Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KANSAS CITY SOUTHERN | d661897d8k.htm |

November 28, 2018 Credit Suisse Industrials Conference Kansas City Southern Exhibit 99.1

Safe Harbor Statement This presentation contains “forward-looking statements” within the meaning of the securities laws concerning potential future events involving KCS and its subsidiaries, which could materially differ from the events that actually occur. Words such as “projects,” “estimates,” “forecasts,” “believes,” “intends,” “expects,” “anticipates,” and similar expressions are intended to identify many of these forward-looking statements. Such forward-looking statements are based upon information currently available to management and management’s perception thereof as of the date hereof. Differences that actually occur could be caused by a number of external factors over which management has little or no control, including: competition and consolidation within the transportation industry; the business environment in industries that produce and use items shipped by rail; loss of the rail concession of KCS’ subsidiary, Kansas City Southern de México, S.A. de C.V.; the termination of, or failure to renew, agreements with customers, other railroads and third parties; access to capital; disruptions to KCS’ technology infrastructure, including its computer systems; natural events such as severe weather, hurricanes and floods; market and regulatory responses to climate change; legislative and regulatory developments and disputes; rail accidents or other incidents or accidents on KCS’ rail network or at KCS’ facilities or customer facilities involving the release of hazardous materials, including toxic inhalation hazards; fluctuation in prices or availability of key materials, in particular diesel fuel; dependency on certain key suppliers of core rail equipment; changes in securities and capital markets; availability of qualified personnel; labor difficulties, including strikes and work stoppages; acts of terrorism or risk of terrorist activities; war or risk of war; domestic and international economic, political and social conditions; the level of trade between the United States and Asia or Mexico; fluctuations in the peso-dollar exchange rate; increased demand and traffic congestion; the outcome of claims and litigation involving KCS or its subsidiaries; and other factors affecting the operation of the business. More detailed information about factors that could affect future events may be found in filings by KCS with the Securities and Exchange Commission, including KCS’ Annual Report on Form 10-K for the year ended December 31, 2017 (File No. 1-4717) and subsequent reports. Forward-looking statements are not, and should not be relied upon as, a guarantee of future performance or results, nor will they necessarily prove to be accurate indications of the times at or by which any such performance or results will be achieved. As a result, actual outcomes and results may differ materially from those expressed in forward-looking statements. KCS is not obligated to update any forward-looking statements to reflect future events or developments. All reconciliations to GAAP can be found on the KCS website, kcsouthern.com/investors.

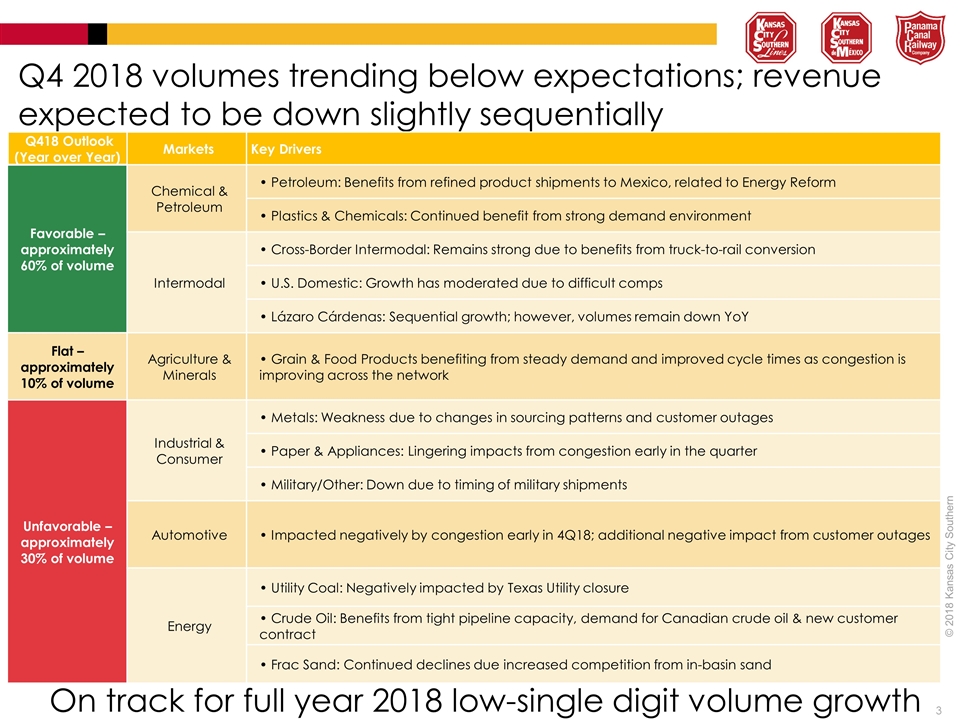

Q4 2018 volumes trending below expectations; revenue expected to be down slightly sequentially Q418 Outlook (Year over Year) Markets Key Drivers Favorable – approximately 60% of volume Chemical & Petroleum • Petroleum: Benefits from refined product shipments to Mexico, related to Energy Reform • Plastics & Chemicals: Continued benefit from strong demand environment Intermodal • Cross-Border Intermodal: Remains strong due to benefits from truck-to-rail conversion • U.S. Domestic: Growth has moderated due to difficult comps • Lázaro Cárdenas: Sequential growth; however, volumes remain down YoY Flat – approximately 10% of volume Agriculture & Minerals • Grain & Food Products benefiting from steady demand and improved cycle times as congestion is improving across the network Unfavorable – approximately 30% of volume Industrial & Consumer • Metals: Weakness due to changes in sourcing patterns and customer outages • Paper & Appliances: Lingering impacts from congestion early in the quarter • Military/Other: Down due to timing of military shipments Automotive • Impacted negatively by congestion early in 4Q18; additional negative impact from customer outages Energy • Utility Coal: Negatively impacted by Texas Utility closure • Crude Oil: Benefits from tight pipeline capacity, demand for Canadian crude oil & new customer contract • Frac Sand: Continued declines due increased competition from in-basin sand On track for full year 2018 low-single digit volume growth

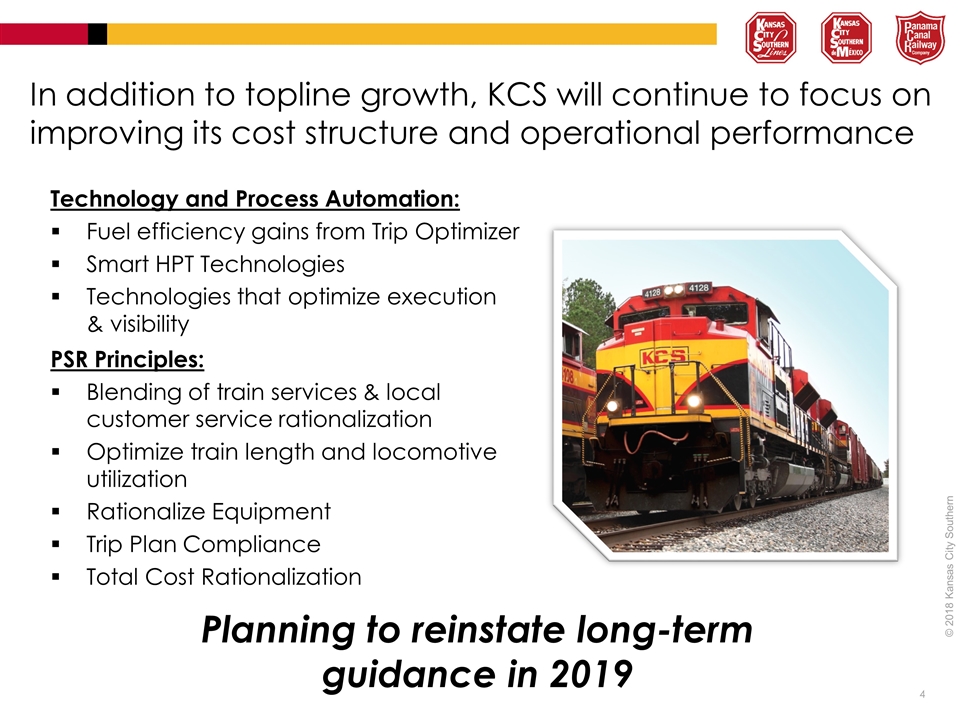

Technology and Process Automation: Fuel efficiency gains from Trip Optimizer Smart HPT Technologies Technologies that optimize execution & visibility In addition to topline growth, KCS will continue to focus on improving its cost structure and operational performance Planning to reinstate long-term guidance in 2019 PSR Principles: Blending of train services & local customer service rationalization Optimize train length and locomotive utilization Rationalize Equipment Trip Plan Compliance Total Cost Rationalization