Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BlueLinx Holdings Inc. | q32018earnings991.htm |

| 8-K - 8-K - BlueLinx Holdings Inc. | q32018earnings8k.htm |

BlueLinx Third Quarter 2018 Earnings Webcast

Notes To Investors Forward-Looking Statements. This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future results, performance, liquidity levels or achievements, and may contain the words “believe,” “anticipate,” “expect,” “estimate,” “intend,” “project,” “plan,” “will be,” “will likely continue,” “will likely result” or words or phrases of similar meaning. The forward-looking statements in this presentation include statements regarding the progress and expected timing of the integration of the Cedar Creek business; the expected annual run-rate synergies from the integration of the Cedar Creek business; the expected timing of future consolidations of legacy BlueLinx and legacy Cedar Creek sites in overlapping geographies; the expected timing of the consolidation of the enterprise resource planning (ERP) systems of the legacy BlueLinx and legacy Cedar Creek businesses; the timing and success of ongoing supplier partnership negotiations; the expected costs to achieve synergies in the integration of the Cedar Creek business; our plans and expectations for our existing real estate portfolio, including the ability to sell, and the potential proceeds to be received from the sale of, owned real estate; our strategic initiatives; our capital structure and its ability to support growth and future deleveraging; our expected future leverage and future leverage ratios; and our expectations for the treatment of net operating losses in the future. These forward-looking statements are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties, including the factors described in the “Risk Factors” section in our Annual Report on Form 10-K for the year ended December 30, 2017, our Quarterly Reports on Form 10-Q, and in our periodic reports filed with the Securities and Exchange Commission from time to time. Given these risks and uncertainties, you are cautioned not to place undue reliance on forward-looking statements. Unless otherwise indicated, all forward-looking statements are as of the date they are made, and we undertake no obligation to update these forward-looking statements, whether as a result of new information, the occurrence of future events, or otherwise. Non-GAAP Financial Measures and Supplementary Financial Information. BlueLinx reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). We also believe that presentation of certain non-GAAP measures, such as Adjusted EBITDA, as well as GAAP-based and non-GAAP supplemental financial measures, may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. Explanations of these non-GAAP measures and these GAAP-based and non-GAAP supplemental financial measures are included in the accompanying Appendix to this presentation. And any non-GAAP measures used herein are reconciled herein or in the financial tables in the Appendix to their most directly comparable GAAP measures. We caution that non- GAAP measures and supplemental financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Immaterial Rounding Differences. Immaterial rounding adjustments and differences may exist between slides, press releases, and previously issued presentations. This presentation and the associated remarks made during this conference call are integrally related and are intended to be presented and understood together. 2

Third Quarter 2018 - Key Highlights Third Quarter 2018 • Q3 Pro forma Net Sales were $860 million, up $19 million from Q3 2017 • Adjusted EBITDA of $17 million; best Q3 in over a decade • Cedar Creek integration continues to move forward on schedule • Annual run-rate synergies expected to exceed $25 million by year end • Historical Q3 decline in lumber and panel commodity prices negatively impacted Q3 results 3

Integration Highlights ACCOMPLISHMENTS • Continue to anticipate at least $50 million in annual run-rate synergies • Consolidated facilities/fabrication in seven locations: • Consolidated facilities in Atlanta, Des Moines, Springfield, Grand Rapids, Minneapolis, Lubbock • Consolidated fabrication in Dallas/Ft. Worth • Anticipate three additional consolidations in Q4 2018 and three more in the first half of 2019 • Expect ERP consolidations for all overlap geographies to be completed by Q1 2019 • Full ERP consolidation on schedule to be completed by end of 2019 • Completed Human Resources system integration in Q3 2018 • Supplier partnership and volume purchasing negotiations continue • Negotiated numerous indirect expense categories in Q3 2018 • Travel, Office Supplies, etc. 4

Significant Acquisition Synergies from Cedar Creek • Expect annual run-rate synergies of at least $25M by end of 2018 • $10M ahead of original 2018 plan • Costs to achieve synergies estimated to be $25-$40M, down from original estimate of $40-$55M • Up to $25M of potential gross proceeds on sale of owned real estate in overlap markets EXPECTED YEAR-END RUN-RATE SYNERGIES $ in millions OPPORTUNITIES $50+ $48 - Plan ~20% ▪ - Actions completed General & Efficiency improvements Administrative ahead of plan synergies ~35% ▪ Supply Chain Overlap markets $25+ & Network ▪ Route optimization $10 ▪ ~45% Supplier rationalization ✓$15 Procurement ▪ Cost disparity 2018E 2019E 2020E 5

Commodity Lumber and Panel Business Impacts Q2 ‘18 vs. Q3 ‘18 COMMODITY PRICES Q3 ’17 vs. Q3 ’18 COMMODITY PRO FORMA NET SALES Lumber Panels OSB $600 $550 $25 $500 -17% ($12) $336 $450 -24% $323 $400 -25% $350 Q3 '17 Volume Price Q3 '18 Jun-18 Jul-18 Aug-18 Sep-18 Source: Random Lengths KEY HIGHLIGHTS Q3 ’17 vs. Q3 ’18 COMMODITY PRO FORMA GROSS PROFIT • Pro forma Gross Profit down $17M due to commodity price deflation ($1) • Lumber composite index dropped 24% during Q3 ‘18 ($17) $29 • Panel composite index dropped 17% during Q3 ‘18 $11 • OSB index dropped 25% during Q3 ’18 Q3 '17 Volume Commodity Q3 '18 Pressure1 1 Includes lower of cost or net realizable value (NRV) inventory value reduction of $5M 6

Commodity Lumber and Panel Price Volatility COMMODITY MARKET OUTLOOK • Commodity price declines over 20% within a three-month period occurred only four times in the last 15 years • Decline in Q3 2018 of 24% • $17 million Gross Profit impact in Q3 represents approximately 2.0% of four-year aggregate 2017 Pro forma Adjusted EBITDA with synergies1 • BlueLinx does not speculate in commodity markets • Severity and speed of decline impacts wholesale distribution 1Assumes four years of Adjusted EBITDA at 2017 Pro forma Adjusted EBITDA plus annual run-rate synergies of $50M 15-YEAR HISTORICAL COMMODITY PRICES $600 -24% $525 -25% $450 -25% $375 -29% $300 Composite IndexComposite $225 $150 2006 2011 2016 2003 2004 2005 2007 2008 2009 2010 2012 2013 2014 2015 2017 2018 Lumber Panels 7 Source: Random Lengths Lumber % change

End-Use Market Outlook MARKET OUTLOOK • Single Family Housing Starts up 2.4% in Q3 2018 compared to Q3 2017 • Builders Confidence Index is consistent with growing residential construction market • Average 30 year fixed-rate mortgage interest rates increased 20 bps to 4.7% at the end of Q3 2018 • U.S. unemployment rate of 3.7% at the end of Q3 2018 • Tariffs continue to add volatility to import quantities and pricing BUILDERS CONFIDENCE INDEX HISTORICAL U.S. SINGLE FAMILY HOUSING STARTS NAHB Builders Confidence Index (%) ($ in 000s) U.S. Census Bureau 90 2,000 80 1,800 70 1,600 1,400 60 1,200 50 1,000 40 800 30 600 20 400 10 200 0 0 1990 2018 1962 1966 1970 1974 1978 1982 1986 1994 1998 2002 2006 2010 2014 2018 1985 1988 1991 1994 1997 2000 2003 2006 2009 2012 2015 8

Strategic Initiatives Successful Integration Emphasize Sales Enhance of Cedar Creek Growth Margins • $3B of addressable spend • Increase local customer • Emphasis on products for cost savings interaction to grow market and markets with higher opportunities share margin profiles • Identifiable and • Develop and deploy best • Additional customized achievable cost savings of practices in selling solution offerings at least $50M through processes supply chain, G&A and • Maintain systematic procurement • Utilize broad product pricing discipline offering across vast • Dedicated leadership distribution network team assigned to integration 9

Financial Overview

Financial Summary – Third Quarter 2018 • Net Sales of $860M, up $380M or 79% • Pro forma Net Sales of $860M, up $19M or 2% • Gross Profit of $92M1, up $31M • Pro forma Gross Profit of $93M2, down $18M • Gross Margin of 10.7%1 • Pro forma Gross Margin of 10.8%2 • Net Loss of $10M includes the following one-time items: • Partial multi-employer pension plan withdrawal charge of $7M • Acquisition related legal, consulting, professional fees, and integration costs of $4M • Acquisition related inventory step-up charge of $1M • Adjusted EBITDA of $17M1, up $3M • Pro forma Adjusted EBITDA of $17M2, down $13M • Excess Availability including cash on hand averaged $142M 1 Includes lower of cost or net realizable value (NRV) inventory value reduction of $5M and acquisition-related inventory step-up charge of $1M 11 2 Includes lower of cost or net realizable value (NRV) inventory value reduction of $5M

Financial Summary – YTD Third Quarter 2018 • Net Sales of $2,190M, up $808M or 59% • Pro forma Net Sales of $2,593M, up $133M or 5% • Gross Profit of $251M1, up $75M • Pro forma Gross Profit of $313M2, remained flat • Gross Margin of 11.4%1 • Pro forma Gross Margin of 12.1%2 • Net Loss of $32M includes the following one-time items: • Acquisition related legal, consulting, professional fees, and integration costs of $19M • Stock Appreciation Rights of $15M • Acquisition related inventory step-up charge of $12M • Partial multi-employer pension plan withdrawal charge of $7M • Adjusted EBITDA of $62M1, up $28M • Pro forma Adjusted EBITDA of $73M2, down $9M 1 Includes lower of cost or net realizable value (NRV) inventory value reduction of $5M and acquisition-related inventory step-up charge of $12M 12 2 Includes lower of cost or net realizable value (NRV) inventory value reduction of $5M

Pro forma Net Sales and Gross Margin PRO FORMA NET SALES PRO FORMA GROSS MARGIN¹ Specialty 15.5% 15.5% 14.8% 14.2% Structural $860 9.3% $841 8.4% 8.6% 5.6% Q3'17 Q3'18 Q3 '15 Q3 '16 Q3 '17 Q3 '18 YEAR-OVER-YEAR HIGHLIGHTS • Pro forma Net Sales increased by $19M or 2% from the same quarter last year • Specialty margins remained consistent with same quarter last year; 130 bps growth since Q3’15 1 Does not include lower of cost or net realizable value (NRV) inventory value reduction of $5M 13

Strong Deleveraging Potential $ in millions Post Integration Estimated Annual Uses of Cash ~$143+ Expected Run-Rate Cost Savings ~($18) $50M+ ~($17) ~$75 ~($23) ~($5) ~($2) ~($3) Sep'18 TTM ABL Term Loan Capital Lease CapEx2 Cash Taxes2,4 Other 2,5 Cash Adj. EBITDA Interest2 Interest2 Payments2,3 Available for Estimate1 Debt Reduction Note: 9.29M outstanding shares as of 11/7/2018 1September ’18 TTM Adj. EBITDA Estimate = September ‘18 TTM Pro forma Adj. EBITDA + $50M Expected Run-Rate Cost Savings 2Illustrative example based on annualized Q3 2018 cash outflows by multiplying Q3 2018 by four 3Capital Lease Principal ($8), Capital Lease Interest ($15) 4Cash taxes primarily consist of state taxes due to Federal NOLs 14 5Comprised mostly of pension cash payments

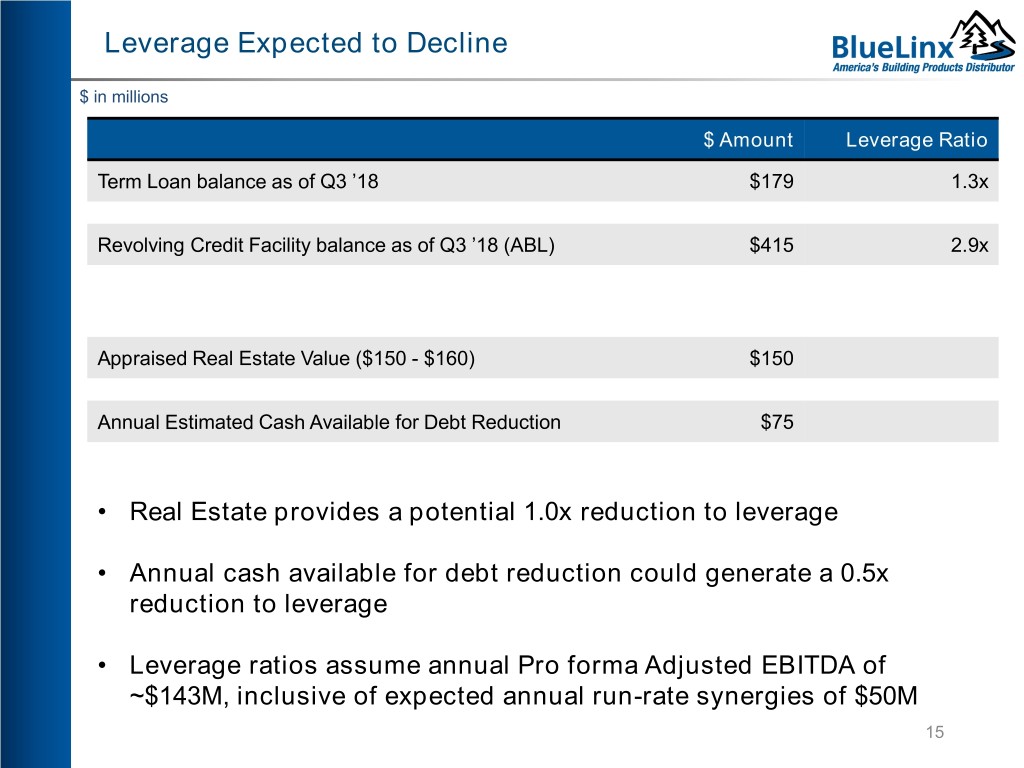

Leverage Expected to Decline $ in millions $ Amount Leverage Ratio Term Loan balance as of Q3 ’18 $179 1.3x Revolving Credit Facility balance as of Q3 ’18 (ABL) $415 2.9x Appraised Real Estate Value ($150 - $160) $150 Annual Estimated Cash Available for Debt Reduction $75 • Real Estate provides a potential 1.0x reduction to leverage • Annual cash available for debt reduction could generate a 0.5x reduction to leverage • Leverage ratios assume annual Pro forma Adjusted EBITDA of ~$143M, inclusive of expected annual run-rate synergies of $50M 15

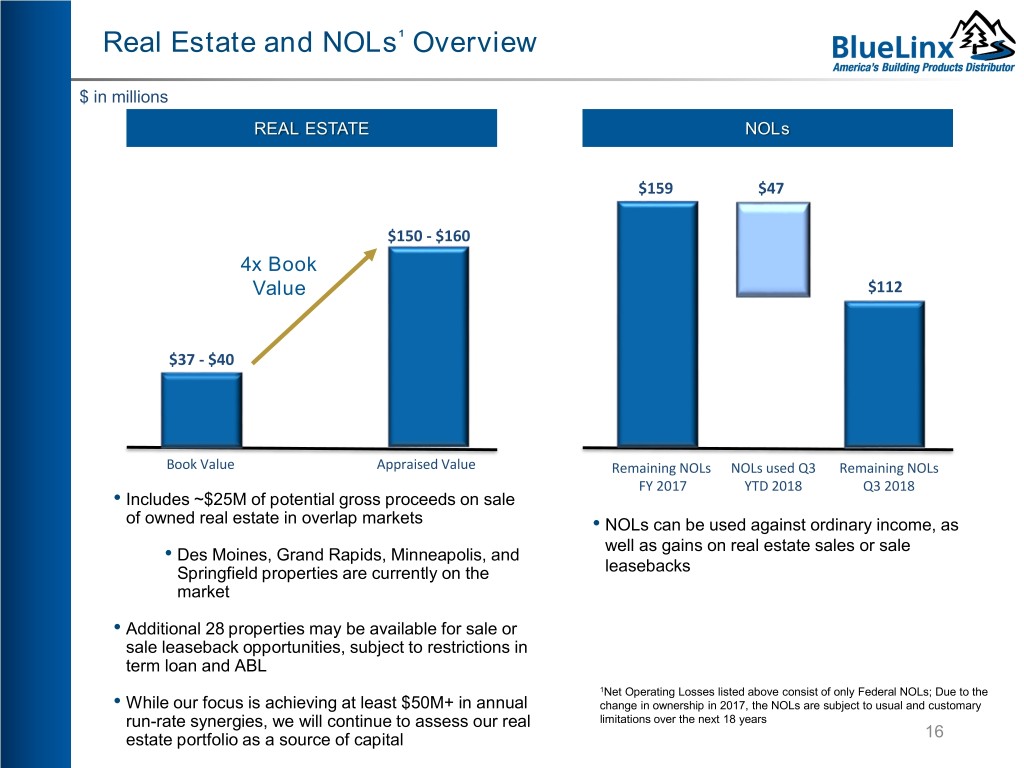

Real Estate and NOLs¹ Overview $ in millions REAL ESTATE NOLs $159 $47 $150 - $160 4x Book Value $112 $37 - $40 Book Value Appraised Value Remaining NOLs NOLs used Q3 Remaining NOLs FY 2017 YTD 2018 Q3 2018 • Includes ~$25M of potential gross proceeds on sale of owned real estate in overlap markets • NOLs can be used against ordinary income, as well as gains on real estate sales or sale • Des Moines, Grand Rapids, Minneapolis, and Springfield properties are currently on the leasebacks market • Additional 28 properties may be available for sale or sale leaseback opportunities, subject to restrictions in term loan and ABL 1Net Operating Losses listed above consist of only Federal NOLs; Due to the • While our focus is achieving at least $50M+ in annual change in ownership in 2017, the NOLs are subject to usual and customary run-rate synergies, we will continue to assess our real limitations over the next 18 years estate portfolio as a source of capital 16

Appendix

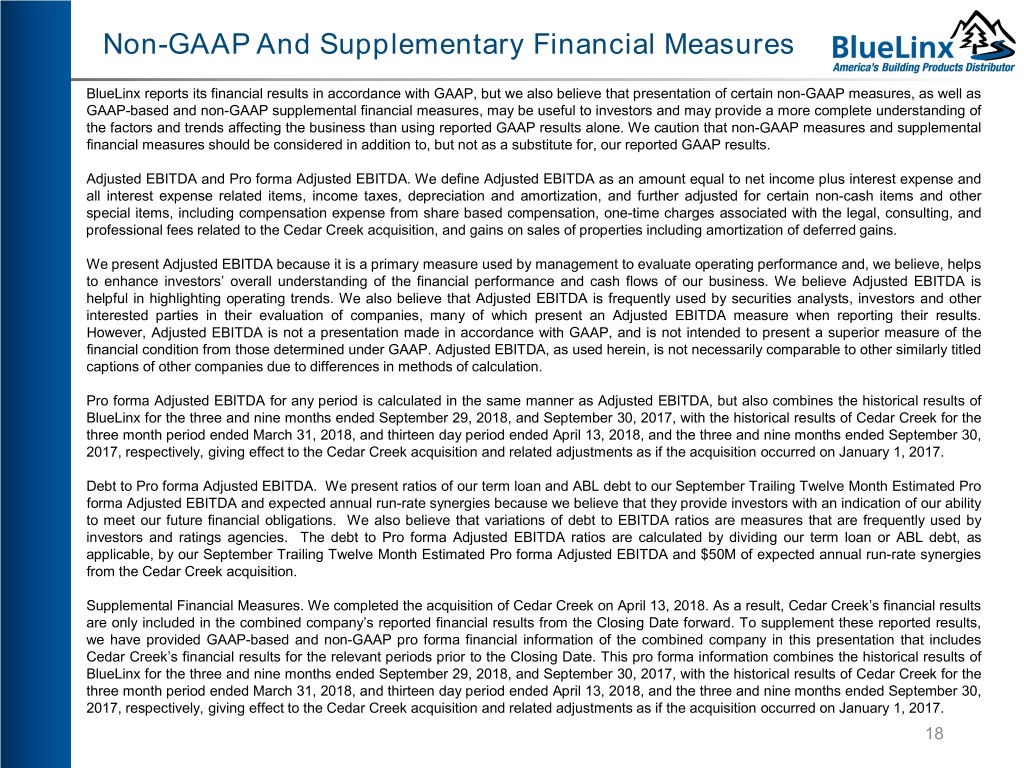

Non-GAAP And Supplementary Financial Measures BlueLinx reports its financial results in accordance with GAAP, but we also believe that presentation of certain non-GAAP measures, as well as GAAP-based and non-GAAP supplemental financial measures, may be useful to investors and may provide a more complete understanding of the factors and trends affecting the business than using reported GAAP results alone. We caution that non-GAAP measures and supplemental financial measures should be considered in addition to, but not as a substitute for, our reported GAAP results. Adjusted EBITDA and Pro forma Adjusted EBITDA. We define Adjusted EBITDA as an amount equal to net income plus interest expense and all interest expense related items, income taxes, depreciation and amortization, and further adjusted for certain non-cash items and other special items, including compensation expense from share based compensation, one-time charges associated with the legal, consulting, and professional fees related to the Cedar Creek acquisition, and gains on sales of properties including amortization of deferred gains. We present Adjusted EBITDA because it is a primary measure used by management to evaluate operating performance and, we believe, helps to enhance investors’ overall understanding of the financial performance and cash flows of our business. We believe Adjusted EBITDA is helpful in highlighting operating trends. We also believe that Adjusted EBITDA is frequently used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an Adjusted EBITDA measure when reporting their results. However, Adjusted EBITDA is not a presentation made in accordance with GAAP, and is not intended to present a superior measure of the financial condition from those determined under GAAP. Adjusted EBITDA, as used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of calculation. Pro forma Adjusted EBITDA for any period is calculated in the same manner as Adjusted EBITDA, but also combines the historical results of BlueLinx for the three and nine months ended September 29, 2018, and September 30, 2017, with the historical results of Cedar Creek for the three month period ended March 31, 2018, and thirteen day period ended April 13, 2018, and the three and nine months ended September 30, 2017, respectively, giving effect to the Cedar Creek acquisition and related adjustments as if the acquisition occurred on January 1, 2017. Debt to Pro forma Adjusted EBITDA. We present ratios of our term loan and ABL debt to our September Trailing Twelve Month Estimated Pro forma Adjusted EBITDA and expected annual run-rate synergies because we believe that they provide investors with an indication of our ability to meet our future financial obligations. We also believe that variations of debt to EBITDA ratios are measures that are frequently used by investors and ratings agencies. The debt to Pro forma Adjusted EBITDA ratios are calculated by dividing our term loan or ABL debt, as applicable, by our September Trailing Twelve Month Estimated Pro forma Adjusted EBITDA and $50M of expected annual run-rate synergies from the Cedar Creek acquisition. Supplemental Financial Measures. We completed the acquisition of Cedar Creek on April 13, 2018. As a result, Cedar Creek’s financial results are only included in the combined company’s reported financial results from the Closing Date forward. To supplement these reported results, we have provided GAAP-based and non-GAAP pro forma financial information of the combined company in this presentation that includes Cedar Creek’s financial results for the relevant periods prior to the Closing Date. This pro forma information combines the historical results of BlueLinx for the three and nine months ended September 29, 2018, and September 30, 2017, with the historical results of Cedar Creek for the three month period ended March 31, 2018, and thirteen day period ended April 13, 2018, and the three and nine months ended September 30, 2017, respectively, giving effect to the Cedar Creek acquisition and related adjustments as if the acquisition occurred on January 1, 2017. 18

Adjusted EBITDA (In millions) (Unaudited) 2018 2017 2018 2017 Q3 Q3 Q3 YTD Q3 YTD Net (loss) income $ (9.9) $ 5.7 $ (31.9) $ 9.5 Adjustments: Depreciation and amortization 8.1 2.2 18.2 6.9 Interest expense 13.3 5.7 33.9 16.3 Provision for (Benefit from) income taxes (7.3) 0.1 (7.9) 0.8 Gain from sales of property — — — (6.7) Amortization of deferred gain (1.3) — (3.8) — Share-based compensation expense 1.7 0.3 14.7 1.8 Multi-employer pension withdrawal 6.5 — 6.5 5.5 Inventory step-up adjustment 0.9 — 11.8 — Merger and acquisition costs(1) 3.8 — 19.1 — Restructuring, severance, and legal 0.8 (0.1) 1.1 (0.0) Adjusted EBITDA $ 16.6 $ 14.0 $ 61.7 $ 34.1 (1) Reflects primarily legal, professional and other integration costs related to the Cedar Creek acquisition 19

Pro forma Adjusted EBITDA (In millions) (Unaudited) 2018 2017 2018 2017 Q3 Q3 Q3 YTD Q3 YTD Net (loss) income $ (6.2) $ 8.0 $ (5.5) $ (20.5) Adjustments: Depreciation and amortization 8.1 7.0 23.5 21.0 Interest expense 13.3 12.0 39.9 32.5 Provision for (Benefit from) income taxes (6.3) 2.2 (3.2) (1.8) Gain from sales of property — — — (6.7) Amortization of deferred gain (1.3) (0.5) (3.8) (1.0) Share-based compensation expense 1.7 0.3 14.7 1.8 Multi-employer pension withdrawal 6.5 — 6.5 5.5 Inventory step-up adjustment — — — 11.8 Merger and acquisition costs(1) — — — 37.9 Restructuring, severance, and legal 0.8 1.0 1.1 1.6 Adjusted EBITDA $ 16.6 $ 30.1 $ 73.2 $ 82.1 (1) Reflects primarily legal, professional and other integration costs related to the Cedar Creek acquisition 20

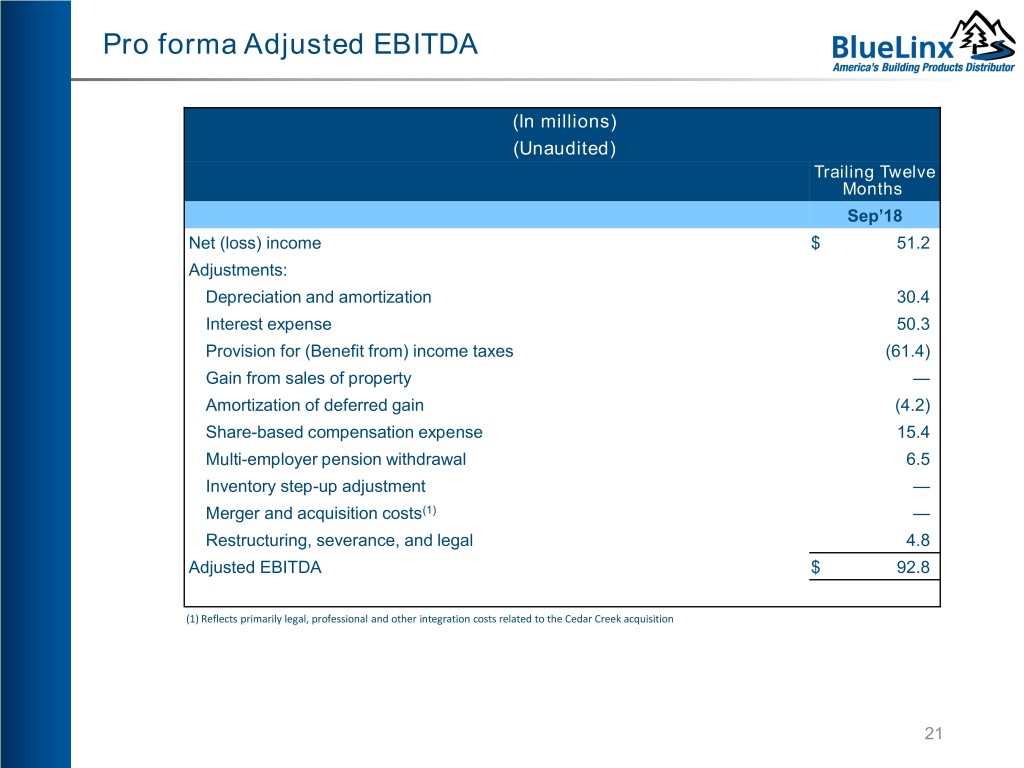

Pro forma Adjusted EBITDA (In millions) (Unaudited) Trailing Twelve Months Sep’18 Net (loss) income $ 51.2 Adjustments: Depreciation and amortization 30.4 Interest expense 50.3 Provision for (Benefit from) income taxes (61.4) Gain from sales of property — Amortization of deferred gain (4.2) Share-based compensation expense 15.4 Multi-employer pension withdrawal 6.5 Inventory step-up adjustment — Merger and acquisition costs(1) — Restructuring, severance, and legal 4.8 Adjusted EBITDA $ 92.8 (1) Reflects primarily legal, professional and other integration costs related to the Cedar Creek acquisition 21

Reconciliation of GAAP to Adjusted Measures 22

Please reference our Earnings Release and 10-Q available on our website www.BlueLinxCo.com