Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23.2 - Hawkeye Systems, Inc. | ex23-2.htm |

| EX-5 - EXHIBIT 5.1 - Hawkeye Systems, Inc. | ex5-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

AMENDMENT NO 2 TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

HAWKEYE SYSTEMS, INC. |

(Exact name of registrant as specified in its charter) |

|

Nevada |

(State or other jurisdiction of incorporation or organization) |

|

3861 |

(Primary Standard Industrial Classification Code Number) |

|

83-0799093 |

(I.R.S. Employer Identification Number) |

|

|

Los Angeles, CA 90046 Phone: (310) 606-2054 |

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

|

|

Los Angeles, CA 90046 Phone: (310) 606-2054

With a copy to: Cutler Law Group 6575 West Loop South, Suite 500 Bellaire, TX 77401 Telephone: (713) 888-0040 Facsimile: (713) 583-7150 |

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

After this Registration Statement becomes effective. |

(Approximate date of commencement of proposed sale to the public) |

1

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act

Large accelerated filer oAccelerated filer o

Non-accelerated filer o Smaller reporting company ý

(Do not check if a smaller reporting company)

CALCULATION OF REGISTRATION FEE

Title of Each Class of | Amount | Proposed | Proposed | Amount of |

Common Stock | 5,000,000 | $2.00 | $10,000,000 | $1,245.00 |

Common Stock1 | 3, 2 03,250 | $2.00 | $6, 4 06,500 | $7 76 . 47 |

Common Stock issuable upon the exercise of Series A Warrants at $.30 per share2 | 1,505,500 | $2.00 | $3,011,000 | $374.87 |

Common Stock issuable upon the exercise of Series B Warrants at $.50 per share2 | 1,505,500 | $2.00 | $3,011,000 | $374.87 |

Common Stock issuable upon the exercise of Series C Warrants at $1.00 per share2 | 1,505,500 | $2.00 | $3,011,000 | $374.87 |

Common Stock issuable upon the exercise of Series D Warrants at $2.00 per share2 | 1,505,500 | $2.00 | $3,011,000 | $374.87 |

Common Stock issuable upon the exercise of Series A Warrants at $1.00 per share3 | 1,145 ,000 | $2.00 | $ 2 , 2 90,000 | $ 277.55 |

Common Stock issuable upon the exercise of Series B Warrants at $2.00 per share3 | 1,145 ,000 | $2.00 | $ 2 , 2 90,000 | $ 277.55 |

Total | 16 , 5 15,250 | $2.00 | $3 3 , 0 30,500 | $ 4,003.24 |

(1)Shares offered by Selling Shareholders previously issued in a private offering of securities pursuant to Section 4(2) of the Securities Act; these shares were issued at prices at $.05, $0.15 and $0.50 per share.

2

(2)Shares issuable upon the exercise of warrants issued to shareholders in connection with a $0.15 private placement.

(3)Shares issuable upon the exercise of warrants issued to shareholders in connection with a $0.50 private placement.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT HAS FILED A FURTHER AMENDMENT THAT SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

3

SUBJECT TO COMPLETION, DATED NOVEMBER 6 , 2018

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the securities and exchange commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

PROSPECTUS

HAWKEYE SYSTEMS, INC.

5,000,000 Shares of Common Stock Offered by the Company

3, 2 03,250 Shares of Common Stock Offered by Selling Shareholders

8,3 12,000 Shares of Common Offered by Selling Shareholders issuable upon exercise of Warrants

This prospectus relates to the offer and sale of a maximum of up to 5,000,000 shares (the “Maximum Offering”) of common stock, $0.0001 par value (“Common Shares”) at $2.00 per share by Hawkeye Systems, Inc., a Nevada corporation (“we”, “us”, “our”, “Hawkeye”, “Company” or similar terms). There is no minimum for this Offering. The Offering will commence promptly on the date upon which this prospectus is declared effective by the SEC and will continue for 18 months. At the discretion of our board of directors, we may discontinue the offering before expiration of the 18-month period. We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

The offering of the 5,000,000 shares is a “best efforts” offering, which means that our officers and directors will use their best efforts to sell the common stock and there is no commitment by any person to purchase any shares. The shares will be offered at a fixed price of $2.00 per share for the duration of the offering. Proceeds from the sale of the shares will be used to implement our plan of operation. Any funds that we raise from our offering of 5,000,000 shares of common stock will be immediately available for our use and will not be returned to investors. We will receive gross proceeds of $10,000,000 if all the shares in this offering are sold.

This is a direct participation offering since we are offering the stock directly to the public without the participation of an underwriter. Our officers and directors are solely responsible for selling shares under this offering and no commission will be paid on any sales. Our officers and directors intend to offer our shares to friends, family members, and business acquaintances for a period of 18 months from the effective date of this prospectus. In offering the securities on our behalf, our officers and directors will rely on safe harbor from broker-dealer registration set out in Rule 3a4-1 under the Securities and Exchange Act of 1934.

Prior to this offering, there has been no public market for our common stock and we have not applied for the listing or quotation of our common stock on any public market. We have arbitrarily determined the offering price of $2.00 per share in relation to this offering. The offering price bears no relationship to our assets, book value, earnings or any other customary investment criteria. After the effective date of the registration statement, we intend to seek a market maker to file an

1

application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTCQB. We currently have no market maker who is willing to list quotations for our stock. There is no assurance that an active trading market for our shares will develop or will be sustained if developed.

This prospectus also relates to the sale of 3, 2 03,250 shares of our common stock currently held by various shareholders (the “Selling Shareholders”), as well as up to 8,3 12,000 shares of our common stock which may be issued to the Selling Shareholders upon the exercise of warrants. Of these warrants: (i) 1,505, 5 00 are exercisable into shares of common stock by the Selling Shareholders at a price of $0.30 per share; (ii) (i) 1,505, 5 00 are exercisable into shares of common stock by the Selling Shareholders at a price of $0.50 per share; (iii) 2, 8 50, 5 00 are exercisable into shares of common stock by the Selling Shareholders at a price of $1.00 per share; and (iv) 2, 8 50, 5 00 are exercisable into shares of common stock by the Selling Shareholders at a price of $2.00 per share. The prices at which the Selling Shareholders may sell the shares at $2.00 per share until such time as the shares are listed on a national securities exchange, or quoted on the OTC Bulletin Board, OTCQX or OTCQB, at which time the shares may be sold at prevailing market prices or in privately negotiated transactions. We will not receive proceeds from the sale of our shares by the Selling Shareholders. The selling shareholders are not affiliated with or controlled by the Company. They purchased their shares in individual transactions in private placements from the Company and not with a view to sell or distribute those shares. They are consequently not "underwriters" within the meaning of the Securities Act of 1933, as amended

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common shares.

Our business is subject to many risks and an investment in our shares of common stock will also involve a high degree of risk. You should carefully consider the factors described under the heading “risk factors” beginning on page 8 before investing in our shares of common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

____________________

The date of this Prospectus is November 6 , 2018

2

PROSPECTUS SUMMARY……………………………………………………………………...5

RISK FACTORS………………………………………………………………………………….8

USE OF PROCEEDS……………………………………………………………………………22

DETERMINATION OF OFFERING PRICE…………………………………………………...24

DILUTION………………………………………………………………………………………24

SELLING SHAREHOLDERS…………………………………………………………………..28

PLAN OF DISTRIBUTION……………………………………………………………………..30

DESCRIPTION OF SECURITIES………………………………………………………………33

DESCRIPTION OF BUSINESS………………………………………………………………...36

RELATED STOCKHOLDER MATTERS……………………………………………………...45

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS……………………………...46

DIRECTORS, EXECUTIVE OFFICERS, PROMOTER AND

CONTROL PERSONS…………………………………………………………………………..50

EXECUTIVE COMPENSATION……………………………………………………………….54

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT……………………………………………………………...56

DISCLOSURE OF COMISSION POSITION ON

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES………………………………..56

INTEREST OF NAMED EXPERTS AND COUNSEL………………………………………...56

WHERE YOU CAN FIND MORE INFORMATION…………………………………………..56

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS

ON ACCOUNTING AND FINANCIAL DISCLOSURE………………………………………57

FINANCIAL STATEMENTS………………………………………………………………….F-1

Until _____, 2018 (90 business days after the effective date of this prospectus) all dealers that effect transactions in these securities whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

3

A CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

4

As used in this prospectus, references to the “Company,” “we,” “our”, “us” or “Hawkeye” refer to Hawkeye Systems, Inc. unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

Our Company

Hawkeye Systems, Inc., a Nevada corporation incorporated on May 15, 2018, is a technology company that is developing cutting edge optical imaging products for military and law enforcement markets to assist with intelligence, surveillance and reconnaissance (“ISR”). Other potential markets include commercial entertainment and outdoor sportsmanship activities. This “SOCOM to Commercial” (United States Special Operations Command to Commercial) model has worked well for other companies.

On June 7, 2018, the Company entered into a joint-venture partnership with Insight Engineering, LLC (“Insight”). On August 1, 2018, the Company and Insight incorporated Optical Flow, LLC and entered into an operating agreement (the “Joint Venture” or “Optical Flow”) which superseded the previous joint-venture partnership. Pursuant to the Joint Venture, the Company and Insight will co-develop high resolution imaging systems.

The Company currently owns fifty (50%) percent of the Joint Venture. Pursuant to the terms and conditions of the Joint Venture, the Company must contribute $2,000,000 to the Joint Venture over a 12-month period or the Company’s percentage of participation will be reduced by the pro rata percentage that the actual contribution bears to the $2,000,000 requirement .

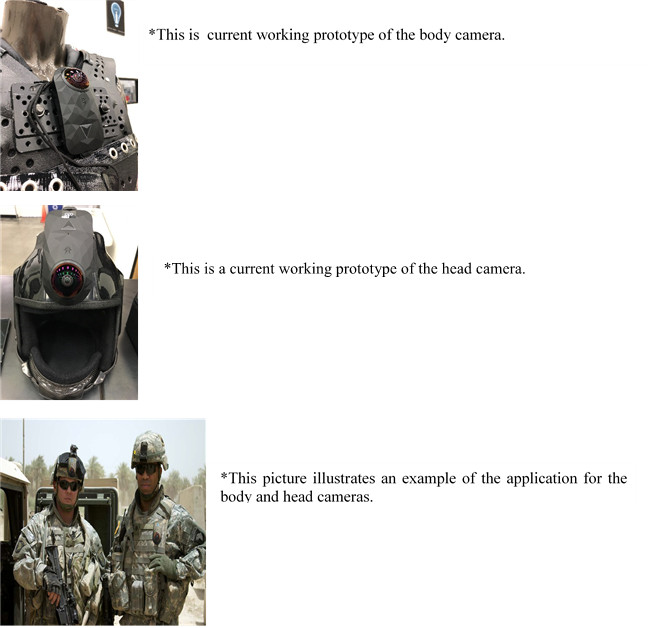

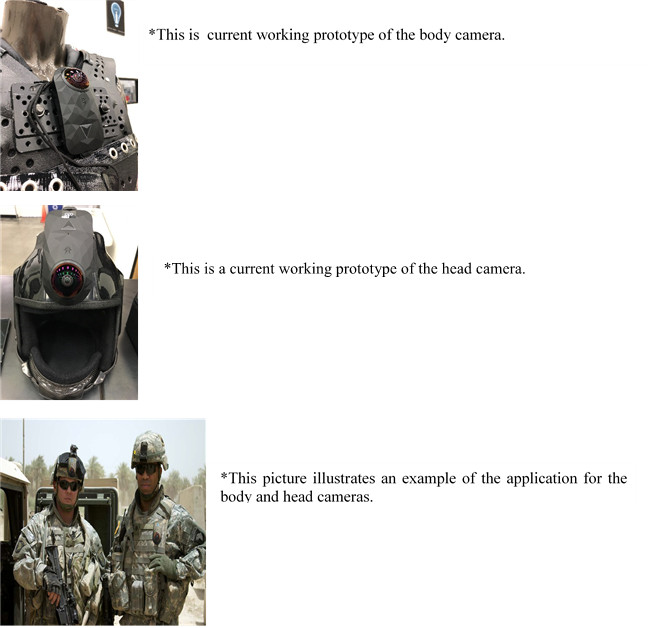

To date, the Company has contributed $350,000 of cash towards the Joint Venture. The Joint Venture is currently developing a wide field of view, single lens virtual reality imaging product. Initially, these products are being designed to be able to be mounted to law enforcement and/or military personnel to record and stream high resolution images to a Wi Fi or Bluetooth network, when required.

The Joint Venture also retained Terminal Horizon Operations and Resourcing, Inc. (doing business as “Thor International”). Thor International is assisting the Joint Venture with the CRADA and IWP (as defined herein).

On August 1, 2018 the Joint Venture and Insight entered into an exclusive and worldwide license for military and law enforcement purposes (the “License”) to use and build products derived from all technology, information, intellectual property and other materials for or relevant to the 360 degree visible and infrared spectrum single lens camera platform, including without limitation, all

5

business plans, technical plans, specifications, templates, demonstration versions, hardware, equipment, software, devices, methods, apparatus, and product designs. The License is also subject to a five (5%) percent net sales royalty payable to Insight. The License will allow the Joint Venture to excel in developing a next generation body and head camera that sees behind the user and presents a clear and wide field of view. The Joint Venture will develop and own additional technology that may include further iterations of this system, and all the related mounting and charging technologies that facilitate its use.

Our plan of operations over the 12-month period following the successful completion of at least 1,000,000 shares from our offering of 5,000,000 shares of our common stock is to complete development and marketing of our Optical Flow products for military and law enforcement markets.

The Company’s principal office is located at 7119 W. Sunset Blvd, #468, Los Angeles, CA 90046. Our telephone number is (310) 606-2054.

We are an “emerging growth company” within the meaning of the federal securities laws. For as long as we are an emerging growth company, we will not be required to comply with the requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, the reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and the exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We intend to take advantage of these reporting exemptions until we are no longer an emerging growth company.

This is a direct participation offering since we are offering the stock directly to the public without the participation of an underwriter. Our officers and directors will be solely responsible for selling shares under this offering and no commission will be paid on any sales.

There has been no market for our securities and a public market may never develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we intend to seek to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”) for our common stock to be eligible for trading on the Over-the-Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application. There can be no assurance that our common stock will ever be quoted on a stock exchange or a quotation service or that any market for our stock will develop.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common shares.

6

The Offering

Securities Being Offered by the Company: | 5,000,000 shares of common stock, par value $0.0001 per share. |

Securities Being Offered by Selling Shareholders | 3,003,250 shares of common stock |

Securities Being Offering by Selling Shareholders upon the exercise of warrants | 7,912,000 shares of common stock |

Offering price | $2.00 per share |

Previous Private Placements | Prior t o this offering the Company completed four separate private placements: (i) a private placement of 2,362,500 shares at $.01 per share; (ii) a private placement of 612,500 shares at $.05 per share; (iii) a private placement of 1,772,000 Units at $.15 per Unit (with each Unit consisting of one share of common stock, one warrant to purchase a share of common stock at $.30 per share, one warrant to purchase a share of common stock at $.50 per share, one warrant to purchase a share of common stock at $1.00 per share and one warrant to purchase a share of common stock at $2.00 per share); and (iv) a private place of 7 01,250 Units at $.50 per Unit (with each Unit consisting of one share of common stock, two warrants to purchase a share of common stock at $1.00 per share and two warrants to purchase a share of common stock at $2.00 per share). |

Net proceeds to us | $10,000,000 assuming the maximum number of shares sold. For further information on the Use of Proceeds, see page 22. |

Shares Outstanding Prior to Offering | 9,0 86,416 shares of common stock (does not include shares issuable upon exercise of warrants). |

Shares Outstanding After Offering | 1 4,0 86,416 shares of common stock (assuming no exercises of outstanding warrants). |

Subscriptions

| All subscriptions once accepted by us are irrevocable. |

Registration Costs | All registration costs shall be borne by the Company |

Risk Factors

| See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

Going Concern

| Our financial statements from inception on May 15, 2018 through our fiscal period ended September 30, 2018 report no revenues and a net loss of $ 51 , 291 .00. Our independent auditor has issued an audit opinion for our Company which includes a statement expressing substantial doubt as to our ability to continue as a going concern. |

7

RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following known material risks and uncertainties in addition to other information in this prospectus in evaluating our company and its business before purchasing shares of our company’s common stock. You could lose all or part of your investment due to any of these risks. An investment in the Company is speculative. A purchase of any of the securities of the Company involves a high degree of risk and should be undertaken only by purchasers whose financial resources are sufficient to enable them to assume such risks and who have no need for immediate liquidity in their investment. An investment in the securities of the Company should not constitute a major portion of an individual’s investment portfolio and should only be made by persons who can afford a total loss of their investment. Prospective purchasers should evaluate carefully the following risk factors associated with an investment in the Company’s securities prior to purchasing any of the securities.

Limited Operating History

The Company has a limited operating history on which to base an evaluation of its business and prospects. The Company is subject to all the risks inherent in a small company seeking to develop, market and distribute new products. The likelihood of the Company’s success must be considered, in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the development, introduction, marketing and distribution of new products and services in a competitive environment.

Such risks for the Company include, but are not limited to, dependence on the success and acceptance of the Company’s products, the ability to attract and retain a suitable customer base, and the management of growth. To address these risks, the Company must, among other things, generate increased demand, attract a sufficient clientele base, respond to competitive developments, increase our brand name visibility, successfully introduce new products, attract, retain and motivate qualified personnel and upgrade and enhance the Company’s technologies to accommodate expanded service offerings. In view of the rapidly evolving nature of the Company’s business and its limited operating history, the Company believes that period-to-period comparisons of its operating results are not necessarily meaningful and should not be relied upon as an indication of future performance.

The Company is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues.

Need for Additional Capital

The Company has limited revenue-producing operations and will require the proceeds from this offering to execute its full business plan. The Company believes the proceeds from this offering will be sufficient to develop and commercialize our initial products as described in “Description of Business”. However, the Company can give no assurance that all, or even a significant portion of these shares will be sold and that any moneys raised will be sufficient to execute the entire business plan of the Company. In order to complete the development of our

8

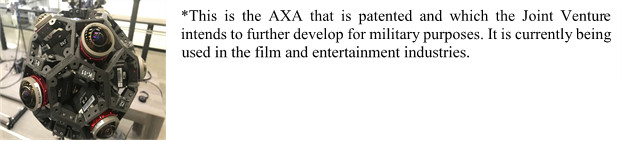

360-degree visible and infrared spectrum single lens camera platform, the Company expects that it will need at least $1,650,000 of additional capital which we anticipate will be part of the proceeds of this offering . In order to complete development of the AXA, the Company expects that it will need at least $2,000,000 of additional capital from proceeds of this offering specifically for the AXA. Further, no assurance can be given if additional capital is needed as to how much additional capital will be required or that additional financing can be obtained, or if obtainable, that the terms will be satisfactory to the Company, or that such financing would not result in a substantial dilution of shareholder’s interest. A failure to raise capital when needed would have a material adverse effect on the Company’s business, financial condition and results of operations. In addition, debt and other debt financing may involve a pledge of assets and may be senior to interests of equity holders. Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult for the Company to obtain additional capital or to pursue business opportunities, including potential acquisitions. If adequate funds are not obtained, the Company may be required to reduce, curtail, or discontinue operations.

The concurrent sales of a substantial number of shares of our common stock by the Selling Shareholders in this offering could cause our stock price to fall, reduce demand for shares and reduce liquidity to investors.

Included as part of this offering is a concurrent sale by Selling Shareholders of up to 3,003,250 shares of common stock previously issued to them and an additional 7,912,000 shares of common stock that may be issued to such Selling Shareholders upon the exercise of warrants. Sales of a substantial number of shares of our common stock in the public market could occur at any time after a market develops. These sales, or the market perception that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock. These shares may be resold in the public market immediately upon development of a market.

Purchasers of our common stock will incur immediate dilution and may experience further dilution.

Because we have sold in private placements and issued to our founders common stock at significantly lower prices than the shares sold in this Offering, purchasers will immediately incur dilution. See “dilution.” Further, upon the exercise of warrants issued in such private placements shareholders may experience further dilution. In addition, we are authorized to issue up to 400,000,000 shares of common stock and 50,000,000 shares of preferred stock. Our Board of Directors has the authority to cause us to issue additional shares of common stock without consent of any of our stockholders. Consequently, the stockholders may experience more dilution in their ownership of our Company in the future, which could have an adverse effect on the trading market for our common shares.

9

We are materially dependent on acceptance of our products by law enforcement and military markets, both domestic and international. If law enforcement agencies or military do not purchase and use our products, we will have no revenues and be adversely affected.

At any point, due to external factors and opinions, whether or not related to product performance, law enforcement agencies or military may elect to no t purchase our camera systems or other products.

Contracting on government programs is subject to significant regulation, including rules related to bidding, billing and accounting kickbacks and false claims, and any non-compliance could subject us to fines and penalties or possible debarment.

Like all government contractors, we are subject to risks associated with this contracting, including substantial civil and criminal fines and penalties. These fines and penalties could be imposed for failing to follow procurement integrity and bidding rules, employing improper billing practices or otherwise failing to follow cost accounting standards, receiving or paying kickbacks or filing false claims. We expect to be subjected to audits and investigations by U.S. and State government agencies and authorities. The failure to comply with the terms of our government contracts could harm our business reputation. It could also result in our progress payments being withheld or our suspension or debarment from future government contracts, which could have a material affect on our operational and financial results.

We currently have no sales.

We have yet to derive any revenues from sales of our camera system products. Our failure to develop sufficient demand for these products, or their failure to maintain broad market acceptance, would significantly harm our growth prospects, operating results and financial condition.

The success of our camera system is materially dependent on acceptance of this business model by our law enforcement and military customers. Delayed or lengthy time to adoption by law enforcement agencies or military will negatively impact our sales and profitability.

Typically law enforcement agencies and military are slow to adopt new technologies, including our camera system products. As we are a new company completing development, our products are not presently widely adopted by our potential law enforcement and military customers. As such, the sales cycle has additional complexity with the need to educate our customers and address issues regarding technical requirements, implementation and training and other issues. Delays in successfully securing widespread adoption of our camera system could adversely affect our revenues, profitability and financial condition.

If we are unable to design, introduce and sell new products or new product features successfully, our business and financial results could be adversely affected.

Our future success will depend on our ability to develop new products or new product features that achieve market acceptance in a timely and cost-effective manner. The development of new products and new product features is complex, time consuming and expensive, and we may experience delays in completing the development and introduction of new products. We cannot

10

provide any assurance that products that we may develop in the future will achieve market acceptance. If we fail to develop new products or new product features on a timely basis that achieve market acceptance, our business, financial results and competitive position could be adversely affected.

Delays in product development schedules may adversely affect our revenues and cash flows.

The development of our complex camera system is a complex and time-consuming process. New products and enhancements to existing products can require long development and testing periods. Our increasing focus on our camera system also presents new and complex development issues. Significant delays in new product or service releases or significant problems in creating new products or services could adversely affect our business, financial results and competitive position.

We face risks associated with rapid technological change and new competing products.

The technology associated with law enforcement and military devices is receiving significant attention and is rapidly evolving. While neither we nor the Joint Venture currently have a patent, Insight and its partners have some patent protection in certain key areas of our camera systems. It is possible, however, that new technology may result in competing products that operate outside those patents and could present significant competition for our products, which could adversely affect our business, financial results and competitive position.

Defects in our products could reduce demand for our products and result in a loss of sales, delay in market acceptance and damage to our reputation.

Complex components and assemblies used in our products may contain undetected defects that are subsequently discovered at any point in the life of the product. Defects in our products could result in a loss of sales, delay in market acceptance and damage to our reputation and increased warranty costs, which could adversely affect our business, financial results and competitive position.

If our security measures are breached and unauthorized access is obtained to customers’ data or our data, our network may be perceived as not being secure, customers may curtail or stop using products from our Company service and we may incur significant legal and financial exposure and liabilities.

Law enforcement and military are exceptionally concerned about protection of data. Sales of our products involves the storage and transmission of customers’ proprietary information, and security breaches could expose us to a risk of loss of information or the total deletion of all stored customer data, litigation and possible liability. We devote resources to engineer secure products and ensure security vulnerabilities are mitigated, and we require out third-party service providers to do so as well. Despite these efforts, security measures may be breached as a result of third-party action, employee error, and malfeasance or otherwise. Breaches could occur during transfer of data to data centers or at any time, and result in unauthorized access to our data or our customers’ data. Third-parties may attempt to fraudulently induce employees or customers into disclosing sensitive information such as user names, passwords or other information in order to gain access to our data or our customers’ data. Additionally, hackers may develop and deploy viruses, worms,

11

and other malicious software programs that attack or gain access to our networks and data centers. Because the techniques used to obtain unauthorized access, or to sabotage systems, change frequently and generally are not recognized until launched against a target, we may be unable to anticipate these techniques or to implement adequate preventative measures. Moreover, our security measures and/or those of our third party service providers and/or customers may not detect such security breaches if they occur. Any security breach could result in a loss of confidence in our Company, damage our reputation, lead to legal liability, negatively impact our future sales and significantly harm our growth prospects, operating results and financial condition.

Our intended end-user customers are subject to budgetary and political constraints that may delay or prevent sales.

Our intended end-user customers are government law enforcement or military agencies. These agencies often do not set their own budgets and therefore, have limited control over the amount of money they can spend. In addition, these agencies experience political pressure that may dictate the manner in which they spend money. As a result, even if an agency wants to acquire our products, it may be unable to purchase them due to budgetary or political constraints, particularly in challenging economic environments. There can be no assurance that the economic and budgeting issues will not worsen and adversely impact sales of our products. Some government agency orders may also be canceled or substantially delayed due to budgetary, political or other scheduling delays, which frequently occur in connection with the acquisition of products by such agencies, and such cancellations may accelerate or be more severe than we have experienced historically.

We may have to expend significant resources in anticipation of a sale due to lengthy sales cycles and may receive no revenue in return.

Generally, law enforcement and military agencies consider a wide range of issues before committing to purchase our products, including product benefits, training costs, the cost to use our products in addition to, or in place of, other products, budget constraints and product reliability, safety and efficacy. The length of our sales cycle may range from a few weeks to as long as several years. Adverse publicity surrounding our products or the safety of such products could lengthen our sales cycle with customers. We may incur substantial selling costs and expend significant effort in connection with the evaluation of our products by potential customers before they place an order. If these potential customers do not purchase our products, we will have expended significant resources and received no revenue in return.

Due to municipal government funding rules, any potential contracts are subject to appropriation, termination for convenience, or similar cancellation clauses, which could allow our potential customers to cancel or not exercise options to renew contracts in the future.

If we secure a government customer, and if agencies do not appropriate money in future year budgets, terminate potential contracts for convenience or if other cancellation clauses are invoked, revenue associated with these bookings will not ultimately be recognized, and could result in a reduction to bookings.

12

We may face personal injury, wrongful death and other liability claims that harm our reputation and adversely affect our potential sales and financial condition.

If we secure customers, our products may be used in aggressive military of law enforcement confrontations that may result in serious, permanent bodily injury or death to those involved. Our products may be associated with these injuries. A person, or the family members of a person, injured in a confrontation or otherwise in connection with the use of our products, may bring legal action against us to recover damages on the basis of theories including wrongful death, personal injury, negligent design or defective product. We may also be subject to lawsuits involving allegations of misuse of our products. If successful, wrongful death, personal injury, misuse and other claims could have a material adverse effect on our operating results and financial condition and could result in negative publicity about our products. Although we carry product liability insurance, we may incur significant legal expenses within our self-insured retention in defending these lawsuits and significant litigation could also result in a diversion of management’s attention and resources, negative publicity and a potential award of monetary damages in excess of our insurance coverage. The outcome of any litigation is inherently uncertain and there can be no assurance that our existing or any future litigation will not have a material adverse effect on our business, financial condition or operating results.

We are subject to claw-back terms.

The Joint Venture that we have with Insight is subject to claw-back provisions if we do not meet the payment terms under the license and operating agreements. Effectively, the Company’s 50% percentage of participation will be reduced by the pro rata percentage that the actual contribution bears to the $2,000,000 requirement.

Litigation

The Company and/or its directors and officers may be subject to a variety of civil or other legal proceedings, with or without merit. From time to time in the ordinary course of its business, we may become involved in various legal proceedings, including commercial, employment and other litigation and claims, as well as governmental and other regulatory investigations and proceedings. Such matters can be time-consuming, divert management’s attention and resources and cause us to incur significant expenses. Furthermore, because litigation is inherently unpredictable, the results of any such actions may have a material adverse effect on our business, operating results or financial condition.

Protection of Intellectual Property Rights

The future success of our business is dependent upon the intellectual property rights surrounding our technology, including trade secrets, know-how and continuing technological innovation. Although we will seek to protect our proprietary rights, our actions may be inadequate to protect any proprietary rights or to prevent others from claiming violations of their proprietary rights. There can be no assurance that other companies are not investigating or developing other technologies that are similar to our technology. In addition, effective intellectual property protection may be unenforceable or limited in certain countries, and the global nature of the Internet makes it impossible to control the ultimate designation of our technology. Any of these

13

claims, with or without merit, could subject us to costly litigation. If the protection of proprietary rights is inadequate to prevent unauthorized use or appropriation by third parties, the value of our brand and other intangible assets may be diminished. Any of these events could have an adverse effect on our business and financial results.

Our dependence on third-party suppliers for key components of our devices could delay shipment of our products and reduce our sales.

We will depend on certain domestic and foreign suppliers for the delivery of components used in the assembly of our products. Our reliance on third-party suppliers creates risks related to our potential inability to obtain an adequate supply of components or sub-assemblies and reduced control over pricing and timing of delivery of components and sub-assemblies. Specifically, we depend on suppliers of sub-assemblies, machined parts, injection molded plastic parts, printed circuit boards, custom wire fabrications and other miscellaneous customer parts for our products. We do not have long-term agreements with any of our suppliers and there is no guarantee that supply will not be interrupted. Due to changes imposed for imports of foreign products into the U.S., as well as potential port closures and delays created by terrorist attacks or threats, public health issues, national disasters or work stoppages, we are exposed to risk of delays caused by freight carriers or customs clearance issues for our imported parts. Any interruption of supply for any material components of our products could significantly delay the shipment or development of our products and have a material adverse effect on the Company.

Component shortages could result in our inability to produce at a volume to adequately meet customer demand, which could result in a loss of sales, delay in deliveries and injury to our reputation.

Single or sole-source components used in the manufacture of our products may become unavailable or discontinued. Delays caused by industry allocations or obsolescence may take weeks or months to resolve. In some cases, parts obsolescence may require a product re-design to ensure quality replacement components. These delays could cause significant delays in manufacturing and loss of sales, leading to adverse effects significantly impacting our financial condition or results of operations and injure our reputation.

Catastrophic events may disrupt our business.

A disruption or failure of our systems or operations in the event of a major earthquake, weather event, fire, explosion, failure to contain hazardous materials, industrial accident, cyber-attack, terrorist attack, or other catastrophic event could cause delays in completing sales, providing services, or performing other mission-critical functions. A catastrophic event that results in the destruction or disruption of any of our critical business or information technology systems could harm our ability to conduct normal business operations and our operating results as well as expose us to claims, litigation and governmental investigations and fines.

A cyber or security breach or disruption or failure in a computer system could adversely affect us.

Our operations depend on the continued and secure functioning of our computer and communications systems and the protection of information stored in computer databases

14

maintained by us and, in certain circumstance, by third parties. Such systems and databases are subject to breach, damage, disruption or failure from, among other things, cyber attacks and other unauthorized intrusions, power losses, telecommunications failures, earthquakes, fires and other natural disasters.

We face threats to our computer and communications systems and databases of unauthorized access, computer hackers, computer viruses, malicious code, cyber crime, organized cyber attacks and other security problems and system disruptions. In particular, we may be targeted by experienced computer programmers and hackers (including those sponsored by foreign governments) who may attempt to penetrate our cyber security defenses and damage or disrupt our computer and communications systems and misappropriate or compromise our intellectual property or other confidential information or that of our customers.

However, despite our efforts to secure our systems and databases and meet cyber protection and information assurance requirements, we may still face system failures, data breaches, loss of intellectual property and interruptions in our operations, which could have a material adverse effect on our business, financial condition and results of operations.

Undetected problems in our products could impair our financial results and give rise to potential product liability claims.

If there are defects in the design, production or testing of our or our subcontractors’ products and systems, including our products sold for public safety purposes in the homeland security area, we could face substantial repair, replacement or service costs, potential liability and damage to our reputation. In addition, we must comply with regulations and practices to prevent the use of parts and components that are considered as counterfeit or that violate third party intellectual property rights. We may not be able to obtain product liability or other insurance to fully cover such risks, and our efforts to implement appropriate design, testing and manufacturing processes for our products or systems may not be sufficient to prevent such occurrences, which could have a material adverse effect on our business, results of operations and financial condition.

Our future success depends on our ability to develop new offerings and technologies.

The markets we serve are characterized by rapid changes in technologies and evolving industry standards. In addition, some of our systems and products that are intended to be installed on platforms may have a limited life or become obsolete. Our future success will require that we:

identify emerging technological trends;

identify additional uses for our existing technology to address customer needs;

develop and maintain competitive products and services;

add innovative solutions that differentiate our offerings from those of our competitors;

bring solutions to the market quickly at cost-effective prices;

develop working prototypes as a condition to receiving contract awards; and

structure our business, through joint ventures, and other forms of alliances, to reflect the competitive environment.

15

We will need to invest significant financial resources to pursue these goals, and there can be no assurance that adequate financial resources will continue to be available to us for these purposes. We may experience difficulties that delay or prevent our development, introduction and marketing of new or enhanced offerings, and such new or enhanced offerings may not achieve adequate market acceptance. Moreover, new technologies or changes in industry standards or customer requirements could render our offerings obsolete or unmarketable. Any new offerings and technologies are likely to involve costs and risks relating to design changes, the need for additional capital and new production tools, satisfaction of customer specifications, adherence to delivery schedules, specific contract requirements, supplier performance, customer performance and our ability to predict program costs. New products may lack sufficient demand or experience technological problems or production delays. If we fail in our new product development efforts, or our products or services fail to achieve market acceptance more rapidly than the products or services of our competitors, our ability to obtain new contracts could be negatively impacted. Any of the foregoing costs and risks could have a material adverse impact on our business, results of operations, financial condition and cash flows.

We face acquisition and integration risks.

From time to time we make equity or asset acquisitions and investments in companies and technology ventures. Such acquisitions involve risks and uncertainties such as:

our pre-acquisition due diligence may fail to identify material risks;

significant acquisitions may negatively impact our cash flow;

significant goodwill assets recorded on our consolidated balance sheet from prior acquisitions are subject to impairment testing, and unfavorable changes in circumstances could result in impairment to those assets;

acquisitions may result in significant additional unanticipated costs associated with price adjustments or write-downs;

we may not integrate newly-acquired businesses and operations in an efficient and cost-effective manner;

we may fail to achieve the strategic objectives, cost savings and other benefits expected from acquisitions, which could negatively impact our financial ratios and covenants;

the technologies acquired may not prove to be those needed to be successful in our markets or may not have adequate intellectual property rights protection;

we may assume significant liabilities that exceed the enforceability or other limitations of applicable indemnification provisions, if any, or the financial resources of any indemnifying parties, including indemnity for tax or regulatory compliance issues, such as anti-corruption and environmental compliance, that may result in our incurring successor liability;

we may fail to retain key employees of the acquired businesses;

the attention of senior management may be diverted from our existing operations; and

certain of our newly acquired operating subsidiaries in various countries could be subject to more restrictive regulations by the local authorities after our acquisition, including regulations relating to foreign ownership of, and export authorizations for, local companies.

16

Bankruptcy of joint venture partners could impose delays and costs on us with respect to the jointly owned intellectual property and products.

In addition to the possible effects on our joint venture of a bankruptcy filing by us, the bankruptcy of one of the other investors in any of our jointly owned businesses could materially and adversely affect us.

We operate in a competitive industry.

The markets in which we participate are highly competitive and characterized by technological change. If we are unable to improve existing systems and products and develop new systems and technologies in order to meet evolving customer demands, our business could be adversely affected. The market for body worn camera platforms continues to evolve in response to changing technologies, shifting customer needs and expectations and the potential introduction of new products. Competitors in this specific market with a focus on military and law enforcement include GoPro, Inc., Axon Enterprises Inc. and MOHOC, Inc. Continued evolution in the industry and technology shifts are creating opportunities for both established and new competitors. Competitors to AXA include Raytheon Company and L3 Technologies, Inc. Key competitive factors include: product performance; product features; product quality and warranty; total cost of ownership; data security; data and information work flows; company reputation and financial strength; and relationship with customers. In addition, our competitors could introduce new products with innovative capabilities, which could adversely affect our business. Many of these competitors are larger and have greater resources than us, and therefore may be better positioned to take advantage of economies of scale and develop new technologies. Some of these competitors are also our suppliers in some programs.

Growth Strategy Implementation; Ability to Manage Growth

The Company anticipates that significant expansion will be required to address potential growth in its customer base and market opportunities. The Company’s expansion is expected to place a significant strain on the Company’s management, operational and financial resources. To manage any material growth of its operations and personnel, the Company may be required to improve existing operational and financial systems, procedures and controls and to expand, train and manage its employee base. There can be no assurance that the Company’s planned personnel, systems, procedures and controls will be adequate to support the Company’s future operations, that management will be able to hire, train, retain, motivate and manage required personnel or that the Company’s management will be able to successfully identify, manage and exploit existing and potential market opportunities. If the Company is unable to manage growth effectively, its business, prospects, financial condition and results of operations may be materially adversely affected.

Dependence upon Management and Key Personnel

The Company is, and will be, heavily dependent on the skill, acumen and services of the management of the Company, in particular Corby Marshall. The loss of the services of these key individuals, and certain others, for any substantial length of time would materially and adversely affect the Company’s results of operation and financial position (See “Management”). The Joint

17

Venture agreement may be terminated in the event Corby Marshall is no longer an officer or director other than as a result of death or disability. Management and directors of the Company are not required to devote any specific number of hours to the Company.

Other Nonpublic Sales of Securities Likely

As part of the Company’s plan to raise additional capital, the Company will likely make offers and sales of its common stock and/or preferred stock to qualified investors in transactions which are exempt from registration under the 1933 Act, as amended, in the future. Other offers and sales of common stock or preferred stock may be at prices per share that are higher or lower than the price per share in this offering or higher or lower than the conversion rate of the share of this offering. The Company reserves the right to set prices at its discretion, which prices need not relate to any ascertainable criterion of value. There can be no assurance the Company will not make other offers at lower prices per share, when, at the Company’s discretion, such price is deemed by the Company to be reasonable under the circumstances. Additional future nonpublic sales of equity may result in dilution of shareholder interests in the Company.

Arbitrary Offering Price

The offering price of the common shares offered hereunder has been arbitrarily determined by the Company and bears no relationship to any objective criterion of value. The price does not bear any relationship to the assets, book value, historical earnings or net worth of the Company. In determining the offering price, the Company considered such factors as the prospects, if any, for similar companies, the previous experience of management, the Company’s anticipated results of operations, the present financial resources of the Company and the likelihood of acceptance of this offering. Please review any financial or other information contained in this prospectus with qualified persons to determine its suitability as an investment before purchasing any shares in this offering.

Limited Market for Securities

The Company’s securities are not currently quoted on any recognized stock exchange or trading platform. Therefore, there is currently no market for the Company’s common stock is limited. There can be no assurance that a meaningful trading market will develop. If a market does not develop, investors in this offering may be required to hold their shares for an unlimited period of time and may be unable to sell their shares other than in privately negotiated transactions.

The Company’s Common Stock is subject to penny stock rules and regulations

The common stock sold in this offering will be considered to be a “penny stock” under applicable rules and regulations. The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure related to the market for penny stocks and for trades in any stock defined as a penny stock. The Commission adopted regulations under such Act, which defines penny stock to be any non-NASDAQ equity security that has a market price of less than $5.00 per share (as defined). Unless exempt, for any transaction in a penny stock, the new rules require the delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the Commission explaining important concepts involving the penny stock market, the nature of such market, terms used in such market, the broker/dealer's duties to the customer, a toll-free

18

telephone number for inquiries about the broker/dealer's disciplinary history and the customer's rights and remedies in case of fraud or abuse in the sale. Disclosure also has to be made about commissions payable to both the broker/dealer and the registered representative and current quotations of securities. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Non-NASDAQ stocks would not be covered by the definition of penny stock for (i) issuers who have $3,000,000 in tangible assets ($5,000,000 if the issuer has not been in continuous operation for three years); (ii) transactions in which the customer is an institutional accredited investor; and (iii) transactions that are not recommended by the broker/dealer.

Dividend Policy

To date, the Company has not declared or paid any cash dividends on its stock and do not anticipate paying cash dividends in the foreseeable future. The payment of cash dividends, if any, in the future will be at the sole discretion of the Board of Directors.

Control by Existing Management

Under the terms of the Company’s Articles of Incorporation filed with the Secretary of State of Nevada with respect to the rights, preferences and limitations of the common shares, each common shareholder is entitled to vote on any matters presented to stockholders of the Company. The present officers and directors of the Company will own approximately 45.3 % of the issued and outstanding common shares and will continue to own approximately 29.2 % if all of the shares offered hereunder are sold. As a result, purchasers of the common shares will have only a limited voice in the Company’s management, which is likely to be controlled by the present officers and directors of the Company. Although if all shares are sold management will not have actual 50% majority control, management is likely to vote as group and will still retain significant voting control of the Company. (See “Principal Shareholders” and “Description of Securities”).

Proceeds Applied to General Corporate Purposes - Management Discretion

Although a portion of the net proceeds of this prospectus are for specific uses, the balance will be available for working capital and general corporate purposes. Therefore, the application of the net proceeds of this offering is substantially within the discretion of the management. Investors will be relying on the Company’s management and business judgment based solely on limited information. No assurance can be given that the application of the net proceeds of this prospectus will result in the Company achieving its financial and strategic objectives.

Profitability

There is no assurance that we will earn profits in the future, or that profitability will be sustained. There is no assurance that future revenues will be sufficient to generate the funds required to continue our business development and marketing activities. If we do not have sufficient capital to fund our operations, we may be required to reduce our sales and marketing efforts or forego certain business opportunities. To date, we have not made any sales.

19

The Company’s product features may infringe claims of third-party patents, which could affect its business and profitability adversely.

The Company cannot assure that its product features do not infringe on patents held by others or that they will not in the future.

If all or any portion of the Company’s services were found to infringe a patent, it could be required to restructure its payment system, stop offering its payment product altogether, or pay substantial damages or license fees to third party patent owners. Even if the Company prevails in a lawsuit, litigation can be expensive and can consume substantial amounts of management time and attention.

If the Company cannot keep pace with rapid technological developments to provide new and innovative programs, products and services, the use of its products and its revenues could decline.

Rapid, significant technological changes continue to confront the industry in which the Company operates. The Company cannot predict the effect of technological changes on its business. The Company expects that new technologies applicable to the industry in which it operates will continue to emerge. These new technologies may be superior to, or render obsolete, the technologies that the Company currently uses in its products. Incorporating new technologies into the Company products may require substantial expenditures and take considerable time, and ultimately may not be successful. In addition, the Company’s ability to adopt and develop new technologies may be inhibited by industry-wide standards, new laws and regulations, resistance to change from consumers or merchants, or third parties’ intellectual property rights. The Company’s success will depend on its ability to develop new technologies and adapt to technological changes, evolving industry standards as well as the regulatory environment.

If we are unable to maintain and promote our brand, our business and operating results may be harmed.

Management of the Company believes that maintaining and promoting our brand is critical to expanding our customer base. Maintaining and promoting our brand will depend largely on our ability to continue to provide useful, reliable and innovative services, which we may not do successfully. We may introduce new features, products, services or terms of service that our customers do not like, which may negatively affect our brand and reputation. Maintaining and enhancing our brand may require us to make substantial investments, and these investments may not achieve the desired goals. If we fail to successfully promote and maintain our brand or if we incur excessive expenses in this effort, our business and operating results could be adversely affected.

Conflicts of Interest

Certain of our directors and officers are also directors and officers of other companies, and conflicts of interest may arise between their duties as our officers and directors and as officers and directors of such other companies. In addition, as applicable, such directors and officers will refrain from voting on any matter in which they have a conflict of interest.

20

Going-Concern Risks

The financial statements have been prepared on a going concern basis under which an entity is considered to be able to realize its assets and satisfy its liabilities in the ordinary course of business. Our future operations are dependent upon the identification and successful completion of equity or debt financing and the achievement of profitable operations at an indeterminate time in the future. There can be no assurances that we will be successful in completing an equity or debt financing or in achieving profitability.

Declines in economic conditions, including increased volatility in the capital and credit markets, could adversely affect our business, results of operations and financial condition.

An economic recession can result in extreme volatility and disruption of our capital and credit markets. The resulting economic environment may be affected by dramatic declines in the stock and housing markets, increases in foreclosures, unemployment and costs of living, as well as limited access to credit. Additionally, access to capital and credit markets could be disrupted over an extended period, which may make it difficult to obtain the financing we may need for future growth and/or to meet our debt service obligations as they mature. Any of these events could harm our business, results of operations and financial condition.

21

USE OF PROCEEDS

Our public offering of 5,000,000 shares is being made on a self-underwritten basis: no minimum number of shares must be sold in order for the offering to proceed. The offering price per share is $2.00. In addition to the current cash on hand, the table below depicts how we plan to utilize the proceeds in the event that 25%, 50%, 75% and 100% of the shares in this offering are sold; however, the amounts actually expended for working capital as well as other purposes may vary significantly and will depend on a number of factors, including the amount of our future revenues and the other factors described under “Risk Factors.” Accordingly, we will retain broad discretion in the allocation of proceeds of this Offering.

Number of shares sold | 25% | 50% | 75% | 100% |

Gross proceeds from this Offering (1)(2) | $2,500,000 | $5,000,000 | $7,500,000 | $10,000,000 |

Offering Costs | $70,000 | $70,000 | $70,000 | $70,000 |

Net proceeds from this Offering | $2,430,000 | $4,930,000 | $7,430,000 | $9,930,000 |

Operations | Nil | Nil | $2,000,000 | $3,700,000 |

Software/Platform Development for head/body camera(3) | $1,650,000 | $1,650,000 | $1,650,000 | $1,650,000 |

Software/Platform Development for AXA | Nil(4) | $2,500,000 | $2,500,000 | $2,500,000 |

Marketing & Advertising | $130,000 | $130,000 | $230,000 | $455,000 |

Regulatory Matters (legal, and compliance) | $75,000 | $75,000 | $125,000 | $250,000 |

Intellectual Property | $75,000 | $75,000 | $125,000 | $175,000 |

General & Administrative | $100,000 | $100,000 | $300,000 | $500,000 |

General Working Capital | $400,000 | $400,000 | $400,000 | $700,000 |

(1)Expenditures for the 12 months following the completion of this offering. The expenditures are categorized by significant area of activity. The Company will hire more employees and consultants and scale up its operations based on the amount of funds it has.

(2)Due to the uncertainties inherent in product development it is difficult to estimate with certainty the exact amounts of the net proceeds from this offering that may be used for the above purposes.

(3)Pursuant to the Joint Venture with Insight. 20% of the funds for research and design; 30% for building the early hardware prototypes; 17.5% for software platform development; 10% for product demonstrations and sales; 15% for final refinements and inputs from customers; and 7.5% for testing and certification. To date, the Company has contributed $350,000 to the Joint Venture for the development of its products.

(4)If the Company does not raise at least $2,000,000 it may not develop the AXA. The Company expects that it will need to raise at least $5,000,000 to fully develop both the head/body camera technology and the AXA product.

The above figures represent only estimated costs. There may be circumstances, however, where for sound business reasons a reallocation of funds may be necessary. Use of proceeds will be subject to the discretion of management.

Any funds we raise from our offering of 5,000,000 shares of common stock will be immediately available for our use and will not be returned to investors. We will not maintain an escrow, trust, or similar account for the receipt of proceeds from the sale of our shares. Accordingly, if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. If a creditor sues us and obtains a judgment against us, the creditor could garnish the bank account and take possession of the subscriptions. If that happens, you will lose your investment and your funds will be used to pay creditors.

This prospectus also relates to shares of our common stock that may be offered and sold from time to time by the Selling Shareholders. We will receive no proceeds from the sale of shares by the Selling Shareholders of common stock registered in this offering.

22

We have previously received approximately $659,425 from the sale of shares to the Selling Shareholders. The application of the proceeds of these private sales is at the discretion of management. In addition, we may receive up to $9,741,100 in additional proceeds upon the exercise of warrants issued in connection with these private placements. The application of any such proceeds from exercise of warrants is at the discretion of management.

This expected use of net proceeds from this offering and our existing cash represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors, including the progress of our development, the status of and results of input from consumers and merchants, regulatory matters and any collaborations that we may enter into with third parties for our product development, and any unforeseen cash needs.

23

DETERMINATION OF THE OFFERING PRICE

The offering price of the 5,000,000 shares being offered has been determined arbitrarily by us. The price does not bear any relationship to our assets, book value, earnings, or other established criteria for valuing a privately held company. Accordingly, the offering price should not be considered an indication of the actual value of the securities.

DILUTION

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholders. The following tables compare the differences of your investment in our shares with the investment of our existing stockholders.

The price of the current offering is fixed at $2.00 per share. This price is significantly higher than the price paid by existing shareholders for common equity since the Company’s inception.

As of September 30, 2018, the net tangible book value of our shares of common stock was $4 39,849 or approximately $0.05 per share based upon 9,0 86,416 shares outstanding.

If 100% of the Shares Are Sold:

Upon completion of this offering, in the event all of the shares are sold, the net tangible book value of the 14,0 86,416 shares to be outstanding will be $10, 369 ,850 or approximately $0.7 4 per share. The net tangible book value per share prior to the offering is $0.05. The net tangible book value of the shares held by our existing stockholders will be increased by $0. 69 per share without any additional investment on their part. Investors in the offering will incur an immediate dilution from $2.00 per share to $0.7 4 per share.

After completion of this offering, if 5,000,000 shares are sold, investors in the offering will own approximately 3 5.5 % of the total number of shares then outstanding for which they will have made cash investment of $10,000,000, or $2.00 per share. Our existing stockholders will own approximately 64 .5 % of the total number of shares then outstanding, for which they have fully paid contributions of cash totaling $ 7 59,425 or $0. 084 per share.

After completion of this offering, if all 5,000,000 shares are sold and all of the 8,3 12,000 warrants issued to prior investors are exercised, investors in the offering will own approximately 2 2.3 % of the shares then outstanding for which they will have made a cash investment of $10,000,000, or $2.00 per share. Upon exercise of such warrants, our existing stockholders will own approximately 7 7.7 % of the total number of shares then outstanding, for which they will have paid contributions of cash totaling $1 1,6 00,525 or $0.6 6 per share.

24

If 75% of the Shares Are Sold

Upon completion of this offering, in the event 3,750,000 shares are sold, the net tangible book value of the 12, 8 36,416 shares to be outstanding will be $7,9 39 , 849 , or approximately $0.6 2 per share. The net tangible book value per share prior to the offering is $0.05. The net tangible book value of the shares held by our existing stockholders will be increased by $0. 57 per share without any additional investment on their part. Investors in the offering will incur an immediate dilution from $2.00 per share to $0.6 2 per share.

After completion of this offering, if 3,750,000 shares are sold and all of the 8,3 12,000 warrants issued to prior investors are exercised, investors in the offering will own approximately 1 7.7 % of the shares then outstanding for which they will have made a cash investment of $ 7,5 00,000, or $2.00 per share. Upon exercise of such warrants, our existing stockholders will own approximately 8 2 . 3 % of the total number of shares then outstanding, for which they will have paid contributions of cash totaling $1 1 , 6 00,525 or $0.6 6 per share.

If 50% of the Shares Are Sold

Upon completion of this offering, in the event 2,500,000 shares are sold, the net tangible book value of the 11, 5 86,614 shares to be outstanding will be $5, 369 ,850, or approximately $0.4 6 per share. The net tangible book value per share prior to the offering is $0.05. The net tangible book value of the shares held by our existing stockholders will be increased by $0.4 1 per share without any additional investment on their part. Investors in the offering will incur an immediate dilution from $2.00 per share to $0.4 6 per share.

After completion of this offering, if 2,500,000 shares are sold and all of the 8,3 12,000 warrants issued to prior investors are exercised, investors in the offering will own approximately 1 2.6 % of the shares then outstanding for which they will have made a cash investment of $ 5 ,000,000, or $2.00 per share. Upon exercise of such warrants, our existing stockholders will own approximately 87. 4 % of the total number of shares then outstanding, for which they will have paid contributions of cash totaling $1 1,6 00,525 or $0.6 6 per share.

If 25% of the Shares Are Sold

Upon completion of this offering, in the event 1,250,000 shares are sold, the net tangible book value of the 10, 3 36,614 shares to be outstanding will be $2, 869,849 or approximately $0.2 8 per share. The net tangible book value per share prior to the offering is $0.05. The net tangible book value of the shares held by our existing stockholders will be increased by $0.2 3 per share without any additional investment on their part. Investors in the offering will incur an immediate dilution from $2.00 per share to $0.2 8 per share.

After completion of this offering, if 1,250,000 shares are sold and all of the 8,3 12,000 warrants issued to prior investors are exercised, investors in the offering will own approximately 6. 7 % of the shares then outstanding for which they will have made a cash investment of $ 2,5 00,000, or $2.00 per share. Upon exercise of such warrants, our existing stockholders will own

25

approximately 93 . 3 % of the total number of shares then outstanding, for which they will have paid contributions of cash totaling $1 1,6 00,525 or $0.6 6 per share.