Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PRINCIPAL FINANCIAL GROUP INC | pfg8-krepresentation111518.htm |

2018 Investor Day November 15, 2018

Welcome John Egan Vice President - Investor Relations

Forward looking statements Certain statements made by the company which are not historical facts may be considered forward-looking statements, including, without limitation, statements as to non-GAAP operating earnings, net income attributable to PFG, net cash flows, realized and unrealized gains and losses, capital and liquidity positions, sales and earnings trends, and management’s beliefs, expectations, goals and opinions. The company does not undertake to update these statements, which are based on a number of assumptions concerning future conditions that may ultimately prove to be inaccurate. Future events and their effects on the company may not be those anticipated, and actual results may differ materially from the results anticipated in these forward-looking statements. The risks, uncertainties and factors that could cause or contribute to such material differences are discussed in the company’s annual report on Form 10-K for the year ended Dec. 31, 2017, and in the company’s quarterly report on Form 10-Q for the quarter ended Sep. 30, 2018, filed by the company with the U.S. Securities and Exchange Commission, as updated or supplemented from time to time in subsequent filings. These risks and uncertainties include, without limitation: adverse capital and credit market conditions may significantly affect the company’s ability to meet liquidity needs, access to capital and cost of capital; conditions in the global capital markets and the economy generally; volatility or declines in the equity, bond or real estate markets; changes in interest rates or credit spreads or a sustained low interest rate environment; the company’s investment portfolio is subject to several risks that may diminish the value of its invested assets and the investment returns credited to customers; the company’s valuation of investments and the determination of the amount of allowances and impairments taken on such investments may include methodologies, estimations and assumptions that are subject to differing interpretations; any impairments of or valuation allowances against the company’s deferred tax assets; the company’s actual experience could differ significantly from its pricing and reserving assumptions; the pattern of amortizing the company’s DAC and other actuarial balances on its universal life- type insurance contracts, participating life insurance policies and certain investment contracts may change; changes in laws, regulations or accounting standards; the company may not be able to protect its intellectual property and may be subject to infringement claims; the company’s ability to pay stockholder dividends and meet its obligations may be constrained by the limitations on dividends Iowa insurance laws impose on Principal Life; litigation and regulatory investigations; from time to time the company may become subject to tax audits, tax litigation or similar proceedings, and as a result it may owe additional taxes, interest and penalties in amounts that may be material; applicable laws and the company’s certificate of incorporation and by-laws may discourage takeovers and business combinations that some stockholders might consider in their best interests; competition, including from companies that may have greater financial resources, broader arrays of products, higher ratings and stronger financial performance; a downgrade in the company’s financial strength or credit ratings; client terminations, withdrawals or changes in investor preferences; inability to attract and retain qualified employees and sales representatives and develop new distribution sources; an interruption in telecommunication, information technology or other systems, or a failure to maintain the confidentiality, integrity or availability of data residing on such systems; international business risks; fluctuations in foreign currency exchange rates; the company may need to fund deficiencies in its “Closed Block” assets; the company’s reinsurers could default on their obligations or increase their rates; risks arising from acquisitions of businesses; and loss of key vendor relationships or failure of a vendor to protect information of our customers or employees. 4

GAAP metrics Principal Financial Group, Inc. U.S. GAAP Financial Measures (in millions, except as indicated) Trailing 12 months 9/30/2013 9/30/2014 9/30/2015 9/30/2016 9/30/2017 9/30/2018 PFG Net income available to common stockholders 1 $861.2 $1,074.1 $1,226.1 $1,252.1 $1,786.6 $2,151.8 Net income diluted earnings per share $2.89 $3.53 $4.11 $4.27 $6.11 $7.39 Weighted average common shares outstanding 2 297.7 298.7 298.5 292.8 292.7 290.0 Common stockholders' equity attributable to parent $8,736.4 $9,774.4 $9,620.3 $10,794.6 $11,996.4 $11,700.8 Preferred stock 0.1 0.1 - - - - Preferred stock paid-in capital 541.9 541.9 - - - - Noncontrolling interest 95.0 52.6 65.5 69.2 70.9 67.9 Stockholders' equity $9,373.4 $10,369.0 $9,685.8 $10,863.8 $12,067.3 $11,768.7 Average common stockholders' equity attributable to parent $8,977.6 $9,255.4 $9,697.4 $10,207.5 $11,395.5 $11,848.6 Net income ROE available to common stockholders (including AOCI) 9.6% 11.6% 12.6% 12.3% 15.7% 18.2% Trailing 12 months 9/30/2013 9/30/2014 9/30/2015 9/30/2016 9/30/2017 9/30/2018 PFG Net income available to common stockholders 1 $861.2 $1,074.1 $1,226.1 $1,252.1 $1,786.6 $2,151.8 Net realized capital (gains) losses 149.0 2.3 36.3 (173.4) (520.7) 3.1 Net realized capital (gains) losses after-tax adjustments (21.6) 97.3 103.1 181.6 181.9 1.8 Other after-tax adjustments 25.6 106.2 (74.2) 2.0 52.0 (524.5) Non-GAAP operating earnings 3 $1,014.2 $1,279.9 $1,291.3 $1,262.3 $1,499.8 $1,632.2 1 9/30/2018 TTM net income available to common stockholders benefited $568.3 million as a result of U.S. tax reform ; 9/30/2017 TTM net income available to common stockholders benefited $410.8 million as a result of real estate transactions. 2 Weighted average shares outstanding for the nine-months ended. 5 3 This is a non-GAAP financial measure and is reconciled to GAAP on this page.

GAAP metrics Principal Financial Group, Inc. U.S. GAAP Financial Measures (in millions, except as indicated) Trailing 12 months PFG 09/30/2018 Income (loss) before income taxes $1,856.3 Net realized capital (gains) losses 3.1 Net realized capital (gains) losses pre-tax adjustments 50.1 Pre-tax operating (earnings) losses attributable to noncontrolling interest (12.0) Income taxes related to equity method investments 61.6 Principal Financial Group Foundation, Inc. contribution 70.0 Pre-tax operating earnings (losses) 1 $2,029.1 Trailing 12 months PFG 09/30/2018 Income taxes $(308.6) Net realized capital gains (losses) tax adjustments 49.6 Income taxes attributable to noncontrolling interest (0.2) Income taxes related to equity method investments 61.6 Other tax adjustments: Principal Financial Group Foundation, Inc. contribution 26.2 Tax Cuts and Jobs Act 568.3 Income taxes1 $396.9 6 1 This is a non-GAAP financial measure and is reconciled to GAAP on this page

GAAP metrics Principal Financial Group, Inc. U.S. GAAP Financial Measures Trailing 12 months 9/30/2018 (in millions, except as indicated) Impact of 3Q18 actuarial Excluding 3Q18 actuarial As reported assumption review assumption review 1 Segment pre-tax operating earnings (losses) RIS-Fee $549.0 $7.7 $541.3 Principal Global Investors 576.8 - 576.8 Principal International 279.8 (53.5) 333.3 Total Fee 1,405.6 (45.8) 1,451.4 RIS-Spread 362.0 11.5 350.5 Specialty Benefits 277.1 6.2 270.9 Individual Life 169.8 (15.5) 185.3 Total Risk 446.9 (9.3) 456.2 Pre-tax operating earnings (losses) excluding Corporate 2,214.5 (43.6) $2,258.1 Corporate (185.4) - (185.4) Non-GAAP pre-tax operating earnings 2 $2,029.1 $(43.6) $2,072.7 Income taxes2 396.9 (22.1) 419.0 Non-GAAP operating earnings 2 $1,632.2 $(21.5) $1,653.7 1 This is a non-GAAP financial measure and is reconciled to GAAP on this page. 7 2 This is a non-GAAP financial measure and the “as reported” figures are reconciled to GAAP on the previous slides.

Use of non-GAAP financial measures A non-GAAP financial measure is a numerical measure of performance, financial position, or cash flows that includes adjustments from a comparable financial measure presented in accordance with U.S. GAAP. The company uses a number of non-GAAP financial measures management believes are useful to investors because they illustrate the performance of the company’s normal, ongoing operations which is important in understanding and evaluating the company’s financial condition and results of operations. While such measures are also consistent with measures utilized by investors to evaluate performance, they are not, however, a substitute for U.S. GAAP financial measures. Therefore, the company has provided reconciliations of the non-GAAP financial measures to the most directly comparable U.S. GAAP financial measure within the slides. The company adjusts U.S. GAAP financial measures for items not directly related to ongoing operations. However, it is possible these adjusting items have occurred in the past and could recur in future reporting periods. Management also uses non-GAAP financial measures for goal setting, as a basis for determining employee and senior management awards and compensation, and evaluating performance on a basis comparable to that used by investors and securities analysts. The company also uses a variety of other operational measures that do not have U.S. GAAP counterparts, and therefore do not fit the definition of non-GAAP financial measures. Assets under management is an example of an operational measure that is not considered a non-GAAP financial measure. 8

Agenda Time Topic Presenter(s) 1:00 pm Welcome John Egan 1:05 pm CEO perspective Dan Houston Gary Scholten, Kara Hoogensen, Jerry Patterson, 1:35 pm Panel discussion: Digital and technology Renee Schaaf, Ellen Shumway 2:40 pm Break John Egan, Nora Everett, Amy Friedrich, 2:50 pm Panel discussion: Business unit opportunities Pat Halter, Luis Valdés 3:55 pm Financial update Deanna Strable Dan Houston, Deanna Strable, Nora Everett, 4:15 pm General Q&A Amy Friedrich, Pat Halter, Luis Valdés 4:45 pm Networking All presenters 9

CEO perspective Dan Houston Chairman, President & Chief Executive Officer

Principal remains well-positioned to: Capitalize on key Continue to deliver Address key macroeconomic trends above market growth challenges • Era of personal • Retirement and • Fee pressures responsibility long-term savings • Demand for low • Aging populations in the U.S., Latin cost investments and longer life America and Asia • Competitive expectancies • Asset management landscape – at scale • Wealth creation in globally and non-traditional emerging markets • Protection in the U.S. competition 11

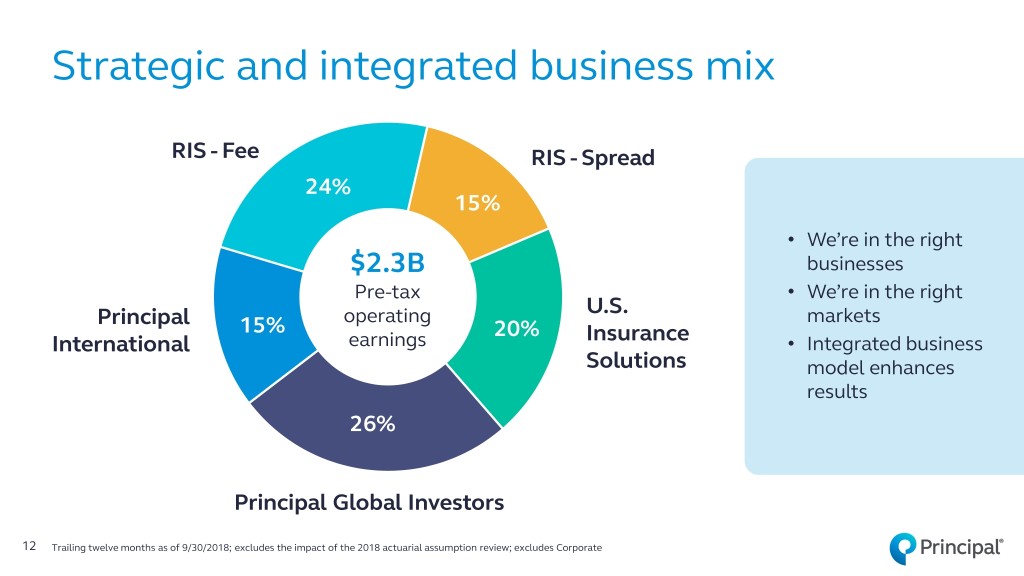

Strategic and integrated business mix RIS - Fee RIS - Spread 24% 15% • We’re in the right $2.3B businesses Pre-tax • We’re in the right Principal operating U.S. markets 15% 20% Insurance International earnings • Integrated business Solutions model enhances results 26% Principal Global Investors 12 Trailing twelve months as of 9/30/2018; excludes the impact of the 2018 actuarial assumption review; excludes Corporate

The customer remains at the center of our strategy Our customers Small to Medium Sized Individuals Institutions Businesses (SMBs) Customer We help people We help businesses We tailor investment Individuals save and invest; address risks and solutions to client Institutions and protect against compete for talent, preferences, risk SMBs financial risks through insurance, tolerances and long- through insurance retirement and term investment and guaranteed other employee benefits. objectives. income. Our foundation Customer Focus | Talent Development | Financial Strength | Integrity | Operational Excellence | Capital & Risk Management | Diversity & Inclusion | Social Responsibility 13

Leading market positions • Top 40 global asset manager • Top 5 retirement & group benefits/leading SMB franchise (U.S.) Strong • #1 pension (Latin America); #4 retail mutual funds (China) competitive • Top 20 Advisor sold fund family (U.S.) Strong investment performance positioning ‒ • 89% of funds above median for 5 year performance1 • 80% of fund level AUM carries 4 or 5 star rating1 playing to • Best Fund awards in Asia, Europe, Latin America and U.S. our strengths Broad diversification • By customer type and geography • By asset class and solution set • By source of non-GAAP operating earnings: Fee 64%, Spread 17%, Risk 20%2 1 As of 9/30/18 2 Trailing twelve months ended 9/30/18. Excludes Corporate. Because of rounding, not all percentages add up to 100%. Sources: Plansponsor Recordkeeping Survey, July, 2018; LIMRA non-med survey, 2017; World’s 500 Largest Asset Managers, Willis Towers Watson, Oct. 2018; 14 LatAm ranking based on AUM as of March 2018 among multi-country providers; East Money, June 2018;.Strategic Insight Flow Watch Series, Sept. 2018.

Enhancing our solution set • 100+ new funds launched in 2017 and 2018 • ETF franchise now in top 25 • Internos acquisition Expanding our distribution network Continue to • More than 160 third party platform placements in 2017 and 2018 execute • Alibaba/Ant Financial, Tencent, Paytm Using technology to benefit customers and advisors efficiently and • Multiple mobile rollouts in 2017 and 2018 • Digital pension product launch in Brazil effectively • RobustWealth acquisition Advancing our brand • 9 percentage point increase in consumer awareness since 1Q17 • Best employers/best places to work recognition • Most ethical company recognition 15

Continue to achieve above industry growth in AUM 5 Year AUM CAGRs (2012-2017)1 11.0% Among top 50: • 15th fastest 8.3% 8.4% growing firm • 11th largest ranking increase (up 5 spots in 5 years) Principal Top 20 global Top 500 global asset managers asset managers 1 Calculated based on local currency 16 Source: The World’s 500 Largest Asset Managers, Willis Towers Watson, Oct. 2018; study based on results through 2017; ranking changes relate to rankings among top 50 firms

Continue to prioritize revenue growth Alternatives, active specialties and solutions continue to be key drivers Industry AUM and revenue growth (2017-2022E) Passive 120 90% 86% Active core 80% 100 Alternatives, 70% active specialties 59% 80 60% & solutions 50% 60 40% 33% 40 30% 20% 20 11% 10% 0 0% AUM growth Revenue growth % of AUM growth % of Revenue growth ($trillions) ($billions) 17 Source: Digital Metamorphosis, BCG, July 2018

Capitalizing on key trends

Revisiting and capitalizing on key trends 1 2 3 4 5 Era of personal Aging Emerging market Informal Innovation and responsibility populations, middle class employment digitization Responsibility longer life population Prevalence of Changes to how people for financial expectancies growth informal acquire and pay for security shifting employment in goods and services; Reinforces New wealth creation to individuals certain emerging emergence of non- importance of drives growth markets coupled traditional competitors retirement opportunity beyond with expansion of represents threat; but readiness, and appreciation of gig economy digitization also creates critical nature of existing assets and creating coverage opportunity for retirement income taking market share issues differentiation solutions 19

1 Era of personal responsibility Insufficient income replacement spotlights need for long-term savings vehicles Mexico 29% Hong Kong 33% Malaysia 34% Target is Chile 39% 70+% of Thailand 47% income U.S. 49% China 54% Brazil 56% 0% 10% 20% 30% 40% 50% 60% 70% Sources: For Brazil, Chile, and Mexico, Pensions at a Glance: Latin America and the Caribbean; for China, Global Aging Institute (GAI) calculations; for Hong Kong, 20 Malaysia, and Thailand, Pensions at a Glance: Asia/Pacific 2013; for U.S., https://www.oecd.org/unitedstates/PAG2017-USA.pdf

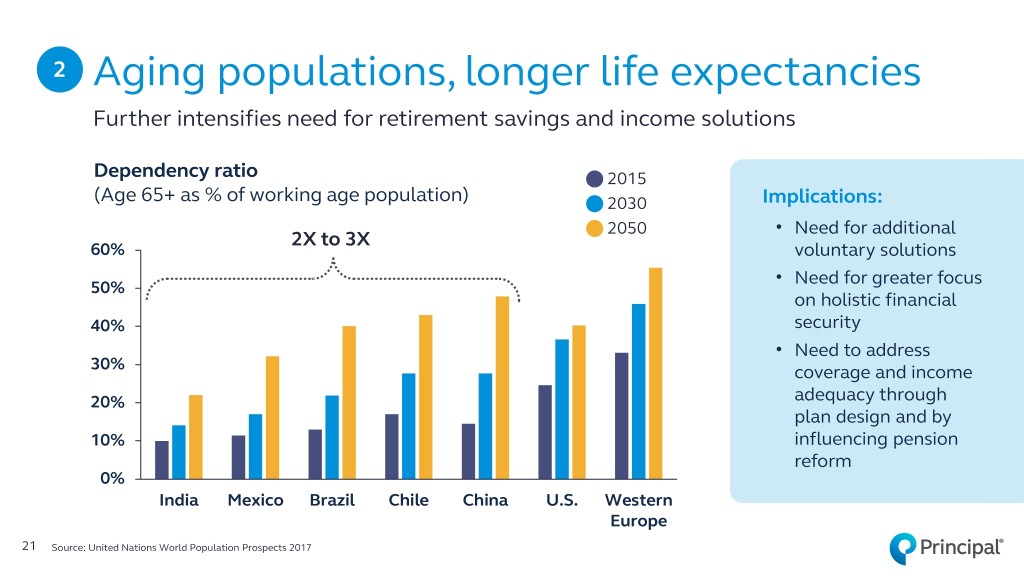

2 Aging populations, longer life expectancies Further intensifies need for retirement savings and income solutions Dependency ratio 2015 (Age 65+ as % of working age population) 2030 Implications: 2050 • Need for additional 2X to 3X 60% voluntary solutions • Need for greater focus 50% on holistic financial 40% security • Need to address 30% coverage and income 20% adequacy through plan design and by 10% influencing pension reform 0% India Mexico Brazil Chile China U.S. Western Europe 21 Source: United Nations World Population Prospects 2017

3 Growth of emerging market middle class Asia-Pacific dominates expansion Regional contribution to next middle class billion 2015-2022E (Population in billions) Implications: 1.1 • Resource allocation – 1.0 Asia Pacific represents nearly 90% of 0.9 Rest 0.8 of Asia expansion 0.7 • Need for solutions and 0.6 China distribution that can 0.5 address local demand 0.4 0.3 • Need for accelerated 0.2 India investment in digital 0.1 solutions 0.0 Asia Middle East & Sub-Saharan Central & North Europe Pacific North Africa Africa South America America 22 Source: The Unprecedented Expansion of the Global Middle Class, Brookings, Feb. 2017

4 Informal employment and gig economy Presents massive digital sales and advice opportunity 2 billion people For hundreds of work informally “millions of workers, (>60% of world’s population) informality means a lack of access to are in emerging and finance 93% developing countries ” 23 Source: Informal Economy, International Labour Organization, Apr. 2018

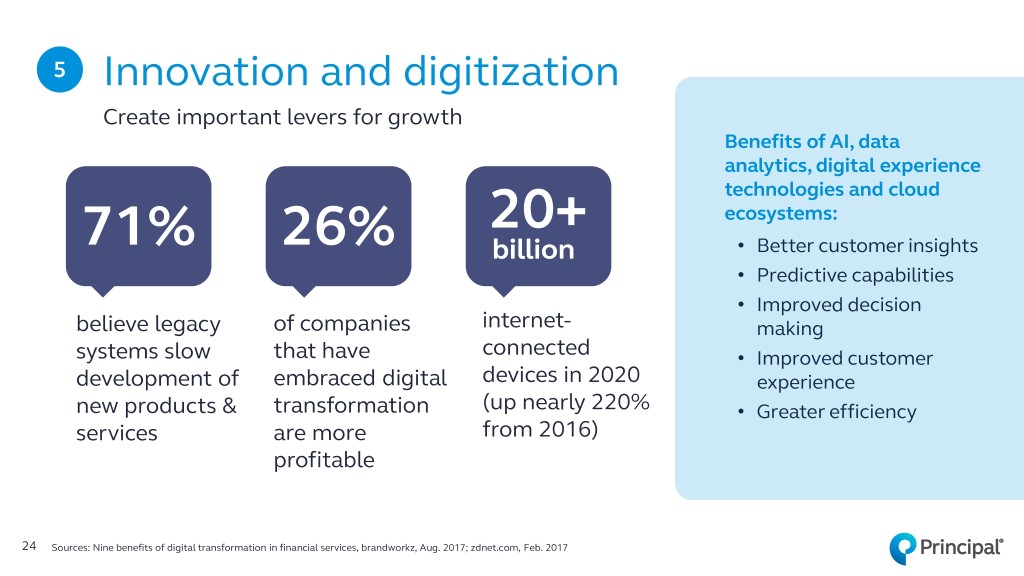

5 Innovation and digitization Create important levers for growth Benefits of AI, data analytics, digital experience technologies and cloud 20+ ecosystems: 71% 26% billion • Better customer insights • Predictive capabilities • Improved decision believe legacy of companies internet- making connected systems slow that have • Improved customer development of embraced digital devices in 2020 experience new products & transformation (up nearly 220% • Greater efficiency services are more from 2016) profitable 24 Sources: Nine benefits of digital transformation in financial services, brandworkz, Aug. 2017; zdnet.com, Feb. 2017

Narrowing the focus

A global overview Significant opportunity for asset management industry overall Global investable assets (in USD trillions) Investable assets Projections: $400 managed by asset • Total global $350 management industry investable assets up >$130 trillion $300 Investable assets not managed by asset (5.4% CAGR) $250 management industry • Industry AUM up $200 >$60 trillion $150 (6.2% CAGR) $100 • Industry penetration increases from $50 40% to 42% $0 2016 2025E 26 Source: Asset & Wealth Management Revolution, PwC, 2017

A regional overview Trend toward equities and fixed income enhances opportunity ($ in trillions) Total Equity Balanced Cash heavy wealth heavy Highlights: $167 $56 $41 $38 $15 $8 $5 $4 • More mature 11% 23% 37% 26% markets have 39% 39% 12% 37% 61% greater investment 70% 4% 4% in equities and fixed 17% 25% income 65% 50% 15% 59% 52% 43% Less mature 16% 37% 24% • 14% markets more cash Global North Western Asia- Japan Middle Latin Eastern heavy but with America Europe Pacific East & America Europe additional long- Africa term potential Equities Bonds Cash & deposits Source: BCG Global Wealth Market-Sizing Database, 2017. Note: Private financial wealth, including life insurance 27 and pensions, is measured across all households. Because of rounding, not all percentages add up to 100.

Global Asset Management Principal Global Asset Management (GAM) Principal Principal Global Strategy, International General Global RobustWealth Marketing & (PI) investment Account Investors (PGI) operations* Product Institutional Retirement High Net Worth/ investors investors Retail investors 28 *As permitted and in accordance with regulatory guidelines in the markets in which we operate.

Where we’ll compete #1 United • Total projected AUM growth dwarfs all other opportunities States • SMB market remains massive opportunity for retirement and group benefits • China to become 2nd largest investment management market by 2030 (Casey Quirk projection) #2 China and • Substantial upward trend in demand for asset management (AM) industry solutions SE Asia • Strong new wealth creation • Strong demand for AM industry solutions (particularly in Brazil and Mexico) Latin • Opportunity to achieve leading share across markets #3 America • Pension reform bodes well for retirement and long-term savings businesses • Strong new wealth creation • Strong current and expected future demand for AM industry solutions in the institutional #4 Europe and high net worth markets • Continued strong demand for active strategies • Increasing cross border success in Dublin and Luxembourg • Highest projected growth rate India • Increasing demand for AM industry solutions #5 (longer-term) • Strong new wealth creation 29

How we’ll win Take market Maximize Make the Talent/workforce Technology, data share existing block pie bigger of the future and innovation • Goal for all • Innovative • New plan • Workplace • Data analytics businesses enrollment formation flexibility; linking for underwriting, solutions diversity & propensity to • Competitive • Under-served business buy, customer pricing • Benefit event markets and outcomes segmentation asset retention geographies • Delivering better • Expanding • Algorithm driven outcomes • Cross-BU leadership investment collaboration capabilities; strategies • Mandatory/ succession Online: tools, voluntary • preparedness education, 401k, cross-purchase IRA rollovers, insurance portal 30

Q&A

Digital and technology Panel discussion Gary Scholten Chief Information Officer & Chief Digital Officer

Principal digital strategies Digital infrastructure Customer Direct Investment Business experience sales & advice process efficiency 33

Kara Hoogensen Vice President Group Benefits Jerry Patterson Senior Vice President On the panel Retirement & Income Solutions Renee Schaaf Senior Vice President & Chief Operating Officer Principal International Ellen Shumway Senior Executive Director - Strategy & Investments Principal Global Investors 34

• Digital is business strategy driven • 20%+ IRRs; benefits will emerge two-thirds through revenue growth, one-third through expense efficiencies Summary • Revenue growth will emerge from: • New channels & new customer segments thoughts • Increased plan participation • Reduced lapses • Improved traditional distribution performance • Benefits will start to emerge in 2019, but net digital impact will be at a similar level as 2018 • Proven ability to execute and focused on realizing benefits 36

Kara Hoogensen Vice President Group Benefits Jerry Patterson Senior Vice President Q&A Retirement & Income Solutions Renee Schaaf Senior Vice President & Chief Operating Officer Principal International Ellen Shumway Senior Executive Director - Strategy & Investments Principal Global Investors 37

Break

Business unit opportunities Panel discussion John Egan Vice President – Investor Relations

Principal’s businesses Retirement U.S. Principal Global Principal & Income Insurance Investors International Solutions Solutions Vision for our future… 40

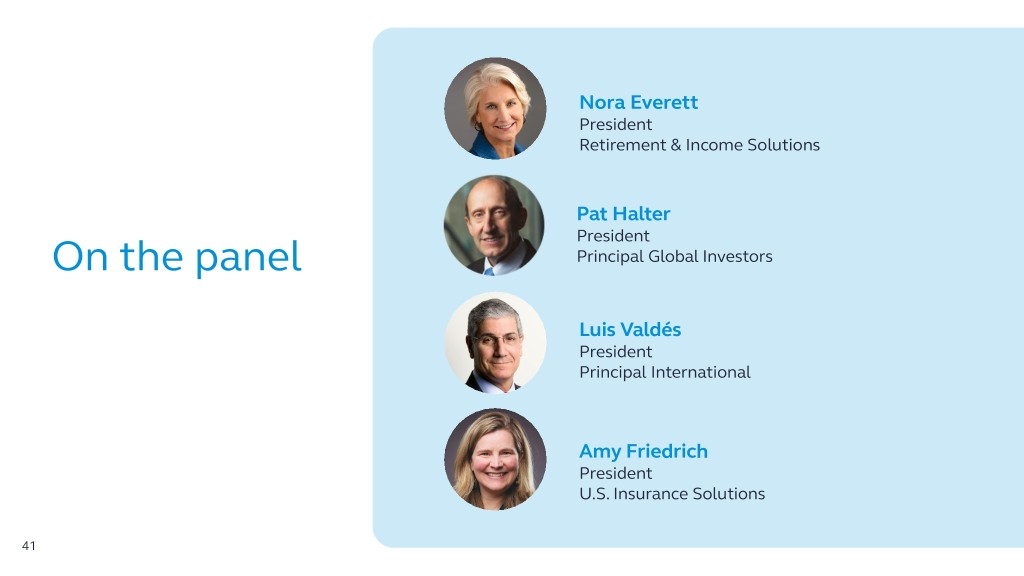

Nora Everett President Retirement & Income Solutions Pat Halter President On the panel Principal Global Investors Luis Valdés President Principal International Amy Friedrich President U.S. Insurance Solutions 41

Retirement & Income Solutions Principal International • Underserved target market – • Growing opportunity set – our half of all SMBs don’t currently current footprint covers half the have a retirement plan offering world’s population • Largest retirement market – • Favorable demographics - growing U.S. has almost double the assets of demand for retirement and long-term Summary the next nine countries combined savings products positions us for • Ability to offer guaranteed products sustainable growth is a differentiator • Our marquee partners offer us thoughts tremendous distribution capabilities Principal Global Investors U.S. Insurance Solutions • Strong investment performance provides foundation for growth • Strategic importance for Principal with over 90K SMB relationships • Niche active management strategies still very much in demand globally • Specialty Benefits – focus on the SMB market a big differentiator • Collaboration with RIS, PI and USIS provides for unique opportunity set for Principal • Individual Life - more than 50% of our sales focused on business owner and executive solutions 43

Nora Everett President Retirement & Income Solutions Pat Halter President Q&A Principal Global Investors Luis Valdés President Principal International Amy Friedrich President U.S. Insurance Solutions 44

Financial update Deanna Strable Chief Financial Officer

What differentiates Principal? Proven history of execution Long-term Investing Strong focused growth for the financial strategy future position 10%+ average growth Committed to investment At one of our strongest in non-GAAP operating for growth through: financial positions as a earnings and earnings • Organic growth public company per diluted share (EPS)1 • M&A over the last 5 years • Business capabilities 46 1 As of 9/30/2018 TTM and excludes the impact of the 3Q 2018 actuarial assumption review. See appendix for non-GAAP financial measure reconciliations.

Coming from a position of strength Capital Leverage Profitability Over $2B 20% Excess and 14.5% Low debt-to- ROE1 available capital capital ratio • Includes capital at • No debt maturities • A proven, diversified Holdco, subsidiaries, until 2022 business model and excess above a • Flexibility exists to • Strong result reflecting 420% RBC ratio increase the leverage business mix and capital • Estimated RBC >450% ratio for the right position opportunity As of 9/30/2018 1 Return on equity excluding AOCI, other than foreign currency translation. Excludes the impact of the 3Q 2018 actuarial assumption review. 47 This is a non-GAAP financial measure; see appendix for a reconciliation to the closest GAAP measure.

A diversified high quality portfolio Commercial Mortgages Fixed Maturities portfolio 17% CMBS 12/31/2008 9/30/2018 5% MBS NAIC 1 57% 68% 7% Corporate NAIC 2 38% 28% Private Bonds NAIC 3 – 6 5% 4% 17% ABS $79B 8% Total U.S. Commercial Mortgage quality invested 12/31/2008 9/30/2018 assets & cash Government, Bond Equivalent Rating Agency, State 61% 92% & Political (A and above) 11% Current loan-to-value 62% 45% Corporate Other1 Public Bonds 7% 25% Current debt service coverage 1.7x 2.6x Cash 3% As of 9/30/2018 48 1 Other includes Equity Securities, Residential Mortgages, Real Estate, Policy Loans, Investment in Equity Method subs, Direct Finance Leases and Other Investments

Intentional diversification & limited exposure to products with higher risks RIS - Fee RIS - Spread • Defined contribution • Fixed annuities and defined benefit • Pension risk transfer Products we’ve limited or • Variable annuities • GICs and MTNs • Trust 24% 15% • Bank managed our exposure to: $2.3B • Long-term care Principal Pre-tax • Variable annuities International 15% operating 20% U.S. Insurance earnings • Products with minimum • Pensions, mutual funds, Solutions interest rate guarantees asset management and • Group dental, vision, annuities 26% life, critical illness, accident, and disability • Individual disability Principal Global • Individual life Investors • Institutional, retail, and high net worth 49 Trailing twelve months as of 9/30/2018; excludes the impact of the 2018 actuarial assumption review; excludes Corporate

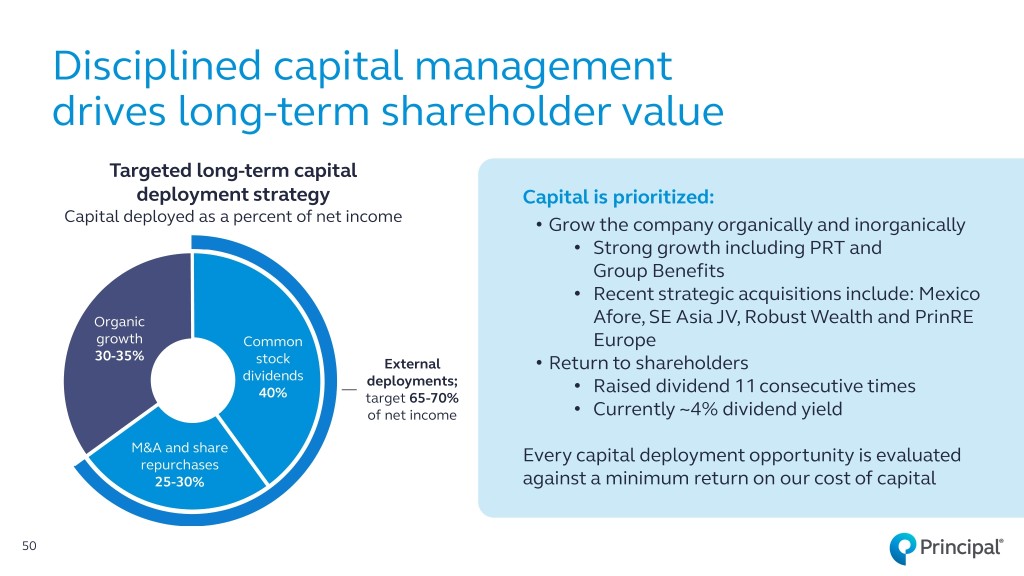

Disciplined capital management drives long-term shareholder value Targeted long-term capital deployment strategy Capital is prioritized: Capital deployed as a percent of net income • Grow the company organically and inorganically • Strong growth including PRT and Group Benefits • Recent strategic acquisitions include: Mexico Organic Afore, SE Asia JV, Robust Wealth and PrinRE growth Common Europe 30-35% stock External • Return to shareholders dividends deployments; • Raised dividend 11 consecutive times 40% target 65-70% of net income • Currently ~4% dividend yield M&A and share repurchases Every capital deployment opportunity is evaluated 25-30% against a minimum return on our cost of capital 50

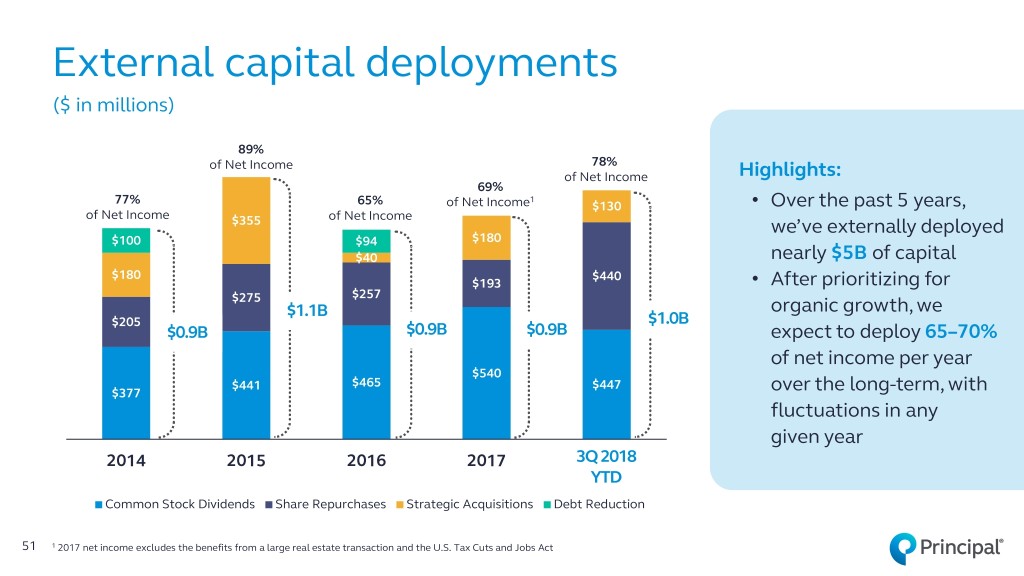

External capital deployments ($ in millions) 89% of Net Income 78% of Net Income Highlights: 69% 77% 1 65% of Net Income $130 • Over the past 5 years, of Net Income of Net Income $355 we’ve externally deployed $100 $94 $180 $40 nearly $5B of capital $180 $440 $193 • After prioritizing for $275 $257 $1.1B organic growth, we $205 $1.0B $0.9B $0.9B $0.9B expect to deploy 65–70% of net income per year $540 $441 $465 $447 $377 over the long-term, with fluctuations in any given year 2014 2015 2016 2017 3Q3Q 2018 YTD Common Stock Dividends Share Repurchases Strategic Acquisitions Debt Reduction 51 1 2017 net income excludes the benefits from a large real estate transaction and the U.S. Tax Cuts and Jobs Act

Proven results Proven above market long-term Experienced results Balanced and management disciplined team High quality approach asset to capital portfolio and deployment Strong conservative financial liability average growth in non-GAAP position profile operating earnings and earnings 10%+ per diluted share (EPS)1 Strategic growth oriented business mix average ROE 50 bps expansion per year2 1 CAGR 3Q 2013 - 3Q 2018 on a trailing twelve month basis; excludes the impacts of the 2018 actuarial assumption review 2 5 year average as of 9/30/2018. Return on equity excluding AOCI, other than foreign currency translation. Excludes the impact of the 3Q 2018 actuarial 52 assumption review. This is a non-GAAP financial measure; see appendix for a reconciliation to the closest GAAP measure.

General Q&A

Dan Houston Amy Friedrich Chairman, President & President Chief Executive Officer U.S. Insurance Solutions Q&A Deanna Strable Pat Halter Chief Financial Officer President Principal Global Investors Nora Everett Luis Valdés President President Retirement & Income Principal International Solutions 54

Thank you

Appendix

Non-GAAP financial measure reconciliations Principal Financial Group, Inc. (in millions, except as indicated) Trailing 12 months PFG 09/30/2013 09/30/2014 09/30/2015 09/30/2016 09/30/2017 09/30/2018 Non-GAAP operating earnings 1 $1,014.2 $1,279.9 $1,291.3 $1,262.3 $1,499.8 $1,632.2 Actuarial assumption review - (39.0) (31.2) 48.2 42.9 21.5 Non-GAAP operating earnings excluding actuarial assumption review $1,014.2 $1,240.9 $1,260.1 $1,310.5 $1,542.7 $1,653.7 Average stockholders' equity attributable to parent $8,977.6 $9,255.4 $9,697.4 $10,207.5 $11,395.5 $11,848.6 Average net unrealized capital (gains) losses (997.2) (892.0) (1,027.8) (1,260.2) (1,470.5) (816.1) Average net unrecognized postretirement benefit obligation 391.0 296.2 260.2 400.7 410.9 410.7 Average stockholders' equity x-AOCI other than foreign currency translation adjustment $8,371.4 $8,659.6 $8,929.8 $9,348.0 $10,336.0 $11,443.2 Per diluted share: Net income $2.89 $3.53 $4.11 $4.27 $6.11 $7.39 Net realized capital (gains) losses 0.43 0.34 0.47 0.02 (1.16) 0.01 Other after-tax adjustments 0.09 0.35 (0.25) 0.01 0.17 (1.79) Adjustment for redeemable noncontrolling interest - 0.07 - - - - Non-GAAP operating earnings $3.41 $4.29 $4.33 $4.30 $5.12 $5.61 Actuarial assumption review - (0.13) (0.10) 0.17 0.14 0.08 Non-GAAP operating earnings excluding actuarial assumption review $3.41 $4.16 $4.23 $4.47 $5.26 $5.69 57 1 This is a non-GAAP financial measure and is reconciled to GAAP on slide 5.

Non-GAAP financial measure reconciliations Principal Financial Group, Inc. (in millions, except as indicated) Trailing 12 months PFG 09/30/2013 09/30/2014 09/30/2015 09/30/2016 09/30/2017 09/30/2018 Net income ROE available to common stockholders (including AOCI) 9.6% 11.6% 12.6% 12.3% 15.7% 18.2% Net unrealized capital (gains) losses 1.1% 1.2% 1.4% 1.6% 2.2% 1.3% Net unrecognized postretirement benefit obligation -0.4% -0.4% -0.3% -0.5% -0.6% -0.7% Net income ROE available to common stockholders (x-AOCI other than FCTA) 10.3% 12.4% 13.7% 13.4% 17.3% 18.8% Net realized capital (gains) losses 1.5% 1.2% 1.6% 0.1% -3.3% 0.1% Other after-tax adjustments 0.3% 1.2% -0.8% 0.0% 0.5% -4.6% Non-GAAP operating earnings ROE (x-AOCI other than FCTA) 12.1% 14.8% 14.5% 13.5% 14.5% 14.3% Actuarial assumption review 0.0% -0.5% -0.3% 0.5% 0.4% 0.2% Non-GAAP operating earnings ROE (x-AOCI other than FCTA) excluding actuarial assumption review 12.1% 14.3% 14.2% 14.0% 14.9% 14.5% Stockholders' equity $9,373.4 $10,369.0 $9,685.8 $10,863.8 $12,067.3 $11,768.7 Net unrealized capital (gains) losses (695.5) (1,088.4) (967.2) (1,553.1) (1,387.8) (244.3) Net unrecognized postretirement benefit obligation 447.1 145.2 375.2 426.2 395.6 425.8 Noncontrolling interest (95.0) (52.6) (65.5) (69.2) (70.9) (67.9) Stockholders' equity x-AOCI other than foreign currency translation adjustment 9,030.0 9,373.2 9,028.3 9,667.7 11,004.2 11,882.3 Foreign currency translation adjustment 266.1 563.1 1,116.4 1,035.1 945.2 1,166.1 Stockholders' equity x-AOCI $9,296.1 $9,936.3 $10,144.7 $10,702.8 $11,949.4 $13,048.4 Preferred stock (0.1) (0.1) - - - - Preferred stock paid-in capital (541.9) (541.9) - - - - Stockholders' equity x-AOCI available to common stockholders $8,754.1 $9,394.3 $10,144.7 $10,702.8 $11,949.4 $13,048.4 58

Daniel J. Houston Chairman, President & Chief Executive Officer Daniel J. Houston is Chairman, President and Chief Executive Officer of Principal Financial Group®. He is responsible for overall management of the company. Houston joined Principal® in 1984 in Dallas. He has held several management positions, being named Senior Vice President in 2000, Executive Vice President in 2006 and President of Retirement and Income Solutions in 2008. He was named President and Chief Operating Officer in 2014 before assuming his current role in 2015. Houston is a member of several boards, including Greater Des Moines Partnership, Employee Benefits Research Institute (EBRI), American Council of Life Insurers (ACLI), Iowa State University Business School Dean’s Advisory Council, Partnership for a Healthier America (PHA) and Community Foundation of Greater Des Moines. Houston received his bachelor’s degree from Iowa State University in 1984. He has appeared before the U.S. Senate Special Committee on Aging to discuss the importance of educating the workforce about the financial needs in retirement. Houston joined the joint forum of U.S. Senate Committees on Finance and Health, Education, Labor and Pensions to discuss “Private-Sector Retirement Savings Plans: What Does the Future Hold?” He also authored a chapter in “The Upside of Aging” published by John Wiley & Sons in 2014, on the keys to achieving financial security in retirement. 59

Deanna D. Strable Executive Vice President & Chief Financial Officer Deanna Strable is Executive Vice President and Chief Financial Officer with Principal Financial Group®. She plays a central role in driving and managing long-term strategies for innovation-fueled company growth, including responsibility for corporate strategy and capital markets. Strable joined the company in 1990 as an Actuarial Assistant. She held various actuarial and management roles within Principal® and specifically in the Principal’s insurance business from 1995 through 2016. Strable was promoted to President U.S. Insurance Solutions in 2015 and Executive Vice President in 2016. Strable’s current position was effective February 2017. In addition to her role within Principal, Strable currently serves as past-chair of the Board of Directors for LIMRA LOMA Global (LL Global, Inc) and is a member of the Board of Directors for Simpson College. She also serves on United Way’s USA Board of Trustees after holding various positions for the United Way of Central Iowa. A native of Iowa, Strable received her bachelor’s degree from Northwestern University in Evanston, Illinois. She is a Fellow of the Society of Actuaries and a member of the American Academy of Actuaries. 60

Gary P. Scholten Executive Vice President, Chief Information Officer & Chief Digital Officer Gary P. Scholten is the Executive Vice President, Chief Information Officer and Chief Digital Officer of Principal Financial Group®. He’s responsible for overseeing the company’s use of Information Technology and driving digital strategy into all aspects of the business. He also leads the company’s use of offshore resourcing and oversees sourcing and supplier management. Scholten joined the company in 1980 as an Assistant Planning Analyst. He held multiple IT positions, was promoted to Senior Vice President and Chief Information Officer in 2002, and to Executive Vice President and Chief Information Officer in 2014. He became Chief Digital Officer in 2017. Scholten is a fellow of the Life Office Management Institute and is past chair of the LOMA Individual Product Systems Committee. He chairs Principal Global Services, Private Limited, a wholly owned subsidiary of the Principal Financial Group located in Pune, India. Scholten currently serves on two Principal International Chilean Boards: Principal International de Chile S.A, and Principal Asset Management Chile S.A. Scholten has served as the chairman of the board for the Technology Association of Iowa. In 2011, he was appointed to serve on the Iowa Governor’s Science, Technology, Engineering and Mathematics (STEM) Advisory Council, and joined the group’s executive committee in 2013. Under Scholten’s leadership, Principal® has consistently been ranked in the top half of Computerworld magazine’s “100 Best Places to Work in IT,” and InformationWeek magazine’s “Top 500 Most Innovative Users of Information Technology,” ranking as the number one company in 2006. Scholten received the University of Northern Iowa’s 2011 Alumni Achievement Award for his overall professional accomplishments. A native of Larchwood, Iowa, Scholten received his bachelor’s degree from the University of Northern Iowa in Cedar Falls. 61

Nora M. Everett President, Retirement & Income Solutions Nora Everett is President of Retirement and Income Solutions (RIS) and chairman of Principal Funds at Principal Financial Group®. She is responsible for U.S. retirement, annuity, broker-dealer and banking businesses at Principal®. Everett joined Principal® in 1991 as an attorney and was promoted to Senior Vice President and Deputy General Counsel in 2004. She was promoted to Senior Vice President, Retirement and Investor Services and President of Principal Funds in 2008, and CEO of Principal Funds in 2010. Everett was promoted to her current position in 2015. Prior to joining Principal, she practiced law in Washington, D.C. She earned her bachelor’s degree and Phi Beta Kappa honors from Iowa State University and her J.D. degree from William & Mary Law School. Everett serves on several boards, including Principal Funds, Principal International, Principal Asset Management Company (Asia) Limited in Hong Kong, Origin Asset Management, Finisterre Capital, United Way of Central Iowa, Community Foundation of Greater Des Moines and Greater Des Moines Partnership. She also serves on the Investment Company Institute’s Board of Governors. 62

Amy C. Friedrich President, U.S. Insurance Solutions Amy C. Friedrich is president of U.S. Insurance Solutions with Principal Financial Group®. Friedrich joined Principal® in 2000 in a performance improvement role for Corporate Strategic Development. Later, as a Director in that division, she helped define a long-term strategy for the specialty benefits division and in 2004, she moved into that area. Since then, she’s held many leadership roles, including second Vice President in 2006 and Vice President of Group Benefits in 2008. She took on oversight of individual disability insurance in 2015 when she was named a Senior Vice President. She assumed her current position in 2017 Prior to joining the company, she was a Change Management Manager with Accenture. Friedrich is a native of Van Meter, Iowa and earned her bachelor’s degree in mass communication and philosophy from Buena Vista University in Storm Lake, Iowa and her master’s in organizational communication from Purdue University in West Lafayette, Ind. 63

Patrick G. Halter President & Chief Executive Officer, Principal Global Investors Patrick G. Halter is the President and Chief Executive Officer for Principal Global Investors, the multi-boutique investment management firm within Principal’s Global Asset Management business. Halter is responsible for overseeing the firm’s operations, its 15 investment boutiques, and the fund and distribution teams. Halter joined the company in 1984 in commercial real estate. In 2016, Halter was named Chief Operating Officer of Principal Global Investors, responsible for oversight of primary functions within the firm, including finance, strategic direction, operations, global firm relations, human resources and technology, as well as many of the investment boutiques. Today, he serves on the boards of the firm’s 15 investment boutiques, the Principal Mutual Fund Board, and has board responsibilities with various international ventures. Additionally, he has served as Chief Executive Officer for Principal Real Estate Investors, the dedicated real estate unit of Principal Global Investors, since 2003, with responsibility for overall strategy, business development and boutique management. Halter is past Chairman of the Board of the National Association of Real Estate Investment Managers (NAREIM). He is a member of the Real Estate Roundtable and serves on the REPAC Steering Committee. He is also a member of the Pension and Real Estate Association (PREA), the Association of Foreign Investors in Real Estate (AFIRE) and serves on the Board of the Graaskamp Center for Real Estate at the University of Wisconsin. Halter earned his bachelor’s degree in finance and marketing, and an MBA in finance from the University of Wisconsin. 64

Luis Valdés President & Chief Executive Officer, Principal International Luis Valdés is President and Chief Executive Officer, Principal International. Previously he was President, Principal Financial Group Latin America (2010 – March 2011), supervising operations in Brazil, Chile and Mexico. Valdés also served as Regional Vice President Latin America and Spain, Principal International from 1998 through March 2010. Prior to joining Principal®, Valdés served in several positions as a public servant for the Chilean Government from 1980 through 1991, including his last appointment as Insurance Commissioner for Chile (1989 – 1991). Valdés has been associated with Principal® since 1995 when he was managing director of BanRenta Compania de Seguros de Vida in Chile, and Principal signed its first joint venture in that country. Valdés received his bachelor´s degree in physics and math (1980) and his degree of civil industrial engineering from the Universidad de Chile in Santiago (1982). He received his MBA degree from the IESE – Universidad de Navarra in Barcelona, Spain (1988). Valdés has been an Insurance Market Consultant for the World Bank. He currently serves as Board Chair for BrasilPrev Seguros e Previdencia (Brazil). Valdés is also a member of the Executive Committee and the Honors Committee for the International Insurance Society (IIS). He has been a professor of Business Policy and Finance since 1988 at several universities. Valdés also served as a professor in a postgraduate program in Business at the ESE School Business of Universidad Los Andes. 65

Kara M. Kohler Hoogensen Vice President, Group Benefits Kara M. Kohler Hoogensen is a Vice President with Principal Financial Group®. She has responsibility for the Group Benefits business within U.S. Insurance Solutions (USIS). In addition, Kara leads a team of strategists supporting the USIS and Retirement and Income Solutions (RIS) segments. Kara joined Principal® in 1996 as a Junior Pension Underwriter. She was promoted to Assistant Pension Underwriter in 1998 and to Pension Consultant in 2000. After a year with Merck & Co., Inc. as a Professional Representative, Kara re-joined Principal in May 2001 as a Business Development Consultant. She was promoted to Business Development Officer in 2005 and Director of Business Development in 2006. In January 2007, she moved to the position of Strategy Director in Corporate Strategy. She joined Principal Funds in June 2008 as a Strategy Director. She expanded her responsibilities in February 2009 to assume strategy work for the RIS segment. Kara was named Director - Defined Contribution Investment Only (DCIO) in July 2011 and was promoted to Managing Director – Investment Only in March 2012. In September 2013, Kara also took on responsibilities for investment product development for Principal Funds. She was promoted to Chairman, President and CEO of Principal Bank and Principal Trust Company in June 2014 and became President and CEO of Principal Securities, Inc. in March 2015. From late 2015 through June 2018, she also led a cross-business unit team that navigated the largest regulatory change for the financial services industry since the 1970s (the Department of Labor fiduciary regulation). She assumed her current responsibilities in August 2017. Kara received her bachelor’s degree from Central College in 1996. She has earned her Certified Employee Benefits Specialist (CEBS) designation from the International Foundation of Employee Benefits and Certified Investment Management Analyst (CIMA®) designation. Kara was named to the Des Moines Business Record’s “Forty Under Forty” in the spring of 2009 for her professional and civic accomplishments, was selected to attend the inaugural Fortune Most Powerful Women Next Gen Summit in December 2014 and attended the inaugural G100 Women’s Leadership Acceleration program in December 2016. She has continued participating in the G100 Women’s Leadership Network through June 2018. 66

Gerald (Jerry) Patterson Senior Vice President, Retirement & Income Solutions Jerry Patterson has been a presence in the financial services industry for more than 25 years and has held diverse and senior roles at some of the nation’s largest financial institutions. Patterson currently serves as Senior Vice President, Retirement and Income Solutions with the Principal Financial Group® - leading the company’s retirement plan businesses. Key focus areas include delivering industry leading retirement plan record-keeping services, driving better retirement outcomes through more effective retirement plan designs, behavior-based education and engagement strategies as well as getting more Americans to understand and embrace the power of guaranteed retirement income and addressing the changing needs of workers across generations. Patterson is a national speaker and writer on a broad range of topics, including financial and estate planning, behavioral finance, healthcare, wellness, generational trends, and retirement. He has been featured as a resident blogger for the Huffington Post where he focused on financial wellness and overcoming human nature to attain better financial security outcomes. Patterson is an active participant in several industry and community organizations focused on retirement security and the arts. He is an active board member for the Insured Retirement Institute, Pyramid Theatre Company, Greater Des Moines Public Art Foundation (GDPAF), and Grand View College. Patterson’s education and early career centered on accounting and law. He is a member of the Kansas and Missouri bars. Follow Patterson @JerryWPatterson. 67

Renee Schaaf Senior Vice President & Chief Operating Officer Renee Schaaf is Senior Vice President and Chief Operating Officer for Principal International. In that role, she is responsible for global business development, strategy and operations in key emerging markets in Latin America and Asia. Renee collaborates with all Principal International member companies to advance their global pension and long- term savings businesses. Prior to her current role, Schaaf was the Vice President of Strategic Planning and Business Development for Principal International, where she was responsible for multiple business development disciplines, including: product development, technology, marketing, distribution and customer experience. In addition to her international work, Schaaf has held several leadership positions in various areas of the Principal Financial Group. Before joining Principal International, she was Vice President - Retirement and Investor Services where she was responsible for the U.S. midsized group solutions pension market segment. Product solutions included 401(k) defined contribution plans, defined benefit plans and ESOPs. Renee has considerable knowledge and experience in global pension policy, including voluntary and mandatory pension programs. Renee earned her bachelor’s degree from Iowa State University, Ames, Iowa, and her MBA from Drake University, Des Moines, Iowa. She completed the Global Advanced Management Program from Northwestern University, Kellogg School of Management in 2016. 68

Ellen Shumway Senior Executive Director, Strategy & Investments Ellen Shumway is Senior Executive Director, Strategy and Investments for Principal Global Investors, the asset management arm of Principal Financial Group®. In this capacity, she oversees two of Principal Global Investor’s boutique asset management businesses as well as strategy and global marketing and product development for Principal Global Asset Management. She sits on the Boards of Origin Asset Management, Finisterre Capital, and Robust Wealth. Ellen joined Principal Global Investors in 2008 from her previous position as Vice President-Corporate Strategic Development for the Principal Financial Group. Her background includes 15 years at McKinsey & Company, Chicago, as a partner and leader in the firm’s North American insurance practice. Previously, she was an assistant treasurer at J.P. Morgan & Company, Inc. Ellen received an MBA from the University of Chicago and a bachelor’s degree from Johns Hopkins University. 69

John Egan Vice President, Investor Relations John Egan is Vice President, Investor Relations with the Principal Financial Group®. Egan joined Principal® in 2010. Prior to joining the company, he most recently served as Vice President, Investor Relations with Assurant Inc., and Vice President and Financial Analyst with Assurant Asset Management. Egan earned his bachelor’s degree in accounting from Manhattan College and his M.B.A. in finance from St. John’s University. He serves as a board member of Nippon Life Benefits, Operation Downtown Des Moines and is also a member of the National Investor Relations Institute (NIRI). 70

Contact page John Egan Vice President, Investor Relations 515-235-9500 Egan.John@principal.com Eddie Vonnahme This presentation is available on our website: Director, Investor Relations www.principal.com/investor. 515-362-2018 Vonnahme.Eddie@principal.com Mail 711 High Street Cindy Kreuder Des Moines, IA 50392 Assistant Director, Investor Relations 515-235-9757 Kreuder.Cindy@principal.com Lorna Wieskamp Administrative Assistant 515-362-1110 Wieskamp.Lorna@principal.com 71