Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Spirit of Texas Bancshares, Inc. | d662012dex991.htm |

| EX-10.2 - EX-10.2 - Spirit of Texas Bancshares, Inc. | d662012dex102.htm |

| EX-10.1 - EX-10.1 - Spirit of Texas Bancshares, Inc. | d662012dex101.htm |

| EX-2.1 - EX-2.1 - Spirit of Texas Bancshares, Inc. | d662012dex21.htm |

| 8-K - FORM 8-K - Spirit of Texas Bancshares, Inc. | d662012d8k.htm |

Acquisition of First Beeville Financial Corporation Exhibit 99.2

Forward-Looking Statements This presentation contains statements regarding the proposed transaction (“merger”) between Spirit of Texas Bancshares, Inc. (“Spirit,” “STXB,” “we,” “us,” or “our”) and First Beeville Financial Corporation (“Beeville”). These statements constitute forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Words such as “expects,” “believes,” “estimates,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans, “seeks,” and variations of such words and similar expressions are intended to identify such forward-looking statements which are not statements of historical fact. These statements are based on current expectations, estimates, forecasts and projections and management assumptions about the future performance of each of Spirit, Beeville and the combined company, as well as the businesses and markets in which they do and are expected to operate. These forward-looking statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to assess. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of Spirit and Beeville may not be combined successfully, or such combination may take longer to accomplish than expected; (2) the cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer loss and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the Beeville shareholders may not approve the merger; (6) our acquisition and integration of Comanche National Corporation may continue to occupy management’s time and resources, and the anticipated results from that transaction may not be achieved, or said results may take longer to achieve than expected; (7) adverse governmental or regulatory policies may be enacted; (8) the interest rate environment may further compress margins and adversely affect net interest income; (9) continued diversification of assets and adverse changes to credit quality; (10) difficulties associated with achieving expected future financial results; (11) competition from other financial services companies in Spirit’s and Beeville’s markets; or (12) an economic slowdown that would adversely affect credit quality and loan originations. For a more complete list and description of such risks and uncertainties, refer to Spirit’s Registration Statement on Form S-1, as amended, filed with the Securities and Exchange Commission (the “SEC”) on April 6, 2018 and its related prospectus, filed with the SEC on May 4, 2018, as well as other filings made by Spirit with the SEC. Copies of such filings are available for download free of charge from the Investor Relations section of Spirit’s website at www.sotb.com. Any forward-looking statement made by Spirit in this presentation speaks only as of the date on which it is made. Factors or events that could cause Spirit’s actual results to differ may emerge from time to time, and it is not possible for Spirit to predict all of them. Except as required under the U.S. federal securities laws and the rules and regulations of the SEC, Spirit disclaims any intention or obligation to update any forward-looking statements after the distribution of this presentation, whether as a result of new information, future events, developments, changes in assumptions or otherwise.

Important Additional Information This communication is being made with respect to the proposed transaction involving Spirit and Beeville. This material is not a solicitation of any vote or approval of the Beeville shareholders and is not a substitute for the proxy statement/prospectus or any other documents that Spirit and Beeville may send to their respective shareholders in connection with the proposed merger. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. In connection with the proposed merger, Spirit will file with the SEC a Registration Statement on Form S-4 that will include a proxy statement of Beeville and a prospectus of Spirit, as well as other relevant documents concerning the proposed merger. BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS, INVESTORS AND SHAREHOLDERS ARE URGED TO READ CAREFULLY THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Beeville will mail the proxy statement/prospectus to its shareholders. Beeville shareholders are also urged to carefully review and consider Spirit’s public filings with the SEC, including, but not limited to, its Registration Statement on Form S-1, as amended, filed with the SEC on April 6, 2018, and its related prospectus, filed with the SEC on May 4, 2018, its proxy statement, its Quarterly Reports on Form 10-Q, and its Current Reports on Form 8-K. Copies of the Registration Statement and proxy statement/prospectus and other filings incorporated by reference therein, as well as other filings containing information about Spirit, may be obtained as they become available at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from Spirit at www.sotb.com. Beeville and its directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of Beeville’s shareholders in connection with the proposed transaction. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

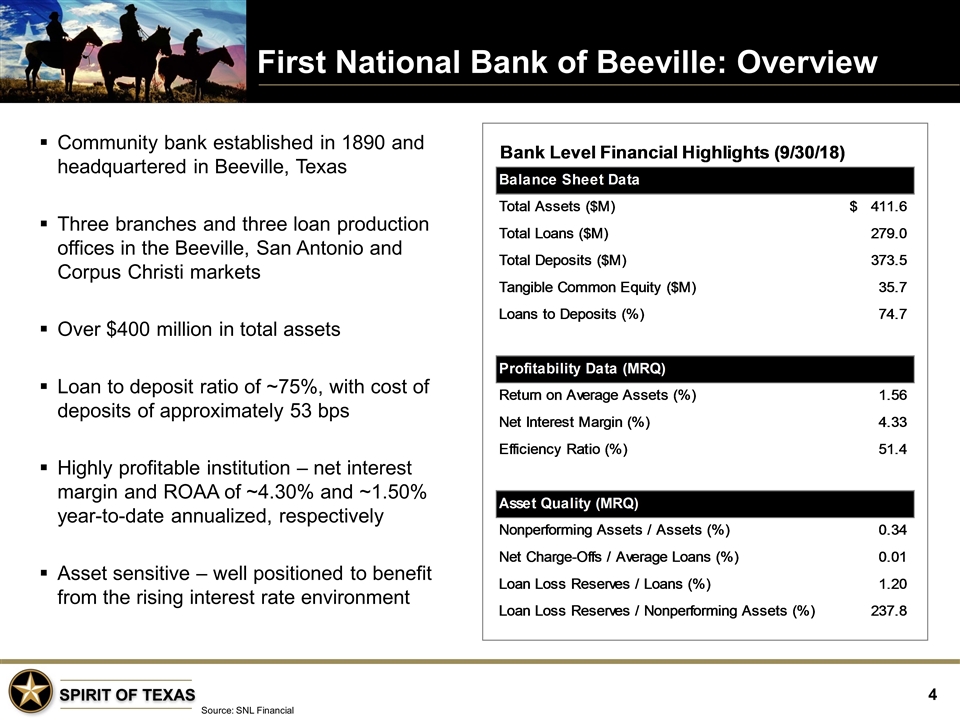

First National Bank of Beeville: Overview Community bank established in 1890 and headquartered in Beeville, Texas Three branches and three loan production offices in the Beeville, San Antonio and Corpus Christi markets Over $400 million in total assets Loan to deposit ratio of ~75%, with cost of deposits of approximately 53 bps Highly profitable institution – net interest margin and ROAA of ~4.30% and ~1.50% year-to-date annualized, respectively Asset sensitive – well positioned to benefit from the rising interest rate environment Source: SNL Financial

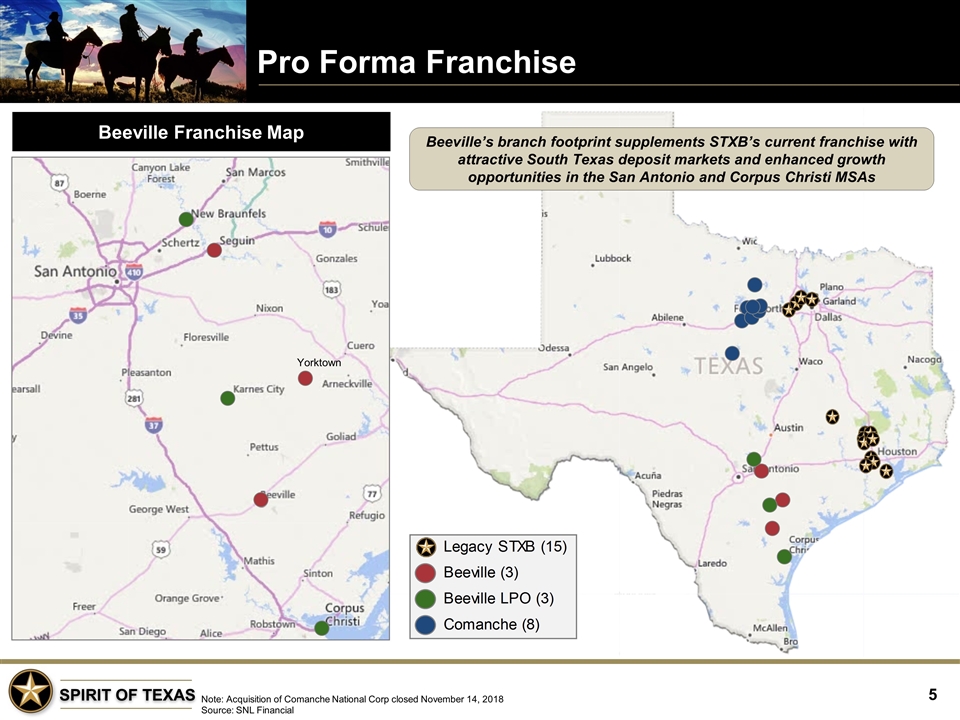

Pro Forma Franchise Note: Acquisition of Comanche National Corp closed November 14, 2018 Source: SNL Financial Beeville Franchise Map Beeville’s branch footprint supplements STXB’s current franchise with attractive South Texas deposit markets and enhanced growth opportunities in the San Antonio and Corpus Christi MSAs Yorktown

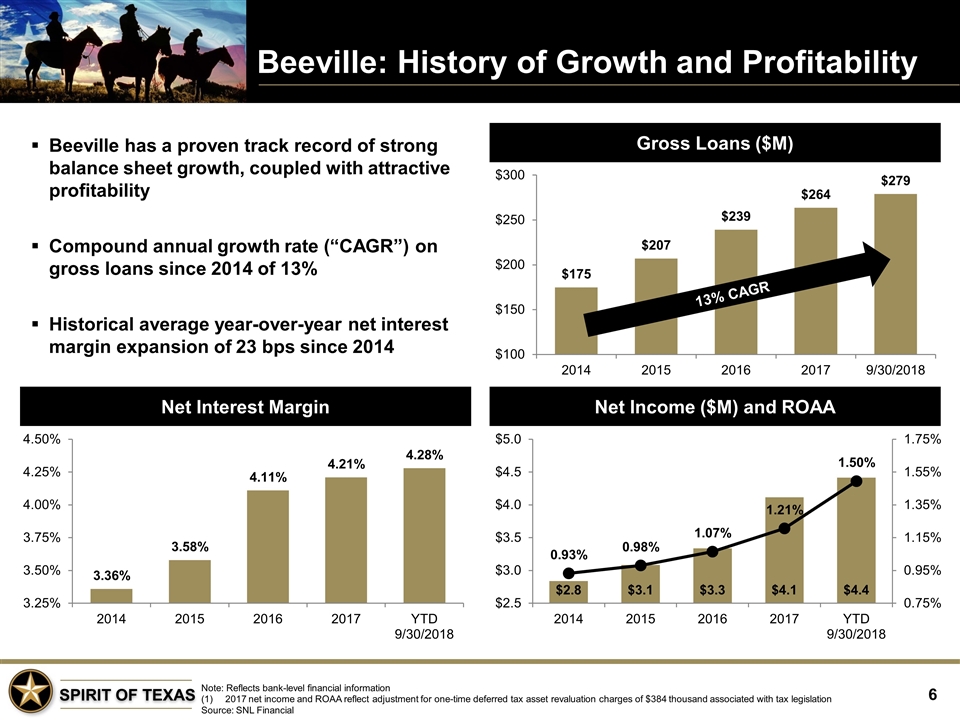

Beeville: History of Growth and Profitability Note: Reflects bank-level financial information 2017 net income and ROAA reflect adjustment for one-time deferred tax asset revaluation charges of $384 thousand associated with tax legislation Source: SNL Financial Gross Loans ($M) Net Income ($M) and ROAA Net Interest Margin Beeville has a proven track record of strong balance sheet growth, coupled with attractive profitability Compound annual growth rate (“CAGR”) on gross loans since 2014 of 13% Historical average year-over-year net interest margin expansion of 23 bps since 2014 13% CAGR

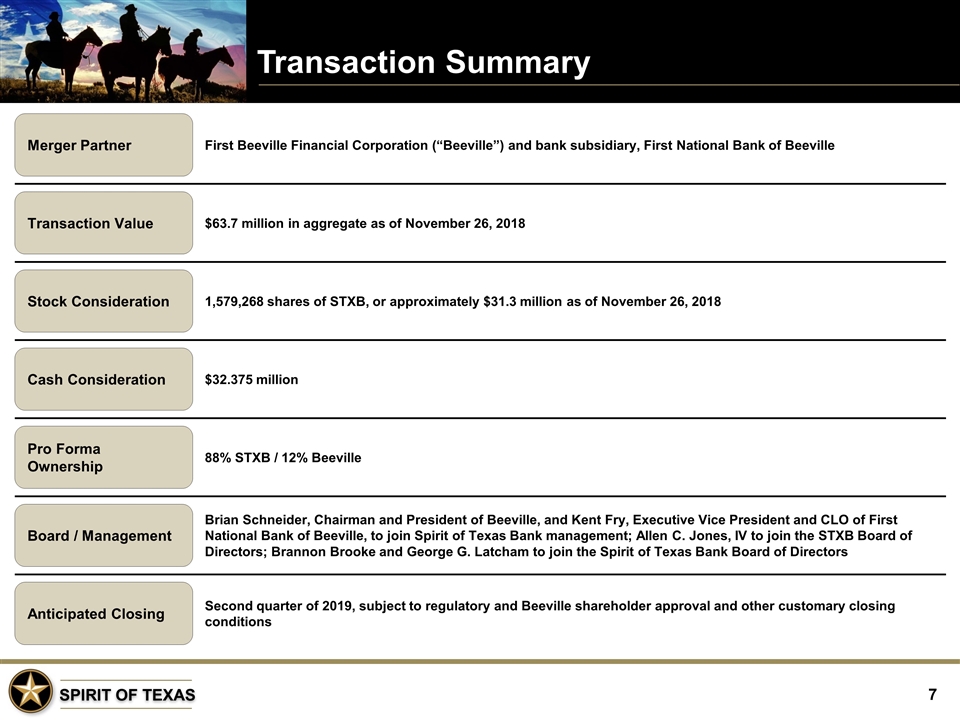

Transaction Summary Merger Partner Transaction Value Cash Consideration Stock Consideration Pro Forma Ownership Board / Management Anticipated Closing First Beeville Financial Corporation (“Beeville”) and bank subsidiary, First National Bank of Beeville $63.7 million in aggregate as of November 26, 2018 $32.375 million 1,579,268 shares of STXB, or approximately $31.3 million as of November 26, 2018 88% STXB / 12% Beeville Brian Schneider, Chairman and President of Beeville, and Kent Fry, Executive Vice President and CLO of First National Bank of Beeville, to join Spirit of Texas Bank management; Allen C. Jones, IV to join the STXB Board of Directors; Brannon Brooke and George G. Latcham to join the Spirit of Texas Bank Board of Directors Second quarter of 2019, subject to regulatory and Beeville shareholder approval and other customary closing conditions

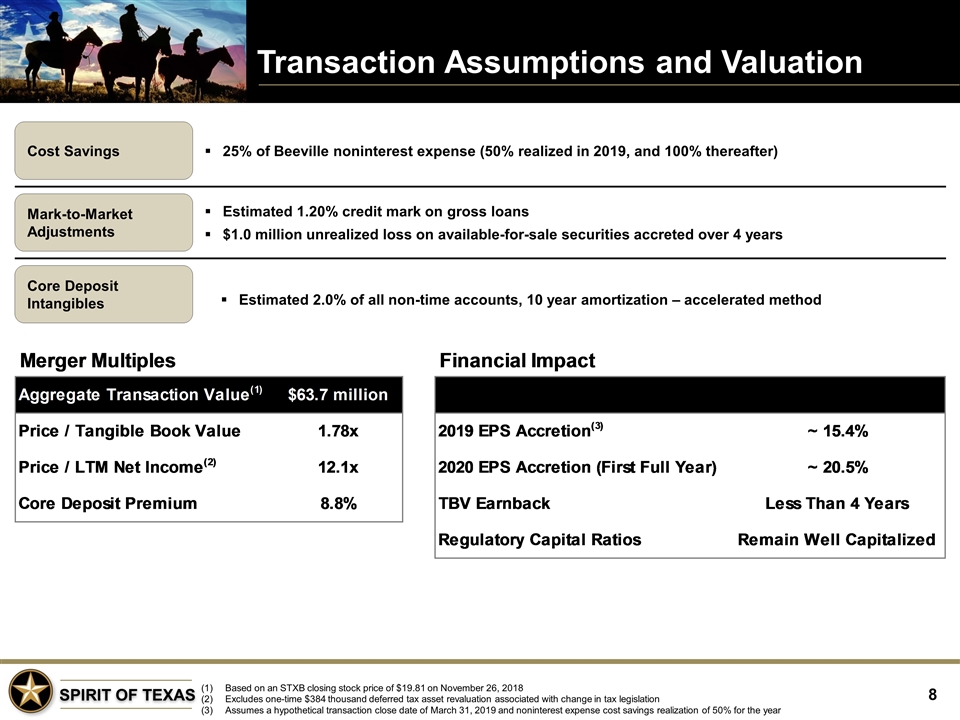

Transaction Assumptions and Valuation Cost Savings 25% of Beeville noninterest expense (50% realized in 2019, and 100% thereafter) Mark-to-Market Adjustments Estimated 1.20% credit mark on gross loans $1.0 million unrealized loss on available-for-sale securities accreted over 4 years Core Deposit Intangibles Estimated 2.0% of all non-time accounts, 10 year amortization – accelerated method Based on an STXB closing stock price of $19.81 on November 26, 2018 Excludes one-time $384 thousand deferred tax asset revaluation associated with change in tax legislation Assumes a hypothetical transaction close date of March 31, 2019 and noninterest expense cost savings realization of 50% for the year

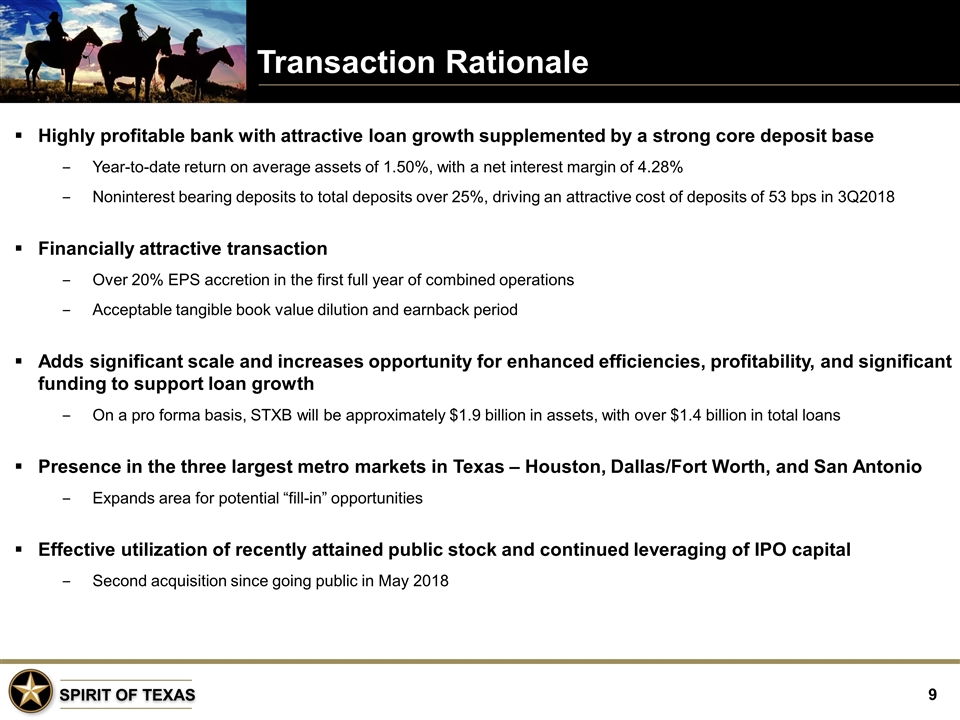

Transaction Rationale Highly profitable bank with attractive loan growth supplemented by a strong core deposit base Year-to-date return on average assets of 1.50%, with a net interest margin of 4.28% Noninterest bearing deposits to total deposits over 25%, driving an attractive cost of deposits of 53 bps in 3Q2018 Financially attractive transaction Over 20% EPS accretion in the first full year of combined operations Acceptable tangible book value dilution and earnback period Adds significant scale and increases opportunity for enhanced efficiencies, profitability, and significant funding to support loan growth On a pro forma basis, STXB will be approximately $1.9 billion in assets, with over $1.4 billion in total loans Presence in the three largest metro markets in Texas – Houston, Dallas/Fort Worth, and San Antonio Expands area for potential “fill-in” opportunities Effective utilization of recently attained public stock and continued leveraging of IPO capital Second acquisition since going public in May 2018

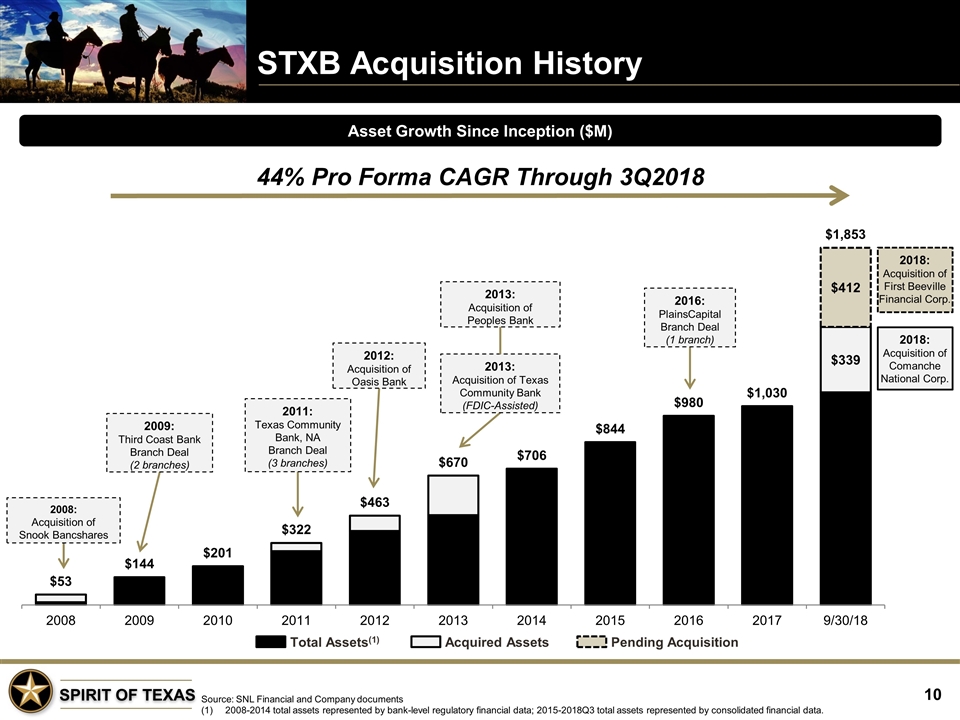

STXB Acquisition History Source: SNL Financial and Company documents 2008-2014 total assets represented by bank-level regulatory financial data; 2015-2018Q3 total assets represented by consolidated financial data. Asset Growth Since Inception ($M) 2008: Acquisition of Snook Bancshares 2009: Third Coast Bank Branch Deal (2 branches) 2011: Texas Community Bank, NA Branch Deal (3 branches) 2012: Acquisition of Oasis Bank 2013: Acquisition of Peoples Bank 2016: PlainsCapital Branch Deal (1 branch) 2013: Acquisition of Texas Community Bank (FDIC-Assisted) 2018: Acquisition of Comanche National Corp. 2018: Acquisition of First Beeville Financial Corp. 44% Pro Forma CAGR Through 3Q2018 Total Assets(1) Acquired Assets Pending Acquisition

Appendix

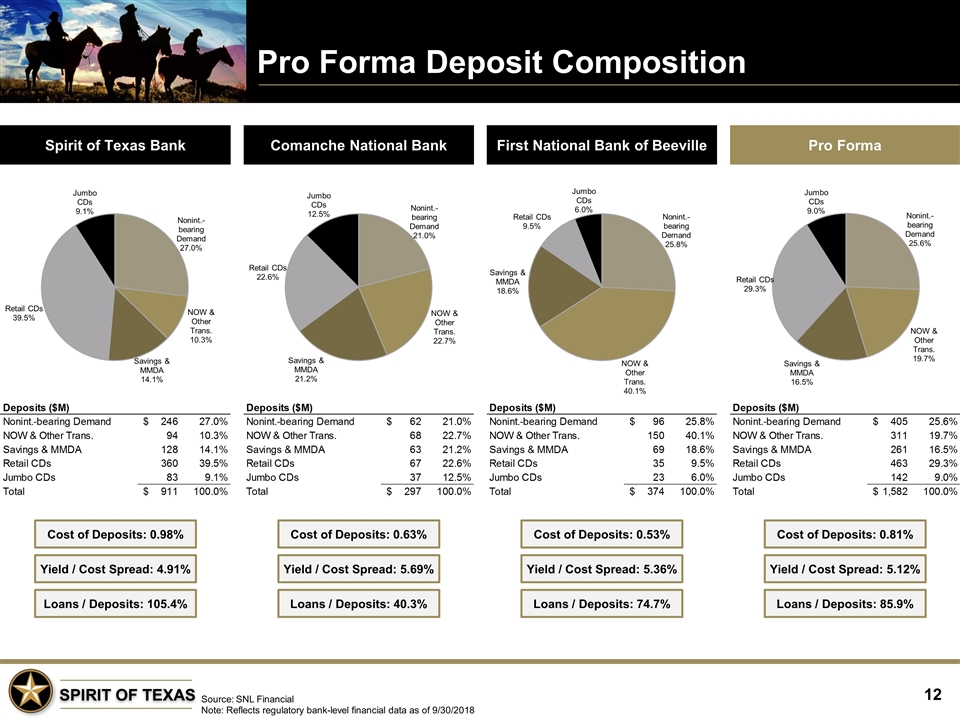

Pro Forma Deposit Composition Spirit of Texas Bank Comanche National Bank Pro Forma First National Bank of Beeville Source: SNL Financial Note: Reflects regulatory bank-level financial data as of 9/30/2018 Cost of Deposits: 0.98% Yield / Cost Spread: 4.91% Loans / Deposits: 105.4% Cost of Deposits: 0.63% Yield / Cost Spread: 5.69% Loans / Deposits: 40.3% Cost of Deposits: 0.53% Yield / Cost Spread: 5.36% Loans / Deposits: 74.7% Cost of Deposits: 0.81% Yield / Cost Spread: 5.12% Loans / Deposits: 85.9%

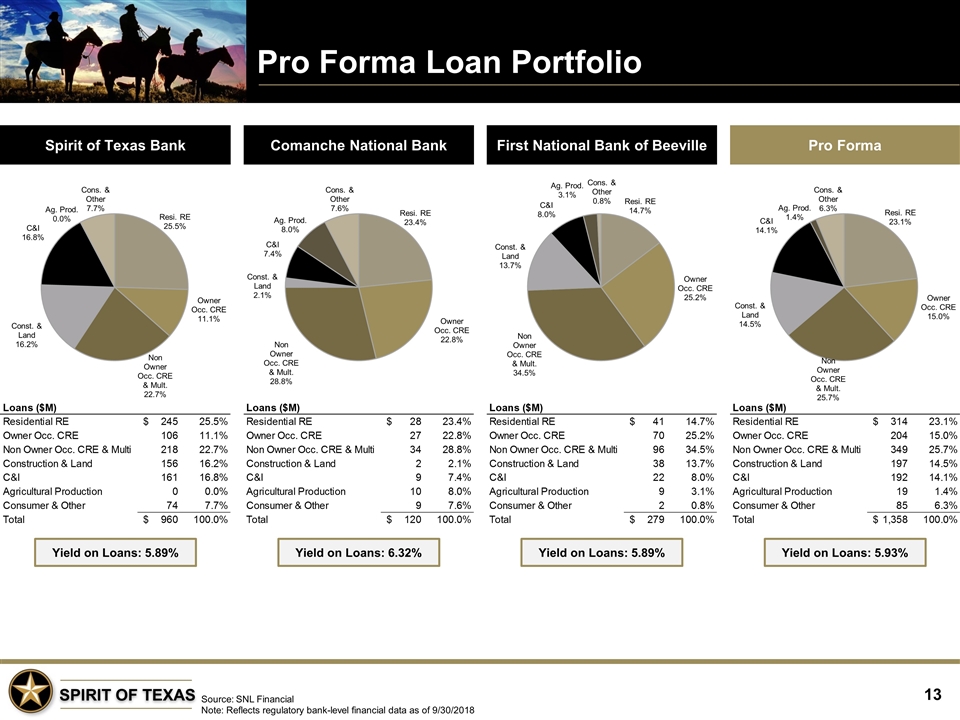

Pro Forma Loan Portfolio Spirit of Texas Bank Comanche National Bank Pro Forma Source: SNL Financial Note: Reflects regulatory bank-level financial data as of 9/30/2018 First National Bank of Beeville Yield on Loans: 5.89% Yield on Loans: 6.32% Yield on Loans: 5.89% Yield on Loans: 5.93%

Contact Information Corporate Headquarters Spirit of Texas Bancshares, Inc. 1836 Spirit of Texas Way Conroe, Texas 77301 (936) 538-1000 Analysts / Investors Jerry Golemon Executive Vice President and Chief Operating Officer (281) 516-4904 jgolemon@sotb.com Media Dennard Lascar Investor Relations Ken Dennard / Natalie Hairston (713) 529-6600 STXB@dennardlascar.com