Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LOWES COMPANIES INC | d427785d8k.htm |

| EX-99.1 - EX-99.1 - LOWES COMPANIES INC | d427785dex991.htm |

Exhibit 99.2

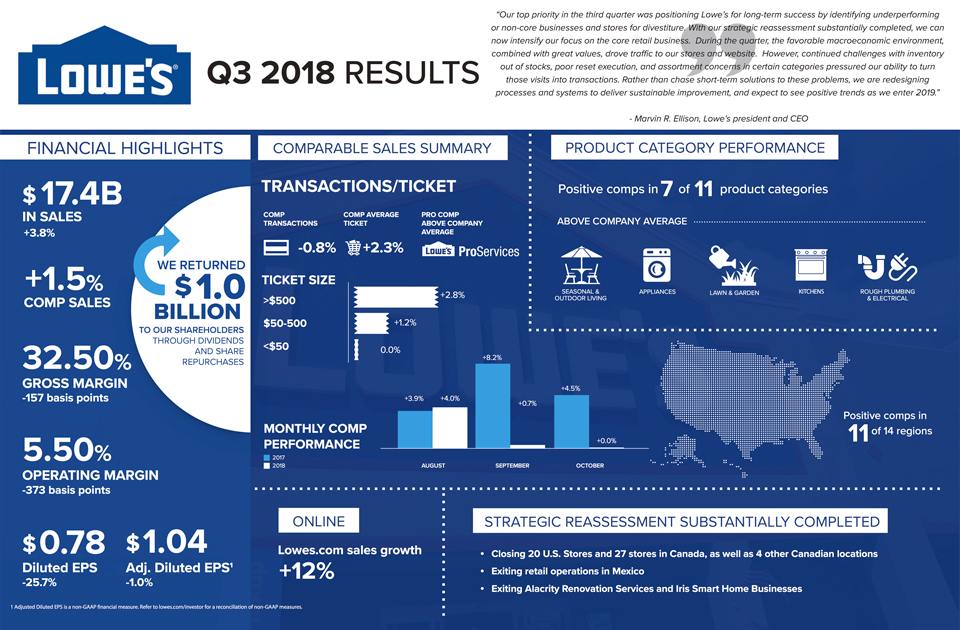

Lowe’s Q3 2018 RESULTS FINANCIAL HIGHLIGHTS COMPARABLE SALES SUMMARY PRODUCT CATEGORY PERFORMANCE “Our top priority in the third quarter was positioning Lowe’s for long-term success by identifying underperforming or non-core businesses and stores for divestiture. With our strategic reassessment substantially completed, we can now intensify our focus on the core retail business. During the quarter, the favorable macroeconomic environment, combined with great values, drove traffic to our stores and website. However, continued challenges with inventory out of stocks, poor reset execution, and assortment concerns in certain categories pressured our ability to turn those visits into transactions. Rather than chase short-term solutions to these problems, we are redesigning processes and systems to deliver sustainable improvement, and expect to see positive trends as we enter 2019.” - Marvin R. Ellison, Lowe’s president and CEO 1 Adjusted Diluted EPS is a non-GAAP financial measure. Refer to lowes.com/investor for a reconciliation of non-GAAP measures. $ 17.4B IN SALES Positive comps in of product categories ABOVE COMPANY AVERAGE +3.8% $0.78 $1.04 Diluted EPS Adj. Diluted EPS -25.7% -1.0% 32.50% GROSS MARGIN -157 basis points 5.50% OPERATING MARGIN -373 basis points +1.5% 7 11 COMP SALES COMP TRANSACTIONS COMP AVERAGE TICKET PRO COMP ABOVE COMPANY AVERAGE -0.8% +2.3% $ BILLION 1.0 WE RETURNED TO OUR SHAREHOLDERS THROUGH DIVIDENDS AND SHARE REPURCHASES TRANSACTIONS/TICKET TICKET SIZE >$500 +1.2% +2.8% 0.0% $50-500 <$50 AUGUST SEPTEMBER OCTOBER +3.9% +4.0% +8.2% +0.7% +4.5% +0.0% MONTHLY COMP PERFORMANCE 2017 2018 ONLINE STRATEGIC REASSESSMENT SUBSTANTIALLY COMPLETED Lowes.com sales growth • Closing 20 U.S. Stores and 27 stores in Canada, as well as 4 other Canadian locations • Exiting retail operations in Mexico • Exiting Alacrity Renovation Services and Iris Smart Home Businesses +12% APPLIANCES ROUGH PLUMBING & ELECTRICAL SEASONAL & LAWN & GARDEN OUTDOOR LIVING KITCHENS Positive comps in 11 of 14 regions

Q1 2017 EARNINGS CALL RECONCILIATION OF NON-GAAP MEASURES

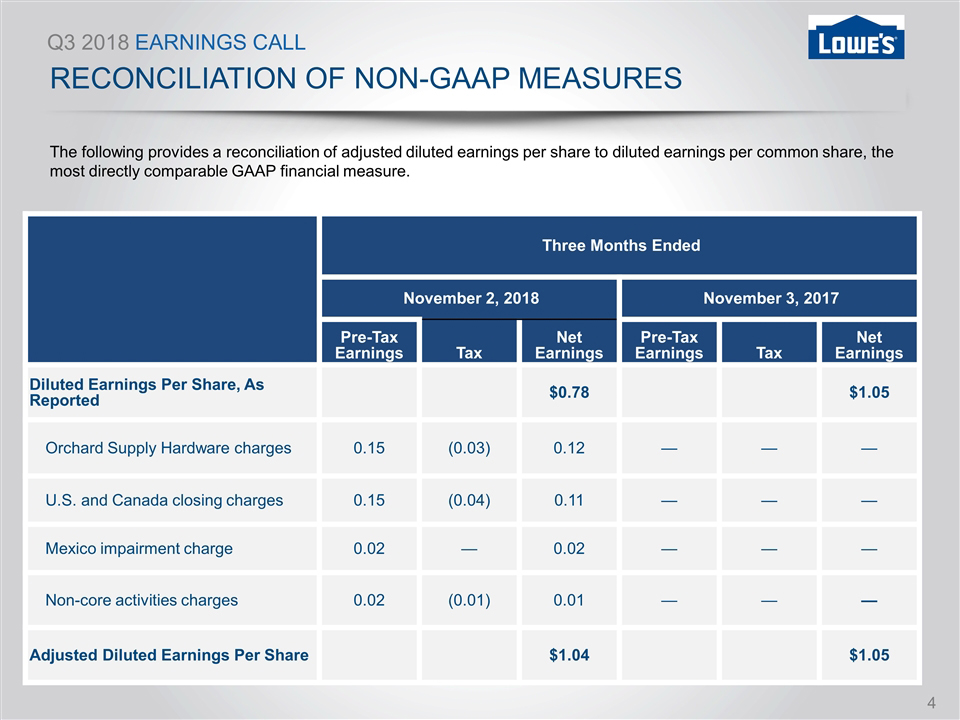

Q3 2018 EARNINGS CALL NON-GAAP MEASURES Management uses non-GAAP financial measures, as further outlined in the following slides, because it considers them to be important supplemental measures of the Company’s performance. Management also believes that these non-GAAP financial measures provide additional insight for analysts and investors in evaluating the Company’s financial and operating performance. These non-GAAP financial measures should not be considered alternatives to, or more meaningful indicators of, the Company’s earnings per common share, forecasted earnings per common share, total debt or other financial measures as prepared in accordance with GAAP. The Company’s methods of determining these non-GAAP financial measures may differ from the methods used by other companies for these or similar non-GAAP financial measures. Accordingly, these non-GAAP financial measures may not be comparable to measures used by other companies. 2

NON-GAAP MEASURES Adjusted Diluted Earnings Per Share / Forecasted Adjusted Diluted Earnings Per Share We have presented Adjusted Diluted Earnings Per Share and Forecasted Adjusted Diluted Earnings Per Share to exclude the impacts of certain respective items, as further detailed below, not contemplated in Lowe’s original Business Outlook for fiscal 2018 to assist the user in understanding performance relative to that Business Outlook. On August 17, 2018, the company committed to exit its Orchard Supply Hardware operations. As a result, the company recognized pre-tax charges of $230 million during the second quarter of fiscal 2018 associated with long-lived asset impairments and discontinued projects. During the third quarter of fiscal 2018, the company recognized pre-tax charges of $123 million associated with accelerated depreciation and amortization, severance and lease obligations. During the fourth quarter of fiscal 2018, the company expects to recognize additional pre-tax charges of $270 million to $350 million related to lease obligations. Total pre-tax charges for fiscal year 2018 are estimated to range from $623 million to $703 million (Orchard Supply Hardware charges); On October 31, 2018, the company committed to close 20 under-performing stores across the U.S. and 31 locations in Canada, including 27 under-performing stores. As a result, the company recognized pre-tax charges of $121 million during the third quarter of fiscal 2018 associated with long-lived asset impairment and severance obligations. During the fourth quarter of fiscal 2018, the company expects to recognize additional pre-tax charges of $190 million to $230 million, primarily associated with accelerated depreciation and lease obligation costs. Total pre-tax charges for fiscal year 2018 are estimated to range from $311 million to $351 million (U.S. and Canada closing charges); On November 20, 2018, the company announced its plans to exit retail operations in Mexico and is exploring strategic alternatives. During the third quarter, $22 million of long-lived asset impairment was recognized on certain assets in Mexico as a result of the strategic evaluation (Mexico impairment charge), and; During the third quarter of fiscal 2018, the company identified certain non-core activities within its U.S. home improvement business to exit, including Alacrity Renovation Services and Iris Smart Home. As a result, during the third quarter of 2018, the company recognized pre-tax charges of $14 million associated with long-lived asset impairment and inventory write-down (Non-core activities charges).

Q3 2018 EARNINGS CALL RECONCILIATION OF NON-GAAP MEASURES The following provides a reconciliation of adjusted diluted earnings per share to diluted earnings per common share, the most directly comparable GAAP financial measure. Three Months Ended November 2, 2018 November 3, 2017 Pre-Tax Net Pre-Tax Net Earnings Tax Earnings Earnings Tax Earnings Diluted Earnings Per Share, As Reported $0.78 $ 1.05 Orchard Supply Hardware charges 0.15 (0.03) 0.12 — — — U.S. and Canada closing charges 0.15 (0.04) 0.11 — — — Mexico impairment charge 0.02 — 0.02 — — — Non-core activities charges 0.02 (0.01) 0.01 — — — Adjusted Diluted Earnings Per Share $1.04 $ 1.05 5

Q3 2018 EARNINGS CALL FORWARD LOOKING STATEMENTS This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements including words such as “believe”, “expect”, “anticipate”, “plan”, “desire”, “project”, “estimate”, “intend”, “will”, “should”, “could”, “would”, “may”, “strategy”, “potential”, “opportunity” and similar expressions are forward-looking statements. Forward-looking statements involve estimates, expectations, projections, goals, forecasts, assumptions, risks and uncertainties. Forward-looking statements include, but are not limited to, statements about future financial and operating results, Lowe’s plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales growth, comparable sales, earnings and performance, shareholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, Lowe’s strategic initiatives, including those relating to acquisitions and dispositions by Lowe’s and the expected impact of such transactions on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing and other statements that are not historical facts. Although we believe that the expectations, opinions, projections and comments reflected in these forward-looking statements are reasonable, such statements involve risks and uncertainties and we can give no assurance that such statements will prove to be correct. Actual results may differ materially from those expressed or implied in such statements. A wide variety of potential risks, uncertainties and other factors could materially affect our ability to achieve the results either expressed or implied by these forward-looking statements including, but not limited to, management and key personnel change, changes in general economic conditions, such as the rate of unemployment, interest rate and currency fluctuations, fuel and other energy costs, slower growth in personal income, changes in consumer spending, changes in the rate of housing turnover, the availability of consumer credit and of mortgage financing, inflation or deflation of commodity prices, recently enacted or proposed tariffs, and other factors that can negatively affect our customers, as well as our ability to: (i) respond to adverse trends in the housing industry, a reduced rate of growth in household formation, and slower rates of growth in housing renovation and repair activity, as well as uneven recovery in commercial building activity; (ii) secure, develop, and otherwise implement new technologies and processes necessary to realize the benefits of our strategic initiatives focused on omni-channel sales and marketing presence and enhance our efficiency, and otherwise successfully execute on our strategy and implement our strategic initiatives, including acquisitions, dispositions, and the closing of certain stores and facilities; (iii) attract, train, and retain highly-qualified associates; (iv) manage our business effectively as we adapt our operating model to meet the changing expectations of our customers; (v) maintain, improve, upgrade and protect our critical information systems from data security breaches, ransomware and other cyber threats; (vi) respond to fluctuations in the prices and availability of services, supplies, and products; (vii) respond to the growth and impact of competition; (viii) address changes in existing or new laws or regulations that affect consumer credit, employment/labor, trade, product safety, transportation/logistics, energy costs, health care, tax, environmental issues or privacy and data protection; (ix) positively and effectively manage our public image and reputation and respond appropriately to unanticipated failures to maintain a high level of product and service quality that could result in a negative impact on customer confidence and adversely affect sales; and (x) effectively manage our relationships with selected suppliers of brand name products and key vendors and service providers, including third party installers. In addition, we could experience impairment losses and other charges if either the actual results of our operating stores are not consistent with the assumptions and judgments we have made in estimating future cash flows and determining asset fair values, or we are required to reduce the carrying amount of our investment in certain unconsolidated entities. With respect to acquisitions and dispositions, potential risks include the effect of such transactions on Lowe’s and the target company’s or operating business’s strategic relationships, operating results and businesses generally; our ability to integrate or divest personnel, labor models, financial, IT and other systems successfully; disruption of our ongoing business and distraction of management; hiring additional management and other critical personnel; increasing or decreasing the scope, geographic diversity and complexity of our operations; significant integration or disposition costs or unknown liabilities; and failure to realize the expected benefits of the transaction. For more information about these and other risks and uncertainties that we are exposed to, you should read the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Policies and Estimates” included in our most recent Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) and the description of material changes thereto, if any, included in our Quarterly Reports on Form 10-Q or subsequent filings with the SEC.The forward-looking statements contained in this presentation are expressly qualified in their entirety by the foregoing cautionary statements. The foregoing list of important factors that may affect future results is not exhaustive. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. All such forward-looking statements are based upon data available as of the date of this presentation or other specified date and speak only as of such date. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf about any of the matters covered in this presentation are qualified by these cautionary statements and in the “Risk Factors” included in our most recent Annual Report on Form 10-K and the description of material changes thereto, if any, included in our Quarterly Reports on Form 10-Q or subsequent filings with the SEC. We expressly disclaim any obligation to update or revise any forward-looking statement, whether as a result of new information, change in circumstances, future events, or otherwise, except as may be required by law. 6