Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - INDEPENDENCE HOLDING CO | tv506970_8k.htm |

Exhibit 99.1

1 201 8 Annual Meeting of Stockholders November 1 2 , 201 8 Independence Holding Company © 2017 The IHC Group

2 3 Independence Holding Company (DE) Independence Capital Corp. (DE) Madison National Life Insurance Company, Inc. (WI) Standard Security Life Insurance Company of New York (NY) IHC Health Holdings Corp. (DE) Independence American Holdings Corp. (DE) IHC Carrier Solutions, Inc. (DE) Independence American Insurance Company (DE) PetPartners, Inc. (DE) IHC Specialty Benefits, Inc. (DE) IHC Corporate Structure

3 □ Specialty H ealth and G roup L ife & D isability insurance company » Management team with average tenure of 25+ years □ Founded in 1980, publicly traded on the NYSE ➢ Market cap over $ 553 M ($ 37.40 per share as of 11/07/2018 ) ➢ Book Value of $ 29.92 per share (as of 9/30/201 8 ) ❑ Three carriers rated A - (Excellent) by A.M. Best ➢ Standard Security Life (New York) ➢ Madison National Life (Wisconsin) ➢ Independence American Insurance (Delaware) ❑ Comprehensive specialty health product suite ➢ Top 3 writer of short - term medical ➢ Top 6 market share in NY Disability Benefits Law ( DBL ) business ➢ Top 6 writer of pet insurance in the US ➢ Top writer of LTD for school districts/municipalities in upper mid - west ❑ Premier Provider of Private Label and Co - Branded Solutions IHC at a Glance

4 Executive Summary ❑ The Company has been successful in transitioning from capital intensive lines of business with unpredictable margins to less capital intensive, higher margin specialty insurance lines ❑ Management continues to selectively deploy excess capital to grow owned distribution ❑ 2018 continuing excellent results in both Specialty Health and Group disability, life, DBL & Paid Family Leave (PFL) ❑ 2019 growth driven by : ➢ Owned call center and enhanced lead generation, including exclusive call center for a nationally recognized insurance, banking, and investment services provider serving millions of members and their families ➢ Elimination of penalty and 90 - day STM rule ➢ Expansion of 1332 waiver programs and federal guidance on Health Reimbursement Arrangements (HRA) funds to purchase STM policies ➢ Unique products, including STM with limited pre - X coverage ➢ New pet distribution

5 STM & F ixed I ndemnity Individual & Association ➢ Plans are available online and are active within 24 hours of applying ➢ Duration rules have recently changed allowing states to determine plan duration ➢ The penalty for not having an ACA plan is $0 in 2019 making STM and FI more attractive DBL & PFL Group ➢ Electronic application submission that allows agents to conveniently submit applications via DBL customized website and receive instant policy numbers ➢ System is complemented by electronic delivery of policy kits ➢ Less than 24 hour turnaround on all new business and administrative changes ➢ Comprehensive interactive website for agents, policyholders and claimants Group Life & LTD Group ➢ Offers plan flexibility that meets the needs of bargained benefits plans ➢ Providers automatic claim submission for Waiver of Premium and online claim intake Pet Insurance Individual ➢ Customers can choose how much of their veterinarian bill is reimbursed from 70%, 80%, 90%, or 100% after a deductible is met ➢ Continuing to expand worksite options and expanding into white label arrangements Dental & Vision Group + Individual ➢ Fast growing and highly profitable individual line being marketing by Anthem, WBEs, eHealth and others ➢ New quoting platform and enrollment platform for groups create value for producers Group LMB & Gap Group ➢ Deductible gap plans help employees manage the financial impact of an inpatient hospitalization or outpatient surgery ➢ Uniquely filed LMB plans are marketed by Anthem, as well as owned distributions Products Product Features All lines of business have consistently generated profits over the last 5 years Unique Products

6 Specialty Health Net Earned Premiums ❑ Earned premiums by major line of business in the Specialty Health Segment are as follows : Three Months Ended Nine Months Ended September 30 , September 30 , Specialty Health Segment Net Earned Premiums by Line: 201 8 201 7 201 8 201 7 Short Term Medical $ 10,086 $ 16,918 $ 27,632 $ 44,229 Hospital Indemnity 18,559 16,414 54,539 30,275 Pet Insurance 10,584 9,654 30,528 29,802 Dental 3,103 3,784 10,029 12,715 Occupational Accident 1,002 1,827 2,502 7,565 Group Gap 2,659 107 5,984 298 International 33 1,031 160 6,925 Other Specialty Health Lines 2,085 1,655 5,586 4,730 $ 48,111 $ 51,390 $ 136,960 $ 136,539

7 IHC Per - Share Value ❑ As market prices warrant, buy back shares of IHC ❑ Recent price levels: ❑ IHC book value $29.92 as of September 30, 2018 ➢ IHC Price to Book Ratio was 1.25 at November 7, 2018 ❑ Russell 2000 Insurance: Life Index Price to Book Ratio was 1.49 as of 9/30/18 ❑ NASDAQ Insurance Index Price to Book Ratio was 1.33 as of 9/30/18

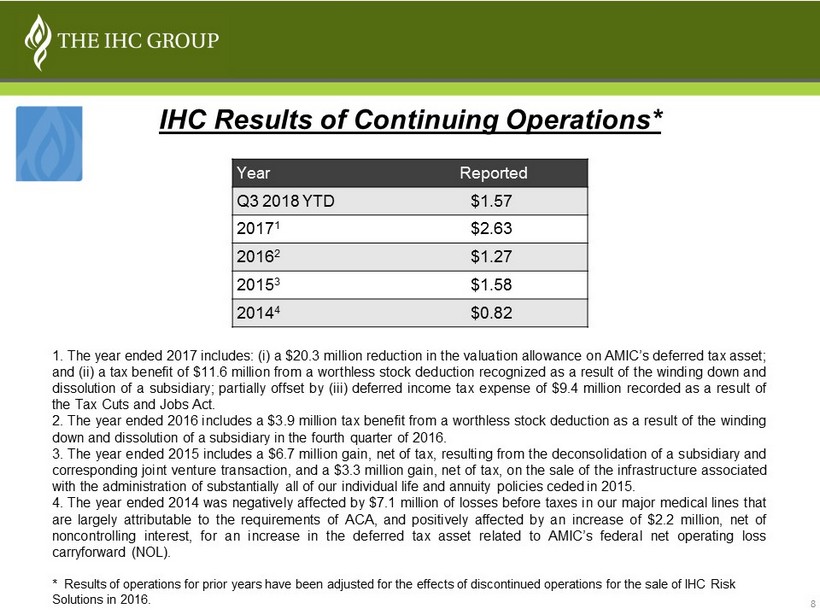

8 IHC Results of Continuing Operations* 1 . The year ended 2017 includes : ( i ) a $ 20 . 3 million reduction in the valuation allowance on AMIC’s deferred tax asset ; and (ii) a tax benefit of $ 11 . 6 million from a worthless stock deduction recognized as a result of the winding down and dissolution of a subsidiary ; partially offset by (iii) deferred income tax expense of $ 9 . 4 million recorded as a result of the Tax Cuts and Jobs Act . 2 . The year ended 2016 includes a $ 3 . 9 million tax benefit from a worthless stock deduction as a result of the winding down and dissolution of a subsidiary in the fourth quarter of 2016 . 3 . The year ended 2015 includes a $ 6 . 7 million gain, net of tax, resulting from the deconsolidation of a subsidiary and corresponding joint venture transaction, and a $ 3 . 3 million gain, net of tax, on the sale of the infrastructure associated with the administration of substantially all of our individual life and annuity policies ceded in 2015 . 4 . The year ended 2014 was negatively affected by $ 7 . 1 million of losses before taxes in our major medical lines that are largely attributable to the requirements of ACA, and positively affected by an increase of $ 2 . 2 million, net of noncontrolling interest, for an increase in the deferred tax asset related to AMIC’s federal net operating loss carryforward (NOL) . * Results of operations for prior years have been adjusted for the effects of discontinued operations for the sale of IHC Ri sk Solutions in 2016. Year Reported Q3 201 8 YTD $ 1.5 7 201 7 1 $ 2.63 201 6 2 $ 1.27 201 5 3 $ 1.58 201 4 4 $ 0.82

9 The graph below matches Independence Holding Company's cumulative 5 - Year total shareholder return on common stock with the cumulative total returns of the Russell 2000 index and the S&P 500 Life & Health Insurance index . The graph tracks the performance of a $ 100 investment in our common stock and in each index (with the reinvestment of all dividends) from 12 / 31 / 2012 to 12 / 31 / 2017 . Comparison of Five Year Cumulative Total Return

10 Current Strategy ❑ Expand owned distribution channels and lead generation ➢ Emphasize online sales and direct - to - consumer channels through direct agency, call center, Health eDeals , and owned general agents ➢ Improve lead flow to call center through organic, paid and referral relationships ❑ Following products should remain top sellers: ➢ Projecting substantial increase in STM sales as best affordable alternative to ACA ➢ STM bundled with fixed indemnity, accident, critical illness and dental will become more popular ➢ HIP designed to be compatible with “free” Bronze plans ➢ Pet insurance generally, but particularly as an employee benefit ➢ PFL - like products in other states ❑ Accelerating roll - out of technology initiatives for direct - to - customer channels and agents ❑ Continue to provide product and call center solutions for national brands ➢ Anthem, UH1, AKC, eHealth and others ❑ Expand distribution of Group Life, LTD and DBL/PFL

11 Forward - Looking Statements Certain statements in this presentation are “forward - looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, cash flows, plans, objectives, future performance and business of IHC. Forward - looking statements by their nature address matters that are, to differing degrees, uncertain. With respect to IHC, particular uncertainties that could adversely or positively affect our future results include, but are not limited to, economic conditions in the markets in which we operate, new federal or state governmental regulation, our ability to effectively operate, integrate and leverage any past or future strategic acquisition, and other factors which can be found in our news releases and filings with the Securities and Exchange Commission. These uncertainties may cause IHC’s actual future results to be materially different than those expressed in this presentation. IHC does not undertake to update its forward - looking statements.