Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Lonestar Resources US Inc. | a991pressrelease.htm |

| EX-10.1 - EXHIBIT 10.1 - Lonestar Resources US Inc. | ninthamendment.htm |

| 8-K - 8-K - Lonestar Resources US Inc. | a8-kxcreditfacilityamendme.htm |

Lonestar Resources US, Inc. Presentation to Investors November 2018

Disclaimer and Forward Looking Statements Forward Looking Statements The information in this presentation includes “forward‐looking statements” that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact included in this presentation, regarding our strategy, future operations, financial position, projected costs, prospects, plans and objectives of management are forward‐looking statements. When used in this presentation, the words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project” and similar expressions are intended to identify forward‐looking statements, although not all forward‐looking statements contain such identifying words. These forward‐looking statements are based on Lonestar Resources US Inc.’s (“LONE” or the “Company”) current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. We caution you that these forward‐looking statements are subject to all of the risks and uncertainties, most of which are difficult to predict and many of which are beyond our control, incident to the exploration for and development, production, gathering and sale of oil and natural gas. These risks include, but are not limited to, variations in the market demand for, and prices of, crude oil, NGLs and natural gas, lack of proved reserves, estimates of crude oil, NGLs and natural gas data, the adequacy of our capital resources and liquidity including, but not limited to, access to additional borrowing, borrowing capacity under our credit facilities, general economic and business conditions, failure to realize expected value creation from property acquisitions, uncertainties about our ability to replace reserves and economically develop our reserves, risks related to the concentration of our operations, drilling results, potential financial losses or earnings reductions from our commodity price risk management programs, potential adoption of new governmental regulations, our ability to satisfy future cash obligations and environmental costs and the risk factors discussed in or referenced in our filings with the United States Securities and Exchange Commission (“SEC”), including our Annual Report on Form 10‐K, our Quarterly Reports on Form 10‐Q and our Current Reports on Form 8‐K in each case as amended. You are cautioned not to place undue reliance on any forward‐looking statements, which speak only as of the date of this presentation. Except as otherwise required by applicable law, we disclaim any duty to update any forward‐looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date of this presentation. Our production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected by significant commodity price declines or cost increases. Reconciliation of Non‐GAAP Financial Measure EBITDAX is a financial measure that is not presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Reconciliations of this non‐ GAAP financial measure can be found in this presentation. Industry and Market Data This presentation has been prepared by LONE and includes market data and other statistical information from third‐party sources, including independent industry publications, government publications or other published independent sources. Although LONE believes these third‐party sources are reliable as of their respective dates, LONE has not independently verified the accuracy or completeness of this information. Some data are also based on the LONE’s good faith estimates, which are derived from its review of internal sources as well as the third‐party sources described above. This document and any related presentation do not constitute an offer or invitation to subscribe for or purchase any securities, and it should not be construed as an offering document. Any decision to purchase securities in the context of a proposed offering, if any, should be made on the basis of information contained in the offering document related to such an offering. This presentation does not constitute a recommendation regarding any securities of Lonestar Resources America, Inc. or Lonestar Resources US Inc. 2

Company Profile . Pure Play Eagle Ford Operator… Share Price YTD • +63,000 Net Acres in the Crude Oil Window of the Eagle Ford Shale $12.00 500 • Unfettered access to oil and gas transportation infrastructure $11.00 $7.04 $10.00 • 100% LLS‐Based Oil Sales‐ Current Oil Price = Premium to WTI 400 • Technical leader in the Eagle Ford, drilling extended reach laterals with proprietary $9.00 $8.00 targeting and completion techniques, yielding differential results 300 $7.00 Shares) (US$) $6.00 ('000 . Quality Drilling Inventory Built at Low Costs Price $5.00 200 1 • 254 drilling locations (and growing) $4.00 Share • Oil‐intensive drilling inventory‐ reserves are 86% crude oil & NGL’s $3.00 Volume 100 • 5‐year All‐Sources Finding & Onstream Costs of $8.94 per Boe $2.00 $1.00 . Rapid Production Growth Bolstered By Sooner Purchase $0.00 0 • 2018 Production Guidance ‐10,600 – 11,200 Boe/d (+68% vs. 2017) 4 Volume LONE Equity Price • 2019 Production Guidance‐ increased to 13,500‐14,500 boe/d (+25% vs. 2018)4 . Sooner Acquisition Builds On Company Strengths… Enterprise Value • Purchase Price‐ $38.7 MM Ticker (NASDAQ:NMS) LONE • Proved Reserves‐ 13.7 MMBOE Share Price2 $7.04 • Proved PV‐10‐ $77.0 MM • Potential For Significant Upside in: Shares Out (Fully Diluted) 3 40.1 MM • Extending Lower Eagle Ford Laterals Market Cap $282 MM • Stacked Development in Upper Eagle Ford and Austin Chalk 3 . …While Maintaining Balance Sheet Strength Cash $4.5 MM • Borrowing Base increased from $160 MM to $275 MM on 11/15/18 Long Term Debt3 $413 MM • Proforma Liquidity $115 MM3 Enterprise Value $691 MM 1Based on YE17 Reserve Report 2Novemer 16, 2018 3At September 30, 2018 4 Our production estimates are based on, among other things, our current planned capital expenditures and drilling program, our ability to drill and complete wells in a manner consistent with prior performance, certain drilling, completion and equipping cost assumptions and certain well performance assumptions. In addition, achieving these production estimates and maintaining the required capital expenditures and drilling activity to achieve these estimates will depend on the availability of capital, regulatory approval and the existing regulatory environment, realized commodity prices, rig and service availability, actual drilling results as well as other factors. Investors should also recognize that the reliability of any guidance diminishes the farther in 3 the future that the data is forecast, and it is thus increasingly likely that our actual results will differ materially from our guidance.

Experienced Management Team Executive Previous Experience Biography . John H. Pinkerton 37 years experience in the oil and gas industry . Founder, Chairman and Chief Executive Officer Range Resources Chairman of the Board . Built Range Resources into a $10 billion Exploration & Production company Frank D. Bracken, III . 32 years experience in oil and gas finance . Previously Managing Director at Jefferies LLC, where he led >$5 billion in oil and gas transactions Chief Executive Officer GOG . Former CFO / Director of Gerrity Oil & Gas Corp, a NYSE‐listed DJ Basin E&P Company Gerrity Oil & Gas . 33 years oil and gas industry experience Barry D. Schneider . Senior level expertise in management of regional business units at large independent oil & gas Chief Operating Officer companies . Previously with US public companies Denbury Resources and Conoco‐Phillips . 33 years in all aspects of oil and gas exploration and development Jana Payne . Geologic Manager for Petrohawk, responsible for discovery of Hawkville Field, first commercial Eagle Ford Shale well in 2008 VP – Geosciences . Senior Exploitation Manager for Halcon Resources . Experience in Eagle Ford, Haynesville, Bossier, Utica and Tuscaloosa Marine Shales . Over 37 years oil and gas industry experience Tom H. Olle . Senior level expertise in reservoir management / project development across a broad array of VP – Reservoir Engineering reservoir types . Senior roles at US public companies Encore Acquisition Corp and Burlington Resources High Caliber Executive Team with Deep Industry Expertise and 30 Years of Average Experience 4

Lonestar’s Expanded Footprint Engineered Avg. Region Net Acres Locations WI HBP Western 18,447 50 96% 88% Eastern Central 35,392 193 98% 70% Eastern 9,729 32 65% 68% Total 63,568 275 92% 74% Central Western Sooner Lonestar Acreage* Acquired Acreage 5 1 Acreage values at of 9/30/18 proforma the impact of the Sabine acquisition. * Please see the reserves disclosures at the end of this presentation

Geo‐Engineered Completions Continue to Improve Results Technical Process Application Experience • Vertical Pilot Logs Used To Select Geo‐target to Optimize Both Reservoir & Mechanical Properties Horned Frog (2015,2018) . Reservoir Properties ‐ Porosity, Total Organic Content, Clay Volume Beall Ranch (2015, 2016) . Mechanical Properties ‐ Young’s Modulus, Poisson’s Ratio, Minimum In‐situ Stress Cyclone (2016, 2017,2018) Results of Analysis Determine Geosteering Target Burns Ranch (2016, 2017) • Azimuthal Gamma Ray LWD Tool to Assist in Geosteering . Multi‐planar Gamma ray data determines dip angle and direction in real time Beall Ranch (2015, 2016) • Lateral “Thru‐Bit” Logs Run to TD for Detailed Rock Properties Analysis Cyclone/Hawkeye (2016, 2017,2018) . Triple Combo Log with Spectral Gamma Ray and Dipole Sonic Logs Burns Ranch (2016, 2017) Horned Frog (2018) • Mangrove Stimulation Design . Utilize Thru‐Bit Log Data For Reservoir Characterization Horned Frog (2015, 2018) . Models Key Mechanical Properties To Optimize Stimulation Beall Ranch (2015, 2016) . Vertical and lateral rock heterogeneity Cyclone/Hawkeye (2016, 2017, 2018) . Planar and Non‐planar fractures Burns Ranch (2016, 2017) . Account for multi‐well stress shadows to optimize zipper fracs Facilitates Design of Engineered (Non‐Geometric) Completion, Usually Yielding 150’ Stages • Increased Use of Diverters, Both Near‐Field and Far‐Field Beall Ranch (2016) . Engineered fibrous pill designed to create near‐wellbore isolation to augment frac efficacy across all Cyclone/Hawkeye (2016, 2017, 2018) perforations, maximizing wellbore coverage Burns Ranch (2016, 2017) . Increase efficiency through fewer pumped stages, coiled tubing plug drill outs Horned Frog (2015, 2018) • Employ Extended Reach Laterals to Drive Efficiencies and Returns Beall Ranch (2016) . Acquire Leasehold in Geometries That Allow For 8,000’ to 13,000’ laterals . Say something about hole straightness / drill‐outs, etc. Cyclone/Hawkeye (2016, 2017, 2018) . LONE has drilled 20 wells over 8,000’ Burns Ranch (2017) • Engineered Flowback Beall Ranch (2016. 2017) . Lonestar has increasingly applied controlled flowbacks Cyclone/Hawkeye (2016, 2017, 2018) . Implement solids and fluids analysis to avoid negative impact of hydraulic fractures and assess success of Burns Ranch (2017) completion strategies Wildcat (2017) 6

The Value of Extended Reach Laterals in the Eagle Ford Surface & Facilities Drilling Pad Wellhead Equipment Separation Storage Compression $0.4 MM Gathering $0.4 MM Cumulative Cost Lateral 5,000’ + 5,000’ 10,000’ Vertical + Angle Completed Well Cost ($MM) $4.9 MM $2.3 MM $7.2 MM Drilling Gross Reserves (BOE) 281,000 354,000 632,000 Completion $1.7 MM Casing Net Reserves (BOE) 227,000 294,000 521,000 Tubing Cementing Cumulative Cost Finding & Onstream Cost ($/BOE) $21.59 $7.82 $13.82 $1.3 MM PV10 ($MM) $2.2 MM $5.0 MM $8.2 MM Internal Rate of Return2 32% 253% 80% Extended Reach 5,000’ Lateral Total +5,000’ Lateral Total Drilling Drilling Completion Completion Casing $4.9 MM Casing $7.2 MM Fracture Stimulation Fracture Stimulation Other Other $3.2 MM Cumulative Cost $2.3 MM Cumulative Cost Note: Prices based on $65 flat oil and $2.75 gas flat deck 1 Surface and faculties costs are allocated for 3 well pad (Source of reserve forecast for 10,000’ lateral‐ W.D. Von Gonten from our Cyclone area); 2IRR based on reserve forecast for 10,000’ lateral and average type curve from W.D. Von Gonten for our Cyclone area 7

Sooner Acquisition De Witt County

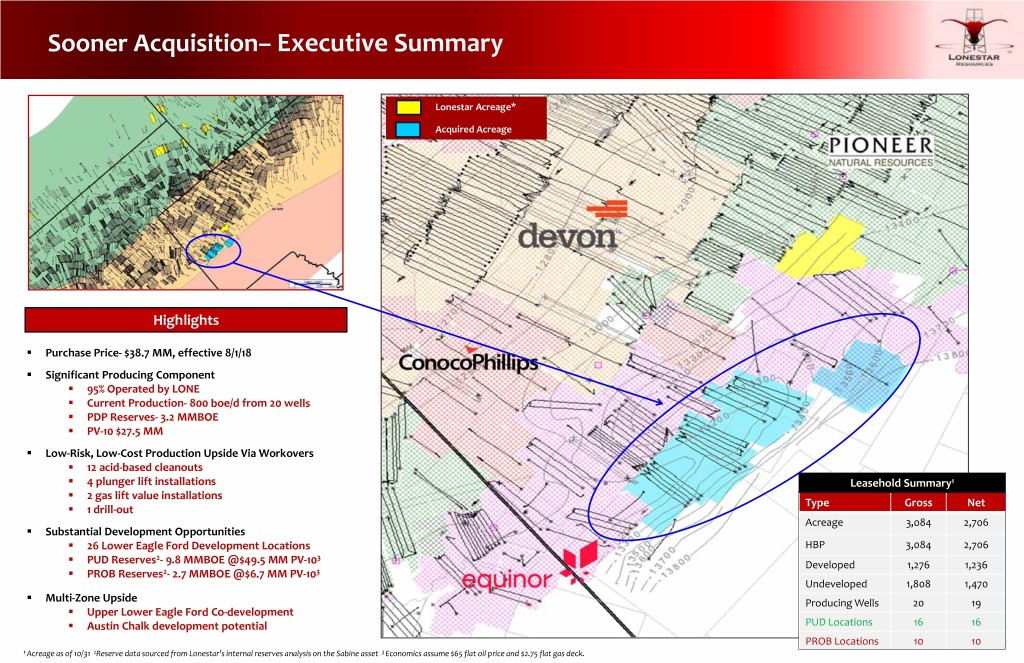

Sooner Acquisition– Executive Summary Lonestar Acreage* Acquired Acreage Highlights . Purchase Price‐ $38.7 MM, effective 8/1/18 . Significant Producing Component . 95% Operated by LONE . Current Production‐ 800 boe/d from 20 wells . PDP Reserves‐ 3.2 MMBOE . PV‐10 $27.5 MM . Low‐Risk, Low‐Cost Production Upside Via Workovers . 12 acid‐based cleanouts . 4 plunger lift installations Leasehold Summary1 . 2 gas lift value installations Type Gross Net . 1 drill‐out Acreage 3,084 2,706 . Substantial Development Opportunities . 26 Lower Eagle Ford Development Locations HBP 3,084 2,706 2 3 . PUD Reserves ‐ 9.8 MMBOE @$49.5 MM PV‐10 Developed 1,276 1,236 . PROB Reserves2‐ 2.7 MMBOE @$6.7 MM PV‐103 Undeveloped 1,808 1,470 . Multi‐Zone Upside Producing Wells 20 19 . Upper Lower Eagle Ford Co‐development . Austin Chalk development potential PUD Locations 16 16 PROB Locations 10 10 9 1 Acreage as of 10/31 2Reserve data sourced from Lonestar’s internal reserves analysis on the Sabine asset 3 Economics assume $65 flat oil price and $2.75 flat gas deck.

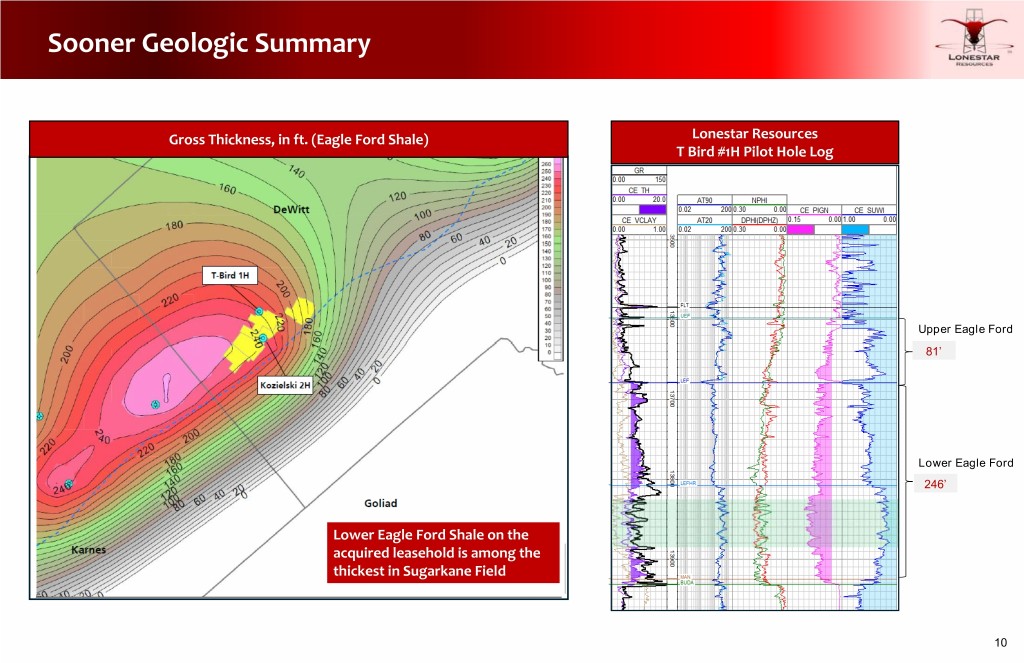

Sooner Geologic Summary Gross Thickness, in ft. (Eagle Ford Shale) Lonestar Resources T Bird #1H Pilot Hole Log Upper Eagle Ford 81’ Lower Eagle Ford 246’ Lower Eagle Ford Shale on the acquired leasehold is among the thickest in Sugarkane Field 10

Sooner– Locator Map (DeWitt County, Texas) DeWitt Karnes Leasehold Summary1 Type Gross Net Acreage 3,084 2,706 HBP 3,084 2,706 Developed 1,276 1,236 Undeveloped 1,808 1,470 Producing Wells 20 19 PUD Locations 16 16 PROB Locations 10 10 Legend Reserves Information PDP Net Oil Net NGL Net Gas Net Equiv. PUD PV‐10 Category Wells (MMbbl) (MMbbl) (Bcf) (MMBOE) ($MM) PROB Proved Developed 20 0.4 1.2 9.5 3.2 $27.5 LONESTAR ACREAGE Proved Undeveloped 16 2.3 3.4 24.5 9.8 $49.5 ACQUIRED ACREAGE Total Proved 36 2.8 4.6 34.0 13.0 $77.0 Probable Undeveloped 10 0.6 0.9 7.0 2.7 $6.7 Proved & Probable 46 3.4 5.5 41.0 15.7 $83.7 11 1 Acreage as of 10/31 2Reserve data sourced from Lonestar’s internal reserves analysis on the Sabine asset 3 Economics assume NYKMEX Strip Pricing at 11/15/18

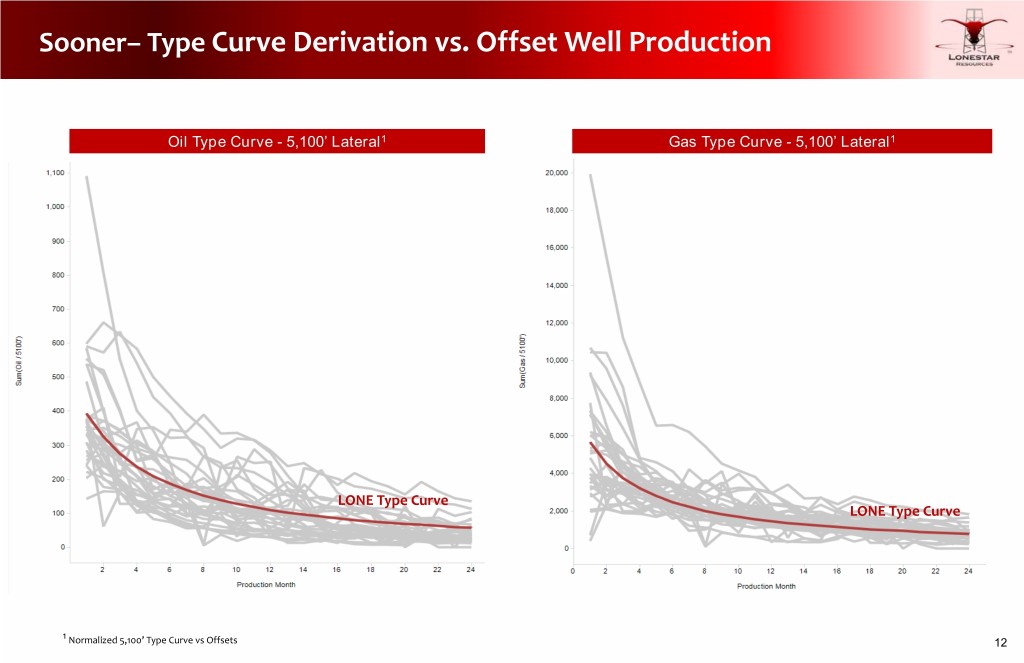

Sooner– Type Curve Derivation vs. Offset Well Production Oil Type Curve - 5,100’ Lateral1 Gas Type Curve - 5,100’ Lateral1 LONE Type Curve LONE Type Curve 1 Normalized 5,100’ Type Curve vs Offsets 12

Sooner– Modern Completions Yielding Impressive Results Recent Well Results Lonestar Acreage* Acquired Acreage 1 Gano-Dlugosch 1 Comp Date :6/3/2018: ~2,000#/ft A1: 5,820’ –IP30: 1,266 Mcf/d / 83 Bo/d A2: 5,568’ –IP30: 11,664 Mcf/d / 386 Bo/d A3: 4,565’ –IP30: 11,729 Mcf/d / 323 Bo/d A4: 5,457’ –IP30: 11,221 Mcf/d / 305 Bo/d A1: 5,820’ –IP30: 12,167 Mcf/d / 287 Bo/d 2 Rhoades B Comp Date :2/5/2018: ~2,000#/ft B1: 4,166’ –IP30: 7,429 Mcf/d / 307 Bo/d B2: 6,153’ –IP30: 8,313 Mcf/d / 791 Bo/d New wells B3: 5,496’ –IP30: 7,448 Mcf/d / 669 Bo/d 4 DUC’s 3 3 Yanta Cattle Comp Date :4/9//2018 3: 5,972’ –IP30: 5,449 Mcf/d / 1,000 Bo/d 4 Rupert Ripps Comp Date :1/11/2018: ~2,700#/ft 2 B1: 4,166’ –IP30: 7,429 Mcf/d / 307 Bo/d B2: 4,575’ –IP30: 7,833 Mcf/d/ 340 Bo/d 13

Sooner Type Curve Summary Sooner Type Curve 1 2 1 Production Net Cashflow 2,000 Type Curve Statistics Avg Lateral Length: 5,100 Year (boepd) ($MM) 1,800 EUR (Mboe)1: 954 Year 1865$6.6 PV‐10 ($MM)2: $4.5 Year 2322$2.4 1,600 Cap Ex ($MM): $7.1 Year 3198$1.5 IRR2: 51% Year 4142$1.0 1,400 Year 5110$0.8 (Boepd) 1,200 1,000 Production 800 600 Stream ‐ 400 3 200 0 123456789101112131415161718192021222324 Months Type Curve 1 Type Curve data sourced from Lonestar’s internal reserves analysis on the Sabine asset 2 Economics assume NYMEX Strip at 11/15/18 14

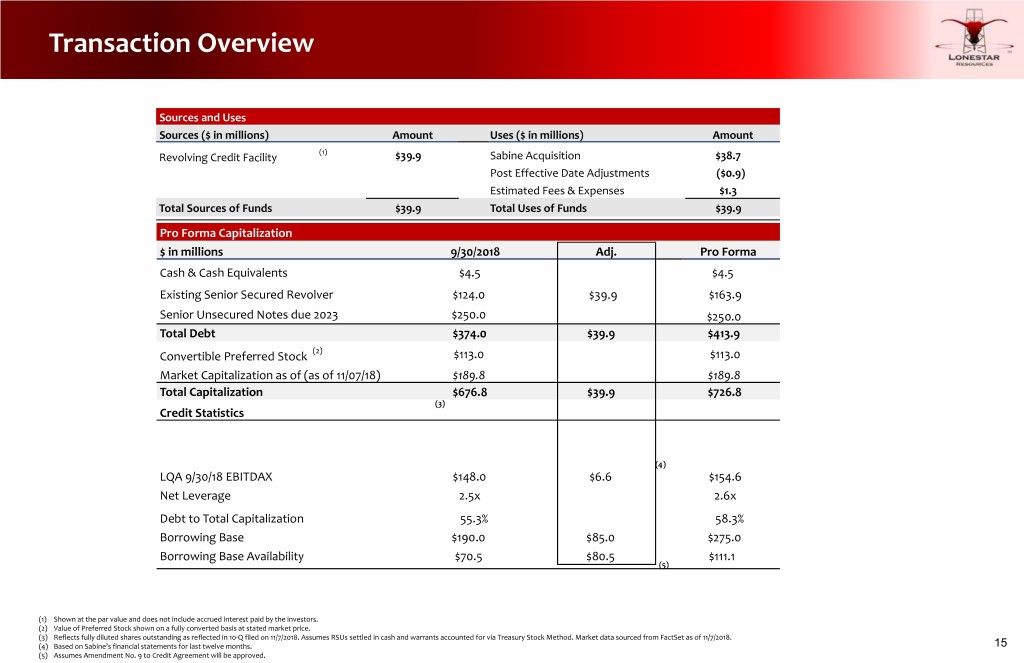

Transaction Overview Sources and Uses Sources ($ in millions) Amount Uses ($ in millions) Amount (1) Revolving Credit Facility $39.9 Sabine Acquisition $38.7 Post Effective Date Adjustments ($0.9) Estimated Fees & Expenses $1.3 Total Sources of Funds $39.9 Total Uses of Funds $39.9 Pro Forma Capitalization $ in millions 9/30/2018 Adj. Pro Forma Cash & Cash Equivalents $4.5 $4.5 Existing Senior Secured Revolver $124.0$39.9 $163.9 Senior Unsecured Notes due 2023 $250.0 $250.0 Total Debt $374.0 $39.9 $413.9 Convertible Preferred Stock (2) $113.0 $113.0 Market Capitalization as of (as of 11/07/18) $189.8 $189.8 Total Capitalization $676.8 $39.9 $726.8 (3) Credit Statistics (4) LQA 9/30/18 EBITDAX $148.0 $6.6 $154.6 Net Leverage 2.5x 2.6x Debt to Total Capitalization 55.3% 58.3% Borrowing Base $190.0 $85.0 $275.0 Borrowing Base Availability $70.5 $80.5 $111.1 (5) (1) Shown at the par value and does not include accrued interest paid by the investors. (2) Value of Preferred Stock shown on a fully converted basis at stated market price. (3) Reflects fully diluted shares outstanding as reflected in 10‐Q filed on 11/7/2018. Assumes RSUs settled in cash and warrants accounted for via Treasury Stock Method. Market data sourced from FactSet as of 11/7/2018. (4) Based on Sabine’s financial statements for last twelve months. 15 (5) Assumes Amendment No. 9 to Credit Agreement will be approved.

2018 Capital Program Areas of Focus

Cyclone/Hawkeye – Locator Map Leasehold Summary Type Gross Net Acreage 12,102 7,237 HBP 9,660 5,141 Developed 2,957 2,619 Undeveloped 9,145 4,617 Producing Wells 16 12 PUD Locations 24 13 PROB Locations 21 15 Total Locations 50 35 Legend PDP PUD PROB 17

Cyclone/Hawkeye‐ Economic Summary Hawkeye 1H –2H vs. Type Curve 1 Type Curve Statistics 160 900 Avg Lateral Length: 9,645' 140 EUR (Mboe):632 (MBO) 120 2 $8.2 800 PV‐10 ($MM) : 100 Cap Ex ($MM):$7.2 80 2 Production 80% IRR : 60 Oil 700 40 Cum. 20 600 0 (Bopd) 0123456789 500 Months WDVG Actual P roduction 400 Production 300 To date3, production Oil 200 outperformance have increased PV‐10 to 100 $9.0MM and IRR to 90% 0 123456789101112131415161718192021222324 Months WDVG Actual Production 1 Type Curve data sourced from Lonestar’s 12/31/17 reserve report, independently engineered by WD Von Gonten & Co. 2 Economics assume $65 flat oil price and $2.75 flat gas deck. 3 Production 18 outperformance assumes actuals to date and type curve thereafter.

Gonzales County Lateral Extensions Cyclone / Hawkeye Area Development Map Lonestar Acreage Acquired Acreage 1 Legend PDP PUD PROB 19 1 Leasehold shown as hatched is associated with a top lease

Gonzales County Lateral Extensions Lateral Inventory • Lengthens 22 of our 60 locations by 50% 11,000 • Adds $27.5 MM of PV‐10 & 1.7 MMBOE 10,000 9,000 8,000 7,000 (feet) 6,000 Length 5,000 4,000 Lateral 3,000 2,000 1,000 0 12345678910111213141516171819202122 Original Extended 20

Horned Frog – Locator Map NW Frog Horned Leasehold Summary1 Type Gross Net Acreage 6.809 6,048 HBP 6,432 5,326 Developed 689 572 Undeveloped 6,120 5,478 Producing Wells 6 6 PUD Locations 11 11 PROB/Other 16 16 Locations Total Locations 27 27 Legend PDP PUD PROB 21 1Acreage as of 8/1e *Offset operator EUR’s are Lonestar internal estimates

Horned Frog Economic Evaluation – G#1H – H#1H Horned Frog G#1H –H#1H vs. Type Curve Type Curve Statistics1 400 2,500 Avg Lateral Length: 11,363' 350 (MBoe) EUR (Mboe):1,163 300 2 PV‐10 ($MM) : $5.3 250 Cap Ex ($MM):$7.9200 Production 2 2,000 IRR : 55% 150 Cum. 100 Stream ‐ 50 3 (Boepd) 0 1,500 01234567 Months WDVG Actual Production Production 1,000 To date3, production Stream outperformance has ‐ 500 increased PV‐10 to 3 $7.4MM and IRR to 106% 0 123456789101112131415161718192021222324 Months WDVG Actual Production 1 Type Curve data sourced from Lonestar’s 12/31/17 reserve report, independently engineered by WD Von Gonten & Co. 2 Economics assume $65 flat oil price and $2.75 flat gas deck. 3 Production 22 outperformance assumes actuals to date and type curve thereafter.

Horned Frog Results Lonestar Wells vs. Other Operators’ Direct Offsets Highlights 1,750 G1H H1H . Max‐30 IP’s for Lonestar’s new wells at Horned Frog averaged 2,155 Boe/d 1,500 . 11,362’ avg. lateral length (#/ft) . 1,650 #/ft proppant (with diverters) 1,250 . 210‐Day IP’s for Lonestar’s new wells at Horned Frog averaged 1,708 Boe/d Concenration 1,000 . Lonestar’s new wells at Horned Frog outperformed both its own prior wells, and all “modern” completions 750 drilled in 2017 by other operators Proppant . LONE Has Repeated Its Success at Horned Frog NW 500 . Log‐derived petrophysics picked a new, oily target 0306090120150180 . Wells have outperformed Type Curve by 11% 210‐Day Production (BOEPD / 1,000' Lateral) . 125% more oil than the G&H wells . Lonestar has 27 drilling locations in Horned Frog Area, Vintage Completions Modern Completions LONE Wells with very little Proved Reserves at 12/31/17 . 9 Proved Undeveloped . 11 Probable Undeveloped . 7 Unbooked locations at 12/31/17 23

Horned Frog Economic Evaluation –NW 2H –3H Horned Frog NW 2H –3H vs. Type Curve 1 Type Curve Statistics 120 1,100 Avg Lateral Length: 7,410' 110 100 EUR (Mboe):73390 (Mboe) 2 1,000 PV‐10 ($MM) : $5.0 80 70 Cap Ex ($MM):$7.060 900 2 Production 50 49% IRR : 40 30 Stream 800 ‐ 3 20 (Boepd) 10 0 700 01234 600 Months WDVG Actual Production 500 Production 400 300 To date3, production outperformance have Stream ‐ 200 increased PV‐10 to 3 $6.1MM and IRR to 72% 100 0 123456789101112131415161718192021222324 Months LONE Curve Actual Production 1 Type Curve data sourced from Lonestar’s 12/31/17 reserve report, independently engineered by WD Von Gonten & Co. 2 Economics assume $65 flat oil price and $2.75 flat gas deck. 3 Production outperformance assumes actuals to date and type curve thereafter. 24

Karnes County – Locator Map Leasehold Summary Type Gross Net Acreage 4,991 3,886 HBP 4,259 3,274 Developed 2,773 2,107 Undeveloped 2,218 1,779 Producing Wells 12 9 PUD Locations 35 28 Legend PDP PUD PROB 25 1Acreage as of 8/1e

Karnes County Economic Evaluation Karnes County Well Results vs. Type Curve Type Curve Statistics 1 90 1,000 Avg Lateral Length: 6,123' 80 70 (MBoe) (Mboe) EUR :45860 2 PV‐10 ($MM) : $6.4 50 Cap Ex ($MM):$5.840 Production 800 IRR2: 99% 30 Cum. 20 (Boepd) 10 Stream 0 ‐ 600 3 01234 Months of Production WDVG GRG 18H ‐ 20H GRG 24H ‐ 26H Production 400 200 Stream ‐ 3 0 123456789101112131415161718192021222324 Months of Production WDVG GRG 18H‐20H GRG 24H ‐ 26H 1 Type Curve data sourced from Lonestar’s 12/31/17 reserve report, independently engineered by WD Von Gonten & Co. 2 Economics assume $65 flat oil price and $2.75 flat gas deck. 3 Production 26 outperformance assumes actuals to date and type curve thereafter.

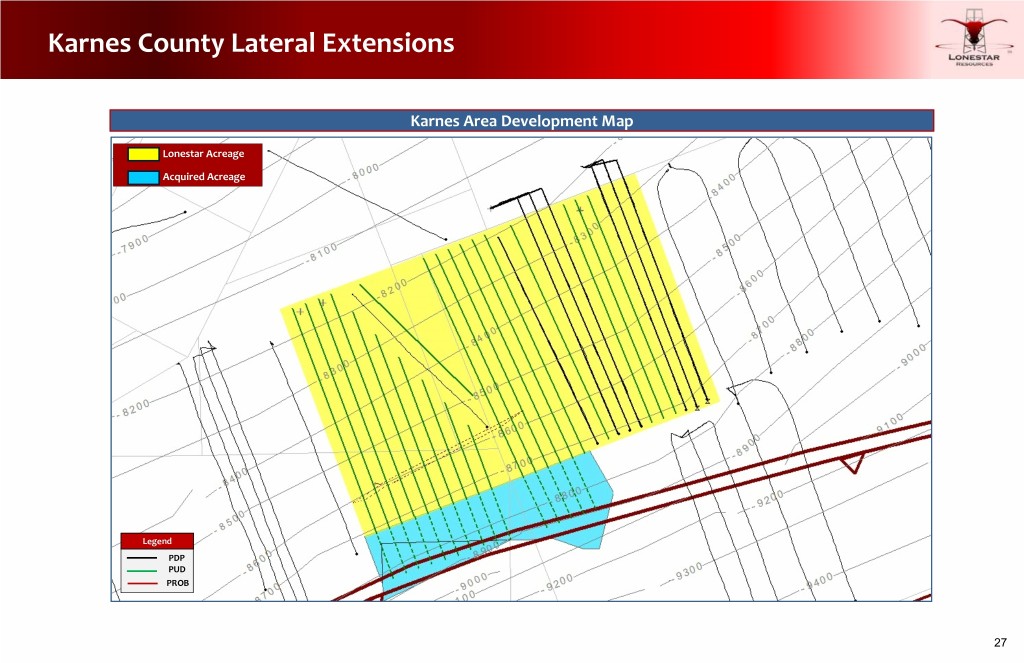

Karnes County Lateral Extensions Karnes Area Development Map Lonestar Acreage Acquired Acreage Legend PDP PUD PROB 27

Karnes County Lateral Extensions Lateral Inventory • Lengthens 20 of our 27 locations by 34% 8,400 • Adds $24.2 MM of PV‐10 & 1.5 MMBOE 7,800 7,200 6,600 6,000 5,400 (feet) 4,800 4,200 Length 3,600 3,000 Lateral 2,400 1,800 1,200 600 0 123456789101112131415161718192021 Original Extended 28

Year‐To‐Date Acreage Additions Lonestar’s Acreage Position Lonestar Acreage Acquired Acreage Impact of Acreage Additions Net Reserves Proved Locations Length Property Acres Bonus Payment (MMBOE) PV‐10 Affected Increased Horned Frog NW 993 $1,250 $1.2 5.0 $38.1 7 100% Cyclone/Hawkeye 2,727 $1,069 $2.9 1.7 $27.5 22 50% Karnes County 275 $192 $0.1 1.5 $24.2 20 34% Total 3,995 $1,053 $4.2 8.2 $89.8 49 51% 29 1 All reserves and economic data calculated using a $65 flat oil price and $2.75 flat gas deck for the purposes of illustrating the potential impact to reserves and PV-10 for the company.

Appendix

Restated Reconciliation of Adjusted EBITDAX to Net Income Three Months Ended Three Months Ended Three Months Ended September 30, 2018 June 30, 2018 March 31, 2018 $ in thousands Net Income (Loss) ($21,685) ($23,525) ($18,425) Income tax (benefit) expense ($282) ($3,103) ($3,109) Interest expense (1) $12,190 $11,230 $11,148 Exploration expense $109 ‐‐ ‐‐ Depreciation, depletion, amortization and accretion $23,775 $20,737 $15,425 EBITDAX $14,107 $5,339 $5,039 Rig standby expense(2) $27 ‐‐ ‐‐ Non‐recurring costs(3) $60 ‐‐ ‐‐ Stock‐based compensation $924 $2,281 $432 Loss on sale of oil and gas properties (gain) ‐‐ ‐‐ ‐‐ Impairment of oil and gas properties $12,169 ‐‐ ‐‐ Unrealized loss (gain) on derivative financial instruments $9,911 $18,896 $7,594 Unrealized loss (gain) on warrants ($509) $2,462 $152 Lease write‐off ‐‐ ‐‐ $1,568 Loss on extinguishment of debt ‐‐ ‐‐ $8,619 Other expense (income) $315 $232 ($7) Adjusted EBITDAX $37,004 $29,210 $23,397 Note: Periods ended June 30 and March 31 have been amended as of 10/26/2018 to reflect corrected accounting policies related to accounting for depreciation, depletion, amortization and accretion. (1) Interest expense also includes Amortization of finance costs and Dividends paid on Series A Preferred Stock. (2) Represents downtime associated with a drilling rig contract. 31 (3) Non‐recurring costs consists of Acquisitions Costs and General and Administrative Expenses related to the re‐domiciliation to the United States, and listing on NASDAQ.

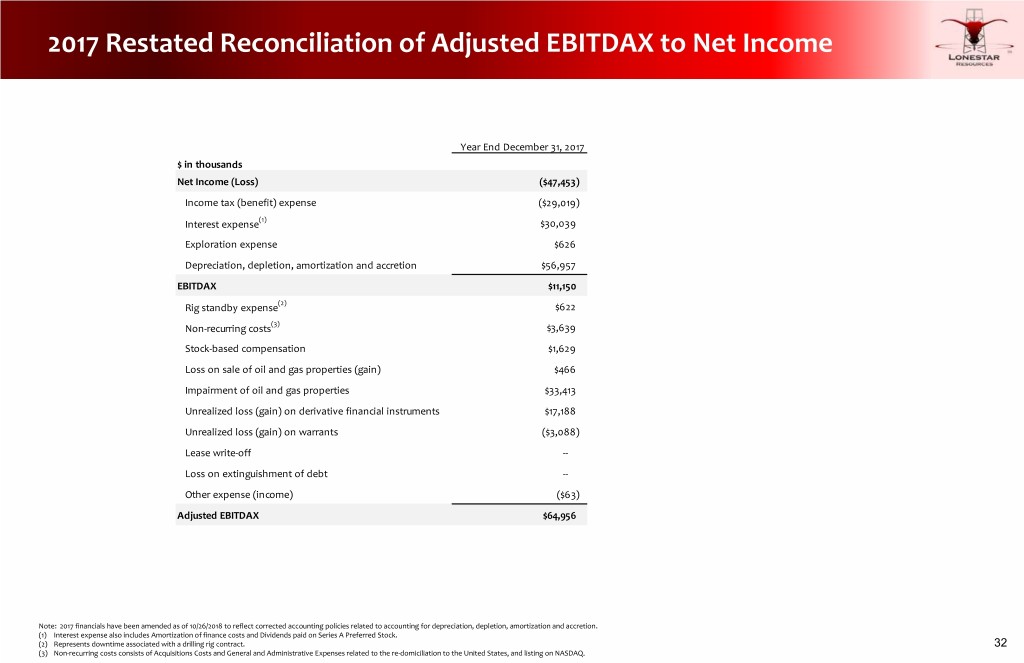

2017 Restated Reconciliation of Adjusted EBITDAX to Net Income Year End December 31, 2017 $ in thousands Net Income (Loss) ($47,453) Income tax (benefit) expense ($29,019) Interest expense(1) $30,039 Exploration expense $626 Depreciation, depletion, amortization and accretion $56,957 EBITDAX $11,150 Rig standby expense(2) $622 Non‐recurring costs(3) $3,639 Stock‐based compensation $1,629 Loss on sale of oil and gas properties (gain) $466 Impairment of oil and gas properties $33,413 Unrealized loss (gain) on derivative financial instruments $17,188 Unrealized loss (gain) on warrants ($3,088) Lease write‐off ‐‐ Loss on extinguishment of debt ‐‐ Other expense (income) ($63) Adjusted EBITDAX $64,956 Note: 2017 financials have been amended as of 10/26/2018 to reflect corrected accounting policies related to accounting for depreciation, depletion, amortization and accretion. (1) Interest expense also includes Amortization of finance costs and Dividends paid on Series A Preferred Stock. (2) Represents downtime associated with a drilling rig contract. 32 (3) Non‐recurring costs consists of Acquisitions Costs and General and Administrative Expenses related to the re‐domiciliation to the United States, and listing on NASDAQ.

2016 Restated Reconciliation of Adjusted EBITDAX to Net Income Year End December 31, 2016 $ in thousands Net Income (Loss) ($98,700) Income tax (benefit) expense $24,986 Interest expense(1) $29,583 Exploration expense $382 Depreciation, depletion, amortization and accretion $52,175 EBITDAX $8,426 Rig standby expense(2) $2,261 Non‐recurring costs(3) $1,556 Stock‐based compensation $448 Loss on sale of oil and gas properties (gain) ($74) Impairment of oil and gas properties $35,570 Unrealized loss (gain) on derivative financial instruments $36,368 Unrealized loss (gain) on warrants ($568) Lease write‐off ‐‐ Gain on extinguishment of debt ($28,480) Other expense (income) $1,261 Adjusted EBITDAX $56,768 Note: 2016 financials have been amended as of 10/26/2018 to reflect corrected accounting policies related to accounting for depreciation, depletion, amortization and accretion. (1) Interest expense also includes Amortization of finance costs and Dividends paid on Series A Preferred Stock. (2) Represents downtime associated with a drilling rig contract. 33 (3) Non‐recurring costs consists of Acquisitions Costs and General and Administrative Expenses related to the re‐domiciliation to the United States, and listing on NASDAQ.