Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Marker Therapeutics, Inc. | tv506096_ex32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Marker Therapeutics, Inc. | tv506096_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Marker Therapeutics, Inc. | tv506096_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Marker Therapeutics, Inc. | tv506096_ex31-1.htm |

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | Quarterly Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 for the quarterly period ended September 30, 2018 |

| ¨ | Transition Report Under Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from _____ to _____. |

Commission File Number: 001-37939

MARKER THERAPEUTICS, INC.

(Name of registrant in its charter)

| DELAWARE | 45-4497941 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

|

5 West Forsyth Street, Suite 200 Jacksonville, FL |

32202 | |

| (Address of principal executive offices) | (Zip Code) | |

| 904-516-5436 | ||

| (Issuer's telephone number) |

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “accelerated filer”, “large accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act (check one):

| ¨ | Large accelerated filer | ¨ | Accelerated filer |

| x | Non-accelerated filer | x | Smaller reporting company |

| ¨ | Emerging growth company | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of November 8, 2018, the Company had 45,370,695 shares of common stock issued and outstanding.

| PART I. | FINANCIAL INFORMATION |

| Item 1. | Financial Statements |

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| September 30, 2018 | December 31, 2017 | |||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash | $ | 4,294,271 | $ | 5,129,289 | ||||

| Prepaid expenses and deposits | 96,967 | 51,150 | ||||||

| Total current assets | 4,391,238 | 5,180,439 | ||||||

| Total assets | $ | 4,391,238 | $ | 5,180,439 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 3,588,771 | $ | 1,508,312 | ||||

| Warrant liability | 107,000 | 9,000 | ||||||

| Promissory note | 5,000 | 5,000 | ||||||

| Total current liabilities | 3,700,771 | 1,522,312 | ||||||

| Total liabilities | 3,700,771 | 1,522,312 | ||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||

| Stockholders' equity: | ||||||||

| Preferred stock - $0.001 par value, 5 million shares authorized at September 30, 2018 and December 31, 2017, respectively | ||||||||

| Series A, $0.001 par value, 1.25 million shares designated, 0 shares issued and outstanding as of September 30, 2018 and December 31, 2017, respectively | - | - | ||||||

| Series B, $0.001 par value, 1.5 million shares designated, 0 shares issued and outstanding as of September 30, 2018 and December 31, 2017, respectively | - | - | ||||||

| Common stock, $0.001 par value, 41.7 million shares authorized, 13.8 million and 10.6 million shares issued and outstanding as of September 30, 2018 and December 31, 2017, respectively | 13,845 | 10,616 | ||||||

| Additional paid-in capital | 171,221,851 | 161,067,538 | ||||||

| Accumulated deficit | (170,545,229 | ) | (157,420,027 | ) | ||||

| Total stockholders' equity | 690,467 | 3,658,127 | ||||||

| Total liabilities and stockholders' equity | $ | 4,391,238 | $ | 5,180,439 | ||||

See accompanying notes to these unaudited condensed consolidated financial statements.

| 1 |

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

| For the three months ended | For the nine months ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Revenues: | ||||||||||||||||

| Grant income | $ | - | $ | 183,064 | $ | 205,994 | $ | 183,064 | ||||||||

| Total revenues | - | 183,064 | 205,994 | 183,064 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | 1,877,260 | 1,623,302 | 5,303,647 | 3,815,119 | ||||||||||||

| General and administrative | 2,551,146 | 2,549,272 | 7,202,036 | 5,167,582 | ||||||||||||

| Total operating expenses | 4,428,406 | 4,172,574 | 12,505,683 | 8,982,701 | ||||||||||||

| Loss from operations | (4,428,406 | ) | (3,989,510 | ) | (12,299,689 | ) | (8,799,637 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Change in fair value of warrant liabilities | 40,000 | 4,000 | (98,000 | ) | 8,500 | |||||||||||

| Debt extinguishment gain | - | - | - | 492,365 | ||||||||||||

| Net loss | $ | (4,388,406 | ) | $ | (3,985,510 | ) | $ | (12,397,689 | ) | $ | (8,298,772 | ) | ||||

| Net loss per share, Basic and Diluted | $ | (0.32 | ) | $ | (0.39 | ) | $ | (1.03 | ) | $ | (0.91 | ) | ||||

| Weighted average number of common shares outstanding | 13,733,406 | 10,219,138 | 12,082,176 | 9,081,678 | ||||||||||||

See accompanying notes to these unaudited condensed consolidated financial statements.

| 2 |

CONDENSED CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

(UNAUDITED)

| Total | ||||||||||||||||||||

| Common Stock | Additional Paid- | Accumulated | Stockholders' | |||||||||||||||||

| Shares | Par value | in Capital | Deficit | Equity | ||||||||||||||||

| Balance at January 1, 2018 | 10,615,724 | $ | 10,616 | $ | 161,067,538 | $ | (157,420,027 | ) | $ | 3,658,127 | ||||||||||

| Issuance of common stock in private placement | 1,300,000 | 1,300 | 3,118,700 | - | 3,120,000 | |||||||||||||||

| Stock options exercised for cash | 10,416 | 10 | 18,115 | - | 18,125 | |||||||||||||||

| Stock warrants exercised for cash | 1,496,881 | 1,497 | 4,342,674 | - | 4,344,171 | |||||||||||||||

| Stock warrants cashless exercised | 215,336 | 215 | (215 | ) | - | - | ||||||||||||||

| Stock-based compensation | 206,446 | 207 | 1,947,526 | - | 1,947,733 | |||||||||||||||

| Fair value of repriced warrants as inducement | - | - | 727,513 | (727,513 | ) | - | ||||||||||||||

| Net loss | - | - | - | (12,397,689 | ) | (12,397,689 | ) | |||||||||||||

| Balance, September 30, 2018 | 13,844,803 | $ | 13,845 | $ | 171,221,851 | $ | (170,545,229 | ) | $ | 690,467 | ||||||||||

See accompanying notes to these unaudited condensed consolidated financial statements.

| 3 |

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| For the nine months ended | ||||||||

| September 30, | ||||||||

| 2018 | 2017 | |||||||

| Cash Flows from Operating Activities: | ||||||||

| Net loss | $ | (12,397,689 | ) | $ | (8,298,772 | ) | ||

| Reconciliation of net loss to net cash used in operating activities: | ||||||||

| Changes in fair value of warrant liabilities | 98,000 | (8,500 | ) | |||||

| Stock-based compensation | 1,947,733 | 2,332,915 | ||||||

| Debt extinguishment gain | - | (492,365 | ) | |||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expenses and deposits | (45,817 | ) | (26,381 | ) | ||||

| Accounts payable and accrued expenses | 2,080,459 | 532,122 | ||||||

| Net cash used in operating activities | (8,317,314 | ) | (5,960,981 | ) | ||||

| Cash Flows from Financing Activities: | ||||||||

| Proceeds from issuance of common stock and warrants in private placement, net of offering costs | 3,120,000 | 5,408,343 | ||||||

| Proceeds from exercise of stock warrants, net of offering costs | 4,344,171 | 619,623 | ||||||

| Proceeds from exercise of stock options | 18,125 | - | ||||||

| Repurchase of common stock to pay for employee withholding taxes | - | (310,493 | ) | |||||

| Net cash provided by financing activities | 7,482,296 | 5,717,473 | ||||||

| Net decrease in cash | (835,018 | ) | (243,508 | ) | ||||

| Cash at beginning of period | 5,129,289 | 7,851,243 | ||||||

| Cash at end of period | $ | 4,294,271 | $ | 7,607,735 | ||||

| For the nine months ended | ||||||||

| September 30, | ||||||||

| 2018 | 2017 | |||||||

| Supplemental schedule of non-cash financing activities: | ||||||||

| Fair value of repriced warrants as inducement | $ | 727,513 | $ | 622,042 | ||||

| Stock warrants cashless exercised | $ | 215 | $ | - | ||||

See accompanying notes to these unaudited condensed consolidated financial statements.

| 4 |

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2018

(Unaudited)

Note 1: Nature of Operations

Marker Therapeutics, Inc., a Delaware corporation formerly known as TapImmune, Inc. (the “Company” or “we”), is a clinical-stage immuno-oncology company specializing in the development and commercialization of innovative cell-based immunotherapies for the treatment of hematological malignancies and solid tumor indications, and novel peptide-based vaccines for the treatment of breast and ovarian cancers. The Company’s cell-based immunotherapy technology is based on the selective expansion of non-engineered, tumor-specific T cells that recognize tumor associated antigens (i.e. tumor targets) and kill tumor cells expressing those targets. Once infused into patients, this population of T cells recognizes multiple tumor targets to produce broad spectrum anti-tumor activity. Because the Company does not genetically engineer its T cells, when compared to current engineered CAR-T and TCR-based approaches, its products (i) are significantly less expensive and easier to manufacture, (ii) appear to be markedly less toxic, and (iii) are associated with potentially meaningful clinical benefit. As a result, the Company believes its portfolio of T cell therapies has a potentially compelling therapeutic product profile, as compared to current gene-modified CAR-T and TCR-based therapies. In addition, the Company’s legacy Folate Receptor Alpha program (TPIV200) for breast and ovarian cancers and our HER2/neu program (TPIV100/110) are in a combined five Phase II clinical trials. In parallel, the Company has been working on a proprietary nucleic acid-based antigen expression technology named PolyStart™ to improve the ability of the immune system to recognize and destroy diseased cells. The Company was incorporated in Nevada in 1992 and reincorporated in Delaware in October 2018 in connection with the Marker Transaction.

On October 17, 2018, the Company completed its previously announced business combination with Marker Cell Therapy, Inc., formerly known as Marker Therapeutics, Inc., a privately-held Delaware corporation (“Marker Cell”), in accordance with the terms of an Agreement and Plan of Merger and Reorganization dated as of May 15, 2018 (the “Merger Agreement”) by and among the Company, Timberwolf Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of the Company (“Merger Sub”), and Marker. On October 17, 2018, pursuant to the Merger Agreement, Merger Sub was merged with and into Marker Cell (the “Merger”), with Marker Cell being the surviving corporation and becoming a wholly-owned subsidiary of the Company. In connection with the Merger, the Company changed its name to Marker Therapeutics, Inc. and Marker Cell changed its name to Marker Cell Therapy, Inc. At the effective time of the Merger, the former Marker Cell stockholders received (i) an aggregate of 13,914,255 shares of the Company’s common stock which equaled the number of shares of the Company’s common stock issued and outstanding immediately prior to the effective time of the Merger, and (ii) an aggregate of 5,046,003 warrants which equaled the number of the Company’s warrants and stock options issued and outstanding immediately prior to the effective time of the Merger.

NOTE 2: Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and pursuant to the instructions to Form 10-Q and Article 8 of Regulation S-X of the Securities and Exchange Commission (“SEC”) and on the same basis as the Company prepares its annual audited consolidated financial statements. In the opinion of management, the accompanying unaudited condensed consolidated financial statements reflect all adjustments, consisting of normal recurring adjustments, considered necessary for a fair presentation of such interim results.

The results for the condensed consolidated statement of operations are not necessarily indicative of results to be expected for the year ending December 31, 2018 or for any future interim period. The condensed consolidated balance sheet at September 30, 2018 has been derived from unaudited financial statements; however, it does not include all of the information and notes required by U.S. GAAP for complete financial statements. The accompanying condensed consolidated financial statements should be read in conjunction with the consolidated financial statements for the year ended December 31, 2017, and notes thereto included in the Company’s annual report on Form 10-K filed on March 23, 2018 and the Company’s Form 8-K and Form 8-K/A filed on October 30, 2018 and October 26, 2018, respectively.

| 5 |

NOTE 3: LIQUIDITY AND FINANCIAL CONDITION

As of September 30, 2018, the Company had cash of approximately $4.3 million. On October 17, 2018, concurrent with the completion of the merger with Marker Cell, the Company issued shares of its common stock to certain accredited investors in a private placement transaction for proceeds of $61.8 million, net of banker fees, pursuant to the terms of the Securities Purchase Agreement.

The Company’s activities since inception have consisted principally of acquiring product and technology rights, raising capital, and performing research and development. Successful completion of the Company’s development programs and, ultimately, the attainment of profitable operations are dependent on future events, including, among other things, its ability to access potential markets; secure financing, develop a customer base; attract, retain and motivate qualified personnel; and develop strategic alliances and collaborations. From inception, the Company has been funded by a combination of equity and debt financings.

The Company expects to continue to incur substantial losses over the next several years during its development phase. To fully execute its business plan, the Company will need to complete certain research and development activities and clinical studies. Further, the Company’s product candidates will require regulatory approval prior to commercialization. These activities will span many years and require substantial expenditures to complete and may ultimately be unsuccessful. Any delays in completing these activities could adversely impact the Company. The Company plans to meet its capital requirements primarily through issuances of debt and equity securities and, in the longer term, revenue from product sales.

Note 4: SIGNIFICANT ACCOUNTING POLICIES

There have been no material changes in the Company’s significant accounting policies to those previously disclosed in the Company’s annual report on Form 10-K, which was filed with the SEC on March 23, 2018.

New Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (“FASB”) or other standard setting bodies that we adopt as of the specified effective date. Unless otherwise discussed, we do not believe that the impact of recently issued standards that are not yet effective will have a material impact on our financial position or results of operations upon adoption.

Recent Accounting Pronouncements Adopted in the Year

Compensation-Stock Compensation

In May 2017, the FASB issued Accounting Standards Update (“ASU”) No. 2017-09, Compensation—Stock Compensation (Topic 718): Scope of Modification Accounting, which clarifies when to account for a change to the terms or conditions of a share-based payment award as a modification. Under the new guidance, modification accounting is required only if the fair value, the vesting conditions, or the classification of the award (as equity or liability) changes as a result of the change in terms or conditions. It is effective prospectively for the annual period beginning after December 15, 2017 and interim periods within that annual period. Early adoption is permitted. The Company adopted ASU 2017-09 on January 1, 2018; the adoption of ASU 2017-09 did not have a material impact on its financial condition or results of operations, as the Company has not had any modifications to share-based payment awards. However, if the Company does have a modification to an award in the future, it will follow the guidance in ASU 2017-09.

Revenue from Contracts with Customers

In May 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606)” (ASU 2014-09) as modified by ASU No. 2015-14, “Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date,” ASU 2016-08, “Revenue from Contracts with Customers (Topic 606): Principal versus Agent Considerations (Reporting Revenue Gross versus Net),” ASU No. 2016-10, “Revenue from Contracts with Customers (Topic 606): Identifying Performance Obligations and Licensing,” and ASU No. 2016-12, “Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients.” The revenue recognition principle in ASU 2014-09 is that an entity should recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In addition, new and enhanced disclosures will be required. Companies may adopt the new standard either using the full retrospective approach, a modified retrospective approach with practical expedients, or a cumulative effect upon adoption approach. The Company adopted the new standard effective January 1, 2018, using the modified retrospective approach. The only impact of the adoption of ASU 2014-09 was to reclassify the Company's grant income as revenue.

Recent Accounting Pronouncements Not Yet Adopted

Accounting for Certain Financial Instruments with Down Round Features

On July 13, 2017, the FASB issued a two-part ASU, No. 2017-11, (i). Accounting for Certain Financial Instruments with Down Round Features and (ii) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial Instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests With a Scope Exception.

| 6 |

The ASU is effective for public business entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018 and the interim periods within that annual period. Early adoption is permitted. The Company will be evaluating the impact of adopting this standard on the consolidated financial statements and disclosures.

Improvements to Non-Employee Share-Based Payment Accounting

In June 2018, the FASB issued ASU 2018-07 “Improvements to Non-employee Share-Based Payment Accounting”, which simplifies the accounting for share-based payments granted to non-employees for goods and services. Under the ASU, most of the guidance on such payments to non-employees would be aligned with the requirements for share-based payments granted to employees. The amendments are effective for fiscal years beginning after December 15, 2019, and interim periods within fiscal years beginning after December 15, 2020. Early adoption is permitted, but no earlier than an entity’s adoption date of Topic 606. The Company is currently evaluating the impact of the new standard on its consolidated financial statements.

Leases

In February 2016, the FASB issued ASU No. 2016-02, “Leases (Topic 842)” (“ASU 2016-02”) which supersedes ASC Topic 840, Leases. ASU 2016-02 requires lessees to recognize a right-of-use asset and a lease liability on their balance sheets for all the leases with terms greater than twelve months. Based on certain criteria, leases will be classified as either financing or operating, with classification affecting the pattern of expense recognition in the income statement. For leases with a term of twelve months or less, a lessee is permitted to make an accounting policy election by class of underlying asset not to recognize lease assets and lease liabilities. If a lessee makes this election, it should recognize lease expense for such leases generally on a straight-line basis over the lease term. ASU 2016-02 is effective for fiscal years beginning after December 15, 2018, and interim periods within those years, with early adoption permitted. In transition, lessees and lessors are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach. In July 2018, the FASB issued ASU No. 2018-11, “Leases (Topic 842): Targeted Improvements” that allows entities to apply the provisions of the new standard at the effective date (e.g. January 1, 2019), as opposed to the earliest period presented under the modified retrospective transition approach (January 1, 2017) and recognize a cumulative-effect adjustment to the opening balance of retained earnings in the period of adoption. The modified retrospective approach includes a number of optional practical expedients primarily focused on leases that commenced before the effective date of Topic 842, including continuing to account for leases that commence before the effective date in accordance with previous guidance, unless the lease is modified. The Company currently expects that most of its operating lease commitments will be subject to the new standard and recognized as operating lease liabilities and right-of-use assets upon its adoption of Topic 842, which will increase the total assets and total liabilities that the Company reports relative to such amounts prior to adoption. The Company is evaluating the impact of this guidance on its condensed consolidated financial statements.

SEC Disclosure Update and Simplification

In August 2018, the SEC adopted the final rule under SEC Release No. 33-10532, Disclosure Update and Simplification, amending certain disclosure requirements that were redundant, duplicative, overlapping, outdated or superseded. In addition, the amendments expanded the disclosure requirements on the analysis of stockholders' equity for interim financial statements. Under the amendments, an analysis of changes in each caption of stockholders' equity presented in the balance sheet must be provided in a note or separate statement. The analysis should present a reconciliation of the beginning balance to the ending balance of each period for which a statement of comprehensive income is required to be filed. This final rule was effective on November 5, 2018. The Company is evaluating the impact of this guidance on its condensed consolidated financial statements.

Note 5: NET LOSS PER SHARE APPLICABLE TO COMMON SHAREHOLDER

Basic loss per common share is computed by dividing net loss by the weighted average number of common shares outstanding during the reporting period. Diluted loss per common share is computed similarly to basic loss per common share except that it reflects the potential dilution that could occur if dilutive securities or other obligations to issue common stock were exercised or converted into common stock.

The following table sets forth the computation of net loss per share:

| 7 |

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Numerator: | ||||||||||||||||

| Net loss | $ | (4,388,406 | ) | $ | (3,985,510 | ) | $ | (12,397,689 | ) | $ | (8,298,772 | ) | ||||

| Denominator: | ||||||||||||||||

| Weighted average common shares outstanding | 13,733,406 | 10,219,138 | 12,082,176 | 9,081,678 | ||||||||||||

| Net loss per share data: | ||||||||||||||||

| Basic and Diluted | $ | (0.32 | ) | $ | (0.39 | ) | $ | (1.03 | ) | $ | (0.91 | ) | ||||

The following securities, rounded to the thousand, were not included in the diluted net loss per share calculation because their effect was anti-dilutive for the periods presented:

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2018 | 2017 | |||||||

| Common stock options | 439,000 | 455,000 | ||||||

| Common stock purchase warrants | 4,625,000 | 6,517,500 | ||||||

| Common stock warrants - liability treatment | 27,000 | 3,500 | ||||||

| Potentially dilutive securities | 5,091,000 | 6,976,000 | ||||||

Note 6: WARRANT LIABILITY AND FAIR VALUE MEASUREMENTS

A summary of quantitative information with respect to valuation methodology and significant unobservable inputs used for the Company’s common stock purchase warrants that are categorized within Level 3 of the fair value hierarchy for the nine months ended September 30, 2018 and 2017 is as follows:

| September 30, | September 30, | |||||||

| 2018 | 2017 | |||||||

| Stock price | $ | 9.05 | $ | 3.01 | ||||

| Exercise price | $ | 9.72 | $ | 1.20 | ||||

| Contractual term (years) | 1.33 | 0.78 | ||||||

| Volatility (annual) | 86 | % | 63 | % | ||||

| Risk-free rate | 2 | % | 1 | % | ||||

| Dividend yield (per share) | 0 | % | 0 | % | ||||

The foregoing assumptions are reviewed quarterly and are subject to change based primarily on management’s assessment of the probability of the events described occurring. Accordingly, changes to these assessments could materially affect the valuations.

Financial Liabilities Measured at Fair Value on a Recurring Basis

Financial liabilities measured at fair value on a recurring basis are summarized below and disclosed on the balance sheet under Warrant liability:

| 8 |

| Fair value measured at September 30, 2018 | ||||||||||||||||

| Quoted prices in active | Significant other | Significant | ||||||||||||||

| markets | observable inputs | unobservable inputs | Fair value at | |||||||||||||

| (Level 1) | (Level 2) | (Level 3) | September 30, 2018 | |||||||||||||

| Warrant liability | $ | - | $ | - | $ | 107,000 | $ | 107,000 | ||||||||

| Fair value measured at December 31, 2017 | ||||||||||||||||

| Quoted prices in active | Significant other | Significant | ||||||||||||||

| markets | observable inputs | unobservable inputs | Fair value at | |||||||||||||

| (Level 1) | (Level 2) | (Level 3) | December 31, 2017 | |||||||||||||

| Warrant liability | $ | - | $ | - | $ | 9,000 | $ | 9,000 | ||||||||

The fair value accounting standards define fair value as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is determined based upon assumptions that market participants would use in pricing an asset or liability. Fair value measurements are rated on a three-tier hierarchy as follows:

| · | Level 1 inputs: Quoted prices (unadjusted) for identical assets or liabilities in active markets; |

| · | Level 2 inputs: Inputs, other than quoted prices included in Level 1, that are observable either directly or indirectly; and |

| · | Level 3 inputs: Unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own assumptions. |

There were no transfers between Level 1, 2 or 3 during the nine months ended September 30, 2018.

The following table presents changes in Level 3 liabilities measured at fair value for the nine months ended September 30, 2018:

| Warrant | ||||

| Liability | ||||

| Balance - December 31, 2017 | $ | 9,000 | ||

| Change in fair value of warrant liability | 98,000 | |||

| Balance – September 30, 2018 | $ | 107,000 | ||

Note 7: STOCKHOLDERS’ EQUITY

Common Stock Transactions

Common Stock Purchase Agreement

On May 14, 2018, the Company’s largest stockholder Eastern Capital Limited entered into a Common Stock Purchase Agreement with the Company pursuant to which it purchased 1,300,000 shares of common stock at a price per share of $2.40 providing gross proceeds to the Company of $3.12 million.

Exercise and Repricing of Warrants Held by Existing Institutional Investors

On May 14, 2018, certain institutional holders of outstanding warrants entered into Warrant Exercise Agreements with the Company that provide for an amendment to the exercise price of the warrants being exercised at $2.50 per share. Upon closing of the Warrant Exercise Agreements, such institutional holders immediately exercised warrants for 782,505 shares of common stock providing aggregate proceeds to the Company of approximately $2.0 million.

The fair value relating to the modification of exercise prices on the repriced and exercised warrants was treated as deemed dividend on the statement of stockholders’ equity of $728,000.

A weighted average summary of quantitative information with respect to valuation methodology and significant unobservable inputs used for the Company’s common stock purchase warrants that are included in the modification is as follows:

| 9 |

| Weighted Average Inputs | ||||||||

| Before | After | |||||||

| Modification | Modification | |||||||

| Exercise price | $ | 9.93 | $ | 2.50 | ||||

| Contractual term (years) | 2.37 | 2.37 | ||||||

| Volatility (annual) | 79 | % | 79 | % | ||||

| Risk-free rate | 1.5 | % | 1.5 | % | ||||

| Dividend yield (per share) | 0 | % | 0 | % | ||||

Exercise of Stock Warrants

During the nine months ended September 30, 2018, certain outstanding warrants were exercised by warrant holders providing aggregate proceeds to the Company of approximately $2.4 million and resulted in the issuance of approximately 930,000 shares of common stock, which is net of 152,588 warrant shares cancelled due to use of cashless exercise provisions. 215,344 of the stock warrants exercised were exercised on a cashless basis.

Exercise of Stock Options

In January 2018, 10,416 shares of common stock were issued pursuant to stock option exercises at an exercise price equal to $1.74 per share.

Consulting Arrangements

During the nine months ended September 30, 2018, the Company issued 206,446 shares of common stock in connection with consulting agreements. The fair value of the common stock of approximately $1.3 million was recognized as stock-based compensation expense, $1.2 million in general and administrative expenses and $0.1 million in research and development expenses.

Share Purchase Warrants

A summary of the Company’s share purchase warrants as of September 30, 2018 and changes during the period is presented below:

| Weighted Average | ||||||||||||||||

| Number of | Weighted Average | Remaining Contractual | Total Intrinsic | |||||||||||||

| Warrants | Exercise Price | Life (in years) | Value | |||||||||||||

| Balance - January 1, 2018 | 6,520,000 | $ | 6.11 | 3.16 | $ | 1,739,000 | ||||||||||

| Issued | - | - | - | - | ||||||||||||

| Cashless exercised | (215,000 | ) | 4.04 | - | - | |||||||||||

| Exercised for cash | (1,497,000 | ) | 6.79 | - | - | |||||||||||

| Expired or cancelled | (156,000 | ) | 4.00 | - | - | |||||||||||

| Balance - September 30, 2018 | 4,652,000 | $ | 6.06 | 2.50 | $ | 17,583,000 | ||||||||||

Note 8: STOCK-BASED COMPENSATION

The following table sets forth stock-based compensation expenses recorded during the respective periods:

| For the three months ended | For the nine months ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Stock Compensation expenses: | ||||||||||||||||

| Research and development | $ | 189,000 | $ | 18,700 | $ | 656,000 | $ | 56,100 | ||||||||

| General and administrative | 662,000 | 1,667,300 | 1,291,000 | 2,276,900 | ||||||||||||

| Total stock compensation expenses | $ | 851,000 | $ | 1,686,000 | $ | 1,947,000 | $ | 2,333,000 | ||||||||

At September 30, 2018, the total stock-based compensation cost related to unvested awards not yet recognized was $108,000. The expected weighted average period compensation costs to be recognized was 0.40 years. Future option grants will impact the compensation expense recognized.

| 10 |

Note 9: grant income

During the nine months ended September 30, 2018 and 2017, the Company received $0.2 million of a grant awarded to Mayo Foundation from the U.S. Department of Defense for the Phase II Clinical Trial of TPIV200. The grant compensated the Company for clinical supplies manufactured and provided by the Company for the clinical study. In accordance with Accounting Standards Update No. 2014-09, “Revenue from Contracts with Customers (Topic 606)” issued by the Financial Accounting Standards Board, the Company recorded the $0.2 million of grant income as revenue.

Note 10: SUBSEQUENT EVENT

The Merger

On October 17, 2018, the Company completed its previously announced business combination with Marker Cell Therapy, Inc., formerly known as Marker Therapeutics, Inc., a privately-held Delaware corporation (“Marker Cell”), in accordance with the terms of an Agreement and Plan of Merger and Reorganization dated as of May 15, 2018 (the “Merger Agreement”) by and among the Company, Timberwolf Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of the Company (“Merger Sub”), and Marker. On October 17, 2018, pursuant to the Merger Agreement, Merger Sub was merged with and into Marker Cell (the “Merger”), with Marker Cell being the surviving corporation and becoming a wholly-owned subsidiary of the Company. In connection with the Merger, the Company changed its name to Marker Therapeutics, Inc. and Marker Cell changed its name to Marker Cell Therapy, Inc. At the effective time of the Merger, the former Marker Cell stockholders received (i) an aggregate of 13,914,255 shares of the Company’s common stock which equaled the number of shares of the Company’s common stock issued and outstanding immediately prior to the effective time of the Merger, and (ii) an aggregate of 5,046,003 warrants which equaled the number of the Company’s warrants and stock options issued and outstanding immediately prior to the effective time of the Merger.

The accounting for the business combination accounting is not complete. The Company is in the process of concluding on the total fair value of consideration issued and the allocation of fair value of assets acquired and liabilities assumed and therefore such information has not been concluded in these financial statements.

Securities Purchase Agreements

On October 17, 2018, concurrent with the completion of the Merger, the Company issued to certain accredited investors in a private placement transaction (the “Financing”), an aggregate of 17,500,000 shares of its common stock, and warrants to purchase 13,437,500 shares of common stock at an exercise price of $5.00 per share with a five-year term, for gross proceeds of $70 million pursuant to the terms of the Securities Purchase Agreements, dated June 8, 2018, by and among the Company and certain accredited investors (the “Securities Purchase Agreements”). Upon consummation of the Financing, and as a condition to the Securities Purchase Agreements, the Company is, among other things, obligated to file a resale registration statement with the SEC within 15 days following completion of the Financing.

| 11 |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This quarterly report on Form 10-Q contains forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, that involve risks and uncertainties. All statements other than statements relating to historical matters including statements to the effect that we “believe”, “expect”, “anticipate”, “plan”, “target”, “intend” and similar expressions should be considered forward-looking statements. Our actual results could differ materially from those discussed in the forward-looking statements as a result of a number of important factors, including factors discussed in this section and elsewhere in this quarterly report on Form 10-Q, and the risks discussed in our other filings with the Securities and Exchange Commission. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s analysis, judgment, belief or expectation only as the date hereof. We assume no obligation to update these forward-looking statements to reflect events or circumstance that arise after the date hereof.

As used in this quarterly report: (i) the terms “we”, “us”, “our”, “Marker” and the “Company” mean Marker Therapeutics, Inc. and its wholly owned subsidiaries, Marker Cell Therapy, Inc. and GeneMax Pharmaceuticals Inc. which wholly owns GeneMax Pharmaceuticals Canada Inc., unless the context otherwise requires; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

The following should be read in conjunction with our unaudited condensed consolidated interim financial statements and related notes for the three and nine months ended September 30, 2018 included in this quarterly report, as well as our Annual Report on Form 10-K for the year ended December 31, 2017 filed on March 23, 2018.

Company Overview

We are a clinical-stage immuno-oncology company specializing in the development and commercialization of innovative cell-based immunotherapies for the treatment of hematological malignancies and solid tumor indications and novel peptide-based vaccines for the treatment of breast and ovarian cancers.

Our cell-based immunotherapy technology is based on the selective expansion of non-engineered, tumor-specific T cells that recognize tumor associated antigens (i.e. tumor targets) and kill tumor cells expressing those targets. Once infused into patients, this population of T cells recognizes multiple tumor targets to produce broad spectrum anti-tumor activity. Because we do not genetically engineer its T cells, when compared to current engineered CAR-T and TCR-based approaches, its products (i) are significantly less expensive and easier to manufacture, (ii) appear to be markedly less toxic, and (iii) are associated with potentially meaningful clinical benefit. As a result, we believe our portfolio of T cell therapies has a potentially compelling therapeutic product profile, as compared to current gene-modified CAR-T and TCR-based therapies. In addition, our legacy Folate Receptor Alpha program (TPIV200) for breast and ovarian cancers and its HER2/neu program (TPIV100/110) are in five Phase II clinical trials. In parallel, we have been working on a proprietary nucleic acid-based antigen expression technology named PolyStart™ to improve the ability of the immune system to recognize and destroy diseased cells.

Immuno-oncology, which utilizes a patient’s own immune system to combat cancer, is one of the most actively pursued areas of research by biotechnology and pharmaceutical companies today. Interest and excitement about immunotherapy is driven by compelling efficacy data in cancers with historically bleak outcomes, and the potential to achieve a cure or functional cure for some patients. Harnessing the power of the immune system is an important component of fighting cancerous cells in the body. Our MultiTAA T cell therapy platform identifies and selects for effectively all T cells that are specific for any peptide from the antigens that our targets (e.g., WT1, MAGE-A4, PRAME, Survivin, NY-ESO-1, and SSX2). Our in-vitro manufacturing process promotes proliferation of very rare cancer-killing T cells to augment their anti-tumor properties and provide benefit to patients following their infusion. By using the multi-antigen targeted approach, our proprietary technology can kill heterogeneous tumor cell populations more effectively than single-antigen targeted approaches, thereby reducing the likelihood of tumor escape and potentially increasing the durability of a patient’s response to therapy.

Recent Developments

Merger Agreement

On October 17, 2018, the Company completed its previously announced business combination with Marker Cell Therapy, Inc., formerly known as Marker Therapeutics, Inc., a privately-held Delaware corporation (“Marker Cell”), in accordance with the terms of an Agreement and Plan of Merger and Reorganization dated as of May 15, 2018 (the “Merger Agreement”) by and among the Company, Timberwolf Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of the Company (“Merger Sub”), and Marker. On October 17, 2018, pursuant to the Merger Agreement, Merger Sub was merged with and into Marker Cell (the “Merger”), with Marker Cell being the surviving corporation and becoming a wholly-owned subsidiary of the Company. In connection with the Merger, the Company changed its name to Marker Therapeutics, Inc. and Marker Cell changed its name to Marker Cell Therapy, Inc. At the effective time of the Merger, the former Marker Cell stockholders received (i) an aggregate of 13,914,255 shares of the Company’s common stock which equaled the number of shares of the Company’s common stock issued and outstanding immediately prior to the effective time of the Merger, and (ii) an aggregate of 5,046,003 warrants which equaled the number of the Company’s warrants and stock options issued and outstanding immediately prior to the effective time of the Merger.

| 12 |

The issuance of the shares of Company common stock to the former stockholders of Marker Cell in connection with the Merger and related transactions was approved by the Company’s stockholders at the 2018 annual meeting of stockholders (the “2018 Annual Meeting”) held on October 16, 2018.

In connection with the Merger, the Company filed an amendment to its articles of incorporation in Nevada to increase the authorized shares of common stock from 41,666,667 shares to 150,000,000 shares and to change the Company’s name to Marker Therapeutics, Inc. (“Certificate of Amendment”). The Company then reincorporated from a Nevada corporation to a Delaware corporation and filed its certificate of incorporation in Delaware. Finally, a certificate of merger was filed in Delaware to merge Marker Cell Therapy, Inc. (f/k/a Marker Therapeutics, Inc.) with and into Merger Sub, with Marker Cell Therapy, Inc. being the surviving corporation and wholly owned subsidiary of the Company. The name change, reincorporation and Merger were all effective as of October 17, 2018. Beginning as of the market open on October 18, 2018, shares of the Company’s common stock commenced trading on The Nasdaq Capital Market under its new ticker symbol “MRKR”.

Securities Purchase Agreements

On October 17, 2018, concurrent with the completion of the Merger, the Company issued to certain accredited investors in a private placement transaction (the “Financing”), an aggregate of 17,500,000 shares of its common stock, and warrants to purchase 13,437,500 shares of common stock at an exercise price of $5.00 per share with a five-year term, for aggregate proceeds of $70 million pursuant to the terms of the Securities Purchase Agreements, dated June 8, 2018, by and among the Company and certain accredited investors (the “Securities Purchase Agreements”). Upon consummation of the Financing, and as a condition to the Securities Purchase Agreements, the Company is, among other things, obligated to file a resale registration statement with the SEC within 15 days following completion of the Financing.

After taking into account the issuance of shares in the Financing described above, immediately following the effective time of the Merger, the pro forma ownership of the issued and outstanding shares of Company common stock on a fully diluted basis (assuming all issued and outstanding warrants and options are exercised) will be approximately as follows: Marker Cell’s former stockholders 27.5%, Company stockholders prior to the Merger 27.5%, and the private placement stockholders 45%. Following the completion of the Merger and the Financing, there were 45,328,510 issued and outstanding shares of the Company’s common stock.

Products and Technology in Development

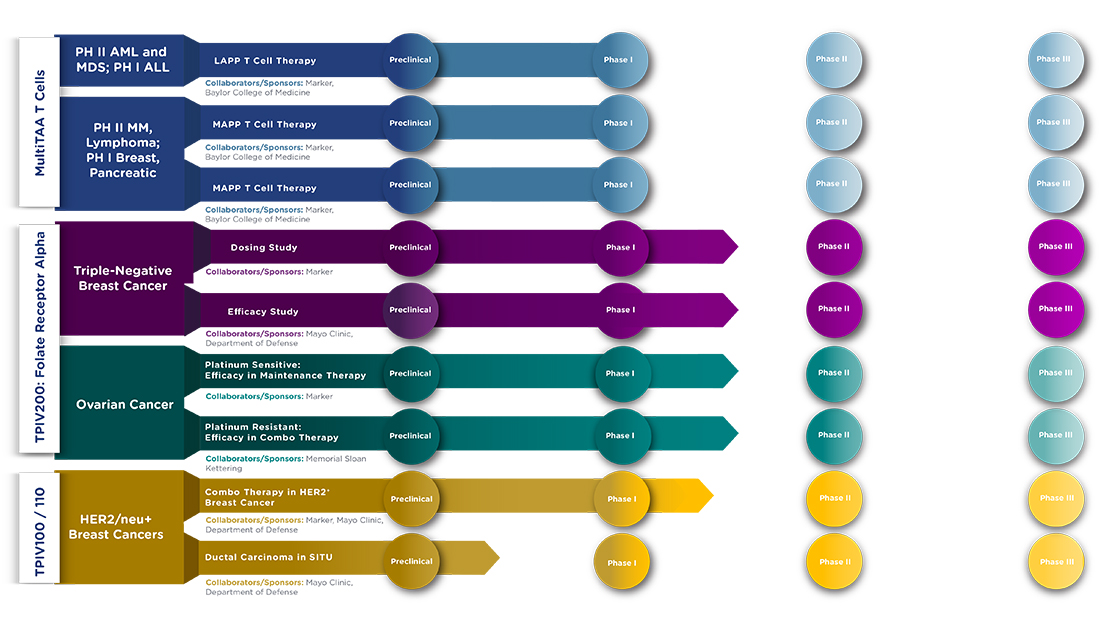

The following chart sets forth our products and technologies under development.

| 13 |

Our MULTI TAA T Cell Products

We are advancing two legacy Marker Cell products through clinical development:

| 1) | Mixed Antigen Peptide Pool (“MAPP”) T cells, which are currently used for patients with lymphoma, multiple myeloma and selected solid tumors, is an autologous product that targets the NY-ESO-1, PRAME, MAGE-A4, Survivin and SSX2 antigens, and |

| 2) | Leukemia Antigen Peptide Pool (“LAPP”) T cells, which are used for patients with AML, is an allogeneic product targeting the WT1, NY-ESO-1, PRAME, and Survivin antigens using the blood of the stem cell donor as a source of the cells used for therapy. |

While the blood source and the antigens for stimulation differ between the LAPP and the MAPP products, the manufacturing process for each product is otherwise identical.

Even if the single-antigen specific therapy can eliminate all the tumor cells expressing the targeted antigen, the residual tumor cells that do not express that antigen may survive and expand. In addition, tumor cells may also downregulate or mutate the targeted antigen, thus becoming invisible to the T cell therapy. Both phenomena create a transformed tumor that is impervious to that therapy. This process is referred to as antigen-negative tumor immune escape.

Our solution to the problem of tumor heterogeneity was to develop T cell products that simultaneously attack multiple tumor-expressed antigens and thereby enable more complete initial tumor targeting, thus minimizing the subsequent opportunity for the cancer to engage escape mechanisms. Of note, data suggest this strategy may be responsible for recruitment and activation of unique cancer-killing cells from the patient’s own immune repertoire to participate in cancer eradication, further minimizing the possibility for tumor cell escape.

Our proprietary MultiTAA T cell platform may have meaningful advantages over current CAR-T and TCR cell therapy approaches. Compared to current gene-modified T cell therapies, our programs are characterized by the following:

| 14 |

• Demonstrated clinical benefit, without the need for lymphodepletion before infusion: In our Phase I lymphoma study, we saw complete responses (“CRs”) in 50 – 60% of its evaluable patients. We believe it is significant that no patient with a CR has subsequently relapsed with disease, whereas typically 30% or more of patients with CR in reported CAR-T studies relapse within one year. In patient results to date, observed therapeutic responses appear to be highly durable, with some patients being relapse-free beyond two years.

• Non-gene-modified: Unlike CAR-T and TCR approaches, our therapy requires no genetic modification of T cells, a costly and complex process that significantly complicates the manufacturing of a patient product. We believes our therapy can be manufactured at a fraction of the cost of a gene-modified T cell product, with substantially reduced complexity of manufacturing.

• Low incidence rate of adverse events: In approximately 60 patients treated to date, we have seen only one grade III adverse reaction possibly related to our therapy. This appears to compare favorably with published CD19 CAR-T studies, wherein up to 95% of patients had associated grade III or higher adverse events during treatment. We believe that it is notable that there have been no cases of cytokine-release syndrome (“CRS”), or related serious adverse events (“SAEs”) in patients treated with its therapy to date.

• Capable of addressing a broad repertoire of cancer cells: While CAR-T and TCR therapies generally target a single epitope, our manufacturing process selects for T cells that are specific for multiple peptides derived from several targeted antigens. Deep gene sequencing of our products shows that a typical patient dose usually consists of approximately 4,000 unique T cell clonotypes targeting up to five different tumor-associated antigens. In layman’s terms, the five antigen targets can be recognized by a very wide range of T cells, facilitating robust killing of targeted cancer cells.

• Appears to drive endogenous immune responses: We see evidence of “epitope spreading” in its patients, meaning that our therapy is potentially inducing an enhanced response by the patient’s own T cells (specific for an expanded set of tumor-associated antigens beyond those targeted by our infused product). Our correlative analyses show expansion of endogenous T cells, other than those present in our product, in the months following the infusion of our product. This phenomenon, also known as “antigen spreading,” is potentially important in generating a durable response for a patient, because it enables the killing of tumors that do not express any of the antigens initially targeted by our product.

Our Folate Products

Folate Receptor alpha (“FRa”) is overexpressed in over 80% of breast cancers and in addition, over 90% of ovarian cancers, for which the only treatment options are surgery, radiation therapy and chemotherapy, leaving a very important and urgent clinical need for a new therapeutic strategy. Time to recurrence is relatively short for ovarian cancer and survival prognosis is extremely poor after recurrence. In the United States alone, there are approximately 30,000 ovarian cancer patients and 40,000 triple-negative breast cancer patients newly diagnosed every year. The FRa vaccine (now called TPIV200) intended to treat these conditions is composed of a mixture of five FRa immunogenic peptides adjuvanted with low-dose granulocyte-macrophage colony-stimulating factor GM-CSF.

GMP Manufacturing Scale Up of TPIV200 and Production to Supply Additional Phase II Clinical Trials

We have developed a commercial-quality lyophilized formulation of the TPIV200 peptides in a single vial for reconstitution and injection. Multi-gram peptide production scale-up has been successfully concluded, as well as GMP manufacturing of a second clinical lot of the TPIV200 peptides. The supply will be used in the company’s ongoing Phase II study in platinum-sensitive ovarian cancer, as well as the 280-patient Phase II study sponsored by the Mayo Clinic and funded by the U.S. Department of Defense (DoD) for treating triple-negative breast cancer. We also made various improvements to the vaccine manufacturing process, resulting in what we believe to be a superior formulation of the vaccine that is more amenable to large-scale manufacturing and commercialization. Thus, Good Manufacturing Practice (“GMP”) manufacturing development for the Phase II trials has been completed.

Phase I Human Clinical Trial – Folate Alpha Breast and Ovarian Cancers – Mayo Clinic

On July 27, 2015, we exercised our option agreement with Mayo Foundation with the signing of a worldwide exclusive license agreement to commercialize the proprietary FRa vaccine technology for all cancer indications. As part of this agreement, the IND for the Folate Receptor alpha Phase I trial was transferred from Mayo Foundation to the Company for Phase II clinical trials as our lead product.

The results from the initial 21-patient Phase I clinical trial for the FRa vaccine have now been reported. Twenty-one patients with breast or ovarian cancer, who had undergone standard surgery and adjuvant treatment, were treated with one cycle of cyclophosphamide. Following this, patients were vaccinated intradermally with TPIV200 on day one of a 28-day cycle for a maximum of six vaccination cycles. On March 15, 2018, we announced the publication of the clinical data from this trial. The results show that over 90% developed robust and durable antigen-specific immune responses against FRa without regard for HLA type, which aligns with the intended mechanism of action of the vaccine. TPIV200 vaccine was safe and well-tolerated; 20 out of 21 evaluable patients showed positive immune responses, providing a strong rationale for progressing to Phase II trials. Further, the data showed that 16 out of 16 patients in the observation stage showed persistent immune responses (Source: published online 15Mar2018; DOI: 10.1158/1078-0432.CCR-17-2499).

| 15 |

Phase II Development of TPIV200 for Triple-negative Breast Cancer

Triple-negative breast cancer (TNBC) is one of the most difficult cancers to treat and represents a clear unmet medical need. On September 15, 2015, we announced that our collaborators at the Mayo Foundation had been awarded a grant of $13.3 million from the DoD. This grant led by Dr. Keith Knutson of the Mayo Clinic in Jacksonville, Florida covers the costs for a 280-patient Phase II clinical trial of the FRa vaccine in patients with TNBC. We are working closely with Mayo Foundation on this clinical trial by providing clinical and manufacturing expertise, as well as providing GMP vaccine formulations under contract. This Phase II study of TPIV200 in the treatment of triple-negative breast cancer began enrolling patients in late 2017 and enrollment continues. Details regarding this trial can be found at www.clinicaltrials.gov under identifier numbers NCT03012100 and RU011501I.

On June 21, 2016, we announced the initiation of a randomized four-arm Phase II trial of TNBC that is sponsored and conducted by the Company (FRV-002), enrolling women with stage I-III disease who have completed initial surgery and chemo/radiation therapy. This open-label, 80-patient clinical trial is designed to evaluate dosing regimens, pre-treatment, efficacy, and immune responses. The study is evaluating two doses of TPIV200 (a high dose and a low dose), each of which will be tested both with and without immune priming with cyclophosphamide prior to vaccination. Key data from the trial is expected to be included in a future Biologics License Application submission to the FDA for marketing clearance. We completed enrollment in late 2017 and are now treating and following the patients. An independent Data Safety Monitoring Board (DSMB) reviews the safety in this ongoing Phase II study; no safety issues have been identified to date. Details regarding this trial can be found at www.clinicaltrials.gov under the identifier number NCT02593227.

Phase II Development of TPIV200 for Ovarian Cancer

On December 9, 2015, we announced that we received Orphan Drug Designation from the U.S. Food & Drug Administration’s Office of Orphan Products Development (“OOPD”) for our cancer vaccine TPIV200 in the treatment of ovarian cancer. The TPIV200 ovarian cancer clinical program will now receive benefits including tax credits on clinical research and seven-year market exclusivity upon receiving marketing approval. TPIV200 is a multi-epitope peptide vaccine that targets Folate Receptor alpha which is overexpressed in multiple cancers including over 90% of ovarian cancer cells. On February 3, 2016, we announced that the U.S. FDA designated the investigation of the multiple-epitope TPIV200 vaccine for maintenance therapy in subjects with platinum-sensitive advanced ovarian cancer who achieved stable disease or partial response following completion of standard-of-care chemotherapy, as a Fast Track Development Program.

On April 21, 2016, we announced our participation in an ovarian cancer study sponsored by Memorial Sloan Kettering Cancer Center (MSKCC) in New York City in collaboration with AstraZeneca Pharmaceuticals in ovarian cancer patients who are not responsive to platinum, a commonly used chemotherapy for ovarian cancer. This study, an open-label Phase II study of TPIV200 in 40 patients is designed to look at the effects of combination therapy with AstraZeneca’s checkpoint inhibitor durvalumab (anti-PD-L1). Because they are unresponsive to platinum, these patients have no real remaining options. Interim results from the first 27 patients were presented at the AACR-Rivkin Symposium in September 2018; safety of the combination was established in these heavily-pretreated patients and a subset of patients exhibited durable disease stabilization. ORR and PFS with combination treatment was not superior from the expected efficacy of single-agent PD-1/PD-L1 blockade. However, post-immunotherapy follow-up was suggestive of improved clinical benefit from standard therapies, as the majority of patients post-progression went on to receive subsequent standard therapy with durable clinical benefit, creating a rationale for exploration of these agents in combination with chemotherapy. Although we have no business relationship with AstraZeneca, we are paying for one-half of the costs of the clinical study, in addition to providing our TPIV200 for the study. Details regarding this trial can be found at www.clinicaltrials.gov under identifier numbers NCT02764333.

On January 10, 2017, we announced the initiation of a Company-sponsored Phase II study in platinum-sensitive ovarian cancer patients (FRV-004). This multi-center, double-blind efficacy study is designed to evaluate TPIV200 compared to GM-CSF alone in a randomized, placebo-controlled fashion during the first maintenance period after primary surgery and chemotherapy. Patients at this stage of their treatment have the highest potential for an immunotherapeutic effect and no other approved treatment options. We have opened multiple clinical sites and enrollment of the 120 patients has proceeded ahead of schedule. Safety is reviewed by an independent DSMB quarterly and an interim efficacy analysis is planned in 2019, once 50 patients have progressed. Details regarding this trial can be found at www.clinicaltrials.gov under the identifier number NCT02978222.

| 16 |

TPIV 100/110 – HER2/neu peptides with GM-CSF

Human epidermal growth factor receptor 2 (HER2/neu) amplification/overexpression is an effective therapeutic target in breast and gastric cancer. Over-expressed HER2 is detected predominantly in malignancies of epithelial origin, such as breast, gastric, esophageal, colorectal, salivary gland, pancreatic, epithelial ovarian, endometrial, and bladder carcinomas, as well as gallbladder and extrahepatic cholangiocarcinomas. HER2 is over-expressed in approximately 25% of breast cancers and its expression is associated with unfavorable pathologic features and aggressive disease if not treated with targeted therapies, relative to other forms of breast cancer. While the outcome of patients with HER2 positive breast cancer has significantly improved in the past few decades with an advent of anti-HER2 therapies, a substantial number of resected patients still subsequently develop metastatic disease. The continued prevalence of these cancers represents a high unmet medical need, justifying the targeted development of immunotherapeutic strategies.

Phase I Human Clinical Trial – HER2/neu+ Breast Cancer – Mayo Clinic

A Phase I study using a vaccine containing four HER2/neu peptides adjuvanted with GM-CSF (now called TPIV100) was initiated in 2012 at the Mayo Clinic and the primary readout was completed in 2015. Final safety analysis on all the patients treated showed that the vaccine was safe in that context. In addition, 19 out of 20 evaluable patients showed robust T-cell immune responses to the antigens in the vaccine composition providing a solid case for advancement to Phase II. Data from the study was presented at the San Antonio Breast Cancer Symposium on December 10, 2015. An additional secondary endpoint incorporated into this Phase I Trial will be a two-year follow-on recording the time to disease recurrence in the participating breast cancer patients. Details regarding this trial can be found at www.clinicaltrials.gov under the identifier number NCT01632332.

Transition of the HER2/neu Vaccine

On June 7, 2016, we announced that the Company had exercised its option agreement with Mayo Clinic and signed a worldwide license agreement to the proprietary HER2/neu vaccine technology. The license gives the Company the right to develop and commercialize the technology in any cancer indication in which the Her2/neu antigen is overexpressed. As part of this agreement, the IND for the HER2/neu Phase I Trial was transferred from Mayo Foundation to the Company for Phase II clinical trials as TPIV100, our second product.

On March 14, 2017, we announced that our partners at the Mayo Clinic received a $3.8 million grant from the DoD to conduct a Phase Ib study of the HER2-targeted vaccine candidate in an early form of breast cancer called ductal carcinoma in situ (DCIS). This is the second Company vaccine to be tested in a fully-funded study sponsored by the Mayo Clinic. We are working closely with Mayo Foundation on this clinical trial by providing clinical and manufacturing expertise, as well as providing GMP vaccine formulations under contract. If the study is successful, our HER2/neu vaccine may eventually augment or even replace standard surgery and chemotherapy, and potentially could become part of a routine immunization schedule for preventing breast cancer in healthy women. The study is expected to enroll 40 – 45 women with DCIS and begin to commence such enrollment during late 2018.

Phase II Development of the HER2/neu TPIV110 Vaccine

For subsequent clinical studies, we have added a Class I peptide, also licensed from the Mayo Clinic on April 16, 2012, to the four Class II peptides, producing TPIV 110 when the five peptides are mixed with GM-CSF. Management believes that the combination of Class I and Class II HER2/neu antigens, gives us the leading HER2/neu vaccine platform. We are amending the IND to incorporate the fifth peptide in subsequent studies to produce an even more robust vaccine activating both CD4+ (helper) and CD8+ (killer) T-cells. Discussions with the FDA have resulted in similar Phase II manufacturing process development that we conducted for TPIV200 that should allow us to file the amended IND for TPIV110 in late-2018.

On October 10, 2018, we announced that Mayo Clinic had been awarded a grant of $11 million from the DoD. This grant is intended to cover the costs of a large randomized, double-blind Phase 2 study of the Company’s HER2/neu-targeted breast cancer vaccine, TPIV110 compared to GM-CSF alone, in combination with trastuzumab (Herceptin®) and pertuzumab (Perjeta®), for treating up to 190 women with HER2/neu-positive breast cancer. We are working closely with Mayo Foundation on this clinical trial by providing clinical and manufacturing expertise, as well as providing GMP vaccine formulations under contract. The study will ask whether the administration of vaccine during trastuzumab and pertuzumab maintenance therapy in patients with residual disease post-neoadjuvant chemotherapy blocks disease recurrence and the development of metastatic breast cancer. By prevention of recurrence and metastasis, the expectation is that mortality associated with breast cancer will be decreased. Aside from the immunization component of the approach, another unique aspect is study of the role of the immune response, induced by monoclonal antibody therapy, in the neoadjuvant setting by engaging another 190 patients that demonstrated complete pathologic response to therapy but who do not get vaccine, potentially enabling a better understanding of mechanisms of immune escape.

Products and Technology – Pre-clinical

Polystart

In addition to the clinical developments, our peptide vaccine technology can be coupled with our PolyStart™ nucleic acid-based technology, which is designed to make vaccines significantly more effective by producing four times the required peptides for the immune systems to recognize and act on.

| 17 |

On February 7, 2017, we announced that we received a Notice of Allowance from the U.S. Patent and Trademark Office of our patent application titled, “Chimeric nucleic acid molecules with non-AUG initiation sequences and uses thereof,” which represents our first patent on our Polystart program.

On March 22, 2018, a Notice of Allowance was received that expanded the claims beyond FRA or Her2/neu peptide epitopes to broadly include any polypeptide portion comprising any poly-antigen arrays (PAAs) (i.e., for any tumor antigen or any infectious pathogen). We anticipate additional patent filings in connection with our research and development in this area. We plan to develop Polystart as both a stand-alone therapy and as a ‘boost strategy’ to be used synergistically with our peptide-based vaccines for breast and ovarian cancers.

Results of Operations

In this discussion of the Company’s results of operations and financial condition, amounts, other than per-share amounts, have been rounded to the nearest thousand dollars.

Three Months Ended September 30, 2018 Compared to Three Months Ended September 30, 2017

We recorded a net loss of $4.4 million or ($0.32) basic and diluted per share during the three months ended September 30, 2018 compared to a net loss of $4.0 million or ($0.39) basic and diluted per share during the three months ended September 30, 2017. The change in net loss period over period was due to the following changes:

Revenue

Grant income

During the three months ended September 30, 2017, we received $183,000 of a grant awarded to Mayo Foundation from the US Department of Defense for the Phase II Clinical Trial of TPIV200. The grant compensated us for clinical supplies manufactured by us and provided for the clinical study.

Operating Expenses

Operating expenses incurred during the three months ended September 30, 2018 were $4.4 million compared to $4.2 million in the prior period. Significant changes in operating expenses are outlined as follows:

| · | Research and development costs during the three months ended September 30, 2018 were $1.9 million compared to $1.6 million during the prior year period. The three months ended September 30, 2018 had increased expenses from the prior period relating to our clinical trials. |

| · | General and administrative expenses were $2.6 million during the three months ended September 30, 2018 as compared to $2.5 million during the prior year period. This slight increase was due to increased expenses relating to: |

| o | $0.2 million of headcount-related expenses, |

| o | $0.5 million of legal and other expenses relating to the announced merger agreement, and |

| o | $0.2 million of other miscellaneous general and administrative expenses. |

For the three-month period ended September 30, 2017, we recorded $0.8 million of stock-based compensation expenses relating to stock grants pursuant to Peter Hoang’s and Glynn Wilson’s employment agreements. These savings partially offset the increased expenses identified above.

| 18 |

Other Expense

Change in fair value of warrant liabilities

The change in fair value of warrant liabilities for the three months ended September 30, 2018 was ($40,000) as compared to ($4,000) for the three months ended September 30, 2017. This decrease by $40,000 for the three months ended September 30, 2018 is reflected by a corresponding other income in the condensed consolidated statement of operations.

Nine Months Ended September 30, 2018 Compared to Nine Months Ended September 30, 2017

We recorded a net loss of $12.4 million or ($1.03) basic and diluted per share during the nine months ended September 30, 2018 compared to a net loss of $8.3 million or ($0.91) basic and diluted per share during the nine months ended September 30, 2017. The change in net loss period over period was due to the following:

Revenue

Grant income

During the nine months ended September 30, 2018, we received $206,000 of a grant awarded to Mayo Foundation from the US Department of Defense for the Phase II Clinical Trial of TPIV200. The grant compensated us for clinical supplies manufactured by us and provided for the clinical study. During the nine months ended September 30, 2017, we received $183,000 of grant income.

Operating Expenses

Operating expenses incurred during the nine months ended September 30, 2018 were $12.5 million compared to $9.0 million in the prior period. Significant changes in operating expenses are outlined as follows:

| · | Research and development costs during the nine months ended September 30, 2018 were $5.3 million compared to $3.8 million during the prior year period. The nine months ended September 30, 2018 had increased expenses from the prior period relating to our clinical trials. |

| · | General and administrative expenses increased to $7.2 million during the nine months ended September 30, 2018 from $5.2 million during the prior year period. This was due to increased expenses relating to: |

| o | $0.2 million of stock-based compensation expenses for employees and outside consultants, |

| o | $0.3 million of headcount-related expenses, |

| o | $2.2 million of expenses relating to the announced merger agreement, and |

| o | $0.1 million of investor relations expenses. |

For the nine-month period ended September 30, 2017, we recorded $0.8 million of stock-based compensation expenses relating to stock grants pursuant to Peter Hoang’s and Glynn Wilson’s employment agreements. These savings partially offset the increased expenses identified above.

Other Expense

Change in fair value of warrant liabilities

The change in fair value of warrant liabilities for the nine months ended September 30, 2018 was $98,000 as compared to ($9,000) for the nine months ended September 30, 2017. This increase by $98,000 for the nine months ended September 30, 2018 is reflected by a corresponding other expense in the condensed consolidated statement of operations.

Debt extinguishment gain

In 2003 we entered into a license agreement with a foreign based third-party for certain adenovirus technology. The license agreement was amended several times between inception and 2008 at which time it was amended and restated and had a fixed three-year term expiring in 2011. During such time, we did not pursue the technology and have not undertaken further work in the area covered by the technology license. Neither we nor the third-party took further actions under or pursuant to the license agreement. We carried a historical accrual of approximately $0.5 million under the amended license agreement related to certain obligations provided for in the license agreement. The license agreement was governed by the laws of a foreign jurisdiction. We sought and obtained legal advice related to such accrued obligations under the expired license agreement. We relied upon a judicial conclusion, as opined upon by outside legal counsel in the applicable foreign jurisdiction, that a court in such foreign jurisdiction would grant relief releasing us from liability under the license agreement, and in accordance with Accounting Standards Codification 405 “Extinguishment of Liabilities”, we recorded a debt extinguishment gain of $0.5 million and reduced the liability amount owed to $0 during the nine months ended September 30, 2017.

| 19 |

Liquidity and Capital Resources

We have not generated any revenues since inception other than revenue form grants we received. We have financed our operations primarily through public and private offerings of our stock and debt including warrants and the exercises thereof.

The following table sets forth our cash and working capital as of September 30, 2018 and December 31, 2017:

| September 30, | December 31, | |||||||

| 2018 | 2017 | |||||||

| Cash | $ | 4,294,000 | $ | 5,129,000 | ||||

| Working Capital | $ | 690,000 | $ | 3,658,000 | ||||

Cash Flows

The following table summarizes our cash flows for the nine months ended September 30, 2018 and 2017:

| Nine Months Ended | ||||||||

| September 30, | ||||||||

| 2018 | 2017 | |||||||

| Net Cash provided by (used in): | ||||||||

| Operating activities | $ | (8,317,000 | ) | $ | (5,961,000 | ) | ||

| Financing activities | 7,482,000 | 5,717,000 | ||||||

| Net decrease in cash | $ | (835,000 | ) | $ | (244,000 | ) | ||

Financings

Our financing activities during the nine months ended September 30, 2018 were as follows:

Common Stock Purchase Agreement

On May 14, 2018, the Company’s largest stockholder Eastern Capital Limited entered into a Common Stock Purchase Agreement with the Company pursuant to which it purchased 1,300,000 shares of common stock at a price per share of $2.40 providing gross proceeds to the Company of $3.12 million.

Exercise and Repricing of Warrants Held by Existing Institutional Investors

On May 14, 2018, certain institutional holders of outstanding warrants entered into Warrant Exercise Agreements with the Company that provide for an amendment to the exercise price of the warrants being exercised at $2.50 per share. Upon closing of the Warrant Exercise Agreements, such institutional holders immediately exercised warrants for 782,505 shares of common stock providing aggregate proceeds to the Company of approximately $2.0 million.

The fair value relating to the modification of exercise prices on the repriced and exercised warrants was treated as deemed dividend on the statement of stockholders’ equity of $728,000.

Exercise of Stock Warrants

During the nine months ended September 30, 2018, certain outstanding warrants were exercised by warrant holders providing aggregate proceeds to the Company of approximately $2.4 million and resulted in the issuance of approximately 930,000 shares of common stock, which is net of 152,588 warrant shares cancelled due to use of cashless exercise provisions. 215,344 of the stock warrants exercised were exercised on a cashless basis.

| 20 |

Exercise of Stock Options

In January 2018, a former officer exercised 10,416 shares of common stock pursuant to stock options providing proceeds of $18,000.

Other Financings

Securities Purchase Agreements

On October 17, 2018, concurrent with the completion of the Merger, the Company issued to certain accredited investors in a private placement transaction (the “Financing”), an aggregate of 17,500,000 shares of its common stock, and warrants to purchase 13,437,500 shares of common stock at an exercise price of $5.00 per share with a five-year term, for aggregate proceeds of $70 million pursuant to the terms of the Securities Purchase Agreements, dated June 8, 2018, by and among the Company and certain accredited investors.

Future Capital Requirements

As of September 30, 2018, we had working capital of $0.7 million, compared to working capital of $3.7 million as of December 31, 2017.

We expect our expenses to steadily increase as we move forward with the efforts in carrying out our clinical development plans, including those to be initiated from our new subsidiary Marker Cell. Three of our clinical studies are expected to be funded by a total of approximately $28 million of grants made by the DOD to the Mayo Clinic. We believe our existing cash, inclusive of the funds received from our recently closed private placement financing will fund our operations into mid-2020. We will require additional capital in the future to continue conducting research and development, to fund Phase II clinical trials of our licensed, patented technologies, to fund non-clinical testing and to possibly begin cultivating collaborative relationships for the Phase II and future Phase III clinical testing. Our plans could include seeking both equity and debt financing, alliances or other partnership agreements with entities interested in our technologies, or other business transactions that could generate sufficient resources to ensure continuation of our operations and research and development programs.

We expect to continue to seek additional funding for our operations and future capital requirements. Any such required additional capital may not be available on reasonable terms, if at all. If we were unable to obtain additional financing, we may be required to reduce the scope of, delay or eliminate some or all of our planned clinical testing and research and development activities, which could harm our business. The sale of additional equity or debt securities may result in additional dilution to our shareholders. If we raise additional funds through the issuance of debt securities or preferred stock, these securities could have rights senior to those holders of our common stock and could contain covenants that could restrict our operations. We also will require additional capital beyond our currently forecasted amounts.