Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Advanced Emissions Solutions, Inc. | ex991-pradestoacquireacs.htm |

| EX-2.1 - EXHIBIT 2.1 - Advanced Emissions Solutions, Inc. | ex21-purchaseandsalesagree.htm |

| 8-K - 8-K - Advanced Emissions Solutions, Inc. | a8-kitem101901terrainitial.htm |

Advanced Emissions Solutions, Inc. Nasdaq: ADES Advancing Cleaner Energy Carbon Solutions Acquisition and Refined Coal Update November 16, 2018 © 2018 Advanced Emissions Solutions, Inc. All rights reserved.

SAFE HARBOR This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, which provides a “safe harbor” for such statements in certain circumstances. The forward-looking statements include estimated future RC cash flows, projections on ADA Carbon Solutions, LLC (“Carbon Solutions”) revenues, Carbon Solutions’ EBITDA, amount of operating synergies from the potential combination and future RC cash flows, expectations about Carbon Solutions' business opportunities, timing of the closing of the proposed acquisition, the ability to monetize deferred tax assets, and potential transactions with tax-equity investors. These forward-looking statements involve risks and uncertainties. Actual events or results could differ materially from those discussed in the forward-looking statements as a result of various factors including, but not limited to, future demand for Carbon Solutions’ products, our ability to cost-effectively integrate Carbon Solutions and recognize anticipated synergies, the Company’s ability to secure appropriate financing, timing of new and pending regulations and any legal challenges to or extensions of compliance dates of them; as well as other factors relating to our business, as described in our filings with the SEC, with particular emphasis on the risk factor disclosures contained in those filings. You are cautioned not to place undue reliance on the forward-looking statements and to consult filings we have made and will make with the SEC for additional discussion concerning risks and uncertainties that may apply to our business and the ownership of our securities. The forward-looking statements speak only as to the date of this presentation. 2 2

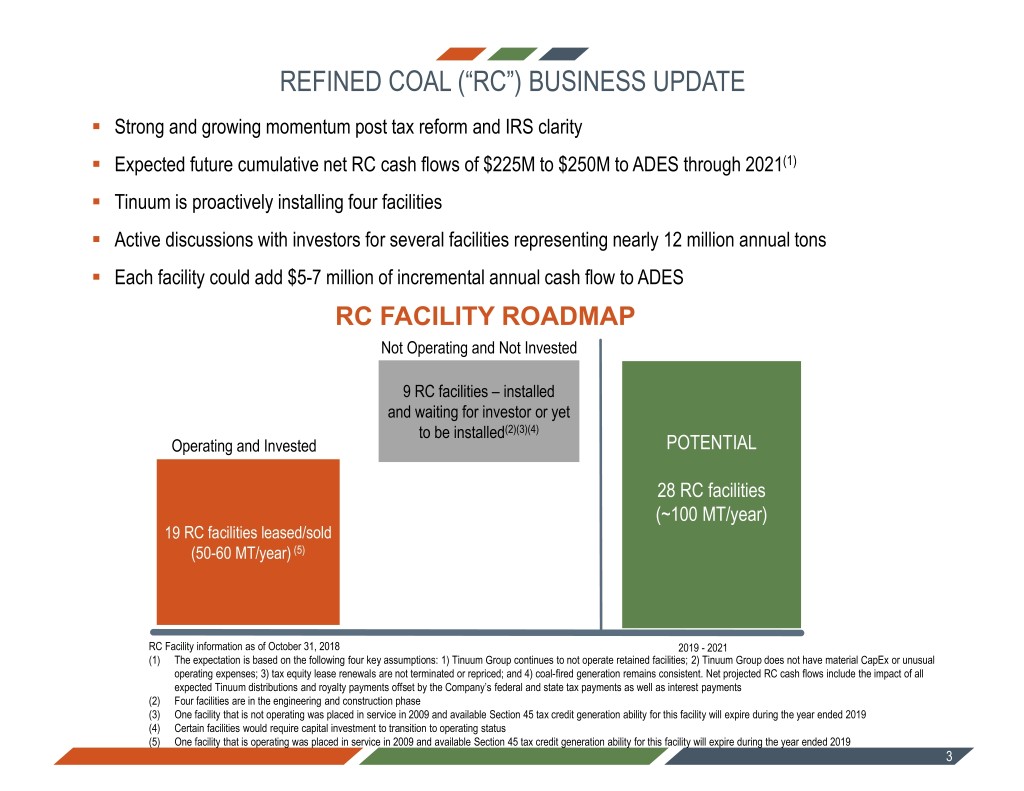

REFINED COAL (“RC”) BUSINESS UPDATE . Strong and growing momentum post tax reform and IRS clarity . Expected future cumulative net RC cash flows of $225M to $250M to ADES through 2021(1) . Tinuum is proactively installing four facilities . Active discussions with investors for several facilities representing nearly 12 million annual tons . Each facility could add $5-7 million of incremental annual cash flow to ADES RC FACILITY ROADMAP Not Operating and Not Invested 9 RC facilities – installed and waiting for investor or yet to be installed(2)(3)(4) Operating and Invested POTENTIAL 28 RC facilities (~100 MT/year) 19 RC facilities leased/sold (50-60 MT/year) (5) RC Facility information as of October 31, 2018 2019 - 2021 (1) The expectation is based on the following four key assumptions: 1) Tinuum Group continues to not operate retained facilities; 2) Tinuum Group does not have material CapEx or unusual operating expenses; 3) tax equity lease renewals are not terminated or repriced; and 4) coal-fired generation remains consistent. Net projected RC cash flows include the impact of all expected Tinuum distributions and royalty payments offset by the Company’s federal and state tax payments as well as interest payments (2) Four facilities are in the engineering and construction phase (3) One facility that is not operating was placed in service in 2009 and available Section 45 tax credit generation ability for this facility will expire during the year ended 2019 (4) Certain facilities would require capital investment to transition to operating status (5) One facility that is operating was placed in service in 2009 and available Section 45 tax credit generation ability for this facility will expire during the year ended 2019 3

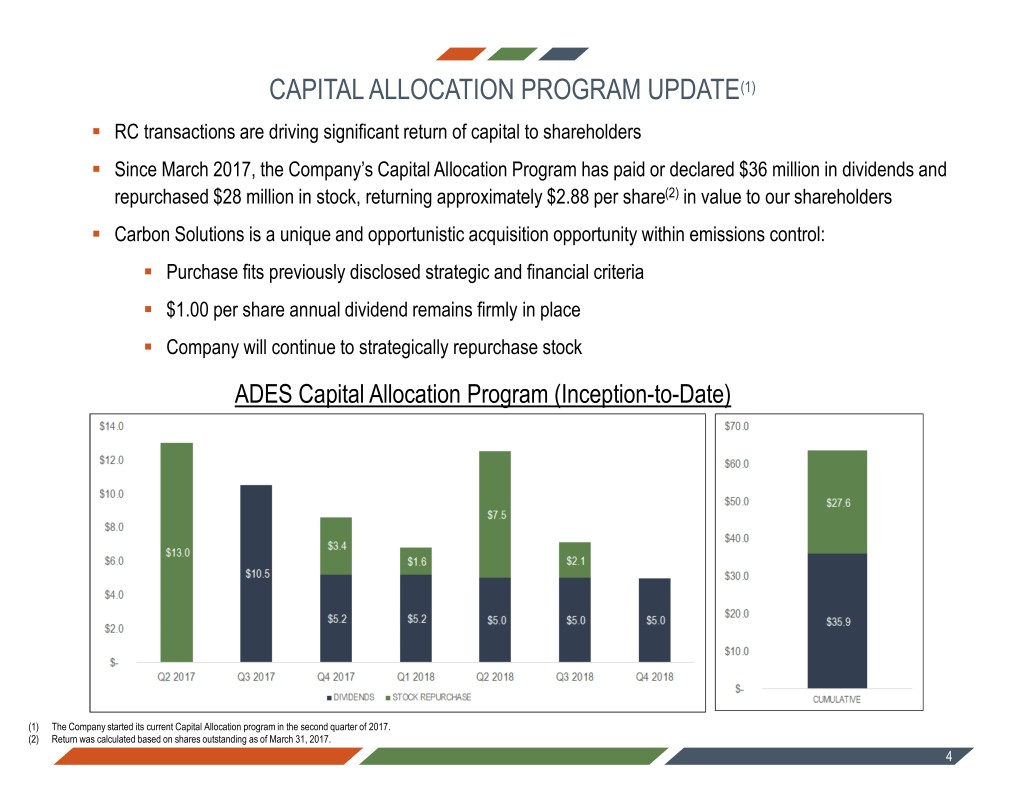

CAPITAL ALLOCATION PROGRAM UPDATE(1) . RC transactions are driving significant return of capital to shareholders . Since March 2017, the Company’s Capital Allocation Program has paid or declared $36 million in dividends and repurchased $28 million in stock, returning approximately $2.88 per share(2) in value to our shareholders . Carbon Solutions is a unique and opportunistic acquisition opportunity within emissions control: . Purchase fits previously disclosed strategic and financial criteria . $1.00 per share annual dividend remains firmly in place . Company will continue to strategically repurchase stock ADES Capital Allocation Program (Inception-to-Date) (1) The Company started its current Capital Allocation program in the second quarter of 2017. (2) Return was calculated based on shares outstanding as of March 31, 2017. 4

Acquisition of Carbon Solutions 5

TRANSACTION OVERVIEW . North American mercury control powdered activated carbon (“PAC”) leader with 45% market share ADA-CS (“Carbon . Nearly $400 million of initial capital investment Solutions”) Overview . Industry-leading products supported by world-class research & development (“R&D”) . Vertically-integrated, automated supply chain drives industry’s lowest cost of production . $75 million purchase price represents a 4.2x multiple of adjusted pro forma EBITDA – $65 million cash payment – Assumption of $10 million in capital equipment leases . Financed through a new $70 million secured term loan Deal Terms – Secured by ADES assets (including cash flows from Tinuum) – Attractive coupon and favorable call protection – Three year tenor; expected weighted life of ~two years . Standard and customary closing conditions and expected to close by end of 2018 . $73 million of adjusted pro forma revenue . Tangible SG&A-driven operating synergies of $2 to $3 million Summary Financials(1) . (Pro-forma, projected 2018) $18 million adjusted pro forma EBITDA including recently signed long-term customer contracts and operating synergies . $8 million normalized CapEx . Under utilized strategic asset with 65%+ contribution margins Growth Opportunity(1) . Continued organic growth in mercury control . Opportunity for growth in adjacent activated carbon products 6 (1) See Appendix for definitions and reconciliations of non-GAAP measures

CARBON SOLUTIONS – COMPANY OVERVIEW . Vertically integrated mercury control PAC leader with approximately 45% market share . Long-term requirements-based contracts with blue-chip utilities . Uniquely-configured asset base drives industry’s lowest cost of production with immediate growth opportunities Five Forks Red River Headquarters Lignite Mine Plant Distribution Littleton, CO Saline, LA Coushatta, LA Natchitoches, LA . Corporate Offices . Ground-leased lignite mine . Primary carbon activation . Packaging and transportation . Sales, R&D, and Services provides reliable source of and processing plant . Strategically located near high-quality materials . ~30 employees . 200 million pounds rail-spur . 40+ years of supply production capacity . Located ~five miles from . Enables efficient, just-in-time ADES . Sub-contracted operations . Supplemental income from national distribution through North American Coal excess power . 6,000 points of automation . ~90 non-union FTEs 7

SUSTAINABLE COMPETITIVE ADVANTAGE IN MERCURY CONTROL . Nearly ~$400 million of initial capital investment Cost Advantage Grows with creates cost and quality leadership: Higher Utilization . Vertically integrated coal source . Self-sustaining power turbine Competitor A . Highly automated plant operations Competitor B . Non-unionized workforce 15 TO 20% UNIT COST . Unique configuration drives cost leadership despite ADVANTAGE EVEN WITH LOWER UTILIZATION RATE lower utilization rate . Low-cost operator status enables continued market leadership in commodity and specialty products PRODUCTION COSTPER POUND Carbon Solutions . Competitors operating at >85% capacity and focused on other activated carbon markets 45% 55% 65% 75% 85% 95% PLANT UTILIZATION RATE Source: Internal estimates based upon publicly available information 8

ORGANIC GROWTH OPPORTUNITIES IN MERCURY CONTROL SERVICE AND COMBINATIONS PAC CAPACITY & PRICING . Mercury control consumables market, exclusive of . Concentrated market where competitors have switched refined coal, is $200- $250 million annually market focus or shuttered capacity . PAC is the dominant product used by coal-fired utilities to . PAC market supply and demand re-balancing control toxic mercury emissions . Carbon Solutions well-positioned to gain market share . Carbon Solutions is the market leader in PAC . Continued operating momentum as evidenced by new . Pro forma ADES platform with three leading mercury blue-chip customer wins control products for coal-fired utilities Mercury Control Consumable Products Other Mercury Control PAC Share by Supplier 4% Carbon Scrubber Solutions PAC Competitor A Additive 45% 71% 22% 9% Halogen 16% Competitor B Other 28% Competitors Source: Internal estimate based upon public information, current industry pricing and understanding of market share 5% 9

ORGANIC GROWTH OPPORTUNITIES IN MERCURY CONTROL REFINED COAL EXPIRATION . The market will expand as Section 45 tax credits expire at the end of 2019 and 2021 . Nearly 75 plants generating approximately 175 million tons of RC in operation today . As RC units expire, these large coal-fired utilities will seek competitive solutions to help comply with mercury control regulations . Based on today’s plant configurations, this shift will drive material incremental consumables volumes . ADES uniquely positioned given ownership in Tinuum and 30+ years of industry experience . Opportunity to capture share of $35 - $45 million annual market as refined coal units retire PREMIUM PRODUCTS . Carbon Solutions has market leading R&D expertise to drive growth through premium solutions . Recent wins involving premium products allow customers to overcome challenging operating conditions and meet state and federal mercury regulations . Engineered, collaborative solutions drive customer loyalty . Premium products command higher price and margin Source: Internal estimate based upon public information, current industry pricing and understanding of market share 10

GROWTH OPPORTUNITIES TODAY TOMORROW Continue to gain market share and margin Pursue higher margin and higher growth Mercury Removal Municipal Water Broader Water Market Adjacent Segments & International Expansion . . Carbon Solutions can and . Positioned for continued Opportunity to leverage . Regenerated Carbon profitable growth due to does compete, albeit Carbon Solutions’ best-in- maintained market minimally, without any class production facility and . Chemicals and Food incremental plant leadership and stable make investments to . International Mercury investment demand as prices stabilize capture broader Control . Gain additional share . However, additional commercial and consumer through premium products, feedstock sourcing is market cost advantage and RC necessary transition CURRENT PLANT CONFIGURATION INVESTMENT NEEDED 11

INDUSTRY INFLECTION POINT . Thermal coal volumes and pricing have stabilized – Volumes have declined from 980mm tons in 2010 to 680mm tons in 2017 – Surviving fleets better-positioned with lower leverage – EIA(1) expects thermal coal to contribute ~30% of nation’s power by 2030 PAC Market Rationalization . Capacity reductions have rationalized the market; low-cost leader wins – Coal-fired power market volatility has impacted supply chain – Pricing declines have driven capacity closures and product shifts – Improved solutions-driven environment . Ability to create significant shareholder value through opportunistic, strategic M&A . Unique insight into the asset and markets served Unique, Strategic M&A Opportunity . Utilization of tax assets accumulated through ADES’ historical investment in RC . Emissions Control product offerings are sub-scale on a stand-alone but can enhance market share growth when coupled with Carbon Solutions (1) EIA stands for Environmental Impact Assessment 12

CARBON SOLUTIONS SELECT FINANCIAL METRICS STRONG & STABLE FINANCIAL PROFILE TOTAL VOLUME (MM OF LBS.) . Mercury Control PAC market operates on two to 110 three year requirements-based contracts 105 93 92 . Recent wins in high-performance products support 2015 2016 2017 2018 E modest 2019 growth expectations TOTAL REVENUES ($MM) (1) . Adjusted EBITDA margins averaged more than 20% over the last three years $80 $73 – Market pricing stabilized $72 $69 – Synergies offer accretion opportunity 2015 2016 2017 2018 E (1) . $8 million normalized CapEx ADJUSTED EBITDA ($MM) AND MARGIN (%) . Rapid de-leveraging through Tinuum cash flows; three year loan tenor with weighted life ~two years $20 $18 $14 $12 . Attractive acquisition financing supports continued 2015 2016 2017 2018 E Capital Allocation Program 20% 25% 17% 24% Adjusted Margin (%) (1) See Appendix for definitions and reconciliations of non-GAAP measures 13

NEW PLATFORM & EXPANDED EMISSIONS CONTROL LEADERSHIP Advanced Emissions Solutions NASDAQ: ADES Tinuum Group (42.5% stake) ADA-ES (100%) Carbon Solutions (100%) . Strong projected RC cash flows . Chemicals for coal-fired utilities . PAC for coal-fired utilities, industrials and WaterPAC . 9 remaining facilities . Includes M-Prove™ Technolgies . 7 issued or allowed and 22 pending . Four RC facilities in the . 44 US patents, 12 pending patents in U.S., Canada and China installation phase . 5 international patents, 7 pending . 2018E Adjusted revenue of $73 million . Active discussions with and Adjusted EBITDA of $18 million(1) potential investors for 12 million tons Tinuum Brings: ADES and ADA-ES Bring: Carbon Solutions Brings: Stable and growing cash flows Public platform Leading PAC operation Supports capital allocation plan Tax assets Strong technical and leadership team RC knowledge and customer base Complimentary products Proven sales organization Open COO position (1) See Appendix for definitions and reconciliations of non-GAAP measures 14

CARBON SOLUTIONS INVESTMENT RATIONALE 1 2 3 Market Leader Strategic Asset Base Industry Inflection 45% share in North American mercury Built for a larger MATS market, with Smaller players exiting & larger control activated carbon market nearly $400 million of investment competitors shuttering/moving capacity to adjacent markets Recurring revenue; multi-year Low-cost operator requirements-based contracts Carbon Solutions recently re-signed Estimated $2-3 million run rate new contracts with more attractive (1) R&D driving momentum in premium, synergies per year by 2Q19 terms specialty product Avg. 3-yr. Adjusted EBITDA margin >20%, 65%+ Contribution margin(1) 4 5 Growth-Oriented Assets Unique Strategic Fit Large, under-utilized plant Founding investor and owner of Carbon Solutions Advantaged low-cost PAC position Tangible SG&A-driven operating and Mercury control growth through share potential revenue synergies gains and refined coal sunset Utilize existing tax assets Long-term opportunities in adjacent activated carbon markets (1) See Appendix for definitions and reconciliations of non-GAAP measures 15

Appendix 16

ACTIVATED CARBON MARKET OVERVIEW . Raw materials (coal, coconut shells & wood) processed to become porous and absorptive; used in a variety of consumer and industrial applications to remove harmful gases, vapors and solids Market Overview . North American Activated Carbon market is ~750mm pounds, growing ~3% annually . Primary market competitors include Calgon/Kuraray and Cabot . Leadership and focus in Mercury Control Activated Carbon PAC Market Segments (750mm lbs.) . Carbon Solutions has under-utilized Chemical capacity that we believe can be re- & Other configured to penetrate adjacent Food 8% 7% Water Carbon Solutions markets with higher growth and margins Treatment Air & Gas 37% Positioning . Calgon/Kuraray capacity focused on - Other higher growth and margin water market 11% . Cabot reduced plant capacity in 2017 Air & Gas - Mercury and de-emphasized segment and utilize Control significant portions of existing capacity to 37% pursue other markets Source: IHS Chemical Activated Carbon Chemical Economics Handbook 15 June 2017 17

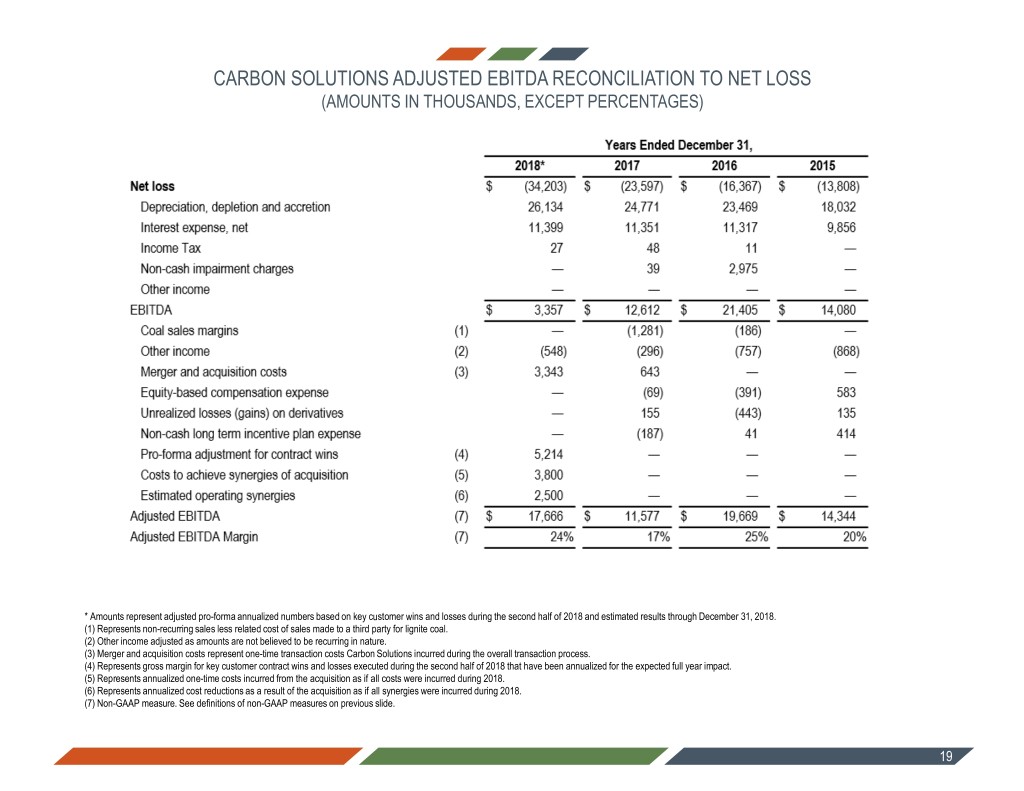

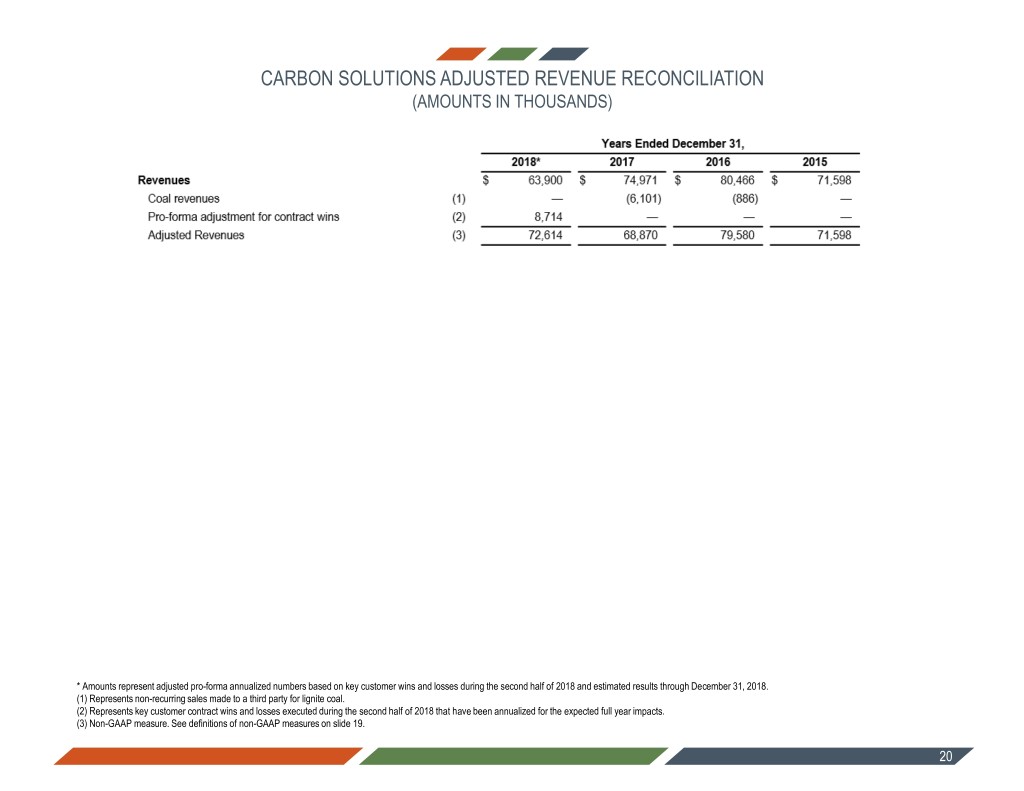

DISCLOSURE REGARDING NON-GAAP FINANCIAL MEASURES AND USE OF PROJECTIONS Note on Non-GAAP Financial Measures To supplement the Carbon Solutions financial information presented in accordance with U.S. generally accepted accounting principles, or GAAP, the Investor Presentation includes non-GAAP measures of certain financial performance. These non-GAAP measures include Adjusted EBITDA, Adjusted EBITDA margin, Adjusted revenue and Contribution margin. The Company included non-GAAP measures because management believes that they help to facilitate comparisons of Carbon Solutions’ operating results between periods. The Company believes the non-GAAP measures provide useful information to both management and users of the financial statements by excluding certain expenses, gains and losses that may not be indicative of core operating results and business outlook. These non-GAAP measures are not in accordance with, or an alternative to, measures prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. These measures should only be used to evaluate Carbon Solutions’ results of operations in conjunction with the corresponding GAAP measures. The Company has defined Adjusted EBITDA, as it relates to this transaction, as EBITDA (consolidated net income before depreciation, depletion and accretion, interest expense, net, income taxes and non-cash impairment charges each of which is presented in the tables included earlier in this presentation), adjusted for the impact of the following items that are either non-cash or that the Company does not consider representative of its ongoing operating performance: coal sales profit, other income, mergers and acquisition costs, equity-based compensation expense, unrealized losses (gains) on derivatives, non-cash long term incentive plan expense and pro-forma adjustment for contract wins. The Company has defined Adjusted EBITDA margin as Adjusted EBITDA, as defined above, over Adjusted revenue, as defined below. Because Adjusted EBITDA and Adjusted EBITDA margin omit certain non-cash items and other non-recurring cash charges or other items, the Company believes that each measure is less susceptible to variances that affect Carbon Solutions’ operating performance resulting from depreciation, amortization and other non-cash and non-recurring cash charges or other items. The Company presents Adjusted EBITDA and the related Adjusted EBITDA margin because the Company believes they are useful as supplemental measures in evaluating the performance of Carbon Solutions’ operating businesses and provides greater transparency into Carbon Solutions results of operations. The Company's management uses Adjusted EBITDA and Adjusted EBITDA margin as factors in evaluating the performance of Carbon Solutions for this transaction. Adjusted EBITDA and Adjusted EBITDA margin have limitations as analytical tools, and you should not consider these measures in isolation or as a substitute for analyzing Carbon Solutions’ results as reported under GAAP. The Adjusted EBITDA guidance does not include certain charges and costs. The adjustments to EBITDA in future periods are generally expected to be similar to the kinds of charges and costs excluded from Adjusted EBITDA for this transaction, but may not be identical as the Company continues to evaluate what information is most beneficial to investors. The exclusion of these charges and costs in future periods may have a significant impact on the Company's Adjusted EBITDA. Adjusted revenue is calculated as Revenues adjusted for the impact of the coal revenues. When used in conjunction with GAAP financial measures, Adjusted revenue is a supplemental measure of operating performance that management believes is a useful measure to evaluate Carbon Solutions’ performance relative to the performance of its competitors as well as performance period over period. Additionally, the Company believes that each measure is less susceptible to variances that affect its operating performance results. Contribution Margin is calculated as gross margin plus fixed cost and depreciation. Use of Projections This Investor Presentation, referred to above, contains financial projections with respect to Carbon Solutions’ estimated adjusted pro-forma revenues, adjusted EBITDA and adjusted EBITDA margin for Carbon Solutions’ fiscal year ending December 31, 2018, all of which are non-GAAP measures. Neither ADES’s independent auditors nor the independent auditors of Carbon Solutions audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Investor Presentation and, accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Investor Presentation. These projections should not be relied upon as being necessarily indicative of future results. In this Investor Presentation, certain of the above-mentioned projected financial information has been repeated (in each case, with an indication that the information is an estimate and is subject to the qualifications presented herein), for purposes of providing comparisons with historical data. The assumptions and estimates underlying the prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. Accordingly, there can be no assurance that the prospective results are indicative of the future performance of ADES or Carbon Solutions or that actual results will not differ materially from those presented in the prospective financial information. Inclusion of the prospective financial information in this Press Release and related Investor Presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved. 18

CARBON SOLUTIONS ADJUSTED EBITDA RECONCILIATION TO NET LOSS (AMOUNTS IN THOUSANDS, EXCEPT PERCENTAGES) * Amounts represent adjusted pro-forma annualized numbers based on key customer wins and losses during the second half of 2018 and estimated results through December 31, 2018. (1) Represents non-recurring sales less related cost of sales made to a third party for lignite coal. (2) Other income adjusted as amounts are not believed to be recurring in nature. (3) Merger and acquisition costs represent one-time transaction costs Carbon Solutions incurred during the overall transaction process. (4) Represents gross margin for key customer contract wins and losses executed during the second half of 2018 that have been annualized for the expected full year impact. (5) Represents annualized one-time costs incurred from the acquisition as if all costs were incurred during 2018. (6) Represents annualized cost reductions as a result of the acquisition as if all synergies were incurred during 2018. (7) Non-GAAP measure. See definitions of non-GAAP measures on previous slide. 19

CARBON SOLUTIONS ADJUSTED REVENUE RECONCILIATION (AMOUNTS IN THOUSANDS) * Amounts represent adjusted pro-forma annualized numbers based on key customer wins and losses during the second half of 2018 and estimated results through December 31, 2018. (1) Represents non-recurring sales made to a third party for lignite coal. (2) Represents key customer contract wins and losses executed during the second half of 2018 that have been annualized for the expected full year impacts. (3) Non-GAAP measure. See definitions of non-GAAP measures on slide 19. 20