail capabilities o2018 growth capital spend ~$625-670 million oBuilding out gasoline and ULSD railcar loading capabilities at our Woodhaven, MI terminal oIncludes planned contribution of $45-60 million to fund capital expenditures at the South Texas Gateway joint oExpanding connectivity and building a butane rail facility venture within our Tampa, FL terminal facility oIncludes the recent acquisition of the remaining 20% oExpanding and creating an integrated Pittsburgh Complex equity interest in BTP between our Pittsburgh, Coraopolis and Indianola terminal oAnticipate annual growth capital spend of ~$250-350 oReconfiguring the Albany, NY terminal to support a refined million prospectively products rail and truck rack business oAvailable liquidity on revolver(1) ~$924 million oButane blending services and onshore storage at Buckeye Bahamas Hub oConverted approximately 2 million barrels of capacity to Debt Maturities Over Next 5 Years handle a wider spectrum of products at Buckeye Bahamas Hub 1,200 1,000 oProjects to further capability to handle specialty crude s n 800 o i l products in the Caribbean l i 600 M $1.0B n I i 400 Our strategy is focused on maintaining and $ $525M 200 $400M - growing Buckeye's core business to offer the - highest potential returns for unitholders 2018 2019 2020 2021 2022 (1) As of September 30, 2018. © Copyright 2018 Buckeye Partners, L.P. 11

INVESTMENT SUMMARY Diverse portfolio of assets with strong balance sheet, solid investment grade rating and financial flexibility, poised to take advantage of strategic growth opportunities oPredominantly fee-based cash flows from our transportation, terminal throughput, storage and processing activities oSignificant geographic and product diversity, broader product service capabilities and significant near-term growth projects oPremier Corpus Christi assets well-positioned to capitalize on growing U.S. exports of crude oil from Gulf Coast oNo GP IDRs and C Corp governance oCommitted to maintaining an investment grade credit rating oAnticipate $1.4 billion of asset divestitures to be completed by year end Buckeye Bayonne Terminal oValuations realized believed to be more representative of intrinsic value of Buckeye oTargeted financial metrics: oLeverage less than 4.5x oDistribution coverage greater than 1.2x oEmpowered, commercially focused and team-oriented employees accountable and incentivized to deliver results Buckeye Texas Partners condensate splitters © Copyright 2018 Buckeye Partners, L.P. 12

NON-GAAP RECONCILIATIONS

NON-GAAP FINANCIAL MEASURES Adjusted EBITDA and distributable cash flow are measures not defined by accounting principles generally accepted in the United States of America (“GAAP”). We define Adjusted EBITDA as earnings before interest expense, income taxes, depreciation and amortization, further adjusted to exclude certain non-cash items, such as non-cash compensation expense; transaction, transition, and integration costs associated with acquisitions; certain gains and losses on foreign currency transactions and foreign currency derivative financial instruments, as applicable; and certain other operating expense or income items, reflected in net income, that we do not believe are indicative of our core operating performance results and business outlook, such as hurricane-related costs, gains and losses on property damage recoveries, and gains and losses on asset sales. We define distributable cash flow as Adjusted EBITDA less cash interest expense, cash income tax expense, and maintenance capital expenditures, that are incurred to maintain the operating, safety, and/or earnings capacity of our existing assets, plus or minus realized gains or losses on certain foreign currency derivative financial instruments, as applicable. These definitions of Adjusted EBITDA and distributable cash flow are also applied to our proportionate share in the Adjusted EBITDA and distributable cash flow of significant equity method investments, such as that in VTTI, B.V. (“VTTI”), and are not applied to our less significant equity method investments. The calculation of our proportionate share of the reconciling items used to derive these VTTI performance metrics is based upon our 50% equity interest in VTTI, prior to adjustments related to noncontrolling interests in several of its subsidiaries and partnerships, which are immaterial. These adjustments include gains and losses on foreign currency derivative financial instruments used to hedge VTTI’s United States dollar denominated distributions which are excluded from Adjusted EBITDA and included in distributable cash flow when realized. Adjusted EBITDA and distributable cash flow are non-GAAP financial measures that are used by our senior management, including our Chief Executive Officer, to assess the operating performance of our business and optimize resource allocation. We use Adjusted EBITDA as a primary measure to: (i) evaluate our consolidated operating performance and the operating performance of our business segments; (ii) allocate resources and capital to business segments; (iii) evaluate the viability of proposed projects; and (iv) determine overall rates of return on alternative investment opportunities. We use distributable cash flow as a performance metric to compare cash-generating performance of Buckeye from period to period and to compare the cash-generating performance for specific periods to the cash distributions (if any) that are expected to be paid to our unitholders. Distributable cash flow is not intended to be a liquidity measure. Buckeye believes that investors benefit from having access to the same financial measures used by senior management and that these measures are useful to investors because they aid in comparing Buckeye’s operating performance with that of other companies with similar operations. The Adjusted EBITDA and distributable cash flow data presented by Buckeye may not be comparable to similarly titled measures at other companies because these items may be defined differently by other companies. Please see the attached reconciliations of each of Adjusted EBITDA and distributable cash flow to net income. © Copyright 2018 Buckeye Partners, L.P. 14

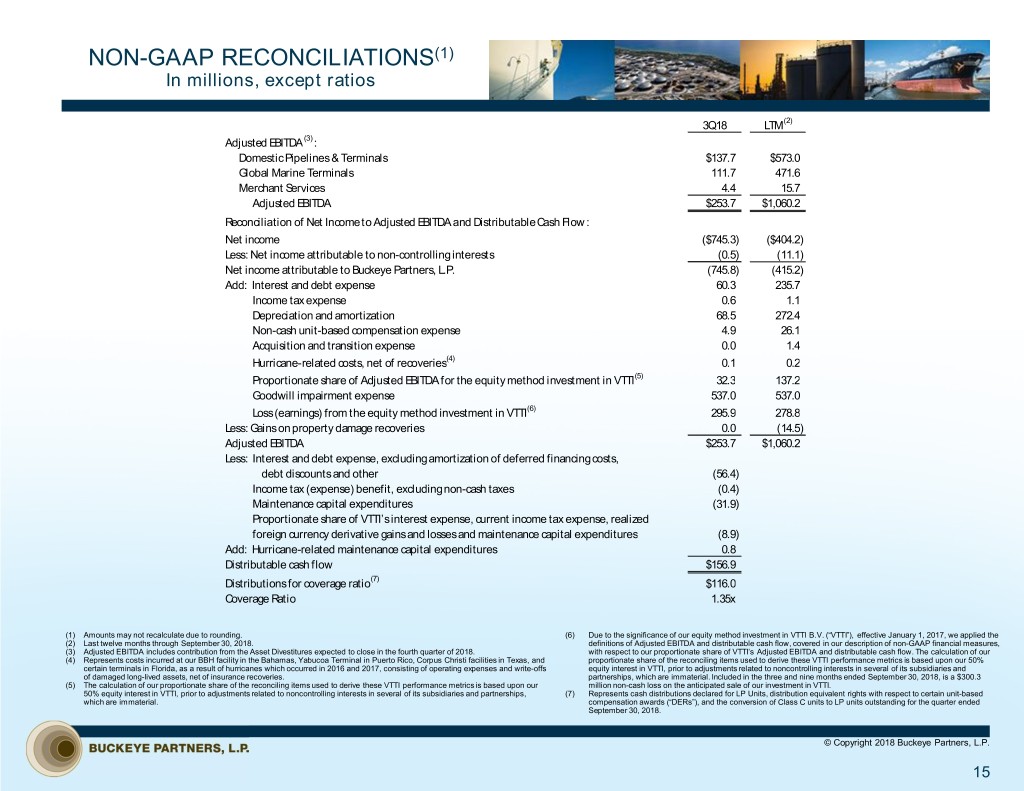

NON-GAAP RECONCILIATIONS(1) In millions, except ratios 3Q18 LTM(2) Adjusted EBITDA (3) : Domestic Pipelines & Terminals $137.7 $573.0 Global Marine Terminals 111.7 471.6 Merchant Services 4.4 15.7 Adjusted EBITDA $253.7 $1,060.2 Reconciliation of Net Income to Adjusted EBITDA and Distributable Cash Flow: Net income ($745.3) ($404.2) Less: Net income attributable to non-controlling interests (0.5) (11.1) Net income attributable to Buckeye Partners, L.P. (745.8) (415.2) Add: Interest and debt expense 60.3 235.7 Income tax expense 0.6 1.1 Depreciation and amortization 68.5 272.4 Non-cash unit-based compensation expense 4.9 26.1 Acquisition and transition expense 0.0 1.4 Hurricane-related costs, net of recoveries(4) 0.1 0.2 Proportionate share of Adjusted EBITDA for the equity method investment in VTTI(5) 32.3 137.2 Goodwill impairment expense 537.0 537.0 Loss (earnings) from the equity method investment in VTTI(6) 295.9 278.8 Less: Gains on property damage recoveries 0.0 (14.5) Adjusted EBITDA $253.7 $1,060.2 Less: Interest and debt expense, excluding amortization of deferred financing costs, debt discounts and other (56.4) Income tax (expense) benefit, excluding non-cash taxes (0.4) Maintenance capital expenditures (31.9) Proportionate share of VTTI’s interest expense, current income tax expense, realized foreign currency derivative gains and losses and maintenance capital expenditures (8.9) Add: Hurricane-related maintenance capital expenditures 0.8 Distributable cash flow $156.9 Distributions for coverage ratio(7) $116.0 Coverage Ratio 1.35x (1) Amounts may not recalculate due to rounding. (6) Due to the significance of our equity method investment in VTTI B.V. (“VTTI”), effective January 1, 2017, we applied the (2) Last twelve months through September 30, 2018. definitions of Adjusted EBITDA and distributable cash flow, covered in our description of non-GAAP financial measures, (3) Adjusted EBITDA includes contribution from the Asset Divestitures expected to close in the fourth quarter of 2018. with respect to our proportionate share of VTTI’s Adjusted EBITDA and distributable cash flow. The calculation of our (4) Represents costs incurred at our BBH facility in the Bahamas, Yabucoa Terminal in Puerto Rico, Corpus Christi facilities in Texas, and proportionate share of the reconciling items used to derive these VTTI performance metrics is based upon our 50% certain terminals in Florida, as a result of hurricanes which occurred in 2016 and 2017, consisting of operating expenses and write-offs equity interest in VTTI, prior to adjustments related to noncontrolling interests in several of its subsidiaries and of damaged long-lived assets, net of insurance recoveries. partnerships, which are immaterial. Included in the three and nine months ended September 30, 2018, is a $300.3 (5) The calculation of our proportionate share of the reconciling items used to derive these VTTI performance metrics is based upon our million non-cash loss on the anticipated sale of our investment in VTTI. 50% equity interest in VTTI, prior to adjustments related to noncontrolling interests in several of its subsidiaries and partnerships, (7) Represents cash distributions declared for LP Units, distribution equivalent rights with respect to certain unit-based which are immaterial. compensation awards (“DERs”), and the conversion of Class C units to LP units outstanding for the quarter ended September 30, 2018. © Copyright 2018 Buckeye Partners, L.P. 15