Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 TRANSCRIPT - Western Midstream Partners, LP | wgp20188-kxnovemberxex992.htm |

| EX-99.1 - EXHIBIT 99.1 PRESS RELEASE - Western Midstream Partners, LP | wgp20188-kxnovemberxex991.htm |

| EX-2.1 - EXHIBIT 2.1 - Western Midstream Partners, LP | wgp20188-kxnovemberxex21.htm |

| 8-K - 8-K - Western Midstream Partners, LP | wgp20188-kxnovember.htm |

INVESTOR RELATIONS Jon VandenBrand Director 832.636.1007 Jack Spinks Manager 832.636.3738 NYSE: WES, WGP WWW.WESTERNGAS.COM WESTERN GAS ANNOUNCES SIMPLIFICATION TRANSACTION AND STRATEGIC ACQUISITION PROVIDES 2019 OUTLOOK November 8, 2018

Cautionary Language Regarding Forward Looking Statements Important Information for Investors and Unitholders This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In connection with the proposed transaction discussed herein, Western Gas Equity Partners, LP (“WGP”) will file with the Securities and Exchange Commission (the “Commission”) a registration statement on Form S-4, which will include a prospectus of WGP and a proxy statement of Western Gas Partners, LP (“WES”). WES and WGP also plan to file other documents with the Commission regarding the proposed transaction. After the registration statement has been declared effective by the Commission, a definitive proxy statement/prospectus will be mailed to the unitholders of WES. INVESTORS AND UNITHOLDERS OF WES ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED TRANSACTION THAT WILL BE FILED WITH THE COMMISSION CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and unitholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about WES and WGP once such documents are filed with the Commission, through the website maintained by the Commission at http://www.sec.gov. Copies of the documents filed with the Commission by WES and WGP will be available free of charge on their internet website at www.westerngas.com or by contacting their Investor Relations Department at 832-636-6000. Participants in the Solicitation WES, WGP, their respective general partners and their respective general partners’ directors and executive officers may be deemed to be participants in the solicitation of proxies from the unitholders of WES in connection with the proposed transaction. Information about the directors and executive officers of WES is set forth in WES’s Annual Report on Form 10-K which was filed with the Commission on February 16, 2018. Information about the directors and executive officers of WGP is set forth in WGP’s Annual Report on Form 10-K which was filed with the Commission on February 16, 2018. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the Commission when they become available. Free copies of these documents can be obtained using the contact information above. Cautionary Statement Regarding Forward-Looking Statements This presentation contains forward-looking statements. For example, statements regarding future financial performance, future competitive positioning, future market demand, future benefits to unitholders, future economic and industry conditions, the proposed transaction (including its benefits, results, effects and timing) and whether and when the transaction will be consummated, are forward-looking statements within the meaning of federal securities laws. WES, WGP and their respective general partners believe that their expectations are based on reasonable assumptions. No assurance, however, can be given that such expectations will prove to have been correct. A number of factors could cause actual results to differ materially from the projections, anticipated results or other expectations expressed in this presentation. Such factors include, but are not limited to: the failure of the unitholders of WES to approve the proposed transaction; the risk that the conditions to the closing of the proposed transaction are not satisfied; the risk that regulatory approvals required for the proposed transaction are not obtained or are obtained subject to conditions that are not anticipated; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; uncertainties as to the timing of the proposed transaction; competitive responses to the proposed transaction; unexpected costs, charges or expenses resulting from the proposed transaction; the outcome of pending or potential litigation; the inability to retain key personnel; uncertainty of the expected financial performance of the pro-forma partnership, following completion of the proposed transaction; and any changes in general economic and/or industry specific conditions. WES and WGP caution that the foregoing list of factors is not exclusive. Additional information concerning these and other risk factors is contained in WES’s and WGP’s most recently filed Annual Reports on Form 10-K, subsequent Quarterly Reports on Form 10-Q, recent Current Reports on Form 8-K, and other Commission filings, which are available at the Commission’s website, http://www.sec.gov. All subsequent written and oral forward-looking statements concerning WES, WGP, the proposed transaction or other matters attributable to WES and WGP or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Each forward looking statement speaks only as of the date of the particular statement. Except as required by law, WES, WGP and their respective general partners undertake no obligation to publicly update or revise any forward-looking statements. A reconciliation of any forecasted Adjusted EBITDA to net cash provided by operating activities and net income, or forecasted Adjusted gross margin to operating income, is not provided because the items necessary to estimate such amounts are not reasonably accessible or estimable at this time. www.westerngas.com | NYSE: WES, WGP WESTERN GAS 2

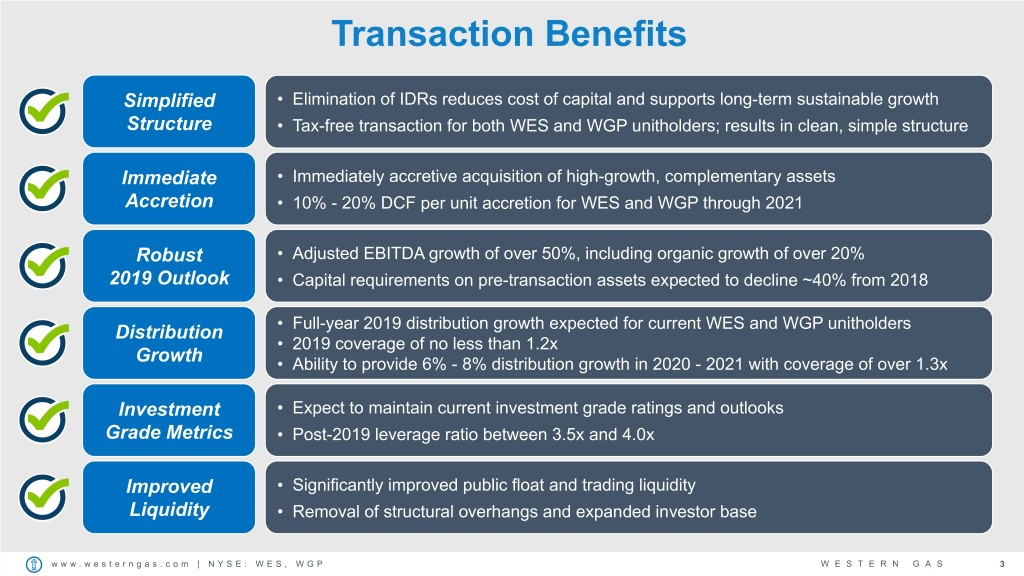

Transaction Benefits Simplified • Elimination of IDRs reduces cost of capital and supports long-term sustainable growth Structure • Tax-free transaction for both WES and WGP unitholders; results in clean, simple structure Immediate • Immediately accretive acquisition of high-growth, complementary assets Accretion • 10% - 20% DCF per unit accretion for WES and WGP through 2021 Robust • Adjusted EBITDA growth of over 50%, including organic growth of over 20% 2019 Outlook • Capital requirements on pre-transaction assets expected to decline ~40% from 2018 Distribution • Full-year 2019 distribution growth expected for current WES and WGP unitholders • 2019 coverage of no less than 1.2x Growth • Ability to provide 6% - 8% distribution growth in 2020 - 2021 with coverage of over 1.3x Investment • Expect to maintain current investment grade ratings and outlooks Grade Metrics • Post-2019 leverage ratio between 3.5x and 4.0x Improved • Significantly improved public float and trading liquidity Liquidity • Removal of structural overhangs and expanded investor base www.westerngas.com | NYSE: WES, WGP WESTERN GAS 3

Transaction Overview and Structure WGP will acquire WES in a unit-for-unit, tax-free exchange Pro Forma Structure . Incentive distribution rights (IDRs) and WES general partner units eliminated Anadarko Public Petroleum Unitholders . Each publicly traded WES common unit exchanged for 1.525 WGP common units Corp (APC) . WES common units currently owned by APC (including Class C units) exchanged at same ratio ~44.5% ~55.5% . WES survives as a private partnership and APC retains a 2% ownership Western Gas Equity Partners, LP 2% WES will acquire substantially all APC Midstream assets for ~$4.0B NYSE: WGP . 2019E Adjusted EBITDA of ~$420 million including $40 million of incremental G&A 98% . Acquisition financed with 50% cash and 50% new units issued to APC . $2.0 billion term loan commitment to finance cash consideration Western Gas Partners, LP1 Transaction expected to close 1Q19 . Subject to WES unitholder vote Existing Acquisition Assets Assets 1) WES will remain the borrower for all existing and future indebtedness and owner of all operating assets and equity interests. www.westerngas.com | NYSE: WES, WGP WESTERN GAS 4

High-Growth, Complementary Acquisition DJ Basin Asset Overview APC Acreage APC Mineral Interest Gas Gathering Contract / Oil Pipelines 1 Oil Stabilization Facility Asset Ownership Description Term Gas Processing Facility DBM Oil • ~530 miles oil gathering pipelines COS & MVC / Future Latham Plant 100% Services • ~190 MBbls/d crude treating capacity 2033 APC Water • ~620 miles water gathering pipelines COS & MVC / 100% Holdings • 17 SWD wells with 505 MBbls/d capacity 2033 WAMSUTTER PIPELINE Bone Spring 50% • 125 MMcf/d processing COS / 2022 Gas Plant2 Delaware Basin Delaware Basin Delaware Mi Vida 50% • 200 MMcf/d processing MVC / 2025 5 MILES Gas Plant2 Wattenberg Oil • ~280 miles crude gathering pipelines COS & MVC / 100% Complex • ~155 MBbls/d total stabilization capacity 2028 Delaware Basin SADDLEHORN PIPELINE Wattenberg DJ Basin 100% • 290 MMcf/d processing Life of Lease NEW MEXICO Basin DJ Plant TEXAS Cushing Ramsey Saddlehorn • ~600 mile FERC regulated crude pipeline LOVING 20% MVC Pipeline2 • 340 MBbls/d capacity CULBERSON PANOLA PIPELINE WINKLER Mentone Panola • ~250 mile FERC regulated NGL pipeline 15% Dedication Pipeline2 • 100 MBbls/d capacity REEVES Other 5 MILES Other APC Leasehold WARD Wamsutter • ~50 miles of crude gathering pipelines Existing/Future Gas Plant 100% IT Shippers Existing/Future Gas Gathering Lines Mt. Belvieu Pipeline • 13 MBbls/d capacity Existing/Future Regional Oil Treating Facility Existing/Future Oil Pipelines Existing/Future Water Pipelines Acquisition of high-growth assets at attractive multiple 1) All statistics as of September 30, 2018. of ~9.5x 2019E Adjusted EBITDA of ~$420 million 2) Non-operated equity interest. Note: MVCs: Minimum Volume Commitments, COS: Cost-of-Service, Dedication: Acreage dedication, SWD: Salt Water Disposal www.westerngas.com | NYSE: WES, WGP WESTERN GAS 5

Significant Exposure to Growing Basins 2019E Adjusted EBITDA: 2019E Total Capital Expenditures: $1.8 to $1.9 Billion $1.3 to $1.4 Billion Delaware Basin Delaware Basin 40% 54% Equity Investments 10% Other 13% DJ Basin DJ Basin 37% 37% Note: Delaware Basin Adjusted EBITDA includes distributions from, and Total Capital Expenditures includes contributions to, the following equity investments: Red Bluff Express Pipeline, Mi Vida and Bone Spring gas processing plants. www.westerngas.com | NYSE: WES, WGP WESTERN GAS 6

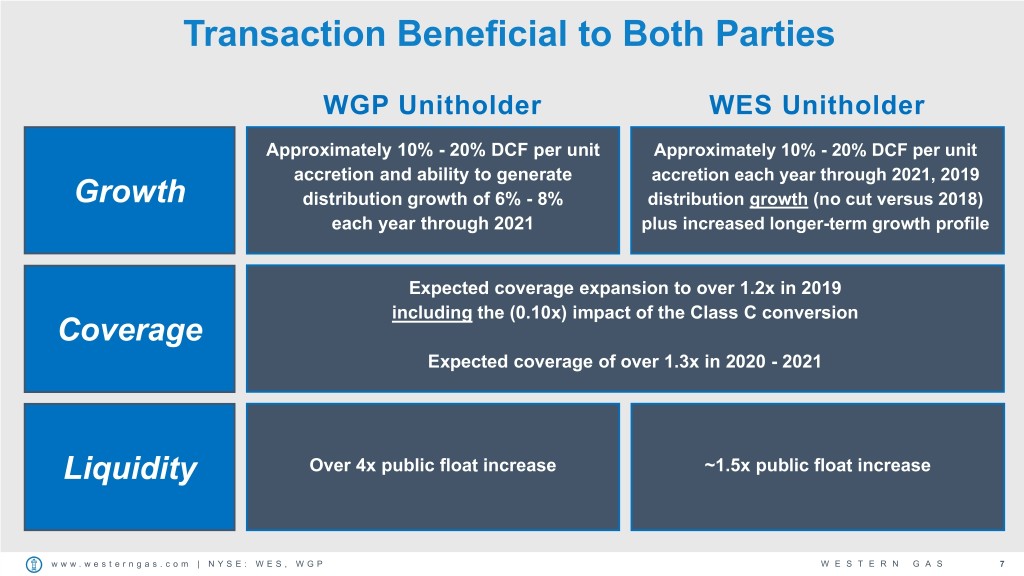

Transaction Beneficial to Both Parties WGP Unitholder WES Unitholder Approximately 10% - 20% DCF per unit Approximately 10% - 20% DCF per unit accretion and ability to generate accretion each year through 2021, 2019 Growth distribution growth of 6% - 8% distribution growth (no cut versus 2018) each year through 2021 plus increased longer-term growth profile Expected coverage expansion to over 1.2x in 2019 including the (0.10x) impact of the Class C conversion Coverage Expected coverage of over 1.3x in 2020 - 2021 Liquidity Over 4x public float increase ~1.5x public float increase www.westerngas.com | NYSE: WES, WGP WESTERN GAS 7

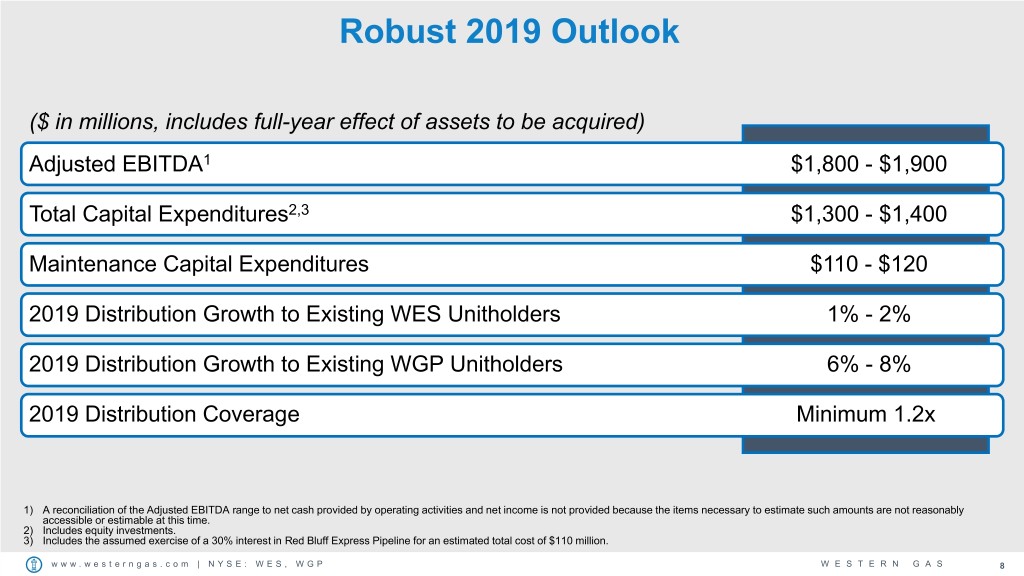

Robust 2019 Outlook ($ in millions, includes full-year effect of assets to be acquired) Adjusted EBITDA1 $1,800 - $1,900 Total Capital Expenditures2,3 $1,300 - $1,400 Maintenance Capital Expenditures $110 - $120 2019 Distribution Growth to Existing WES Unitholders 1% - 2% 2019 Distribution Growth to Existing WGP Unitholders 6% - 8% 2019 Distribution Coverage Minimum 1.2x 1) A reconciliation of the Adjusted EBITDA range to net cash provided by operating activities and net income is not provided because the items necessary to estimate such amounts are not reasonably accessible or estimable at this time. 2) Includes equity investments. 3) Includes the assumed exercise of a 30% interest in Red Bluff Express Pipeline for an estimated total cost of $110 million. www.westerngas.com | NYSE: WES, WGP WESTERN GAS 8