Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OPPENHEIMER HOLDINGS INC | opy8-kinvestorpresentation.htm |

Oppenheimer Holdings Inc. Third Quarter Update November 2018

Safe Harbor Statement This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. (the “company”) may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the company’s current beliefs, expectations and assumptions regarding the future of the company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the company’s control. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forwarding-looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC on March 2, 2018 (the “2017 10-K”). In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements include those factors discussed in Part II, “Item 7. Management’s Discussion & Analysis of Financial Condition and Results of Operations – Factors Affecting ‘Forward- Looking Statements’” of the 2017 10-K. Any forward-looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2017 10-K and the company’s other SEC filings including the company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2018 (the “Quarterly Report”). There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. Therefore, you should not rely on any of these forward- looking statements. Any forward-looking statement made by the company in this presentation is based only on information currently available to the company and speaks only as of the date on which it is made. The company does not undertake any obligation to publicly update or revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. 2

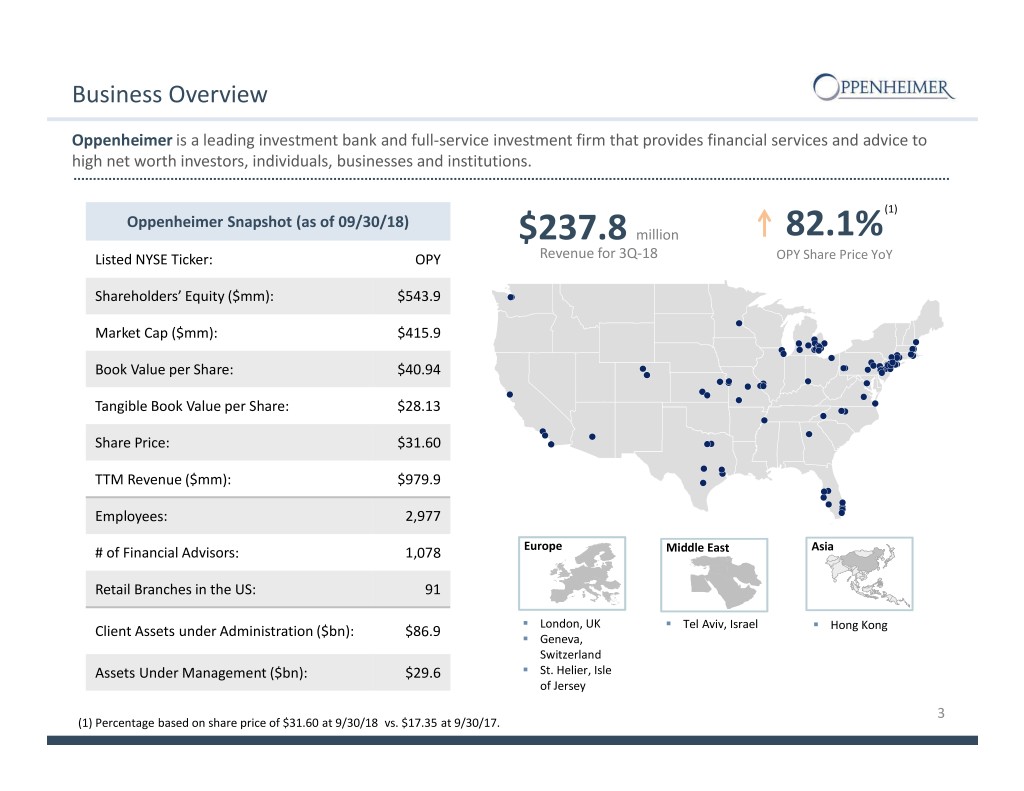

Business Overview Oppenheimer is a leading investment bank and full-service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. (1) Oppenheimer Snapshot (as of 09/30/18) $237.8 million 82.1% Listed NYSE Ticker: OPY Revenue for 3Q-18 OPY Share Price YoY Shareholders’ Equity ($mm): $543.9 Market Cap ($mm): $415.9 Book Value per Share: $40.94 Tangible Book Value per Share: $28.13 Share Price: $31.60 TTM Revenue ($mm): $979.9 Employees: 2,977 # of Financial Advisors: 1,078 Europe Middle East Asia Beijing Shanghai Hong Kong Retail Branches in the US: 91 Client Assets under Administration ($bn): $86.9 ° London, UK ° Tel Aviv, Israel ° Hong Kong ° Geneva, Switzerland Assets Under Management ($bn): $29.6 ° St. Helier, Isle of Jersey 3 (1) Percentage based on share price of $31.60 at 9/30/18 vs. $17.35 at 9/30/17.

Summary Operating Results (Unaudited) ($000’s) For the 3-Months Ended Highlights REVENUE 9-30-18 9-30-17 % Change Commissions $ 79,678 $ 77,635 2.6% V Management fees continue to Advisory fees 78,154 74,329 5.1% increase due to higher net new Investment banking 28,328 23,940 18.3% assets and market appreciation Bank deposit sweep income 30,053 21,146 42.1% Interest 13,403 12,952 3.5% V Investment banking results increased due to higher equity Principal transactions, net (1) (16) 5,135 * underwriting and M&A fees Other 8,214 11,083 (25.9)% Total Revenue 237,814 226,220 5.1% V Increases in short-term interest rates continue to benefit bank EXPENSES deposit sweep income (2) Compensation and related expenses 152,846 142,090 7.6% V Lower legal and regulatory costs Non-Compensation related expenses 77,824 72,302 7.6% during the 3Q-18 Total Expenses 230,670 214,392 7.6% Pre-tax Income (loss)(1)(2) 7,144 11,828 (39.6)% V The effective income tax rate was 29.2% for the 3Q-18 due primarily to the lower Federal Net income (loss)(1)(2) $ 5,061 $ 7,403 (31.6)% tax rate under the TCJA Basic net income per share $ 0.38 $ 0.59 (35.6)% Diluted net income per share $ 0.36 $ 0.57 (36.8)% * Percentage not meaningful. (1) During the 3Q-18 the company recognized losses of $8.1 million (after-tax impact of $6.0 million) related to sales of ARS. (2) During the 3Q-18 the company had increased compensation expenses of $4.3 million (after-tax impact of $3.2 million) directly correlated to the 4 increase in the company’s stock price through its stock appreciation rights program.

Third Quarter Financial Highlights (In $millions) Advisory Fees Investment Banking Revenue Interest and Fee Revenues Commission Revenue Principal Transactions Revenue (1) (1) 3Q-18 principal transaction revenue after backing out $8.1 million of recognized losses related to sales of ARS. 5

Business Segments Our business is well diversified across a wide range of clients, services and industries Business Mix – TTM Revenue ($983.4mm) (1) Private client services and asset WEALTH MANAGEMENT management solutions tailored to unique financial objectives Investment banking services and CAPITAL MARKETS capital markets products for institutions and corporations Wealth Management Revenue ($mm) Capital Markets Revenue ($mm) Note: Wealth Management includes both Private Client and Asset Management business segments. (1) Does not include $(3.5) million allocated to Corporate/Other. 6

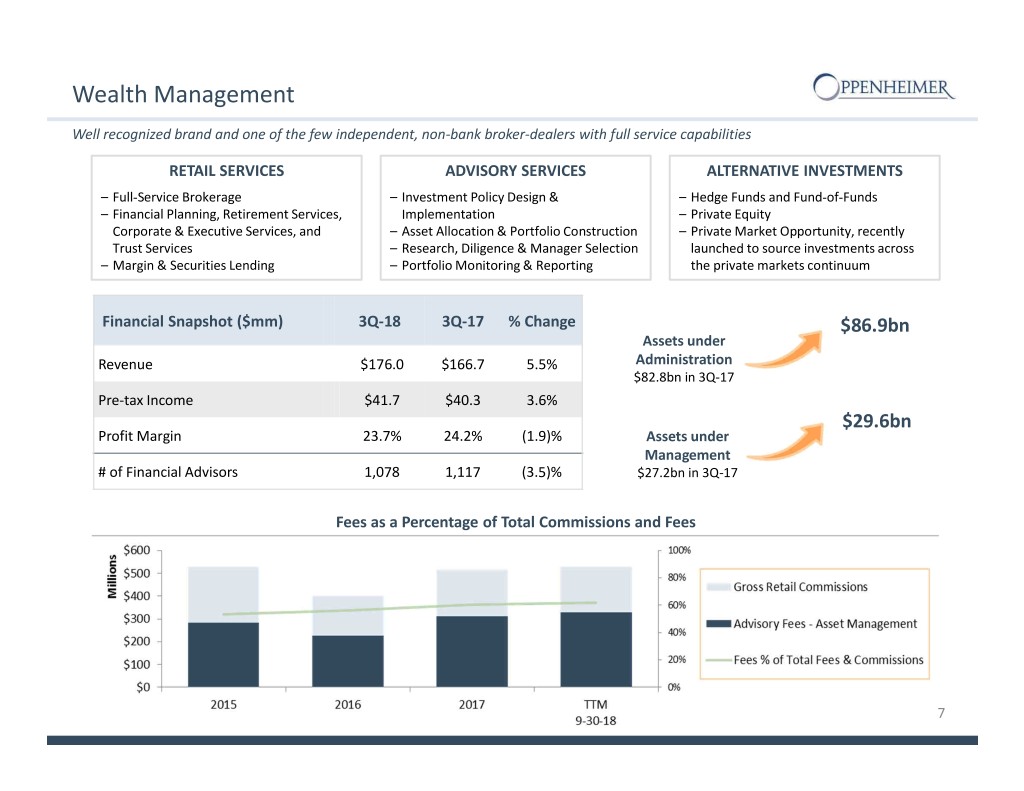

Wealth Management Well recognized brand and one of the few independent, non-bank broker-dealers with full service capabilities RETAIL SERVICES ADVISORY SERVICES ALTERNATIVE INVESTMENTS – Full-Service Brokerage – Investment Policy Design & – Hedge Funds and Fund-of-Funds – Financial Planning, Retirement Services, Implementation – Private Equity Corporate & Executive Services, and – Asset Allocation & Portfolio Construction – Private Market Opportunity, recently Trust Services – Research, Diligence & Manager Selection launched to source investments across – Margin & Securities Lending – Portfolio Monitoring & Reporting the private markets continuum Financial Snapshot ($mm) 3Q-18 3Q-17 % Change $86.9bn Assets under Revenue $176.0 $166.7 5.5% Administration $82.8bn in 3Q-17 Pre-tax Income $41.7 $40.3 3.6% $29.6bn Profit Margin 23.7% 24.2% (1.9)% Assets under Management # of Financial Advisors 1,078 1,117 (3.5)% $27.2bn in 3Q-17 Fees as a Percentage of Total Commissions and Fees 7

Capital Markets A leading capital markets business providing sophisticated investment banking, research, and trading solutions INSTITUTIONAL EQUITIES INVESTMENT BANKING GLOBAL FIXED INCOME – Sales and Trading – Mergers & Acquisitions – Taxable Fixed Income – Equity Research – Equity Capital Markets – Non-Taxable Fixed Income • 32 senior research analysts covering – Debt Capital Markets – Public Finance 500+ companies – Restructuring & Special Situations – Corporate Access (Conferences & NDRs) (In $millions) Institutional Equities Commissions Equity Underwriting Fees Financial Snapshot ($mm) 3Q-18 3Q-17 % Change Revenue $68.1 $58.8 15.9% Pre-tax Income $(2.1) $(1.6) 26.7% Advisory Fees from IBK Global Fixed Income Revenue Profit Margin (3.0)% (2.8)% 9.3% $19.5 Investment Banking Focus Industries Healthcare Technology Consumer Transportation & Finance & Real Energy & Retail Logistics Estate 8

Select 3Q-18 Investment Banking Transactions $85,000,000 $50,000,000 $32,000,000 Undisclosed Technology, Media & Communications Financial Institutions & Real Estate Technology, Media & Communications Transportation & Logistics Mergers & Acquisitions Unsecured Notes Offering Equity Private Placement Mergers & Acquisitions Exclusive Financial Advisor Co-Lead Manager Lead Arranger Exclusive Financial Advisor September 2018 September 2018 September 2018 August 2018 $115,000,000 Undisclosed Undisclosed $60,000,000 Healthcare Technology, Media & Communications Energy Healthcare Confidentially Marketed Follow-on Mergers & Acquisitions Special Situations Advisory IPO Sole Bookrunner Exclusive Financial Advisor Exclusive Financial Advisor Co-manager August 2018 August 2018 July 2018 July 2018 9

Capital Structure Conservative risk profile with strong balance sheet Liquidity & Capital ° Issued $200 million 5 year 6.75% Senior Secured Notes in June 2017 ° Level 3 assets represent .91% of total assets (lowest level since 1Q-10) ° During the 3Q-18, the Company obtained additional liquidity on its ARS owned of $45.2 million through ARS issuer redemptions and tender offers, net of additional client buybacks Book Value & Tangible Book Value per Share ($) (1) Total Assets divided by Total Stockholders’ Equity. 10

Historical Financial Ratios Consolidated Adjusted EBITDA ($mm) Long-Term Debt to Consolidated Adjusted EBITDA (x) Consolidated Adjusted EBITDA Margin (%) Interest Coverage (x) 11

For more information contact Investor Relations at info@opco.com 2307903.1