Attached files

| file | filename |

|---|---|

| 8-K - WEC ENERGY GROUP FORM 8-K - WEC ENERGY GROUP, INC. | wecenergygroupform8-k11092.htm |

Focused on Performance Investor Update: November 2018

Cautionary Statement Regarding Forward-Looking Information Much of the information contained in this presentation is forward-looking information based upon management’s current expectations and projections that involve risks and uncertainties. Forward-looking information includes, among other things, information concerning earnings per share, rate case activity, earnings per share growth, cash flow, sources of revenue, dividend growth and dividend payout ratios, capital plans, construction costs, generating unit retirements, investment opportunities, corporate initiatives (including any generation reshaping plan), rate base, and environmental matters (including emission reductions). Readers are cautioned not to place undue reliance on this forward-looking information. Forward-looking information is not a guarantee of future performance and actual results may differ materially from those set forth in the forward-looking information. In addition to the assumptions and other factors referred to in connection with the forward-looking information, factors that could cause WEC Energy Group’s actual results to differ materially from those contemplated in any forward- looking information or otherwise affect our future results of operations and financial condition include, among others, the following: general economic conditions, including business and competitive conditions in the company’s service territories; timing, resolution and impact of future rate cases and other regulatory decisions; the company’s ability to continue to successfully integrate the operations of its subsidiaries; availability of the company’s generating facilities and/or distribution systems; unanticipated changes in fuel and purchased power costs; key personnel changes; varying weather conditions; continued industry consolidation; cyber-security threats; the value of goodwill and its possible impairment; construction risks; equity and bond market fluctuations; the impact of tax reform and any other legislative and regulatory changes, including changes to existing and/or anticipated environmental standards; current and future litigation and regulatory investigations; changes in accounting standards; and other factors described under the heading “Factors Affecting Results, Liquidity, and Capital Resources” in Management’s Discussion and Analysis of Financial Condition and Results of Operations and under the headings “Cautionary Statement Regarding Forward- Looking Information” and “Risk Factors” contained in WEC Energy Group’s Form 10-K for the year ended December 31, 2017 and in subsequent reports filed with the Securities and Exchange Commission. WEC Energy Group expressly disclaims any obligation to publicly update or revise any forward-looking information. 1

Company Statistics $21.6 billion market cap (1) 1.6 million electric customers 2.9 million natural gas customers 60% ownership of American Transmission Company 69,600 miles of electric distribution 48,000 miles of gas distribution $18.5 billion of rate base (2) (1) As of 10/31/2018 (2) 2017 average rate base 2

Our strategy is to create long-term value by focusing on the fundamentals: safety, world-class reliability, operating efficiency, financial discipline and customer care. One of the 100 Best One of America’s 2018 CEO of the Year Corporate Citizens Best Employers Most Outstanding Energy Corporate Responsibility Magazine Forbes Delivery Holding Companies Gale Klappa CEO Monthly Magazine Most reliable utility in 2018 Most Trusted Best in the U.S. in America and in the Midwest Utility Brand Large Customer Satisfaction We Energies Wisconsin Public Service We Energies & Wisconsin Public Service PA Consulting Market Strategies International JD Power 3

A Decade of EPS Growth $4.00 $3.50 $3.00 $2.50 $2.00 $1.50 $1.00 $0.50 $0.00 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 GAAP Adjusted 2018 Guidance 4

Proven Track Record of Performance EPS Guidance 2017 Exceeded 2016 Exceeded 2015 Exceeded 2014 Exceeded The only regulated utility 2013 Exceeded to beat guidance every year for more than a 2012 Exceeded decade 2011 Exceeded 2010 Exceeded 2009 Exceeded 2008 Exceeded 2007 Exceeded 2006 Exceeded 2005 Exceeded 2004 Exceeded 5

5-Year Capital Plan 6

By Line of Business Increasing 5-Year Capital Plan by $700 million Continues to Support 5-7% EPS Growth $16,000 $14,114 $14,000 $13,412 $1,427 $1,589 $12,000 $1,487 $911 $10,000 $8,000 $5,514 $5,869 $6,000 $4,000 $2,707 Plan New $2,780 $2,000 Plan Former $2,691 $2,551 $- In millions 2018-2022 2019-2023 Generation Electric Delivery Gas Delivery Energy Infrastructure ATC Investment* * ATC is accounted for using the equity method; this represents WEC’s portion of the investment 7

2019-2023 Capital Plan ($ in billions) Total of $14.1 billion New Energy Infrastructure $1.2 8% Gas Distribution $5.1 36% Technology Upstream $1.1 Wind Farm - 8% Infrastructure Generation ATC $0.3 $2.5 Investment* 2% 18% Electric $1.4 Distribution 10% $2.5 18% * ATC is accounted for using the equity method; this represents WEC’s portion of the investment 8

2019–2023 Capital Plan Breakdown of Major Segments ($ in billions) Total Capital Plan of $14.1 billion Generation Gas Distribution New Renewables $1.0 SMP $1.5 New Gas 0.5 Growth 1.0 Maintenance Capital 1.0 System Renewal 1.6 Total $2.5 Required Relocation 0.6 Manlove Storage 0.4 Electric Distribution Total $5.1 Growth $0.7 System Renewal 1.4 Technology Required Relocation 0.2 Automated Meters $0.5 SMRP 0.2 Systems and Equipment 0.6 Total $2.5 Total $1.1 9

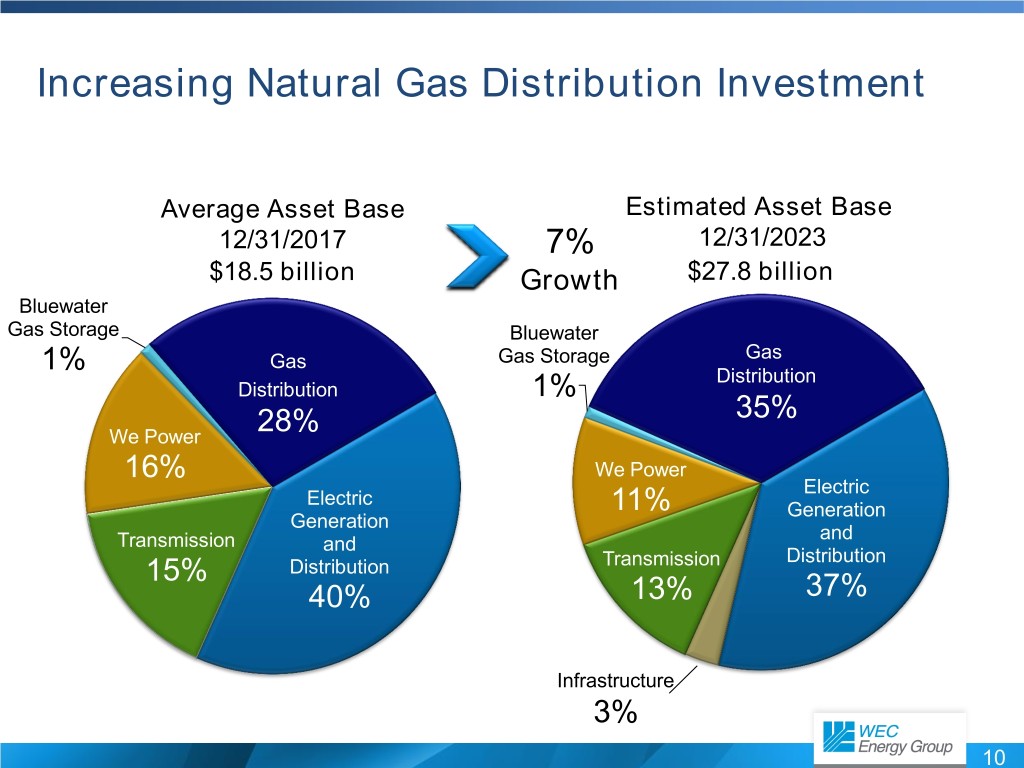

Increasing Natural Gas Distribution Investment Average Asset Base Estimated Asset Base 12/31/2017 7% 12/31/2023 $18.5 billion Growth $27.8 billion Bluewater Gas Gas Gas Storage Distribution Bluewater Distribution 1% Gas Gas Storage 35%Gas 29% Distribution Distribution 1% FERC FERC 35% Regulated Regulated We Power 28% Electric 15% Electric 15% 16% We Power Generation Generation Electric Electric 11% and DistributionGeneration and DistributionGeneration and Transmission and 50% 56% Distribution 15% Distribution Transmission 40% 13% 37% Infrastructure 3% 10

Our Capital Plan in Context Capital plan extends the runway for 5 to 7 percent growth from our core business well into the future Electric sales growth expected to accelerate in later part of 5-year plan Electric distribution capital expected to grow in next iteration of 5-year capital plan Beginning to plan for replacement of energy supply from Point Beach PPA (generation represents ~25% of WEPCO sales) 11

Confident in Achieving Our EPS Growth Guidance $4.00 $3.50 $3.00 $2.50 $2.00 $1.50 $1.00 2015 2016 2017 2018E 2019 2020 2015 Base GAAP Adjusted* *See Appendix 2 for reconciliation of adjusted amounts to GAAP amounts (1) 6.9% growth rate calculated from 2015 base of $2.72 per share and increased 2018 earnings guidance (2) Based on original 2018 guidance midpoint of $3.28 per share 12

Solid Dividend Growth Continues 5-7% 13.5% compound Annualized Dividends Per Share annual growth rate $2.21** off 2010 base $2.08 $1.98 $1.83* Targeting dividend payout of 65-70% of $1.56 earnings $1.445 Projecting dividend $1.20 growth in line with $1.04 earnings growth $0.80 2010 2011 2012 2013 2014 2015 2016 2017 2018 *Annualized based on fourth quarter 2015 dividend of $0.4575 **Annualized based on first quarter 2018 dividend of $0.5525 13

Generation Reshaping 14

Reshaping our Generation Fleet for a Clean, Reliable Future Balancing reliability and customer cost with environmental stewardship We have set aggressive Taken as a whole, changes to our generation goals to reduce carbon fleet should reduce costs to customers, preserve dioxide emissions by fuel diversity and reduce carbon emissions. approximately 40% below 2005 levels by Reshaping our generation includes: 2030 and 80% by 2050. Retiring older fossil-fueled generating units Building state-of-the-art natural gas generation Investing in cost-effective zero-carbon generation 15

Achieving Our Carbon Goal Reduction Goals: Achieved and anticipated CO2 reductions (mass) 0% 40 % -10% below 2005 levels by 2030 -20% -30% 8 0% -40% below 2005 levels by 2050 -50% -60% -70% -80% 2005 2017 2030 2050 Milestone years 16

Coal-Fueled Generation Reducing Greenhouse Gas Emissions 4,935 Apr. Pleasant Prairie 1,190 MW MW Sept. Edgewater 100 MW Oct. Pulliam 200 MW 3,095 Presque Isle 350 MW MW 2017 2018 2019 2020 17

Building Natural Gas-Fueled Generation 400+ MW of natural gas-fueled generation U.P. of Michigan (UMERC) Reciprocating Internal Combustion Engines RICE generation (RICE) are modular, run 180 MW on natural gas and Estimated investment of $266 million* allow for reliable and Expected in-service – second quarter 2019 flexible operations. WPS RICE generation 55 MW Anticipated need – 2022 Option to invest in West Riverside Energy Center Combined cycle 200 MW 2020-2023 Additional projects being actively developed *Estimated investment of $277 million including AFUDC 18

Investing in Zero-Carbon Generation Wisconsin Public Service and Madison Gas & Electric Solar generation have partnered on two major solar projects* technology has improved in efficiency, become Badger Hollow Solar Farm more cost-effective and Located in Iowa County, Wisconsin complements our WPS would own 100 MW (MGE 50 MW) summer demand curve. Two Creeks Solar Project Located in Two Rivers, Wisconsin WPS would own 100 MW (MGE 50 MW) WPS total expected purchase price of ~ $260 million Commercial operation targeted for 2020 Wisconsin Electric filed with PSCW for approval of two innovative renewable energy pilot programs Solar Now Pilot (35 MW) Dedicated Renewable Energy Resource Pilot (150 MW) Additional projects being actively developed * Pending Public Service Commission of Wisconsin approval 19

Regional Economy 20

Foxconn in Wisconsin Expected capital investment by Foxconn of Foxconn announced $10 billion dollars July 26, 2017, Wisconsin’s largest Goal of creating 13,000 jobs, and an estimated economic development 22,000 indirect jobs created throughout Wisconsin project and largest Largest greenfield investment by a foreign-based corporate attraction company in U.S. history as measured by jobs project in U.S. history, as measured by jobs. One of the largest manufacturing campuses in the world Groundbreaking ceremony held on June 28, 2018, and significant construction is underway North American headquarters in Milwaukee, and innovation centers in Green Bay, Eau Claire and Racine Operations expected to begin in 2020, ramping up through 2023 Source: inWisconsin.com 21

Wisconsin Segment Sales Forecast Benefits from Regional Economic Growth Year-over-Year 2019 – 2021 2022 - 2023 Annual Sales Electric Flat – 0.5% 1.2% - 1.5% Growth Forecast (weather-normalized) Gas 0.5% – 1% 1.2% - 1.5% 22

Powering Industry Leaders in our Region 23

Key Takeaways for WEC Energy Group Track record of exceptional performance Portfolio of premium businesses Investment opportunities support 5-7 percent EPS growth with minimal impact on base rates 100 percent of capital allocated to regulated businesses or contracted renewables/gas storage Dividend growth projected to be in line with earnings growth No need to issue additional equity through forecast period Poised to deliver among the best risk-adjusted returns in the industry 24

Appendix #1

Electric Distribution Natural Gas Distribution Electric Generation Non-Utility Energy Infrastructure Electric Transmission 60% ownership 26

“Delivering” the Future Project Highlights Electric Resilience Electric Redesign Technology Enhancements • Installing 2,200 miles of • Major investments planned to • Advanced metering program underground circuits to address aging infrastructure that uses integrated system of replace troublesome smart meters to enable two-way • Expect to spend $2.5 billion overhead lines, and adding communication between utilities over the next 5 years on distribution automation and customers electric delivery equipment through our • Upgrading We Energies • Committed to delivering the System Modernization and customer information system Reliability Project at WPS future with infrastructure that will reduce operating costs • Project to spend ~ $1.1 billion • $430 million investment and meet new environmental (2019 – 2023) across four expected to be complete by standards states we serve the end of 2021 Phase 1 ~ 98% complete Phase 2 ~ 17% complete 27

Peoples Gas Natural Gas System Modernization Program Extensive effort to modernize natural gas infrastructure in city of Chicago Ultimately replace 2,000 miles of piping Approximately 26% complete* Investment recovery under a monthly rider Project $280-$300 million average annual investment Illinois law authorizes rider through 2023 *Total program completion percentage is based on the weighted average of program categories that comprise the major components of the SMP project 28

New Generation in Upper Peninsula Provides a long-term generation solution for electric ~180 MW of clean, natural reliability in Upper Peninsula gas-fired generation from Estimated $266 million ($277 million including AFUDC) Reciprocating Internal investment to be made by Michigan utility – UMERC Combustion Engines (RICE) Half of investment recovered in retail rates Targeted commercial operation: Half of investment recovered by 20-year agreement second quarter 2019 with Cliffs Natural Resources Allows for retirement of Presque Isle Power Plant in second quarter of 2019 Received approval and final written order from Michigan Commission on October 25, 2017 Procurement is Construction is 100% 65% complete complete 29

Infrastructure Investment Bishop Hill III Wind Energy Center Developed by Invenergy and placed into service in May 2018 53 GE wind turbines with Located in Henry County, Illinois a capacity of ~132 MW Total investment: $148 million for an 80% ownership interest Expected to provide returns that are higher than those in our regulated business Approximately mid-8% unlevered internal rate of return Qualifies for 100% bonus depreciation and production tax credits 22-year offtake agreement with a current wholesale customer, WPPI Energy FERC approval received on August 29 Acquisition closed on August 31 Announced an incremental investment of $18 million, pending FERC approval, for an additional 10% equity interest 30

Infrastructure Investment Upstream Wind Energy Center Currently being built by Invenergy in Antelope County, Nebraska 81 GE wind turbines with Total investment: $276 million a capacity of ~200 MW for an 80% ownership interest Expected to provide returns that are higher than those in our regulated business Approximately mid-8% unlevered internal rate of return Qualifies for 100% bonus depreciation and production tax credits 10-year offtake agreement with affiliate of an A-rated publicly traded company (Allianz) Received FERC approval on August 20 Closing anticipated in early 2019 after commercial operation is achieved 31

Power the Future Investments Natural Gas Coal Capacity 1,090 MW 1,030 MW1 Investment $664 million $2 billion1 ROE 12.7% 12.7% Equity 53% 55% In Service Dates Unit 1 – July 2005 Unit 1 – February 2010 Unit 2 – May 2008 Unit 2 – January 2011 Lease Terms 25 years 30 years Cost Per Unit of Capacity $609/kW $1,950/kW 1. All capacity and investment amounts reflect WEC ownership only. Demonstrated capacity for the coal units is 1,056 MW – value shown in table is amount guaranteed in lease agreement. 32

By Line of Business Capital Plan Drives 5% to 7% EPS Growth $3,500 $3,277 $265 $3,000 $2,902 $2,882 $2,605 $282 $481 $2,578 $371 $2,476 $2,500 $291 $297 $205 $330 $180 $171 $102 $402 $2,000 ATC Investment $1,375 $1,146 Energy Infrastructure $1,082 $1,388 $997 $1,500 Gas Delivery $963 Electric Delivery Generation* $1,000 $598 $570 $503 $581 $597 $512 $500 $646 $480 $558 $590 $338 $419 $- 2018 2019 2020 2021 2022 2023 Approximately $14.1 billion projected capital spend from 2019-2023 * Generation includes ~$275 million of capital spend at We Power 33

By State Robust Capital Projection 2018-2023 $3,500 $3,277 $2,902 $265 $2,882 $3,000 $2,605 $282 $481 $2,577 $371 $2,476 $2,500 $291 $297 $136 $205 $329 $180 $106 $249 $157 $102 $93 $402 ATC Investment $2,000 $97 $687 Energy Infrastructure $603 $90 $769 $525 $574 MERC/MGU $1,500 $504 Illinois WI/MI Delivery $1,150 $1,007 $882 $1,000 WI/MI Generation* $992 $1,059 $881 $500 $558 $590 $646 $402 $338 $419 $- 2018 2019 2020 2021 2022 2023 Depreciation at the utilities expected to average $960 million annually, and $124 million at ATC, over the 2019-2023 period * Generation includes ~$275 million of capital spend at We Power 34

American Transmission Company WEC portion of investment from 2019-2023: $1.4 billion Key Assumptions Projected Capital Expenditures (millions) ATC’s 2017 average rate base: (Inside Traditional Footprint) $3.5 billion Implies WEC’s average rate $485 base growth of $128 million $470 $441 ROE currently under FERC $410 review $341 $300 $291 $282 5-year (2019-2023) WEC $265 projected capital investment: $246 $204 Inside footprint: $1.2 billion $180 Outside footprint: $250 million 2018 2019 2020 2021 2022 2023 ATC WEC portion 60% 35

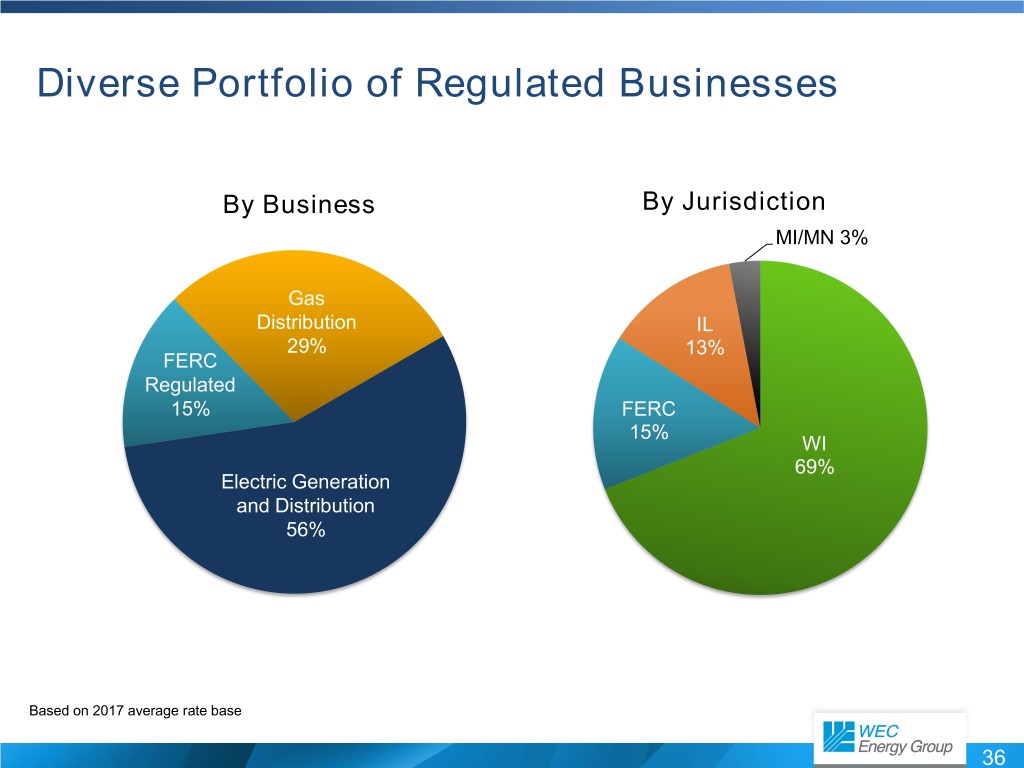

Diverse Portfolio of Regulated Businesses By Business By Jurisdiction MI/MN 3% Gas Distribution IL 29% 13% FERC Regulated 15% FERC 15% WI 69% Electric Generation and Distribution 56% Based on 2017 average rate base 36

Composition of Rate Base Total 2017 Rate Base of $18.5 billion Wisconsin Electric Power the Future Wisconsin Public Service Corporation UMERC Wisconsin Gas North Shore Gas 33.5% 15.7% Peoples Gas Minnesota Energy Resources 15.7% Michigan Gas Utilities ATC 0.5% 11.4% Bluewater 7.0% 0.5% 11.9% 1.1% 1.1% 1.6% Note: Power the Future value represents investment book value 37

Balanced Sales Mix 2017 Retail MWh Deliveries Mix* 35% Large C&I by Segment Paper 24% Foundry (SIC 33) 11% Mining/Minerals 10% Small C&I Large C&I Food/Agriculture 9% 36% 35% Other Manufacturing 8% Metal (SIC 34,35,37) 7% Medical 5% Residential Office 4% plus Farm Education 4% 29% Printing 3% Chemical 3% Other 12% *Wisconsin segment includes Michigan electric and retail choice customers in the Upper Peninsula 38

Strong Financial Condition Electric and Gas Utilities Credit Ratings Distribution* Utilities Number of Utility Rating Issuers 140 Wisconsin Electric A- 120 100 Wisconsin Gas A 80 60 Wisconsin Public Service A- 40 20 Peoples Gas A- 0 AA - A A- BBB+ BBB BBB- Below Investment Grade *Source: Standard & Poor’s Financial Services LLC (January 31, 2018) 39

Manageable Levels of Refinancing $1,000 Long-Term Debt Maturities $900 $800 $700 $600 $500 $400 $300 No debt maturities in $200 2022 or 2023 $100 $- In millions 2018 2019 2020 2021 2022 2023 Hold Co WEPCO WPS PGL 40

No Equity Issuances Anticipated Balance Sheet Remains Strong Funds from Operations/Debt Holding Company Debt 20% to Total Debt 19% 30% 19% 18% 29% 25% 17% 16-18% 16% 20% 15% Goal of 30% 15% 14% or Less 13% 10% 12% 5% 11% 10% 0% 2017 2018-2023E 2017 2018-2023E 41

Rate-Making Parameters by Company Utility Equity Layer (1) Authorized ROE Wisconsin Electric 48.5%-53.5% 10.2% Wisconsin Public Service 49.0%-54.0% 10.0% Wisconsin Gas 47.0%-52.0% 10.3% Peoples Gas 50.33% 9.05% North Shore Gas 50.48% 9.05% Minnesota Energy Resources 50.32% 9.11% Michigan Gas Utilities 52% 9.9% We Power 53%-55% 12.7% American Transmission Company 50% 10.82%(3) Constructive regulatory environments Earnings sharing mechanism at all Wisconsin utilities (2) 1. Represents the equity component of capital; rates are set at the mid-point of any range 2. Applied through 2019 3. Long term projections assume 10.2% 42

Electric Residential Bills below National Average National Average Wisconsin Electric Wisconsin Public Service $1,299 $1,300 $1,304 $1,281 $1,264 $1,226 $1,200 $1,187 $1,190 $1,172 $955 $949 $959 $952 $930 2013 2014 2015 2016 2017 Source: SNL data for average annual residential bills 43

Key Rate Making Components Michigan– Illinois – Minnesota – Electric & Wisconsin – Wisconsin – Area Gas Gas Gas Gas Electric Gas Pipeline Replacement PGL Rider Bad Debt Rider ✓ Bad Debt Escrow Accounting WE / WG WE Decoupling ✓ ✓ Fuel Cost Recovery 1 for 1 recovery of prudent fuel costs +/- 2% band Manufactured Gas Plant Site ✓ ✓ ✓ ✓ N/A Clean Up Recovery Invested Capital Tax Rider ✓ Forward-looking test years ✓ ✓ ✓ 2 years 2 years 50/50 first 50 bp above Earnings cap/sharing allowed ROE, 100% to customers beyond 50 bp* *Wisconsin Electric Power Company and Wisconsin Gas earnings cap applies 2016 – 2019, Wisconsin Public Service cap applies 2018 – 2019 44

Regulatory and Open Docket Update Estimated Key Dates Wisconsin (apps.psc.wi.gov) . Received approval on Forward Wind Center . Decision on new solar generation projects (Docket: 5-BS-228) Q4 2018 . Decision on renewable energy pilot programs (Docket: 6630-TE-102) Q1 2019 Illinois (icc.illinois.gov) . Final Commission order on System Modernization Project (Docket 16-0376) . Decision on 2015 QIP reconciliation (Docket: 16-0197) Q1 2019 . No rate case filing for 2018 Michigan (michigan.gov/mpsc) . Received approval on proposed new generation of natural-gas-fired Reciprocating Internal Combustion Engines (RICE) in the Upper Peninsula (Docket U-18224) Minnesota (mn.gov/puc) . Interim rate increase of $9.5 million or 3.8% effective January 1, 2018* . Decision on proposed base rate increase of $12.6 million or 5.0% Q4 2018 FERC (ferc.gov) . Decision on Upstream Wind Energy Center (Docket EC18-103-000) . Decision on 80% investment of Bishop Hill III (Docket EC18-121-000) . Decision on additional 10% investment of Bishop Hill (Docket EC19-15-000) Q4 2018 . Decision on second MISO/ATC ROE Complaint (Docket EL15-45) Q2 2019 * Interim rates decreased by $2.5 million to $7.0 million on April 1, 2018 to reflect changes related to tax reform 45

Regulatory Environment Wisconsin Illinois Governor Scott Walker (R) Governor Bruce Rauner (R) Commission Commission Gubernatorial appointment, Gubernatorial appointment, Senate Senate confirmation confirmation Chairman: Gubernatorial appointment Chairman: Gubernatorial appointment 6-year staggered terms 5-year staggered terms Wisconsin Commissioners Illinois Commissioners Term Name Party Began Serving Name Party Began Serving Term Ends Ends Brien Sheahan Lon Roberts R 01/2015 01/2020 R 03/2017 03/2023 Chair Chair John Rosales D 03/2015 01/2019 Mike Huebsch R 03/2015 03/2021 Sadzi Martha R 01/2017 01/2022 Olivia Rich Zipperer R 03/2018 03/2019 D. Ethan Kimbrel D 01/2018 01/2023 Anastasia Palivos I 01/2018 01/2023 46

Industry Leading Total Shareholder Returns* Over the past decade, WEC Energy Group has consistently delivered among the best total returns in the industry 300% 250% 200% WEC Energy Group Dow Jones Utilities 150% S&P Utilities Philadelphia Utility S&P Electric 100% 50% 0% One-Year Three-Year Five-Year Ten-Year * Total return including reinvested dividends for the 10 years ended December 31, 2017 47

Gale Klappa Kevin Fletcher Scott Lauber Beth Straka CEO and Chairman President EVP, CFO and SVP Communications Treasurer and Investor Relations 48

Appendix #2

Reconciliation of Reported EPS (GAAP) to Adjusted EPS (Non-GAAP) 2017 2016 Reported EPS – GAAP basis $ 3.79 $ 2.96 Tax benefit related to Tax Cuts and Jobs Act of 2017 $ (0.65) – Acquisition Costs – $ 0.01 Adjusted EPS – Non-GAAP basis* $ 3.14 $ 2.97 * WEC Energy Group has provided adjusted earnings per share (non-GAAP earnings per share) as a complement to, and not as an alternative to, reported earnings per share presented in accordance with GAAP. Adjusted earnings per share exclude a one-time reduction in income tax expense related to a revaluation of our deferred taxes as a result of the Tax Cuts and Jobs Act of 2017 as well as costs related to the acquisition of Integrys, neither of which is indicative of WEC Energy Group’s operating performance. Therefore, WEC Energy Group believes that the presentation of adjusted earnings per share is relevant and useful to investors to understand the company’s operating performance. Management uses such measures internally to evaluate the company’s performance and manage its operations. 50