Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - ENERGIZER HOLDINGS, INC. | d647259dex992.htm |

| EX-99.1 - EX-99.1 - ENERGIZER HOLDINGS, INC. | d647259dex991.htm |

| 8-K - 8-K - ENERGIZER HOLDINGS, INC. | d647259d8k.htm |

Energizer Investor Call November 15, 2018 Exhibit 99.3

Cautionary Note Regarding Forward-Looking Statements This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including without limitation, statements about the expected benefits of the proposed transaction, the manner in which the proposed transaction is expected to be financed and anticipated timing of the completion of the proposed transactions. These forward-looking statements generally are identified by the words “opportunity,” “offers,” “expected,” “intends,” “anticipated” and similar words and expressions. Any statements that are not statements of historical fact should be considered to be forward-looking statements. Any such forward looking statements are made based on information currently known and are subject to various risks and uncertainties. Risks and uncertainties to which these forward-looking statements are subject include, without limitation: (1) the proposed transactions may not be completed on the anticipated terms and timing or at all, (2) required regulatory approvals, including antitrust approvals, are not obtained, or that in order to obtain such regulatory approvals, conditions are imposed that adversely affect the anticipated benefits from the proposed transactions or cause the parties to abandon the proposed transaction, (3) a condition to closing of the proposed transaction may not be satisfied, (4) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the transactions, (5) the ability to obtain or consummate financing or refinancing related to the transactions upon acceptable terms or at all, (6) risks associated with third party contracts containing consent and/or other provisions that may be triggered by the proposed transactions, (7) negative effects of the announcement or the consummation of the transaction on the market price of Energizer’s common stock, (8) the potential impact of unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition and losses on the future prospects, business and management strategies for the management, expansion and growth of Energizer’s operations after the consummation of the transactions and on the other conditions to the completion of the proposed transactions, (9) the risks and costs associated with, and the ability of Energizer to, integrate the businesses successfully and to achieve anticipated synergies, (10) the risk that disruptions from the proposed transactions will harm Energizer’s business, including current plans and operations, (11) risks related to changes and developments in external competitive market factors, such as introduction of new product features or technological developments, development of new competitors or competitive brands or competitive promotional activity or spending, (12) the ability of Energizer to retain and hire key personnel, (13) adverse legal and regulatory developments or determinations or adverse changes in, or interpretations of, U.S. or other foreign laws, rules or regulations, including tax laws, rules and regulations, that could delay or prevent completion of the proposed transactions or cause the terms of the proposed transactions to be modified, and (14) management’s response to any of the aforementioned factors. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to Energizer’s most recent 10-K, 10-Q, 8-K reports and other publicly available filings. Energizer does not assume any obligation to publicly provide revisions or updates to any forward looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Agenda Financial Highlights for the Fourth Quarter and Fiscal 2018 and Outlook for Fiscal 2019 Transformational M & A Update on Spectrum Battery transaction Announcement of Spectrum Global Auto Care acquisition Combined Entity Detailed Review of Fourth Quarter and Fiscal 2018 Results Fiscal 2019 Outlook

Financial Highlights Adjusted Earnings Per Share

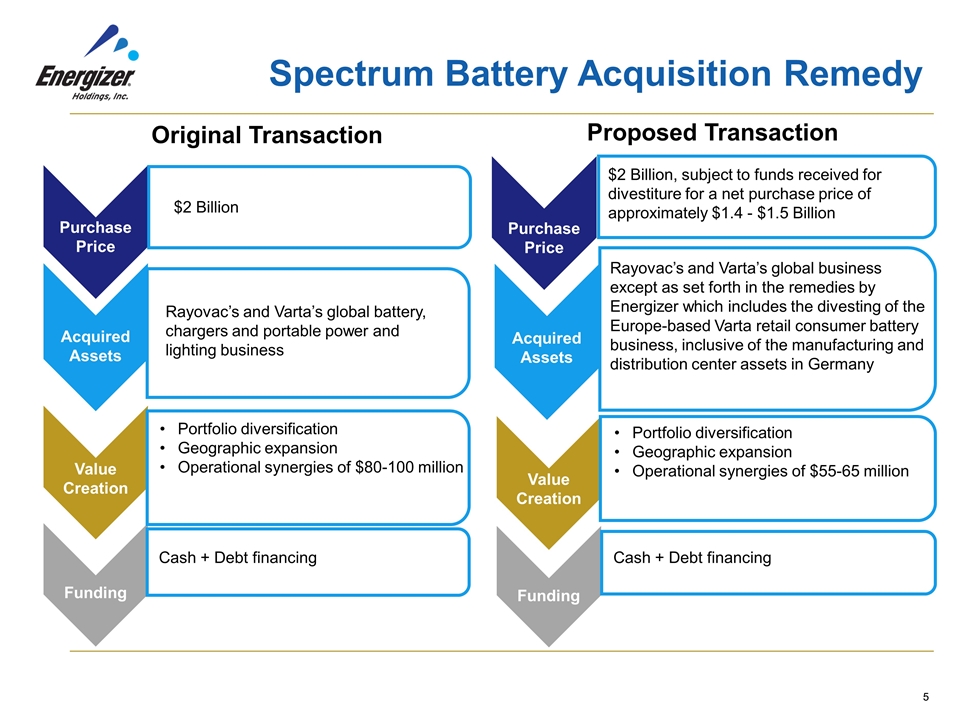

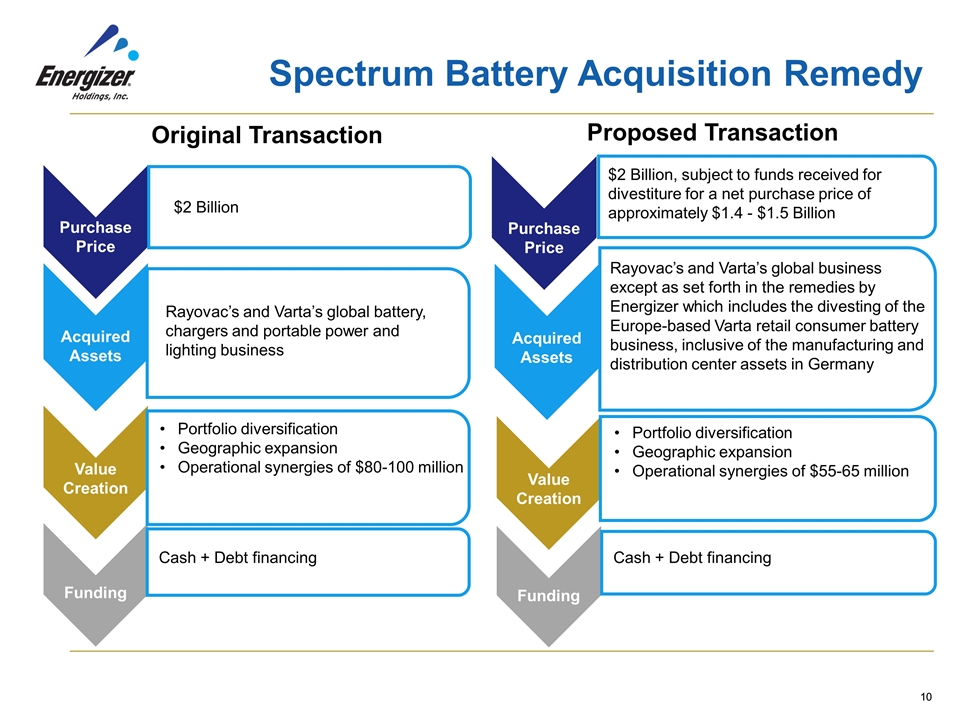

$2 Billion Cash + Debt financing Cash + Debt financing Portfolio diversification Geographic expansion Operational synergies of $55-65 million Rayovac’s and Varta’s global business except as set forth in the remedies by Energizer which includes the divesting of the Europe-based Varta retail consumer battery business, inclusive of the manufacturing and distribution center assets in Germany $2 Billion, subject to funds received for divestiture for a net purchase price of approximately $1.4 - $1.5 Billion Rayovac’s and Varta’s global battery, chargers and portable power and lighting business Portfolio diversification Geographic expansion Operational synergies of $80-100 million 8 Spectrum Battery Acquisition Remedy Original Transaction Proposed Transaction Purchase Price Acquired Assets Value Creation Funding Purchase Price Acquired Assets Value Creation Funding

Spectrum Brands’ Global Auto Care Overview The acquisition of Spectrum’s Global Auto Care creates scale for Energizer’s Global Auto Care platform Strong financial profile and robust free cash flow performance Last twelve months ended June 30, 2018 - Net Sales of $465mm Last twelve months ended June 30, 2018 - Adjusted EBITDA $117mm Operates in large, growing category with strong fundamentals U.S. Category $2.8 billion1 Projected CAGR of 1.8% through 2023 Iconic brands, Armor All®, STP®, and A/C Pro®, with leadership share positions Strong commercial relationships, including captaincy that influences $2 billion in category sales 8 Global Auto Care Overview Source: Spectrum Brands and management estimates 1NPD RTS+RTSX Combined – YTD 2018 (through July)

Spectrum Brands’ Global Auto Care Business Represents a Compelling Opportunity Spectrum Global Auto Care Creates Scale and Strength Operational Enhancements Financial Benefits Expands portfolio of iconic brands and creates a second platform in our auto care segment to drive future growth and expansion Enhances position with customers through commercial expertise and category captaincies Catapults Energizer to a leadership position in the category Free cash flow growth through top line growth and operational improvements Maintains healthy balance sheet while diversifying cash flows and adding scale Enhances our long-term shareholder value proposition Adds state-of-the-art auto care manufacturing facility Drives productivity across integrated supply chain Leverages Energizer’s Marketing and R&D core competencies to accelerate innovation

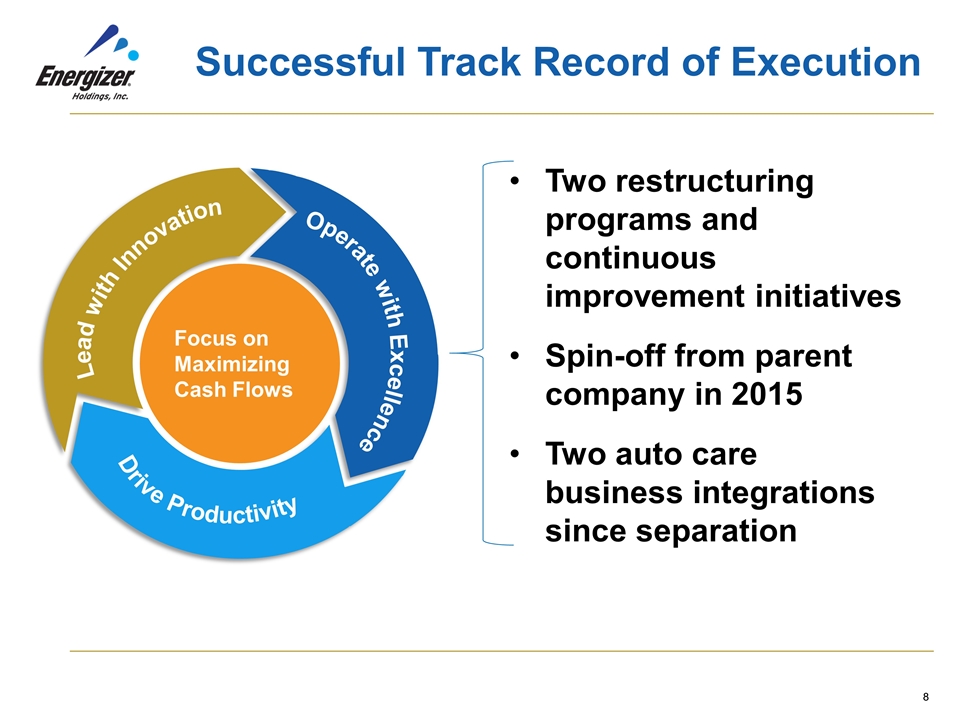

Successful Track Record of Execution Two restructuring programs and continuous improvement initiatives Spin-off from parent company in 2015 Two auto care business integrations since separation 8 Focus on Maximizing Cash Flows Lead with Innovation Operate with Excellence Drive Productivity

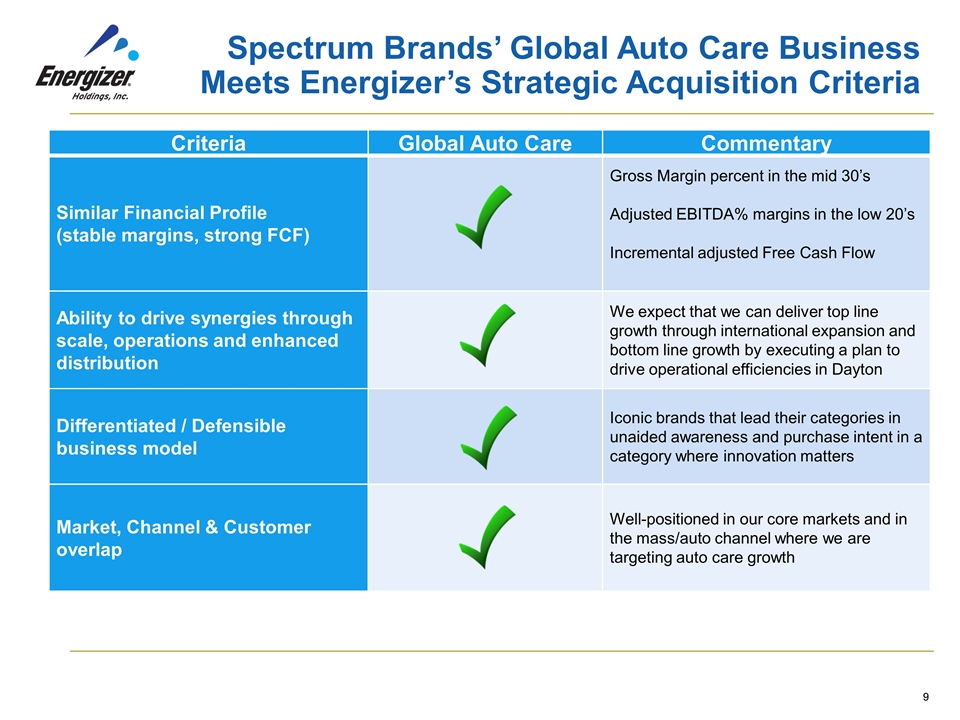

Spectrum Brands’ Global Auto Care Business Meets Energizer’s Strategic Acquisition Criteria 6 Criteria Global Auto Care Commentary Similar Financial Profile (stable margins, strong FCF) Gross Margin percent in the mid 30’s Adjusted EBITDA% margins in the low 20’s Incremental adjusted Free Cash Flow Ability to drive synergies through scale, operations and enhanced distribution We expect that we can deliver top line growth through international expansion and bottom line growth by executing a plan to drive operational efficiencies in Dayton Differentiated / Defensible business model Iconic brands that lead their categories in unaided awareness and purchase intent in a category where innovation matters Market, Channel & Customer overlap Well-positioned in our core markets and in the mass/auto channel where we are targeting auto care growth

$2 Billion Cash + Debt financing Cash + Debt financing Portfolio diversification Geographic expansion Operational synergies of $55-65 million Rayovac’s and Varta’s global business except as set forth in the remedies by Energizer which includes the divesting of the Europe-based Varta retail consumer battery business, inclusive of the manufacturing and distribution center assets in Germany $2 Billion, subject to funds received for divestiture for a net purchase price of approximately $1.4 - $1.5 Billion Rayovac’s and Varta’s global battery, chargers and portable power and lighting business Portfolio diversification Geographic expansion Operational synergies of $80-100 million 8 Spectrum Battery Acquisition Remedy Original Transaction Proposed Transaction Purchase Price Acquired Assets Value Creation Funding Purchase Price Acquired Assets Value Creation Funding

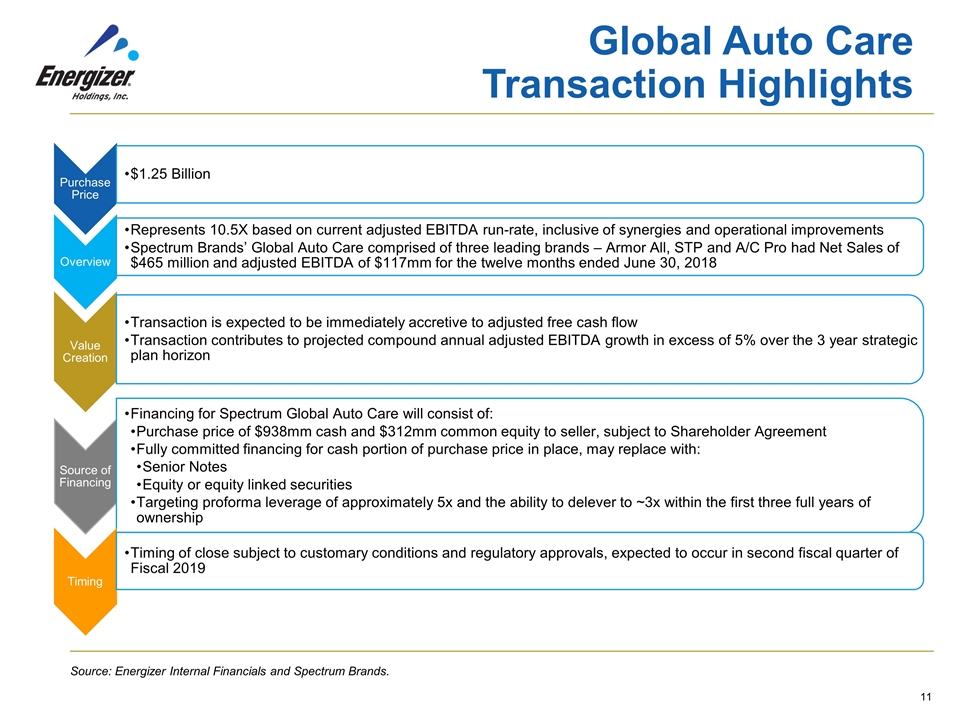

Global Auto Care Transaction Highlights Source: Energizer Internal Financials and Spectrum Brands. Purchase Price $1.25 Billion Overview Represents 10.5X based on current adjusted EBITDA run-rate, inclusive of synergies and operational improvements Value Creation Transaction is expected to be immediately accretive to adjusted free cash flow Spectrum Brands’ Global Auto Care comprised of three leading brands – Armor All, STP and A/C Pro had Net Sales of $465 million and adjusted EBITDA of $117mm for the twelve months ended June 30, 2018 Transaction contributes to projected compound annual adjusted EBITDA growth in excess of 5% over the 3 year strategic plan horizon Source of Financing Financing for Spectrum Global Auto Care will consist of: Timing Timing of close subject to customary conditions and regulatory approvals, expected to occur in second fiscal quarter of Fiscal 2019 Purchase price of $938mm cash and $312mm common equity to seller, subject to Shareholder Agreement Fully committed financing for cash portion of purchase price in place, may replace with: Senior Notes Equity or equity linked securities Targeting proforma leverage of approximately 5x and the ability to delever to ~3x within the first three full years of ownership

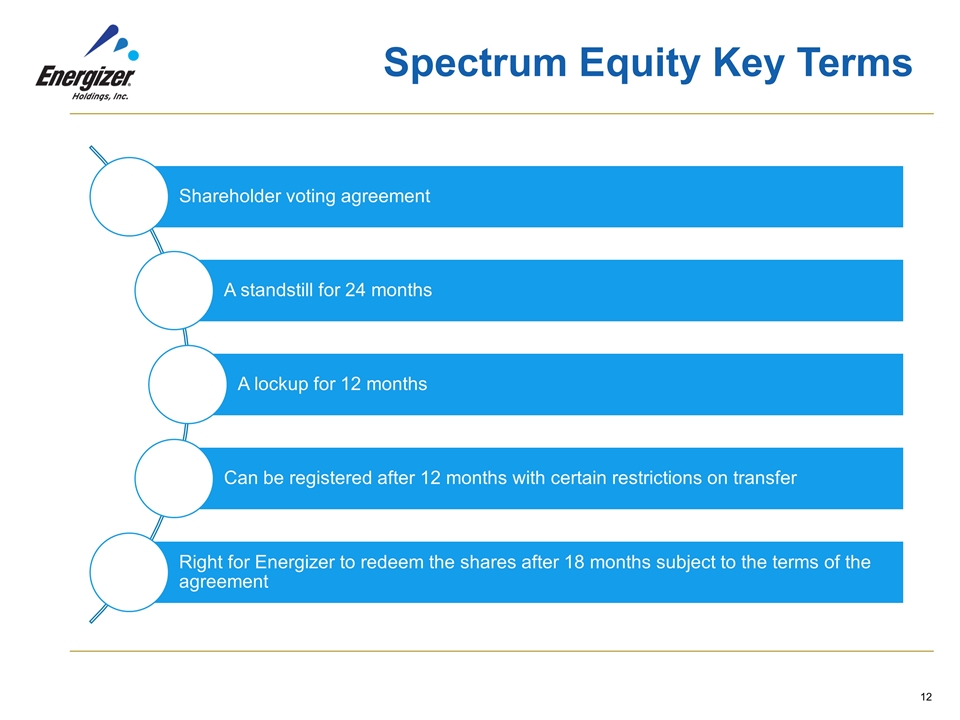

Spectrum Equity Key Terms Shareholder voting agreement A standstill for 24 months A lockup for 12 months Can be registered after 12 months with certain restrictions on transfer Right for Energizer to redeem the shares after 18 months subject to the terms of the agreement

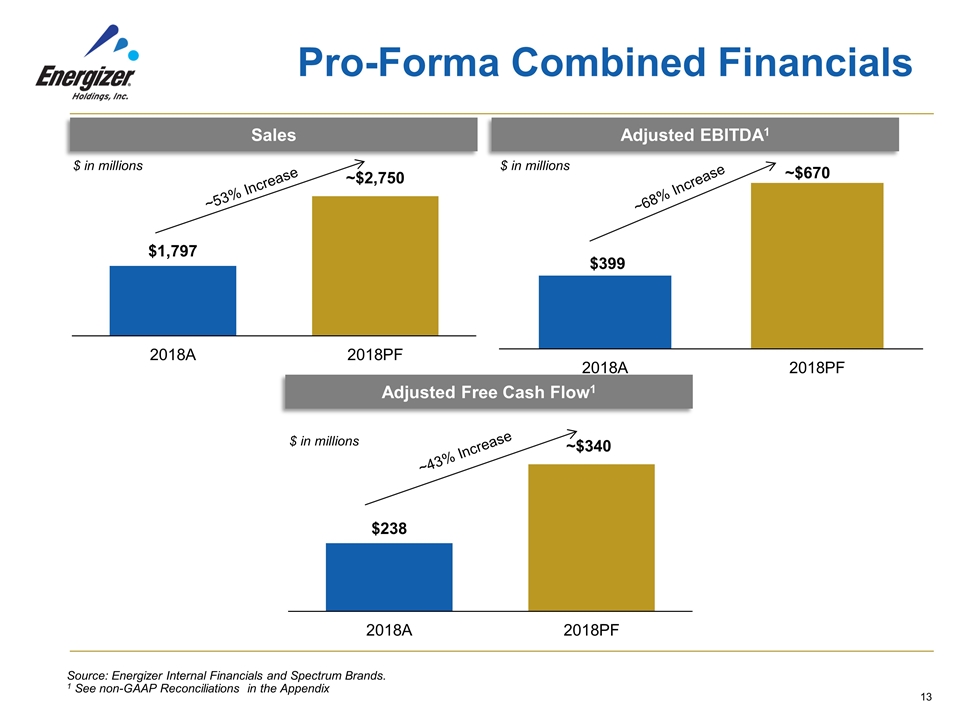

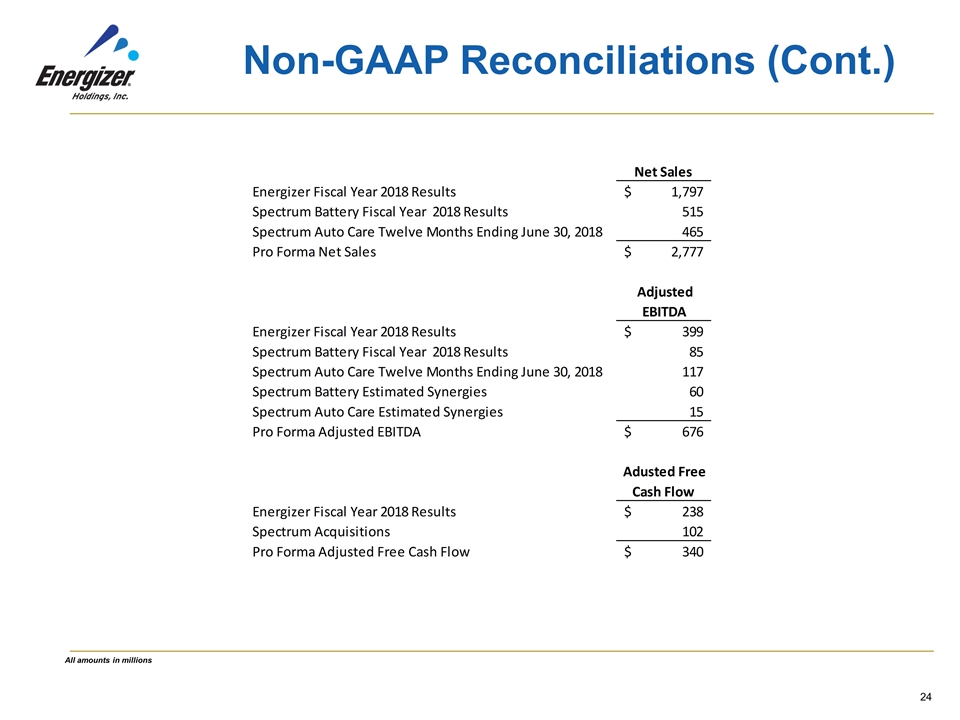

Pro-Forma Combined Financials 13 Sales Adjusted EBITDA1 Adjusted Free Cash Flow1 ~53% Increase ~68% Increase ~43% Increase Source: Energizer Internal Financials and Spectrum Brands. 1 See non-GAAP Reconciliations in the Appendix

Energizer Results and Outlook Fourth Quarter Fiscal 2018 Results Category Performance Category Outlook Fiscal 2019 Outlook

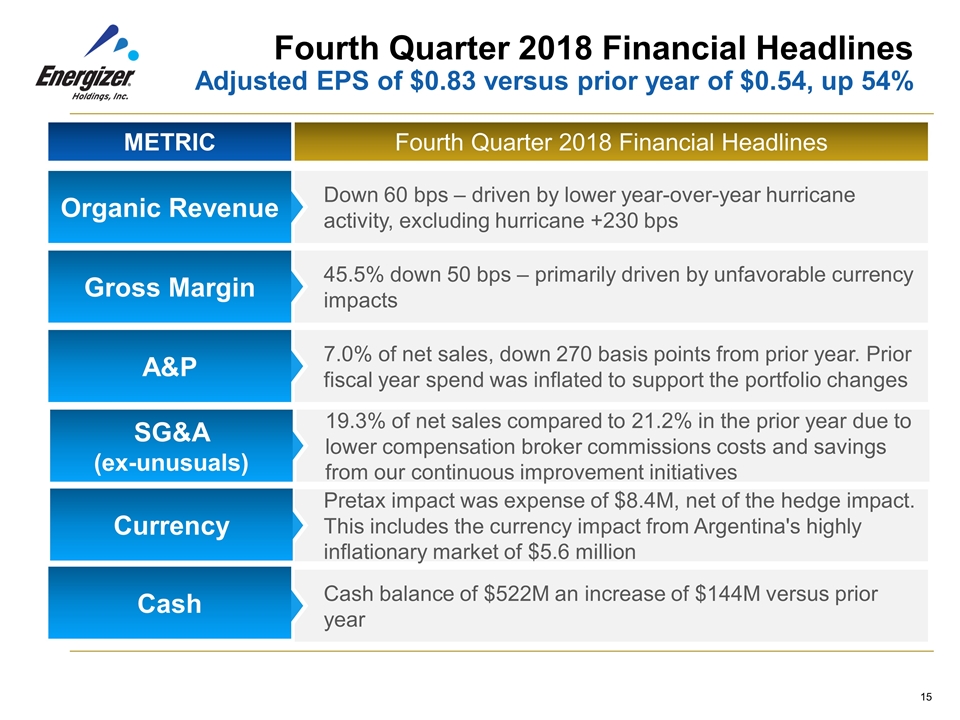

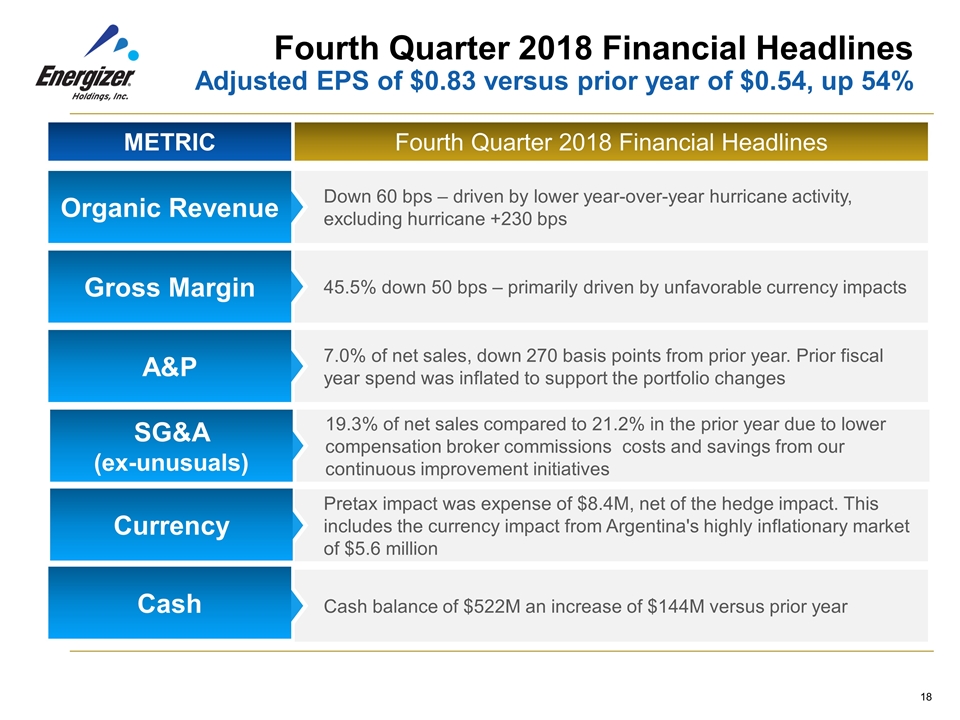

Fourth Quarter 2018 Financial Headlines Adjusted EPS of $0.83 versus prior year of $0.54, up 54% Down 60 bps – driven by lower year-over-year hurricane activity, excluding hurricane +230 bps Organic Revenue 45.5% down 50 bps – primarily driven by unfavorable currency impacts Gross Margin 7.0% of net sales, down 270 basis points from prior year. Prior fiscal year spend was inflated to support the portfolio changes A&P 19.3% of net sales compared to 21.2% in the prior year due to lower compensation broker commissions costs and savings from our continuous improvement initiatives Pretax impact was expense of $8.4M, net of the hedge impact. This includes the currency impact from Argentina's highly inflationary market of $5.6 million Currency Cash balance of $522M an increase of $144M versus prior year Cash METRIC Fourth Quarter 2018 Financial Headlines SG&A (ex-unusuals)

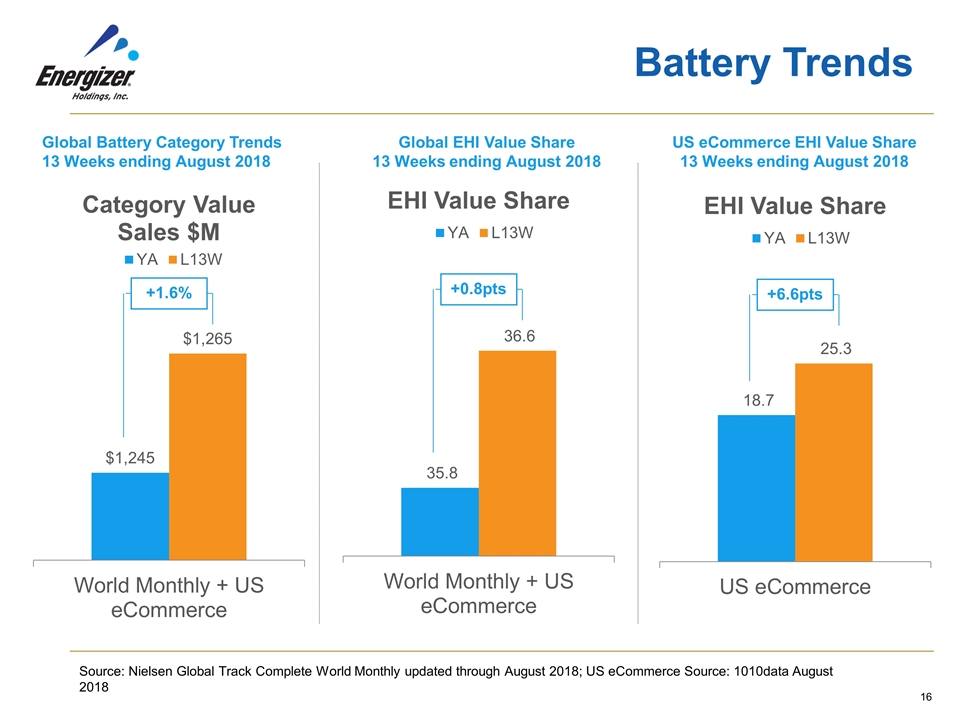

Battery Trends Global Battery Category Trends 13 Weeks ending August 2018 Global EHI Value Share 13 Weeks ending August 2018 US eCommerce EHI Value Share 13 Weeks ending August 2018 +1.6% +0.8pts +6.6pts Source: Nielsen Global Track Complete World Monthly updated through August 2018; US eCommerce Source: 1010data August 2018

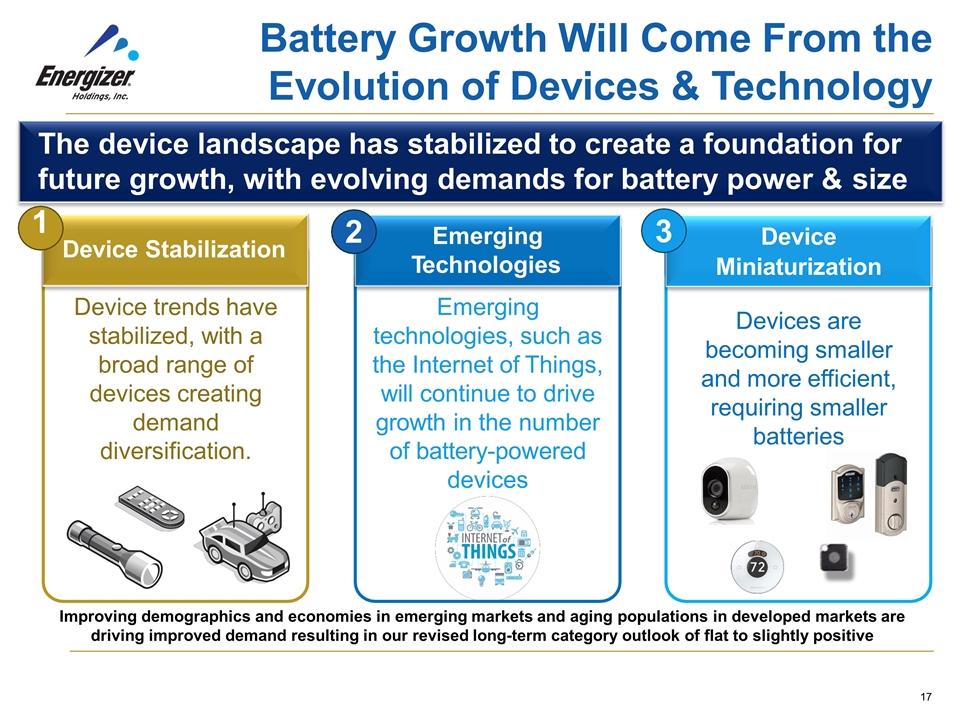

Devices are becoming smaller and more efficient, requiring smaller batteries Emerging technologies, such as the Internet of Things, will continue to drive growth in the number of battery-powered devices Device trends have stabilized, with a broad range of devices creating demand diversification. Battery Growth Will Come From the Evolution of Devices & Technology The device landscape has stabilized to create a foundation for future growth, with evolving demands for battery power & size 1 Device Stabilization Device Miniaturization Emerging Technologies 23 Improving demographics and economies in emerging markets and aging populations in developed markets are driving improved demand resulting in our revised long-term category outlook of flat to slightly positive

Fourth Quarter 2018 Financial Headlines Adjusted EPS of $0.83 versus prior year of $0.54, up 54% Down 60 bps – driven by lower year-over-year hurricane activity, excluding hurricane +230 bps Organic Revenue 45.5% down 50 bps – primarily driven by unfavorable currency impacts Gross Margin 7.0% of net sales, down 270 basis points from prior year. Prior fiscal year spend was inflated to support the portfolio changes A&P 19.3% of net sales compared to 21.2% in the prior year due to lower compensation broker commissions costs and savings from our continuous improvement initiatives Pretax impact was expense of $8.4M, net of the hedge impact. This includes the currency impact from Argentina's highly inflationary market of $5.6 million Currency Cash balance of $522M an increase of $144M versus prior year Cash METRIC Fourth Quarter 2018 Financial Headlines SG&A (ex-unusuals)

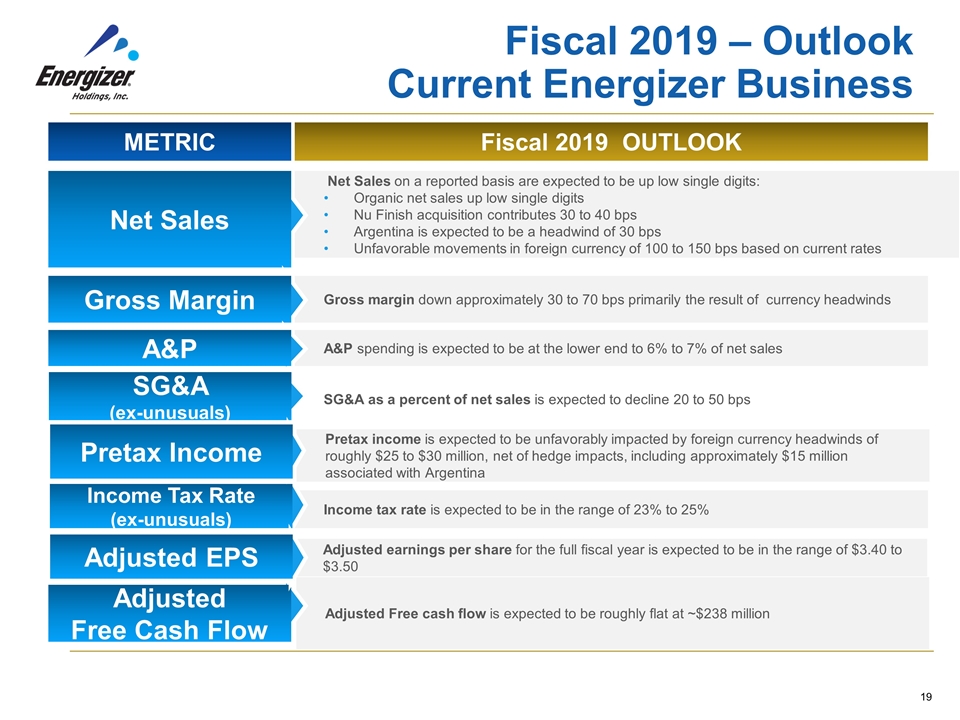

SG&A as a percent of net sales is expected to decline 20 to 50 bps Fiscal 2019 – Outlook Current Energizer Business Net Sales on a reported basis are expected to be up low single digits: Organic net sales up low single digits Nu Finish acquisition contributes 30 to 40 bps Argentina is expected to be a headwind of 30 bps Unfavorable movements in foreign currency of 100 to 150 bps based on current rates Net Sales Gross margin down approximately 30 to 70 bps primarily the result of currency headwinds Gross Margin A&P spending is expected to be at the lower end to 6% to 7% of net sales A&P Pretax income is expected to be unfavorably impacted by foreign currency headwinds of roughly $25 to $30 million, net of hedge impacts, including approximately $15 million associated with Argentina Income tax rate is expected to be in the range of 23% to 25% Adjusted Free cash flow is expected to be roughly flat at ~$238 million Adjusted Free Cash Flow METRIC Fiscal 2019 OUTLOOK SG&A (ex-unusuals) Income Tax Rate (ex-unusuals) Adjusted earnings per share for the full fiscal year is expected to be in the range of $3.40 to $3.50 Adjusted EPS Pretax Income

Q & A

Appendix

2 Non-GAAP Financial Measures Non-GAAP financial measures While the Company reports financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”), this presentation includes non-GAAP measures, including, without limitation, free cash flow, EBITDA and Adjusted EBITDA. We believe these non-GAAP measures provide a meaningful comparison to the corresponding historical or future period, assist investors in performing their analysis, and provide investors with visibility into the underlying financial performance of the Company’s business. The Company believes that these non-GAAP measures are presented in such a way as to allow investors to more clearly understand the nature and amount of the adjustments to arrive at the non-GAAP measure. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. Additionally, these non-GAAP measures may differ from similarly titled measures presented by other companies. A reconciliation of these non-GAAP measures to the nearest comparable GAAP measure is available at the end of this presentation. We are unable to provide a reconciliation of non-GAAP measures of the acquired business due to the carve-out nature of the proposed transaction.

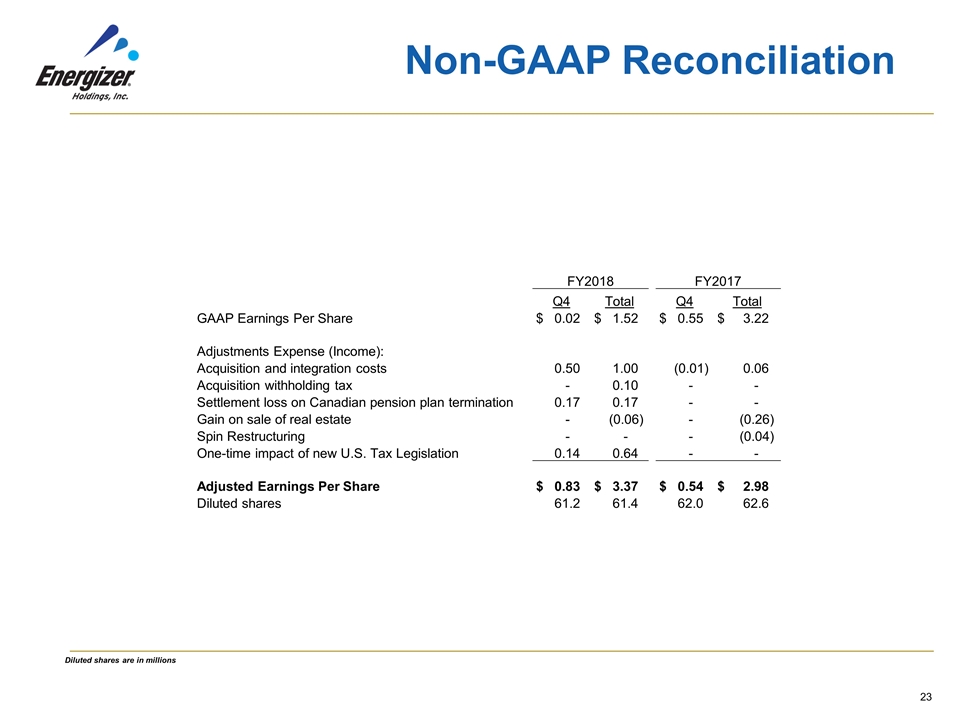

Non-GAAP Reconciliation Diluted shares are in millions FY2018 FY2017 Q4 Total Q4 Total GAAP Earnings Per Share $ 0.02 $ 1.52 $ 0.55 $ 3.22 Adjustments Expense (Income): Acquisition and integration costs 0.50 1.00 (0.01) 0.06 Acquisition withholding tax - 0.10 - - Settlement loss on Canadian pension plan termination 0.17 0.17 - - Gain on sale of real estate - (0.06) - (0.26) Spin Restructuring - - - (0.04) One-time impact of new U.S. Tax Legislation 0.14 0.64 - - Adjusted Earnings Per Share $ 0.83 $ 3.37 $ 0.54 $ 2.98 Diluted shares 61.2 61.4 62.0 62.6

Non-GAAP Reconciliations (Cont.) All amounts in millions

Non-GAAP Reconciliations (Cont.) All amounts in millions Non-GAAP Outlook. For our fiscal year 2019 outlook, the Company is unable to provide reconciliation to the full year Adjusted EPS range of $3.40 to $3.50 and Adjusted Free Cash flow of approximately $238 million to comparable GAAP measures due to the uncertainty regarding the timing and amount of future acquisition and integration costs and related cash payments. Given the uncertainty of the exact closing date, we are unable to forecast the amount of acquisition and integration costs that will be incurred in fiscal 2019.