Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - Walmart Inc. | earningsrelease-10312018.htm |

| 8-K - FORM 8-K - Walmart Inc. | form8-kx11152018.htm |

Safe harbor and non-GAAP measures This presentation contains statements as to Walmart management's guidance regarding earnings per share, adjusted earnings per share, effective tax rate or adjusted effective tax rate for the fiscal year ending January 31, 2019 and comparable sales (excluding fuel) for Walmart U.S. for the 52 weeks ending January 25, 2019. Walmart believes such statements are "forward-looking statements" as defined in, and are intended to enjoy the protection of the safe harbor for forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Assumptions on which such forward-looking statements are based are also forward-looking statements. Walmart's actual results may differ materially from the guidance provided as a result of changes in circumstances, assumptions not being realized or other risks, uncertainties and factors including: • economic, geo-political, capital markets and business conditions, trends and events around the world and in the markets in which Walmart operates; • currency exchange rate fluctuations, changes in market interest rates and commodity prices; • unemployment levels; competitive pressures; inflation or deflation, generally and in particular product categories; • consumer confidence, disposable income, credit availability, spending levels, shopping patterns, debt levels and demand for certain merchandise; • consumer enrollment in health and drug insurance programs and such programs' reimbursement rates; • the amount of Walmart's net sales denominated in the U.S. dollar and various foreign currencies; • the impact of acquisitions, investments, divestitures, store or club closures, and other strategic decisions; • Walmart's ability to successfully integrate acquired businesses, including within the eCommerce space; • Walmart's effective tax rate and the factors affecting Walmart's effective tax rate, including assessments of certain tax contingencies, valuation allowances, changes in law, administrative audit outcomes, impact of discrete items and the mix of earnings between the U.S. and Walmart's international operations; • changes in existing tax, labor and other laws and regulations and changes in tax rates, trade agreements, trade restrictions and tariff rates; • customer traffic and average ticket in Walmart's stores and clubs and on its eCommerce websites; • the mix of merchandise Walmart sells, the cost of goods it sells and the shrinkage it experiences; • the amount of Walmart's total sales and operating expenses in the various markets in which it operates; • transportation, energy and utility costs and the selling prices of gasoline and diesel fuel; • supply chain disruptions and disruptions in seasonal buying patterns; • consumer acceptance of and response to Walmart's stores, clubs, digital platforms, programs, merchandise offerings and delivery methods; • cyber security events affecting Walmart and related costs; • developments in, outcomes of, and costs incurred in legal or regulatory proceedings to which Walmart is a party; • casualty and accident-related costs and insurance costs; • the turnover in Walmart's workforce and labor costs, including healthcare and other benefit costs; • changes in accounting estimates or judgments; • the level of public assistance payments; • natural disasters, public health emergencies, civil disturbances, and terrorist attacks; and • Walmart's expenditures for Foreign Corrupt Practices Act "FCPA" and other compliance related costs, including the adequacy of the accrual with respect to this matter. Such risks, uncertainties and factors also include the risks relating to Walmart’s strategy, operations and performance and the financial, legal, tax, regulatory, compliance, reputational and other risks discussed in Walmart’s most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the SEC. Walmart urges you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this presentation. Walmart cannot assure you that the results reflected or implied by any forward-looking statement will be realized or, even if substantially realized, that those results will have the forecasted or expected consequences and effects for or on Walmart’s operations or financial performance. The forward-looking statements made in this presentation are as of the date of this presentation. Walmart undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances. This presentation includes certain non-GAAP measures as defined under SEC rules, including net sales, revenue, and operating income on a constant currency basis, adjusted EPS, adjusted EPS guidance, free cash flow and return on investment. Refer to information about the non-GAAP measures contained in this presentation. Additional information as required by Regulation G and Item 10(e) of Regulation S-K regarding non-GAAP measures can be found in our most recent Form 10-K and our Form 8-K furnished as of the date of this presentation with the SEC, which are available at www.stock.walmart.com. 2

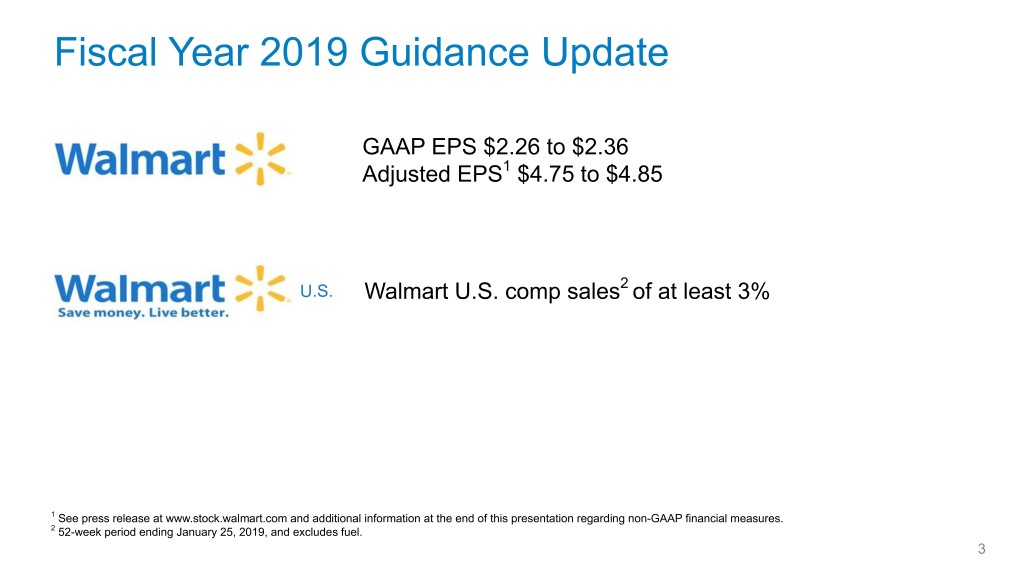

Fiscal Year 2019 Guidance Update GAAP EPS $2.26 to $2.36 Adjusted EPS1 $4.75 to $4.85 U.S. Walmart U.S. comp sales2 of at least 3% 1 See press release at www.stock.walmart.com and additional information at the end of this presentation regarding non-GAAP financial measures. 2 52-week period ending January 25, 2019, and excludes fuel. 3

Walmart Inc. 1 1 1 1 (Amounts in millions, except per share data) Q3 $ Δ % Δ YTD $ Δ % Δ Total revenue $124,894 $1,715 1.4% $375,612 $11,536 3.2% Total revenue, constant currency2 $126,122 $2,943 2.4% $374,622 $10,546 2.9% Net sales $123,897 $1,761 1.4% $372,586 $11,975 3.3% Net sales, constant currency2 $125,113 $2,977 2.4% $371,614 $11,003 3.1% Membership & other income $997 -$46 -4.4% $3,026 -$439 -12.7% Operating income $4,986 $222 4.7% $15,890 -$80 -0.5% Operating income, constant currency2 $5,043 $279 5.9% $15,800 -$170 -1.1% Interest expense, net $534 -$7 -1.3% $1,524 -$155 -9.2% Other (gains) and losses $1,876 $1,876 NM $8,570 $8,570 NM Consolidated net income attributable to Walmart $1,710 -$39 -2.2% $2,983 -$4,704 -61.2% EPS $0.58 $0.00 —% $1.01 -$1.53 -60.2% Adjusted EPS2 $1.08 $0.08 8.0% $2.43 -$0.64 14.0% 1 Change versus prior year comparable period. 2 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. NM = Not meaningful 4

Walmart Inc. Q3 bps Δ1 YTD bps Δ1 Gross profit rate 24.8% -21 bps 24.7% -18 bps Operating expenses as a percentage of net sales 21.6% -38 bps 21.3% -16 bps Effective tax rate2 29.5% -441 bps 41.9% 904 bps Debt to total capitalization3 NP NP 45.9% 630 bps Return on assets4 NP NP 2.6% -320 bps Return on investment4 NP NP 13.4% -130 bps 1 Basis points change versus prior year comparable period. 2 The decrease in the effective tax rate for the quarter was primarily due to the lower U.S. corporate income tax rate. The increase in the YTD effective tax rate was primarily due to the loss on sale of a majority stake in Walmart Brazil. 3 Debt to total capitalization calculated as of October 31, 2018. Increase versus prior comparable period primarily due to $16 billion debt issuance to fund a portion of the purchase price for the Flipkart acquisition. Debt includes short-term borrowings, long-term debt due within one year, capital lease and financing obligations due within one year, long-term debt, and long-term capital lease and financing obligations. Total capitalization includes debt and total Walmart shareholders' equity. 4 Calculated for the trailing 12 months ended October 31, 2018. For ROI, see press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. NP = not provided; NM = not meaningful 5

Walmart Inc. 1 1 (Amounts in millions) Q3 $ Δ % Δ Receivables, net $5,785 -$80 -1.4% Inventories $50,380 $233 0.5% Accounts payable $49,729 $2,142 4.5% 1 Change versus prior year comparable period. 6

Walmart Inc. 1 (Amounts in millions) YTD $ Δ Operating cash flow 17,308 248 Capital expenditures 7,014 106 Free cash flow2 10,294 142 1 1 (Amounts in millions) Q3 % Δ YTD % Δ Dividends 1,530 0.3% $4,597 -0.4% Share repurchases3 2,317 4.9% $4,161 -37.5% Total $3,847 3.0% $8,758 -22.3% 1 Change versus prior year comparable period. 2 See press release located at www.stock.walmart.com and reconciliations at the end of this presentation regarding non- GAAP financial measures. 3 $14.6 billion remaining of the $20 billion authorization approved in October 2017. The company repurchased 7 approximately 24.4 million shares in Q3.

Walmart U.S. (Amounts in millions) Q3 Δ1 YTD Δ1 Net sales $80,583 3.7% $241,146 4.0% Comparable sales2,3 3.4% 70 bps 3.3% 130 bps • Comp traffic 1.2% -30 bps NP NP • Comp ticket 2.2% 100 bps NP NP eCommerce impact3 ~140 bps ~60 bps NP NP Gross profit rate Decrease -28 bps Decrease -29 bps Operating expense rate Decrease -28 bps Decrease -15 bps Operating income4 $3,937 2.9% $12,343 0.4% 1 Change versus prior year comparable period. 2 Comp sales for the 13-week period ended October 26, 2018, excluding fuel. 3 The results of new acquisitions are included in our comp sales metrics in the 13th month after acquisition. 4 In the first quarter of fiscal 2019, the company revised its corporate overhead allocations to the operating segments. Accordingly, previous segment operating income was recast to be comparable to the current period. NP - Not provided 8

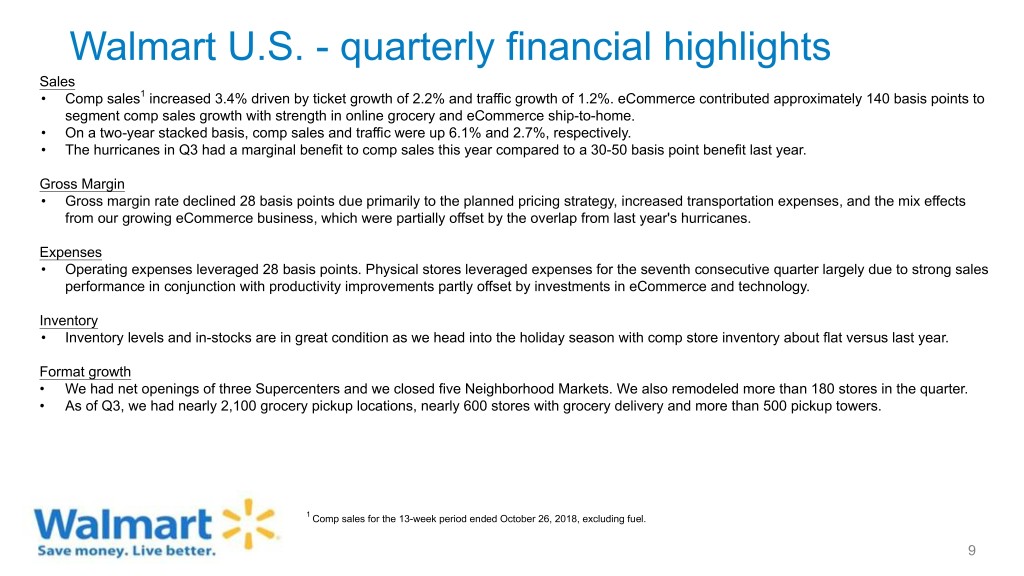

Walmart U.S. - quarterly financial highlights Sales • Comp sales1 increased 3.4% driven by ticket growth of 2.2% and traffic growth of 1.2%. eCommerce contributed approximately 140 basis points to segment comp sales growth with strength in online grocery and eCommerce ship-to-home. • On a two-year stacked basis, comp sales and traffic were up 6.1% and 2.7%, respectively. • The hurricanes in Q3 had a marginal benefit to comp sales this year compared to a 30-50 basis point benefit last year. Gross Margin • Gross margin rate declined 28 basis points due primarily to the planned pricing strategy, increased transportation expenses, and the mix effects from our growing eCommerce business, which were partially offset by the overlap from last year's hurricanes. Expenses • Operating expenses leveraged 28 basis points. Physical stores leveraged expenses for the seventh consecutive quarter largely due to strong sales performance in conjunction with productivity improvements partly offset by investments in eCommerce and technology. Inventory • Inventory levels and in-stocks are in great condition as we head into the holiday season with comp store inventory about flat versus last year. Format growth • We had net openings of three Supercenters and we closed five Neighborhood Markets. We also remodeled more than 180 stores in the quarter. • As of Q3, we had nearly 2,100 grocery pickup locations, nearly 600 stores with grocery delivery and more than 500 pickup towers. 1 Comp sales for the 13-week period ended October 26, 2018, excluding fuel. 9

Walmart U.S. - quarterly merchandise highlights Category Comp Comments Food and consumables had strong comp sales and traffic throughout the quarter. On a two-year stack basis, the grocery comp was the best Grocery1 + low single-digit in nearly nine years. Strength was broad-based, but particularly strong in fresh food. Overall, our pricing strategy, omni offer and improved private brands are resonating with customers. Branded drug inflation and growth in the 90-day scripts contributed to Health & wellness + mid single-digit the positive comp sales performance in pharmacy. We delivered solid sales results across most categories in the quarter, General with the strongest comp sales from apparel due in part to strength in merchandise2 + low single-digit the new private brands; toys due to new and expanded assortment; and automotive due to strength in tires, batteries and oil. 1 Includes food and consumables. 2 General merchandise includes entertainment, toys, hardlines, apparel, home and seasonal. 10

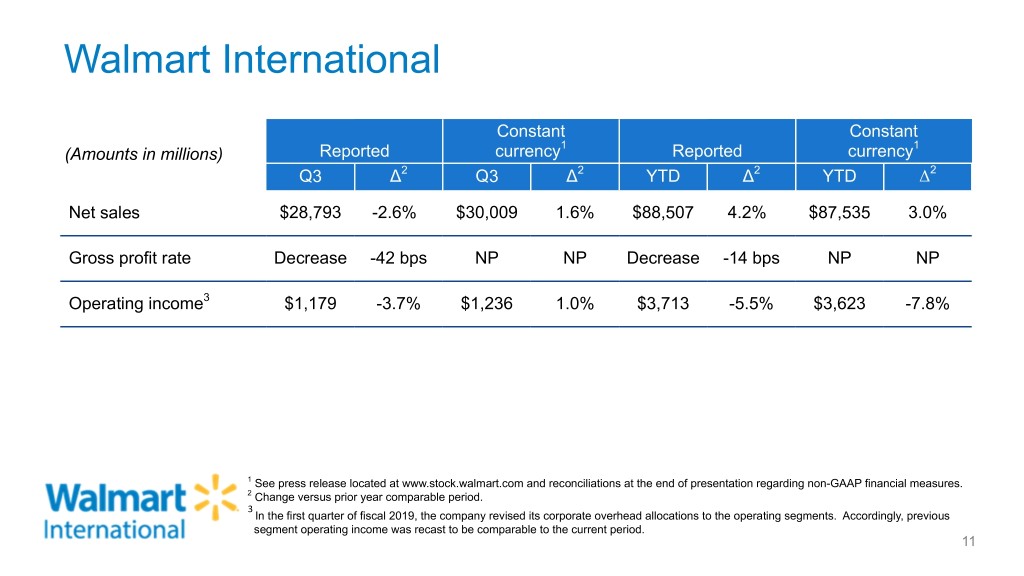

Walmart International Constant Constant 1 1 (Amounts in millions) Reported currency Reported currency Q3 Δ2 Q3 Δ2 YTD1 Δ2 YTD Δ2 Net sales $28,793 -2.6% $30,009 1.6% $88,507 4.2% $87,535 3.0% Gross profit rate Decrease -42 bps NP NP Decrease -14 bps NP NP Operating income3 $1,179 -3.7% $1,236 1.0% $3,713 -5.5% $3,623 -7.8% 1 See press release located at www.stock.walmart.com and reconciliations at the end of presentation regarding non-GAAP financial measures. 2 Change versus prior year comparable period. 3 In the first quarter of fiscal 2019, the company revised its corporate overhead allocations to the operating segments. Accordingly, previous segment operating income was recast to be comparable to the current period. 11

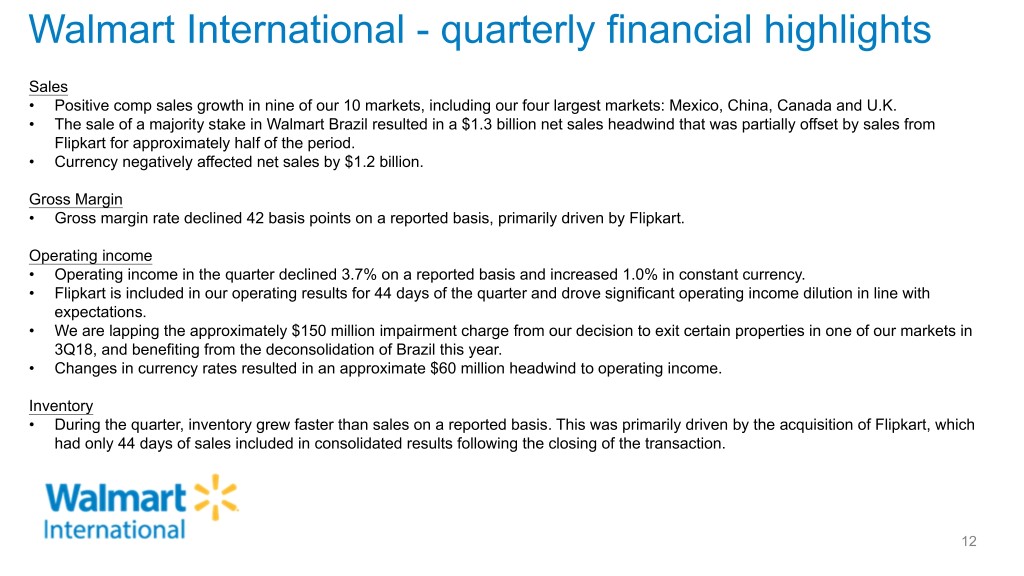

Walmart International - quarterly financial highlights Sales • Positive comp sales growth in nine of our 10 markets, including our four largest markets: Mexico, China, Canada and U.K. • The sale of a majority stake in Walmart Brazil resulted in a $1.3 billion net sales headwind that was partially offset by sales from Flipkart for approximately half of the period. • Currency negatively affected net sales by $1.2 billion. Gross Margin • Gross margin rate declined 42 basis points on a reported basis, primarily driven by Flipkart. Operating income • Operating income in the quarter declined 3.7% on a reported basis and increased 1.0% in constant currency. • Flipkart is included in our operating results for 44 days of the quarter and drove significant operating income dilution in line with expectations. • We are lapping the approximately $150 million impairment charge from our decision to exit certain properties in one of our markets in 3Q18, and benefiting from the deconsolidation of Brazil this year. • Changes in currency rates resulted in an approximate $60 million headwind to operating income. Inventory • During the quarter, inventory grew faster than sales on a reported basis. This was primarily driven by the acquisition of Flipkart, which had only 44 days of sales included in consolidated results following the closing of the transaction. 12

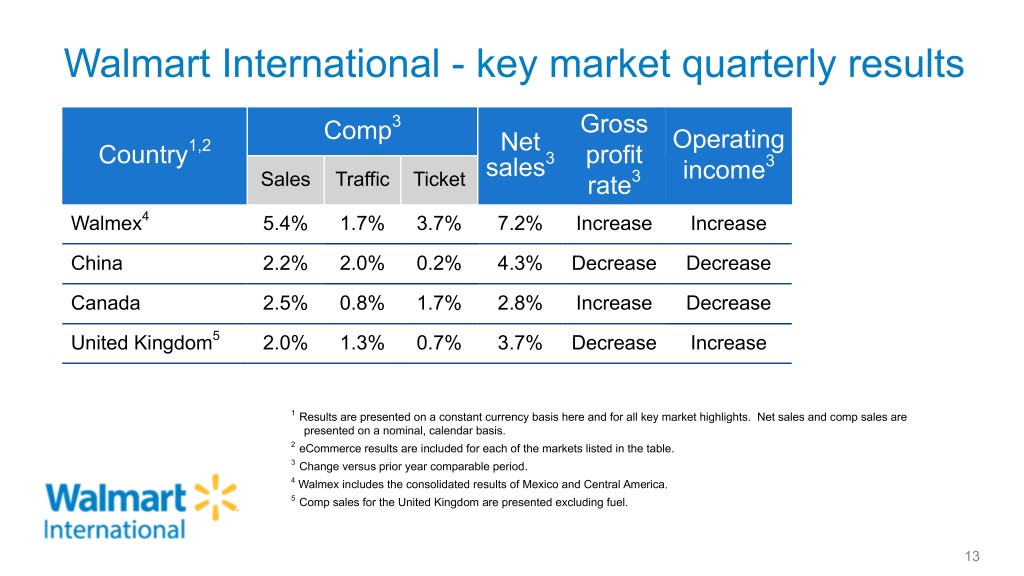

Walmart International - key market quarterly results Comp3 Gross 1,2 Net Operating Country 3 profit sales income3 Sales Traffic Ticket rate3 Walmex4 5.4% 1.7% 3.7% 7.2% Increase Increase China 2.2% 2.0% 0.2% 4.3% Decrease Decrease Canada 2.5% 0.8% 1.7% 2.8% Increase Decrease United Kingdom5 2.0% 1.3% 0.7% 3.7% Decrease Increase 1 Results are presented on a constant currency basis here and for all key market highlights. Net sales and comp sales are presented on a nominal, calendar basis. 2 eCommerce results are included for each of the markets listed in the table. 3 Change versus prior year comparable period. 4 Walmex includes the consolidated results of Mexico and Central America. 5 Comp sales for the United Kingdom are presented excluding fuel. 13

Walmart International - key market highlights Walmex • Net sales increased 7.2% and comp sales increased 5.4%, driven by strength across multiple regions, led by Mexico. • In Mexico, comp sales increased 6.3% or 13.5% on a two-year stacked basis. • Comp sales growth continued to outpace ANTAD1 self-service; Walmex has now achieved 15 consecutive quarters of outperformance versus the market. • Omnichannel sales in Mexico increased over 40%, benefiting from a 10x increase in the number of marketplace sellers since September 2017 to over 690 sellers listed on the site. China • Net sales increased 4.3% and comp sales increased 2.2%, benefiting from strong sales at Sam's Club and flagship stores on JD.com. • The decline in gross margin rate was primarily due to price investments in fresh, softline clearance and promotional events. • Expanded the one-hour delivery service with JD Daojia to more than 30 additional stores this quarter. We now have over 230 stores that offer the one-hour delivery service. • Our Scan & Go app launched on the WeChat platform in April and exceeded 10 million users in early September. This is the first mini- program in physical retail to reach this milestone. 1 ANTAD - Asociación Nacional de Tiendas de Autoservicio y Departamentales; The National Association of Supermarkets and Department Stores 14

Walmart International - key market highlights Canada • Net sales increased 2.8%, with comp sales growth of 2.5%. • Gained 30 basis points of market share in food, consumables, and health and wellness for the 12-week period ended October 27th, according to Nielsen. • Gross profit rate benefited from better buying terms. • Expenses deleveraged due to minimum wage legislative changes, omnichannel acceleration and higher labor costs associated with growth in the fresh business. • In eCommerce, sales increased over 20%, we added 40 additional online grocery pickup locations, and began shipping from our new dedicated fulfillment center during the quarter. U.K. • Net sales increased 3.7%, with comp sales growth of 2.0%. ◦ This is the sixth consecutive quarter of positive comp sales growth. ◦ Sales performance benefited from continued strength of our private label brands. • Continued to see improved performance in food volumes and comp traffic growth. • Gross profit rate declined, reflecting continued food price investments. • Continued strong working capital discipline as sales increased and inventory declined, while maintaining a strong in-stock position. 15

Sam's Club With fuel Without fuel1 With fuel Without fuel1 (Amounts in millions) Q3 Δ2 Q3 Δ2 YTD Δ2 YTD Δ2 Net sales $14,521 -2.3% $13,002 -4.3% $42,933 -1.8% $38,675 -3.8% Comparable sales3 5.3% 130 bps 3.2% 40 bps 6.1% 330 bps 4.0% 210 bps • Comp traffic NP NP 6.2% 260 bps NP NP NP NP • Comp ticket NP NP -3.0% -220 bps NP NP NP NP eCommerce impact NP NP ~130 bps ~50 bps NP NP NP NP Gross profit rate Decrease -27 bps Increase 6 bps Decrease -37 bps Decrease -13 bps Membership income NP NP NP 1.6% NP NP NP 1.2% Operating income4 $379 -12.5% $345 -9.9% $1,106 -9.6% $1,027 -9.0% 1 Represents financial information of all non-fuel operations. For the three and nine months ended October 31, 2018, fuels sales were $1.5 billion and $4.3 billion, respectively and fuel operating income was $34 million and $79 million, respectively. 2 Change versus prior year comparable period. 3 Comp sales for the 13-week period ended October 26, 2018. 4 In the first quarter of fiscal 2019, the company revised its corporate overhead allocations to the operating segments. Accordingly, previous segment operating income was recast to be comparable to the current period. NP - Not provided 16

Sam's Club - quarterly financial highlights Sales • Comp sales1 growth was broad-based among major categories and increased 3.2% in the period, including growth in comp traffic of 6.2%. Tobacco negatively affected comp sales by 250 basis points, and the transfer of sales from closed clubs contributed over half of the comp sales increase, excluding fuel. • eCommerce sales increased 32% as both direct-to-home and Club Pickup performed well. • Private brand sales penetration increased to nearly 27%, excluding fuel and tobacco. Gross Profit • Gross profit rate declined 27 basis points and increased 6 basis points, with and without fuel, respectively. Stronger fuel sales, which have lower margins, negatively affected gross profit rate. Without fuel, gross profit rate benefited from reduced tobacco volumes, partially offset by investments in price, eCommerce fulfillment costs and shrink. Operating Expenses • Operating expenses as a percentage of net sales increased 18 and 43 basis points, with and without fuel, respectively. Reduced tobacco sales, along with higher incentive compensation, wages and severance costs were the primary contributing factors. Membership Income • Membership income increased 1.6% versus last year. The Plus membership tier continues to perform well through improvements to the value proposition, including free shipping with no minimum purchase. Membership trends continue to improve. Inventory • Inventory declined 8.1% primarily due to closed clubs and is in a good position as we head into the holiday season. Inventory at comp clubs declined 0.6%. 1 Comp sales for the 13-week period ended October 26, 2018, excluding fuel. 17

Sam's Club - quarterly category highlights Category Comp Comments Fresh / Freezer / Cooler + mid single-digit Produce, deli, prepared foods and seafood performed well. Grocery and beverage + mid single-digit Water, soda and snacks performed well. Consumables + high single-digit All categories achieved at least mid single-digit growth. Home and apparel + low double-digit Broad-based strength across categories. Technology, office and entertainment + mid single-digit Mobile, office and gift cards performed well. Health and wellness + mid single-digit OTC performed well and was primarily responsible for the growth. 18

Third-party FCPA and compliance-related expenses Q3 YTD (Amounts in millions) FY19 FY18 FY19 FY18 Ongoing inquiries and investigations $6 $2 $14 $22 Global compliance program and organizational enhancements 3 3 10 11 Total $9 $5 $24 $33 These expenses are included in our Corporate and support expenses. These amounts exclude the accrual made in the third quarter of FY19 for the securities class-action and the accrual made in the third quarter of FY18 for the FCPA matter. 19

Non-GAAP measures - ROI We include Return on Assets ("ROA"), which is calculated in accordance with U.S. generally accepted accounting principles ("GAAP") as well as Return on Investment ("ROI") as measures to assess returns on assets. Management believes ROI is a meaningful measure to share with investors because it helps investors assess how effectively Walmart is deploying its assets. Trends in ROI can fluctuate over time as management balances long-term strategic initiatives with possible short-term impacts. We consider ROA to be the financial measure computed in accordance with GAAP that is the most directly comparable financial measure to our calculation of ROI. ROA was 2.6 percent and 5.8 percent for the trailing twelve months ended October 31, 2018 and 2017, respectively. ROI was 13.4 percent and 14.7 percent for the trailing twelve months ended October 31, 2018 and 2017, respectively. The decline in ROA was primarily due to the decrease in consolidated net income over the trailing twelve months which was the result of the $4.5 billion net loss related to the sale of the majority stake in Walmart Brazil, unrealized loss on our JD.com investment, restructuring and impairment charges in the fourth quarter of fiscal 2018 and loss on extinguishment of debt in the fourth quarter of fiscal 2018. The decline in ROI was due to the decrease in operating income over the trailing twelve months, primarily driven by the restructuring and impairment charges in the fourth quarter of fiscal 2018, as well as the increase in average total assets, primarily driven by the Flipkart acquisition. We define ROI as adjusted operating income (operating income plus interest income, depreciation and amortization, and rent expense) for the trailing 12 months divided by average invested capital during that period. We consider average invested capital to be the average of our beginning and ending total assets, plus average accumulated depreciation and average amortization, less average accounts payable and average accrued liabilities for that period, plus a rent factor equal to the rent for the fiscal year or trailing 12 months multiplied by a factor of 8. When we have discontinued operations, we exclude the impact of the discontinued operations. Our calculation of ROI is considered a non-GAAP financial measure because we calculate ROI using financial measures that exclude and include amounts that are included and excluded in the most directly comparable GAAP financial measure. For example, we exclude the impact of depreciation and amortization from our reported operating income in calculating the numerator of our calculation of ROI. In addition, we include a factor of 8 for rent expense that estimates the hypothetical capitalization of our operating leases. As mentioned above, we consider return on assets to be the financial measure computed in accordance with generally accepted accounting principles most directly comparable to our calculation of ROI. ROI differs from ROA (which is consolidated net income for the period divided by average total assets for the period) because ROI: adjusts operating income to exclude certain expense items and adds interest income; adjusts total assets for the impact of accumulated depreciation and amortization, accounts payable and accrued liabilities; and incorporates a factor of rent to arrive at total invested capital. Because of the adjustments mentioned above, we believe ROI more accurately measures how we are deploying our key assets and is more meaningful to investors than ROA. Although ROI is a standard financial measure, numerous methods exist for calculating a company's ROI. As a result, the method used by management to calculate our ROI may differ from the methods used by other companies to calculate their ROI. 20

Non-GAAP measures - ROI cont. The calculation of ROA and ROI, along with a reconciliation of ROI to the calculation of ROA, is as follows: Walmart Inc. Return on Assets and Return on Investment Trailing Twelve Months Trailing Twelve Months Ended October Ended October (Dollars in millions) 2018 31,2017 (Dollars in millions) 2018 31,2017 CALCULATION OF RETURN ON ASSETS CALCULATION OF RETURN ON INVESTMENT Numerator Numerator Consolidated net income $ 5,729 $ 12,146 Operating income $ 20,357 $ 22,175 Denominator + Interest income 190 145 Average total assets1 $ 217,999 $ 208,136 + Depreciation and amortization 10,649 10,533 Return on assets (ROA) 2.6% 5.8% + Rent 3,053 2,667 Adjusted operating income $ 34,249 $ 35,520 As of October 31, Denominator Certain Balance Sheet Data 2018 2017 2016 Average total assets1 $ 217,999 $ 208,136 + Average accumulated depreciation Total assets $ 226,583 $ 209,414 $ 206,857 and amortization1 84,136 79,253 Accumulated depreciation and amortization 85,827 82,445 76,061 - Average accounts payable1 48,658 45,289 Accounts payable 49,729 47,587 42,990 - Average accrued liabilities1 22,276 21,500 Accrued liabilities 22,795 21,757 21,243 + Rent x 8 24,424 21,336 Average invested capital $ 255,625 $ 241,936 Return on investment (ROI) 13.4% 14.7% 1 The average is based on the addition of the account balance at the end of the current period to the account balance at the end of the prior period and dividing by 2. 21

Non-GAAP measures - free cash flow We define free cash flow as net cash provided by operating activities in a period minus payments for property and equipment made in that period. We had net cash provided by operating activities of $17.3 billion for the nine months ended October 31, 2018, which was relatively flat compared to $17.1 billion for the nine months ended October 31, 2017. We generated free cash flow of $10.3 billion for the nine months ended October 31, 2018, which was also relatively flat compared to $10.2 billion for the nine months ended October 31, 2017. Net cash provided by operating activities and free cash flow were benefited by a decrease in tax payments primarily as a result of Tax Reform, offset by the timing of vendor payments. Free cash flow is considered a non-GAAP financial measure. Management believes, however, that free cash flow, which measures our ability to generate additional cash from our business operations, is an important financial measure for use in evaluating the company's financial performance. Free cash flow should be considered in addition to, rather than as a substitute for, consolidated net income as a measure of our performance and net cash provided by operating activities as a measure of our liquidity. Additionally, Walmart's definition of free cash flow is limited, in that it does not represent residual cash flows available for discretionary expenditures, due to the fact that the measure does not deduct the payments required for debt service and other contractual obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow as a measure that provides supplemental information to our Consolidated Statements of Cash Flows. Although other companies report their free cash flow, numerous methods may exist for calculating a company's free cash flow. As a result, the method used by Walmart's management to calculate our free cash flow may differ from the methods used by other companies to calculate their free cash flow. The following table sets forth a reconciliation of free cash flow, a non-GAAP financial measure, to net cash provided by operating activities, which we believe to be the GAAP financial measure most directly comparable to free cash flow, as well as information regarding net cash used in investing activities and net cash used in financing activities. Nine Months Ended October 31, (Dollars in millions) 2018 2017 Net cash provided by operating activities $ 17,308 $ 17,060 Payments for property and equipment (capital expenditures) -7,014 -6,908 Free cash flow $ 10,294 $ 10,152 Net cash used in investing activities1 $ -20,554 $ -5,854 Net cash used in financing activities 5,921 -11,416 1 "Net cash used in investing activities" includes payments for property and equipment, which is also included in our computation of free cash flow. 22

Non-GAAP measures - constant currency In discussing our operating results, the term currency exchange rates refers to the currency exchange rates we use to convert the operating results for countries where the functional currency is not the U.S. dollar into U.S. dollars or for countries experiencing hyperinflation. We calculate the effect of changes in currency exchange rates as the difference between current period activity translated using the current period's currency exchange rates and the comparable prior year period's currency exchange rates. Additionally, no currency exchange rate fluctuations are calculated for non-USD acquisitions until owned for 12 months. Throughout our discussion, we refer to the results of this calculation as the impact of currency exchange rate fluctuations. When we refer to constant currency operating results, this means operating results without the impact of the currency exchange rate fluctuations. The disclosure of constant currency amounts or results permits investors to better understand Walmart's underlying performance without the effects of currency exchange rate fluctuations. The table below reflects the calculation of constant currency for total revenues, net sales and operating income for the three and nine months ended October 31, 2018. Three Months Ended October 31, Nine Months Ended October 31, Walmart International Consolidated Walmart International Consolidated Percent Percent Percent Percent (Dollars in millions) 2018 Change1 2018 Change1 2018 Change1 2018 Change1 Total revenues: As reported $ 29,091 -2.6% $ 124,894 1.4% $ 89,494 3.7% $ 375,612 3.2% Currency exchange rate fluctuations 1,228 N/A 1,228 N/A -990 N/A -990 N/A Constant currency total revenues $ 30,319 1.5% $ 126,122 2.4% $ 88,504 2.5% $ 374,622 2.9% Net sales: As reported $ 28,793 -2.6% $ 123,897 1.4% $ 88,507 4.2% $ 372,586 3.3% Currency exchange rate fluctuations 1,216 N/A 1,216 N/A -972 N/A -972 N/A Constant currency net sales $ 30,009 1.6% $ 125,113 2.4% $ 87,535 3.0% $ 371,614 3.1% Operating income: As reported $ 1,179 -3.7% $ 4,986 4.7% $ 3,713 -5.5% $ 15,890 -0.5% Currency exchange rate fluctuations 57 N/A 57 N/A -90 N/A -90 N/A Constant currency operating income $ 1,236 1.0% $ 5,043 5.9% $ 3,623 -7.8% $ 15,800 -1.1% 1 Change versus prior year comparable period. 23

Non-GAAP measures - adjusted EPS Adjusted diluted earnings per share from continuing operations attributable to Walmart (Adjusted EPS) is considered a non-GAAP financial measure under the SEC's rules because it excludes certain amounts not excluded in the diluted earnings per share from continuing operations attributable to Walmart calculated in accordance with GAAP (EPS) for such period. Management believes that Adjusted EPS is a meaningful measure to share with investors because it best allows comparison of the performance for the comparable period. In addition, Adjusted EPS affords investors a view of what management considers Walmart's core earnings performance and the ability to make a more informed assessment of such core earnings performance. We have calculated Adjusted EPS for the three months ended October 31, 2018 by adjusting EPS for the following: (1) loss upon finalizing the sale of a majority stake in Walmart Brazil, (2) adjustment in the provisional amount related to Tax Reform, and (3) unrealized gains and losses on the company's equity investment in JD.com. The most directly comparable financial measure calculated in accordance with GAAP is EPS. We adjust for the following two items on a recurring basis each quarter: • Tax Reform - The SEC allows companies to record provisional amounts during a one year measurement period from the U.S. Tax Reform enactment date. While the company recorded provisional amounts as of January 31, 2018, the company adjusts such provisional amounts during fiscal 2019. As the company adjusted EPS in fiscal 2018 for the impact of Tax Reform, for consistency, management adjusts EPS for any fiscal 2019 changes to the provisional amounts. • Unrealized gains and losses - Beginning in fiscal 2019, due to a change in U.S. accounting principles, Walmart is required to include unrealized gains/losses of certain equity investments within net income. The company's unrealized gains/losses primarily relate to Walmart's equity investment in JD.com. While the company's investment in JD.com was a strategic decision for the company's retail operations in China, management's measurement of that strategy is primarily focused on the Walmart China financial results rather than the investment value of JD.com. Accordingly, management adjusts EPS for the unrealized JD.com investment gains/losses. 24

Non-GAAP measures - adjusted EPS Three Months Ended Percent Nine Months Ended Percent October 31, 2018 Change1 October 31, 20182 Change1 Diluted earnings per share: Reported EPS $0.58 —% $1.01 -60.2% Pre-Tax Tax Net Pre-Tax Tax Net Adjustments: Impact Impact3 Impact Impact Impact3 Impact Unrealized (gains) and losses on JD.com investment $ 0.61 $ (0.13) $ 0.48 $ 1.25 $ (0.28) $ 0.97 Loss on sale of majority stake in Walmart Brazil 0.03 — 0.03 1.64 (0.10) 1.54 Adjustment to provisional amount for Tax Reform — (0.01) (0.01) — (0.02) (0.02) Net adjustments $ 0.50 $ 2.49 Adjusted EPS $ 1.08 8.0% $ 3.50 14.0% 1 Change versus prior year comparable period. 2 Quarterly adjustments or adjusted EPS may not sum to YTD adjustments or YTD adjusted EPS due to rounding. Additionally, individual adjustments may not sum to net adjustments due to rounding. 3 Calculated based on nature of item, including any realizable deductions, and statutory rate in effect for relevant jurisdictions. 25

Non-GAAP measures - adjusted EPS We have calculated Adjusted EPS for the three and nine months ended October 31, 2017 by adjusting EPS for the following: (1) the loss on the early extinguishment of certain debt, (2) the FCPA accrual based on discussions with government agencies regarding the possible resolution of the FCPA matter, (3) the impairment of certain properties due to our decision to exit those properties in one of our international markets and (4) for the nine months ended October 31, 2017 only, the gain on sale of Suburbia. Adjusted EPS for the three and nine months ended October 31, 2017 is a non-GAAP financial measure. The most directly comparable financial measure calculated in accordance with GAAP is EPS for the three and nine months ended October 31, 2017. Three Months Ended October 31, 2017 Nine Months Ended October 31, 2017 Diluted earnings per share: Reported EPS $0.58 $2.54 Pre-Tax Tax Pre-Tax Tax NCI Adjustments: Impact Impact1 Net Impact Impact Impact1 Impact2 Net Impact Loss on early extinguishment of debt $0.45 $(0.16) $0.29 $0.71 $(0.25) $— $0.46 FCPA accrual 0.09 — 0.09 0.09 — — 0.09 Impairment of certain international properties 0.05 -0.01 0.04 0.05 -0.01 — 0.04 Gain on sale of Suburbia — — — -0.13 0.04 0.04 -0.05 Net adjustments $0.42 $0.54 Adjusted EPS3 $1.00 $3.07 1 Calculated based on nature of item and statutory rate in effect for relevant jurisdictions. 2 Calculated based on the ownership percentages of the noncontrolling interest at Walmex. 3 Quarterly adjustments or adjusted EPS may not sum to YTD adjustments or YTD adjusted EPS due to rounding. Additionally, individual adjustments may not sum to net adjustments due to rounding. 26

Non-GAAP measures - adjusted EPS guidance Adjusted EPS Guidance is considered a non-GAAP financial measure. Management believes that Adjusted EPS Guidance for fiscal 2019 is a meaningful metric to share with investors because that metric, which adjusts EPS for certain items recorded in the period, is the metric that best allows comparison of the expected performance for fiscal 2019 to the comparable prior period. In addition, the metric affords investors a view of what management is forecasting for Walmart's core earnings performance for fiscal 2019 and also affords investors the ability to make a more informed assessment of the core earnings performance for the comparable period. We have calculated Adjusted EPS Guidance for fiscal 2019 by adjusting for the amount of the impact of: (1) the sale of a majority stake in Walmart Brazil, (2) adjustments in the provisional amount related to Tax Reform, and (3) unrealized gains and losses on the company's equity investment in JD.com. Fiscal 2019 Diluted earnings per share: Forecasted EPS2 $2.26 to $2.36 Pre-Tax Tax Net Adjustments: Impact Impact1 Impact Unrealized (gains) and losses on JD.com investment $1.25 -$0.28 $0.97 Loss on sale of majority stake in Walmart Brazil 1.64 -0.10 1.54 Adjustment to provisional amount for Tax Reform — -0.02 -0.02 Net adjustments $2.49 Adjusted EPS guidance2 $4.75 to $4.85 1 Calculated based on nature of item, including any realizable deductions, and statutory rate in effect for relevant jurisdictions. 2 Forecasted GAAP effective tax rate is 34% to 36%, which is affected by ~10% due to the combined affect of unrealized losses on JD.com investment, sale of a majority stake in Walmart Brazil and Tax Reform adjustments. Forecasted adjusted effective tax rate is 24% to 26%. 27

Additional resources at stock.walmart.com • Unit counts & square footage • Comparable store sales, including and excluding fuel • Terminology • Fiscal year 2019 earnings dates 28