Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HERTZ GLOBAL HOLDINGS, INC | q32018pressrelease.htm |

| 8-K - 8-K - HERTZ GLOBAL HOLDINGS, INC | q32018earnings8-k.htm |

HERTZ GLOBAL HOLDINGS, INC. 3Q 2018 Earnings Call November 9, 2018 8:30 am ET

Safe Harbor Statement Certain statements made within this presentation contain forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not guarantees of performance and by their nature are subject to inherent uncertainties. Actual results may differ materially. Any forward-looking information relayed in this presentation speaks only as of November 9, 2018 and Hertz Global Holdings, Inc. (the “Company”) undertakes no obligation to update that information to reflect changed circumstances. Additional information concerning these statements is contained in the Company’s press release regarding its third quarter 2018 results issued on November 8, 2018, and the Risk Factors and Forward-Looking Statements sections of the Company’s 2017 Annual Report on Form 10-K filed on February 27, 2018 and the Company's third quarter 2018 Quarterly Report on Form 10-Q filed on November 8, 2018. Copies of these filings are available from the SEC, the Hertz website, or the Company’s Investor Relations Department. 1

Non-GAAP Measures and Key Metrics THE FOLLOWING NON-GAAP MEASURES1 AND KEY METRICS WILL BE USED IN THE PRESENTATION: Adjusted Corporate EBITDA Total RPD Adjusted Corporate EBITDA Margin Total RPU Adjusted Pre-tax Income (Loss) T&M rate Adjusted Net Income (Loss) Net Depreciation Per Unit Per Month Adjusted Diluted Earnings (Loss) Per Share Average Vehicles (Adjusted Diluted EPS) Vehicle Utilization Adjusted Free Cash Flow Transaction Days 1Definitions and reconciliations of non-GAAP measures are provided in the Company’s third quarter 2018 press release issued on November 8, 2018 and as an exhibit to the Company’s Form 8-K filed on November 9, 2018. 2

Agenda Kathryn Marinello BUSINESS President & Chief Executive Officer OVERVIEW Hertz Global Holdings, Inc. FINANCIAL RESULTS Jamere Jackson OVERVIEW Chief Financial Officer Hertz Global Holdings, Inc. 3

U.S. Operational Turnaround: Gaining Traction Executing Strategically • Managing fleet mix based on the highest rental and residual returns • Planning fleet capacity at the local level using advanced demand-forecasting tools • Driving service and operational excellence through training and process improvements • Returning excitement to our value proposition and brands • Leading through systems innovation Hertz. We’re here to get you there. 4

QUARTERLY OVERVIEW Jamere Jackson CHIEF FINANCIAL OFFICER Hertz Global Holdings, Inc.

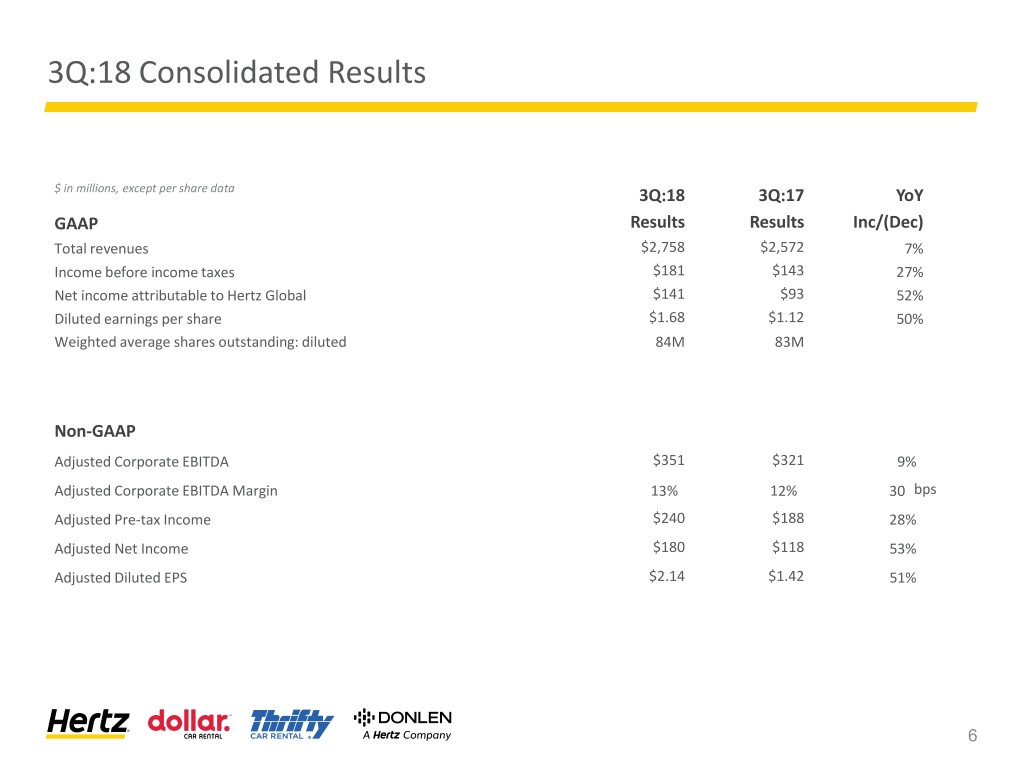

3Q:18 Consolidated Results $ in millions, except per share data 3Q:18 3Q:17 YoY GAAP Results Results Inc/(Dec) Total revenues $2,758 $2,572 7% Income before income taxes $181 $143 27% Net income attributable to Hertz Global $141 $93 52% Diluted earnings per share $1.68 $1.12 50% Weighted average shares outstanding: diluted 84M 83M Non-GAAP Adjusted Corporate EBITDA $351 $321 9% Adjusted Corporate EBITDA Margin 13% 12% 30 bps Adjusted Pre-tax Income $240 $188 28% Adjusted Net Income $180 $118 53% Adjusted Diluted EPS $2.14 $1.42 51% 6

3Q:18 U.S. RAC U.S. RAC (YoY quarterly results) Performance Overview Revenue1 Transaction Days Total RPD • Revenue +10%, +8% ex-TNC2 ◦ Days +7%, +4% ex-TNC ◦ RPD +3%, +3% ex-TNC ◦ T&M rate +5% • Growth initiatives are delivering T&M rate Total RPU ◦ Disciplined fleet management ◦ Exceptional service ◦ Differentiated brands • Balanced growth across the portfolio ◦ All brands delivering growth ◦ On-Airport, Off-Airport strong • Adjusted Corporate EBITDA $208M, +25% • Adjusted Corporate EBITDA Margin 11%, +140 bps 1Revenue as shown for U.S. RAC represents total revenue excluding ancillary retail vehicle sales revenue. 2TNC means transportation network companies that provide ride-hailing services. 7

3Q:18 U.S. RAC Fleet U.S. RAC (YoY quarterly results) Continued Focus on Optimizing Fleet Vehicle Utilization (bps) Capacity1 • Capacity increased + 7%, + 4% ex-TNC ◦ Solid market growth ◦ Supporting our growth initiatives • 81% Utilization, +30 basis points ◦ Rigorous local demand forecasting ◦ Disciplined fleet management 1Capacity equals Average Vehicles 8

3Q:18 U.S. RAC Net Depreciation Per Unit Per Month +1% (6)% (13)% (19)% (15)% Year-Over-Year Trend Continues to Improve • Solid execution and disciplined fleet acquisitions • Residual value market strength continued into the 3rd Quarter • Increased unit sales through high-return retail channel • Opportunistic fleet rotations continue to drive strong results 9

3Q:18 U.S. RAC Fleet Sales Initiative Non-Program Vehicle Disposition Channel Mix Focused on Driving More Sales Through Alternative Channels +15% 64.6K • Strong residual market 56.0K • Units sold through retail channel grew 7.5% YoY 37% • World-class sales-team and capability Retail 40% • Top ten used vehicle retailer • Upgraded website is live www.hertzcarsales.com 39% Dealer Direct 41% 24% Auction 19% 3Q:17 3Q:18 10

3Q:18 International RAC International RAC (YoY quarterly results)1 Performance Overview1 Revenue Transaction Days Total RPD • Revenue +2%, +4% ex-Brazil ◦ Brazil operations divested August 2017 ◦ Results ex-Brazil - Days +2% T&M rate Total RPU - RPD +1% ◦ Softer leisure demand in Europe ◦ APAC growth solid • Depreciation per unit per month +3% • Adjusted Corporate EBITDA $140M, (11)% • Adjusted Corporate EBITDA Margin 19%, (260) bps 1Results shown are in constant currency. Constant currency for 2018 periods are based on December 31, 2017 foreign currency exchange rates. Constant currency for 2017 periods are based on December 31, 2016 foreign currency exchange rates. 11

DEBT, LIQUIDITY AND CASH FLOW OVERVIEW Jamere Jackson CHIEF FINANCIAL OFFICER Hertz Global Holdings, Inc.

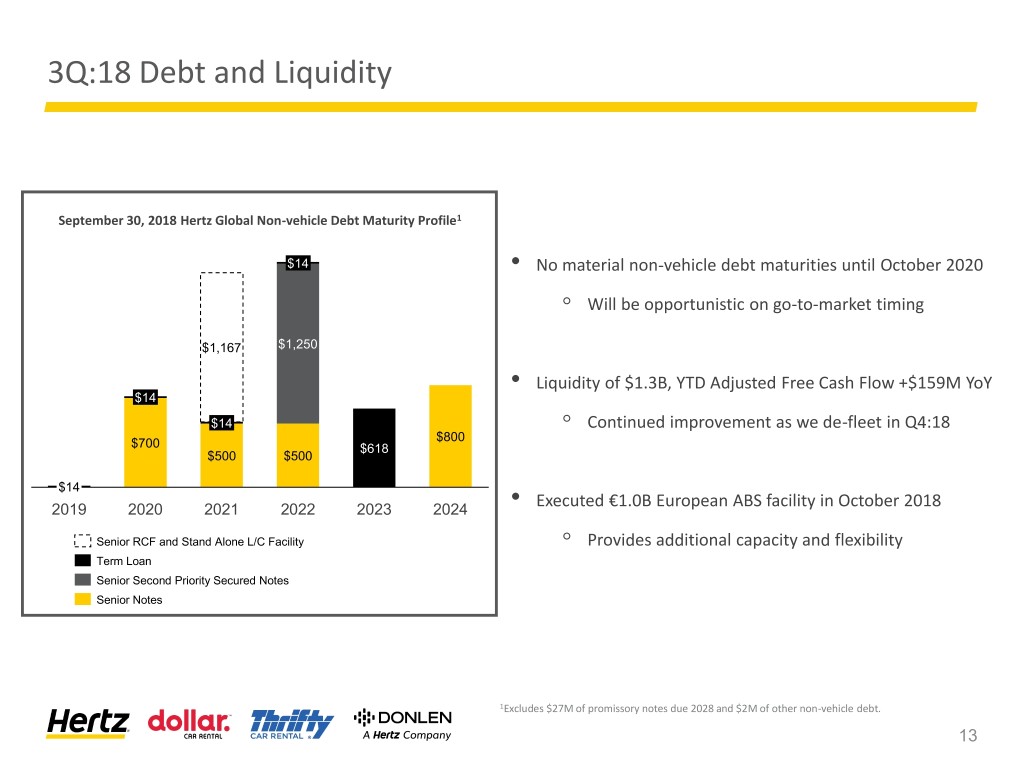

3Q:18 Debt and Liquidity September 30, 2018 Hertz Global Non-vehicle Debt Maturity Profile1 $14 • No material non-vehicle debt maturities until October 2020 ◦ Will be opportunistic on go-to-market timing $1,167 $1,250 • Liquidity of $1.3B, YTD Adjusted Free Cash Flow +$159M YoY $14 $14 ◦ Continued improvement as we de-fleet in Q4:18 $800 $700 $618 $500 $500 $14 2019 2020 2021 2022 2023 2024 • Executed €1.0B European ABS facility in October 2018 Senior RCF and Stand Alone L/C Facility ◦ Provides additional capacity and flexibility Term Loan Senior Second Priority Secured Notes Senior Notes 1Excludes $27M of promissory notes due 2028 and $2M of other non-vehicle debt. 13

Key Areas of Focus • Sustain top line momentum…growth initiatives ◦ Disciplined fleet management ◦ Service excellence ◦ Innovation ◦ Brand-building marketing • Execute technology transformation • Drive productivity Revenue Growth .... Asset Efficiency .... Productivity .... Innovation 14

Q&A