Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Equitable Holdings, Inc. | ex991eqhearningsrelease093.htm |

| 8-K - 8-K - Equitable Holdings, Inc. | form8-keqh093018pressrelea.htm |

Financial Supplement Third Quarter 2018

Table of Contents Consolidated Financials and Key Metrics Page Key Metrics Summary 4 Consolidated Statements of Income (Loss) 5 Consolidated Balance Sheets 6 Consolidated Capital Structure 7 Operating Earnings (Loss) by Segment and Corporate and Other (1/2) 8 Operating Earnings (Loss) by Segment and Corporate and Other (2/2) 9 Assets Under Management and Administration 10 Sales Metrics by Segment 11 Select Metrics from Business Segments Individual Retirement Statements of Income (Loss) and Summary Metrics 13 Select Operating Metrics 14 Group Retirement Statements of Income (Loss) and Summary Metrics 15 Select Operating Metrics 16 Investment Management and Research Statements of Income (Loss) and Summary Metrics 17 Select Operating Metrics 18 Net Flows 19 Protection Solutions Statements of Income (Loss) and Summary Metrics 20 Select Operating Metrics 21 Investments Consolidated Investment Portfolio Composition 23 Consolidated Results of General Account Investment Assets 24 Additional Information Deferred Acquisition Costs Rollforward 26 Use of Non-GAAP Financial Measures 27 Reconciliation of Non-GAAP Measures (1/3) 28 Reconciliation of Non-GAAP Measures (2/3) 29 Reconciliation of Non-GAAP Measures (3/3) 30 Glossary of Selected Financial and Product Terms 31 Analyst Coverage, Ratings & Contact Information 32 This financial supplement should be read in conjunction with AXA Equitable Holdings, Inc.’s (“EQH”) Quarterly Report on Form 10-Q for the nine months ended September 30, 2018. AXA Equitable Holdings’ filings with the Securities and Exchange Commission (“SEC”) can be accessed upon filing at the SEC’s website at www.sec.gov, and at our website at ir.axaequitableholdings.com. All information included in this financial supplement is unaudited. This Financial Supplement includes information from prior periods which have been revised and/or restated. For additional details, please refer to our Form 10-Q for the quarterly period ended September 30, 2018. 2

Consolidated Financials and Key Metrics 3

Key Metrics Summary Three Months Ended or As of Year-to-Date or As of (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Change 9/30/2017 9/30/2018 Change Net income (loss) $ 106 $ 627 $ 337 $ 261 $ (443) N/M $ 630 $ 154 (75.6)% Net income (loss) attributable to the noncontrolling interest (96) (144) (123) (97) (53) 44.8 % (279) (273) 2.2 % Net income (loss) attributable to Holdings 10 483 214 164 (496) N/M 351 (118) (133.6)% Non-GAAP Operating Earnings(1) 400 921 483 486 693 73.3 % 1,114 1,662 49.2 % Total equity attributable to Holdings 12,401 13,421 13,547 13,364 12,411 0.1 % 12,401 12,411 0.1 % Less: Accumulated other comprehensive income (loss) (345) (108) (946) (1,310) (1,595) (362.3)% (345) (1,595) (362.3)% Total equity attributable to Holdings (ex. AOCI): 12,746 13,529 14,493 14,674 14,006 9.9 % 12,746 14,006 9.9 % Pro Forma Non-GAAP Operating ROE (1)(2): 12.0% 13.6% 13.6% 15.6% 15.6% Debt to capital: Debt to Capital 26.9% 27.9% 27.9% Debt to Capital (ex. AOCI) 25.1% 25.5% 25.5% Per share: Diluted earnings per share Net income (loss) attributable to Holdings 0.02 0.86 0.38 0.29 (0.89) N/M 0.63 (0.21) (133.3)% Non-GAAP Operating Earnings(1) 0.71 1.64 0.86 0.87 1.23 73.2 % 1.99 1 2.96 48.7 % Book value per share – Diluted(1) 22.11 23.92 24.15 23.82 22.15 0.2 % 22.11 22.15 0.2 % Book value per share (ex. AOCI) – Diluted(1) 22.72 24.12 25.83 26.15 25.00 10.0 % 22.72 25.00 10.0 % Weighted-average common shares outstanding: Basic 561.0 561.0 561.0 561.0 560.3 (0.1)% 561.0 560.8 Diluted 561.0 561.0 561.0 561.1 560.3 (0.1)% 561.0 560.8 Ending common shares outstanding: Basic 561.0 561.0 561.0 561.0 558.5 (0.4)% 561.0 558.5 Diluted 561.0 561.0 561.0 561.1 558.5 (0.4)% 561.0 558.5 Return to Stockholders Common stock dividend 73 Repurchase of common shares 57 Total capital returned to stockholders 130 Market Values: S&P 500 2,519 2,674 2,641 2,718 2,914 15.7 % 2,519 2,914 15.7 % US 10-Year Treasury 2.3% 2.4% 2.7% 2.9% 3.1% 2.3% 3.1% Notes: (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer to the “Use of Non-GAAP Financial Measures” section of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Non-GAAP Reconciliation” section in this document. (2) Calculated using Pro Forma Non-GAAP Operating Earnings, excluding impact of non-recurring items which occurred in the fourth quarter of 2017. Please see “Additional Information” for adjustments of non-recurring items. 4

Consolidated Statements of Income (Loss) Three Months Ended Year-to-Date (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Change 9/30/2017 9/30/2018 Change Revenues Policy charges and fee income $ 953 $ 883 $ 966 $ 964 $ 951 (0.2)% $ 2,810 $ 2,881 2.5 % Premiums 267 299 279 275 269 0.7 % 825 823 (0.2)% Net derivative gains (losses) (316) (18) (236) (46) (2,006) (534.8)% 232 (2,288) N/M Net investment income (loss) 794 705 591 596 681 (14.2)% 2,377 1,868 (21.4)% Total investment gains (losses), net (12) (159) 102 (22) (35) (191.7)% (32) 45 240.6 % Investment management and service fees 1,018 1,123 1,055 1,075 1,088 6.9 % 2,970 3,218 8.4 % Other income 102 89 117 124 135 32.4 % 356 376 5.6 % Total revenues 2,806 2,922 2,874 2,966 1,083 (61.4)% 9,538 6,923 (27.4)% Benefits and other deductions Policyholders’ benefits 1,077 466 594 900 318 (70.5)% 3,900 1,812 (53.5)% Interest credited to policyholders’ account balances 255 252 271 268 278 9.0 % 743 817 10.0 % Compensation and benefits 524 528 620 558 548 4.6 % 1,609 1,726 7.3 % Commissions and distribution related payments 388 421 411 418 425 9.5 % 1,183 1,254 6.0 % Interest expense 42 45 46 60 65 54.8 % 115 171 48.7 % Amortization of deferred policy acquisition costs, net 23 (34) 10 15 (363) N/M (150) (338) (125.3)% Other operating costs and expenses 450 468 494 425 430 (4.4)% 1,608 1,349 (16.1)% Total benefits and other deductions 2,759 2,146 2,446 2,644 1,701 (38.3)% 9,008 6,791 (24.6)% Income (loss) from operations, before income taxes 47 776 428 322 (618) N/M 530 132 (75.1)% Income tax (expense) benefit 59 (149) (91) (61) 175 196.6 % 100 23 (77.0)% Net income (loss) 106 627 337 261 (443) N/M 630 155 (75.4)% Less: net (income) loss attributable to the noncontrolling interest (96) (144) (123) (97) (53) 44.8 % (279) (273) 2.2 % Net income (loss) attributable to Holdings $ 10 $ 483 $ 214 $ 164 $ (496) N/M $ 351 $ (118) (133.6)% Adjustments related to: Variable annuity product features (1) — 507 369 176 250 1,403 738 1,829 Investment gains (losses) 11 159 (102) 22 36 32 (44) Goodwill impairment — — — — — 369 — Net actuarial gains (losses) related to pension and other 34 34 131 27 24 101 182 postretirement benefit obligations Other adjustments 56 58 90 89 51 61 229 Income tax (expense) benefit related to above (35) (198) (55) (75) (409) (446) (461) adjustments Non-recurring tax items (183) 16 28 11 84 (92) 45 Non-GAAP Operating earnings(2) 400 921 483 487 693 1,114 1,662 Notes: (1) This reconciling item was previously referred to as “GMxB product features”, but is now referred to more broadly as “Variable annuity product features” to reflect the exclusion of embedded derivatives on our SCS product from non-GAAP Operating Earnings. (2) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer to the “Use of Non-GAAP Financial Measures” section of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Non-GAAP Reconciliation” section in this document. 5

Consolidated Balance Sheets Balances as of (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Assets Total investments $ 78,265 $ 81,782 $ 78,883 $ 76,828 $ 78,942 Cash and cash equivalents 6,446 4,814 6,091 6,833 4,777 Cash and securities segregated, at fair value 789 825 1,025 1,289 1,263 Broker-dealer related receivables 2,206 2,158 2,300 2,276 2,224 Deferred policy acquisition costs 6,090 5,919 6,243 6,285 6,736 Goodwill and other intangible assets, net 4,840 4,824 4,813 4,802 4,791 Amounts due from reinsurers 5,035 5,023 4,953 4,954 4,909 Loans to affiliates 1,234 1,230 885 — — GMIB reinsurance contract asset, at fair value 2,011 1,894 1,734 1,636 1,375 Current and deferred income taxes 268 84 232 50 321 Other assets 2,628 2,510 3,239 3,025 3,124 Separate Accounts assets 121,106 124,552 121,858 122,967 125,989 Total assets $ 230,918 $ 235,615 $ 232,256 $ 230,947 $ 234,451 Liabilities Policyholders’ account balances $ 46,006 $ 47,171 $ 47,666 $ 48,849 $ 50,066 Future policy benefits and other policyholders’ liabilities 31,082 30,330 29,566 29,298 29,504 Broker-dealer related payables 550 783 466 603 491 Securities sold under agreements to repurchase 3,284 1,887 1,904 1,850 1,900 Customers related payables 2,384 2,229 2,549 2,713 2,781 Amounts due to reinsurers 1,439 1,436 1,396 1,398 1,415 Short-term and long-term debt 1,933 2,408 2,373 4,922 4,806 Loans from affiliates 2,994 3,622 2,530 — — Other liabilities 4,289 4,053 4,342 3,350 3,485 Separate Accounts liabilities 121,106 124,552 121,858 122,968 125,989 Total liabilities 215,067 218,471 214,650 215,950 220,437 Redeemable noncontrolling interest 440 626 1,024 146 143 Equity Common stock 6 6 6 6 6 Capital in excess of par value 998 1,298 2,050 2,065 2,025 Treasury Shares — — — 2 (56) Retained earnings 11,742 12,225 12,437 12,601 12,031 Accumulated other comprehensive income (loss) (345) (108) (946) (1,310) (1,595) Total equity attributable to Holdings 12,401 13,421 13,547 13,364 12,411 Noncontrolling interest 3,010 3,097 3,035 1,487 1,460 Total equity 15,411 16,518 16,582 14,851 13,871 Total liabilities, redeemable noncontrolling interest and equity $ 230,918 $ 235,615 $ 232,256 $ 230,947 $ 234,451 6

Consolidated Capital Structure Balances as of (in millions USD, unless otherwise indicated) 6/30/2018 9/30/2018 Short-term debt AB commercial paper $ 515 $ 398 AB revolving credit facility — — Total short-term debt 515 398 Total long-term debt 4,407 4,408 Total short-term and long-term debt: [A] 4,922 4,806 Equity Common stock 6 6 Capital in excess of par value 2,065 2,025 Treasury stock, at cost — (56) Retained earnings 12,601 12,031 Accumulated other comprehensive income (loss) (1,310) (1,595) Total equity attributable to Holdings 13,364 12,411 Noncontrolling interest 1,487 1,460 Total equity 14,851 13,871 Total equity attributable to Holdings (ex. AOCI): [B] 14,674 14,006 Capital Total capitalization 18,298 17,217 Total capitalization (ex. AOCI): [A+B] 19,608 18,812 Debt to capital Debt to capital 26.9% 27.9% Debt to capital (ex. AOCI) 25.1% 25.5% Common shares outstanding Beginning balance 561.0 561.1 Repurchases — 2.5 Issuances — — Ending basic common shares outstanding 561.0 558.5 Total potentially dilutive shares 0.1 0.0 Total diluted shares 561.1 558.5 7

Operating Earnings (Loss) by Segment and Corporate and Other (1/2) Three Months Ended September 30, 2018 Individual Inv Mgmt and Protection Corporate and (in millions USD, unless otherwise indicated) Retirement Group Retirement Research Solutions Other Consolidated Revenues Policy charges, fee income and premiums $ 560 $ 70 $ — $ 485 $ 103 $ 1,218 Net investment income (loss) 247 140 7 233 98 725 Investment gains (losses), net including derivative gains (losses) 69 — (6) 2 4 69 Investment Management, service fees and other income 194 52 850 55 75 1,226 Segment revenues 1,070 262 851 774 280 3,238 Benefits and other deductions Policyholders’ benefits 312 3 — 515 208 1,038 Interest credited to policyholders’ account balances 63 72 — 117 26 278 Commissions and distribution related payments 166 22 107 66 65 426 Amortization of deferred policy acquisition costs, net (102) (56) — (192) (6) (356) Compensation and benefits and other operating costs and expenses 122 63 539 104 55 883 Interest expense — — 3 — 62 65 Segment benefits and other deductions 561 104 649 610 410 2,334 Operating earnings (loss), before income taxes 509 158 202 164 (130) 904 Income Taxes (75) (24) (30) (28) 23 (134) Operating earnings (loss), before noncontrolling interest 434 134 172 136 (107) 770 Less: Operating (earnings) loss attributable to the noncontrolling interest — — (76) — (1) (77) Operating earnings (loss) $ 434 $ 134 $ 96 $ 137 $ (108) $ 693 Average capital(1) 7,043 1,210 2,607 Non-GAAP Operating ROC by segment (2)(3)(4) 22.9% 31.2% 9.6% Three Months Ended September 30, 2017 Individual Inv Mgmt and Protection Corporate and Retirement Group Retirement Research Solutions Other Consolidated Revenues Policy charges, fee income and premiums $ 531 $ 51 $ — $ 518 $ 119 $ 1,219 Net investment income (loss) 211 150 9 226 115 711 Investment gains (losses), net including derivative gains (losses) 73 2 (5) 3 1 74 Investment Management, service fees and other income 183 45 788 51 53 1,120 Segment revenues 998 248 792 798 288 3,124 Benefits and other deductions Policyholders’ benefits 272 — — 432 209 913 Interest credited to policyholders’ account balances 49 71 — 119 17 256 Commissions and distribution related payments 144 20 106 65 53 388 Amortization of deferred policy acquisition costs, net (49) (23) — 90 2 20 Compensation and benefits and other operating costs and expenses 131 62 510 104 47 854 Interest expense (7) — 2 — 36 31 Segment benefits and other deductions 540 130 618 810 364 2,462 Operating earnings (loss), before income taxes 458 118 174 (12) (76) 662 Income Taxes (130) (32) (29) 9 23 (159) Operating earnings (loss), before noncontrolling interest 328 86 145 (3) (53) 503 Less: Operating (earnings) loss attributable to the noncontrolling interest (2) (1) (100) — — (103) Operating earnings (loss) $ 326 $ 85 $ 45 $ (3) $ (53) $ 400 Notes: (1) For average capital by segment, capital components pertaining to specific segments such as DAC along with targeted capital are directly attributed to these segments. Targeted capital for each segment is established using assumptions supporting CTE98 levels under most economic conditions. (2) Protection Solutions Non-GAAP Operating ROC excludes impact of certain one-time items. Total post-tax adjustment to operating earnings was determined by multiplying approximately $535 million total pre-tax adjustments in policyholders’ benefits, DAC amortization (net) and policy charges, fee income and premiums by a tax rate of 33%. (3) Non-GAAP Operating ROC is calculated by dividing trailing twelve months operating earnings (loss) on a segment basis by average capital on a segment basis, excluding AOCI and NCI. For average capital amounts by segment, capital components pertaining directly to specific segments such as DAC along with targeted capital are directly attributed to these segments. Targeted capital for each segment is established using assumptions supporting CTE98 levels under most economic conditions. (4) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer to the “Use of Non-GAAP Financial Measures” section of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Non-GAAP Reconciliation” section in this document. 8

Operating Earnings (Loss) by Segment and Corporate and Other (2/2) Year to Date September 30, 2018 Individual Inv Mgmt and Protection Corporate and (in millions USD, unless otherwise indicated) Retirement Group Retirement Research Solutions Other Consolidated Revenues Policy charges, fee income and premiums $ 1,619 $ 204 $ — $ 1,562 $ 317 $ 3,702 Net investment income (loss) 733 395 14 647 340 2,129 Investment gains (losses), net including derivative gains (losses) (52) 1 (4) 4 5 (46) Investment Management, service fees and other income 573 145 2,592 165 199 3,674 Segment revenues 2,873 745 2,602 2,378 861 9,459 Benefits and other deductions Policyholders’ benefits 608 3 — 1,343 568 2,522 Interest credited to policyholders’ account balances 176 216 — 359 66 817 Commissions and distribution related payments 462 72 323 207 191 1,255 Amortization of deferred policy acquisition costs, net (196) (82) — (47) (13) (338) Compensation and benefits and other operating costs and expenses 367 191 1,614 324 214 2,710 Interest expense — — 7 — 164 171 Segment benefits and other deductions 1,417 400 1,944 2,186 1,190 7,137 Operating earnings (loss), before income taxes 1,456 345 658 192 (329) 2,322 Income Taxes (249) (58) (98) (32) 60 (377) Operating earnings (loss), before noncontrolling interest 1,207 287 560 160 (269) 1,945 Less: Operating (earnings) loss attributable to the noncontrolling interest — — (286) — 3 (283) Operating earnings (loss) 1,207 287 274 160 (266) 1,662 Year to Date September 30, 2017 Individual Inv Mgmt and Protection Corporate and Retirement Group Retirement Research Solutions Other Consolidated Revenues Policy charges, fee income and premiums 1,560 171 — 1,559 345 3,635 Net investment income (loss) 609 391 32 607 428 2,067 Investment gains (losses), net including derivative gains (losses) 340 (6) (20) 4 (1) 317 Investment Management, service fees and other income 549 129 2,295 160 193 3,326 Segment revenues 3,058 685 2,307 2,330 965 9,345 Benefits and other deductions Policyholders’ benefits 1,082 — — 1,265 669 3,016 Interest credited to policyholders’ account balances 126 211 — 355 51 743 Commissions and distribution related payments 458 67 305 201 152 1,183 Amortization of deferred policy acquisition costs, net (195) (53) — 113 (3) (138) Compensation and benefits and other operating costs and expenses 405 193 1,516 331 178 2,623 Interest expense — — 5 — 99 104 Segment benefits and other deductions 1,876 418 1,826 2,265 1,146 7,531 Operating earnings (loss), before income taxes 1,182 267 481 65 (181) 1,814 Income Taxes (334) (73) (85) (11) 65 (438) Operating earnings (loss), before noncontrolling interest 848 194 396 54 (116) 1,376 Less: Operating (earnings) loss attributable to the noncontrolling interest (4) (1) (258) — 1 (262) Operating earnings (loss) 844 193 138 54 (115) 1,114 9

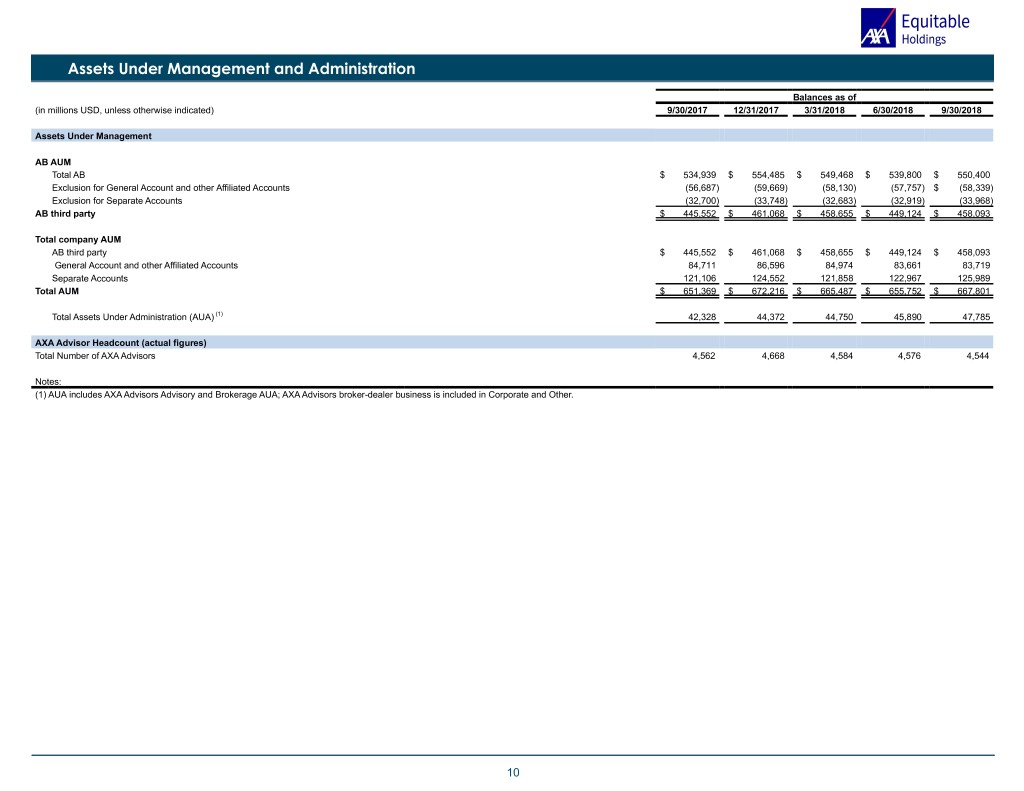

Assets Under Management and Administration Balances as of (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Assets Under Management AB AUM Total AB $ 534,939 $ 554,485 $ 549,468 $ 539,800 $ 550,400 Exclusion for General Account and other Affiliated Accounts (56,687) (59,669) (58,130) (57,757) $ (58,339) Exclusion for Separate Accounts (32,700) (33,748) (32,683) (32,919) (33,968) AB third party $ 445,552 $ 461,068 $ 458,655 $ 449,124 $ 458,093 Total company AUM AB third party $ 445,552 $ 461,068 $ 458,655 $ 449,124 $ 458,093 General Account and other Affiliated Accounts 84,711 86,596 84,974 83,661 83,719 Separate Accounts 121,106 124,552 121,858 122,967 125,989 Total AUM $ 651,369 $ 672,216 $ 665,487 $ 655,752 $ 667,801 Total Assets Under Administration (AUA) (1) 42,328 44,372 44,750 45,890 47,785 AXA Advisor Headcount (actual figures) Total Number of AXA Advisors 4,562 4,668 4,584 4,576 4,544 Notes: (1) AUA includes AXA Advisors Advisory and Brokerage AUA; AXA Advisors broker-dealer business is included in Corporate and Other. 10

Sales Metrics by Segment Three Months Ended or As of Year-to-Date (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Change 9/30/2017 9/30/2018 Change Insurance Operations: Individual Retirement First year premiums and deposits $ 1,610 $ 1,683 $ 1,619 $ 1,861 $ 1,897 17.8 % $ 5,412 $ 5,378 (0.6)% Renewal premium and deposits 65 102 87 78 82 26.2 % 252 246 (2.4)% Total Gross Premiums 1,675 1,785 1,706 1,939 1,979 18.1 % 5,664 5,624 (0.7)% Group Retirement First year premiums and deposits 304 390 343 352 344 13.2 % 997 1,038 4.1 % Renewal premium and deposits 369 477 498 528 393 6.5 % 1,359 1,428 5.1 % Total Gross Premiums 673 867 841 880 737 9.5 % 2,356 2,466 4.7 % Protection Solutions First year premiums and deposits 103 120 102 125 105 1.9 % 310 331 6.8 % Renewal premium and deposits 633 648 652 642 632 (0.2)% 1,946 1,926 (1.0)% Total Gross Premiums 736 768 754 767 737 0.1 % 2,256 2,257 — % Investment Management and Research (in billions USD): Gross Sales by distribution channel Institutional 3.3 3.5 14.8 3.9 3.7 12.1 % 9.8 22.4 128.6 % Retail 13.9 12.9 14.9 11.6 12.6 (9.4)% 40.9 39.2 (4.2)% Private Wealth Management 2.8 2.9 4.4 3.5 3.0 7.1 % 8.7 11.0 26.4 % Firmwide Gross Sales 20.0 19.3 34.1 19.0 19.3 (3.5)% 59.4 72.6 22.2 % Gross sales by investment service Equity Active 5.8 6.0 10.9 8.6 8.7 50.0 % 15.9 28.2 77.4 % Equity Passive (1) 0.7 — — 1.1 (0.1) (114.3)% 1.2 1.0 (16.7)% Fixed Income - Taxable 10.4 8.9 8.5 5.2 7.3 (29.8)% 32.2 21.0 (34.8)% Fixed Income - Tax-Exempt 1.6 2.2 2.3 1.9 2.0 25.0 % 5.7 6.2 8.8 % Fixed Income Passive (1) 0.1 — — — — (100.0)% 0.1 — (100.0)% Other (2) 1.4 2.2 12.4 2.2 1.4 — % 4.3 16.2 276.7 % Firmwide Gross Sales 20.0 19.3 34.1 19.0 19.3 (3.5)% 59.4 72.6 22.2 % Notes: (1) Includes index and enhanced index services. (2) Includes certain multi-asset solutions and services and certain alternative investments. 11

Select Metrics from Business Segments 12

Individual Retirement - Statements of Income (Loss) and Summary Metrics Three Months Ended Year-to-Date (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Change 9/30/2017 9/30/2018 Change Revenues Policy charges, fee income and premiums $ 531 $ 556 $ 529 $ 530 $ 560 5.5 % $ 1,560 $ 1,619 3.8 % Net investment income (loss) 211 256 228 258 247 17.1 % 609 733 20.4 % Investment gains (losses), net including derivative gains (losses) 73 314 (216) 95 69 (5.5)% 340 (52) (115.3)% Investment Management, service fees and other income 183 190 188 191 194 6.0 % 549 573 4.4 % Segment revenues 998 1,316 729 1,074 1,070 7.2 % 3,058 2,873 (6.0)% — Benefits and other deductions — Policyholders’ benefits 272 585 (9) 305 312 14.7 % 1,082 608 (43.8)% Interest credited to policyholders’ account balances 49 48 59 54 63 28.6 % 126 176 39.7 % Commissions and distribution related payments 144 151 144 152 166 15.3 % 458 462 0.9 % Amortization of deferred policy acquisition costs, net (49) (98) (43) (51) (102) (108.2)% (195) (196) (0.5)% Compensation and benefits, interest expense, and other operating costs and expenses 124 118 121 124 122 (1.6)% 405 367 (9.4)% Segment benefits and other deductions 540 804 272 584 561 3.9 % 1,876 1,417 (24.5)% Operating earnings (loss), before income taxes 458 512 457 490 509 11.1 % 1,182 1,456 23.2 % Income taxes (130) (101) (87) (87) (75) 42.3 % (334) (249) 25.4 % Operating earnings (loss), before noncontrolling interest 328 411 370 403 434 32.3 % 848 1,207 42.3 % Less: Operating (earnings) loss attributable to the noncontrolling interest (2) (3) (2) 2 — 100.0 % (4) — 100.0 % Operating earnings (loss) 326 408 368 405 434 33.1 % 844 1,207 43.0 % Summary Metrics TTM NUMBER 1,252 1,414 1,507 1,615 1,615 Non-GAAP Operating ROC(1)(2) —% 18.1% 20.2% 20.8% 22.9% —% 22.9% Average account value(3) 99,753 102,180 102,607 102,452 104,430 4.7 % 97,270 104,584 7.5 % Return on assets(4) 1.66% 1.82% 1.87% 1.88% —% 1.88% Net flows (144) (314) (462) (149) (258) (79.2)% 246 (869) (453.3)% Current Product Offering 772 788 579 867 749 (3.0)% 3,066 2,195 (28.4)% Fixed Rate (916) (1,102) (1,041) (1,016) (1,007) (9.9)% (2,820) (3,064) (8.7)% First year premiums and deposits 1,610 1,683 1,619 1,861 1,897 17.8 % 5,412 5,378 (0.6)% Notes: (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer to the “Use of Non-GAAP Financial Measures” section of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Non-GAAP Reconciliation” section in this document. (2) Non-GAAP Operating ROC is calculated by dividing trailing twelve months operating earnings (loss) on a segment basis by average capital on a segment basis, excluding AOCI and NCI. For average capital by segment, capital components pertaining to specific segments such as DAC along with targeted capital are directly attributed to these segments. Targeted capital for each segment is established using assumptions supporting CTE98 levels under most economic conditions. (3) Average account value calculated as the sum of total account value balance as of beginning of period and total account value balance as of end of period, divided by two. (4) Return on assets calculated using trailing twelve months operating earnings, before income taxes and average account value. 13

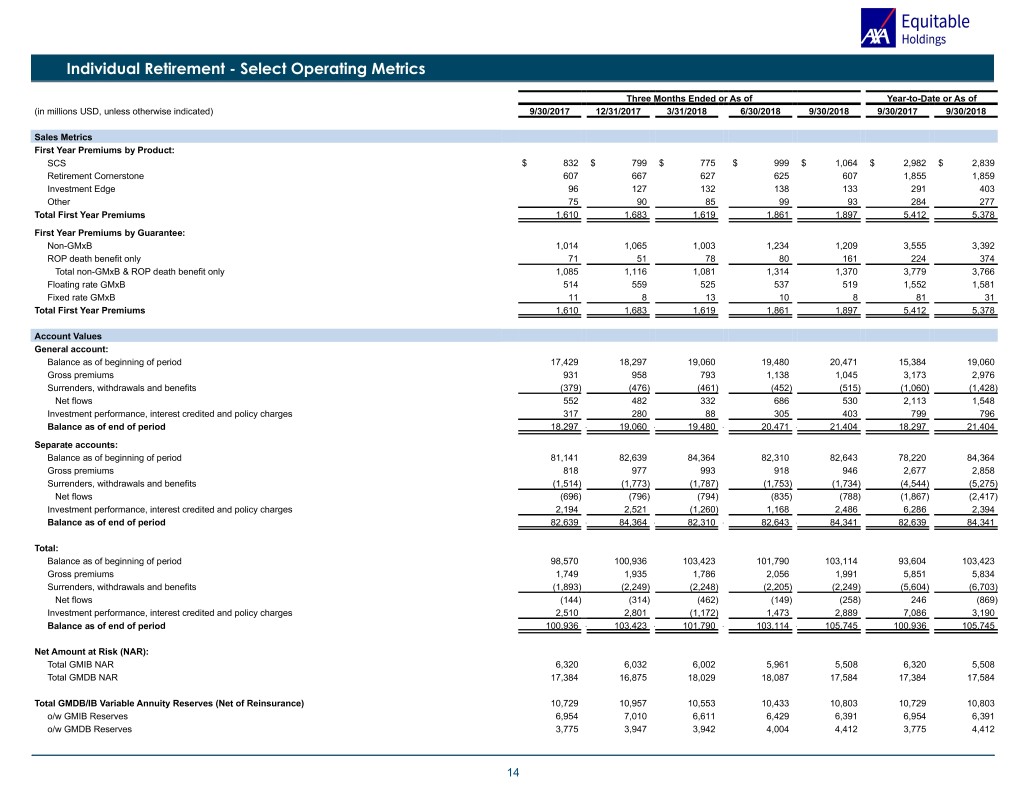

Individual Retirement - Select Operating Metrics Three Months Ended or As of Year-to-Date or As of (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 9/30/2017 9/30/2018 Sales Metrics First Year Premiums by Product: SCS $ 832 $ 799 $ 775 $ 999 $ 1,064 $ 2,982 $ 2,839 Retirement Cornerstone 607 667 627 625 607 1,855 1,859 Investment Edge 96 127 132 138 133 291 403 Other 75 90 85 99 93 284 277 Total First Year Premiums 1,610 1,683 1,619 1,861 1,897 5,412 5,378 First Year Premiums by Guarantee: Non-GMxB 1,014 1,065 1,003 1,234 1,209 3,555 3,392 ROP death benefit only 71 51 78 80 161 224 374 Total non-GMxB & ROP death benefit only 1,085 1,116 1,081 1,314 1,370 3,779 3,766 Floating rate GMxB 514 559 525 537 519 1,552 1,581 Fixed rate GMxB 11 8 13 10 8 81 31 Total First Year Premiums 1,610 1,683 1,619 1,861 1,897 5,412 5,378 Account Values General account: Balance as of beginning of period 17,429 18,297 19,060 19,480 20,471 15,384 19,060 Gross premiums 931 958 793 1,138 1,045 3,173 2,976 Surrenders, withdrawals and benefits (379) (476) (461) (452) (515) (1,060) (1,428) Net flows 552 482 332 686 530 2,113 1,548 Investment performance, interest credited and policy charges 317 280 88 305 403 799 796 Balance as of end of period 18,297 — 19,060 — 19,480 — 20,471 — 21,404 18,297 21,404 Separate accounts: Balance as of beginning of period 81,141 82,639 84,364 82,310 82,643 78,220 84,364 Gross premiums 818 977 993 918 946 2,677 2,858 Surrenders, withdrawals and benefits (1,514) (1,773) (1,787) (1,753) (1,734) (4,544) (5,275) Net flows (696) (796) (794) (835) (788) (1,867) (2,417) Investment performance, interest credited and policy charges 2,194 2,521 (1,260) 1,168 2,486 6,286 2,394 Balance as of end of period 82,639 — 84,364 — 82,310 — 82,643 — 84,341 82,639 84,341 Total: Balance as of beginning of period 98,570 100,936 103,423 101,790 103,114 93,604 103,423 Gross premiums 1,749 1,935 1,786 2,056 1,991 5,851 5,834 Surrenders, withdrawals and benefits (1,893) (2,249) (2,248) (2,205) (2,249) (5,604) (6,703) Net flows (144) (314) (462) (149) (258) 246 (869) Investment performance, interest credited and policy charges 2,510 2,801 (1,172) 1,473 2,889 7,086 3,190 Balance as of end of period 100,936 — 103,423 — 101,790 — 103,114 — 105,745 100,936 105,745 99,753 102,180 102,607 102,452 104,430 97,270 104,584 Net Amount at Risk (NAR): Total GMIB NAR 6,320 6,032 6,002 5,961 5,508 6,320 5,508 Total GMDB NAR 17,384 16,875 18,029 18,087 17,584 17,384 17,584 Total GMDB/IB Variable Annuity Reserves (Net of Reinsurance) 10,729 10,957 10,553 10,433 10,803 10,729 10,803 o/w GMIB Reserves 6,954 7,010 6,611 6,429 6,391 6,954 6,391 o/w GMDB Reserves 3,775 3,947 3,942 4,004 4,412 3,775 4,412 14

Group Retirement - Statements of Income (Loss) and Summary Metrics Three Months Ended Year-to-Date (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Change 9/30/2017 9/30/2018 Change Revenues Policy charges, fee income and premiums $ 51 $ 77 $ 64 $ 70 $ 70 37.3 % $ 171 $ 204 19.3 % Net investment income (loss) 150 137 131 124 1 140 (6.7)% 391 395 1.0 % Investment gains (losses), net including derivative gains (losses) 2 (2) (1) 2 — (100.0)% (6) 1 116.7 % Investment Management, service fees and other income 45 45 44 49 52 15.6 % 129 145 12.4 % Segment revenues 248 257 238 245 262 5.6 % 685 745 8.8 % — — Benefits and other deductions — — Policyholder benefits — — — — 3 — 3 Interest credited to policyholders’ account balances 71 71 70 74 72 1.4 % 211 216 2.4 % Commissions and distribution related payments 20 26 24 26 22 10.0 % 67 72 7.5 % Amortization of deferred policy acquisition costs, net (23) (10) (11) (15) (56) (143.5)% (53) (82) (54.7)% Compensation and benefits, interest expense, and other operating costs and expenses 62 68 62 66 63 1.6 % 193 191 (1.0)% Segment benefits and other deductions 130 155 145 151 104 (20.0)% 418 400 (4.3)% Operating earnings (loss), before income taxes 118 102 93 94 158 33.9 % 267 345 29.2 % Income taxes (32) (14) (17) (17) (24) 25.0 % (73) (58) 20.5 % Operating earnings (loss), before noncontrolling interest 86 88 76 77 134 55.8 % 194 287 47.9 % Less: Operating (earnings) loss attributable to the noncontrolling interest (1) 2 — — — 100.0 % (1) — 100.0 % Operating earnings (loss) $ 85 $ 90 $ 76 $ 77 $ 134 57.6 % $ 193 $ 287 48.7 % Summary Metrics Non-GAAP Operating ROC(1)(2) — 24.5% 25.8% 27.5% 31.2% —% 31.2% Average account value(3) 32,420 33,381 33,912 34,284 35,112 8.3 % 31,497 34,741 10.3 % Return on assets(4) 1.11% 1.12% 1.19% 1.27% 1.29% Net flows (4) 19 101 150 (100) (2,400.0)% 247 152 (38.5)% Gross premiums 673 867 841 880 737 9.5 % 2,356 2,466 4.7 % Notes: (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer to the “Use of Non-GAAP Financial Measures” section of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Non-GAAP Reconciliation” section in this document. (2) Non-GAAP Operating ROC is calculated by dividing trailing twelve months operating earnings (loss) on a segment basis by average capital on a segment basis, excluding AOCI and NCI. For average capital amounts by segment, capital components pertaining directly to specific segments such as DAC along with targeted capital are directly attributed to these segments. Targeted capital for each segment is established using assumptions supporting CTE98 levels under most economic conditions. (3) Average account value calculated as the sum of total account value balance as of beginning of period and total account value balance as of end of period, divided by two. (4) Return on assets calculated using trailing twelve months operating earnings, before income taxes and average account value. 15

Group Retirement - Select Operating Metrics Three Months Ended or As of Year-to-Date or As of (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 9/30/2017 9/30/2018 Sales Metrics Gross premiums: First-year premiums $ 304 $ 390 $ 343 $ 352 $ 344 $ 997 $ 1,038 Renewal premiums 369 477 498 528 393 1,359 1,428 Group Retirement premiums 673 867 841 880 737 2,356 2,466 Gross premiums by market: Tax-exempt 192 260 207 212 224 612 644 Corporate 103 114 122 133 112 355 366 Other 9 16 14 7 8 30 28 Total First Year Premiums 304 390 343 352 290 997 1,038 Tax-exempt 256 356 357 399 286 975 1,042 Corporate 71 72 84 82 78 222 243 Other 42 49 57 47 29 162 143 Total renewal premiums 369 477 498 528 454 1,359 1,428 Group Retirement premiums by market 673 867 841 880 744 2,356 2,466 Account Values General account: Balance as of beginning of period 11,210 11,316 11,319 11,393 11,502 10,999 11,319 Gross premiums 270 252 259 283 290 826 832 Surrenders, withdrawals and benefits (240) (320) (254) (248) (285) (728) (786) Net flows 30 (68) 5 35 5 98 46 Investment performance, interest credited and policy charges 76 71 69 74 80 219 222 Balance as of end of period 11,316 11,319 11,393 11,502 11,587 11,316 11,587 Separate accounts: Balance as of beginning of period 20,772 21,541 22,587 22,525 23,147 19,139 22,587 Gross premiums 403 603 578 602 454 1,520 1,634 Surrenders, withdrawals and benefits (437) (516) (482) (487) (559) (1,371) (1,528) Net flows (34) 87 96 115 (105) 149 106 Investment performance, interest credited and policy charges 803 959 (158) 507 947 2,253 1,296 Balance as of end of period 21,541 22,587 22,525 23,147 23,989 21,541 23,989 Total: Balance as of beginning of period 31,982 32,857 33,906 33,918 34,649 30,138 33,906 Gross premiums 673 855 837 885 744 2,345 2,466 Surrenders, withdrawals and benefits (677) (836) (736) (735) (844) (2,098) (2,314) Net flows (4) 19 101 150 (100) 247 152 Investment performance, interest credited and policy charges 879 1,030 (89) 581 1,027 2,472 1,518 Balance as of end of period 32,857 33,906 33,918 34,649 35,576 32,857 35,576 16

Investment Management and Research - Statements of Income (Loss) and Summary Metrics Three Months Ended Year-to-Date (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Change 9/30/2017 9/30/2018 Change Revenues Net investment income (loss) $ 9 $ 28 $ 3 $ 4 $ 7 (22.2)% $ 32 $ 14 (56.3)% Investment gains (losses), net including derivative gains (losses) (5) (4) 2 — (6) (20.0)% (20) (4) 80.0 % Investment Management, service fees and other income 788 885 904 838 850 7.9 % 2,295 2,592 12.9 % Segment Revenues 792 909 909 842 851 7.4 % 2,307 2,602 12.8 % Benefits and other deductions Commissions and distribution related payments 106 110 110 106 107 0.9 % 305 323 5.9 % Compensation and benefits, interest expense, and other operating costs and expenses 512 520 564 515 542 5.9 % 1,521 1,621 6.6 % Total benefits and other deductions 618 630 674 621 649 5.0 % 1,826 1,944 6.5 % Operating earnings (loss), before income taxes 174 279 235 221 202 16.1 % 481 658 36.8 % Income taxes (29) (54) (27) (41) (30) (3.4)% (85) (98) (15.3)% Operating earnings (loss), before noncontrolling interest 145 225 208 180 172 18.6 % 396 560 41.4 % Less: Operating (earnings) loss attributable to the noncontrolling interest (100) (151) (127) (83) (76) 24.0 % (258) (287) (11.2)% Operating earnings (loss) 45 74 81 97 96 113.3 % 138 274 98.6 % Summary Metrics Adjusted operating margin(1) 25.0% 35.2% 30.1% 27.3% 29.7% 24.7% 29.1% Net flows (in billions USD) 4.5 4.2 (2.4) (7.7) 1.3 9.0 (8.8) Total AUM (in billions USD) 534.9 554.5 549.5 539.8 550.4 534.9 550.4 Ownership Structure of AB AXA and its subsidiaries 64.0% 63.3% 63.0% 63.3% 63.7% 64.0% 63.7% AB Holding 34.9% 35.5% 35.8% 35.9% 35.5% 34.9% 35.5% Unaffiliated holders 1.1% 1.2% 1.2% 0.8% 0.8% 1.1% 0.8% Total 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% AXA and its subsidiaries total economic interest 64.9% 64.7% 64.4% 64.7% 65.1% 64.9% 65.1% o/w EQH total economic interest 46.7% 46.7% 46.5% 64.7% 65.1% 46.7% 65.1% Units of limited partnership outstanding 265.8 268.7 269.8 270.2 268.6 265.8 268.6 Notes: (1) Adjusted Operating Margin is a non-GAAP financial measure used by AllianceBernstein’s (“AB”) management in evaluating AB’s financial performance on a standalone basis and to compare its performance, as reported by AB in its public filings. It is not comparable to any other non-GAAP financial measure used herein. 17

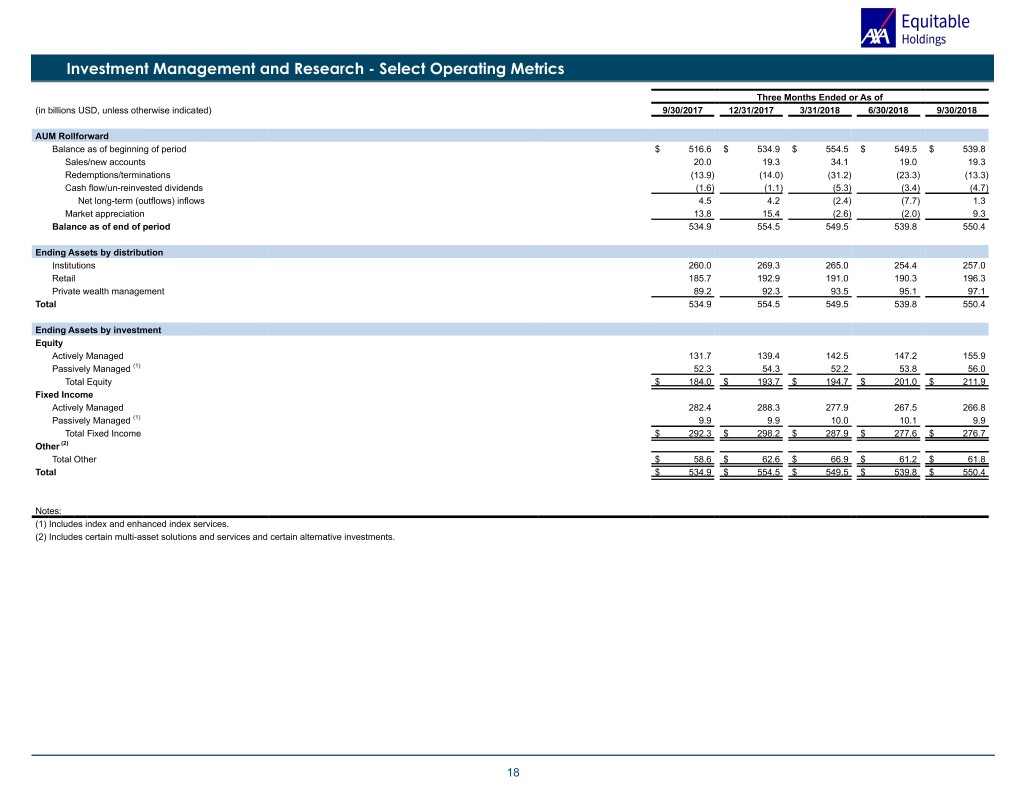

Investment Management and Research - Select Operating Metrics Three Months Ended or As of (in billions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 AUM Rollforward Balance as of beginning of period $ 516.6 $ 534.9 $ 554.5 $ 549.5 $ 539.8 Sales/new accounts 20.0 19.3 34.1 19.0 19.3 Redemptions/terminations (13.9) (14.0) (31.2) (23.3) (13.3) Cash flow/un-reinvested dividends (1.6) (1.1) (5.3) (3.4) (4.7) Net long-term (outflows) inflows 4.5 4.2 (2.4) (7.7) 1.3 Market appreciation 13.8 15.4 (2.6) (2.0) 9.3 Balance as of end of period 534.9 554.5 549.5 539.8 550.4 Ending Assets by distribution Institutions 260.0 269.3 265.0 254.4 257.0 Retail 185.7 192.9 191.0 190.3 196.3 Private wealth management 89.2 92.3 93.5 95.1 97.1 Total 534.9 554.5 549.5 539.8 550.4 Ending Assets by investment Equity Actively Managed 131.7 139.4 142.5 147.2 155.9 Passively Managed (1) 52.3 54.3 52.2 53.8 56.0 Total Equity $ 184.0 $ 193.7 $ 194.7 $ 201.0 $ 211.9 Fixed Income Actively Managed 282.4 288.3 277.9 267.5 266.8 Passively Managed (1) 9.9 9.9 10.0 10.1 9.9 Total Fixed Income $ 292.3 $ 298.2 $ 287.9 $ 277.6 $ 276.7 Other (2) Total Other $ 58.6 $ 62.6 $ 66.9 $ 61.2 $ 61.8 Total $ 534.9 $ 554.5 $ 549.5 $ 539.8 $ 550.4 Notes: (1) Includes index and enhanced index services. (2) Includes certain multi-asset solutions and services and certain alternative investments. 18

Investment Management and Research - Net Flows (in billions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Net Flows by Distribution Channel Institutions US $ 0.5 $ 1.6 $ (5.6) $ (0.7) $ (1.2) Global and Non-US 0.9 1.4 2.8 (7.3) 1.0 Total Institutions $ 1.4 $ 3.0 $ (2.8) $ (8.0) $ (0.2) Retail US (0.5) 0.7 0.2 1.0 2.6 Global and Non-US 3.5 0.3 (1.5) (1.6) (1.4) Total Retail $ 3.0 $ 1.0 $ (1.3) $ (0.6) $ 1.2 Private Wealth US (0.3) (0.1) 0.8 0.2 (0.2) Global and Non-US 0.4 0.3 0.9 0.7 0.5 Total Private Wealth $ 0.1 $ 0.2 $ 1.7 $ 0.9 $ 0.3 Total Net Flows by Distribution Channel $ 4.5 $ 4.2 $ (2.4) $ (7.7) $ 1.3 Net Flows by Investment Service Equity Active US (1.0) (0.9) (1.5) 1.2 1.3 Global and Non-US 1.9 0.9 4.4 2.2 1.6 Total Equity Active $ 0.9 $ — $ 2.9 $ 3.4 $ 2.9 Equity Passive (1) US (0.4) (1.2) (1.1) 0.1 (1.1) Global and Non-US 0.1 (0.2) (0.4) 0.2 (0.1) Total Equity Passive (1) $ (0.3) $ (1.4) $ (1.5) $ 0.3 $ (1.2) Fixed Income - Taxable US 0.9 2.8 (4.4) (1.8) 0.5 Global and Non-US 2.8 0.1 (5.2) (4.1) (1.0) Total Fixed Income - Taxable $ 3.7 $ 2.9 $ (9.6) $ (5.9) $ (0.5) Fixed Income - Tax-Exempt US (0.1) 0.9 0.8 0.3 0.4 Global and Non-US 0.0 0.0 0.0 0.0 0.0 Total Fixed Income - Taxable $ (0.1) $ 0.9 $ 0.8 $ 0.3 $ 0.4 Fixed Income - Passive (1) US — 0.0 0.1 0.2 — Global and Non-US (0.1) — 0.0 0.0 -0.1 Total Fixed Income - Passive (1) $ (0.1) $ — $ 0.1 $ 0.2 $ (0.1) Other (2) US 0.3 0.6 1.5 0.6 0.1 Global and Non-US 0.1 1.2 3.4 (6.6) (0.3) Total Other (2) $ 0.4 $ 1.8 $ 4.9 $ (6.0) $ (0.2) Total Net Flows by Investment Service $ 4.5 $ 4.2 $ (2.4) $ (7.7) $ 1.3 Active vs. Passive Net Flows Actively Managed Equity $ 0.9 $ — $ 2.9 $ 3.4 $ 2.9 Fixed Income 3.6 3.8 (8.8) (5.6) (0.1) Other (2) 0.4 1.7 4.8 (6.0) (0.3) Total $ 4.9 $ 5.5 $ (1.1) $ (8.2) $ 2.5 Passively Managed (1) Equity (0.3) (1.4) (1.5) 0.3 (1.2) Fixed Income (0.1) — 0.1 0.2 (0.1) Other (2) 0.0 0.1 0.1 — 0.1 Total $ (0.4) $ (1.3) $ (1.3) $ 0.5 $ (1.2) Total Active vs Passive Net Flows $ 4.5 $ 4.2 $ (2.4) $ (7.7) $ 1.3 Notes: (1) Includes index and enhanced index services (2) Includes certain multi-asset solutions and services and certain alternative investments. 19

Protection Solutions - Statements of Income (Loss) and Summary Metrics Three Months Ended or As of Year-to-Date or As of (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 Change 9/30/2017 9/30/2018 Change Revenues Policy charges, fee income and premiums $ 518 $ 436 $ 540 $ 537 $ 485 (6.4)% $ 1,559 $ 1,562 0.2 % Net investment income (loss) 226 243 220 194 233 3.1 % 607 647 6.6 % Investment gains (losses), net including derivative gains (losses) 3 (4) (1) 3 2 (33.3)% 4 4 — % Investment Management, service fees and other income 51 52 55 56 55 7.8 % 160 165 3.1 % Segment revenues 798 727 814 790 775 (2.9)% 2,330 2,378 2.1 % Benefits and other deductions — — Policyholders’ benefits 432 (300) 409 419 515 19.2 % 1,265 1,343 6.2 % Interest credited to policyholders’ account balances 119 111 122 120 117 (1.7)% 355 359 1.1 % Commissions and distribution related payments 65 73 66 75 66 1.5 % 201 207 3.0 % Amortization of deferred policy acquisition costs, net 90 60 61 84 (192) (313.3)% 113 (47) (141.6)% Compensation and benefits, interest expense, and other operating costs and expenses 104 112 114 107 104 — % 331 324 (2.1)% Segment benefits and other deductions 810 56 772 805 610 (24.7)% 2,265 2,186 (3.5)% Operating earnings (loss), before income taxes (12) 671 42 (15) 165 1,475.0 % 65 192 195.4 % Income taxes 9 (221) (7) 3 (28) (411.1)% (11) (32) (190.9)% Operating earnings (loss), before noncontrolling interest (3) 450 35 (12) 137 4,666.7 % 54 160 196.3 % Less: Operating (earnings) loss attributable to the noncontrolling interest — (2) — — — — — Operating earnings (loss) (3) 448 35 (12) 137 4,666.7 % 54 160 196.3 % Summary Metrics Non-GAAP Operating ROC (1)(2)(3) —% 5.2 % 5.2% 4.2% 9.6% —% 9.6% Benefit ratio (4) 69.0% (26.0)% 65.2% 68.2% — 81.5% 69.5% 71.6% Gross written premiums 736 768 754 767 737 0.1 % 2,256 2,257 — % Annualized premiums 55 61 56 67 56 1.8 % 161 179 11.2 % Total in-force face amount (in billions USD) 445 446 444 443 443 (0.4)% 446 443 (0.7)% Notes: (1) This measure is a Non-GAAP financial measure. For an explanation of our use of Non-GAAP financial measures, refer to the “Use of Non-GAAP Financial Measures” section of this document. For a reconciliation of this item to the most directly comparable GAAP measure, refer to the “Non-GAAP Reconciliation” section in this document. (2) Protection Solutions Non-GAAP Operating ROC excludes impact of certain one-time items. Total post-tax adjustment to operating earnings was determined by multiplying approximately $535 million total pre-tax adjustments in policyholders’ benefits, DAC amortization (net) and policy charges, fee income and premiums by a tax rate of 33%. (3) Non-GAAP Operating ROC is calculated by dividing trailing twelve months operating earnings (loss) on a segment basis by average capital on a segment basis, excluding AOCI and NCI. For average capital by segment, capital components pertaining to specific segments such as DAC along with targeted capital are directly attributed to these segments. Targeted capital for each segment is established using assumptions supporting CTE98 levels under most economic conditions. (4) Benefit ratio is calculated as sum of policyholders’ benefits and interest credited to policyholders’ account balances dividend by segment revenues. 20

Protection Solutions - Select Operating Metrics Three Months Ended or As of Year-to-Date or As of (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 9/30/2017 9/30/2018 Sales Metrics First Year Premiums by Product Line: Universal Life $ 1 $ — $ 1 $ 1 $ 1 $ 4 $ 3 Indexed Universal Life 49 58 48 65 51 161 163 Variable Universal Life 43 45 39 43 40 118 122 Term 4 5 4 5 5 14 14 Employee Benefits 6 13 10 11 8 13 29 Other (1) — (1) — — — — — Total 103 120 102 125 105 310 331 Renewals by Product Line: Universal Life 218 221 220 230 237 692 687 Indexed Universal Life 48 48 55 56 55 141 166 Variable Universal Life 243 239 242 225 213 721 680 Term 117 130 126 122 114 373 362 Employee Benefits — 1 3 4 7 — 14 Other (1) 7 9 6 5 6 19 17 Total 633 648 652 642 632 1,946 1,926 Total Gross Premiums 736 768 754 767 737 2,256 2,257 In-force Metrics In-force Face Amount by Product (2) (in billions): Universal Life (3) 60 59 58 58 57 60 57 Indexed Universal Life 20 20 21 22 22 20 22 Variable Universal Life (4) 129 129 129 128 128 129 128 Term 235 236 235 234 234 235 234 Whole Life 2 2 2 2 2 2 2 Total 446 446 444 443 443 446 444 In-force Policy Count by Product (2) (in thousands): Universal Life (3) 191 188 185 181 180 191 180 Indexed Universal Life 43 45 47 48 50 43 50 Variable Universal Life (4) 318 316 314 312 309 318 309 Term 341 340 338 336 335 341 335 Whole Life 20 20 20 19 19 20 19 Total 913 909 904 896 893 913 893 Protection Solutions Reserves (5) General Account 16,741 16,101 16,145 16,213 16,372 16,741 16,372 Separate Accounts 12,163 12,643 12,396 12,597 13,055 12,163 13,055 Total 28,904 28,744 28,541 28,810 29,427 28,904 29,427 Notes: (1) For the individual life insurance premiums, other includes Whole Life insurance and other products available for sale but not actively marketed. (2) Does not include life insurance sold as part of our employee benefits business as it is a start-up business with a limited amount of in-force policies. (3) Universal Life includes guaranteed Universal Life insurance products. (4) Variable Universal Life includes variable life insurance and corporate-owned life insurance. (5) Does not include our employee benefits business as it is a start-up business and therefore has immaterial in-force policies. 21

Investments 22

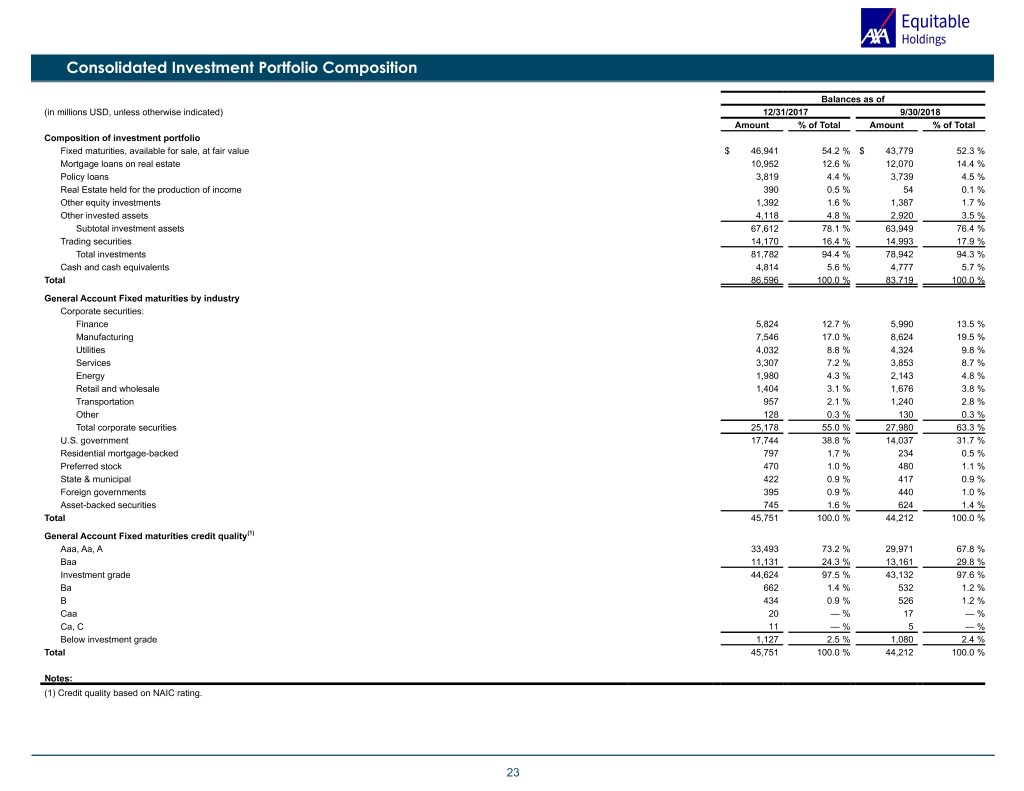

Consolidated Investment Portfolio Composition Balances as of (in millions USD, unless otherwise indicated) 12/31/2017 9/30/2018 Amount % of Total Amount % of Total Composition of investment portfolio Fixed maturities, available for sale, at fair value $ 46,941 54.2 % $ 43,779 52.3 % Mortgage loans on real estate 10,952 12.6 % 12,070 14.4 % Policy loans 3,819 4.4 % 3,739 4.5 % Real Estate held for the production of income 390 0.5 % 54 0.1 % Other equity investments 1,392 1.6 % 1,387 1.7 % Other invested assets 4,118 4.8 % 2,920 3.5 % Subtotal investment assets 67,612 78.1 % 63,949 76.4 % Trading securities 14,170 16.4 % 14,993 17.9 % Total investments 81,782 94.4 % 78,942 94.3 % Cash and cash equivalents 4,814 5.6 % 4,777 5.7 % Total 86,596 100.0 % 83,719 100.0 % General Account Fixed maturities by industry Corporate securities: Finance 5,824 12.7 % 5,990 13.5 % Manufacturing 7,546 17.0 % 8,624 19.5 % Utilities 4,032 8.8 % 4,324 9.8 % Services 3,307 7.2 % 3,853 8.7 % Energy 1,980 4.3 % 2,143 4.8 % Retail and wholesale 1,404 3.1 % 1,676 3.8 % Transportation 957 2.1 % 1,240 2.8 % Other 128 0.3 % 130 0.3 % Total corporate securities 25,178 55.0 % 27,980 63.3 % U.S. government 17,744 38.8 % 14,037 31.7 % Residential mortgage-backed 797 1.7 % 234 0.5 % Preferred stock 470 1.0 % 480 1.1 % State & municipal 422 0.9 % 417 0.9 % Foreign governments 395 0.9 % 440 1.0 % Asset-backed securities 745 1.6 % 624 1.4 % Total 45,751 100.0 % 44,212 100.0 % General Account Fixed maturities credit quality(1) Aaa, Aa, A 33,493 73.2 % 29,971 67.8 % Baa 11,131 24.3 % 13,161 29.8 % Investment grade 44,624 97.5 % 43,132 97.6 % Ba 662 1.4 % 532 1.2 % B 434 0.9 % 526 1.2 % Caa 20 — % 17 — % Ca, C 11 — % 5 — % Below investment grade 1,127 2.5 % 1,080 2.4 % Total 45,751 100.0 % 44,212 100.0 % Notes: (1) Credit quality based on NAIC rating. 23

Consolidated Results of General Account Investment Portfolio Nine Months Ended Nine Months Ended Year Ended (in millions USD, unless otherwise indicated) 9/30/2018 9/30/2017 12/31/2017 Yield Amount(1) Yield Amount(1) Yield Amount(1) Fixed Maturities: Income (loss) 3.83 % $ 1,280 3.87 % $ 1,229 3.77 % $ 1,628 Ending assets 44,212 42,616 45,751 Mortgages: Income (loss) 4.19 % 362 4.44 % 341 4.38 % 454 Ending assets 12,070 10,623 10,952 Real Estate Held for Production of Income: Income (loss) (4.35)% (6) (2.99)% (3) 1.30 % 2 Ending assets 54 394 390 Other Equity Investments: Income (loss) 8.69 % 85 13.09 % 123 14.37 % 169 Ending assets 1,325 1,280 1,289 Policy Loans: Income 5.62 % 159 5.74 % 165 5.77 % 221 Ending assets 3,739 3,824 3,819 Cash and Short-term Investments: Income 0.72 % 25 0.63 % 24 0.65 % 32 Ending assets 3,788 5,570 4,539 Repurchase and Funding agreements: Interest expense and other (76) (50) (71) Ending (liabilities) (4,891) (4,550) (4,882) Total invested Assets: Income 3.99 % 1,829 4.20 % 1,829 4.12 % 2,436 Ending assets 60,297 59,757 61,858 Short Duration VA: Income (loss) 2.35 % 229 1.91 % 142 2.00 % 206 Ending assets 14,084 11,352 11,945 Total: Investment income 3.71 % 2,058 3.86 % 1,971 3.81 % 2,642 Less: investment fees (0.08)% (44) (0.08)% (40) (0.08)% (59) Investment income, net 3.63 % 2,014 3.78 % 1,932 3.73 % 2,583 General Account Ending Net Assets 74,381 71,109 73,803 Operating Earnings adjustments: Repurchase and Funding Agreements interest expense 76 50 71 AB and other non-General Account investment income 39 85 152 Operating Net investment income 2,129 2,067 2,806 Notes: (1) Amount for fixed maturities and mortgages represents original cost, reduced by repayments and writedowns and adjusted for amortization of premiums or accretion of discount; cost for equity securities represents original cost reduced by writedowns; cost for other limited partnership interests represents original cost adjusted for equity in earnings and reduced by distributions. 24

Additional Information 25

Deferred Acquisition Costs Rollforward Three Months Ended or As of Year-to-Date or As of (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 9/30/2017 9/30/2018 Deferred Acquisition Costs Balance as of beginning of period $ 6,111 $ 6,090 $ 5,919 $ 6,245 $ 6,285 $ 6,049 $ 5,919 Capitalization of commissions, sales and issue expenses 162 173 161 171 180 514 512 Amortization (185) (139) (171) (186) 183 (364) (174) Change in unrealized investment gains and losses 2 (205) 336 55 88 (109) 479 Balance as of end of period $ 6,090 $ 5,919 $ 6,245 $ 6,285 $ 6,736 $ 6,090 $ 6,736 Deferred Acquisition Costs by segment and Corporate and Other Individual Retirement $ 2,786 $ 2,877 $ 2,929 $ 2,992 $ 3,171 $ 2,786 $ 3,171 Group Retirement 668 678 664 675 640 668 640 Protection Solutions 2,570 2,304 2,538 2,471 2,757 2,570 2,757 Corporate and Other 66 60 114 147 168 66 168 Total $ 6,090 $ 5,919 $ 6,245 $ 6,285 $ 6,736 $ 6,090 $ 6,736 (162) (173) (161) (171) (180) (514) (512) 185 139 171 186 (183) 364 174 26

Use of Non-GAAP Financial Measures In addition to our results presented in accordance with U.S. GAAP, we report Non-GAAP Operating Earnings, Pro Forma Non-GAAP Operating ROE, and Non-GAAP Operating ROC by segment for our Individual Retirement, Group Retirement and Protection Solutions segments, Book value per share, excluding AOCI, and Non-GAAP Operating Earnings per share, each of which is a measure that is not determined in accordance with U.S. GAAP. Management believes that the use of these non-GAAP financial measures, together with relevant U.S. GAAP measures, provides a better understanding of our results of operations and the underlying profitability drivers and trends of our business. These non-GAAP financial measures are intended to remove from our results of operations the impact of market changes (where there is mismatch in the valuation of assets and liabilities) as well as certain other expenses which are not part of our underlying profitability drivers or likely to re-occur in the foreseeable future, as such items fluctuate from period-to period in a manner inconsistent with these drivers. These measures should be considered supplementary to our results that are presented in accordance with U.S. GAAP and should not be viewed as a substitute for the U.S. GAAP measures. Other companies may use similarly titled non-GAAP financial measures that are calculated differently from the way we calculate such measures. Consequently, our non-GAAP financial measures may not be comparable to similar measures used by other companies. Non-GAAP Operating Earnings Non-GAAP Operating Earnings is an after-tax non-GAAP financial measure used to evaluate our financial performance on a consolidated basis. The most significant of such adjustments relates to our derivative positions, which protect economic value and statutory capital, and are more sensitive to changes in market conditions than the variable annuity product liabilities as valued under U.S. GAAP. This is a large source of volatility in net income. In the first quarter of 2018, the Company revised its Non-GAAP Operating Earnings definition as it relates to the treatment of certain elements of the profitability of its variable annuity products with indexed-linked features to align to the treatment of its variable annuity products with GMxB features. In addition, adjustments for variable annuity products with index-linked features previously included within Other adjustments in the calculation of Non-GAAP Operating Earnings are now included with the adjustments for variable annuity products with GMxB features in the broader adjustment category, Variable annuity product features. The presentations of Non-GAAP Operating Earnings in prior periods were revised to reflect this change in definition. Non-GAAP Operating Earnings equals our consolidated after-tax net income attributable to Holdings adjusted to eliminate the impact of the following items: • Items related to Variable Annuity product features which include certain changes in the fair value of the derivatives and other securities we use to hedge these features and changes in the fair value of the embedded derivatives reflected within Variable annuity products’ net derivative results; • Investment (gains) losses, which includes other-than-temporary impairments of securities, sales or disposals of securities/investments, realized capital gains/losses and valuation allowances; • Goodwill impairment, which includes a write-down of goodwill in first quarter of 2017 • Net actuarial (gains) losses, which includes actuarial gains and losses as a result of differences between actual and expected experience on pension plan assets or projected benefit obligation during a given period related to pension, other post retirement benefit obligations, and the one-time impact of the settlement of the defined benefit obligation; • Other adjustments, which includes restructuring costs related to severance, lease write-offs related to non-recurring restructuring activities and separation costs; and • Income tax expense (benefit) related to the above items and non-recurring tax items, which includes the effect of uncertain tax positions for a given audit period, permanent differences due to goodwill impairment, and the Tax Reform Act. Because Non-GAAP Operating Earnings excludes the foregoing items that can be distortive or unpredictable, management believes that this measure enhances the understanding of the Company’s underlying drivers of profitability and trends in our business, thereby allowing management to make decisions that will positively impact our business. We use our prevailing corporate federal income tax rate of 21% in 2018 and 35% in 2017, while taking into account any non-recurring differences for events recognized differently in our financial statements and federal income tax returns as well as partnership income taxed at lower rates when reconciling Net income (loss) attributable to Holdings to Non-GAAP Operating Earnings. Pro Forma Non-GAAP Operating ROE and Non-GAAP Operating ROC by Segment We report Pro Forma Non-GAAP Operating ROE as well as Non-GAAP Operating ROC by segment for our Individual Retirement, Group Retirement and Protection Solutions segments, each of which is a non- GAAP financial measure used to evaluate our recurrent profitability on a consolidated basis and by segment, respectively. We calculate Pro Forma Non-GAAP Operating ROE by dividing Pro Forma Non-GAAP Operating Earnings by consolidated average equity attributable to Holdings, excluding AOCI and NCI. We calculate Non-GAAP Operating ROC by segment by dividing operating earnings (loss) on a segment basis by average capital on a segment basis, excluding AOCI and NCI, as described below. AOCI fluctuates period-to-period in a manner inconsistent with our underlying profitability drivers as the majority of such fluctuation is related to the market volatility of the unrealized gains and losses associated with our available for sale (“AFS”) securities. Therefore, we believe excluding AOCI is more effective for analyzing the trends of our operations. We do not calculate Non-GAAP Operating ROC by segment for our Investment Management & Research segment because we do not manage that segment from a return of capital perspective. Instead, we use metrics more directly applicable to an asset management business, such as AUM, to evaluate and manage that segment. For Non-GAAP Operating ROC by segment, capital components pertaining directly to specific segments such as DAC along with targeted capital are directly attributed to these segments. Targeted capital for each segment is established using assumptions supporting CTE98 levels under most economic scenarios. CTE is a statistical measure of tail risk which quantifies the total asset requirement to sustain a loss if an event outside a given probability level has occurred. CTE98 denotes the financial resources a company would need to cover the average of the worst 2% of scenarios. To enhance the ability to analyze these measures across periods, interim periods are annualized. Non-GAAP Operating ROC by segment should not be used as a substitute for ROE. Book Value Per Share, excluding AOCI We use the term “book value” to refer to “Total equity attributable to Holdings.” Book Value Per Share, excluding AOCI, is our stockholder’s equity, excluding AOCI, divided by ending common shares outstanding – diluted. Non-GAAP Operating Earnings Per Share Non-GAAP Operating Earnings Per Share is calculated by dividing Non-GAAP Operating Earnings by ending common shares outstanding – diluted. 27

Reconciliation of Non-GAAP Measures (1/3) Three Months Ended Year-to-Date (in millions USD, unless otherwise indicated) 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 9/30/2017 9/30/2018 Net income (loss) attributable to Holdings Net income (loss) attributable to Holdings $ 10 $ 483 $ 214 $ 164 $ (496) $ 351 $ (118) Adjustments related to: Variable annuity product features(1) 507 369 176 250 1,403 738 1,829 Investment gains (losses) 11 159 (102) 22 36 32 (44) Goodwill impairment — — — — — 369 — Net actuarial gains (losses) related to pension and other postretirement benefit obligations 34 34 131 27 24 101 182 Other adjustments 56 58 90 89 51 61 229 Income tax (expense) benefits related to above adjustments (35) (198) (55) (75) (409) (446) (461) Non-recurring tax items (183) 16 28 11 84 (92) 45 Non-GAAP Operating earnings (loss) 400 921 482 488 693 1,114 1,662 Net income (loss) attributable to Holdings per diluted common share 0.02 0.86 0.38 0.29 (0.89) 0.63 (0.21) Adjustments related to: Variable annuity product features(1) 0.90 0.66 0.31 0.45 2.50 1.32 3.26 Investment gains (losses) 0.02 0.28 (0.18) 0.04 0.06 0.06 (0.08) Goodwill impairment — — — — — 0.66 — Net actuarial gains (losses) related to pension and other postretirement benefit obligations 0.06 0.06 0.23 0.05 0.04 0.18 0.32 Other adjustments 0.10 0.10 0.16 0.16 0.10 0.11 0.41 Income tax (expense) benefit related to above adjustments (0.06) (0.35) (0.10) (0.13) (0.73) (0.80) (0.82) Non-recurring tax items (0.33) 0.03 0.05 0.02 0.15 (0.16) 0.08 Non-GAAP Operating earnings per diluted common share 0.71 1.64 0.85 0.88 1.23 1.99 2.96 Book Value per share Book Value per Share 22.11 23.92 24.15 23.82 22.15 22.11 22.15 Less: Per share impact of AOCI (0.61) (0.20) (1.68) (2.33) (2.85) (0.61) (2.85) Book value per share (ex. AOCI) 22.72 24.12 25.83 26.15 25.00 22.72 25.00 Notes: 561.0 561.0 561.0 561.1 560.3 561.0 560.8 (1) This reconciling item was previously referred to as “GMxB product features”, but is now referred to more broadly as “Variable annuity product features” to reflect the exclusion of embedded derivatives on our SCS product from non-GAAP Operating Earnings. 28

Reconciliation of Non-GAAP Measures (2/3) Three Months Ended or As of Twelve Months Ended (in millions USD, unless otherwise indicated) 6/30/2017 9/30/2017 12/31/2017 3/31/2018 6/30/2018 9/30/2018 3/31/2018 6/30/2018 9/30/2018 Net Income to Pro forma Net Income Net Income (loss), as reported $ 708 $ 106 $ 627 $ 337 $ 261 $ (443) $ 1,778 $ 1,331 $ 782 Adjustments related to: Pro forma adjustments before income tax(1) (72) (40) (41) (28) (6) — (181) (115) (75) Income tax impact 3 — (6) (5) (2) 1 (8) (13) (12) Pro forma adjustments, net of income tax (69) (40) (47) (33) (8) 1 (189) (128) (87) Pro forma net income (loss) 639 66 580 304 253 (442) 1,589 1,203 695 Less: Pro forma net income (loss) attributable to the noncontrolling interest (28) (65) (91) (81) (90) (53) (265) (327) (315) Pro forma net income (loss) attributable to Holdings $ 611 $ 1 $ 489 $ 223 $ 163 $ (495) $ 1,324 $ 876 $ 380 Pro forma Net Income to Pro forma Non-GAAP Operating Earnings Pro forma net income (loss) attributable to Holdings 611 1 489 223 163 (495) $ 1,324 $ 876 $ 380 Adjustments related to: Variable annuity product features (45) 509 372 177 249 1,403 1,013 1,307 2,201 Investment (gains) losses (4) 12 160 (103) 23 36 65 92 116 Goodwill impairment — (2) — — — — (2) (2) — Net actuarial (gains) losses related to pension and other postretirement benefit obligations 33 35 34 132 26 24 234 227 216 Other adjustments 23 59 55 86 50 230 293 284 Income tax (expense) benefits related to above adjustments (222) (130) (201) (52) (78) (331) (605) (461) (662) Non-recurring tax items — (92) 16 27 12 6 (49) (37) 61 Pro forma Non-GAAP Operating Earnings 396 392 925 404 481 693 $ 2,210 $ 2,295 $ 2,596 Pro forma Equity Reconciliation Average Twelve Months Ended Total equity attributable to Holdings 12,360 12,401 13,421 13,547 13,364 12,411 12,932 13,183 13,186 Pro forma adjustments (1) (718) 892 702 3 — — 220 399 176 Pro forma total equity attributable to Holdings 11,642 13,293 14,123 13,550 13,364 12,411 13,152 13,582 13,362 Less: Accumulated other comprehensive income (loss) (333) (345) (108) (946) (1,310) (1,595) (433) (677) (990) Pro forma total equity attributable to Holdings excluding AOCI 11,975 13,638 14,231 14,496 14,674 14,006 13,585 14,259 14,352 Return on Equity Reconciliation Twelve Months Ended or As of Net income (loss) attributable to Holdings 618 10 483 214 164 (496) 1,325 871 365 Average equity attributable to Holdings 12,932 13,183 13,186 Return on Equity 10.2% 6.6% 2.8% Pro forma Non-GAAP Operating Earnings 396 392 925 497 481 693 2,210 2,295 2,596 Pro forma average equity attributable to Holdings excluding AOCI 13,585 14,259 14,352 Pro forma Non-GAAP Return on Equity 16.3% 16.1% 18.1% Pro forma Non-GAAP Operating Earnings excluding Q4 2017 non-recurring items (2) 396 392 566 497 481 693 1,851 1,936 2,237 Pro forma average equity attributable to Holdings excluding AOCI 13,585 14,259 14,352 Pro forma Non-GAAP ROE excluding Q4 2017 non-recurring items 13.6% 13.6% 15.6% Notes: (1) Pro Forma adjustments relate to certain reorganization transactions that occurred in 2018, including: (1) the acquisition of AXA’s remaining interest in AB and minority interests in AXA Financial, Inc.; (2) the transfer of certain U.S. property & casualty business held by AXA Equitable Holdings to AXA; (3) the issuance of $3.8 billion of external debt and (4) the settlement of all outstanding financing balances with AXA. (2) The post-tax adjustment to Pro Forma Non-GAAP Operating Earnings for Q42017 non-recurring items was determined by multiplying $535 million total pre-tax adjustments in policyholder’s benefits, DAC amortization (net), policy charges, fee income and premiums by a tax rate of 33%. 29

Reconciliation of Non-GAAP Measures (3/3) Twelve Months Ended Twelve Months Ended (in millions USD, unless otherwise indicated) 12/31/2016 12/31/2017 12/31/2017 Net Income to Pro forma Net Income Net Income (loss), as reported — — $ 1,257 Adjustments related to: Pro forma adjustments before income tax(1) — — (154) Income tax impact — — (3) Pro forma adjustments, net of income tax — — (157) Pro forma net income (loss) — — 1,100 Less: Pro forma net income (loss) attributable to the noncontrolling interest — — (276) Pro forma net income (loss) attributable to Holdings — — $ 824 Pro forma Net Income to Pro forma Non-GAAP Operating Earnings Pro forma net income (loss) attributable to Holdings — — $ 824 Adjustments related to: Variable annuity product features — — 1,113 Investment (gains) losses — — 192 Goodwill impairment — — 369 Net actuarial (gains) losses related to pension and other postretirement benefit obligations — — 136 Other adjustments — — 115 Income tax (expense) benefits related to above adjustments — — (651) Non-recurring tax items — — (76) Pro forma Non-GAAP Operating Earnings — — $ 2,022 Pro forma Equity Reconciliation Average Twelve Months Ended Total equity attributable to Holdings 11,406 13,421 12,414 Pro forma adjustments (1) 1,080 702 891 Pro forma total equity attributable to Holdings 12,486 14,123 13,305 Less: Accumulated other comprehensive income (loss) (921) (108) (515) Pro forma total equity attributable to Holdings excluding AOCI 13,407 14,231 13,819 Return on Equity Reconciliation Twelve Months Ended or As of Net income (loss) attributable to Holdings — — 834 Average equity attributable to Holdings — — 12,414 Return on Equity 6.7% Pro forma Non-GAAP Operating Earnings — — 2,022 Pro forma average equity attributable to Holdings excluding AOCI — — 13,819 Pro forma Non-GAAP Return on Equity 14.6% Pro forma Non-GAAP Operating Earnings excluding Q4 2017 non-recurring items (2) — — 1,663 Pro forma average equity attributable to Holdings excluding AOCI — — 13,819 Pro forma Non-GAAP ROE excluding Q4 2017 non-recurring items 12.0% Notes: (1) Pro Forma adjustments relate to certain reorganization transactions that occurred in 2018, including: (1) the acquisition of AXA’s remaining interest in AB and minority interests in AXA Financial, Inc.; (2) the transfer of certain U.S. property & casualty business held by AXA Equitable Holdings to AXA; (3) the issuance of $3.8 billion of external debt and (4) the settlement of all outstanding financing balances with AXA. (2) The post-tax adjustment to Pro Forma Non-GAAP Operating Earnings for Q42017 non-recurring items was determined by multiplying $535 million total pre-tax adjustments in policyholder’s benefits, DAC amortization (net), policy charges, fee income and premiums by a tax rate of 33%. 30

Glossary of Selected Financial and Product Terms Account Value (“AV”) - AV generally equals the aggregate policy account value of our retirement and protection products. General Account AV refers to account balances in investment options that are backed by the General Account while Separate Account AV refers to Separate Account investment assets. Annualized premiums - 100% of first year recurring premiums (up to target) and 10% of excess first year premiums or first year premiums from single premium products. Assets Under Administration (“AUA”) - AUA includes non-insurance client assets that are invested in our savings and investment products or serviced by our AXA Advisors platform. We provide administrative services for these assets and generally record the revenues received as distribution fees. Assets Under Management (“AUM”) - AUM means investment assets that are managed by one of our subsidiaries and includes: (i) assets managed by AB, (ii) the assets in our GAIA portfolio and (iii) the Separate Account assets of our Individual Retirement, Group Retirement and Protection Solutions businesses. Total AUM reflects exclusions between segments to avoid double counting. Benefit base - A notional amount (not actual cash value) used to calculate the owner’s guaranteed benefits within an annuity contract. The death benefit and living benefit within the same contract may not have the same benefit base. Current Product Offering (Individual Retirement) - Products sold 2011 and later. Deferred acquisition costs (“DAC”) - Represents the incremental costs related directly to the successful acquisition of new and certain renewal insurance policies and annuity contracts and which have been deferred on the balance sheet as an asset. Fixed Rate (Individual Retirement) - Pre 2011 GMxB products. FYP - First year premium and deposits. Gross premiums - FYP and Renewal premium and deposits. GMxB - A general reference to all forms of variable annuity guaranteed benefits, including guaranteed minimum living benefits, or GMLBs (such as GMIBs, GMWBs and GMABs), and guaranteed minimum death benefits, or GMDBs (inclusive of return of premium death benefit guarantees). Guaranteed minimum death benefits (“GMDB”) - An optional benefit (available for an additional cost) that guarantees an annuitant’s beneficiaries are entitled to a minimum payment based on the benefit base, which could be greater than the underlying AV, upon the death of the annuitant. Guaranteed minimum income benefits (“GMIB”) - An optional benefit (available for an additional cost) where an annuitant is entitled to annuitize the policy and receive a minimum payment stream based on the benefit base, which could be greater than the underlying AV. Guaranteed minimum living benefits (“GMLB”) - A reference to all forms of guaranteed minimum living benefits, including GMIBs, GMWBs and GMABs (does not include GMDBs). Invested assets - Includes fixed maturity securities, equity securities, mortgage loans, policy loans, alternative investments and short-term investments. Inv Mgmt and Research - Abbreviation for Investment Management and Research. Premiums and deposits - Amounts a policyholder agrees to pay for an insurance policy or annuity contract that may be paid in one or a series of payments as defined by the terms of the policy or contract. Protection Solutions Reserves - Protection Solutions Reserves equals the aggregate value of Policyholders’ account balances and Future policy benefits for policies in our Protection Solutions segment. Renewal premium and deposits - Premiums and deposits after the first twelve months of the policy or contract. Return of premium (“ROP”) death benefit - This death benefit pays the greater of the account value at the time of a claim following the owner’s death or the total contributions to the contract (subject to adjustment for withdrawals). The charge for this benefit is usually included in the M&E fee that is deducted daily from the net assets in each variable investment option. We also refer to this death benefit as the Return of Principal death benefit. Net flows - Net change in customer account balances in a period including, but not limited to, gross premiums, surrenders, withdrawals and benefits. It excludes investment performance, interest credited to customer accounts and policy charges. Net long-term flows - Net change of assets under management in a period which includes new sales net of redemptions of mutual funds and terminations of separately managed accounts and cash flow which includes both cash invested or withdrawn from existing clients. In addition, cash flow includes fees received from certain clients. It excludes the impact of the markets. Pre-tax return on assets - calculated as segment pre-tax operating earnings. 31

Analyst Coverage, Ratings & Contact Information Analyst Coverage Firm Analyst Phone Number Autonomous Research Erik Bass 1 (646) 561-6248 Bank of America Merrill Jay Cohen 1 (646) 855-5716 Barclays Jay Gelb 1 (212) 526-1561 Citi Suneet Kamath 1 (212) 816-3457 Credit Suisse Andrew Kligerman 1 (212) 325-5069 Deutsche Bank Joshua Shanker 1 (212) 250-7127 Evercore ISI Thomas Gallagher 1 (212) 446-9439 Goldman Sachs Alex Scott 1 (917) 343-7160 J.P. Morgan Jimmy Bhullar 1 (212) 622-6397 Keefe, Bruyette, & Woods Ryan Krueger 1 (860) 722-5930 Morgan Stanley Nigel Dally 1 (212) 761-4132 RBC Capital Markets Mark Dwelle 1 (804) 782-4008 SunTrust Robinson Humphrey Mark Hughes 1 (615) 748-4422 This list is provided for informational purposes only. AXA Equitable Holdings does not endorse the analyses, conclusions or recommendations contained in any reports issued by these or any other analysts. Ratings A.M. Best S&P Moody’s Last review date 3/7/2018 3/6/2018 4/11/2018 Financial Strength Ratings: AXA Equitable Life A A+ A2 MLOA A A+ A2 Credit Ratings: AXA Equitable Holdings — BBB+ Baa2 AXA Financial bbb+ BBB+ Baa2 AB (1) — A/Stable/A-1 A2 Investor and Media Contacts Contact Investor Relations Contact Media Relations Kevin Molloy Priya Mehrotra Dan Woodrow Gina Tyler (212) 314-2476 (212) 314-2466 (212) 314-2036 (212) 314-2010 IR@axa-equitable.com MediaRelations@axa-equitable.com www.ir.axaequitableholdings.com www.axaequitableholdings.com Notes: (1) Last review dates: S&P as of November 9, 2018, Moody’s as of May 17, 2017. 32