Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cleco Corporate Holdings LLC | cleco8k_111318.htm |

Cleco Corporate Holdings LLC EEI Financial Conference November 2018

Forward Looking Statements • Statements in this presentation include “forward‐looking statements” about future events, circumstances and results within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, both as amended by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this presentation, including, without limitation, statements containing the words “may,” “might,” “will,” “should,” “could,” “anticipate,” “estimate,” “expect,” “predict,” “project,” “future”, “potential,” “intend,” “seek to,” “plan,” “assume,” “believe,” “target,” “forecast,” “goal,” “objective,” “continue” or the negative of such terms or other variations thereof and similar expressions, are statements that could be deemed forward‐looking statements. These statements are based on the current expectations of Cleco’s management. • Although Cleco believes that the expectations reflected in such forward‐looking statements are reasonable, such forward‐ looking statements are based on numerous assumptions (some of which may prove to be incorrect) and are subject to risks and uncertainties that could cause the actual results and events in future periods to differ materially from Cleco’s expectations and those expressed or implied by these forward‐looking statements because of a number of risks, uncertainties and other factors, all of which could have material adverse effects on future results, performance or achievements of Cleco. Therefore, forward‐looking statements are not guarantees or assurances of future performance, and actual results could differ materially from those indicated by the forward‐looking statements. Given these risks and uncertainties, investors should not place undue reliance on any forward‐looking statements. Factors that may cause results to differ materially from those described in the forward‐looking statements are set forth in Cleco’s Annual Report on Form 10‐K for the fiscal year ended Dec. 31, 2017, which was filed with the Securities and Exchange Commission on Feb. 26, 2018, under the headings Part I, Item 1A, “Risk Factors,” and Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and in subsequently filed Forms 10‐Q and 8‐K. All written and oral forward‐ looking statements attributable to Cleco or persons acting on its behalf are expressly qualified in their entirety by these factors. The forward‐looking statements represent Cleco’s views as of the date on which such statements were made and Cleco undertakes no obligation to update any forward‐looking statements, whether as a result of changes in actual results, change in assumptions, or other factors affecting such statements. 2

Cleco Attendees Bill Fontenot President & Chief Executive Officer 31 years of industry and Cleco experience Kazi Hasan Chief Financial Officer 22 years of industry experience; joined Cleco 2018 Kristin Guillory Treasurer 14 years of industry and Cleco experience 3

Executive Summary • At its core, Cleco is a stable, single‐state, regulated utility with steady cash flows in a constructive regulatory environment • Private ownership by an experienced consortium allows for access to long‐term, flexible capital to manage and grow the business through a prudent capital structure • Experienced management team focuses on execution of strategy and maintenance of strong Louisiana business • Pending transaction reflects natural expansion of generation fleet and customer base in neighboring communities, through a two‐step process to expand the regulated utility • Acquisition by Cleco Holdings in December 2018/January 2019 • Planned merger of assets into Cleco Power, subject to regulatory approval Acquisition expected to drive pivotal growth opportunity as Cleco strives to become Louisiana’s leading energy provider 4

Cleco Power 5

Cleco Power Overview Cleco Power is a well operated, vertically integrated utility with a strong regulatory framework and diverse fuel mix . Regulated electric utility, serving over 290,000 retail customers in rural areas of Louisiana with over 12,000 circuit miles of distribution and 1,300 circuit miles of transmission lines . Fully upgraded Advanced Metering Infrastructure technology in place ‒ Continuous “smart grid” technology investment improves service restoration Regulated Generation . Further serves 157,000 wholesale end‐use customers in Louisiana and Mississippi through Retail Service Territory wholesale power contracts Wholesale Territory . 9 generating units across 5 parishes provides geographical diversity . Fuel diversity across system provides cost stability for customers ‒ Fuel categories include natural gas, petcoke, lignite and coal . Generation fleet serves both retail and wholesale demand ‒ 2018 peak demand of 2,879MW . Current capacity length allows for up to 400 MW of load growth with existing fleet . Successful in proactive franchise renewals; no franchise expirations until July 2021 Electricity Sold(1) Revenue from Electricity Sold(1) Capacity Mix(1) Total Electricity Sold: 11,344 GWh Total Base Revenue: $652 million Total Nameplate Capacity: 3,310MW Wholesale Wholesale 9% Lignite Residential Other Retail 26% 2% 10% 31% Industrial Petcoke 13% Residential 19% Natural Gas Other Retail 46% 66% 1% Commercial Coal Industrial Commercial 30% 5% 18% 24% 1) As of 12/31/2017; Source: 2017 SEC Form 10‐K 6

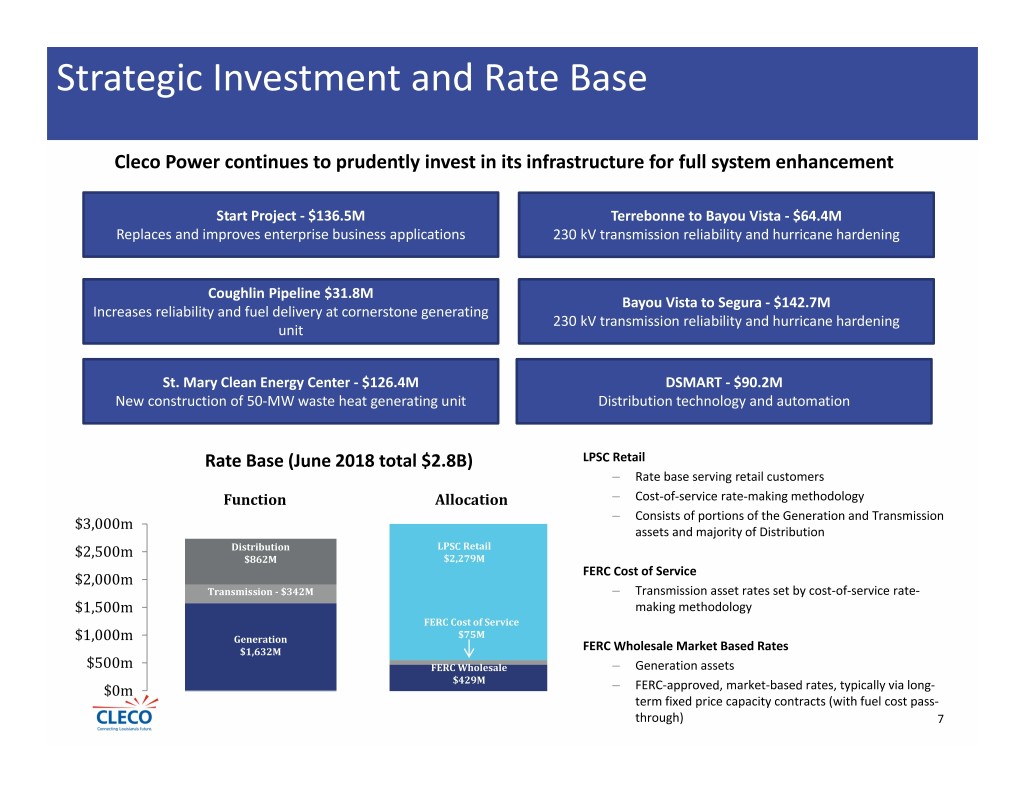

Strategic Investment and Rate Base Cleco Power continues to prudently invest in its infrastructure for full system enhancement Start Project ‐ $136.5M Terrebonne to Bayou Vista ‐ $64.4M Replaces and improves enterprise business applications 230 kV transmission reliability and hurricane hardening Coughlin Pipeline $31.8M Bayou Vista to Segura ‐ $142.7M Increases reliability and fuel delivery at cornerstone generating 230 kV transmission reliability and hurricane hardening unit St. Mary Clean Energy Center ‐ $126.4M DSMART ‐ $90.2M New construction of 50‐MW waste heat generating unit Distribution technology and automation Rate Base (June 2018 total $2.8B) LPSC Retail – Rate base serving retail customers Function Allocation – Cost‐of‐service rate‐making methodology – Consists of portions of the Generation and Transmission $3,000m assets and majority of Distribution Distribution LPSC Retail $2,500m $862M $2,279M FERC Cost of Service $2,000m Transmission ‐ $342M – Transmission asset rates set by cost‐of‐service rate‐ $1,500m making methodology FERC Cost of Service $1,000m Generation $75M $1,632M FERC Wholesale Market Based Rates $500m FERC Wholesale – Generation assets $429M $0m – FERC‐approved, market‐based rates, typically via long‐ term fixed price capacity contracts (with fuel cost pass‐ through) 7

Formula Rate Plan (FRP) . Effective July 1, 2014 – June 30, 2020 Regulatory Highlights ‒ Next rate case filed July 1, 2019 for new rates July 1, 2020 Fuel Cost Pass‐Through ‐ 2 month lag . Achieves rate stability and mechanisms for cost recovery FRP Rider recovery . Target ROE to 10.0% ‒ Earn up to 10.9% (before customer sharing) Environmental Cost Recovery ‒ Over 10.9% but less than 11.75% (60% customer sharing) Ability to over‐earn ROE ‒ Over 11.75% (100% customer refund) ‒ Effective 11.24% maximum return for retail Blanket Financing Authority . Ability to earn on major projects with minimal regulatory lag Storm securitization through FRP riders . Regulatory capital structure of 51% equity/49% debt The FRP provides regulatory rate‐making certainty for the utility and permits Cleco Power to exceed its targeted ROE through an over‐earning sharing band mechanism 8

Cleco Cajun Acquisition Update 9

Acquisition Summary Confidential . Purchase of NRG South Central Generating LLC assets including electric cooperative and municipal contracts for $1.0B . Lease 100% of Cottonwood to NRG subsidiary through May 2025 . Strategy of full incremental debt pay‐down through 2024 . Assets planned to be merged into Cleco Power with full fleet optimization and integration, subject to regulatory approval . Conceptual settlement reached with LPSC staff and consultants; acquisition expected to close December 2018/January 2019 Lease and capacity contracts provide predictable cash flow and market risk mitigation through 2024. Regulated utility integration targeted as ultimate goal. 10

Cajun Asset Summary . Assignment of 15 contracts totaling 1,784 MW through April 2025 . Purchase of 2,292 MW Louisiana generating assets 86% of capacity – 40% coal/60% gas contracted through April 2025 . Purchase of 1,263 MW Cottonwood (TX) assets – Combined cycle gas Acquisition Results NRG South ‐ LA Cottonwood Cleco Power+ Cleco Power Cleco Generation Cleco Cajun Cleco service territory Peak load MW 2,508 4,256 Cajun service territory Nameplate Capacity MW 3,310 6,865 Customers 445,000 740,000 Parishes 23 47 Transaction significantly increases Cleco’s scale with nearly 750,000 customers and nearly 7 GW of generation, providing a natural extension of our service territory, including areas with increased industrial load growth 1 – 119 MW muni contracts end by 2021; 50MW SWEPCO contract extends through 2026 3 ‐ Includes estimated wholesale end‐users 11 2 ‐ Cleco 2017 peak; Cajun 2016 peak

Acquisition Financing Debt repayment schedule at Cleco Holdings effectuates full debt amortization by contract expiration Incremental Cleco Holdings Debt Cleco (Beginning of year, Millions) Partners L.P. $450 $400 $400 $333 Cleco Group LLC $350 $300 $267 $250 $200 $200 Cleco Corporate Holdings LLC $150 $133 $100 $67 $50 $‐ $‐ 2019 2020 2021 2022 2023 2024 Cleco commits to maximum issuance of $400M Cleco Power LLC (OpCo) Cleco Cajun LLC with full repayment by 2024 Remaining funding sourced from additional investor equity, lockbox proceeds, and cash available at Cleco Holdings 12

Consolidated Financial Results and Liquidity 13

Year to Date Results As of September 30, 2018 120.0 110.0 100.0 90.0 27.9 23.3 0.7 6.2 80.0 3.5 20.5 70.0 13.2 60.0 5.6 Millions 50.0 84.1 40.0 77.0 30.0 20.0 10.0 ‐ 2017 Net income Revenue, net of Electric Customer Non‐recoverable O&M Depreciation and Cajun transaction Other, net Income tax 2018 Net income recoverable fuel Credits fuel amortization costs Unfavorable Favorable Net income has improved year‐over‐year Driven by: Partially offset by: . Higher customer usage . Higher customer credits related to tax rate change . Lower income tax rate . Cleco Cajun transaction costs . Increased O&M from generating outages 14

Liquidity Evaluation and Outlook Credit Ratings Liquidity Moody’s S&P Fitch Cleco Liquidity Position (millions) 09/30/2018 Cleco Holdings Baa3 BBB‐ BBB‐ Cash and Cash Equivalents $185.6 Downgrade Outlook Watch Stable Stable Credit Facility – Cleco Holdings1 $100.0 Cleco Power A3 BBB+ BBB+ Credit Facility – Cleco Power $300.0 Outlook Stable Stable Stable Total $585.6 Bond Maturities (in millions) Credit Facility Terms Cleco Holdings Weighted Average Cost of Debt Cleco Power Power = 4.7% Cleco Holdings Cleco Power Consolidated = 4.2% Fixed rate debt = 89% $700 Facility Size1 $100M $300M $600 $500 Expires 04/2021 04/2021 $400 Balance $0 $0 Millions $300 $200 Facility Fee 0.275% 0.125% $100 Rate LIBOR +1.75% LIBOR+1.125% $‐ 2019 2024 2029 2034 2039 2044 1) As part of the Cajun acquisition financing, Cleco Holdings’ credit facility capacity will expand to $175M. 15

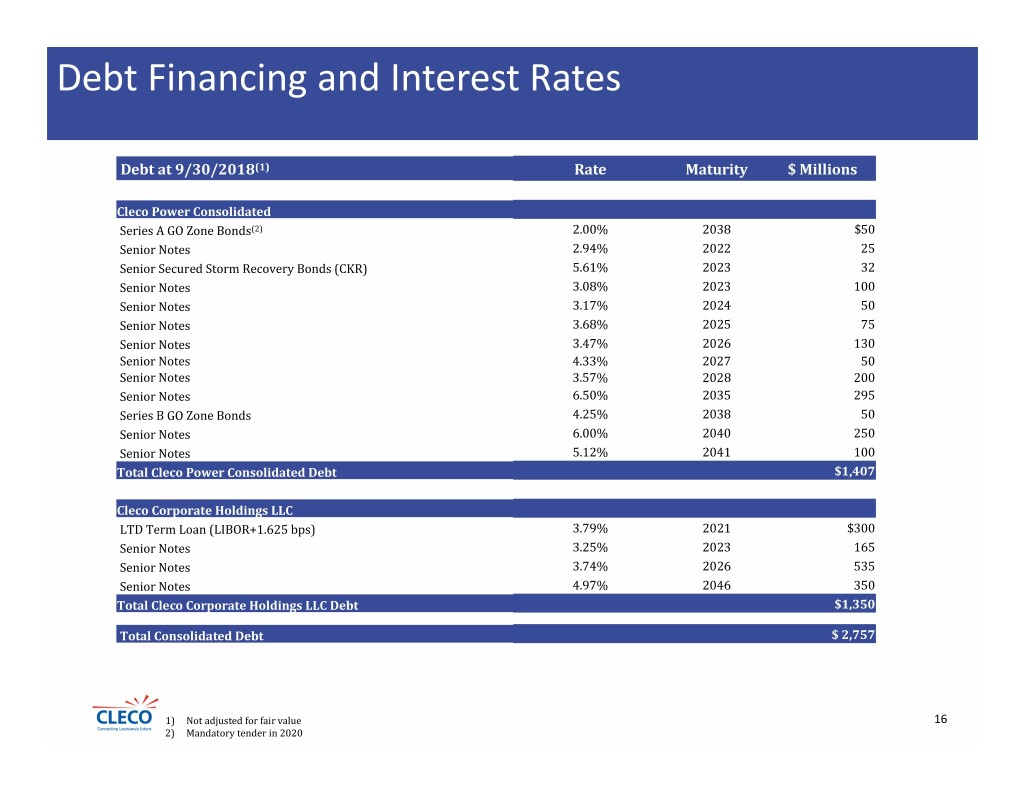

Debt Financing and Interest Rates Debt at 9/30/2018(1) Rate Maturity $ Millions Cleco Power Consolidated Series A GO Zone Bonds(2) 2.00% 2038 $50 Senior Notes 2.94% 2022 25 Senior Secured Storm Recovery Bonds (CKR) 5.61% 2023 32 Senior Notes 3.08% 2023 100 Senior Notes 3.17% 2024 50 Senior Notes 3.68% 2025 75 Senior Notes 3.47% 2026 130 Senior Notes 4.33% 2027 50 Senior Notes 3.57% 2028 200 Senior Notes 6.50% 2035 295 Series B GO Zone Bonds 4.25% 2038 50 Senior Notes 6.00% 2040 250 Senior Notes 5.12% 2041 100 Total Cleco Power Consolidated Debt $1,407 Cleco Corporate Holdings LLC LTD Term Loan (LIBOR+1.625 bps) 3.79% 2021 $300 Senior Notes 3.25% 2023 165 Senior Notes 3.74% 2026 535 Senior Notes 4.97% 2046 350 Total Cleco Corporate Holdings LLC Debt $1,350 Total Consolidated Debt $ 2,757 1) Not adjusted for fair value 16 2) Mandatory tender in 2020