Attached files

| file | filename |

|---|---|

| 8-K - 8-K - US BANCORP \DE\ | d640605d8k.htm |

BancAnalysts Association of Boston Conference 2018 November 9, 2018 Jeff von Gillern Vice Chairman, Technology and Operations Services Terry Dolan Vice Chairman and Chief Financial Officer Exhibit 99.1

The following information appears in accordance with the Private Securities Litigation Reform Act of 1995: Today’s presentation contains forward-looking statements about U.S. Bancorp. Statements that are not historical or current facts, including statements about beliefs and expectations, are forward-looking statements and are based on the information available to, and assumptions and estimates made by, management as of the date hereof. These forward-looking statements cover, among other things, anticipated future revenue and expenses and the future plans and prospects of U.S. Bancorp. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause actual results to differ materially from those anticipated. Deterioration in general business and economic conditions or turbulence in domestic or global financial markets could adversely affect U.S. Bancorp’s revenues and the values of its assets and liabilities, reduce the availability of funding to certain financial institutions, lead to a tightening of credit, and increase stock price volatility. Stress in the commercial real estate markets, as well as a downturn in the residential real estate markets, could cause credit losses and deterioration in asset values. In addition, changes to statutes, regulations, or regulatory policies or practices could affect U.S. Bancorp in substantial and unpredictable ways. U.S. Bancorp’s results could also be adversely affected by changes in interest rates; deterioration in the credit quality of its loan portfolios or in the value of the collateral securing those loans; deterioration in the value of its investment securities; legal and regulatory developments; litigation; increased competition from both banks and non-banks; changes in the level of tariffs and other trade policies of the United States and its global trading partners; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management’s ability to effectively manage credit risk, market risk, operational risk, compliance risk, strategic risk, interest rate risk, liquidity risk and reputational risk. For discussion of these and other risks that may cause actual results to differ from expectations, refer to U.S. Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2017, on file with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Corporate Risk Profile” contained in Exhibit 13, and all subsequent filings with the Securities and Exchange Commission under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934. However, factors other than these also could adversely affect U.S. Bancorp’s results, and the reader should not consider these factors to be a complete set of all potential risks or uncertainties. Forward-looking statements speak only as of the date hereof, and U.S. Bancorp undertakes no obligation to update them in light of new information or future events. This presentation includes non-GAAP financial measures to describe U.S. Bancorp’s performance. The calculations of these measures are provided in the Appendix. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Forward-looking Statements and Additional Information

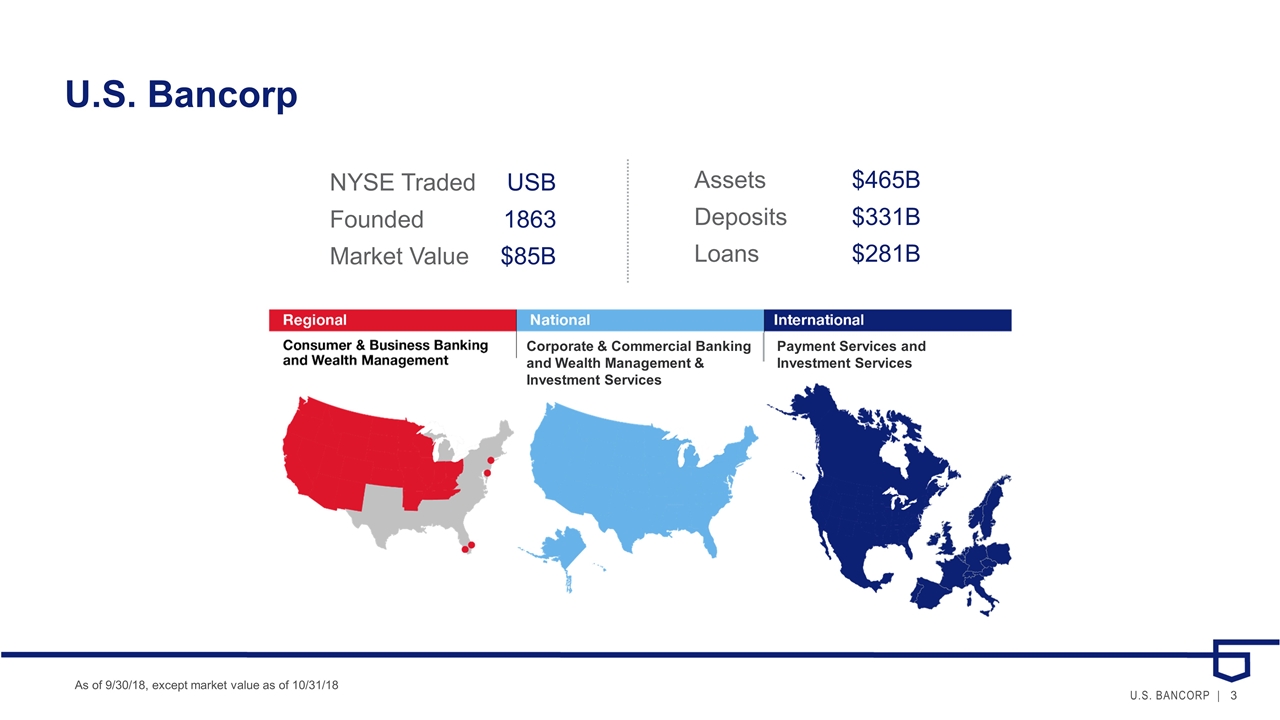

U.S. Bancorp As of 9/30/18, except market value as of 10/31/18 NYSE TradedUSB Founded 1863 Market Value $85B Assets $465B Deposits $331B Loans $281B Payment Services and Investment Services Corporate & Commercial Banking and Wealth Management & Investment Services

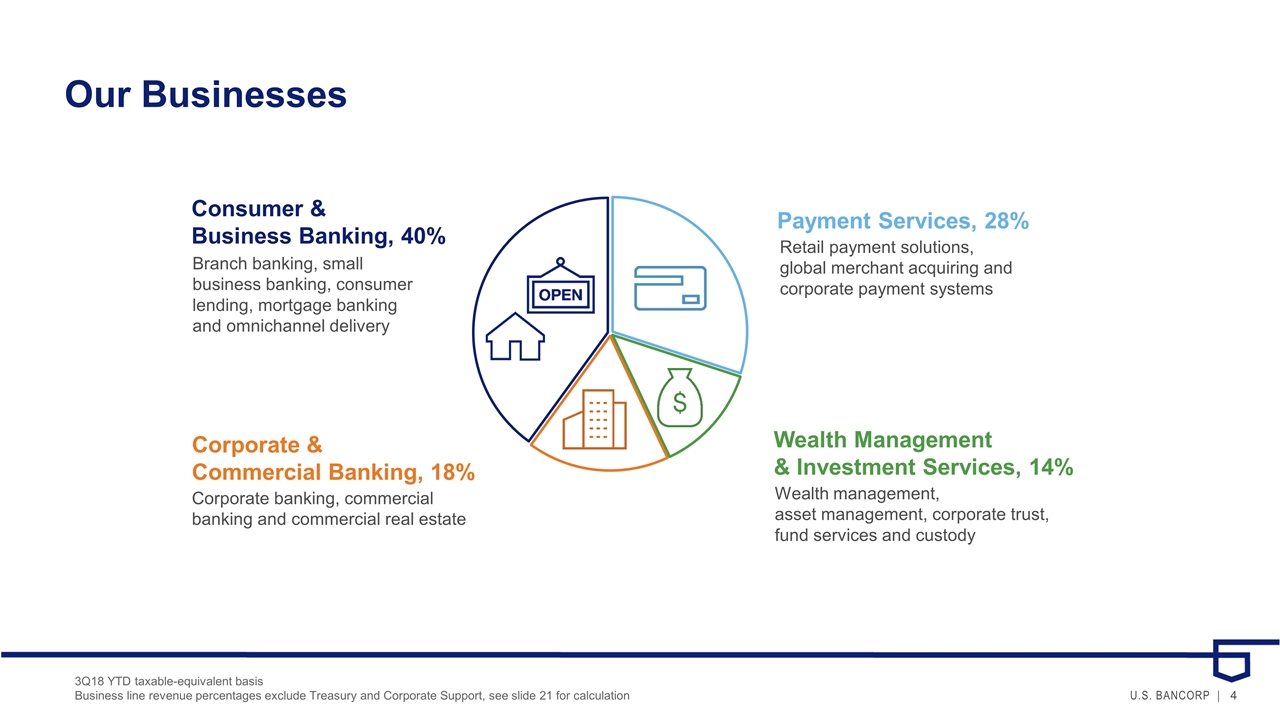

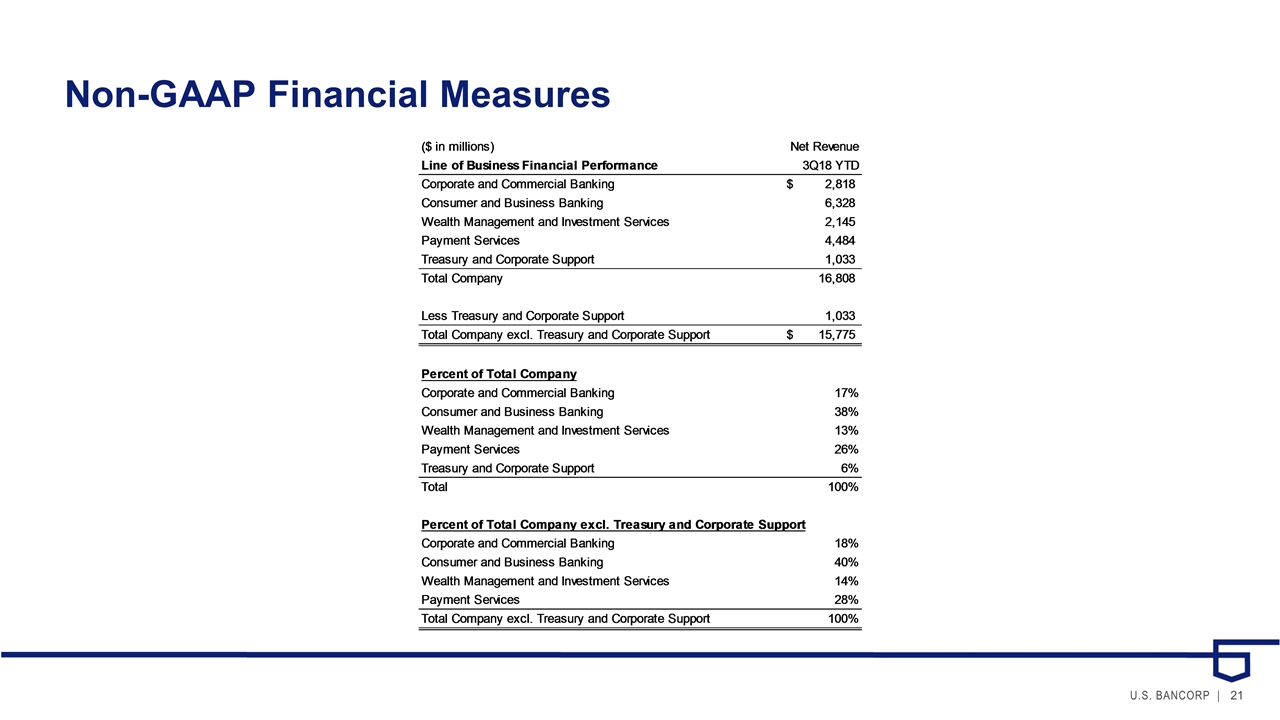

Our Businesses Consumer & Business Banking, 40% Branch banking, small business banking, consumer lending, mortgage banking and omnichannel delivery Payment Services, 28% Retail payment solutions, global merchant acquiring and corporate payment systems Corporate & Commercial Banking, 18% Corporate banking, commercial banking and commercial real estate Wealth Management & Investment Services, 14% Wealth management, asset management, corporate trust, fund services and custody 3Q18 YTD taxable-equivalent basis Business line revenue percentages exclude Treasury and Corporate Support, see slide 21 for calculation

Our Strategy We are creating the future now, embracing change and leveraging technology and innovation to meet our customers’ evolving expectations.

Our Approach to Technology We leverage technology to… Drive growth and returns Drive revenue Increase efficiency Minimize risk and loss … and we employ technology defensively and offensively.

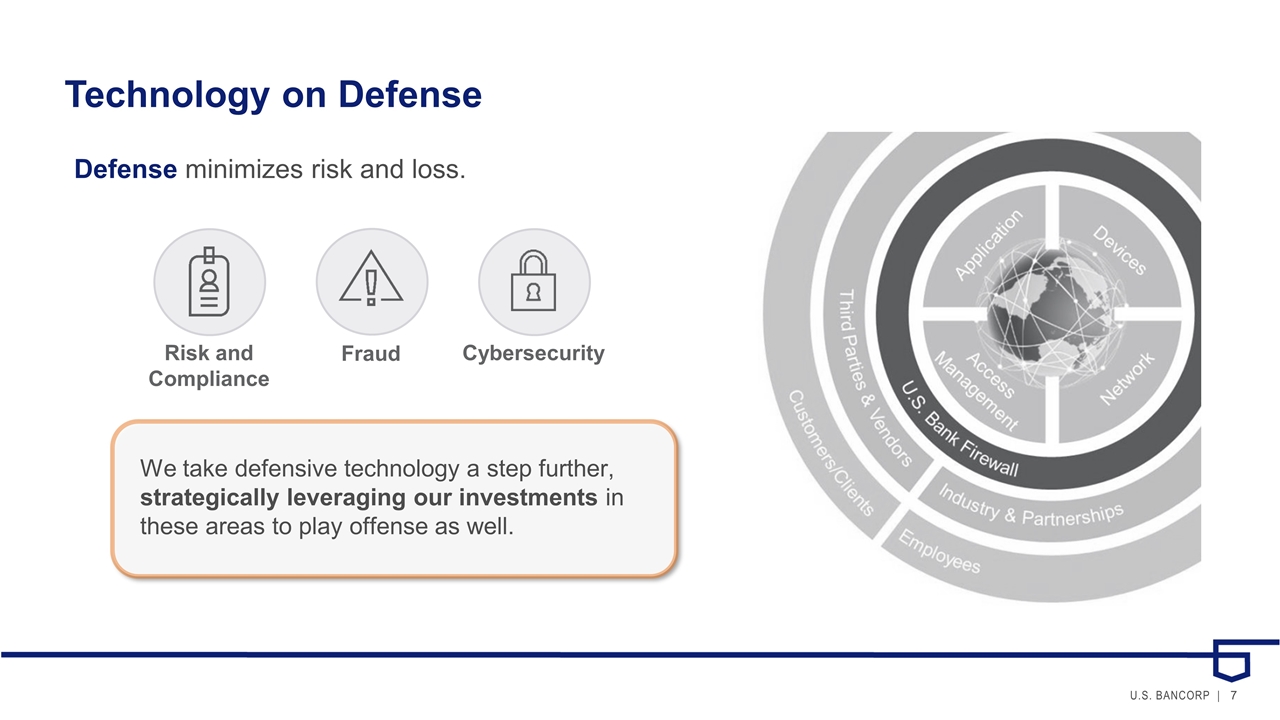

Technology on Defense Defense minimizes risk and loss. Cybersecurity Fraud Risk and Compliance We take defensive technology a step further, strategically leveraging our investments in these areas to play offense as well.

Securely Enabling USB’s Digital-first Strategy As cybersecurity and fraud intelligence converge, we continue to innovate and leverage our investments in intelligence-driven, machine-speed information security techniques. 24/7 monitoring, dedicated data science, hunting and threat intelligence 4.9 billion security events reviewed daily Threat automation actions reduced from days to milliseconds 6 petabytes of information security data Artificial intelligence and machine learning Secure cloud enablement Robotic process automation and orchestration Strong customer authentication choices Data and processing capacity

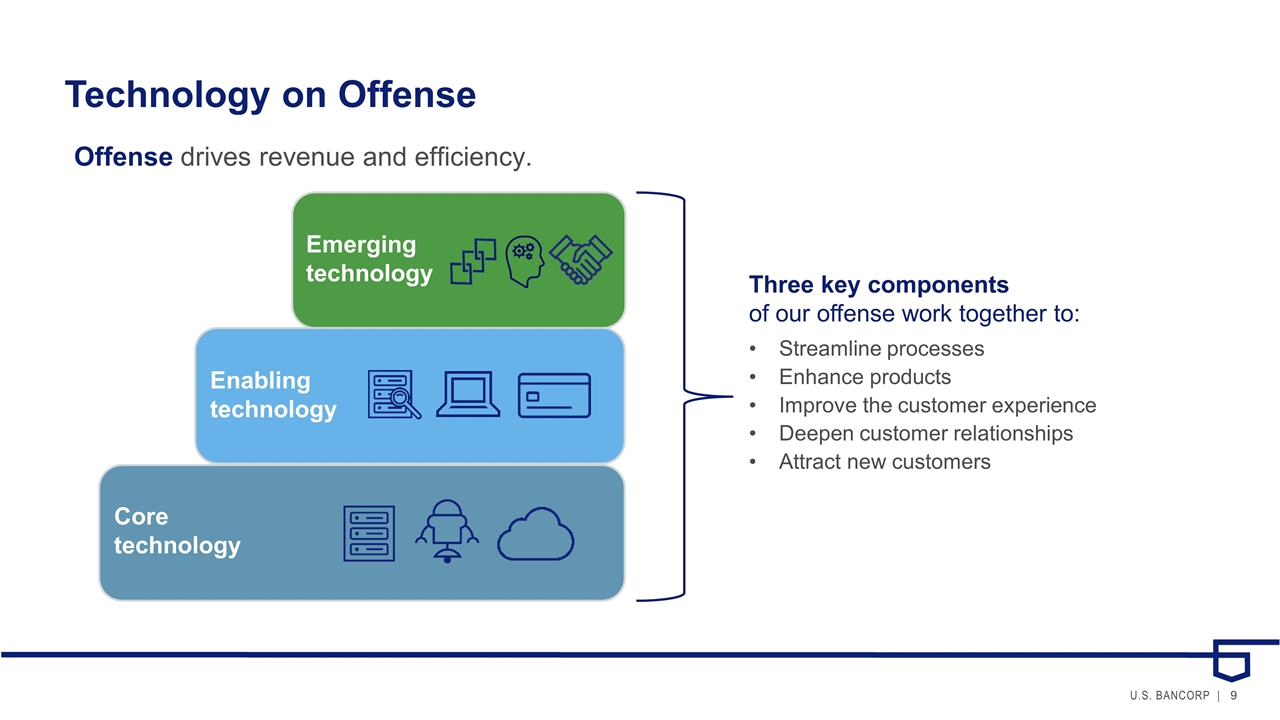

Technology on Offense Offense drives revenue and efficiency. Three key components of our offense work together to: Streamline processes Enhance products Improve the customer experience Deepen customer relationships Attract new customers Emerging technology Core technology Enabling technology Emerging technology

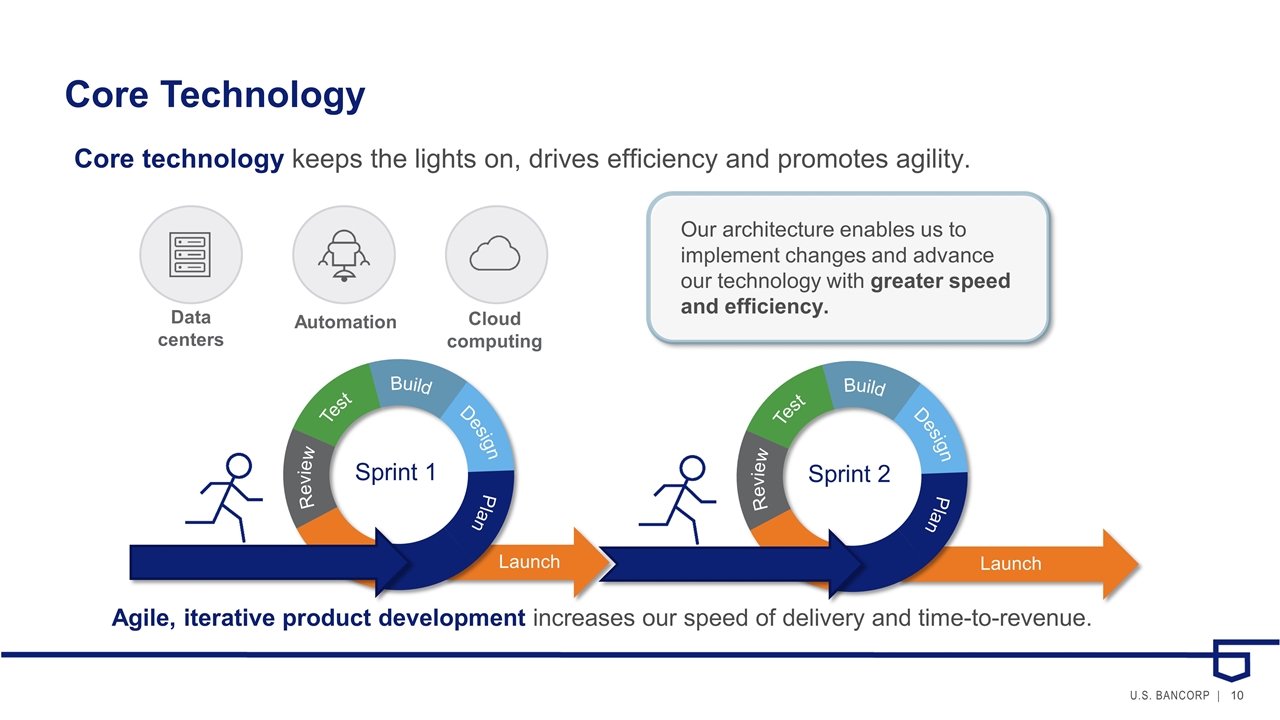

Core Technology Core technology keeps the lights on, drives efficiency and promotes agility. Our architecture enables us to implement changes and advance our technology with greater speed and efficiency. Data centers Automation Cloud computing Test Build Design Review Plan Launch Sprint 1 Test Build Design Review Plan Launch Sprint 2 Agile, iterative product development increases our speed of delivery and time-to-revenue.

Enabling Technology Enabling technology provides ready access to data with speed, control and security. Technology enables us to put data to work, delivering insights and intelligence that turn customer interactions and financial transactions into information-rich opportunities. Data analytics APIs Real-time payments Know Your Customer data is readily available in our Enterprise Landing Zone.

Emerging Technology Emerging technology allows us to seamlessly deliver the whole bank to our customers, serving them when, where and how they desire. Distributed ledger Artificial intelligence Fintech engagement We focus on bringing the most effective emerging technology to our customers, removing the human element where appropriate while maintaining a high-touch feel. We employ artificial intelligence to provide our customers with personalized insights and actionable advice.

It All Comes Together in Our Experience Studios We are adopting agile across all of our businesses to transform the customer experience and accelerate time-to-impact. Cross-functional teams work together in our Experience Studios to rapidly deliver new and enhanced products. Experience Studio Agile Transformation

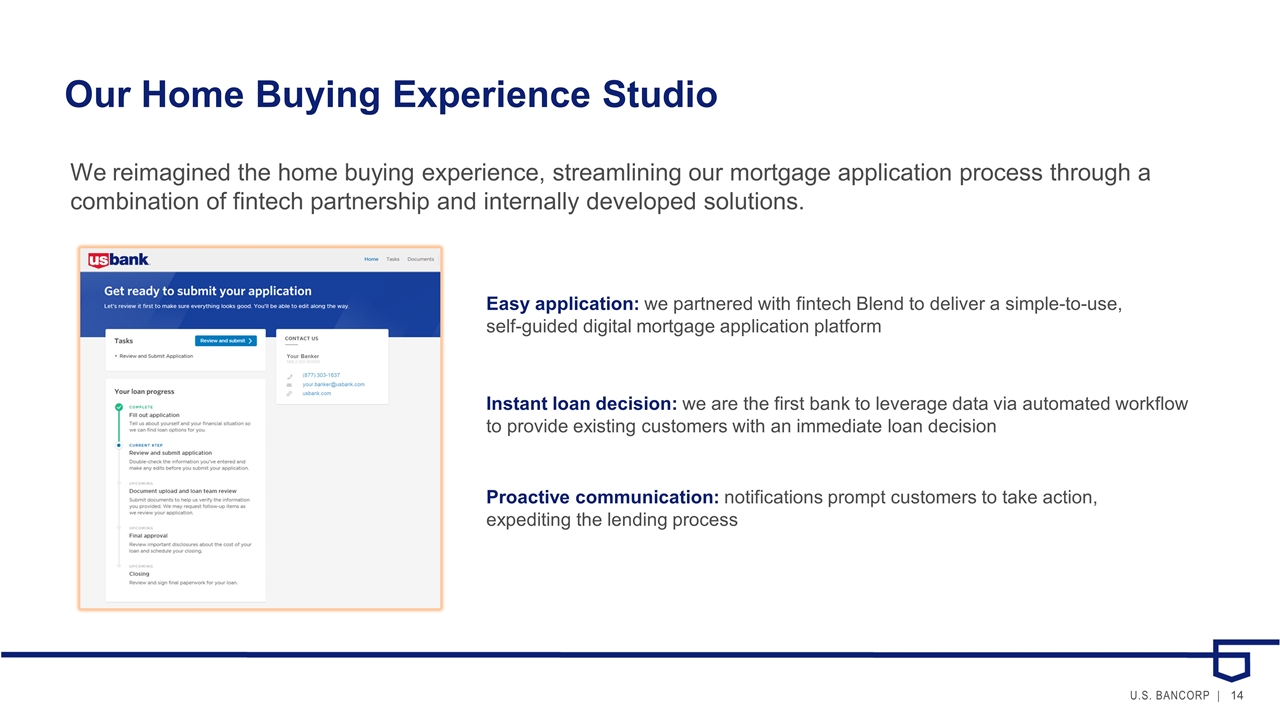

Our Home Buying Experience Studio We reimagined the home buying experience, streamlining our mortgage application process through a combination of fintech partnership and internally developed solutions. Easy application: we partnered with fintech Blend to deliver a simple-to-use, self-guided digital mortgage application platform Instant loan decision: we are the first bank to leverage data via automated workflow to provide existing customers with an immediate loan decision Proactive communication: notifications prompt customers to take action, expediting the lending process Your Banker NMLS ID# 909090 (877) 303-1637 your.banker@usbank.com usbank.com

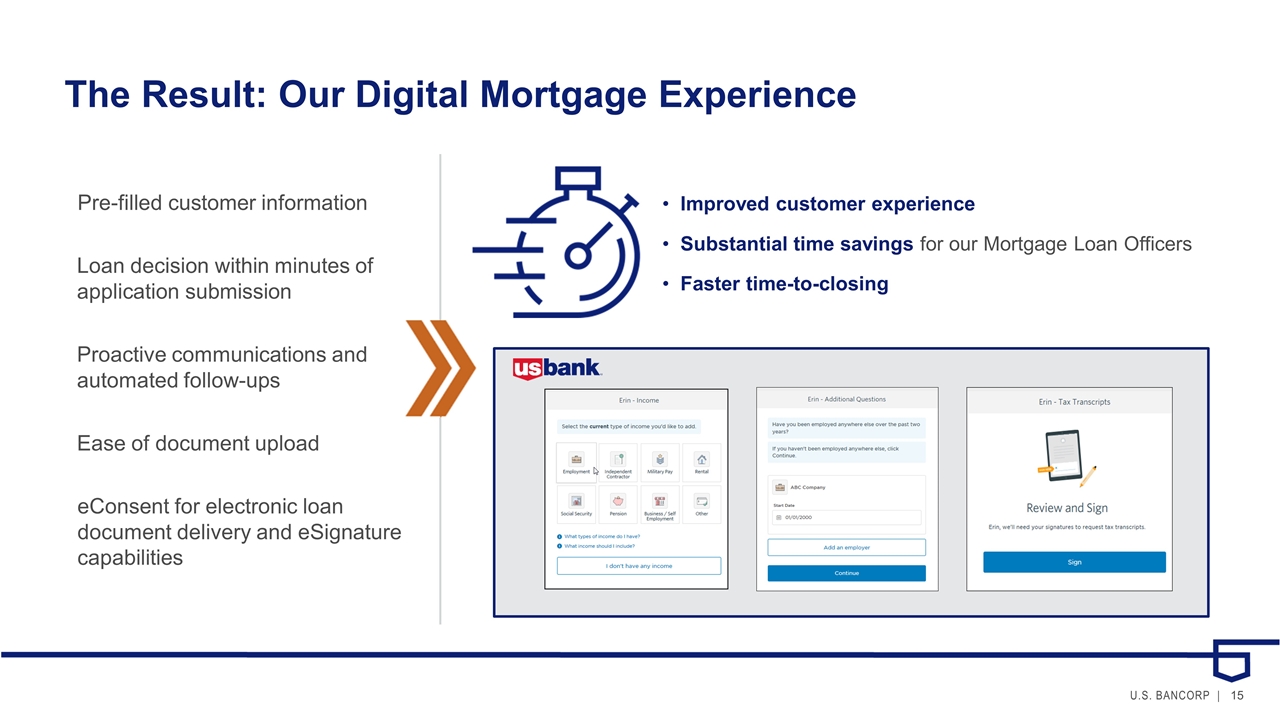

The Result: Our Digital Mortgage Experience Pre-filled customer information Loan decision within minutes of application submission Proactive communications and automated follow-ups eConsent for electronic loan document delivery and eSignature capabilities Improved customer experience Substantial time savings for our Mortgage Loan Officers Faster time-to-closing Ease of document upload

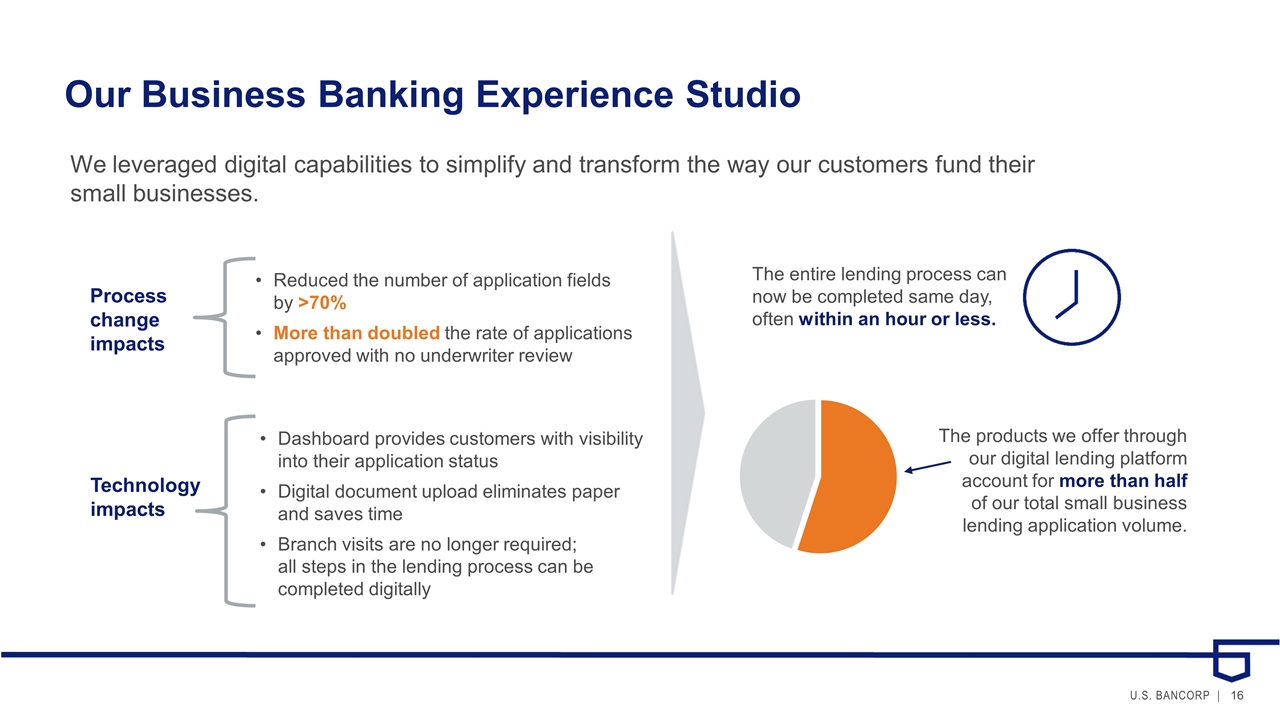

Our Business Banking Experience Studio We leveraged digital capabilities to simplify and transform the way our customers fund their small businesses. Process change impacts Technology impacts Reduced the number of application fields by >70% More than doubled the rate of applications approved with no underwriter review Dashboard provides customers with visibility into their application status Digital document upload eliminates paper and saves time Branch visits are no longer required; all steps in the lending process can be completed digitally The products we offer through our digital lending platform account for more than half of our total small business lending application volume. The entire lending process can now be completed same day, often within an hour or less.

Our Mobile App Experience Studio As mobile engagement continues to climb, a robust mobile app is a critical component of our digital-first strategy. Making opening, onboarding and accessing accounts fast and easy Offering a competitive set of features and functions Excelling at core banking tasks our customers use most Leveraging data responsibly to offer personalized insights and guidance and empower our customers make smarter decisions and optimize their financial health We are redesigning our mobile app with a focus on:

We Are Embracing the Future of Banking Customer acquisition Product development Business processes Delivery channels Customer service We are leveraging technology, innovating and modernizing our processes to optimize all aspects of our business. Increased revenue Greater efficiency Improved profitability Growth and returns

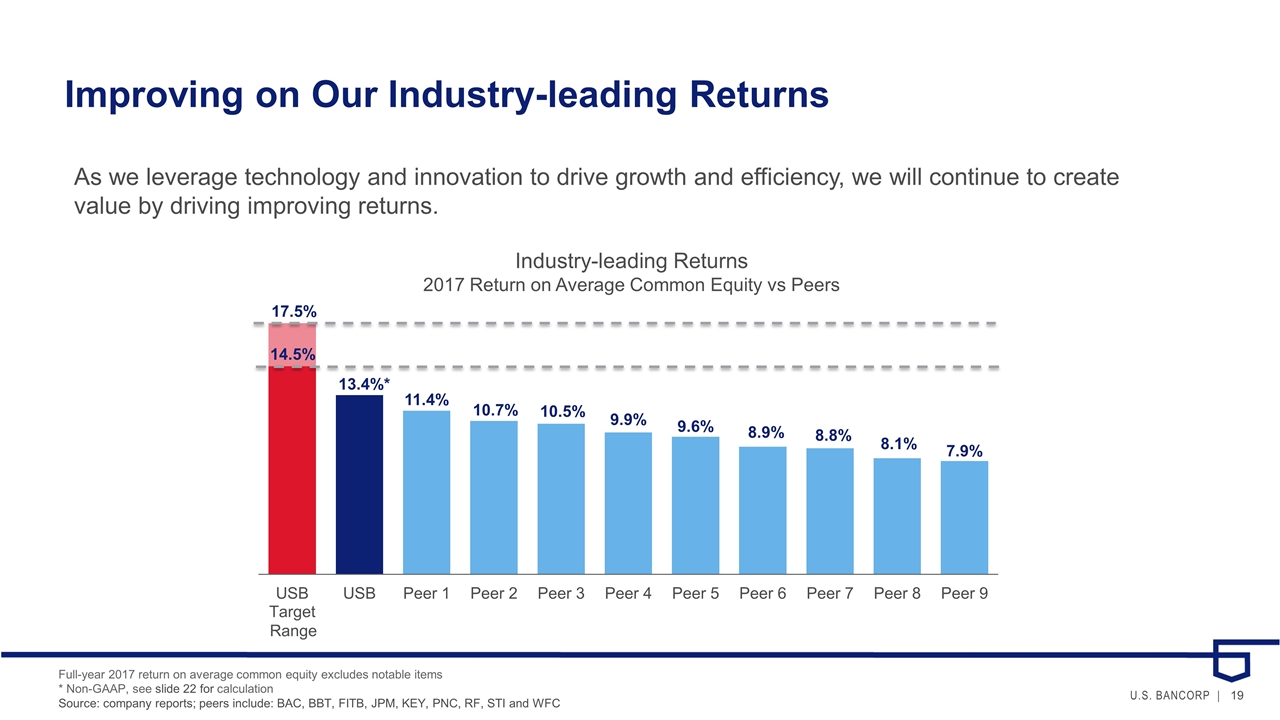

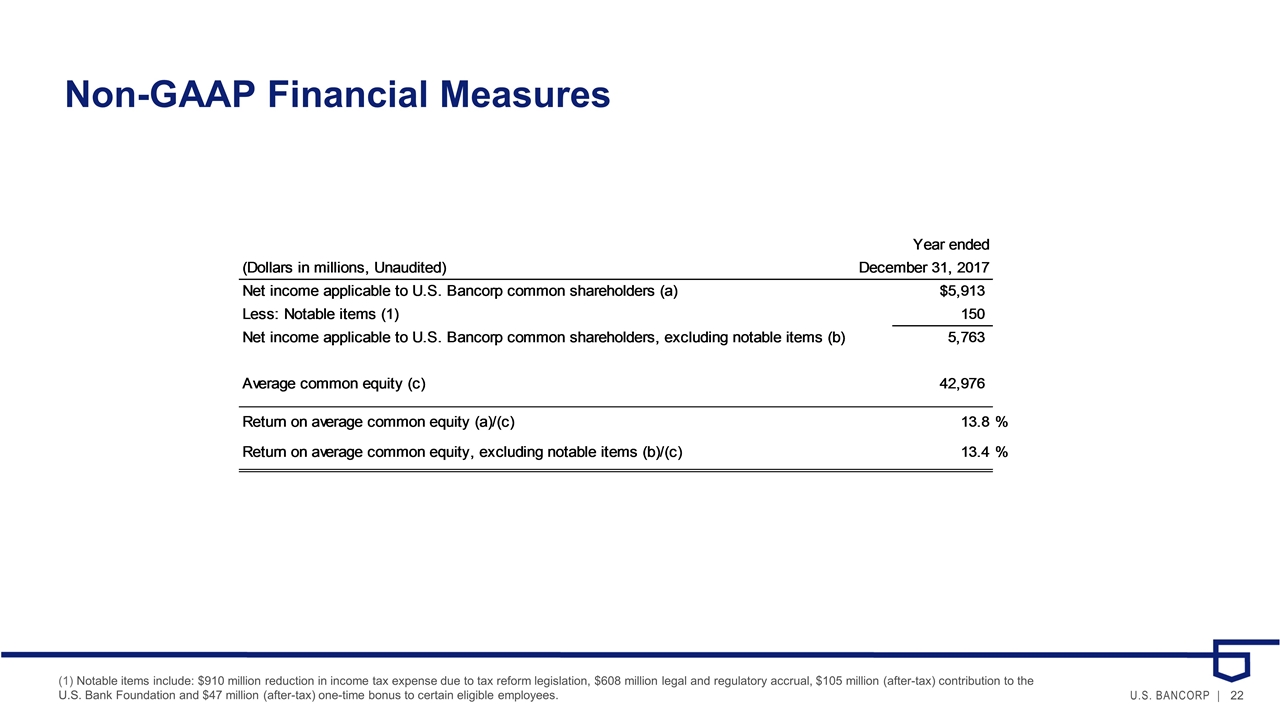

Improving on Our Industry-leading Returns As we leverage technology and innovation to drive growth and efficiency, we will continue to create value by driving improving returns. 17.5% 14.5% Industry-leading Returns 2017 Return on Average Common Equity vs Peers Full-year 2017 return on average common equity excludes notable items * Non-GAAP, see slide 22 for calculation Source: company reports; peers include: BAC, BBT, FITB, JPM, KEY, PNC, RF, STI and WFC Range

Appendix

Non-GAAP Financial Measures

Non-GAAP Financial Measures (1) Notable items include: $910 million reduction in income tax expense due to tax reform legislation, $608 million legal and regulatory accrual, $105 million (after-tax) contribution to the U.S. Bank Foundation and $47 million (after-tax) one-time bonus to certain eligible employees.