Attached files

| file | filename |

|---|---|

| EX-23 - Beam Global | ex23_1.htm |

| EX-4.4 - FORM OF REPRESENTATIVE WARRANT - Beam Global | ex4_4.htm |

| EX-4.3 - FORM OF WARRANT AGENCY AGREEMENT - Beam Global | ex4_3.htm |

| EX-4.2 - FORM OF INVESTOR WARRANT - Beam Global | ex4_2.htm |

| EX-1 - FORM OF UNDERWRITING AGREEMENT - Beam Global | ex1_1.htm |

As filed with the Securities and Exchange Commission on November 14 , 2018

Registration No. 333-226040

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

PRE-EFFECTIVE AMENDMENT NO. 2

TO

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENVISION SOLAR INTERNATIONAL, INC.

(Name of Registrant in its Charter)

| Nevada | 3674 | 26-1342810 |

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

5660 Eastgate Dr., San Diego, California 92121

Telephone: (858) 799-4583

(Address and telephone number of principal executive offices)

Desmond Wheatley

Chief Executive Officer

5660 Eastgate Dr.

San Diego, California 92121

Telephone: (858) 799-4583

(Name, address and telephone number of agent for service)

Copies to:

|

Mark J. Richardson, Esq. Richardson & Associates 1453 Third Street Promenade, Suite 315 Santa Monica, California 90401 (310) 393-9992

|

Barry I. Grossman, Esq. Sarah E. Williams, Esq. Jonathan H. Deblinger, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas, 11th Floor New York, New York 10105 (212) 370-1300 |

Approximate Date of Proposed Sale to the Public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | [ ] | Accelerated filer | [ ] |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] |

| Emerging Growth Company | [ ] |

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1) |

Amount of Registration Fee |

| Units consisting of shares of Common Stock, par value $0.001 per share, and Warrants to purchase shares of Common Stock, par value $0.001 per share (2) | $11,500,000 | $1,431.75 |

| Common Stock included as part of the Units | Included with Units above | ___ |

| Warrants to purchase shares of Common Stock included as part of the Units (3) | Included with Units above | ___ |

| Representatives’ Warrant to purchase Common Stock (3) | ___ | ___ |

| Shares of Common Stock issuable upon exercise of the Warrants (4)(5) | [$ ] | [$ ] |

| Shares of Common Stock issuable upon exercise of Representatives’ Warrants (5)(6) | [$ ] | [$ ] |

| TOTAL | [$ ] | [$] |

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes Units which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| (3) | In accordance with Rule 457(g) under the Securities Act, because the shares of the Registrant’s common stock underlying the Warrants and Representative’s warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby. |

| (4) | There will be issued [ ] warrants to purchase [ ] share[s] of common stock for every [ ] shares of common stock offered. The warrants are exercisable at a per share price of [ %] of the common stock public offering price. |

| (5) | Includes shares of common stock which may be issued upon exercise of additional warrants which may be issued upon exercise of 45-day option granted to the underwriters to cover over-allotment, if any. |

| (6) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The Representative’s warrants are exercisable at a per share exercise price equal to 110% of the public offering price. As estimated solely for the purpose of recalculating the registration fee pursuant to Rule 457(g) under the Securities Act, the proposed maximum aggregate offering price of the Representative’s warrants is [$ ], which is equal to 110% of [$ ] ([ %] of [$]). |

In the event of a stock split, stock dividend, or similar transaction involving the common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION, DATED NOVEMBER 14, 2018

ENVISION SOLAR INTERNATIONAL, INC.

[ ] Units

Each Unit Consisting of

[_____] Share[s] of Common Stock (par value $0.001)

and

[___] Warrant[s] to Purchase up to [___] Share[s] of Common Stock,

at [$______] per Unit

This is a firm commitment public offering of [______] Units, each Unit consisting of [ ] share[s] of common stock, $0.001 par value per share, and [ ] warrant[s] to purchase [____] share[s] of common stock, of Envision Solar International, Inc., a Nevada corporation. Each warrant is immediately exercisable for one share of common stock at an exercise price of $_____ per share (or __% of the price of each share of common stock sold in the offering) and will expire five years from the date of issuance. The Units will not be certificated and the shares of common stock and the warrants comprising such Units are immediately separable and will be issued separately in this offering.

Our common stock is presently traded on the OTC-QB Market, operated by OTC Markets Group, under the symbol “EVSI.” We have applied to have our common stock and warrants listed on The NASDAQ Capital Market under the symbols “EVSI” and “EVSIW”, respectively. No assurance can be given that our application will be approved. On ______, 2018, the last reported sales price for our common stock as quoted on the OTC-QB Market was $[ ] per share. Quotes of stock trading prices on an over-the-counter marketplace may not be indicative of the market price on a national securities exchange.

The share and per share information in this prospectus does not reflect , except where specifically indicated, a proposed reverse stock split of the authorized and outstanding common stock of 1-for- [_] to occur on or before the offering.

In reviewing this prospectus, you should carefully consider the matters described in the section titled “Risk Factors” beginning on page [ ] of this prospectus. INVESTORS SHOULD ONLY CONSIDER AN INVESTMENT IN THESE SECURITIES IF THEY CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Share | Total | |

| Public offering price | $ | $ |

| Underwriting discounts and commissions (1) | $ | $ |

| Proceeds to us before offering expenses (2) | $ | $ |

| (1) | Does not reflect additional compensation to the underwriters in the form of warrants to purchase up to ____ shares of common stock (assuming the over-allotment option is fully exercised) at an exercise price equal to 110% of the public offering price. We have also agreed to reimburse the underwriters for certain expenses. See “Underwriting” on page ___ of this prospectus for a description of these arrangements. |

| (2) | We estimate the total expenses of this offering will be approximately $____. Assumes no exercise of the over-allotment option we have granted to the Underwriters as described below. |

We have granted the underwriters a 45-day option to purchase up to _____ additional shares of common stock and/or [ ] warrants.

The underwriters expect to deliver our shares and warrants to purchasers in the offering on or about _______, 2018.

Maxim Group LLC

You should rely only on information contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus or in any free writing prospectus. Neither the delivery of this prospectus nor the sale of our securities means that the information contained in this prospectus or any free writing prospectus is correct after the date of this prospectus or such free writing prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our securities in any circumstances under which the offer or solicitation is unlawful or in any state or other jurisdiction where the offer is not permitted.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus and the information in any free writing prospectus that we may provide you in connection with this offering is accurate only as of the date of that free writing prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us.

Through and including ______, 2018 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

CAUTIONARY STATEMENT CONCERNING FORWARD LOOKING STATEMENTS

Some of the statements in this prospectus and in the documents incorporated herein by reference contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our ability to control or predict and that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue” or the negative of these terms or other comparable terminology.

Forward-looking statements are inherently subject to risks and uncertainties, many of which we cannot predict with accuracy and some of which we might not even anticipate. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at the time made, we can give no assurance that such expectations will be achieved. Actual events or results may differ materially. Readers are cautioned not to place undue reliance on forward-looking statements. We have no duty to update or revise any forward-looking statements after the date of this prospectus or to conform them to actual results, new information, future events or otherwise.

The following factors, among others, could cause our and our industry’s future results to differ materially from historical results or those anticipated:

| · | adverse economic conditions; |

| · | potential fluctuation in quarterly results; |

| · | volatility or decline of our stock price; |

| · | the possibility we may be unable to manage our growth; |

| · | extensive competition; |

| · | loss of members of our senior management; |

| · | regulatory interpretations and changes; |

| · | our failure to earn revenues or profits; |

| · | inadequate capital and barriers to raising capital or to obtaining the financing needed to implement our business plans; |

| 1 |

| · | changes in demand for our products and services; |

| · | rapid and significant changes in technology and markets; |

| · | litigation with or legal claims and allegations by outside parties; and |

| · | insufficient revenues to cover operating costs. |

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of these forward-looking statements.

You should read these risk factors and the other cautionary statements made in this prospectus as being applicable to all related forward-looking statements wherever they appear in this prospectus. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

This summary highlights certain information appearing elsewhere in this prospectus. For a more complete understanding of this offering, you should read the entire prospectus carefully, including the risk factors and the financial statements. References in this prospectus to “we,” “us,” “our,” “Envision,” and “Company” refer to Envision Solar International, Inc. You should read both this prospectus and any prospectus supplement together with additional information described below under the heading “Where You Can Find More Information.”

Company Overview

Envision Solar International, Inc., a Nevada corporation (hereinafter the “Company,” “us,” “we,” “our” or “Envision”) is a sustainable technology innovation company based in San Diego, California. Focusing on what we refer to as “Solar 3.0,” we invent, design, engineer, manufacture and sell solar powered products that enable vital and highly valuable services in locations where it is either too expensive or too impactful to connect to the utility grid, or where the requirements for electrical power are so important that grid failures, like blackouts, are intolerable. When competing with utilities or typical solar companies, we rely on our products’ ease of deployment, reliability, accessibility, and total cost of ownership, rather than producing the cheapest kilowatt hour with the help of subsidies.

Envision’s solar powered products and proprietary technology solutions target three markets that are experiencing significant growth with annual global spending in the billions of dollars:

| · | electric vehicle charging infrastructure; |

| · | out of home advertising platforms; and |

| · | energy security and disaster preparedness. |

The Company focuses on creating renewably energized, high-quality products for electric vehicle (“EV”) charging, outdoor media and branding, and energy security that are rapidly deployable and attractively designed.

We believe that there is a clear need for a rapidly deployable and highly scalable EV charging infrastructure, and that our EV ARC™ and Solar Tree® products fulfill that requirement. We are agnostic as to the EV charging service equipment (“EVSE”) and integrate best of breed solutions based upon our customer’s requirements. For example, our EV ARC™ and Solar Tree® products have been deployed with Chargepoint, Blink, Juice Box, Bosch, AeroVironment and other high quality EV charging solutions. We can make recommendations to customers or we can comply with their specifications and/or existing charger networks. EV ARC™ and Solar Tree® products replace the infrastructure required to support EV chargers, not the chargers themselves. We do not sell EV charging, rather we sell products which enable it.

We believe our chief differentiators are:

| · | our ability to invent, design, engineer, and manufacture solar powered products which dramatically reduce the cost, time and complexity of the installation and operation of EV charging infrastructure and outdoor media platforms when compared to traditional, utility grid tied alternatives; |

| · | our products’ capability to operate during grid outages and to provide a source of emergency power rather than becoming inoperable during times of grid interruptions; and |

| 2 |

| · | our ability to create new, marketable and patentable inventions which are a complex integration of our own proprietary technology and parts, and other commonly available engineered components, creating further barriers to entry for our competition. |

The resulting products are built to have what we believe is the longest life expectancy in the industry while also delivering valuable amenities and potentially highly attractive revenue opportunities for our customers. Envision’s products are designed to deliver multiple layers of value such as: environmental impact free renewably energized EV charging; media, branding, and advertising platforms; sustainable and secure energy production; reduced carbon footprint; high visibility "green halo" branding; reduction of net operating costs through reduced utility bills; revenue creation opportunities through sales of digital out of home (“DOOH”) media; and sponsorship and naming rights. The Company sells its products to customers with requirements in one or more of the three verticals the Company addresses. Qualified customers can also lease our EV ARC™ products through leasing relationships we have developed. Envision’s products can qualify for various federal, state, and local financial incentives which can significantly reduce final out-of-pocket costs from our selling price for eligible customers. Currently, the main source of our revenue is from the sale of the patented EV ARC™ to government agencies and private enterprise.

Recent Events

| · | On September 25, 2018, the Company entered into an amendment to the revolving convertible promissory note between Envision Solar, the borrower, and SFE VCF, LLC, the lender. The amendment extended the term of the revolving note until December 31, 2019. There were no other changes to the note. |

| · | Between October 23, 2018 and November 8, 2018, the Company received commitment letters from seven individual lenders (five of whom are existing equity holders in the Company) committing to participate in the refinance of $1.4M of the $1.5M term loan from SFE VCF, LLC, under substantially the same terms as the existing maturing term note, and to provide the refinance funds within five (5) business days of receiving written confirmation from the Company of the successful closing of the public offering described in this document. |

| · | On October 16, 2018, a delegation from the Shanxi Energy and Traffic Investment Company, a Chinese State-Owned Enterprise, visited Envision’s factory to perform due diligence on the Company, its products and facilities, and to discuss moving forward with the negotiations on a definitive agreement for a new jointly owned company in China (NEWCO). At the end of a series of meetings, which took place throughout the day, the SETIC delegation reported to the Company that they were impressed with the Company, its products and facilities. They expressed their intention to return to Shanxi, China with a recommendation to proceed with the business relationship outlined in the LOI executed by Envision and SETIC in April 2018, and that they wish to accelerate the pace of negotiations and activities required to that end. |

| · | On October 15, 2018, the European Patent Office issued a notice of intention to grant a patent for our EV ARC™ product in Europe (European Patent No. 13828020.1). |

| · | On October 4, 2018, Envision Solar announced that Alleghany College became the first community college in the US to select Envision’s EV ARC™ product for public EV charging. |

| · | On October 11, 2018, Envision Solar announced the delivery of EV ARC™ products to five state hospitals in California, marking the first adoption of the product by a state hospital group. |

| · | On October 22, 2018, Envision Solar received its first purchase order from the city of Fort Lauderdale, Florida. |

| · | On November 1, 2018, Envision Solar announced the first deliveries of EV ARC™ products to California’s Department of Fish and Wildlife. |

Product and Technology Overview

We currently produce and sell two categories of product: the patented EV ARC™ (Electric Vehicle Autonomous Renewable Charger) and the patented Solar Tree®.

| 3 |

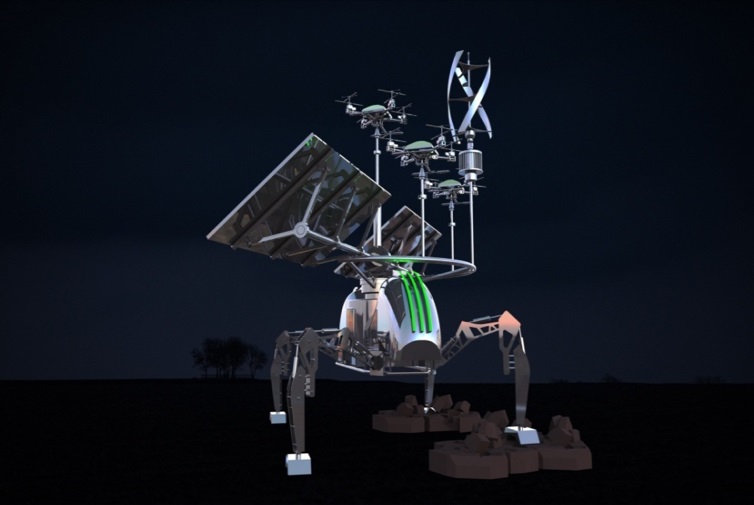

|

| ||

| EV ARC™ | Solar Tree® | ||

We have recently submitted a third and fourth product category, the EV-Standard™ and the UAV ARC™ product, for patent approval. Both are patent pending and in late stage product development and engineering. All four product lines incorporate the same underlying technology and value, having a built-in renewable energy source in the form of attached solar panels and/or light wind generator, along with on-board battery storage. The EV ARC™ product is a permanent solution in a transportable format and the Solar Tree® product is a permanent solution in a fixed format. The EV-Standard™ is also fixed but uses an existing streetlamp’s foundation and grid connection. The UAV ARC™ is a permanent solution in a transportable format and will be used to charge drone (UAV) fleets. We believe that our series of products offer multiple layers of value to our customers while leveraging the same underlying technology and fabrication techniques and infrastructure that we use for all of our products. This enables us to reach a broad customer base with varied product offerings without maintaining the overhead normally associated with a diverse set of products.

EV ARC™ and Solar Tree® products can also be equipped to provide emergency power to users such as first responders during times of emergency or other grid failures. Because our products replenish their batteries every day, even during cloudy conditions, we believe that they are some of the most robust and reliable back-up energy sources available today. Several of our current government customers are ordering EV ARC™ units with our optional E Power panels integrated into the units. E Power is a series of secured power outlets with directed and primary energy access available to emergency responders or whoever our customers designate. This is a source of increased revenue for us and, we believe, a compelling additional value proposition for our products.

EV ARC™ and Solar Tree® products can be grid connected if the customer wishes. Our first utility customer connected its EV ARC™ units to the grid in 2015. The EV ARC™ products provide solar powered EV charging, but they also serve as grid stability tools. During times of low energy use the utility will charge the EV ARC™ on board batteries. During times of grid stress, the utility takes energy from EV ARC™ batteries thus reducing stress on their generation assets and grid infrastructure. We believe that “Grid Balancing” offers a potentially significant market opportunity for Envision’s products as electrical grids become increasingly unstable due to increased demand, aging infrastructure, extreme weather events or nefarious foreign or domestic actors. Experts from utilities such as San Diego Gas & Electric have told us that this is the case and that distributed storage is an important part of their future plans.

We believe these factors make our products a compelling value proposition to anyone who intends to install such devices. Our customers can deploy EV charging quickly, efficiently, and without digging up their parking lots. The positive carbon foot print is greater because our products use sunlight to charge the employees’ EVs and, we believe, the marketing and branding impact is far greater because the enterprise has a highly visible demonstration of its commitment to the environment.

Growth Strategy

We currently operate in three rapidly growing and underserved markets: EV charging infrastructure, outdoor media, and energy security. Our products are being used in 1 7 U.S. states and four international countries. We believe that the products we produce have a global appeal and that we are only at a nascent period in the development of our sector. We believe we have a strategic growth plan in place that will enable us to increase our customer base and revenues while leading to increased profitability in the following manners:

• Increased sales and marketing to educate our universe of potential customers. We have historically not invested in significant marketing activities and have only recently added a sales team. To date most of our sales have been made through

| 4 |

word of mouth or management relationships. As a result of not having a large historical sales and marketing budget, only a small percentage of the potential prospective customers for our products are aware that we exist and the value that our products deliver. We have observed that we have a high conversion rate from prospects to customers when we are able to demonstrate the value of our products to those prospects. We believe that with increased investment in marketing and sales we will be able to reach a much larger audience of prospects who could benefit from our products, and that we should be able to maintain our high conversion rates from prospects to customers.

| • Continue to expand our geographic footprint and customer base. We have sold product that is being used in 1 7 U.S. states and four international countries to date. We believe that investment in growing our geographical footprint both domestically through increased selling and marketing , and also internationally with a focus on Europe and Asia , will deliver significant growth opportunities. Our sales have been heavily focused on the U.S. coastal regions, specifically California and the Northeast. Our contract with the State of California was recently renewed for two more years with two more one-year options at the State’s election, for a potential total of four additional years. The scope of the contract expanded to include more of our products. The contract is mandatory for State governmental agencies in California seeking the solutions our products provide, and can be used by others such as county and municipal agencies at their option. The contract allows governmental agencies (and some non-governmental agencies such as universities) to issue purchase orders to us without having to go through any competitive process such as requests for proposals (RFP) or technical or other due diligence. The value of purchase orders anticipated by the State of California to be issued by government offices under this renewed contract is over $20 million. This amount is not binding. The State of California is not required to spend the amount estimated. In fact, the government agencies may spend more or less than the estimated amount depending on demand for our products. The California contract does not have a cancellation clause but we believe it can be terminated by nonrenewal or for cause. Furthermore, in studying the online published general conditions for these types of contracts, we note that they can be terminated for convenience, or for lack of funding, though we have no indication that this is likely. On September 10, 2018, the Company received a new $3,300,000 order from the City of New York for 50 EV ARC™ units for delivery before the end of this year (2018). The Company’s current total contracted backlog is now approximately $6,500,000. We observe that those U.S. coastal regions often lead where technology transitions are concerned, and we expect the rest of the U.S. to follow the coastal leads as is historically the norm. We believe that this will result in further geographic growth for our products domestically as well as with our international expansion. |

• Enhance

our gross margins by focusing on increased sales, improved operating efficiencies and reduced cost of materials and production.

Our gross profits are the profits we make after deducting the costs associated with manufacturing our products from the revenue

we receive from our customers for those products. Our gross profits are impacted by cost contributions which fall into two categories:

| 1. | Variable costs |

| 2. | Fixed costs |

Variable costs include the cost of the direct raw materials, such as batteries, solar panels, electronics and steel, and direct labor associated with each product and as such vary in proportion to the volume of units we sell. When we sell more units our variable costs increase and when we sell less the opposite generally occurs.

Fixed costs are more or less constant at certain levels of sales and production and include contributions such as rent and insurance. The lower the volume of sales we make, the higher the contribution of fixed costs will be to each of those sales. Conversely, as we increase our sales volumes the contribution of fixed costs to each unit is decreased. Generally Accepted Accounting Principles (GAAP) require that, under “absorption costing”, a portion of our fixed costs is assigned to each unit of production. For example, if our fixed costs were $1M per year and we only sold one product during that year the fixed cost contribution for that product would be $1M dollars and would be added to the variable cost to calculate our gross profits (or more likely, losses). If, on the other hand, we sold 100 units during the same period the fixed cost contribution for each product would be $10,000 per unit, or 1/100th of $1M, and, when added to our variable costs, would result in a far lower cost of goods sold (COGS) per unit and as a result a much improved gross profit. At a certain volume of unit sales any manufacturing company should meet a fixed cost break-even point assuming their variable costs are less than the price they charge their customers for the products.

There are a variety of ways we can reduce our variable costs which include:

| 1. | Negotiation of better pricing from our vendors |

| 2. | Improved efficiencies in our processes |

| 3. | Product design improvements |

| 4. | Insourcing of certain processes which are currently performed by outside providers (who endeavor to make a gross profit on the services they provide us) |

| 5 |

We believe that there is really only one way to reduce our per unit fixed costs as long as we continue to pursue our current strategy: Increase unit sales volumes.

Year to date (2018) our fixed costs have been as high as approximately 17% of our revenues. If we had sold twice as many similarly priced units then our fixed cost contribution would have been approximately half that amount, or less than 10% of revenue, which would have improved our gross profit by the same amount.

Our variable direct costs per unit in 2018 have been as low as approximately 70% of our revenues meaning that, excluding the fixed costs described above, our per unit gross profit has been as high as approximately 30% even in the lower volumes we have produced to date.

In prior years we have generally reported gross losses because the combination of our fixed and variable costs resulted in COGS which were greater than the revenues we generated from the sale of our products. In the first and second quarters of 2018, we sold and delivered a sufficient number of units to reach, and exceed, our fixed and variable cost breakeven point. As a result, we have reported gross profits rather than losses in 2018. Please refer to the Management’s Discussion and Analysis of Financial Condition and Results of Operation beginning on page 30 and our financial statements beginning on page 97 of this document for a full description of our financial results.

• Measures we are taking to improve our gross profits. We are continually striving to increase our sales volumes and in the first half of 2018, our revenues are 327% higher than our 2017 results. We believe that this trend will continue and our historically high backlog ($5.7M at time of writing) and pipeline (approximately $27M including the latest California Contract) combined with positive growth trends in demand in the markets in which we focus, inform that belief (described in the “Industry Overview” section of this document starting on page 58).

We have assumed in the past, and continue to assume, that our sales will increase and will, as a result, reduce the impact of our per unit fixed cost contributions. For example, we believe that our factory is sufficiently large enough to allow for a five-fold increase in unit production without significant increases in fixed costs. We selected a factory of this size (along with its fixed costs) because we believe that we will be able to grow our sales as the markets we address, such as electric vehicle (EV) charging, grow as further discussed in this document. We also believe that it is not unusual for manufacturing companies to have higher fixed cost contributions to their COGS in the early stages of market and product development. We anticipated this as we planned for our current facilities and growth, even though we understood that these higher fixed costs would negatively impact our gross profits in the early stages of our evolution.

We also continue to strive to reduce our direct variable costs and we have observed that in many instances we have been successful in this area. For example, we have negotiated reduced pricing with our vendors of steel, solar panels, inverters, tracking gears and batteries which are the largest cost contributors to each of our products. We have also become more efficient in our fabrication processes which has reduced the direct unit labor hours associated with producing our products.

There are also market forces at work which, in the case of our most expensive components, are contributing to lower direct variable costs for our products. According to Forbes, battery prices have fallen from over $1000 per kWh in 2010 to less than $200 per kWh in 2017, and Forbes forecasts that prices will reach $100 per kWh by 2025. Forbes also forecasts that second life (used batteries which would still work on our products) will fall to less than $50 per kWh. We currently pay more than $300 per kWh and as such see significant opportunities for future reductions in our COGS as the price of batteries falls.

Solar modules have seen similar precipitous price declines. Bloomberg provides a benchmark monocrystaline module price of $0.37 per watt in 2017 down from $10.00 per watt in the early nineties. While we use more expensive modules than the Bloomberg benchmark (because they are higher quality and have a higher output efficiency), we have still benefited significantly during the last few years from the decrease in solar module pricing. We believe that we will see further reductions in cost per watt for the foreseeable future.

We have observed that increased unit sales do not only reduce our fixed per unit costs but can also favorably impact our direct variable costs. For example, on October 1, 2018, we negotiated a reduction of approximately five percent on the price we pay for steel for our products. On the same day we negotiated a reduction of approximately three percent on the price that we pay for certain major electronic components that we integrate into our products. Our solar module vendor has informed us that our current increased purchasing should result in a 4% reduction in the price that we pay for solar modules. We anticipate achieving that reduction as a result of the increased volume in orders we are placing in the fourth quarter of 2018. These price reductions have not been driven by commodity pricing, rather, they are the result of our increased buying power with our vendors and in particular, the large orders we are placing so that we can execute on our current (fourth quarter 2018) backlog which is at an all-time high of approximately $6.5M. We have observed that we have been able to negotiate price reductions on other of the

| 6 |

components and commodities which we integrate into our end products as a result of our increased buying power. We believe that there are further significant gains to be made in that area as our sales volumes increase.

We currently outsource the painting and coating of our products to a third party. We are aware that this third-party endeavors to earn a gross profit when selling paint and coating services to us. We also incur costs and disruptions transporting our products to and from the painting vendor’s facility. We believe that an investment in an improvement to our facility that would make it possible for us to paint and coat our own products could lead to 50% cost reductions related to those tasks and improved product flow, which might further reduce our COGS and increase our production capacity.

Our pricing strategies and our investments in fixed overheads such as our manufacturing facility have been driven by our belief that the demand for our products will increase as the markets on which we focus evolve, and we see an increase in unit sales as a result. We have not endeavored to cover all of our costs with the sale of a small number of units because we believe that the higher sales price might have priced our products out of the market. Our belief in the growth of our target markets and in our ability to continually reduce costs as we increase production volumes has led us to the decisions we have made around product pricing and investment in overhead. We believe that the positive gross profits we have reported so far in 2018, combined with the growth in our sales and our historical ability to reduce direct variable costs, support our continuation of this strategy and that we can increase our gross profit margins to 50%, including fixed cost contributions, in the future. The management team encourages all members of our sales and operations teams to contribute continuously to these efforts.

• Increased leverage of outsourcing as our manufacturing process scales. We have invested in facilities to enable us to produce our products in-house. This strategy has enabled us to efficiently grow through our product development process while controlling and reducing costs. However, as our product development process matures and as we become experts on our manufacturing process, we believe that we will benefit by out sourcing the manufacturing of certain components of our products to manufacturing vendors. We believe that we will be able to cherry pick certain of our components for outsourced manufacturing, simultaneously reducing our costs and increasing our capacity. While we intend to continue in-house manufacturing for all new products, we anticipate a future when the manufacturing of our mature products is carried out by far larger and more efficient manufacturers at greater speed and lower cost.

• Expansion of our recurring revenue business. As our business matures we will begin to expand the recurring revenue component of our business model through service and maintenance contracts, data gathering and sharing, outdoor media and branding, naming rights, and sponsorships of networks and products. Historically, we did not focus on service and maintenance contracts but rather focused on unit number growth. Many of our customers have indicated to us that they would be interested in acquiring service and maintenance contracts as well as extended warranties from us. We believe that as we grow our customer base we will have increasing opportunities to add recurring revenue through these services. We believe that our ability to gather and share data about the vehicles and other users of our products may become increasingly valuable as the markets we focus on, such as EV charging, mature. We are working with partners to create recurring revenue streams through sponsorship and naming rights for networks of our products.

• Capture market share of the electrified personal and public transportation space, which is at a nascent phase. To date we have concentrated on fueling the revolution in sedan electrification, however, we believe that other modes of electrified transportation are growing rapidly. The expansion in the use of electric bicycles, scooters and motor scooters is evident in many large cities across the U.S., Asia and Europe. As more people rely on last mile solutions such as e-bikes and e-scooters, the requirements for charging infrastructure will proliferate. We are working with an electric bike and scooter manufacturer to bundle two wheeled electric modes of transport with our EV ARC™ product. We believe that sales of bundled solutions combining our products with others transportation solutions represents another significant growth opportunity. The growth in the use of electric buses is happening at a more rapid pace than that of EV sedans. We have already sold our Solar Tree® DC fast charging solution to the Fresno County Rural Transit Authority for use in the charging of their public buses. This will be our first such deployment but we believe that it will lead to significant opportunities in this rapidly growing space.

• The network effect (IoT) will drive significant value from the data we collect. The units we produce communicate to our central facility, which creates a network effect. Units will be able to communicate with each other in the future. Each of our products sends data back to our central facility across a wireless network. The more units we have deployed the more data we will be able collect and the more we can learn about charging habits, EVs, traffic patterns and many other useful data sets. We believe that there will be significant value in this data in the future. For example, we believe that our outdoor media business segment will become more valuable as more units are deployed and communicating data about their individual usage. Our ability to communicate remotely with our media assets means that we will increasingly be able to change content on the units, perhaps in response to the individual users. As parcel delivery increasingly electrifies and the use of drones and package drop-off locations multiply, we believe that our portfolio of deployed assets, particularly UAV ARC™ units if and when they are deployed, will become increasingly valuable as a source of information as well as electricity for fueling and energizing network and physical assets, which will allow for branded “locker” facilities.

| 7 |

• Continued expansion of our Outdoor Media Business unit. We believe that a significant opportunity for increased high margin, recurring revenue exists in this business unit as a result of new contract wins. In November 2017 we signed an agreement with Outfront Media (NYSE:OUT) to sell naming rights and sponsorship arrangements for networks of our products deployed across cities. We believe that we are progressing towards success with this initiative. We intend to retain title to future products deployed under this business model and believe that we will be able to capture significant and increasing levels of recurring revenue while maintaining ownership of the underlying assets. Although we have delivered a small number of our products with outdoor media platforms integrated to date, we believe there is significant room to expand this aspect of our business in a meaningful way.

• Develop and innovate new products while building a strong IP portfolio. The majority of our revenues come from sales of our EV ARC™ and our Solar Tree® products. The underlying technology is the same for both product sets and we have leveraged the same proprietary underlying technology to invent two new products, which are currently patent pending: (i) EV Standard™, which is a renewable energy street lamp replacement EV charging infrastructure solution and (ii) UAV ARC™ or DCN™ – Drone Charging Network, a renewable energy drone recharging product. This will allow us to broaden our market appeal while not significantly increasing the requirements of our manufacturing lines. We believe this strategy will enable us to grow revenues more profitably through increased operating leverage. We intend to continue to research other areas in which we believe that our ability to deliver rapidly deployed, highly reliable and cost effective sources of renewable energy in a productized format are embraced by prospective customers, so that we can continue to invent and develop new products which we believe will bring value to our target audiences. We believe that with sufficient investment we will be able to bring new products to market and create significant and rapidly growing opportunities to generate more revenue.

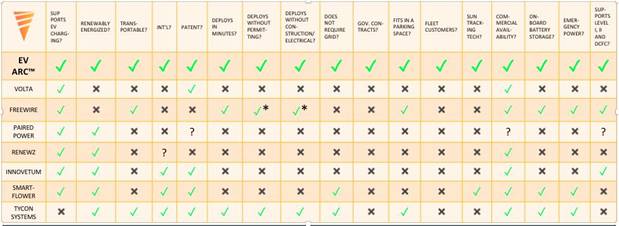

Competitive Advantages

We believe our chief differentiators from our competitors are our ability to invent, design, engineer, and manufacture solar powered products which dramatically reduce the cost, time and complexity of the installation and operation of EV charging infrastructure and outdoor media platforms when compared to traditional, utility grid tied alternatives.

• Rapid and impact free deployment of our products. We believe that our product’s capability to be installed on a customer’s premises in a matter of minutes rather than taking several months as competing products can is a strong competitive advantage.

• Scalability. We believe that the global requirements for EV charging will be large and that consumer demand will grow faster than traditionally deployed infrastructure can serve. Our ability to mass produce and rapidly deploy large numbers of EV chargers without going through planning and construction will make our products highly scalable, which we view as a significant differentiator.

• Lower t otal c ost of o wnership. We believe that our reliance on renewable energy sources such as solar and wind rather than utility provided electricity, combined with our low or no construction installation requirements, will make our products less expensive to own and operate in many instances.

• Low environmental impact. The buying decisions of many of our customers are often driven by environmental and sustainability concerns as well as a desire to reduce the carbon impact that either exists today in many markets or is perceived by our customers to be an inevitability in the future. Because our products are renewably energized and require little or no installation, they have low environmental impact. They are also highly visible and convey an environmentally conscious image for our customers to their constituencies.

• Unique operating capabilities of our products. We believe that our products’ capability to operate during grid outages and to provide a source of emergency power rather than becoming inoperable during times of emergency or other grid interruptions are significant differentiators from our competitors. Our products give our customers ultimate flexibility in a time of need while also providing operational efficiencies in normal operating conditions.

• Strong patent portfolio to protect our products. Our ability to create new and patentable inventions which are marketable and a complex integration of our own proprietary technology and parts with other commonly available engineered components is a further barrier to entry for our competition. The resulting products are built to have the longest life expectancy in the industry while also delivering valuable amenities and potentially highly attractive revenue opportunities for our customers.

• Diversified product portfolio provides multiple verticals to monetize. Envision’s products are designed to deliver multiple layers of value. Those value propositions include impact-free, renewably-energized EV charging; media, branding, and advertising platforms; sustainable and secure energy production and storage; reduced carbon footprint; high visibility "green halo" branding; reduction of net operating costs through reduced utility bills; and revenue creation opportunities through sales of digital

| 8 |

out of home (“DOOH”) media. The Company sells its products to customers with requirements in one or more of the three verticals it addresses. Qualified customers can also lease our EV ARC™ products through leasing relationships we have developed. Envision’s products can qualify for various federal, state, and local financial incentives which can significantly reduce final out-of-pocket costs from our selling price for eligible customers.

• Manufacturing and operating efficiencies. We believe that the continuation of our strategy to create highly engineered, highly scalable products that are manufactured in-house and that are delivered complete or as a kit of parts to the customer site, and which require minimal planning, entitlement, or field labor activities, is further positioning us as a leader in the provision of unique and highly scalable solutions to the markets we target. Our products are complex but standardized, readily deployable and reduce the exposure of the Company and our customers to the risks and inherent margin erosion that are incumbent in field deployments.

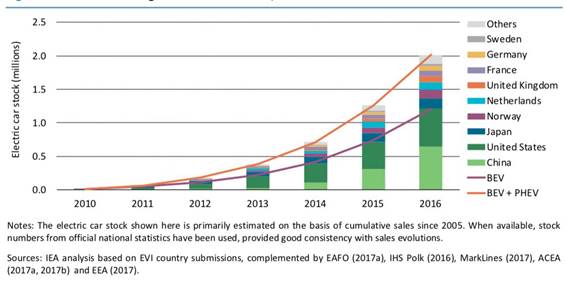

Industry Overview

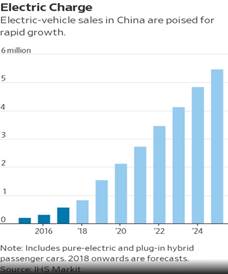

EV Charging. The global electric car stock surpassed two million vehicles in 2016 after crossing the one million threshold in 2015, and exceeded three million vehicles by November 2017. In the third quarter of 2018, the stock increased to four million. As the number of electric cars on the road has continued to increase, private and publicly accessible charging infrastructure has also continued to grow. In 2016, the annual growth rate of publicly available charging (72%) was higher than, but of a similar magnitude to, the electric car stock growth rate in the same year (60%).

According to Bloomberg, financial services firm Morgan Stanley has estimated that the world will need to spend $2.7 trillion on charging infrastructure to provide for the anticipated growth of EVs. Governor Brown of California has issued an executive order requiring the installation of 250,000 EV chargers by 2025. This equates to an average of more than 40,000 charger installations per year. To date, the EV charging industry has installed a total of about 16,000 grid-tied EV chargers in California. In September 2018, Governor Brown issued a further executive order setting out a goal for California to be carbon neutral by 2045, meaning that all the electricity consumed in the state will have to come from renewable sources. We believe that the combination of these two executive orders will create an improved set of opportunities for us to sell our products. Many nations including the United Kingdom, Norway, Germany and France have announced total bans on internal combustion vehicle sales after specified dates, starting with Norway in 2025. China is considering similar bans and President Xi Xingping has recently called for the installation of 4.8 million chargers by 2020.

Autonomous vehicles (AVs) are receiving increasing press coverage and, significantly, increasing investment from national and international participants. On October 4, 2018 the Wall Street Journal reported that Honda will invest $2.75B in GM’s self-driving car unit, GM Cruise. Japan’s SoftBank Group has already invested $2.2B in GM Cruise. Ford has set up the Ford Autonomous Vehicle Unit, Fiat Chrysler has joined a BMW led consortium which includes Intel and Mobileye, with the aim of producing fully automated vehicles by 2021. Toyota announced in August that it would invest $500 million in Uber to jointly develop autonomous vehicles, and Google parent Alphabet continues to invest in Waymo. According to CB Insights there were 46 corporations developing autonomous vehicles as of September 2018.

While there are many approaches to evolving AVs, one constant is that in almost every case the vehicles themselves are or will be electric vehicles. An increase in the volume of electric AVs will mean a requirement for an increase in the availability of EV charging infrastructure which, we believe, further supports our business model.

The global need for large numbers of highly scalable, rapidly deployable EV charging solutions is clear. We believe that our products uniquely satisfy this need and can meet the expected demand.

Outdoor Media. “Digital Out of Home Advertising” is the third fastest growing advertising medium, according to Magna. Double digit growth with billions of dollars per year in national and global spending make outdoor advertising an attractive opportunity. Industry veterans spend a good deal of time looking for the “new new” in advertising. They seek a solution that is environmentally friendly, cost effective, and most importantly, can make its way through the significant hurdles of permitting and zoning. We believe that our products are ideally suited to uniquely reduce many of the barriers to entry for outdoor advertising, and as such we believe that significant opportunities may present themselves to us as we continue to address this market.

Energy Security. According to insideenergy.org, the grid disruption database shows a marked increase in outages from 2000 through the first half of 2014. According to the Department of Energy, grid outages cost U.S. businesses approximately $200 billion each year, and lives have been lost due to power interruptions. Secure and reliable sources of electrical power are a strategic imperative, recognized by the U.S. military as representing one of our most significant vulnerabilities. Government and enterprise customers are investing in off-grid emergency power solutions such as diesel generators.

| 9 |

Our products provide a highly reliable source of energy that is not susceptible to grid interruptions. Because they generate and store all of their own energy, our products will continue to charge EVs and provide a secure source of emergency back-up power, even during grid outages and failures such as those caused by hurricanes, earthquakes, flooding or heavy snow, or by terrorists or those that could be perpetrated by nefarious nation states such as the utility grid hacking incidents described in recent articles in the Wall Street Journal.

Intellectual Property

Envision owns the registered trademarks Solar Grove® and Solar Tree® structures. The Company has been issued five patents: one for our Solar Tree ® structure (patent No. 7,705,277), one for EnvisionTrak™, a dual-synchronous tracking system for its solar products (patent No. 8,648,551), one for our EV ARC™ product (patent No. 9209648), one for Transformer ARC™ (patent No. 9,917,471), and one for our EV ARC™ product in China (Patent No. 201380042601.2). Additionally, on October 15, 2018, the European Patent Office issued a notice of intention to grant a patent for our EV ARC™ product in Europe (European Patent No. 13828020.1).

Our EV-Standard™ and UAV ARC™ products are currently patent-pending. Our patented Transformer ARC™ product is patent pending in China and we have one other product in the patent application drafting process.

All of our patents refer to products which are currently in production and being sold to and used by our key customers. We believe that the patents for which we are currently applying will have similar or better market success.

Listing on the Nasdaq Stock Market

We have applied to list our common stock and warrants on The Nasdaq Stock Market (“NASDAQ”) under the symbols “EVSI” and “EVSIW”, respectively. If our listing application is approved, we expect to list our common stock and warrants on NASDAQ upon consummation of this offering, at which point our common stock will cease to be traded on the OTC-QB Market. No assurance can be given that our listing application will be approved. This offering will occur only if NASDAQ approves the listing of our common stock and warrants on NASDAQ. NASDAQ listing requirements include, among other things, a stock price threshold. As a result, prior to effectiveness, we will need to take the necessary steps to meet NASDAQ listing requirements, including but not limited to a reverse split of our common stock. If NASDAQ does not approve the listing of our common stock and warrants, we will not proceed with this offering. Quotes of stock trading prices on an over-the-counter marketplace may not be indicative of the market price on a national securities exchange.

Corporate Information

Our executive offices are located at 5660 Eastgate Dr., San Diego, California 92121 and our telephone number is (858) 799-4583. Our website address is www.envisionsolar.com. We have not incorporated by reference into this prospectus the information included on or linked from our website and you should not consider it to be part of this prospectus.

Principal Risks

We are subject to various risks discussed in detail under “Risk Factors,” which include risks related to the following:

| · | an investment in us is speculative as we recently emerged from our late development stage; |

| · | we have sustained recurring losses since inception and have received a “going concern” qualification from our auditors; |

| · | we do not have sufficient capital to continue or expand our business unless we raise additional capital; |

| · | we face competition from larger competitors in the EV charging industry, although primarily from grid connected equipment suppliers, and competition may intensify in the future; |

| · | our revenue growth in the first half of 2018 is not necessarily indicative of our future results, although year over year revenue growth is strongly trending positive; |

| · | our current revenue is concentrated from a small number of customers; |

| 10 |

| · | our business would be materially harmed if we fail to protect our patents, trademarks, tradenames and other intellectual property; |

| · | our plan to expand our marketing and sales with more resources, more products and more geographic markets may not succeed and may result in operating losses; |

| · | the loss of our chief executive officer or other key personnel would have a material adverse impact on us; |

| · | a financial crisis or global, national, or regional recession could have a material adverse impact on us; |

| · | failure to achieve our business performance expectations as reflected in forward-looking statements that may be made by us; |

| · | our financial condition and operating results may be materially adversely impacted by litigation and claims made against us that are not fully covered by insurance; |

| · | we may have liabilities that we are unable to pay; |

| · | we may experience higher operating costs and lower revenue than we expect; |

| · | interruptions in the provision of key supplies and services on which we rely could cause manufacturing and delivery delays; |

| · | inability to keep pace with rapid technological changes and innovation; |

| · | lower gasoline prices causing a decline in the demand and selling price for our products; |

| · | existing government regulations and changes to them in the future could have a material adverse effect on our operating results, financial condition and business performance; |

| · | general commercial and consumer demand for EV charging, outdoor media and energy security products may decline in the future; |

| · | potential dilution of the ownership of existing shareholders in us due to the issuance of new securities by us in the future; |

| · | rapid and significant changes to costs of raw materials due to government tariffs or other market factors; |

| · | our failure to maintain an effective system of internal financial controls; |

| · | volatility or decline of our stock price; |

| · | the planned reverse stock split of our authorized and outstanding common stock could cause our common stock market value to decline; and |

| · | we do not intend to declare or pay dividends on our common stock in the foreseeable future. |

Please see the “Risk Factors” section commencing on page [ ] for more information concerning the risks of investing in us.

| 11 |

Summary of the Offering

| Securities offered: | [ ] Units, each Unit consisting of [_______] share[s] of our common stock and [_______] warrant[s] to purchase [_______] share[s] of our common stock. Each warrant will have an exercise price of $[ ] per share [___% of the public offering price of the common stock], is exercisable immediately and will expire five years from the date of issuance. | |

|

Common Stock prior to Offering:

|

144,893,995 | |

|

Number of Warrants:

|

[ ] | |

|

Number of Shares:

|

[ ] | |

|

Warrant exercise price:

|

[ ] | |

|

Share price range for split:

|

[ ] | |

| Common stock outstanding after the offering: |

[_______] , not including the possible sale of over-allotment shares, if any . The number of shares of our common stock to be outstanding after the completion of this offering is based on 144,893,995 shares of our common stock outstanding as of June 30, 2018 , not yet adjusted to reflect a planned reverse stock split of the Company’s authorized, issued and outstanding common stock of one-for-[ ], and excludes the following, not yet adjusted to reflect the reverse stock split : • 15,174,175 shares of common stock issuable upon the exercise of stock options outstanding as of June 30, 2018 with a weighted average exercise price per share of $0.23; • 16,325,825 shares of common stock reserved for the future issuance of options under our 2011 Stock Option Plan; • 5,817,950 shares of common stock issuable upon exercise of warrants as of June 30, 2018 with a weighted average exercise price per share of $0.17; • 12,274,762 shares of common stock issuable upon the conversion of outstanding convertible promissory notes as of June 30, 2018. • a reverse stock split of our common stock of 1-for-[ ] to be effective prior to the closing of this offering. |

|

|

Underwriter’s Over-Allotment Option: |

The Underwriting Agreement provides that we will grant to the underwriter an option, exercisable within 45 days after the closing of this offering, to acquire up to an additional 15% of the total number of shares of common stock and/or warrants to be offered by us pursuant to this offering, solely for the purpose of covering over-allotments. |

|

| Use of proceeds: | We estimate that we will receive net proceeds of approximately [ ] from our sale of shares of common stock and warrants in this offering, after deducting underwriting discounts and estimated offering expenses payable by us. We intend to use the net proceeds of this offering to provide funding for the following purposes: to expand our business both domestically and internationally through an increase in our sales and marketing campaigns, to grow our sales team, improve product development and manufacturing efficiencies, repay the bridge loan recently borrowed, and for working capital and other general corporate purposes. | |

| Subscription price: | [$ ] per Unit. | |

|

Trading symbol: |

Our common stock is presently quoted on the OTC-QB Market under the symbol “EVSI”. We have applied to have our common stock and warrants listed on the NASDAQ Capital Market under the symbols “EVSI” and “EVSIW,” respectively. |

|

| 12 |

|

Risk factors: |

Investing in our securities involves substantial risks. You should carefully review and consider the “Risk Factors” section of this prospectus beginning on page __ and the other information in this prospectus for a discussion of the factors you should consider before you decide to invest in this offering. |

|

Lock-up: |

We and our directors, officers and principal stockholders have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of 180 days after the date of this prospectus. See “Underwriting” section on page __. |

Summary Consolidated Financial Information

The following summary consolidated statements of operations data for the years ended December 31, 2017 and 2016 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the six and three months ended June 30, 2018 and 2017 and the consolidated balance sheets data as of June 30, 2018 are derived from our unaudited consolidated financial statements that are included elsewhere in this prospectus. The historical financial data presented below is not necessarily indicative of our financial results in future periods, and the results for the six and three months ended June 30, 2018 are not necessarily indicative of our operating results to be expected for the full fiscal year ending December 31, 2018 or any other period. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles (“U.S. GAAP”). Our unaudited consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

Summary Statements of Operations Data

| For the Three Months Ended June 30, | For the Six Months Ended June 30, | For the Fiscal Years Ended December 31*, | ||||||||||||||||||||||

(unaudited) 2018 | (unaudited) 2017 | (unaudited) 2018 | (unaudited) 2017 |

2017 |

2016 | |||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||

| Total Revenues | $ | 844,495 | $ | 507,730 | $ | 3,720,467 | $ | 878,419 | $ | 1,412,042 | $ | 2,781,273 | ||||||||||||

| Total Cost of Revenues | 825,761 | 520,836 | 3,667,433 | 895,379 | 1,884,793 | 2,925,994 | ||||||||||||||||||

| Gross Profit (Loss) | 18,734 | (13,106 | ) | 53,034 | (16,960 | ) | (472,751 | ) | (144,721 | ) | ||||||||||||||

| Operating Expenses: | ||||||||||||||||||||||||

| Total Operating Expenses | (573,151 | ) | (545,292 | ) | 1,182,320 | 1,214,281 | (2,227,645 | ) | (2,643,672 | ) | ||||||||||||||

| Total Other (Expense) Income | (219,854 | ) | (45,134 | ) | (656,592 | ) | 8,136 | (340,234 | ) | 156,477 | ||||||||||||||

| Tax Expense | — | (800 | ) | — | (800 | ) | (800 | ) | (1,600 | ) | ||||||||||||||

| Net Loss | $ | (774,271 | ) | $ | (604,332 | ) | $ | (1,785,878 | ) | $ | (1,223,905 | ) | $ | (3,041,430 | ) | $ | (2,633,516 | ) | ||||||

| Net Loss Per Share | ||||||||||||||||||||||||

| Basic and Diluted(1) | $ | (0.01 | ) | $ | (0.00 | ) | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.02 | ) | $ | (0.02 | ) | ||||||

| Weighted Average Number of Common Shares Outstanding | ||||||||||||||||||||||||

| Basic and Diluted(1) | 144,706,495 | 125,647,287 | 144,101,477 | 124,039,447 | 127,470,749 | 112,469,828 | ||||||||||||||||||

* derived from audited consolidated financial statements.

(1) Does not reflect planned 1 for [ ] reverse stock split.

The following table presents consolidated balance sheet data as of June 30, 2018 on:

| · | an actual basis; |

| · | a pro forma basis giving effect to the sale by us of ___ shares of common stock in this offering at an assumed public offering price of $________ per share, after deducting underwriting discounts and commissions and estimated offering expenses. |

The pro forma information will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

| 13 |

| June 30, 2018 | June 30, 2018 | |||||

| Consolidated Balance Sheet Data: | Actual (Unaudited) | Pro Forma(1) (Unaudited) | ||||

| Cash | $ | 128,675 | [$ ] | |||

| Working capital (deficit) | $ | (1,765,422 | ) | [$ ] | ||

| Total assets | $ | 2,233,720 | [$ ] | |||

| Total liabilities | $ | 3,670,045 | [$ ] | |||

| Total stockholders’ equity (deficit) | $ | (1,436,325 | ) | [$ ] | ||

| (1) | A $1.00 increase or decrease in the assumed public offering price per share would increase or decrease our cash and cash equivalents, working capital (deficit), total assets and total stockholders’ equity (deficit) by $________, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the underwriting discount and estimated offering expenses payable by us. |

Any investment in our common stock involves a high degree of risk. You should consider carefully the risks described below, together with all of the other information contained in this prospectus, before you decide whether to purchase our common stock. If any of these actually occur, our business, financial condition or operating results could be adversely affected. The risks described below are not the only ones we face. Additional risks not currently known to us or that we currently do not deem material also may become important factors that may materially and adversely affect our business. The trading price of our common stock could decline due to any of these described or additional risks and you could lose part or all of your investment.

Risks Relating to Our Business

Our Company recently emerged from its late development stage, which increases the risk of investment in our common stock. This investment in us is speculative because the trend of increasing sales has only recently begun and may not be sustained. Funding is needed to expand our sales and marketing campaigns for current markets and to extend the business into new markets, such as China and Europe. We must also allocate capital, if available, to pay costs and liabilities until we achieve positive cash flow, of which there is no assurance. Historically, we have not been profitable and there is no assurance that the Company will be profitable in the future. The Company may not be able to successfully develop, manage, or market its products and services. Intense competition and. government regulation may hinder the Company’s performance. The Company is exposed to other risks inherent in its business.

We have sustained recurring losses since inception and expect to incur additional losses in the foreseeable future. We have received a “going concern” qualification from our auditors, which indicates that there are substantial risks to the Company continuing as a going concern. We were formed on June 12, 2006 and have reported annual net losses since inception. For our fiscal years ended December 31, 2017 and December 31, 2016, we experienced net losses of $3,041,430 and $2,633,516, respectively (reflects cash and noncash expenses under generally accepted accounting principles). For the six months ended June 30, 2018, our net loss was $1,785,878 (reflects cash and noncash expenses under generally accepted accounting principles). Further, as of June 30, 2018, we had an accumulated deficit of $40,062,757 (reflects cash and noncash expenses under generally accepted accounting principles), a working capital deficit of $1,765,422, and a stockholder’s deficit of $1,436,325. The Company’s consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements included in this prospectus do not include any adjustments relating to the recoverability and classification of asset amounts or the classification of liabilities that might be necessary should the Company be unable to continue as a going concern. In addition, we expect to incur additional losses in the future, and there can be no assurance that we will achieve profitability. Our future viability, profitability and growth depend upon our ability to raise capital and successfully operate and expand our operations. We cannot assure that any of our efforts will prove successful or that we will not continue to incur operating losses. These factors raise substantial doubt as to the Company’s ability to operate as a going concern.

We may need to raise additional capital or financing after this offering to continue to execute and expand our business. We expect that the net proceeds from this offering will be sufficient to sustain our operations for the foreseeable future, but we may need to raise additional capital after this offering to expand or if positive cash flow is not achieved and maintained. As of June 30, 2018, our available cash balance was $128,675. We may be required to pursue sources of additional capital through various means, including sale and leasing arrangements, and debt or equity financings. Any new securities that we may issue in future transactions to raise capital may be more favorable for our new investors than this offering. Newly issued securities may include preferences, superior voting rights, and the issuance of warrants or other convertible securities that will have additional dilutive effects. We cannot assure that additional funds will be available when needed from any source or, if available, will be available on terms that are acceptable to us. Further, we may incur substantial costs in pursuing future capital and/or financing, including investment banking fees, legal fees,

| 14 |

accounting fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which will adversely impact our financial condition and results of operations. Our ability to obtain needed financing may be impaired by such factors as the weakness of capital markets, and the fact that we have not been profitable, which could impact the availability and cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, is not sufficient to satisfy our capital needs, we may have to reduce our operations accordingly.