Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PDS Biotechnology Corp | ex99_1.htm |

| EX-2.3 - EXHIBIT 2.3 - PDS Biotechnology Corp | ex2_3.htm |

| EX-2.2 - EXHIBIT 2.2 - PDS Biotechnology Corp | ex2_2.htm |

| EX-2.1 - EXHIBIT 2.1 - PDS Biotechnology Corp | ex2_1.htm |

| 8-K - 8-K - PDS Biotechnology Corp | form8k.htm |

Exhibit 99.2

PDS Biotechnology and Edge TherapeuticsProposed Combination November 26, 2018 A new

generation of multi-functional immunotherapies

Forward-Looking Statements 1 This presentation contains forward-looking statements about

Edge Therapeutics, Inc. and PDS Biotechnology Corporation, and their respective businesses, business prospects, strategy and plans, including but not limited to statements regarding anticipated preclinical and clinical drug development

activities and timelines and market opportunities. All statements other than statements of historical facts included in this presentation are forward-looking statements. The words “anticipates,” “may,” “can,” “plans,” “believes,” “estimates,”

“expects,” “projects,” “intends,” “likely,” “will,” “should,” “to be,” and any similar expressions or other words of similar meaning are intended to identify those assertions as forward-looking statements. These forward-looking statements

involve substantial risks and uncertainties that could cause actual results to differ materially from those anticipated. Factors that may cause actual results to differ materially from such forward-looking statements include those identified

under the caption “Risk Factors” in the documents filed by Edge with the Securities and Exchange Commission from time to time, including its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. You are

cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Except to the extent required by applicable law or regulation, neither Edge nor PDS undertakes any obligation to

update the forward-looking statements included in this presentation to reflect subsequent events or circumstances.

Other Important Information 1 In connection with the proposed strategic merger, Edge

intends to file relevant materials with the Securities and Exchange Commission (SEC), including a registration statement on Form S-4 that will contain a proxy statement and prospectus. Investors may obtain the proxy statement/prospectus (when

available), as well as other filings containing information about Edge, free of charge, from the SEC's Web site (www.sec.gov). In addition, investors and securityholders may obtain free copies of the documents filed with the SEC by Edge by

directing a written request to: Edge Therapeutics, Inc. 300 Connell Drive #4000, Berkeley Heights, NJ 07922, Attention: Corporate Secretary or delivered via e-mail to investors@Edgetherapeutics.com. Investors and securityholders are urged to

read the proxy statement, prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the merger.This communication shall not constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Participants in the

Solicitation Edge and PDS Biotechnology and their respective directors and executive officers and certain of their other members of management and employees may be deemed to be participants in the solicitation of proxies from the stockholders

of Edge in connection with the proposed transaction. Information regarding the special interests of these directors and executive officers in the merger will be included in the proxy statement/prospectus referred to above. Additional

information regarding the directors and executive officers of Edge is also included in Edge Annual Report on Form 10-K for the year ended December 31, 2017, filed with the SEC on March 1, 2018. These documents are available free of charge

from the sources indicated above.

Transaction Overview 1 Key Terms Board of Directors and Organization Timing and

Closing Privately-held PDS Biotechnology has agreed to merge with a subsidiary of Edge Therapeutics in an all-stock transactionEdge shareholders expected to own ~30% of the combined company and PDS shareholders ~70%Upon closing, the merged

company will operate under the PDS Biotechnology name Board of directors to include 7 representatives: 4 designated by PDS and 3 designated by EdgeHeadquarted in Berkeley Heights, NJ Transaction has been approved by boards of both

companiesClosing subject to approval of Edge and PDS shareholders and satisfaction or waiver of customary closing conditionsExpected to close in Q1 2019

Edge and PDS Combined Company Overview 1 Proposed merger to form a clinical-stage cancer

immunotherapy biotechnology company developing novel products for treating early- and late-stage cancerGrowing product pipeline utilizing Versamune®, a novel, versatile, multi-functional immunotherapy platform Phase 1/2 clinical data on lead

product candidate PDS0101 suggests immunotherapeutic anti-cancer activity and favorable safety profile of Versamune® potentially advantageous in early- and late- stage cancerCompany plans to initiate multiple late-stage clinical studies of

PDS0101 in HPV-associated cancersExpected cash balance of ~$25 million at closing 5

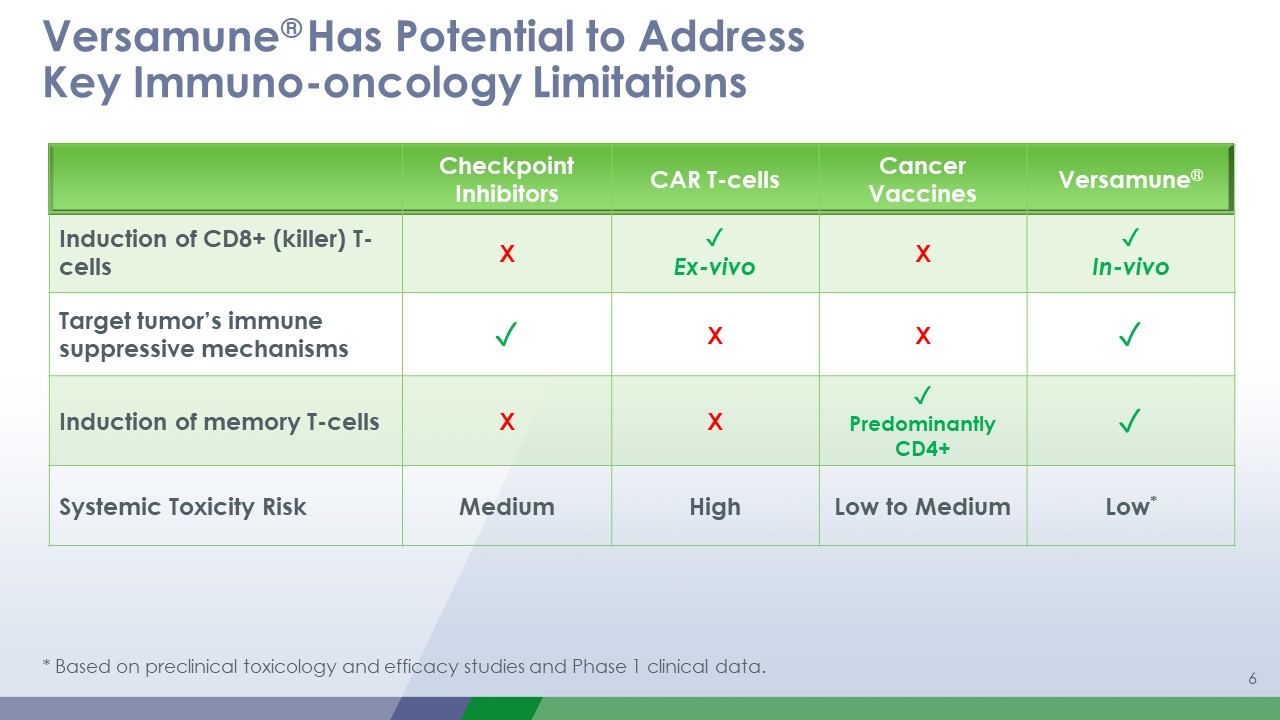

1 Versamune® Has Potential to AddressKey Immuno-oncology Limitations Checkpoint

Inhibitors CAR T-cells Cancer Vaccines Versamune® Induction of CD8+ (killer) T-cells X ✓Ex-vivo X ✓In-vivo Target tumor’s immune suppressive mechanisms ✓ X X ✓ Induction of memory T-cells X X ✓Predominantly CD4+ ✓ Systemic

Toxicity Risk Medium High Low to Medium Low* * Based on preclinical toxicology and efficacy studies and Phase 1 clinical data.

Versamune® Unique Multiple Mechanisms of Action Promote In-vivo Killer T-cell Induction Priming and training of tumor-recognizing killer T-cells (CD8+) Overcomes tumor immune suppression (Reduction of Tregs) Versamune SC Injection Activates critical immune

signaling pathway to arm killer T-cells (Type I Interferons)

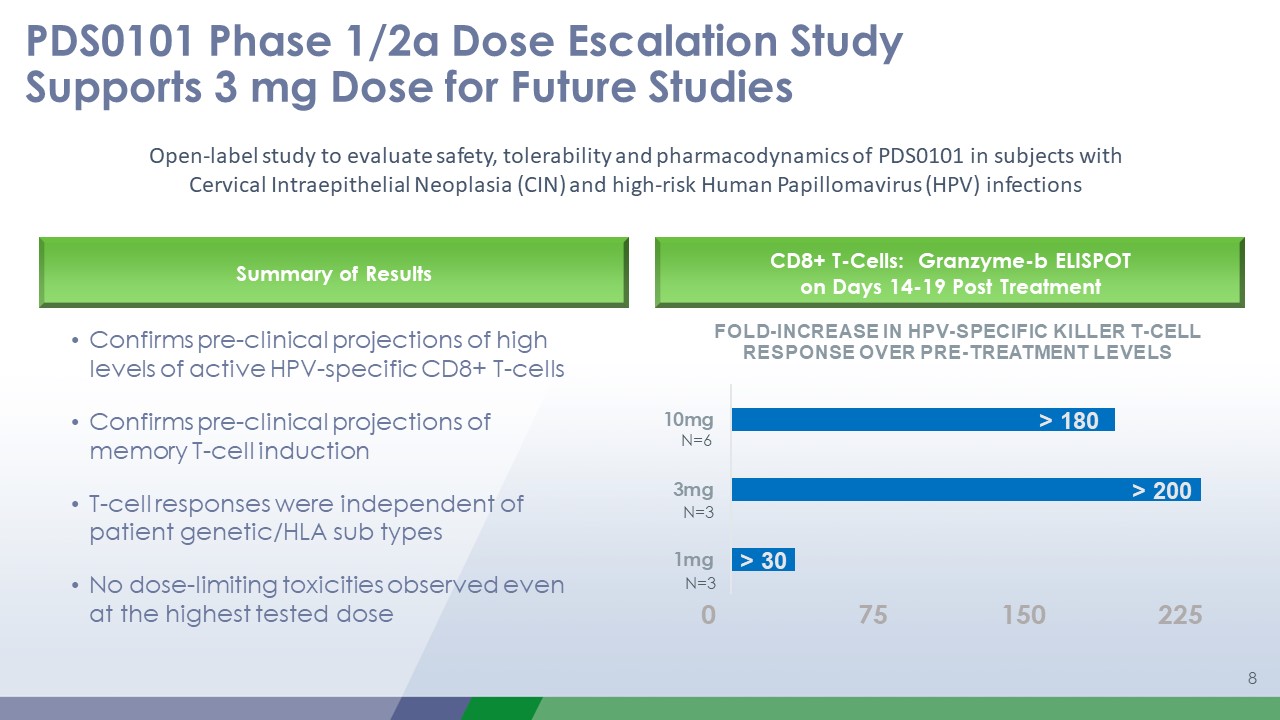

PDS0101 Phase 1/2a Dose Escalation Study Supports 3 mg Dose for Future Studies 1 CD8+

T-Cells: Granzyme-b ELISPOT on Days 14-19 Post Treatment N=6 N=3 N=3 Open-label study to evaluate safety, tolerability and pharmacodynamics of PDS0101 in subjects withCervical Intraepithelial Neoplasia (CIN) and high-risk Human

Papillomavirus (HPV) infections Confirms pre-clinical projections of high levels of active HPV-specific CD8+ T-cellsConfirms pre-clinical projections of memory T-cell inductionT-cell responses were independent of patient genetic/HLA sub

typesNo dose-limiting toxicities observed even at the highest tested dose Summary of Results

Growing Pipeline of PDS Fully-Owned Cancer Immunotherapies 1 Product Cancer

Indication Preclinical Phase 1 Phase 2a Phase 2b PDS0101(HPV- related Cancers) Head & neck Recurrent/metastatic + pembrolizumab Cervical pre-cancer CIN 2/3 Anal pre-cancerAIN 2/3 Cervical Stage

II-IVa PDS0102 Prostate and breast PDS0103 Ovarian, colorectal, lung, breast PDS0104 Melanoma, glioma Funded clinical trials Planned additional studies (MERCK) (NATIONAL

CANCER INSTITUTE) (NATIONAL CANCER INSTITUTE)

Versamune® Competitive Barriers Patent Protection in U.S., EU, Asia Patent Protection in U.S., EU, Asia Multiple issued patents: Expected to

provide patent protection into the 2030s Multiple patent applications: Future patent applications could extend into the late-2030s Regulatory Exclusivity (Biologics) Protection for a new molecular entity Manufacturing Know-how & Trade Secrets

PDS0101 Targets Large and Unmet Market Opportunities 1 HPV disease market is estimated to

be over $5B worldwide by 2025HPV-Related CancersOver 75,000 new cases of HPV-related cancers in US and Europe annuallyHPV Pre-cancersOver 1million new incidences of high-grade, treatment-required HPV pre-cancers in U.S. and Europe

annually PDS0101 Targets Large and Unmet Market Opportunities 11

1 Anticipated Milestones Initiate PDS0101 monotherapy registration program in Cervical

Intraepithelial Neoplasia (CIN) 2/3Initiate PDS0101-Keytruda combination Phase 2 study in head and neck cancerComplete manufacturing of clinical supply for PDS0101Continue to advance prostate, ovarian and melanoma cancer pipeline towards

potential IND filings

Experienced Leadership Team Frank Bedu-Addo, PhDCEO & Co-Founder Brian

LeuthnerPresident Lauren Wood, MDChief Medical Officer Gregory Conn, PhDChief Scientific Officer & Co-Founder Andrew Saik, MBAChief Financial Officer NIH National Cancer Inst. 13

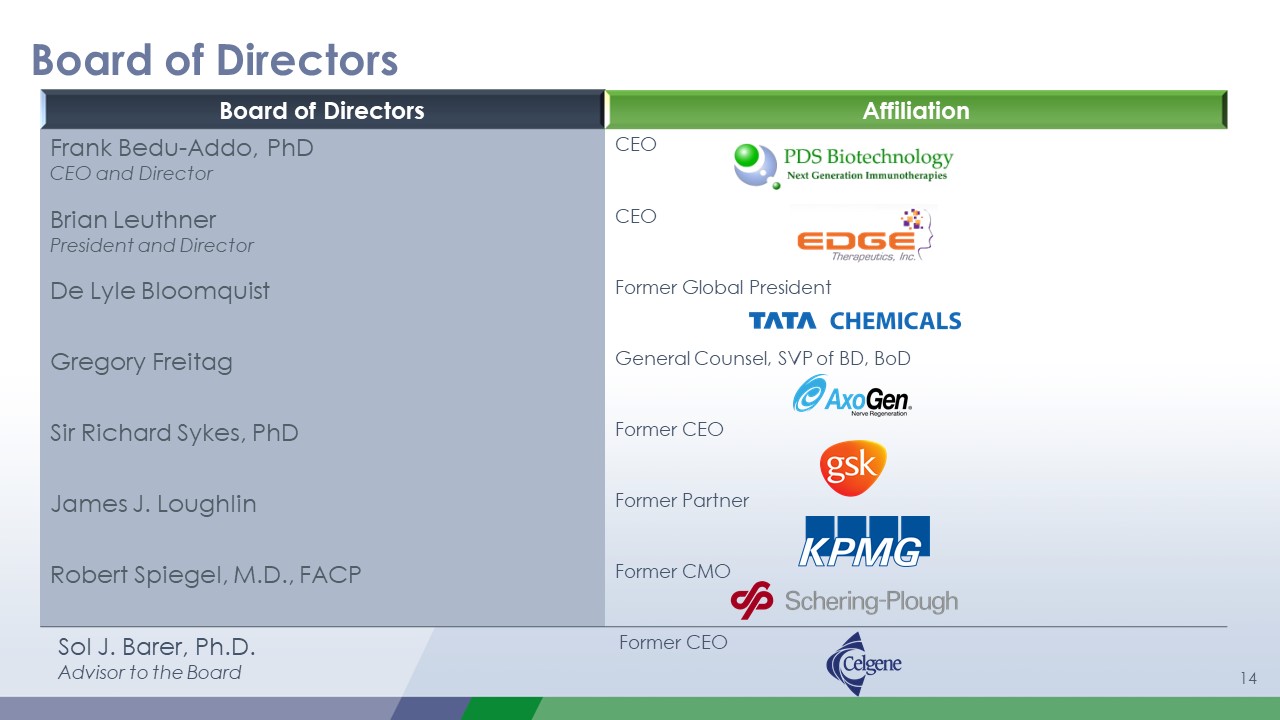

Board of Directors Affiliation Frank Bedu-Addo, PhDCEO and Director CEO Brian

LeuthnerPresident and Director CEO De Lyle Bloomquist Former Global President Gregory Freitag General Counsel, SVP of BD, BoD Sir Richard Sykes, PhD Former CEO James J. Loughlin Former Partner Robert Spiegel, M.D., FACP Former

CMO Board of Directors Sol J. Barer, Ph.D.Advisor to the Board Former CEO 14

Edge and PDS Combined Company Overview 1 Proposed merger to form a clinical-stage cancer

immunotherapy biotechnology company developing novel products for treating early- and late-stage cancerGrowing product pipeline utilizing Versamune®, a novel, versatile, multi-functional immunotherapy platform Phase 1/2 clinical data on lead

product candidate PDS0101 suggests immunotherapeutic anti-cancer activity and favorable safety profile of Versamune® potentially advantageous in early- and late- stage cancerCompany plans to initiate multiple late-stage clinical studies of

PDS0101 in HPV-associated cancersExpected cash balance of ~$25 million at closing 15