Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PINNACLE WEST CAPITAL CORP | exhibit991pressrelease93018.htm |

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | a8-kfor93018earnings.htm |

THIRD QUARTER 2018 RESULTS November 8, 2018 Third Quarter 2018

FORWARD LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,” “project” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining high reliability and customer service levels; variations in demand for electricity, including those due to weather seasonality, the general economy, customer and sales growth (or decline), and the effects of energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballot initiatives and regulation, including those relating to environmental requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investments; our ability to meet renewable energy and energy efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future economic conditions in Arizona, including in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and equity capital and the ability to access capital markets when required; environmental, economic and other concerns surrounding coal-fired generation, including regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust, pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements; generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal year ended December 31, 2017, which you should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation to update these statements, even if our internal estimates change, except as required by law. In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders. We present “gross margin” per diluted share of common stock. Gross margin refers to operating revenues less fuel and purchased power expenses. Gross margin is a “non-GAAP financial measure,” as defined in accordance with SEC rules. The appendix contains a reconciliation of this non-GAAP financial measure to the referenced revenue and expense line items on our Consolidated Statements of Income, which are the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles in the United States of America (GAAP). We view gross margin as an important performance measure of the core profitability of our operations, and is used by our management in analyzing the operations of our business. We believe that investors benefit from having access to the same financial measures that management uses. We present “adjusted interest, net of AFUDC” and “adjusted other” that have been adjusted for the deferral impacts of the Four Corner’s Selective Catalytic Reduction equipment. We also present “adjusted gross margin” and “adjusted operations and maintenance” that have been adjusted to exclude costs and offsettingoperating revenues associated with renewable energy and demand side management programs. We also present “adjusted income taxes" that shows the impact of tax reform. Adjusted interest, net of AFUDC, adjusted other, adjusted gross margin, adjusted operations and maintenance, and adjusted income taxes are “non-GAAP financial measures,” as defined in accordance with SEC rules. The appendix contains a reconciliation to show the deferral impacts of the Four Corners Selective Catalytic Reduction equipment, the exclusion of costs and offsetting operating revenues associated with renewable energy and demand side management programs, and the impact of tax reform. We believe the information provided in the reconciliation provides investors with useful indicators of our results that are comparable among periods because they exclude the effects of unusual items that may occur on an irregular basis, such as the installation of the SCR equipment and tax reform impacts, and exclude the effects of programs that overstate our gross margin. 2 Third Quarter 2018

CONSOLIDATED EPS COMPARISON 2018 VS. 2017 3rd Quarter Earnings Year-to-Date Earnings $2.80 $4.31 $2.46 $4.16 2018 2017 2018 2017 3 Third Quarter 2018

EPS VARIANCES 3RD QUARTER 2018 VS. 3RD QUARTER 2017 Pension & Adjusted OPEB Income Adjusted 3 Adjusted Non- Taxes Gross Adjusted Adjusted $2.80 Interest, service $0.48 Margin1 O&M1 Other, Other net of Credits, $2.46 $0.04 $(0.12) D&A net2 Taxes AFUDC2 net $(0.08) $0.03 $(0.04) $(0.01) $0.04 Gross Margin Weather $ 0.23 Rate Increase $ 0.20 Sales / Usage $ 0.07 Transmission $ 0.05 Seasonal Revenue $ (0.18) Shift Federal Tax $ (0.34) Reform LFCR $ 0.00 3Q 2017 Other $ 0.01 3Q 2018 1 Excludes costs and offsetting operating revenues associated with renewable energy and demand side management programs. 2 Driver adjusted for the deferral impacts of the Four Corners Selective Catalytic Reduction (SCR) equipment. 3 The effects of federal corporate tax cuts positively impacted results by $0.14 per share. See non-GAAP reconciliation in Appendix. 4 Third Quarter 2018

ECONOMIC Arizona and Metro Phoenix remain attractive places to INDICATORS live and do business Year over Year Employment Growth Maricopa County ranked #1 in U.S. for U.S. Phoenix population growth for second straight year - U.S. Census Bureau March 2018 5.0% 4.0% Arizona is a top 5 state in personal income growth 3.0% - U.S. Bureau of Economic Analysis March 2018 2.0% Above-average job growth in tourism, 1.0% health care, manufacturing, financial 0.0% services, and construction Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 APS partnered with Greater Phoenix Single Family & Multifamily Housing Permits Economic Council and Arizona Commerce Maricopa County Authority to welcome 21 new companies Single Family Multifamily Projected 40,000 to the state in 2017 30,000 2017 housing construction at highest level since 2007 20,000 Arizona #1 state in the country in 2017 10,000 for in-bound moves - North American Moving Services January 2018 0 '07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18E 5 Third Quarter 2018

EPS GUIDANCE AS OF NOVEMBER 8, 2018 Key Drivers 2018 - 2019 $4.75 – $4.95 + Four Corners Selective Catalytic Reduction (SCR) step-increase + Modest sales growth $4.35 – $4.55 + Higher transmission revenue + Lower O&M, primarily due to lower planned outage expense and cost management + Lower/flat interest expense, excluding AFUDC – Higher D&A due to plant additions – Higher Taxes Other Than Income Taxes, primarily higher property taxes 2018 Guidance 2019 Guidance – Lower AFUDC See key factors and assumptions in Appendix. 6 Third Quarter 2018

APPENDIX Third Quarter 2018

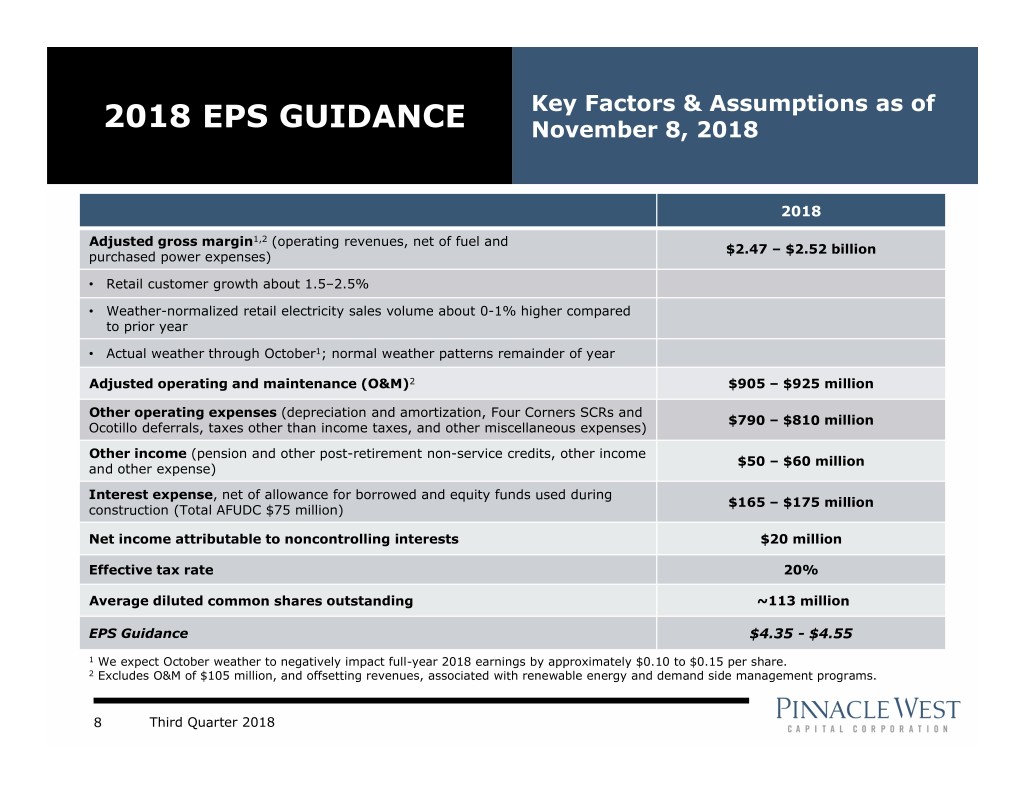

Key Factors & Assumptions as of 2018 EPS GUIDANCE November 8, 2018 2018 Adjusted gross margin1,2 (operating revenues, net of fuel and $2.47 – $2.52 billion purchased power expenses) • Retail customer growth about 1.5–2.5% • Weather-normalized retail electricity sales volume about 0-1% higher compared to prior year • Actual weather through October1; normal weather patterns remainder of year Adjusted operating and maintenance (O&M)2 $905 – $925 million Other operating expenses (depreciation and amortization, Four Corners SCRs and $790 – $810 million Ocotillo deferrals, taxes other than income taxes, and other miscellaneous expenses) Other income (pension and other post-retirement non-service credits, other income $50 – $60 million and other expense) Interest expense, net of allowance for borrowed and equity funds used during $165 – $175 million construction (Total AFUDC $75 million) Net income attributable to noncontrolling interests $20 million Effective tax rate 20% Average diluted common shares outstanding ~113 million EPS Guidance $4.35 - $4.55 1 We expect October weather to negatively impact full-year 2018 earnings by approximately $0.10 to $0.15 per share. 2 Excludes O&M of $105 million, and offsetting revenues, associated with renewable energy and demand side management programs. 8 Third Quarter 2018

Key Factors & Assumptions as of 2019 EPS GUIDANCE November 8, 2018 2019 Adjusted gross margin1 (operating revenues, net of fuel and $2.50 – $2.56 billion purchased power expenses) • Retail customer growth about 1.5–2.5% • Weather-normalized retail electricity sales volume about 0-1% higher compared to prior year • Assumes normal weather Adjusted operating and maintenance (O&M)1 $865 – $885 million Other operating expenses (depreciation and amortization, Ocotillo deferral, and $850 – $870 million taxes other than income taxes) Other income (pension and other post-retirement non-service credits, other income $35 – $45 million and other expense) Interest expense, net of allowance for borrowed and equity funds used during $195 – $205 million construction (Total AFUDC $40 million) Net income attributable to noncontrolling interests $20 million Effective tax rate 10% Average diluted common shares outstanding 113.6 million EPS Guidance $4.75 - $4.95 1 Excludes O&M of $80 million, and offsetting revenues, associated with renewable energy and demand side management programs. 9 Third Quarter 2018

Key Factors & Assumptions as of FINANCIAL OUTLOOK November 8, 2018 Gross Margin – Customer and Sales Growth (2018-2020) Assumption Impact Retail customer growth • Expected to average about 2-3% annually • Strength in Arizona and U.S. economic conditions Weather-normalized retail electricity sales • About 0.5–1.5% volume growth Gross Margin – Related to 2017 Rate Review Order Assumption Impact Lost Fixed Cost Recovery (LFCR) • Offsets 30-40% of revenues lost due to ACC-mandated energy efficiency and distributed renewable generation initiatives Environmental Improvement Surcharge • Ability to recover up to $14 million annually of carrying costs for government-mandated (EIS) environmental capital expenditures (cumulative per kWh cap rate of $0.00050) Power Supply Adjustor (PSA) • 100% recovery • Includes certain environmental chemical costs and third-party battery storage Transmission Cost Adjustor (TCA) • TCA is filed each May and automatically goes into rates effective June 1 • Transmission revenue is accrued each month as it is earned APS Solar Communities • Additions to flow through RES until next base rate case Four Corners Units 4 and 5 SCRs • 2019 step increase Property Tax Rate Deferral: APS is allowed to defer for future recovery (or credit to customers) the Arizona property tax expense above (or below) the 2015 test year caused by changes to the applicable composite property tax rate. Outlook Through 2020: Goal of earning more than 9.5% Return on Equity (earned Return on Equity based on average Total Shareholder’s Equity for PNW consolidated, weather-normalized)1 1 In 2018, we expect to infuse up to $150 million of equity capital from Pinnacle West into APS. 10 Third Quarter 2018

Tax Cuts and Jobs Act provides TAX REFORM benefits to both our customers and shareholders • TEAM PHASE I: The ACC approved $119 million annual EPS Impacts rate reduction reflecting the lower federal tax rate. • The impact of the lower federal income tax rate is Effective for the March 2018 billing cycle based on our quarterly pre-tax earnings • TEAM PHASE II: Filed in August 2018, returns an • The reduction to customers’ rates through the TEAM is additional $86.5 million in “excess” deferred taxes based on a per kWh sales credit previously collected to ACC customers, beginning January 1, 2019. Currently subject to ACC review EPS Variances APS Retail Customer Savings Q1 Q2 Q3 YTD (in millions) Gross Margin ($0.20) ($0.20) ($0.34) ($0.74) (Rate Refunds) $250 Adjusted Income $200 $0.00 $0.30 $0.48 $0.78 Taxes $150 $100 Rate Base Growth • Higher incremental rate base of $110 million in 2018 $50 and $150 million in 2019 $0 2018 2019 Cash Taxes • Minimal cash tax payments in 2018 and 2019 due to TEAM I TEAM II utilization of existing tax credit carryforwards • Cash taxes trend to normalized level in 2020 after tax • FERC FORMULA: In May 2018, APS received approval credit carryforward balance is fully utilized from FERC to provide for a $57 million annual rate reduction, beginning June 1, 2018 through its wholesale transmission rates 11 Third Quarter 2018

APS CAPITAL Capital expenditures will support our growing customer base and EXPENDITURES utilization of advanced technology ($ Millions) Other $1,341 $99 $1,211 $1,206 $1,153 Distribution $74 $139 $125 $419 Transmission $467 Clean $518 $598 $174 Generation $137 $147 Environmental1 $151 $193 $201 $167 $80 New Gas $158 2 $119 $149 Generation $235 $30 $13 $43 $168 $84 $108 $115 Traditional Generation 2017 2018 2019 2020 Projected • The chart does not include capital expenditures related to 4CA’s 7% interest in the Four Corners Power Plant Units 4 and 5 of $29 million in 2017 and $10 million in 2018. • 2018 – 2020 as disclosed in the Third Quarter 2018 Form 10-Q. 1 Includes Selective Catalytic Reduction controls at Four Corners with in-service dates of Q4 2017 (Unit 5) and Q2 2018 (Unit 4). 2 Ocotillo Modernization Project: 2 units scheduled for completion in Q4 2018, 3 units scheduled for completion in Q2 2019. 12 Third Quarter 2018

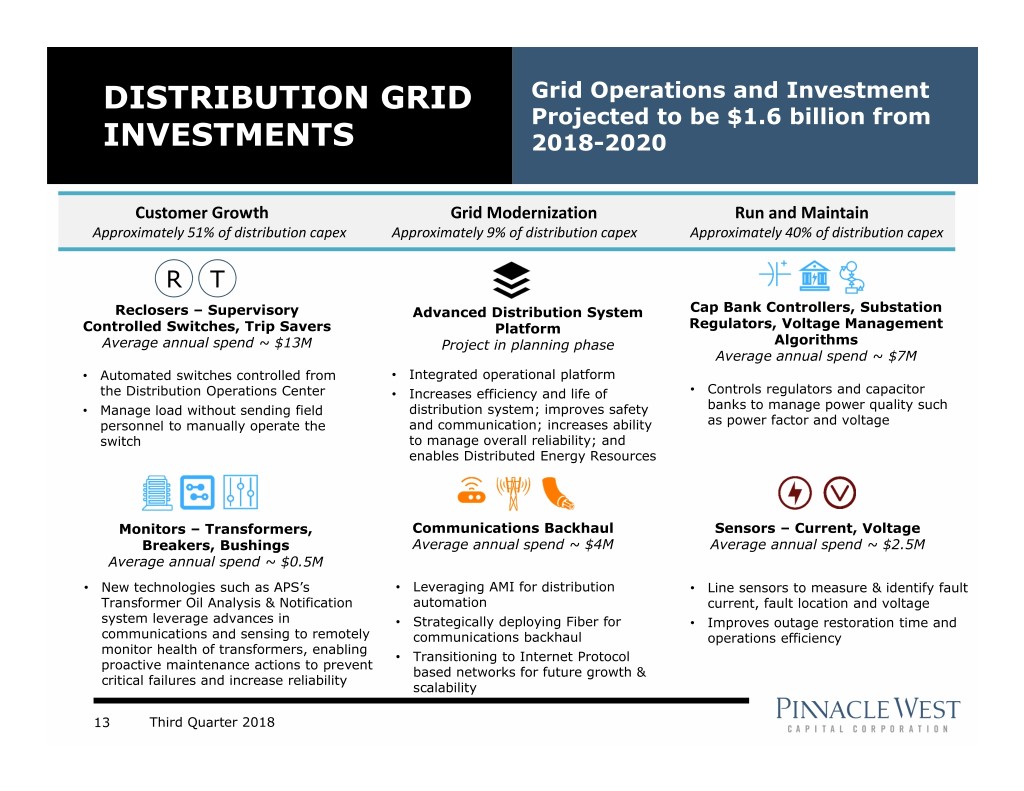

DISTRIBUTION GRID Grid Operations and Investment Projected to be $1.6 billion from INVESTMENTS 2018-2020 Customer Growth Grid Modernization Run and Maintain Approximately 51% of distribution capex Approximately 9% of distribution capex Approximately 40% of distribution capex R T Reclosers – Supervisory Advanced Distribution System Cap Bank Controllers, Substation Controlled Switches, Trip Savers Platform Regulators, Voltage Management Average annual spend ~ $13M Project in planning phase Algorithms Average annual spend ~ $7M • Automated switches controlled from • Integrated operational platform the Distribution Operations Center • Increases efficiency and life of • Controls regulators and capacitor • Manage load without sending field distribution system; improves safety banks to manage power quality such personnel to manually operate the and communication; increases ability as power factor and voltage switch to manage overall reliability; and enables Distributed Energy Resources Monitors – Transformers, Communications Backhaul Sensors – Current, Voltage Breakers, Bushings Average annual spend ~ $4M Average annual spend ~ $2.5M Average annual spend ~ $0.5M • New technologies such as APS’s • Leveraging AMI for distribution • Line sensors to measure & identify fault Transformer Oil Analysis & Notification automation current, fault location and voltage system leverage advances in • Strategically deploying Fiber for • Improves outage restoration time and communications and sensing to remotely communications backhaul operations efficiency monitor health of transformers, enabling • Transitioning to Internet Protocol proactive maintenance actions to prevent based networks for future growth & critical failures and increase reliability scalability 13 Third Quarter 2018

Pinnacle West’s indicated annual dividend is $2.95 per share; DIVIDEND GROWTH targeting ~6% annual dividend growth Dividend Growth Goal Indicated Annual Dividend Rate at Year-End $2.95 $2.78 $2.62 $2.50 $2.38 $2.27 $2.18 $2.10 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Targeted Future dividends subject to declaration at Board of Directors’ discretion. 14 Third Quarter 2018

APS’s revenues come from a RATE BASE regulated retail rate base and meaningful transmission business APS Rate Base Growth Total Approved Rate Base Year-End ACC FERC Generation & Distribution Transmission Rate Base Guidance: 6-7% Average Annual Growth Rate 17% $1.8 83% $1.5 $1.4 ACC FERC Rate Effective Date 8/19/2017 6/1/2018 $9.1 Test Year Ended 12/31/20151 12/31/20171 $6.8 $7.1 Rate Base $6.8B $1.6B Equity Layer 55.8% 53.4% Allowed ROE 10.0% 10.75% 2016 2017 2018 2019 2020 Projected 1 Adjusted to include post test-year plant in rates Rate base $ in billions, rounded 15 Third Quarter 2018

OPERATIONS & Goal is to keep O&M per kWh flat, MAINTENANCE adjusted for planned outages ($ Millions) $905 - $925 $858 $865 - $885 $848 75 - 85 50 - 60 72 63 830 - 840 776 795 815 - 825 20161 20171 2018E1 2019E PNW Consolidated ex RES/DSM2 Planned Fleet Outages 1 Reclassified to reflect the adoption of the new accounting requirements for presenting pension and other postretirement non-service costs (“Pension & OPEB Presentation”). Increases in O&M due to the Pension & OPEB Presentation change are approximately $20 million in 2016, $25 million in 2017 and $35 million in 2018, which are offset in pension and other postretirement non-service credits on the income statement. See Notes 5 and 13 in the Third Quarter 2018 Form 10-Q for additional information. 2 Excludes RES/DSM of $83 million in 2016, $91 million in 2017, $105 million in 2018E, and $80 million in 2019E. 16 Third Quarter 2018

2019 PLANNED OUTAGE Coal, Nuclear and Large Gas and SCHEDULE Oil Planned Outages Q1 Q2 Q4 Estimated Estimated Estimated Plant Unit Duration Plant Unit Duration in Plant Unit Duration in Days Days in Days Four 4 12 Palo Verde 1 30 Palo Verde 344 Corners Four West 5 12 Cholla* 1 16 462 Corners Phoenix Cholla* 1 30 Redhawk* 2 28 Redhawk* 2 29 *Outage duration spans Q1-Q2. Number of days noted per quarter. 17 Third Quarter 2018

BALANCE SHEET STRENGTH Credit Ratings2 Long-Term Debt Maturity Schedule • APS Senior Unsecured: A- or equivalent ratings ($Millions) or better at S&P, Moody’s and Fitch $600 • PNW Senior Unsecured: BBB+ or equivalent ratings or better at S&P, Moody’s and Fitch $500 2018 Major Financing Activities • $300 million 30-year 4.20% APS senior unsecured $400 $300 notes issued August 2018 • Expect to issue up to $150 million of registered or $300 $600 bank market debt at PNW • No additional long-term debt expected at APS $200 • 2019 Major Financing Activities $250 $100 • Currently expect up to $950 million of term debt issuance at APS $82 $- 20181 2019 2020 2 We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on APS PNW our costs of funds. 1 Maturities paid off in the second quarter of 2018. 18 Third Quarter 2018

CREDIT RATINGS AND METRICS Pinnacle APS 2015 2016 2017 West Corporate Credit Ratings1 APS Moody’s A2 A3 FFO / Debt 29.7% 26.5% 26.9% S&P A- A- FFO / Interest 5.8x 5.0x 5.2x Debt / Fitch A- A- 45.8% 47.7% 47.3% Capitalization Senior Unsecured1 Pinnacle West Moody’s A2 A3 FFO / Debt 28.9% 25.1% 24.7% S&P A- BBB+ FFO / Interest 5.6x 4.9x 4.8x Debt / Fitch A A- 47.0% 49.0% 50.3% Capitalization Note: Moody’s, Fitch and S&P rate the outlooks for APS and Pinnacle West as Stable. Source: Standard & Poor’s 1We are disclosing credit ratings to enhance understanding of our sources of liquidity and the effects of our ratings on our costs of funds. 19 Third Quarter 2018

OCOTILLO MODERNIZATION PROJECT AND FOUR CORNERS SCRs • Included in the 2017 Rate Review Order1, APS has been granted Accounting Deferral Orders for two large generation-related capital investments – Ocotillo Modernization Project: Retiring two aging, steam-based, natural gas units, and replacing with 5 new, fast-ramping, combustion turbine units – Four Corners Power Plant: Installed Selective Catalytic Reduction (SCR) equipment to comply with Federal environmental standards Ocotillo Modernization Project Four Corners SCRs Units 6, 7 – Fall 2018 Unit 5 – Late 2017 In-Service Dates Units 3, 4 and 5 – Spring 2019 Unit 4 – Spring 2018 Total Cost (APS) $500 million $400 million Estimated Cost Deferral $45 million (through 2019) $30 million (through 2018) • Cost deferral from date of commercial • Cost deferral from time of installation operation to the effective date of rates to incorporation of the SCR costs in in next rate case rates using a step increase beginning Accounting Deferral • Includes depreciation, O&M, property in 2019 taxes, and capital carrying charge2 • Includes depreciation, O&M, property taxes, and capital carrying charge2 1 The ACC’s decision is subject to appeals. 2 APS will calculate the capital carrying charge using the 5.13% embedded cost of debt established in the 2017 Rate Review Order. 20 Third Quarter 2018

FOUR CORNERS SCR Hearing concluded on September STEP INCREASE 7, 2018 Key Components of APS’s Filed Request Financial Cost of Capital Bill Impact • Consistent with prior • 7.85% Return on Rate • Rate rider applied as a disclosed estimates Base1 percentage of base rates – Weighted Average Cost for all applicable customers of Capital (WACC) • $390 million direct costs • 5.13% Return on Deferral1 • $67.5 million revenue vs. $400 million1 – Embedded Cost of Debt requirement2 contemplated in APS’s recent rate case • $40 million in indirect • 5% Depreciation Rate • ~2% bill impact costs (overhead, AFUDC) – 20-year useful life (2038-depreciation study) • 5-year Deferral Amortization 1 Based on 2017 Rate Review Order 2 Arizona Corporation Commission Staff recommended a $58.5 million revenue increase. 21 Third Quarter 2018

GROSS MARGIN EFFECTS OF WEATHER VARIANCES VS. NORMAL Pretax Millions $15 $10 21 $5 10 9 3 $0 - $(5) $(10) (13) (25) $(15) $(20) Q1 Q2 Q3 Q4 Q1 Q2 Q3 2017 2018 $(1) Million $6 Million All periods recalculated to current 10-year rolling average (2006 – 2015) 22 Third Quarter 2018

RENEWABLE ENERGY AND DEMAND SIDE MANAGEMENT EXPENSES1 Pretax Millions Renewable Energy Demand Side Management $40 $30 10 10 12 $20 16 14 12 $10 21 15 19 17 12 12 5 $0 2 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2017 2018 $91 Million $86 Million 1 Renewable energy and demand side management expenses are offset by adjustment mechanisms. 23 Third Quarter 2018

Residential DG (MWdc) Annual Additions 150 133 97 RESIDENTIAL PV 74 57 44 51 1 22 APPLICATIONS 10 18 2009 2012 2014 2016 2018 YTD 4,000 3718 3432 3,500 3,000 2464 2,500 2143 2330 1944 2,000 1818 1561 2033 1602 1426 1413 1442 1434 1,500 1267 1291 1366 1283 1364 1442 1153 1001 1230 953 1157 1349 1,000 808 1158 1189 1168 789 954 1057 1141 1002 1077 759 832 500 680 715 629 614 538 484 321 0 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2015 Applications 2016 Applications 2017 Applications 2018 Applications 1 Monthly data equals applications received minus cancelled applications. As of September 30, 2018, approximately 83,100 residential grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling approximately 661 MWdc of installed capacity. Excludes APS Solar Partner Program residential PV systems. Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found on the site, but are not included in the chart above. 24 Third Quarter 2018

2018 KEY DATES ACC Key Dates / Docket # Q1 Q2 Q3 Q4 Lost Fixed Cost Recovery Filed Feb 15 E-01345A-11-0224 Transmission Cost Adjustor Filed May 15 E-01345A-11-0224 Implemented Jun 1 2019 DSM/EE Implementation Plan Dec: File 2019 Plan E-01345A-18-0105 Jun 12: 2018 RES Plan 2019 RES Implementation Plan approved E-01345A-18-0226 June 29: Filed 2019 Plan Apr 27: Filed Four Oct 1: Year Two RCP APS Rate Review/ Feb: Customer Corners SCR Request Sep 7: Four Corners SCR Export Rate Four Corners SCR Step Increase Transition began May 1: Filed Year Two Hearing concluded Implemented E-01345A-16-0036 RCP Export Rate ACC declined to Resource Planning and Procurement acknowledge Arizona E-00000V-15-0094 utility’s IRPs Modification of the Federal Tax Reform Aug: Second filing under Implemented March 1 Rate Adjustment AU-00000A-17-0379 TEAM Possible Modification to Commission Energy Rules Aug: New Docket Opened RU-00000A-18-0284 Oct 1: Hearing Customer Complaint – Stacey Champion Concluded E-01345A-18-0002 Nov 16: Final Briefs Due Other Key Dates Q1 Q2 Q3 Q4 Arizona State Legislature In session Jan 8 – May 4 Elections Aug 28: Primary Nov 6: General 25 Third Quarter 2018

NON-GAAP MEASURE RECONCILIATION Three Months Ended September 30, Tax Benefit Four of Lower RES/ Corners Pre-Tax 2018 RES/ 2017 EPS 1 2 1,3 $ millions pretax, except per share amounts 2018 DSM Deferral Income Adjusted 2017 DSM Adjusted Impact Operating revenues$ 1,268 $ (27) $ - $ - $ 1,241 $ 1,183 $ (28) $ 1,155 Fuel and purchased power expenses (390) - - - (390) (310) - (310) Gross margin 878 (27) - - 851 873 (28) 845 $ 0.04 Operations and maintenance 247 (26) - - 221 231 (28) 203 $ (0.12) Allowance for equity funds used during construction (12) - - - (12) (13) - (13) Interest charges 62 - (5) - 57 56 - 56 Allowance for borrowed funds used during construction (6) - - - (6) (6) - (6) Interest expense, net of AFUDC 44 - (5) - 39 37 - 37 $ (0.01) Other expenses (operating) 1 - - - 1 3 - 3 Other income (7) - 5 - (2) (1) - (1) Other expense 5 - - - 5 5 - 5 Renewable energy and demand side management and similar regulatory programs, net - (1) - - (1) - - - Other (1) (1) 5 - 3 7 - 7 $ 0.03 Income taxes 84 - - 6 90 144 - 144 $ 0.48 1 Line items from Consolidated Statements of Income. 2 See Note 4, Regulatory Matters, in Form 10-Q for the period ended September 30, 2018, for total Four Corners deferral impacts. 3 No impact to 2017 Consolidated Statements of Income related to Four Corners deferral. 26 Third Quarter 2018 Numbers may not foot due to rounding.

NON-GAAP MEASURE RECONCILIATION 2018 GUIDANCE 2018 Guidance $ millions pretax Operating revenues1 $ 3,665 -$ 3,725 Fuel and purchased power expenses1 (1,090) - (1,100) Gross margin 2,575 - 2,625 Adjustments: Renewable energy and demand side management programs (105) - (105) Adjusted gross margin$ 2,470 -$ 2,520 Operations and maintenance1 $ 1,010 -$ 1,030 Adjustments: Renewable energy and demand side management programs (105) - (105) Adjusted operations and maintenance$ 905 -$ 925 1 Line items from Consolidated Statements of Income. 27 Third Quarter 2018

NON-GAAP MEASURE RECONCILIATION 2019 GUIDANCE 2019 Guidance $ millions pretax Operating revenues1 $ 3,625 -$ 3,695 Fuel and purchased power expenses1 (1,045) - (1,055) Gross margin 2,580 - 2,640 Adjustments: Renewable energy and demand side management programs (80) - (80) Adjusted gross margin$ 2,500 -$ 2,560 Operations and maintenance1 $ 945 -$ 965 Adjustments: Renewable energy and demand side management programs (80) - (80) Adjusted operations and maintenance$ 865 -$ 885 1 Line items from Consolidated Statements of Income. 28 Third Quarter 2018

CONSOLIDATED STATISTICS 3 Months Ended September 30, 9 Months Ended September 30, 2018 2017 Incr (Decr) 2018 2017 Incr (Decr) ELECTRIC OPERATING REVENUES (Dollars in Millions) Ret ail Resident ial$ 695 $ 661 34 $ 1,512 $ 1,439 $ 73 Business 497 474 23 1,275 1,245 30 Total Retail 1,192 1,136 56 2,787 2,684 103 Sales for Resale (Wholesale) 54 22 32 80 63 17 Transmission for Others 16 14 2 46 35 11 Other Miscellaneous Services 5 7 (2) 16 17 (1) Total Elec tric Operating Revenues$ 1,267 $ 1,178 89 $ 2,929 $ 2,799 $ 130 ELECTRIC SALES (GWH) Ret ail Resident ial 5,002 4,753 249 10,686 10,655 31 Business 4,470 4,310 160 11,390 11,421 (31) Total Retail 9,472 9,063 409 22,076 22,076 - Sales for Resale (Wholesale) 1,042 655 387 1,781 2,278 (497) Total Elec tric Sales 10,514 9,718 796 23,857 24,354 (497) RETAIL SALES (GWH) - WEATHER NORMALIZED Resident ial 4,930 4,915 15 10,680 10,655 25 Business 4,450 4,353 97 11,373 11,381 (8) Total Retail Sales 9,380 9,268 112 22,053 22,036 17 Retail sales (GWH) (% over prior year) 1.2% 0.5% 0.7% 0.1% (0.3)% 0.4% AVERAGE ELECTRIC CUSTOMERS Ret ail Cust omers Residential 1,098,916 1,079,344 19,572 1,097,607 1,078,672 18,935 Business 134,606 134,830 (224) 134,390 133,667 723 Total Retail 1,233,522 1,214,174 19,348 1,231,997 1,212,339 19,658 Wholesale Customers 40 40 - 35 42 (7) Total Customers 1,233,562 1,214,214 19,348 1,232,032 1,212,382 19,650 Total Customer Growth (% over prior year) 1.6% 1.9% (0.3)% 1.6% 1.7% (0.1)% RETAIL USAGE - WEATHER NORMALIZED (KWh/Average Customer) Resident ial 4,486 4,554 (68) 9,730 9,878 (148) Business 33,062 32,282 780 84,629 85,142 (513) 29 Third Quarter 2018 Numbers may not foot due to rounding.

CONSOLIDATED STATISTICS 3 Months Ended September 30, 9 Months EndedSeptember 30, 2018 2017 Incr (Decr) 2018 2017 Incr (Decr) ENERGY SOURCES (GWH) Generation Production Nuc lear 2,462 2,514 (52) 7,078 7,146 (68) Coal 2,612 2,093 519 5,443 5,634 (191) Gas, Oil and Other 2,833 2,666 167 6,044 5,682 362 Renewables 182 174 8 496 446 50 Total Generation Production 8,090 7,447 643 19,061 18,908 153 Purchased Power - Conventional 2,396 2,223 173 4,669 4,644 25 Resales 17 238 (221) 169 633 (464) Renewables 468 390 78 1,543 1,467 76 Total Purchased Power 2,882 2,851 31 6,381 6,744 (363) Total Energy Sources 10,971 10,298 673 25,442 25,652 (210) POWER PLANT PERFORMANCE Capacity Factors - Owned Nuclear 97% 99% (2)% 94% 95% (1)% Coal 71% 57% 14% 50% 52% (2)% Gas, Oil and Other 40% 38% 2% 29% 27% 2% Solar 36% 34% 2% 33% 30% 3% System Average 59% 54% 5% 46% 46% 0% 30 Third Quarter 2018 Numbers may not foot due to rounding.

CONSOLIDATED STATISTICS 3 Months Ended September 30, 9 Months Ended September 30, 2018 2017 Incr (Decr) 2018 2017 Incr (Decr) WEATHER INDIC ATORS - RESIDENTIAL Actual Cooling Degree-Days 1,304 1,153 151 1,817 1,724 93 Heating Degree-Days - - - 323 439 (116) Average Humidity 32% 32% (0)% 26% 26% 0% 10-Year Averages (2006 - 2015) Cooling Degree-Days 1,236 1,236 - 1,725 1,725 - Heating Degree-Days - - - 473 473 - Average Humidity 31% 31% - 25% 25% - 31 Third Quarter 2018 Numbers may not foot due to rounding.