Attached files

| file | filename |

|---|---|

| EX-32.2 - Shepherd's Finance, LLC | ex32-2.htm |

| EX-32.1 - Shepherd's Finance, LLC | ex32-1.htm |

| EX-31.2 - Shepherd's Finance, LLC | ex31-2.htm |

| EX-31.1 - Shepherd's Finance, LLC | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

[X] Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Quarterly Period Ended September 30, 2018

or

[ ] Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the Transition Period From to

Commission File Number 333-203707

SHEPHERD’S FINANCE, LLC

(Exact name of registrant as specified on its charter)

| Delaware | 36-4608739 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| Incorporation or organization) | Identification No.) |

13241 Bartram Park Blvd., Suite 2401, Jacksonville, Florida 32258

(Address of principal executive offices)

(302) 752-2688

(Registrant’s telephone number including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [X] | |

| Emerging growth company | [X] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

FORM 10-Q

SHEPHERD’S FINANCE, LLC

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Form 10-Q of Shepherd’s Finance, LLC, other than historical facts, may be considered forward-looking statements within the meaning of the federal securities laws. Words such as “may,” “will,” “expect,” “anticipate,” “believe,” “estimate,” “continue,” “predict,” or other similar words identify forward-looking statements. Forward-looking statements appear in a number of places in this report, including without limitation, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and include statements regarding our intent, belief or current expectation about, among other things, trends affecting the markets in which we operate, our business, financial condition and growth strategies. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those predicted in the forward-looking statements as a result of various factors, including but not limited to those set forth in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2017, as filed with the Securities and Exchange Commission. If any of the events described in “Risk Factors” occur, they could have an adverse effect on our business, consolidated financial condition, results of operations, and cash flows.

When considering forward-looking statements, you should keep these risk factors, as well as the other cautionary statements in this report and in our 2017 Form 10-K in mind. You should not place undue reliance on any forward-looking statement. We are not obligated to update forward-looking statements.

| 3 |

PART I – FINANCIAL INFORMATION

Shepherd’s Finance, LLC

Interim Condensed Consolidated Balance Sheets

| As of | ||||||||

| (in thousands of dollars) | September

30, 2018 | December

31, 2017 | ||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 3,345 | $ | 3,478 | ||||

| Accrued interest receivable | 620 | 720 | ||||||

| Loans receivable, net | 42,541 | 30,043 | ||||||

| Foreclosed assets | 6,323 | 1,036 | ||||||

| Property, plant and equipment, net | 1,023 | 1,020 | ||||||

| Other assets | 274 | 58 | ||||||

| Total assets | $ | 54,126 | $ | 36,355 | ||||

| Liabilities, Redeemable Preferred Equity and Members’ Capital | ||||||||

| Liabilities | ||||||||

| Customer interest escrow | $ | 877 | $ | 935 | ||||

| Accounts payable and accrued expenses | 863 | 705 | ||||||

| Accrued interest payable | 1,867 | 1,353 | ||||||

| Notes payable secured, net of deferred financing costs | 20,338 | 11,644 | ||||||

| Notes payable unsecured, net of deferred financing costs | 24,847 | 16,904 | ||||||

| Due to preferred equity member | 32 | 31 | ||||||

| Total liabilities | 48,824 | 31,572 | ||||||

| Commitments and Contingencies (Notes 3 and 9) | ||||||||

| Redeemable Preferred Equity | ||||||||

| Series C preferred equity | 1,426 | 1,097 | ||||||

| Members’ Capital | ||||||||

| Series B preferred equity | 1,320 | 1,240 | ||||||

| Class A common equity | 2,556 | 2,446 | ||||||

| Members’ capital | 3,876 | 3,686 | ||||||

| Total liabilities, redeemable preferred equity and members’ capital | $ | 54,126 | $ | 36,355 | ||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

| 4 |

Shepherd’s Finance, LLC

Interim Condensed Consolidated Statements of Operations - Unaudited

For the Three and Nine Months ended September 30, 2018 and 2017

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| (in thousands of dollars) | 2018 | 2017 | 2018 | 2017 | ||||||||||||

| Interest Income | ||||||||||||||||

| Interest and fee income on loans | $ | 2,045 | $ | 1,673 | $ | 5,917 | $ | 4,203 | ||||||||

| Interest expense: | ||||||||||||||||

| Interest related to secured borrowings | 552 | 342 | 1,480 | 718 | ||||||||||||

| Interest related to unsecured borrowings | 587 | 424 | 1,550 | 1,192 | ||||||||||||

| Interest expense | 1,139 | 748 | 3,030 | 1,910 | ||||||||||||

| Net interest income | 906 | 925 | 2,887 | 2,293 | ||||||||||||

| Less: Loan loss provision | 2 | 8 | 61 | 34 | ||||||||||||

| Net interest income after loan loss provision | 904 | 917 | 2,826 | 2,259 | ||||||||||||

| Non-Interest Income | ||||||||||||||||

| Gain from sale of foreclosed assets | - | - | - | 77 | ||||||||||||

| Gain from foreclosure of assets | 20 | - | 20 | - | ||||||||||||

| Total non-interest expense/income | 20 | - | 20 | 77 | ||||||||||||

| Income | 924 | 917 | 2,846 | 2,336 | ||||||||||||

| Non-Interest Expense | ||||||||||||||||

| Selling, general and administrative | 680 | 525 | 1,988 | 1,423 | ||||||||||||

| Depreciation and amortization | 23 | 12 | 61 | 24 | ||||||||||||

| Loss from sale of foreclosed assets | 3 | - | 3 | - | ||||||||||||

| Loss from foreclosure of assets | 47 | - | 47 | - | ||||||||||||

| Impairment loss on foreclosed assets | 4 | 47 | 89 | 202 | ||||||||||||

| Total non-interest expense | 757 | 584 | 2,188 | 1,649 | ||||||||||||

| Net Income | $ | 167 | 333 | $ | 658 | $ | 687 | |||||||||

| Earned distribution to preferred equity holders | 69 | 61 | 199 | 149 | ||||||||||||

| Net income attributable to common equity holders | $ | 98 | 272 | $ | 459 | $ | 538 | |||||||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

| 5 |

Shepherd’s Finance, LLC

Interim Condensed Consolidated Statements of Changes in Members’ Capital - Unaudited

For the Nine Months Ended September 30, 2018

| (in thousands of dollars) | Nine Months Ended September

30, | |||

| Members’ capital, beginning balance | $ | 3,686 | ||

| Net income | 658 | |||

| Contributions from members (preferred) | 80 | |||

| Earned distributions to preferred equity holders | (199 | ) | ||

| Distributions to common equity holders | (349 | ) | ||

| Members’ capital, ending balance | $ | 3,876 | ||

The accompanying notes are an integral part of the interim condensed consolidated financial statements.

| 6 |

Shepherd’s Finance, LLC

Interim Condensed Consolidated Statements of Cash Flows - Unaudited

For the Nine Months Ended September 30, 2018 and 2017

Nine Months Ended September 30, | ||||||||

| (in thousands of dollars) | 2018 | 2017 | ||||||

| Cash flows from operations | ||||||||

| Net income | $ | 658 | $ | 687 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities | ||||||||

| Amortization of deferred financing costs | 142 | 165 | ||||||

| Provision for loan losses | 61 | 34 | ||||||

| Net loan origination fees deferred | 375 | 120 | ||||||

| Change in deferred origination expense | (31 | ) | (26 | ) | ||||

| Impairment of foreclosed assets | 89 | 202 | ||||||

| Depreciation and amortization | 61 | 24 | ||||||

| Gain on foreclosed assets | (20 | ) | - | |||||

| Loss on foreclosed assets | 47 | - | ||||||

| Gain from sale of foreclosed assets | - | (77 | ) | |||||

| Loss from sale of foreclosed assets | 3 | - | ||||||

| Net change in operating assets and liabilities | ||||||||

| Other assets | (216 | ) | (67 | ) | ||||

| Accrued interest receivable | (143 | ) | (155 | ) | ||||

| Customer interest escrow | (58 | ) | 39 | |||||

| Accounts payable and accrued expenses | 672 | 217 | ||||||

| Net cash provided by operating activities | 1,640 | 1,163 | ||||||

| Cash flows from investing activities | ||||||||

| Loan originations and principal collections, net | (18,072 | ) | (9,663 | ) | ||||

| Proceeds from sale of loans | 198 | - | ||||||

| Investment in foreclosed assets | (1,039 | ) | (296 | ) | ||||

| Proceeds from sale of foreclosed assets | 370 | 1,890 | ||||||

| Property plant and equipment additions | (64 | ) | (698 | ) | ||||

| Net cash used in investing activities | (18,607 | ) | (8,767 | ) | ||||

| Cash flows from financing activities | ||||||||

| Contributions from redeemable preferred equity | 1,400 | 1,004 | ||||||

| Contributions from members (preferred) | 80 | 70 | ||||||

| Distributions to redeemable preferred equity | (1,176 | ) | - | |||||

| Distributions to preferred equity holders | (93 | ) | (88 | ) | ||||

| Distributions to common equity holders | (349 | ) | (189 | ) | ||||

| Proceeds from secured note payable | 19,181 | 11,760 | ||||||

| Repayments of secured note payable | (9,905 | ) | (6,914 | ) | ||||

| Proceeds from unsecured notes payable | 12,149 | 9,412 | ||||||

| Redemptions/repayments of unsecured notes payable | (4,258 | ) | (6,481 | ) | ||||

| Deferred financing costs paid | (195 | ) | (65 | ) | ||||

| Net cash provided by financing activities | 16,834 | 8,509 | ||||||

| Net increase (decrease) in cash and cash equivalents | (133 | ) | 905 | |||||

| Cash and cash equivalents | ||||||||

| Beginning of period | 3,478 | 1,566 | ||||||

| End of period | $ | 3,345 | $ | 2,471 | ||||

| Supplemental disclosure of cash flow information | ||||||||

| Cash paid for interest | $ | 2,466 | $ | 1,616 | ||||

| Non-cash investing and financing activities | ||||||||

| Earned but not paid distribution of preferred equity holders | $ | 105 | $ | 29 | ||||

| Foreclosure of assets | $ | 4,494 | $ | - | ||||

| Accrued interest reduction due to foreclosure | $ | 243 | $ | - | ||||

| Secured line of credit reduction due to construction loan purchase | $ | 477 | - | |||||

The accompanying notes are an integral part of these interim condensed consolidated financial statements.

| 7 |

Shepherd’s Finance, LLC

Notes to Interim Condensed Consolidated Financial Statements (unaudited)

Information presented throughout these notes to the interim condensed consolidated financial statements (unaudited) is in thousands of dollars.

1. Description of Business and Basis of Presentation

Description of Business

Shepherd’s Finance, LLC and subsidiary (the “Company”) was originally formed as a Pennsylvania limited liability company on May 10, 2007. The Company is the sole member of a consolidating subsidiary, 84 REPA, LLC. The Company operates pursuant to its Second Amended and Restated Operating Agreement by and among Daniel M. Wallach and the other members of the Company effective as of March 16, 2017.

As of September 30, 2018, the Company extends commercial loans to residential homebuilders (in 16 states) to:

| ● | construct single family homes, | |

| ● | develop undeveloped land into residential building lots, and | |

| ● | purchase and improve for sale older homes. |

Basis of Presentation

The accompanying (a) interim condensed consolidated balance sheet as of December 31, 2017, which has been derived from audited consolidated financial statements, and (b) unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information, the instructions to Form 10-Q and Article 10 of Regulation S-X. While certain information and disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), management believes that the disclosures herein are adequate to make the unaudited interim condensed consolidated information presented not misleading. In the opinion of management, the unaudited interim condensed consolidated financial statements reflect all adjustments necessary for a fair presentation of the consolidated financial position, results of operations, and cash flows for the periods presented. Such adjustments are of a normal, recurring nature. The consolidated results of operations for any interim period are not necessarily indicative of results expected for the fiscal year ending December 31, 2018. These unaudited interim condensed consolidated financial statements should be read in conjunction with the 2017 consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K as of and for the year ended December 31, 2017. The accounting policies followed by the Company are set forth in Note 2 – Summary of Significant Accounting Policies in the 2017 financial statements.

Accounting Standards Adopted in the Period

Accounting Standards Update (“ASU”) 2016-01, “Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities (An Amendment of FASB ASC 825).” The Financial Accounting Standards Board (“FASB”) issued ASU 2016-01 in January 2016, and it was intended to enhance the reporting model for financial instruments to provide users of financial statements with improved decision-making information. The amendments of ASU 2016-01 include: (i) requiring equity investments, except those accounted for under the equity method of accounting or those that result in the consolidation of an investee, to be measured at fair value, with changes in fair value recognized in net income; (ii) requiring a qualitative assessment to identify impairment of equity investments without readily determinable fair values; and (iii) clarifying that an entity should evaluate the need for a valuation allowance on a deferred tax asset related to available-for-sale securities in combination with the entity’s other deferred tax assets.

| 8 |

ASU 2016-01 became effective for the Company on January 1, 2018. The adoption of ASU 2016-01 did not have a material impact on the Company’s consolidated financial statements.

ASU 2014-09, “Revenue from Contracts with Customers (Topic 606).” Issued in May 2014, ASU 2014-09 added FASB Accounting Standards Codification (“ASC”) Topic 606, “Revenue from Contracts with Customers,” and superseded revenue recognition requirements in FASB ASC Topic 605, “Revenue Recognition,” and certain cost guidance in FASB ASC Topic 605-35, “Revenue Recognition – Construction-Type and Production-Type Contracts.” ASU 2014-09 requires an entity to recognize revenue when (or as) an entity transfers control of goods or services to a customer at the amount to which the entity expects to be entitled. Depending on whether certain criteria are met, revenue should be recognized either over time, in a manner that depicts the entity’s performance, or at a point in time, when control of the goods or services is transferred to the customer. ASU 2014-09 became effective for the Company on January 1, 2018. The adoption of ASU 2014-09 did not have a material impact on the Company’s consolidated financial statements.

On January 1, 2018, the Company implemented ASU 2014-09, codified at ASC Topic 606. The Company adopted ASC Topic 606 using the modified retrospective transition method. As of December 31, 2017, the Company had no uncompleted customer contracts and, as a result, no cumulative transition adjustment was made during the first quarter of 2018. Results for reporting periods beginning January 1, 2018 are presented under ASC Topic 606, while prior period amounts continue to be reported under legacy U.S. GAAP.

The majority of the Company’s revenue is generated through interest earned on financial instruments, including loans, which falls outside the scope of ASC Topic 606. All of the Company’s revenue that is subject to ASC Topic 606 would be included in non-interest income; however, not all non-interest income is subject to ASC Topic 606. The Company had no contract liabilities or unsatisfied performance obligations with customers as of September 30, 2018.

Reclassifications

Certain prior year amounts have been reclassified for consistency with current period presentation.

2. Fair Value

The Company had no financial instruments measured at fair value on a recurring basis as of September 30, 2018 and December 31, 2017.

The following tables present the balances of non-financial instruments measured at fair value on a non-recurring basis as of September 30, 2018 and December 31, 2017.

September 30, 2018

| Carrying | Estimated | Quoted Prices in Active Markets for Identical Assets | Significant Other Observable Inputs | Significant Unobservable Inputs | ||||||||||||||||

| Amount | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||||||

| Foreclosed assets | $ | 6,323 | $ | 6,323 | $ | - | $ | - | $ | 6,323 | ||||||||||

| Impaired Loans | 1,000 | 997 | - | - | 997 | |||||||||||||||

| 9 |

December 31, 2017

| Quoted

Prices |

||||||||||||||||||||

| in

Active Markets for |

Significant Other |

Significant | ||||||||||||||||||

| Identical | Observable | Unobservable | ||||||||||||||||||

| Carrying | Estimated | Assets | Inputs | Inputs | ||||||||||||||||

| Amount | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||||||

| Foreclosed assets | $ | 1,036 | $ | 1,036 | $ | – | $ | – | $ | 1,036 | ||||||||||

The table below is a summary of fair value estimates for financial instruments and the level of the fair value hierarchy within which the fair value measurements are categorized at the periods indicated:

September 30, 2018

| Quoted Prices | ||||||||||||||||||||

| in Active | ||||||||||||||||||||

| Markets for | Significant Other |

Significant | ||||||||||||||||||

| Identical | Observable | Unobservable | ||||||||||||||||||

| Carrying | Estimated | Assets | Inputs | Inputs | ||||||||||||||||

| Amount | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||||||

| Financial Assets: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 3,345 | $ | 3,345 | $ | 3,345 | $ | – | $ | – | ||||||||||

| Loans receivable, net | 42,541 | 42,541 | – | – | 42,541 | |||||||||||||||

| Accrued interest receivable | 620 | 620 | – | – | 620 | |||||||||||||||

| Financial Liabilities: | ||||||||||||||||||||

| Customer interest escrow | 877 | 877 | – | – | 877 | |||||||||||||||

| Notes payable secured, net | 20,338 | 20,338 | – | – | 20,338 | |||||||||||||||

| Notes payable unsecured, net | 24,847 | 24,847 | – | – | 24,847 | |||||||||||||||

| Accrued interest payable | 1,867 | 1,867 | – | – | 1,867 | |||||||||||||||

December 31, 2017

| Quoted | ||||||||||||||||||||

| Prices | ||||||||||||||||||||

| in

Active Markets for |

Significant Other |

Significant | ||||||||||||||||||

| Identical | Observable | Unobservable | ||||||||||||||||||

| Carrying | Estimated | Assets | Inputs | Inputs | ||||||||||||||||

| Amount | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||||||

| Financial Assets: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 3,478 | $ | 3,478 | $ | 3,478 | $ | – | $ | – | ||||||||||

| Loans receivable, net | 30,043 | 30,043 | – | – | 30,043 | |||||||||||||||

| Accrued interest receivable | 720 | 720 | – | – | 720 | |||||||||||||||

| Financial Liabilities: | ||||||||||||||||||||

| Customer interest escrow | 935 | 935 | – | – | 935 | |||||||||||||||

| Notes payable secured | 11,644 | 11,644 | – | – | 11,644 | |||||||||||||||

| Notes payable unsecured, net | 16,904 | 16,904 | – | – | 16,904 | |||||||||||||||

| Accrued interest payable | 1,353 | 1,353 | – | – | 1,353 | |||||||||||||||

| 10 |

3. Financing Receivables

Financing receivables are comprised of the following as of September 30, 2018 and December 31, 2017:

| September

30, 2018 |

December

31, 2017 |

|||||||

| Loans receivable, gross | $ | 45,214 | $ | 32,375 | ||||

| Less: Deferred loan fees | (1,222 | ) | (847 | ) | ||||

| Less: Deposits | (1,434 | ) | (1,497 | ) | ||||

| Plus: Deferred origination expense | 141 | 109 | ||||||

| Less: Allowance for loan losses | (158 | ) | (97 | ) | ||||

| Loans receivable, net | $ | 42,541 | $ | 30,043 | ||||

Commercial Construction and Development Loans

Commercial Loans – Construction Loan Portfolio Summary

As of September 30, 2018, the Company’s portfolio consisted of 232 commercial construction and seven development loans with 68 borrowers within 16 states.

The following is a summary of the loan portfolio to builders for home construction loans as of September 30, 2018 and December 31, 2017:

| Year | Number of States |

Number of Borrowers |

Number of Loans |

Value of Collateral(1) | Commitment Amount | Gross Amount Outstanding |

Loan to Value Ratio(2) |

Loan Fee | ||||||||||||||||||||||||

| 2018 | 16 | 68 | 232 | $ | 91,989 | $ | 60,943 | $ | 40,179 | 66 | %(3) | 5 | % | |||||||||||||||||||

| 2017 | 16 | 52 | 168 | 75,931 | 47,087 | 29,564 | 62 | %(3) | 5 | % | ||||||||||||||||||||||

| (1) | The value is determined by the appraised value. |

| (2) | The loan to value ratio is calculated by taking the commitment amount and dividing by the appraised value. |

| (3) | Represents the weighted average loan to value ratio of the loans. |

Commercial Loans – Real Estate Development Loan Portfolio Summary

The following is a summary of our loan portfolio to builders for land development as of September 30, 2018 and December 31, 2017:

| Year | Number of States | Number of Borrowers | Number of |

Gross Value of Collateral(1) | Commitment Amount(3) | Gross Amount Outstanding |

Loan to Value Ratio(2) |

Loan Fee | ||||||||||||||||||||||||

| 2018 | 3 | 3 | 7 | $ | 7,046 | $ | 6,434 | $ | 5,035 | 71 | % | $ | 1,000 | |||||||||||||||||||

| 2017 | 1 | 1 | 3 | 4,997 | 4,600 | 2,811 | 56 | % | 1,000 | |||||||||||||||||||||||

| (1) | The value is determined by the appraised value adjusted for remaining costs to be paid. A portion of this collateral is $1,320 and $1,240 as of September 30, 2018 and December 31, 2017, respectively, of preferred equity in our Company. In the event of a foreclosure on the property securing these loans, the portion of our collateral that is preferred equity might be difficult to sell, which may impact our ability to recover the loan balance. In addition, a portion of the collateral value is estimated based on the selling prices anticipated for the homes. |

| (2) | The loan to value ratio is calculated by taking the outstanding amount and dividing by the appraised value calculated as described above. |

| (3) | The commitment amount does not include letters of credit and cash bonds. |

| (4) | As of December 31, 2017, our development loans consisted of borrowings which originated in December 2011 and to which we refer throughout this report as the “Pennsylvania Loans”. |

| 11 |

Credit Quality Information

The following tables present credit-related information at the “class” level in accordance with FASB ASC 310-10-50, “Disclosures about the Credit Quality of Finance Receivables and the Allowance for Credit Losses.” See our Form 10-K for the year ended December 31, 2017, as filed with the SEC, for more information.

Gross finance receivables – By risk rating:

| September

30, 2018 |

December

31, 2017 |

|||||||

| Pass | $ | 40,103 | $ | 25,656 | ||||

| Special mention | 4,111 | 6,719 | ||||||

| Classified – accruing | - | - | ||||||

| Classified – nonaccrual | 1,000 | - | ||||||

| Total | $ | 45,214 | $ | 32,375 | ||||

Gross finance receivables – Method of impairment calculation:

| September

30, 2018 |

December

31, 2017 |

|||||||

| Performing loans evaluated individually | $ | 17,193 | $ | 14,992 | ||||

| Performing loans evaluated collectively | 27,021 | 17,383 | ||||||

| Non-performing loans with a specific reserve | - | - | ||||||

| Non-performing loans without a specific reserve | 1,000 | - | ||||||

| Total | $ | 45,214 | $ | 32,375 | ||||

As September 30, 2018 and December 31, 2017, there were no loans acquired with deteriorated credit quality.

Impaired Loans

The following is a summary of our impaired nonaccrual commercial construction loans as of September 30, 2018 and December 31, 2017.

| September

30, 2018 |

December

31, 2017 |

|||||||

| Unpaid principal balance (contractual obligation from customer) | $ | 1,000 | $ | - | ||||

| Charge-offs and payments applied | - | - | ||||||

| Gross value before related allowance | 1,000 | - | ||||||

| Related allowance | (3 | ) | - | |||||

| Value after allowance | $ | 997 | $ | - | ||||

| 12 |

Concentrations

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of loans receivable. Our concentration risks for individual borrowers are summarized in the table below:

| September 30, 2018 | December 31, 2017 | |||||||||||

| Percent of | Percent of | |||||||||||

| Borrower | Loan | Borrower | Loan | |||||||||

| City | Commitments | City | Commitments | |||||||||

| Highest concentration risk | Pittsburgh, PA | 25 | % | Pittsburgh, PA | 22 | % | ||||||

| Second highest concentration risk | Orlando, FL | 10 | % | Sarasota, FL | 7 | % | ||||||

| Third highest concentration risk | Cape Coral, FL | 3 | % | Savannah, GA | 5 | % | ||||||

4. Foreclosed Assets

The following table is a roll forward of foreclosed assets:

Nine Months Ended | Year Ended | Nine Months Ended | ||||||||||

| Beginning balance | $ | 1,036 | $ | 2,798 | $ | 2,798 | ||||||

| Additions from loans | 4,737 | - | - | |||||||||

| Additions for construction/development | 1,039 | 317 | 296 | |||||||||

| Sale proceeds | (370 | ) | (1,890 | ) | (1,890 | ) | ||||||

| Gain on sale | - | 77 | 77 | |||||||||

| Loss on sale | (3 | ) | - | - | ||||||||

| Gain on foreclosure | 20 | - | - | |||||||||

| Loss on foreclosure | (47 | ) | - | - | ||||||||

| Impairment loss on foreclosed assets | (89 | ) | (266 | ) | (202 | ) | ||||||

| Ending balance | $ | 6,323 | $ | 1,036 | $ | 1,079 | ||||||

During the nine months ended September 30, 2018 we recorded four deed in lieu of foreclosures. Three of the four were with a certain borrower with a completed home and two lots. The fourth was with a borrower who defaulted on a loan by failing to make interest payments.

During the first nine of months of 2018, we reclassified $4,737 to foreclosed assets, $4,494 of principal from loans receivable, net; and $243 from accrued interest receivable. We sold one of our foreclosed assets with sales proceeds of $370 and a loss on the sale of $3.

During the quarter ended September 30, 2018, we reclassified $597 to foreclosed assets and recognized a gain on foreclosure of $20 on the two lots and a loss on foreclosure of $47 on the completed home.

| 13 |

5. Borrowings

The following table displays our borrowings and a ranking of priority:

| Priority Rank | September

30, 2018 |

December

31, 2017 |

||||||||||

| Borrowing Source | ||||||||||||

| Borrowings secured by loans | 1 | $ | 16,931 | $ | 11,644 | |||||||

| Other secured borrowings | 2 | 3,511 | - | |||||||||

| Unsecured line of credit (senior) | 3 | 500 | - | |||||||||

| Other unsecured borrowings (senior subordinated) | 4 | 1,008 | 279 | |||||||||

| Unsecured Notes through our public offering, gross | 5 | 17,975 | 14,121 | |||||||||

| Other unsecured borrowings (subordinated) | 5 | 5,008 | 2,617 | |||||||||

| Other unsecured borrowings (junior subordinated) | 6 | 590 | 173 | |||||||||

| Total | $ | 45,523 | $ | 28,834 | ||||||||

The following table shows the maturity of outstanding borrowings as of September 30, 2018:

| Year Maturing | Total Amount Maturing |

Public Offering |

Other Unsecured |

Secured Borrowings |

||||||||||||

| 2018 | $ | 18,254 | $ | 1,259 | $ | 60 | $ | 16,935 | ||||||||

| 2019 | 12,888 | 7,386 | 2,628 | 2,874 | ||||||||||||

| 2020 | 6,723 | 3,436 | 3,272 | 15 | ||||||||||||

| 2021 | 3,789 | 3,773 | - | 16 | ||||||||||||

| 2022 and thereafter | 3,869 | 2,121 | 1,146 | 602 | ||||||||||||

| Total | $ | 45,523 | $ | 17,975 | $ | 7,106 | $ | 20,442 | ||||||||

Secured Borrowings

Purchase and Sale Agreements

In March 2018, we entered into the Seventh Amendment (the “Seventh Amendment”) to our Loan Purchase and Sale Agreement (the “S.K. Funding LPSA”) with S.K. Funding, LLC (“S.K. Funding”).

The purpose of the Seventh Amendment was to allow S.K. Funding to purchase a portion of the Pennsylvania Loans for a purchase price of $649.

The timing of the Company’s principal and interest payments to S.K. Funding under the Seventh Amendment, and S.K. Funding’s obligation to fund the Pennsylvania Loans, vary depending on the total principal amount of the Pennsylvania Loans outstanding at any time, as follows:

| ● | If the total principal amount exceeds $1,000, S.K. Funding must fund the amount between $1,000 and less than or equal to $3,500. | |

| ● | If the total principal amount is less than $4,500, then the Company will also repay S.K. Funding’s principal as principal payments are received on the Pennsylvania Loans from the underlying borrowers in the amount by which the total principal amount is less than $4,500 until S.K. Funding’s principal has been repaid in full. | |

| ● | The interest rate accruing to S.K. Funding under the Seventh Amendment is 10.5% calculated on a 365/366-day basis. |

The Seventh Amendment has a term of 24 months and will automatically renew for an additional six-month term unless either party gives written notice of its intent not to renew at least nine months prior to the end of a term. S.K. Funding will have a priority position as compared to the Company in the case of a default by any of the borrowers.

| 14 |

Lines of Credit

Amendments to the Lines of Credit with Mr. Wallach and His Affiliates

During June 2018, we entered into a First Amendment to the line of credit with our Chief Executive Officer and his wife (the “Wallach LOC”) which modified the interest rate on the Wallach LOC to generally equal the prime rate plus 3%. The interest rate for the Wallach LOC was 8.0% and 4.4% as of September 30, 2018 and 2017, respectively. As of September 30, 2018, and 2017, we borrowed $0 against the Wallach LOC. Interest was $10 and $20 for the quarter and nine months ended September 30, 2018, respectively. As of September 30, 2018, $1,250 remained available on the Wallach LOC.

During June 2018, we entered into a First Amendment to the line of credit with the 2007 Daniel M. Wallach Legacy Trust, which is our CEO’s trust (the “Wallach Trust LOC”) which modified the interest rate on the Wallach Trust LOC to generally equal the prime rate plus 3%. The interest rate for this borrowing was 8.0% and 4.4% as of September 30, 2018 and 2017, respectively. As of September 30, 2018, and 2017, we borrowed $0 against the Wallach Trust LOC. As of September 30, 2018, $250 remained available on the Wallach Trust LOC.

Line of Credit (Shuman)

During July 2017, we entered into a line of credit agreement (the “Shuman LOC Agreement”) with a group of lenders (collectively, “Shuman”). Pursuant to the Shuman LOC Agreement, Shuman provides us with a revolving line of credit (the “Shuman LOC”) with the following terms:

| ● | Principal not to exceed $1,325; | |

| ● | Secured with assignments of certain notes and mortgages; | |

| ● | Cost of funds to us of 10%; and | |

| ● | Due in July 2019, unless extended by Shuman for one or more additional 12-month periods. |

The Shuman LOC was fully borrowed as of September 30, 2018. Interest expense was $33 and $100 for the quarter and nine months ended September 30, 2018, respectively.

Modification to the Line of Credit with Paul Swanson

During April 2018, we entered into a Master Loan Modification Agreement (the “Swanson Modification Agreement”) with Paul Swanson which modified the line of credit agreement between us and Mr. Swanson dated October 23, 2017. Pursuant to the Swanson Modification Agreement, Mr. Swanson provides us with a revolving line of credit (the “Swanson LOC”) with the following terms:

| ● | Principal not to exceed $7,000; | |

| ● | Secured with assignments of certain notes and mortgages; | |

| ● | Cost of funds to us of 9%; and | |

| ● | Automatic renewal in September 2018 and extended for 15 months. |

The Swanson LOC was fully borrowed as of September 30, 2018. Interest expense was $180 and $445 for the quarter and nine months ended September 30, 2018, respectively.

Line of Credit (Myrick)

During June 2018, we entered into a line of credit agreement (the “Myrick LOC Agreement”) with our Executive Vice President (“EVP”) of Sales, William Myrick. Pursuant to the Myrick LOC Agreement, Mr. Myrick provides us with a line of credit (the “Myrick LOC”) with the following terms:

| ● | Principal not to exceed $1,000; | |

| ● | Secured by a lien against all of our assets; | |

| ● | Cost of funds to us of prime rate plus 3%; and | |

| ● | Due upon demand. |

As of September 30, 2018, $1,000 remained available on the Myrick LOC. Interest expense was $14 and $17 for the quarter and nine months ended September 30, 2018, respectively.

| 15 |

London Financial

During September 2018, we entered into a Master Loan Agreement (“London Loan”) with London Financial Company, LLC (“London Financial”) with the following terms:

| ● | Principal of $3,250; | |

| ● | Secured by collateral of land and improvements by a certain foreclosed asset; | |

| ● | Cost of funds to us of 12%; and | |

| ● | Due in September 2019. |

As of September 30, 2018, $2,860 was borrowed against the London Loan with an additional $390 that remained available upon completion of additional work performed of the foreclosed asset. Interest expense was $3 for the quarter and nine months ended September 30, 2018.

Mortgage Payable

During January 2018, we entered into a commercial mortgage on our office building with the following terms:

| ● | Principal not to exceed $660; | |

| ● | Interest rate at 5.07% per annum based on a year of 360 days; and | |

| ● | Due in January 2033. |

The principal amount of the Company’s commercial mortgage was $651 as of September 30, 2018. Interest expense was $9 and $27 for the quarter and nine months ended September 30, 2018, respectively.

Summary

Borrowings secured by loan assets are summarized below:

| September 30, 2018 | December 31, 2017 | |||||||||||||||

| Due

From |

Due

From |

|||||||||||||||

| Book Value of | Shepherd’s |

Book Value of | Shepherd’s |

|||||||||||||

| Loans

which |

Finance

to Loan |

Loans

which |

Finance

to Loan |

|||||||||||||

| Served

as Collateral |

Purchaser or Lender |

Served as Collateral |

Purchaser or Lender |

|||||||||||||

| Loan Purchaser | ||||||||||||||||

| Builder Finance, Inc. | $ | 7,467 | $ | 4,510 | $ | 7,483 | $ | 4,089 | ||||||||

| S.K. Funding | 9,366 | 6,716 | 9,128 | 4,134 | ||||||||||||

| Lender | ||||||||||||||||

| Shuman | 1,575 | 1,325 | 1,747 | 1,325 | ||||||||||||

| Paul Swanson | 5,965 | 4,380 | 2,518 | 2,096 | ||||||||||||

| Total | $ | 24,373 | $ | 16,931 | $ | 20,876 | $ | 11,644 | ||||||||

| 16 |

Unsecured Borrowings

Other Unsecured Debts*

Our other unsecured debts are detailed below:

| Principal

Amount Outstanding as of |

||||||||||||||

| Loan | Maturity

Date |

Interest

Rate (1) |

September 30, 2018 | December

31, 2017 |

||||||||||

| Unsecured Note with Seven Kings Holdings, Inc. | February 2019 (2) | 9.5 | % | $ | 500 | $ | 500 | |||||||

| Unsecured Line of Credit from Builder Finance, Inc. | January 2019 | 10.0 | % | 500 | - | |||||||||

| Unsecured Line of Credit from Paul Swanson | April 2020(3) | 9.0 | % | 2,621 | 1,904 | |||||||||

| Subordinated Promissory Note | September 2019(4) | 9.5 | % | 1,125 | - | |||||||||

| Subordinated Promissory Note | December 2019 | 10.5 | % | 113 | 113 | |||||||||

| Subordinated Promissory Note | April 2020 | 10.0 | % | 100 | 100 | |||||||||

| Subordinated Promissory Note | October 2019 | 10.0 | % | 150 | - | |||||||||

| Senior Subordinated Promissory Note | March 2022(4) | 10.0 | % | 400 | - | |||||||||

| Senior Subordinated Promissory Note | March 2022(5) | 1.0 | % | 728 | - | |||||||||

| Junior Subordinated Promissory Note | March 2022(5) | 22.5 | % | 417 | - | |||||||||

| Senior Subordinated Promissory Note | October 2020(6) | 1.0 | % | 279 | 279 | |||||||||

| Junior Subordinated Promissory Note | October 2020(6) | 20.0 | % | 173 | 173 | |||||||||

| $ | 7,106 | $ | 3,069 | |||||||||||

(1) Interest rate per annum, based upon actual days outstanding and a 365/366 day year.

(2) Due six months after lender gives notice.

(3) Automatically renewed in September 2018 and extended for 15 months.

(4) Due on the earlier of six months after lender gives notice or September 2019.

(4) Lender may require us to repay $20 of principal and all unpaid interest with 10 days’ notice.

(5) These notes were issued to the same holder and, when calculated together, yield a blended return of 11% per annum.

(6) These notes were issued to the same holder and, when calculated together, yield a blended return of 10% per annum.

Unsecured Notes through the Public Offering (“Notes Program”)

The effective interest rate on the notes (“Notes”) offered pursuant to the Notes Program at September 30, 2018 and December 31, 2017 was 9.83% and 9.21%, respectively, not including the amortization of deferred financing costs. There are limited rights of early redemption. The following table shows the roll forward of the Notes Program:

| Nine

Months Ended September 30, 2018 |

Year Ended December 31, 2017 |

Nine

Months Ended September 30, 2017 |

||||||||||

| Gross Notes outstanding, beginning of period | $ | 14,121 | $ | 11,221 | $ | 11,221 | ||||||

| Notes issued | 6,357 | 8,375 | 8,299 | |||||||||

| Note repayments / redemptions | (2,503 | ) | (5,475 | ) | (5,381 | ) | ||||||

| Gross Notes outstanding, end of period | $ | 17,975 | $ | 14,121 | $ | 14,139 | ||||||

| Less deferred financing costs, net | 233 | 286 | 311 | |||||||||

| Notes outstanding, net | $ | 17,742 | $ | 13,835 | $ | 13,828 | ||||||

| 17 |

The following is a roll forward of deferred financing costs:

| Nine Months | Year | Nine Months | ||||||||||

| Ended | Ended | Ended | ||||||||||

| September

30, 2018 |

December

31, 2017 |

September

30, 2017 |

||||||||||

| Deferred financing costs, beginning balance | $ | 1,102 | $ | 1,014 | $ | 1,014 | ||||||

| Additions | 89 | 88 | 65 | |||||||||

| Deferred financing costs, ending balance | $ | 1,191 | $ | 1,102 | $ | 1,079 | ||||||

| Less accumulated amortization | (958 | ) | (816 | ) | (768 | ) | ||||||

| Deferred financing costs, net | $ | 233 | $ | 286 | $ | 311 | ||||||

The following is a roll forward of the accumulated amortization of deferred financing costs:

| Nine Months | Year | Nine Months | ||||||||||

| Ended | Ended | Ended | ||||||||||

| September

30, 2018 |

December

31, 2017 |

September

30, 2017 |

||||||||||

| Accumulated amortization, beginning balance | $ | 816 | $ | 603 | $ | 603 | ||||||

| Additions | 142 | 213 | 165 | |||||||||

| Accumulated amortization, ending balance | $ | 958 | $ | 816 | $ | 768 | ||||||

6. Redeemable Preferred Equity

The following is a roll forward of our Series C cumulative preferred equity (“Series C Preferred Units”):

Nine Months Ended September

30, |

Year Ended December

31, |

Nine Months Ended September

30, |

||||||||||

| Beginning balance | $ | 1,097 | $ | – | $ | – | ||||||

| Additions from new investment | 1,400 | 1,004 | 1,004 | |||||||||

| Redemptions | (1,176 | ) | - | - | ||||||||

| Additions from reinvestment | 105 | 93 | 61 | |||||||||

| Ending balance | $ | 1,426 | $ | 1,097 | $ | 1,065 | ||||||

On July 31, 2018, we redeemed all of our outstanding Series C Preferred Units, which were held by two investors. On August 1, 2018, we sold 12 of our Preferred Units to Daniel M. Wallach, our CEO and Chairman of our board of managers, and his wife, Joyce S. Wallach, for the total price of $1,200. In addition, on August 30, 2018, we sold two of our Series C Preferred Units to two investors, for the total price of $200,000.

The following table shows the earliest redemption options for investors in our Series C Preferred Units as of September 30, 2018:

| Year of Available Redemption | Total

Amount Redeemable | |||

| 2024 | $ | 1,426 | ||

| Total | $ | 1,426 | ||

| 18 |

7. Members’ Capital

There are currently two classes of equity units outstanding that the Company classifies as Members’ Capital: Class A common units (“Class A Common Units”) and Series B cumulative preferred units (“Series B Preferred Units”). As of September 30, 2018, the Class A Common Units are held by nine members, all of whom have no personal liability. All Class A common members have voting rights in proportion to their capital account. There were 2,629 Class A Common Units outstanding at both September 30, 2018 and December 31, 2017.

In January 2018, our Chief Financial Officer and EVP of Operations purchased 2% and 1% of our outstanding Class A Common Units, respectively, from our CEO. In March 2018, our EVP of Sales purchased 14.3% of our outstanding Class A Common Units from our CEO.

The Series B Preferred Units were issued to the Hoskins Group through a reduction in a loan issued by the Hoskins Group to the Company. In December 2015, the Hoskins Group agreed to purchase 0.1 Series B Preferred Units for $10 at each closing of a lot to a third party in the Hamlet’s and Tuscany subdivision. As of September 30, 2018, the Hoskins Group owns a total of 13.2 Series B Preferred Units, which were issued for a total of $1,320.

8. Related Party Transactions

As of September 30, 2018, each of the Company’s two independent managers own 1% of our Class A Common Units. As of September 30, 2018, our CFO, EVP of Operations, and EVP of Sales each own 2%, 2%, and 15.3% of our Class A Common Units, respectively.

As of September 30, 2018, the Company had $1,250, $250 and $1,000 available to borrow against the Wallach LOC, Wallach Trust LOC and Myrick LOC, respectively. A more detailed description is included in Note 5 above. These borrowings are in notes payable secured, net of deferred financing costs on the interim condensed consolidated balance sheet.

In February 2018, the Company issued a Subordinated Promissory Note in the principal amount of $1,125 to a trust affiliated with Seven Kings Holdings, Inc. One of our independent managers, Kenneth R. Summers, is the trustee of that trust. This borrowing is included in notes payable unsecured, net of deferred financing costs on the interim condensed consolidated balance sheet.

In March 2018, the Company issued a Senior Subordinated Promissory Note in the principal amount of $400 to family members of our CEO. This borrowing is included in the notes payable unsecured, net of deferred financing costs on the interim condensed consolidated balance sheet.

On August 1, 2018, we sold 12 of our Preferred Units to Daniel M. Wallach, our CEO and Chairman of our board of managers, and his wife, Joyce S. Wallach, for the total price of $1,200.

In September 2018, we sold three loans to our CEO at their gross loans receivable balance of $281, and as such, no gain or loss was recognized on the sale. Cash received was $104 and the remaining purchase price was funded through a $177 reduction in the principal balance of the line of credit extended by the CEO to the Company. The Company continues to service these loans. As of September 30, 2018, we had $16 in builder deposits related to these loans, and the principal balance being serviced was $281.

Also, in September 2018, we sold two loans to our EVP of Sales at their gross loans receivable balance of $394, and as such, no gain or loss was recognized on the sale. Cash received was $94 and the remaining purchase price was funded through a $300 reduction in the principal balance of the line of credit extended by the EVP of Sales to the Company. The Company continues to service these loans. As of September 30, 2018, we had $6 in builder deposits related to these loans, and the principal balance being serviced was $394.

9. Commitments and Contingencies

Unfunded commitments to extend credit, which have similar collateral, credit risk, and market risk to our outstanding loans, were $22,163 and $19,312 at September 30, 2018 and December 31, 2017, respectively.

| 19 |

10. Selected Quarterly Condensed Consolidated Financial Data (Unaudited)

Summarized unaudited quarterly condensed consolidated financial data for the three quarters of 2018 and four quarters of 2017 are as follows:

| Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Quarter 3 | Quarter 2 | Quarter 1 | ||||||||||||||||||||||

| 2018 | 2018 | 2018 | 2017 | 2017 | 2017 | 2017 | ||||||||||||||||||||||

| Net Interest Income after Loan Loss Provision | $ | 904 | $ | 996 | $ | 926 | $ | 802 | $ | 917 | $ | 725 | $ | 617 | ||||||||||||||

| Non-Interest Income | 20 | - | - | – | – | – | 77 | |||||||||||||||||||||

| SG&A expense | 680 | 691 | 617 | 643 | 537 | 456 | 454 | |||||||||||||||||||||

| Depreciation and Amortization | 23 | 21 | 17 | – | – | – | 6 | |||||||||||||||||||||

| Loss from sale of foreclosed assets | 3 | - | - | - | - | - | - | |||||||||||||||||||||

| Non-Interest Expense | 47 | - | - | - | - | - | - | |||||||||||||||||||||

| Impairment loss on foreclosed assets | 4 | 80 | 5 | 64 | 47 | 106 | 49 | |||||||||||||||||||||

| Net Income | $ | 167 | $ | 204 | $ | 287 | $ | 95 | $ | 333 | $ | 163 | $ | 191 | ||||||||||||||

11. Non-Interest expense detail

The following table displays our selling, general and administrative (“SG&A”) expenses:

| For

the Nine Months Ended September 30, |

||||||||

| 2018 | 2017 | |||||||

| Selling, general and administrative expenses | ||||||||

| Legal and accounting | $ | 277 | $ | 164 | ||||

| Salaries and related expenses | 1,306 | 976 | ||||||

| Board related expenses | 54 | 82 | ||||||

| Advertising | 58 | 42 | ||||||

| Rent and utilities | 38 | 22 | ||||||

| Loan and foreclosed asset expenses | 80 | 30 | ||||||

| Travel | 73 | 45 | ||||||

| Other | 102 | 62 | ||||||

| Total SG&A | $ | 1,988 | $ | 1,423 | ||||

12. Subsequent Events

Management of the Company has evaluated subsequent events through November 8, 2018, the date these interim condensed consolidated financial statements were issued.

On October 31, 2018, we sold four of our Series C Preferred Units to an investor for the total price of $400.

| 20 |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

(All dollar [$] amounts shown in thousands.)

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our interim condensed consolidated financial statements and the notes thereto contained elsewhere in this report. The following Management’s Discussion and Analysis of Financial Condition and Results of Operations should also be read in conjunction with our audited annual consolidated financial statements and related notes and other consolidated financial data included in the Company’s Annual Report on Form 10-K as of and for the year ended December 31, 2017. See also “Cautionary Note Regarding Forward-Looking Statements” preceding Part I.

Overview

Net income for the third quarter and first nine months of 2018 decreased by $166 and $29 when compared to the same periods of 2017, respectively. The decrease in net income was mainly due to a loss of interest income of $138 and $280 for the third quarter and first nine months of 2018; respectively, related to an increase in our foreclosed assets. In addition, our selling, general and administrative (“SG&A”) expenses increased $80 and $330 for the third quarter and first nine months of 2018, respectively.

For the nine months ended September 30, 2018, we did not receive default rate interest on non-performing loans. For the quarter and nine months ended September 30, 2017 interest income included $104 of default rate interest on certain loans.

Management made the decision to add additional employees to support the growth of the Company, which primarily includes our Chief Financial Officer, Executive Vice President of Sales, and Vice President of Administration, and resulted in an increase in our payroll expenses. As of September 30, 2018, we had a total of 20 employees compared to seven as of September 30, 2017.

We had $45,215 and $30,043 in loan assets as of September 30, 2018 and December 31, 2017, respectively. In addition, we had 232 construction loans in 16 states with 68 borrowers and seven development loans in three states with three borrowers.

Cash provided by operations increased $477 for the nine months ended September 30, 2018 as compared to the same period of 2017. Our increase in operating cash flow was due primarily to higher loan originations.

Originations increased by $6,802 or 114% to $14,572 for the quarter ended September 30, 2018 and by $18,675 or 62% to $48,772 for the nine months ended September 30, 2018 compared to the same periods of 2017.

Critical Accounting Estimates

To assist in evaluating our interim condensed consolidated financial statements, we describe below the critical accounting estimates that we use. We consider an accounting estimate to be critical if: (1) the accounting estimate requires us to make assumptions about matters that were highly uncertain at the time the accounting estimate was made, and (2) changes in the estimate that are reasonably likely to occur from period to period, or use of different estimates that we reasonably could have used, would have a material impact on our consolidated financial condition or results of operations. See our Form 10-K as of and for the year ended December 31, 2017, as filed with the SEC, for more information on our critical accounting estimates. No material changes to our critical accounting estimates have occurred since December 31, 2017 unless listed below.

Loan Losses

Fair value of collateral has the potential to impact the calculation of the loan loss provision (the amount we have expensed over time in anticipation of loan losses we have not yet realized). Specifically, relevant to the allowance for loan loss reserve is the fair value of the underlying collateral supporting the outstanding loan balances. Fair value measurements are an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants. Due to a rapidly changing economic market, an erratic housing market, the various methods that could be used to develop fair value estimates, and the various assumptions that could be used, determining the collateral’s fair value requires significant judgment.

| September 30, 2018 | ||||

| Loan Loss | ||||

| Provision | ||||

| Change in Fair Value Assumption | Higher/(Lower) | |||

| Increasing fair value of the real estate collateral by 35%* | $ | - | ||

| Decreasing fair value of the real estate collateral by 35%** | $ | (1,671 | ) | |

* Increases in the fair value of the real estate collateral do not impact the loan loss provision, as the value generally is not “written up.”

** Assumes the loans were nonperforming and a book amount of the loans outstanding of $37,770.

| 21 |

Foreclosed Assets

The fair value of real estate will impact our foreclosed asset value, which is recorded at 100% of fair value (after selling costs are deducted).

| September 30, 2018 | ||||

| Foreclosed | ||||

| Assets | ||||

| Change in Fair Value Assumption | Higher/(Lower) | |||

| Increasing fair value of the foreclosed asset by 35%* | $ | - | ||

| Decreasing fair value of the foreclosed asset by 35% | $ | (2,213 | ) | |

* Increases in the fair value of the foreclosed assets do not impact the carrying value, as the value generally is not “written up.” Those gains would be recognized at the sale of the asset.

** Assumes a book amount of the foreclosed assets of $6,323.

Consolidated Results of Operations

Key financial and operating data for the three and nine months ended September 30, 2018 and 2017 are set forth below. For a more complete understanding of our industry, the drivers of our business, and our current period results, this discussion should be read in conjunction with our interim condensed consolidated financial statements, including the related notes and the other information contained in this document.

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, | September 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Interest Income | ||||||||||||||||

| Interest and fee income on loans | $ | 2,045 | $ | 1,673 | $ | 5,917 | $ | 4,203 | ||||||||

| Interest expense: | ||||||||||||||||

| Interest related to secured borrowings | 552 | 342 | 1,480 | 718 | ||||||||||||

| Interest related to unsecured borrowings | 587 | 424 | 1,550 | 1,192 | ||||||||||||

| Interest expense | 1,139 | 748 | 3,030 | 1,910 | ||||||||||||

| Net interest income | 906 | 925 | 2,887 | 2,293 | ||||||||||||

| Less: Loan loss provision | 2 | 8 | 61 | 34 | ||||||||||||

| Net interest income after loan loss provision | 904 | 917 | 2,826 | 2,259 | ||||||||||||

| Non-Interest Income | ||||||||||||||||

| Gain from sale of foreclosed assets | - | - | - | 77 | ||||||||||||

| Gain from foreclosure of assets | 20 | - | 20 | - | ||||||||||||

| Total non-interest expense/income | 20 | - | 20 | 77 | ||||||||||||

| Income | 924 | 917 | 2,846 | 2,336 | ||||||||||||

| Non-Interest Expense | ||||||||||||||||

| Selling, general and administrative | 680 | 525 | 1,988 | 1,423 | ||||||||||||

| Depreciation and amortization | 23 | 12 | 61 | 24 | ||||||||||||

| Loss from sale of foreclosed assets | 3 | - | 3 | - | ||||||||||||

| Loss from foreclosure of assets | 47 | - | 47 | - | ||||||||||||

| Impairment loss on foreclosed assets | 4 | 47 | 89 | 202 | ||||||||||||

| Total non-interest expense | 757 | 584 | 2,188 | 1,649 | ||||||||||||

| Net Income | $ | 167 | 333 | $ | 658 | $ | 687 | |||||||||

| Earned distribution to preferred equity holders | 69 | 61 | 199 | 149 | ||||||||||||

| Net income attributable to common equity holders | $ | 98 | 272 | $ | 459 | $ | 538 | |||||||||

| 22 |

Interest Spread

The following table displays a comparison of our interest income, expense, fees, and spread:

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||||||||||||||||||

| Interest Income | * | * | * | * | ||||||||||||||||||||||||||||

| Interest income on loans | $ | 1,400 | 13 | % | $ | 1,198 | 15 | % | $ | 4,108 | 14 | % | $ | 2,829 | 14 | % | ||||||||||||||||

| Fee income on loans | 645 | 6 | % | 475 | 6 | % | 1,809 | 6 | % | 1,374 | 6 | % | ||||||||||||||||||||

| Interest and fee income on loans | 2,045 | 19 | % | 1,673 | 21 | % | 5,917 | 20 | % | 4,203 | 20 | % | ||||||||||||||||||||

| Interest expense unsecured | 540 | 5 | % | 380 | 5 | % | 1,408 | 5 | % | 1,027 | 5 | % | ||||||||||||||||||||

| Interest expense secured | 552 | 5 | % | 324 | 4 | % | 1,480 | 5 | % | 718 | 3 | % | ||||||||||||||||||||

| Amortization offering costs | 47 | - | % | 44 | - | % | 142 | - | % | 165 | 1 | % | ||||||||||||||||||||

| Interest expense | 1,139 | 10 | % | 748 | 9 | % | 3,030 | 10 | % | 1,910 | 9 | % | ||||||||||||||||||||

| Net interest income (spread) | 906 | 9 | % | 925 | 12 | % | 2,887 | 10 | % | 2,293 | 11 | % | ||||||||||||||||||||

| Weighted average outstanding loan asset balance | $ | 43,732 | $ | 31,742 | $ | 40,566 | $ | 27,161 | ||||||||||||||||||||||||

*annualized amount as percentage of weighted average outstanding gross loan balance

There are three main components that can impact our interest spread:

● Difference between the interest rate received (on our loan assets) and the interest rate paid (on our borrowings). The loans we have originated have interest rates which are based on our cost of funds, with a minimum cost of funds of 5%. For most loans, the margin is fixed at 2%; however, for our development loans the margin is fixed at 7%. Loans originated after June 30, 2018 are at an increase of 1% to approximately 3% margin. This component is also impacted by the lending of money with no interest cost (our equity).

For the quarter and nine months ended September 30, 2018, the difference between interest income and interest expense was 3% and 4%, respectively. For the quarter and nine months ended September 30, 2017, the difference between interest income and interest expense was 6% and 5%, respectively. The decrease of 3% for the quarter ended September 30, 2018 compared to 2017 was due primarily to 1) higher default rate interest charged and collected on certain of our loans in 2017 vs. 2018 (1%), 2) $104 of the associated interest income of these defaulted loans was recognized in the third quarter of 2017 instead of the second quarter of 2017, which increased the spread in the third quarter of 2017 compared to the same quarter in 2018 by 1%, and 3) an increase in foreclosed assets in the third quarter of 2018 as compared to the same quarter in 2018 (also 1%). The 1% decrease for the nine month period is due to both the increase in foreclosed assets and the lack of collected default interest on nonperforming loans.

| 23 |

We currently anticipate that the difference between our interest income and interest expense will continue to be 3% for the remainder of 2018. With the increase in our pricing which started with loans created in the third quarter, we anticipate our standard margin to be 3% on all future construction loans and 7% on all development loans which yields a blended margin of approximately 3.4%. This will be decreased currently by about 1% by having an abnormal amount of foreclosed assets while we only have seven foreclosed assets compared to 237 loans, the balance is $6,323 compared to $42,541 of loans due to one large foreclosed asset in Sarasota for $3,897) and by loans not paying interest (typically impacting the number by 0.3%) and increased (typically by 0.5%) by loans which have higher interest rates due to age and other factors and by 0.8% due to lending a portion of our equity. These factors should yield us a spread in the low 3%’s until the Sarasota property is sold, and then in the low 4%’s thereafter, assuming no other significant changes to our business. Currently we are finishing construction of the Sarasota property and anticipate listing it for sale in the fourth quarter of 2018.

● Fee income. Our construction loans have a 5% fee on the amount that we commit to lend, which is amortized over the expected life of each of those loans; however, we do not recognize a loan fee on our development loans. When loans terminate quicker than their expected life, the remaining unrecognized fee is recognized upon the termination of the loan. When loans exceed their expected life, no additional fee income is recognized. For both the quarter and nine months ended September 30, 2018 our fee income remained consistent compared to the same periods of 2017.

We currently anticipate that fee income will continue at the same 6% rate for the remainder of 2018.

● Amount of nonperforming assets. Generally, we can have three types of nonperforming assets that negatively affect interest spread: loans not paying interest, foreclosed assets, and cash. All of our loans were paying interest in the quarter ended September 30, 2018 and quarter and nine months ended September 30, 2017. One loan was not paying interest in the nine months ended September 30, 2018.

Foreclosed assets do not provide a monthly interest return. During the nine months ended September 30, 2018, we recorded $4,494 from Loan receivables, net to Foreclosed assets on the balance sheet as of September 30, 2018, which resulted in a negative impact on our interest spread.

The amount of nonperforming assets is expected to rise over the next several months, due to expected development costs related to foreclosed assets, anticipated foreclosure of assets, and idle cash increases related to anticipated large borrowing inflows. The nonperforming asset balance will drop significantly with the sale of the Sarasota property.

SG&A Expenses

The following table displays our SG&A expenses:

| Three Months | Nine Months | |||||||||||||||

| Ended September 30, | Ended September 30, | |||||||||||||||

| 2018 | 2017 | 2018 | 2017 | |||||||||||||

| Selling, general and administrative expenses | ||||||||||||||||

| Legal and accounting | $ | 54 | $ | 39 | $ | 277 | $ | 164 | ||||||||

| Salaries and related expenses | 473 | 393 | 1,306 | 976 | ||||||||||||

| Board related expenses | 17 | 27 | 54 | 82 | ||||||||||||

| Advertising | 23 | 17 | 58 | 42 | ||||||||||||

| Rent and utilities | 18 | 8 | 38 | 22 | ||||||||||||

| Loan and foreclosed asset expenses | 42 | 4 | 80 | 30 | ||||||||||||

| Travel | 22 | 13 | 73 | 45 | ||||||||||||

| Other | 31 | 24 | 102 | 62 | ||||||||||||

| Total SG&A | $ | 680 | $ | 525 | $ | 1,988 | $ | 1,423 | ||||||||

| 24 |

Our SG&A expense increased $155 and $565 for the quarter and nine months ended September 30, 2018 due significantly to the following:

| ● | Legal and accounting expenses increased due to additional work performed related to the growth of the Company; | |

| ● | Salaries and related expenses increased due to our hiring of 13 new employees, which was partially offset by a reduction in our CEO’s salary; and | |

| ● | Loan and foreclosed asset expenses increased due to an increase in additional loan title and search fees of related to higher originations and an increase in foreclosed asset expenses related to work performed to complete certain of our foreclosed assets. |

Impairment Loss on Foreclosed Assets

We owned seven foreclosed assets as of September 30, 2018, compared to four foreclosed assets as of December 31, 2017. Three of the foreclosed assets are lots under construction, two are completed homes, and two are land lots. We do not anticipate losses on the sale of foreclosed assets in the future; however, this may be subject to change based on the final selling price of the foreclosed assets.

We had three impaired loans as of September 30, 2018 and none as of December 31, 2017. During the third quarter of 2018, we reclassified $27 from interest income to accrued interest receivable on the interim condensed consolidated balance sheet related to the impaired loans.

Loan Loss Provision

Our loan loss provision decreased by $6 and increased by $27 for the quarter and nine months ended September 30, 2018, respectively, compared to the same periods of 2017. The decrease for the quarter ended September 30, 2018 was primarily due to a reduction in loan balances. The increase in the nine months ended September 30, 2018 was primarily due to increases in loan balances and qualitative reserve percentage as a result of the change in housing values.

Consolidated Financial Position

Loans Receivable

Commercial Loans – Construction Loan Portfolio Summary

We anticipate that the aggregate balance of our construction loan portfolio will increase as loans near maturity and as we have new loan originations.

The following is a summary of our loan portfolio to builders for home construction loans as of September 30, 2018.

| State | Number

of Borrowers | Number

of Loans | Value of Collateral(1) | Commitment Amount | Gross Amount Outstanding | Loan to Value Ratio(2) | Loan Fee | |||||||||||||||||||||

| Colorado | 3 | 7 | 3,878 | 2,684 | 2,096 | 69 | % | 5 | % | |||||||||||||||||||

| Florida | 18 | 73 | 24,789 | 17,463 | 10,349 | 70 | % | 5 | % | |||||||||||||||||||

| Georgia | 7 | 9 | 6,955 | 4,781 | 3,830 | 69 | % | 5 | % | |||||||||||||||||||

| Idaho | 1 | 2 | 605 | 424 | 53 | 70 | % | 5 | % | |||||||||||||||||||

| Indiana | 2 | 7 | 2,124 | 1,486 | 699 | 70 | % | 5 | % | |||||||||||||||||||

| Michigan | 4 | 28 | 6,303 | 4,205 | 2,501 | 67 | % | 5 | % | |||||||||||||||||||

| New Jersey | 5 | 16 | 5,295 | 3,645 | 2,741 | 69 | % | 5 | % | |||||||||||||||||||

| New York | 1 | 3 | 915 | 641 | 555 | 70 | % | 5 | % | |||||||||||||||||||

| North Carolina | 5 | 12 | 4,196 | 2,872 | 1,429 | 68 | % | 5 | % | |||||||||||||||||||

| North Dakota | 1 | 1 | 375 | 263 | 227 | 70 | % | 5 | % | |||||||||||||||||||

| Ohio | 1 | 2 | 1,620 | 1,000 | 902 | 62 | % | 5 | % | |||||||||||||||||||

| Pennsylvania | 3 | 32 | 23,055 | 13,184 | 9,740 | 57 | % | 5 | % | |||||||||||||||||||

| South Carolina | 12 | 29 | 8,319 | 5,823 | 3,648 | 70 | % | 5 | % | |||||||||||||||||||

| Tennessee | 1 | 2 | 750 | 525 | 310 | 70 | % | 5 | % | |||||||||||||||||||

| Utah | 1 | 1 | 485 | 319 | 107 | 66 | % | 5 | % | |||||||||||||||||||

| Virginia | 3 | 8 | 2,325 | 1,628 | 992 | 70 | % | 5 | % | |||||||||||||||||||

| Total | 68 | 232 | $ | 91,989 | $ | 60,943 | $ | 40,179 | 66 | %(3) | 5 | % | ||||||||||||||||

| (1) | The value is determined by the appraised value. |

| (2) | The loan to value ratio is calculated by taking the commitment amount and dividing by the appraised value. |

| (3) | Represents the weighted average loan to value ratio of the loans. |

| 25 |

The following is a summary of our loan portfolio to builders for home construction loans as of December 31, 2017.

| State | Number of Borrowers | Number of Loans | Value of Collateral(1) | Commitment Amount | Gross Amount Outstanding | Loan to Value Ratio(2) | Loan Fee | |||||||||||||||||||||

| Colorado | 3 | 6 | $ | 3,224 | $ | 2,196 | $ | 925 | 68 | % | 5 | % | ||||||||||||||||

| Delaware | 1 | 1 | 244 | 171 | 147 | 70 | % | 5 | % | |||||||||||||||||||

| Florida | 15 | 54 | 25,368 | 16,555 | 10,673 | 65 | % | 5 | % | |||||||||||||||||||

| Georgia | 7 | 13 | 8,932 | 5,415 | 3,535 | 61 | % | 5 | % | |||||||||||||||||||

| Indiana | 2 | 2 | 895 | 566 | 356 | 63 | % | 5 | % | |||||||||||||||||||

| Michigan | 4 | 25 | 7,570 | 4,717 | 2,611 | 62 | % | 5 | % | |||||||||||||||||||

| New Jersey | 2 | 11 | 3,635 | 2,471 | 1,227 | 68 | % | 5 | % | |||||||||||||||||||

| New York | 1 | 5 | 1,756 | 929 | 863 | 53 | % | 5 | % | |||||||||||||||||||

| North Carolina | 3 | 6 | 1,650 | 1,155 | 567 | 70 | % | 5 | % | |||||||||||||||||||

| Ohio | 1 | 1 | 711 | 498 | 316 | 70 | % | 5 | % | |||||||||||||||||||

| Oregon | 1 | 1 | 607 | 425 | 76 | 70 | % | 5 | % | |||||||||||||||||||

| Pennsylvania | 2 | 20 | 15,023 | 7,649 | 5,834 | 51 | % | 5 | % | |||||||||||||||||||

| South Carolina | 7 | 18 | 4,501 | 3,058 | 1,445 | 68 | % | 5 | % | |||||||||||||||||||

| Tennessee | 1 | 2 | 690 | 494 | 494 | 72 | % | 5 | % | |||||||||||||||||||

| Utah | 1 | 2 | 790 | 553 | 344 | 70 | % | 5 | % | |||||||||||||||||||

| Virginia | 1 | 1 | 335 | 235 | 150 | 70 | % | 5 | % | |||||||||||||||||||

| Total | 52 | (4) | 168 | $ | 75,931 | $ | 47,087 | $ | 29,564 | 62 | %(3) | 5 | % | |||||||||||||||

| (1) | The value is determined by the appraised value. |

| (2) | The loan to value ratio is calculated by taking the commitment amount and dividing by the appraised value. |

| (3) | Represents the weighted average loan to value ratio of the loans. |

| (4) | One builder in multiple states. |

| 26 |

Commercial Loans – Real Estate Development Loan Portfolio Summary

The following is a summary of our loan portfolio to builders for land development as of September 30, 2018 and December 31, 2017. A significant portion of our development loans consist of three development loans to a borrower in Pittsburgh, Pennsylvania (the “Pennsylvania Loans”). Our additional development loans are in South Carolina and Florida.

| Year | Number

of States | Number of | Number

of Loans | Value

of Collateral(1) | Commitment Amount | Gross Amount Outstanding | Loan

to Value Ratio(2) | Loan Fee | ||||||||||||||||||||||||

| 2018 | 3 | 3 | 7 | $ | 7,046 | $ | 6,434 | $ | 5,035 | 71 | % | $ | 1,000 | |||||||||||||||||||

| 2017 | 1 | 1 | 3 | 4,997 | 4,600 | (3) | 2,811 | 56 | % | 1,000 | ||||||||||||||||||||||

| (1) | The value is determined by the appraised value adjusted for remaining costs to be paid. Part of this collateral is $1,320 as of September 30, 2018 and $1,240 as of December 31, 2017 of preferred equity in our Company. In the event of a foreclosure on the property securing these loans, the portion of our collateral that is preferred equity might be difficult to sell, which may impact our ability to eliminate the loan balance. Part of the collateral value is estimated based on the selling prices anticipated for the homes. Appraised values will replace these estimates in the third quarter of 2018. |

| (2) | The loan to value ratio is calculated by taking the outstanding amount and dividing by the appraised value calculated as described above. |

| (3) | The commitment amount does not include letters of credit and cash bonds. |

Combined Loan Portfolio Summary

Financing receivables are comprised of the following as of September 30, 2018 and December 31, 2017:

| September

30, 2018 | December

31, 2017 | |||||||

| Loans receivable, gross | $ | 45,214 | $ | 32,375 | ||||

| Less: Deferred loan fees | (1,222 | ) | (847 | ) | ||||

| Less: Deposits | (1,434 | ) | (1,497 | ) | ||||

| Plus: Deferred origination expense | 141 | 109 | ||||||

| Less: Allowance for loan losses | (158 | ) | (97 | ) | ||||

| Loans receivable, net | $ | 42,541 | $ | 30,043 | ||||

The following is a roll forward of combined loans:

Nine Months Ended | Year Ended | Nine Months Ended | ||||||||||

| Beginning balance | $ | 30,043 | $ | 20,091 | $ | 20,091 | ||||||

| Additions | 30,606 | 33,451 | 24,099 | |||||||||

| Payoffs/sales | (22,260 | ) | (22,645 | ) | (13,810 | ) | ||||||

| Moved to foreclosed assets | 4,494 | - | – | |||||||||

| Change in deferred origination expense | 31 | 55 | 26 | |||||||||

| Change in builder deposit | 64 | (636 | ) | (626 | ) | |||||||

| Change in loan loss provision | (61 | ) | (44 | ) | (34 | ) | ||||||

| New loan fees | (2,194 | ) | (2,127 | ) | (1,494 | ) | ||||||

| Earned loan fees | 1,818 | 1,898 | 1,374 | |||||||||

| Ending balance | $ | 42,541 | $ | 30,043 | $ | 29,626 | ||||||

| 27 |

Finance Receivables – By risk rating:

| September

30, 2018 | December

31, 2017 | |||||||

| Pass | $ | 40,103 | $ | 25,656 | ||||

| Special mention | 4,111 | 6,719 | ||||||

| Classified - accruing | - | - | ||||||

| Classified – nonaccrual | 1,000 | - | ||||||

| Total | $ | 45,214 | $ | 32,375 | ||||

Finance Receivables – Method of impairment calculation:

| September

30, 2018 | December

31, 2017 | |||||||

| Performing loans evaluated individually | $ | 17,193 | $ | 14,992 | ||||

| Performing loans evaluated collectively | 27,021 | 17,383 | ||||||

| Non-performing loans with a non-specific reserve | - | - | ||||||

| Non-performing loans without a specific reserve | 1,000 | - | ||||||

| Total | $ | 45,214 | $ | 32,375 | ||||

At September 30, 2018 and December 31, 2017, there were no loans acquired with deteriorated credit quality.

Impaired Loans

The following is a summary of our impaired nonaccrual commercial construction loans as of September 30, 2018 and December 31, 2017. All loans listed have a related allowance for loan losses:

| September

30, 2018 | December

31, 2017 | |||||||

| Unpaid principal balance (contractual obligation from customer) | $ | 1,000 | $ | - | ||||

| Charge-offs and payments applied | - | - | ||||||

| Gross value before related allowance | 1,000 | - | ||||||

| Related allowance | 3 | - | ||||||

| Value after allowance | $ | 997 | $ | - | ||||

Below is an aging schedule of gross loans receivable as of September 30, 2018, on a recency basis:

| No.

Accts. | Unpaid Balances | % | ||||||||||

| Current loans (current accounts and accounts on which more than 50% of an original contract payment was made in the last 59 days) | 237 | 44,482 | 98 | % | ||||||||

| 60–89 days | - | - | % | |||||||||

| 90–179 days | 2 | 732 | 2 | % | ||||||||

| 180–269 days | - | - | - | % | ||||||||

| Subtotal | 239 | 45,214 | 100 | % | ||||||||

| Interest only accounts (Accounts on which interest, deferment, extension and/or default charges were received in the last 60 days) | - | - | - | % | ||||||||

| Partial Payment accounts (Accounts on which the total received in the last 60 days was less than 50% of the original contractual monthly payment. “Total received” to include interest on simple interest accounts, as well as late charges on deferment charges on pre-computed accounts.) | - | - | - | % | ||||||||

| Total | 239 | 45,214 | 100 | % | ||||||||

| 28 |

Below is an aging schedule of gross loans receivable as of September 30, 2018, on a contractual basis:

| No.

Accts. | Unpaid Balances | % | ||||||||||

| Contractual Terms - All current Direct Loans and Sales Finance Contracts with installments past due less than 60 days from due date. | 237 | 44,482 | 98 | % | ||||||||

| 60–89 days | - | - | - | % | ||||||||

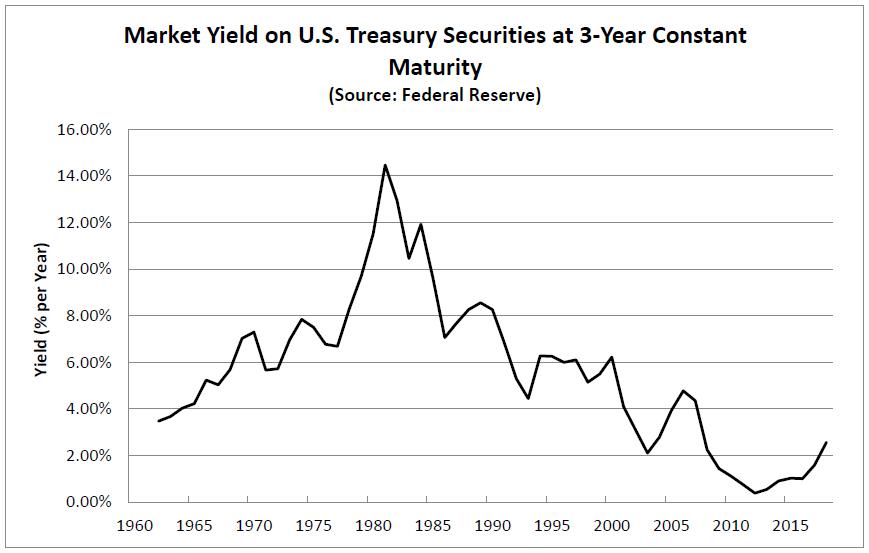

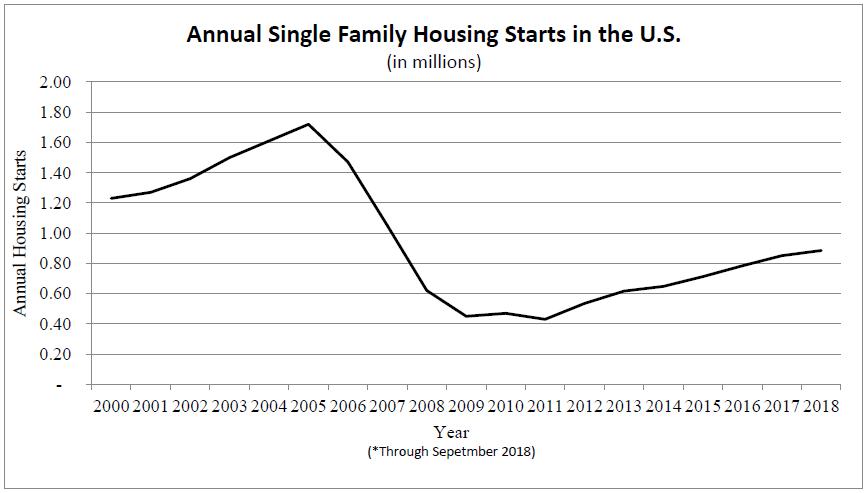

| 90–179 days | 2 | 732 | 2 | % | ||||||||