Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Groupon, Inc. | exhibit991-q32018.htm |

| 8-K - 8-K - Groupon, Inc. | a2018q38-k.htm |

Q3 2018 11.7.2018 Dear Fellow Stockholders, This November we celebrate Groupon’s tenth anniversary. Much has changed in the intervening decade since our first 2-for-1 pizza offer in Chicago. Groupon is now a fixture in hundreds of communities around the world. We’ve worked with more than 1 million merchants, and we have nearly 50 million customers in 15 countries. We’ve built the largest local marketplace in the United States and Europe, and we’ve made Groupon a household name and one of the most visited retail apps in the U.S., synonymous with value and savings. While we have much to be proud of, we recognize how much we’ve changed over the years and that our progress hasn’t always been a smooth road. We also recognize that we’re not done changing. Related, we’ve been spending time with our current stockholders and prospective investors to discuss ways we can help them better understand our progress. We’ve taken the feedback to heart and are making some changes in our overall approach to how we communicate about our business. To ensure we are telling the most clear and insightful story to our investors, we are moving to a quarterly stockholder letter to provide more color and updates on our strategy, initiatives and results. This will mean less time on prepared remarks and more time for Q&A on our quarterly conference calls. As our first letter, and to ensure we properly set the context for our path forward, this one will contain more data and is longer than our letters should be going forward.

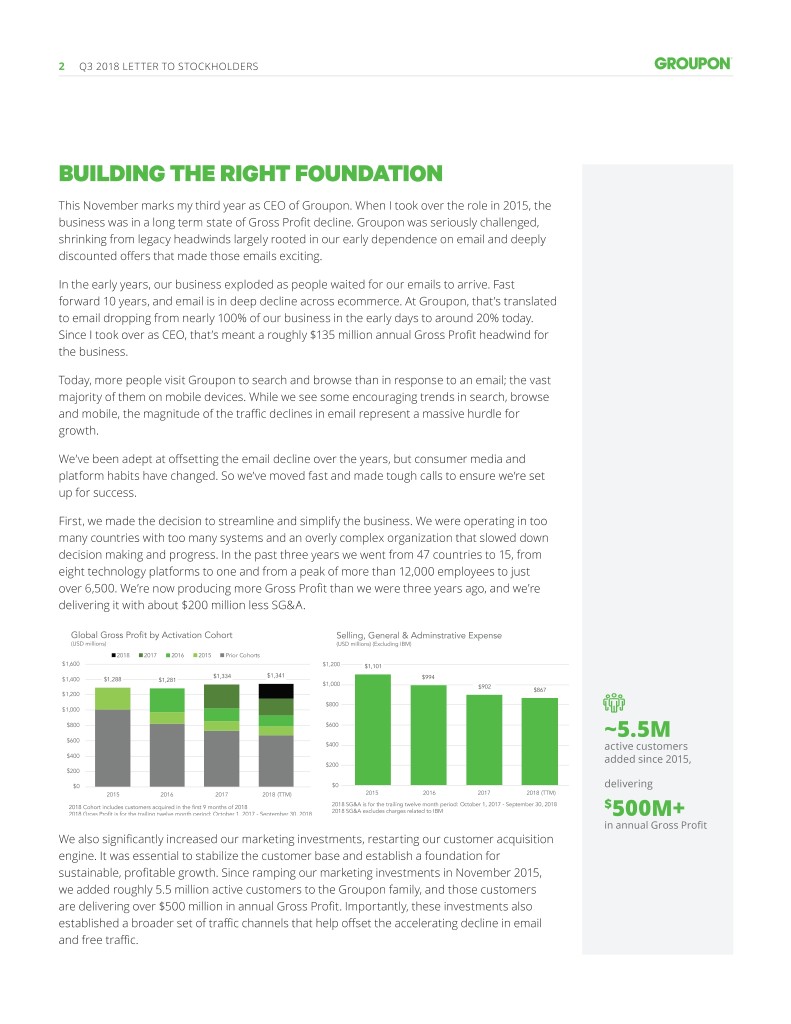

2 Q3 2018 LETTER TO STOCKHOLDERS BUILDING THE RIGHT FOUNDATION This November marks my third year as CEO of Groupon. When I took over the role in 2015, the business was in a long term state of Gross Profit decline. Groupon was seriously challenged, shrinking from legacy headwinds largely rooted in our early dependence on email and deeply discounted offers that made those emails exciting. In the early years, our business exploded as people waited for our emails to arrive. Fast forward 10 years, and email is in deep decline across ecommerce. At Groupon, that’s translated to email dropping from nearly 100% of our business in the early days to around 20% today. Since I took over as CEO, that’s meant a roughly $135 million annual Gross Profit headwind for the business. Today, more people visit Groupon to search and browse than in response to an email; the vast majority of them on mobile devices. While we see some encouraging trends in search, browse and mobile, the magnitude of the traffic declines in email represent a massive hurdle for growth. We’ve been adept at offsetting the email decline over the years, but consumer media and platform habits have changed. So we’ve moved fast and made tough calls to ensure we’re set up for success. First, we made the decision to streamline and simplify the business. We were operating in too many countries with too many systems and an overly complex organization that slowed down decision making and progress. In the past three years we went from 47 countries to 15, from eight technology platforms to one and from a peak of more than 12,000 employees to just over 6,500. We’re now producing more Gross Profit than we were three years ago, and we’re delivering it with about $200 million less SG&A. Global Gross Profit by Activation Cohort Selling, General & Adminstrative Expense (USD millions) (USD millions) (Excluding IBM) 2018 2017 2016 2015 Prior Cohorts $1,600 $1,200 $1,101 $1,334 $1,341 $1,400 $1,288 $1,281 $994 $1,000 $902 $867 $1,200 $800 $1,000 $800 $600 ~5.5M $600 $400 active customers $400 added since 2015, $200 $200 $0 $0 delivering 2015 2016 2017 2018 (TTM) 2015 2016 2017 2018 (TTM) 2018 SG&A is for the trailing twelve month period: October 1, 2017 - September 30, 2018 2018 Cohort includes customers acquired in the first 9 months of 2018 2018 SG&A excludes charges related to IBM $ 2018 Gross Profit is for the trailing twelve month period: October 1, 2017 - September 30, 2018 500M+ in annual Gross Profit We also significantly increased our marketing investments, restarting our customer acquisition engine. It was essential to stabilize the customer base and establish a foundation for sustainable, profitable growth. Since ramping our marketing investments in November 2015, we added roughly 5.5 million active customers to the Groupon family, and those customers are delivering over $500 million in annual Gross Profit. Importantly, these investments also established a broader set of traffic channels that help offset the accelerating decline in email and free traffic.

3 Q3 2018 LETTER TO STOCKHOLDERS As a result, we added stability to the business, turned around the long-term slide in Gross Profit, and began a multi-year journey to rebuild our product and experience for merchants and consumers. However, the pressure related to our legacy voucher business is annoyingly persistent, and we haven’t yet put it behind us. THIRD QUARTER PERFORMANCE Q3 Adjusted EBITDA For much of the past three years, executing against our strategy and key initiatives has helped % us rise above our legacy headwinds and grow Gross Profit and Adjusted EBITDA while delivering 21 solid Free Cash Flow — even while some of our new initiatives disrupt our voucher business. YoY Occasionally the headwinds have outpaced our progress, and the third quarter provides an apt snapshot of the efficacy of our work to reduce costs, as well as our challenges and opportunities. In the third quarter, we delivered Net Income of $45 million and Adjusted EBITDA of $56 million, an increase of 21% year-over-year and well ahead of our expectations. In ~260K contrast, we delivered roughly flat Gross Profit of $306 million, which is below our expectations active International and driven largely by challenges in email and free traffic channels in North America. We saw customers in Q3, pressure from Q2 carry over in North America, with declining customers, Gross Profit and units contributing to the as we refined our approach to marketing, continued to grow Groupon+ redemptions and faced increasing headwinds in our legacy product and traffic channels. fifth On the other hand, International continued to perform in Q3, with increased marketing straight investment driving nearly 260,000 active customers, and solid execution against our product quarter parity and operational initiatives helping to deliver the fifth straight quarter of year-over-year of YoY International Gross Profit growth. We remain very excited about the long-term potential in this business, and its Gross Profit growth near-term progress is helping us deliver solid results while we evolve our North America business. We are not happy with our North America performance, but we are encouraged by the momentum of our strategic initiatives and expect to continue investing through the disruption and for the future. THE PATH FORWARD Our vision is clear: become the global marketplace for local services, experiences and goods. For consumers that means we will be an everyday utility when they are shopping for and discovering transactable inventory with merchants in their local communities. For merchants that means we will be a trusted source of incremental customers and more profitable relationships. To help achieve this vision, we are actively disrupting our legacy voucher business — to the extent that we effectively have two versions of our local business at this point. One is a high margin, low frequency, email-based voucher business that we believe limits the potential value we can bring to consumers and merchants. We’re moving away from this business. The other is a lower margin, higher frequency, mobile marketplace that’s growing and that we believe significantly increases our potential to add value to more consumers and merchants. We are moving to this business.

4 Q3 2018 LETTER TO STOCKHOLDERS Successfully moving beyond email and our legacy voucher business is at the core of our long- term strategy and the four key initiatives we laid out at the beginning of the year: enhancing the customer experience; establishing Groupon as a true open platform for local; realizing the potential of our international business and last but not least, continued operational rigor. We are executing against this strategy every day and have done much to smooth our transformation. With a more efficient cost structure providing room to invest in profitable marketing programs, Gross Profit has actually grown over the past three years despite our headwinds. We simply aren’t happy with this growth because we believe it can be much higher over time. We need to move even faster to capture that opportunity. “WE HAVE SOME EXCITING GROWTH STORIES TRANSFORMATION AND GROWTH UNFOLDING INSIDE GROUPON Our initiatives are showing that our platform has the potential for accelerated growth. While THAT GIVE US they may be difficult to see given the size of the overall business, we have some exciting growth CONFIDENCE stories unfolding inside Groupon that give us confidence we are moving in the right direction. WE ARE MOVING IN THE RIGHT DIRECTION.” BUILDING THE NEW LOCAL MARKETPLACE First and foremost is our marketplace transformation, which is fueled by our 2018 initiatives on customer experience and open platform. To better serve the demand of our mobile consumer, with their increasing search and browse intent, we need a vast, frictionless marketplace of offers. Marketplace serves to answer those needs in a way that an emailed deal-a-day never could. Increasing the number of offers on the platform is critical in this effort. In the past three years, we’ve grown the number of local merchants on Groupon by more than 60% to now include hundreds of thousands of small businesses - and that doesn’t even include national merchants, who lend household names and broad geographic coverage to our marketplace. Opening our platform to third-party partners has also played a key role in this growth, with more than 12% of our offers now coming through partnerships with great brands like Grubhub, Coursehorse, Peek, Porch, Golfnow, and more. These third-party offers are steadily gaining traction on our platform, and we have nearly doubled Gross Profit from Marketplace partners over the past year. REMOVING THE VOUCHER We also launched a series of new products on the platform that improve the redemption experience and open Groupon to more merchants through lower discounts and lower margins. The two we’re most excited about are card-linked offers and booking. As a core part of our Marketplace offering, these products have the potential to eliminate the voucher. In addition, we believe they can help solve a problem that’s plagued the legacy voucher business from the very start: repeat monetization. Through greater utility, low friction and always-on availability, they give consumers more reasons to buy through Groupon and are attractive to a broader range of merchants. Importantly, we’re seeing both booking and card- linked offers improve customer purchase frequency. Customers who redeem on Groupon+ for example roughly double their purchase frequency. This is a core focus for our team, as every incremental unit per customer at our current economics can mean hundreds of millions of

WE ARE BUILDING THE DAILY HABIT FOR LOCAL COMMERCE 5 Q3 2018 LETTER TO STOCKHOLDERS PUBLIC FACT SHEET Q2 2018 HIGHLIGHTS $324M GLOBAL >70% OF TRANSACTIONS GROSS PROFIT ON MOBILE $56.2M GLOBAL $1.3B GLOBAL ADJUSTED EBITDA¹ GROSS BILLINGS 1 Adjusted EBITDA is a non-GAAP performance measure. For a reconciliation to the most comparable U.S. GAAP performance measure, “Net income (loss) from continuing operations,” see the tables to the Company’s second quarter earnings release posted on the Investor Relations site, http://investor.groupon.com. dollars of incremental Gross Profit and Adjusted EBITDA in aggregate. IMPROVED THE SIGNIFICANTLY INCREASED CUSTOMER EXPERIENCE PLATFORM INVENTORY Enrolled ~1 million new cards in Groupon+ during the Brought in significant additional inventory from third second quarter alone and continued to deepen supply parties, having launched or expanded partnerships Card-Linked Offers. We have grown Groupon+, our first card-linked offers product, rapidly GROUPON+in our more than 25 Groupon+ markets with Grubhub, Major League Baseball, American 5.1M cards linked in Groupon+ with Visa, Mastercard Express, CourseHorse, Viator and more since we began ramping the program in Q3 last year. Over that time, merchants live has and American Express network partners increased by nearly 200% year-over-year to 6,000 merchants, cards enrolled have grown 300% to 6 million, and redemptions have grown nearly 500% year-over-year to 1.3 million this quarter, even as they are redeemed at a lower rate than our traditional voucher. Groupon+ is a key way we are disrupting the legacy voucher business and it is growing at the expense of voucher sales. Since Q3 of last year, scaling Groupon+ has generated a roughly $20 6 MILLION million Gross Profit headwind as we biased our on-site marketing and impressions to begin cards enrolled driving adoption of card-linked offers on our platform. INTERNATIONAL GROSS PROFIT +11% Y

Y +120,000 NEW INTERNATIONAL CUSTOMERS We believe that investing in a highly convenient, higher-frequency product that works for LAUNCHED FIRST INTERNATIONAL THIRD PARTY WE ARE BUILDING THE DAILY% HABITSUPPLY FOR PARTNERSHIP LOCAL COMMERCE WITH VIATOR UK a much wider swath of local businesses is absolutely the right move. So much so that the 300 PUBLIC FACT SHEET enrollment question we’re now asking ourselves is how we move to card-linking faster to help replace the BOOSTING growthLOCAL YOY SA�ING CONSUMERS voucher entirely on Groupon, as opposed to how we scale Groupon+ as a single card-linked COMMERCE MONEY product in one vertical. To that end, we’re laying the groundwork for expanding card linking as a TOP � RAN�ED APP core purchase, redemption and loyalty experience across our business and you should expect OF ALL TIME to see it in more verticals and more merchants soon. on iOS1 ��� CUSTOMER ONE MILLION 2 Booking. Similarly, we’ve grown booking units, which includes reservations, appointments and MERCHANTS SATISFACTION worked with to date ticketing, nicely at 13% year-over-year. We now seat tens of millions of diners, salon clients and 6,000 merchants TOP � concert goers through our booking experiences annually, which makes Groupon one of the Pumped more than ECOMMERCE BRAND ��� BILLION INTO in U.S. by monthly unique users 3 leading sites for booking activities in our markets. Our live events business in the U.S. is a great LOCAL BUSINESSES example of what happens when we deliver amazing inventory in a fully bookable and mobile- ��� MILLION DOWNLOADS enabled experience: live events units have grown more than twice as fast as the rest of our of the Groupon mobile app 1 SensorTower, “The Highest Rated iOS Apps and Games of All Time, North America local business over the past three years. ��� OF CUSTOMERS According to App Store Users,” 2018. say they are likely to buy again from 2ForeSee Groupon Customer Satisfaction Study, May 2018 (commissioned Groupon in the next 60 days by Groupon) 3Verto Analytics, “E-commerce Properties, November 2017,” U.S. Adults, ages 18+ We also have great traction with booking partnerships. In addition to expanded integrations ForeSee Groupon Customer Satisfaction Study, May 2018 (commissioned by Groupon) More than ���� MILLION with Ticketmaster, Viator, tickets.com and others, we recently signed a partnership with ����� EMPLOYEES GLOBALLY ACTI�E CUSTOMERS WE ARE BUILDING THE DAILYMindbody HABIT FOR LOCAL to bring COMMERCE even more bookableWE AREinventory BUILDING THEin Health, DAILY HABIT Beauty FOR LOCAL and COMMERCE Wellness to our site. 81% of customers say they are PUBLIC FACT SHEET PUBLIC FACT SHEET likely to return to merchant again ForeSee Groupon Customer Satisfaction Study, May 2018 (commissioned by Groupon) Q2 2018 HIGHLIGHTSThis is another strong trend, and our opportunityQ2 2018here isHIGHLIGHTS similar to card-linking: make booking an integral part of the Groupon experience, available to more merchants and consumers in ACTI�E IN NEARLY ��� BILLION $324M GLOBAL >70% OF TRANSACTIONS $324M GLOBAL >70% OF TRANSACTIONS S � ��� more verticals, faster. RIE � M GROUPONS SOLD GROSS PROFIT ON MOBILE GROSS PROFIT ON MOBILE T A N R $56.2M GLOBAL $1.3B GLOBAL $56.2M GLOBAL $1.3B GLOBAL U � MORE THAN ��� BILLION INCREASING OUR MOBILE LEADERSHIP O E ADJUSTED EBITDA¹ GROSS BILLINGS ADJUSTED EBITDA¹ GROSS BILLINGS C T SA�ED BY CONSUMERS 1 Adjusted EBITDA is a non-GAAP performance measure. For a reconciliation to the most comparable U.S. GAAP performance measure, “Net income (loss) from continuing operations,” see the tables to the Company’s second quarter earnings 1 Adjusted EBITDA is a non-GAAP performance measure. For a reconciliation to the most comparable U.S. GAAP performance measure, “Net income (loss) from continuing operations,” see the tables to the Company’s second quarter earnings release posted on the Investor Relations site, http://investor.groupon.com. release posted on the Investor Relations site, http://investor.groupon.com. � S Mobile is a key enabler for our voucherless marketplace, and arguably one of our biggest � as of IMPROVED THE SIGNIFICANTLY INCREASED IMPROVED THE SIGNIFICANTLY INCREASED in North America CUSTOMER EXPERIENCE productPLATFORM successes INVENTORY over the years.CUSTOMER We’ve builtEXPERIENCE the third mostPLATFORM visited retail INVENTORY app in the U.S., and 6/30/18 Enrolled ~1 million new cards in Groupon+ during the Brought in significant additional inventory from third Enrolled ~1 million new cards in Groupon+ during the Brought in significant additional inventory from third second quarter alone and continued to deepen supply parties, having launched or expanded partnerships second quarter alone and continued to deepen supply parties, having launched or expanded partnerships in our more than 25 Groupon+ markets onewith of Grubhub, the highest-ratedMajor League Baseball, American iOS apps in our ofmore all than time.25 Groupon+ Today, markets more thanwith Grubhub,80% Majorof our League users Baseball, Americanvisit Groupon 5.1M cards linked in Groupon+ with Visa, Mastercard Express, CourseHorse, Viator and more 5.1M cards linked in Groupon+ with Visa, Mastercard Express, CourseHorse, Viator and more and American Express network partners using a mobile device, which is welland American ahead Express of network our partners ecommerce peers. 190 TOP 6 > 70% MILLION RANKED APP transactions DOWNLOADS OF ALL TIME on mobile 1 of the Groupon App on iOS INTERNATIONAL GROSS PROFIT +11% Y

Y INTERNATIONAL GROSS PROFIT +11% Y

Y +120,000 NEW1 SensorTower, INTERNATIONAL “The HighestCUSTOMERS Rated iOS Apps and Games of All Time, According+120,000 to App NEW Store INTERNATIONAL Users,” 2018. CUSTOMERS LAUNCHED FIRST INTERNATIONAL THIRD PARTY LAUNCHED FIRST INTERNATIONAL THIRD PARTY SUPPLY PARTNERSHIP WITH VIATOR UK SUPPLY PARTNERSHIP WITH VIATOR UK

6 Q3 2018 LETTER TO STOCKHOLDERS While we see this as a key strategic advantage long-term, moving so quickly from desktop to mobile is expensive — average purchase prices on mobile tend to be significantly lower than desktop, and overall mobile conversion rates are 35% lower than desktop. The majority of the conversion gap comes from mobile web, which on average converts at roughly half of desktop. More challenging still, mobile web traffic is growing faster than any other platform. Growing our daily mobile traffic from roughly 65% to over 80% over the past three years has meant facing a near-term financial headwind that we believe will pay dividends over time. In the interim, we’re addressing the conversion gap — which is a significant opportunity for us — with a focus on moving more traffic to our higher converting mobile app, faster app and page speeds, better deal and location relevance, improved navigation and an easier checkout process. As I mentioned last quarter, our team is also heads-down working on a next-gen Groupon mobile experience that is designed to better serve the marketplace we’re building versus optimizing the daily deal business of the past. We expect to test into that new experience throughout 2019. INVESTING IN CUSTOMER QUALITY AND SMART MARKETING We expect that the gains we make on the customer experience will help improve the efficiency % and effectiveness of our marketing programs. While you’ve seen us bias our marketing spend 3 toward customer acquisition in North America in the past, we are now investing more in TTM Gross Profit per customer growth in International and on maximizing the lifetime value of our customer base. Sustainable businesses North America aren’t built on one-and-done customers, so we’re choosing to focus our attention and marketing dollars on our best customers, understanding that some low-value subscribers will attrit. % This doesn’t mean we’re eschewing new customers. We’ll continue to opportunistically invest in 7 TTM Gross Profit per customer acquisition where it makes sense — especially in International — and we’ll continue customer growth to work to fill the top of the funnel. However, as we continue to advance our application of data, International targeting and segmentation, we will be much more selective as to which customers we acquire and retain within our Gross Profit return period (within 12 to 18 months). We have a more granular view of customer lifetime value than ever and we’re using it to make smarter investment decisions. As an outcome of this, especially in light of our aforementioned traffic trends, there very well may be some amount of net customer loss on the platform in the near-term. We saw that in Q3 in North America, and we expect that trend to continue into 2019. That doesn’t mean we’re tapped out on customer growth. It means that we don’t see the need to invest in unprofitable customers to hit an arbitrary number. Make no mistake, it’s hard to see our customer numbers decline. That said, at this point we believe it’s more important to generate higher quality customers with higher frequency and higher Gross Profit per customer than to just generate more net adds. That’s what will enable us to invest and grow the customer base even more profitably over time. We are already seeing improvements in Gross Profit per customer and we expect to continue to see increases in this metric over time. In North America, we grew Gross Profit per customer for Q3 on a trailing-twelve month basis by 3% versus the prior year period to $28.96. We also grew International Q3 Gross Profit per customer on a trailing-twelve month basis by 7% to $24.89, highlighting the ability to both grow customer count and generate incremental value in International. The opportunity here remains compelling.

7 Q3 2018 LETTER TO STOCKHOLDERS CONTINUED OPERATIONAL RIGOR Supporting our investments in our transformation and growth stories is a continued focus on Operational Rigor. We don’t for a second believe that we can cut our way to growth or that cost cutting is a substitute for healthy topline growth. But we do believe that we need to be disciplined operators and continually improve our efficiency. We have seen first hand the improvements in speed and quality that come from operating a more streamlined business and building a culture of ownership. We expect to continue to make strides in this area moving forward. SUMMARY AND WHAT’S NEXT Bottom line, our work isn’t done. We’re working through a period of massive change and we know this has been a bumpy road for some of our stockholders. This isn’t a turnaround, it’s a transformation. If this were a basic turnaround, we’d probably limit our focus to cost and “OUR CONVICTION optimizing our voucher business to the point it could become irrelevant. Instead, we are IS HIGH BECAUSE investing aggressively in the future of Groupon and disrupting our legacy business while OUR FUTURE, VOUCHERLESS managing the headwinds related to it shrinking. Our conviction is high because our future, EXPERIENCES voucherless experiences are growing and delivering the kinds of experiences today’s consumer ARE GROWING demands. AND DELIVERING THE KINDS OF There have been bumps in the road, and our strategy is helping smooth them out. Our EXPERIENCES marketplace efforts are growing nicely, and new products are beginning to contribute, albeit in a TODAY’S CONSUMER small way today. As higher frequency, lower margin products they will take time to scale in order DEMANDS.” to deliver substantial Gross Profit upside. Given the disruption potential of some of these efforts, we’ve been pretty conservative rolling them out. We need to do more to accelerate them. We have the tools and assets to navigate this transformation. We have a strong balance sheet and a business that delivers strong free cash flow. We have nearly 50 million customers, an amazing ability to reach and build relationships with small businesses, a trusted brand and a world-class team that’s committed to delivering on the promise of this platform. We’re building toward a product that our customers can be delighted to use four to five times per month, not four to five times per year. And that is a massive prize worth fighting for and investing to achieve. We’re exploring a series of initiatives designed to accelerate these high growth programs which we’ll be ready to discuss more fully next quarter. Thank you for being a part of this transformation. We look forward to keeping you updated on our progress through the next 10 years and beyond. Best, Rich Williams CEO

APPENDIX WEBCAST CONFERENCE CALL DETAILS Groupon will hold a conference call to discuss its third quarter 2018 financial results on Wednesday, November 7, 2018, at 10:00am EST. The webcast can be accessed WEDNESDAY, live at investor.groupon.com. A replay of the webcast will be available through the NOV. 7, 2018 same link following the conference call, along with the earnings press release, financial 10:00 A.M. EST tables and slide presentation. Non-GAAP Financial Measures and Operating Metrics This letter contains references to the following non-GAAP financial measures: Adjusted EBITDA, Free Cash Flow and SG&A excluding IBM patent litigation. These non-GAAP financial measures, which are presented on a continuing operations basis, are intended to aid investors in better understanding our current financial performance and prospects for the future as seen through the eyes of management. We believe that these non-GAAP financial measures facilitate comparisons with our historical results and with the results of peer companies who present similar measures (although other companies may define non-GAAP measures differently than we define them, even when similar terms are used to identify such measures). However, these non-GAAP financial measures are not intended to be a substitute for those reported in accordance with U.S. GAAP. For additional information regarding these non-GAAP financial measures and reconciliations of these measures to the most applicable financial measures under U.S. GAAP, see "Non-GAAP Reconciliation Schedules" and "Supplemental Financial and Operating Metrics" included in the tables accompanying the earnings press release announcing our financial results for the quarter ended September 30, 2018 posted to our Investor Relations site, investor.groupon.com. Note on Forward-Looking Statements The statements contained in this letter that refer to plans and expectations for the next quarter, the full year or the future are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including statements regarding our future results of operations and financial position, business strategy and plans and our objectives for future operations. The words "may," "will," "should," "could," "expect," "anticipate," "believe," "estimate," "intend," "continue" and other similar expressions are intended to identify forward-looking statements. We have based these forward looking statements largely on current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements involve risks and uncertainties that could cause our actual results to differ materially from those expressed or implied in our forward-looking statements. Such risks and uncertainties include, but are not limited to, risk related to volatility in our operating results; execution of our business and marketing strategies; retaining existing customers and adding new customers; challenges arising from our international operations, including fluctuations in currency exchange rates, legal and regulatory developments and any potential adverse impact from the United Kingdom's likely exit from the European Union; retaining and adding high quality merchants; our voucherless offerings; cybersecurity breaches; competing successfully in our industry; changes to merchant payment terms; providing a strong mobile experience for our customers; maintaining our information technology infrastructure; delivery and routing of our emails; claims related to product and service offerings; managing inventory and order fulfillment risks; litigation; managing refund risks; retaining and attracting members of our executive team; completing and realizing the anticipated benefits from acquisitions, dispositions, joint ventures and strategic investments; lack of control over minority investments; tax liabilities; tax legislation; compliance with domestic and foreign laws and regulations, including the CARD Act, GDPR and regulation of the Internet and e-commerce; classification of our independent contractors; protecting our intellectual property; maintaining a strong brand; customer and merchant fraud; payment-related risks; our ability to raise capital if necessary and our outstanding indebtedness; global economic uncertainty; our common stock, including volatility in our stock price; our convertible senior notes; and our ability to realize the anticipated benefits from the hedge and warrant transactions. For additional information regarding these and other risks and uncertainties, we urge you to refer to the factors included under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our Annual Report on Form 10-K for the year ended December 31, 2017, and Quarterly Reports on Form 10-Q and our other filings with the Securities and Exchange Commission, copies of which may be obtained by visiting the company's Investor Relations web site at investor.groupon.com or the SEC's web site at www.sec.gov. Groupon's actual results could differ materially from those predicted or implied and reported results should not be considered an indication of future performance. You should not rely upon forward-looking statements as predictions of future events. Although Groupon believes that the expectations reflected in the forward-looking statements are reasonable, it cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither Groupon nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The forward-looking statements reflect our expectations as of November 7, 2018. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this letter to conform these statements to actual results or to changes in our expectations. About Groupon Groupon (NASDAQ: GRPN) is building the daily habit in local commerce, offering a vast mobile and online marketplace where people discover and save on amazing things to do, eat, see and buy. By enabling real-time commerce across local businesses, travel destinations, consumer products and live events, shoppers can find the best a city has to offer. Groupon is redefining how small businesses attract and retain customers by providing them with customizable and scalable marketing tools and services to profitably grow their businesses. To download Groupon's top-rated mobile apps, visit www.groupon.com/mobile. To search for great deals or subscribe to Groupon emails, visit www.groupon.com. To learn more about the company’s merchant solutions and how to work with Groupon, visit www.groupon.com/merchant.