Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SVB FINANCIAL GROUP | d652568d8k.htm |

| EX-99.1 - EX-99.1 - SVB FINANCIAL GROUP | d652568dex991.htm |

Exhibit 99.2 SVB Financial Group to Acquire Healthcare Investment Bank Leerink Partners Presentation to Investors November 13, 2018Exhibit 99.2 SVB Financial Group to Acquire Healthcare Investment Bank Leerink Partners Presentation to Investors November 13, 2018

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, and involve risks and uncertainties that could result in our actual results differing materially from those projected in the forward-looking statements. In this presentation, we makes forward-looking statements regarding our plans to acquire Leerink Holdings; the expected closing timeframe; the expected benefits to us as a result of the consummation of the acquisition; the expanded service and product offering contemplated after the acquisition; SVB Leerink’s growth plans; and plans regarding Leerink’s personnel. There are various important factors that could cause actual events to differ from such forward-looking statements, including, among others, failure to complete the proposed transaction in a timely manner or at all, including to satisfy closing conditions (including ability to obtain required regulatory approvals) on a timely basis or at all; the effects of the transaction (or its announcement) on the business or operations of us or Leerink or on the employees, clients, business partners or investors of us or Leerink; the retention of Leerink personnel and customers; our ability to successfully integrate Leerink without material unanticipated costs or adverse results to our or Leerink’s existing businesses and to achieve expected benefits and synergies associated with the acquisition within anticipated time frames or at all; the applicability of the Bank Holding Company Act (including the Volcker Rule) to Leerink; the potential for disruption to our existing plans and operation or diversion of management's attention from ongoing business concerns; risks related to unforeseen liabilities of Leerink; general economic and market conditions; and other risk factors described in documents filed by us with the U.S. Securities and Exchange Commission. For information about other important factors that could cause actual results to differ materially from those discussed in the forward-looking statements contained in this presentation, please refer to our public reports filed with the U.S. Securities and Exchange Commission, including our most recently-filed quarterly or annual report. The forward-looking statements included in this presentation are made only as of the date of this presentation and we undertake no obligation to update any forward-looking statement to reflect events or circumstances that arise after the date such statements are made. SVB Financial Group Investor Presentation 2Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts, and involve risks and uncertainties that could result in our actual results differing materially from those projected in the forward-looking statements. In this presentation, we makes forward-looking statements regarding our plans to acquire Leerink Holdings; the expected closing timeframe; the expected benefits to us as a result of the consummation of the acquisition; the expanded service and product offering contemplated after the acquisition; SVB Leerink’s growth plans; and plans regarding Leerink’s personnel. There are various important factors that could cause actual events to differ from such forward-looking statements, including, among others, failure to complete the proposed transaction in a timely manner or at all, including to satisfy closing conditions (including ability to obtain required regulatory approvals) on a timely basis or at all; the effects of the transaction (or its announcement) on the business or operations of us or Leerink or on the employees, clients, business partners or investors of us or Leerink; the retention of Leerink personnel and customers; our ability to successfully integrate Leerink without material unanticipated costs or adverse results to our or Leerink’s existing businesses and to achieve expected benefits and synergies associated with the acquisition within anticipated time frames or at all; the applicability of the Bank Holding Company Act (including the Volcker Rule) to Leerink; the potential for disruption to our existing plans and operation or diversion of management's attention from ongoing business concerns; risks related to unforeseen liabilities of Leerink; general economic and market conditions; and other risk factors described in documents filed by us with the U.S. Securities and Exchange Commission. For information about other important factors that could cause actual results to differ materially from those discussed in the forward-looking statements contained in this presentation, please refer to our public reports filed with the U.S. Securities and Exchange Commission, including our most recently-filed quarterly or annual report. The forward-looking statements included in this presentation are made only as of the date of this presentation and we undertake no obligation to update any forward-looking statement to reflect events or circumstances that arise after the date such statements are made. SVB Financial Group Investor Presentation 2

Strategic combination • The acquisition of Leerink strengthens SVB’s position as the leading financial services provider to global Life Science and Healthcare Companies – A leading life science and healthcare focused company adds expertise and clients to SVB’s franchise • Expands our solutions available to support the most innovative companies in the sector – Full suite of integrated financial services by adding equity capital markets, mergers & acquisitions, and convertible business • Enhances our deep sector expertise – Top research capabilities and advisory expertise align with SVB’s sector focus • Client-centric culture shared across the platform – Focus on relationships rather than transactions, with a high percentage of repeat clients • Diversifies earnings stream – Increases fee income contribution to total revenue • Strong financial returns with IRR > 20%, accretive to earnings, and additive to ROE – Maintain strong capital position SVB Financial Group Investor Presentation 3Strategic combination • The acquisition of Leerink strengthens SVB’s position as the leading financial services provider to global Life Science and Healthcare Companies – A leading life science and healthcare focused company adds expertise and clients to SVB’s franchise • Expands our solutions available to support the most innovative companies in the sector – Full suite of integrated financial services by adding equity capital markets, mergers & acquisitions, and convertible business • Enhances our deep sector expertise – Top research capabilities and advisory expertise align with SVB’s sector focus • Client-centric culture shared across the platform – Focus on relationships rather than transactions, with a high percentage of repeat clients • Diversifies earnings stream – Increases fee income contribution to total revenue • Strong financial returns with IRR > 20%, accretive to earnings, and additive to ROE – Maintain strong capital position SVB Financial Group Investor Presentation 3

SVB serves innovative companies of all sizes around the world Technology + Life Science & Healthcare Accelerator Growth Corp Fin Investors Individuals Revenue Revenue Revenue Private Equity Private Bank <$5M $5M–$75M >$75M Venture Capital Wealth Management l SVB Financial Group’s offices l SVB Financial Group’s international banking network China | Germany | Israel | United Kingdom | United States SVB Financial Group Investor Presentation 4SVB serves innovative companies of all sizes around the world Technology + Life Science & Healthcare Accelerator Growth Corp Fin Investors Individuals Revenue Revenue Revenue Private Equity Private Bank <$5M $5M–$75M >$75M Venture Capital Wealth Management l SVB Financial Group’s offices l SVB Financial Group’s international banking network China | Germany | Israel | United Kingdom | United States SVB Financial Group Investor Presentation 4

SVB is the financial partner of choice for innovative life science & healthcare companies Sector expertise Our clients More than More than MEDICAL HEALTHCARE IT DEVICES 2,680 50% / DIGITAL HEALTH Life science and healthcare of U.S. life science and healthcare clients in the U.S., as of 3Q’18 companies that have done a secondary in 2018 are SVB clients BIOPHARMA & HEALTHCARE DIAGNOSTICS SERVICES 66% 15% of VC-backed life science and Year-over-year client growth healthcare companies that since Q1 2016 Client Funds & Loans portfolios went public in the U.S. in 2018 2 are SVB clients *Additional clients in the UK, Germany, and China 1 total client funds $33.3B $27.5B Client investments (off-balance sheet) 65 public company clients with $4.8B Noninterest-bearing deposits market cap over $1B $1.0B Interest-bearing deposits 1 total loan commitments $2.7B $1.20B Biopharma and diagnostics $420M Healthcare services $570M Healthcare IT/digital health $520M Medical devices 1. As reported on a consolidated basis as of September 30, 2018. 2. Q3 2018 PitchBook-NVCA Venture Monitor. SVB Financial Group Investor Presentation 5SVB is the financial partner of choice for innovative life science & healthcare companies Sector expertise Our clients More than More than MEDICAL HEALTHCARE IT DEVICES 2,680 50% / DIGITAL HEALTH Life science and healthcare of U.S. life science and healthcare clients in the U.S., as of 3Q’18 companies that have done a secondary in 2018 are SVB clients BIOPHARMA & HEALTHCARE DIAGNOSTICS SERVICES 66% 15% of VC-backed life science and Year-over-year client growth healthcare companies that since Q1 2016 Client Funds & Loans portfolios went public in the U.S. in 2018 2 are SVB clients *Additional clients in the UK, Germany, and China 1 total client funds $33.3B $27.5B Client investments (off-balance sheet) 65 public company clients with $4.8B Noninterest-bearing deposits market cap over $1B $1.0B Interest-bearing deposits 1 total loan commitments $2.7B $1.20B Biopharma and diagnostics $420M Healthcare services $570M Healthcare IT/digital health $520M Medical devices 1. As reported on a consolidated basis as of September 30, 2018. 2. Q3 2018 PitchBook-NVCA Venture Monitor. SVB Financial Group Investor Presentation 5

Leerink is a leading life science & healthcare investment bank Founded: 1995 Headquarters: Boston, Massachusetts Locations: New York, San Francisco, and Charlotte Founder and CEO: Jeff Leerink President and Head of Investment Banking: Jim Boylan Chief Administrative Officer: Joe Gentile Equity Capital Markets M&A Expertise Consistently ranked “Top 5” A leading M&A Advisor providing Bookrunning Underwriter for IPOs strategic advice to leaders in this and Follow-on Offerings dynamic market Research Sales & Trading Experienced Healthcare research team Seasoned Sales and Trading Platform covering 180 companies across covering over 900 institutions and therapeutics, life science tools, clinical making a market in over 500 diagnostics, medical devices and healthcare stocks healthcare services / IT Convertibles Asset Management Underwriting and structuring for corporate ~$750m AUM multi-strategy asset management business clients, as well as sales & trading ideas and that includes i) Leerink Revelation Partners: secondary execution across the universe of healthcare investing in healthcare, and ii) Leerink Transformation convertibles for institutional clients Partners: healthcare/ technology fund SVB Financial Group Investor Presentation 6Leerink is a leading life science & healthcare investment bank Founded: 1995 Headquarters: Boston, Massachusetts Locations: New York, San Francisco, and Charlotte Founder and CEO: Jeff Leerink President and Head of Investment Banking: Jim Boylan Chief Administrative Officer: Joe Gentile Equity Capital Markets M&A Expertise Consistently ranked “Top 5” A leading M&A Advisor providing Bookrunning Underwriter for IPOs strategic advice to leaders in this and Follow-on Offerings dynamic market Research Sales & Trading Experienced Healthcare research team Seasoned Sales and Trading Platform covering 180 companies across covering over 900 institutions and therapeutics, life science tools, clinical making a market in over 500 diagnostics, medical devices and healthcare stocks healthcare services / IT Convertibles Asset Management Underwriting and structuring for corporate ~$750m AUM multi-strategy asset management business clients, as well as sales & trading ideas and that includes i) Leerink Revelation Partners: secondary execution across the universe of healthcare investing in healthcare, and ii) Leerink Transformation convertibles for institutional clients Partners: healthcare/ technology fund SVB Financial Group Investor Presentation 6

Expands Our Solutions to Support Our Client Base Full suite of financial services Global Commercial Bank ¤ Silicon Valley SVB Capital SVB Private Bank Bank/Wealth Treasury Management: FX, Private venture ¤ investing expertise, Cards, Payments Advisory Global commercial oversight and banking for innovators, Private banking and Asset/Fund Management management enterprises and ¤¤ investment strategies investors for influencers in the Private Bank innovation ecosystem ¤ Wealth Management ¤ + Equity Capital Markets ¤ • Expansive client base Convertible Capital Markets ¤ • Full suite of equity, convertible, and advisory solutions M&A Advisory ¤ • Top research franchise • MEDAcorp, a specialized knowledge asset Sales and Trading ¤ • Deep relationships with investors and strategic partners Equity Research ¤ SVB Financial Group Investor Presentation 7Expands Our Solutions to Support Our Client Base Full suite of financial services Global Commercial Bank ¤ Silicon Valley SVB Capital SVB Private Bank Bank/Wealth Treasury Management: FX, Private venture ¤ investing expertise, Cards, Payments Advisory Global commercial oversight and banking for innovators, Private banking and Asset/Fund Management management enterprises and ¤¤ investment strategies investors for influencers in the Private Bank innovation ecosystem ¤ Wealth Management ¤ + Equity Capital Markets ¤ • Expansive client base Convertible Capital Markets ¤ • Full suite of equity, convertible, and advisory solutions M&A Advisory ¤ • Top research franchise • MEDAcorp, a specialized knowledge asset Sales and Trading ¤ • Deep relationships with investors and strategic partners Equity Research ¤ SVB Financial Group Investor Presentation 7

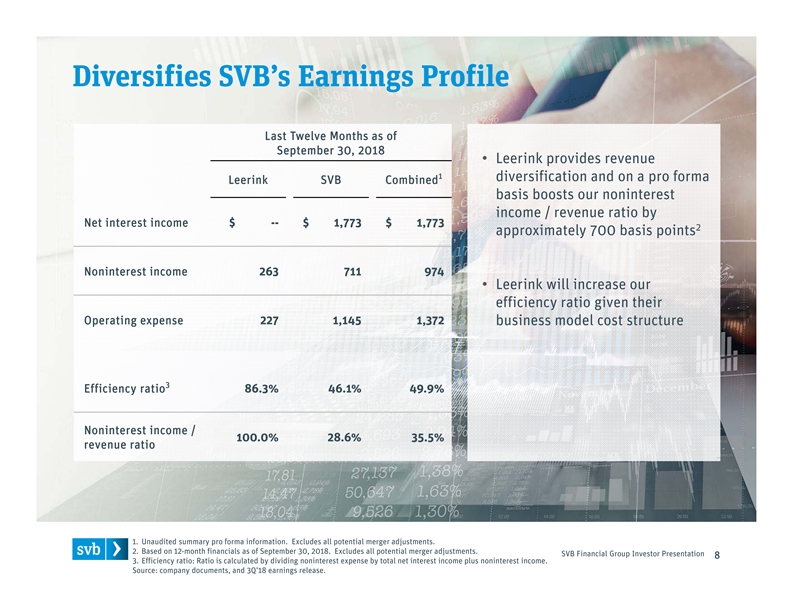

Diversifies SVB’s Earnings Profile Last Twelve Months as of September 30, 2018 • Leerink provides revenue 1 diversification and on a pro forma Leerink SVB Combined basis boosts our noninterest income / revenue ratio by Net interest income $ -- $ 1,773 $ 1,773 2 approximately 700 basis points Noninterest income 263 711 974 • Leerink will increase our efficiency ratio given their Operating expense 227 1,145 1,372 business model cost structure 3 Efficiency ratio 86.3% 46.1% 49.9% Noninterest income / 100.0% 28.6% 35.5% revenue ratio 1. Unaudited summary pro forma information. Excludes all potential merger adjustments. 2. Based on 12-month financials as of September 30, 2018. Excludes all potential merger adjustments. SVB Financial Group Investor Presentation 8 3. Efficiency ratio: Ratio is calculated by dividing noninterest expense by total net interest income plus noninterest income. Source: company documents, and 3Q’18 earnings release.Diversifies SVB’s Earnings Profile Last Twelve Months as of September 30, 2018 • Leerink provides revenue 1 diversification and on a pro forma Leerink SVB Combined basis boosts our noninterest income / revenue ratio by Net interest income $ -- $ 1,773 $ 1,773 2 approximately 700 basis points Noninterest income 263 711 974 • Leerink will increase our efficiency ratio given their Operating expense 227 1,145 1,372 business model cost structure 3 Efficiency ratio 86.3% 46.1% 49.9% Noninterest income / 100.0% 28.6% 35.5% revenue ratio 1. Unaudited summary pro forma information. Excludes all potential merger adjustments. 2. Based on 12-month financials as of September 30, 2018. Excludes all potential merger adjustments. SVB Financial Group Investor Presentation 8 3. Efficiency ratio: Ratio is calculated by dividing noninterest expense by total net interest income plus noninterest income. Source: company documents, and 3Q’18 earnings release.

Summary of Key Transaction Terms 1 • $280 million of cash to Leerink unitholders Purchase Price • Leerink to be re-branded as “SVB Leerink” Branding • Jeff Leerink to remain CEO • Jim Boylan to remain President and Head of Investment Banking Management • Joe Gentile to remain CAO • $60 million retention pool paid over 5 years to key employees Retention • Key employees have signed employment and retention agreements • Leerink unitholder consent already obtained Approvals Required • Customary regulatory approvals, FINRA and HSR • Q1 2019 Expected Closing 1. Subject to delivery of agreed upon capital; Leerink will dividend any excess capital to unitholders prior to close. SVB Financial Group Investor Presentation 9Summary of Key Transaction Terms 1 • $280 million of cash to Leerink unitholders Purchase Price • Leerink to be re-branded as “SVB Leerink” Branding • Jeff Leerink to remain CEO • Jim Boylan to remain President and Head of Investment Banking Management • Joe Gentile to remain CAO • $60 million retention pool paid over 5 years to key employees Retention • Key employees have signed employment and retention agreements • Leerink unitholder consent already obtained Approvals Required • Customary regulatory approvals, FINRA and HSR • Q1 2019 Expected Closing 1. Subject to delivery of agreed upon capital; Leerink will dividend any excess capital to unitholders prior to close. SVB Financial Group Investor Presentation 9

Strong Financial Returns Expected Revenue synergies identified but not included in our metrics; no cost savings assumed • >20% IRR • 2019: 1.3% 1 EPS Accretion • 2020: 1.8% • 4% dilutive to tangible book value per share at close 2 TBV Impact • ~5 year earnback • +100 basis points accretive to our return on tangible common equity ROATCE Impact • TCE / TA: ~35 basis point decline Solid Pro Forma Capital Ratios • CET1: ~60 basis point decline 1. Pro forma EPS is inclusive of intangible amortization, which is pending and subject to change. 2. Earnback measure is based on the ‘crossover’ method, which measures the time period in which it takes our pro forma tangible book value per share to exceed our projected standalone tangible book value per share. SVB Financial Group Investor Presentation 10Strong Financial Returns Expected Revenue synergies identified but not included in our metrics; no cost savings assumed • >20% IRR • 2019: 1.3% 1 EPS Accretion • 2020: 1.8% • 4% dilutive to tangible book value per share at close 2 TBV Impact • ~5 year earnback • +100 basis points accretive to our return on tangible common equity ROATCE Impact • TCE / TA: ~35 basis point decline Solid Pro Forma Capital Ratios • CET1: ~60 basis point decline 1. Pro forma EPS is inclusive of intangible amortization, which is pending and subject to change. 2. Earnback measure is based on the ‘crossover’ method, which measures the time period in which it takes our pro forma tangible book value per share to exceed our projected standalone tangible book value per share. SVB Financial Group Investor Presentation 10

Summary • The acquisition of Leerink strengthens SVB’s position as the leading financial services provider to global Life Science and Healthcare Companies • Expands our solutions available to support the most innovative companies in the sector • Enhances our deep sector expertise • Client-centric culture shared across the platform • Diversifies earnings stream • Strong financial returns with IRR > 20%, accretive to earnings, and additive to ROE SVB Financial Group Investor Presentation 11Summary • The acquisition of Leerink strengthens SVB’s position as the leading financial services provider to global Life Science and Healthcare Companies • Expands our solutions available to support the most innovative companies in the sector • Enhances our deep sector expertise • Client-centric culture shared across the platform • Diversifies earnings stream • Strong financial returns with IRR > 20%, accretive to earnings, and additive to ROE SVB Financial Group Investor Presentation 11

Appendix SVB Financial Group Investor Presentation 12Appendix SVB Financial Group Investor Presentation 12

Leerink Partners U.S. Cumulative Ranking: By Deal Value & Deal Count Bookrun Equity Bookrun Convertibles M&A (1) 2015 – 2018 YTD 2016 – 2018 YTD 2015 – 2018 YTD Deal Deal Deal Rank Company Rank Company Rank Company Value Value Value 1 J.P. Morgan $11,924 1 Goldman Sachs $57,412 1 J.P. Morgan $3,047 2 Cowen & Company $8,781 2 Goldman Sachs $1,676 2 JPMorgan $50,350 3 Jefferies $7,927 3 Morgan Stanley $1,483 3Citi $37,724 4 Morgan Stanley $31,325 4 $7,823 4 $1,225 5 Bank of America Merrill Lynch $26,470 5 Bank of America Merrill Lynch $1,129 5 Goldman Sachs $7,781 6 Centerview Partners $23,304 6 Jefferies $1,056 6 Bank of America Merrill Lynch $6,768 7 Jefferies $21,327 7 Morgan Stanley $5,946 7 Cowen & Company $728 8 Guggenheim Partners $20,065 8 Citi $4,125 8 Wells Fargo Securities $537 9 Lazard $18,236 9 Piper Jaffray $3,901 9 RBC Capital Markets $510 10 Barclays $17,808 Credit Suisse $3,486 10 10 Citi $500 11 $16,935 Deal Deal Deal Rank Company Rank Company Rank Company Count Count Count 1 J.P. Morgan 167 1 J.P. Morgan 24 1 J.P Morgan 65 2 Cowen & Company 165 2 Goldman Sachs 12 2 Jefferies 40 3 Jefferies 153 3 Morgan Stanley 10 338 144 10 4 4 4 Goldman Sachs 34 5 Bank of America Merrill Lynch 27 5 Goldman Sachs 101 5 Bank of America Merrill Lynch 8 6Citi 27 6 Bank of America Merrill Lynch 95 6 Jefferies 8 7 Morgan Stanley 91 7Cowen & Company 6 7 Piper Jaffray & Co 27 8Citi 83 8 Wells Fargo Securities 6 8 Morgan Stanley 22 9 Lazard 22 9 Piper Jaffray 79 9 RBC Capital Markets 4 10 Credit Suisse 63 10 Citi 4 10 Houlihan Lokey 22 Note: Healthcare equity rankings are apportioned evenly among bookrunners with a target market between $50mm - $250mm for IPOs and between $50mm - $500mm for Follow-Ons and Convertibles. Healthcare M&A transactions include corporate deals between $50mm - $5bn and PE deals between $50mm -$1bn. (1) Cumulative ranking for convertibles represents 2016 to 2018YTD. Investment in Convertibles team in 2016. SVB Financial Group Investor Presentation 13 Source: Dealogicas of 11/6/2018.Dollars are in millions.Leerink Partners U.S. Cumulative Ranking: By Deal Value & Deal Count Bookrun Equity Bookrun Convertibles M&A (1) 2015 – 2018 YTD 2016 – 2018 YTD 2015 – 2018 YTD Deal Deal Deal Rank Company Rank Company Rank Company Value Value Value 1 J.P. Morgan $11,924 1 Goldman Sachs $57,412 1 J.P. Morgan $3,047 2 Cowen & Company $8,781 2 Goldman Sachs $1,676 2 JPMorgan $50,350 3 Jefferies $7,927 3 Morgan Stanley $1,483 3Citi $37,724 4 Morgan Stanley $31,325 4 $7,823 4 $1,225 5 Bank of America Merrill Lynch $26,470 5 Bank of America Merrill Lynch $1,129 5 Goldman Sachs $7,781 6 Centerview Partners $23,304 6 Jefferies $1,056 6 Bank of America Merrill Lynch $6,768 7 Jefferies $21,327 7 Morgan Stanley $5,946 7 Cowen & Company $728 8 Guggenheim Partners $20,065 8 Citi $4,125 8 Wells Fargo Securities $537 9 Lazard $18,236 9 Piper Jaffray $3,901 9 RBC Capital Markets $510 10 Barclays $17,808 Credit Suisse $3,486 10 10 Citi $500 11 $16,935 Deal Deal Deal Rank Company Rank Company Rank Company Count Count Count 1 J.P. Morgan 167 1 J.P. Morgan 24 1 J.P Morgan 65 2 Cowen & Company 165 2 Goldman Sachs 12 2 Jefferies 40 3 Jefferies 153 3 Morgan Stanley 10 338 144 10 4 4 4 Goldman Sachs 34 5 Bank of America Merrill Lynch 27 5 Goldman Sachs 101 5 Bank of America Merrill Lynch 8 6Citi 27 6 Bank of America Merrill Lynch 95 6 Jefferies 8 7 Morgan Stanley 91 7Cowen & Company 6 7 Piper Jaffray & Co 27 8Citi 83 8 Wells Fargo Securities 6 8 Morgan Stanley 22 9 Lazard 22 9 Piper Jaffray 79 9 RBC Capital Markets 4 10 Credit Suisse 63 10 Citi 4 10 Houlihan Lokey 22 Note: Healthcare equity rankings are apportioned evenly among bookrunners with a target market between $50mm - $250mm for IPOs and between $50mm - $500mm for Follow-Ons and Convertibles. Healthcare M&A transactions include corporate deals between $50mm - $5bn and PE deals between $50mm -$1bn. (1) Cumulative ranking for convertibles represents 2016 to 2018YTD. Investment in Convertibles team in 2016. SVB Financial Group Investor Presentation 13 Source: Dealogicas of 11/6/2018.Dollars are in millions.

Q&A Greg Becker, CEO Mike Descheneaux, President of Silicon Valley Bank Dan Beck, CFOQ&A Greg Becker, CEO Mike Descheneaux, President of Silicon Valley Bank Dan Beck, CFO