Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NEOGENOMICS INC | a8-kinvestorpresentationno.htm |

Exhibit 99.1 INVESTOR PRESENTATION NOVEMBER 2018

Forward-Looking Statements This presentation has been prepared by NeoGenomics, Inc. (“we,” ”us,” “our,” “NeoGenomics” or the “Company”) and is made for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities, nor shall there be any sale of any securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. The information set forth herein does not purport to be complete or to contain all of the information you may desire. Statements contained herein are made as of the date of this presentation unless stated otherwise, and neither this presentation, nor any sale of securities, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date or that information will be updated or revised to reflect information that subsequently becomes available or changes occurring after the date hereof. This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 relating to business, operations, and financial conditions of the Company. Words such as, but not limited to, “look forward to,” “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “would,” “should” and “could,” and similar expressions or words, identify forward-looking statements. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, there can be no assurance that its expectations will be realized. Actual results could differ materially from those projected in the Company’s forward-looking statements due to numerous known and unknown risks and uncertainties. All forward-looking statements speak only as of the date of this presentation and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to revise or update this presentation to reflect events or circumstances after the date hereof. Non-GAAP Adjusted EBITDA "Adjusted EBITDA" is defined by NeoGenomics as net income from continuing operations before: (i) interest expense, (ii) tax expense, (iii) depreciation and amortization expense, non-cash stock-based compensation expense, and if applicable in a reporting period, acquisition-related transaction expenses (vi) non-cash impairments of intangible assets (vii) debt financing costs (viii) and other significant non-recurring or non-operating (income) or expenses. 2

Investment Highlights Leading publicly-traded, comprehensive, pure-play oncology testing company in the U.S. Substantial Oncology/Genetics Market tailwinds Significant near-term growth drivers Market share gains driven by customer satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 3

Who We Are COMMON PURPOSE We saves lives by improving patient care. VISION By providing uncompromising quality, exceptional service and innovative solutions, we will be the World’s leading cancer testing and information company. VALUES − Quality − Integrity − Accountability − Teamwork − Innovation We are Focused and Genuine 4

Company Overview Comprehensive, oncology-focused test menu • Extensive molecular-oncology offering, with ~160 tests • A leader in immuno-oncology testing • In-house digital pathology expertise Extensive clinical expertise • 60+ pathologists and PhDs Global Pharma Services offering • $97 million backlog of signed contracts • Labs in US, Europe and Asia (under development) Significant scale and scope • 2600+ hospitals and cancer centers • 700,000+ tests per year • Broad geographic coverage with major labs in California, Florida and Texas 5

US Oncology Lab Market Clinical Reference Labs Pure Play Oncology Reference Labs Niche Oncology Players (with oncology divisions) (comprehensive test menus) (limited test menus) 6

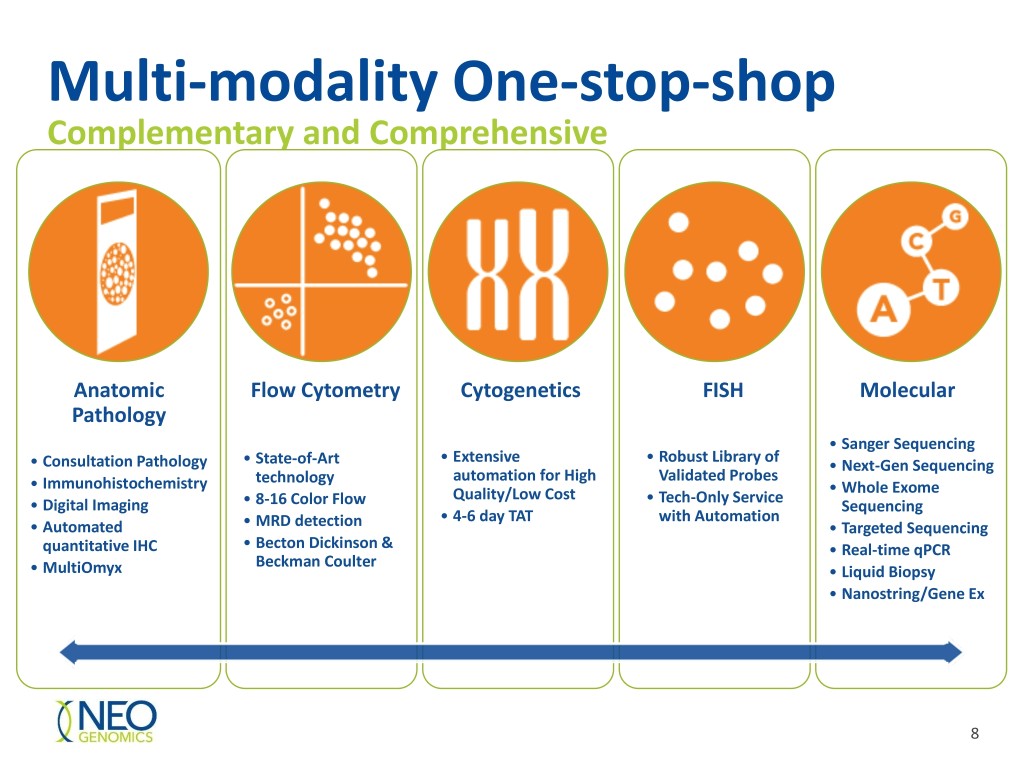

Our Competitive Advantage • Comprehensive, multi-modality “one-stop-shop” • Large and advanced somatic cancer test menu • Unparalleled reach into all customer segments, including hospitals, pathologists, and community oncology practices • National footprint and extensive payer contracts • Outstanding client service and partnership models • Synergistic Pharma and Clinical businesses 7

Multi-modality One-stop-shop Complementary and Comprehensive Anatomic Flow Cytometry Cytogenetics FISH Molecular Pathology • Sanger Sequencing • Extensive • Robust Library of • Consultation Pathology • State-of-Art • Next-Gen Sequencing technology automation for High Validated Probes • Immunohistochemistry • Whole Exome Quality/Low Cost • Tech-Only Service • Digital Imaging • 8-16 Color Flow Sequencing • 4-6 day TAT with Automation • Automated • MRD detection • Targeted Sequencing quantitative IHC • Becton Dickinson & • Real-time qPCR Beckman Coulter • MultiOmyx • Liquid Biopsy • Nanostring/Gene Ex 8

Leading Molecular Offering Broad Menu Market Leading Results • 157 different tests • $50M clinical revenue run rate • More than 30 multi-gene tumor tests • 25%+ volume growth • TMB, MSI, other immuno-oncology assays WGS, WES, RNA-SEQ, NeoAg Targeted genomic/RNA seq. & 1000’s Cancer Panels 100’s Illumina MiSeq < 10 Illumina HiSeq qPCR, Sanger, Fragment Analysis, dPCR, RT-PCR NanoString ABI3730; ABI3500; 1 ViiA7; Rotorgene; Cobas; RainDance # of Biomarkers 9

Our Pharma Services Offering FDA Filing, Pre-Clinical Research & Phase Phase Phase Approval & Launch Discovery I II III Preparation Biomarker Discovery Analytical Validation Dx Development Clinical Validation Assay Design & Development Rx Development Track Dx Development Track Pharma Services Division Specialist Services Pharma Services Technologies • Project management • Discovery/proof of concept • IHC (qual and quant) • Bioinformatics • Development & optimization • Flow cytometry • Data management • Assay validations • FISH & RNA-ISH • Medical/scientific consultation • Inter-site precision • Sanger, PCR & NGS • Regulatory • Clinical trial testing: Phase 1 – 3 • NanoString™ • Logistics • Manufacturing • MultiOmyx™ • Medical data services • Commercialization • Digital pathology • LDT & IVD assays 10

Net Promoter Score Overview: • Survey Opened June 4th • Survey Closed June 30th • 8 Questions + Comments • 903 Responded to the Survey • 655 Optional Comments received Distribution of Client Ratings - Q2 2018 450 393 400 Highest NPS 350 recorded for 300 NeoGenomics! 250 214 200 170 # Ratings # 150 100 60 50 29 19 7 6 1 3 1 0 10 9 8 7 6 5 4 3 2 1 0 Client Rating 11

Track Record of Growth – Clinical Services **Clinical Genetic Testing Annual Revenue Clinical Genetic Tests Performed ($, MMs) 657,394 $210 563,132 $203 $182 221,191 $79 $63 175,688 $56 135,580 $40 $32 112,434 75,576 $27 56,710 $18 44,924 $6 $10 20,998 31,868 4,082 12,838 $0.6 $2 1,152 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Pro Forma Clarient 2015 Genetic Test Revenue Pro Forma Clarient 2015 Clinical Genetic Tests NEO Clinical Genetic Testing Revenue NEO Clincial Genetic Tests Performed *Base NEO represents organic clinical genetic revenue and test volume growth from legacy business and excludes the impacts from Pharma Services and the PathLogic and Clarient acquisitions (prior to 2016). **Clinical Revenue presented net of bad debt expense to conform with ASC 606 presentation. 12

Track Record of Growth - Pharma Services $MMs $120.0 75% YoY Backlog Growth $100.0 97.2 89.6 $80.0 71.7 68.7 $60.0 55.4 $40.0 26.4 21.2 21% YoY 16.7 19.3 $20.0 13.8 Revenue 9.6 7.9 8.0 6.5 8.2 Growth $0.0 Q3'17 Q4'17 Q1'18 (4.2) Q2'18 (0.3) Q3'18 (2.1) -$20.0 Revenue Booked (net) Change in Dormant Projects Ending Backlog Reported backlog as of Jan 1, 2018 is net of projects deemed to be dormant (i.e., with no activity for more than 12 months) 13

Track Record of Improvement in Cost per Test $350 $328 $325 $318 $300 $294 $275 $256 $250 $243 $225 $221 $201 $200 $179 $175 $150 2010 2011 2012 2013 2014 2015 2016 2017 Average Cost of Good Sold / Clinical Genetic Test 14

Oncology Market Tailwinds Aging population driving cancer incidence Increased survival driving follow-on testing Growing number of therapeutic options Increased therapeutic complexity Burgeoning oncology drug pipeline Emerging platforms and tests (NGS, TMB, MSI, etc.) 15

Significant Near-Term Growth Drivers 6 Close and Integrate Genoptix 5 Proactively address revenue 4 per test New managed care and GPO 3 contracts Pursue FDA- Approved multi- 2 gene NGS panel Global strategic alliance with PPD 1 Large backlog of signed Pharma contracts 16

Global Strategic Alliance With PPD PPD’s preferred lab for oncology testing Significant revenue opportunity Expands global client base Expansion into Asia Collaborations for companion diagnostics Opportunities to leverage laboratory data for trials 17

A New Standard in Oncology Testing NeoGenomics Well established as a leading provider of oncology testing for pathologists and hospitals Genoptix Unprecedented reach to all customer segments Broadest and deepest test menu in the Industry Outstanding reputation Deep knowledge of community oncology practice and relationships with Gold standard consults and reports community oncologists Broad portfolio of managed care/GPO contracts Highly efficient, oncology-focused operations, medical team, and sales force 18

Expands Reach into Oncology Practices Significant opportunity Genoptix is well established in for growth this market segment $2.5 billion revenue 40 person oncologist-focused sales opportunity force (5x larger than NeoGenomics’ current oncology team) >2,000 independent, Customized reports specifically community oncology tailored for the oncologist practices community Important channel for fastest Specialized pathologists with years growing tests (e.g., NGS and of experience working directly with Liquid Biopsy) oncologists 19

Leverages Best Offerings MANAGED CARE CUSTOMIZED EXTENSIVE PHARMA NATIONAL AND GPO REPORTING TEST MENU SERVICES FOOTPRINT CONTRACTS NeoGenomics’ test Synergistic With operations on NeoGenomics Genoptix has a menu includes many pharma services both coasts, has a broad suite of tests that Genoptix business drives NeoGenomics will portfolio of customized does not currently be able to improve access to contracts in reporting tools offer to its customers turn-around time • Broader portfolio companion for Genoptix which that are of NGS tests diagnostics customers Genoptix does considered the • 10-color flow not participate gold standard • Greater number of among IHC tests oncologists • Solid tumor pathology 20

COMPASS® and CHART® COMPASS: comprehensive, hematopathologist-directed, integrated assessment report • Customized workflow on each patient case to provide a disease-specific evaluation based on up-to-date guidelines • Actionable diagnosis in a one-page correlation report • Consultation with assigned hematopathologist available on every case • Notification of acute cases and unexpected diagnoses within 24 hours • Real-time electronic reporting with Genoptix Online, powered by eCOMPASS™ • Review of challenging cases and presentation of tumor conferences with a Genoptix Hematopathologist through eRounds CHART: a longitudinal report including a consultative review and correlation with relevant prior findings by a Genoptix Hematopathologist, used to: • Monitor response to therapy • Determine disease progression • Evaluate clonal evolution • Assess residual disease 21

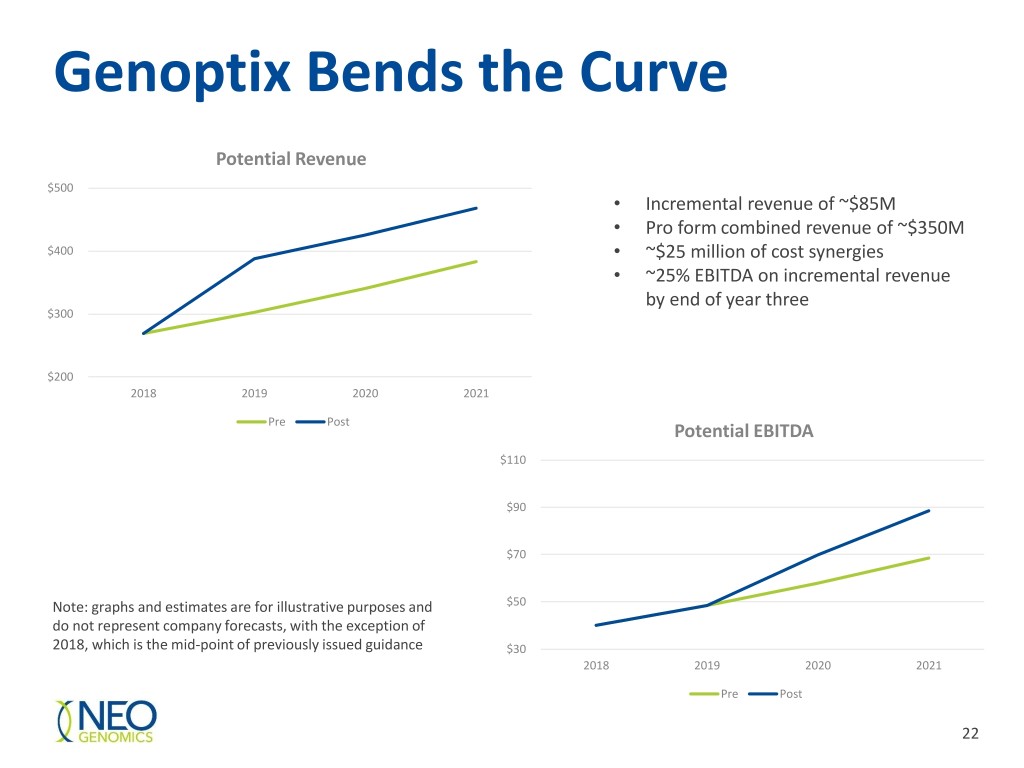

Genoptix Bends the Curve Potential Revenue $500 • Incremental revenue of ~$85M • Pro form combined revenue of ~$350M $400 • ~$25 million of cost synergies • ~25% EBITDA on incremental revenue by end of year three $300 $200 2018 2019 2020 2021 Pre Post Potential EBITDA $110 $90 $70 Note: graphs and estimates are for illustrative purposes and $50 do not represent company forecasts, with the exception of 2018, which is the mid-point of previously issued guidance $30 2018 2019 2020 2021 Pre Post 22

Investment Highlights Leading pure-play oncology testing company Significant market growth tailwinds Extensive molecular/oncology test menu Leader in immuno-oncology testing Market share gains driven by customer satisfaction Rapidly growing Pharma Services business Track record of profitable growth and cash flow 23

Appendix 24

Balance Sheet, September 30, 2018 (unaudited, in thousands) September 30, December 31, 2017 ASSETS 2018 (Restated) Cash and cash equivalents $ 118,440 $ 12,821 Accounts receivable 62,694 60,427 Inventory 6,829 7,474 Other current assets 6,307 5,153 Total current assets 194,270 85,875 Property and equipment (net of accumulated depreciation of $49,492 and $40,530, respectively) 41,004 36,504 Intangible assets, net 69,909 74,165 Goodwill 147,019 147,019 Other assets 2,937 891 TOTAL ASSETS $ 455,139 $ 344,454 LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ EQUITY Accounts payable and other current liabilities $ 33,163 $ 27,482 Short-term portion of capital leases and senior debt 13,892 8,989 Total current liabilities 47,055 36,471 Long-term portion of capital leases and senior debt 96,427 96,435 Long-term pharma contract liability 1,199 283 Deferred income tax liability, net 6,899 6,688 Total long-term liabilities 104,525 103,406 TOTAL LIABILITIES 151,580 139,877 Series A Redeemable Convertible Preferred Stock — 32,615 Stockholders' Equity 303,559 171,962 TOTAL LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS' EQUITY $ 455,139 $ 344,454 25

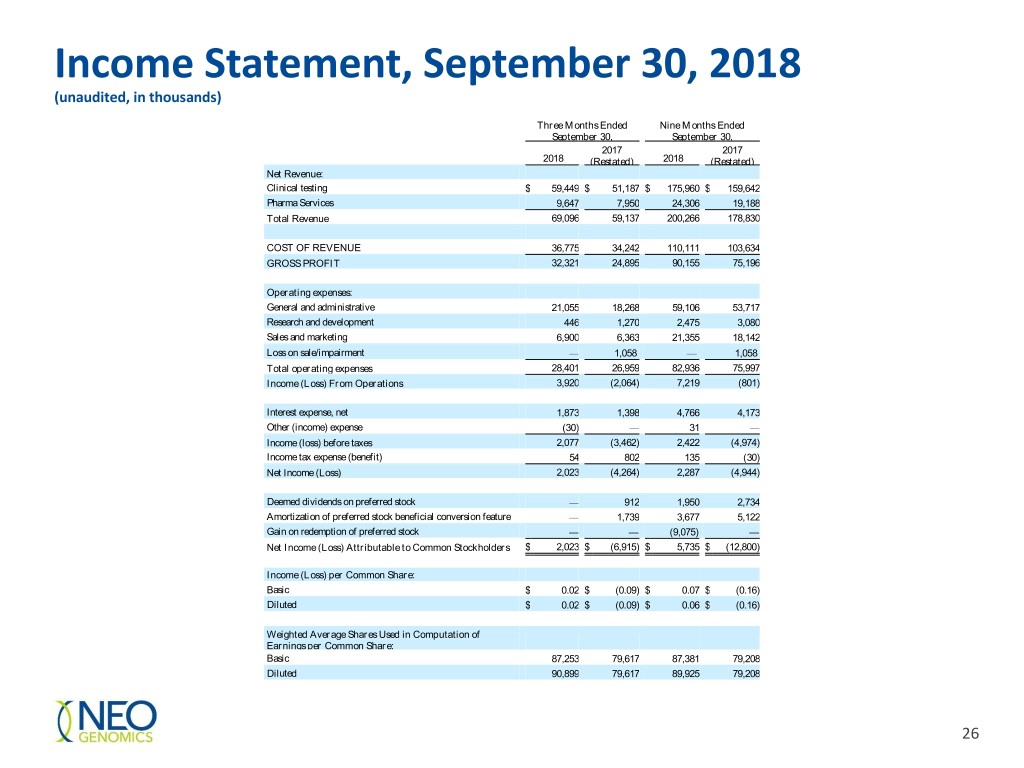

Income Statement, September 30, 2018 (unaudited, in thousands) Three Months Ended Nine Months Ended September 30, September 30, 2017 2017 2018 (Restated) 2018 (Restated) Net Revenue: Clinical testing $ 59,449 $ 51,187 $ 175,960 $ 159,642 Pharma Services 9,647 7,950 24,306 19,188 Total Revenue 69,096 59,137 200,266 178,830 COST OF REVENUE 36,775 34,242 110,111 103,634 GROSS PROFIT 32,321 24,895 90,155 75,196 Operating expenses: General and administrative 21,055 18,268 59,106 53,717 Research and development 446 1,270 2,475 3,080 Sales and marketing 6,900 6,363 21,355 18,142 Loss on sale/impairment — 1,058 — 1,058 Total operating expenses 28,401 26,959 82,936 75,997 Income (Loss) From Operations 3,920 (2,064) 7,219 (801) Interest expense, net 1,873 1,398 4,766 4,173 Other (income) expense (30) — 31 — Income (loss) before taxes 2,077 (3,462) 2,422 (4,974) Income tax expense (benefit) 54 802 135 (30) Net Income (Loss) 2,023 (4,264) 2,287 (4,944) Deemed dividends on preferred stock — 912 1,950 2,734 Amortization of preferred stock beneficial conversion feature — 1,739 3,677 5,122 Gain on redemption of preferred stock — — (9,075) — Net Income (Loss) Attributable to Common Stockholders $ 2,023 $ (6,915) $ 5,735 $ (12,800) Income (Loss) per Common Share: Basic $ 0.02 $ (0.09) $ 0.07 $ (0.16) Diluted $ 0.02 $ (0.09) $ 0.06 $ (0.16) Weighted Average Shares Used in Computation of Earnings per Common Share: Basic 87,253 79,617 87,381 79,208 Diluted 90,899 79,617 89,925 79,208 26

Statements of Cash Flows, September 30, 2018 (unaudited, in thousands) Nine Months Ended September 30, CASH FLOWS FROM OPERATING ACTIVITIES 2018 2017 (Restated) Net income (loss) $ 2,287 $ (4,944) Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation 11,477 11,739 Amortization of intangibles 4,255 5,201 Amortization of debt issue costs 392 330 Loss on disposal of assets 278 — Loss on sale of Path Logic — 1,058 Stock based compensation 5,148 5,812 Changes in assets and liabilities, net 5,496 (6,918) NET CASH PROVIDED BY OPERATING ACTIVITIES 29,333 12,278 CASH FLOWS FROM INVESTING ACTIVITIES Purchases of property and equipment (11,091) (10,167) NET CASH USED IN INVESTING ACTIVITIES (11,091) (10,167) CASH FLOWS FROM FINANCING ACTIVITIES (Repayment) advances on revolving credit facility, net (20,000) 2,496 Redemption of preferred stock (50,096) — Repayment of capital lease obligations, loans (4,774) (4,126) Repayment of term loan and revolving credit facility (8,587) (2,816) Proceeds from term loan 30,000 — Payments of debt issue costs (576) — Issuance of common stock 141,595 2,218 Payments of equity issue costs (150) (197) NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES 87,412 (2,425) Effects of foreign exchange rate changes on cash and cash equivalents (35) — NET CHANGE IN CASH AND CASH EQUIVALENTS 105,619 (314) CASH AND CASH EQUIVALENT, BEGINNING OF PERIOD 12,821 12,525 CASH AND CASH EQUIVALENTS, END OF PERIOD $ 118,440 $ 12,211 SUPPLEMENTAL DISCLOSURE OF CASH FLOW InterestINFORMATION: paid $ 4,722 $ 3,879 Income taxes paid, net of refunds (76) 272 SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING INFORMATION: Equipment acquired under capital lease/loan obligations $ 7,569 $ 3,240 27

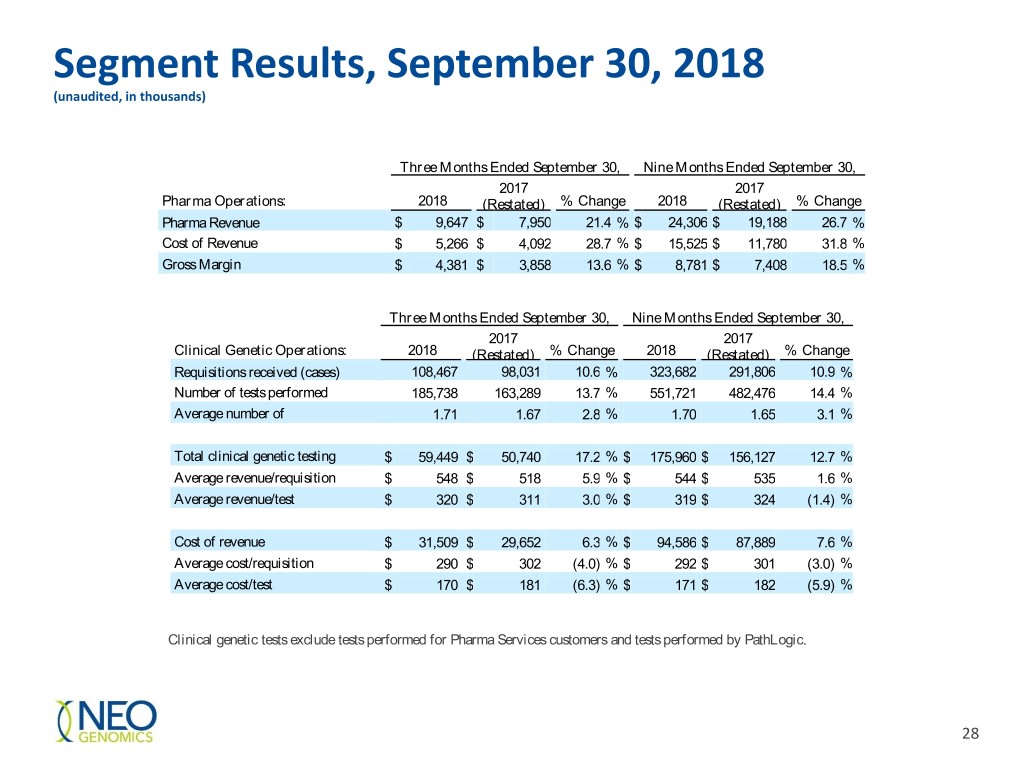

Segment Results, September 30, 2018 (unaudited, in thousands) Three Months Ended September 30, Nine Months Ended September 30, 2017 2017 Pharma Operations: 2018 (Restated) % Change 2018 (Restated) % Change Pharma Revenue $ 9,647 $ 7,950 21.4 % $ 24,306 $ 19,188 26.7 % Cost of Revenue $ 5,266 $ 4,092 28.7 % $ 15,525 $ 11,780 31.8 % Gross Margin $ 4,381 $ 3,858 13.6 % $ 8,781 $ 7,408 18.5 % Three Months Ended September 30, Nine Months Ended September 30, 2017 2017 Clinical Genetic Operations: 2018 (Restated) % Change 2018 (Restated) % Change Requisitions received (cases) 108,467 98,031 10.6 % 323,682 291,806 10.9 % Number of tests performed 185,738 163,289 13.7 % 551,721 482,476 14.4 % Average number of 1.71 1.67 2.8 % 1.70 1.65 3.1 % tests/requisition Total clinical genetic testing $ 59,449 $ 50,740 17.2 % $ 175,960 $ 156,127 12.7 % Averagerevenue revenue/requisition $ 548 $ 518 5.9 % $ 544 $ 535 1.6 % Average revenue/test $ 320 $ 311 3.0 % $ 319 $ 324 (1.4) % Cost of revenue $ 31,509 $ 29,652 6.3 % $ 94,586 $ 87,889 7.6 % Average cost/requisition $ 290 $ 302 (4.0) % $ 292 $ 301 (3.0) % Average cost/test $ 170 $ 181 (6.3) % $ 171 $ 182 (5.9) % Clinical genetic tests exclude tests performed for Pharma Services customers and tests performed by PathLogic. 28

Adjusted EBITDA, September 30, 2018 (unaudited, in thousands) Three Months Ended Nine Months Ended September 30, September 30, 2017 2017 2018 (Restated) 2018 (Restated) Net Income (Loss) (GAAP) $ 2,023 $ (4,264) $ 2,287 $ (4,944) Adjustments to Net Income (Loss): Interest expense, net 1,873 1,398 4,766 4,173 Income tax expense (benefit) 54 802 135 (30) Amortization of intangibles 1,421 1,751 4,255 5,201 Depreciation 4,034 3,833 11,477 11,739 EBITDA 9,405 3,520 22,920 16,139 Further Adjustments to EBITDA: Facility moving expenses/other 670 5 2,486 620 Loss on sale of business — 1,058 — 1,058 Non-cash, stock-based compensation 1,191 2,760 5,148 5,812 Adjusted EBITDA (non-GAAP) $ 11,266 $ 7,343 $ 30,554 $ 23,629 29

2018 Guidance (unaudited, in thousands) For the Year Ended December 31, 2018 Low Range High Range Net income attributable to common stockholders (GAAP) $ 4,000 $ 5,000 Amortization of intangibles 4,500 4,500 Non-cash, stock-based compensation (4) 6,000 7,000 Acquisition related transaction expenses 2,600 2,600 Facility moving expenses 2,000 2,000 Preferred stock dividends and amortization of BCF (3,500) (3,500) Adjusted Net Income (non-GAAP) $ 15,600 $ 17,600 Interest and taxes 7,900 7,900 Depreciation 16,500 16,500 Adjusted EBITDA (non-GAAP) $ 40,000 $ 42,000 Net income per common share (GAAP) Diluted EPS $ 0.04 $ 0.05 Adjustments to diluted loss per share: Amortization of intangibles 0.05 0.05 Non-cash, stock based compensation expenses 0.07 0.08 Acquisition related transaction expenses 0.03 0.03 Facility moving expenses 0.02 0.02 Preferred stock dividends and amortization of BCF (0.04) (0.04) Adjusted Diluted EPS (non-GAAP) $ 0.17 $ 0.19 Weighted average assumed shares outstanding in 2018: Diluted Common Shares (GAAP) 85,600 85,600 Options and restricted stock not included in diluted shares 2,600 2,600 Series A Preferred Stock outstanding 3,300 3,300 Adjusted diluted shares outstanding (non-GAAP) 91,500 91,500 30

Quarterly Impact of ASU 606 Adoption (unaudited, in thousands) As Previously Reported Q1 2017 Q2 2017 Q3 2017 Q4 2017 Total 2017 Net Revenue Clinical Testing $ 56,690 $ 59,791 $ 56,186 $ 59,079 $ 231,748 Pharma Services 4,986 6,299 6,866 8,713 26,863 Total Revenue 61,676 66,090 63,052 67,792 258,611 Gross Profit 27,196 31,178 28,810 33,132 120,316 Total operating expenses 27,311 29,864 32,172 28,645 117,992 Income (Loss) from Operations (115) 1,314 (3,362) 4,487 2,324 Interest expense $ 1,364 $ 1,411 $ 1,398 $ 1,368 $ 5,540 Other expense — — — 265 265 Income tax (benefit) (825) (54) 340 (2,096) (2,635) expense Net Income (Loss) $ (654) $ (43) $ (5,100) $ 4,950 $ (846) Adjustments due to adoption of accounting standard Q1 2017 Q2 2017 Q3 2017 Q4 2017 Total 2017 Net Revenue Clinical Testing $ (3,783) $ (4,244) $ (4,999) $ (5,623) $ (18,651) Pharma Services (465) 418 1,084 (747) 291 Total Revenue (4,248) (3,826) (3,915) (6,370) (18,360) Gross Profit (Loss) (4,248) (3,826) (3,915) (6,370) (18,359) Total operating expenses (3,783) (4,353) (5,213) (5,588) (18,937) Income (Loss) from Operations (465) 527 1,298 (782) 578 Interest expense — — — — — Other expense — — — 253 253 Income tax (benefit) 46 1 462 (128) 381 expense Net Income (Loss) $ (511) $ 526 $ 836 $ (401) $ 450 As Restated Q1 2017 Q2 2017 Q3 2017 Q4 2017 Total 2017 Net Revenue Clinical Testing $ 52,907 $ 55,547 $ 51,187 $ 53,456 $ 213,097 Pharma Services 4,521 6,717 7,950 7,966 27,154 Total Revenue 57,428 62,264 59,137 61,422 240,251 Gross Profit 22,948 27,352 24,895 26,762 101,957 Total operating expenses 23,528 25,511 26,959 23,057 99,055 Income (Loss) from Operations (580) 1,841 (2,064) 3,705 2,902 Interest expense 1,364 1,411 1,398 1,368 5,540 Other expense — — — (12) (12) Income tax (benefit) (779) (53) 802 (2,224) (2,254) expense Net Income (Loss) $ (1,165) $ 483 $ (4,264) $ 4,549 $ (396) 31